Alta Copper Corp ehemals Candente Copper (Seite 66)

eröffnet am 16.03.06 14:25:14 von

neuester Beitrag 02.05.24 13:30:28 von

neuester Beitrag 02.05.24 13:30:28 von

Beiträge: 7.255

ID: 1.047.911

ID: 1.047.911

Aufrufe heute: 6

Gesamt: 607.004

Gesamt: 607.004

Aktive User: 0

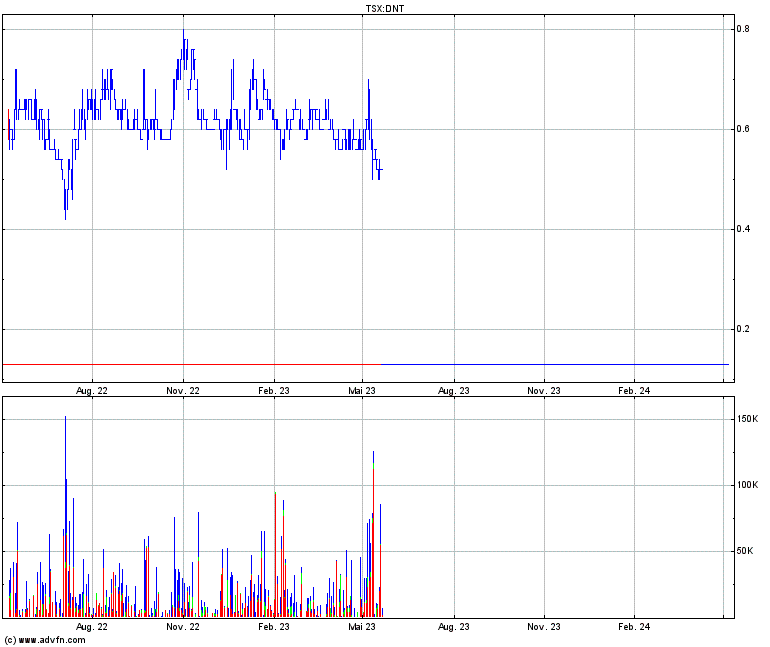

ISIN: CA0212641066 · WKN: A3EE56

0,3980

EUR

-3,40 %

-0,0140 EUR

Letzter Kurs 22:21:06 Lang & Schwarz

Neuigkeiten

30.04.24 · Accesswire |

13.03.24 · Accesswire |

29.02.24 · Accesswire |

20.12.23 · Accesswire |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,8360 | +17,66 | |

| 0,7875 | +17,54 | |

| 0,5500 | +17,02 | |

| 2,0500 | +13,89 | |

| 0,5120 | +13,27 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,4650 | -9,86 | |

| 0,9760 | -10,87 | |

| 12,000 | -25,00 | |

| 0,6601 | -26,22 | |

| 46,24 | -98,00 |

Beitrag zu dieser Diskussion schreiben

Irgendwann muss selbst diese Verreckerfirma mal anziehen ...

Management antwortet seit Wochen nicht ... Na ja . Haben das Ding vor Jahren verzockt als man dachte man ist viel mehr Wert als 2,50 Dollar pro Share .. Da stand Kupfer auch nur bei 3 CAD .

Management antwortet seit Wochen nicht ... Na ja . Haben das Ding vor Jahren verzockt als man dachte man ist viel mehr Wert als 2,50 Dollar pro Share .. Da stand Kupfer auch nur bei 3 CAD .

08.08.17 21:58:05 Uhr

0,09 CAD

+28,57% [+0,02]

0,09 CAD

+28,57% [+0,02]

Lage der Nation...

Thu Jun 29, 2017

Candente and Plan B sign Definitive Agreement on Don Gregorio Cu-Au Porphyry Project, Peru

Vancouver, British Columbia, June 29th, 2017. Candente Copper Corp. (TSX NT, BVL

NT, BVL NT,) ("Candente Copper", "Company") is pleased to announce that the Company has entered into a definitive agreement ("the Agreement") to option the Don Gregorio Cu-Au porphyry project to Plan B Minerals ("Plan B").

