ANALYSE: Akorn-Aktie möglicherweise vor noch größerem Absturz - Raymond James - 500 Beiträge pro Seite | Diskussion im Forum

eröffnet am 01.03.18 21:25:17 von

neuester Beitrag 07.10.20 22:22:31 von

neuester Beitrag 07.10.20 22:22:31 von

Beiträge: 146

ID: 1.275.357

ID: 1.275.357

Aufrufe heute: 0

Gesamt: 8.853

Gesamt: 8.853

Aktive User: 0

ISIN: US0097281069 · WKN: 888920

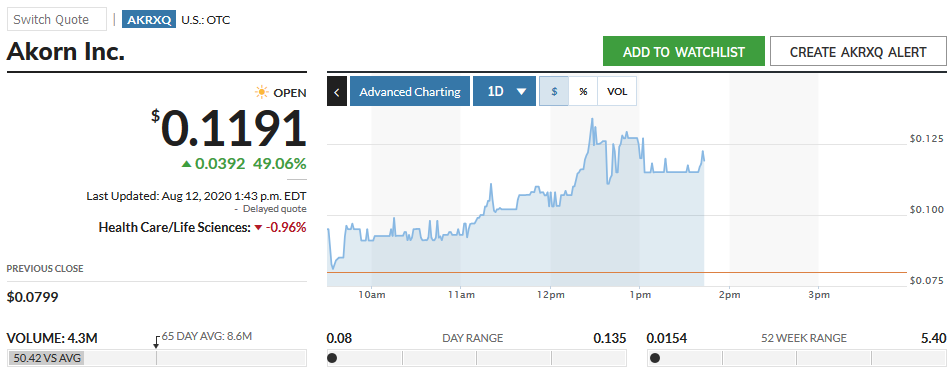

0,0270

USD

0,00 %

0,0000 USD

Letzter Kurs 03.10.20 Nasdaq OTC

Werte aus der Branche Pharmaindustrie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,2000 | +471,16 | |

| 0,5700 | +55,23 | |

| 5,4500 | +41,56 | |

| 119,40 | +29,92 | |

| 1,2100 | +21,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7295 | -19,03 | |

| 5,2500 | -19,23 | |

| 0,7500 | -27,88 | |

| 0,7500 | -48,28 | |

| 2,5600 | -70,32 |

Es handelt sich um einen automatisiert angelegten Thread zur Nachricht "ANALYSE: Akorn-Aktie möglicherweise vor noch größerem Absturz - Raymond James" vom Autor dpa-AFX

Das Investmenthaus Raymond James zeichnet angesichts der aktuellen Probleme beim US-Generikahersteller Akorn für dessen Aktie ein düsteres Szenario. Der deutsche Gesundheitskonzern Fresenius SE will Akorn übernehmen, doch mögliche …

Lesen Sie den ganzen Artikel: ANALYSE: Akorn-Aktie möglicherweise vor noch größerem Absturz - Raymond James

Das Investmenthaus Raymond James zeichnet angesichts der aktuellen Probleme beim US-Generikahersteller Akorn für dessen Aktie ein düsteres Szenario. Der deutsche Gesundheitskonzern Fresenius SE will Akorn übernehmen, doch mögliche …

Lesen Sie den ganzen Artikel: ANALYSE: Akorn-Aktie möglicherweise vor noch größerem Absturz - Raymond James

http://investors.akorn.com/phoenix.zhtml?c=78132&p=irol-news…

=>

Akorn Issues Statement on Investigation

LAKE FOREST, Ill., Feb. 26, 2018 (GLOBE NEWSWIRE) -- Akorn, Inc. (Nasdaq:AKRX), a leading specialty generic pharmaceutical company, today issued the following statement:

“Akorn and Fresenius Kabi AG, with the assistance of outside consultants, are investigating alleged breaches of FDA data integrity requirements relating to product development at the Company. To date, the Company’s investigation has not found any facts that would result in a material impact on Akorn’s operations and the Company does not believe this investigation should affect the closing of the transaction with Fresenius. The Company does not intend to provide further updates as the investigation proceeds. The Company is continuing to work to obtain regulatory clearance for the transaction.”

=>

Akorn Issues Statement on Investigation

LAKE FOREST, Ill., Feb. 26, 2018 (GLOBE NEWSWIRE) -- Akorn, Inc. (Nasdaq:AKRX), a leading specialty generic pharmaceutical company, today issued the following statement:

“Akorn and Fresenius Kabi AG, with the assistance of outside consultants, are investigating alleged breaches of FDA data integrity requirements relating to product development at the Company. To date, the Company’s investigation has not found any facts that would result in a material impact on Akorn’s operations and the Company does not believe this investigation should affect the closing of the transaction with Fresenius. The Company does not intend to provide further updates as the investigation proceeds. The Company is continuing to work to obtain regulatory clearance for the transaction.”

Antwort auf Beitrag Nr.: 57.164.457 von faultcode am 01.03.18 21:25:17=>

* FRE fällt heute deutlich

* AKRX steigt heute deutlich ??

=> ich leg mir hier mal ne kleine Posi zu...

Frei nach dem Motto von George Soros (*):

Invest first and then investigate.

(*) https://www.elitetrader.com/et/threads/george-soros-on-tradi…

* FRE fällt heute deutlich

* AKRX steigt heute deutlich ??

=> ich leg mir hier mal ne kleine Posi zu...

Frei nach dem Motto von George Soros (*):

Invest first and then investigate.

(*) https://www.elitetrader.com/et/threads/george-soros-on-tradi…

Antwort auf Beitrag Nr.: 57.164.628 von faultcode am 01.03.18 21:45:39

da Fresenius SE nun das Kneifen anfängt, indem sie einen Vorwand suchen, aus dem Deal herauszukommen, nachdem sie wohl feststellten, dass sie - in ihrer Anfangseuphorie - zuviel Geld bezahlen müssten

=> ob's wirklich so laufen wird bis Jahresende?

Akorn (AKRX) Issues Statement as Fresenius Seeks to Terminate Merger

https://www.streetinsider.com/Corporate+News/Akorn+%28AKRX%2…

=>

“We categorically disagree with Fresenius’ accusations. The previously disclosed ongoing investigation, which is not a condition to closing, has not found any facts that would result in a material adverse effect on Akorn’s business and therefore there is no basis to terminate the transaction.

We intend to vigorously enforce our rights, and Fresenius’ obligations, under our binding merger agreement.”

=> da hat jemand bei Fresenius (Kabis) nicht richtig aufgepasst

heute mit Expansion Breakdown

(noch unbestätigt)da Fresenius SE nun das Kneifen anfängt, indem sie einen Vorwand suchen, aus dem Deal herauszukommen, nachdem sie wohl feststellten, dass sie - in ihrer Anfangseuphorie - zuviel Geld bezahlen müssten

=> ob's wirklich so laufen wird bis Jahresende?

Akorn (AKRX) Issues Statement as Fresenius Seeks to Terminate Merger

https://www.streetinsider.com/Corporate+News/Akorn+%28AKRX%2…

=>

“We categorically disagree with Fresenius’ accusations. The previously disclosed ongoing investigation, which is not a condition to closing, has not found any facts that would result in a material adverse effect on Akorn’s business and therefore there is no basis to terminate the transaction.

We intend to vigorously enforce our rights, and Fresenius’ obligations, under our binding merger agreement.”

=> da hat jemand bei Fresenius (Kabis) nicht richtig aufgepasst

Antwort auf Beitrag Nr.: 57.606.063 von faultcode am 23.04.18 12:45:37pre-market standen mal kurz USD12.99 an

--> den Gefallen wird mir der Markt aber wohl nicht mehr machen heute --> dennoch "3-Tage-Regel" abwarten --> Mittwoch im Laufe des Tages noch mal vorbeischauen..

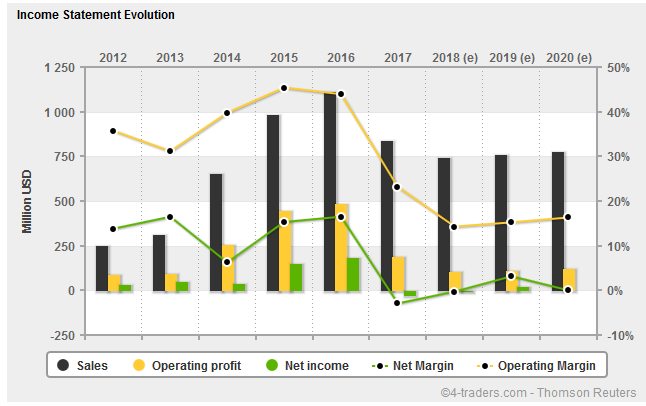

mein Total Fair Value (konversativ) liegt momentan bei USD8.40 mit:

- mat.book value -USD1.79 (2016 (*)) --> AR2017 noch immer nicht draussen --> wird aber wohl auch zum 31.12.2017 <0 sein

- EPS2018e: USD0.61

__FactSet: USD0.62

__Thomson Reuters: USD0.05 !!

- CAGR EPS 2018e-2028e: 10%

- term.CAGR EPS 2029e-2038e: 2%

- discount rate: 10%

=> durch die vielen M&A-Aktivitäten ist sowohl Umsatz-, Cash Flow- und Ergebnis-Stabilität praktisch nicht gegeben

=> aber unter USD10 pro Aktie kann man mMn nichts falsch machen, ganz unabhängig davon wie die FRE-Geschichte ausgehen wird!

(*) Ende 2016 schleppte AKRX grob USD1b an Goodwill und intangible assets mit sich herum!

--> den Gefallen wird mir der Markt aber wohl nicht mehr machen heute --> dennoch "3-Tage-Regel" abwarten --> Mittwoch im Laufe des Tages noch mal vorbeischauen..

mein Total Fair Value (konversativ) liegt momentan bei USD8.40 mit:

- mat.book value -USD1.79 (2016 (*)) --> AR2017 noch immer nicht draussen --> wird aber wohl auch zum 31.12.2017 <0 sein

- EPS2018e: USD0.61

__FactSet: USD0.62

__Thomson Reuters: USD0.05 !!

- CAGR EPS 2018e-2028e: 10%

- term.CAGR EPS 2029e-2038e: 2%

- discount rate: 10%

=> durch die vielen M&A-Aktivitäten ist sowohl Umsatz-, Cash Flow- und Ergebnis-Stabilität praktisch nicht gegeben

=> aber unter USD10 pro Aktie kann man mMn nichts falsch machen, ganz unabhängig davon wie die FRE-Geschichte ausgehen wird!

(*) Ende 2016 schleppte AKRX grob USD1b an Goodwill und intangible assets mit sich herum!

Antwort auf Beitrag Nr.: 57.606.534 von faultcode am 23.04.18 13:43:45

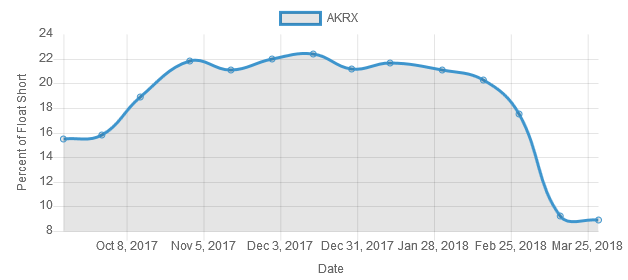

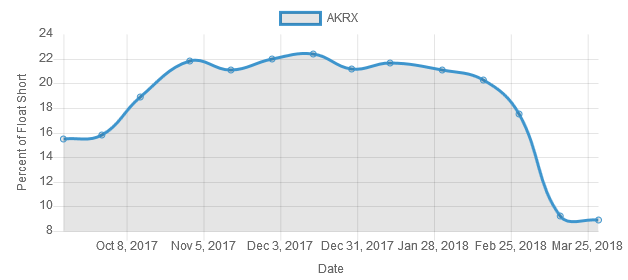

=>

Shortquote noch bei 8...9%

https://www.shortpainbot.com/?s=akrx=>

Antwort auf Beitrag Nr.: 57.606.063 von faultcode am 23.04.18 12:45:37

http://investors.akorn.com/phoenix.zhtml?c=78132&p=irol-news…

=>

Akorn, Inc. (NASDAQ:AKRX), today filed a complaint in Delaware Chancery Court asking that Fresenius Kabi AG be required to fulfill its obligations under the definitive merger agreement, and issued the following statement:

“Fresenius’ attempt to terminate the transaction on the pretext that the findings from the ongoing investigation are a breach of the merger agreement is completely without merit.

The previously disclosed ongoing investigation, of which we have voluntarily notified and are in regular communication with the Food and Drug Administration, has not found any facts that would result in a material adverse effect on Akorn’s business and therefore there is no basis to terminate the transaction.

The investigation is not a condition to closing and the only remaining condition is approval from the Federal Trade Commission. We intend to vigorously enforce our rights, and Fresenius’ obligations, under our binding merger agreement.”...

Klage seitens Akorn schon da

Akorn Asks Delaware Court to Require Fresenius Kabi to Fulfill Its Obligations under Merger Agreementhttp://investors.akorn.com/phoenix.zhtml?c=78132&p=irol-news…

=>

Akorn, Inc. (NASDAQ:AKRX), today filed a complaint in Delaware Chancery Court asking that Fresenius Kabi AG be required to fulfill its obligations under the definitive merger agreement, and issued the following statement:

“Fresenius’ attempt to terminate the transaction on the pretext that the findings from the ongoing investigation are a breach of the merger agreement is completely without merit.

The previously disclosed ongoing investigation, of which we have voluntarily notified and are in regular communication with the Food and Drug Administration, has not found any facts that would result in a material adverse effect on Akorn’s business and therefore there is no basis to terminate the transaction.

The investigation is not a condition to closing and the only remaining condition is approval from the Federal Trade Commission. We intend to vigorously enforce our rights, and Fresenius’ obligations, under our binding merger agreement.”...

ist der Abschlag da übertrieben ?

Antwort auf Beitrag Nr.: 57.607.584 von Hufeisenmagnet am 23.04.18 15:24:28wenn man das wüsste es wird auf jedenfall eine schöne Summe Geld fliessen Vertrag ist Vertrag und die müssen erfüllt werden oder es muss gezahlt werden

Antwort auf Beitrag Nr.: 57.608.055 von dig101 am 23.04.18 16:10:47das mit dem Vertrag ist aber strittig..............

Antwort auf Beitrag Nr.: 57.608.055 von dig101 am 23.04.18 16:10:47Hallo Dig101,

sehr optimistische Einschätzung. Ich nehme an Du hast den Vertrag gelesen, den der Freseniusvorstand behauptet, dass eine Kündigung ohne Ausgleich lt. Vertrag möglich ist.

Okay der Akornvorstand behauptet dass eine Kündigung nicht möglich ist, aber der behauptet ja auch sich mit seinen Produkten an die gesetzlichen Vorgaben gehalten zu haben.

