VanadiumCorp, ehemals PacificOre Mining - 500 Beiträge pro Seite

eröffnet am 29.04.08 11:24:20 von

neuester Beitrag 04.04.22 13:11:55 von

neuester Beitrag 04.04.22 13:11:55 von

Beiträge: 237

ID: 1.140.822

ID: 1.140.822

Aufrufe heute: 0

Gesamt: 14.734

Gesamt: 14.734

Aktive User: 0

ISIN: CA9214281086 · WKN: A1W9KM

0,0175

USD

+9,38 %

+0,0015 USD

Letzter Kurs 15.04.22 Nasdaq OTC

Werte aus der Branche Stahl und Bergbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 42,93 | +19,98 | |

| 247,15 | +16,31 | |

| 3.200,00 | +15,90 | |

| 3,0470 | +11,82 | |

| 12,040 | +11,38 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6280 | -7,10 | |

| 33,00 | -7,30 | |

| 0,5510 | -8,17 | |

| 50.000,00 | -8,76 | |

| 4,6500 | -10,23 |

APELLA LAUNCHES DRILL PROGRAM ON TOUCHDOWN GOLD PROJECT

17 Apr 2008 - 11:30am

Apella Resources Inc. (TSX.V Symbol - (APA); Frankfurt Symbol - (NWN), and its Board of Directors are pleased to announce that the Company is commencing a 2,500 to 3,000 meter diamond drill program consisting of approximately 10 holes, on its wholly owned Touchdown Gold project. The company will be drilling targets identified in its recent compilation and assessment of the Companies Crone Pulse EM Surface survey coupled withthe recent Government of Quebec’s (GSC) Airborne MEGATEM Survey.

The Touchdown is part of Apella’s Chibougamau Assemblage, and is located near the town of Chapais, in central Quebec. In 1987, Minnova Inc. reported a drill defined resource estimate of 163,295 tonnes grading 5.83 g/t gold on the property. Apella is not treating the historical resource estimate as a National Instrument 43-101 defined resource for reserves verified by a qualified person and the historical resource estimate should not be relied upon. The reported drill defined resource is included in this press release for illustrative purposes only and should not be disclosed or interpreted out of context.

The qualified person for the purposes of this news release is Dr. Christian G. Derosier, P.Geo.

Apella invites the public to visit its NEW website at http://www.Apellaresources.com or e-mail us at Apella@Apellaresources.com to be added to the Company’s e-mail list for press releases and updates.

ON BEHALF OF THE BOARD OF DIRECTORS OF APELLA RESOURCES INC.

“Patrick D. O’Brien”

Patrick D. O’Brien – Chairman

17 Apr 2008 - 11:30am

Apella Resources Inc. (TSX.V Symbol - (APA); Frankfurt Symbol - (NWN), and its Board of Directors are pleased to announce that the Company is commencing a 2,500 to 3,000 meter diamond drill program consisting of approximately 10 holes, on its wholly owned Touchdown Gold project. The company will be drilling targets identified in its recent compilation and assessment of the Companies Crone Pulse EM Surface survey coupled withthe recent Government of Quebec’s (GSC) Airborne MEGATEM Survey.

The Touchdown is part of Apella’s Chibougamau Assemblage, and is located near the town of Chapais, in central Quebec. In 1987, Minnova Inc. reported a drill defined resource estimate of 163,295 tonnes grading 5.83 g/t gold on the property. Apella is not treating the historical resource estimate as a National Instrument 43-101 defined resource for reserves verified by a qualified person and the historical resource estimate should not be relied upon. The reported drill defined resource is included in this press release for illustrative purposes only and should not be disclosed or interpreted out of context.

The qualified person for the purposes of this news release is Dr. Christian G. Derosier, P.Geo.

Apella invites the public to visit its NEW website at http://www.Apellaresources.com or e-mail us at Apella@Apellaresources.com to be added to the Company’s e-mail list for press releases and updates.

ON BEHALF OF THE BOARD OF DIRECTORS OF APELLA RESOURCES INC.

“Patrick D. O’Brien”

Patrick D. O’Brien – Chairman

CRONE’S PULSE EM SURFACE SURVEY RESULTS

16 Apr 2008 - 8:00am

Apella Resources Inc. (TSX.V Symbol - (APA); Frankfurt Symbol - (NWN), and its Board of Directors are pleased to announce the results obtained from the Crone Pulse EM Surface

survey carried out on its Touchdown Property which is part of the company's Chibougamau Assemblage located in the Chapais area, Province of Quebec. These results which are detailed in the following paragraphs, added to a recent compilation of all geological data, including the underground exploration work, permit to justify an aggressive drilling program which will be undertaken as soon as a drill rig is available. The equipment used for the surface survey was a Crone Pulse EM Surface system and for the drill hole survey, was a 3D borehole Pulse EM.

The survey was conducted to confirm the presence of three Megatem anomalies and to test the extension at depth of previous EM conductors picked-up by past owners of the

claims. Three large loops were designed to provide good coupling to steeply dipping structures and to ensure that any targets of interest within the survey area would be well energized.

Conductor 1A exhibits high conductivity and would rank as a very high priority massive sulphide target. This conductor is associated with felsic volcanic rocks which extend along the northern shore of Laura Lake. Top of the conductor anomaly is suggested at a depth of 200m with a conductance in excess of 100S.

Conductor 2A was picked-up on three consecutive lines (300 m). A short wavelength response indicated a near surface source (25 - 50 m) with an excellent conductivity. Conductors 3A and 4A were rated as low priority.

Six diamond drill holes were tested with the 3D borehole Pulse EM. Results of this survey appear somewhat complex, but several discrete anomalous sources are readily evident in hole TD7-1. Holes TD7-2 and TD7-3 show subtle build-up in the middle and near the end suggesting the presence of conductors located beyond the end of the hole.

The qualified person for the purposes of this news release is Dr. Christian G. Derosier, MSc, DSc, geology.

Apella invites the public to visit its NEW website at http://www.Apellaresources.com or e-mail us at Apella@Apellaresources.com to be added to the Company's e-mail list for press releases and updates.

ON

BEHALF OF THE BOARD OF DIRECTORS OF APELLA RESOURCES INC.

"Patrick D. O'Brien"

Patrick

D. O'Brien - Chairman

S.E.C.Exemption12(g)3-2(b) File

No. 82-3822, Standard & Poors Listed, Dun & Bradstreet Listed.

16 Apr 2008 - 8:00am

Apella Resources Inc. (TSX.V Symbol - (APA); Frankfurt Symbol - (NWN), and its Board of Directors are pleased to announce the results obtained from the Crone Pulse EM Surface

survey carried out on its Touchdown Property which is part of the company's Chibougamau Assemblage located in the Chapais area, Province of Quebec. These results which are detailed in the following paragraphs, added to a recent compilation of all geological data, including the underground exploration work, permit to justify an aggressive drilling program which will be undertaken as soon as a drill rig is available. The equipment used for the surface survey was a Crone Pulse EM Surface system and for the drill hole survey, was a 3D borehole Pulse EM.

The survey was conducted to confirm the presence of three Megatem anomalies and to test the extension at depth of previous EM conductors picked-up by past owners of the

claims. Three large loops were designed to provide good coupling to steeply dipping structures and to ensure that any targets of interest within the survey area would be well energized.

Conductor 1A exhibits high conductivity and would rank as a very high priority massive sulphide target. This conductor is associated with felsic volcanic rocks which extend along the northern shore of Laura Lake. Top of the conductor anomaly is suggested at a depth of 200m with a conductance in excess of 100S.

Conductor 2A was picked-up on three consecutive lines (300 m). A short wavelength response indicated a near surface source (25 - 50 m) with an excellent conductivity. Conductors 3A and 4A were rated as low priority.

Six diamond drill holes were tested with the 3D borehole Pulse EM. Results of this survey appear somewhat complex, but several discrete anomalous sources are readily evident in hole TD7-1. Holes TD7-2 and TD7-3 show subtle build-up in the middle and near the end suggesting the presence of conductors located beyond the end of the hole.

The qualified person for the purposes of this news release is Dr. Christian G. Derosier, MSc, DSc, geology.

Apella invites the public to visit its NEW website at http://www.Apellaresources.com or e-mail us at Apella@Apellaresources.com to be added to the Company's e-mail list for press releases and updates.

ON

BEHALF OF THE BOARD OF DIRECTORS OF APELLA RESOURCES INC.

"Patrick D. O'Brien"

Patrick

D. O'Brien - Chairman

S.E.C.Exemption12(g)3-2(b) File

No. 82-3822, Standard & Poors Listed, Dun & Bradstreet Listed.

APELLA COMMENCES GEOPHYSICS PROGRAM ON LOST ISLAND PROJECT

11 Apr 2008 - 12:00pm

Vancouver, BC - Friday, April 11th 2008, 12:00 p.m. PDT

Apella Resources Inc. (TSX.V Symbol (APA); Frankfurt Symbol (NWN), and its Board of Directors are pleased to announce that the Company has completed twenty-four kilometers of line cutting and a cut line grid on its Lost Island Project in Chibougamau, Quebec. Apella has now commenced a Geophysical program on the Lost Island property, to investigate various gold showings/anomalies that were previously identified using an Airborne Magnetic Survey.

The Lost Island Project is ideally situated on the southern shore of Lac Merrill and is easily accessible by service road from highway 113 and highway 167. These claims include a government soil geochemistry anomaly of 140 ppb Au and two copper showings. The Company is now in the process of compiling and interpreting all of its results to date in order to establish a timetable for follow-up exploration, which is expected to include diamond drilling.

Apella invites the public to visit its NEW website at http://www.Apellaresources.com or e-mail us at Apella@Apellaresources.com to be added to the Company's e-mail list for press releases and updates.

ON BEHALF OF THE BOARD OF DIRECTORS OF APELLA RESOURCES INC.

