Carpathian Gold CPN.TO - auf dem weg zum Produzenten - 500 Beiträge pro Seite

eröffnet am 07.03.11 15:29:41 von

neuester Beitrag 12.09.16 15:08:37 von

neuester Beitrag 12.09.16 15:08:37 von

Beiträge: 292

ID: 1.164.397

ID: 1.164.397

Aufrufe heute: 0

Gesamt: 30.418

Gesamt: 30.418

Aktive User: 0

ISIN: CA29872L2066 · WKN: A2ARP6 · Symbol: ESM

0,0415

EUR

0,00 %

0,0000 EUR

Letzter Kurs 25.04.24 Lang & Schwarz

Neuigkeiten

23.04.24 · globenewswire |

03.04.24 · globenewswire |

01.03.24 · globenewswire |

14.11.23 · globenewswire |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 227,00 | +21,91 | |

| 5,1500 | +21,75 | |

| 29,98 | +18,24 | |

| 16,050 | +17,41 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6850 | -6,80 | |

| 29,70 | -7,19 | |

| 0,8800 | -7,37 | |

| 0,5400 | -8,47 | |

| 46,88 | -97,99 |

CPN hat zwei Hauptprojekte. Da ist zunächst das Riacho dos Machados (RDM) Project in Brasilien. Im August 2009 wurden die Ergebnisse einer PEA veröffentlicht

- Produktion von 102.000 oz Au p.a. über zunächst 7,1 Jahre

- Op. cash cost iHv U$428/oz

- NPV @ 5% iHv U$123 Mio after tax, basierend auf einem Goldpreis von U$900/oz (aktuell >U$1400/oz)

- IRR iHv 32%

- CAPEX U$126 Mio incl. Sustaining Capital

Vor ein paar Tagen wurde angekündigt, daß die Ergebnisse der Machbarkeitsstudie innerhalb der nächsten Wochen vorliegen sollen. Dann könnte es ziemlich schnell gehen, denn CPN hat sich bereits im Vorfeld die Finanzierung grundsätzlich gesichert:

- Im Mai 2010 wurde ein gold sale agreement mit der Macquarie Bank über U$30 Mio abgeschlossen, wovon zwei Tranchen über insgesamt U$22,5 noch abzurufen sind (Details:http://finance.yahoo.com/news/Carpathian-Concludes-US30-ccn-…)

- Im September 2010 hat man sich mit der Macquarie Bank grundsätzlich auf die Bereitstellung einer Projektfinanzierung von bis zu U$75 Mio verständigt. Gleichzeitig hat man sich mit Caterpillar Financial Services bzgl einer Leasingfinanzierung von bis zu U$22 Mio verständigt (Details:http://finance.yahoo.com/news/Carpathian-Signs-Project-ccn-1…)

- Im November 2010 wurde eine Aktienplatzierung über C$51,6 Mio (94 Mio Aktien @ C$0,55) durchgeführt (geplant waren zunächst nur C$35 Mio).

In Summe stünden CPN also, natürlich unter der Voraussetzung, daß aus den prinzipiellen Zusagen auch feste Verträge werden, rund C$167 Mio zur Verfügung. Damit wäre auch eine von mir erwartete höhere CAPEX (die bisherige grobe Schätzung ist ja mehr als 1,5 Jahre alt) abgedeckt. Das Risiko einer weiteren Verwässerung wäre also eher gering einzuschätzen

Auch Teile der Anlage wurden bereits gekauft (siehe http://finance.yahoo.com/news/Carpathian-Completes-Mill-ccn-…, um das Projekt schnellstmöglich in Produktion zu bringen.

Die Erteilung der Minenlizenz steht noch aus, die erforderlichen Unterlagen wurden aber bereits eingereicht.

Bewertung

Stand 30.09.10 waren 289 Mio Aktien ausstehend zzgl 21 Mio Optionen @ 33 Cent und 24 Mio Warrants @ 38 Cent. Hinzu kommen 94 Mio Aktien aus der letzten Platzierung. Voll verwässert ergeben sich also etwa 428 Mio Aktien. Basierend auf dem Schlusskurs vom Freitag beträgt die Marktkapitalisierung somit rund C$240 Mio

Das wäre schon eine attraktive Bewertung für einen 100k oz Produzenten. Aber CPN hat zudem ein wesentlich bedeutenderes Projekt, das allerdings noch nicht so weit forgeschritten ist. Darauf werde ich später eingehen. Jedenfalls ist das in keinster Weise in der Unternehmensbewertung berücksichtigt.

weiterführende Informationen

Unternehmensmeldungen

http://finance.yahoo.com/q?s=CPN.TO

Homepage

http://www.carpathiangold.com

Präsentation

http://www.carpathiangold.com/Theme/Carpathian/files/doc_pre…

Q-Bericht

http://www.sedar.com/GetFile.do?lang=EN&docClass=5&issuerNo=… (Finanzteil)

http://www.sedar.com/GetFile.do?lang=EN&docClass=7&issuerNo=… (MD&A)

SEDAR-Filings

http://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issu…

- Produktion von 102.000 oz Au p.a. über zunächst 7,1 Jahre

- Op. cash cost iHv U$428/oz

- NPV @ 5% iHv U$123 Mio after tax, basierend auf einem Goldpreis von U$900/oz (aktuell >U$1400/oz)

- IRR iHv 32%

- CAPEX U$126 Mio incl. Sustaining Capital

Vor ein paar Tagen wurde angekündigt, daß die Ergebnisse der Machbarkeitsstudie innerhalb der nächsten Wochen vorliegen sollen. Dann könnte es ziemlich schnell gehen, denn CPN hat sich bereits im Vorfeld die Finanzierung grundsätzlich gesichert:

- Im Mai 2010 wurde ein gold sale agreement mit der Macquarie Bank über U$30 Mio abgeschlossen, wovon zwei Tranchen über insgesamt U$22,5 noch abzurufen sind (Details:http://finance.yahoo.com/news/Carpathian-Concludes-US30-ccn-…)

- Im September 2010 hat man sich mit der Macquarie Bank grundsätzlich auf die Bereitstellung einer Projektfinanzierung von bis zu U$75 Mio verständigt. Gleichzeitig hat man sich mit Caterpillar Financial Services bzgl einer Leasingfinanzierung von bis zu U$22 Mio verständigt (Details:http://finance.yahoo.com/news/Carpathian-Signs-Project-ccn-1…)

- Im November 2010 wurde eine Aktienplatzierung über C$51,6 Mio (94 Mio Aktien @ C$0,55) durchgeführt (geplant waren zunächst nur C$35 Mio).

In Summe stünden CPN also, natürlich unter der Voraussetzung, daß aus den prinzipiellen Zusagen auch feste Verträge werden, rund C$167 Mio zur Verfügung. Damit wäre auch eine von mir erwartete höhere CAPEX (die bisherige grobe Schätzung ist ja mehr als 1,5 Jahre alt) abgedeckt. Das Risiko einer weiteren Verwässerung wäre also eher gering einzuschätzen

Auch Teile der Anlage wurden bereits gekauft (siehe http://finance.yahoo.com/news/Carpathian-Completes-Mill-ccn-…, um das Projekt schnellstmöglich in Produktion zu bringen.

Die Erteilung der Minenlizenz steht noch aus, die erforderlichen Unterlagen wurden aber bereits eingereicht.

Bewertung

Stand 30.09.10 waren 289 Mio Aktien ausstehend zzgl 21 Mio Optionen @ 33 Cent und 24 Mio Warrants @ 38 Cent. Hinzu kommen 94 Mio Aktien aus der letzten Platzierung. Voll verwässert ergeben sich also etwa 428 Mio Aktien. Basierend auf dem Schlusskurs vom Freitag beträgt die Marktkapitalisierung somit rund C$240 Mio

Das wäre schon eine attraktive Bewertung für einen 100k oz Produzenten. Aber CPN hat zudem ein wesentlich bedeutenderes Projekt, das allerdings noch nicht so weit forgeschritten ist. Darauf werde ich später eingehen. Jedenfalls ist das in keinster Weise in der Unternehmensbewertung berücksichtigt.

weiterführende Informationen

Unternehmensmeldungen

http://finance.yahoo.com/q?s=CPN.TO

Homepage

http://www.carpathiangold.com

Präsentation

http://www.carpathiangold.com/Theme/Carpathian/files/doc_pre…

Q-Bericht

http://www.sedar.com/GetFile.do?lang=EN&docClass=5&issuerNo=… (Finanzteil)

http://www.sedar.com/GetFile.do?lang=EN&docClass=7&issuerNo=… (MD&A)

SEDAR-Filings

http://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issu…

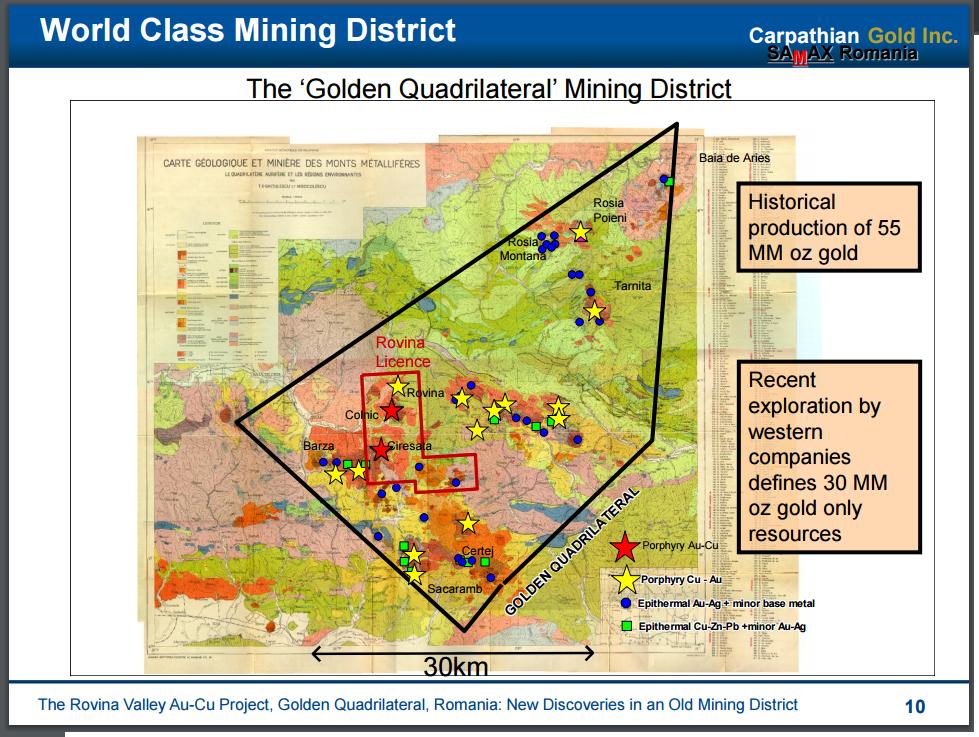

Bei dem zweiten Hauptprojekt handelt es sich um das Gold-Kupfer-Projekt Rovina Valley Au-Cu in Rumänien. Dieses verfügt über Gesamtressourcen von

