Henry Schein - Weltmarktführer Dentalhandel - 500 Beiträge pro Seite

eröffnet am 21.01.10 15:31:42 von

neuester Beitrag 03.09.21 20:21:35 von

neuester Beitrag 03.09.21 20:21:35 von

Beiträge: 31

ID: 1.155.463

ID: 1.155.463

Aufrufe heute: 0

Gesamt: 4.758

Gesamt: 4.758

Aktive User: 0

ISIN: US8064071025 · WKN: 897961 · Symbol: HSIC

70,78

USD

-3,08 %

-2,25 USD

Letzter Kurs 16:15:01 Nasdaq

Neuigkeiten

29.04.24 · Business Wire (engl.) |

23.04.24 · Business Wire (engl.) |

22.04.24 · Business Wire (engl.) |

21.04.24 · wallstreetONLINE Redaktion |

18.04.24 · Business Wire (engl.) |

Werte aus der Branche Gesundheitswesen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,9700 | +324,79 | |

| 1,7400 | +74,00 | |

| 15,610 | +41,91 | |

| 6,9900 | +19,90 | |

| 0,5150 | +16,48 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,7700 | -13,24 | |

| 2,0000 | -15,97 | |

| 0,5700 | -16,60 | |

| 0,5800 | -17,14 | |

| 1,8819 | -55,93 |

04.11.2009 13:07

Henry Schein Reports Record Third Quarter Results / Net sales up 6.9% in local currencies excluding seasonal influenza vaccines Company introduces 2010 guidance

MELVILLE, N.Y., Nov. 4 /PRNewswire-FirstCall/ -- Henry Schein, Inc. , the largest provider of healthcare products and services to office-based practitioners, today reported record financial results for the quarter ended September 26, 2009.

Net sales for the third quarter of 2009 were $1.7 billion, an increase of 0.9% compared with the third quarter of 2008. This consists of a 3.1% decline related to foreign currency exchange and a 4.0% growth in local currencies. Excluding sales of seasonal influenza vaccines, which declined from last year's third quarter, net sales increased 3.7%, or 6.9% growth in local currencies (see Exhibit A for details of sales growth).

Income from continuing operations attributable to Henry Schein, Inc. for the third quarter of 2009 was $94.0 million or $1.03 per diluted share, an increase of 39.2% for both figures compared with the third quarter of 2008. Current and prior-year results include certain unusual items, most notably an overseas tax benefit in the 2009 quarter. Excluding these items, non-GAAP income from continuing operations was $72.9 million or $0.80 per share, an increase of 3.3% and 3.9%, respectively, compared with the third quarter of 2008 (see Exhibit B for reconciliation of GAAP income and EPS from continuing operations to non-GAAP income and EPS from continuing operations). When also excluding sales of seasonal influenza vaccines, which declined from last year's third quarter, non-GAAP diluted EPS from continuing operations increased approximately 18%.

"We are pleased to report net sales growth in local currencies of approximately 7% excluding sales of seasonal influenza vaccines, with solid increases in our Medical, International and Technology Groups," said Stanley M. Bergman, Chairman and Chief Executive Officer of Henry Schein. "A number of unusual items impacted our third quarter results in both the current and prior year. On a normalized basis excluding these items and sales of seasonal influenza vaccines, we are proud to report 18% growth in diluted EPS from continuing operations."

Dental Group sales of $622 million declined 3.0%, consisting of a 0.5% decline related to foreign currency exchange and a 2.5% decline in local currencies. The 2.5% decline in local currencies included 1.3% growth in Dental consumable merchandise sales and a 12.8% decline in Dental equipment sales and service revenues.

"We continue to believe that the market for Dental consumable merchandise has stabilized and, as expected, our decrease in sales of Dental equipment has improved from the previous quarter's rate of decline," commented Mr. Bergman.

Medical Group sales of $411 million declined 3.1%. Excluding sales of seasonal influenza vaccines, Medical Group sales increased 8.6%.

"During the third quarter we sold approximately 6.5 million doses of seasonal influenza vaccine, and as of today we have sold approximately 8.5 million doses for the year," said Mr. Bergman. "Sales growth of nearly 9% excluding seasonal influenza vaccine reflects strong sales of consumable products, as well as sales of products related to the treatment and prevention of the H1N1 virus."

International Group sales of $584 million increased 8.5%, consisting of an 8.4% decline related to foreign currency exchange and 16.9% growth in local currencies.

"We had double-digit local currency sales growth in our International dental, medical and veterinary businesses during the quarter," added Mr. Bergman.

Technology and Value-Added Services Group sales of $43 million increased 5.4% during the quarter, consisting of a 1.9% decline related to foreign currency exchange and 7.3% growth in local currencies.

"During the quarter we saw continued strong growth in electronic services, as well as the beneficial impact of the acquisition of a European veterinary software and practice management business," explained Mr. Bergman.

Year-to-Date Results

For the first nine months of 2009, net sales of $4.8 billion represent a decrease of 1.0% compared with the first nine months of 2008. This decrease includes a 5.9% decline related to foreign currency exchange and 4.9% growth in local currencies.

Income from continuing operations attributable to Henry Schein, Inc. for the first nine months of 2009 was $222.1 million or $2.45 per diluted share, an increase of 20.6% and 22.5%, respectively, compared with the first nine months of 2008. Excluding unusual items noted above, income from continuing operations attributable to Henry Schein, Inc. for the first nine months of 2009 was $203.8 million or $2.25 per diluted share, an increase of 8.8% and 10.3%, respectively, compared with the first nine months of 2008 (see Exhibit B for reconciliation of GAAP income and EPS from continuing operations to non-GAAP income and EPS from continuing operations).

2009 EPS Guidance Henry Schein today updated 2009 financial guidance, as follows: -- Fourth quarter 2009 diluted EPS attributable to Henry Schein, Inc. is expected to be $0.89 to $0.91. -- 2009 diluted EPS attributable to Henry Schein, Inc. is expected to be $3.14 to $3.16 excluding the unusual items included in Exhibit B. This represents growth of approximately 8% compared with restated 2008 results of $2.92, excluding charges related to the Lehman Brothers bankruptcy as well as restructuring costs. -- Guidance for 2009 diluted EPS attributable to Henry Schein, Inc. is for current continuing operations including completed or previously announced acquisitions, and does not include the impact of potential future acquisitions, if any. 2010 EPS Guidance Henry Schein today introduced 2010 financial guidance, as follows: -- 2010 diluted EPS attributable to Henry Schein, Inc. is expected to be $3.40 to $3.56, representing growth of 8% to 13% compared with the midpoint of 2009 guidance. -- Guidance for 2010 diluted EPS attributable to Henry Schein, Inc. is for current continuing operations including completed or previously announced acquisitions, and does not include the impact of potential future acquisitions, if any. Third Quarter Conference Call Webcast

The Company will hold a conference call to discuss third quarter financial results today, beginning at 10:00 a.m. Eastern time. Individual investors are invited to listen to the conference call over the Internet through Henry Schein's Web site at http://www.henryschein.com/. In addition, a replay will be available beginning shortly after the call has ended.

About Henry Schein

Henry Schein, a Fortune 500® company and a member of the NASDAQ 100® Index, is recognized for its excellent customer service and highly competitive prices. The Company's four business groups - Dental, Medical, International and Technology - serve more than 575,000 customers worldwide, including dental practitioners and laboratories, physician practices and animal health clinics, as well as government and other institutions. The Company operates through a centralized and automated distribution network, which provides customers in more than 200 countries with a comprehensive selection of more than 90,000 national and Henry Schein private-brand products in stock, as well as more than 100,000 additional products available as special-order items. Henry Schein also provides exclusive, innovative technology offerings for dental, medical and veterinary professionals, including value-added practice management software and electronic health record solutions.

Headquartered in Melville, N.Y., Henry Schein employs over 12,500 people and has operations or affiliates in 23 countries. The Company's net sales reached a record $6.4 billion in 2008. For more information, visit the Henry Schein Web site at http://www.henryschein.com/.

Henry Schein Reports Record Third Quarter Results / Net sales up 6.9% in local currencies excluding seasonal influenza vaccines Company introduces 2010 guidance

MELVILLE, N.Y., Nov. 4 /PRNewswire-FirstCall/ -- Henry Schein, Inc. , the largest provider of healthcare products and services to office-based practitioners, today reported record financial results for the quarter ended September 26, 2009.

Net sales for the third quarter of 2009 were $1.7 billion, an increase of 0.9% compared with the third quarter of 2008. This consists of a 3.1% decline related to foreign currency exchange and a 4.0% growth in local currencies. Excluding sales of seasonal influenza vaccines, which declined from last year's third quarter, net sales increased 3.7%, or 6.9% growth in local currencies (see Exhibit A for details of sales growth).

Income from continuing operations attributable to Henry Schein, Inc. for the third quarter of 2009 was $94.0 million or $1.03 per diluted share, an increase of 39.2% for both figures compared with the third quarter of 2008. Current and prior-year results include certain unusual items, most notably an overseas tax benefit in the 2009 quarter. Excluding these items, non-GAAP income from continuing operations was $72.9 million or $0.80 per share, an increase of 3.3% and 3.9%, respectively, compared with the third quarter of 2008 (see Exhibit B for reconciliation of GAAP income and EPS from continuing operations to non-GAAP income and EPS from continuing operations). When also excluding sales of seasonal influenza vaccines, which declined from last year's third quarter, non-GAAP diluted EPS from continuing operations increased approximately 18%.

