Soufun - größtes Immobilienportal der Welt aus China - 500 Beiträge pro Seite

eröffnet am 25.04.11 12:13:13 von

neuester Beitrag 12.09.19 13:46:04 von

neuester Beitrag 12.09.19 13:46:04 von

Beiträge: 35

ID: 1.165.727

ID: 1.165.727

Aufrufe heute: 0

Gesamt: 5.049

Gesamt: 5.049

Aktive User: 0

ISIN: US30711Y3009 · WKN: A2P6U9 · Symbol: SFUNY

6,0000

USD

0,00 %

0,0000 USD

Letzter Kurs 26.04.24 Nasdaq OTC

Werte aus der Branche Internet

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,6800 | +18,31 | |

| 20,200 | +12,85 | |

| 2,9200 | +12,31 | |

| 0,6050 | +12,04 | |

| 0,8820 | +10,94 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,5300 | -8,73 | |

| 28,26 | -9,57 | |

| 10,870 | -10,61 | |

| 2,7500 | -15,95 | |

| 1,2400 | -51,56 |

China’s March Residential Prices Extend Gains, SouFun Says

April 01, 2011, 4:06 AM EDT

By Bloomberg News

(Updates with Soho Chairman’s comments on 10th paragraph.)

April 1 (Bloomberg) -- China’s home prices rose 0.6 percent in March, led by smaller cities, said SouFun Holdings Ltd., raising doubts that government measures to control the risk of asset bubbles are effective.

Residential prices rose in 82 of 100 cities tracked by SouFun from February, with average values climbing to 8,738 yuan ($1,335) a square meter (10.76 square feet), SouFun, the nation’s biggest real-estate website owner, said in an e-mailed statement today. Home prices increased 0.5 percent in February from January, the slowest pace in six months.

About 40 Chinese cities said last month they will cap new home prices below annual economic and disposable per-capita income growth after local governments were ordered to submit home price control targets by the end of March. The Chinese government is intensifying efforts to keep housing affordable after prices gained for 19 consecutive months to December and climbed in all but two of the 70 cities the government monitors in February.

“Prices in small cities without purchase restrictions remained quite strong,” said Danny Bao, a Hong Kong-based property analyst at Daiwa Securities Capital Markets Ltd.

China has this year raised the minimum down payment for second-home purchases and introduced taxes on residential properties in Shanghai and Chongqing. Chinese cities including the capital Beijing, Shanghai and Guangzhou also announced restrictions on home purchases last month, responding to measures imposed by the central government.

Shares Rise

A gauge tracking property shares on the Shanghai Composite Index rose 2.4 percent at the 3 p.m. close, the most since March 23 and the best performer among the five industry groups on the benchmark measure, which increased 1.3 percent.

Home prices in Shanghai were little changed last month, while in Beijing they rose 0.6 percent, SouFun said. Baoding, a mid-sized central city, posted a 2.6 percent gain from February, the biggest advance, while the eastern city of Dezhou fell 0.9 percent, the largest decline.

It might take at least three to six months to see if the government’s property measures are working, said Bao, who expects a possible decline in home prices in the second half. The slowdown in February might have been due to the week-long Lunar New Year holidays, analysts said at the time.

Hold Off Curbs

SouFun, based in Beijing, started compiling the monthly home data of 100 cities in July and usually releases them before national statistics bureau figures. Government indexes of new and existing homes for March are due on April 18.

The government will probably hold off on further property measures to control home prices because the current restrictions on purchases are the most severe so far, Pan Shiyi, chairman for Soho China Ltd., said today in a conference call.

Premier Wen Jiabao said on March 5 that China will “resolutely” press ahead with controls on the property market to curb speculation, reiterating a promise to keep housing affordable. The government will “severely punish” irregularities in the real-estate market, implement differentiated credit and tax policies, and hold local officials accountable for maintaining stable home prices, he said.

April 01, 2011, 4:06 AM EDT

By Bloomberg News

(Updates with Soho Chairman’s comments on 10th paragraph.)

April 1 (Bloomberg) -- China’s home prices rose 0.6 percent in March, led by smaller cities, said SouFun Holdings Ltd., raising doubts that government measures to control the risk of asset bubbles are effective.

