Cenovus Energy - Älteste Beiträge zuerst

eröffnet am 15.09.19 01:49:31 von

neuester Beitrag 08.12.23 14:17:09 von

neuester Beitrag 08.12.23 14:17:09 von

Beiträge: 49

ID: 1.311.773

ID: 1.311.773

Aufrufe heute: 3

Gesamt: 3.411

Gesamt: 3.411

Aktive User: 0

ISIN: CA15135U1093 · WKN: A0YD8C · Symbol: CVE

28,42

CAD

-0,28 %

-0,08 CAD

Letzter Kurs 22:00:00 Toronto

Neuigkeiten

02.05.24 · globenewswire |

01.05.24 · globenewswire |

25.04.24 · globenewswire |

03.04.24 · wO Chartvergleich |

27.02.24 · globenewswire |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,8050 | +39,52 | |

| 1,2760 | +37,95 | |

| 1,1500 | +27,78 | |

| 1,0400 | +18,18 | |

| 8,2500 | +16,36 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,4000 | -9,43 | |

| 2,0500 | -9,69 | |

| 850,20 | -12,51 | |

| 11,800 | -12,59 | |

| 1,5450 | -19,32 |

--> https://www.wallstreet-online.de/diskussion/1289261-21-30/oe…

--> werde ab Montag über eine Aufstockung nachdenken

--> CVE's Liegenschaften sind "safe", zumindest politisch

..und Herr Trudeau soll im Wahlkampf irgendwie unter Druck stehen: https://www.welt.de/politik/ausland/article200113526/Kanada-…

--> werde ab Montag über eine Aufstockung nachdenken

--> CVE's Liegenschaften sind "safe", zumindest politisch

..und Herr Trudeau soll im Wahlkampf irgendwie unter Druck stehen: https://www.welt.de/politik/ausland/article200113526/Kanada-…