NT,) ("Candente Copper", "Company") is pleased to announce that the Company has entered into a definitive agreement ("the Agreement") to option the Don Gregorio Cu-Au porphyry project to Plan B Minerals ("Plan B").

In accordance with the Agreement, Plan B has the right to earn a 60% interest in the Don Gregorio property in Peru from Candente Copper's wholly owned subsidiary, Cobriza Metals Corp. ("Cobriza") by making payments totaling USD$500,000 to the Company and completing 10,000 metres("m") of drilling within 3 years of receiving government drilling permits.

To date, the Company has received payments totaling USD$50,000. A further USD$50,000 is due 90 days after signing the Agreement. One-half of the aforementioned payments are to be used to fund Candente Copper team's work in community engagement and agreements. The Company is to also receive USD$100,000 on or before 30 days of receipt of drill permits for the first phase drill program, a further USD$100,000 within 30 days of completing the first phase drill program (5,000 m) and the final USD$200,000 within 60 days of completing the second phase (an additional 5,000 m).

"Candente has always considered the Don Gregorio as a very high quality exploration target, given the success of previous drilling in identifying significant copper and gold mineralization in a porphyry setting. We are very pleased to now have Plan B bring its expertise and commitment to further exploration at Don Gregorio.", commented Joanne Freeze, P.Geo., Candente Copper's CEO."

Candente Copper acquired Don Gregorio from the Peruvian government in a competitive auction in 2008. Don Gregorio covers a mineralized (Cu-Au) porphyry system previously drilled by other parties in 1977 and 1995. A total of 1,642 metres ("m") were drilled to date in 12 holes. Eight of these holes were drilled to depths of 107 m or less and only two holes reached depths to approximately 260 m. Mineral intercepts from the historic drilling include 153.3m of 0.394% Cu with 0.18 g/t Au. A total of 930 surface samples were collected from the 1970's to 2011 and include:

20m of 1.23% Cu and 0.26 g/t Au

9m at 1.13% Cu and 0.90 g/t Au

3m at 1.36% Cu and 0.84 g/t Au

About Candente Copper

Candente Copper is a mineral exploration company engaged in acquisition, exploration, and development of mineral properties. The Company is currently focused on its 100% owned Cañariaco project, which includes the Feasibility stage Cañariaco Norte deposit as well as the Cañariaco Sur deposit and Quebrada Verde prospect, located within the western Cordillera of the Peruvian Andes in the Department of Lambayeque in Northern Peru.

On behalf of the Board of Candente Copper Corp.

"Joanne C. Freeze" P.Geo.

CEO, Director

_______________________________________

For further information please contact:

info@candentecopper.com

www.candentecopper.com

or:

Walter Spagnuolo

Manager, Investor Relations

mobile: +1 (604) 306-8477

local: + 1 (604) 689-1957 ext 3

or:

Patrick Elliott

VP Finance, Director

Plan B Minerals Corporation

Ph: 604 644 6940

Joanne C. Freeze, P.Geo., CEO, and Michael Thicke, P.Geo., VP Exploration, are the Qualified Persons as defined by National Instrument 43-101 for the projects discussed above. They have reviewed and approved the contents of this release.

This news release may contain forward-looking statements including but not limited to comments regarding timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Candente Copper relies upon litigation protection for forward-looking statements.

Candente and Plan B sign Definitive Agreement on Don Gregorio Cu-Au Porphyry Project, Peru

Vancouver, British Columbia, June 29th, 2017. Candente Copper Corp. (TSX

NT, BVL

NT, BVL NT,) ("Candente Copper", "Company") is pleased to announce that the Company has entered into a definitive agreement ("the Agreement") to option the Don Gregorio Cu-Au porphyry project to Plan B Minerals ("Plan B").