Residential prices rose in 82 of 100 cities tracked by SouFun from February, with average values climbing to 8,738 yuan ($1,335) a square meter (10.76 square feet), SouFun, the nation’s biggest real-estate website owner, said in an e-mailed statement today. Home prices increased 0.5 percent in February from January, the slowest pace in six months.

About 40 Chinese cities said last month they will cap new home prices below annual economic and disposable per-capita income growth after local governments were ordered to submit home price control targets by the end of March. The Chinese government is intensifying efforts to keep housing affordable after prices gained for 19 consecutive months to December and climbed in all but two of the 70 cities the government monitors in February.

“Prices in small cities without purchase restrictions remained quite strong,” said Danny Bao, a Hong Kong-based property analyst at Daiwa Securities Capital Markets Ltd.

China has this year raised the minimum down payment for second-home purchases and introduced taxes on residential properties in Shanghai and Chongqing. Chinese cities including the capital Beijing, Shanghai and Guangzhou also announced restrictions on home purchases last month, responding to measures imposed by the central government.

Shares Rise

A gauge tracking property shares on the Shanghai Composite Index rose 2.4 percent at the 3 p.m. close, the most since March 23 and the best performer among the five industry groups on the benchmark measure, which increased 1.3 percent.

Home prices in Shanghai were little changed last month, while in Beijing they rose 0.6 percent, SouFun said. Baoding, a mid-sized central city, posted a 2.6 percent gain from February, the biggest advance, while the eastern city of Dezhou fell 0.9 percent, the largest decline.

It might take at least three to six months to see if the government’s property measures are working, said Bao, who expects a possible decline in home prices in the second half. The slowdown in February might have been due to the week-long Lunar New Year holidays, analysts said at the time.

Hold Off Curbs

SouFun, based in Beijing, started compiling the monthly home data of 100 cities in July and usually releases them before national statistics bureau figures. Government indexes of new and existing homes for March are due on April 18.

The government will probably hold off on further property measures to control home prices because the current restrictions on purchases are the most severe so far, Pan Shiyi, chairman for Soho China Ltd., said today in a conference call.

Premier Wen Jiabao said on March 5 that China will “resolutely” press ahead with controls on the property market to curb speculation, reiterating a promise to keep housing affordable. The government will “severely punish” irregularities in the real-estate market, implement differentiated credit and tax policies, and hold local officials accountable for maintaining stable home prices, he said.

SOUFUN DECLARES CASH DIVIDENDS TO SHAREHOLDERS

BEIJING, Jul 31, 2011 (BUSINESS WIRE) --

SouFun Holdings Limited (NYSE: SFUN, "SouFun"), the leading real estate and home furnishing Internet portal in China, today announced that its Board of Directors has approved and declared a cash dividend of US$1.00 per share on SouFun's ordinary shares. Each of the SouFun's American depositary shares ("ADS") represents one ordinary share.

The cash dividend will be paid on or about August 17, 2011 to shareholders of record as of the close of business on August 11, 2011. Dividends to be paid to SouFun's ADS holders through the depositary bank, JPMorgan Chase Bank, N.A., will be subject to the terms of the deposit agreement, including the fees and expenses payable thereunder.

BEIJING, Jul 31, 2011 (BUSINESS WIRE) --

SouFun Holdings Limited (NYSE: SFUN, "SouFun"), the leading real estate and home furnishing Internet portal in China, today announced that its Board of Directors has approved and declared a cash dividend of US$1.00 per share on SouFun's ordinary shares. Each of the SouFun's American depositary shares ("ADS") represents one ordinary share.

The cash dividend will be paid on or about August 17, 2011 to shareholders of record as of the close of business on August 11, 2011. Dividends to be paid to SouFun's ADS holders through the depositary bank, JPMorgan Chase Bank, N.A., will be subject to the terms of the deposit agreement, including the fees and expenses payable thereunder.

inzwischen gegenüber April halbiert...

Thursday, 10 Nov 2011 05:49am EST

Soufun Holdings Ltd raised fiscal 2011 guidance and expects fiscal 2011 total revenues to be between $330.0-$340.0 million, representing a 56.0% to 60.7% growth compared to the total revenues (excluding those from prepaid card business) for fiscal 2010. According to I/B/E/S Estimates, analysts were expecting the Company to report revenue of $328.3 million for fiscal 2011.