- 6,9 Mio oz Au und

- 1,4 Mrd lbs Cu

Im März des vergangenen Jahres wurden die Ergebnisse einer PEA präsentiert. Highlights:

- Production of 238.000 oz Au p.a. for the first 5 years; averaging 196.000 oz p.a over the mine life

- Production of 53,5 Mio lbs Cu for the first 5 years; averaging 49,4 Mio lbs Cu p.a. over the mine life

- entsprechend durchschnittlich 343.600 oz Au equivalent p.a.

- Mine life of 19 years

- 6,22 Mio Au equivalent oz produced over the mine life

- Operating cash cost of U$379/oz with Cu as a by-product credit and U$483/oz Au on a co-product basis (Cu cash cost is U$1,05/lb on a co-product basis)

- NPV @ 5% of U$1,13 Mrd at U$1.000/oz Au and U$3,00/lb Cu

- IRR 24,2%, with a 3,3-year payback

- Initial CAPEX of U$509 Mio, at U$1.000/oz Au and U$3,00/lb Cu

ausführlich: http://www.carpathiangold.com/news/press-releases/press-rele…

Rumänien ist kein ganz einfaches Pflaster; andere Minenkonzerne haben so ihre Schwierigkeiten. Umso wichtiger sind die folgenden Aussagen seitens CPN:

The onsite metallurgical facility will include conventional unit operations such as crushing, grinding, froth flotation and dewatering to produce a Au-rich Cu flotation concentrate. Ore processing will utilize an industry-standard flotation process-only at 40.000 t/day to produce a Au-rich saleable Cu concentrate containing 18-22% Cu and 50-60 g Au/t. This process does not require the use of cyanide.

There has been no previous commercial mining activity at RVP and the proposed mine site footprint as defined by the PEA does not include any known protected heritage sites or archaeological occurrences and has been designed to minimize impact in the nearby communities of Rovina and Bucuresci.

Auch für Rovina erwartet CPN die Umwandlung der Explorations- in eine Minenlizenz "in early 2011". Desweiteren wird ein 2010 begonnenes Bohrprogramm über 20.000 m abgeschlossen. Vor ein paar Tagen wurde zudem bekanntgegeben, daß man das Bohrprogramm um 15.000 m ausweiten möchte. Ein zweites Bohrgerät ist bereits auf dem Weg, dem 2-3 weitere folgen sollen. Ein Ressourcen-Update soll bis Jahresende vorliegen, eine Vor-Machbarkeitsstudie steht für das 1.Hj 2012 auf der Agenda.

- 6,9 Mio oz Au und

- 1,4 Mrd lbs Cu

Im März des vergangenen Jahres wurden die Ergebnisse einer PEA präsentiert. Highlights:

- Production of 238.000 oz Au p.a. for the first 5 years; averaging 196.000 oz p.a over the mine life

- Production of 53,5 Mio lbs Cu for the first 5 years; averaging 49,4 Mio lbs Cu p.a. over the mine life

- entsprechend durchschnittlich 343.600 oz Au equivalent p.a.

- Mine life of 19 years

- 6,22 Mio Au equivalent oz produced over the mine life

- Operating cash cost of U$379/oz with Cu as a by-product credit and U$483/oz Au on a co-product basis (Cu cash cost is U$1,05/lb on a co-product basis)

- NPV @ 5% of U$1,13 Mrd at U$1.000/oz Au and U$3,00/lb Cu

- IRR 24,2%, with a 3,3-year payback

- Initial CAPEX of U$509 Mio, at U$1.000/oz Au and U$3,00/lb Cu

ausführlich: http://www.carpathiangold.com/news/press-releases/press-rele…

Rumänien ist kein ganz einfaches Pflaster; andere Minenkonzerne haben so ihre Schwierigkeiten. Umso wichtiger sind die folgenden Aussagen seitens CPN:

The onsite metallurgical facility will include conventional unit operations such as crushing, grinding, froth flotation and dewatering to produce a Au-rich Cu flotation concentrate. Ore processing will utilize an industry-standard flotation process-only at 40.000 t/day to produce a Au-rich saleable Cu concentrate containing 18-22% Cu and 50-60 g Au/t. This process does not require the use of cyanide.

There has been no previous commercial mining activity at RVP and the proposed mine site footprint as defined by the PEA does not include any known protected heritage sites or archaeological occurrences and has been designed to minimize impact in the nearby communities of Rovina and Bucuresci.

Auch für Rovina erwartet CPN die Umwandlung der Explorations- in eine Minenlizenz "in early 2011". Desweiteren wird ein 2010 begonnenes Bohrprogramm über 20.000 m abgeschlossen. Vor ein paar Tagen wurde zudem bekanntgegeben, daß man das Bohrprogramm um 15.000 m ausweiten möchte. Ein zweites Bohrgerät ist bereits auf dem Weg, dem 2-3 weitere folgen sollen. Ein Ressourcen-Update soll bis Jahresende vorliegen, eine Vor-Machbarkeitsstudie steht für das 1.Hj 2012 auf der Agenda.

bin dabei

Carpathian Intersects 482 m of 1.06 g/t Au & 0.21% Cu and Continues to Increase Size of Ciresata Deposit With More Wide Zones of Au-Cu Mineralization

TORONTO, ONTARIO--(Marketwire - March 22, 2011) - Carpathian Gold Inc. (TSX:CPN) (the "Corporation" or "Carpathian") is pleased to provide further results from its 35,000 meter planned 2011 drill program at the Corporation's 100% owned Rovina Valley Project ("RVP") in west-central Romania. The RVP includes three Au-Cu porphyries discovered by the Corporation with the focus of the 2011 drilling program on the Au-rich Ciresata Porphyry deposit. The 2011 drill program will focus on defining the limits of the Ciresata deposit, upgrade the inferred resource to the measured plus indicated resource categories, as well as test satellite targets.

Core hole RGD-20 is near the southern edge of the known mineralization halo in an area with sparse drilling and intersected 240 metres of significant gold-copper grades which extends the >0.80 g/t Au-eq grade shell 120 metres to the southwest and contributes higher grades.

Core hole RGD-21 is located at the northwest edge of the present drill pattern and intersected 626 meters of high-grade gold-copper mineralization that extends this zone and is open northwest of the present drill pattern. This drill hole expands the >0.80 g/t Au-eq grade shell significantly from the previous resource estimate in 2008. Highlight intersections from this hole are shown below.

Drill hole From (m) To (m) Length (m) Au (g/t) Cu (%) Au-eq* (g/t)

RGD-20** 310 550 240 0.81 0.16 1.13

Including 421 497 76 1.01 0.17 1.36

RGD-21** 170 773 603 0.94 0.20 1.34

Including 170 773 603 0.94 0.20 1.34

Including 147 629 482 1.06 0.21 1.50

Including 208 544 336 1.22 0.23 1.70

* To estimate Au-eq (Gold Equivalent) a gold price of US $1000 and a copper price of US $3.00/lb is used. Metallurgical recoveries are not taken into account. This is consistent with the Au-eq. calculations the Corporation has used in its recent press releases for Ciresata.

** RGD-20 is located on drill fence 925N and drilled vertical to 778.0 m depth; RGD-21 is located on drill fence 1140N and drill vertical to 879.7 m depth. Drill hole locations are shown on Drill-hole Plan Map at www.carpathiangold.com.

"We continue to be impressed with the drill results from the Ciresata porphyry and look forward to further drill results from our accelerated program", said Dino Titaro, President and CEO of Carpathian." Mr. Titaro adds, "The Ciresata porphyry continues to demonstrate its high-grade tenor emphasizing the new gold-rich porphyry class of deposit we have discovered in Romania. We believe that the 2011 drill program could add significantly to the size of this deposit and provide a good basis for pre-feasibility/feasibility studies at the Rovina Valley Project in 2011".

The Ciresata porphyry system is a blind deposit that begins 40 to 140 m below surface. Drill hole RDG-21 with 626 metres at 0.92 g/t Au and 0.19% Cu extends the high-grade core of Ciresata to the northwest edge of the present drill pattern. This intersection is located 100 metres west of drill hole RGD-17 which intersected 716 metres at 1.14 g/t Au and 0.16% Cu (see Corporation's Press Release dated September 8th, 2010) and indicates this high-grade zone is open to the west and north. Two drill rigs are presently operating at Ciresata with plans to ramp-up to four operating drill rigs in the next 3-4 weeks.

RVP Background Information

RVP is comprised of three Au-Cu porphyry systems (Rovina, Colnic and Ciresata) discovered by the Corporation. From 2006 to 2009, 181 diamond drill holes totaling 71,375 m have been completed on the project. In late 2008, PEG Mining Consultants Inc. ("PEG") completed a NI 43-101 resource estimate ("2008 Resource").