"Patrick D. O'Brien"

Patrick D. O'Brien - Chairman

11 Apr 2008 - 12:00pm

Vancouver, BC - Friday, April 11th 2008, 12:00 p.m. PDT

Apella Resources Inc. (TSX.V Symbol (APA); Frankfurt Symbol (NWN), and its Board of Directors are pleased to announce that the Company has completed twenty-four kilometers of line cutting and a cut line grid on its Lost Island Project in Chibougamau, Quebec. Apella has now commenced a Geophysical program on the Lost Island property, to investigate various gold showings/anomalies that were previously identified using an Airborne Magnetic Survey.

The Lost Island Project is ideally situated on the southern shore of Lac Merrill and is easily accessible by service road from highway 113 and highway 167. These claims include a government soil geochemistry anomaly of 140 ppb Au and two copper showings. The Company is now in the process of compiling and interpreting all of its results to date in order to establish a timetable for follow-up exploration, which is expected to include diamond drilling.

Apella invites the public to visit its NEW website at http://www.Apellaresources.com or e-mail us at Apella@Apellaresources.com to be added to the Company's e-mail list for press releases and updates.

ON BEHALF OF THE BOARD OF DIRECTORS OF APELLA RESOURCES INC.

"Patrick D. O'Brien"

Patrick D. O'Brien - Chairman

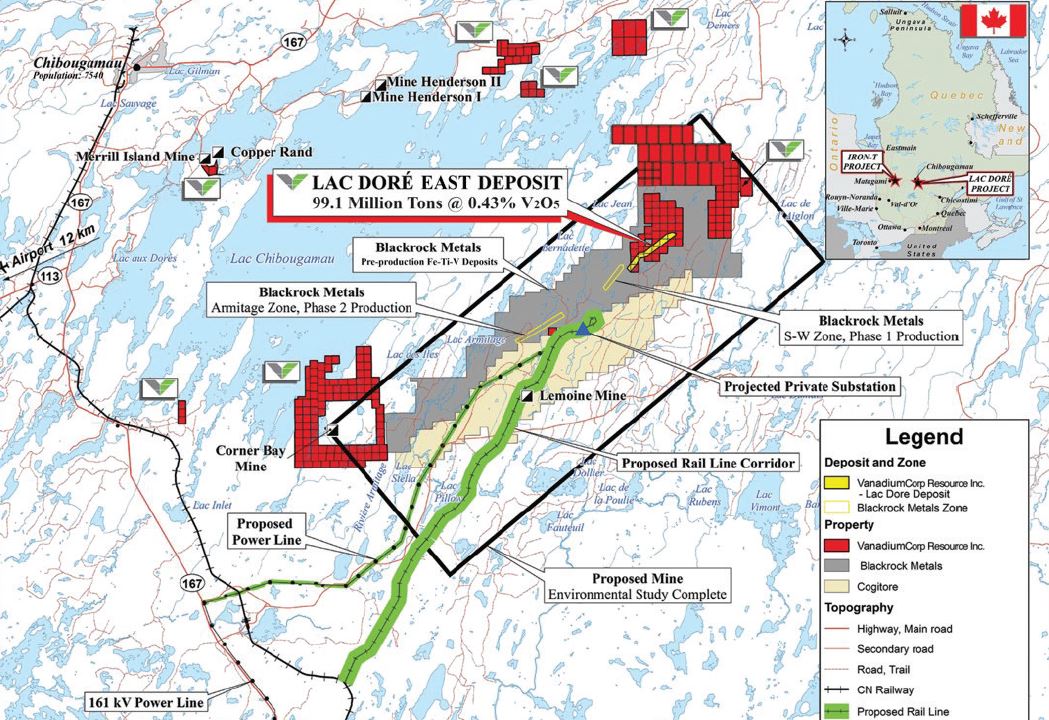

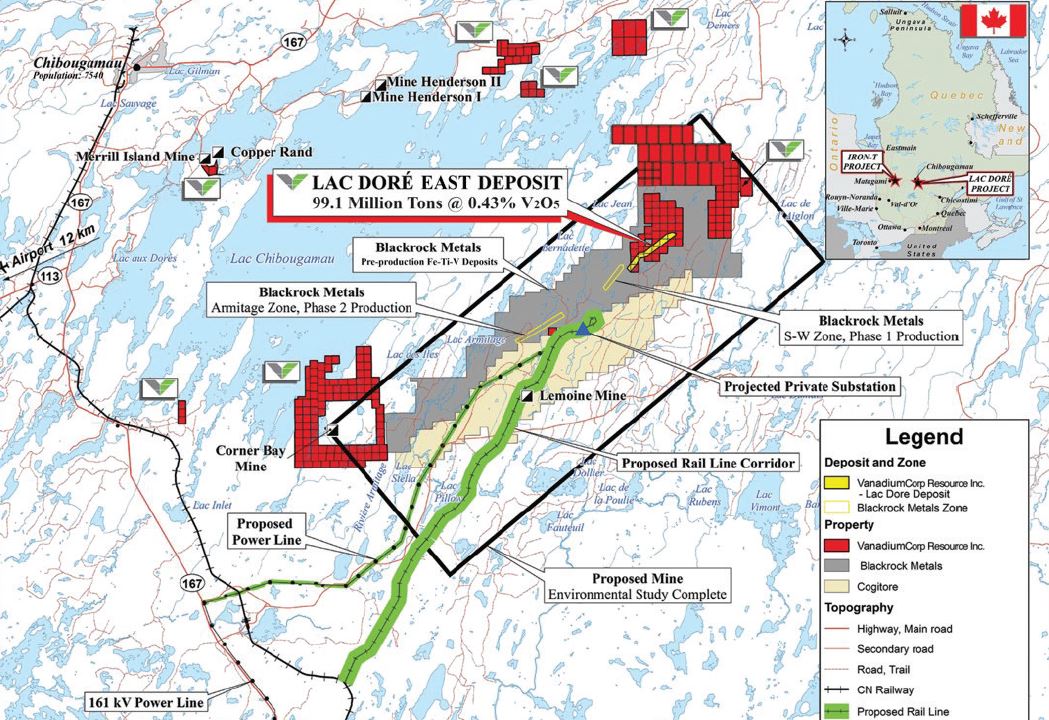

APELLA RESOURCES SIGNIFICANTLY INCREASES LAC DORE VANADIUM INTERESTS

2 Apr 2008 - 7:30am

Vancouver, BC - Wednesday, April 2nd 2008, 7:30 a.m. PDT

Apella Resources Inc. (TSX.V Symbol (APA); Frankfurt Symbol (NWN), and its Board of Directors are pleased to announce that the Company has acquired 30 additional mining claims in the Lac Dore Vanadium camp, increasing its Lac Dore interests by 60%.

One of the claims acquired, hosts a historical drill hole (DDH-13), pre NI 43-101 figures, that contained two significant, key mineralized intersections as follows:

· First key intersection: 40.18 meters long ran from 2 meters below surface to the 42 meter mark. It assayed 0.45% (V205) Vanadium Pentoxide and 7.09% (Ti02) Titanium Oxide over the 40.18 meters.

· Second key intersection: 98.00 meters long ran from the 85 meter mark to the 183 meter mark. It assayed 1.32% (V205) Vanadium Pentoxide and 8.05% (Ti02) Titanium Oxide over the 98.00 meters.

Included in these new interests are also 12 claims acquired to incorporate the potential for Platinum and Palladium which, like the Bushveld in South Africa, is commonly found to be associated with Vanadium deposits.

Apella has established itself at the forefront of North American vanadium exploration and development. The Company is committed to a strategic goal of attaining production through decisive acquisition and development. To date, North America has no primary sources of Vanadium production but Apella is poised to become the first.

The qualified person for the purposes of this news release is Dr. Christian G. Derosier, MSc, DSc, geology.

Apella invites the public to visit its NEW website at http://www.Apellaresources.com or e-mail us at Apella@Apellaresources.com to be added to the Company's e-mail list for press releases and updates.

ON BEHALF OF THE BOARD OF DIRECTORS OF APELLA RESOURCES INC.

"Patrick D. O'Brien"

Patrick D. O'Brien - Chairman

2 Apr 2008 - 7:30am

Vancouver, BC - Wednesday, April 2nd 2008, 7:30 a.m. PDT

Apella Resources Inc. (TSX.V Symbol (APA); Frankfurt Symbol (NWN), and its Board of Directors are pleased to announce that the Company has acquired 30 additional mining claims in the Lac Dore Vanadium camp, increasing its Lac Dore interests by 60%.

One of the claims acquired, hosts a historical drill hole (DDH-13), pre NI 43-101 figures, that contained two significant, key mineralized intersections as follows:

· First key intersection: 40.18 meters long ran from 2 meters below surface to the 42 meter mark. It assayed 0.45% (V205) Vanadium Pentoxide and 7.09% (Ti02) Titanium Oxide over the 40.18 meters.

· Second key intersection: 98.00 meters long ran from the 85 meter mark to the 183 meter mark. It assayed 1.32% (V205) Vanadium Pentoxide and 8.05% (Ti02) Titanium Oxide over the 98.00 meters.

Included in these new interests are also 12 claims acquired to incorporate the potential for Platinum and Palladium which, like the Bushveld in South Africa, is commonly found to be associated with Vanadium deposits.

Apella has established itself at the forefront of North American vanadium exploration and development. The Company is committed to a strategic goal of attaining production through decisive acquisition and development. To date, North America has no primary sources of Vanadium production but Apella is poised to become the first.

The qualified person for the purposes of this news release is Dr. Christian G. Derosier, MSc, DSc, geology.

Apella invites the public to visit its NEW website at http://www.Apellaresources.com or e-mail us at Apella@Apellaresources.com to be added to the Company's e-mail list for press releases and updates.

ON BEHALF OF THE BOARD OF DIRECTORS OF APELLA RESOURCES INC.

"Patrick D. O'Brien"

Patrick D. O'Brien - Chairman

hey, 30% plus an einem tag, wer weis was darüber?

Antwort auf Beitrag Nr.: 34.340.807 von gobu am 20.06.08 13:22:49Muß man nur auf der Homepage nachlesen. Die haben wohl zusätzliche Claims in dem Vanadium-Projekt zugesprochen bekommen. Und alten Informationen nach soll dieses Vanadium-Vorkommen das 2.größte auf der Welt sein.

