Marathon Petroleum - 500 Beiträge pro Seite

eröffnet am 08.05.19 21:35:55 von

neuester Beitrag 14.12.23 16:49:24 von

neuester Beitrag 14.12.23 16:49:24 von

Beiträge: 41

ID: 1.303.626

ID: 1.303.626

Aufrufe heute: 0

Gesamt: 4.366

Gesamt: 4.366

Aktive User: 0

ISIN: US56585A1025 · WKN: A1JEXK · Symbol: MPC

182,55

USD

-0,22 %

-0,40 USD

Letzter Kurs 04.05.24 NYSE

Neuigkeiten

03.05.24 · Accesswire |

29.04.24 · Accesswire |

22.04.24 · Accesswire |

18.04.24 · Accesswire |

15.04.24 · Accesswire |

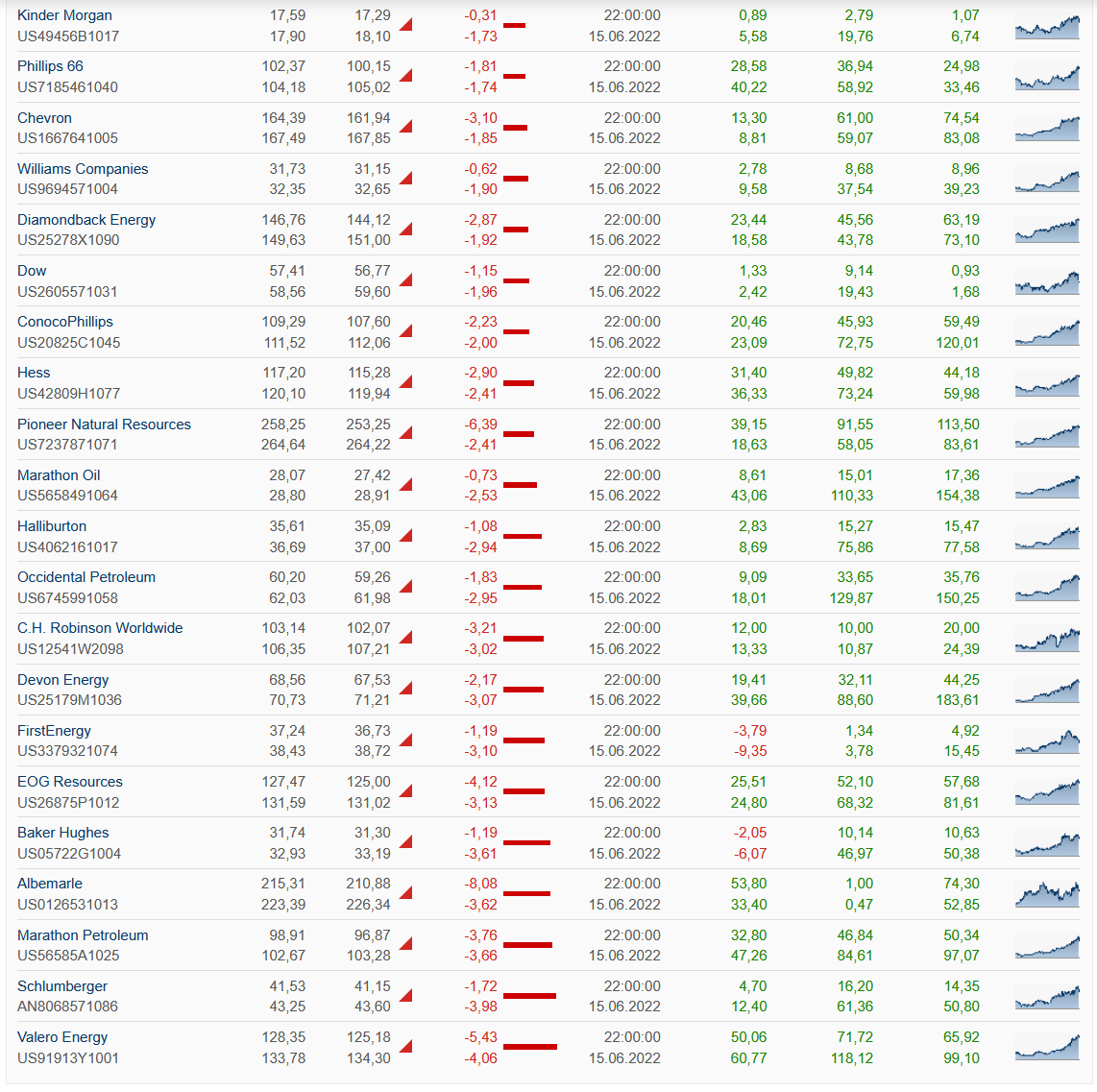

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1.300,00 | +23,81 | |

| 0,8529 | +22,54 | |

| 34,02 | +20,81 | |

| 0,8000 | +14,29 | |

| 19,650 | +11,77 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 12,145 | -8,89 | |

| 4,6700 | -10,19 | |

| 6,4900 | -10,97 | |

| 4,2000 | -11,39 | |

| 0,7400 | -22,11 |

8.5.

Marathon Petroleum combines midstream units, surprise loss drags down shares

https://finance.yahoo.com/news/marathon-petroleum-merge-mids…

=>

...Marathon Petroleum Corp said on Wednesday it would combine its midstream units in a $9 billion deal, but shares fell more than 5 percent following a surprise quarterly loss on lower-than-expected refining margins.

The deal comes months after the U.S. refiner said it had been weighing a possible merger of MPLX and Andeavor Logistics LP, the two master limited partnerships (MLPs) in its midstream segment that transport, store and market crude oil and its refined products.

"This transaction simplifies our MLPs into a single listed entity and creates a leading, large-scale, diversified midstream company anchored by fee-based cash flows," Chief Executive Officer Gary Heminger said in a statement.

The deal further deepens the refiner's presence in the Permian basin, the largest oilfield in the United States, building on its $23 billion Andeavor acquisition last year, the company said.

Marathon has been strengthening its midstream operations and retail unit, which includes Speedway gas stations and convenience stores and Andeavor's retail and direct dealer business, to diversify its revenue streams beyond refining.

"This transaction can likely unlock $2 billion value net to MPC that is being discounted by the market due to the overhang of this combination and concerns around future growth," Cowen & Co said.

Marathon Petroleum shares have fallen 4 percent so far this year, underperforming a 11 percent rise in the broader S&P 500 Energy Index.

Andeavor Logistics units rose nearly 9 percent to $35.66, while MPLX units fell about 2.5 percent to $30.76.

SURPRISE LOSS

Marathon Petroleum also reported a surprise first-quarter loss on Wednesday due to lower-than-expected refining margins and higher inventories.

The company's shares fell 5.3 percent to $56.31 as its surprise quarterly loss contrasted with rivals HollyFrontier Corp, Valero Energy Corp and Phillips 66, refiners that beat profit estimates at a time when analysts had expected poor performances.

Loss from Marathon Petroleum's refining and marketing unit nearly tripled to $334 million, bigger than $262 million estimated by Credit Suisse. Refining margins per barrel of $11.17 also fell short of Credit Suisse estimate of $13.85.

Excluding items, the company reported a loss of 9 cents per share, while analysts had expected a profit of 5 cents, according to IBES data from Refinitiv...

--> diese Reintegration von MLP's (US master limited partnerships) ist ja seit den US-Steuergesetzt-Änderungen, bzw. Reinterpretationen der IRS, zur Zeit sehr in Mode

Marathon Petroleum combines midstream units, surprise loss drags down shares

https://finance.yahoo.com/news/marathon-petroleum-merge-mids…

=>

...Marathon Petroleum Corp said on Wednesday it would combine its midstream units in a $9 billion deal, but shares fell more than 5 percent following a surprise quarterly loss on lower-than-expected refining margins.

The deal comes months after the U.S. refiner said it had been weighing a possible merger of MPLX and Andeavor Logistics LP, the two master limited partnerships (MLPs) in its midstream segment that transport, store and market crude oil and its refined products.

"This transaction simplifies our MLPs into a single listed entity and creates a leading, large-scale, diversified midstream company anchored by fee-based cash flows," Chief Executive Officer Gary Heminger said in a statement.

The deal further deepens the refiner's presence in the Permian basin, the largest oilfield in the United States, building on its $23 billion Andeavor acquisition last year, the company said.

Marathon has been strengthening its midstream operations and retail unit, which includes Speedway gas stations and convenience stores and Andeavor's retail and direct dealer business, to diversify its revenue streams beyond refining.

"This transaction can likely unlock $2 billion value net to MPC that is being discounted by the market due to the overhang of this combination and concerns around future growth," Cowen & Co said.

Marathon Petroleum shares have fallen 4 percent so far this year, underperforming a 11 percent rise in the broader S&P 500 Energy Index.

Andeavor Logistics units rose nearly 9 percent to $35.66, while MPLX units fell about 2.5 percent to $30.76.

SURPRISE LOSS

Marathon Petroleum also reported a surprise first-quarter loss on Wednesday due to lower-than-expected refining margins and higher inventories.

The company's shares fell 5.3 percent to $56.31 as its surprise quarterly loss contrasted with rivals HollyFrontier Corp, Valero Energy Corp and Phillips 66, refiners that beat profit estimates at a time when analysts had expected poor performances.

Loss from Marathon Petroleum's refining and marketing unit nearly tripled to $334 million, bigger than $262 million estimated by Credit Suisse. Refining margins per barrel of $11.17 also fell short of Credit Suisse estimate of $13.85.

Excluding items, the company reported a loss of 9 cents per share, while analysts had expected a profit of 5 cents, according to IBES data from Refinitiv...

--> diese Reintegration von MLP's (US master limited partnerships) ist ja seit den US-Steuergesetzt-Änderungen, bzw. Reinterpretationen der IRS, zur Zeit sehr in Mode

Antwort auf Beitrag Nr.: 60.520.932 von faultcode am 08.05.19 21:35:55

Marathon Petroleum's stock surges after Elliott urges action to unlock shareholder value

https://www.marketwatch.com/story/marathon-petroleums-stock-…

--> dazu noch von 2016:

Cramer warns of disastrous consequences for Elliott’s stake in Marathon Petroleum

https://www.cnbc.com/2016/12/09/cramer-warns-of-disastrous-c…

ich glaub, das ist nun der 3.Versuch oder so: Elliott

25.9. Marathon Petroleum's stock surges after Elliott urges action to unlock shareholder value

https://www.marketwatch.com/story/marathon-petroleums-stock-…

--> dazu noch von 2016:

Cramer warns of disastrous consequences for Elliott’s stake in Marathon Petroleum

https://www.cnbc.com/2016/12/09/cramer-warns-of-disastrous-c…

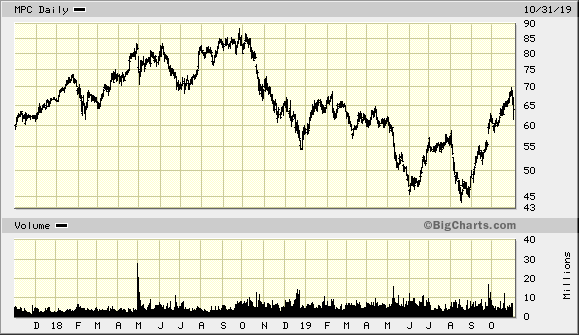

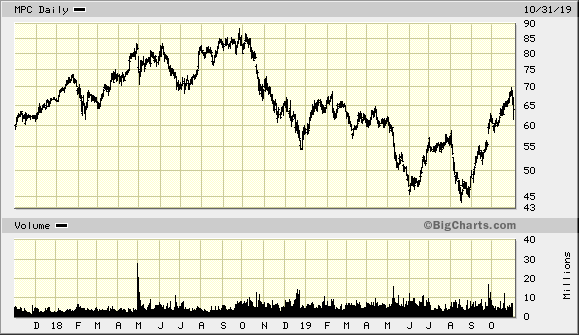

31.10.

Marathon Petroleum to change CEO, split company after hedge fund campaign

https://finance.yahoo.com/news/1-marathon-sell-speedway-see-…

=>

...Marathon Petroleum Corp chief Gary Heminger will leave the company next year and the largest U.S. independent refiner will launch a sweeping restructuring including the spinoff of its retail operations, steps demanded by activist investors.

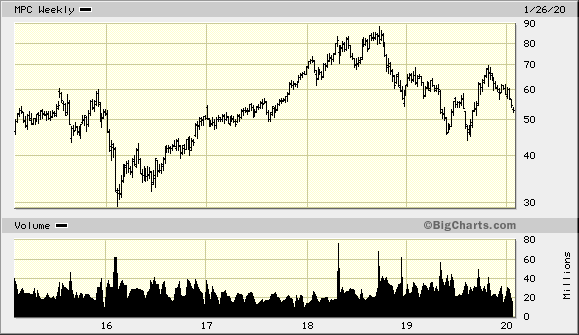

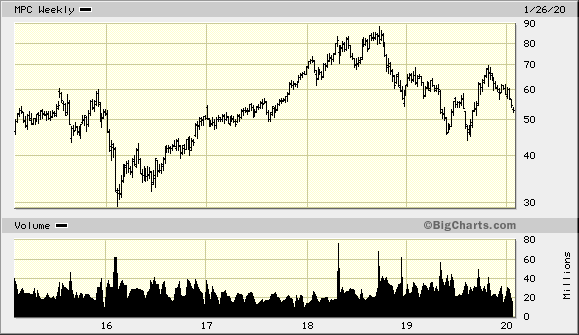

The changes were a victory for Elliott Management, DE Shaw and other investors that had sought a shakeup to boost the company's lagging share price following its troubled 2018 acquisition of rival Andeavor. Still, shares on Thursday slid 3.5% to $63.82 in mid-day trade despite third quarter results that topped analysts' estimates.

The $23 billion Andeavor deal gave Marathon a coast-to-coast refining network. But its shares fell to a two-year low this summer as investors were disappointed with the deal's impact on results.

Marathon said Chief Executive Officer Heminger would retire next year when his current term ends. He has worked for Marathon since the mid-1970s and has been at the helm since 2011. Greg Goff, a top executive and former CEO of Andeavor, also will leave at year-end, the company said.

...

Billionaire Paul Singer's Elliott, which last month said it owns a 2.5% economic interest in Marathon, has argued a three-way split of the company would boost shareholder value by as much as $40 billion.

As well as spinning off the retail gas station business Speedway, Marathon said it was launching a strategic review of its pipeline and storage operations. The two businesses provide about half of Marathon's earnings. Speedway will trade as an independent public company after the separation is completed.

Elliott said it supported the moves announced on Thursday, adding it expected these measures would unlock substantial value for shareholders.

Former Andeavor board members Paul Foster and Jeff Stevens, who together own about 1.7% of Marathon, also had backed the proposals and had called for Heminger's immediate removal. The two declined to comment on Thursday.

"We see this (spinoff) as unlocking significant value for current MPC shareholders," analysts at Edward Jones wrote in a note.

Separately, Marathon beat analysts' estimates for quarterly profit on Thursday, benefiting from transporting higher volumes of crude and natural gas across its pipelines.

Excluding items, the company reported an adjusted profit of $1.63 per share, compared to analysts' average estimates of $1.38 per share, according to IBES data from Refinitiv.

Net income attributable to the company rose 48.6% to $1.10 billion, or $1.67 per share, in the third quarter ended Sept. 30. It earned $1.62 a share in the same quarter a year ago.

Total revenue and other income rose to $31.20 billion from $23.13 billion.

Till a day before Elliott made its call for changes on Sept. 25, Marathon's shares were down about 6% this year. Shares were up about 12% for the year through Wednesday's close.

Smaller rival HollyFrontier Corp also posted a better-than-expected quarterly profit on Thursday, a week after peers Phillips 66 and Valero Energy Corp reported earnings beat. (Reporting by Shradha Singh and Shanti S Nair in Bengaluru; Editing by Subhranshu Sahu, Gary McWilliams and David Gregorio)

--> ich bin nicht so sehr gehen einen three-way split of the company (wie kann ich ernsthaft dagegen sein als supermini Kleinstaktionär ), aber ich denke mal am Ende habe ich 3 verschiedene Aktien statt einer --> Portfolio-Fragmentation, die dazu führt (bei mir), entweder solche zu kleinen Positionen aufzustocken oder rauszuwerfen. Letzteres kann aber genau die falsche Entscheidung sein

), aber ich denke mal am Ende habe ich 3 verschiedene Aktien statt einer --> Portfolio-Fragmentation, die dazu führt (bei mir), entweder solche zu kleinen Positionen aufzustocken oder rauszuwerfen. Letzteres kann aber genau die falsche Entscheidung sein

Marathon Petroleum to change CEO, split company after hedge fund campaign

https://finance.yahoo.com/news/1-marathon-sell-speedway-see-…

=>

...Marathon Petroleum Corp chief Gary Heminger will leave the company next year and the largest U.S. independent refiner will launch a sweeping restructuring including the spinoff of its retail operations, steps demanded by activist investors.