A detailed Preliminary Economic Assessment ("PEA") was released on March 23, 2010. The PEA was completed by PEG, which led a consortium of specialists assembled for the study. The onsite metallurgical facility will include conventional unit operations such as crushing, grinding, froth flotation and dewatering to produce a gold-rich copper flotation concentrate. Ore processing will utilize an industry-standard flotation process-only at a rate of 40,000 tonnes per day to produce a gold-rich saleable copper concentrate. This process does not require the use of cyanide.

A summary of the PEA results is provided below.

Average annual gold production of 238,000 ounces per annum for the first five years and averaging 196,000 ounces per annum over the mine life of 19 years, for a total of 3.72 million ounces of recoverable gold over the life-of-mine (LOM).

Average annual copper production of 53.5 million lbs for the first five years and averaging 49.4 million lbs per annum over the19-year mine life, totaling 938 million lbs of recoverable copper over LOM.

Total gold equivalent ounces produced over the 19-year mine life are 6.22 million.

Total operating cash cost of US $81/oz with copper as a by-product credit and US $446/oz gold on a co-product basis (copper cash cost is US $1.05/lb on a co-product basis), using metal prices of US $1,000/oz Au and US $3.00/lb Cu.

At metal prices of US $1,000/oz gold and US $3.00/lb copper the NPV is US $1.13 billion based on a 5% discount rate.

Project internal rate of return ("IRR") of 24.2%, with an approximate 3.3-year payback on an initial Project capital expenditure of US $509.4 million, at a gold price of US $1,000/oz and copper price of US $3.00/lb.

There has been no previous commercial mining activity at RVP and the proposed mine site footprint as defined by the PEA does not include any known protected heritage sites or archaeological occurrences and has been designed to minimize impact in the nearby communities of Rovina and Bucuresci.

According to the cautionary statement required by NI 43-101, it should be noted that this PEA is preliminary in nature as it includes inferred mineral resources that cannot be categorized as reserves at this time and as such there is no certainty that the preliminary assessment and economics will be realized. The full Study of the PEA is available on www.SEDAR.com.

.........

TORONTO, ONTARIO--(Marketwire - March 22, 2011) - Carpathian Gold Inc. (TSX:CPN) (the "Corporation" or "Carpathian") is pleased to provide further results from its 35,000 meter planned 2011 drill program at the Corporation's 100% owned Rovina Valley Project ("RVP") in west-central Romania. The RVP includes three Au-Cu porphyries discovered by the Corporation with the focus of the 2011 drilling program on the Au-rich Ciresata Porphyry deposit. The 2011 drill program will focus on defining the limits of the Ciresata deposit, upgrade the inferred resource to the measured plus indicated resource categories, as well as test satellite targets.

Core hole RGD-20 is near the southern edge of the known mineralization halo in an area with sparse drilling and intersected 240 metres of significant gold-copper grades which extends the >0.80 g/t Au-eq grade shell 120 metres to the southwest and contributes higher grades.

Core hole RGD-21 is located at the northwest edge of the present drill pattern and intersected 626 meters of high-grade gold-copper mineralization that extends this zone and is open northwest of the present drill pattern. This drill hole expands the >0.80 g/t Au-eq grade shell significantly from the previous resource estimate in 2008. Highlight intersections from this hole are shown below.

Drill hole From (m) To (m) Length (m) Au (g/t) Cu (%) Au-eq* (g/t)

RGD-20** 310 550 240 0.81 0.16 1.13

Including 421 497 76 1.01 0.17 1.36

RGD-21** 170 773 603 0.94 0.20 1.34

Including 170 773 603 0.94 0.20 1.34

Including 147 629 482 1.06 0.21 1.50

Including 208 544 336 1.22 0.23 1.70

* To estimate Au-eq (Gold Equivalent) a gold price of US $1000 and a copper price of US $3.00/lb is used. Metallurgical recoveries are not taken into account. This is consistent with the Au-eq. calculations the Corporation has used in its recent press releases for Ciresata.

** RGD-20 is located on drill fence 925N and drilled vertical to 778.0 m depth; RGD-21 is located on drill fence 1140N and drill vertical to 879.7 m depth. Drill hole locations are shown on Drill-hole Plan Map at www.carpathiangold.com.

"We continue to be impressed with the drill results from the Ciresata porphyry and look forward to further drill results from our accelerated program", said Dino Titaro, President and CEO of Carpathian." Mr. Titaro adds, "The Ciresata porphyry continues to demonstrate its high-grade tenor emphasizing the new gold-rich porphyry class of deposit we have discovered in Romania. We believe that the 2011 drill program could add significantly to the size of this deposit and provide a good basis for pre-feasibility/feasibility studies at the Rovina Valley Project in 2011".

The Ciresata porphyry system is a blind deposit that begins 40 to 140 m below surface. Drill hole RDG-21 with 626 metres at 0.92 g/t Au and 0.19% Cu extends the high-grade core of Ciresata to the northwest edge of the present drill pattern. This intersection is located 100 metres west of drill hole RGD-17 which intersected 716 metres at 1.14 g/t Au and 0.16% Cu (see Corporation's Press Release dated September 8th, 2010) and indicates this high-grade zone is open to the west and north. Two drill rigs are presently operating at Ciresata with plans to ramp-up to four operating drill rigs in the next 3-4 weeks.

RVP Background Information

RVP is comprised of three Au-Cu porphyry systems (Rovina, Colnic and Ciresata) discovered by the Corporation. From 2006 to 2009, 181 diamond drill holes totaling 71,375 m have been completed on the project. In late 2008, PEG Mining Consultants Inc. ("PEG") completed a NI 43-101 resource estimate ("2008 Resource").

A detailed Preliminary Economic Assessment ("PEA") was released on March 23, 2010. The PEA was completed by PEG, which led a consortium of specialists assembled for the study. The onsite metallurgical facility will include conventional unit operations such as crushing, grinding, froth flotation and dewatering to produce a gold-rich copper flotation concentrate. Ore processing will utilize an industry-standard flotation process-only at a rate of 40,000 tonnes per day to produce a gold-rich saleable copper concentrate. This process does not require the use of cyanide.

A summary of the PEA results is provided below.

Average annual gold production of 238,000 ounces per annum for the first five years and averaging 196,000 ounces per annum over the mine life of 19 years, for a total of 3.72 million ounces of recoverable gold over the life-of-mine (LOM).

Average annual copper production of 53.5 million lbs for the first five years and averaging 49.4 million lbs per annum over the19-year mine life, totaling 938 million lbs of recoverable copper over LOM.

Total gold equivalent ounces produced over the 19-year mine life are 6.22 million.

Total operating cash cost of US $81/oz with copper as a by-product credit and US $446/oz gold on a co-product basis (copper cash cost is US $1.05/lb on a co-product basis), using metal prices of US $1,000/oz Au and US $3.00/lb Cu.

At metal prices of US $1,000/oz gold and US $3.00/lb copper the NPV is US $1.13 billion based on a 5% discount rate.

Project internal rate of return ("IRR") of 24.2%, with an approximate 3.3-year payback on an initial Project capital expenditure of US $509.4 million, at a gold price of US $1,000/oz and copper price of US $3.00/lb.

There has been no previous commercial mining activity at RVP and the proposed mine site footprint as defined by the PEA does not include any known protected heritage sites or archaeological occurrences and has been designed to minimize impact in the nearby communities of Rovina and Bucuresci.

According to the cautionary statement required by NI 43-101, it should be noted that this PEA is preliminary in nature as it includes inferred mineral resources that cannot be categorized as reserves at this time and as such there is no certainty that the preliminary assessment and economics will be realized. The full Study of the PEA is available on www.SEDAR.com.

.........

Antwort auf Beitrag Nr.: 41.246.864 von grasgruener am 22.03.11 12:23:06sehr gute Ergebnisse

das sollte doch reichen um den Abwärtstrend zu brechen

trotz des gestrigen Suboptimalen Anstieges sieht der Chart weiter top aus - die Chance das der MACD kreuzt und ein Kaufsignal generiert sind weiter gestiegen!

die gestern veröffentlichten Ergebnisse sind ein Klasse für sich!

RDG-21 603m mit 0,94g/T darunter ein Abschnitt mit 482m mit 1,06g/T

klingt vielleicht nicht viel - aber da openPitminable sind die Gehalte ökonomisch abbaubar!!!

die PEA nochmal zum geniessen - denke das Projekt wird kommen, allein die Arbeitskräfte werden dort dringend gebraucht inklusive der Folgeauftrage durch den Bau usw.

A summary of the PEA results is provided below.

Average annual gold production of 238,000 ounces per annum for the first five years and averaging 196,000 ounces per annum over the mine life of 19 years, for a total of 3.72 million ounces of recoverable gold over the life-of-mine (LOM).

Average annual copper production of 53.5 million lbs for the first five years and averaging 49.4 million lbs per annum over the19-year mine life, totaling 938 million lbs of recoverable copper over LOM.

Total gold equivalent ounces produced over the 19-year mine life are 6.22 million.

Total operating cash cost of US $81/oz with copper as a by-product credit and US $446/oz gold on a co-product basis (copper cash cost is US $1.05/lb on a co-product basis), using metal prices of US $1,000/oz Au and US $3.00/lb Cu.

At metal prices of US $1,000/oz gold and US $3.00/lb copper the NPV is US $1.13 billion based on a 5% discount rate.

Project internal rate of return ("IRR") of 24.2%, with an approximate 3.3-year payback on an initial Project capital expenditure of US $509.4 million, at a gold price of US $1,000/oz and copper price of US $3.00/lb.

die gestern veröffentlichten Ergebnisse sind ein Klasse für sich!

RDG-21 603m mit 0,94g/T darunter ein Abschnitt mit 482m mit 1,06g/T

klingt vielleicht nicht viel - aber da openPitminable sind die Gehalte ökonomisch abbaubar!!!

die PEA nochmal zum geniessen - denke das Projekt wird kommen, allein die Arbeitskräfte werden dort dringend gebraucht inklusive der Folgeauftrage durch den Bau usw.