Der Markt tendiert jedenfalls deutlich.

Gruß

Schlummschütze

sehr optimistische Einschätzung. Ich nehme an Du hast den Vertrag gelesen, den der Freseniusvorstand behauptet, dass eine Kündigung ohne Ausgleich lt. Vertrag möglich ist.

Okay der Akornvorstand behauptet dass eine Kündigung nicht möglich ist, aber der behauptet ja auch sich mit seinen Produkten an die gesetzlichen Vorgaben gehalten zu haben.

Der Markt tendiert jedenfalls deutlich.

Gruß

Schlummschütze

Antwort auf Beitrag Nr.: 57.608.154 von Hufeisenmagnet am 23.04.18 16:20:59Sagt Fres. am Ende ist es ein Vertrag der erfüllt werden muss

informieren muss man sich auf jeden Fall

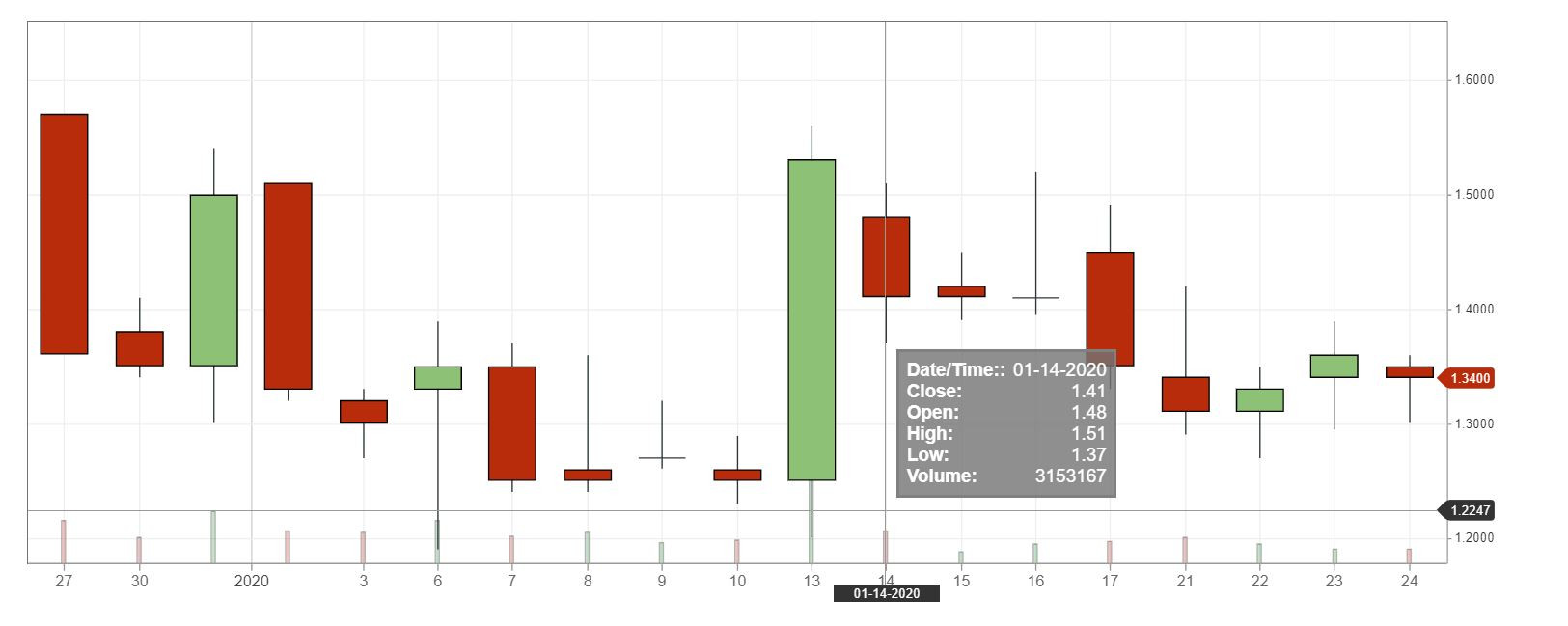

Der Chart sieht für mich gefährlich und zugleich interessant aus.

Eröffnung 14,110EUR

Tageshoch 14,110EUR

Tagestief 8,000EUR

Vortageskurs 16,020EUR

Volumen 27,09 Tsd.Stk.

52-Wochen Hoch 16,100EUR

52-Wochen Tief 13,900EUR

ich riskier erst mal einen Blick

Der Chart sieht für mich gefährlich und zugleich interessant aus.

Einfaches Einfügen von wallstreetONLINE Charts: So funktionierts.

Eröffnung 14,110EUR

Tageshoch 14,110EUR

Tagestief 8,000EUR

Vortageskurs 16,020EUR

Volumen 27,09 Tsd.Stk.

52-Wochen Hoch 16,100EUR

52-Wochen Tief 13,900EUR

ich riskier erst mal einen Blick

Antwort auf Beitrag Nr.: 57.608.205 von Schlummschuetze am 23.04.18 16:25:25Tja wer hat jetzt recht falls fre. aber nicht recht hat sollte der kurs sehr schnell sehr hoch wieder gehen

Die Frage ist wer schliesst so einen Vertrag ab ich glaube niemand die leute müssten sehr dumm sein einen Vertrag abzuschließen den man jederzeit ohne Strafe kündigen kann.

Die Frage ist wer schliesst so einen Vertrag ab ich glaube niemand die leute müssten sehr dumm sein einen Vertrag abzuschließen den man jederzeit ohne Strafe kündigen kann.

Antwort auf Beitrag Nr.: 57.608.268 von Hufeisenmagnet am 23.04.18 16:30:36Falls hier ein paar 100 $ an Abfindung fliessen sollte man schnell wieder sehr hoch steigen vielleicht sogar über 20 $ .

Antwort auf Beitrag Nr.: 57.608.436 von dig101 am 23.04.18 16:45:24So richtig überzeugst du mich nicht.

Da lese ich liebe die News und mach mir mein eigenes Bild.

Du schmeisst hier mit Zahlen um dich, da finde ich nix konkretes und sachliches

Da lese ich liebe die News und mach mir mein eigenes Bild.

Du schmeisst hier mit Zahlen um dich, da finde ich nix konkretes und sachliches

Antwort auf Beitrag Nr.: 57.608.577 von Hufeisenmagnet am 23.04.18 17:00:53Am Ende wird man sich schon einigen aber nix bekommen bei Vertragsbruch kann ich mir schwer vorstellen.

Fres. will einfach nur günstig aus der Sache raus kommen und dafür sind alle Mittel recht.

Der Kurs wird zeigen wer recht hat die erste Panik ist vorbei und vielleicht kauft sich fres wieder günstig ein

Fres. will einfach nur günstig aus der Sache raus kommen und dafür sind alle Mittel recht.

Der Kurs wird zeigen wer recht hat die erste Panik ist vorbei und vielleicht kauft sich fres wieder günstig ein

Antwort auf Beitrag Nr.: 57.608.322 von dig101 am 23.04.18 16:35:20Hi Dig101.

grundsätzlich sind Verträge dazu da um gebrochen zu werden.

Fre beruft sich ja auch darauf, dass Akorn gegen mehrere Punkte verstossen hätte.

Akorn muss seinerseits unabhängig von den Chancen Klagen, da ihnen die

Anwälte der Aktionäre im Nacken sitzen, die Akorn verklagt haben, wegen Verschweigens

von negativen kursrelevanten Aussichten.

Also selbst bei Abfindung wird viel Geld direkt wieder aus Akorn rausgesaugt.

Übernahme würde ich immer noch nicht ausschließen, erwarte dann aber einen großen

Preisnachlass (mindestens 50 %). Wäre natürlich ein deutliches Aufgeld zu aktuellen Kursen

und für beide Seiten vielleicht immer noch die beste Lösung.

Ansonsten wird es eng für Akorn (hohe Umsatzeinbrüche, hohe Verluste, mit Rechtsfällen beschäftigter Vorstand, der sich nicht ausreichend um die eigentlichen Geschäfte kümmern kann.).

Gruß

Schlummschütze

grundsätzlich sind Verträge dazu da um gebrochen zu werden.

Fre beruft sich ja auch darauf, dass Akorn gegen mehrere Punkte verstossen hätte.

Akorn muss seinerseits unabhängig von den Chancen Klagen, da ihnen die

Anwälte der Aktionäre im Nacken sitzen, die Akorn verklagt haben, wegen Verschweigens

von negativen kursrelevanten Aussichten.

Also selbst bei Abfindung wird viel Geld direkt wieder aus Akorn rausgesaugt.

Übernahme würde ich immer noch nicht ausschließen, erwarte dann aber einen großen

Preisnachlass (mindestens 50 %). Wäre natürlich ein deutliches Aufgeld zu aktuellen Kursen

und für beide Seiten vielleicht immer noch die beste Lösung.

Ansonsten wird es eng für Akorn (hohe Umsatzeinbrüche, hohe Verluste, mit Rechtsfällen beschäftigter Vorstand, der sich nicht ausreichend um die eigentlichen Geschäfte kümmern kann.).

Gruß

Schlummschütze

aus einer Sekundärquelle:

"Im Übernahmevertrag hatten die Bad Homburger keine Auflösungsgebühr im Falle eines Scheiterns (Breakup fee) vereinbart. Fresenius bestätigte entsprechend seine Jahresprognose für Konzernergebnis und -umsatz."

https://boerse.ard.de/aktien/fresenius-will-akorn-nicht100.h…

"Im Übernahmevertrag hatten die Bad Homburger keine Auflösungsgebühr im Falle eines Scheiterns (Breakup fee) vereinbart. Fresenius bestätigte entsprechend seine Jahresprognose für Konzernergebnis und -umsatz."

https://boerse.ard.de/aktien/fresenius-will-akorn-nicht100.h…

Akorn zieht nach Übernahme-Absage gegen Fresenius vor Gericht

Der US-Generikahersteller weist die Vorwürfe des Gesundheitskonzerns kategorisch zurück.

Fresenius droht nun ein juristisches Nachspiel.

http://www.handelsblatt.com/unternehmen/industrie/us-generik…

da geht die Schlammschlacht los................

Der US-Generikahersteller weist die Vorwürfe des Gesundheitskonzerns kategorisch zurück.

Fresenius droht nun ein juristisches Nachspiel.

http://www.handelsblatt.com/unternehmen/industrie/us-generik…

da geht die Schlammschlacht los................

Antwort auf Beitrag Nr.: 57.608.994 von Global-Player83 am 23.04.18 17:37:40Würde schreiben dumm gelaufen wenn es wirklich so ist.

Ganz ehrlich, wenn Fresenius Akorn übernehmen will/wollte, dann diktieren die doch die Konditionen, Strafen etc.

Und was soll Akorn seinen Aktionären denn sagen? "Ja, Fresenius hatte recht, es gab Unregelmäßigkeiten mit der FDA". Dann könnten die Chefs aber ihren Hut nehmen, so hat man stillschweigen mit Fresenius vereinbart und zieht eine Pseudo Klage durch, bei der mann sich als Opfer darstellt. Der US-Generika Hersteller steht im harten Konkurrenzkampf und der Preisdruck macht sich negativ auf die Gewinnentwicklung bemerkbar. Wenn es "innenpolitisch" nicht so läuft, muss man halt "außenpolitisch" (für Ablenkung Sorgen = Klage) auf die Pauke hauen.

Und was soll Akorn seinen Aktionären denn sagen? "Ja, Fresenius hatte recht, es gab Unregelmäßigkeiten mit der FDA". Dann könnten die Chefs aber ihren Hut nehmen, so hat man stillschweigen mit Fresenius vereinbart und zieht eine Pseudo Klage durch, bei der mann sich als Opfer darstellt. Der US-Generika Hersteller steht im harten Konkurrenzkampf und der Preisdruck macht sich negativ auf die Gewinnentwicklung bemerkbar. Wenn es "innenpolitisch" nicht so läuft, muss man halt "außenpolitisch" (für Ablenkung Sorgen = Klage) auf die Pauke hauen.

Fresenius alleges 'blatant fraud' at U.S. drugmaker Akorn

heute (auch) <-15% wg.: https://www.reuters.com/article/us-akorn-m-a-fresenius/frese…=>

...German healthcare group Fresenius (FREG.DE) alleged it uncovered “blatant fraud at the very top level” of U.S. generic drugmaker Akorn Inc (AKRX.O) after Fresenius agreed to acquire the company for $4.75 billion, according to a court filing made public late on Tuesday...

=> The court scheduled the trial to begin on July 9.

...

The drugmaker will ask a Delaware judge at a hearing on Tuesday to fast-track its lawsuit and schedule a trial as soon as next month, according to court documents.

Fresenius wants the trial to be held in January.

...

Akorn said in its lawsuit last month that Fresenius uncovered data integrity problems that are common in the generic drug industry and is seizing on them to try to back out of a deal it soured on for financial reasons.

=> ehrlich: ich sehe das auch so.

But Fresenius alleged that an Akorn executive vice president for quality assurance, whose name was redacted from the court filing, knowingly directed the submission of fraudulent testing data to the U.S. Food and Drug Administration.

The fabricated data concerned Akorn’s application to market the antibiotic azithromycin, and Fresenius alleged the fraudulent scheme began in 2012.

Fresenius also alleged that “the same scheme has infected” at least five other Akorn products.

In the court filing, Fresenius said its investigation revealed “blatant fraud at the very top level of Akorn’s executive team, stunning evidence of blatant and pervasive data integrity violations.”

Akorn has said in court documents it investigated the possible submission of falsified data and fired an executive who was involved.

“Critically, azithromycin and the five other drug products in question either have never been marketed or are not currently being marketed and were never forecasted to form a material portion of Akorn’s future earnings,” the company said in one of the documents.

=> als ob Datenschummel in der Pharmaindustrie was ganz Neues wäre!

--> d.h., ich gehe davon aus, dass AKRX so schummelt wie im Prinzip alle anderen auch -- inklusive Fresenius Kabi

--> oder im Umkehrschluss: das ist nicht ungefährlich für Fresenius (im wichtigen US-Markt), wenn sie sich dort wie die grossen Aufklärer und Aufräumer aufführen...

ich gehe von folgenden Annahmen aus:

=> Datenschummel seitens Akorn hat stattgefunden

=> Fresenius nutzt das als "Vorwand" um die geplante Übernahme abzusagen

=> u.a vor allem weil die Kennzahlen von Akorn sich deutlich eingetrübt haben

"It’s easy to see why Fresenius might want out; the deal “math has clearly changed,” Stanicky noted, adding that Akorn is expecting 2018 earnings of $156 million, well below Fresenius’ initial outlook of $380 million ot $420 million. And the FTC may be requiring divestments that Fresenius isn’t keen on, pressuring the equation even further.

But “worsened economics do not impact FRE's obligation to close this deal. Hence the focus on ‘failure to fulfill closing conditions,’” Stanicky wrote."