The changes were a victory for Elliott Management, DE Shaw and other investors that had sought a shakeup to boost the company's lagging share price following its troubled 2018 acquisition of rival Andeavor. Still, shares on Thursday slid 3.5% to $63.82 in mid-day trade despite third quarter results that topped analysts' estimates.

The $23 billion Andeavor deal gave Marathon a coast-to-coast refining network. But its shares fell to a two-year low this summer as investors were disappointed with the deal's impact on results.

Marathon said Chief Executive Officer Heminger would retire next year when his current term ends. He has worked for Marathon since the mid-1970s and has been at the helm since 2011. Greg Goff, a top executive and former CEO of Andeavor, also will leave at year-end, the company said.

...

Billionaire Paul Singer's Elliott, which last month said it owns a 2.5% economic interest in Marathon, has argued a three-way split of the company would boost shareholder value by as much as $40 billion.

As well as spinning off the retail gas station business Speedway, Marathon said it was launching a strategic review of its pipeline and storage operations. The two businesses provide about half of Marathon's earnings. Speedway will trade as an independent public company after the separation is completed.

Elliott said it supported the moves announced on Thursday, adding it expected these measures would unlock substantial value for shareholders.

Former Andeavor board members Paul Foster and Jeff Stevens, who together own about 1.7% of Marathon, also had backed the proposals and had called for Heminger's immediate removal. The two declined to comment on Thursday.

"We see this (spinoff) as unlocking significant value for current MPC shareholders," analysts at Edward Jones wrote in a note.

Separately, Marathon beat analysts' estimates for quarterly profit on Thursday, benefiting from transporting higher volumes of crude and natural gas across its pipelines.

Excluding items, the company reported an adjusted profit of $1.63 per share, compared to analysts' average estimates of $1.38 per share, according to IBES data from Refinitiv.

Net income attributable to the company rose 48.6% to $1.10 billion, or $1.67 per share, in the third quarter ended Sept. 30. It earned $1.62 a share in the same quarter a year ago.

Total revenue and other income rose to $31.20 billion from $23.13 billion.

Till a day before Elliott made its call for changes on Sept. 25, Marathon's shares were down about 6% this year. Shares were up about 12% for the year through Wednesday's close.

Smaller rival HollyFrontier Corp also posted a better-than-expected quarterly profit on Thursday, a week after peers Phillips 66 and Valero Energy Corp reported earnings beat. (Reporting by Shradha Singh and Shanti S Nair in Bengaluru; Editing by Subhranshu Sahu, Gary McWilliams and David Gregorio)

--> ich bin nicht so sehr gehen einen three-way split of the company (wie kann ich ernsthaft dagegen sein als supermini Kleinstaktionär

), aber ich denke mal am Ende habe ich 3 verschiedene Aktien statt einer --> Portfolio-Fragmentation, die dazu führt (bei mir), entweder solche zu kleinen Positionen aufzustocken oder rauszuwerfen. Letzteres kann aber genau die falsche Entscheidung sein

), aber ich denke mal am Ende habe ich 3 verschiedene Aktien statt einer --> Portfolio-Fragmentation, die dazu führt (bei mir), entweder solche zu kleinen Positionen aufzustocken oder rauszuwerfen. Letzteres kann aber genau die falsche Entscheidung sein

Antwort auf Beitrag Nr.: 61.811.839 von faultcode am 31.10.19 21:43:01noch in 2020Q1 soll ein neuer CEO her

ansonsten:

29.1.

Marathon Petroleum (MPC) Q4 Earnings and Revenues Beat Estimates

https://finance.yahoo.com/news/marathon-petroleum-mpc-q4-ear…

..Marathon Petroleum (MPC) came out with quarterly earnings of $1.56 per share, beating the Zacks Consensus Estimate of $0.85 per share. This compares to earnings of $2.41 per share a year ago. These figures are adjusted for non-recurring items.

This quarterly report represents an earnings surprise of 83.53%. A quarter ago, it was expected that this refiner would post earnings of $1.30 per share when it actually produced earnings of $1.63, delivering a surprise of 25.38%.

Over the last four quarters, the company has surpassed consensus EPS estimates three times.

Marathon Petroleum, which belongs to the Zacks Oil and Gas - Refining and Marketing industry, posted revenues of $31.38 billion for the quarter ended December 2019, surpassing the Zacks Consensus Estimate by 5.66%. This compares to year-ago revenues of $32.54 billion. The company has topped consensus revenue estimates two times over the last four quarters...

ansonsten:

29.1.

Marathon Petroleum (MPC) Q4 Earnings and Revenues Beat Estimates

https://finance.yahoo.com/news/marathon-petroleum-mpc-q4-ear…

..Marathon Petroleum (MPC) came out with quarterly earnings of $1.56 per share, beating the Zacks Consensus Estimate of $0.85 per share. This compares to earnings of $2.41 per share a year ago. These figures are adjusted for non-recurring items.

This quarterly report represents an earnings surprise of 83.53%. A quarter ago, it was expected that this refiner would post earnings of $1.30 per share when it actually produced earnings of $1.63, delivering a surprise of 25.38%.

Over the last four quarters, the company has surpassed consensus EPS estimates three times.

Marathon Petroleum, which belongs to the Zacks Oil and Gas - Refining and Marketing industry, posted revenues of $31.38 billion for the quarter ended December 2019, surpassing the Zacks Consensus Estimate by 5.66%. This compares to year-ago revenues of $32.54 billion. The company has topped consensus revenue estimates two times over the last four quarters...

26.2.

Fire is ‘confined’ at Marathon’s California refinery, supply cut, fire officials say

https://www.cnbc.com/2020/02/26/fire-is-confined-at-marathon…

A fire in a cooling tower, following an explosion, at Marathon Petroleum’s Carson refinery in California on Tuesday, has been “confined and supply has been shut off,” the Los Angeles County Fire Department said on Twitter.

It was not immediately clear whether supply had been cut off to the affected portion of the plant, or the entire refinery.

Residual fuel is burning off at the plant, the fire department added.

“Marathon personnel (are) keeping flames in check via fixed ground monitors while they work to depressurize the system. LACOFD assisting.” the fire department tweeted.

No injuries have been reported at this time, a Fox News affiliate reported.

The Los Angeles County Sheriff’s Department said on Twitter that the perimeter around the Marathon refinery had been secured and that they did not anticipate the need to evacuate residents.

In a filing with the state pollution regulator, the refinery reported an “electrical/mechanical malfunction.”

Marathon, which operates the 363,000 barrel-per-day plant, was not immediately available for comment.

...

Fire is ‘confined’ at Marathon’s California refinery, supply cut, fire officials say

https://www.cnbc.com/2020/02/26/fire-is-confined-at-marathon…

A fire in a cooling tower, following an explosion, at Marathon Petroleum’s Carson refinery in California on Tuesday, has been “confined and supply has been shut off,” the Los Angeles County Fire Department said on Twitter.

It was not immediately clear whether supply had been cut off to the affected portion of the plant, or the entire refinery.

Residual fuel is burning off at the plant, the fire department added.

“Marathon personnel (are) keeping flames in check via fixed ground monitors while they work to depressurize the system. LACOFD assisting.” the fire department tweeted.

No injuries have been reported at this time, a Fox News affiliate reported.

The Los Angeles County Sheriff’s Department said on Twitter that the perimeter around the Marathon refinery had been secured and that they did not anticipate the need to evacuate residents.

In a filing with the state pollution regulator, the refinery reported an “electrical/mechanical malfunction.”

Marathon, which operates the 363,000 barrel-per-day plant, was not immediately available for comment.

...

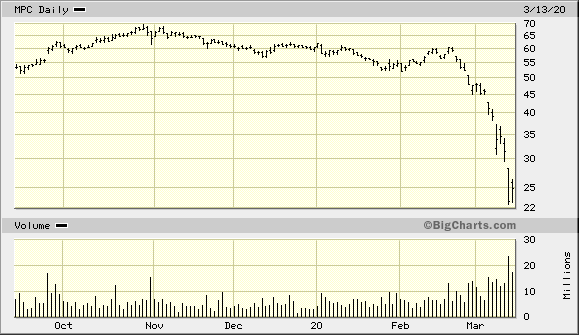

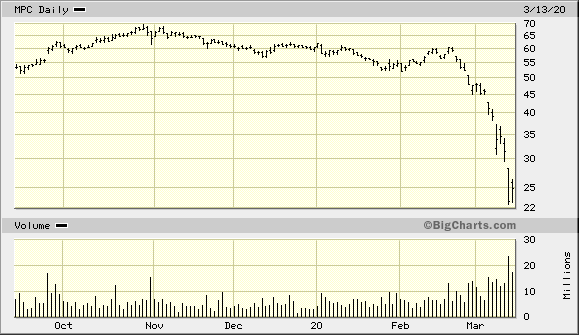

solche Kursstürze haben auch einen Vorteil mMn:

--> da bekommt man als Anleger zügig angezeigt, daß demnächst eine Rezession ins Haus steht

Also kein mühsamer Abstieg über viele Monate hinweg, sondern zackig -58% in nur einem

--> da bekommt man als Anleger zügig angezeigt, daß demnächst eine Rezession ins Haus steht

Also kein mühsamer Abstieg über viele Monate hinweg, sondern zackig -58% in nur einem

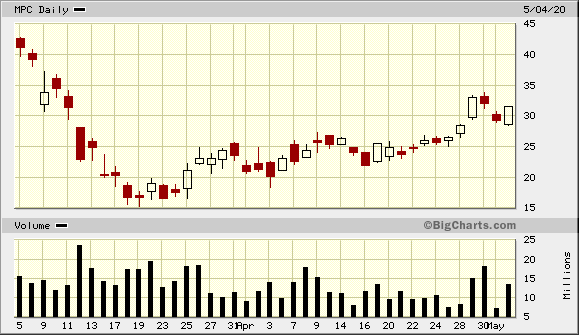

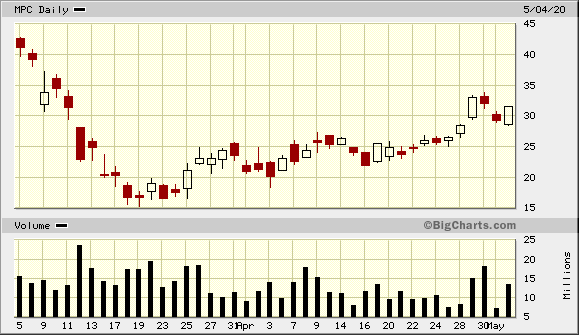

Antwort auf Beitrag Nr.: 63.003.809 von faultcode am 13.03.20 21:58:595.5.

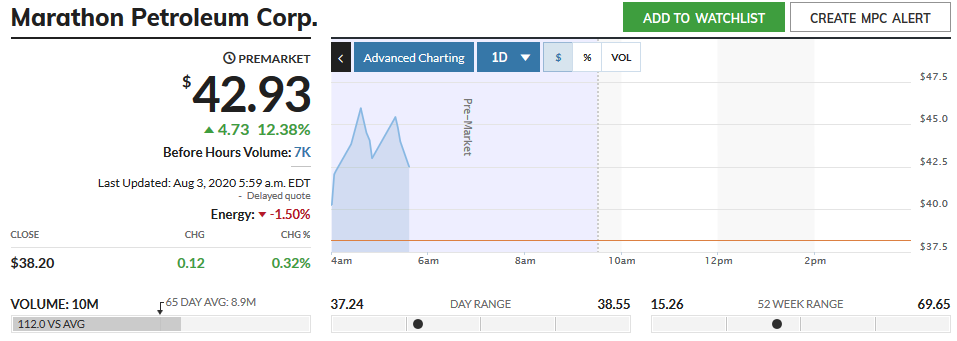

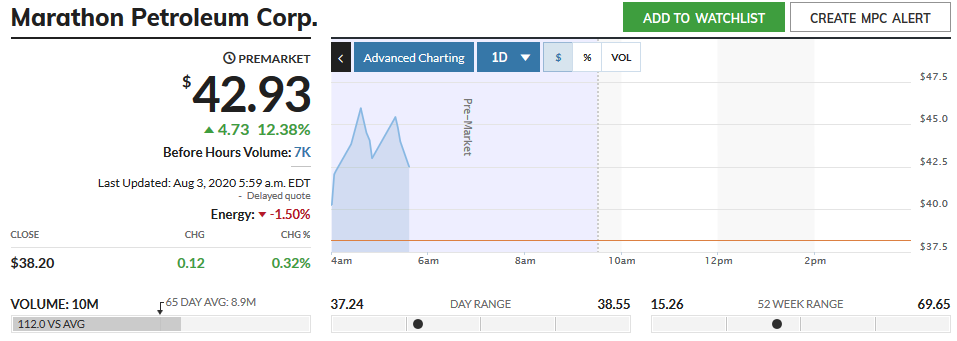

Marathon Petroleum shares jump premarket as company posts smaller-than-expected loss

https://www.marketwatch.com/story/marathon-petroleum-shares-…

Marathon Petroleum Corp. shares rose 7.8% in premarket trade Tuesday, after the oil refiner posted a narrower-than-expected loss for the first quarter.

Findlay, Ohio-based Marathon said it had net loss of $9.2 billion, or $14.25 a share, in the quarter, after a loss of $7 million, or 1 cents a share, in the year-earlier period. Excluding $12.4 billion in non-cash impairments, the company's adjusted per-share loss came to 16 cents, narrower than the 25 cents loss consensus forecast of FactSet analysts.

Revenue fell to $25.215 billion from $28.253 billion a year ago, and below the $27.100 billion FactSet consensus. "Recent global events, including the COVID-19 pandemic and oil price tensions, have been disruptive to the personal and professional lives of many and significantly impacted demand for the transportation fuels we manufacture," Chief Executive Michael J. Hennigan said in a statement.

The company is cutting its 2020 capex budget by $1.4 billion, or about 30%, temporarily suspending its share buyback program and boosting liquidity by tapping credit facilities. The company issued $2.5 billion in senior notes in April and secured an additional $1 billion revolving credit facility.

As of May 5, Marathon had about $7.5 billion in total credit capacity and about $6.75 billion in available borrowing capacity.

...

Marathon Petroleum shares jump premarket as company posts smaller-than-expected loss

https://www.marketwatch.com/story/marathon-petroleum-shares-…

Marathon Petroleum Corp. shares rose 7.8% in premarket trade Tuesday, after the oil refiner posted a narrower-than-expected loss for the first quarter.

Findlay, Ohio-based Marathon said it had net loss of $9.2 billion, or $14.25 a share, in the quarter, after a loss of $7 million, or 1 cents a share, in the year-earlier period. Excluding $12.4 billion in non-cash impairments, the company's adjusted per-share loss came to 16 cents, narrower than the 25 cents loss consensus forecast of FactSet analysts.

Revenue fell to $25.215 billion from $28.253 billion a year ago, and below the $27.100 billion FactSet consensus. "Recent global events, including the COVID-19 pandemic and oil price tensions, have been disruptive to the personal and professional lives of many and significantly impacted demand for the transportation fuels we manufacture," Chief Executive Michael J. Hennigan said in a statement.

The company is cutting its 2020 capex budget by $1.4 billion, or about 30%, temporarily suspending its share buyback program and boosting liquidity by tapping credit facilities. The company issued $2.5 billion in senior notes in April and secured an additional $1 billion revolving credit facility.

As of May 5, Marathon had about $7.5 billion in total credit capacity and about $6.75 billion in available borrowing capacity.

...

2.7.

Goldman Says Refineries to Shut on Less Demand, New Projects

https://www.msn.com/en-us/money/markets/goldman-says-refiner…

...

The global refining industry is entering a consolidation phase as slowing oil demand growth is set to coincide with large-scale projects that will start coming online next year, according to Goldman Sachs Group Inc.

The demand hit from the coronavirus is yet to cause any delays in a number of mega-refining projects, most of which are in China and the Middle East, that will start operations from 2021 to 2024, the bank said in a note. This will cause global utilization rates to be 3% lower over this period than in 2019.

“We expect competition to intensify leading to below consensus -- and mid-cycle -- refining margins over 2021-22 and potential refinery closures in developed markets,” analysts including Nikhil Bhandari said in the note. Global oil demand will return to pre-virus levels by 2022, they said.

Emerging markets will provide the bulk of oil consumption growth in the first half of this decade and the new mega-refineries will be located close to where the demand is, according to Goldman. This means refinery closures will be more likely in developed nations.

Among oil products, gasoline will lead the recovery in fuel demand, the lender said. The outlook for distillates is more challenging as jet fuel’s recovery will be slower and diesel consumption will be hit by the uptake of electric vehicles in the medium term. In addition, the new mega-refineries are distillates heavy.

Gasoline and diesel consumption will return to 2019 levels by next year, while jet fuel is unlikely to get there until at least 2023, the analysts said. Liquefied petroleum gas and naphtha will be key long-term growth drivers on the back of growing petrochemical consumption, while overall oil demand won’t peak before 2030, they said.

Goldman Says Refineries to Shut on Less Demand, New Projects

https://www.msn.com/en-us/money/markets/goldman-says-refiner…

...

The global refining industry is entering a consolidation phase as slowing oil demand growth is set to coincide with large-scale projects that will start coming online next year, according to Goldman Sachs Group Inc.