Antwort auf Beitrag Nr.: 61.486.361 von faultcode am 15.09.19 01:49:31

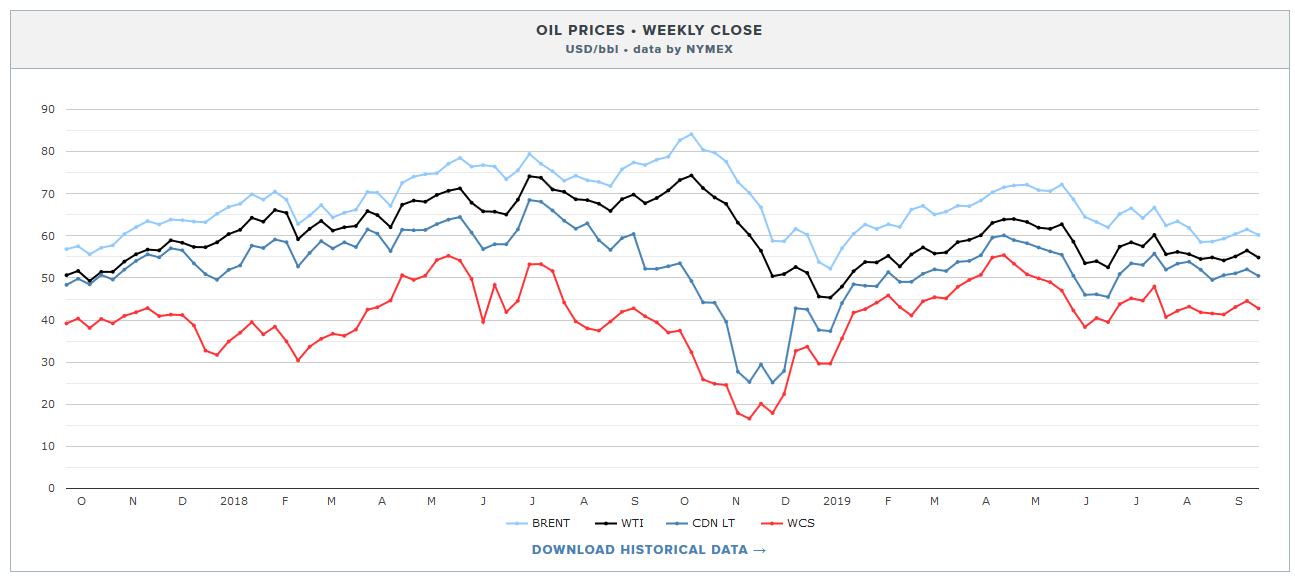

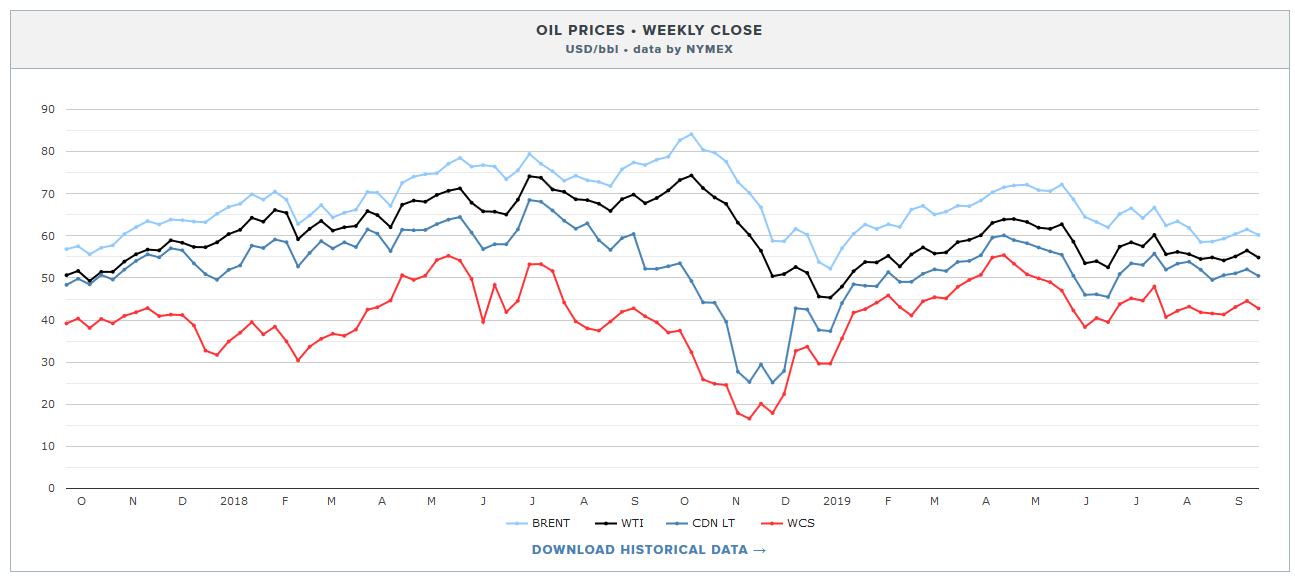

https://www.oilsandsmagazine.com/energy-statistics/oil-and-g…

https://www.oilsandsmagazine.com/energy-statistics/oil-and-g…

Antwort auf Beitrag Nr.: 61.492.952 von faultcode am 16.09.19 13:28:18premarket NYSE +7% --> USD10.0

31.10.

Cenovus Energy beats profit estimates on higher oil prices, cost control

https://ca.finance.yahoo.com/news/canadas-cenovus-energy-rep…

=>

...Canadian oil producer Cenovus Energy Inc <CVE.TO> posted a better-than-expected profit on Thursday, benefiting from higher crude prices because of government-imposed production curbs and rise in U.S. sales, and a tight leash on costs.

Canada's main oil-producing province, Alberta, ordered curtailments on oil production this year to deal with pipeline bottlenecks that had led to a glut in crude storage and record price discounts.

Cenovus, which has gained from a smaller discount on Canadian oil compared to U.S. oil, has been one of the most vocal supporters of the government intervention.

...

Cenovus and several other producers have proposed the provincial government allow some companies to produce more than what they are allowed, as long as that incremental crude can be moved to the market by rail.

The Alberta government, elected in April, inherited C$3.7 billion worth of crude-by-rail contracts from the previous administration that it has been trying to offload onto the private sector.

The company said it transported an average of 80,000 barrels per day of oil by rail to the U.S. in Sept, and is on track to ramp up its crude-by-rail volumes to 100,000 barrels per day by end of the year.

Cenovus added that including barrels shipped by pipeline, it is now moving about one-third of its oil sands production to the U.S. markets, compared with less than 20% in 2018.

The company said total operating costs for oil sands in the quarter remained unchanged from the previous year, and fell to C$6.90 per barrel from C$8.70 in the previous quarter.

The Calgary-based company reported a net profit of C$187 million ($141.97 million), or 15 Canadian cents per share, for the third quarter, compared with a loss of C$242 million, or 20 Canadian cents per share, a year earlier.

Excluding items, the company reported a profit of 23 Canadian cents per share beating analysts' average estimate of 20 Canadians cents per share, according to IBES data from Refinitiv.