"We are pleased to report net sales growth in local currencies of approximately 7% excluding sales of seasonal influenza vaccines, with solid increases in our Medical, International and Technology Groups," said Stanley M. Bergman, Chairman and Chief Executive Officer of Henry Schein. "A number of unusual items impacted our third quarter results in both the current and prior year. On a normalized basis excluding these items and sales of seasonal influenza vaccines, we are proud to report 18% growth in diluted EPS from continuing operations."

Dental Group sales of $622 million declined 3.0%, consisting of a 0.5% decline related to foreign currency exchange and a 2.5% decline in local currencies. The 2.5% decline in local currencies included 1.3% growth in Dental consumable merchandise sales and a 12.8% decline in Dental equipment sales and service revenues.

"We continue to believe that the market for Dental consumable merchandise has stabilized and, as expected, our decrease in sales of Dental equipment has improved from the previous quarter's rate of decline," commented Mr. Bergman.

Medical Group sales of $411 million declined 3.1%. Excluding sales of seasonal influenza vaccines, Medical Group sales increased 8.6%.

"During the third quarter we sold approximately 6.5 million doses of seasonal influenza vaccine, and as of today we have sold approximately 8.5 million doses for the year," said Mr. Bergman. "Sales growth of nearly 9% excluding seasonal influenza vaccine reflects strong sales of consumable products, as well as sales of products related to the treatment and prevention of the H1N1 virus."

International Group sales of $584 million increased 8.5%, consisting of an 8.4% decline related to foreign currency exchange and 16.9% growth in local currencies.

"We had double-digit local currency sales growth in our International dental, medical and veterinary businesses during the quarter," added Mr. Bergman.

Technology and Value-Added Services Group sales of $43 million increased 5.4% during the quarter, consisting of a 1.9% decline related to foreign currency exchange and 7.3% growth in local currencies.

"During the quarter we saw continued strong growth in electronic services, as well as the beneficial impact of the acquisition of a European veterinary software and practice management business," explained Mr. Bergman.

Year-to-Date Results

For the first nine months of 2009, net sales of $4.8 billion represent a decrease of 1.0% compared with the first nine months of 2008. This decrease includes a 5.9% decline related to foreign currency exchange and 4.9% growth in local currencies.

Income from continuing operations attributable to Henry Schein, Inc. for the first nine months of 2009 was $222.1 million or $2.45 per diluted share, an increase of 20.6% and 22.5%, respectively, compared with the first nine months of 2008. Excluding unusual items noted above, income from continuing operations attributable to Henry Schein, Inc. for the first nine months of 2009 was $203.8 million or $2.25 per diluted share, an increase of 8.8% and 10.3%, respectively, compared with the first nine months of 2008 (see Exhibit B for reconciliation of GAAP income and EPS from continuing operations to non-GAAP income and EPS from continuing operations).

2009 EPS Guidance Henry Schein today updated 2009 financial guidance, as follows: -- Fourth quarter 2009 diluted EPS attributable to Henry Schein, Inc. is expected to be $0.89 to $0.91. -- 2009 diluted EPS attributable to Henry Schein, Inc. is expected to be $3.14 to $3.16 excluding the unusual items included in Exhibit B. This represents growth of approximately 8% compared with restated 2008 results of $2.92, excluding charges related to the Lehman Brothers bankruptcy as well as restructuring costs. -- Guidance for 2009 diluted EPS attributable to Henry Schein, Inc. is for current continuing operations including completed or previously announced acquisitions, and does not include the impact of potential future acquisitions, if any. 2010 EPS Guidance Henry Schein today introduced 2010 financial guidance, as follows: -- 2010 diluted EPS attributable to Henry Schein, Inc. is expected to be $3.40 to $3.56, representing growth of 8% to 13% compared with the midpoint of 2009 guidance. -- Guidance for 2010 diluted EPS attributable to Henry Schein, Inc. is for current continuing operations including completed or previously announced acquisitions, and does not include the impact of potential future acquisitions, if any. Third Quarter Conference Call Webcast

The Company will hold a conference call to discuss third quarter financial results today, beginning at 10:00 a.m. Eastern time. Individual investors are invited to listen to the conference call over the Internet through Henry Schein's Web site at http://www.henryschein.com/. In addition, a replay will be available beginning shortly after the call has ended.

About Henry Schein

Henry Schein, a Fortune 500® company and a member of the NASDAQ 100® Index, is recognized for its excellent customer service and highly competitive prices. The Company's four business groups - Dental, Medical, International and Technology - serve more than 575,000 customers worldwide, including dental practitioners and laboratories, physician practices and animal health clinics, as well as government and other institutions. The Company operates through a centralized and automated distribution network, which provides customers in more than 200 countries with a comprehensive selection of more than 90,000 national and Henry Schein private-brand products in stock, as well as more than 100,000 additional products available as special-order items. Henry Schein also provides exclusive, innovative technology offerings for dental, medical and veterinary professionals, including value-added practice management software and electronic health record solutions.

Headquartered in Melville, N.Y., Henry Schein employs over 12,500 people and has operations or affiliates in 23 countries. The Company's net sales reached a record $6.4 billion in 2008. For more information, visit the Henry Schein Web site at http://www.henryschein.com/.

26.02.2010 13:05

Henry Schein Announces New Strategic Partnership With Brain-Pad(R) / Company will be the exclusive distributor for Brain-Pad's NatureZone(TM) UV/Ozone oral appliance sanitizer in North America

MELVILLE, N.Y., Feb. 26 /PRNewswire-FirstCall/ -- Henry Schein, Inc. , the largest distributor of health care products and services to office-based practitioners, today announced a new strategic partnership with Brain-Pad. Under a new five year agreement, Henry Schein Dental will be the exclusive professional dental distributor in the U.S. and Canada for the NatureZone(TM) one-touch UV/Ozone oral appliance sanitizer.

(Photo: http://www.newscom.com/cgi-bin/prnh/20100226/NY61361 )

Brain-Pad's NatureZone(TM) UV/Ozone oral sanitizer is an innovative new solution to quickly, safely and effectively disinfect, sanitize and deodorize oral appliances including mouth guards, retainers, dentures, night guards, and more. Equipped with a unique, patented ultraviolet light and ozone ion technology, NatureZone(TM) kills 99.9 percent of germs and viruses that can lead to MRSA, Staph, and Strep bacteria on any oral appliance in less than three minutes.

Henry Schein will also market and distribute Brain-Pad's line of protective and performance dual-arch athletic mouth guards to dental practitioners and laboratories on a non-exclusive basis.

"Mouth guards that provide critical protection for athletes and important oral health appliances such as retainers and dentures can pose a significant health risk due to the serious pathogens these appliances can harbor," said Tim Sullivan, President of Henry Schein Dental. "Henry Schein is proud to partner with Brain-Pad to ensure that this safe, easy-to-use, portable sanitizing product is available to all of our customers and their patients."

"Henry Schein's unparalleled distribution networks, close relationships with customers, and stellar reputation for educating its customers about the most innovative new products on the market makes Henry Schein an ideal partner for Brain-Pad," said Joseph Manzo, Chief Executive Officer of Brain-Pad, Inc. "Our products give dental patients solutions to protect their investment in dental procedures and appliances. We look forward to collaborating with Henry Schein to provide these unique protective and performance products for dental professionals across North America."

Henry Schein Announces New Strategic Partnership With Brain-Pad(R) / Company will be the exclusive distributor for Brain-Pad's NatureZone(TM) UV/Ozone oral appliance sanitizer in North America

MELVILLE, N.Y., Feb. 26 /PRNewswire-FirstCall/ -- Henry Schein, Inc. , the largest distributor of health care products and services to office-based practitioners, today announced a new strategic partnership with Brain-Pad. Under a new five year agreement, Henry Schein Dental will be the exclusive professional dental distributor in the U.S. and Canada for the NatureZone(TM) one-touch UV/Ozone oral appliance sanitizer.

(Photo: http://www.newscom.com/cgi-bin/prnh/20100226/NY61361 )

Brain-Pad's NatureZone(TM) UV/Ozone oral sanitizer is an innovative new solution to quickly, safely and effectively disinfect, sanitize and deodorize oral appliances including mouth guards, retainers, dentures, night guards, and more. Equipped with a unique, patented ultraviolet light and ozone ion technology, NatureZone(TM) kills 99.9 percent of germs and viruses that can lead to MRSA, Staph, and Strep bacteria on any oral appliance in less than three minutes.

Henry Schein will also market and distribute Brain-Pad's line of protective and performance dual-arch athletic mouth guards to dental practitioners and laboratories on a non-exclusive basis.

"Mouth guards that provide critical protection for athletes and important oral health appliances such as retainers and dentures can pose a significant health risk due to the serious pathogens these appliances can harbor," said Tim Sullivan, President of Henry Schein Dental. "Henry Schein is proud to partner with Brain-Pad to ensure that this safe, easy-to-use, portable sanitizing product is available to all of our customers and their patients."