Quelle: https://www.fiercepharma.com/pharma/fresenius-dumps-4-3b-ako…

Die für mich spannendere Frage ist, wo liegt der faire Wert der Akorn-Aktie ohne Berücksichtigung des Übernahme-Streits?

=> Datenschummel seitens Akorn hat stattgefunden

=> Fresenius nutzt das als "Vorwand" um die geplante Übernahme abzusagen

=> u.a vor allem weil die Kennzahlen von Akorn sich deutlich eingetrübt haben

"It’s easy to see why Fresenius might want out; the deal “math has clearly changed,” Stanicky noted, adding that Akorn is expecting 2018 earnings of $156 million, well below Fresenius’ initial outlook of $380 million ot $420 million. And the FTC may be requiring divestments that Fresenius isn’t keen on, pressuring the equation even further.

But “worsened economics do not impact FRE's obligation to close this deal. Hence the focus on ‘failure to fulfill closing conditions,’” Stanicky wrote."

Quelle: https://www.fiercepharma.com/pharma/fresenius-dumps-4-3b-ako…

Die für mich spannendere Frage ist, wo liegt der faire Wert der Akorn-Aktie ohne Berücksichtigung des Übernahme-Streits?

Antwort auf Beitrag Nr.: 57.685.269 von Global-Player83 am 03.05.18 12:28:14Hi,

ohne die Übernahmephantasie ist Akorn wohl wertlos.

Akorn schreibt rote Zahlen, die Umsätze brechen weg, eine Lawine von Prozessen (mit Fresenius, die Schadenersatzforderungen der sich betrogen fühlenden eigenen Aktionäre, Betrug bei Medikamentenzulassungen und damit auch hier Bußgelder und Schadenersatzprozesse)-

Wenn die Freseniusbehauptungen stimmen bleibt nicht mehr viel.

Gruß

Schlummschütze

ohne die Übernahmephantasie ist Akorn wohl wertlos.

Akorn schreibt rote Zahlen, die Umsätze brechen weg, eine Lawine von Prozessen (mit Fresenius, die Schadenersatzforderungen der sich betrogen fühlenden eigenen Aktionäre, Betrug bei Medikamentenzulassungen und damit auch hier Bußgelder und Schadenersatzprozesse)-

Wenn die Freseniusbehauptungen stimmen bleibt nicht mehr viel.

Gruß

Schlummschütze

Antwort auf Beitrag Nr.: 57.692.418 von Schlummschuetze am 04.05.18 08:57:59

=> das wäre aus Sicht von Fresenius aber unlogisch. Gut, es steht das einschränkende Wort "wohl" oben dabei.

Denn dann stellt sich die Frage: was wollte Fresenius (Kabi) eigentlich von Akorn?

=> vor diesem Hintergrund gibt es ja nur noch zwei Möglichkeiten:

(A) Fresenius (Kabi) ist zu doof Übernahmeziele hinreichend zu prüfen:

...Stephan Sturm, Vorstandsvorsitzender von Fresenius, sagte: „Mit diesen Akquisitionen (FC: gemeint Merck Biosimilar + Akorn) stellen wir bei Fresenius Kabi die Weichen für ein noch breiter angelegtes und dauerhaft kräftiges Wachstum über das laufende Jahrzehnt hinaus. Akorn ergänzt das Produktangebot von Fresenius Kabi im Generika-Geschäft bestens.

...

Die US-amerikanischen Unternehmenszentralen von Akorn und Fresenius Kabi liegen nur wenige Kilometer voneinander entfernt im Norden des US-Bundesstaats Illinois...

aus: https://www.fresenius.de/5770

--> diese ganz Meldung überschlägt sich fast für Freude auf das Geschäft von Akorn

=> dagegen spricht aber der M&A-Trackrekord von Fresenius und von auch von Stephan Sturm als CFO und später CEO (2016) von Fresenius

--> OK, vielleicht war das nun sein erster grosser Fehler bei Fresenius (als CEO)

oder

(B) man ist auf ganz hinterhältige Betrüger reingefallen, was man nicht absehen konnte bei einem Übernahmeziel in der Nachbarschaft:

- ich habe auf Google Maps nachgemessen: es sind vom:

Three Corporate Drive Lake Zurich, IL 60047 (FRE/HQ)

bis

Lake Forest, IL, (AKRX/HQ)

nur 15 miles = 30min Autofahrt!

=> das ist keine Fern-Übernahme. Beide Standorte sind etabliert, auch mit Produktion (Manufacturing Locations), z.B.:

FRE:

* Melrose Park village, Cook County, IL

<-- 180 miles -->

AKRX:

* 1222 W. Grand Ave., Decatur, IL

=> kaum zu glauben, dass nicht mal Info's und Personen hin und her gegangen sind

- in IL alleine arbeiten jeweils mehrere hundert Personen bei Fresenius Kabi, als auch bei Akorn

=> und da soll ich glauben, dass die eine Gruppe über Jahre ruchlose Betrüger sind ("unter anderen schwerwiegende Verstöße gegen FDA-Vorgaben", FRE, 22.4.), die nur noch auf naive Deutsche mit ihrem "stupid German money" gewartet haben?

Einer Gruppe, die auch regelmässig von der FDA (indirekt wenigstens) kontrolliert wird?

Im Heimatland der FDA-Regularien wie 21 CFR Part 11, denen sich auch alle europäischen Pharma-Produktions-Standorte mutmasslich und streng unterwerfen?

__

nebenbei:

- bei glassdoor bekommt Fresenius Kabi USA (2,4) schlechtere Noten als Akorn (3,3 - was aber auch nicht wirklich gut ist), bei fast identischer Anzahl von Bewertungen mit Anzahl >= 60 (auch wenn man das nicht überbewerten sollte - v.a. nicht als Aktionär; gibt gute Gegenbeispiele dazu...)

Zitat von Schlummschuetze: ...ohne die Übernahmephantasie ist Akorn wohl wertlos...

=> das wäre aus Sicht von Fresenius aber unlogisch. Gut, es steht das einschränkende Wort "wohl" oben dabei.

Denn dann stellt sich die Frage: was wollte Fresenius (Kabi) eigentlich von Akorn?

=> vor diesem Hintergrund gibt es ja nur noch zwei Möglichkeiten:

(A) Fresenius (Kabi) ist zu doof Übernahmeziele hinreichend zu prüfen:

...Stephan Sturm, Vorstandsvorsitzender von Fresenius, sagte: „Mit diesen Akquisitionen (FC: gemeint Merck Biosimilar + Akorn) stellen wir bei Fresenius Kabi die Weichen für ein noch breiter angelegtes und dauerhaft kräftiges Wachstum über das laufende Jahrzehnt hinaus. Akorn ergänzt das Produktangebot von Fresenius Kabi im Generika-Geschäft bestens.

...

Die US-amerikanischen Unternehmenszentralen von Akorn und Fresenius Kabi liegen nur wenige Kilometer voneinander entfernt im Norden des US-Bundesstaats Illinois...

aus: https://www.fresenius.de/5770

--> diese ganz Meldung überschlägt sich fast für Freude auf das Geschäft von Akorn

=> dagegen spricht aber der M&A-Trackrekord von Fresenius und von auch von Stephan Sturm als CFO und später CEO (2016) von Fresenius

--> OK, vielleicht war das nun sein erster grosser Fehler bei Fresenius (als CEO)

oder

(B) man ist auf ganz hinterhältige Betrüger reingefallen, was man nicht absehen konnte bei einem Übernahmeziel in der Nachbarschaft:

- ich habe auf Google Maps nachgemessen: es sind vom:

Three Corporate Drive Lake Zurich, IL 60047 (FRE/HQ)

bis

Lake Forest, IL, (AKRX/HQ)

nur 15 miles = 30min Autofahrt!

=> das ist keine Fern-Übernahme. Beide Standorte sind etabliert, auch mit Produktion (Manufacturing Locations), z.B.:

FRE:

* Melrose Park village, Cook County, IL

<-- 180 miles -->

AKRX:

* 1222 W. Grand Ave., Decatur, IL

=> kaum zu glauben, dass nicht mal Info's und Personen hin und her gegangen sind

- in IL alleine arbeiten jeweils mehrere hundert Personen bei Fresenius Kabi, als auch bei Akorn

=> und da soll ich glauben, dass die eine Gruppe über Jahre ruchlose Betrüger sind ("unter anderen schwerwiegende Verstöße gegen FDA-Vorgaben", FRE, 22.4.), die nur noch auf naive Deutsche mit ihrem "stupid German money" gewartet haben?

Einer Gruppe, die auch regelmässig von der FDA (indirekt wenigstens) kontrolliert wird?

Im Heimatland der FDA-Regularien wie 21 CFR Part 11, denen sich auch alle europäischen Pharma-Produktions-Standorte mutmasslich und streng unterwerfen?

__

nebenbei:

- bei glassdoor bekommt Fresenius Kabi USA (2,4) schlechtere Noten als Akorn (3,3 - was aber auch nicht wirklich gut ist), bei fast identischer Anzahl von Bewertungen mit Anzahl >= 60 (auch wenn man das nicht überbewerten sollte - v.a. nicht als Aktionär; gibt gute Gegenbeispiele dazu...)

Antwort auf Beitrag Nr.: 57.685.269 von Global-Player83 am 03.05.18 12:28:14

=> USD17.50 laut Morning Star (angeblich)

Quelle: Post auf StockTwits, 4.5.

=> (17.50 - 11.70)/11.70 = +49.6%

=> allerdings, wenn dem so tatsächlich wäre, kann das Drift dahin (zurück) längere Zeit in Anspruch nehmen, denn Zusatz-Kosten kommen auf Akorn auf jeden Fall zu, neben einem Malus nun (vielleicht so 6m <= t < 18m)

__

Andere Frage: warum wartet Fresenius eigentlich das Ergebnis der (unabh.) Untersuchung bei Akron nicht ab?

--> woher wissen die eigentlich schon nach 2 Monaten, dass es "schwerwiegende Verstöße gegen FDA-Vorgaben" gab?

=> was passiert, wenn es nur "nicht-schwerwiegende Verstöße gegen FDA-Vorgaben" gab?

=> ..und was passiert, wenn im Melrose Park village bei Fresenius Kabi nun auch "Verstösse gegen FDA-Vorgaben" gefunden werden sollten?

--> ich meine, wenn man schon mal in Illinois beim vertieften Prüfen ist...

Zitat von Global-Player83: ...Die für mich spannendere Frage ist, wo liegt der faire Wert der Akorn-Aktie ohne Berücksichtigung des Übernahme-Streits?

=> USD17.50 laut Morning Star (angeblich)

Quelle: Post auf StockTwits, 4.5.

=> (17.50 - 11.70)/11.70 = +49.6%

=> allerdings, wenn dem so tatsächlich wäre, kann das Drift dahin (zurück) längere Zeit in Anspruch nehmen, denn Zusatz-Kosten kommen auf Akorn auf jeden Fall zu, neben einem Malus nun (vielleicht so 6m <= t < 18m)

__

Andere Frage: warum wartet Fresenius eigentlich das Ergebnis der (unabh.) Untersuchung bei Akron nicht ab?

--> woher wissen die eigentlich schon nach 2 Monaten, dass es "schwerwiegende Verstöße gegen FDA-Vorgaben" gab?

=> was passiert, wenn es nur "nicht-schwerwiegende Verstöße gegen FDA-Vorgaben" gab?

=> ..und was passiert, wenn im Melrose Park village bei Fresenius Kabi nun auch "Verstösse gegen FDA-Vorgaben" gefunden werden sollten?

--> ich meine, wenn man schon mal in Illinois beim vertieften Prüfen ist...

Antwort auf Beitrag Nr.: 57.699.597 von faultcode am 05.05.18 02:33:18

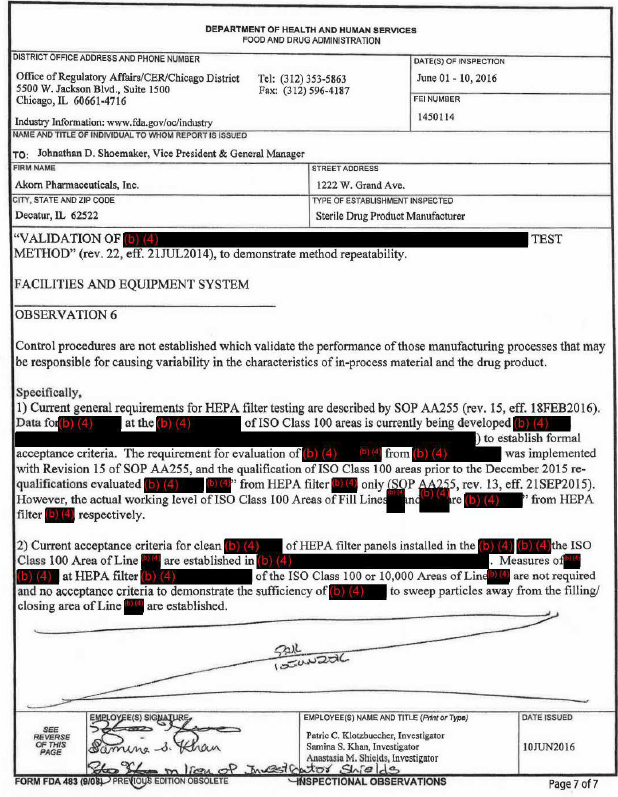

Zwei Mängelberichte von 2016 und 2017 sind leicht im Internet zu finden, wenn auch mit teilweise Schwärzungen:

(a) 2016-06-01..10, 7 Seiten, Mängel in:

- production system

- quality system

- lab controls system

- facilities and equipment system

(b) 2017-04-20..26, 4 Seiten - quasi ein Follow-up von (a), da die Fabrik immer noch Defizite aufzeigte

Aus https://www.fiercepharma.com/manufacturing/akorn-sterile-pla…, 2017-10-24:

...

- Despite the observations (FC: gemeint ist auch der Zustand nach April 2017), the FDA has continued to approve new products from that plant. Akorn's last five approved drugs, four of them sterile injectables, are being produced at the facility.

- (Fresenius) got three U.S. plants and one in India in the Akorn deal, which is slated to close in early 2018.

- Sterile injectables accounted for about 35% of Akorn's $1.1 billion in sales last year, but analysts also liked that Fresenius was additionally acquiring some new segments like ophthalmics and topical solutions, which might be less vulnerable to the generics pricing pressure that has made life difficult for generics producers in the last few years.

...

=> also die FDA genehmigte den Weiterbetrieb (mit welchen Einschränkungen, wenn überhaupt?) der Fabrik, aber Fresenius - mit eigener, nicht-unabhängiger Prüfung - will von all dem nichts gewusst haben?

