Impala Nr.2 (Seite 4)

eröffnet am 26.11.15 08:40:01 von

neuester Beitrag 05.12.23 17:10:47 von

neuester Beitrag 05.12.23 17:10:47 von

Beiträge: 459

ID: 1.222.071

ID: 1.222.071

Aufrufe heute: 0

Gesamt: 44.283

Gesamt: 44.283

Aktive User: 0

ISIN: ZAE000083648 · WKN: A0KFSB · Symbol: IPHB

4,3400

EUR

+0,70 %

+0,0300 EUR

Letzter Kurs 03.05.24 Tradegate

Neuigkeiten

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,8360 | +17,66 | |

| 1,0950 | +16,00 | |

| 2,4000 | +14,83 | |

| 552,55 | +13,76 | |

| 33,17 | +13,52 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5500 | -8,33 | |

| 1,3160 | -9,12 | |

| 185,00 | -9,76 | |

| 0,7000 | -11,39 | |

| 12,000 | -25,00 |

Beitrag zu dieser Diskussion schreiben

Dividende/Jahreszahlen

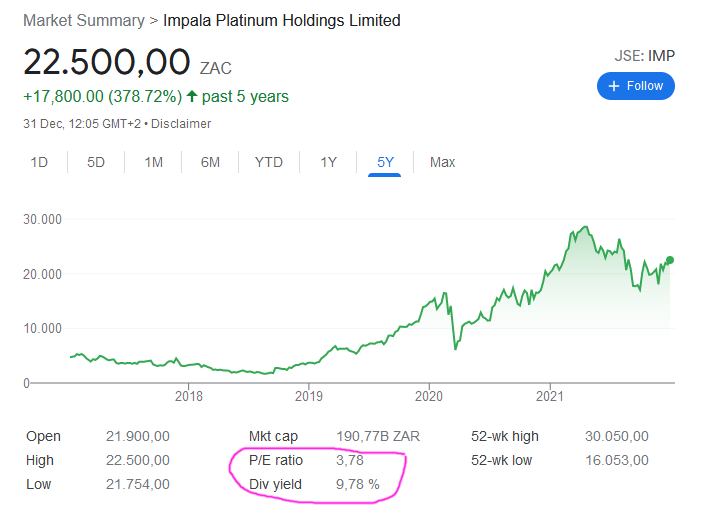

Ein ganz kurzer Überblick. Das Geschäftsjahr endete zum 30.06.2022.Die Schlußdividende beträgt 1.050 Südafrikanische Cents, also aktuell etwa 0,61 €. Damit ergibt sich eine Jahresdividende von 1.575 Südafrikanischen Cents, etwa 0,91 € oder beim aktuellen Kurs einer Dividendenrendite von 8,5 %.

Der Gewinn/Aktie betrug 3.840 Rand-Cent, also etwa 2,23 €/Aktie, womit wir bei einem KGV von 5 wären.

Bei RBPlat ist man dabei, seinen Anteil weiter auszubauen, zur Zeit dürfte dieser etwa 39 % betragen. Inzwischen wird RBPlat bereits konsolidiert, wenn ich den Geschäftsbericht richtig verstanden habe.

Aus meiner Sicht durchaus sehr gute und vielversprechende Zahlen.

7.6.

Platinum Surplus is ‘Fragile’ Amid Supply Risks, Council Warns

https://www.bnnbloomberg.ca/platinum-surplus-is-fragile-amid…

...

Platinum’s surplus is “fragile” amid supply risks and growing demand, according to the World Platinum Investment Council.

“Supply is fairly constrained and you will not see supply from mines growing in the near or medium-term future,” Chief Executive Officer Paul Wilson said at a precious metals conference in Singapore on Tuesday. “What we see in terms of demand growth is really quite exciting. We believe the market is at a turning point.”

Platinum is increasingly being used in catalytic converters for gasoline-powered cars instead of predominantly in diesel vehicles as previously, substituting palladium which is trading at a premium, Wilson said. There will also be a considerable boost in demand from the hydrogen economy, he added.

