Mit HEXAGON als JV-Partner bei "American Innovation Metals" in die Geburt der chinaunabhängigen REE (Seite 5)

eröffnet am 31.03.20 23:28:35 von

neuester Beitrag 02.03.24 07:24:21 von

neuester Beitrag 02.03.24 07:24:21 von

Beiträge: 488

ID: 1.322.730

ID: 1.322.730

Aufrufe heute: 1

Gesamt: 34.308

Gesamt: 34.308

Aktive User: 0

ISIN: AU000000HXG7 · WKN: A2ABJ0

0,0140

EUR

+3,70 %

+0,0005 EUR

Letzter Kurs 06.05.24 Lang & Schwarz

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7875 | +17,54 | |

| 0,5500 | +17,02 | |

| 4,8600 | +15,71 | |

| 2,0500 | +13,89 | |

| 0,5120 | +13,27 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8400 | -8,50 | |

| 0,7200 | -9,43 | |

| 0,9760 | -10,87 | |

| 0,6601 | -26,22 | |

| 1,1600 | -46,79 |

Beitrag zu dieser Diskussion schreiben

South Star schreibt im "South Star Battery Metals 2021 END OF YEAR SUMMARY"

Alabama Graphite Project

We are very excited about the potential of this project in an important growth

jurisdiction and leveraging our technical expertise and commercial relationships to spin

this project up quickly. We are putting together our 2022 work program for Board

approval, but I am preparing a program that includes the following items:

• Exploration & Drilling Program

• Maiden Resource Definition

• Preliminary Environmental Characterization

• Metallurgical testing program to create about approximately 15kg of concentrate

and initial value -add testing program.

Quelle: https://www.globenewswire.com/Tracker?data=8p1w7Q64CN5brpU3P…

Alabama Graphite Project

We are very excited about the potential of this project in an important growth

jurisdiction and leveraging our technical expertise and commercial relationships to spin

this project up quickly. We are putting together our 2022 work program for Board

approval, but I am preparing a program that includes the following items:

• Exploration & Drilling Program

• Maiden Resource Definition

• Preliminary Environmental Characterization

• Metallurgical testing program to create about approximately 15kg of concentrate

and initial value -add testing program.

Quelle: https://www.globenewswire.com/Tracker?data=8p1w7Q64CN5brpU3P…

Antwort auf Beitrag Nr.: 70.739.745 von Oginvest am 03.02.22 22:51:44 Soeben nochmals gelesen - von dem earn-in mit South Star gibt's kein Geld, die sollen die Projekt-Kosten übernehmen und im besten Fall wenn alles wie geplant umgesetzt wird, werden sie Aktien von South Star erhalten, demnach nicht direkt Geld mit dem sich was bezahlen lässt. Gehe daher auch von einer irgendwann kommenden KE aus, falls nicht ein anderen Investor bekannt wird.

Antwort auf Beitrag Nr.: 70.730.955 von Neuer2019 am 03.02.22 12:42:25?Gibt's "Hydrogen Support" vom australischen Staat? Geld vom Earn-in?

Zitat von Oginvest: Binding 75% Earn-in and Option Agreement over Hexagon’s Ceylon Graphite Project in Alabama, USA signed with South Star Battery Metals Corp.

Hexagon Energy Materials Limited (ASX: HXG, “Hexagon” or “the Company”) is pleased to advise that, further to the Company’s 4 November and 2 December 2021 ASX announcements, a binding Earn-in and Option Agreement (“the Agreement”) covering the 75% earn-in by South Star Battery Metals Corp. (“South Star”) to Hexagon’s Ceylon Graphite Project located in Alabama, USA (“Project”) has been signed.

South Star will now progress work against the Earn-in milestones to acquire an interest of up to 75% of the Ceylon Graphite Project.

Hexagon currently owns 80% of the Ceylon Graphite Project, with the balance held by private owners including U.S. Critical Minerals LLC (“USCM”), as shareholders in the Project owner, Charge Minerals LLC (“Charge Minerals”).

The core elements of the Earn-in and Option Agreement which runs over three years are:-

Weiter > https://hxgenergymaterials.com.au/wp-content/uploads/2021/12…

Antwort auf Beitrag Nr.: 70.715.445 von Oginvest am 02.02.22 09:48:10Hexagon hat schon ein großes Potenzial,wenn die alles so durchziehen wie beschrieben.