"Henry Schein's unparalleled distribution networks, close relationships with customers, and stellar reputation for educating its customers about the most innovative new products on the market makes Henry Schein an ideal partner for Brain-Pad," said Joseph Manzo, Chief Executive Officer of Brain-Pad, Inc. "Our products give dental patients solutions to protect their investment in dental procedures and appliances. We look forward to collaborating with Henry Schein to provide these unique protective and performance products for dental professionals across North America."

Mar 10, 2010 23:38 ET

BIOLASE and Henry Schein Extend and Amend Licensing and Distribution Agreement

BIOLASE Announces Preliminary 2009 Fourth Quarter Results

IRVINE, CA--(Marketwire - March 10, 2010) - BIOLASE Technology, Inc. (NASDAQ: BLTI), the world's leading dental laser company, announced today that it has amended its licensing and distribution agreement with Henry Schein, Inc. (NASDAQ: HSIC), the largest provider of healthcare products and services to office-based practitioners. Within the United Kingdom, Australia, New Zealand, Belgium, Luxembourg, Netherlands, Spain, Germany, Italy, Austria, and North America, all dental sales will continue to be provided exclusively through Henry Schein.

The amended agreement provides strong incentives for Henry Schein to focus on its core customer base, and the purchase minimums have been agreed based upon that focus. In addition to the Henry Schein core customer base, BIOLASE will have strong incremental sales and margin incentives to penetrate additional dental offices. The agreement also allows for higher sales organization incentives, unique financing programs and increased luminary and educational events.

The new purchasing arrangement provides for minimum purchase commitments for laser equipment totaling $18 million over a twelve-month term, plus a large portion of additional laser equipment sales generated by BIOLASE's increased focus into the additional accounts not traditionally focused on by Henry Schein. In addition, Henry Schein will purchase other categories of products, such as consumables, parts, and services as needed, without any minimum or cap. For perspective, the total non-laser revenues of BIOLASE for 2009 were $11.6 million. Under the previous agreement, minimum purchase commitments totaling $42.7 million for all laser equipment, products, and services in all applicable markets through the fourteen-month period ending March 31, 2010 will be satisfied.

BIOLASE CEO David Mulder said, "Since partnering with Henry Schein in 2006, our sales of diode lasers, consumables, and services have more than doubled, and we have enjoyed a deeper penetration into a solid base of Henry Schein accounts. We expect that penetration to continue, but are looking for additional upside by rapidly expanding Waterlase® penetration into the rest of the North American marketplace. Based upon Henry Schein's reported overall market share in North America and the incremental opportunities we are pursuing together, we anticipate strong upside. We are excited that the extended agreement will expand our reach, while maintaining the strength and support of the Henry Schein organization."

The extended and amended agreement provides for a one-year term, and either BIOLASE or Henry Schein may request termination of the agreement upon 60 days' advance written notice to the other party. The agreement may be extended by BIOLASE and Henry Schein for an additional six months, upon mutual agreement of the parties.

Mulder continued, "Henry Schein has stressed a very strong confidence in BIOLASE product development efforts and has reaffirmed its commitment to lasers in dentistry. The Henry Schein organization is particularly excited about carrying the new iLase™. We are all pleased with the new direction that we are taking together."

2009 Fourth Quarter Results and 2010 Outlook

BIOLASE today announced that, based on a preliminary review of its financial performance for the fourth quarter ended December 31, 2009, the Company expects to report quarterly revenues of approximately $10.4 million. The Company will provide additional details on a full-year 2009 results conference call and webcast when it reports full financial results on March 18.

BIOLASE CEO David Mulder said, "Our overall sales for the year were strongly impacted by the global economy and our shift in distribution strategy in four countries. Our fourth quarter sales were in alignment with the minimum purchases under the existing contract with Henry Schein. We do believe that end user sales were higher in the quarter and that the pipeline inventory of our distributors were reduced. As previously discussed, the previous minimum purchase agreement with Henry Schein was a great help in solidifying the Company, as we reduced our operating expenses and planned for our future. However, while a minimum purchase agreement has the benefit of filling in valleys of lower sales, the agreement could also reduce BIOLASE sales in peak periods, despite end user sales. We expect that the extended and amended agreement with Henry Schein will help us capture greater future upside potential."

Mulder concluded, "Looking forward, we expect revenues for the first half of 2010 will be impacted by the transition to the new agreement, and also from the placement of prepaid orders from Henry Schein in the 2010 first quarter that will be fulfilled in subsequent quarters per the previous amended agreement. Our Diolase 10™ sales have begun and we are working on clinical support and an additional handpiece specifically designed for added features. We continue to work closely on the Procter & Gamble-related project, and believe we are now close to an agreement. We expect that the new agreement and products will be an incremental opportunity for BIOLASE, Henry Schein, and our other global partners."

About Henry Schein

Henry Schein, a Fortune 500® company and a member of the NASDAQ 100® Index, is recognized for its excellent customer service and highly competitive prices. The Company's four business groups -- Dental, Medical, International and Technology -- serve more than 600,000 customers worldwide, including dental practitioners and laboratories, physician practices and animal health clinics, as well as government and other institutions. The Company operates through a centralized and automated distribution network, which provides customers in more than 200 countries with a comprehensive selection of more than 90,000 national and Henry Schein private-brand products in stock, as well as more than 100,000 additional products available as special-order items. Henry Schein also provides exclusive, innovative technology offerings for dental, medical and veterinary professionals, including value-added practice management software and electronic health record solutions.

Headquartered in Melville, N.Y., Henry Schein employs more than 13,500 people and has operations or affiliates in 23 countries. The Company's net sales reached a record $6.5 billion in 2009. For more information, visit the Henry Schein Web site at www.henryschein.com.

About BIOLASE Technology, Inc.

BIOLASE Technology, Inc. (http://www.biolase.com), the world's leading dental laser company, is a medical technology company that develops, manufactures and markets lasers and related products focused on technologies that advance the practice of dentistry and medicine. The Company's products incorporate patented and patent pending technologies designed to provide clinically superior performance with less pain and faster recovery times. BIOLASE's principal products are dental laser systems that perform a broad range of dental procedures, including cosmetic and complex surgical applications. Other products under development address ophthalmology and other medical and consumer markets.

BIOLASE and Henry Schein Extend and Amend Licensing and Distribution Agreement

BIOLASE Announces Preliminary 2009 Fourth Quarter Results

IRVINE, CA--(Marketwire - March 10, 2010) - BIOLASE Technology, Inc. (NASDAQ: BLTI), the world's leading dental laser company, announced today that it has amended its licensing and distribution agreement with Henry Schein, Inc. (NASDAQ: HSIC), the largest provider of healthcare products and services to office-based practitioners. Within the United Kingdom, Australia, New Zealand, Belgium, Luxembourg, Netherlands, Spain, Germany, Italy, Austria, and North America, all dental sales will continue to be provided exclusively through Henry Schein.

The amended agreement provides strong incentives for Henry Schein to focus on its core customer base, and the purchase minimums have been agreed based upon that focus. In addition to the Henry Schein core customer base, BIOLASE will have strong incremental sales and margin incentives to penetrate additional dental offices. The agreement also allows for higher sales organization incentives, unique financing programs and increased luminary and educational events.

The new purchasing arrangement provides for minimum purchase commitments for laser equipment totaling $18 million over a twelve-month term, plus a large portion of additional laser equipment sales generated by BIOLASE's increased focus into the additional accounts not traditionally focused on by Henry Schein. In addition, Henry Schein will purchase other categories of products, such as consumables, parts, and services as needed, without any minimum or cap. For perspective, the total non-laser revenues of BIOLASE for 2009 were $11.6 million. Under the previous agreement, minimum purchase commitments totaling $42.7 million for all laser equipment, products, and services in all applicable markets through the fourteen-month period ending March 31, 2010 will be satisfied.

BIOLASE CEO David Mulder said, "Since partnering with Henry Schein in 2006, our sales of diode lasers, consumables, and services have more than doubled, and we have enjoyed a deeper penetration into a solid base of Henry Schein accounts. We expect that penetration to continue, but are looking for additional upside by rapidly expanding Waterlase® penetration into the rest of the North American marketplace. Based upon Henry Schein's reported overall market share in North America and the incremental opportunities we are pursuing together, we anticipate strong upside. We are excited that the extended agreement will expand our reach, while maintaining the strength and support of the Henry Schein organization."

The extended and amended agreement provides for a one-year term, and either BIOLASE or Henry Schein may request termination of the agreement upon 60 days' advance written notice to the other party. The agreement may be extended by BIOLASE and Henry Schein for an additional six months, upon mutual agreement of the parties.

Mulder continued, "Henry Schein has stressed a very strong confidence in BIOLASE product development efforts and has reaffirmed its commitment to lasers in dentistry. The Henry Schein organization is particularly excited about carrying the new iLase™. We are all pleased with the new direction that we are taking together."

2009 Fourth Quarter Results and 2010 Outlook

BIOLASE today announced that, based on a preliminary review of its financial performance for the fourth quarter ended December 31, 2009, the Company expects to report quarterly revenues of approximately $10.4 million. The Company will provide additional details on a full-year 2009 results conference call and webcast when it reports full financial results on March 18.