The demand hit from the coronavirus is yet to cause any delays in a number of mega-refining projects, most of which are in China and the Middle East, that will start operations from 2021 to 2024, the bank said in a note. This will cause global utilization rates to be 3% lower over this period than in 2019.

“We expect competition to intensify leading to below consensus -- and mid-cycle -- refining margins over 2021-22 and potential refinery closures in developed markets,” analysts including Nikhil Bhandari said in the note. Global oil demand will return to pre-virus levels by 2022, they said.

Emerging markets will provide the bulk of oil consumption growth in the first half of this decade and the new mega-refineries will be located close to where the demand is, according to Goldman. This means refinery closures will be more likely in developed nations.

Among oil products, gasoline will lead the recovery in fuel demand, the lender said. The outlook for distillates is more challenging as jet fuel’s recovery will be slower and diesel consumption will be hit by the uptake of electric vehicles in the medium term. In addition, the new mega-refineries are distillates heavy.

Gasoline and diesel consumption will return to 2019 levels by next year, while jet fuel is unlikely to get there until at least 2023, the analysts said. Liquefied petroleum gas and naphtha will be key long-term growth drivers on the back of growing petrochemical consumption, while overall oil demand won’t peak before 2030, they said.

6.7.

Dakota Access Oil Line to Be Shut by Court in Blow for Trump

https://finance.yahoo.com/news/dakota-access-oil-line-shut-1…

...

The Dakota Access pipeline must shut down by Aug. 5, a district court ruled Monday in a stunning defeat for the Trump administration and the oil industry.

The decision, which shuts the pipeline during a court-ordered environmental review that’s expected to extend into 2021, is a momentous win for American Indian tribes that have opposed the Energy Transfer LP project for years. It comes just a day after Dominion Energy Inc. and Duke Energy Corp. scuttled another project, the Atlantic Coast natural gas pipeline, after years of legal delays.

Environmentalists have increasingly used the courts to try to block additional investment in fossil fuel infrastructure while they push for a clean energy transition. Tribes, landowners, and other project opponents have also complained about local impacts from construction and potential spills on or near their land.

The sophisticated legal onslaught has led to delays and disruptions for several other pipelines, including Keystone XL. But Monday’s court order, if upheld on appeal, marks the first time a major, in-service oil pipeline will be forced to shutter because of environmental concerns.

Energy Transfer said it’s “immediately pursuing all available legal and administrative processes” to challenge the decision.

‘Historic Day’

The U.S. District Court for the District of Columbia said a crucial federal permit for Dakota Access fell too far short of National Environmental Policy Act requirements to allow the pipeline to continue operating while regulators conduct a broader analysis the court ordered in a previous decision.

The ruling scraps a critical permit from the Army Corps of Engineers, and requires the pipeline to end its three-year run of delivering oil from North Dakota shale fields to an Illinois oil hub. Judge James E. Boasberg said Dakota Access must shut down the pipeline and empty it of oil by Aug. 5.

“Today is a historic day for the Standing Rock Sioux Tribe and the many people who have supported us in the fight against the pipeline,” tribal Chairman Mike Faith said in a statement. “This pipeline should have never been built here. We told them that from the beginning.”

Boasberg acknowledged that the ruling would cause major disruptions for Dakota Access and the North Dakota drillers that supply its oil.

“Yet, given the seriousness of the Corps’ NEPA error, the impossibility of a simple fix, the fact that Dakota Access did assume much of its economic risk knowingly, and the potential harm each day the pipeline operates, the Court is forced to conclude that the flow of oil must cease,” he wrote, referring to the National Environmental Policy Act.

Energy Transfer said it plans to immediately ask Boasberg to freeze the decision, and will head to the U.S. Court of Appeals if that request is denied.

The company said it’s confident “that once the law and full record are fully considered Dakota Access Pipeline will not be shut down and that oil will continue to flow.”

The Army Corps referred questions about the ruling to the Justice Department, which didn’t immediately respond to requests for comment, including on whether it intends to appeal the ruling. But Energy Secretary Dan Brouillette slammed the ruling, and said the Trump administration would continue promoting U.S. energy infrastructure.

“It is disappointing that, once again, an energy infrastructure project that provides thousands of jobs and millions of dollars in economic revenue has been shut down by the well-funded environmental lobby, using our Nation’s court system to further their agenda,” he said in a statement.

Disruptions

Katie Bays, co-founder of Washington-based Sandhill Strategy LLC, said the court ruling “is likely to be enormously disruptive.” The Army Corps’ 18-month timeline for addressing flaws in its environmental review makes Energy Transfer “vulnerable to a change in administration and a more draconian policy towards oil pipelines,” she said.

ClearView Energy Partners analyst Christine Tezak said “there is a strong possibility that the new Biden Administration could decide to not reissue the authorizations now that the permits have been vacated.”

The ruling will also fuel litigation against other projects, as it “just totally overturns that conventional wisdom” that courts will never force in-service pipelines to shut down, said Southern Methodist University law professor James W. Coleman.

“There’s no legal rule that says you won’t shut down an existing pipeline but people felt like that was such a constant that they could count on it,” he said.

Coleman assigned 50% odds to the prospect that the D.C. Circuit would stay the lower court’s decision. Some analysts speculated odds as low as 30%.

The pro-pipeline GAIN Coalition argued that Monday’s decision jeopardizes energy security, and said it’s confident “common sense will prevail and this decision will be stayed or overturned.” The American Petroleum Institute called for permitting reform.

“Our nation’s outdated and convoluted permitting rules are opening the door for a barrage of baseless, activist-led litigation, undermining American energy progress and denying local communities the environmental, employment and economic benefits modern pipelines provide,” the oil industry group said.

Energy Transfer’s shares fell as much as 13.8% Monday for the biggest intraday drop since mid-March.

Continental Resources Inc., the shale producer founded by Harold Hamm, another prominent Trump supporter, also fell on the decision, as did Hess Corp. Both companies have significant operations in the Bakken shale field, and a shutdown of Dakota Access will make it harder for them to pipe their crude out of the basin.

Physical sweet crude prices in the U.S. rose slightly against oil futures on Monday, as the closing of the pipeline means less oil supply. However, prices for oil produced in North Dakota have come under pressure as the loss of the conduit would mean less interest from buyers.

Years of Opposition

Boasberg’s decision comes after four years of litigation from tribes opposed to Dakota Access’ route across Lake Oahe, a dammed section of the Missouri River just a half-mile from the Standing Rock Indian Reservation in the Dakotas.

The Standing Rock Sioux, Cheyenne River Sioux, and others sued the Army Corps for approving the water crossing in 2016, saying it put tribal water supplies and cultural resources at risk.

Their frustrations triggered an outpouring of support from fellow tribes, indigenous advocates, and environmentalists from across the country. Thousands of pipeline opponents camped out in North Dakota for months to show their opposition.

The Obama administration responded by withholding a final permit and committing to a new consultation process, but President Donald Trump quickly put Dakota Access back on track after taking office in 2017.

Kelcy Warren, the billionaire chief executive officer of Energy Transfer, has long been a Trump fan. He recently hosted a fundraiser for the president’s re-election campaign at his private Dallas home.

“My God, this is going to be refreshing,” Warren told investors two days after Trump won the last election.

Despite high-profile opposition to Dakota Access, including from celebrities and some of Warren’s favorite musicians, the Energy Transfer founder has stood by the project, going so far as to say he talks about Dakota Access “like I talk about my son” earlier this year.

“I’m so proud of that project,” he said.

Trouble in Court

But the district court in Washington found flaws in the government’s pipeline approval process. Boasberg ordered the Army Corps to conduct additional environmental review in mid-2017, but allowed the pipeline to remain in service during that time.

Earlier this year, the court again identified shortcomings in the Army Corps’ review, concluding that the agency didn’t fully consider expert disagreement over the risk of an oil spill in Lake Oahe. The Army Corps must do an in-depth environmental impact statement for Dakota Access, the judge said.

Boasberg issued the opinion in March and ordered both sides to submit new briefs explaining whether the pipeline should shut down in light of the decision.

The default consequence for an agency violation of the National Environmental Policy Act is invalidation of the permit at issue, but legal precedent allows courts to balance that outcome against other factors, including how disruptive nixing a permit would be, and how likely an agency is to support its original decision after additional analysis.

The Army Corps has said it expects to finish the court-ordered analysis in mid-2021.

The case is Standing Rock Sioux Tribe v. Army Corps of Engineers, D.D.C., No. 1:16-cv-01534, 7/6/20.

...

cf.

Dakota pipeline investors could face major hit after adverse ruling

https://finance.yahoo.com/news/dakota-pipeline-investors-cou…

...

The Dakota Access ownership group is represented by Energy Transfer (38%), Phillips 66 (25%), Enbridge Inc (28%) and Marathon Petroleum Corp (9%), according to a 2019 Moody's Investors Service report that rated the bond offering "Baa2."

Phillips 66 disclosed in May that its maximum potential contribution under the equity agreement was about $631 million, according to a filing with the U.S. Securities and Exchange Commission. Marathon Petroleum's maximum contribution is $230 million, according to a filing.

Canada's Enbridge and Marathon Petroleum also are part of the agreement that could require financial support for the bonds.

...

Dakota Access Oil Line to Be Shut by Court in Blow for Trump

https://finance.yahoo.com/news/dakota-access-oil-line-shut-1…

...

The Dakota Access pipeline must shut down by Aug. 5, a district court ruled Monday in a stunning defeat for the Trump administration and the oil industry.

The decision, which shuts the pipeline during a court-ordered environmental review that’s expected to extend into 2021, is a momentous win for American Indian tribes that have opposed the Energy Transfer LP project for years. It comes just a day after Dominion Energy Inc. and Duke Energy Corp. scuttled another project, the Atlantic Coast natural gas pipeline, after years of legal delays.

Environmentalists have increasingly used the courts to try to block additional investment in fossil fuel infrastructure while they push for a clean energy transition. Tribes, landowners, and other project opponents have also complained about local impacts from construction and potential spills on or near their land.

The sophisticated legal onslaught has led to delays and disruptions for several other pipelines, including Keystone XL. But Monday’s court order, if upheld on appeal, marks the first time a major, in-service oil pipeline will be forced to shutter because of environmental concerns.

Energy Transfer said it’s “immediately pursuing all available legal and administrative processes” to challenge the decision.

‘Historic Day’

The U.S. District Court for the District of Columbia said a crucial federal permit for Dakota Access fell too far short of National Environmental Policy Act requirements to allow the pipeline to continue operating while regulators conduct a broader analysis the court ordered in a previous decision.

The ruling scraps a critical permit from the Army Corps of Engineers, and requires the pipeline to end its three-year run of delivering oil from North Dakota shale fields to an Illinois oil hub. Judge James E. Boasberg said Dakota Access must shut down the pipeline and empty it of oil by Aug. 5.

“Today is a historic day for the Standing Rock Sioux Tribe and the many people who have supported us in the fight against the pipeline,” tribal Chairman Mike Faith said in a statement. “This pipeline should have never been built here. We told them that from the beginning.”

Boasberg acknowledged that the ruling would cause major disruptions for Dakota Access and the North Dakota drillers that supply its oil.

“Yet, given the seriousness of the Corps’ NEPA error, the impossibility of a simple fix, the fact that Dakota Access did assume much of its economic risk knowingly, and the potential harm each day the pipeline operates, the Court is forced to conclude that the flow of oil must cease,” he wrote, referring to the National Environmental Policy Act.

Energy Transfer said it plans to immediately ask Boasberg to freeze the decision, and will head to the U.S. Court of Appeals if that request is denied.

The company said it’s confident “that once the law and full record are fully considered Dakota Access Pipeline will not be shut down and that oil will continue to flow.”

The Army Corps referred questions about the ruling to the Justice Department, which didn’t immediately respond to requests for comment, including on whether it intends to appeal the ruling. But Energy Secretary Dan Brouillette slammed the ruling, and said the Trump administration would continue promoting U.S. energy infrastructure.

“It is disappointing that, once again, an energy infrastructure project that provides thousands of jobs and millions of dollars in economic revenue has been shut down by the well-funded environmental lobby, using our Nation’s court system to further their agenda,” he said in a statement.

Disruptions

Katie Bays, co-founder of Washington-based Sandhill Strategy LLC, said the court ruling “is likely to be enormously disruptive.” The Army Corps’ 18-month timeline for addressing flaws in its environmental review makes Energy Transfer “vulnerable to a change in administration and a more draconian policy towards oil pipelines,” she said.

ClearView Energy Partners analyst Christine Tezak said “there is a strong possibility that the new Biden Administration could decide to not reissue the authorizations now that the permits have been vacated.”

The ruling will also fuel litigation against other projects, as it “just totally overturns that conventional wisdom” that courts will never force in-service pipelines to shut down, said Southern Methodist University law professor James W. Coleman.

“There’s no legal rule that says you won’t shut down an existing pipeline but people felt like that was such a constant that they could count on it,” he said.

Coleman assigned 50% odds to the prospect that the D.C. Circuit would stay the lower court’s decision. Some analysts speculated odds as low as 30%.

The pro-pipeline GAIN Coalition argued that Monday’s decision jeopardizes energy security, and said it’s confident “common sense will prevail and this decision will be stayed or overturned.” The American Petroleum Institute called for permitting reform.

“Our nation’s outdated and convoluted permitting rules are opening the door for a barrage of baseless, activist-led litigation, undermining American energy progress and denying local communities the environmental, employment and economic benefits modern pipelines provide,” the oil industry group said.

Energy Transfer’s shares fell as much as 13.8% Monday for the biggest intraday drop since mid-March.

Continental Resources Inc., the shale producer founded by Harold Hamm, another prominent Trump supporter, also fell on the decision, as did Hess Corp. Both companies have significant operations in the Bakken shale field, and a shutdown of Dakota Access will make it harder for them to pipe their crude out of the basin.

Physical sweet crude prices in the U.S. rose slightly against oil futures on Monday, as the closing of the pipeline means less oil supply. However, prices for oil produced in North Dakota have come under pressure as the loss of the conduit would mean less interest from buyers.

Years of Opposition

Boasberg’s decision comes after four years of litigation from tribes opposed to Dakota Access’ route across Lake Oahe, a dammed section of the Missouri River just a half-mile from the Standing Rock Indian Reservation in the Dakotas.

The Standing Rock Sioux, Cheyenne River Sioux, and others sued the Army Corps for approving the water crossing in 2016, saying it put tribal water supplies and cultural resources at risk.

Their frustrations triggered an outpouring of support from fellow tribes, indigenous advocates, and environmentalists from across the country. Thousands of pipeline opponents camped out in North Dakota for months to show their opposition.

The Obama administration responded by withholding a final permit and committing to a new consultation process, but President Donald Trump quickly put Dakota Access back on track after taking office in 2017.

Kelcy Warren, the billionaire chief executive officer of Energy Transfer, has long been a Trump fan. He recently hosted a fundraiser for the president’s re-election campaign at his private Dallas home.

“My God, this is going to be refreshing,” Warren told investors two days after Trump won the last election.

Despite high-profile opposition to Dakota Access, including from celebrities and some of Warren’s favorite musicians, the Energy Transfer founder has stood by the project, going so far as to say he talks about Dakota Access “like I talk about my son” earlier this year.

“I’m so proud of that project,” he said.

Trouble in Court

But the district court in Washington found flaws in the government’s pipeline approval process. Boasberg ordered the Army Corps to conduct additional environmental review in mid-2017, but allowed the pipeline to remain in service during that time.

Earlier this year, the court again identified shortcomings in the Army Corps’ review, concluding that the agency didn’t fully consider expert disagreement over the risk of an oil spill in Lake Oahe. The Army Corps must do an in-depth environmental impact statement for Dakota Access, the judge said.

Boasberg issued the opinion in March and ordered both sides to submit new briefs explaining whether the pipeline should shut down in light of the decision.

The default consequence for an agency violation of the National Environmental Policy Act is invalidation of the permit at issue, but legal precedent allows courts to balance that outcome against other factors, including how disruptive nixing a permit would be, and how likely an agency is to support its original decision after additional analysis.

The Army Corps has said it expects to finish the court-ordered analysis in mid-2021.

The case is Standing Rock Sioux Tribe v. Army Corps of Engineers, D.D.C., No. 1:16-cv-01534, 7/6/20.

...

cf.

Dakota pipeline investors could face major hit after adverse ruling

https://finance.yahoo.com/news/dakota-pipeline-investors-cou…

...

The Dakota Access ownership group is represented by Energy Transfer (38%), Phillips 66 (25%), Enbridge Inc (28%) and Marathon Petroleum Corp (9%), according to a 2019 Moody's Investors Service report that rated the bond offering "Baa2."

Phillips 66 disclosed in May that its maximum potential contribution under the equity agreement was about $631 million, according to a filing with the U.S. Securities and Exchange Commission. Marathon Petroleum's maximum contribution is $230 million, according to a filing.

Canada's Enbridge and Marathon Petroleum also are part of the agreement that could require financial support for the bonds.

...