Den sie scheinen sich ja jetzt nur speziell auf das Hauptgeschäft zu konzentrieren - Hydrogen Project und Ni-Cu-PGE.

Nur wo kommt das benötigte Kapital her!

Muß da eine Kapitalerhöhung her oder gibt es doch noch andere Weg sich Geld zu beschaffen, z.B. Verkauf vom anderen Vermögenswerten oder noch eine ganz andere Quelle.

Den sie scheinen sich ja jetzt nur speziell auf das Hauptgeschäft zu konzentrieren - Hydrogen Project und Ni-Cu-PGE.

Nur wo kommt das benötigte Kapital her!

Muß da eine Kapitalerhöhung her oder gibt es doch noch andere Weg sich Geld zu beschaffen, z.B. Verkauf vom anderen Vermögenswerten oder noch eine ganz andere Quelle.

McIntosh Project announcement media coverage

Below are links to media coverage received following yesterday's McIntosh Project announcement for your interest.• Market Herald - Hexagon Energy Materials (ASX:HXG) focus on under-explored area at McIntosh

https://themarketherald.com.au/hexagon-energy-materials-asxh…

• Stockhead - Unlocking McIntosh Project potential for hydrogen energy transition

https://stockhead.com.au/energy/asx-green-energy-stocks-glob…

For additional information please contact:

Merrill Gray

Managing Director

Hexagon Energy Materials Ltd

T: +61 8 6244 0349

E: info@hxgenergymaterials.com.au

Nick Howe

Media Contact

GRACosway

T: +61 2 8987 2121

E: nhowe@gracosway.com.au

McIntosh Ni-Cu-PGE Project - Progress Update 2 February 2022

Hexagon Energy Materials Ltd is pleased to announce that further interrogation of historic data completed by Hexagon has highlighted a 2.2 km strike of Panton Suite within the Melon Patch prospect, that has known PGE mineralisation from historic drilling and costeaning, all strengthening 2022 drilling plans.

Hexagon’s Managing Director, Merrill Gray, said “McIntosh is core to Hexagon’s future energy materials strategy moving forward. We are focussed on unlocking this asset’s value at a time where Nickel prices are at a 10-year high and there is great value being placed on PGEs for use in fuel cell and electrolyser manufacture - key to the hydrogen energy transition. The upcoming 2022 exploration program at McIntosh comes at a time well suited to future market demands.”

For full details of today's ASX announcement: https://hxgenergymaterials.com.au/wp-content/uploads/2022/02…

Hexagon Energy Materials Ltd is pleased to announce that further interrogation of historic data completed by Hexagon has highlighted a 2.2 km strike of Panton Suite within the Melon Patch prospect, that has known PGE mineralisation from historic drilling and costeaning, all strengthening 2022 drilling plans.

Hexagon’s Managing Director, Merrill Gray, said “McIntosh is core to Hexagon’s future energy materials strategy moving forward. We are focussed on unlocking this asset’s value at a time where Nickel prices are at a 10-year high and there is great value being placed on PGEs for use in fuel cell and electrolyser manufacture - key to the hydrogen energy transition. The upcoming 2022 exploration program at McIntosh comes at a time well suited to future market demands.”

For full details of today's ASX announcement: https://hxgenergymaterials.com.au/wp-content/uploads/2022/02…

December 2021 Quarterly Activities Report & Appendix 5B 31 January 2022

ASX Announcement | 31 January 2022 Hexagon Energy Materials Limited (ASX: HXG)September – December 2021 Quarterly Activities Report

Pre-Feasibility Study identifies business improvement opportunities on the Northern Territory (Pedirka) Hydrogen Project, Graphite deal secured and further Ni-Cu-PGE progress at

Hexagon’s McIntosh Project.