A summary of the PEA results is provided below.

Average annual gold production of 238,000 ounces per annum for the first five years and averaging 196,000 ounces per annum over the mine life of 19 years, for a total of 3.72 million ounces of recoverable gold over the life-of-mine (LOM).

Average annual copper production of 53.5 million lbs for the first five years and averaging 49.4 million lbs per annum over the19-year mine life, totaling 938 million lbs of recoverable copper over LOM.

Total gold equivalent ounces produced over the 19-year mine life are 6.22 million.

Total operating cash cost of US $81/oz with copper as a by-product credit and US $446/oz gold on a co-product basis (copper cash cost is US $1.05/lb on a co-product basis), using metal prices of US $1,000/oz Au and US $3.00/lb Cu.

At metal prices of US $1,000/oz gold and US $3.00/lb copper the NPV is US $1.13 billion based on a 5% discount rate.

Project internal rate of return ("IRR") of 24.2%, with an approximate 3.3-year payback on an initial Project capital expenditure of US $509.4 million, at a gold price of US $1,000/oz and copper price of US $3.00/lb.

Jahresabschluß 2010

Consolidated Financial Statements

http://www.sedar.com/GetFile.do?lang=EN&docClass=5&issuerNo=…

Management’s Discussion and Analysis

http://www.sedar.com/GetFile.do?lang=EN&docClass=7&issuerNo=…

Consolidated Financial Statements

http://www.sedar.com/GetFile.do?lang=EN&docClass=5&issuerNo=…

Management’s Discussion and Analysis

http://www.sedar.com/GetFile.do?lang=EN&docClass=7&issuerNo=…

Carpathian Updates Resource Estimate for RDM Gold Project, Brazil: Open-Pit Measured + Indicated Resource Increase by 15%

Auszug:

2011 Resource Estimate Highlights include:

- Measured plus Indicated mineral resource of 936,600 ounces of gold (open-pit plus underground), an increase of 15% from the 2010 Resource Estimate.

- Inferred resource of 587,300 ounces of gold (open-pit plus underground).

- Inferred mineral resource for the open-pit portion of the deposit of 240,700 ounces of gold.

http://finance.yahoo.com/news/Carpathian-Updates-Resource-cc…

Auszug:

2011 Resource Estimate Highlights include:

- Measured plus Indicated mineral resource of 936,600 ounces of gold (open-pit plus underground), an increase of 15% from the 2010 Resource Estimate.

- Inferred resource of 587,300 ounces of gold (open-pit plus underground).

- Inferred mineral resource for the open-pit portion of the deposit of 240,700 ounces of gold.

http://finance.yahoo.com/news/Carpathian-Updates-Resource-cc…

06.04.11

Carpathian Receives Positive Feasibility Study and Announces Construction Decision for Its RDM Gold Project, Brazil

Highlights of the feasibility study are as follows:

Proven and probable open-pit reserves of 20.9 million tonnes at 1.24 g/t Au for 830,200 ounces of gold (based on a US$950 per ounce gold pit-shell).

Initial 8-year mine life at a mill throughput of approximately 7,000 tonnes per day utilizing conventional open-pit mining and crushing-grinding with CIL recovery of gold.

Average annual recoverable gold production of 93,400 ounces (100,000 ounces/year in the first three years of operation).

Average cash operating cost over the life of mine of US$558 per ounce.

Pre-tax project net present value ("NPV") of US$150.8 million based on a 5% discount rate using a gold price of US$ 1,150 per ounce for gold resulting in an internal rate of return ("IRR) of 24.9%.

After-tax project NPV of US$123.8 million based on a 5% discount rate at US$ 1,150 per ounce of gold with an IRR of 21.9%.

Using near current spot price of US$1,350 per oz of gold, the after-tax NPV based on a 5% discount rate is US$220.1 million with an IRR of 33.4%.

Estimated start up capital of US$160 million.

Global measured plus indicated mineral resource of 936,600 ounces (inclusive of mineral reserves) and 587,300 ounces in the inferred category.

Additional opportunities for future conversion of resources to reserves and resource growth, reduction in capital and increased mill feed grade.

ausführlich: http://tmx.quotemedia.com/article.php?newsid=40114378&qm_sym…

Carpathian Receives Positive Feasibility Study and Announces Construction Decision for Its RDM Gold Project, Brazil

Highlights of the feasibility study are as follows:

Proven and probable open-pit reserves of 20.9 million tonnes at 1.24 g/t Au for 830,200 ounces of gold (based on a US$950 per ounce gold pit-shell).

Initial 8-year mine life at a mill throughput of approximately 7,000 tonnes per day utilizing conventional open-pit mining and crushing-grinding with CIL recovery of gold.

Average annual recoverable gold production of 93,400 ounces (100,000 ounces/year in the first three years of operation).

Average cash operating cost over the life of mine of US$558 per ounce.

Pre-tax project net present value ("NPV") of US$150.8 million based on a 5% discount rate using a gold price of US$ 1,150 per ounce for gold resulting in an internal rate of return ("IRR) of 24.9%.

After-tax project NPV of US$123.8 million based on a 5% discount rate at US$ 1,150 per ounce of gold with an IRR of 21.9%.

Using near current spot price of US$1,350 per oz of gold, the after-tax NPV based on a 5% discount rate is US$220.1 million with an IRR of 33.4%.

Estimated start up capital of US$160 million.

Global measured plus indicated mineral resource of 936,600 ounces (inclusive of mineral reserves) and 587,300 ounces in the inferred category.

Additional opportunities for future conversion of resources to reserves and resource growth, reduction in capital and increased mill feed grade.

ausführlich: http://tmx.quotemedia.com/article.php?newsid=40114378&qm_sym…

12.04.11

Carpathian Gold neues Kursziel

Rating-Update:

Richard Gray, Analyst von Cormark Securities, stuft die Aktie von Carpathian Gold unverändert mit "buy" ein. Das Kursziel werde von 1,15 auf 1,00 Kanadische Dollar gesenkt. (Analyse vom 11.04.11)

Offenlegung von möglichen Interessenskonflikten: Mögliche Interessenskonflikte können Sie auf der Site des Erstellers/ der Quelle der Analyse einsehen.

Quelle: AKTIENCHECK.DE

Carpathian Gold neues Kursziel

Rating-Update:

Richard Gray, Analyst von Cormark Securities, stuft die Aktie von Carpathian Gold unverändert mit "buy" ein. Das Kursziel werde von 1,15 auf 1,00 Kanadische Dollar gesenkt. (Analyse vom 11.04.11)

Offenlegung von möglichen Interessenskonflikten: Mögliche Interessenskonflikte können Sie auf der Site des Erstellers/ der Quelle der Analyse einsehen.

Quelle: AKTIENCHECK.DE

Update Factsheet

http://www.carpathiangold.com/Theme/Carpathian/files/CPN-Fac…

neue Präsentation

http://www.carpathiangold.com/Theme/Carpathian/files/CPN%20A…

http://www.carpathiangold.com/Theme/Carpathian/files/CPN-Fac…

neue Präsentation

http://www.carpathiangold.com/Theme/Carpathian/files/CPN%20A…

hallo zusammen

was denkt ihr: ist es zeit zum nachkaufen oder sollte man noch abwarten. ich habe bei o,44 Euro eine "mittlere" posi gekauft.

schwierige frage ich weiss ja schon.............

grus

renorulez

was denkt ihr: ist es zeit zum nachkaufen oder sollte man noch abwarten. ich habe bei o,44 Euro eine "mittlere" posi gekauft.

schwierige frage ich weiss ja schon.............

grus

renorulez

Antwort auf Beitrag Nr.: 41.395.454 von renorulez am 20.04.11 14:35:12solche Entscheidungen solltest du selbst treffen. Ein etwaiger Nachkauf hängt ja neben den unternehmensspezifischen Aspekten auch von anderen Faktoren ab wie der bisherigen Depotgewichtung, allgemeine Depotausrichtung (Sektorengewichtung), der Cashquote usw.

Bzgl CPN kann man festhalten, daß die Aktie mit Blick auf die erst kürzlich veröffentlichte Machbarkeitsstudie deutlich unterbewertet ist.

Bzgl CPN kann man festhalten, daß die Aktie mit Blick auf die erst kürzlich veröffentlichte Machbarkeitsstudie deutlich unterbewertet ist.

Antwort auf Beitrag Nr.: 41.395.828 von MFC500 am 20.04.11 15:28:33ich danke dir für die antwort

gruss

renorulez

gruss

renorulez

Bin jetzt auch mal mit einer ersten Position dabei. Vielen Dank für die gute Zusammenfassung.

12 Mio. Stück Umsatz

und Plus trotz Minenblutbad

ich denke der rumänische Urknall kommt bald

dann werde aus meinen 15% Minus ganz schnell 100% Plus

und Plus trotz Minenblutbad

ich denke der rumänische Urknall kommt bald

dann werde aus meinen 15% Minus ganz schnell 100% Plus

heute nochmal aufgestockt

zwei bemerkenswerte Einzeldeals heute

erneut beeindruckende Bohrergebnisse:

May 11, 2011

Carpathian Gold is pleased to provide further results from its 35,000 metre 2011 diamond drill program at the Corporation's 100% owned Rovina Valley Project ("RVP") in west-central Romania. The RVP includes three Au-Cu porphyries discovered by the Corporation with the focus of the 2011drilling program on the gold-rich Ciresata copper porphyry deposit. Four drill rigs are presently working at the Ciresata deposit with the objective of defining the deposit limits, upgrading the inferred resource to the measured plus indicated resource categories, as well as testing satellite targets.