Total production fell 9.5% to 448,496 barrels of oil equivalent per day(boe/d) as the company stuck to the mandatory production limits.

Cenovus Energy beats profit estimates on higher oil prices, cost control

https://ca.finance.yahoo.com/news/canadas-cenovus-energy-rep…

=>

...Canadian oil producer Cenovus Energy Inc <CVE.TO> posted a better-than-expected profit on Thursday, benefiting from higher crude prices because of government-imposed production curbs and rise in U.S. sales, and a tight leash on costs.

Canada's main oil-producing province, Alberta, ordered curtailments on oil production this year to deal with pipeline bottlenecks that had led to a glut in crude storage and record price discounts.

Cenovus, which has gained from a smaller discount on Canadian oil compared to U.S. oil, has been one of the most vocal supporters of the government intervention.

...

Cenovus and several other producers have proposed the provincial government allow some companies to produce more than what they are allowed, as long as that incremental crude can be moved to the market by rail.

The Alberta government, elected in April, inherited C$3.7 billion worth of crude-by-rail contracts from the previous administration that it has been trying to offload onto the private sector.

The company said it transported an average of 80,000 barrels per day of oil by rail to the U.S. in Sept, and is on track to ramp up its crude-by-rail volumes to 100,000 barrels per day by end of the year.

Cenovus added that including barrels shipped by pipeline, it is now moving about one-third of its oil sands production to the U.S. markets, compared with less than 20% in 2018.

The company said total operating costs for oil sands in the quarter remained unchanged from the previous year, and fell to C$6.90 per barrel from C$8.70 in the previous quarter.

The Calgary-based company reported a net profit of C$187 million ($141.97 million), or 15 Canadian cents per share, for the third quarter, compared with a loss of C$242 million, or 20 Canadian cents per share, a year earlier.

Excluding items, the company reported a profit of 23 Canadian cents per share beating analysts' average estimate of 20 Canadians cents per share, according to IBES data from Refinitiv.

Total production fell 9.5% to 448,496 barrels of oil equivalent per day(boe/d) as the company stuck to the mandatory production limits.

Wie seht ihr die nahe Zukunft von Cenovus? Dr. Michael Burry, der "The Big Short"-Investor ist scheinbar auch eingestiegen letztes Quartal, zumindest hielt er am 31. Dezember 600.000 Aktien in seinem Fonds.

Josef Schachter discusses Cenovus Energy

https://www.bnnbloomberg.ca/video/josef-schachter-discusses-…

https://www.bnnbloomberg.ca/video/josef-schachter-discusses-…

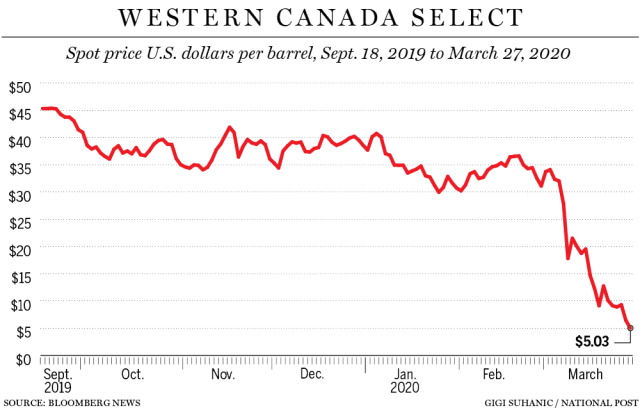

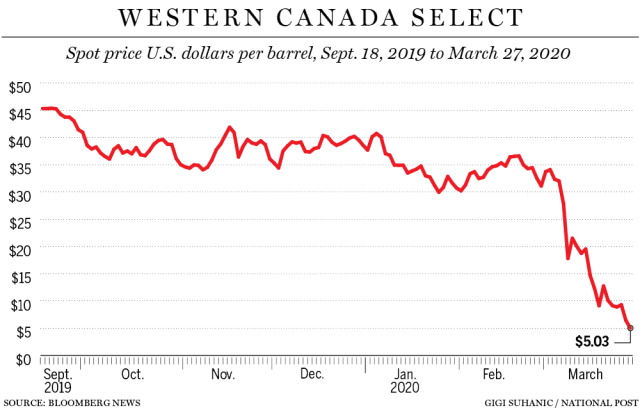

27.3.

Canadian heavy oil collapses another 28% to under $5 as oilsands face shut-ins

https://business.financialpost.com/commodities/energy/canadi…

...

