Northrop Grumman - Die letzten 30 Beiträge

eröffnet am 21.09.18 16:57:22 von

neuester Beitrag 29.04.23 14:44:01 von

neuester Beitrag 29.04.23 14:44:01 von

Beiträge: 23

ID: 1.288.984

ID: 1.288.984

Aufrufe heute: 0

Gesamt: 3.475

Gesamt: 3.475

Aktive User: 0

ISIN: US6668071029 · WKN: 851915 · Symbol: NOC

481,71

USD

-1,30 %

-6,35 USD

Letzter Kurs 19:52:28 NYSE

Neuigkeiten

25.04.24 · globenewswire |

17.04.24 · dpa-AFX |

26.03.24 · Business Wire (engl.) |

21.03.24 · globenewswire |

11.03.24 · dpa-AFX |

Werte aus der Branche Luftfahrt und Raumfahrt

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,4500 | +13,31 | |

| 17,970 | +10,38 | |

| 61,72 | +8,99 | |

| 2,6500 | +8,61 | |

| 61,74 | +8,32 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,2270 | -4,66 | |

| 2,3100 | -4,94 | |

| 46,74 | -5,71 | |

| 0,5300 | -7,02 | |

| 4,2500 | -9,38 |

Beitrag zu dieser Diskussion schreiben

Northrop Zahlen und Aussichten sind nicht so viel schlechter als bei Lockheed und auch Raytheon ; der Kursverlauf aber doch , für mich Grund zum Nachkaufen . An eine Beruhigung der politischen Großwetterlage glaube ich auf Jahre nicht ...

warum ist hier trotz Richtung Norden alles eingeschlafen

STO – ZOCK !!! bei NOC

Meine Analyse soll eine Hilfe bei der Entscheidungsfindung sein und keine Empfehlung. Ob meine Einschätzung eintrifft oder nicht, wird sich in Zukunft zeigen. An der Börse gibt es keine Garantie, und jeder handelt auf eigenes Risiko. Ich nenne jeweils einige KO-Scheine, mit denen diese Analyse getradet werden könnte – Auch hier, jeder muss für sich selbst entscheiden. Ich analysiere, schreibe meine Erwartung und Einschätzungen auf. Das Risiko der Spekulation, durch ein Investment, trägt der Käufer zu 100% alleine.

Good Luck

Chartier

Meine Analyse soll eine Hilfe bei der Entscheidungsfindung sein und keine Empfehlung. Ob meine Einschätzung eintrifft oder nicht, wird sich in Zukunft zeigen. An der Börse gibt es keine Garantie, und jeder handelt auf eigenes Risiko. Ich nenne jeweils einige KO-Scheine, mit denen diese Analyse getradet werden könnte – Auch hier, jeder muss für sich selbst entscheiden. Ich analysiere, schreibe meine Erwartung und Einschätzungen auf. Das Risiko der Spekulation, durch ein Investment, trägt der Käufer zu 100% alleine.

Good Luck

Chartier

zu gd

https://www.bnnbloomberg.ca/video/gordon-reid-discusses-gene…

noc nervt ganz schön

sind aber aktienrückkäufer

und drei jahre konso sind fast vorbei und denke danach gehen wir ganz schnell auf 400 $

https://www.bnnbloomberg.ca/video/gordon-reid-discusses-gene…

noc nervt ganz schön

sind aber aktienrückkäufer

und drei jahre konso sind fast vorbei und denke danach gehen wir ganz schnell auf 400 $

sorry , sollte 305 sein

wenn wir jetzt wieder zum 4 oder 5 mal an der 350 abprallen, geb ich auf.