EXECUTIVE SUMMARY

•

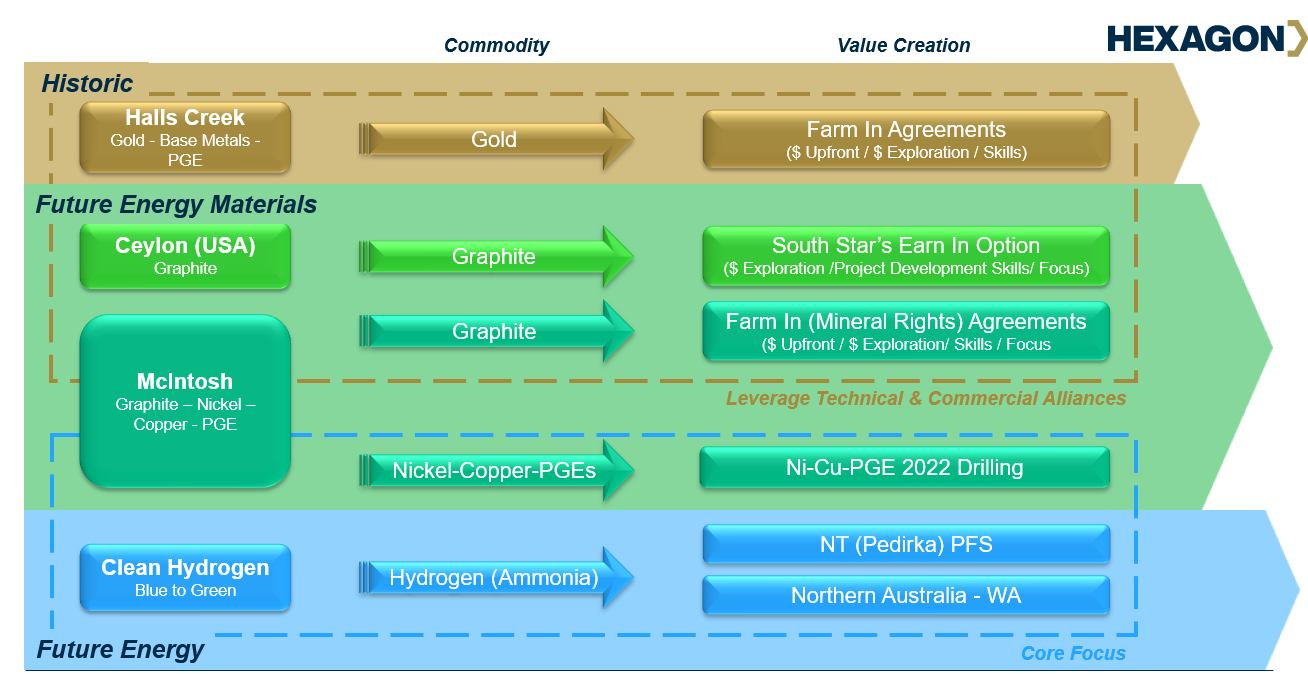

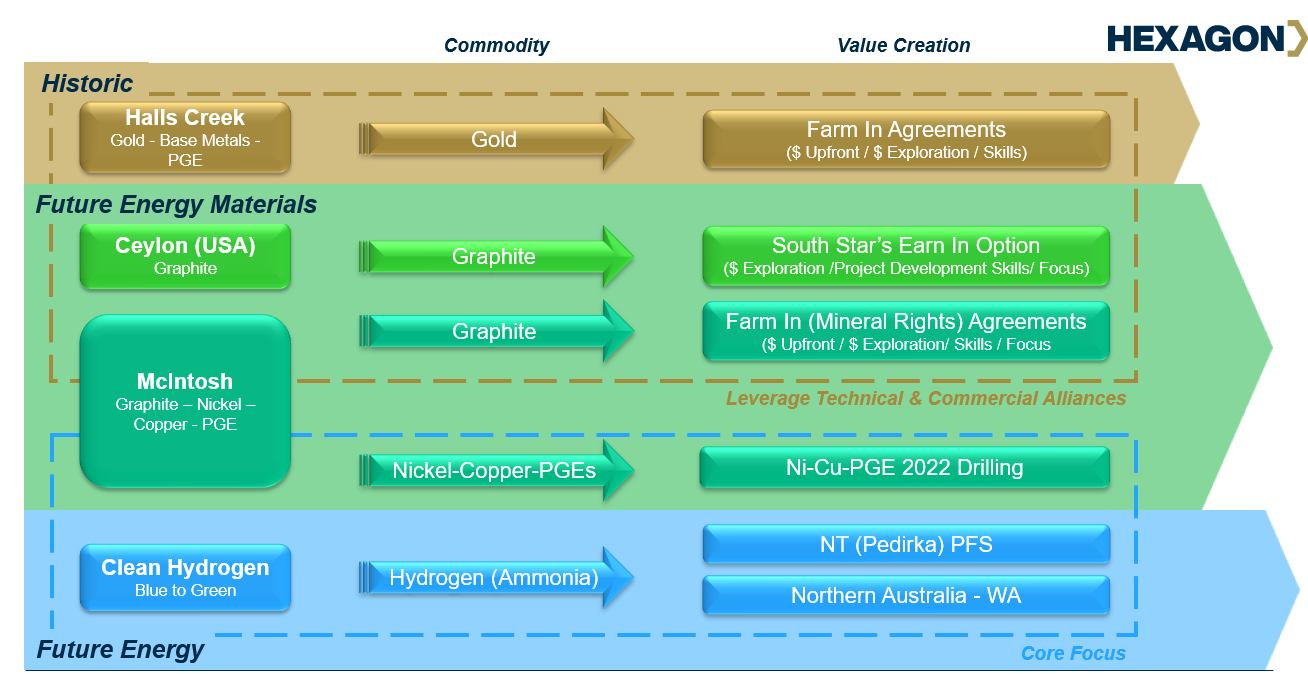

Having undertaken a detailed strategic review of the Company’s asset portfolio in the later part of 2021, Hexagon has defined a clear strategy for growth as a future energy and future energy materials business.

•

Key milestones necessary for Hexagon’s goals to participate in the large, global, future energy and future energy materials markets to be achieved have been clarified.

•

The Hexagon management team looks forward to achieving these and continuing to grow

momentum, through the imminent completion of the NT (Pedirka) Clean Hydrogen Project Pre-

Feasibility Study (PFS), further McIntosh Project progress and the securing of key alliances

across its other assets.

Hexagon Energy Materials Limited (ASX: HXG) (‘Hexagon’ or ‘the Company’) is pleased to providethis quarterly activities report for the period ending 31 December 2021 (Q2 FY22).

A strategic review of the Company’s asset base and project development activities has been

undertaken since the new management team has been in place. Q2 FY22 saw the Company lay out a clear plan to optimise value across Hexagon’s highly prospective portfolio of assets and projects.

Hexagon’s strategy is to participate in the large, global, future energy and future energy materials markets. The Company’s portfolio of assets is well positioned to meet the demand created by the emerging market needs of these sectors.