Antwort auf Beitrag Nr.: 64.317.572 von faultcode am 07.07.20 10:41:3317.7.

Marathon Petroleum May Get $15B-Plus Bid for Speedway Unit

https://www.thestreet.com/investing/marathon-petroleum-may-r…

Marathon Petroleum MPC shares rose Friday after a report that private equity firm TDR Capital is considering a $15 billion-plus bid for the refiner’s Speedway gas station unit

The London PE firm is asking banks how much financing they would provide for such a deal, knowledgeable sources told Bloomberg.

Any offer from TDR would probably include a partner, they said. Marathon has said Speedway is valued at $15 billion to $18 billion.

TDR already owns EG Group, which has expanded through acquisitions into one of the world’s largest convenience-store and gas-station chains.

Marathon Petroleum last fall said it planned to separate its Speedway unit as part of an effort to appease activist investors, who were urging the company to do something about its growing debt.

The debt came mostly from its $23 billion purchase of fellow refiner Andeavor in 2018.

Marathon then held talks to sell the division to Seven & I Holdings, the Japanese parent of 7-Eleven convenience stores, for more than $20 billion. But the deal fell through in March as the coronavirus pandemic prompted both companies to shelve the plan.

Then Marathon reportedly turned to Canada’s Alimentation Couche-Tard for an $18 billion deal, but nothing has transpired on that front.

TDR has conferred with Alimentation, the owner of the Circle K convenience-store chain, about cooperating in a bid, one of Bloomberg’s sources said.

The sources said others also are considering bids.

...

Marathon Petroleum May Get $15B-Plus Bid for Speedway Unit

https://www.thestreet.com/investing/marathon-petroleum-may-r…

Marathon Petroleum MPC shares rose Friday after a report that private equity firm TDR Capital is considering a $15 billion-plus bid for the refiner’s Speedway gas station unit

The London PE firm is asking banks how much financing they would provide for such a deal, knowledgeable sources told Bloomberg.

Any offer from TDR would probably include a partner, they said. Marathon has said Speedway is valued at $15 billion to $18 billion.

TDR already owns EG Group, which has expanded through acquisitions into one of the world’s largest convenience-store and gas-station chains.

Marathon Petroleum last fall said it planned to separate its Speedway unit as part of an effort to appease activist investors, who were urging the company to do something about its growing debt.

The debt came mostly from its $23 billion purchase of fellow refiner Andeavor in 2018.

Marathon then held talks to sell the division to Seven & I Holdings, the Japanese parent of 7-Eleven convenience stores, for more than $20 billion. But the deal fell through in March as the coronavirus pandemic prompted both companies to shelve the plan.

Then Marathon reportedly turned to Canada’s Alimentation Couche-Tard for an $18 billion deal, but nothing has transpired on that front.

TDR has conferred with Alimentation, the owner of the Circle K convenience-store chain, about cooperating in a bid, one of Bloomberg’s sources said.

The sources said others also are considering bids.

...

Antwort auf Beitrag Nr.: 64.457.354 von faultcode am 18.07.20 03:29:16USD21b sind's nun geworden:

3.8.

Marathon Petroleum sells Speedway to 7-Eleven owner for $21 billion

https://ca.finance.yahoo.com/news/marathon-petroleum-sells-s…

...

Marathon Petroleum <MPC.N> has agreed to sell its Speedway gas stations in the United States to Japanese retail group Seven & i Holdings <3382.T> for $21 billion, the companies said, five months after the deal was put on hold amid the coronavirus outbreak.

Marathon, under pressure from activist investor Elliott Management, said last year it would launch sweeping restructuring, including spinning off Speedway, which it said was worth as much as $18 billion, including debt.

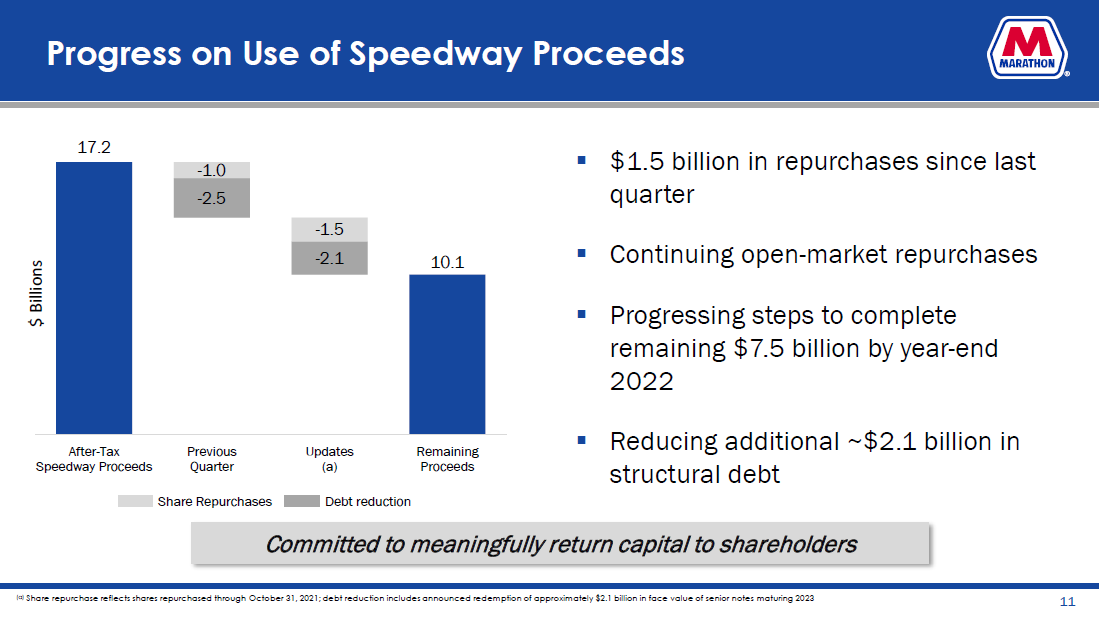

After-tax proceeds from the sale, which has been approved by the boards of both companies, are estimated at $16.5 billion, Marathon said, adding it will use the proceeds to pay existing debt.

For Seven & i, owner of the 7-Eleven convenience store chain, the deal helps it shift its focus beyond a saturated Japan market, multiplying its portfolio of U.S. gas stations and corner stores acquired through a $3.3 billion deal with Sunoco <SUN.N> in 2017.

7-Eleven said the latest deal will bring its store count in the United States and Canada to about 14,000.

The deal, which is expected to close in the first quarter of 2021, includes a 15-year fuel supply agreement for about 7.7 billion gallons per year associated with the Speedway business, said Marathon, the largest U.S. refiner by volume.

The Japanese company abandoned the deal in March, according to sources at the time, due to worries about the price tag - reportedly around $22 billion - especially due to growing concerns about global economic slowdown amid the virus outbreak.

Many analysts and investors had said the initially reported deal price was too high. But some also said it still made sense for Seven & i to expand further in North America.

In Japan, the convenience store chain faces a slow economy as well as tough competition from rivals such as FamilyMart <8028.T> and Lawson <2651.T>, as well as discount drugstores and online retail giants like Amazon.com <AMZN.O>.

7-Eleven also said it expects to achieve $475 million to $575 million of synergies through the third year after the deal's closing.

The deal will also produce compound annual growth over 15% in 7–Eleven's operating income through the first three years after closing, the company said. It added the purchase price reflected $3 billion in tax benefits.

...

3.8.

Marathon Petroleum sells Speedway to 7-Eleven owner for $21 billion

https://ca.finance.yahoo.com/news/marathon-petroleum-sells-s…

...

Marathon Petroleum <MPC.N> has agreed to sell its Speedway gas stations in the United States to Japanese retail group Seven & i Holdings <3382.T> for $21 billion, the companies said, five months after the deal was put on hold amid the coronavirus outbreak.

Marathon, under pressure from activist investor Elliott Management, said last year it would launch sweeping restructuring, including spinning off Speedway, which it said was worth as much as $18 billion, including debt.

After-tax proceeds from the sale, which has been approved by the boards of both companies, are estimated at $16.5 billion, Marathon said, adding it will use the proceeds to pay existing debt.

For Seven & i, owner of the 7-Eleven convenience store chain, the deal helps it shift its focus beyond a saturated Japan market, multiplying its portfolio of U.S. gas stations and corner stores acquired through a $3.3 billion deal with Sunoco <SUN.N> in 2017.

7-Eleven said the latest deal will bring its store count in the United States and Canada to about 14,000.

The deal, which is expected to close in the first quarter of 2021, includes a 15-year fuel supply agreement for about 7.7 billion gallons per year associated with the Speedway business, said Marathon, the largest U.S. refiner by volume.

The Japanese company abandoned the deal in March, according to sources at the time, due to worries about the price tag - reportedly around $22 billion - especially due to growing concerns about global economic slowdown amid the virus outbreak.

Many analysts and investors had said the initially reported deal price was too high. But some also said it still made sense for Seven & i to expand further in North America.

In Japan, the convenience store chain faces a slow economy as well as tough competition from rivals such as FamilyMart <8028.T> and Lawson <2651.T>, as well as discount drugstores and online retail giants like Amazon.com <AMZN.O>.

7-Eleven also said it expects to achieve $475 million to $575 million of synergies through the third year after the deal's closing.

The deal will also produce compound annual growth over 15% in 7–Eleven's operating income through the first three years after closing, the company said. It added the purchase price reflected $3 billion in tax benefits.

...

1.8.

Marathon Petroleum to permanently close two U.S. oil refineries

https://ca.finance.yahoo.com/news/marathon-petroleum-permane…

...

Marathon Petroleum <MPC.N> plans to permanently close two small U.S. oil refineries in Martinez, California, and Gallup, New Mexico, the company said, eliminating 800 jobs in response to lower fuels demand.

The largest U.S. refiner by volume had earlier idled the two facilities following weak demand due to COVID-19 outbreaks in the United States. U.S. refiners on average idled about 20% of total processing capacity on falling vehicle and air travel.

Marathon said it plans to use the Martinez facility as an oil-storage facility and is evaluating its future use to produce renewable diesel, a fuel made from industry waste and used cooking oil. Martinez is California's fourth largest refinery.

The company on Monday is forecast to swing to a second-quarter loss of $1.75 per share, from a $1.73 per share profit a year ago, according to Refinitiv data.

...

Marathon spokesman Sid Barth declined further comment about the closures on Saturday.

About 860 employees work at the 161,000 barrel per day (bpd) Martinez and 27,000-bpd Gallup refineries. "Most jobs at these refineries will no longer be necessary, and we expect to begin a phased reduction of staffing levels" in October, the company said.

The closings are not anticipated to result in supply disruptions. "We will continue to utilize our integrated system to meet customer commitments," the company said in a statement on its website.

...

Marathon Petroleum to permanently close two U.S. oil refineries

https://ca.finance.yahoo.com/news/marathon-petroleum-permane…

...

Marathon Petroleum <MPC.N> plans to permanently close two small U.S. oil refineries in Martinez, California, and Gallup, New Mexico, the company said, eliminating 800 jobs in response to lower fuels demand.

The largest U.S. refiner by volume had earlier idled the two facilities following weak demand due to COVID-19 outbreaks in the United States. U.S. refiners on average idled about 20% of total processing capacity on falling vehicle and air travel.

Marathon said it plans to use the Martinez facility as an oil-storage facility and is evaluating its future use to produce renewable diesel, a fuel made from industry waste and used cooking oil. Martinez is California's fourth largest refinery.

The company on Monday is forecast to swing to a second-quarter loss of $1.75 per share, from a $1.73 per share profit a year ago, according to Refinitiv data.

...

Marathon spokesman Sid Barth declined further comment about the closures on Saturday.

About 860 employees work at the 161,000 barrel per day (bpd) Martinez and 27,000-bpd Gallup refineries. "Most jobs at these refineries will no longer be necessary, and we expect to begin a phased reduction of staffing levels" in October, the company said.

The closings are not anticipated to result in supply disruptions. "We will continue to utilize our integrated system to meet customer commitments," the company said in a statement on its website.

...

ich gehe davon aus, daß das nicht nur für MPC unter den Refinern gilt, aber hier womöglich ganz besonders:

11.8.

Marathon Poised for $1.1 Billion Tax Refund From Coronavirus Aid

https://finance.yahoo.com/news/marathon-poised-1-1-billion-1…

...

