AngloGold Ashanti LTD ADR ISIN: US0351282068 | WKN: 915102 | Ticker Symbol: AU

eröffnet am 07.06.15 17:49:43 von

neuester Beitrag 12.05.23 14:34:22 von

neuester Beitrag 12.05.23 14:34:22 von

Beiträge: 196

ID: 1.213.776

ID: 1.213.776

Aufrufe heute: 0

Gesamt: 21.130

Gesamt: 21.130

Aktive User: 0

ISIN: US0351282068 · WKN: 915102

18,150

USD

-0,87 %

-0,160 USD

Letzter Kurs 23.09.23 NYSE

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 5,1500 | +21,75 | |

| 15,715 | +20,33 | |

| 0,9000 | +16,13 | |

| 15.699,00 | +15,27 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6050 | -6,20 | |

| 0,5180 | -7,09 | |

| 10,040 | -7,89 | |

| 0,5400 | -8,47 | |

| 46,88 | -97,99 |

Beitrag zu dieser Diskussion schreiben

12.5.

AngloGold to primary list in New York, secondary list in Joburg, domicile in UK

https://www.miningweekly.com/article/anglogold-to-primary-li…

...

Gold mining company AngloGold Ashanti is targeting September as the month in which it will invert its stock exchange listings.

Its primary listing on the Johannesburg Stock Exchange will become a secondary listing, its American Depository Receipt (ADR) listing in New York will be uplifted to become a fully fledged primary listing, and the company's domicile will be the UK to keep tax constant for South African shareholders, who hold 40% of the stock.

Sixty per cent of the stock is held outside of South Africa and two-thirds of its share trading already takes place in New York.

“We intend to make this transition as seamless as possible,” AngloGold Ashanti CEO Alberto Calderon, a former International Monetary Fund luminary, told journalists in a media briefing on May 12 in which Mining Weekly participated.

“Today we announce the proposed redomicile of AngloGold Ashanti. In recent times there has been increased focus on the main drivers of AngloGold Ashanti, starting with the operating model and optimizing of our assets and then moving to strengthen our senior leadership team and refresh our overall organisational culture and values.

“We have made good progress in each of these areas and expect them to continue to bear fruit in the coming months and years.

“In parallel, we have examined the question around the most appropriate corporate structure and determined whether there was latent value to be unlocked. It has been a persisting question from our shareholders, particularly with the disposal of our last substantive operating assets in South Africa.

“After concluding a comprehensive review, we have decided on the following thought process.

‘The first thing is that more than 99% of our people are outside of South Africa, where we no longer have any assets.

“It is also evident, when you look at the current corporate structure, that we are disadvantaged versus our North American peers in several metrics, for example, shares selling at a significant discount.

“Nevertheless, we recognise and value our South African heritage and history. We also respect that 40% of our shareholders are South African today and that still more than 60% of our production is in Africa.

“So, this led to a fit-for-purpose structure where we would be a UK corporate domicile. Importantly, being domiciled in the UK will imply a seamless transition for especially our South African shareholders.

“In addition to this, we will plan to have a US listing on the New York Stock Exchange, which is where our ADRs are today. The very interesting thing is that today, two-thirds of the shares are already negotiated on that stock exchange. So, we’re building up from an historical position which is important, and with this, we will have access to the largest pool of gold capital in the world, that is New York.

“Let me, before finalising, recognise and thank the South African government and the South African regulators for their constructive and understanding approach to this negotiation. I’d like to recognise that historically, we would not have been able to grow and incorporate Ashanti and others without the collaboration and the permission from in particular the SARS and the Reserve Bank of South Africa.

“We intend to make this transition as seamless as possible. The Johannesburg office will remain the same, we’ll have the same board and other things. We’re talking about a cost of around 5% of market capitalisation but that is linked to the share price.

“Finally, we expect to close this transaction around September of this year if we get the support of our shareholders,” said Calderon.

...

AngloGold to primary list in New York, secondary list in Joburg, domicile in UK

https://www.miningweekly.com/article/anglogold-to-primary-li…

...

Gold mining company AngloGold Ashanti is targeting September as the month in which it will invert its stock exchange listings.

Its primary listing on the Johannesburg Stock Exchange will become a secondary listing, its American Depository Receipt (ADR) listing in New York will be uplifted to become a fully fledged primary listing, and the company's domicile will be the UK to keep tax constant for South African shareholders, who hold 40% of the stock.

Sixty per cent of the stock is held outside of South Africa and two-thirds of its share trading already takes place in New York.

“We intend to make this transition as seamless as possible,” AngloGold Ashanti CEO Alberto Calderon, a former International Monetary Fund luminary, told journalists in a media briefing on May 12 in which Mining Weekly participated.

“Today we announce the proposed redomicile of AngloGold Ashanti. In recent times there has been increased focus on the main drivers of AngloGold Ashanti, starting with the operating model and optimizing of our assets and then moving to strengthen our senior leadership team and refresh our overall organisational culture and values.

“We have made good progress in each of these areas and expect them to continue to bear fruit in the coming months and years.

“In parallel, we have examined the question around the most appropriate corporate structure and determined whether there was latent value to be unlocked. It has been a persisting question from our shareholders, particularly with the disposal of our last substantive operating assets in South Africa.