Weiter > https://hxgenergymaterials.com.au/wp-content/uploads/2022/01…

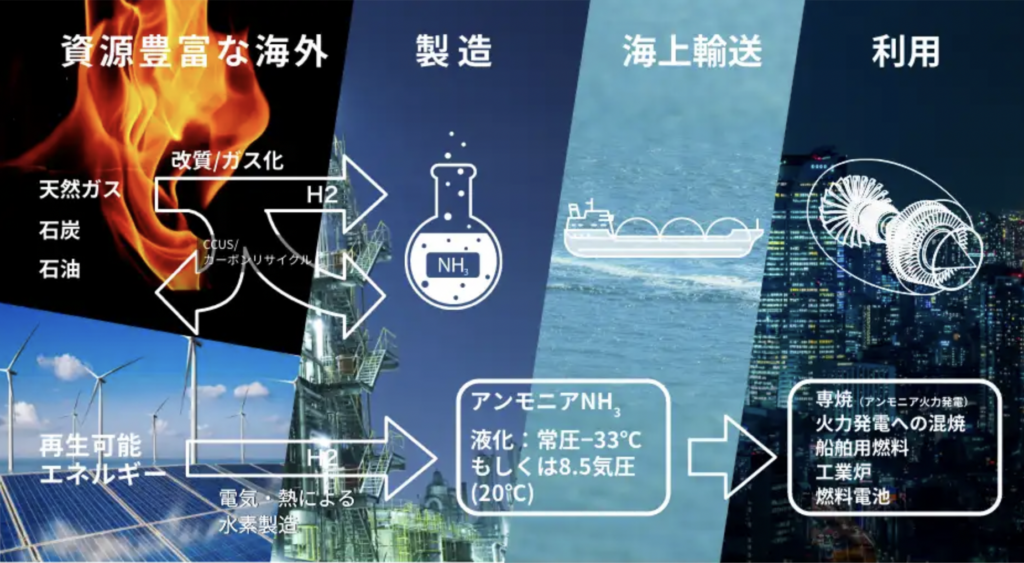

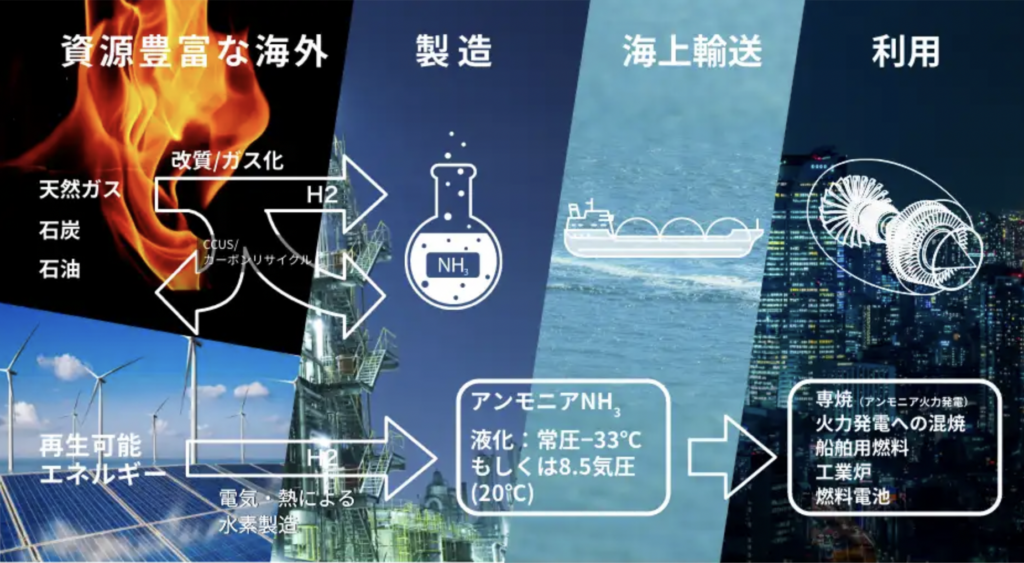

Hexagon is excited to read Ammonia Energy Association's news this week that JERA are targetting 50% ammonia-coal co-firing by 2030.

JERA targets 50% ammonia-coal co-firing by 2030

Four critical ammonia energy projects included in new funding announcement

Japanese government funding via NEDO (the New Energy and Industrial Technology Development Organisation) will support four critical ammonia energy projects, including JERA’s new plan to demonstrate 50% ammonia-coal co-firing by 2030.

https://www.nedo.go.jp/news/press/AA5_101502.html Click to learn more about NEDO’s funding announcement, which includes a JERA project to demonstrate 50% ammonia-coal co-firing by 2030 (Japanese language).

https://www.nedo.go.jp/news/press/AA5_101502.html Click to learn more about NEDO’s funding announcement, which includes a JERA project to demonstrate 50% ammonia-coal co-firing by 2030 (Japanese language).

These four projects will receive funding as part of a larger umbrella scheme named the “Fuel Ammonia Supply Chain Construction Project” (Japanese language), which has a budget of $500 million. This umbrella scheme – devised in close consultation between NEDO & METI – is slated to run until 2030 and aims to:

- reduce the supply cost of ammonia to “the high 10-Yen range per m3 [hydrogen equivalents]” by 2030. This roughly converts to US$1-2/kg hydrogen.

- introduce 20-40 ammonia combustion units for electricity generation by 2030 (both co-firing and 100% ammonia-fed).

- solve technical difficulties preventing high efficiency, low cost ammonia synthesis.

- build a fuel ammonia supply chain which integrates production and consumption.

Weiter > https://www.ammoniaenergy.org/articles/jera-targets-50-ammon…

JERA targets 50% ammonia-coal co-firing by 2030

Four critical ammonia energy projects included in new funding announcement

Japanese government funding via NEDO (the New Energy and Industrial Technology Development Organisation) will support four critical ammonia energy projects, including JERA’s new plan to demonstrate 50% ammonia-coal co-firing by 2030.

https://www.nedo.go.jp/news/press/AA5_101502.html Click to learn more about NEDO’s funding announcement, which includes a JERA project to demonstrate 50% ammonia-coal co-firing by 2030 (Japanese language).

https://www.nedo.go.jp/news/press/AA5_101502.html Click to learn more about NEDO’s funding announcement, which includes a JERA project to demonstrate 50% ammonia-coal co-firing by 2030 (Japanese language).These four projects will receive funding as part of a larger umbrella scheme named the “Fuel Ammonia Supply Chain Construction Project” (Japanese language), which has a budget of $500 million. This umbrella scheme – devised in close consultation between NEDO & METI – is slated to run until 2030 and aims to:

- reduce the supply cost of ammonia to “the high 10-Yen range per m3 [hydrogen equivalents]” by 2030. This roughly converts to US$1-2/kg hydrogen.