Soufun Holdings Ltd raised fiscal 2011 guidance and expects fiscal 2011 total revenues to be between $330.0-$340.0 million, representing a 56.0% to 60.7% growth compared to the total revenues (excluding those from prepaid card business) for fiscal 2010. According to I/B/E/S Estimates, analysts were expecting the Company to report revenue of $328.3 million for fiscal 2011.

aufgestockt

Zahlen sind da: http://ir.soufun.com/phoenix.zhtml?c=233487&p=irol-newsArtic…

Q1-Ergebnis war 3x Vorjahr

aber so was macht mir Angst: http://chovanec.wordpress.com/2012/05/19/no-guarantee/

BEIJING, May 8, 2013 /PRNewswire/ -- SouFun Holdings Limited (NYSE: SFUN) ("SouFun"), the leading real estate Internet portal and one of the leading home furnishing and improvement websites in China, announced today its unaudited financial results for the first quarter 2013. (Amounts are in US dollars, unless otherwise specified.)

First Quarter 2013 Highlights

Revenue in the first quarter of 2013 was $91.0 million, a 55.6% increase from the corresponding period in 2012.

Operating income in the first quarter of 2013 was $37.2 million, a 161.9% increase from the corresponding period in 2012. Non-GAAP operating income in the first quarter of 2013 was $39.0 million, a 151.9% increase from the corresponding period in 2012.

Net income attributable to SouFun Holdings Limited's shareholders was $28.4 million, or $0.34 per fully diluted share, which was a year-over-year increase of 95.5%. Non-GAAP net income attributable to SouFun Holdings Limited's shareholders was $33.2 million, or $0.40 per fully diluted share, which was a year-over-year increase of 134.3%.

"We had a very strong quarter to start 2013," said Vincent Mo, Executive Chairman of SouFun. "Our focus on expanding existing business and constant innovation has allowed SouFun to deliver solid results quarter after quarter. We will continue to invest in our people, technology, and local city infrastructure. We believe such investments are critical to ensure SouFun's long-term sustainable expansion and will create significant value for our shareholders in the long run."

First Quarter 2013 Highlights

Revenue in the first quarter of 2013 was $91.0 million, a 55.6% increase from the corresponding period in 2012.

Operating income in the first quarter of 2013 was $37.2 million, a 161.9% increase from the corresponding period in 2012. Non-GAAP operating income in the first quarter of 2013 was $39.0 million, a 151.9% increase from the corresponding period in 2012.

Net income attributable to SouFun Holdings Limited's shareholders was $28.4 million, or $0.34 per fully diluted share, which was a year-over-year increase of 95.5%. Non-GAAP net income attributable to SouFun Holdings Limited's shareholders was $33.2 million, or $0.40 per fully diluted share, which was a year-over-year increase of 134.3%.

"We had a very strong quarter to start 2013," said Vincent Mo, Executive Chairman of SouFun. "Our focus on expanding existing business and constant innovation has allowed SouFun to deliver solid results quarter after quarter. We will continue to invest in our people, technology, and local city infrastructure. We believe such investments are critical to ensure SouFun's long-term sustainable expansion and will create significant value for our shareholders in the long run."

!

Dieser Beitrag wurde vom System automatisch gesperrt. Bei Fragen wenden Sie sich bitte an feedback@wallstreet-online.de

http://www.it-times.de/news/nachricht/datum/2013/12/02/soufu…" target="_blank" rel="nofollow ugc noopener">http://www.it-times.de/news/nachricht/datum/2013/12/02/soufu…

http://blogs.barrons.com/emergingmarketsdaily/2013/11/08/sou…" target="_blank" rel="nofollow ugc noopener">http://blogs.barrons.com/emergingmarketsdaily/2013/11/08/sou…

plus 11% heute

http://blogs.barrons.com/emergingmarketsdaily/2013/11/08/sou…" target="_blank" rel="nofollow ugc noopener">http://blogs.barrons.com/emergingmarketsdaily/2013/11/08/sou…

plus 11% heute

da ich keine Lust habe auf die Löschung durch den Mod, hier einfach mal weitere Links.Wer das Potential nicht sieht.....