About 10% of global production is from Russia and that supply is “somewhat at risk” as its unclear how it will flow to markets in future, Wilson said. The hazards associated with the Russia-Ukraine situation could mop up the surplus forecast by the council this year, he added.

Citing expected lower output from South Africa and Russia, the council last month cut its surplus outlook for 2022 to 627,000 ounces in May from 652,000 ounces earlier this year, and its supply forecast to 7.78 million ounces from 8.18 million ounces.

Lease rates peaked at about 10% in May, implying some short-term difficulties in getting supply, Wilson said. Spot platinum traded at about $1,012 an ounce on Tuesday, and is up about 4.5% this year.

Platinum Surplus is ‘Fragile’ Amid Supply Risks, Council Warns

https://www.bnnbloomberg.ca/platinum-surplus-is-fragile-amid…

...

Platinum’s surplus is “fragile” amid supply risks and growing demand, according to the World Platinum Investment Council.

“Supply is fairly constrained and you will not see supply from mines growing in the near or medium-term future,” Chief Executive Officer Paul Wilson said at a precious metals conference in Singapore on Tuesday. “What we see in terms of demand growth is really quite exciting. We believe the market is at a turning point.”

Platinum is increasingly being used in catalytic converters for gasoline-powered cars instead of predominantly in diesel vehicles as previously, substituting palladium which is trading at a premium, Wilson said. There will also be a considerable boost in demand from the hydrogen economy, he added.

About 10% of global production is from Russia and that supply is “somewhat at risk” as its unclear how it will flow to markets in future, Wilson said. The hazards associated with the Russia-Ukraine situation could mop up the surplus forecast by the council this year, he added.

Citing expected lower output from South Africa and Russia, the council last month cut its surplus outlook for 2022 to 627,000 ounces in May from 652,000 ounces earlier this year, and its supply forecast to 7.78 million ounces from 8.18 million ounces.

Lease rates peaked at about 10% in May, implying some short-term difficulties in getting supply, Wilson said. Spot platinum traded at about $1,012 an ounce on Tuesday, and is up about 4.5% this year.

Russland produziert rund 40 % des weltweiten Palladiums, und Südafrika ist der einzige andere große Produzent mit einem ähnlichen Marktanteil.

Es wird daher befürchtet, dass mögliche Versorgungsengpässe und steigende Preise zu Produktionseinschränkungen bei den Automobilherstellern führen werden.

Alles deutet jedoch darauf hin, dass das südafrikanische Palladium in Zukunft von einer erhöhten Nachfrage profitieren wird.

Es wird daher befürchtet, dass mögliche Versorgungsengpässe und steigende Preise zu Produktionseinschränkungen bei den Automobilherstellern führen werden.

Alles deutet jedoch darauf hin, dass das südafrikanische Palladium in Zukunft von einer erhöhten Nachfrage profitieren wird.

Palladium price set to rally for years on shortages, Impala Platinum says

Prices of palladium and rhodium are poised to rally for years as a supply squeeze tightens for the metals that are key to curbing vehicle emissions, said the head of the world’s third-largest producer of platinum group metalsPrices of palladium and rhodium — which are used in catalytic converters — have risen more than 30% this year. The lack of “major investment in new supply” may help support the rally, said Nico Muller, the chief executive officer at Impala Platinum Holdings Ltd.

Sign Up for the Precious Metals Digest

“We are in a different structural environment at the moment,” Muller said in an interview in his office in Johannesburg on Thursday. “I believe that the fundamental market dynamics are going to provide strong price support for our metals for at least the next four or five years, potentially even longer.”

https://www.mining.com/web/palladium-price-set-to-rally-for-…

11.2.

S.African miner RBPlat recommends shareholders accept Impala's offer

https://www.kitco.com/news/2022-02-11/S-African-miner-RBPlat…

...