NT,) ("Candente Copper", "Company") is pleased to announce that the Company has entered into a definitive agreement ("the Agreement") to option the Don Gregorio Cu-Au porphyry project to Plan B Minerals ("Plan B").In accordance with the Agreement, Plan B has the right to earn a 60% interest in the Don Gregorio property in Peru from Candente Copper's wholly owned subsidiary, Cobriza Metals Corp. ("Cobriza") by making payments totaling USD$500,000 to the Company and completing 10,000 metres("m") of drilling within 3 years of receiving government drilling permits.

To date, the Company has received payments totaling USD$50,000. A further USD$50,000 is due 90 days after signing the Agreement. One-half of the aforementioned payments are to be used to fund Candente Copper team's work in community engagement and agreements. The Company is to also receive USD$100,000 on or before 30 days of receipt of drill permits for the first phase drill program, a further USD$100,000 within 30 days of completing the first phase drill program (5,000 m) and the final USD$200,000 within 60 days of completing the second phase (an additional 5,000 m).

"Candente has always considered the Don Gregorio as a very high quality exploration target, given the success of previous drilling in identifying significant copper and gold mineralization in a porphyry setting. We are very pleased to now have Plan B bring its expertise and commitment to further exploration at Don Gregorio.", commented Joanne Freeze, P.Geo., Candente Copper's CEO."

Candente Copper acquired Don Gregorio from the Peruvian government in a competitive auction in 2008. Don Gregorio covers a mineralized (Cu-Au) porphyry system previously drilled by other parties in 1977 and 1995. A total of 1,642 metres ("m") were drilled to date in 12 holes. Eight of these holes were drilled to depths of 107 m or less and only two holes reached depths to approximately 260 m. Mineral intercepts from the historic drilling include 153.3m of 0.394% Cu with 0.18 g/t Au. A total of 930 surface samples were collected from the 1970's to 2011 and include:

20m of 1.23% Cu and 0.26 g/t Au

9m at 1.13% Cu and 0.90 g/t Au

3m at 1.36% Cu and 0.84 g/t Au

About Candente Copper

Candente Copper is a mineral exploration company engaged in acquisition, exploration, and development of mineral properties. The Company is currently focused on its 100% owned Cañariaco project, which includes the Feasibility stage Cañariaco Norte deposit as well as the Cañariaco Sur deposit and Quebrada Verde prospect, located within the western Cordillera of the Peruvian Andes in the Department of Lambayeque in Northern Peru.

On behalf of the Board of Candente Copper Corp.

"Joanne C. Freeze" P.Geo.

CEO, Director

_______________________________________

For further information please contact:

info@candentecopper.com

www.candentecopper.com

or:

Walter Spagnuolo

Manager, Investor Relations

mobile: +1 (604) 306-8477

local: + 1 (604) 689-1957 ext 3

or:

Patrick Elliott

VP Finance, Director

Plan B Minerals Corporation

Ph: 604 644 6940

Joanne C. Freeze, P.Geo., CEO, and Michael Thicke, P.Geo., VP Exploration, are the Qualified Persons as defined by National Instrument 43-101 for the projects discussed above. They have reviewed and approved the contents of this release.

This news release may contain forward-looking statements including but not limited to comments regarding timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Candente Copper relies upon litigation protection for forward-looking statements.

Antwort auf Beitrag Nr.: 55.182.443 von a.c. am 22.06.17 07:29:35Peru ist politisch stabil. langfristig - und das ist weltweiter Fach-Konsens - wird der Kupferpreis wieder ansteigen. die Frage nur, wird das in 2-3 Jahren, in 5 oder erst in 10 Jahren der Fall sein, diese Frage bleibt derzeit unbeantwortet.

auf bundesebene sieht es schon sehr danach aus. hatte ich ja mit meinem artikel zuvor schon angemerkt. auf kommunaler ebene hingegen gibt es massive widerstände gegen bergbauprojekte. ob da speziell bei DNT jemals ein kompromiss gefunden wird mit dem alle seiten leben können bleibt reine spekulation.