Antwort auf Beitrag Nr.: 34.340.807 von gobu am 20.06.08 13:22:49Muß man nur auf der Homepage nachlesen. Die haben wohl zusätzliche Claims in dem Vanadium-Projekt zugesprochen bekommen. Und alten Informationen nach soll dieses Vanadium-Vorkommen das 2.größte auf der Welt sein.

Ich habe letzte woche ein ganz interessante Gespräch mit dem Vize Präsident Adrien O`Brien gehabt.

Infolge dessen habe ich mir eine kleinere Posi ins Depot geholt. Auch wenn für mich noch einige Risiken zu erkennen sind, überwiegen meiner meinung nach die Argumente für einen spekulativen kauf.

Laut Mr. O`brien sind momentan ca. 102.000.000 Aktien und Warrents (fully diluted) ausstehend, was dann einer MK von ca. 15 millionen Can Dollar entspricht.

Desweiteren haben sie, unter anderem aus einem Claimverkauf ca. 2,3millionen Cash on Hand + Aktien und Warrents von Goldbrooks, ich meine ca. 2millionen Aktien + 1,5 millionen Warrents.

Ältere Financials sind auf SEDAR einsehbar.

Und nun wirds spannend, Apella ist die ehemalige Novawest, laut Mr. O`Brien, ist die Firma schon über 10 Jahre in Quebec und Ontario tätig gewesen.

Die Claims in Ontarion, sind in die Spin off company pro minerals eingebracht worden.

- Lac Dore und Iron T haben wohl wirklich das potential ein top Vanadium Project zu werden, ähnlich gute Grades wie bei Largo.

Man sehe sich nur mal Largo Resources und die Performance die letzten Wochen an, wenn die Angaben von Apella stimmen, dann hat apella 10 mal mehr im Boden als Largo bei ihrem Marcaras project. Und dass bei grades die auch über 1% V205

liegen.

Zitat website Apella: „The deposit contains inferred mineable vanadium pentoxide resources of about 5.5 billion pounds” laut Mr. O`Brien leicht abbaubar.

Dazu nochmal das iron t project.

Ein Analyst schreibt zu Largo und deren Marcaras Prospect:

Bullish prices and sustained demand are good news for Largo in light of its recently announced ferrovanadium off-take agreement with Glencore, whereby Glencore agreed to buy Maracas’ production at a discount to spot prices (see our note from May 15, 2008) for six years with an additional six year option. Current prices are well above our long-term ferrovanadium price assumption of $23 per kilogram, which we used in our cash-flow model of the Maracas Project. Below is a table summarizing the NPVPS (fully financed) sensitivity to the ferrovanadium price assuming a 5 million kg of ferrovanadium per year production scenario. Note that this scenario is better than the 4 million kgs per year we used to generate our original NAV and $1.75/share target. Our original NAV incorporated a risk adjusted value for the incremental production assuming a 15% probability of success in ramping production from 4 million to 5 million kgs. For ease of comparison we have re-run our model at the estimated 5 million kgs per year ferrovanadium production.”

Vanadium scheint also wirklich interessant!

More information coming soon...

Infolge dessen habe ich mir eine kleinere Posi ins Depot geholt. Auch wenn für mich noch einige Risiken zu erkennen sind, überwiegen meiner meinung nach die Argumente für einen spekulativen kauf.

Laut Mr. O`brien sind momentan ca. 102.000.000 Aktien und Warrents (fully diluted) ausstehend, was dann einer MK von ca. 15 millionen Can Dollar entspricht.

Desweiteren haben sie, unter anderem aus einem Claimverkauf ca. 2,3millionen Cash on Hand + Aktien und Warrents von Goldbrooks, ich meine ca. 2millionen Aktien + 1,5 millionen Warrents.

Ältere Financials sind auf SEDAR einsehbar.

Und nun wirds spannend, Apella ist die ehemalige Novawest, laut Mr. O`Brien, ist die Firma schon über 10 Jahre in Quebec und Ontario tätig gewesen.

Die Claims in Ontarion, sind in die Spin off company pro minerals eingebracht worden.

- Lac Dore und Iron T haben wohl wirklich das potential ein top Vanadium Project zu werden, ähnlich gute Grades wie bei Largo.

Man sehe sich nur mal Largo Resources und die Performance die letzten Wochen an, wenn die Angaben von Apella stimmen, dann hat apella 10 mal mehr im Boden als Largo bei ihrem Marcaras project. Und dass bei grades die auch über 1% V205

liegen.

Zitat website Apella: „The deposit contains inferred mineable vanadium pentoxide resources of about 5.5 billion pounds” laut Mr. O`Brien leicht abbaubar.

Dazu nochmal das iron t project.

Ein Analyst schreibt zu Largo und deren Marcaras Prospect:

Bullish prices and sustained demand are good news for Largo in light of its recently announced ferrovanadium off-take agreement with Glencore, whereby Glencore agreed to buy Maracas’ production at a discount to spot prices (see our note from May 15, 2008) for six years with an additional six year option. Current prices are well above our long-term ferrovanadium price assumption of $23 per kilogram, which we used in our cash-flow model of the Maracas Project. Below is a table summarizing the NPVPS (fully financed) sensitivity to the ferrovanadium price assuming a 5 million kg of ferrovanadium per year production scenario. Note that this scenario is better than the 4 million kgs per year we used to generate our original NAV and $1.75/share target. Our original NAV incorporated a risk adjusted value for the incremental production assuming a 15% probability of success in ramping production from 4 million to 5 million kgs. For ease of comparison we have re-run our model at the estimated 5 million kgs per year ferrovanadium production.”

Vanadium scheint also wirklich interessant!

More information coming soon...

schönes plus in can gestern + 33% hoch gekommen von 0.075 im ATL so kann es weitergehen , wenn die 0,15 hält sollte es weiter hochgehen, werde heute nachmittag (hoffentlich) meine kurze übersicht weiterführen, bin mom, zu sehr auf quest fixiert, hammer gewinne halt.

na ja wenn das pferd durch sein sollte (nicht das die aktie schlecht ist, quest mein ich, aber auf wellen soll man reiten, es sei denn man hat so ne langfristperle im visier.)

ist hier sonst noch jemand interessiert???

na ja wenn das pferd durch sein sollte (nicht das die aktie schlecht ist, quest mein ich, aber auf wellen soll man reiten, es sei denn man hat so ne langfristperle im visier.)

ist hier sonst noch jemand interessiert???

Sicher!

Wenn die restlichen Claims(Lac Dore)auch an APA gehen,dann ,sitzen Wir auf einem Pulverfass!

,sitzen Wir auf einem Pulverfass!

Wenn die restlichen Claims(Lac Dore)auch an APA gehen,dann

,sitzen Wir auf einem Pulverfass!

,sitzen Wir auf einem Pulverfass!

Antwort auf Beitrag Nr.: 34.360.734 von schmacki am 24.06.08 11:42:14was ist dein kursziel auf 6 bzw. 12 monate?

hast du irgendwelche konstruktive infos beizusteuern, lass uns den theart doch mal ein wenig hochfahren, schau bei largo rein, vanadium ist heiß wenn die jungs von w:o begreifen was hier für ein potential ist, wirds nen 10bagger, vielleicht noch ein schöner bäcker, zürich oder sonst was push and we go for it!

hast du irgendwelche konstruktive infos beizusteuern, lass uns den theart doch mal ein wenig hochfahren, schau bei largo rein, vanadium ist heiß wenn die jungs von w:o begreifen was hier für ein potential ist, wirds nen 10bagger, vielleicht noch ein schöner bäcker, zürich oder sonst was push and we go for it!

APA braucht keinen Push!!Lac Dore hat 50 Mrd.Dollar oder noch mehr im Boden!!!

Antwort auf Beitrag Nr.: 34.362.308 von schmacki am 24.06.08 14:24:06allerdings auch noch einige unsicherheiten und keinen management bonus, um sinne die haben es dort oder da schon mal vorgemacht wie es geht.

Angebliche Mrd. Reserven habe ich schon von hunderten explorern gehört, die jetzt zum teil bei 0,01 E rumhuschen und mit mk`S von unter 3mio

was schätzt du kurszieltechnisch?

Angebliche Mrd. Reserven habe ich schon von hunderten explorern gehört, die jetzt zum teil bei 0,01 E rumhuschen und mit mk`S von unter 3mio

was schätzt du kurszieltechnisch?

Antwort auf Beitrag Nr.: 34.362.056 von teatimenow am 24.06.08 13:56:43

was bringt Dir ein Kursziel??

aber bei Bedarf geb ich Dir eins aus,

kannst dann da auch Deine Vorstellungen mit einfliessen lassen,

einzige Bedingung:

es muss >5 E liegen.

was bringt Dir ein Kursziel??

aber bei Bedarf geb ich Dir eins aus,

kannst dann da auch Deine Vorstellungen mit einfliessen lassen,

einzige Bedingung:

es muss >5 E liegen.

Antwort auf Beitrag Nr.: 34.362.567 von Popeye82 am 24.06.08 14:49:37also lassen wir mal die gold-copper deposits bei seite, evt. könnte apella die auch zum teil verkaufen um cash für die beiden vanadium projekte aufzubringen.

also lac dore soll 5.5 billion also milliarden pound V2O5 im boden haben, das leicht abbaubar ist.

der momentane marktpreis liegt laut www.minormetals.com etwa bei 18 dollar lb.

hm 5.5mrd * sagen wir 10 $ (konsevativ) wären allein resourcen im wert von 55mrd. die aktuelle mk ist ca. 18 millionen can dollar. ergo:

Apella`s Lac Dore (und apella hat ja noch mehr) ist mit weniger als 0,1% seiner resourcen bewertet.

ich denke 5 can dollar wären schon denkbar.

also lac dore soll 5.5 billion also milliarden pound V2O5 im boden haben, das leicht abbaubar ist.

der momentane marktpreis liegt laut www.minormetals.com etwa bei 18 dollar lb.

hm 5.5mrd * sagen wir 10 $ (konsevativ) wären allein resourcen im wert von 55mrd. die aktuelle mk ist ca. 18 millionen can dollar. ergo:

Apella`s Lac Dore (und apella hat ja noch mehr) ist mit weniger als 0,1% seiner resourcen bewertet.

ich denke 5 can dollar wären schon denkbar.