“After concluding a comprehensive review, we have decided on the following thought process.

‘The first thing is that more than 99% of our people are outside of South Africa, where we no longer have any assets.

“It is also evident, when you look at the current corporate structure, that we are disadvantaged versus our North American peers in several metrics, for example, shares selling at a significant discount.

“Nevertheless, we recognise and value our South African heritage and history. We also respect that 40% of our shareholders are South African today and that still more than 60% of our production is in Africa.

“So, this led to a fit-for-purpose structure where we would be a UK corporate domicile. Importantly, being domiciled in the UK will imply a seamless transition for especially our South African shareholders.

“In addition to this, we will plan to have a US listing on the New York Stock Exchange, which is where our ADRs are today. The very interesting thing is that today, two-thirds of the shares are already negotiated on that stock exchange. So, we’re building up from an historical position which is important, and with this, we will have access to the largest pool of gold capital in the world, that is New York.

“Let me, before finalising, recognise and thank the South African government and the South African regulators for their constructive and understanding approach to this negotiation. I’d like to recognise that historically, we would not have been able to grow and incorporate Ashanti and others without the collaboration and the permission from in particular the SARS and the Reserve Bank of South Africa.

“We intend to make this transition as seamless as possible. The Johannesburg office will remain the same, we’ll have the same board and other things. We’re talking about a cost of around 5% of market capitalisation but that is linked to the share price.

“Finally, we expect to close this transaction around September of this year if we get the support of our shareholders,” said Calderon.

...

Noch wer an da?

Die beleidigung hat geholfen 😀

Die ArschAnti läuft in die andere richtung als der goldpreis 🤣🤣

In der Krise fahren die dicken Schiffe.

Antwort auf Beitrag Nr.: 70.520.486 von Malecon am 15.01.22 18:46:00letztendlich sind es 7,5% Minus geworden ...löse dich von den Charts von irgendwelchen sch.. Analysten ....die meisten sind für den A.,...

Antwort auf Beitrag Nr.: 70.548.899 von Malecon am 18.01.22 18:22:58

sehe keine Lücke die 6% tiefer lang inzwischen auch noch die 19 gerissen ....ich hatte gestern überlegt Teile von dieser Aktie heute zu verkaufen ....und in einen anderen Sektor zu investieren ...und dann so ein Desaster heute .... ...somit habe ich dann den Teil nicht verkauft ...

...somit habe ich dann den Teil nicht verkauft ...

Zitat von Malecon: Auf dem Chart war auch eine kleine Lücke nach unten zu sehen, die heute geschlossen wurde.

Alles ok so weit, nichts dramatisches.

sehe keine Lücke die 6% tiefer lang inzwischen auch noch die 19 gerissen ....ich hatte gestern überlegt Teile von dieser Aktie heute zu verkaufen ....und in einen anderen Sektor zu investieren ...und dann so ein Desaster heute ....

...somit habe ich dann den Teil nicht verkauft ...

...somit habe ich dann den Teil nicht verkauft ...

Auf dem Chart war auch eine kleine Lücke nach unten zu sehen, die heute geschlossen wurde.

Alles ok so weit, nichts dramatisches.

Alles ok so weit, nichts dramatisches.

Antwort auf Beitrag Nr.: 70.520.486 von Malecon am 15.01.22 18:46:00damit ist dieses Chartbild auch wieder im A....  Der einzige Sektor welcher noch schlechter als die EM Miner läuft ist der Biotech Sektor der kleinen Werte ....

Der einzige Sektor welcher noch schlechter als die EM Miner läuft ist der Biotech Sektor der kleinen Werte ....

Der einzige Sektor welcher noch schlechter als die EM Miner läuft ist der Biotech Sektor der kleinen Werte ....

Der einzige Sektor welcher noch schlechter als die EM Miner läuft ist der Biotech Sektor der kleinen Werte ....

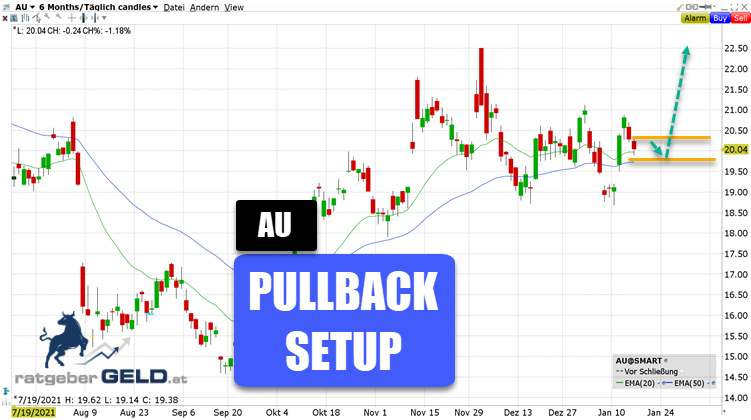

Außer der Bullenflagge spricht auch die Saisonalität beim gelben Edelmetall für einen Long Trade bei AngloGold Ashanti (AU):

Quelle: https://www.finanznachrichten.de/nachrichten-2022-01/5498287…

💡