gibt eigentlich nichts neues

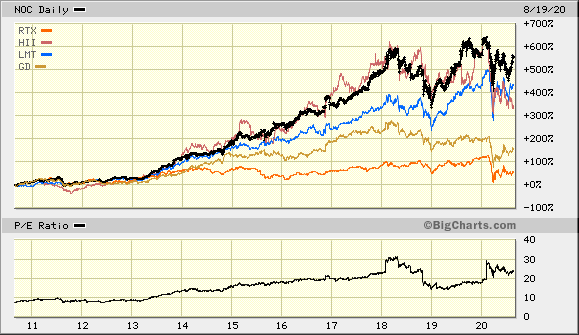

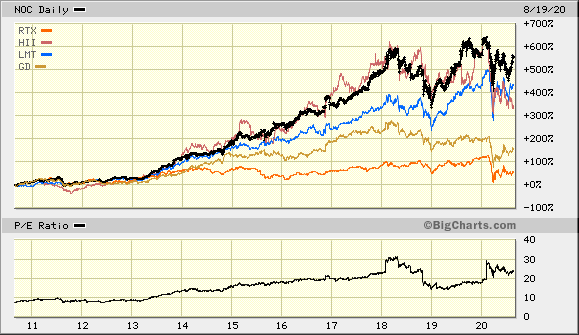

sieht ganz gut aus, rtx ist halt jetzt ba zulieferer

der bereich wird auch nach dem november weiter laufen

weiter laufen

sieht ganz gut aus, rtx ist halt jetzt ba zulieferer

der bereich wird auch nach dem november

weiter laufen

weiter laufen

https://www.finanzen.ch/nachrichten/aktien/lockheed-erhaelt-…

------

In a July letter to the Pentagon explaining its decision to drop out, Boeing complained that the Air Force "takes no steps to mitigate Northrop's anticompetitive and inherently unfair cost, resource, and integration advantages," and said Northrop has also been unwilling to enter into an agreement that would prevent the sharing of confidential business information.

https://www.fool.com/investing/2019/09/21/boeing-calls-for-g…

------

In a July letter to the Pentagon explaining its decision to drop out, Boeing complained that the Air Force "takes no steps to mitigate Northrop's anticompetitive and inherently unfair cost, resource, and integration advantages," and said Northrop has also been unwilling to enter into an agreement that would prevent the sharing of confidential business information.

https://www.fool.com/investing/2019/09/21/boeing-calls-for-g…

Was ist los?

Raytheon is in late-stage talks to combine with United Technologies’ aerospace unit in an all-stock deal to create a new company worth more than $100 billion, a tie-up that would consolidate the aviation and defense sectors, according to a source familiar with the matter.

The deal, which could be announced as early as Monday morning, would combine United Technologies’ aerospace business with Raytheon and bring the two suppliers to giants like Airbus, Boeing and Lockheed Martin under one roof.

For Tomahawk missile-maker Raytheon, the deal provides exposure to the booming commercial aerospace sector through the United Technologies’ unit, which makes everything from high-value jet engines and competes with General Electric, to cockpit controls, aircraft seats and cabin interiors for passenger jets. United Technologies would gain footing in the cyber-security and defense sectors through the deal.

Farmington, Conn.-based United Technologies in November 2018 announced it was spinning off its Otis elevator business and its Carrier air conditioning unit, into separate companies. The aerospace business would be combined with Raytheon, the person said. United Technologies CEO Gregory Hayes would become CEO of the combined company, which would be called Raytheon Technologies, and Raytheon’s CEO Thomas Kennedy would become chairman, according to the person.

Raytheon and United Technologies have a combined market value of nearly $166 billion. United Technologies has been beefing up its commercial aerospace business, which includes jet engine maker Pratt and Whitney. In November 2018, it closed its acquisition of Rockwell Collins.

The new company, after Carrier and Otis are separated out, is expected to have a combined market value of more than $100 billion, the person said.

The deal, a so-called merger of equals, wouldn’t close before 2020, when United Technologies expects to complete the separation of the elevator and air conditioning businesses, the person said. If completed, United Technologies shareholders are expected to have a majority with about 53% of the new company, while Raytheon’s would own 47%, the person added.

United Technologies would have eight board seats and Raytheon would have seven, said the source.

The deal, which could still fall apart, was reported earlier by The Wall Street Journal. Deal talks started several months ago, the source said.

The combined company would be headquartered in the Boston metropolitan area, the person said. Raytheon is based in Waltham, Mass., a Boston suburb.

RBC and Citigroup are advising Raytheon on the deal and Morgan Stanley and Evercore are working with United Technologies, according to the person.

Raytheon declined to comment. United Technologies did not immediately respond to a request for comment.

The deal, which could be announced as early as Monday morning, would combine United Technologies’ aerospace business with Raytheon and bring the two suppliers to giants like Airbus, Boeing and Lockheed Martin under one roof.