Approximately 7,000 metres of the planned drill program have been completed year to date with results through drill-hole RGD-21 previously reported. Assay results from drill-holes RGD-22, 23, and 24 located in the south and southwest margin of the deposit have recently been received and include the following highlight intersections:

-- 434 metres at 0.95 g/t Au and 0.16% Cu (1.23 g/t Au-eq) in drill hole

RGD-24

-- Inclusive of 357 metres at 1.06 g/t Au and 0.17% Cu (1.41 g/t Au-

eq)(i)

-- 358 metres at 0.88 g/t Au and 0.16% Cu (1.21 g/t Au-eq) in drill hole

RGD-23

-- Inclusive of 210 metres at 1.02 g/t Au and 0.18% Cu (1.39 g/t Au-

eq)(i)

-- 410 metres at 0.73 g/t Au and 0.16% Cu (1.06 g/t Au-eq) in drill hole

RGD-22

-- Inclusive of 172 metres at 1.05 g/t Au and 0.22% Cu (1.50 g/t Au-

eq)(i)

"We continue to be impressed with the drill results from the Ciresata porphyry and look forward to further drill results from our accelerated program", said Dino Titaro, President and CEO of Carpathian." Mr. Titaro adds, "The Ciresata porphyry continues to demonstrate its high-grade tenor emphasizing the new gold-rich porphyry class of deposit we have discovered in Romania. The results from the ongoing 2011 drill program support our belief that the size of this deposit will be enhanced and will contribute significantly to the results of our RVP pre-feasibility study".

Core hole RGD-23 is the southern-most deep drill hole completed to date and extends the drill-defined mineralization a further 60 metres to the south. This drill hole intersected significant gold-copper mineralization over 358 metres and includes a higher-grade core of 210 metres at 1.39 g/t Au-eq(i).

Core hole RGD-22 is a step-out from drill hole RGD-16 (which intersected 791 m at 0.63 g/t Au and 0.14% Cu, including 208 m of 1.13 g/t Au and 0.19% Cu) located on the southwest margin of the deposit and extended the drill-defined mineralization a further 75 metres to the southwest. Hole RGD-22 intersected significant gold-copper mineralization over 410 metres and includes a higher-grade core of 172 metres at 1.50 g/t Au-eq(i).

Core hole RGD-24 is an in-fill drill hole in the southwest part of the deposit and near drill hole RGD-5, which was only drilled to a relatively shallow depth of 369 metres (which intersected 65 m at 0.77 g/t Au and 0.12% Cu for 1.02 g/t Au-eq). RGD-24 intersected significant gold-copper mineralization well below the area tested by hole RGD-5 and intersected 434 metres of strong gold copper mineralization, including 357 metres of 1.41 g/t Au-eq(i).

Drill hole locations are shown on the Drill-hole Plan Map on the Corporations website at www.carpathiangold.com.

Below is a drill-hole intersection table from the recently received assay results:

weiter: http://www.carpathiangold.com/news/press-releases/press-rele…

May 11, 2011

Carpathian Gold is pleased to provide further results from its 35,000 metre 2011 diamond drill program at the Corporation's 100% owned Rovina Valley Project ("RVP") in west-central Romania. The RVP includes three Au-Cu porphyries discovered by the Corporation with the focus of the 2011drilling program on the gold-rich Ciresata copper porphyry deposit. Four drill rigs are presently working at the Ciresata deposit with the objective of defining the deposit limits, upgrading the inferred resource to the measured plus indicated resource categories, as well as testing satellite targets.

Approximately 7,000 metres of the planned drill program have been completed year to date with results through drill-hole RGD-21 previously reported. Assay results from drill-holes RGD-22, 23, and 24 located in the south and southwest margin of the deposit have recently been received and include the following highlight intersections:

-- 434 metres at 0.95 g/t Au and 0.16% Cu (1.23 g/t Au-eq) in drill hole

RGD-24

-- Inclusive of 357 metres at 1.06 g/t Au and 0.17% Cu (1.41 g/t Au-

eq)(i)

-- 358 metres at 0.88 g/t Au and 0.16% Cu (1.21 g/t Au-eq) in drill hole

RGD-23

-- Inclusive of 210 metres at 1.02 g/t Au and 0.18% Cu (1.39 g/t Au-

eq)(i)

-- 410 metres at 0.73 g/t Au and 0.16% Cu (1.06 g/t Au-eq) in drill hole

RGD-22

-- Inclusive of 172 metres at 1.05 g/t Au and 0.22% Cu (1.50 g/t Au-

eq)(i)

"We continue to be impressed with the drill results from the Ciresata porphyry and look forward to further drill results from our accelerated program", said Dino Titaro, President and CEO of Carpathian." Mr. Titaro adds, "The Ciresata porphyry continues to demonstrate its high-grade tenor emphasizing the new gold-rich porphyry class of deposit we have discovered in Romania. The results from the ongoing 2011 drill program support our belief that the size of this deposit will be enhanced and will contribute significantly to the results of our RVP pre-feasibility study".

Core hole RGD-23 is the southern-most deep drill hole completed to date and extends the drill-defined mineralization a further 60 metres to the south. This drill hole intersected significant gold-copper mineralization over 358 metres and includes a higher-grade core of 210 metres at 1.39 g/t Au-eq(i).

Core hole RGD-22 is a step-out from drill hole RGD-16 (which intersected 791 m at 0.63 g/t Au and 0.14% Cu, including 208 m of 1.13 g/t Au and 0.19% Cu) located on the southwest margin of the deposit and extended the drill-defined mineralization a further 75 metres to the southwest. Hole RGD-22 intersected significant gold-copper mineralization over 410 metres and includes a higher-grade core of 172 metres at 1.50 g/t Au-eq(i).

Core hole RGD-24 is an in-fill drill hole in the southwest part of the deposit and near drill hole RGD-5, which was only drilled to a relatively shallow depth of 369 metres (which intersected 65 m at 0.77 g/t Au and 0.12% Cu for 1.02 g/t Au-eq). RGD-24 intersected significant gold-copper mineralization well below the area tested by hole RGD-5 and intersected 434 metres of strong gold copper mineralization, including 357 metres of 1.41 g/t Au-eq(i).

Drill hole locations are shown on the Drill-hole Plan Map on the Corporations website at www.carpathiangold.com.

Below is a drill-hole intersection table from the recently received assay results:

weiter: http://www.carpathiangold.com/news/press-releases/press-rele…

Carpathian Advancing the RDM Gold Project, Brazil and Provides an Update on Activities

May 12, 2011

Carpathian Gold is pleased to provide a progress update on its 100% owned Riacho dos Machados gold project ("RDM" or the "Project), located in Minas Gerais State, Brazil. On April 6, 2011, the Corporation announced the results of a positive NI 43-101 compliant Feasibility Study and a construction decision for the Project.

The Project is rapidly advancing with site construction and pre-production phases to begin in the second and third quarters of 2011. The bids for the site works, access road upgrades and fuel supply are being finalized with an expected mobilization date of August 2011. Detailed monthly and yearly production mining plans are currently being prepared and optimized to enhance the mill-feed grade. Additionally, detailed engineering for the construction phase of the Project is progressing on schedule.

With regard to the senior debt financing for the development of the Project, technical and legal due diligence is well underway with a targeted completion time frame in about 60 days.

To manage the Project activities and subsequent operations, the Corporation's wholly owned Brazilian Subsidiary, Mineracao Riachos dos Machados Ltda. ("MRDM") has recently hired several key professionals to ensure that the Project is completed within the budget and projected timeline with expected gold production targeted to begin towards the end of 2012. Managers for all key areas of our future mining operations are now in place. They include the General Manger, the Safety Coordinator, the Manager of Finance, Accounting, and Control, the Manager of Technical Services, the Process Plant Manager and the Manager of Environment, Community and Government Relations. MRDM has also interviewed several candidates for the position of Mine Manager and expects to have this position filled soon.

The Corporation is very pleased with the high quality calibre of the Brazilian team that has been assembled to date as they have the necessary experience and know-how to bring the Project into production and ensure that it is profitable in the years ahead. These people are the majority of core people that are required to develop and manage the operations and success of the RDM Gold Project. This team will be directly involved with the development of the Project as well as with the recruitment process to acquire the additional personnel necessary to operate and maintain the facilities in a safety oriented, efficient and cost effective manner and in full compliance with best practice environmental standards.

Exploration Program

The gold mineralization on the Project is situated within a continuous 14.0 kilometre long shear zone hosted in Precambrian metamorphic rocks with a demonstrated gold endowment. This shear zone is fully covered by the Corporation's mining concession and exploration licenses that extend over a continuous strike-length of approximately 40 kilometres. The most intensely explored zone to date has been at the RDM mine site location and only represents approximately 2.0 kilometres of the southern portion of the 14 km long shear zone. There are numerous surface gold targets of similar gold grade that occur along strike of the mine site within this shear zone and to date a total of at least five (5) priority exploration targets have been outlined north of the open-pit area and one to the south. The Corporation expects to embark on a drilling exploration program in June to evaluate these targets as well as other targets with the goal of defining further resources with the potential to provide additional plant feed and mine life.

Background highlights of the recently announced Feasibility Study

-- Proven and probable open-pit reserves of 20.9 million tonnes at 1.24 g/t Au for 830,200 ounces of gold (based on a US$950 per ounce gold pit-shell).

-- Initial 8-year mine life at a mill throughput of approximately 7,000 tonnes per day utilizing conventional open-pit mining and crushing-grinding with CIL recovery of gold.

-- Average annual recoverable gold production of 93,400 ounces (100,000 ounces/year in the first three years of operation).

-- Average cash operating cost over the life of mine of US$558 per ounce. -- Pre-tax project net present value ("NPV") of US$150.8 million based on a 5% discount rate using a gold price of US$ 1,150 per ounce resulting in an internal rate of return ("IRR) of 24.9%.

-- After-tax project NPV of US$123.8 million based on a 5% discount rate at US$ 1,150 per ounce with an IRR of 21.9%.