- introduce 20-40 ammonia combustion units for electricity generation by 2030 (both co-firing and 100% ammonia-fed).

- solve technical difficulties preventing high efficiency, low cost ammonia synthesis.

- build a fuel ammonia supply chain which integrates production and consumption.

Weiter > https://www.ammoniaenergy.org/articles/jera-targets-50-ammon…

Antwort auf Beitrag Nr.: 70.614.463 von Oginvest am 24.01.22 10:32:28ABOUT HEXAGON ENERGY MATERIALS LIMITED

Hexagon Energy Materials Limited (ASX: HXG) is an Australian company focused on clean energy project

development and energy materials exploration and project development.

Hexagon is developing a business to deliver decarbonised hydrogen (blue ammonia) into export and

domestic markets, at scale. The Pre-Feasibility Study for the NT (Pedirka) H2 Project located in Australia’s

Northern Territory, utilising gasification and Carbon Capture and Storage (CCS), is in progress with a

range of base case improvement opportunities in progression.

Hexagon’s plan is to progressively increase its renewable energy usage transitioning from blue to green

hydrogen production, on a commercial basis, over time.

Hexagon also owns the McIntosh Nickel-Copper-PGE and Graphite project in Western Australia (WA) and

the Halls Creek Gold and Base metals project in WA. In the USA, Hexagon has an 80 per cent controlling

interest of the Ceylon Graphite project located in Alabama over which South Star Battery Materials Corp.

(TSXV: STS) on 7 December 2021 signed an Option to earn up to 75% in.

Hexagon’s overarching goal for 2022 is to secure and leverage technical and commercial alliances by

commodity across its project portfolio and maintain a core focus on Northern Australian Future Energy

Materials and Future Energy project developments, in-house. Figure 1 below summarises Hexagon’s

Strategy.

Figure 1: Hexagon’s Strategy.

About FRV Australia

FRV Australia is one of the largest solar developers, asset owners and renewable energy platforms in

Australia and one of the first solar developers to enter the Australian market and the first company to

deliver a project-financed large scale solar farm in Australia with the Royalla Solar Farm near Canberra

operating since August 2014. The company has developed almost 800MWdc of Australian PV assets built

or under construction across 9 projects for a total project investment value of over 1 billion dollars. The

activities are based in Sydney and the company has a multidisciplinary team of over 40 employees with

the ambition to continue leading the global transition to a more sustainable energy future. FRV Australia has evolved from being just a developer to becoming an independent power producer. The company is

owned by Abdul Latif Jameel Energy, a world leader in the development of sustainable energy solutions

(51%) and OMERS, one of Canada's largest defined benefit pension plans (49%); the OMERS stake is

managed by OMERS Infrastructure, a global leader in infrastructure investing. For more information,

please visit: frv.com

About FRV

FRV, part of Abdul Latif Jameel Energy, is a leading global renewable energy development company. In

line with our ambition to continue leading the global transition to a more sustainable energy future, FRV

has evolved from being just a developer to becoming an independent power producer.

We aim to be the world's leading green energy and infrastructure platform. To achieve this strategic

vision, we have accelerated our growth through the return on our activities, shareholder contributions

and asset rotation through the sale of minority stakes. As a result, the company expects to invest more

than US$ 1.5 billion with the goal of doubling total installed capacity from 2 GW in 2021 to 4 GW in

2024. For more information, please visit: frv.com

About Abdul Latif Jameel Energy

Abdul Latif Jameel Energy was established in 2012, and is now a leading independent power producer,

and a premier service provider in the renewable energy sector, with interests in 16 countries around the

world with capabilities in renewable energy, including solar PV, wind, waste-to-energy and environmental

solutions, including desalination, water and wastewater treatment. For more information, please visit:

alj.com/energy

About OMERS and OMERS Infrastructure

OMERS Infrastructure manages investments globally in infrastructure on behalf of OMERS, the defined

benefit pension plan for municipal employees in the Province of Ontario, Canada. Investments are aimed

at steady returns to help deliver sustainable, affordable and meaningful pensions to OMERS members.