For Tomahawk missile-maker Raytheon, the deal provides exposure to the booming commercial aerospace sector through the United Technologies’ unit, which makes everything from high-value jet engines and competes with General Electric, to cockpit controls, aircraft seats and cabin interiors for passenger jets. United Technologies would gain footing in the cyber-security and defense sectors through the deal.

Farmington, Conn.-based United Technologies in November 2018 announced it was spinning off its Otis elevator business and its Carrier air conditioning unit, into separate companies. The aerospace business would be combined with Raytheon, the person said. United Technologies CEO Gregory Hayes would become CEO of the combined company, which would be called Raytheon Technologies, and Raytheon’s CEO Thomas Kennedy would become chairman, according to the person.

Raytheon and United Technologies have a combined market value of nearly $166 billion. United Technologies has been beefing up its commercial aerospace business, which includes jet engine maker Pratt and Whitney. In November 2018, it closed its acquisition of Rockwell Collins.

The new company, after Carrier and Otis are separated out, is expected to have a combined market value of more than $100 billion, the person said.

The deal, a so-called merger of equals, wouldn’t close before 2020, when United Technologies expects to complete the separation of the elevator and air conditioning businesses, the person said. If completed, United Technologies shareholders are expected to have a majority with about 53% of the new company, while Raytheon’s would own 47%, the person added.

United Technologies would have eight board seats and Raytheon would have seven, said the source.

The deal, which could still fall apart, was reported earlier by The Wall Street Journal. Deal talks started several months ago, the source said.

The combined company would be headquartered in the Boston metropolitan area, the person said. Raytheon is based in Waltham, Mass., a Boston suburb.

RBC and Citigroup are advising Raytheon on the deal and Morgan Stanley and Evercore are working with United Technologies, according to the person.

Raytheon declined to comment. United Technologies did not immediately respond to a request for comment.