-- Using a price of US$1,350 per oz for gold, the after-tax NPV based on a 5% discount rate is US$220 million with an IRR of 33.4%.

-- Estimated start up capital of US$160 million. -- Global measured plus indicated mineral resource of 936,600 ounces (inclusive of mineral reserves) with another 587,300 ounces in the inferred category.

-- Additional opportunities for future conversion of resources to reserves and resource growth, reduction in capital and increased mill feed grade.

http://finance.yahoo.com/news/Carpathian-Advancing-the-RDM-c…

May 12, 2011

Carpathian Gold is pleased to provide a progress update on its 100% owned Riacho dos Machados gold project ("RDM" or the "Project), located in Minas Gerais State, Brazil. On April 6, 2011, the Corporation announced the results of a positive NI 43-101 compliant Feasibility Study and a construction decision for the Project.

The Project is rapidly advancing with site construction and pre-production phases to begin in the second and third quarters of 2011. The bids for the site works, access road upgrades and fuel supply are being finalized with an expected mobilization date of August 2011. Detailed monthly and yearly production mining plans are currently being prepared and optimized to enhance the mill-feed grade. Additionally, detailed engineering for the construction phase of the Project is progressing on schedule.

With regard to the senior debt financing for the development of the Project, technical and legal due diligence is well underway with a targeted completion time frame in about 60 days.

To manage the Project activities and subsequent operations, the Corporation's wholly owned Brazilian Subsidiary, Mineracao Riachos dos Machados Ltda. ("MRDM") has recently hired several key professionals to ensure that the Project is completed within the budget and projected timeline with expected gold production targeted to begin towards the end of 2012. Managers for all key areas of our future mining operations are now in place. They include the General Manger, the Safety Coordinator, the Manager of Finance, Accounting, and Control, the Manager of Technical Services, the Process Plant Manager and the Manager of Environment, Community and Government Relations. MRDM has also interviewed several candidates for the position of Mine Manager and expects to have this position filled soon.

The Corporation is very pleased with the high quality calibre of the Brazilian team that has been assembled to date as they have the necessary experience and know-how to bring the Project into production and ensure that it is profitable in the years ahead. These people are the majority of core people that are required to develop and manage the operations and success of the RDM Gold Project. This team will be directly involved with the development of the Project as well as with the recruitment process to acquire the additional personnel necessary to operate and maintain the facilities in a safety oriented, efficient and cost effective manner and in full compliance with best practice environmental standards.

Exploration Program

The gold mineralization on the Project is situated within a continuous 14.0 kilometre long shear zone hosted in Precambrian metamorphic rocks with a demonstrated gold endowment. This shear zone is fully covered by the Corporation's mining concession and exploration licenses that extend over a continuous strike-length of approximately 40 kilometres. The most intensely explored zone to date has been at the RDM mine site location and only represents approximately 2.0 kilometres of the southern portion of the 14 km long shear zone. There are numerous surface gold targets of similar gold grade that occur along strike of the mine site within this shear zone and to date a total of at least five (5) priority exploration targets have been outlined north of the open-pit area and one to the south. The Corporation expects to embark on a drilling exploration program in June to evaluate these targets as well as other targets with the goal of defining further resources with the potential to provide additional plant feed and mine life.

Background highlights of the recently announced Feasibility Study

-- Proven and probable open-pit reserves of 20.9 million tonnes at 1.24 g/t Au for 830,200 ounces of gold (based on a US$950 per ounce gold pit-shell).

-- Initial 8-year mine life at a mill throughput of approximately 7,000 tonnes per day utilizing conventional open-pit mining and crushing-grinding with CIL recovery of gold.

-- Average annual recoverable gold production of 93,400 ounces (100,000 ounces/year in the first three years of operation).

-- Average cash operating cost over the life of mine of US$558 per ounce. -- Pre-tax project net present value ("NPV") of US$150.8 million based on a 5% discount rate using a gold price of US$ 1,150 per ounce resulting in an internal rate of return ("IRR) of 24.9%.

-- After-tax project NPV of US$123.8 million based on a 5% discount rate at US$ 1,150 per ounce with an IRR of 21.9%.

-- Using a price of US$1,350 per oz for gold, the after-tax NPV based on a 5% discount rate is US$220 million with an IRR of 33.4%.

-- Estimated start up capital of US$160 million. -- Global measured plus indicated mineral resource of 936,600 ounces (inclusive of mineral reserves) with another 587,300 ounces in the inferred category.

-- Additional opportunities for future conversion of resources to reserves and resource growth, reduction in capital and increased mill feed grade.

http://finance.yahoo.com/news/Carpathian-Advancing-the-RDM-c…

Q1-Bericht

Financial Statements http://www.sedar.com/GetFile.do?lang=EN&docClass=5&issuerNo=…

MD&A http://www.sedar.com/GetFile.do?lang=EN&docClass=7&issuerNo=…

Financial Statements http://www.sedar.com/GetFile.do?lang=EN&docClass=5&issuerNo=…

MD&A http://www.sedar.com/GetFile.do?lang=EN&docClass=7&issuerNo=…

heute gehts richtig zur Sache - im positiven Sinne, ist man garnicht mehr gewohnt.......

Brazil eyes new tax on big mining projects: paper

* Gov't wants new tax on big mining projects

* Mining industry says to lose competitiveness

* Mines and finance ministries discuss new mining tax

June 21 2011

Brazil could create a new tax on large mining projects as part of the government's overhaul of the mining code, a local paper reported on Tuesday, a move that would be costly for mining giant Vale.

The mining and finance ministries are considering imposing a so-called "special participation" tax on large mining projects similar to one that already exists in the oil sector for high productivity fields, the Folha de S. Paulo newspaper reported, without naming sources.

The proposal would levy the tax on 25 percent of the existing mining concessions, the paper said, including the main projects of Brazil's Vale, the world's largest iron ore miner.

The proposal would make up part of a broader overhaul of regulations covering Brazil's mining sector, which would also include a potential increase in royalties that companies must pay to the government.

The special participation tax would be applied to gross revenues from production, and deducted from investments in exploration and operational costs, Folha reported.

It would come on top of royalties that mining companies already pay that currently stand at roughly 2 percent of net revenue. Analysts in recent months have said they expect the government to raise royalty rates.

The mining industry opposes tax increases, particularly the royalty increase, saying that it would reduce the Brazil's competitiveness because mining companies already have a high overall tax burden.

The government expects to send a draft bill to Congress in the second half of 2011, after more than a year of discussions with the industry.

Separately, Brazil's mining industry group Ibram said iron ore production will double by 2015 to 787 million tonnes a year from the current 370 million tonnes, and that Vale's dominance in the local market will diminish with new mining investments by other companies.

http://af.reuters.com/article/metalsNews/idAFN1E75K02P201106…

* Gov't wants new tax on big mining projects

* Mining industry says to lose competitiveness

* Mines and finance ministries discuss new mining tax

June 21 2011

Brazil could create a new tax on large mining projects as part of the government's overhaul of the mining code, a local paper reported on Tuesday, a move that would be costly for mining giant Vale.

The mining and finance ministries are considering imposing a so-called "special participation" tax on large mining projects similar to one that already exists in the oil sector for high productivity fields, the Folha de S. Paulo newspaper reported, without naming sources.

The proposal would levy the tax on 25 percent of the existing mining concessions, the paper said, including the main projects of Brazil's Vale, the world's largest iron ore miner.

The proposal would make up part of a broader overhaul of regulations covering Brazil's mining sector, which would also include a potential increase in royalties that companies must pay to the government.

The special participation tax would be applied to gross revenues from production, and deducted from investments in exploration and operational costs, Folha reported.

It would come on top of royalties that mining companies already pay that currently stand at roughly 2 percent of net revenue. Analysts in recent months have said they expect the government to raise royalty rates.

The mining industry opposes tax increases, particularly the royalty increase, saying that it would reduce the Brazil's competitiveness because mining companies already have a high overall tax burden.

The government expects to send a draft bill to Congress in the second half of 2011, after more than a year of discussions with the industry.

Separately, Brazil's mining industry group Ibram said iron ore production will double by 2015 to 787 million tonnes a year from the current 370 million tonnes, and that Vale's dominance in the local market will diminish with new mining investments by other companies.

http://af.reuters.com/article/metalsNews/idAFN1E75K02P201106…

heute gab´s gewaltige Umsätze. Leider ohne daß dies zu höheren Kursen führte

Antwort auf Beitrag Nr.: 41.726.436 von MFC500 am 30.06.11 22:26:35was kann man daraus schliessen? Versuchter "Ausbruch" nach oben?

Antwort auf Beitrag Nr.: 41.726.766 von Timesystem1002 am 30.06.11 23:59:28Es ist eine Auffälligkeit, mehr nicht. Ob sie Vorbote von was auch immer ist, wird man sehen

Carpathian Reports Further Significant Drill Results at Ciresata, Romania: 314 m of 1.08 g/t Au and 0.20% Cu (1.48 g/t Au-eq(i))

http://www.stockhouse.com/News/CanadianReleasesDetail.aspx?n…

Carpathian Gold Inc CPN 7/11/2011 11:44:04 AMTORONTO, ONTARIO, Jul 11, 2011 (MARKETWIRE via COMTEX News Network) --

Carpathian Gold Inc. (TSX:CPN) (the "Corporation" or "Carpathian") is pleased to provide further results from its 35,000 metre 2011 diamond drill program at the Corporation's 100% owned Rovina Valley Project ("RVP") in west-central Romania. The RVP includes three Au-Cu porphyries discovered by the Corporation with the focus of the 2011 drilling program on the gold-rich Ciresata copper porphyry deposit. Four drill rigs are presently working at the Ciresata deposit, with a fifth drill rig arriving this week, with the objective of defining the deposit limits, upgrading the inferred resource to the measured plus indicated resource categories, as well as testing satellite targets.