BIOLASE CEO David Mulder said, "Our overall sales for the year were strongly impacted by the global economy and our shift in distribution strategy in four countries. Our fourth quarter sales were in alignment with the minimum purchases under the existing contract with Henry Schein. We do believe that end user sales were higher in the quarter and that the pipeline inventory of our distributors were reduced. As previously discussed, the previous minimum purchase agreement with Henry Schein was a great help in solidifying the Company, as we reduced our operating expenses and planned for our future. However, while a minimum purchase agreement has the benefit of filling in valleys of lower sales, the agreement could also reduce BIOLASE sales in peak periods, despite end user sales. We expect that the extended and amended agreement with Henry Schein will help us capture greater future upside potential."

Mulder concluded, "Looking forward, we expect revenues for the first half of 2010 will be impacted by the transition to the new agreement, and also from the placement of prepaid orders from Henry Schein in the 2010 first quarter that will be fulfilled in subsequent quarters per the previous amended agreement. Our Diolase 10™ sales have begun and we are working on clinical support and an additional handpiece specifically designed for added features. We continue to work closely on the Procter & Gamble-related project, and believe we are now close to an agreement. We expect that the new agreement and products will be an incremental opportunity for BIOLASE, Henry Schein, and our other global partners."

About Henry Schein

Henry Schein, a Fortune 500® company and a member of the NASDAQ 100® Index, is recognized for its excellent customer service and highly competitive prices. The Company's four business groups -- Dental, Medical, International and Technology -- serve more than 600,000 customers worldwide, including dental practitioners and laboratories, physician practices and animal health clinics, as well as government and other institutions. The Company operates through a centralized and automated distribution network, which provides customers in more than 200 countries with a comprehensive selection of more than 90,000 national and Henry Schein private-brand products in stock, as well as more than 100,000 additional products available as special-order items. Henry Schein also provides exclusive, innovative technology offerings for dental, medical and veterinary professionals, including value-added practice management software and electronic health record solutions.

Headquartered in Melville, N.Y., Henry Schein employs more than 13,500 people and has operations or affiliates in 23 countries. The Company's net sales reached a record $6.5 billion in 2009. For more information, visit the Henry Schein Web site at www.henryschein.com.

About BIOLASE Technology, Inc.

BIOLASE Technology, Inc. (http://www.biolase.com), the world's leading dental laser company, is a medical technology company that develops, manufactures and markets lasers and related products focused on technologies that advance the practice of dentistry and medicine. The Company's products incorporate patented and patent pending technologies designed to provide clinically superior performance with less pain and faster recovery times. BIOLASE's principal products are dental laser systems that perform a broad range of dental procedures, including cosmetic and complex surgical applications. Other products under development address ophthalmology and other medical and consumer markets.

01.06.2010 15:05

Nutra Pharma Partners With Henry Schein for Distribution of Nyloxin-Branded Pain Relievers / Nutra Pharma Has Announced That It Has Partnered With Leading Healthcare Products Distributor, Henry Schein, for Distribution of Its Nyloxin-Branded Pain Relieve

CORAL SPRINGS, FL -- (Marketwire) -- 06/01/10 -- Nutra Pharma Corp. (OTCBB: NPHC), a biotechnology company that is developing treatments for Adrenomyeloneuropathy (AMN), HIV and Multiple Sclerosis (MS), has announced today that it has partnered with leading healthcare products distributor, Henry Schein, for distribution of its Nyloxin-branded pain relievers in the United States.

Henry Schein, which ranks #339 on the Fortune 500 list, is the largest distributor of healthcare products and services to medical, dental, and veterinary office-based practitioners. With more than 12,500 "Team Schein Members" worldwide, the Company currently serves approximately 45% of the estimated 250,000 U.S. office-based physician practices, surgical centers and other alternate-care sites. Additionally, the Company serves approximately 85% of the estimated 136,000 U.S. and Canadian office-based dental practices, dental laboratories, as well as governments and other institutions and approximately 75% of the estimated 27,000 U.S. animal health practices.

"As one of the furthest reaching and most admired distributors of healthcare products, we are pleased to partner with Henry Schein for distribution of Nyloxin in the United States," commented Rik J Deitsch, Chairman and CEO of Nutra Pharma Corporation. "We look forward to strengthening our Nyloxin-brand by working closely with Henry Schein to support their distribution of Nyloxin," he said.

Nutra Pharma currently offers two pain relievers under the Nyloxin brand, Nyloxin OTC and Nyloxin Rx. Nyloxin OTC is the Company's over-the-counter (OTC) treatment for moderate to severe (Stage 2) chronic pain. Nyloxin Rx is the Company's prescription treatment for severe (Stage 3) chronic pain. Unlike Stage 2 pain, which interferes with both work and sleep, Nyloxin Rx is aimed at treating the most severe pain that inhibits one's ability to fully function. Both Nyloxin OTC and Nyloxin Rx are manufactured by Nutra Pharma's wholly-owned drug discovery subsidiary, ReceptoPharm, and are available as an oral spray and topical gel.

In addition, Nutra Pharma recently announced the first manufacturing release of Nyloxin Rx for marketing-related distribution. Physicians can currently request samples of Nyloxin Rx through the Healthcare Providers' section of the Nyloxin website: http://www.Nyloxin.com/healthcare_providers.

About Nutra Pharma Corp.

Nutra Pharma Corporation operates as a biotechnology company specializing in the acquisition, licensing, and commercialization of pharmaceutical products and technologies for the management of neurological disorders, cancer, autoimmune, and infectious diseases.

The company, through its subsidiaries, carries out basic drug discovery research and clinical development, and also seeks strategic licensing partnerships to reduce the risks associated with the drug development process.

Currently, Nutra Pharma offers several drug products for sale for the treatment of pain: Cobroxin, the first over-the-counter (OTC) pain reliever clinically proven to treat moderate to severe (Stage 2) chronic pain, and Nyloxin Rx, the only non-narcotic and non-addictive treatment for severe (Stage 3) pain. Both Cobroxin and Nyloxin were developed by Nutra Pharma's wholly-owned drug discovery subsidiary, ReceptoPharm.

In addition to manufacturing Cobroxin and Nyloxin, ReceptoPharm is also developing proprietary therapeutic protein products primarily for the prevention and treatment of viral and neurological diseases, including Multiple Sclerosis (MS), Adrenomyeloneuropathy (AMN), and Human Immunodeficiency Virus (HIV), and pain in humans. Outside of its role as the drug discovery arm for Nutra Pharma, ReceptoPharm provides contract research services through its ISO class 5 and GMP certified facilities.

The company's wholly-owned medical devices subsidiary, Designer Diagnostics, engages in the research and development of diagnostic test kits designed to be used for the rapid identification of infectious diseases, such as Nontuberculous Mycobacteria (NTM).

Nutra Pharma continues to identify intellectual property and companies in the biotechnology arena as potential acquisition candidates.

Nutra Pharma Partners With Henry Schein for Distribution of Nyloxin-Branded Pain Relievers / Nutra Pharma Has Announced That It Has Partnered With Leading Healthcare Products Distributor, Henry Schein, for Distribution of Its Nyloxin-Branded Pain Relieve

CORAL SPRINGS, FL -- (Marketwire) -- 06/01/10 -- Nutra Pharma Corp. (OTCBB: NPHC), a biotechnology company that is developing treatments for Adrenomyeloneuropathy (AMN), HIV and Multiple Sclerosis (MS), has announced today that it has partnered with leading healthcare products distributor, Henry Schein, for distribution of its Nyloxin-branded pain relievers in the United States.

Henry Schein, which ranks #339 on the Fortune 500 list, is the largest distributor of healthcare products and services to medical, dental, and veterinary office-based practitioners. With more than 12,500 "Team Schein Members" worldwide, the Company currently serves approximately 45% of the estimated 250,000 U.S. office-based physician practices, surgical centers and other alternate-care sites. Additionally, the Company serves approximately 85% of the estimated 136,000 U.S. and Canadian office-based dental practices, dental laboratories, as well as governments and other institutions and approximately 75% of the estimated 27,000 U.S. animal health practices.

"As one of the furthest reaching and most admired distributors of healthcare products, we are pleased to partner with Henry Schein for distribution of Nyloxin in the United States," commented Rik J Deitsch, Chairman and CEO of Nutra Pharma Corporation. "We look forward to strengthening our Nyloxin-brand by working closely with Henry Schein to support their distribution of Nyloxin," he said.

Nutra Pharma currently offers two pain relievers under the Nyloxin brand, Nyloxin OTC and Nyloxin Rx. Nyloxin OTC is the Company's over-the-counter (OTC) treatment for moderate to severe (Stage 2) chronic pain. Nyloxin Rx is the Company's prescription treatment for severe (Stage 3) chronic pain. Unlike Stage 2 pain, which interferes with both work and sleep, Nyloxin Rx is aimed at treating the most severe pain that inhibits one's ability to fully function. Both Nyloxin OTC and Nyloxin Rx are manufactured by Nutra Pharma's wholly-owned drug discovery subsidiary, ReceptoPharm, and are available as an oral spray and topical gel.

In addition, Nutra Pharma recently announced the first manufacturing release of Nyloxin Rx for marketing-related distribution. Physicians can currently request samples of Nyloxin Rx through the Healthcare Providers' section of the Nyloxin website: http://www.Nyloxin.com/healthcare_providers.

About Nutra Pharma Corp.

Nutra Pharma Corporation operates as a biotechnology company specializing in the acquisition, licensing, and commercialization of pharmaceutical products and technologies for the management of neurological disorders, cancer, autoimmune, and infectious diseases.