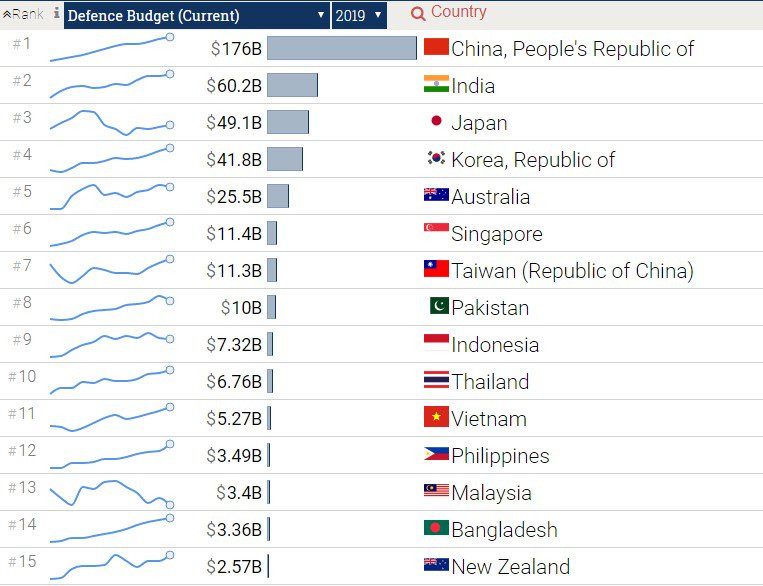

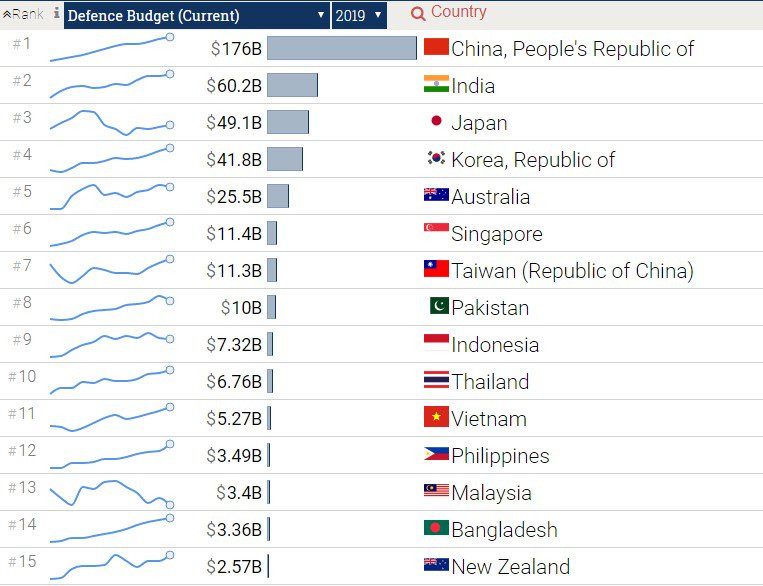

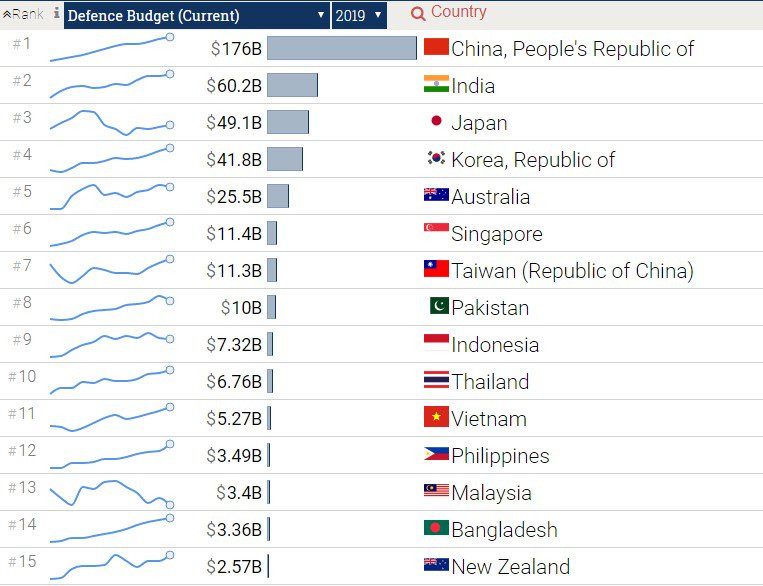

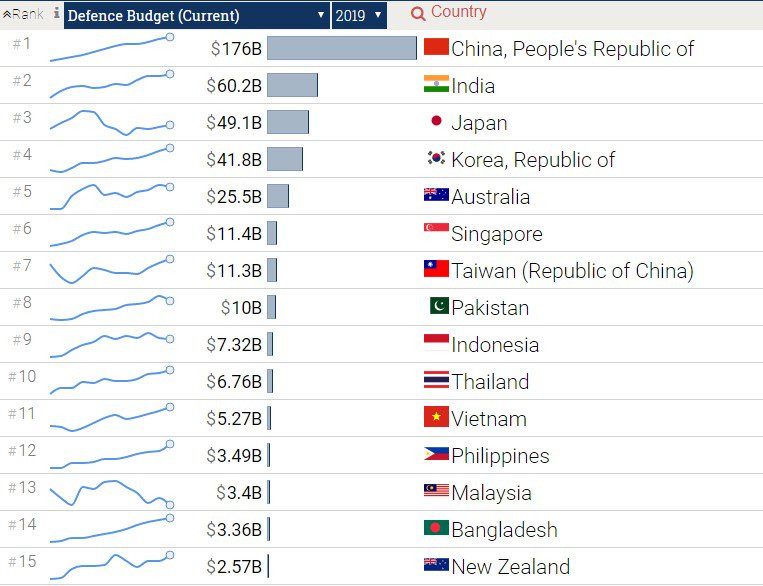

url]" target="_blank" rel="nofollow ugc noopener">https://www.cnbc.com/2019/06/01/acting-us-defense-secretary-calls-asia-allies-to-boost-arms-spending.html[/ url]" target="_blank" rel="nofollow ugc noopener">url]" target="_blank" rel="nofollow ugc noopener">https://www.cnbc.com/2019/06/01/acting-us-defense-secretary-calls-asia-allies-to-boost-arms-spending.html[/

url]" target="_blank" rel="nofollow ugc noopener">url]" target="_blank" rel="nofollow ugc noopener">https://www.cnbc.com/2019/06/01/acting-us-defense-secretary-calls-asia-allies-to-boost-arms-spending.html[/ url]

url]

url]" target="_blank" rel="nofollow ugc noopener">url]" target="_blank" rel="nofollow ugc noopener">https://www.cnbc.com/2019/06/01/acting-us-defense-secretary-calls-asia-allies-to-boost-arms-spending.html[/

url]" target="_blank" rel="nofollow ugc noopener">url]" target="_blank" rel="nofollow ugc noopener">https://www.cnbc.com/2019/06/01/acting-us-defense-secretary-calls-asia-allies-to-boost-arms-spending.html[/ url]

url]