Currently, Canadian heavy crude now costs less than the price paid by a company with long-term contracts to ship it down Enbridge Inc.’s Mainline and Flanagan South systems to Texas.

That’s a problem for producers such as Cenovus Energy Inc., which has commitments to ship 75,000 barrels a day down the system. MEG Energy Corp., another heavy oil producer, has contracts to ship 50,000 barrels a day and has plans to expand to 100,000 barrels a day in the second half of 2020.

Enbridge charges between about US$7 to a little over US$9 a barrel to ship heavy oil to Texas, excluding additional charges such as for power, according to tariff documents. Cenovus declined to comment and MEG didn’t return an email for comment.

...

Canadian heavy oil collapses another 28% to under $5 as oilsands face shut-ins

https://business.financialpost.com/commodities/energy/canadi…

...

Currently, Canadian heavy crude now costs less than the price paid by a company with long-term contracts to ship it down Enbridge Inc.’s Mainline and Flanagan South systems to Texas.

That’s a problem for producers such as Cenovus Energy Inc., which has commitments to ship 75,000 barrels a day down the system. MEG Energy Corp., another heavy oil producer, has contracts to ship 50,000 barrels a day and has plans to expand to 100,000 barrels a day in the second half of 2020.

Enbridge charges between about US$7 to a little over US$9 a barrel to ship heavy oil to Texas, excluding additional charges such as for power, according to tariff documents. Cenovus declined to comment and MEG didn’t return an email for comment.

...

2.4.

Cenovus further cuts 2020 spending, suspends dividend citing oil prices

https://ca.finance.yahoo.com/news/cenovus-energy-futher-cuts…

...

Canadian integrated oil and natural gas company Cenovus Energy <CVE.TO> said on Thursday it would reduce its full-year capital spending by another C$150 million ($106 million) and suspend its dividend, citing low global oil prices.

The fall in crude prices have forced producers to look for ways to reduce cost, and Cenovus said its measures included a 25% cut in compensation for chief executive officer and board members.

The company's other executives will take a 12%-15% reduction in annual base salary, while employees at other levels will experience a graduated smaller salary impact, Cenovus said.

Last month, Cenovus announced a near 32% cut to its capital spending for the year and a temporary suspension of its crude-by-rail program, as an erupting Saudi-Russia oil price war dealt a blow to the struggling Canadian oil industry.

The company on Thursday kept is oil sands production outlook unchanged in then range of 350,000 barrels per day (bpd) to 400,000 bpd for the year.

Cenovus further cuts 2020 spending, suspends dividend citing oil prices

https://ca.finance.yahoo.com/news/cenovus-energy-futher-cuts…

...

Canadian integrated oil and natural gas company Cenovus Energy <CVE.TO> said on Thursday it would reduce its full-year capital spending by another C$150 million ($106 million) and suspend its dividend, citing low global oil prices.

The fall in crude prices have forced producers to look for ways to reduce cost, and Cenovus said its measures included a 25% cut in compensation for chief executive officer and board members.

The company's other executives will take a 12%-15% reduction in annual base salary, while employees at other levels will experience a graduated smaller salary impact, Cenovus said.

Last month, Cenovus announced a near 32% cut to its capital spending for the year and a temporary suspension of its crude-by-rail program, as an erupting Saudi-Russia oil price war dealt a blow to the struggling Canadian oil industry.

The company on Thursday kept is oil sands production outlook unchanged in then range of 350,000 barrels per day (bpd) to 400,000 bpd for the year.

Antwort auf Beitrag Nr.: 63.221.667 von faultcode am 02.04.20 22:30:17

Antwort auf Beitrag Nr.: 63.221.667 von faultcode am 02.04.20 22:30:17

8.4.

Canada’s oil groups battle for survival

Sector scrambles to staunch crude output after local price sinks below $5 a barrel

https://www.ft.com/content/9042d463-db0e-4dc8-8c46-c71cce98e…

8.4.

Canada’s oil groups battle for survival

Sector scrambles to staunch crude output after local price sinks below $5 a barrel

https://www.ft.com/content/9042d463-db0e-4dc8-8c46-c71cce98e…

Beitrag zu dieser Diskussion schreiben

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +1,39 | |

| +0,80 | |

| +1,08 | |

| +0,35 | |

| +0,41 | |

| +1,79 | |

| +2,84 | |

| +1,36 | |

| +0,34 | |

| +0,59 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 208 | ||

| 116 | ||

| 102 | ||

| 54 | ||

| 51 | ||

| 39 | ||

| 39 | ||

| 34 | ||

| 33 | ||

| 31 |

Cenovus Energy