The company, through its subsidiaries, carries out basic drug discovery research and clinical development, and also seeks strategic licensing partnerships to reduce the risks associated with the drug development process.

Currently, Nutra Pharma offers several drug products for sale for the treatment of pain: Cobroxin, the first over-the-counter (OTC) pain reliever clinically proven to treat moderate to severe (Stage 2) chronic pain, and Nyloxin Rx, the only non-narcotic and non-addictive treatment for severe (Stage 3) pain. Both Cobroxin and Nyloxin were developed by Nutra Pharma's wholly-owned drug discovery subsidiary, ReceptoPharm.

In addition to manufacturing Cobroxin and Nyloxin, ReceptoPharm is also developing proprietary therapeutic protein products primarily for the prevention and treatment of viral and neurological diseases, including Multiple Sclerosis (MS), Adrenomyeloneuropathy (AMN), and Human Immunodeficiency Virus (HIV), and pain in humans. Outside of its role as the drug discovery arm for Nutra Pharma, ReceptoPharm provides contract research services through its ISO class 5 and GMP certified facilities.

The company's wholly-owned medical devices subsidiary, Designer Diagnostics, engages in the research and development of diagnostic test kits designed to be used for the rapid identification of infectious diseases, such as Nontuberculous Mycobacteria (NTM).

Nutra Pharma continues to identify intellectual property and companies in the biotechnology arena as potential acquisition candidates.

MELVILLE, N.Y., Aug. 2 /PRNewswire-FirstCall/ -- Henry Schein, Inc. , the largest provider of healthcare products and services to office-based practitioners, today reported record financial results for the quarter ended June 26, 2010.

Net sales for the second quarter of 2010 were $1.8 billion, an increase of 15.1% compared with the second quarter of 2009. This consists of 15.6% growth in local currencies and a decline of 0.5% related to foreign currency exchange. Internal sales growth in local currencies was 2.1% (see Exhibit A for details of sales growth).

Income from continuing operations attributable to Henry Schein, Inc. for the second quarter of 2010 was $84.0 million or $0.90 per diluted share, an increase of 14.6% and 11.1%, respectively, compared with the second quarter of 2009.

"We are reporting strong top-line growth in local currencies for the quarter and we continue to see indications of positive market trends throughout our global business," said Stanley M. Bergman, Chairman and Chief Executive Officer of Henry Schein. "We also are pleased to report that diluted EPS for the first half of 2010 is up 13.8% compared with the first half of 2009, excluding restructuring costs from both periods."

North American Dental sales of $677.6 million increased 8.9%, consisting of 7.5% growth in local currencies and 1.4% growth related to foreign currency exchange. The 7.5% growth in local currencies included 7.1% growth in Dental consumable merchandise sales and 8.6% growth in Dental equipment sales and service revenues.

"Continued internal Dental consumable merchandise sales growth in local currencies affirms our confidence that the market will show gradual improvement for the rest of the year. Strong internal growth in Dental equipment sales reflects higher demand for basic and for high-tech equipment and is another positive market indicator," commented Mr. Bergman.

North American Medical sales declined 0.4% to $286.3 million. "Results for the second quarter of 2010 were negatively impacted by reduced sales of products related to the H1N1 virus, which were significant in the prior-year quarter," remarked Mr. Bergman.

North American Animal Health sales increased 269.7% to $234.7 million, which included sales of Butler Schein Animal Health. "Integration of the Butler Schein Animal Health business continues to progress according to plan and is expected to be completed during the third quarter," commented Mr. Bergman.

International sales of $602.4 million increased 1.8%, consisting of 4.7% growth in local currencies and a decline of 2.9% related to foreign currency exchange. "International results for the second quarter of 2009 were positively impacted, particularly in Germany, by the timing of the biennial IDS trade show in Europe, resulting in a difficult comparison for Q2 2010. Our International results for the second quarter of 2010 reflect continued growth in the Dental and Animal Health businesses, with particular strength in Spain, France, Holland and the U.K.," added Mr. Bergman.

Technology and Value-Added Services sales of $48.4 million increased 13.7% during the quarter, including 8.0% internal sales growth in local currencies. "During the quarter we saw continued strong growth in our electronic services and software businesses," explained Mr. Bergman.

Year-to-Date Results

For the first half of 2010, net sales of $3.6 billion increased 16.7% compared with the first half of 2009. This increase includes 15.1% growth in local currencies and 1.6% growth related to foreign currency exchange.

Income from continuing operations attributable to Henry Schein, Inc. for the first half of 2010 was $144.9 million or $1.56 per diluted share. Excluding first quarter 2010 restructuring costs of $12.3 million pre-tax or $0.09 per diluted share, and first quarter 2009 restructuring costs of $4.0 million pre-tax or $0.03 per diluted share, income from continuing operations attributable to Henry Schein, Inc. for the first half of 2010 was $153.2 million or $1.65 per diluted share, an increase of 17.0% and 13.8%, respectively, compared with the first half of 2009 (see Exhibit B for reconciliation of GAAP net income and EPS to non-GAAP adjusted net income and EPS).

2010 EPS Guidance

Today, Henry Schein increased the low end of its 2010 financial guidance range, as follows:

-- 2010 diluted EPS attributable to Henry Schein, Inc. is expected to be $3.46 to $3.56, compared with previous guidance of $3.44 to $3.56. -- Guidance for 2010 diluted EPS attributable to Henry Schein, Inc. is for current continuing operations as well as completed or previously announced acquisitions, and does not include the impact of potential future acquisitions, if any. -- 2010 guidance excludes the impact of restructuring costs.

The Company noted that it is increasing the low end of its 2010 diluted EPS guidance range despite a strengthening of the U.S. dollar against the euro and pound sterling, which is expected to adversely impact 2010 diluted EPS by $0.05 to $0.06 compared with its initial expectations for the year.

Net sales for the second quarter of 2010 were $1.8 billion, an increase of 15.1% compared with the second quarter of 2009. This consists of 15.6% growth in local currencies and a decline of 0.5% related to foreign currency exchange. Internal sales growth in local currencies was 2.1% (see Exhibit A for details of sales growth).

Income from continuing operations attributable to Henry Schein, Inc. for the second quarter of 2010 was $84.0 million or $0.90 per diluted share, an increase of 14.6% and 11.1%, respectively, compared with the second quarter of 2009.

"We are reporting strong top-line growth in local currencies for the quarter and we continue to see indications of positive market trends throughout our global business," said Stanley M. Bergman, Chairman and Chief Executive Officer of Henry Schein. "We also are pleased to report that diluted EPS for the first half of 2010 is up 13.8% compared with the first half of 2009, excluding restructuring costs from both periods."

North American Dental sales of $677.6 million increased 8.9%, consisting of 7.5% growth in local currencies and 1.4% growth related to foreign currency exchange. The 7.5% growth in local currencies included 7.1% growth in Dental consumable merchandise sales and 8.6% growth in Dental equipment sales and service revenues.

"Continued internal Dental consumable merchandise sales growth in local currencies affirms our confidence that the market will show gradual improvement for the rest of the year. Strong internal growth in Dental equipment sales reflects higher demand for basic and for high-tech equipment and is another positive market indicator," commented Mr. Bergman.

North American Medical sales declined 0.4% to $286.3 million. "Results for the second quarter of 2010 were negatively impacted by reduced sales of products related to the H1N1 virus, which were significant in the prior-year quarter," remarked Mr. Bergman.

North American Animal Health sales increased 269.7% to $234.7 million, which included sales of Butler Schein Animal Health. "Integration of the Butler Schein Animal Health business continues to progress according to plan and is expected to be completed during the third quarter," commented Mr. Bergman.

International sales of $602.4 million increased 1.8%, consisting of 4.7% growth in local currencies and a decline of 2.9% related to foreign currency exchange. "International results for the second quarter of 2009 were positively impacted, particularly in Germany, by the timing of the biennial IDS trade show in Europe, resulting in a difficult comparison for Q2 2010. Our International results for the second quarter of 2010 reflect continued growth in the Dental and Animal Health businesses, with particular strength in Spain, France, Holland and the U.K.," added Mr. Bergman.

Technology and Value-Added Services sales of $48.4 million increased 13.7% during the quarter, including 8.0% internal sales growth in local currencies. "During the quarter we saw continued strong growth in our electronic services and software businesses," explained Mr. Bergman.

Year-to-Date Results

For the first half of 2010, net sales of $3.6 billion increased 16.7% compared with the first half of 2009. This increase includes 15.1% growth in local currencies and 1.6% growth related to foreign currency exchange.

Income from continuing operations attributable to Henry Schein, Inc. for the first half of 2010 was $144.9 million or $1.56 per diluted share. Excluding first quarter 2010 restructuring costs of $12.3 million pre-tax or $0.09 per diluted share, and first quarter 2009 restructuring costs of $4.0 million pre-tax or $0.03 per diluted share, income from continuing operations attributable to Henry Schein, Inc. for the first half of 2010 was $153.2 million or $1.65 per diluted share, an increase of 17.0% and 13.8%, respectively, compared with the first half of 2009 (see Exhibit B for reconciliation of GAAP net income and EPS to non-GAAP adjusted net income and EPS).