http://www.zacks.com/stock/news/115861/soufun-shares-hit-52-…" target="_blank" rel="nofollow ugc noopener">http://www.zacks.com/stock/news/115861/soufun-shares-hit-52-…

aber auch Risiken,die ich für weitgehend eingepreist halte

http://seekingalpha.com/article/1873141-soufun-joins-financi…

http://www.zacks.com/stock/news/115861/soufun-shares-hit-52-…" target="_blank" rel="nofollow ugc noopener">http://www.zacks.com/stock/news/115861/soufun-shares-hit-52-…

aber auch Risiken,die ich für weitgehend eingepreist halte

http://seekingalpha.com/article/1873141-soufun-joins-financi…

SouFun Holdings prices $350 mln of 2.0% Convertible Senior Notes due 2018 73.76

http://finance.yahoo.com/marketupdate/inplay#sfun

Die $250 Millionen Kapitalaufnahme für die Firmeninvestitionen haben zu Gewinnmitnahmen bzw 3,6% geführt,die aber vergleichsweise harmlos sind nach dem Anstieg der letzten Tage.Nachbörslich nur 0,1% minus

http://www.nasdaq.com/symbol/sfun/after-hours

http://finance.yahoo.com/marketupdate/inplay#sfun

Die $250 Millionen Kapitalaufnahme für die Firmeninvestitionen haben zu Gewinnmitnahmen bzw 3,6% geführt,die aber vergleichsweise harmlos sind nach dem Anstieg der letzten Tage.Nachbörslich nur 0,1% minus

http://www.nasdaq.com/symbol/sfun/after-hours

Kommentar von Zacks zu den $350 mln of 2.0% Convertible Senior Notes due 2018

http://finance.yahoo.com/news/soufun-prices-senior-notes-190…

..The new issuance would require SouFun to pay an annual interest of $7 million. Nevertheless, the company’s solid operational performance generates funds adequate enough to service the debt uninterruptedly. Its interest expense in the third quarter of 2013 increased 28.5% year over year to $3.6 million which is expected to increase further, with the issuance of the debt.......

http://finance.yahoo.com/news/soufun-prices-senior-notes-190…

..The new issuance would require SouFun to pay an annual interest of $7 million. Nevertheless, the company’s solid operational performance generates funds adequate enough to service the debt uninterruptedly. Its interest expense in the third quarter of 2013 increased 28.5% year over year to $3.6 million which is expected to increase further, with the issuance of the debt.......

nach dem Split jetzt von ^14 auf unter 9 zurückgekommen; da kann man von Vola sprechen...

zu 8,75 bis auf ein Erinnerungsstück verkauft

War das vor oder nach dem Split? Bin da noch mit ner relativ großen Position drin aber das meiste schon vor 2 Jahren gekauft. Auf dem aktuellen Kursniveau wieder interessant, ist sehr starkes Geschäftsmodell, auch wenn man zu Preisnachlässen gezwungen worden ist, macht ma nimmer noch über 60 Mio USD im Quartal

Hier eine Analyse zum chinesischen Immoscout24 (Sind Produktseitig aber m.E. deutlich besser als I24):

http://www.investresearch.net/soufun-aktie/

Hier eine Analyse zum chinesischen Immoscout24 (Sind Produktseitig aber m.E. deutlich besser als I24):

http://www.investresearch.net/soufun-aktie/

Entwickelt sich dank Short-Squeze sehr gut und Trendwende deutet sich an

Bin weiterhin mit dieser Kernposition zufrieden.

Soufun wird außerdem zur Plattform die den Immobilienplattform komplett abwickelt, riesen markt

Soufun wird außerdem zur Plattform die den Immobilienplattform komplett abwickelt, riesen markt

Antwort auf Beitrag Nr.: 47.519.602 von comiter am 14.08.14 20:02:17natürlich nach dem Split...

in Q1-2015 ist der Gewinn fast verschwunden

in Q1-2015 ist der Gewinn fast verschwunden

Antwort auf Beitrag Nr.: 50.127.930 von R-BgO am 07.07.15 13:04:29ja schon heftig was abgeht und q1 war schlecht aber langfristig wollen sie den immobilienkauf komplett online abwicklen, sowas gibt es in Deutschland noch nicht!

Antwort auf Beitrag Nr.: 50.129.703 von comiter am 07.07.15 15:43:03Hier bin ich mal gespannt wie es weiter geht.

sind nahe am 52 week low, könnte spannend werden!