OMERS Infrastructure also manages capital in several assets for other institutional investors. OMERS

diversified portfolio of large-scale infrastructure assets exhibits stability and strong cash flows, in sectors

including energy, digital services, transportation and government-regulated services. OMERS has

employees in Toronto and other major cities across North America, the U.K., Continental Europe, Asia

and Australia. OMERS is one of Canada's largest defined benefit pension plans with net assets of C$114

billion, as at June 30, 2021.

https://hxgenergymaterials.com.au/wp-content/uploads/2022/01…

Hexagon Energy Materials Limited (ASX: HXG) is an Australian company focused on clean energy project

development and energy materials exploration and project development.

Hexagon is developing a business to deliver decarbonised hydrogen (blue ammonia) into export and

domestic markets, at scale. The Pre-Feasibility Study for the NT (Pedirka) H2 Project located in Australia’s

Northern Territory, utilising gasification and Carbon Capture and Storage (CCS), is in progress with a

range of base case improvement opportunities in progression.

Hexagon’s plan is to progressively increase its renewable energy usage transitioning from blue to green

hydrogen production, on a commercial basis, over time.

Hexagon also owns the McIntosh Nickel-Copper-PGE and Graphite project in Western Australia (WA) and

the Halls Creek Gold and Base metals project in WA. In the USA, Hexagon has an 80 per cent controlling

interest of the Ceylon Graphite project located in Alabama over which South Star Battery Materials Corp.

(TSXV: STS) on 7 December 2021 signed an Option to earn up to 75% in.

Hexagon’s overarching goal for 2022 is to secure and leverage technical and commercial alliances by

commodity across its project portfolio and maintain a core focus on Northern Australian Future Energy

Materials and Future Energy project developments, in-house. Figure 1 below summarises Hexagon’s

Strategy.

Figure 1: Hexagon’s Strategy.

About FRV Australia

FRV Australia is one of the largest solar developers, asset owners and renewable energy platforms in

Australia and one of the first solar developers to enter the Australian market and the first company to

deliver a project-financed large scale solar farm in Australia with the Royalla Solar Farm near Canberra

operating since August 2014. The company has developed almost 800MWdc of Australian PV assets built

or under construction across 9 projects for a total project investment value of over 1 billion dollars. The

activities are based in Sydney and the company has a multidisciplinary team of over 40 employees with

the ambition to continue leading the global transition to a more sustainable energy future. FRV Australia has evolved from being just a developer to becoming an independent power producer. The company is

owned by Abdul Latif Jameel Energy, a world leader in the development of sustainable energy solutions

(51%) and OMERS, one of Canada's largest defined benefit pension plans (49%); the OMERS stake is

managed by OMERS Infrastructure, a global leader in infrastructure investing. For more information,

please visit: frv.com

About FRV

FRV, part of Abdul Latif Jameel Energy, is a leading global renewable energy development company. In

line with our ambition to continue leading the global transition to a more sustainable energy future, FRV

has evolved from being just a developer to becoming an independent power producer.

We aim to be the world's leading green energy and infrastructure platform. To achieve this strategic

vision, we have accelerated our growth through the return on our activities, shareholder contributions

and asset rotation through the sale of minority stakes. As a result, the company expects to invest more

than US$ 1.5 billion with the goal of doubling total installed capacity from 2 GW in 2021 to 4 GW in

2024. For more information, please visit: frv.com

About Abdul Latif Jameel Energy

Abdul Latif Jameel Energy was established in 2012, and is now a leading independent power producer,

and a premier service provider in the renewable energy sector, with interests in 16 countries around the

world with capabilities in renewable energy, including solar PV, wind, waste-to-energy and environmental

solutions, including desalination, water and wastewater treatment. For more information, please visit:

alj.com/energy

About OMERS and OMERS Infrastructure

OMERS Infrastructure manages investments globally in infrastructure on behalf of OMERS, the defined

benefit pension plan for municipal employees in the Province of Ontario, Canada. Investments are aimed

at steady returns to help deliver sustainable, affordable and meaningful pensions to OMERS members.

OMERS Infrastructure also manages capital in several assets for other institutional investors. OMERS

diversified portfolio of large-scale infrastructure assets exhibits stability and strong cash flows, in sectors

including energy, digital services, transportation and government-regulated services. OMERS has

employees in Toronto and other major cities across North America, the U.K., Continental Europe, Asia

and Australia. OMERS is one of Canada's largest defined benefit pension plans with net assets of C$114

billion, as at June 30, 2021.

https://hxgenergymaterials.com.au/wp-content/uploads/2022/01…