__

(*) Form FDA 483 "Inspectional Observations"

- form used by the FDA to document and communicate concerns discovered during these inspections

- https://en.wikipedia.org/wiki/Form_FDA_483

Form FDA 483 "Inspectional Observations" - Mängelanzeigen gut bekannt

Mindestens ein FDA-Mängelbericht (*) über die Decatur, IL-Fabrik von Akorn muss Fresenius vor der Übernahme bekannt gewesen sein.Zwei Mängelberichte von 2016 und 2017 sind leicht im Internet zu finden, wenn auch mit teilweise Schwärzungen:

(a) 2016-06-01..10, 7 Seiten, Mängel in:

- production system

- quality system

- lab controls system

- facilities and equipment system

(b) 2017-04-20..26, 4 Seiten - quasi ein Follow-up von (a), da die Fabrik immer noch Defizite aufzeigte

Aus https://www.fiercepharma.com/manufacturing/akorn-sterile-pla…, 2017-10-24:

...

- Despite the observations (FC: gemeint ist auch der Zustand nach April 2017), the FDA has continued to approve new products from that plant. Akorn's last five approved drugs, four of them sterile injectables, are being produced at the facility.

- (Fresenius) got three U.S. plants and one in India in the Akorn deal, which is slated to close in early 2018.

- Sterile injectables accounted for about 35% of Akorn's $1.1 billion in sales last year, but analysts also liked that Fresenius was additionally acquiring some new segments like ophthalmics and topical solutions, which might be less vulnerable to the generics pricing pressure that has made life difficult for generics producers in the last few years.

...

=> also die FDA genehmigte den Weiterbetrieb (mit welchen Einschränkungen, wenn überhaupt?) der Fabrik, aber Fresenius - mit eigener, nicht-unabhängiger Prüfung - will von all dem nichts gewusst haben?

__

(*) Form FDA 483 "Inspectional Observations"

- form used by the FDA to document and communicate concerns discovered during these inspections

- https://en.wikipedia.org/wiki/Form_FDA_483

Antwort auf Beitrag Nr.: 57.705.550 von faultcode am 06.05.18 22:27:49

Finanzakrobat wird Fresenius-Chef

http://www.rp-online.de/wirtschaft/stephan-sturm-finanzakrob…

=>

...

Banker finden es beachtlich, dass Fresenius viele Fusionen und Übernahmen (M&A) mit einem kleinen Experten-Team durchzieht, meist geräuschlos und ohne externe Hilfe.

"M&A ist schließlich kein Hexenwerk", sagt Sturm dazu.

"Banker als Berater engagieren wir nur, wenn es die Rahmenbedingungen erfordern."

Als sich Sturm und eine Handvoll Kollegen 2013 mit Managern des Konkurrenten Rhön-Klinikum treffen, um über den Kauf zahlreicher Rhön-Kliniken zu verhandeln, sitzt auf Fresenius-Seite außer Sturm kein Banker mit am Tisch.

...

Keine SWOT-Analyse von Akorn durch Fresenius?

Nur Zahlen geguckt, und keine FDA-Berichte gelesen, bzw. lesen lassen?

Einsame Entscheidung im Elfenbeinturm getroffen?

Stephan Sturm hat rund 3 Jahre (1989 – 1991) als Management Consultant bei McKinsey & Co., Duesseldorf and Frankfurt gearbeitet. Er sollte es eigentlich besser wissen.

=> viel Spass mit dem US-Rechtssystem

"M&A ist schließlich kein Hexenwerk" -- Stephan Sturm

28.6.2016Finanzakrobat wird Fresenius-Chef

http://www.rp-online.de/wirtschaft/stephan-sturm-finanzakrob…

=>

...

Banker finden es beachtlich, dass Fresenius viele Fusionen und Übernahmen (M&A) mit einem kleinen Experten-Team durchzieht, meist geräuschlos und ohne externe Hilfe.

"M&A ist schließlich kein Hexenwerk", sagt Sturm dazu.

"Banker als Berater engagieren wir nur, wenn es die Rahmenbedingungen erfordern."

Als sich Sturm und eine Handvoll Kollegen 2013 mit Managern des Konkurrenten Rhön-Klinikum treffen, um über den Kauf zahlreicher Rhön-Kliniken zu verhandeln, sitzt auf Fresenius-Seite außer Sturm kein Banker mit am Tisch.

...

Keine SWOT-Analyse von Akorn durch Fresenius?

Nur Zahlen geguckt, und keine FDA-Berichte gelesen, bzw. lesen lassen?

Einsame Entscheidung im Elfenbeinturm getroffen?

Stephan Sturm hat rund 3 Jahre (1989 – 1991) als Management Consultant bei McKinsey & Co., Duesseldorf and Frankfurt gearbeitet. Er sollte es eigentlich besser wissen.

=> viel Spass mit dem US-Rechtssystem

Antwort auf Beitrag Nr.: 57.699.597 von faultcode am 05.05.18 02:33:18Hallo Faultcode,

Du fragtest nach dem Akornwert ohne Übernahme.

Fresenius wollte Akorn kaufen. Zu dem Zeitpunkt machte Akorn gute Gewinne und Umsatzsprünge.

Inzwischen ist der Umsatz drastisch gefallen und die Gewinne sind weg. Der Akornwert liegt also heute weit unter dem Wert vor der Vertragsunterzeichnung.

Dazu wenn Fresenius aussteigen kann und Recht mit seinen Behauptungen hat, dann kam es zu Zulassungstricksereien bei Medikamenten. Folglich dann zu Bußgeldern und Schadenersatzforderungen von Patienten und Krankenkassen.

Darüberhinaus klagen ja auch schon Aktionäre gegen die Firma, die sich betrogen fühlen, wegen kursrelevanten Falschinformationen. Also auch hier Schadenersatzforderungen.

Zieh beides vom eh schon deutlich geringeren Akornwert ab. Da bleibt nicht mehr viel.

Hat Akorn Recht wird Geld fließen, wenn es aber Betrügereien gab .....

Gruß

Schlummschütze

Du fragtest nach dem Akornwert ohne Übernahme.

Fresenius wollte Akorn kaufen. Zu dem Zeitpunkt machte Akorn gute Gewinne und Umsatzsprünge.

Inzwischen ist der Umsatz drastisch gefallen und die Gewinne sind weg. Der Akornwert liegt also heute weit unter dem Wert vor der Vertragsunterzeichnung.

Dazu wenn Fresenius aussteigen kann und Recht mit seinen Behauptungen hat, dann kam es zu Zulassungstricksereien bei Medikamenten. Folglich dann zu Bußgeldern und Schadenersatzforderungen von Patienten und Krankenkassen.

Darüberhinaus klagen ja auch schon Aktionäre gegen die Firma, die sich betrogen fühlen, wegen kursrelevanten Falschinformationen. Also auch hier Schadenersatzforderungen.

Zieh beides vom eh schon deutlich geringeren Akornwert ab. Da bleibt nicht mehr viel.

Hat Akorn Recht wird Geld fließen, wenn es aber Betrügereien gab .....

Gruß

Schlummschütze

Antwort auf Beitrag Nr.: 57.705.568 von Schlummschuetze am 06.05.18 22:39:50

ich nicht --> Global-Player83 war es oben #24 --> eine Antwort dazu auf #27

=> das wusste Fresenius (Kabi) bereits vor dem Merger agreement (FTC filing am May 8, 2017):

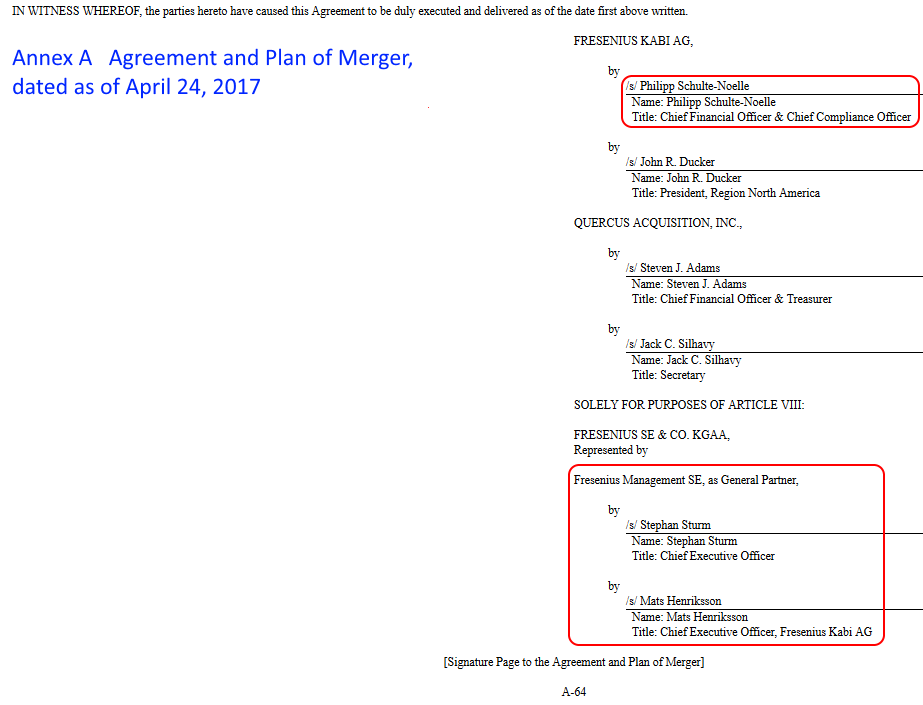

aus (+) unten: --> Financial Forecasts:

...

The March 2017 Management Case was not made available to Fresenius Kabi.

However, the Company’s management provided information to Fresenius Kabi as to how certain assumptions and estimates underlying the November 2016 Management Case would change to reflect the information about recent developments that was used to prepare the March 2017 Management Case....

(e) aus (+) --> March 2017 Management Case:

Revenues:

- 2014: USD555m

- 2015: USD985m

- 2016: USD1,120m

- 2017: USD841m <--- 2017e (+), 2017-03: USD834m = ~ -0.8% ==> diese Abweichung ist marginal

- 2018e: USD1,157m

- 2019e: USD1,258m

...

- 2026e: USD1,680m

=> CAGR 2016-2026: +4.1%

Operating Income / EBIT after Unusual Expense:

- 2014: USD-32.8m

- 2015: USD-36.1m

- 2016: USD327.6m

- 2017: USD-17.7m <--- 2017e (+), 2017-03: USD268m <-- allerdings ist das ein EBIT ohne "unusual expenses"

=> vorher die hohe Abweichung in 2017?

--> wg. "unusual expenses" von rund USD117m

- 2018e: USD394m

- 2019e: USD453m

...

- 2026e: USD545m

=> CAGR 2016-2026: +5.2%

=> man sieht: Akorn hat oft ein "unusual expenses" Problem --> Fresenius muss das - mit einem Investmentbanker an der Spitze - gewusst haben

--> Fresenius muss das - mit einem Investmentbanker an der Spitze - gewusst haben

Allerdings:

- der Free Cash Flow (FCF) von 2010 bis 2017 war immer > 0 !!

Mit 2017-FCF/share von USD1.27 > 2016-FCF/share von USD0.80

FCF hier definiert als "Simple" FCF = Operating Cash Flow - CAPEX

Der vielleicht beste Artikel zu AKRX-FRE Kabi:

2.5.2018

Reviewing The Akorn-Fresenius Merger Fallout

https://seekingalpha.com/article/4168444-reviewing-akorn-fre…

--> sehr lang!

(+) SCHEDULE 14A

https://www.sec.gov/Archives/edgar/data/3116/000130817917000…

--> sehr interessantes Dokument mit viel Info's

AKRX-Deal: closing date is set for July 24. 2018 (1)

Zitat von Schlummschuetze: ...Du fragtest nach dem Akornwert ohne Übernahme...

ich nicht --> Global-Player83 war es oben #24 --> eine Antwort dazu auf #27

Zitat von Schlummschuetze: ...Inzwischen ist der Umsatz drastisch gefallen und die Gewinne sind weg...

=> das wusste Fresenius (Kabi) bereits vor dem Merger agreement (FTC filing am May 8, 2017):

aus (+) unten: --> Financial Forecasts:

...

The March 2017 Management Case was not made available to Fresenius Kabi.

However, the Company’s management provided information to Fresenius Kabi as to how certain assumptions and estimates underlying the November 2016 Management Case would change to reflect the information about recent developments that was used to prepare the March 2017 Management Case....

(e) aus (+) --> March 2017 Management Case:

Revenues:

- 2014: USD555m

- 2015: USD985m

- 2016: USD1,120m

- 2017: USD841m <--- 2017e (+), 2017-03: USD834m = ~ -0.8% ==> diese Abweichung ist marginal

- 2018e: USD1,157m

- 2019e: USD1,258m

...

- 2026e: USD1,680m

=> CAGR 2016-2026: +4.1%

Operating Income / EBIT after Unusual Expense:

- 2014: USD-32.8m

- 2015: USD-36.1m

- 2016: USD327.6m

- 2017: USD-17.7m <--- 2017e (+), 2017-03: USD268m <-- allerdings ist das ein EBIT ohne "unusual expenses"

=> vorher die hohe Abweichung in 2017?

--> wg. "unusual expenses" von rund USD117m

- 2018e: USD394m

- 2019e: USD453m

...

- 2026e: USD545m

=> CAGR 2016-2026: +5.2%

=> man sieht: Akorn hat oft ein "unusual expenses" Problem

--> Fresenius muss das - mit einem Investmentbanker an der Spitze - gewusst haben

--> Fresenius muss das - mit einem Investmentbanker an der Spitze - gewusst haben

Allerdings:

- der Free Cash Flow (FCF) von 2010 bis 2017 war immer > 0 !!

Mit 2017-FCF/share von USD1.27 > 2016-FCF/share von USD0.80

FCF hier definiert als "Simple" FCF = Operating Cash Flow - CAPEX

Der vielleicht beste Artikel zu AKRX-FRE Kabi:

2.5.2018

Reviewing The Akorn-Fresenius Merger Fallout

https://seekingalpha.com/article/4168444-reviewing-akorn-fre…

--> sehr lang!

(+) SCHEDULE 14A

https://www.sec.gov/Archives/edgar/data/3116/000130817917000…

--> sehr interessantes Dokument mit viel Info's

Antwort auf Beitrag Nr.: 57.705.799 von faultcode am 07.05.18 00:38:20

November 2016 Management Case

vom

March 2017 Management Case ?

Beides sind Eingangsgrössen ins SCHEDULE 14A zur Abstimmung für die AKRX-Aktionäre seinerzeit:

Revenues, 2016-11 <--> 2017-03:

2026e: USD1,821m <--> USD1,680m

EBIT, 2016-11 <--> 2017-03:

2026e: USD600m <--> USD545m

..ohne "unusual expenses"

---

Mal schnell nachgerechnet zu https://www.wallstreet-online.de/diskussion/1275357-21-30/an… oben

=> fairer Preis|Morning Star: USD17.50 (~)

Nach DCF mit den "normalen Jahren" 2015 + 2016 und mit:

* mittig EPS ~USD1.35/share

* CAGR +5.5% beim EPS für 10Y

* term.growth 10Y mit 2%

* disc.rate 10%

* Null(!) mat.Buchwert/share (z.Z. leicht < 0)

=> kommt man so auf ~USD16.60 !