Antwort auf Beitrag Nr.: 50.311.797 von delle002 am 01.08.15 09:56:13sieht gut aus und bin rechtzeitig eingestiegen mit meinen Wikifolios

China stabilisiert sich bei Immobilien und Strategie macht Sinn:

seit heute heißt Soufun: Fang

Antwort auf Beitrag Nr.: 53.365.362 von R-BgO am 28.09.16 12:58:15Thread: Fang Holdings - vormals: Soufun

Antwort auf Beitrag Nr.: 53.365.377 von R-BgO am 28.09.16 13:00:47

2016 war ein dickes Verlustjahr und aktuell sieht es nicht viel besser aus

Hie hat w:o es tatsächlich mal fertiggebracht, den alten Thread mit der neuen WKN zu verlinken;

dann kann es auch hier weitergehen...2016 war ein dickes Verlustjahr und aktuell sieht es nicht viel besser aus

Antwort auf Beitrag Nr.: 55.805.487 von R-BgO am 22.09.17 21:36:09

2017

gab es mal wieder ein kleines Plus

Antwort auf Beitrag Nr.: 57.707.245 von R-BgO am 07.05.18 10:28:49

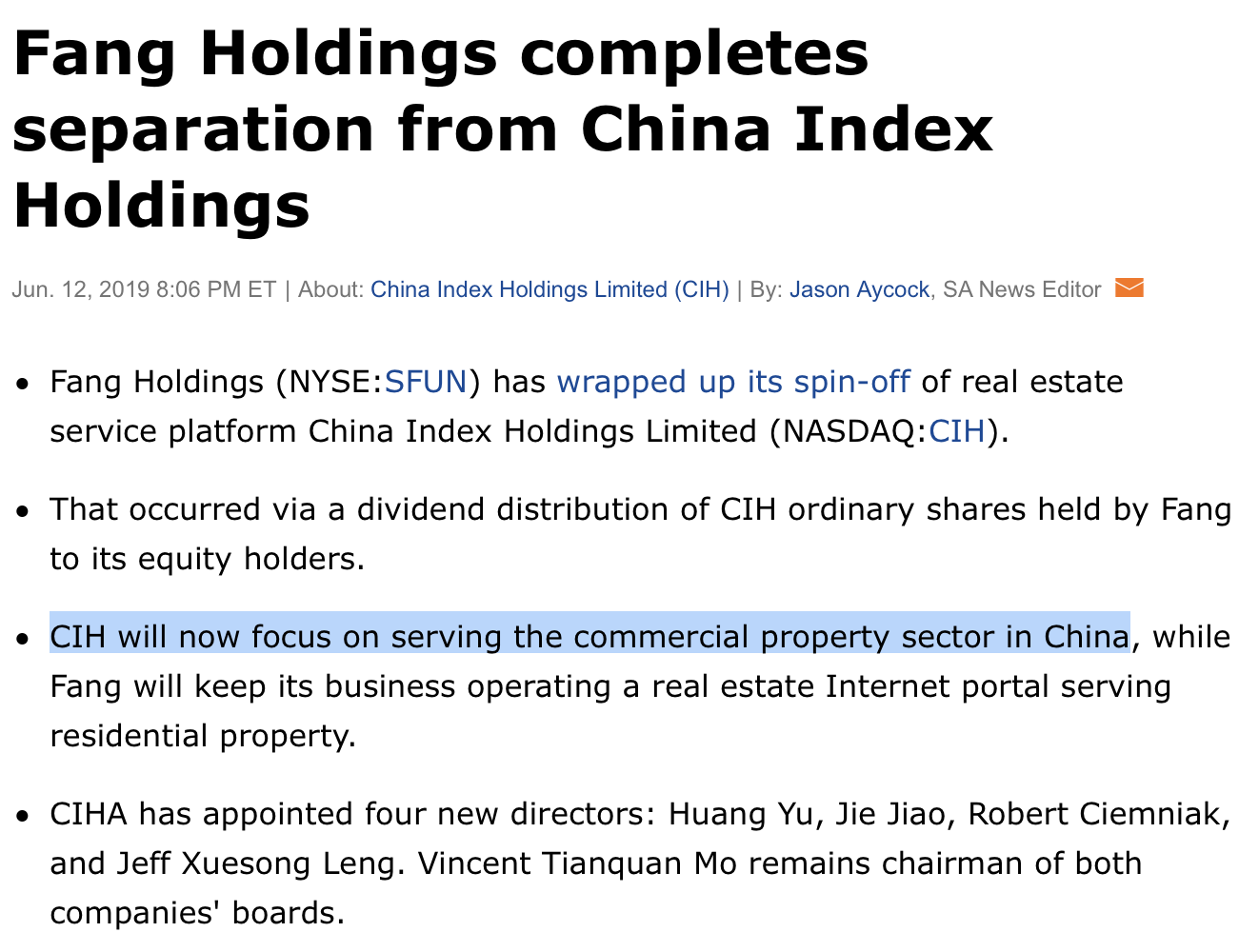

FANG ANNOUNCES CHANGE IN SENIOR MANAGEMENT AND PROPOSED SPIN-OFF OF CHINA INDEX HOLDINGS

BEIJING, Jan. 21, 2019 /PRNewswire/ --

Fang Holdings Limited (NYSE: SFUN) ("Fang" or the "Company"), a leading real estate Internet portal in China, today announced (1) a change in its senior management and (2) a proposed spin-off of China Index Holdings Limited ("CIH"), a wholly-owned subsidiary of Fang.

Change in Senior Management

Mr. Jian Liu, Fang's President, has been appointed as Chief Executive Officer to replace Mr. Vincent Tianquan Mo, effective immediately. Mr. Mo will continue to serve as the Chairman of Fang's board of directors.

Mr. Zijin Li, Fang's deputy Chief Financial Officer, has been appointed as acting Chief Financial Officer and Board Secretary to replace Dr. Hua Lei, effective immediately. Dr. Lei will serve as Fang's Chief Investment Officer, going forward.

Mr. Jian Liu joined Fang in April 2000 and was appointed from Chief Operations Officer to President on July 1, 2016. Mr. Liu was also Fang's first Chief Information Officer. Prior to joining Fang, Mr. Liu had worked at the Information Center of Ningbo Economic Committee in Zhejiang Province. Mr. Liu holds a bachelor's degree in computer science from Ningbo University.

Prior to joining Fang in 2018, Mr. Zijin Li had worked for Aofan International Group in Australia for 10 years in financial management positions and had worked for Fenghui Leasing Ltd. in China for three years as its General Manager of Finance Department. He graduated from Sydney University of Technology with a master's degree and a bachelor's degree.