2010 EPS Guidance

Today, Henry Schein increased the low end of its 2010 financial guidance range, as follows:

-- 2010 diluted EPS attributable to Henry Schein, Inc. is expected to be $3.46 to $3.56, compared with previous guidance of $3.44 to $3.56. -- Guidance for 2010 diluted EPS attributable to Henry Schein, Inc. is for current continuing operations as well as completed or previously announced acquisitions, and does not include the impact of potential future acquisitions, if any. -- 2010 guidance excludes the impact of restructuring costs.

The Company noted that it is increasing the low end of its 2010 diluted EPS guidance range despite a strengthening of the U.S. dollar against the euro and pound sterling, which is expected to adversely impact 2010 diluted EPS by $0.05 to $0.06 compared with its initial expectations for the year.

Henry Schein to acquire Australian veterinary products firm

By Shraysi Tandon

Posted Fri Oct 15, 2010 2:20pm AEDT

Henry Schein poised to enter Australia's veterinary markets through the acquisition of Provet

US healthcare products provider Henry Schein is poised to enter Australia's veterinary markets through the acquisition of Provet. (ABC TV: file photo)

US healthcare products company Henry Schein says it has agreed to acquire Australian veterinary products provider Provet Holdings for $93.2 million.

Henry Schein's chairman and chief executive Stanley Bergman says the deal will mark the firm's entry into the veterinary markets of Australia and New Zealand.

"The acquisition of Provet Holdings will mark our entry into the $620 million Australasian veterinary market," he said in a statement.

Under the terms of the agreement, Provet shareholders will receive $2.14 per share, a 35 per cent premium from the company's last closing share price before the deal was announced.

Provet chairman Garth McGilvray says the terms of the transaction are a fair reflection of the company's value.

Mr McGilvray added that the advantages the deal brings to Provet are "tremendous".

"Becoming part of Henry Schein will benefit our customers, strengthen our relationships with suppliers and present even more opportunities for growth for our team," he said in a statement.

Henry Schein says if the acquisition goes through, the company's animal health division will have annual revenues of nearly $2 billion.

Provet will continue to be led by its current management team which includes chief executive Nigel Nichols, chief operating officer Joseph Best and chief financial officer Chris Lowndes.

The boards of directors of Provet and Henry Schein have approved the transaction, which is now subject to Provet's shareholders and court approvals.

The deal is expected to close around year-end.

By Shraysi Tandon

Posted Fri Oct 15, 2010 2:20pm AEDT

Henry Schein poised to enter Australia's veterinary markets through the acquisition of Provet

US healthcare products provider Henry Schein is poised to enter Australia's veterinary markets through the acquisition of Provet. (ABC TV: file photo)

US healthcare products company Henry Schein says it has agreed to acquire Australian veterinary products provider Provet Holdings for $93.2 million.

Henry Schein's chairman and chief executive Stanley Bergman says the deal will mark the firm's entry into the veterinary markets of Australia and New Zealand.

"The acquisition of Provet Holdings will mark our entry into the $620 million Australasian veterinary market," he said in a statement.

Under the terms of the agreement, Provet shareholders will receive $2.14 per share, a 35 per cent premium from the company's last closing share price before the deal was announced.

Provet chairman Garth McGilvray says the terms of the transaction are a fair reflection of the company's value.

Mr McGilvray added that the advantages the deal brings to Provet are "tremendous".

"Becoming part of Henry Schein will benefit our customers, strengthen our relationships with suppliers and present even more opportunities for growth for our team," he said in a statement.

Henry Schein says if the acquisition goes through, the company's animal health division will have annual revenues of nearly $2 billion.

Provet will continue to be led by its current management team which includes chief executive Nigel Nichols, chief operating officer Joseph Best and chief financial officer Chris Lowndes.

The boards of directors of Provet and Henry Schein have approved the transaction, which is now subject to Provet's shareholders and court approvals.

The deal is expected to close around year-end.

Antwort auf Beitrag Nr.: 40.332.108 von R-BgO am 15.10.10 18:43:40MELVILLE, N.Y., Jan. 3, 2011 /PRNewswire/ -- Henry Schein, Inc. , the largest provider of health care products and services to office-based practitioners, today announced it has completed the acquisition of Provet Holdings Limited . All closing conditions have been met, including approval of the transaction by a majority of Provet Holdings shareholders.

Provet Holdings is Australasia's largest wholesale distributor of veterinary products. Based in Brisbane, Queensland, Provet Holdings reported revenue for the fiscal year ended June 30, 2010 of approximately AUD$283 million (USD$278 million). The last day of trading of its shares on the Australian Stock Exchange was December 16, 2010.

"With this transaction we have further strengthened our position as the global leader in the distribution of veterinary products. Henry Schein's global veterinary business now has annual revenues of nearly $2 billion and we serve approximately 47,000 veterinary practices worldwide," said Stanley M. Bergman, Chairman and Chief Executive Officer of Henry Schein. "The rapid growth of Henry Schein's worldwide animal health presence reflects our long-term commitment to our veterinary customers and our firm belief in the significant potential of the global animal health market."

"Through the comprehensive array of products and services we offer animal health practitioners, we are helping our customers to operate more efficient and successful practices so they can focus on providing quality care. The scale of our veterinary business allows us to share best practices across geographies, and also to provide unrivaled value and market intelligence to the companies whose products and services we represent," he added. "We welcome Provet CEO Dr. Nigel Nichols and his colleagues to Team Schein."

Provet Holdings is a full-service veterinary distributor and service provider, including pharmaceuticals, pet nutrition products, consumables, instruments and equipment, and training and software. The Company is focused on veterinary practices and operates four core businesses: veterinary product wholesaling; sales, support and development of practice management software; consulting, education and training services; and online business activities.

Established in 1982, Provet Holdings has approximately 375 employees, and owns and operates 10 warehouses across Australia and three in New Zealand. The Company serves approximately 1,900 independent veterinary practices in Australasia.

Provet Holdings is Australasia's largest wholesale distributor of veterinary products. Based in Brisbane, Queensland, Provet Holdings reported revenue for the fiscal year ended June 30, 2010 of approximately AUD$283 million (USD$278 million). The last day of trading of its shares on the Australian Stock Exchange was December 16, 2010.

"With this transaction we have further strengthened our position as the global leader in the distribution of veterinary products. Henry Schein's global veterinary business now has annual revenues of nearly $2 billion and we serve approximately 47,000 veterinary practices worldwide," said Stanley M. Bergman, Chairman and Chief Executive Officer of Henry Schein. "The rapid growth of Henry Schein's worldwide animal health presence reflects our long-term commitment to our veterinary customers and our firm belief in the significant potential of the global animal health market."

"Through the comprehensive array of products and services we offer animal health practitioners, we are helping our customers to operate more efficient and successful practices so they can focus on providing quality care. The scale of our veterinary business allows us to share best practices across geographies, and also to provide unrivaled value and market intelligence to the companies whose products and services we represent," he added. "We welcome Provet CEO Dr. Nigel Nichols and his colleagues to Team Schein."

Provet Holdings is a full-service veterinary distributor and service provider, including pharmaceuticals, pet nutrition products, consumables, instruments and equipment, and training and software. The Company is focused on veterinary practices and operates four core businesses: veterinary product wholesaling; sales, support and development of practice management software; consulting, education and training services; and online business activities.

Established in 1982, Provet Holdings has approximately 375 employees, and owns and operates 10 warehouses across Australia and three in New Zealand. The Company serves approximately 1,900 independent veterinary practices in Australasia.

nach Q3 ist EPS um >10% gestiegen;

leider kommt die Aktie nie mal richtig runter, so dass man Schnäppchen machen könnte...

leider kommt die Aktie nie mal richtig runter, so dass man Schnäppchen machen könnte...

Net sales increase 15.6%, diluted EPS up 15.0% to $1.15

MELVILLE, N.Y., Feb. 15, 2012 /PRNewswire/ -- Henry Schein, Inc. (NASDAQ: HSIC), the largest provider of healthcare products and services to office-based practitioners, today reported record financial results for the quarter ended December 31, 2011.

The Company is on a 52/53 week fiscal year ending on the last Saturday in December, and 2011 had an extra selling week compared with 2010. This extra selling week occurred in the fourth quarter of 2011. In order to facilitate more meaningful comparisons, the Company is providing a separate estimate of the impact of the extra week on sales growth and is providing internal sales growth in local currencies excluding that extra week.

Net sales for the fourth quarter of 2011 were $2.3 billion, an increase of 15.6% compared with the fourth quarter of 2010. This consists of internal growth of 5.3%, acquisition growth of 4.7%, a decline related to foreign currency exchange of 0.1% and growth due to the extra week of 5.7% (see Exhibit A for details of sales growth).

Net income attributable to Henry Schein, Inc. for the fourth quarter of 2011 was $104.7 million or $1.15 per diluted share, an increase of 12.6% and 15.0%, respectively, compared with the fourth quarter of 2010.

"We are delighted to have gained market share in all of our business groups during the fourth quarter, with overall mid-single digit internal sales growth complemented by strategic acquisitions. Also, we are proud that net sales for the year exceeded $8.5 billion for the first time," said Stanley M. Bergman, Chairman and Chief Executive Officer of Henry Schein. "Overall our view is that the markets we serve are modestly improving, and we look forward to a return to historic market growth of 5% to 6% annually over the longer term."

North American Dental sales of $806.6 million increased 11.9%, including internal growth of 4.5%, a decline related to foreign currency exchange of 0.1% and growth due to the extra week of 7.5%.