=> also kommt oben ganz gut (~) hin!

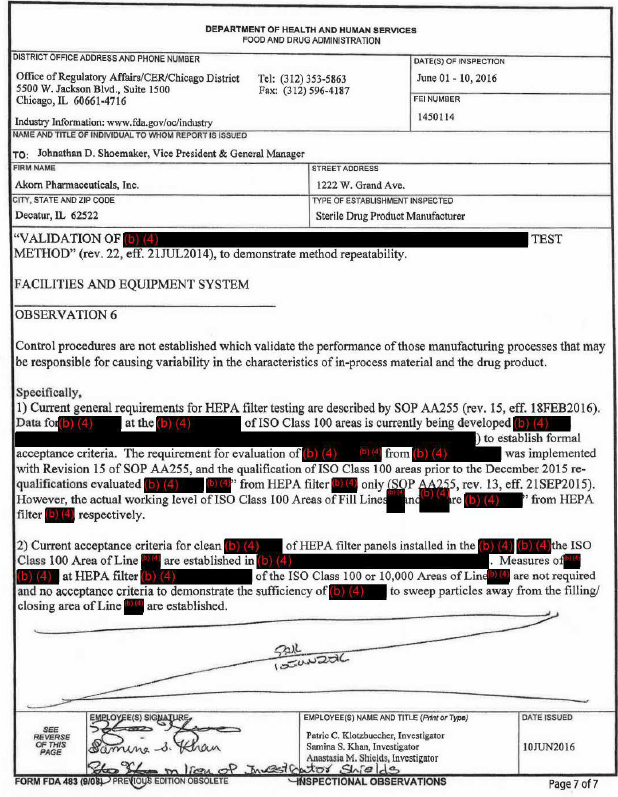

http://www.4-traders.com/AKORN-INC-42504/financials/

=> für mich sieht das nach worst case (2018e ff.) aus

ABER: es gibt Analysten, die das für zu hoch auf Generika-Multiples-Basis halten, und auf ~USD8 kommen (ich glaube auch selbe Quelle wie oben):

=> aber: Akorn ist schon länger nicht mehr als "normaler" US-Generika-Hersteller bewertet worden - auch nicht ab 2015 (das Ende des Wachstums im US-Gesundheitsmarkt)

=> der harmonische Mittelwert beim P/E|year-end in den profitablen Jahren 2010-2016 lag bei 32 !!

=> mit der (konversativen) Schätzung von Thomson Reuters vom 4.5.2018 für 2018e mit EPS = USD0.19 läge man damit bei circa:

USD6 ! für eine Aktie als fairen Wert, den ich für einen worst case halte!

=> nehme ich den Mittelwert aus (~) und den USD6 komme ich auf USD11.75

=> und wo war der letzte Kurs am Freitag? => bei USD11.74

=> so gesehen gibt es momentan sehr wahrscheinlich zwei Lager bei der Akorn-Aktie:

(a) die einen sagen, ab 2018/19 erholen sich die Parameter wieder Richtung 2015 + 2016

(man beachte #31 oben --> der FCF nahm 2017 satt zu, weil der Oper.Cashflow wieder stark zunahm - auch bei erneut erhöhtem CAPEX!)

und:

(b) die anderen sagen, nein - so wie Thomason Reuters - alles wie vor 2015.

Die anhängigen Rechtsfälle sind alle normale Pillepalle. Nicht ein Fall dabei wg. schlechtem Medikament oder IP-Verletzungen. Nur die sind gewöhnlich potenziell gefährlich.

..und man beachte auch:

- Fresenius dachte doch hier nicht kurzfristig mit dem (teilweise) schlechten 2017, sondern langfristig - wie immer eigentlich in der Vergangenheit:

=> nein, an den 2017er-Zahlen von Akorn hat sich Fresenius (Kabi) nicht gestört, sondern mindestens an ihrem eigenen Kaufpreis von USD4.75b = USD34/share

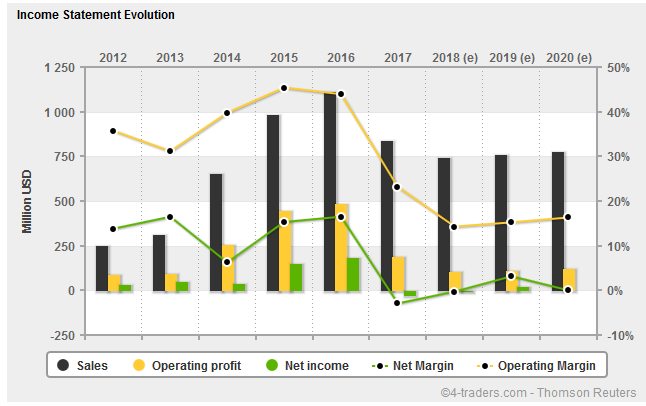

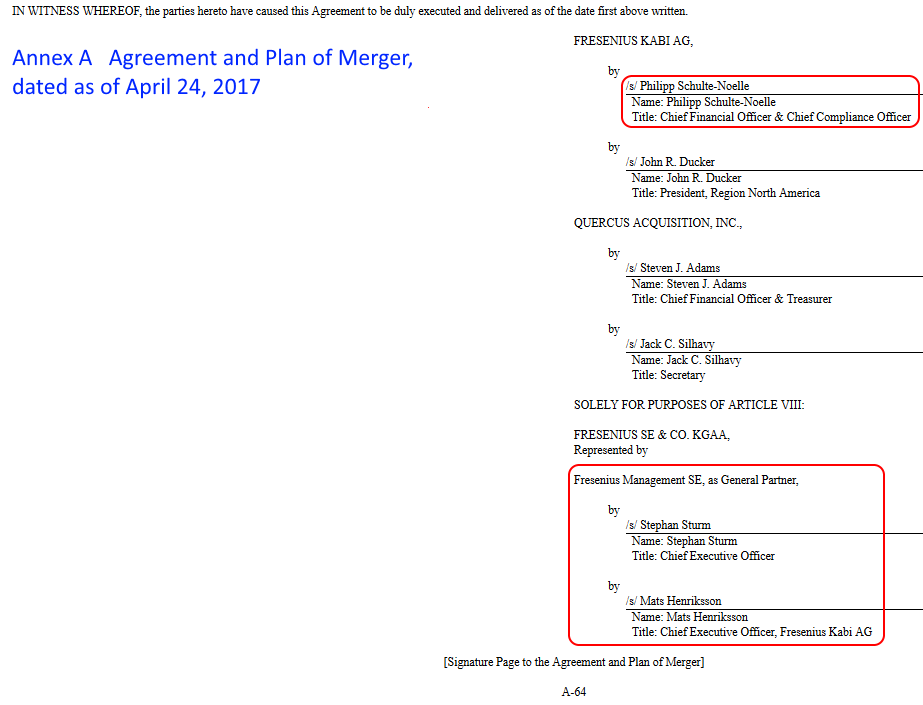

Dieser "Aufsteiger" hat einfach gepennt - und das Merger agreement (auch) unterschrieben:

Philipp Schulte-Noelle

Chief Financial Officer & Chief Compliance Officer, FRESENIUS KABI AG

https://heft.manager-magazin.de/MM/2015/7/135518114/index.ht…

=> klar, wenn der Chef unterschreibt, unterschreibt der CFO halt auch

AKRX-Deal: closing date is set for July 24. 2018 (2)

dazu ein Detail aus (+) oben: wie unterscheiden sich eigentlich der November 2016 Management Case

vom

March 2017 Management Case ?

Beides sind Eingangsgrössen ins SCHEDULE 14A zur Abstimmung für die AKRX-Aktionäre seinerzeit:

Revenues, 2016-11 <--> 2017-03:

2026e: USD1,821m <--> USD1,680m

EBIT, 2016-11 <--> 2017-03:

2026e: USD600m <--> USD545m

..ohne "unusual expenses"

---

Mal schnell nachgerechnet zu https://www.wallstreet-online.de/diskussion/1275357-21-30/an… oben

=> fairer Preis|Morning Star: USD17.50 (~)

Nach DCF mit den "normalen Jahren" 2015 + 2016 und mit:

* mittig EPS ~USD1.35/share

* CAGR +5.5% beim EPS für 10Y

* term.growth 10Y mit 2%

* disc.rate 10%

* Null(!) mat.Buchwert/share (z.Z. leicht < 0)

=> kommt man so auf ~USD16.60 !

=> also kommt oben ganz gut (~) hin!

http://www.4-traders.com/AKORN-INC-42504/financials/

=> für mich sieht das nach worst case (2018e ff.) aus

ABER: es gibt Analysten, die das für zu hoch auf Generika-Multiples-Basis halten, und auf ~USD8 kommen (ich glaube auch selbe Quelle wie oben):

=> aber: Akorn ist schon länger nicht mehr als "normaler" US-Generika-Hersteller bewertet worden - auch nicht ab 2015 (das Ende des Wachstums im US-Gesundheitsmarkt)

=> der harmonische Mittelwert beim P/E|year-end in den profitablen Jahren 2010-2016 lag bei 32 !!

=> mit der (konversativen) Schätzung von Thomson Reuters vom 4.5.2018 für 2018e mit EPS = USD0.19 läge man damit bei circa:

USD6 ! für eine Aktie als fairen Wert, den ich für einen worst case halte!

=> nehme ich den Mittelwert aus (~) und den USD6 komme ich auf USD11.75

=> und wo war der letzte Kurs am Freitag? => bei USD11.74

=> so gesehen gibt es momentan sehr wahrscheinlich zwei Lager bei der Akorn-Aktie:

(a) die einen sagen, ab 2018/19 erholen sich die Parameter wieder Richtung 2015 + 2016

(man beachte #31 oben --> der FCF nahm 2017 satt zu, weil der Oper.Cashflow wieder stark zunahm - auch bei erneut erhöhtem CAPEX!)

und:

(b) die anderen sagen, nein - so wie Thomason Reuters - alles wie vor 2015.

Die anhängigen Rechtsfälle sind alle normale Pillepalle. Nicht ein Fall dabei wg. schlechtem Medikament oder IP-Verletzungen. Nur die sind gewöhnlich potenziell gefährlich.

..und man beachte auch:

- Fresenius dachte doch hier nicht kurzfristig mit dem (teilweise) schlechten 2017, sondern langfristig - wie immer eigentlich in der Vergangenheit:

=> nein, an den 2017er-Zahlen von Akorn hat sich Fresenius (Kabi) nicht gestört, sondern mindestens an ihrem eigenen Kaufpreis von USD4.75b = USD34/share

Dieser "Aufsteiger" hat einfach gepennt - und das Merger agreement (auch) unterschrieben:

Philipp Schulte-Noelle

Chief Financial Officer & Chief Compliance Officer, FRESENIUS KABI AG

https://heft.manager-magazin.de/MM/2015/7/135518114/index.ht…

=> klar, wenn der Chef unterschreibt, unterschreibt der CFO halt auch

Antwort auf Beitrag Nr.: 57.705.799 von faultcode am 07.05.18 00:38:20

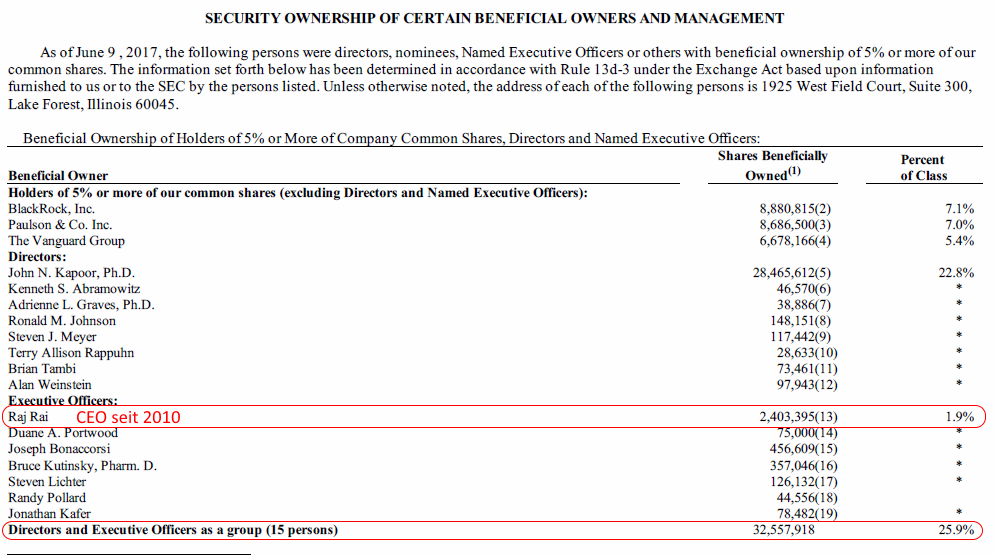

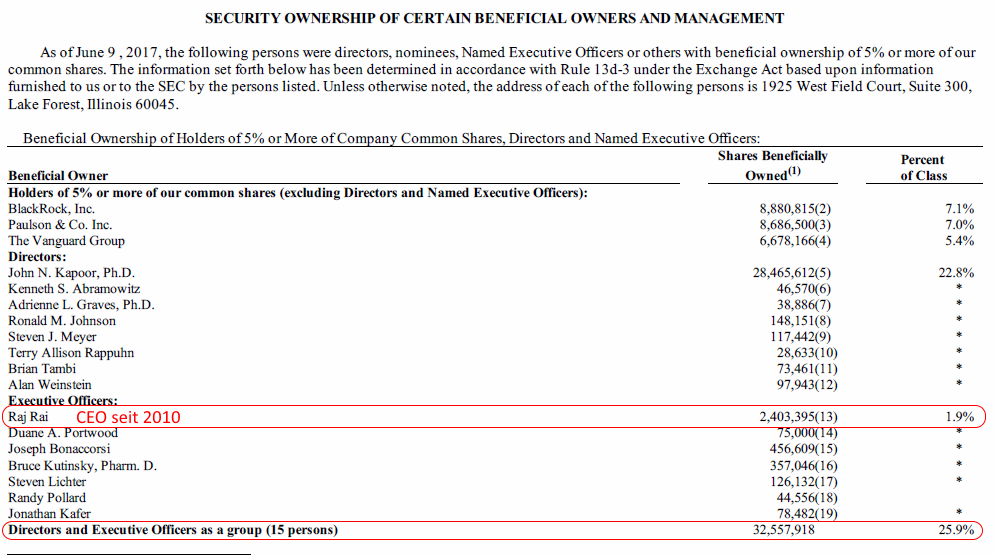

aus (+) oben, oder hier die Links zu den SEC Proxy filings:

http://investors.akorn.com/phoenix.zhtml?c=78132&p=irol-sec&…

--> dort gibt es auch das Haupt-Proxy-Dokument mit 235 PDF-Seiten (neben einigen Ergänzungen bis 2017-06) -- besser zum Verarbeiten:

=>

http://investors.akorn.com/phoenix.zhtml?c=78132&p=irol-govM…

--> die Direktoren und Executives haben alle das Voting agreement unterschrieben (neben dem sehr vielen Kleingedruckten...), so dass obige Besitzangaben auch heute noch zutreffen sollten

=> ich sag's mal so: wenn der Fresenius-Deal nicht zustandekommt, kommt irgendwann 2019ff. ein anderer Übernehmer -- aber nicht mehr für USD34

AKRX-Deal: closing date is set for July 24. 2018 (3) -- Insider dick in der Aktie

=> daher auch der Furor wg. der Fresenius-Deal-Absage

aus (+) oben, oder hier die Links zu den SEC Proxy filings:

http://investors.akorn.com/phoenix.zhtml?c=78132&p=irol-sec&…

--> dort gibt es auch das Haupt-Proxy-Dokument mit 235 PDF-Seiten (neben einigen Ergänzungen bis 2017-06) -- besser zum Verarbeiten:

=>

http://investors.akorn.com/phoenix.zhtml?c=78132&p=irol-govM…

--> die Direktoren und Executives haben alle das Voting agreement unterschrieben (neben dem sehr vielen Kleingedruckten...), so dass obige Besitzangaben auch heute noch zutreffen sollten

=> ich sag's mal so: wenn der Fresenius-Deal nicht zustandekommt, kommt irgendwann 2019ff. ein anderer Übernehmer -- aber nicht mehr für USD34

Erstaunlich was Du hier leistest.