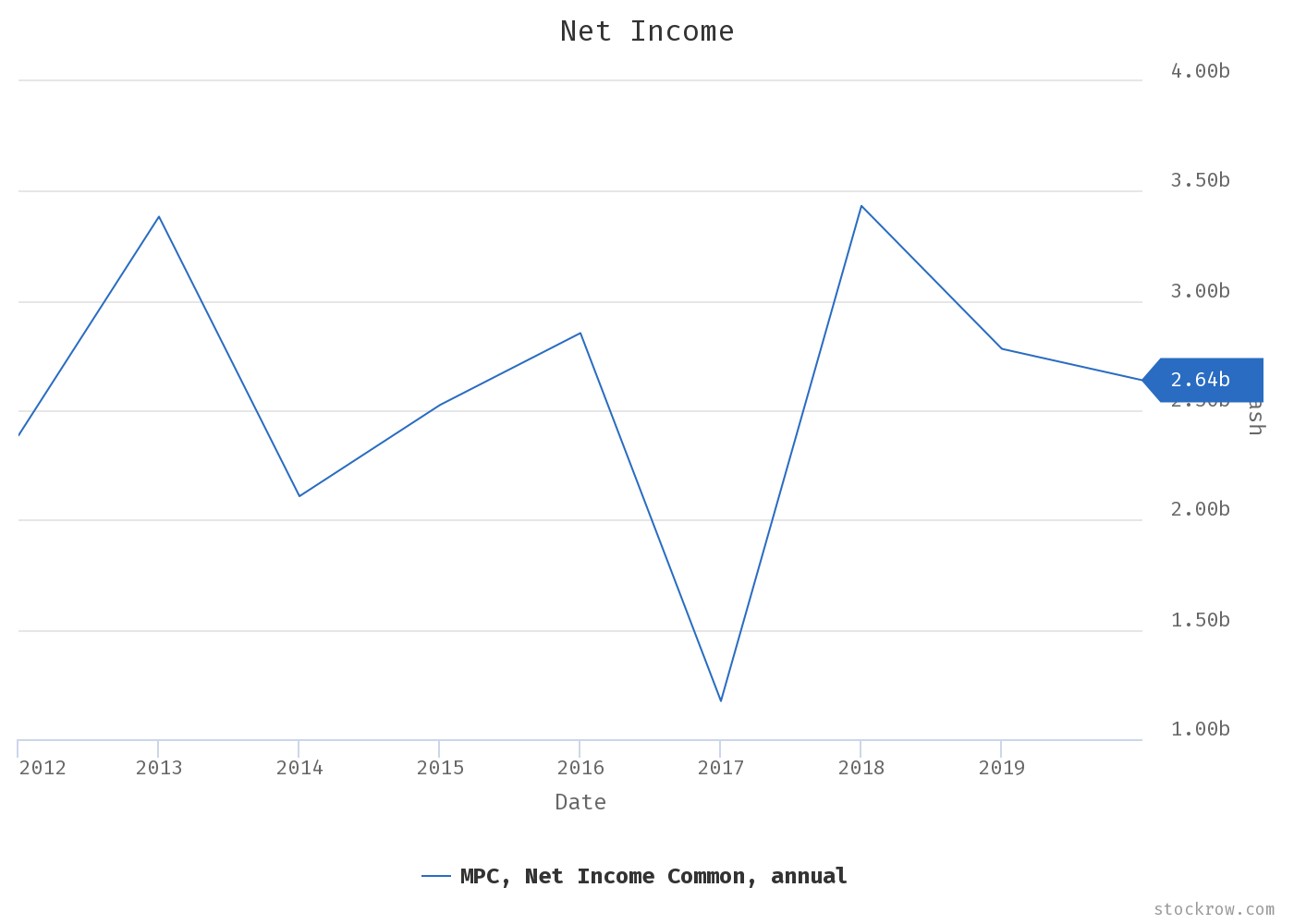

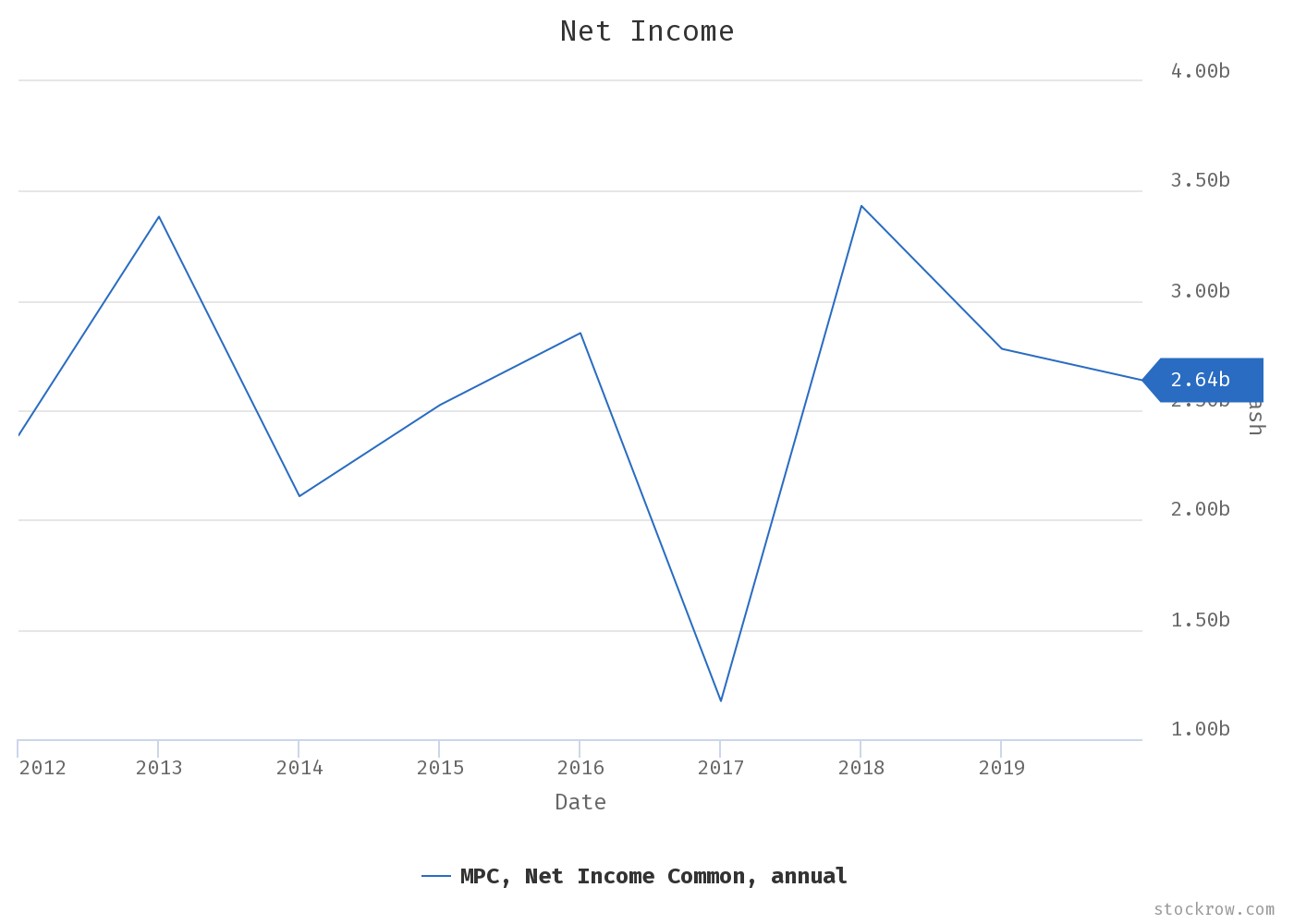

Marathon Petroleum Corp. is poised to claim a $1.1 billion tax refund thanks to the coronavirus stimulus law enacted in March.

That measure included a tax provision that allows companies to immediately deduct net operating losses and apply them to previous returns for five years from 2018, 2019 and 2020 -- instead of only applying those deductions to future years. The benefit is supercharged because deductions taken before the 2017 tax overhaul can be claimed at the 35% corporate tax rate instead of the current 21%.

Companies across the spectrum, including retailers and renewable-energy developers are taking advantage of the net operating loss provisions in the March stimulus law to claim multimillion-dollar refunds. But it is a particular benefit to oil companies that raked in record profits in 2018, only to be battered by this spring’s crash in crude prices and demand. Oil industry advocates stress that companies would much rather be scoring profits than claiming losses.

Marathon anticipates net operating losses this year and expects to carry those back, allowing it to also take advantage of the higher, 35% corporate tax rate in the process, Chief Financial Officer Don Templin told analysts and investors Aug. 3 on a conference call.

Planned Timing

“We think that’s a good thing for MPC,” Templin said. “Our plan would be that we would work on getting our 2020 tax return filed as quickly as we could in 2021 to be able to effect that NOL carryback and the refund that would be associated with that.”

The Findlay, Ohio-based oil refiner previously estimated it would claim $411 million by being able to carry current losses to years in which the tax rate was 35%. It revised that calculation to $309 million in the second quarter, said Marathon spokesman Jamal Kheiry.

Even without the stimulus law change, Marathon would have recorded an estimated $791 million net operating loss tax benefit, Kheiry said. It just would have been monetized in the future at a 21% deferred tax rate.

Like other oil companies, Marathon has been battered by an epic downturn in fuel demand tied to the coronavirus pandemic, as states ordered businesses to halt operations and travel plummeted.

...

https://stockrow.com/MPC/snapshots/income

11.8.

Marathon Poised for $1.1 Billion Tax Refund From Coronavirus Aid

https://finance.yahoo.com/news/marathon-poised-1-1-billion-1…

...

Marathon Petroleum Corp. is poised to claim a $1.1 billion tax refund thanks to the coronavirus stimulus law enacted in March.

That measure included a tax provision that allows companies to immediately deduct net operating losses and apply them to previous returns for five years from 2018, 2019 and 2020 -- instead of only applying those deductions to future years. The benefit is supercharged because deductions taken before the 2017 tax overhaul can be claimed at the 35% corporate tax rate instead of the current 21%.

Companies across the spectrum, including retailers and renewable-energy developers are taking advantage of the net operating loss provisions in the March stimulus law to claim multimillion-dollar refunds. But it is a particular benefit to oil companies that raked in record profits in 2018, only to be battered by this spring’s crash in crude prices and demand. Oil industry advocates stress that companies would much rather be scoring profits than claiming losses.

Marathon anticipates net operating losses this year and expects to carry those back, allowing it to also take advantage of the higher, 35% corporate tax rate in the process, Chief Financial Officer Don Templin told analysts and investors Aug. 3 on a conference call.

Planned Timing

“We think that’s a good thing for MPC,” Templin said. “Our plan would be that we would work on getting our 2020 tax return filed as quickly as we could in 2021 to be able to effect that NOL carryback and the refund that would be associated with that.”

The Findlay, Ohio-based oil refiner previously estimated it would claim $411 million by being able to carry current losses to years in which the tax rate was 35%. It revised that calculation to $309 million in the second quarter, said Marathon spokesman Jamal Kheiry.

Even without the stimulus law change, Marathon would have recorded an estimated $791 million net operating loss tax benefit, Kheiry said. It just would have been monetized in the future at a 21% deferred tax rate.

Like other oil companies, Marathon has been battered by an epic downturn in fuel demand tied to the coronavirus pandemic, as states ordered businesses to halt operations and travel plummeted.

...

https://stockrow.com/MPC/snapshots/income

Antwort auf Beitrag Nr.: 64.735.657 von faultcode am 12.08.20 14:16:031.10.

U.S. oil refiner Marathon Petroleum cuts 12% of staff because of pandemic

https://finance.yahoo.com/news/u-oil-refiner-marathon-petrol…

...

Marathon Petroleum Corp, the top U.S. oil refiner, is cutting 12% of its workforce amid continued declines in fuel consumption due to the COVID-19 pandemic, it said on Wednesday.

Refiners and oil producers have been dismissing staff, slashing spending and reducing production to cope with weak prices and a global glut of fuel. U.S. gasoline futures are down 26% from a year ago and oil is trading down a third from where it began the year.

Marathon will incur an up to $175 million charge to third quarter earnings for the 2,050 job cuts, it reported to the U.S. Securities and Exchange Commission. About 20% of the charge will be recouped from its publicly traded pipeline unit, the company said.

The Findlay, Ohio, firm disclosed the workforce cuts after Reuters on Tuesday reported employees across the company had been notified of impending layoffs.

The cuts includes staff at its Martinez, California, and Gallup, New Mexico refineries, which in July were designated to close. The shutdowns and job cuts will lower overall costs beginning next year, Marathon said in a statement.

Employees of its retail gasoline business are not included in the 12% reduction. Marathon in August agreed to sell its Speedway unit to Japan's Seven & i Holdings Co Ltd, a deal expected to close next year.

Red ink and job cuts are expected across the oil industry as results start rolling out next month. U.S. refiners typically gear up for winter heating oil demand after summer driving season ends. This year, heating oil and gasoline consumption are both depressed.

"The pandemic has resulted in near-record lows on diesel margins, the go-to product for refineries as we enter into the winter heating season," said Andrew Lipow, president of consultancy Lipow Oil Associates.

"The glut in refining capacity has forced these downstream companies into layoffs," he said.

...

U.S. oil refiner Marathon Petroleum cuts 12% of staff because of pandemic

https://finance.yahoo.com/news/u-oil-refiner-marathon-petrol…

...

Marathon Petroleum Corp, the top U.S. oil refiner, is cutting 12% of its workforce amid continued declines in fuel consumption due to the COVID-19 pandemic, it said on Wednesday.

Refiners and oil producers have been dismissing staff, slashing spending and reducing production to cope with weak prices and a global glut of fuel. U.S. gasoline futures are down 26% from a year ago and oil is trading down a third from where it began the year.

Marathon will incur an up to $175 million charge to third quarter earnings for the 2,050 job cuts, it reported to the U.S. Securities and Exchange Commission. About 20% of the charge will be recouped from its publicly traded pipeline unit, the company said.

The Findlay, Ohio, firm disclosed the workforce cuts after Reuters on Tuesday reported employees across the company had been notified of impending layoffs.

The cuts includes staff at its Martinez, California, and Gallup, New Mexico refineries, which in July were designated to close. The shutdowns and job cuts will lower overall costs beginning next year, Marathon said in a statement.

Employees of its retail gasoline business are not included in the 12% reduction. Marathon in August agreed to sell its Speedway unit to Japan's Seven & i Holdings Co Ltd, a deal expected to close next year.

Red ink and job cuts are expected across the oil industry as results start rolling out next month. U.S. refiners typically gear up for winter heating oil demand after summer driving season ends. This year, heating oil and gasoline consumption are both depressed.

"The pandemic has resulted in near-record lows on diesel margins, the go-to product for refineries as we enter into the winter heating season," said Andrew Lipow, president of consultancy Lipow Oil Associates.

"The glut in refining capacity has forced these downstream companies into layoffs," he said.

...

Antwort auf Beitrag Nr.: 65.251.231 von faultcode am 01.10.20 13:55:0416.10.

SEC fines Andeavor $20 mln for inadequate controls over stock buyback plan

https://finance.yahoo.com/news/sec-fines-andeavor-20-mln-224…

...

U.S. refiner Andeavor LLC agreed to pay $20 million in penalties to the Securities and Exchange Commission (SEC) for inadequate controls over a stock buyback plan it executed while it was in talks to be bought by Marathon Petroleum Corp in 2018.

The securities regulator said on Thursday that Andeavor's chief executive officer had directed its finance chief to initiate a $250 million stock buyback two days before the two companies were set to resume talks about a potential deal.

Andeavor's internal accounting controls failed to make sure the buyback adhered to a company policy prohibiting repurchases while it held material non-public information, the order said.

The refiner repurchased 2.6 million shares of its stock from investors at an average price of $97 per share in February and March of 2018, a month after which the two companies agreed to a deal valuing Andeavor at more than $150 per share....

SEC fines Andeavor $20 mln for inadequate controls over stock buyback plan

https://finance.yahoo.com/news/sec-fines-andeavor-20-mln-224…

...

U.S. refiner Andeavor LLC agreed to pay $20 million in penalties to the Securities and Exchange Commission (SEC) for inadequate controls over a stock buyback plan it executed while it was in talks to be bought by Marathon Petroleum Corp in 2018.

The securities regulator said on Thursday that Andeavor's chief executive officer had directed its finance chief to initiate a $250 million stock buyback two days before the two companies were set to resume talks about a potential deal.

Andeavor's internal accounting controls failed to make sure the buyback adhered to a company policy prohibiting repurchases while it held material non-public information, the order said.

The refiner repurchased 2.6 million shares of its stock from investors at an average price of $97 per share in February and March of 2018, a month after which the two companies agreed to a deal valuing Andeavor at more than $150 per share....

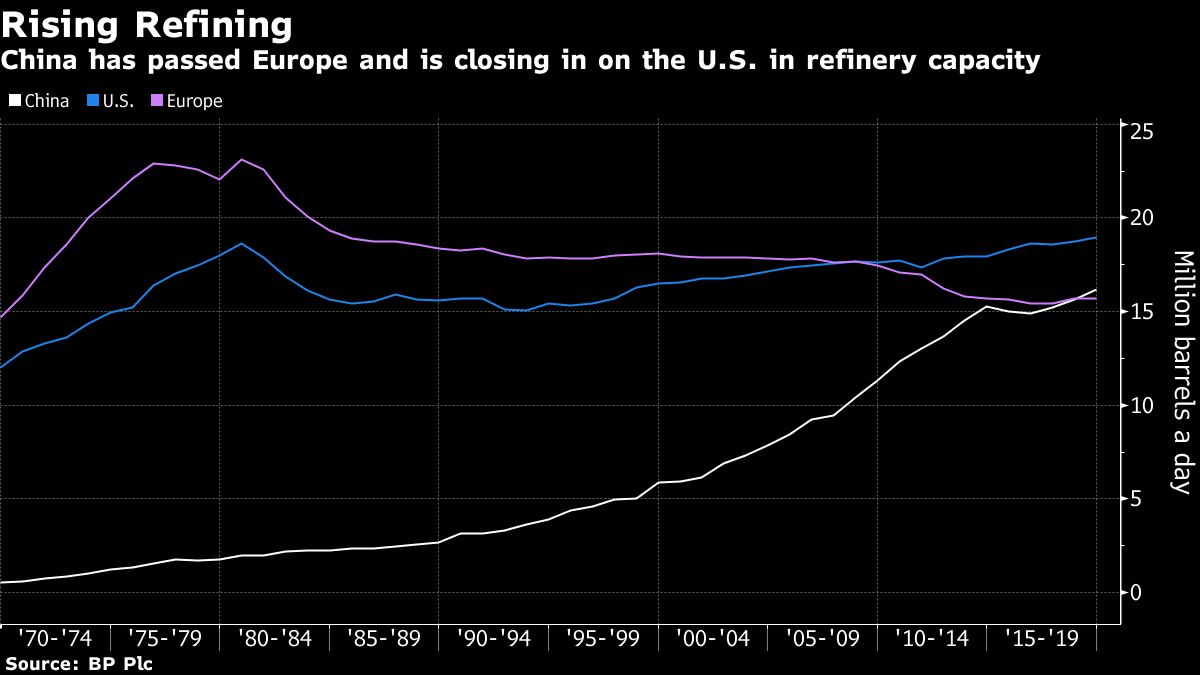

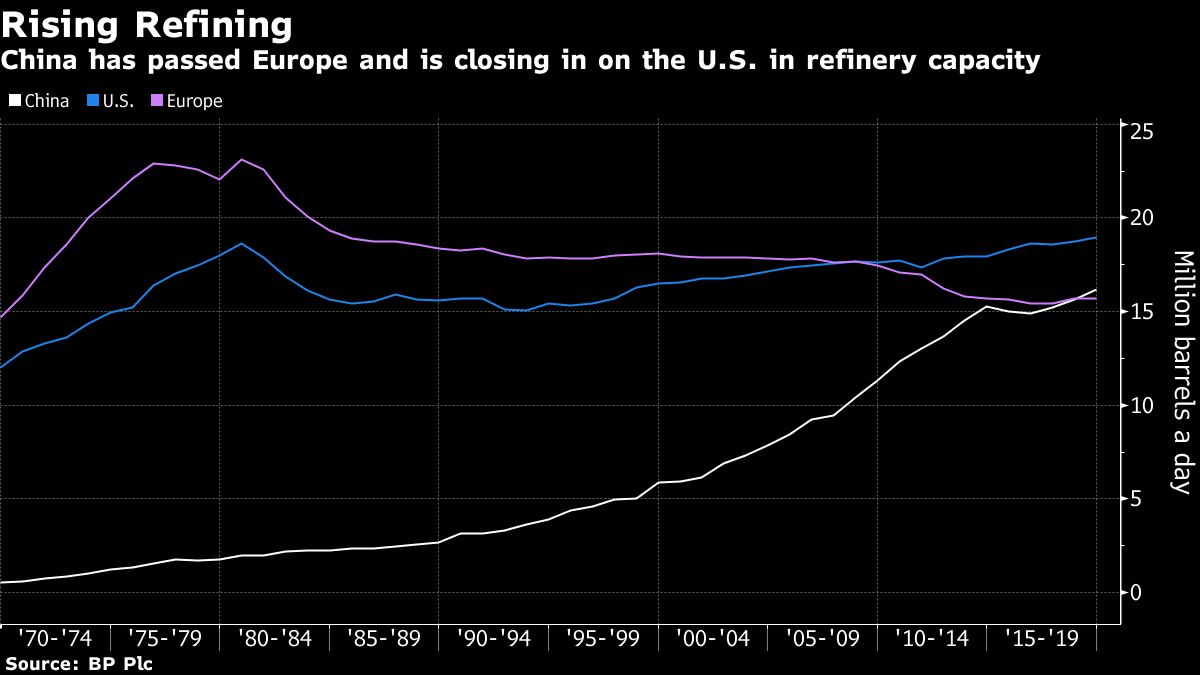

China investiert immer noch massiv in den Ausbau ihrer Raffinerie-Kapaiztät:

7.10.