bisher sehe ICH die chancen für ein generelles scheitern des projekts als weitaus wahrscheinlicher an. das ist eben der hebel auf den man hier zockt. das hat primär nix mit der reinen theoretischen wirtschaftlichkeit usw. zu tun!

auf bundesebene sieht es schon sehr danach aus. hatte ich ja mit meinem artikel zuvor schon angemerkt. auf kommunaler ebene hingegen gibt es massive widerstände gegen bergbauprojekte. ob da speziell bei DNT jemals ein kompromiss gefunden wird mit dem alle seiten leben können bleibt reine spekulation.

bisher sehe ICH die chancen für ein generelles scheitern des projekts als weitaus wahrscheinlicher an. das ist eben der hebel auf den man hier zockt. das hat primär nix mit der reinen theoretischen wirtschaftlichkeit usw. zu tun!

Der seit Jahren schwache Kupferpreis lastet meines Erachtens hauptverantwortlich auf den Kupferwerten.

Zusätzlich kommen teilweise lokale Stimmungen von Bergbau-Gegnern hinzu.

Bei DNT führt der schwache Aktienkurs dazu, die notwendigen Gelder für die weitere Bebohrung von Sur und Verde sowie den Abschluß der FS von Norte am Markt nicht generieren zu können.

Aber Peru ist politisch klar dem Bergbau verschrieben, Candente hält regelmäßig Kontakt zum Bergbau-Ministerium, Freeze hat den Staatspräsidenten bereits 2 mal getroffen.

Darüber hinaus abeitet man an sozialen Projekten, um das Vertrauen der Bevölkerung zu bekommen, aber auch um die Einsicht und das Verständnis für Bergbau zu födern, sowie die Vorteile für die lokale Bevölkerung, die daraus entstehen können, heraus zu arbeiten.

Nicht wenige gehen derzeit davon aus, daß der Kupferpreis noch mehrere Jahre in einer Seitwärtsbewegung verharren könnte.

Wie lange, das kann leider keiner genau vorhersagen.

Für die Aktionäre von DNT dürfte das aber auch unverändert Stillstand bedeuten.

Die vielversprechende Gesamtsituation von Candente ist allerdings unverändert:

Norte 10 Mrd p Kupfer + Sur mit vermutlich ebenfalls 10 MRD p Kupfer + Verde mit X MRD p Kupfer

Die Abbaukosten von Candente sind im internationalen Vergleich sehr konkurrenzfähig, Peru ist politisch stabil. langfristig - und das ist weltweiter Fach-Konsens - wird der Kupferpreis wieder ansteigen. die Frage nur, wird das in 2-3 Jahren, in 5 oder erst in 10 Jahren der Fall sein, diese Frage bleibt derzeit unbeantwortet.

Ich werde meine Anteile langfristig weiter halten und bei Bodenbildung mein Engagement weiter ausbauen.

Von Candente:

LETTER TO SHAREHOLDERS

1100 – 1111 MELVILLE STREET

Vancouver BC, V6E 3V6

Tel: 604.689.1957

Fax: 604.685.1946

Toll free: 1.877.689.1964

Email: info@candente.com

www.candente.com

LETTER TO SHAREHOLDERS

May 1, 2017

Dear Shareholders:

The directors of Candente Copper cordially invite you to attend the annual general meeting (the “Meeting”) of the shareholders of the Company to be held at the offices of Gowling WLG, Suite 2300-550 Burrard Street, Vancouver, British Columbia, Canada V6C 2B5 on June 22, 2017 at 10:00 a.m. (Pacific Time).

Calendar year 2016 saw significantly improved copper prices, increasing from a low of US$1.94 per pound in January to a high of US$2.68 per pound in December, and US$ 2.50 per pound at year end. So far in 2017 copper prices have been in the range of US$2.50 to US2.77 per pound. In addition, the copper treatment fees charged by smelters (“TCRCs”) dropped significantly indicating tight supplies of copper concentrate. Based on the previously completed project study work, Canariaco Norte would be an economically robust project at current copper prices. The copper sector experienced an improved environment for financings through the first half in mid 2016, and in July 2016, management was able to complete a non-brokered financing which raised US$1,073,380.