Ich frage mich jedoch, wieso hat Frisenius hier nicht eher reagiert. Schliesslich hatten die schon länger Interesse an AKORN.

Da schau ich mir doch den Partner genauer an ?

Ich frage mich jedoch, wieso hat Frisenius hier nicht eher reagiert. Schliesslich hatten die schon länger Interesse an AKORN.

Da schau ich mir doch den Partner genauer an ?

Vlt sehen die Umsatz-Gewinn Modelle von Fresenius für Akorn in den nächsten Jahren noch düsterer aus, als die Modelle von Akorn selbst...

Was Fresenius mit Akorn wollte sollte eigentlich klar sein.

Akorn hat einige sehr gute Medikamente (gute Pipeline) und vertreibt diese bisher nur in der USA und Indien.

Fresenius ist mit KABI hingegen global aufgestellt und möchte diese global vertreiben. U.a. deswegen wurde auch immer von 2020 ff mit hohen Gewinnen gerechnet. Das sind einfache Skaleneffekte.

warten wir die Quartalszahlen in paar Tagen mal ab.

Akorn hat einige sehr gute Medikamente (gute Pipeline) und vertreibt diese bisher nur in der USA und Indien.

Fresenius ist mit KABI hingegen global aufgestellt und möchte diese global vertreiben. U.a. deswegen wurde auch immer von 2020 ff mit hohen Gewinnen gerechnet. Das sind einfache Skaleneffekte.

warten wir die Quartalszahlen in paar Tagen mal ab.

Akorn - ein paar Fakten zum Geschäftsmodell

alles aus dem Annual Report 2017 (28.2.2018):1/ man hat (2015, 2016, 2017) 3 Hauptkunden, nämlich US-Distributoren (die aber "natürlich" keine Endkunden sind), nach Net Revenue:

* AmerisourceBergen: 19% (2017)

* Cardinal Health: 18% (2017)

* McKesson: 27% (2017)

In diesen Jahren machten diese immer:

- mindestens 77.4% der Gross Sales aus,

- ..und mindestens 63.5% der Net Revenues aus

(Underschied beider Grössen nach AKRX:

- allowances for chargebacks

- rebates

- administrative fees and others

- promotions

- product returns)

2/ die Geschäfts-Saisonalität ist "nicht signifikant" bei den meisten Produkten

(bei ein paar schon wg. warmer + kalter US-Jahreszeiten)

3/ Haupt-Produkte:

• AK-FLUOR (fluorescein injection, USP) --> Fluoreszenzangiographie des Augenhintergrundes

• Atropine Sulfate Ophthalmic Solution --> Augen

• Clobetasol Propionate Cream --> entzündliche Hauterkrankungen

• Dehydrated Alcohol Injection --> degeneration of nerve function (neurolysis) for control of chronic pain

• Ephedrine Sulfate Injection: >= 10% der Total Net Revenues

--> allergische Störungen

• Myorisan (isotretinoin capsules, USP) --> Akne

• Nembutal Sodium Solution (pentobarbital sodium injection, USP) --> beruhigende Hypnotika,

Behandlung oder Verhinderung von epileptischen, z. B. tonisch-klonischen Anfällen

• Phenylephrine Hydrochloride Ophthalmic Solution --> Augen

• TheraTears --> Augen

• Zioptan --> Augen

USP = United States Pharmacopeial Convention

=> alle anderen Produkte jeweils < 10% der Total Net Revenues

3a/

- nur 8% sind "Consumer Health"-Produkte, der Rest verschreibungspflichtig (2017)

4/ F+E: im Bereich alternativer Dosierformen:

- injectable

- ophthalmic (Augen)

- topical (topisch: Gel, Creme, ...)

- oral

- inhaled liquid

- nasal spray

- otic (Ohren)

- ausgewählte oral solid dose formulations

=> die Arzneien, die man selber herstellt, werden auch selber entwickelt;

die anderen verpartnert man (also Arzneien, die man NICHT selber herstellt)

Seit 2017 gibt es ein neues R&D Center in Cranbury, NJ

5/ Auslandsgeschäft (Währungsrisiko):

- sehr gering mit: USD26m von USD841m (2017, net revenue)

6/ Mitarbeiter 2017 (full-time):

- USA: 1706

- Indien: 425 --> sterile injectable facility -- nicht FDA-approved! Wird angestrebt.

- Schweiz: 153 --> ehemals Excelvision AG: Augen-Produkte

7/ man hat auch Tier-Arzneien im Programm

8/ der (aktuelle) Auditor ist BDO, Chicago IL, und das seit 2016

----

noch Ratings von Moody's für Akorn, Inc. :

- Long Term Rtg B1, 23 Apr 2018

--> B1 = LT Speculative grade: Judged as being speculative and a high credit risk

(mit ... Ba3 besser als B1 besser als B2 besser als B3...)