Approximately 14,500 metres of the planned drill program have been completed at the Ciresata porphyry deposit year-to-date with results through to drill-hole RGD-24 previously reported. Assay results from an additional five drill-holes (RGD-25, 26, 27, 28, 29 and RGD-30) have been received representing 4,152 metres of drilling and are reported herein. With the exception of RGD-27, which is an in-fill hole, all of the other drill holes reported here are located on the outer perimeter of the Ciresata deposit. The following significant Au-Cu intercepts from these latest drill holes are highlight below.

http://www.stockhouse.com/News/CanadianReleasesDetail.aspx?n…

Carpathian Gold Inc CPN 7/11/2011 11:44:04 AMTORONTO, ONTARIO, Jul 11, 2011 (MARKETWIRE via COMTEX News Network) --

Carpathian Gold Inc. (TSX:CPN) (the "Corporation" or "Carpathian") is pleased to provide further results from its 35,000 metre 2011 diamond drill program at the Corporation's 100% owned Rovina Valley Project ("RVP") in west-central Romania. The RVP includes three Au-Cu porphyries discovered by the Corporation with the focus of the 2011 drilling program on the gold-rich Ciresata copper porphyry deposit. Four drill rigs are presently working at the Ciresata deposit, with a fifth drill rig arriving this week, with the objective of defining the deposit limits, upgrading the inferred resource to the measured plus indicated resource categories, as well as testing satellite targets.

Approximately 14,500 metres of the planned drill program have been completed at the Ciresata porphyry deposit year-to-date with results through to drill-hole RGD-24 previously reported. Assay results from an additional five drill-holes (RGD-25, 26, 27, 28, 29 and RGD-30) have been received representing 4,152 metres of drilling and are reported herein. With the exception of RGD-27, which is an in-fill hole, all of the other drill holes reported here are located on the outer perimeter of the Ciresata deposit. The following significant Au-Cu intercepts from these latest drill holes are highlight below.

Antwort auf Beitrag Nr.: 41.771.703 von grasgruener am 11.07.11 18:04:01erneut hervorragende Ergebnisse. Rovina Valley findet leider unverändert keinen Eingang in die Bewertung der Aktie

Man muss halt auch erst 250 Meter Abraum wegräumen, bis man an das Gold und Kupfer rankommt. Für blockcaving scheint mir die Mineralisation zu gering, Open Pit benötigt halt eine irrsinns lange Anlaufzeit, in der du nur Kosten für den Abraum hast, was sich schlecht auf die Verzinsung auswirkt.

Das dürfte nichts desto trotz eine ganz ganz spannende PFS geben.

Immerhin hat der heute gemeldete Intervall über 70$ Materialwert die Tonne.

Das dürfte nichts desto trotz eine ganz ganz spannende PFS geben.

Immerhin hat der heute gemeldete Intervall über 70$ Materialwert die Tonne.

Antwort auf Beitrag Nr.: 41.772.131 von valueinvestor am 11.07.11 19:38:37Jo, es ist ein low-grade Deposit, dessen Mineralisierung zudem nicht obberflächennah verläuft. Aber die PEA lieferte ja bereits erste Indikatoren bzgl der Wirtschaftlichkeit. Dabei wurde für das Rovina und Colnic Deposit konventionelles open-pit mining und für das höhergradige Ciresata Deposit bulk-underground mining zugrunde gelegt.*

Hauptknackpunkt wird aus meiner Sicht die CAPEX sein. Die PFS dürfte einen deutlich höheren Wert ergeben als in der PEA geschätzt. Trotz anzunehmendem Cashflow des Brazilienprojektes wird man zur Realisierung von Rovina einen Partner benötigen. Mit Blick auf die Schwierigkeiten der anderen in Rumänien agierenden Goldexplorer bestehen überdies grundsätzliche Fragezeichen, was die Realisierung des Projektes anbelangt. Hier liegt jedoch umgekehrt auch ein immenses Überraschungspotential, da der aktuelle Kurs nicht einmal den fairen Wert von RDM widerspiegelt

*The Project will be a conventional open pit mine with down-the-hole drill blast hole, hydraulic shovels and conventional haul trucks for the Rovina and Colnic deposits located approximately 2.5 km apart. Mining production from the combined two open pits is planned at 20,000 t/d. The Ciresata deposit will be mined by a combination of a sublevel panel retreat mining in the upper levels of the deposit accessed by a decline from the surface, and an induced block cave method for the lower part of the deposit. The upper sublevel panel retreat mining will allow mining access to high-grade ore while development occurs to prepare for the induced block cave operation at depth. At full capacity, the underground operation will mine 20,000 t/d. Ore from the induced block cave operation will be fed to the centralized process plant located between the Rovina and Colnic deposits via a 6 km inclined conveyor tunnel to the surface.

Hauptknackpunkt wird aus meiner Sicht die CAPEX sein. Die PFS dürfte einen deutlich höheren Wert ergeben als in der PEA geschätzt. Trotz anzunehmendem Cashflow des Brazilienprojektes wird man zur Realisierung von Rovina einen Partner benötigen. Mit Blick auf die Schwierigkeiten der anderen in Rumänien agierenden Goldexplorer bestehen überdies grundsätzliche Fragezeichen, was die Realisierung des Projektes anbelangt. Hier liegt jedoch umgekehrt auch ein immenses Überraschungspotential, da der aktuelle Kurs nicht einmal den fairen Wert von RDM widerspiegelt

*The Project will be a conventional open pit mine with down-the-hole drill blast hole, hydraulic shovels and conventional haul trucks for the Rovina and Colnic deposits located approximately 2.5 km apart. Mining production from the combined two open pits is planned at 20,000 t/d. The Ciresata deposit will be mined by a combination of a sublevel panel retreat mining in the upper levels of the deposit accessed by a decline from the surface, and an induced block cave method for the lower part of the deposit. The upper sublevel panel retreat mining will allow mining access to high-grade ore while development occurs to prepare for the induced block cave operation at depth. At full capacity, the underground operation will mine 20,000 t/d. Ore from the induced block cave operation will be fed to the centralized process plant located between the Rovina and Colnic deposits via a 6 km inclined conveyor tunnel to the surface.

Typisch für Kulmbach, einem Förtsch-Ableger:

Kauf im "Echtegelddepot":

Aktie Carpathian

Stückzahl:

10.000

Ausführungskurs:

0,347 Euro

Ausmachender Betrag:

3.470,00 (exklusive Gebühren)

Depotanteil:

17 Prozent

Maximales Kauflimit

0,36 Euro

Uli Pfauntsch

Hinweis §34 WPHG: Der Autor / die Autoren halten Longpositionen in

Carpathian Gold.

---CM Network GmbH / Grabenstr.4 / 95326 Kulmbach

Kauf im "Echtegelddepot":

Aktie Carpathian

Stückzahl:

10.000

Ausführungskurs:

0,347 Euro

Ausmachender Betrag:

3.470,00 (exklusive Gebühren)

Depotanteil:

17 Prozent

Maximales Kauflimit

0,36 Euro

Uli Pfauntsch

Hinweis §34 WPHG: Der Autor / die Autoren halten Longpositionen in

Carpathian Gold.

---CM Network GmbH / Grabenstr.4 / 95326 Kulmbach

Antwort auf Beitrag Nr.: 41.782.419 von MAE-Carlsson am 13.07.11 15:25:14Was ist deiner Meinung nach dabei nicht in Ordnung ?

Antwort auf Beitrag Nr.: 41.784.642 von Dinino am 13.07.11 20:43:43Frag ich mich auch. Chartausbruch unter hohem Volumen - das sieht richtig gut aus!

Zitat von Dinino: Was ist deiner Meinung nach dabei nicht in Ordnung ?

Dafür wurde Frick verurteilt

Der Autor ist bereits drin, schickt seine Leser, die mit ihren Käufen den marktengen Wert zum Steigen bringen und der Autor profitiert davon privat.

Risikoloses Geschäft, wenn man die Stücke vorher eingesammelt hat und jetzt an die Leser verscherbelt.

Ihr kauft quasi die Stücke von Pfauntsch, der die Aktien vermutlich vor 2 Tagen mit 0,30 gekauft hat.

Antwort auf Beitrag Nr.: 41.785.334 von MAE-Carlsson am 13.07.11 22:48:28Hallo? Es ist ein ECHTGELD-DEPOT - das heißt, dass der Börsenbrief bzw. die Autoren mit echtem Geld investieren. Carpathian hat 180 Millionen Dollar Marketcap. und riesen Streubesitz. Viele große Fonds sind hier mit an Bord - der Vergleich mit Frick-Aktien ist total kindisch.

CPN hat mit 2,6 Mio. Stück in Kanada auf Tageshoch geschlossen - haben wohl mehr ge- als verkauft!?

Die Ölaktie PFC heute mit 500.000 Stück Umsatz um 15% rauf - da haben die Autoren wohl auch geschmissen?

Mann, du musst ja echt schlechte Erfahrungen an der Börse gemacht haben...

CPN hat mit 2,6 Mio. Stück in Kanada auf Tageshoch geschlossen - haben wohl mehr ge- als verkauft!?

Die Ölaktie PFC heute mit 500.000 Stück Umsatz um 15% rauf - da haben die Autoren wohl auch geschmissen?

Mann, du musst ja echt schlechte Erfahrungen an der Börse gemacht haben...

Zitat von schwochner: Hallo? Es ist ein ECHTGELD-DEPOT - das heißt, dass der Börsenbrief bzw. die Autoren mit echtem Geld investieren. Carpathian hat 180 Millionen Dollar Marketcap. und riesen Streubesitz. Viele große Fonds sind hier mit an Bord - der Vergleich mit Frick-Aktien ist total kindisch.

CPN hat mit 2,6 Mio. Stück in Kanada auf Tageshoch geschlossen - haben wohl mehr ge- als verkauft!?

Die Ölaktie PFC heute mit 500.000 Stück Umsatz um 15% rauf - da haben die Autoren wohl auch geschmissen?

Mann, du musst ja echt schlechte Erfahrungen an der Börse gemacht haben...