The financing was over-subscribed and resulted in the addition of new shareholders. However, the number of financings decreased significantly in the third and fourth quarters of 2016, and so far in 2017, it has been difficult to raise financing for small capitalization companies focussed on base metals.

Merger and acquisition activity in the global gold industry continued in 2016, however, merger and acquisition in the copper sector has remained extremely limited. Management at Candente Copper has continued to minimize corporate costs to an absolute minimum and preserve the mineral rights at Canariaco and Don Gregorio.

Peru elected a new President in 2016 - Pedro Pablo Kuczynksi. President Kuczynski is committed to continued economic development in Peru and is especially supportive of the mining industry as the engine of growth for the country. Joanne Freeze, Candente Copper’s CEO, has already met twice with the new President and he has personally confirmed his government’s support for the Canariaco project, both privately and publicly.

Looking ahead, management remains absolutely committed to the development of Canariaco. We continue to focus on identifying opportunities to partner with entities that have the financial and technical strength to put Canariaco into production. Management monitors the financing environment for the copper sector on a continuous basis and would look to strengthen the company’s finances when a satisfactory opportunity presents itself.

Technically, management would like to resume drilling on the Sur deposit with the objective of increasing the size of this deposit and to identify potential zones of higher grade mineralization ultimately demonstrating its value both as a stand alone deposit and also as a blending opportunity for Canariaco Norte. In addition, we would like to initiate drilling at the highly prospective yet undrilled Quebrada Verde copper gold porphyry target, on trend with Sur and Canariaco Norte.

Management believes there is excellent potential to add to the scope and value of the overall Canariaco project with modest drilling programs at Sur and Quebrada Verde, at relatively low cost. The scope of development for Canariaco Norte is well understood at this time, and given the higher costs associated with completion of the feasibility study, management plans to resume the feasibility work only when warranted.

The subdued global interest for the copper sector is not expected to last forever and we remain optimistic that the sector will see renewed interest, especially in significantly under-valued companies such as Candente Copper. As we have stated in the past, only a small number of large scale copper deposits in the advanced feasibility stage of development remain available in mining friendly jurisdictions that are not already owned by major mining companies.

We remain very confident that the robust economics and sound development plan for Canariaco Norte combined with the significant exploration upside potential of the Canariaco Sur copper-gold-silver porphyry system and Verde copper-gold porphyry target has positioned the Canariaco Copper project as one of the top copper projects available.

We would like to thank our Board of Directors for their guidance, our employees for their commitment and especially all of our shareholders for their support and patience.

Sincerely,

“Joanne Freeze”

Joanne Freeze, Chief Executive Officer and Director

“Sean Waller”

Sean Waller, President and Director

Read more at http://www.stockhouse.com/companies/bullboard/t.dnt/candente…

Zusätzlich kommen teilweise lokale Stimmungen von Bergbau-Gegnern hinzu.

Bei DNT führt der schwache Aktienkurs dazu, die notwendigen Gelder für die weitere Bebohrung von Sur und Verde sowie den Abschluß der FS von Norte am Markt nicht generieren zu können.

Aber Peru ist politisch klar dem Bergbau verschrieben, Candente hält regelmäßig Kontakt zum Bergbau-Ministerium, Freeze hat den Staatspräsidenten bereits 2 mal getroffen.

Darüber hinaus abeitet man an sozialen Projekten, um das Vertrauen der Bevölkerung zu bekommen, aber auch um die Einsicht und das Verständnis für Bergbau zu födern, sowie die Vorteile für die lokale Bevölkerung, die daraus entstehen können, heraus zu arbeiten.

Nicht wenige gehen derzeit davon aus, daß der Kupferpreis noch mehrere Jahre in einer Seitwärtsbewegung verharren könnte.