South African junior miner Royal Bafokeng on Friday recommended its shareholders accept the mandatory offer by Impala Platinum to acquire the company, paving the way to create one of the world's biggest platinum group metals (PGM) miner.

"Implats has put on the table a fair offer for their consideration," Steve Phiri, RBPLat's CEO said in a statement to shareholders, recommending they accept the offer.

If the shareholders, who have until June to decide on the mandatory offer, tender their shares, then it would end several months of tussle between Impala and its rival Northam Platinum to take control of Royal Bafokeng (RBPlat).

It would also be the first major consolidation in the PGM sector after a massive rise in the price of platinum, palladium and rhodium in 2020 saw most companies announce bumper divideds, post huge profits and bring their debt to almost zero.

Impala's mandatory offer was triggered in December when the company crossed a 35% shareholding threshold in RBPlat.

...

S.African miner RBPlat recommends shareholders accept Impala's offer

https://www.kitco.com/news/2022-02-11/S-African-miner-RBPlat…

...

South African junior miner Royal Bafokeng on Friday recommended its shareholders accept the mandatory offer by Impala Platinum to acquire the company, paving the way to create one of the world's biggest platinum group metals (PGM) miner.

"Implats has put on the table a fair offer for their consideration," Steve Phiri, RBPLat's CEO said in a statement to shareholders, recommending they accept the offer.

If the shareholders, who have until June to decide on the mandatory offer, tender their shares, then it would end several months of tussle between Impala and its rival Northam Platinum to take control of Royal Bafokeng (RBPlat).

It would also be the first major consolidation in the PGM sector after a massive rise in the price of platinum, palladium and rhodium in 2020 saw most companies announce bumper divideds, post huge profits and bring their debt to almost zero.

Impala's mandatory offer was triggered in December when the company crossed a 35% shareholding threshold in RBPlat.

...

Warum läuft Impala seit September sehr viel besser als Platin/Palladium/Rhodium?

9.12.

Northam Signals Bidding War for Platinum Miner RBPlat

https://finance.yahoo.com/news/northam-approach-signals-batt…

...

Northam Platinum Holdings Ltd. made an unsolicited approach to buy some or all of Royal Bafokeng Platinum Ltd., signaling a bidding war for the South African platinum miner.

The approach comes after Impala Platinum Holdings Ltd. last month revived its pursuit of Royal Bafokeng, seeking control of the smaller producer known as RBPlat, which is key to prolonging the life of its own deep-level operations. Earlier in November, Northam had swooped to buy out RBPlat’s biggest shareholder, thwarting Implats’ initial approach.

“The Northam unsolicited approach does not contain any details as regards the timing or the commercial and financial terms of a possible offer,” RBPlat said in a statement on Thursday.

RBPlat said it’s considering Northam’s request to perform due diligence on the same basis as that undertaken by Implats. Talks with Northam over a possible offer ended after its board rejected a non-binding offer letter dated Oct. 11, RBPlat said.

...

Northam Signals Bidding War for Platinum Miner RBPlat

https://finance.yahoo.com/news/northam-approach-signals-batt…

...

Northam Platinum Holdings Ltd. made an unsolicited approach to buy some or all of Royal Bafokeng Platinum Ltd., signaling a bidding war for the South African platinum miner.

The approach comes after Impala Platinum Holdings Ltd. last month revived its pursuit of Royal Bafokeng, seeking control of the smaller producer known as RBPlat, which is key to prolonging the life of its own deep-level operations. Earlier in November, Northam had swooped to buy out RBPlat’s biggest shareholder, thwarting Implats’ initial approach.

“The Northam unsolicited approach does not contain any details as regards the timing or the commercial and financial terms of a possible offer,” RBPlat said in a statement on Thursday.

RBPlat said it’s considering Northam’s request to perform due diligence on the same basis as that undertaken by Implats. Talks with Northam over a possible offer ended after its board rejected a non-binding offer letter dated Oct. 11, RBPlat said.

...

30.11.