Antwort auf Beitrag Nr.: 34.362.667 von teatimenow am 24.06.08 14:59:42

Ich frag nur was es Dir bringt?!

Kann ich Dir sehr leicht sagen: Gar nichts!

Ich frag nur was es Dir bringt?!

Kann ich Dir sehr leicht sagen: Gar nichts!

Antwort auf Beitrag Nr.: 34.362.865 von Popeye82 am 24.06.08 15:19:21Kursziel regt die fantasie an, und spekulationen - außerdem können verschiedene errechnete Kursziele durchaus investitions hilfe sein. Bei Apella aber wohl alles noch sehr früh ...

Ps: Bei deinen zig tausend auflistungen an unternehmensnachrichten und "sehe, sehr, sehr interessanten" werten - ist auch nicht gerade die logisch.

So

Ps: Bei deinen zig tausend auflistungen an unternehmensnachrichten und "sehe, sehr, sehr interessanten" werten - ist auch nicht gerade die logisch.

So

Antwort auf Beitrag Nr.: 34.363.152 von Diego22 am 24.06.08 15:44:26

Hallo Diego,

mal eine(ernstgemeinte!) Frage

-war mir jetzt nicht ganz klar, ob der letzte Absatz

positiv gemeint, oder als kleiner Seitenhieb zu verstehen

ist?? -könnte mit beidem leben.

Hallo Diego,

mal eine(ernstgemeinte!) Frage

-war mir jetzt nicht ganz klar, ob der letzte Absatz

positiv gemeint, oder als kleiner Seitenhieb zu verstehen

ist?? -könnte mit beidem leben.

Wozu wird Vanadium gebraucht? Hier ist eine sicher sehr interessante Anwendung im Zusammenhang mit erneuerbaren Energien:

http://www.treehugger.com/files/2005/04/the_vanadium_ba.php

http://www.treehugger.com/files/2005/04/the_vanadium_ba.php

Apella Commences Vanadium-Titanium Exploration at Lac Dore North

Thursday October 2, 11:00 am ET

http://biz.yahoo.com/cnw/081002/apella_explrtn_updt.html?.v=…

Thursday October 2, 11:00 am ET

http://biz.yahoo.com/cnw/081002/apella_explrtn_updt.html?.v=…

Top-Vergleich

Berufsunfähigkeit: Mit der richtigen Versicherung bis zu 39% sparen (incl. 5% InsuranceCity Rabatt)

Der Wechsel lohnt sich!

Privat krankenversichert schon ab 59 €* pro Monat – Sparen Sie mit MLP bis zu 2400 €!

Dr. Peters-Rendite Fonds

Beteiligt am Wachstumsmarkt Schifffahrt: 202% Gesamtauszahlung + nahezu steuerfrei!

Abacho.de Logo

Wählen Sie die Ansicht Ihrer Abacho Startseite:

Abacho PortalAbacho Suche

Suche

in

szmtag

Startseite

Suche

News

Auto

Übersetzer

Reisen

Mail/SMS

FreeMail SMS-Versand Telefonkonferenz

My-Hammer - Handwerksauktionen

Kleinanzeigen

Service

Service

Chat

Abacho als Startseite

Abacho4you

Abacho Studien

Abacho Newsletter

Abacho Toolbar

Sie sind hier: Startseite › Mail/SMS › FreeMail

31.10.2008

Voicemail Sprachdienst Kalender Dateien Links Einstellungen Syncronisierung Tools Hilfe AGB

Von Apella Resources Inc.<w.adrian@apellaresources.com>

eMail 2 von 21

An: karstenl@abacho.de

Empfangen: Do 30 Okt 2008 20:38

CC:

Zum Posteingang

News from Apella Resources Inc.

Apella Resources Inc. Header

News Release

IRON-T Vanadium-Titanium Project Delivers Very Encouraging

Vanadium and Titanium Assay Results

October 30th 2008, 11:00 a.m. PDT

Apella Resources Inc. (TSX.V Symbol (APA); Frankfurt Symbol (NWN), is pleased to announce that the company has received assays from its recent channel sampling program carried out on the 100% owned Iron-T Vanadium-Titanium project situated near the mining centre of Matagami in central Quebec. Apella's claims cover a significant portion of the renowned Bell River Complex, where previous exploration work carried out by Noranda Inc. during the 1990's delineated and confirmed the presence of Vanadium, Titanium and Iron mineralization over a distance of about 20 km. Vanadium and Titanium results in the tables below are expressed as a percentage. To convert Vanadium assays to Vanadium Pentoxide (V2O5) equivalents as these are commonly utilized and quoted by the industry, we multiplied the assay results by the required factor of 1.785.The Vanadium values of the mineralized horizons, as shown in the tables below, are equivalent to those of current primary Vanadium producers and potential new producers, globally. The samples were analyzed for a total of 25 elements including the major elements phosphorus and sulfur. Low levels of these particular two elements is important and the sampling results have provided confirmation that the levels of these two elements are indeed very low, meeting or exceeding industry maximum standard levels. The levels of Vanadium and Titanium are very encouraging. Typical grades of currently exploited deposits are in the order of 0.50% V2O5 with a break-even point at the current Vanadium prices, of 0.20% V2O5. The current market prices of Vanadium Pentoxide at $13.50 USD/LB, and Titanium at $14.00 USD/LB have remained stable.

Results of assays are as follows:

Consulting Geologist's sampling:

Sample Number Fe% P% S% TiO2% V% V2O5%

224925 39.60 <0.001 0.581 9.96 0.33 0.589

224926 43.30 <0.001 0.198 11.45 0.37 .660

Apella's field sampling

Sample

Number Fe% P% S% TiO2% V% V2O5%

825401 11.45 0.007 0.425 1.86 0.077 0.137

825402 8.87 0.012 0.287 1.39 0.053 0.095

825403 24.70 <0.001 0.626 5.50 0.203 0.362

825404 39.00 <0.001 0.245 10.15 0.378 0.675

825405 27.10 0.001 0.511 5.75 0.208 0.371

825406 32.80 <0.001 0.503 7.42 0.251 0.448

825407 37.60 <0.001 0.525 9.30 0.300 0.536 825408 39.20 <0.001 0.572 9.79 0.317 0.566

825409 31.90 0.001 0.941 7.01 0.222 0.396

825410 22.30 0.001 0.309 4.93 0.180 0.321

825411 32.70 <0.001 0.432 8.15 0.290 0.518

825412 36.10 <0.001 0.183 9.24 0.331 0.591

825413 36.00 <0.001 0.716 8.65 0.309 0.552

825414 38.20 0.002 0.595 9.36 0.323 0.577

825415 41.20 <0.001 0.566 10.65 0.340 0.607

825416 43.60 <0.001 0.392 11.50 0.365 0.652

825417 32.30 0.001 0.544 7.40 0.241 0.430

825418 27.20 <0.001 0.127 6.76 0.239 0.427

825419 47.10 <0.001 0.279 12.90 0.459 0.819

825420 26.70 <0.001 0.250 6.00 0.221 0.394

825421 35.90 <0.001 0.552 8.70 0.310 0.553

825422 39.40 <0.001 0.608 9.48 0.329 0.587

825423 45.30 <0.001 0.399 12.20 0.380 0.678

825424 37.80 <0.001 0.462 9.40 0.305 0.544

825425 35.60 <0.001 0.524 8.65 0.270 0.482m

The Iron-T is centered just 10 km east of the town of Matagami, Quebec. Since 1963 and the discovery of the Bell Allard base metals mine, Matagami has offered all facilities and infrastructure needed for a mining operation. The 10 km long, 1,672.9 hectare Iron-T mining property covers a significant portion of the Bell River Complex, a layered gabbroic intrusion which contains in its upper part, iron-rich horizons hosting the Vanadium and Titanium mineralization. The vanadium-rich horizons are well defined on the ground and in aeromagnetic surveys by their high magnetic susceptibilities.

It is notable that the Bell River Complex in Quebec hosting the Iron-T may be compared to the Lac Doré layered igneous Complex situated some 250 kilometres east in the Chibougamau mining district of Québec (in part also owned by Apella), and to the Bushveld layered Complex of South Africa, a well described locality for deposits of vanadium. Mineralization is confined to zones of magnetite-ilmenite enrichment in the upper zone gabbroic sequence of these Complexes. Magnetite is predominant over ilmenite with the magnetite crystals commonly displaying ex-solution lamellae of ilmenite. The vanadium is principally associated with magnetite fraction where it replaces trivalent iron.

Samples #224925, and #224926 from the Iron-T were made in early August 2008 by an Independent consulting geologist, Mr. R. Moar, P. Geo., who was awarded the task of preparing a NI 43-101 compliant report on the property. A second sampling was made by Apella's exploration team under the supervision and auspices of Dr. Christian G. Derosier, P.Geo and Vice President-Exploration of Apella. This second sampling which consisted of three long channel samplings was made across a mineralized stripped area uncovered by Noranda in 1998. All samples were properly tagged and sealed before being sent to the ALS-Chemex laboratory in Val d'Or, Quebec where they were assayed using a method of assaying specially tailored in 1998 for the Noranda Bell River project and McKenzie Bay's Lac Doré project. One blank sample was added to the batch of samples sent. Standards were added by the laboratory and duplicates were made at random. Samples were treated by fusion using lithium metaborate followed by X-Ray fluorescence spectrometry for the characterization of iron ores.

Vanadium is a strategic metal and is used in the production of high-quality metal alloys, like strengthened steel, because of its property as an active grain refiner and as a strong deoxidant and can impart strength, hardness and wear resistance to steels. The vanadium industry is relatively new and new uses are continually being discovered for the metal. Following are the a number of the main uses of vanadium by various industries: iron and steel, high-strength steels, full alloy steels, tool steels, carbon steels, stainless and heat resistant steels, cast irons, titanium alloys, superalloys and hard-facing alloys, aerospace engines and airframe materials.