Wie lange, das kann leider keiner genau vorhersagen.

Für die Aktionäre von DNT dürfte das aber auch unverändert Stillstand bedeuten.

Die vielversprechende Gesamtsituation von Candente ist allerdings unverändert:

Norte 10 Mrd p Kupfer + Sur mit vermutlich ebenfalls 10 MRD p Kupfer + Verde mit X MRD p Kupfer

Die Abbaukosten von Candente sind im internationalen Vergleich sehr konkurrenzfähig, Peru ist politisch stabil. langfristig - und das ist weltweiter Fach-Konsens - wird der Kupferpreis wieder ansteigen. die Frage nur, wird das in 2-3 Jahren, in 5 oder erst in 10 Jahren der Fall sein, diese Frage bleibt derzeit unbeantwortet.

Ich werde meine Anteile langfristig weiter halten und bei Bodenbildung mein Engagement weiter ausbauen.

Von Candente:

LETTER TO SHAREHOLDERS

1100 – 1111 MELVILLE STREET

Vancouver BC, V6E 3V6

Tel: 604.689.1957

Fax: 604.685.1946

Toll free: 1.877.689.1964

Email: info@candente.com

www.candente.com

LETTER TO SHAREHOLDERS

May 1, 2017

Dear Shareholders:

The directors of Candente Copper cordially invite you to attend the annual general meeting (the “Meeting”) of the shareholders of the Company to be held at the offices of Gowling WLG, Suite 2300-550 Burrard Street, Vancouver, British Columbia, Canada V6C 2B5 on June 22, 2017 at 10:00 a.m. (Pacific Time).

Calendar year 2016 saw significantly improved copper prices, increasing from a low of US$1.94 per pound in January to a high of US$2.68 per pound in December, and US$ 2.50 per pound at year end. So far in 2017 copper prices have been in the range of US$2.50 to US2.77 per pound. In addition, the copper treatment fees charged by smelters (“TCRCs”) dropped significantly indicating tight supplies of copper concentrate. Based on the previously completed project study work, Canariaco Norte would be an economically robust project at current copper prices. The copper sector experienced an improved environment for financings through the first half in mid 2016, and in July 2016, management was able to complete a non-brokered financing which raised US$1,073,380.

The financing was over-subscribed and resulted in the addition of new shareholders. However, the number of financings decreased significantly in the third and fourth quarters of 2016, and so far in 2017, it has been difficult to raise financing for small capitalization companies focussed on base metals.

Merger and acquisition activity in the global gold industry continued in 2016, however, merger and acquisition in the copper sector has remained extremely limited. Management at Candente Copper has continued to minimize corporate costs to an absolute minimum and preserve the mineral rights at Canariaco and Don Gregorio.

Peru elected a new President in 2016 - Pedro Pablo Kuczynksi. President Kuczynski is committed to continued economic development in Peru and is especially supportive of the mining industry as the engine of growth for the country. Joanne Freeze, Candente Copper’s CEO, has already met twice with the new President and he has personally confirmed his government’s support for the Canariaco project, both privately and publicly.

Looking ahead, management remains absolutely committed to the development of Canariaco. We continue to focus on identifying opportunities to partner with entities that have the financial and technical strength to put Canariaco into production. Management monitors the financing environment for the copper sector on a continuous basis and would look to strengthen the company’s finances when a satisfactory opportunity presents itself.

Technically, management would like to resume drilling on the Sur deposit with the objective of increasing the size of this deposit and to identify potential zones of higher grade mineralization ultimately demonstrating its value both as a stand alone deposit and also as a blending opportunity for Canariaco Norte. In addition, we would like to initiate drilling at the highly prospective yet undrilled Quebrada Verde copper gold porphyry target, on trend with Sur and Canariaco Norte.