"I am very happy that Mr. Jian Liu and Mr. Zijin Li will shoulder more responsibilities for Fang and myself. I believe a new generation of Fang's management will reshape the Company and bring in a fresh working style," said Vincent Mo, Fang' Chairman, "I, together with Dr. Lei, will continue to be fully committed to the Company in all respects and will fully support the new management."

Proposal to Spin Off CIH

Fang currently contemplates a spin-off of CIH to explore different options, including a potential distribution of CIH's ordinary shares to Fang's shareholders, or a potential private sale of CIH's ordinary shares, or a potential listing of CIH on a major stock exchange in the Unites States or other global stock exchanges including Chinese domestic exchanges.

As of the date of this announcement, CIH has submitted a draft registration statement on Form F-1 on a confidential basis to the U.S. Securities and Exchange Commission (the "SEC") for a possible initial public offering (the "Proposed IPO") of American depositary shares ("ADSs") representing ordinary shares of CIH. The number of ADSs proposed to be offered and sold and the dollar amount proposed to be raised in the Proposed IPO have not yet been determined. The Proposed IPO is expected to commence after the SEC completes its review process, subject to market and other conditions including the approval of Fang's board of directors. However, there can be no assurances as to the timing or completion of the Proposed IPO.

This announcement is being made pursuant to and in accordance with Rule 135 under the Securities Act of 1933, as amended. This announcement is not intended to, and does not, constitute an offer to sell or a solicitation of an offer to purchase any securities, in the United States or elsewhere, and it is not intended to, and does not, constitute an offer, solicitation or sale of any securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful. Any public offering of securities to be made in the United States will be made by means of a prospectus that may be obtained from the issuer or the selling security holder and that will contain detailed information about the issuer and management, as well as financial statements.

bisher keine Zahlen;

sieht nach "trouble in paradise" aus:FANG ANNOUNCES CHANGE IN SENIOR MANAGEMENT AND PROPOSED SPIN-OFF OF CHINA INDEX HOLDINGS

BEIJING, Jan. 21, 2019 /PRNewswire/ --

Fang Holdings Limited (NYSE: SFUN) ("Fang" or the "Company"), a leading real estate Internet portal in China, today announced (1) a change in its senior management and (2) a proposed spin-off of China Index Holdings Limited ("CIH"), a wholly-owned subsidiary of Fang.