Lorne Steinberg discusses Northrop Grumman

https://www.bnnbloomberg.ca/video/lorne-steinberg-discusses-…

https://www.bnnbloomberg.ca/video/lorne-steinberg-discusses-…

Raytheon (RTN - Get Report) shares were down 5% in trading Thursday after the defense company reported a first-quarter earnings beat driven by higher weapons sales thanks to increased defense spending under President Donald Trump.

The company reported net income of $2.77 per share on revenue of $6.73 billion. Analysts were modeling for earnings of $2.45 per share on revenue of $6.58 billion.

The company also provided full-year earning guidance of between $11.40 and $11.60 per share on revenue between $28.6 billion and $29.1 billion. Analysts surveyed by FactSet expect Raytheon to earn $11.61 per share on revenue of $28.9 billion.

"We delivered strong operating performance in the first quarter with our company bookings, sales, earnings per share and cash flow all ahead of our expectations," said Thomas A. Kennedy, Raytheon chairman and CEO. "The Raytheon team remains focused on driving strong execution and future growth by developing and delivering innovative solutions that address our customers' most complex challenges."

https://www.thestreet.com/investing/earnings/raytheon-earnin…" target="_blank" rel="nofollow ugc noopener">https://www.thestreet.com/investing/earnings/raytheon-earnin…

aktie fällt 5%, 1.q 500m$ buyback

The company reported net income of $2.77 per share on revenue of $6.73 billion. Analysts were modeling for earnings of $2.45 per share on revenue of $6.58 billion.

The company also provided full-year earning guidance of between $11.40 and $11.60 per share on revenue between $28.6 billion and $29.1 billion. Analysts surveyed by FactSet expect Raytheon to earn $11.61 per share on revenue of $28.9 billion.

"We delivered strong operating performance in the first quarter with our company bookings, sales, earnings per share and cash flow all ahead of our expectations," said Thomas A. Kennedy, Raytheon chairman and CEO. "The Raytheon team remains focused on driving strong execution and future growth by developing and delivering innovative solutions that address our customers' most complex challenges."

https://www.thestreet.com/investing/earnings/raytheon-earnin…" target="_blank" rel="nofollow ugc noopener">https://www.thestreet.com/investing/earnings/raytheon-earnin…

aktie fällt 5%, 1.q 500m$ buyback

http://investor.northropgrumman.com/static-files/d9b50c81-04…

Reports First Quarter 2019 Financial Results• Q1 Sales Increase22 Percent to $8.2 Billion• Q1 EPS Increase 6 Percent to $5.06• Strong Operational Performance at All Sectors• Q1 Net Awards Total $12.3 Billion; Backlog Increases 7 Percent to $57.3 Billion• 2019 MTM-adjusted EPS1 Guidance Increased to $18.90 to $19.30

Reports First Quarter 2019 Financial Results• Q1 Sales Increase22 Percent to $8.2 Billion• Q1 EPS Increase 6 Percent to $5.06• Strong Operational Performance at All Sectors• Q1 Net Awards Total $12.3 Billion; Backlog Increases 7 Percent to $57.3 Billion• 2019 MTM-adjusted EPS1 Guidance Increased to $18.90 to $19.30

geht ja gut los

Lockheed Martin (NYSE:LMT) +6.6% pre-market after crushing Q1 earnings and revenue expectations as well as raising full-year guidance above Wall Street consensus.

LMT says Q1 sales rose at all of its divisions: aeronautics (+27% Y/Y to $5.58B), missiles and fire control (+40% to $2.35B), rotary and mission systems (+17% to $3.76B) and space (+13% to $2.64B).

Operating margins rose in three of the four divisions: aeronautics (10.5% vs. 10.8% in the year-ago quarter), missiles and fire control (17.7% vs. 15.6%), rotary and mission systems (10.1% vs. 9.6%) and space (12.7% vs. 11.3%).