Management believes there is excellent potential to add to the scope and value of the overall Canariaco project with modest drilling programs at Sur and Quebrada Verde, at relatively low cost. The scope of development for Canariaco Norte is well understood at this time, and given the higher costs associated with completion of the feasibility study, management plans to resume the feasibility work only when warranted.

The subdued global interest for the copper sector is not expected to last forever and we remain optimistic that the sector will see renewed interest, especially in significantly under-valued companies such as Candente Copper. As we have stated in the past, only a small number of large scale copper deposits in the advanced feasibility stage of development remain available in mining friendly jurisdictions that are not already owned by major mining companies.

We remain very confident that the robust economics and sound development plan for Canariaco Norte combined with the significant exploration upside potential of the Canariaco Sur copper-gold-silver porphyry system and Verde copper-gold porphyry target has positioned the Canariaco Copper project as one of the top copper projects available.

We would like to thank our Board of Directors for their guidance, our employees for their commitment and especially all of our shareholders for their support and patience.

Sincerely,

“Joanne Freeze”

Joanne Freeze, Chief Executive Officer and Director

“Sean Waller”

Sean Waller, President and Director

Read more at http://www.stockhouse.com/companies/bullboard/t.dnt/candente…

Social License to Operate

As in many developing countries, achieving a social license to operate is the single most important challenge that the mining industry faces in Peru. Income and regional inequalities continue to be a source of social conflicts, which have had a negative impact on a number of mining projects.

Achieving a social license to operate is one challenge, maintaining it is another. The key to both is communicating value through the concept of shared value and, more broadly, of corporate social responsibility, which must be part of mining companies’ operations. The mining community continues to struggle to carry out this communication, based to a great extent on the rapid advancement of social media and strong environmental lobby groups.

In recent years Peru has seen a number highly publicized mega projects being postponed over environmental or community concerns, strikes and anti-mining protests, including the US$ 4.8 billion Conga project, Tia Maria (SPCC), Rio Blanco (Zijin), Cañariaco (Candente Copper). There is belief that community groups are manipulated by politicians, anti-mining NGO’s and other groups with wider political agendas.

The need for a social license to operate is readily accepted by the mining and metals sector. The Canadian Trade Commission Service have a world leading program to educate mining management on Corporate Social Responsibility as the corner stone of social license.

By managing an effective communication process highlighting the positive impact of mining through productive, profitable and sustainable development, initiatives can show the Peruvian government, communities and other stakeholders how their presence in the country can create positive economic and social contributions. This relies on working with local communities to create shared value, listening to what they want, rather than just coming up with initiatives that are not tailored to their needs.

Community support for a project is partly dependent on its economic participation and local employment is an important element of that. Meanwhile, the government is increasingly seeking to fill the gap between community expectations and existing legislation which require community consultation for the development of new projects with increased regulations.

http://sesprofessionals.com/overview-of-perus-mining-industr…

http://sesprofessionals.com/overview-of-perus-mining-industry/#stageexploration

As in many developing countries, achieving a social license to operate is the single most important challenge that the mining industry faces in Peru. Income and regional inequalities continue to be a source of social conflicts, which have had a negative impact on a number of mining projects.

Achieving a social license to operate is one challenge, maintaining it is another. The key to both is communicating value through the concept of shared value and, more broadly, of corporate social responsibility, which must be part of mining companies’ operations. The mining community continues to struggle to carry out this communication, based to a great extent on the rapid advancement of social media and strong environmental lobby groups.

In recent years Peru has seen a number highly publicized mega projects being postponed over environmental or community concerns, strikes and anti-mining protests, including the US$ 4.8 billion Conga project, Tia Maria (SPCC), Rio Blanco (Zijin), Cañariaco (Candente Copper). There is belief that community groups are manipulated by politicians, anti-mining NGO’s and other groups with wider political agendas.

The need for a social license to operate is readily accepted by the mining and metals sector. The Canadian Trade Commission Service have a world leading program to educate mining management on Corporate Social Responsibility as the corner stone of social license.