Non-metal end-uses for Vanadium: catalysts, ceramic, glasses and pigments, electronics, batteries (e.g., vanadium redox batteries).

The qualified person for the purposes of this news release is Dr. Christian G. Derosier, MSc, DSc, geology.

Apella invites the public to visit its NEW website athttp://www.Apellaresources.com or e-mail us at Apella@Apellaresources.com to be added to the Company's e-mail list for press releases and updates.

ON BEHALF OF THE BOARD OF DIRECTORS OF APELLA RESOURCES INC.

"Patrick D. O'Brien"

Patrick D. O'Brien - Chairman

S.E.C.Exemption12(g)3-2(b) File No. 82-3822, Standard & Poors Listed, Dun & Bradstreet Listed.

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE. THIS NEWS RELEASE SHALL NOT CONSTITUITE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY SECURITIES IN ANY JURISDICTION. "SAFE HARBOR" STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995: THIS NEWS RELEASE CONTAINS FORWARD LOOKING STATEMENTS THAT ARE NOT HISTORICAL FACTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES WHICH COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE SET FORTH IN OR IMPLIED HEREIN

Quick Links

Our Website

More About Us

Apella Resources Inc.

Wim Bakker

Investor Relations

horzontal background

Forward email

Safe Unsubscribe

This email was sent to karstenl@abacho.de by w.adrian@apellaresources.com.

Update Profile/Email Address | Instant removal with SafeUnsubscribe™ | Privacy Policy.

Email Marketing by

Apella Resources Inc. | 1600 - 543 Granville Street | Vancouver | BC | V6C 1X8 | Canada

Anhang

Diese Nachricht als : TEXT / PLAIN

Diese Nachricht als : TEXT / HTML

ABACHO

Suchmaschinenportale: Abacho pure Suche | Deutschland | Österreich | Schweiz | UK | Frankreich | Italien | Spanien | Türkei | Abacho4you

Communities: ChatCity | Chatworld | Chatfun | Chat.at | Angel.at

Auktionsportale: MyHammer Deutschland | MyHammer Österreich | MyHammer England

Webtrekk

Hilfe | AGB | Kontakt | Lob/Tadel | Werbung | Impressum | Abacho AG | Referenzen | URL anmelden | Abacho empfehlen | Code of Conduct | Jobs

© 1996 - 2008 Abacho AG

Berufsunfähigkeit: Mit der richtigen Versicherung bis zu 39% sparen (incl. 5% InsuranceCity Rabatt)

Der Wechsel lohnt sich!

Privat krankenversichert schon ab 59 €* pro Monat – Sparen Sie mit MLP bis zu 2400 €!

Dr. Peters-Rendite Fonds

Beteiligt am Wachstumsmarkt Schifffahrt: 202% Gesamtauszahlung + nahezu steuerfrei!

Abacho.de Logo

Wählen Sie die Ansicht Ihrer Abacho Startseite:

Abacho PortalAbacho Suche

Suche

in

szmtag

Startseite

Suche

News

Auto

Übersetzer

Reisen

Mail/SMS

FreeMail SMS-Versand Telefonkonferenz

My-Hammer - Handwerksauktionen

Kleinanzeigen

Service

Service

Chat

Abacho als Startseite

Abacho4you

Abacho Studien

Abacho Newsletter

Abacho Toolbar

Sie sind hier: Startseite › Mail/SMS › FreeMail

31.10.2008

Voicemail Sprachdienst Kalender Dateien Links Einstellungen Syncronisierung Tools Hilfe AGB

Von Apella Resources Inc.<w.adrian@apellaresources.com>

eMail 2 von 21

An: karstenl@abacho.de

Empfangen: Do 30 Okt 2008 20:38

CC:

Zum Posteingang

News from Apella Resources Inc.

Apella Resources Inc. Header

News Release

IRON-T Vanadium-Titanium Project Delivers Very Encouraging

Vanadium and Titanium Assay Results

October 30th 2008, 11:00 a.m. PDT

Apella Resources Inc. (TSX.V Symbol (APA); Frankfurt Symbol (NWN), is pleased to announce that the company has received assays from its recent channel sampling program carried out on the 100% owned Iron-T Vanadium-Titanium project situated near the mining centre of Matagami in central Quebec. Apella's claims cover a significant portion of the renowned Bell River Complex, where previous exploration work carried out by Noranda Inc. during the 1990's delineated and confirmed the presence of Vanadium, Titanium and Iron mineralization over a distance of about 20 km. Vanadium and Titanium results in the tables below are expressed as a percentage. To convert Vanadium assays to Vanadium Pentoxide (V2O5) equivalents as these are commonly utilized and quoted by the industry, we multiplied the assay results by the required factor of 1.785.The Vanadium values of the mineralized horizons, as shown in the tables below, are equivalent to those of current primary Vanadium producers and potential new producers, globally. The samples were analyzed for a total of 25 elements including the major elements phosphorus and sulfur. Low levels of these particular two elements is important and the sampling results have provided confirmation that the levels of these two elements are indeed very low, meeting or exceeding industry maximum standard levels. The levels of Vanadium and Titanium are very encouraging. Typical grades of currently exploited deposits are in the order of 0.50% V2O5 with a break-even point at the current Vanadium prices, of 0.20% V2O5. The current market prices of Vanadium Pentoxide at $13.50 USD/LB, and Titanium at $14.00 USD/LB have remained stable.

Results of assays are as follows:

Consulting Geologist's sampling:

Sample Number Fe% P% S% TiO2% V% V2O5%

224925 39.60 <0.001 0.581 9.96 0.33 0.589

224926 43.30 <0.001 0.198 11.45 0.37 .660

Apella's field sampling

Sample

Number Fe% P% S% TiO2% V% V2O5%

825401 11.45 0.007 0.425 1.86 0.077 0.137

825402 8.87 0.012 0.287 1.39 0.053 0.095

825403 24.70 <0.001 0.626 5.50 0.203 0.362

825404 39.00 <0.001 0.245 10.15 0.378 0.675

825405 27.10 0.001 0.511 5.75 0.208 0.371

825406 32.80 <0.001 0.503 7.42 0.251 0.448

825407 37.60 <0.001 0.525 9.30 0.300 0.536 825408 39.20 <0.001 0.572 9.79 0.317 0.566

825409 31.90 0.001 0.941 7.01 0.222 0.396

825410 22.30 0.001 0.309 4.93 0.180 0.321

825411 32.70 <0.001 0.432 8.15 0.290 0.518

825412 36.10 <0.001 0.183 9.24 0.331 0.591

825413 36.00 <0.001 0.716 8.65 0.309 0.552

825414 38.20 0.002 0.595 9.36 0.323 0.577

825415 41.20 <0.001 0.566 10.65 0.340 0.607

825416 43.60 <0.001 0.392 11.50 0.365 0.652

825417 32.30 0.001 0.544 7.40 0.241 0.430

825418 27.20 <0.001 0.127 6.76 0.239 0.427

825419 47.10 <0.001 0.279 12.90 0.459 0.819

825420 26.70 <0.001 0.250 6.00 0.221 0.394

825421 35.90 <0.001 0.552 8.70 0.310 0.553

825422 39.40 <0.001 0.608 9.48 0.329 0.587

825423 45.30 <0.001 0.399 12.20 0.380 0.678

825424 37.80 <0.001 0.462 9.40 0.305 0.544

825425 35.60 <0.001 0.524 8.65 0.270 0.482m

The Iron-T is centered just 10 km east of the town of Matagami, Quebec. Since 1963 and the discovery of the Bell Allard base metals mine, Matagami has offered all facilities and infrastructure needed for a mining operation. The 10 km long, 1,672.9 hectare Iron-T mining property covers a significant portion of the Bell River Complex, a layered gabbroic intrusion which contains in its upper part, iron-rich horizons hosting the Vanadium and Titanium mineralization. The vanadium-rich horizons are well defined on the ground and in aeromagnetic surveys by their high magnetic susceptibilities.

It is notable that the Bell River Complex in Quebec hosting the Iron-T may be compared to the Lac Doré layered igneous Complex situated some 250 kilometres east in the Chibougamau mining district of Québec (in part also owned by Apella), and to the Bushveld layered Complex of South Africa, a well described locality for deposits of vanadium. Mineralization is confined to zones of magnetite-ilmenite enrichment in the upper zone gabbroic sequence of these Complexes. Magnetite is predominant over ilmenite with the magnetite crystals commonly displaying ex-solution lamellae of ilmenite. The vanadium is principally associated with magnetite fraction where it replaces trivalent iron.

Samples #224925, and #224926 from the Iron-T were made in early August 2008 by an Independent consulting geologist, Mr. R. Moar, P. Geo., who was awarded the task of preparing a NI 43-101 compliant report on the property. A second sampling was made by Apella's exploration team under the supervision and auspices of Dr. Christian G. Derosier, P.Geo and Vice President-Exploration of Apella. This second sampling which consisted of three long channel samplings was made across a mineralized stripped area uncovered by Noranda in 1998. All samples were properly tagged and sealed before being sent to the ALS-Chemex laboratory in Val d'Or, Quebec where they were assayed using a method of assaying specially tailored in 1998 for the Noranda Bell River project and McKenzie Bay's Lac Doré project. One blank sample was added to the batch of samples sent. Standards were added by the laboratory and duplicates were made at random. Samples were treated by fusion using lithium metaborate followed by X-Ray fluorescence spectrometry for the characterization of iron ores.

Vanadium is a strategic metal and is used in the production of high-quality metal alloys, like strengthened steel, because of its property as an active grain refiner and as a strong deoxidant and can impart strength, hardness and wear resistance to steels. The vanadium industry is relatively new and new uses are continually being discovered for the metal. Following are the a number of the main uses of vanadium by various industries: iron and steel, high-strength steels, full alloy steels, tool steels, carbon steels, stainless and heat resistant steels, cast irons, titanium alloys, superalloys and hard-facing alloys, aerospace engines and airframe materials.

Non-metal end-uses for Vanadium: catalysts, ceramic, glasses and pigments, electronics, batteries (e.g., vanadium redox batteries).