"Results in our North American Dental group were strong across the board, and reflect steady patient traffic to dental offices and higher demand for dental equipment," commented Mr. Bergman. "Dental internal growth in local currencies of 4.5% includes 4.8% growth in Dental consumable merchandise sales and 3.8% growth in Dental equipment sales and services revenues, excluding the impact of the extra week."

North American Medical sales of $373.3 million increased 13.9%, including internal growth of 7.1%, acquisition growth of 0.7% and growth due to the extra week of 6.1%. There was no meaningful impact on sales growth from seasonal influenza vaccine products.

"During the fourth quarter we distributed approximately 1.7 million doses of seasonal influenza vaccines, as planned, bringing our total for the year to 11.6 million doses with sales of $88.3 million," remarked Mr. Bergman. "We are most pleased with the performance of our North American Medical group during the quarter, with internal growth well in excess of our estimate for market growth."

North American Animal Health sales of $255.9 million increased 14.9%, including internal growth of 7.2% and growth due to the extra week of 7.7%.

"We also continue to be very pleased with the results from our North American Animal Health business, and believe our performance remains well in excess of market growth," commented Mr. Bergman. "We recently acquired all of Oak Hill Capital Partners' interest in Butler Schein Animal Health, and now own 71.7% of that business. Butler Schein Animal Health is one of the anchors in our leading global animal health business, which has annual sales of approximately $2 billion."

International sales of $833.8 million increased 20.0%, including internal growth of 4.8%, acquisition growth of 12.2% and growth due to the extra week of 3.0%. There was no net impact from foreign currency exchange during the quarter.

"Results for our International group feature solid sales growth to our dental, medical and veterinary customers, complemented by the acquisition of Provet Holdings in Australia and New Zealand," added Mr. Bergman. "Early in January we acquired Veterinary Instrumentation, the leading supplier of surgical instruments and implants to veterinary surgeons in the United Kingdom with sales of approximately $11 million. We look forward to bringing the Veterinary Instrumentation portfolio of high-quality specialty surgical products to a growing number of professionals across Europe, the U.S. and Australasia."

Technology and Value-Added Services sales of $70.7 million increased 23.1% during the quarter, including internal growth of 2.4%, acquisition growth of 14.2% and growth due to the extra week of 6.5%.

"We remain very pleased with the performance of our Technology and Value-Added Services group, with strong sales growth including strategic acquisitions," explained Mr. Bergman. "Fourth quarter results include particular strength in our electronic services and financial services businesses."

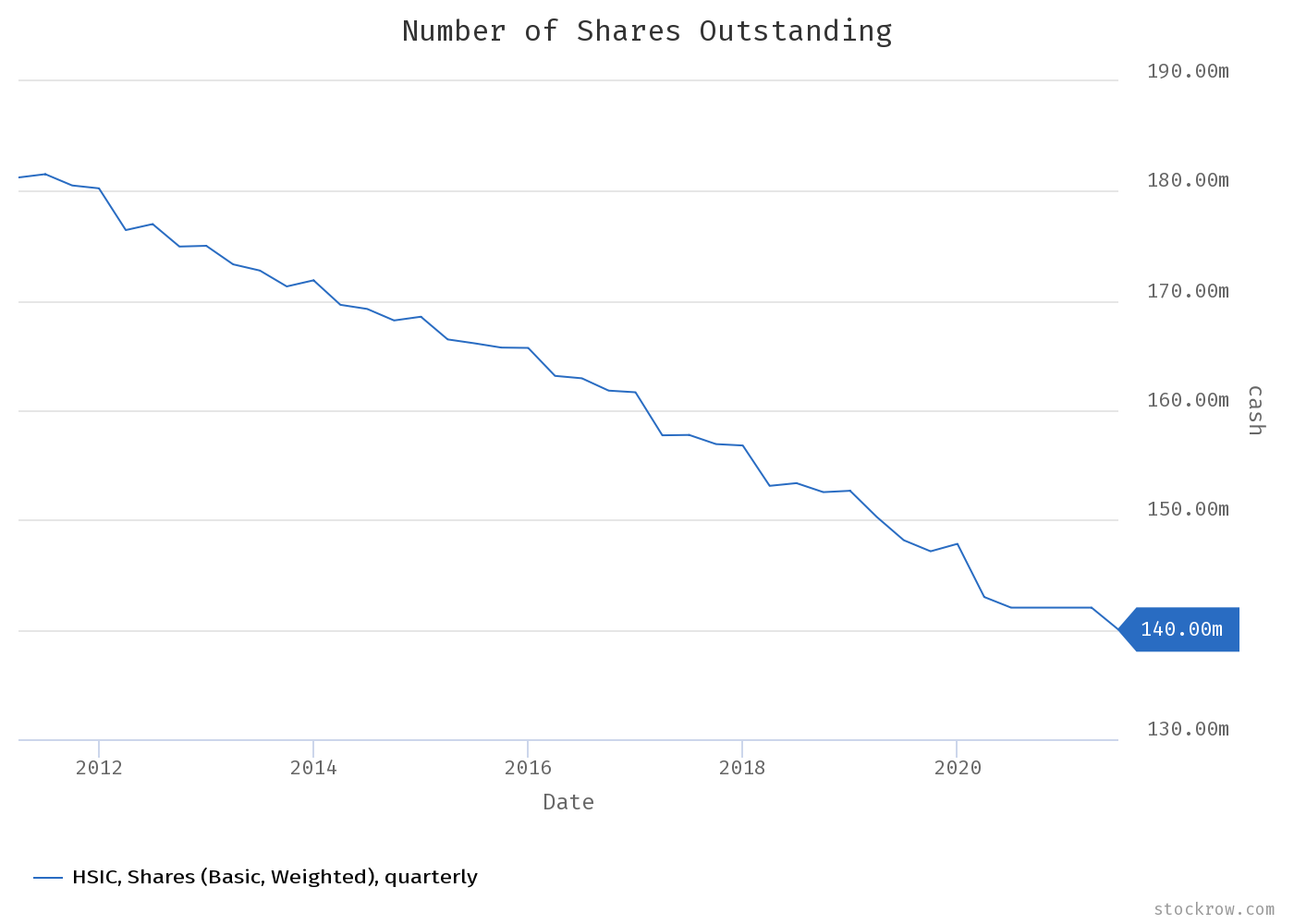

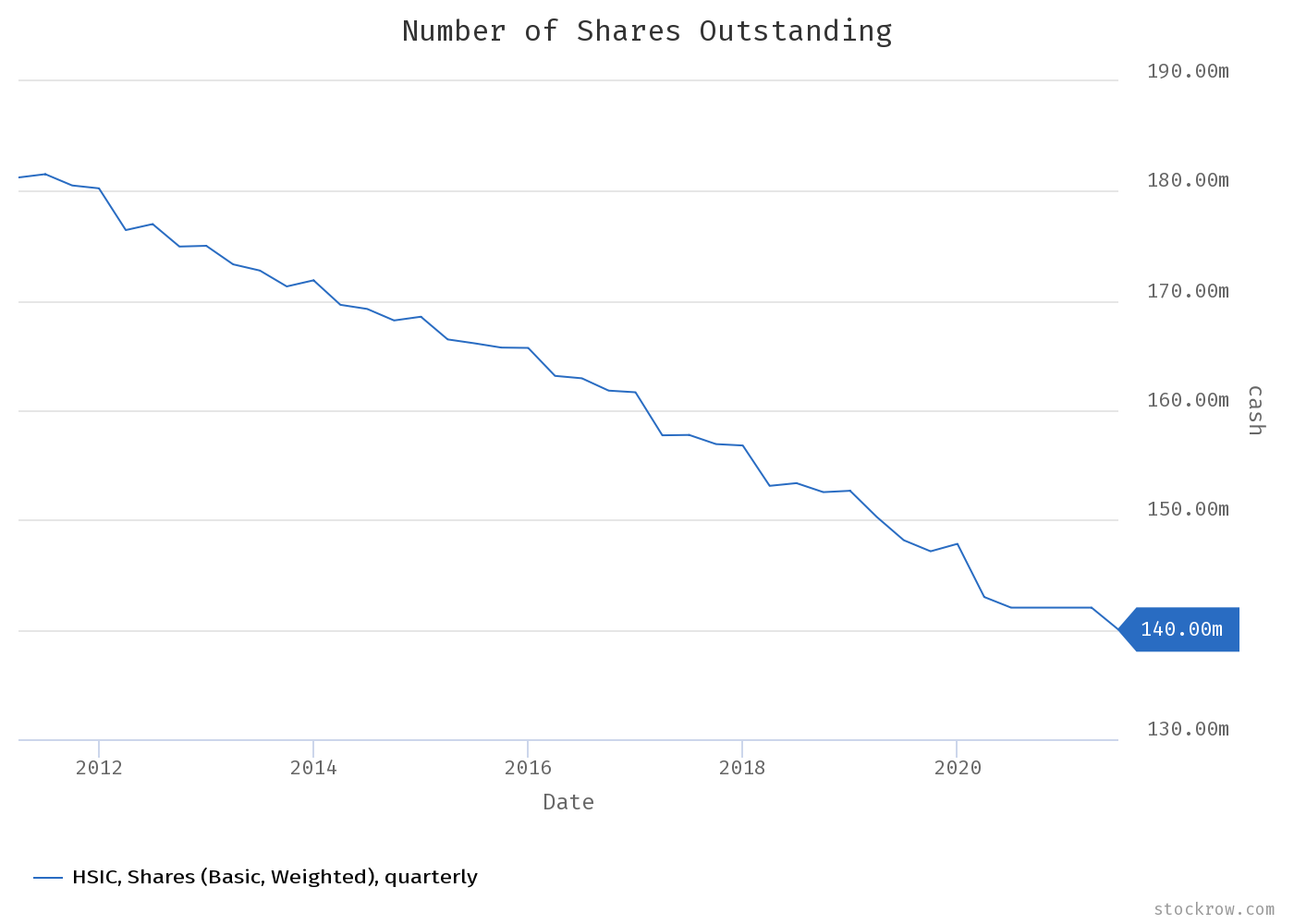

Stock Repurchase Plan

The Company announced that it repurchased 1.1 million shares of its common stock during the fourth quarter at an average price of $61.98 per share, or approximately $68 million. The impact of the repurchase of shares on fourth quarter diluted EPS was less than $0.01. At the close of the fourth quarter, Henry Schein had $100.0 million authorized for future repurchases of its common stock.