By managing an effective communication process highlighting the positive impact of mining through productive, profitable and sustainable development, initiatives can show the Peruvian government, communities and other stakeholders how their presence in the country can create positive economic and social contributions. This relies on working with local communities to create shared value, listening to what they want, rather than just coming up with initiatives that are not tailored to their needs.

Community support for a project is partly dependent on its economic participation and local employment is an important element of that. Meanwhile, the government is increasingly seeking to fill the gap between community expectations and existing legislation which require community consultation for the development of new projects with increased regulations.

http://sesprofessionals.com/overview-of-perus-mining-industr…

http://sesprofessionals.com/overview-of-perus-mining-industry/#stageexploration

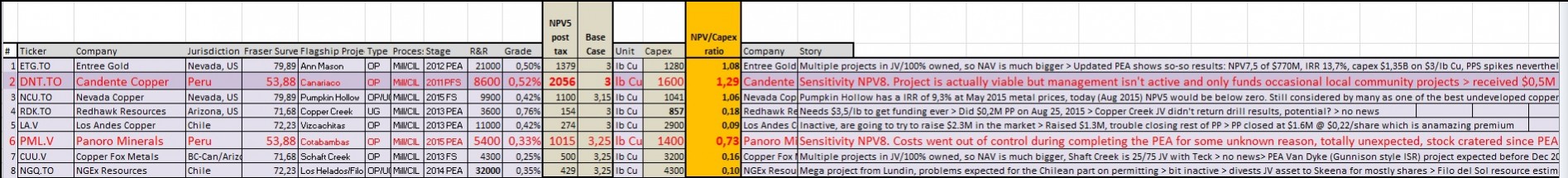

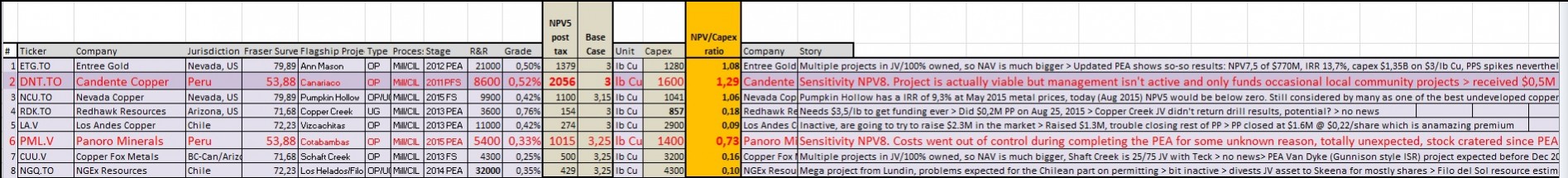

Antwort auf Beitrag Nr.: 55.171.271 von sir_krisowaritschko am 20.06.17 14:29:08Quelle: http://www.criticalinvestor.eu/leveraged

die anmerkungen zu nevada copper und panoro z.b. sind recht zutreffend. und selbst die beiden sind noch 4 mal höher bewertet als dnt.

https://www.wallstreet-online.de/diskussion/500-beitraege/11…

Ich habe mich an Zeiten erinnert, in denen Candente sogar wohl über 1,50Euro lag. Und ich ein recht

glückliches Händchen beim wechseln zwischen Peregrine und Candente hatte.

Damals, also wohl 2011, gab es nach meiner Erinnerung eine Machbarkeitsstudie und es wurde ein Kapitalbedarf von 1,55 Mrd. USD ermittelt. Da ich nicht glaube, daß es billiger wird, habe ich stark gerundet.

Isi

Ich habe mich an Zeiten erinnert, in denen Candente sogar wohl über 1,50Euro lag. Und ich ein recht

glückliches Händchen beim wechseln zwischen Peregrine und Candente hatte.

Damals, also wohl 2011, gab es nach meiner Erinnerung eine Machbarkeitsstudie und es wurde ein Kapitalbedarf von 1,55 Mrd. USD ermittelt. Da ich nicht glaube, daß es billiger wird, habe ich stark gerundet.

Isi