China’s Building Mega Refineries Just as Fuel Demand Stalls

https://www.msn.com/en-us/money/markets/chinas-building-new-…

...

China is investing tens of billions of dollars in new mega-refineries even as its fuel demand is expected to peak within five years, raising the risk it will flood the region with cheap exports.

At least four projects with about 1.4 million barrels a day of crude-processing capacity, more than all refineries in the U.K. combined, are under construction. That’s after the country already added 1 million barrels since the start of 2019.

All that capacity will add more petroleum products and plastics just as China National Petroleum Corp. sees fuel demand peaking in 2025 as electric vehicles sap consumption.

...

7.10.

China’s Building Mega Refineries Just as Fuel Demand Stalls

https://www.msn.com/en-us/money/markets/chinas-building-new-…

...

China is investing tens of billions of dollars in new mega-refineries even as its fuel demand is expected to peak within five years, raising the risk it will flood the region with cheap exports.

At least four projects with about 1.4 million barrels a day of crude-processing capacity, more than all refineries in the U.K. combined, are under construction. That’s after the country already added 1 million barrels since the start of 2019.

All that capacity will add more petroleum products and plastics just as China National Petroleum Corp. sees fuel demand peaking in 2025 as electric vehicles sap consumption.

...

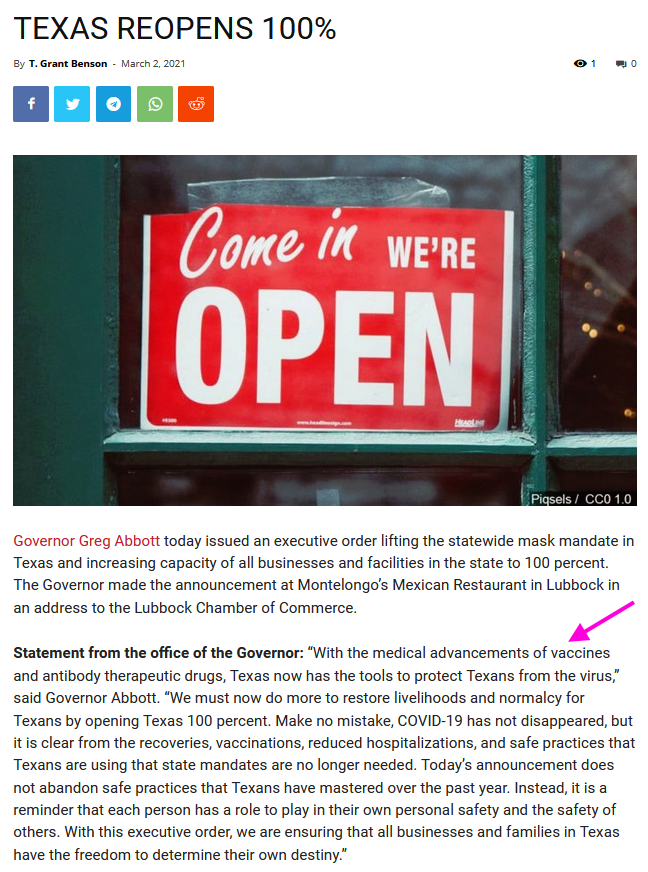

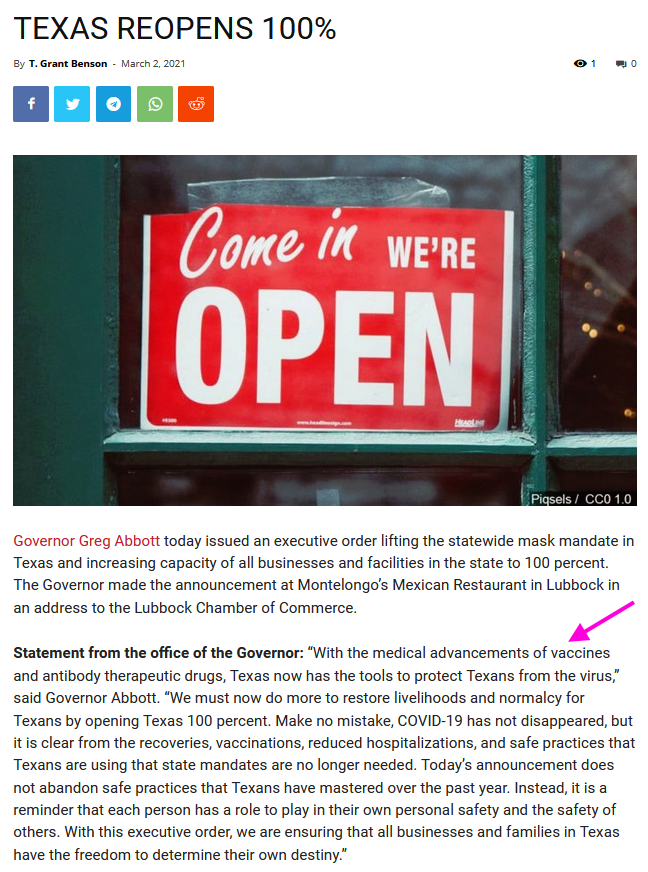

Texas wieder auf!

https://breaking911.com/texas-reopens-100/

MPC in TX:

• Galveston Bay Refinery

• El Paso Refinery

(neben anderen Standorten natürlich)

=> diese Maßnahme setzt andere Staaten nun unter Druck mMn

(das soll keine Wertung sein, ob sinnvoll oder nicht. Aber so ist die Welt.)

https://breaking911.com/texas-reopens-100/

MPC in TX:

• Galveston Bay Refinery

• El Paso Refinery

(neben anderen Standorten natürlich)

=> diese Maßnahme setzt andere Staaten nun unter Druck mMn

(das soll keine Wertung sein, ob sinnvoll oder nicht. Aber so ist die Welt.)

Antwort auf Beitrag Nr.: 67.275.516 von faultcode am 03.03.21 00:45:51FINDLAY, Ohio, May 4, 2021 /PRNewswire/ --

• Reported first-quarter loss of $242 million, or $(0.37) per diluted share, which includes pre-tax charges of $70 million; reported adjusted loss of $132 million, or $(0.20) per diluted share

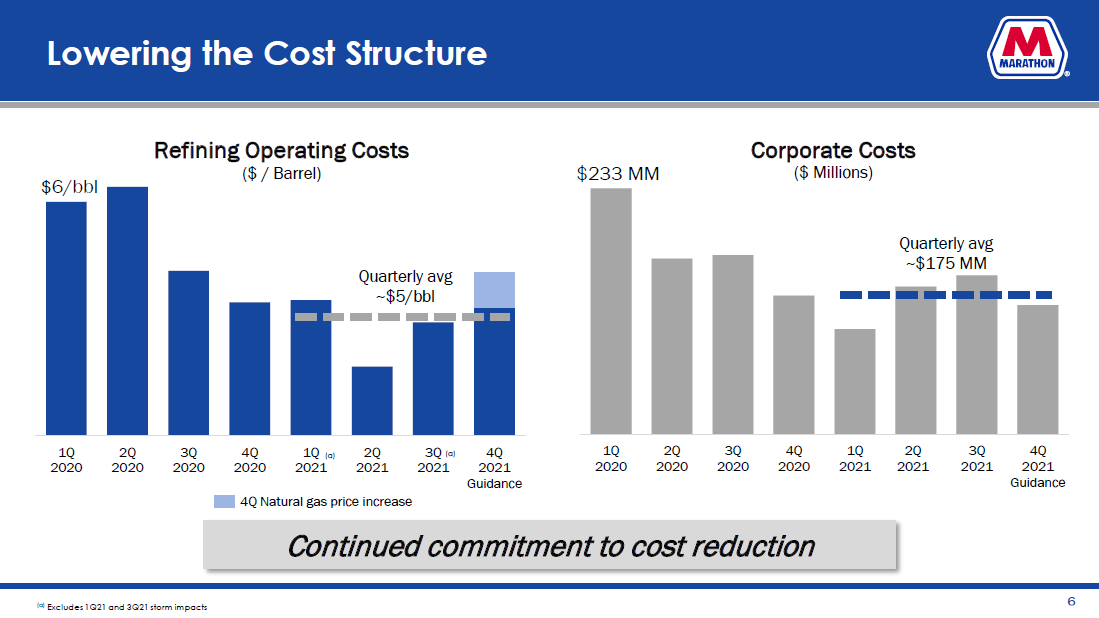

• Reported adjusted EBITDA of $1.6 billion, driven by refining margin recovery, stability of midstream business, and continued focus to lower the overall cost structure

• Progressing renewables portfolio with final investment decision for Martinez conversion

• $21 billion Speedway sale close to completion

...

https://ir.marathonpetroleum.com/investor/news-releases/news…

• Reported first-quarter loss of $242 million, or $(0.37) per diluted share, which includes pre-tax charges of $70 million; reported adjusted loss of $132 million, or $(0.20) per diluted share

• Reported adjusted EBITDA of $1.6 billion, driven by refining margin recovery, stability of midstream business, and continued focus to lower the overall cost structure

• Progressing renewables portfolio with final investment decision for Martinez conversion

• $21 billion Speedway sale close to completion

...