- Long Term Watch Uncertain

- ST Issuer Level Rtg SGL-1, 23 Apr 2018

- ST Issuer Level Watch Not on Watch

- Outlook Ratings Under Review, 26 Apr 2017

LT = Long Term

ST = Short Term

---

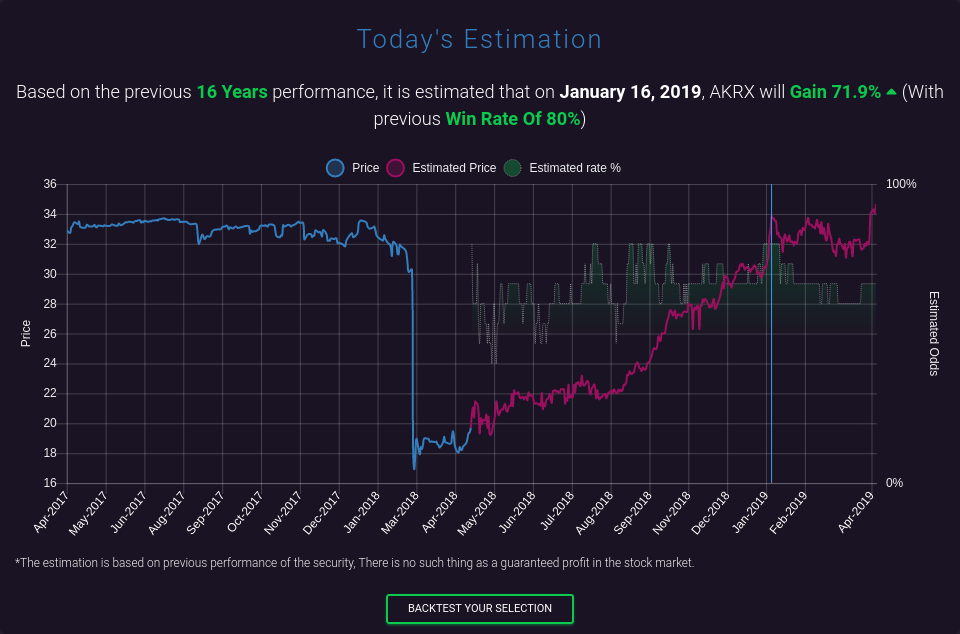

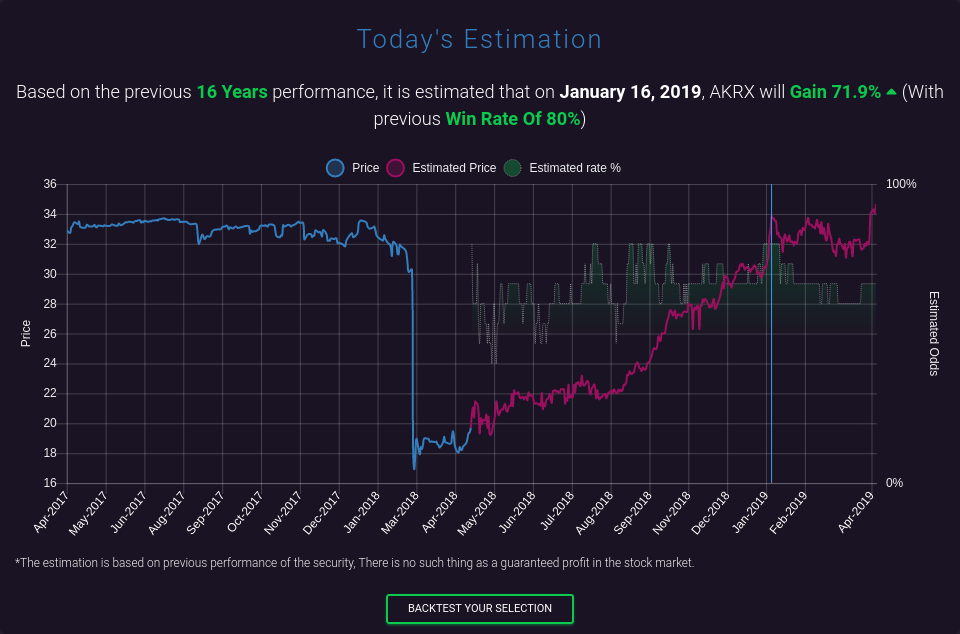

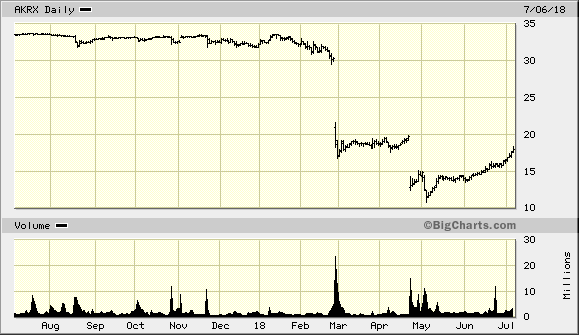

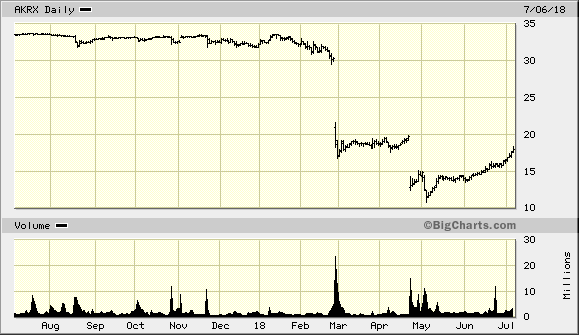

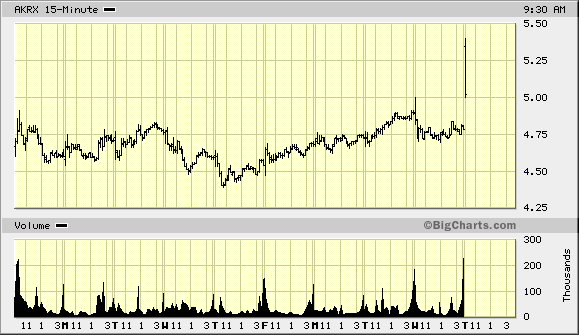

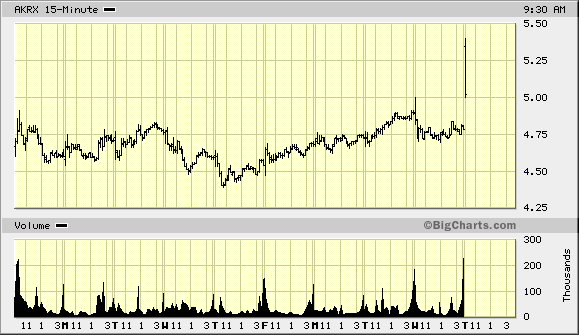

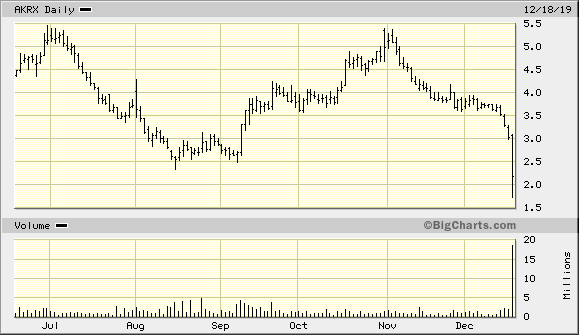

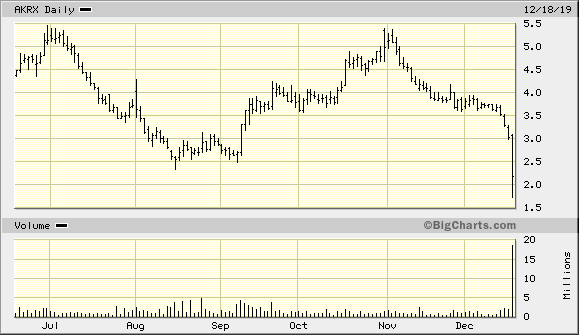

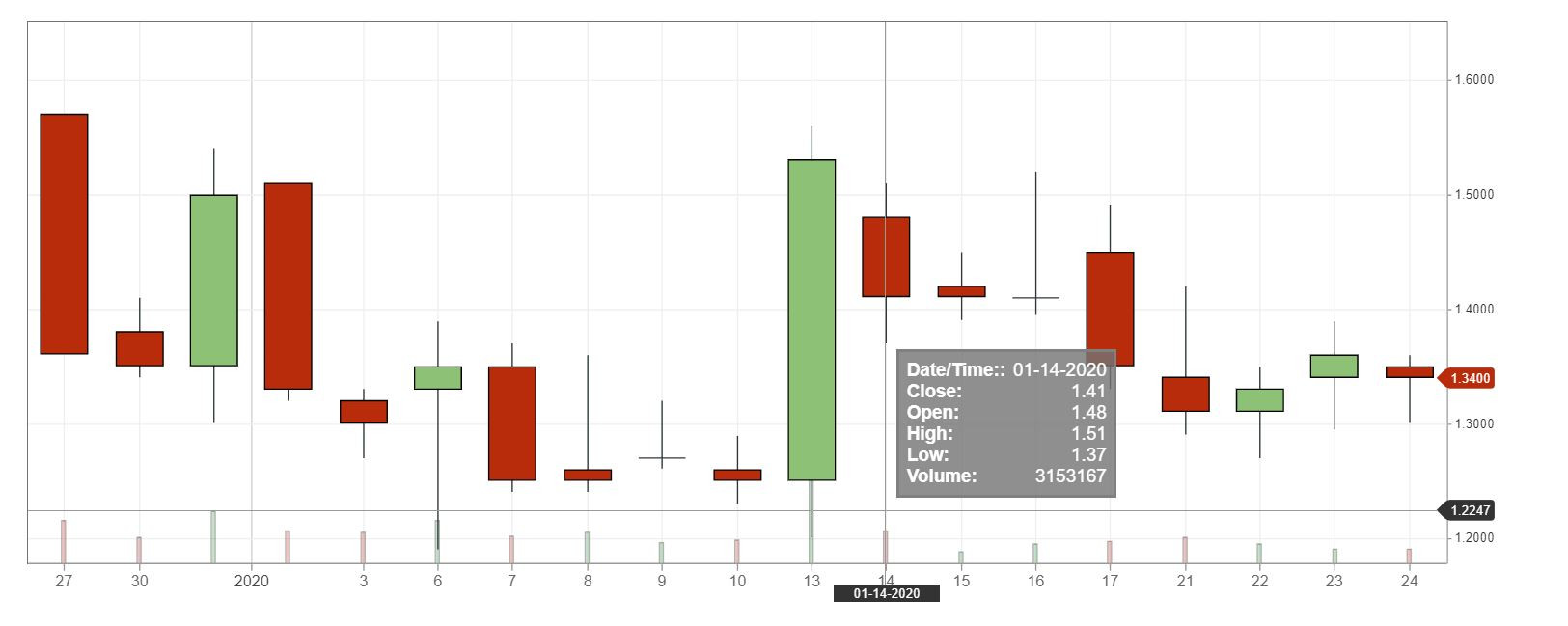

aktueller Chart:

"Sturm" - der Name scheint Programm zu sein --> Ende des Verfahrens 2019 mit einem Vergleich?

https://www.finanzen.net/nachricht/aktien/ausblick-fresenius…=>

...Doch die geplante rund 4,8 Milliarden Dollar schwere Übernahme des US-Generikaherstellers Akorn ließ der Konzern kürzlich wegen Betrugsvorwürfen gegen die Amerikaner platzen.

Beide Seiten streiten demnächst vor einem US-Gericht. Sturm rechnet damit, dass das Verfahren spätestens 2019 abgeschlossen sein sollte, sagte er am Rande des Aktionärstreffens der Nachrichtenagentur Bloomberg....

=> der Mann scheint sehr forsch zu sein. Mir soll's recht sein.

Also würde eine Beilegung in 2020 oder sogar noch später nicht so gut für ihn aussehen

=> wie also "spätestens 2019" zu einem Abschluss des Verfahrens kommen?

=> ich meine, mit einem Vergleich

=> d.h., Fresenius gibt Akorn Geld und zieht weiter, nachdem das Delaware Chancery Court dem Vergleich zugestimmt hat.

Antwort auf Beitrag Nr.: 57.790.252 von faultcode am 18.05.18 14:24:30

https://www.finanzen.net/nachricht/aktien/fresenius-verteidi…

=>...

Sturm wies Vorwürfe zurück, der Konzern habe vor dem Angebot bei Akorn womöglich nicht richtig hingeschaut. "Das war die intensivste Prüfung, die ich bei Fresenius erlebt habe. Sie entsprach höchsten Standards." Die Verstöße seien in Bereichen passiert, in die Fresenius keinen Einblick haben durfte. Sturm führte dies auf die Börsennotierung von Akorn zurück und darauf, dass das Unternehmen ein direkter Wettbewerber der Tochter Kabi sei. "Wir sind an den Rand dessen gegangen, was zulässig war. Überall dort, wo wir nicht hinschauen konnten, haben wir uns im Rahmen des Kaufvertrags sehr gute Absicherungen geben lassen."

Für Fresenius sei der Fall Akorn eine neue Situation. "So etwas gab es in der Tat noch nicht", sagte Sturm. Das Unternehmen ist durch mehrere Milliardenzukäufe zu einem globalen Firmenkonglomerat in der Gesundheitsbranche gewachsen.

Immer wieder wird Fresenius auch als "Akquisitionsmaschine" bezeichnet. Auch die Tochter Kabi, deren Nordamerikageschäft durch die Akorn-Übernahme hätte gestärkt werden sollen, wurde wiederholt durch Zukäufe ausgebaut. So beruht Sturm zufolge der Erfolg von Kabi in Nordamerika auf der 3,7 Milliarden Euro schweren Übernahme des Generikaspezialisten APP, mit der Kabi 2008 überhaupt erst in den US-Pharmamarkt eintrat. Nun will Fresenius auch ohne Akorn sein Geschäft mit Nachahmermedikamenten in Nordamerika ausbauen.

...

Anfang Juli werden sich die beiden Unternehmen vor Gericht wiedertreffen. Aktionärsvertreter wollten vom Vorstand vor allem wissen, mit welchen finanziellen Risiken durch den abgesagten Akorn-Kauf zu rechnen ist und wie lange sich das Verfahren hinziehen wird. Bislang seien bei Fresenius transaktionsbezogene Kosten von insgesamt 60 Millionen Euro vor Steuern angefallen, sagte Sturm.

Der Konzern müsse noch prüfen, inwiefern Rückstellungen im Zusammenhang mit dem Prozess gebildet werden müssten. Von Akorn fordert Fresenius Schadenersatz...

Zu:

"Das war die intensivste Prüfung, die ich bei Fresenius erlebt habe. Sie entsprach höchsten Standards."

=> wie kann das sein, wenn obige FDA-Mängelberichte (Beitrag Nr. 28) vom JUNI 2016 sind -- und leicht auffindbar im Internet

Fresenius verteidigt abgeblasene Akorn-Übernahme

noch Ergänzung von der FRE-HV:https://www.finanzen.net/nachricht/aktien/fresenius-verteidi…

=>...

Sturm wies Vorwürfe zurück, der Konzern habe vor dem Angebot bei Akorn womöglich nicht richtig hingeschaut. "Das war die intensivste Prüfung, die ich bei Fresenius erlebt habe. Sie entsprach höchsten Standards." Die Verstöße seien in Bereichen passiert, in die Fresenius keinen Einblick haben durfte. Sturm führte dies auf die Börsennotierung von Akorn zurück und darauf, dass das Unternehmen ein direkter Wettbewerber der Tochter Kabi sei. "Wir sind an den Rand dessen gegangen, was zulässig war. Überall dort, wo wir nicht hinschauen konnten, haben wir uns im Rahmen des Kaufvertrags sehr gute Absicherungen geben lassen."

Für Fresenius sei der Fall Akorn eine neue Situation. "So etwas gab es in der Tat noch nicht", sagte Sturm. Das Unternehmen ist durch mehrere Milliardenzukäufe zu einem globalen Firmenkonglomerat in der Gesundheitsbranche gewachsen.

Immer wieder wird Fresenius auch als "Akquisitionsmaschine" bezeichnet. Auch die Tochter Kabi, deren Nordamerikageschäft durch die Akorn-Übernahme hätte gestärkt werden sollen, wurde wiederholt durch Zukäufe ausgebaut. So beruht Sturm zufolge der Erfolg von Kabi in Nordamerika auf der 3,7 Milliarden Euro schweren Übernahme des Generikaspezialisten APP, mit der Kabi 2008 überhaupt erst in den US-Pharmamarkt eintrat. Nun will Fresenius auch ohne Akorn sein Geschäft mit Nachahmermedikamenten in Nordamerika ausbauen.

...

Anfang Juli werden sich die beiden Unternehmen vor Gericht wiedertreffen. Aktionärsvertreter wollten vom Vorstand vor allem wissen, mit welchen finanziellen Risiken durch den abgesagten Akorn-Kauf zu rechnen ist und wie lange sich das Verfahren hinziehen wird. Bislang seien bei Fresenius transaktionsbezogene Kosten von insgesamt 60 Millionen Euro vor Steuern angefallen, sagte Sturm.

Der Konzern müsse noch prüfen, inwiefern Rückstellungen im Zusammenhang mit dem Prozess gebildet werden müssten. Von Akorn fordert Fresenius Schadenersatz...

Zu:

"Das war die intensivste Prüfung, die ich bei Fresenius erlebt habe. Sie entsprach höchsten Standards."

=> wie kann das sein, wenn obige FDA-Mängelberichte (Beitrag Nr. 28) vom JUNI 2016 sind -- und leicht auffindbar im Internet

Antwort auf Beitrag Nr.: 57.791.860 von faultcode am 18.05.18 17:53:47

• seit er CEO wurde (2016) "beschleunigt (er) das Tempo", gemeint sind die Übernahmen, hier Quirónsalud (Spanien, Kliniken) und eben Akorn (Frühjahr 2017)

• nach dem Übernahmeangebot soll er "(3) anonyme Hinweise (Schreiben) bekommen haben, dass (Akorn) ... Testreihen für die Zulassung bei .... (der) FDA manipuliert haben soll."

• AR-Chef Gerd Krick (langjähriger Chef von Fresenius) wird als unabhängig dargestellt, der sich in der Akorn-Frage hinter Sturm stellte (und stellt)

• MM meint, dass sich der Prozess bis "weit ins kommende Jahr" ziehen wird

--> das klingt anders als oben (#38):

Sturm rechnet damit, dass das Verfahren spätestens 2019 abgeschlossen sein sollte, sagte er am Rande des Aktionärstreffens der Nachrichtenagentur Bloomberg

• dann noch so zwei Sätze: "Fresenius' Nimbus ist akut gefährdet und Sturms erst recht. Sollte sich am Ende herausstellen, dass er bei der Übernahme an den entscheidenden Stellen zu nachlässig war, kann es sehr schnell eng für ihn werden."

• Rest ist Sturm's Bio von ganz unten bis ganz oben: nicht mit dem Silberlöffel im Mund geboren; sehr ehrgezig, aber zweimal an etablierten Institutionen gescheitert:

-- London School of Economics: keine Aufnahme

-- keine Wall Street-Investmentbank wollte ihn nehmen --> und so landet er (kurz) bei McKinsey und optimiert für VW eine Kabelstränge-Fertigung u.a.

• "neigt gelegentlich zu Stimmungsumschwüngen"; Vorgänger Schneider war "berechenbarer"

• Sturm wurde 2016 CEO, als Fresenius:

- vgl.-weise wenig Schulden hat, ..

- ..und eine volle (Kriegs-)Kasse

• die Quirónsalud-Übernahme gelingt sehr gut

• in den USA sanken bereits die Generika-Preise; nur noch 3 Distributoren sind übrig geblieben; siehe oben Beitrag Nr. 37

• Akorn sei da stark, wo Fresenius Kabi Nachholbedarf hat: bei Arznei-Mitteln, "die in kleinen Dosen verabreicht werden"

• Akorn Chairman John N. Kapoor (*1942/43 in India: https://en.wikipedia.org/wiki/John_Kapoor --> founder of Akorn) als Grossaktionär (bei Akorn) "erweist sich als harter Brocken": siehe Beitrag Nr. 33 oben: 22.8%; "initiiert ein regelrechtes Wettbieten mit zeitweise:

- 4 Pharmafirmen

- 1 Staatsfonds

- 5 Finanzinvestoren

=> Fresenius bietet das meiste Geld mit USD34, +40% zum vorherigen Aktienkurs

Jetzt wird's interessant:

• Akorn's Ruf war damals schon administrativ und finanziell belastet:

- 2014 wurde die Bilanz korrigiert

- 2012...2015: EY, KPMG und BDO: Bilanz-Vermerk: "kein adäquates Controlling-System"

• John N. Kapoor wird in 2017-10 verhaftet wg. Bestechungsgelder in einem anderen Zusammenhang; "Opium-Krise" in den USA: https://www.yahoo.com/news/billionaire-insys-founder-charged…

• das MM: "Sturm glaubt, dass die Akorn-Pipeline stark genug ist, um die Prämie zu rechtfertigen."

• indem Sturm öffentlich die Übernahme abbläst, lässt er den Akorn-Aktienkurs abstürzen und:

"Damit hat er Akorn-CEO Rajat Rai in eine Ecke manövriert, aus der der sich kaum herausverhandeln kann." Grund: die Ansammlung von Hedge funds (HF's) in der Akorn-Aktie bei USD30...32 --> Arbitrage zu den USD34

--> damit kann es keinen Rabatt auf den Akorn-Kaufpreis geben, ohne (erfolgreiche/FC) Schadenersatz-Klagen der HF's zu riskieren.

=> liebes MM: der Mann heisst "Raj Rai" nicht "Rajat Rai" --> bitte, z.B. oben, in den SEC-Dokumenten nachlesen (das richtige Schreiben von Namen wird in den USA sehr ernst genommen...)

• Sturm kaufte am 8.5. für ~EUR1Mio Fresenius-Aktien: http://www.dgap.de/dgap/News/directors_dealings/kauf-sturm-s…

__

mir fällt auf: Stephan Sturm hatte in seiner Karriere zuvor keinen "richtigen" USA-Bezug. Das ist mMn zunächst kein Problem.

Aber für forsches Vorgehen in den USA taugt kein "deutsches" forsches Vorgehen. Siehe Klaus Kleinfeld bei Alcoa/Arconic.

=> das rächt sich eben nun.

MM-Artikel

Ich lese gerade den MM-Artikel 6/2018 ab Seite 70 zu Stephan Sturm. Meine eigene Zusammenfassung daraus:• seit er CEO wurde (2016) "beschleunigt (er) das Tempo", gemeint sind die Übernahmen, hier Quirónsalud (Spanien, Kliniken) und eben Akorn (Frühjahr 2017)

• nach dem Übernahmeangebot soll er "(3) anonyme Hinweise (Schreiben) bekommen haben, dass (Akorn) ... Testreihen für die Zulassung bei .... (der) FDA manipuliert haben soll."