Impala Platinum Says Three Workers Died After Mud Rush Incident

https://www.bnnbloomberg.ca/impala-platinum-says-three-worke…

...

Impala Platinum Holdings Ltd. said three of five workers who went missing on Sunday after a mud rush at one of its mines in Rustenburg have died.

Two workers who were rescued are in a “serious but stable condition” in hospital, the Johannesburg-based platinum-group metals miner said in a statement Tuesday. Mining operations at No. 6 shaft remain suspended, the company said. The deaths raise the number of fatalities at Impala’s Rustenburg operations in recent days to four, after another incident at its number 16 shaft on Saturday killed a contract employee.

South Africa’s mines ministry said Nov. 25 that 58 workers died in industry accidents so far this year due to a deterioration in safety. The rising fatalities indicate that miners’ safety is worsening for a second year, after 60 deaths in 2020, according to Minerals Council South Africa, an industry lobby group.

The sector had its lowest number of annual fatalities on record at 51 workers in 2019, according to the council.

...

Impala Platinum Says Three Workers Died After Mud Rush Incident

https://www.bnnbloomberg.ca/impala-platinum-says-three-worke…

...

Impala Platinum Holdings Ltd. said three of five workers who went missing on Sunday after a mud rush at one of its mines in Rustenburg have died.

Two workers who were rescued are in a “serious but stable condition” in hospital, the Johannesburg-based platinum-group metals miner said in a statement Tuesday. Mining operations at No. 6 shaft remain suspended, the company said. The deaths raise the number of fatalities at Impala’s Rustenburg operations in recent days to four, after another incident at its number 16 shaft on Saturday killed a contract employee.

South Africa’s mines ministry said Nov. 25 that 58 workers died in industry accidents so far this year due to a deterioration in safety. The rising fatalities indicate that miners’ safety is worsening for a second year, after 60 deaths in 2020, according to Minerals Council South Africa, an industry lobby group.

The sector had its lowest number of annual fatalities on record at 51 workers in 2019, according to the council.

...

29.11.

Implats Renews Royal Bafokeng Bid, Valuing Miner at $2.7 Billion

https://ca.finance.yahoo.com/news/implats-revives-bid-contro…

...

Implats, as the miner is known, offered 150 rand in cash and shares to RBPlat shareholders, a 24% premium to the closing price on Nov. 26. That comes after Northam Platinum Holdings Ltd. earlier this month agreed to pay 180 rand a share for a 32.8% stake in RBPlat, thwarting Implats’ initial approach.

Implats has long wanted to own Royal Bafokeng’s low-cost mechanized assets, which are key to prolonging the life of its own deep-level operations in the adjacent Rustenburg mining complex.

While Northam swooped to buy out RBPlat’s biggest shareholder, Implats Chief Executive Officer Nico Muller is still determined to gain majority control.

“Our ambition is to develop to a control position,” the CEO said on a call Monday, after Implats already built a 24.5% stake in RBPlat. “We see the shareholder support that we got already as a proxy of potential support that we can expect going forward.”

...

Implats Renews Royal Bafokeng Bid, Valuing Miner at $2.7 Billion

https://ca.finance.yahoo.com/news/implats-revives-bid-contro…

...

Implats, as the miner is known, offered 150 rand in cash and shares to RBPlat shareholders, a 24% premium to the closing price on Nov. 26. That comes after Northam Platinum Holdings Ltd. earlier this month agreed to pay 180 rand a share for a 32.8% stake in RBPlat, thwarting Implats’ initial approach.

Implats has long wanted to own Royal Bafokeng’s low-cost mechanized assets, which are key to prolonging the life of its own deep-level operations in the adjacent Rustenburg mining complex.

While Northam swooped to buy out RBPlat’s biggest shareholder, Implats Chief Executive Officer Nico Muller is still determined to gain majority control.

“Our ambition is to develop to a control position,” the CEO said on a call Monday, after Implats already built a 24.5% stake in RBPlat. “We see the shareholder support that we got already as a proxy of potential support that we can expect going forward.”

...