https://ir.marathonpetroleum.com/investor/news-releases/news…

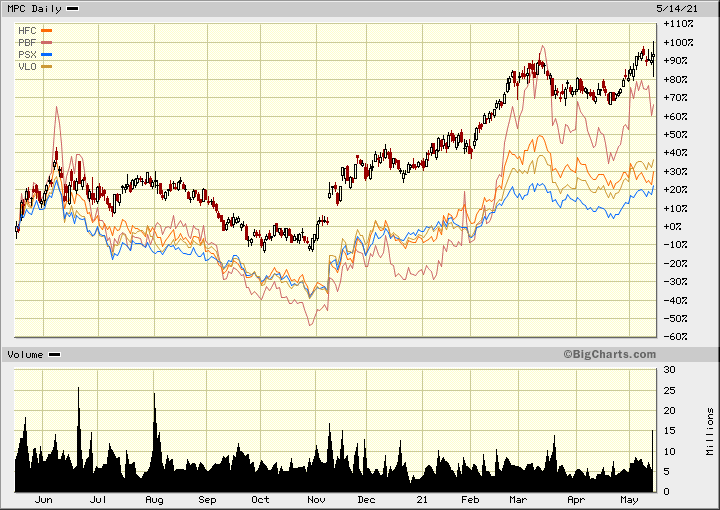

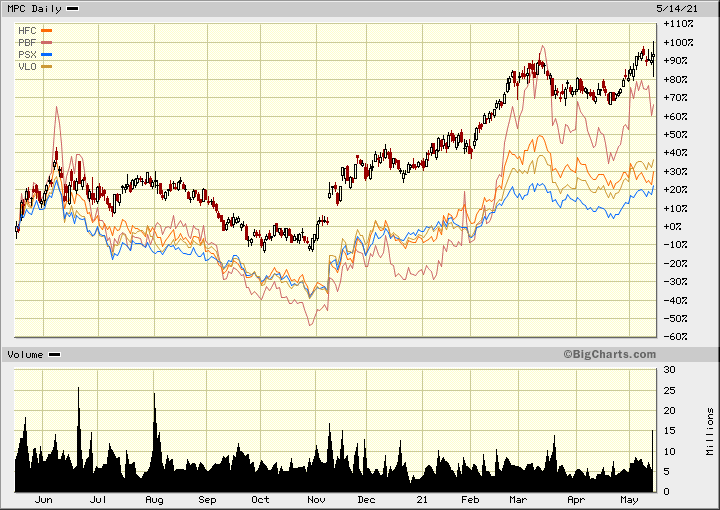

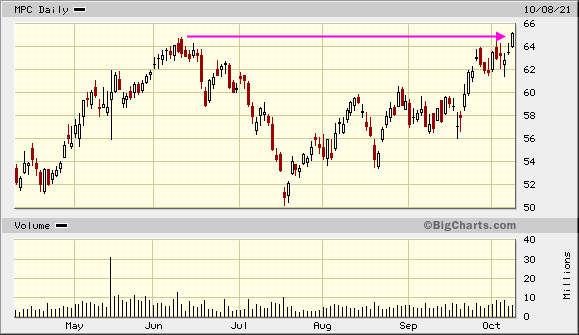

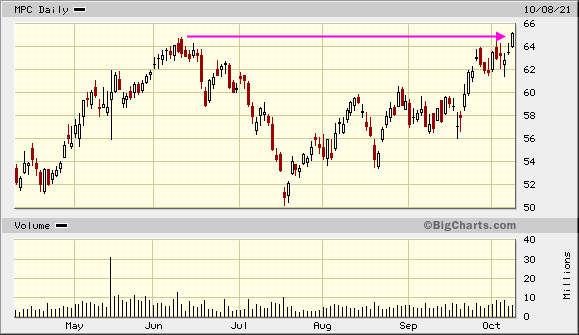

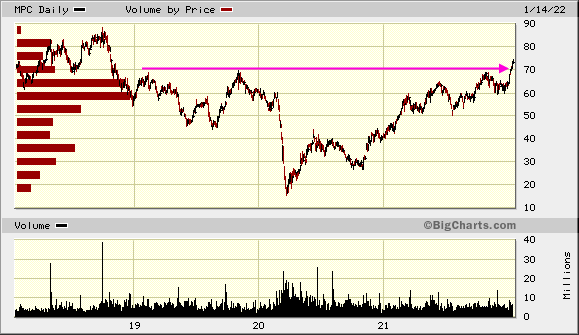

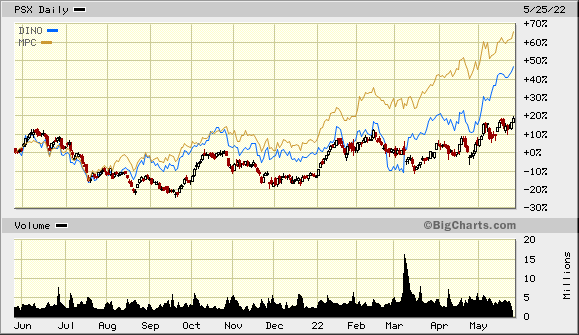

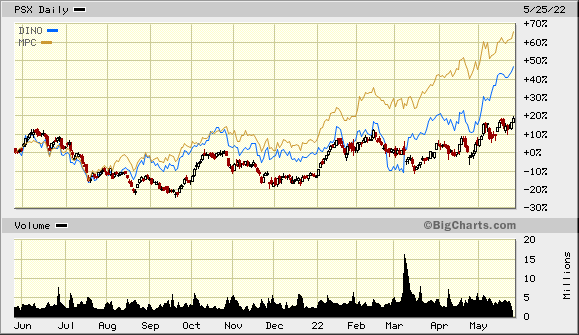

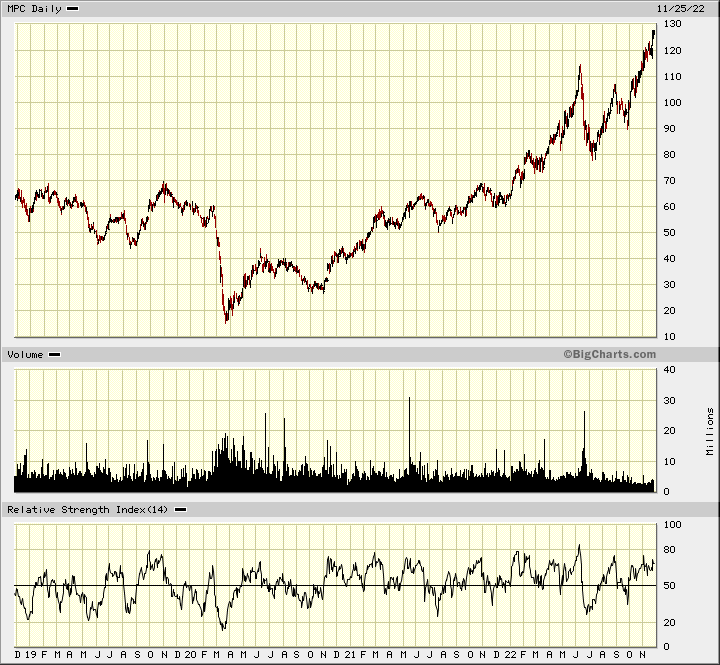

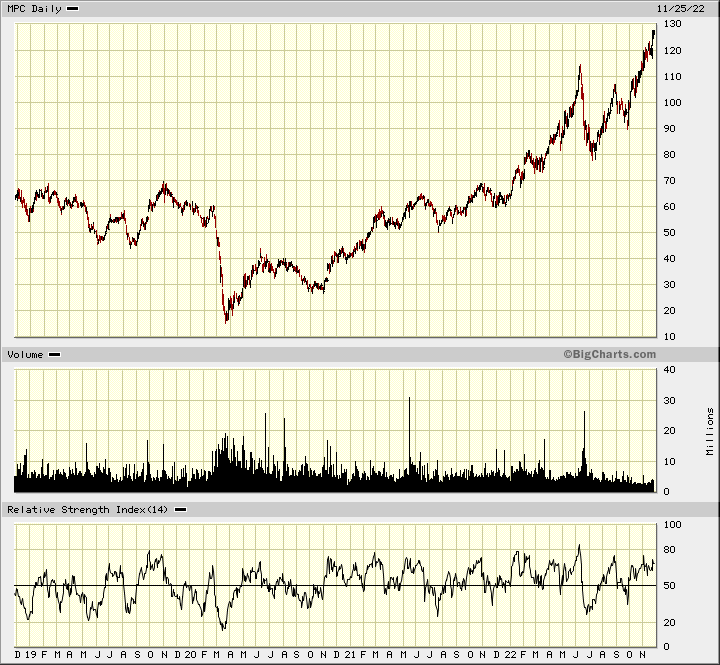

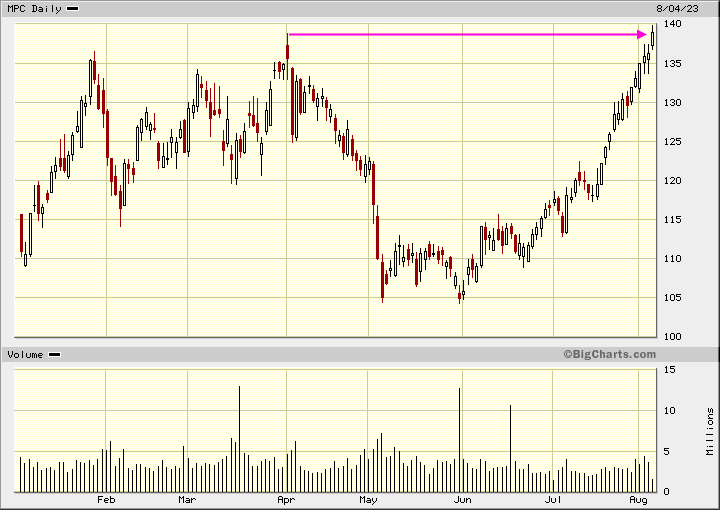

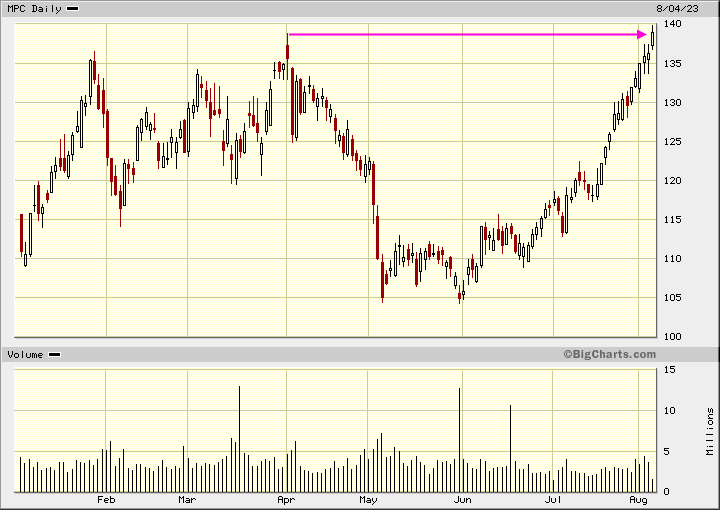

Antwort auf Beitrag Nr.: 68.044.355 von faultcode am 04.05.21 13:22:43MPC rockt sie alle:

--> neues 52-Wochen-Hoch:

(kein total return)

--> neues 52-Wochen-Hoch:

(kein total return)

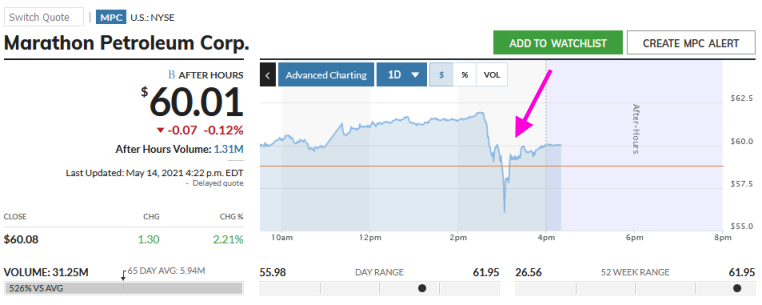

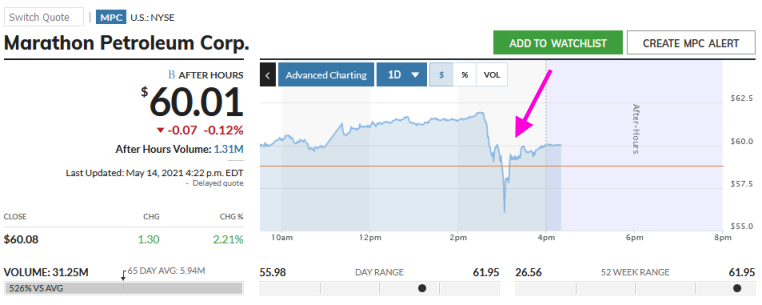

Antwort auf Beitrag Nr.: 68.044.355 von faultcode am 04.05.21 13:22:43Speedway

14.5.

https://www.ftc.gov/news-events/press-releases/2021/05/state…

14.5.

https://www.ftc.gov/news-events/press-releases/2021/05/state…

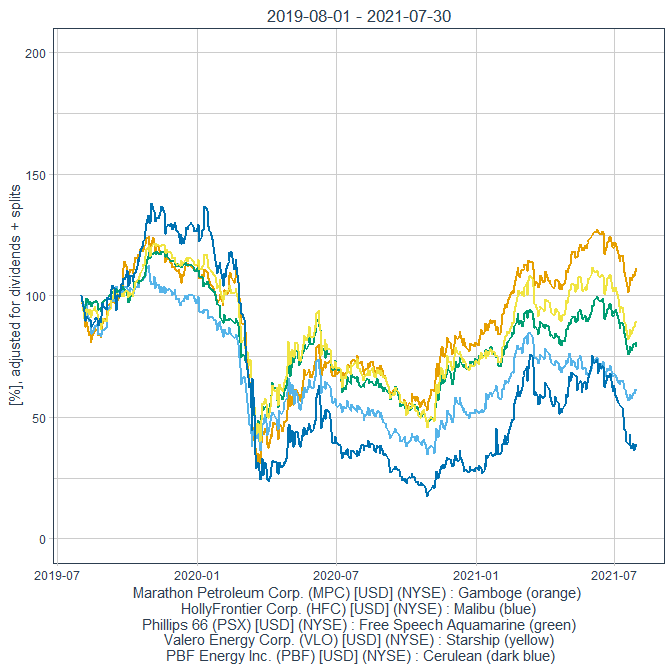

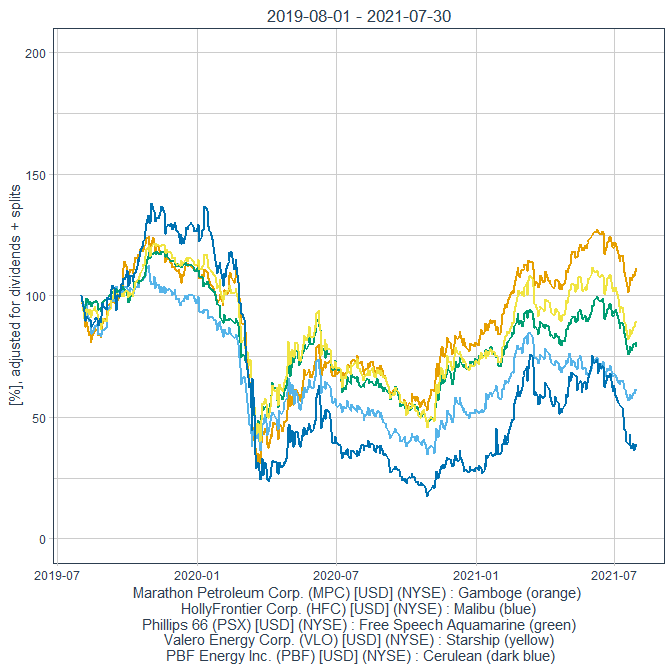

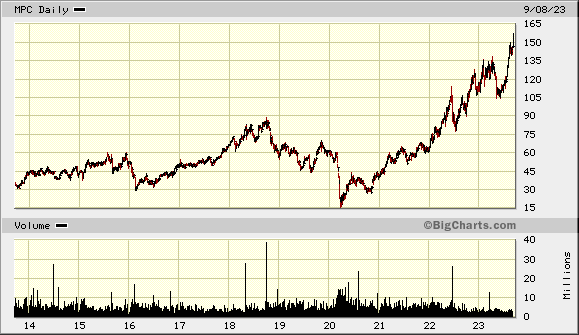

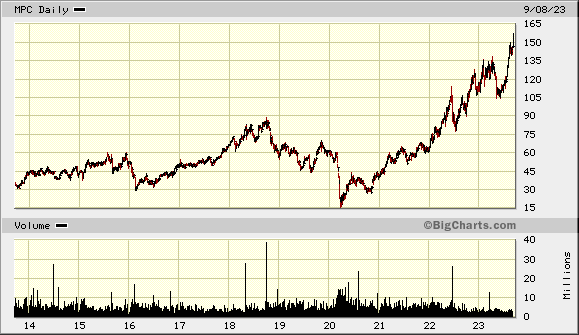

Independent oil refiners: and the winner is..

Marathon Petroleum Corporation

"vor Corona" versus "nach Corona":

das ist keine Total return-Vergleich, sondern nur mit Hilfe der Adjusted close-Preise gemacht; nicht perfekt, aber immerhin

Marathon Petroleum Corporation

"vor Corona" versus "nach Corona":

das ist keine Total return-Vergleich, sondern nur mit Hilfe der Adjusted close-Preise gemacht; nicht perfekt, aber immerhin

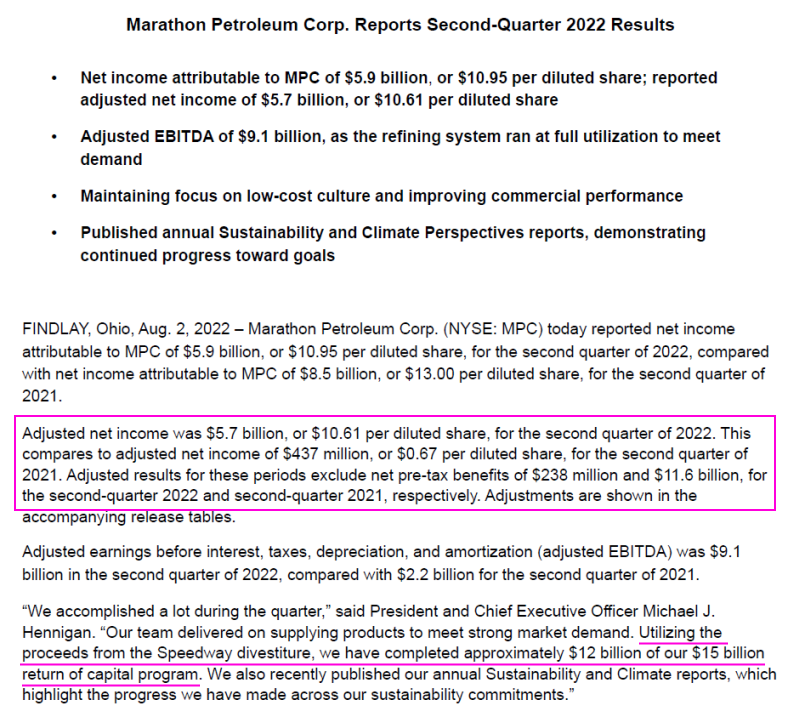

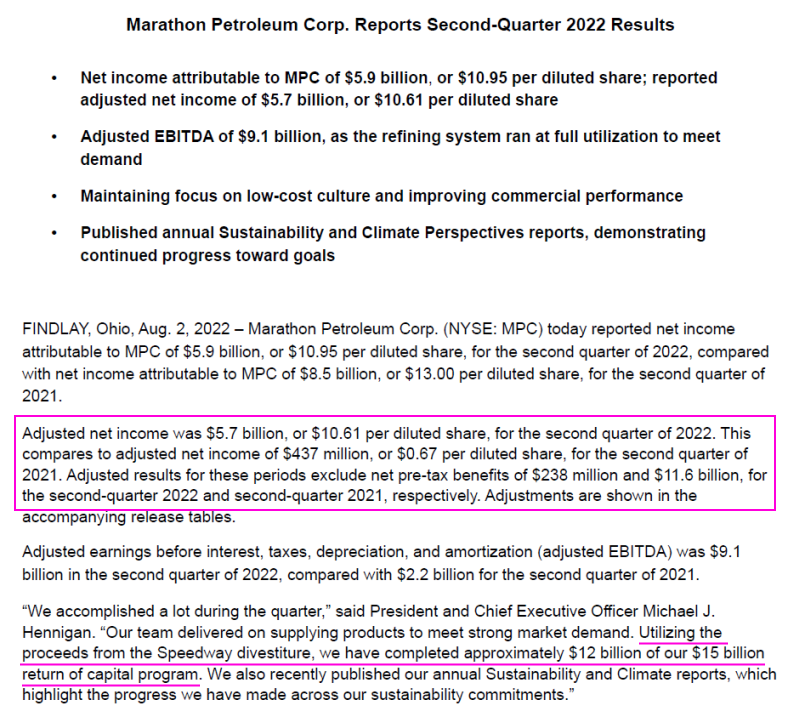

4.8.

Marathon Petroleum Corporation Q2 adjusted earnings Beat Estimates

https://markets.businessinsider.com/news/stocks/marathon-pet…

...

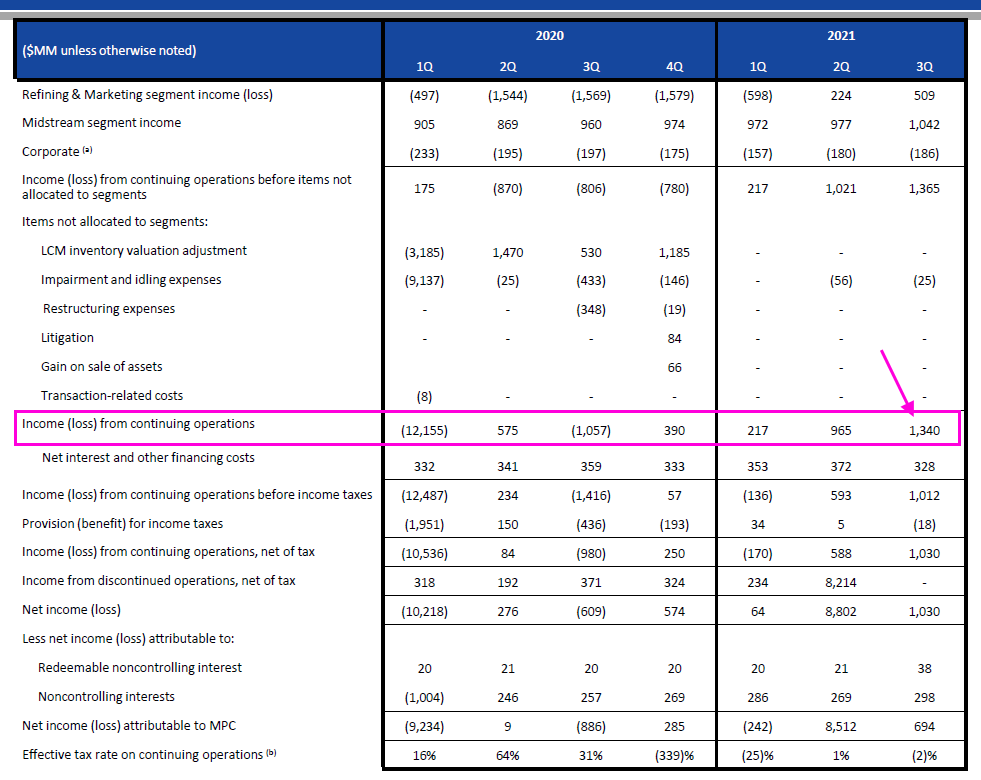

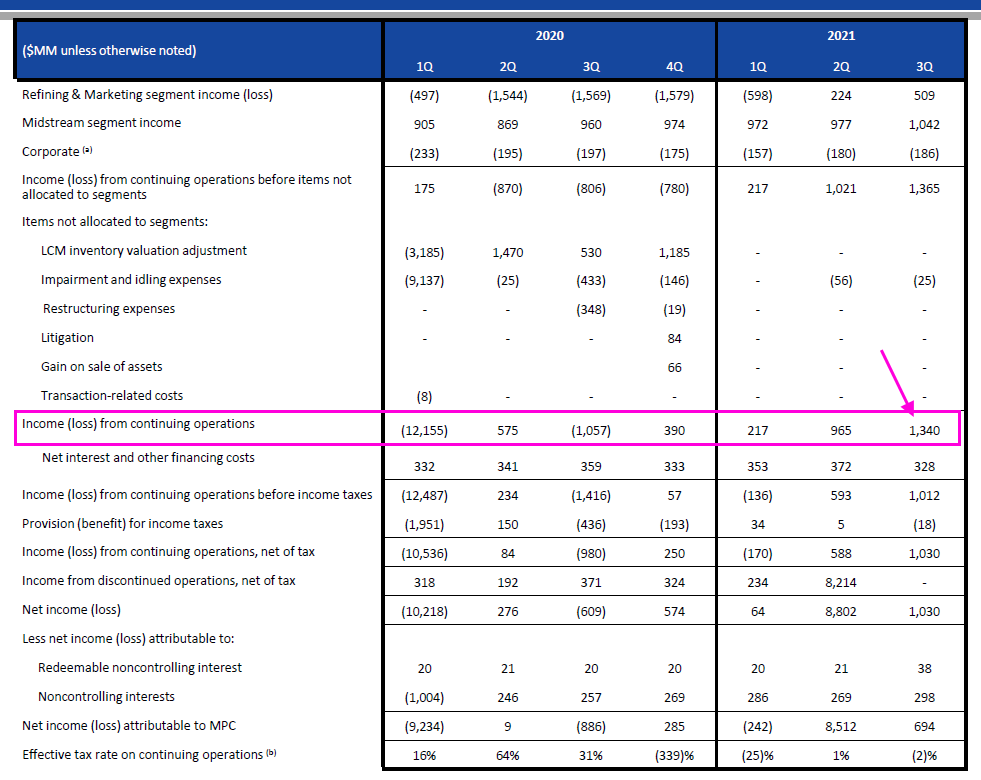

• Earnings: $965 million in Q2 vs. $575 million in the same period last year.