Full-Year Results

For the year, net sales of $8.5 billion increased 13.3% compared with 2010. This consists of internal growth of 4.5%, acquisition growth of 4.9%, growth related to foreign currency exchange of 2.4% and growth due to the extra week of 1.5%.

Net income attributable to Henry Schein, Inc. for 2011 was $367.7 million or $3.97 per diluted share, an increase of 10.1% and 10.9%, respectively, compared with adjusted net income for 2010, which excludes restructuring costs of $12.3 million or $0.09 per diluted share. Growth in diluted EPS was 13.8% on an as-reported basis (see Exhibit B for reconciliation of GAAP net income and EPS to non-GAAP adjusted net income and EPS).

2012 EPS Guidance

Henry Schein today affirmed 2012 financial guidance, as follows:

For 2012 the Company expects diluted EPS attributable to Henry Schein, Inc. to be $4.25 to $4.34, which represents growth of 7% to 9% compared with 2011 results.

The Company notes that the 2012 fiscal year includes one less week than 2011.

Guidance for 2012 diluted EPS attributable to Henry Schein, Inc. excludes restructuring costs.

Guidance for 2012 diluted EPS attributable to Henry Schein, Inc. is for current continuing operations as well as completed or previously announced acquisitions, and does not include the impact of potential future acquisitions, if any.

Strategic Plan

"Executive management of Henry Schein is completing our 2012-2014 strategic plan, which calls for annualized sales to exceed $10 billion by 2015 with improved profitability. At the core of our initiatives to support this plan is the establishment of Global Dental, Global Medical and Global Animal Health business groups, in addition to our Global Technology and Value-Added Services group, while strengthening other company-wide functions," said Mr. Bergman. "These global business groups will provide distinct organizational focus for reaching and serving each of our practitioner segments with the benefits of a global perspective, as well as global product and service offerings and best practices."

He continued, "Among our strategic priorities is optimizing our cost structure and our processes. To that end we will be implementing a restructuring with the goal of improving profitability." The Company noted that it expects to record restructuring charges of approximately $11 million to $13 million, or approximately $0.08 to $0.10 per diluted share, during the first half of 2012 as a result of this action.

Beginning with the reporting of financial results for the first quarter of 2012, net sales and sales comparisons will be provided for each of the global Dental, Medical, Animal Health and Technology and Value-Added Services business groups.

MELVILLE, N.Y., Feb. 15, 2012 /PRNewswire/ -- Henry Schein, Inc. (NASDAQ: HSIC), the largest provider of healthcare products and services to office-based practitioners, today reported record financial results for the quarter ended December 31, 2011.

The Company is on a 52/53 week fiscal year ending on the last Saturday in December, and 2011 had an extra selling week compared with 2010. This extra selling week occurred in the fourth quarter of 2011. In order to facilitate more meaningful comparisons, the Company is providing a separate estimate of the impact of the extra week on sales growth and is providing internal sales growth in local currencies excluding that extra week.

Net sales for the fourth quarter of 2011 were $2.3 billion, an increase of 15.6% compared with the fourth quarter of 2010. This consists of internal growth of 5.3%, acquisition growth of 4.7%, a decline related to foreign currency exchange of 0.1% and growth due to the extra week of 5.7% (see Exhibit A for details of sales growth).

Net income attributable to Henry Schein, Inc. for the fourth quarter of 2011 was $104.7 million or $1.15 per diluted share, an increase of 12.6% and 15.0%, respectively, compared with the fourth quarter of 2010.

"We are delighted to have gained market share in all of our business groups during the fourth quarter, with overall mid-single digit internal sales growth complemented by strategic acquisitions. Also, we are proud that net sales for the year exceeded $8.5 billion for the first time," said Stanley M. Bergman, Chairman and Chief Executive Officer of Henry Schein. "Overall our view is that the markets we serve are modestly improving, and we look forward to a return to historic market growth of 5% to 6% annually over the longer term."

North American Dental sales of $806.6 million increased 11.9%, including internal growth of 4.5%, a decline related to foreign currency exchange of 0.1% and growth due to the extra week of 7.5%.

"Results in our North American Dental group were strong across the board, and reflect steady patient traffic to dental offices and higher demand for dental equipment," commented Mr. Bergman. "Dental internal growth in local currencies of 4.5% includes 4.8% growth in Dental consumable merchandise sales and 3.8% growth in Dental equipment sales and services revenues, excluding the impact of the extra week."

North American Medical sales of $373.3 million increased 13.9%, including internal growth of 7.1%, acquisition growth of 0.7% and growth due to the extra week of 6.1%. There was no meaningful impact on sales growth from seasonal influenza vaccine products.

"During the fourth quarter we distributed approximately 1.7 million doses of seasonal influenza vaccines, as planned, bringing our total for the year to 11.6 million doses with sales of $88.3 million," remarked Mr. Bergman. "We are most pleased with the performance of our North American Medical group during the quarter, with internal growth well in excess of our estimate for market growth."

North American Animal Health sales of $255.9 million increased 14.9%, including internal growth of 7.2% and growth due to the extra week of 7.7%.

"We also continue to be very pleased with the results from our North American Animal Health business, and believe our performance remains well in excess of market growth," commented Mr. Bergman. "We recently acquired all of Oak Hill Capital Partners' interest in Butler Schein Animal Health, and now own 71.7% of that business. Butler Schein Animal Health is one of the anchors in our leading global animal health business, which has annual sales of approximately $2 billion."

International sales of $833.8 million increased 20.0%, including internal growth of 4.8%, acquisition growth of 12.2% and growth due to the extra week of 3.0%. There was no net impact from foreign currency exchange during the quarter.

"Results for our International group feature solid sales growth to our dental, medical and veterinary customers, complemented by the acquisition of Provet Holdings in Australia and New Zealand," added Mr. Bergman. "Early in January we acquired Veterinary Instrumentation, the leading supplier of surgical instruments and implants to veterinary surgeons in the United Kingdom with sales of approximately $11 million. We look forward to bringing the Veterinary Instrumentation portfolio of high-quality specialty surgical products to a growing number of professionals across Europe, the U.S. and Australasia."

Technology and Value-Added Services sales of $70.7 million increased 23.1% during the quarter, including internal growth of 2.4%, acquisition growth of 14.2% and growth due to the extra week of 6.5%.

"We remain very pleased with the performance of our Technology and Value-Added Services group, with strong sales growth including strategic acquisitions," explained Mr. Bergman. "Fourth quarter results include particular strength in our electronic services and financial services businesses."

Stock Repurchase Plan

The Company announced that it repurchased 1.1 million shares of its common stock during the fourth quarter at an average price of $61.98 per share, or approximately $68 million. The impact of the repurchase of shares on fourth quarter diluted EPS was less than $0.01. At the close of the fourth quarter, Henry Schein had $100.0 million authorized for future repurchases of its common stock.

Full-Year Results

For the year, net sales of $8.5 billion increased 13.3% compared with 2010. This consists of internal growth of 4.5%, acquisition growth of 4.9%, growth related to foreign currency exchange of 2.4% and growth due to the extra week of 1.5%.

Net income attributable to Henry Schein, Inc. for 2011 was $367.7 million or $3.97 per diluted share, an increase of 10.1% and 10.9%, respectively, compared with adjusted net income for 2010, which excludes restructuring costs of $12.3 million or $0.09 per diluted share. Growth in diluted EPS was 13.8% on an as-reported basis (see Exhibit B for reconciliation of GAAP net income and EPS to non-GAAP adjusted net income and EPS).

2012 EPS Guidance

Henry Schein today affirmed 2012 financial guidance, as follows:

For 2012 the Company expects diluted EPS attributable to Henry Schein, Inc. to be $4.25 to $4.34, which represents growth of 7% to 9% compared with 2011 results.

The Company notes that the 2012 fiscal year includes one less week than 2011.

Guidance for 2012 diluted EPS attributable to Henry Schein, Inc. excludes restructuring costs.

Guidance for 2012 diluted EPS attributable to Henry Schein, Inc. is for current continuing operations as well as completed or previously announced acquisitions, and does not include the impact of potential future acquisitions, if any.

Strategic Plan