The qualified person for the purposes of this news release is Dr. Christian G. Derosier, MSc, DSc, geology.

Apella invites the public to visit its NEW website athttp://www.Apellaresources.com or e-mail us at Apella@Apellaresources.com to be added to the Company's e-mail list for press releases and updates.

ON BEHALF OF THE BOARD OF DIRECTORS OF APELLA RESOURCES INC.

"Patrick D. O'Brien"

Patrick D. O'Brien - Chairman

S.E.C.Exemption12(g)3-2(b) File No. 82-3822, Standard & Poors Listed, Dun & Bradstreet Listed.

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE. THIS NEWS RELEASE SHALL NOT CONSTITUITE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY SECURITIES IN ANY JURISDICTION. "SAFE HARBOR" STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995: THIS NEWS RELEASE CONTAINS FORWARD LOOKING STATEMENTS THAT ARE NOT HISTORICAL FACTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES WHICH COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE SET FORTH IN OR IMPLIED HEREIN

Quick Links

Our Website

More About Us

Apella Resources Inc.

Wim Bakker

Investor Relations

horzontal background

Forward email

Safe Unsubscribe

This email was sent to karstenl@abacho.de by w.adrian@apellaresources.com.

Update Profile/Email Address | Instant removal with SafeUnsubscribe™ | Privacy Policy.

Email Marketing by

Apella Resources Inc. | 1600 - 543 Granville Street | Vancouver | BC | V6C 1X8 | Canada

Anhang

Diese Nachricht als : TEXT / PLAIN

Diese Nachricht als : TEXT / HTML

ABACHO

Suchmaschinenportale: Abacho pure Suche | Deutschland | Österreich | Schweiz | UK | Frankreich | Italien | Spanien | Türkei | Abacho4you

Communities: ChatCity | Chatworld | Chatfun | Chat.at | Angel.at

Auktionsportale: MyHammer Deutschland | MyHammer Österreich | MyHammer England

Webtrekk

Hilfe | AGB | Kontakt | Lob/Tadel | Werbung | Impressum | Abacho AG | Referenzen | URL anmelden | Abacho empfehlen | Code of Conduct | Jobs

© 1996 - 2008 Abacho AG

Hallo Mickefett,

Ich glaube hier würde ich maximal erstmal beobachten, wie sich das weiterentwickelt. Wenn (FE)Vanadium, dann sollte man sich glaube ich, als "Developer", eher mit Largo, Aurox, Reed Resources, oder Windimurra Vanadium auseinandersetzen.

Grüße, Popeye

Ich glaube hier würde ich maximal erstmal beobachten, wie sich das weiterentwickelt. Wenn (FE)Vanadium, dann sollte man sich glaube ich, als "Developer", eher mit Largo, Aurox, Reed Resources, oder Windimurra Vanadium auseinandersetzen.

Grüße, Popeye

Antwort auf Beitrag Nr.: 35.781.663 von Popeye82 am 31.10.08 19:51:49

Yellow Rock Resources käme vielleicht noch dazu.

Grüße, Popeye

Yellow Rock Resources käme vielleicht noch dazu.

Grüße, Popeye

Antwort auf Beitrag Nr.: 35.781.663 von Popeye82 am 31.10.08 19:51:49Hallo Popeye,

Vielen Dank für Deinen Rat, aber leider kommt er zu spät. Ich bin schon länger in diesen Wert investiert, aber nicht lebensgefährlich.

Jetzt laß ich es dabei.

Gruß Mickefett

Vielen Dank für Deinen Rat, aber leider kommt er zu spät. Ich bin schon länger in diesen Wert investiert, aber nicht lebensgefährlich.

Jetzt laß ich es dabei.

Gruß Mickefett

Lac Dore North Vanadium-Titanium Project Expansion

Thursday December 18, 2008, 1:38 pm EST

www.24hgold.com/news-company-gold-silver-Lac-Dore-North-Vana…

"VANCOUVER, Dec. 18 /CNW/ - Apella Resources Inc. (TSX.V Symbol (APA); Frankfurt Symbol (NWN)), and its Board of Directors are pleased to announce the addition of 340 acres to the Company's Lac Dore North Vanadium Project situated near Chibougamau Quebec. The Lac Dore North Project is now comprised of a total of 53 mining claims and 27 cells in which Apella has a 100-per-cent interest.

The Lac Dore North Vanadium-Titanium-Iron Project, coupled with the Company's Iron-T Vanadium-Titanium-Iron Project and a pending application for claims covering parts of the Lac Dore Vanadium Deposit, clearly establishes Apella at the forefront of North American vanadium exploration and development.

Vanadium is a strategic metal, used mainly in the production of high-strength steel alloys (for tools and oil-and-gas pipelines) and specialized metal alloys for aerospace engines and airframe materials. Another emerging market for Vanadium comes with the development of Vanadium-redox-flow batteries which are not only environmentally friendly, but can be charged and recharged more than 10,000 times and maintain their charge almost indefinitely. Vanadium is also likely to become a main constituent in the next generation of rechargeable lithium batteries. These technologies are currently being implemented in Japan and applications range from heavy industrial use to hybrid automobiles and electronics. Russia and South Africa are currently the world's primary vanadium producers.

The Company is committed to a strategic goal of becoming the only current primary North American Vanadium Producer through decisive acquisition and development.

Apella invites the public to visit its NEW website at www.Apellaresources.com or e-mail us at Apella(at)Apellaresources.com to be added to the Company's e-mail list for press releases and updates. "

Thursday December 18, 2008, 1:38 pm EST

www.24hgold.com/news-company-gold-silver-Lac-Dore-North-Vana…

"VANCOUVER, Dec. 18 /CNW/ - Apella Resources Inc. (TSX.V Symbol (APA); Frankfurt Symbol (NWN)), and its Board of Directors are pleased to announce the addition of 340 acres to the Company's Lac Dore North Vanadium Project situated near Chibougamau Quebec. The Lac Dore North Project is now comprised of a total of 53 mining claims and 27 cells in which Apella has a 100-per-cent interest.

The Lac Dore North Vanadium-Titanium-Iron Project, coupled with the Company's Iron-T Vanadium-Titanium-Iron Project and a pending application for claims covering parts of the Lac Dore Vanadium Deposit, clearly establishes Apella at the forefront of North American vanadium exploration and development.

Vanadium is a strategic metal, used mainly in the production of high-strength steel alloys (for tools and oil-and-gas pipelines) and specialized metal alloys for aerospace engines and airframe materials. Another emerging market for Vanadium comes with the development of Vanadium-redox-flow batteries which are not only environmentally friendly, but can be charged and recharged more than 10,000 times and maintain their charge almost indefinitely. Vanadium is also likely to become a main constituent in the next generation of rechargeable lithium batteries. These technologies are currently being implemented in Japan and applications range from heavy industrial use to hybrid automobiles and electronics. Russia and South Africa are currently the world's primary vanadium producers.

The Company is committed to a strategic goal of becoming the only current primary North American Vanadium Producer through decisive acquisition and development.

Apella invites the public to visit its NEW website at www.Apellaresources.com or e-mail us at Apella(at)Apellaresources.com to be added to the Company's e-mail list for press releases and updates. "

Antwort auf Beitrag Nr.: 36.234.981 von Popeye82 am 18.12.08 22:21:43http://www.apellaresources.com/news/news-release-lac-dore-no…

Es scheint sich beim Lac Doré was zu tun!

Es scheint sich beim Lac Doré was zu tun!

Antwort auf Beitrag Nr.: 36.429.945 von mickefett am 22.01.09 19:30:08http://www.smartstox.com/interviews/apa

Hier ist ein Interview mit Adrian O'Brien, dem Vice-President von Apella, in Englisch.

Hier ist ein Interview mit Adrian O'Brien, dem Vice-President von Apella, in Englisch.

IRON-T VANADIUM-IRON PROJECT EXPANDED

8 May 2009 - 7:30am

Apella Resources Inc.(TSX.V: APA); (Frankfurt Symbol: NWN) and its Board of Directors are pleased to announce that the Company has achieved its goal of acquiring all of its intended high-priority exploration targets identified in the Matagami mining camp. The acquisition of the latest 111 acre package now brings Apella’s Iron-T Vanadium-Iron-Titanium project to a total of 134 contiguous (adjoining) claims, encompassing approximately 10,600 acres.

The Iron-T Vanadium-Iron-Titanium project is ideally located near the mining town of Matagami, Quebec; approximately 780 km north of Montreal. The town of Matagami can provide housing, servicing, supplies, consumables and transport facilities including railway access as required for an efficient mining operation.

Previous work on the Iron-T confirmed the presence of significant Vanadium, Titanium, and Iron mineralization. Apella’s most recent trenching program, the results of which are detailed in Apella’s news release of October 30th, 2008, yielded economic grades of Vanadium, Titanium and Iron. The company has since filed, on SEDAR, a NI 43-101 report on the Iron-T Project.

The mineralization on Apella’s Iron-T project bares striking similarities to such world class deposits as the Rhovan Deposit in South Africa. Virtually all mined vanadium utilized in North America is sourced internationally and imported. A number of these source countries present a significant risk, politically, to future North American supply chains. From Apella’s perspective, this means its Canadian based projects present a rare opportunity and possibility to create a stable and reliable North American source and supply for vanadium and vanadium enriched magnetite iron ore. This would be in addition to the obvious opportunity of providing the vast developing markets of China, India and the far-east with ship-ready magnetite iron ore already enriched with vanadium at a premium price for their steel production. The type of Magnetite sourced Vanadium-Iron-Titanium deposits that Apella has the potential of identifying and developing is not all that common. In fact, this is a rare opportunity for Apella’s stakeholders.

Apella has multiple opportunities with these projects. First and foremost, is the opportunity to quickly establish a world-class, low cost, operation supplying Vanadium enriched Iron-Ore that can simply be processed to meet the specifications of the world’s steel mills eliminating much of their requirement for blending so commonly utilized throughout the industry in the making of alloy steel. Vanadium and Titanium are both key strategic metals with their own unique markets to be addressed. The potential for production of both Ferrovanadium and Vanadium Pentoxide V2O5 exists on all of Apella’s projects.