• EPS: $0.46 in Q2 vs. -$0.28 in the same period last year.

• Excluding items, Marathon Petroleum Corporation reported adjusted earnings of $437 million or $0.67 per share for the period.

• Analysts projected $0.53 per share

• Revenue: $29.83 billion in Q2 vs. $12.3 billion in the same period last year.

Marathon Petroleum Corporation Q2 adjusted earnings Beat Estimates

https://markets.businessinsider.com/news/stocks/marathon-pet…

...

• Earnings: $965 million in Q2 vs. $575 million in the same period last year.

• EPS: $0.46 in Q2 vs. -$0.28 in the same period last year.

• Excluding items, Marathon Petroleum Corporation reported adjusted earnings of $437 million or $0.67 per share for the period.

• Analysts projected $0.53 per share

• Revenue: $29.83 billion in Q2 vs. $12.3 billion in the same period last year.

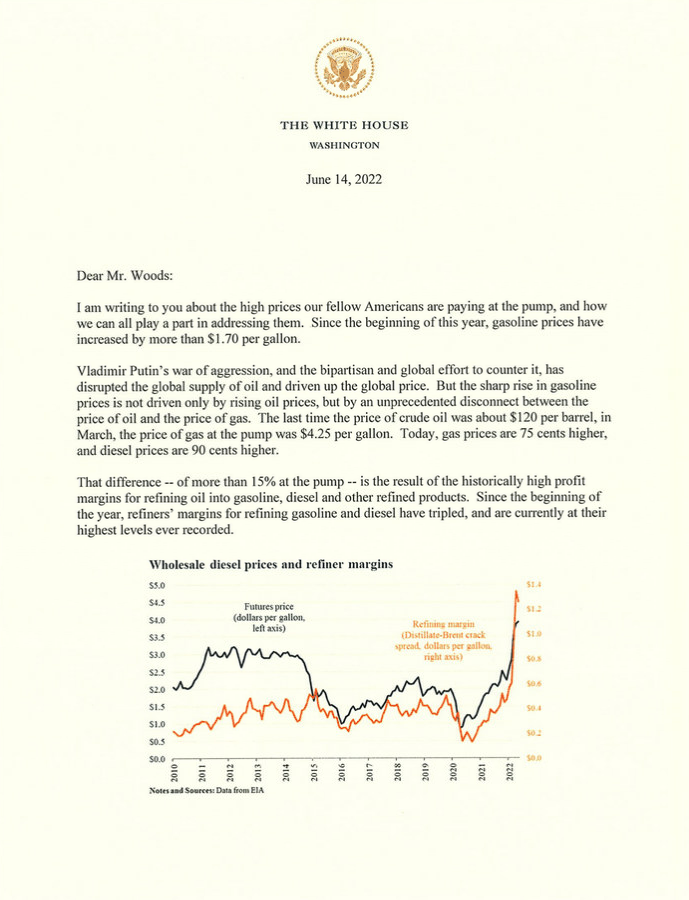

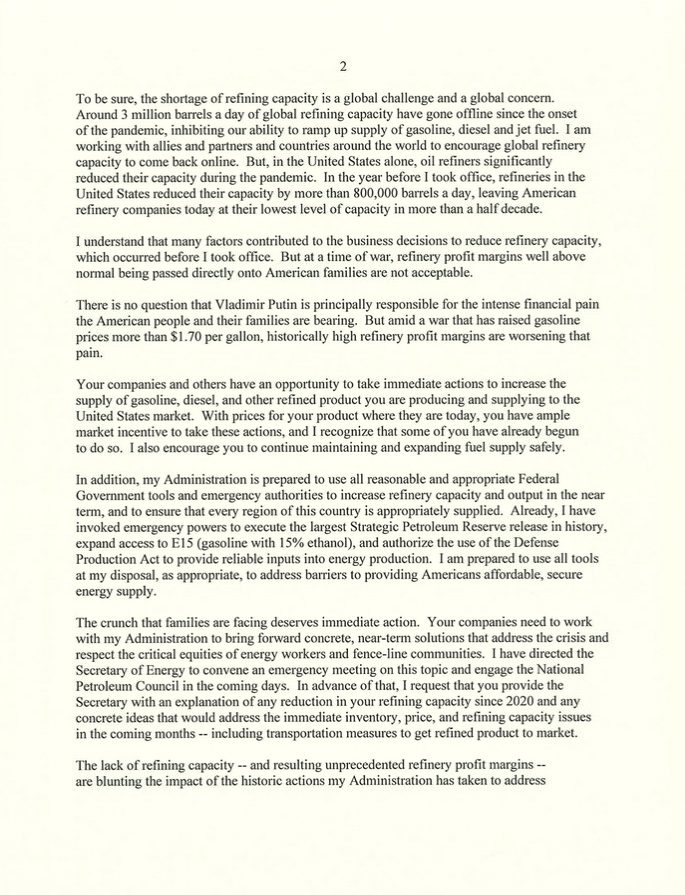

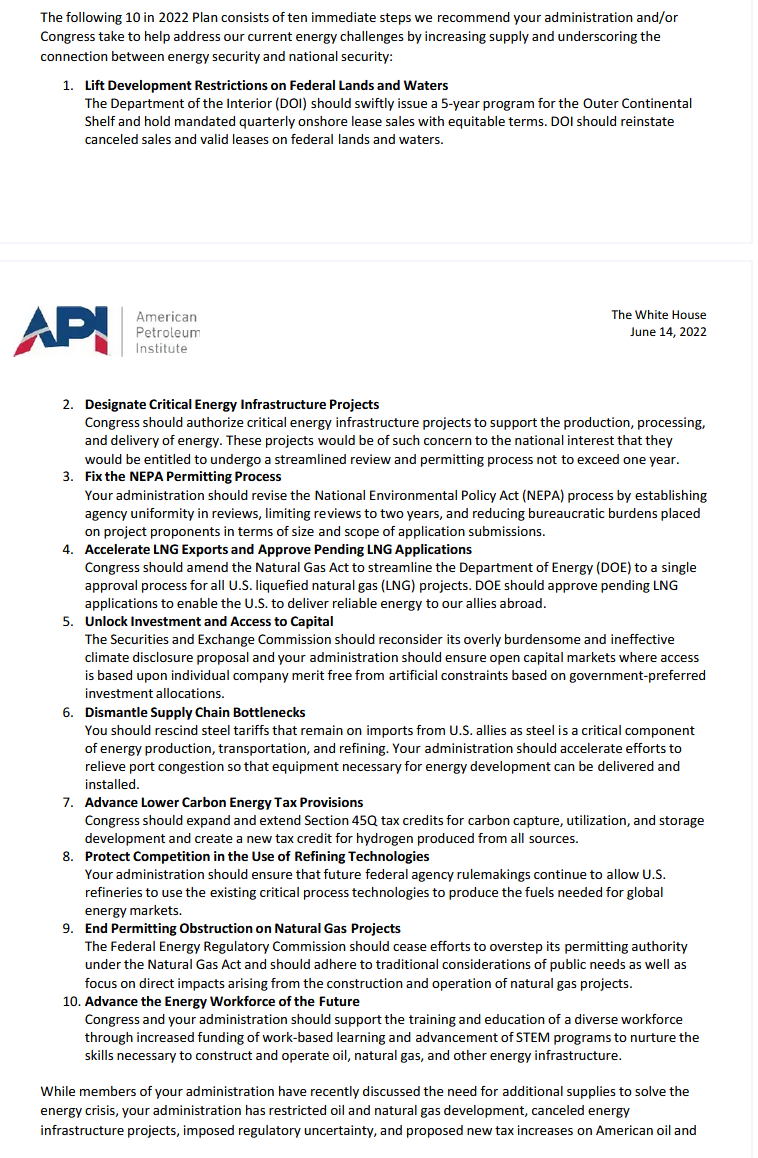

die Biden-Administration hat einen Schuldigen für zu hohe Inflation gefunden:

https://twitter.com/business/status/1432346393432166407

...

FTC Chair Lina Khan is directing staff to identify new legal theories to challenge retail fuel station mergers and investigate possible collusion by national chains to push up prices, she said in an Aug. 25 letter to White House economic adviser Brian Deese obtained by Bloomberg.

...

https://twitter.com/business/status/1432346393432166407

...

FTC Chair Lina Khan is directing staff to identify new legal theories to challenge retail fuel station mergers and investigate possible collusion by national chains to push up prices, she said in an Aug. 25 letter to White House economic adviser Brian Deese obtained by Bloomberg.

...

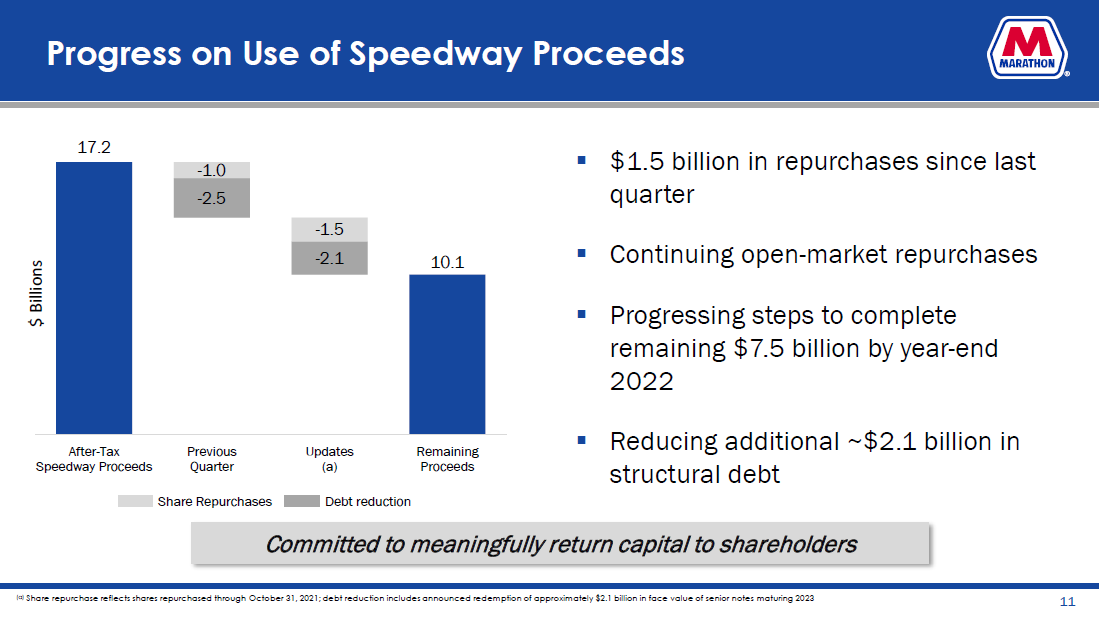

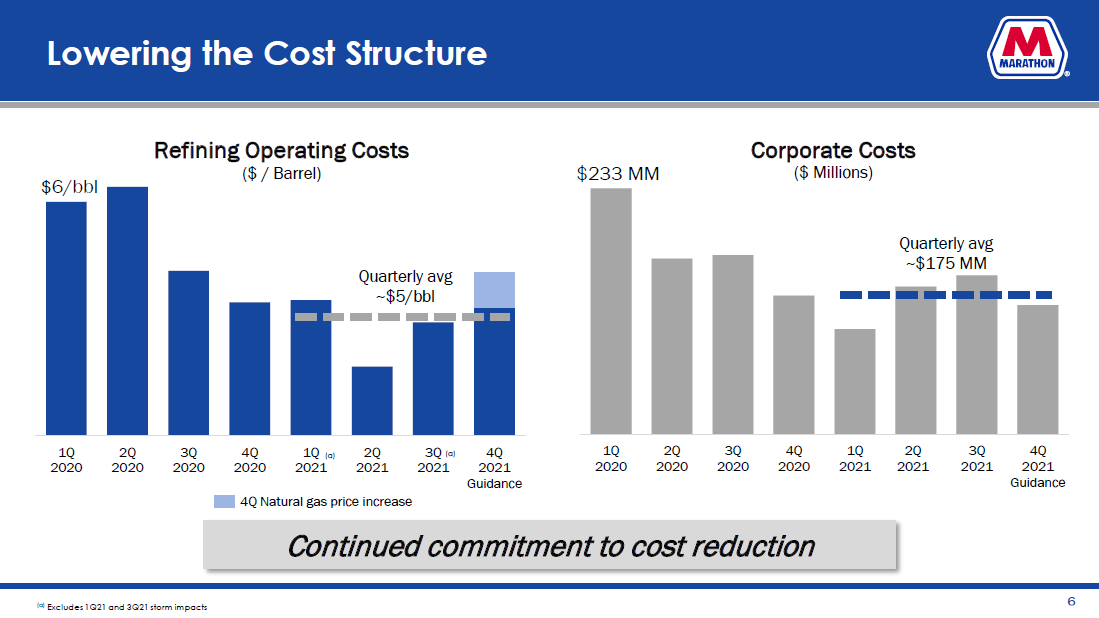

MPC vor dem Durchbruch?

MPC mit mMn gefälligem Q3-Ergebnis. Post-Krise mit höchstem oper. Ergebnis aus fortgeführten Geschäften:

Die Preise für NatGas belasten auch hier.

Daß es beim Speedway-Verkauf noch zu rechtlichen Komplikationen mit der US-Regierung kommen könnte (Beitrag Nr. 20), scheint kein Thema in der Q3-Präsentation zu sein (ich habe das CC-Transkript aber nicht gelesen):

ansonsten:

Die Preise für NatGas belasten auch hier.

Daß es beim Speedway-Verkauf noch zu rechtlichen Komplikationen mit der US-Regierung kommen könnte (Beitrag Nr. 20), scheint kein Thema in der Q3-Präsentation zu sein (ich habe das CC-Transkript aber nicht gelesen):

ansonsten:

Antwort auf Beitrag Nr.: 69.791.625 von faultcode am 03.11.21 14:28:25

in den USA ist NatGas mittlerweile ein gutes Stück wieder zurückgekommen.

=> und durch:

Zitat von faultcode: ...Die Preise für NatGas belasten auch hier....

in den USA ist NatGas mittlerweile ein gutes Stück wieder zurückgekommen.

=> und durch:

21.2.

Marathon’s Huge Louisiana Refinery Rocked by Explosion, Fire

https://finance.yahoo.com/news/marathon-huge-louisiana-oil-r…

...

Marathon Petroleum Corp.’s oil refinery near New Orleans exploded into flames on Monday, threatening to crimp fuel supplies and raise pump prices at a time of already rampant inflation.

The company’s Garyville, Louisiana, plant is one of the nation’s largest and a key supplier of gasoline, diesel and other fuels. Marathon said five people were injured. The blaze that started around 9:30 a.m. local time was declared extinguished about 4 1/2 hours later.

The fire occurred in a hydrocracker, according to a person familiar with the operation, a crucial price of equipment that breaks heavy petroleum molecules down into lighter products such as diesel.

If any damages are significant enough to halt production at the Garyville complex, regional fuel supplies may be stretched.

...

Marathon’s Huge Louisiana Refinery Rocked by Explosion, Fire

https://finance.yahoo.com/news/marathon-huge-louisiana-oil-r…

...

Marathon Petroleum Corp.’s oil refinery near New Orleans exploded into flames on Monday, threatening to crimp fuel supplies and raise pump prices at a time of already rampant inflation.