Man kann auch schmeissen ohne das der Kurs wegknickt.

Jedenfalls ist der Autor vor den Lesern rein und nicht danach.

Es geht um Vorteilsnahme, um Frontrunning. Um risikofreies Geschäft.

Aber ich glaube nicht, dass du das kapierst

......

......

Antwort auf Beitrag Nr.: 41.785.334 von MAE-Carlsson am 13.07.11 22:48:28es besteht ja wohl ein erheblicher Unterschied zwischen dem Pushen wertloser Papiere und einer Aktie wie Carpathian.

guten abend zusammen,

toll geführter Thread werde hier einsteigen warte noch morgen mal ab wo der Kurs hingeht und schlage dann zu

Volumen ist auch sehr gut.

gruß brocki

toll geführter Thread werde hier einsteigen warte noch morgen mal ab wo der Kurs hingeht und schlage dann zu

Volumen ist auch sehr gut.

gruß brocki

For Immediate Release 14 July 2011

Das hat der Rumänien-Mitbewerber Gabriel gemeldet:

Gabriel Resources Ltd

Grant of Archaeological Discharge Certificate

Toronto, Ontario, Canada - July 14, 2011: Gabriel Resources Ltd. ("Gabriel" or "the Company") announces that it has been granted an archaeological discharge certificate for the Carnic open pit at the Company's Rosia Montana gold and silver project ("Project"), located in Romania.

The Company continues to work with the Romanian Government to ensure the Project is fully permitted within the laws of Romania and the European Union. Gabriel will report further on its progress with respect to the permitting approval process in its second quarter results announcement on or around August 3, 2011.

Jonathan Henry commented: "The granting of the archaeological discharge certificate for Carnic is a significant step to receipt of other key permits and approvals required to advance the Rosia Montana gold and silver project, which will deliver much-needed economic development and employment to the region as well as to Romania."

Das hat der Rumänien-Mitbewerber Gabriel gemeldet:

Gabriel Resources Ltd

Grant of Archaeological Discharge Certificate

Toronto, Ontario, Canada - July 14, 2011: Gabriel Resources Ltd. ("Gabriel" or "the Company") announces that it has been granted an archaeological discharge certificate for the Carnic open pit at the Company's Rosia Montana gold and silver project ("Project"), located in Romania.

The Company continues to work with the Romanian Government to ensure the Project is fully permitted within the laws of Romania and the European Union. Gabriel will report further on its progress with respect to the permitting approval process in its second quarter results announcement on or around August 3, 2011.

Jonathan Henry commented: "The granting of the archaeological discharge certificate for Carnic is a significant step to receipt of other key permits and approvals required to advance the Rosia Montana gold and silver project, which will deliver much-needed economic development and employment to the region as well as to Romania."

so bin zu 0,427 dabei

auf gute Zeiten

auf gute Zeiten

Antwort auf Beitrag Nr.: 41.785.334 von MAE-Carlsson am 13.07.11 22:48:281. meines Wissens gibts im Frick Prozess noch lange keine Verurteilung

2. kann man auf der Welle gut mitsurfen

2. kann man auf der Welle gut mitsurfen

Antwort auf Beitrag Nr.: 41.797.169 von brocklesnar am 15.07.11 20:04:18Willkommen an Bord

WOW!

July 18, 2011 07:00 ET

Carpathian Gold Inc. Announces $20 Million Strategic Placement by Barrick Gold Corporation

TORONTO, ONTARIO--(Marketwire - July 18, 2011) - Carpathian Gold Inc. (TSX:CPN) (the "Corporation" or "Carpathian") is pleased to announce that it has concluded an agreement (the "Agreement") with Barrick Gold Corporation ("Barrick") for a CDN$20 Million private placement to purchase 38,461,538 common shares (the "Private Placement" and the "Common Shares") of the Corporation at a price of $0.52 per share. The Common Shares will be subject to a four-month hold period. The proceeds from the Private Placement will be exclusively applied to the Corporation's ongoing exploration and development work on its wholly owned Rovina Valley Project ("RVP") situated in west-central Romania.

The Corporation has committed to use certain of the proceeds from the Private Placement to expand the Corporation's previously announced 2011 drill program by at least an additional 15,000 m (from 35,000 m to 50,000 m) which will focus on expanding the Ciresata Au-Cu porphyry deposit as well as testing surrounding targets and other satellite targets on the project as prescribed by Barrick. Additionally, the remainder of the funds will be used to expedite and complete the on-going drill program for purposes of an updated NI 43-101 resource estimate and to fund the on-going pre-feasibility study. The Corporation will have access to Barrick's technical expertise through an advisory technical committee of five people that will be comprised of three Carpathian and two Barrick representatives. In addition, up to two Barrick employees may be seconded to the project at Barrick's expense.

July 18, 2011 07:00 ET

Carpathian Gold Inc. Announces $20 Million Strategic Placement by Barrick Gold Corporation

TORONTO, ONTARIO--(Marketwire - July 18, 2011) - Carpathian Gold Inc. (TSX:CPN) (the "Corporation" or "Carpathian") is pleased to announce that it has concluded an agreement (the "Agreement") with Barrick Gold Corporation ("Barrick") for a CDN$20 Million private placement to purchase 38,461,538 common shares (the "Private Placement" and the "Common Shares") of the Corporation at a price of $0.52 per share. The Common Shares will be subject to a four-month hold period. The proceeds from the Private Placement will be exclusively applied to the Corporation's ongoing exploration and development work on its wholly owned Rovina Valley Project ("RVP") situated in west-central Romania.

The Corporation has committed to use certain of the proceeds from the Private Placement to expand the Corporation's previously announced 2011 drill program by at least an additional 15,000 m (from 35,000 m to 50,000 m) which will focus on expanding the Ciresata Au-Cu porphyry deposit as well as testing surrounding targets and other satellite targets on the project as prescribed by Barrick. Additionally, the remainder of the funds will be used to expedite and complete the on-going drill program for purposes of an updated NI 43-101 resource estimate and to fund the on-going pre-feasibility study. The Corporation will have access to Barrick's technical expertise through an advisory technical committee of five people that will be comprised of three Carpathian and two Barrick representatives. In addition, up to two Barrick employees may be seconded to the project at Barrick's expense.

Antwort auf Beitrag Nr.: 41.803.142 von grasgruener am 18.07.11 13:07:01klingt nach was großem oder?

Antwort auf Beitrag Nr.: 41.803.142 von grasgruener am 18.07.11 13:07:01die Nachricht als solche ist hervorragend; der Bezugspreis ist es jedoch nicht

wird der Kurs jetzt auf 0,52 erstmal runtergehen aufgrund der heutigen Meldung? ist ja bei einer PP üblich, das der Kurs erstmal nachgibt.

Antwort auf Beitrag Nr.: 41.803.253 von brocklesnar am 18.07.11 13:22:41kann sein muss aber nicht

die Tatsache das Barrick als einer der größten der Branche hier ein strategisches Investment vornimmt wirft insgesamt auf CPN ein sehr gutes Licht

die 0,52 wurden ausgehandelt als CPN wahrscheinlich zwischen 0,40 und 0,45 hinundherpendelte........dort war es ein Aufschlag von 25% - und das ist sehr gut

egal wie es läuft - es verbessert die Aussichten von CPN und beim aktuellem POG wird CPN weiter steigen

die Tatsache das Barrick als einer der größten der Branche hier ein strategisches Investment vornimmt wirft insgesamt auf CPN ein sehr gutes Licht

die 0,52 wurden ausgehandelt als CPN wahrscheinlich zwischen 0,40 und 0,45 hinundherpendelte........dort war es ein Aufschlag von 25% - und das ist sehr gut

egal wie es läuft - es verbessert die Aussichten von CPN und beim aktuellem POG wird CPN weiter steigen

Antwort auf Beitrag Nr.: 41.803.504 von grasgruener am 18.07.11 14:06:13bin hier mal dabei hört sich gut an

Antwort auf Beitrag Nr.: 41.803.576 von AMUN666 am 18.07.11 14:18:38außerdem sollte das reichen um allen klarzumachen das CPN keine Pushbude oder sonstewas ist, sondern ein Qualitätswert!

gab ja einige Zweifel als letzten ein dt.BB auf CPN aufmerksam gemacht hatte........

gab ja einige Zweifel als letzten ein dt.BB auf CPN aufmerksam gemacht hatte........

Antwort auf Beitrag Nr.: 41.803.142 von grasgruener am 18.07.11 13:07:01du hast nur einen Teil der Meldung eingestellt; anbei der Rest:

In connection with this announcement, Carpathian's President and CEO Dino Titaro said, "We view the transaction with Barrick as a significant endorsement of the Rovina Valley Project, our exploration team and Romania as a country with world-class mining potential. Equally important is the fact that these added funds together with access to Barrick's expertise will provide a major step up in Carpathian's development plans for the Rovina Valley Project."

Upon closing of the Private Placement, Barrick will own approximately 9.0% of the Corporation's issued capital. Except in certain circumstances, for as long as Barrick does not sell any Common Shares where its interest would fall below 8.5% in the share capital of the Corporation following the disposition, Barrick will have the right to participate in any future equity offerings by the Corporation to maintain its pro-rata share ownership and a right of first refusal, at the asset level only, on any disposition or sale of the Corporation's Romanian assets.

By way of an agreement entered into in connection with the acquisition by the Corporation of its RDM Project in Brazil, Zoneplan Limited and Repalla Inc. have a period of ten days during which they may elect to participate in a contemporaneous private placement under the same pricing terms in order to maintain their respective interests in the Corporation. In the event where such election is made up to its full allotment, the Corporation may issue approximately an additional 12.0 million common shares.

Closing of the Private Placement which is expected to take place on or about August 1, 2011 is subject to the customary conditions and regulatory approvals, including stock exchange approval.

http://finance.yahoo.com/news/Carpathian-Gold-Inc-Announces-…