On another note, the Vanadium industry itself is relatively young and new uses for Vanadium are continually being identified. The primary use for Vanadium remains for production of steel alloys. Vanadium and Titanium are also extensively used for aerospace engines and airframe materials. Today, Asia has successfully implemented Vanadium in a number of battery technologies superior to previous standards. These next generation batteries represent a green technology that if fully commercialized, would have a significant global impact. The storage capacity for these batteries is suitable for wind, solar, nuclear, backup systems, electric automobiles and many other applications. With the depletion of the world’s petroleum supplies and with environmental and political issues shifting focus to more practical solutions, the outcome of all this is creating a new market for vanadium and possibly a competitive edge for North Americans.

Apella is now initiating plans to bring these projects into the development stage and will keep stakeholders abreast of ongoing matters as these developments proceed.

The qualified person for the purposes of this news release is Dr. Christian G. Derosier, P.Geo.

Apella invites the public to visit its website at http://www.apellaresources.com or e-mail us at apella@apellaresources.com to be added to the Company’s e-mail list for press releases and updates.

8 May 2009 - 7:30am

Apella Resources Inc.(TSX.V: APA); (Frankfurt Symbol: NWN) and its Board of Directors are pleased to announce that the Company has achieved its goal of acquiring all of its intended high-priority exploration targets identified in the Matagami mining camp. The acquisition of the latest 111 acre package now brings Apella’s Iron-T Vanadium-Iron-Titanium project to a total of 134 contiguous (adjoining) claims, encompassing approximately 10,600 acres.

The Iron-T Vanadium-Iron-Titanium project is ideally located near the mining town of Matagami, Quebec; approximately 780 km north of Montreal. The town of Matagami can provide housing, servicing, supplies, consumables and transport facilities including railway access as required for an efficient mining operation.

Previous work on the Iron-T confirmed the presence of significant Vanadium, Titanium, and Iron mineralization. Apella’s most recent trenching program, the results of which are detailed in Apella’s news release of October 30th, 2008, yielded economic grades of Vanadium, Titanium and Iron. The company has since filed, on SEDAR, a NI 43-101 report on the Iron-T Project.

The mineralization on Apella’s Iron-T project bares striking similarities to such world class deposits as the Rhovan Deposit in South Africa. Virtually all mined vanadium utilized in North America is sourced internationally and imported. A number of these source countries present a significant risk, politically, to future North American supply chains. From Apella’s perspective, this means its Canadian based projects present a rare opportunity and possibility to create a stable and reliable North American source and supply for vanadium and vanadium enriched magnetite iron ore. This would be in addition to the obvious opportunity of providing the vast developing markets of China, India and the far-east with ship-ready magnetite iron ore already enriched with vanadium at a premium price for their steel production. The type of Magnetite sourced Vanadium-Iron-Titanium deposits that Apella has the potential of identifying and developing is not all that common. In fact, this is a rare opportunity for Apella’s stakeholders.

Apella has multiple opportunities with these projects. First and foremost, is the opportunity to quickly establish a world-class, low cost, operation supplying Vanadium enriched Iron-Ore that can simply be processed to meet the specifications of the world’s steel mills eliminating much of their requirement for blending so commonly utilized throughout the industry in the making of alloy steel. Vanadium and Titanium are both key strategic metals with their own unique markets to be addressed. The potential for production of both Ferrovanadium and Vanadium Pentoxide V2O5 exists on all of Apella’s projects.

On another note, the Vanadium industry itself is relatively young and new uses for Vanadium are continually being identified. The primary use for Vanadium remains for production of steel alloys. Vanadium and Titanium are also extensively used for aerospace engines and airframe materials. Today, Asia has successfully implemented Vanadium in a number of battery technologies superior to previous standards. These next generation batteries represent a green technology that if fully commercialized, would have a significant global impact. The storage capacity for these batteries is suitable for wind, solar, nuclear, backup systems, electric automobiles and many other applications. With the depletion of the world’s petroleum supplies and with environmental and political issues shifting focus to more practical solutions, the outcome of all this is creating a new market for vanadium and possibly a competitive edge for North Americans.

Apella is now initiating plans to bring these projects into the development stage and will keep stakeholders abreast of ongoing matters as these developments proceed.

The qualified person for the purposes of this news release is Dr. Christian G. Derosier, P.Geo.

Apella invites the public to visit its website at http://www.apellaresources.com or e-mail us at apella@apellaresources.com to be added to the Company’s e-mail list for press releases and updates.

Apella Stakes Magnetite Bay Iron Deposit Interest - 16 Jun 2009

www.apellaresources.com/news/apella-stakes-magnetite-bay-iro…

www.apellaresources.com/news/apella-stakes-magnetite-bay-iro…

Apella commences Field Work on its Lac Dore Iron-Vanadium-Titanium Assemblage - 19 Jun 2009

www.apellaresources.com/news/apella-commences-field-work-on-…

"Apella Resources Inc.(TSX.V: APA); (Frankfurt Symbol: NWN) and its Board of Directors are pleased to announce that Phase 1 of its 2009 field program has commenced on its Lac Dore Iron-Vanadium-Titanium (Fe-V-Ti) Assemblage, adjoining the well known 5.5 billion pound Lac Dore (Fe-V-Ti) deposit reported to be the world’s second largest vanadium deposit. Crews are now on site and undertaking to create a grid encompassing approximately 40 line kilometres on the southwest and northwest claims of the Lac Dore Assemblage. Once this grid is complete a ground geophysical magnetometer survey (“Mag Survey”) will be undertaken in the same area. The purpose of this program is to identify drill targets for a follow-up diamond drill program.

Apella has also put in motion the commencement of a second, similar 40 line kilometer grid, over its Lac Dore North Iron-Vanadium-Titanium Assemblage which also adjoins the well known Lac Dore Iron-Vanadium-Titanium deposit. Readers are referred to Apella press release of January 22, 2009 in which Apella reported its exceptional results obtained from its clearing and channel sampling program carried out on a portion of the ground to be covered by this new grid. A series of diamond drill holes are planned for this area and commencement of the drill program is expected to be announced soon.

The qualified person for the purposes of this news release is Dr. Christian G. Derosier, P.Geo.

Apella invites the public to visit its website at www.apellaresources.com or e-mail us at apella@apellaresources.com to be added to the Company’s e-mail list for press releases and updates.

ON BEHALF OF THE BOARD OF DIRECTORS OF APELLA RESOURCES INC.

“Patrick D. O’Brien”

Patrick D. O’Brien – Chairman

S.E.C. Exemption 12(g)3-2(b) File No. 82-3822, Standard & Poors Listed, Dun & Bradstreet Listed "

www.apellaresources.com/news/apella-commences-field-work-on-…

"Apella Resources Inc.(TSX.V: APA); (Frankfurt Symbol: NWN) and its Board of Directors are pleased to announce that Phase 1 of its 2009 field program has commenced on its Lac Dore Iron-Vanadium-Titanium (Fe-V-Ti) Assemblage, adjoining the well known 5.5 billion pound Lac Dore (Fe-V-Ti) deposit reported to be the world’s second largest vanadium deposit. Crews are now on site and undertaking to create a grid encompassing approximately 40 line kilometres on the southwest and northwest claims of the Lac Dore Assemblage. Once this grid is complete a ground geophysical magnetometer survey (“Mag Survey”) will be undertaken in the same area. The purpose of this program is to identify drill targets for a follow-up diamond drill program.

Apella has also put in motion the commencement of a second, similar 40 line kilometer grid, over its Lac Dore North Iron-Vanadium-Titanium Assemblage which also adjoins the well known Lac Dore Iron-Vanadium-Titanium deposit. Readers are referred to Apella press release of January 22, 2009 in which Apella reported its exceptional results obtained from its clearing and channel sampling program carried out on a portion of the ground to be covered by this new grid. A series of diamond drill holes are planned for this area and commencement of the drill program is expected to be announced soon.

The qualified person for the purposes of this news release is Dr. Christian G. Derosier, P.Geo.

Apella invites the public to visit its website at www.apellaresources.com or e-mail us at apella@apellaresources.com to be added to the Company’s e-mail list for press releases and updates.

ON BEHALF OF THE BOARD OF DIRECTORS OF APELLA RESOURCES INC.

“Patrick D. O’Brien”

Patrick D. O’Brien – Chairman

S.E.C. Exemption 12(g)3-2(b) File No. 82-3822, Standard & Poors Listed, Dun & Bradstreet Listed "

News Release Drilling to commence on Lac Dore North Iron-Vanadium-Titanium(Fe-V2O5-Ti) Project Chibougamau, Quebec - 30 Jun 2009

www.apellaresources.com/news/news-release-drilling-to-commen…

"Apella Resources Inc.(TSX.V: APA); (Frankfurt Symbol: NWN) and its Board of Directors are pleased to announce that Phase 2 of its 2009 exploration work has commenced on its Lac Dore North Iron-Vanadium-Titanium (Fe-V-Ti) Project. Apella's crews have now completed all of the necessary access road building and improvements that were necessary for access. Drill contracts have been signed and the initial 10-hole NQ-core drill program will commence on July 4th.

The Lac Dore North encompasses 18 claims covering an area of approximately 300 hectares (741 acres), covering the northeast extension of the renowned Lac Dore Vanadium-Titanium-Iron (Fe-V-Ti) Deposit, over a strike length of 2.6 kilometers (1.6 miles). The nearby, 5.5 billion pound Lac Dore (Fe-V-Ti) deposit, is reported to be the world's second largest vanadium deposit.

Crews are also on site completing the Phase 1 work which Apella announced on June 19th. The 10-hole drill program will be coupled with a comprehensive mapping program.

Readers are referred to Apella press release of January 22, 2009 in which Apella reported its exceptional Iron-Vanadium-Titanium (Fe-V2O5-TiO2) results obtained from its extensive clearing and channel sampling program carried out in the area about to be drilled. Vanadium values obtained ranged from 0.05% to 0.610%, which after conversion to V205, returned values from 0.089% to 1.089%. The average grade of Vanadium Pentoxide (V205) is 0.55% V2O5. Titanium (Ti02) values range from 1.33% to 12.30%; the average grade of Titanium (Ti02) is 6.40% Ti02. Iron (Fe) values range from 13.23% to 56.50% Fe; the average grade of Iron (Fe) is 32.81% Fe.