• AR-Chef Gerd Krick (langjähriger Chef von Fresenius) wird als unabhängig dargestellt, der sich in der Akorn-Frage hinter Sturm stellte (und stellt)

• MM meint, dass sich der Prozess bis "weit ins kommende Jahr" ziehen wird

--> das klingt anders als oben (#38):

Sturm rechnet damit, dass das Verfahren spätestens 2019 abgeschlossen sein sollte, sagte er am Rande des Aktionärstreffens der Nachrichtenagentur Bloomberg

• dann noch so zwei Sätze: "Fresenius' Nimbus ist akut gefährdet und Sturms erst recht. Sollte sich am Ende herausstellen, dass er bei der Übernahme an den entscheidenden Stellen zu nachlässig war, kann es sehr schnell eng für ihn werden."

• Rest ist Sturm's Bio von ganz unten bis ganz oben: nicht mit dem Silberlöffel im Mund geboren; sehr ehrgezig, aber zweimal an etablierten Institutionen gescheitert:

-- London School of Economics: keine Aufnahme

-- keine Wall Street-Investmentbank wollte ihn nehmen --> und so landet er (kurz) bei McKinsey und optimiert für VW eine Kabelstränge-Fertigung u.a.

• "neigt gelegentlich zu Stimmungsumschwüngen"; Vorgänger Schneider war "berechenbarer"

• Sturm wurde 2016 CEO, als Fresenius:

- vgl.-weise wenig Schulden hat, ..

- ..und eine volle (Kriegs-)Kasse

• die Quirónsalud-Übernahme gelingt sehr gut

• in den USA sanken bereits die Generika-Preise; nur noch 3 Distributoren sind übrig geblieben; siehe oben Beitrag Nr. 37

• Akorn sei da stark, wo Fresenius Kabi Nachholbedarf hat: bei Arznei-Mitteln, "die in kleinen Dosen verabreicht werden"

• Akorn Chairman John N. Kapoor (*1942/43 in India: https://en.wikipedia.org/wiki/John_Kapoor --> founder of Akorn) als Grossaktionär (bei Akorn) "erweist sich als harter Brocken": siehe Beitrag Nr. 33 oben: 22.8%; "initiiert ein regelrechtes Wettbieten mit zeitweise:

- 4 Pharmafirmen

- 1 Staatsfonds

- 5 Finanzinvestoren

=> Fresenius bietet das meiste Geld mit USD34, +40% zum vorherigen Aktienkurs

Jetzt wird's interessant:

• Akorn's Ruf war damals schon administrativ und finanziell belastet:

- 2014 wurde die Bilanz korrigiert

- 2012...2015: EY, KPMG und BDO: Bilanz-Vermerk: "kein adäquates Controlling-System"

• John N. Kapoor wird in 2017-10 verhaftet wg. Bestechungsgelder in einem anderen Zusammenhang; "Opium-Krise" in den USA: https://www.yahoo.com/news/billionaire-insys-founder-charged…

• das MM: "Sturm glaubt, dass die Akorn-Pipeline stark genug ist, um die Prämie zu rechtfertigen."

• indem Sturm öffentlich die Übernahme abbläst, lässt er den Akorn-Aktienkurs abstürzen und:

"Damit hat er Akorn-CEO Rajat Rai in eine Ecke manövriert, aus der der sich kaum herausverhandeln kann." Grund: die Ansammlung von Hedge funds (HF's) in der Akorn-Aktie bei USD30...32 --> Arbitrage zu den USD34

--> damit kann es keinen Rabatt auf den Akorn-Kaufpreis geben, ohne (erfolgreiche/FC) Schadenersatz-Klagen der HF's zu riskieren.

=> liebes MM: der Mann heisst "Raj Rai" nicht "Rajat Rai" --> bitte, z.B. oben, in den SEC-Dokumenten nachlesen (das richtige Schreiben von Namen wird in den USA sehr ernst genommen...)

• Sturm kaufte am 8.5. für ~EUR1Mio Fresenius-Aktien: http://www.dgap.de/dgap/News/directors_dealings/kauf-sturm-s…

__

mir fällt auf: Stephan Sturm hatte in seiner Karriere zuvor keinen "richtigen" USA-Bezug. Das ist mMn zunächst kein Problem.

Aber für forsches Vorgehen in den USA taugt kein "deutsches" forsches Vorgehen. Siehe Klaus Kleinfeld bei Alcoa/Arconic.

=> das rächt sich eben nun.

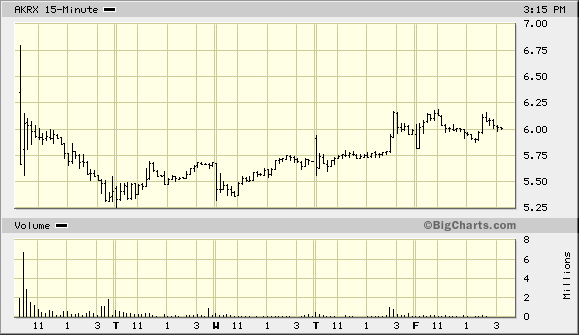

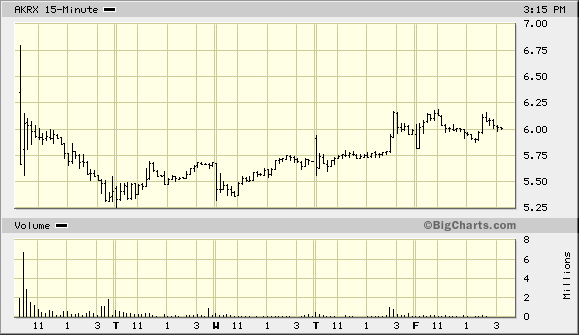

jetzt geht's los: Fresenius und Ex-Übernahmeziel Akorn treffen sich vor Gericht --> 9.7.

https://www.finanzen.net/nachricht/aktien/nach-geplatzter-ue…=>

...

Nachdem der Gesundheitskonzern die geplante Übernahme des Generikaherstellers Ende April wegen seiner Einschätzung nach schwer wiegender Verstöße des US-Unternehmens gegen Vorgaben der US-Gesundheitsbehörde FDA zur Datenintegrität in der Produktentwicklung hat platzen lassen, wird nun ein Gericht darüber entscheiden müssen, ob der DAX-Konzern Akorn vielleicht doch übernehmen muss.

Denn Akorn pocht auf den Vollzug der Transaktion und will dies auf juristischem Wege durchsetzen. Erster Verhandlungstag vor dem zuständigen Court of Chancery im US-Bundesstaat Delaware ist Montag, der 9. Juli.

...

Vor einem amerikanischen Gericht stehen sich ein deutsches und ein US-Unternehmen gegenüber....!? handelt es sich hierbei um ein unparteiisches Schiedsgericht?

die Anleger sind jedenfalls optimistisch bei AKRX gestimmt: heute auch +2%

dazu aus: https://thefly.com/landingPageNews.php?id=2754829

...RBC SEES 'PATH TO CLOSING': In a note published this Monday, RBC Capital analyst Randall Stanicky said the trial should bring some clarity to the ongoing deal uncertainty.

He said he continues to see a path to closing and notes risk and reward are both high, as Akorn's stock is trading at $16-$17 versus the $34 deal price. The analyst added he has not yet seen persuasive evidence justifying the deal break based on his review of litigation documents and a call with legal experts.

AKORN UPSIDE/DOWNSIDE 'LOOKS INTERESTING': On Tuesday of this week, Deutsche Bank analyst Gregg Gilbert noted that Akorn is seeking a ruling that Fresenius be required to complete its acquisition per the merger agreement.

The analyst believes the upside versus downside profile for Akorn from the current price is worth considering.

He sees three potential scenarios:

(a) Fresenius is required to acquire Akorn for $34 per share, representing 102% upside;

(b) the deal breaks and Akorn trades down to single digits on a standalone basis, or 69% downside;

(c) the companies settle for a price below $34 but well above the current stock price, which could yield more upside than downside.

Gilbert believes Akorn's upside/downside "looks interesting" ahead of the key event, he told investors.

...

The trial is set to begin on Monday and is scheduled to last through Friday July 13 at this point, RBC recently told investors...

dazu aus: https://thefly.com/landingPageNews.php?id=2754829

...RBC SEES 'PATH TO CLOSING': In a note published this Monday, RBC Capital analyst Randall Stanicky said the trial should bring some clarity to the ongoing deal uncertainty.

He said he continues to see a path to closing and notes risk and reward are both high, as Akorn's stock is trading at $16-$17 versus the $34 deal price. The analyst added he has not yet seen persuasive evidence justifying the deal break based on his review of litigation documents and a call with legal experts.

AKORN UPSIDE/DOWNSIDE 'LOOKS INTERESTING': On Tuesday of this week, Deutsche Bank analyst Gregg Gilbert noted that Akorn is seeking a ruling that Fresenius be required to complete its acquisition per the merger agreement.

The analyst believes the upside versus downside profile for Akorn from the current price is worth considering.

He sees three potential scenarios:

(a) Fresenius is required to acquire Akorn for $34 per share, representing 102% upside;

(b) the deal breaks and Akorn trades down to single digits on a standalone basis, or 69% downside;

(c) the companies settle for a price below $34 but well above the current stock price, which could yield more upside than downside.

Gilbert believes Akorn's upside/downside "looks interesting" ahead of the key event, he told investors.

...

The trial is set to begin on Monday and is scheduled to last through Friday July 13 at this point, RBC recently told investors...

Kurzer Zock:

So, morgen soll also bereits ein Urteil in der Causa Fresenius vs. Akorn Fallen. Ich sehe drei mögliche Szenarien:

1. Das Gericht verdonnert Fresenius dazu die Akquisition wie ursprünglich abgemacht durchzuziehen. Heißt für 34$ pro Aktie, was eine Verdoppelung des jetzigen Kurses bedeuten würde (Eintrittswahrscheinlichkeit 25%).

2. Das Gericht gibt Fresenius auf ganzer Linie recht und der Deal wird abgeblasen. Würde bedeuten, dass der Kurs sich durchaus halbieren könnte (Eintrittswahrscheinlichkeit 25%).

3. US-Gerichte neigen in solchen Fällen oft zu Kompromisslösungen. Würde hier bedeuten, dass der Deal mit einem gewissen Preisabschlag über die Bühne gehen muss. Also unter 34$ aber wohl deutlich über dem jetzigen Kursniveau. Könnte mir hier Aufschlag von ca. 50% vorstellen (Eintrittswahrscheinlichkeit 50%)

Bei Eintritt von Szenario 2. müsste man die Papier ggf. doch länger halten, bis sich der Kurs nach dem ersten Schock wieder berappelt, immerhin Stand der Laden vor dem ganzen Drama auch schon deutlich über 20$. Einen Totalverlust kann man hier ausschließen, der Laden macht ja solide Gewinne.

So ein Chance/Risiko Verhältnis bietet einem kein Casino… Achtung nur etwas für Zocker und auf keinen Fall eine „normale“ Kaufempfehlung…

Achtung nur etwas für Zocker und auf keinen Fall eine „normale“ Kaufempfehlung…

So, morgen soll also bereits ein Urteil in der Causa Fresenius vs. Akorn Fallen. Ich sehe drei mögliche Szenarien:

1. Das Gericht verdonnert Fresenius dazu die Akquisition wie ursprünglich abgemacht durchzuziehen. Heißt für 34$ pro Aktie, was eine Verdoppelung des jetzigen Kurses bedeuten würde (Eintrittswahrscheinlichkeit 25%).

2. Das Gericht gibt Fresenius auf ganzer Linie recht und der Deal wird abgeblasen. Würde bedeuten, dass der Kurs sich durchaus halbieren könnte (Eintrittswahrscheinlichkeit 25%).

3. US-Gerichte neigen in solchen Fällen oft zu Kompromisslösungen. Würde hier bedeuten, dass der Deal mit einem gewissen Preisabschlag über die Bühne gehen muss. Also unter 34$ aber wohl deutlich über dem jetzigen Kursniveau. Könnte mir hier Aufschlag von ca. 50% vorstellen (Eintrittswahrscheinlichkeit 50%)

Bei Eintritt von Szenario 2. müsste man die Papier ggf. doch länger halten, bis sich der Kurs nach dem ersten Schock wieder berappelt, immerhin Stand der Laden vor dem ganzen Drama auch schon deutlich über 20$. Einen Totalverlust kann man hier ausschließen, der Laden macht ja solide Gewinne.

So ein Chance/Risiko Verhältnis bietet einem kein Casino…

Achtung nur etwas für Zocker und auf keinen Fall eine „normale“ Kaufempfehlung…

Achtung nur etwas für Zocker und auf keinen Fall eine „normale“ Kaufempfehlung… gestern +7.8%

Herr Sturm: wie war das mit:Der Entscheidung liegen unter anderen schwerwiegende Verstöße gegen FDA-Vorgaben zur Datenintegrität bei Akorn zugrunde, die während der von Fresenius eingeleiteten, unabhängigen Untersuchung gefunden wurden. (*)

Fresenius Had Testing Woes Similar to Akorn, Unit Head Says

https://www.bloomberg.com/news/articles/2018-07-12/fresenius…

=>

-- FDA officials cited India plant for computer software issues

-- Drugmaker cited similar problems in canceling Akorn buyout

A Fresenius SE executive acknowledged his company has grappled with testing problems similar to those the German health-care company cited as a basis for pulling out of a $4.3 billion deal to buy U.S. generic drugmaker Akorn Inc.

Mats Henriksson, chief executive of a Fresenius unit, testified Thursday that U.S. Food and Drug Administration inspectors in 2013 questioned drug-injection testing and test-result storage at one of the firm’s plants in India. It took the company two years to address those problems, Henriksson told Delaware Chancery Judge Travis Laster.

If Fresenius is forced to go through with the combination, the health-care conglomerate would take steps to recall all Akorn products tied to the questionable test results and spend four years changing operational procedures, Henriksson said. It would cost Fresenius an estimated $254 million, he said.

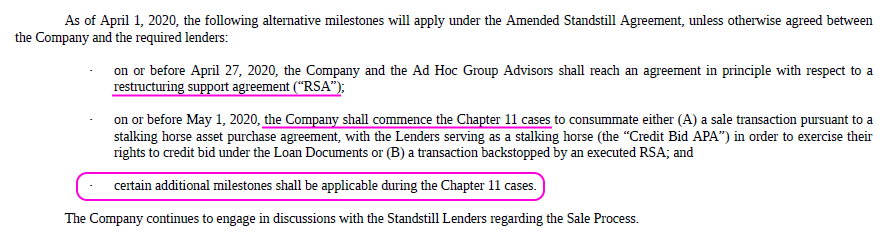

Fresenius officials have criticized Lake Forest, Illinois-based Akorn for using the exact same tests at some of its facilities and questioned whether the drugmaker’s computer security was too lax to guarantee the reliability of its test results.