LMT lifts FY 2019 guidance, now seeing EPS of $20.05-$20.35 from $19.15-$19.45 previously and revenues of $56.75B-$58.25B from prior guidance of $55.75B-$57.25B; analyst consensus calls for EPS of $19.62 and revenues of $56.73B.

wobei die 20$ fürs jahr ja nur ein kleiner scherz sein dürften.

wären ja nur noch 4,66 pro qu.

Lockheed Martin (NYSE:LMT) +6.6% pre-market after crushing Q1 earnings and revenue expectations as well as raising full-year guidance above Wall Street consensus.

LMT says Q1 sales rose at all of its divisions: aeronautics (+27% Y/Y to $5.58B), missiles and fire control (+40% to $2.35B), rotary and mission systems (+17% to $3.76B) and space (+13% to $2.64B).

Operating margins rose in three of the four divisions: aeronautics (10.5% vs. 10.8% in the year-ago quarter), missiles and fire control (17.7% vs. 15.6%), rotary and mission systems (10.1% vs. 9.6%) and space (12.7% vs. 11.3%).

LMT lifts FY 2019 guidance, now seeing EPS of $20.05-$20.35 from $19.15-$19.45 previously and revenues of $56.75B-$58.25B from prior guidance of $55.75B-$57.25B; analyst consensus calls for EPS of $19.62 and revenues of $56.73B.

wobei die 20$ fürs jahr ja nur ein kleiner scherz sein dürften.

wären ja nur noch 4,66 pro qu.

Northrop Grumman announced a new $3 billion share repurchase authorization, increasing the defense contractor's total buyback authorization to $4.1 billion.

http://globenewswire.com/news-release/2018/11/08/1647856/0/e…

die goldmaenner wieder

Huntington Ingalls (HII -5.7%) plunges after Goldman Sachs downgrades shares to Sell from Neutral with a $208 price target, trimmed from $220, as analyst Noah Poponak says the company's pace of growth may not support current valuation levels.Oct. 11, 2018 3:54

die goldmaenner wieder

Huntington Ingalls (HII -5.7%) plunges after Goldman Sachs downgrades shares to Sell from Neutral with a $208 price target, trimmed from $220, as analyst Noah Poponak says the company's pace of growth may not support current valuation levels.Oct. 11, 2018 3:54

superzahlen

Northrop Grumman Corp. (NOC) on Wednesday reported third-quarter net income of $1.14 billion.

On a per-share basis, the Falls Church, Virginia-based company said it had net income of $6.54.

The results topped Wall Street expectations. The average estimate of eight analysts surveyed by Zacks Investment Research was for earnings of $4.35 per share.

The defense contractor posted revenue of $8.09 billion in the period, also surpassing Street forecasts. Five analysts surveyed by Zacks expected $8 billion.

Northrop Grumman expects full-year earnings to be $18.75 to $19 per share, with revenue expected to be $30 billion.

Northrop Grumman Corp. (NOC) on Wednesday reported third-quarter net income of $1.14 billion.

On a per-share basis, the Falls Church, Virginia-based company said it had net income of $6.54.

The results topped Wall Street expectations. The average estimate of eight analysts surveyed by Zacks Investment Research was for earnings of $4.35 per share.

The defense contractor posted revenue of $8.09 billion in the period, also surpassing Street forecasts. Five analysts surveyed by Zacks expected $8 billion.

Northrop Grumman expects full-year earnings to be $18.75 to $19 per share, with revenue expected to be $30 billion.

Huntington Ingalls Industries has been awarded a $5.1 billion U.S. defense contract for the construction of six DDG 51 class ships, the Pentagon said on Thursday.

The U.S. Army has awarded Raytheon Company (RTN) a more than $1.5 billion contract for production of Poland's Patriot™ Integrated Air and Missile Defense System including spare parts, support and training.

gerade bei hii sind 5,1b schon viel.

The U.S. Army has awarded Raytheon Company (RTN) a more than $1.5 billion contract for production of Poland's Patriot™ Integrated Air and Missile Defense System including spare parts, support and training.

gerade bei hii sind 5,1b schon viel.

noc

hii

rtn

alle etwas zurückgekommen.

hii gefällt mir am besten.

hii

rtn

alle etwas zurückgekommen.

hii gefällt mir am besten.

17.04.24 · dpa-AFX · Lockheed Martin |

11.03.24 · dpa-AFX · Boeing |

08.03.24 · BörsenNEWS.de · Emmi |

28.02.24 · BörsenNEWS.de · Emmi |