During that fall 2008 exploration program, Apella's field crew stripped and cleared off two large areas, covering several hundred square meters of magnetite-bearing mineralization, as well as four smaller zones. The stripped areas cover part of the P1 Zone which is found at the base of the Layered Series of the Lac Dore Anorthositic Complex. Normally this zone varies from 30 to 90 meters in thickness. It is the only zone which contains economic values of Vanadium. The P1 Zone is made of an alternation of leucocratic ferrogabbro, magnetite rich ferrogabbro, ferropyroxennite, magnetite rich pyroxenite and magnetites. The channel sampling cut part of this alternation like a horizontal drill hole. It is consequently normal to obtain samples presenting rich and low Vanadium contents.

For ease of reference, the samples obtained by Apella in its fall 2008 channel sampling program are listed in the table below:

Trench Number

Sample ID

Fe

V%

V2O5

TiO2

V1-1

825431

30.60

0.387

0.691

7.42

V1-2

825432

39.90

0.409

0.730

10.20

V1-3

825433

37.20

0.401

0.716

8.58

V1-4

825434

30.20

0.337

0.602

6.94

V1-5

825435

31.20

0.341

0.609

7.07

V1-6

825436

45.00

0.503

0.898

10.25

V2-1

825437

53.40

0.610

1.089

12.30

V2-2

825438

45.90

0.521

0.930

10.35

V2-3

825439

48.60

0.544

0.971

11.05

V2-4

825440

50.30

0.565

1.009

11.65

V2-5

825441

36.60

0.400

0.714

8.43

V2-6

825442

45.50

0.517

0.923

10.75

V3-1

825443

24.10

0.178

0.318

4.26

V3-2

825444

17.05

0.164

0.293

3.49

V3-3

825445

29.40

0.324

0.578

6.42

V3-4

825446

34.80

0.393

0.702

7.72

V3-5

825447

28.60

0.321

0.573

6.17

V4-1

825448

35.60

0.390

0.696

7.40

V4-2

825449

32.50

0.357

0.637

6.93

V4-3

825450

26.20

0.257

0.459

5.15

V5-1

825451

29.20

0.319

0.569

6.32

V6-1

825452

34.30

0.385

0.687

7.80

V6-2

825453

39.50

0.447

0.798

8.86

V6-3

825454

46.60

0.543

0.969

10.70

V6-4

825455

19.05

0.193

0.345

3.97

V6-5

825456

22.00

0.214

0.382

4.60

V7-1

825457

46.80

0.536

0.957

10.25

V8-1

825458

23.90

0.242

0.432

4.97

V8-2

825459

17.20

0.155

0.277

3.18

V8-3

825460

17.50

0.168

0.300

3.36

V8-4

825461

13.75

0.128

0.228

2.77

V9-1

825462

40.50

0.437

0.780

8.51

V9-2

825463

36.90

0.395

0.705

7.81

V6-0

825464

13.24

0.070

0.125

1.93

V6-6

825465

34.42

0.270

0.482

5.80

V6-7

825466

29.61

0.220

0.393

5.03

V6-8

825467

30.77

0.160

0.286

3.62

V6-9

825468

30.21

0.190

0.339

4.09

V6-10

825469

13.72

0.050

0.089

1.33

V6-11

825470

15.96

0.090

0.161

2.36

V6-12

825471

30.00

0.230

0.411

5.00

V6-13

825472

13.63

0.070

0.125

1.83

V6-14

825473

19.45

0.110

0.196

2.71

V6-15

825474

32.15

0.240

0.428

5.39

V6-16

825475

27.09

0.180

0.321

4.28

V6-17

825476

24.31

0.160

0.286

3.98

V6-18

825477

27.26

0.190

0.339

4.47

V6-19

825478

52.10

0.430

0.768

8.91

V6-20

825479

49.01

0.430

0.768

8.75

V6-21

825480

28.00

0.220

0.393

4.64

V6-22

825481

43.41

0.340

0.607

7.09

V6-23

825482

53.26

0.440

0.785

9.19

V6-24

825483

25.40

0.180

0.321

3.94

V6-25

825484

31.70

0.260

0.464

5.59

V6-26

825485

27.13

0.200

0.357

4.58

V10-1

825486

33.09

0.270

0.482

5.84

V10-2

825487

39.95

0.280

0.500

5.98

V10-3

825488

56.50

0.440

0.785

9.19

V10-4

825489

56.20

0.450

0.803

9.25

V10-5

825490

21.17

0.140

0.250

3.35

The samples above were analyzed by ALS-Chemex laboratories in Val d'Or, Quebec and in Perth, Australia, using two different methods. The first method is aimed at Iron ore. It consists of a fusion followed by X-Ray fluorescence spectrometry (ME-XRF-11). The accuracy for Vanadium is 0.001%. However, shipping the samples to Australia required a long quarantine period which does not allow for results prior to a three month time period. Consequently, the Company requested that the laboratory propose a method of assaying providing almost the same results but with a much shorter waiting period. The second batch of samples were treated by fusion (lithium metaborate) followed by X-Ray fluorescence (ME-XRF-06). Results were obtained within three weeks using this method.

The qualified person for the purposes of this news release is Dr. Christian G. Derosier, P.Geo.

Apella invites the public to visit its website at www.apellaresources.com or e-mail us at apella@apellaresources.com to be added to the Company's e-mail list for press releases and updates.

ON BEHALF OF THE BOARD OF DIRECTORS OF APELLA RESOURCES INC.

"Patrick D. O'Brien" "

www.apellaresources.com/news/news-release-drilling-to-commen…

"Apella Resources Inc.(TSX.V: APA); (Frankfurt Symbol: NWN) and its Board of Directors are pleased to announce that Phase 2 of its 2009 exploration work has commenced on its Lac Dore North Iron-Vanadium-Titanium (Fe-V-Ti) Project. Apella's crews have now completed all of the necessary access road building and improvements that were necessary for access. Drill contracts have been signed and the initial 10-hole NQ-core drill program will commence on July 4th.

The Lac Dore North encompasses 18 claims covering an area of approximately 300 hectares (741 acres), covering the northeast extension of the renowned Lac Dore Vanadium-Titanium-Iron (Fe-V-Ti) Deposit, over a strike length of 2.6 kilometers (1.6 miles). The nearby, 5.5 billion pound Lac Dore (Fe-V-Ti) deposit, is reported to be the world's second largest vanadium deposit.

Crews are also on site completing the Phase 1 work which Apella announced on June 19th. The 10-hole drill program will be coupled with a comprehensive mapping program.

Readers are referred to Apella press release of January 22, 2009 in which Apella reported its exceptional Iron-Vanadium-Titanium (Fe-V2O5-TiO2) results obtained from its extensive clearing and channel sampling program carried out in the area about to be drilled. Vanadium values obtained ranged from 0.05% to 0.610%, which after conversion to V205, returned values from 0.089% to 1.089%. The average grade of Vanadium Pentoxide (V205) is 0.55% V2O5. Titanium (Ti02) values range from 1.33% to 12.30%; the average grade of Titanium (Ti02) is 6.40% Ti02. Iron (Fe) values range from 13.23% to 56.50% Fe; the average grade of Iron (Fe) is 32.81% Fe.

During that fall 2008 exploration program, Apella's field crew stripped and cleared off two large areas, covering several hundred square meters of magnetite-bearing mineralization, as well as four smaller zones. The stripped areas cover part of the P1 Zone which is found at the base of the Layered Series of the Lac Dore Anorthositic Complex. Normally this zone varies from 30 to 90 meters in thickness. It is the only zone which contains economic values of Vanadium. The P1 Zone is made of an alternation of leucocratic ferrogabbro, magnetite rich ferrogabbro, ferropyroxennite, magnetite rich pyroxenite and magnetites. The channel sampling cut part of this alternation like a horizontal drill hole. It is consequently normal to obtain samples presenting rich and low Vanadium contents.

For ease of reference, the samples obtained by Apella in its fall 2008 channel sampling program are listed in the table below:

Trench Number

Sample ID

Fe

V%

V2O5

TiO2

V1-1

825431

30.60

0.387

0.691

7.42

V1-2

825432

39.90

0.409

0.730

10.20

V1-3

825433

37.20

0.401

0.716

8.58

V1-4

825434

30.20

0.337

0.602

6.94

V1-5

825435

31.20

0.341

0.609

7.07

V1-6

825436

45.00

0.503

0.898

10.25

V2-1

825437

53.40

0.610

1.089

12.30

V2-2

825438

45.90

0.521

0.930

10.35

V2-3

825439

48.60

0.544

0.971

11.05

V2-4

825440

50.30

0.565

1.009

11.65

V2-5

825441

36.60

0.400

0.714

8.43

V2-6

825442

45.50

0.517

0.923

10.75

V3-1

825443

24.10

0.178

0.318

4.26

V3-2

825444

17.05

0.164

0.293

3.49

V3-3

825445

29.40

0.324

0.578

6.42

V3-4

825446

34.80

0.393

0.702

7.72

V3-5

825447

28.60

0.321

0.573

6.17

V4-1

825448

35.60

0.390

0.696

7.40

V4-2

825449

32.50

0.357

0.637

6.93

V4-3

825450

26.20

0.257

0.459

5.15

V5-1

825451

29.20

0.319

0.569

6.32

V6-1

825452

34.30

0.385

0.687

7.80

V6-2

825453

39.50

0.447

0.798

8.86

V6-3

825454

46.60

0.543

0.969

10.70

V6-4

825455

19.05

0.193

0.345

3.97

V6-5

825456

22.00

0.214

0.382

4.60

V7-1

825457

46.80

0.536

0.957

10.25

V8-1

825458

23.90

0.242

0.432

4.97

V8-2

825459

17.20

0.155

0.277

3.18

V8-3

825460

17.50

0.168

0.300

3.36

V8-4

825461

13.75

0.128

0.228

2.77