Change in Senior Management

Mr. Jian Liu, Fang's President, has been appointed as Chief Executive Officer to replace Mr. Vincent Tianquan Mo, effective immediately. Mr. Mo will continue to serve as the Chairman of Fang's board of directors.

Mr. Zijin Li, Fang's deputy Chief Financial Officer, has been appointed as acting Chief Financial Officer and Board Secretary to replace Dr. Hua Lei, effective immediately. Dr. Lei will serve as Fang's Chief Investment Officer, going forward.

Mr. Jian Liu joined Fang in April 2000 and was appointed from Chief Operations Officer to President on July 1, 2016. Mr. Liu was also Fang's first Chief Information Officer. Prior to joining Fang, Mr. Liu had worked at the Information Center of Ningbo Economic Committee in Zhejiang Province. Mr. Liu holds a bachelor's degree in computer science from Ningbo University.

Prior to joining Fang in 2018, Mr. Zijin Li had worked for Aofan International Group in Australia for 10 years in financial management positions and had worked for Fenghui Leasing Ltd. in China for three years as its General Manager of Finance Department. He graduated from Sydney University of Technology with a master's degree and a bachelor's degree.

"I am very happy that Mr. Jian Liu and Mr. Zijin Li will shoulder more responsibilities for Fang and myself. I believe a new generation of Fang's management will reshape the Company and bring in a fresh working style," said Vincent Mo, Fang' Chairman, "I, together with Dr. Lei, will continue to be fully committed to the Company in all respects and will fully support the new management."

Proposal to Spin Off CIH

Fang currently contemplates a spin-off of CIH to explore different options, including a potential distribution of CIH's ordinary shares to Fang's shareholders, or a potential private sale of CIH's ordinary shares, or a potential listing of CIH on a major stock exchange in the Unites States or other global stock exchanges including Chinese domestic exchanges.

As of the date of this announcement, CIH has submitted a draft registration statement on Form F-1 on a confidential basis to the U.S. Securities and Exchange Commission (the "SEC") for a possible initial public offering (the "Proposed IPO") of American depositary shares ("ADSs") representing ordinary shares of CIH. The number of ADSs proposed to be offered and sold and the dollar amount proposed to be raised in the Proposed IPO have not yet been determined. The Proposed IPO is expected to commence after the SEC completes its review process, subject to market and other conditions including the approval of Fang's board of directors. However, there can be no assurances as to the timing or completion of the Proposed IPO.

This announcement is being made pursuant to and in accordance with Rule 135 under the Securities Act of 1933, as amended. This announcement is not intended to, and does not, constitute an offer to sell or a solicitation of an offer to purchase any securities, in the United States or elsewhere, and it is not intended to, and does not, constitute an offer, solicitation or sale of any securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful. Any public offering of securities to be made in the United States will be made by means of a prospectus that may be obtained from the issuer or the selling security holder and that will contain detailed information about the issuer and management, as well as financial statements.

Antwort auf Beitrag Nr.: 60.991.373 von R-BgO am 10.07.19 08:22:04Ist alles noch recht messy

Aber eigentlich bekommt man die Firma ja umsonst, da sie Cash und Investments haben. Weiß jemand welche genau, da das ja recht stark schwankt?

Ist natürlich hochspekulativ, aber wenn das dreht auch viel Erholungspotential!

Aber eigentlich bekommt man die Firma ja umsonst, da sie Cash und Investments haben. Weiß jemand welche genau, da das ja recht stark schwankt?

Ist natürlich hochspekulativ, aber wenn das dreht auch viel Erholungspotential!

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +0,13 | |

| +1,43 | |

| +1,24 | |

| -1,48 | |

| +3,43 | |

| -0,35 | |

| +1,63 | |

| +4,45 | |

| +2,13 | |

| +2,86 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 204 | ||

| 86 | ||

| 76 | ||

| 58 | ||

| 55 | ||

| 34 | ||

| 34 | ||

| 28 | ||

| 27 | ||

| 26 |