Royal Bank of Scotland - Die letzten 30 Beiträge

eröffnet am 04.11.06 16:29:15 von

neuester Beitrag 16.02.24 13:57:34 von

neuester Beitrag 16.02.24 13:57:34 von

Beiträge: 11.018

ID: 1.092.198

ID: 1.092.198

Aufrufe heute: 0

Gesamt: 1.599.295

Gesamt: 1.599.295

Aktive User: 0

ISIN: GB00BM8PJY71 · WKN: A3DS0H · Symbol: RYSD

3,6050

EUR

+0,81 %

+0,0290 EUR

Letzter Kurs 06.05.24 Tradegate

Neuigkeiten

26.04.24 · dpa-AFX |

26.04.24 · wallstreetONLINE Redaktion |

23.04.24 · Markus Weingran |

16.02.24 · wallstreetONLINE Redaktion |

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8400 | +16,67 | |

| 2,0400 | +15,91 | |

| 5,9000 | +15,69 | |

| 3,4000 | +13,33 | |

| 3,1000 | +10,71 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,7200 | -9,33 | |

| 28,00 | -9,68 | |

| 0,9000 | -11,76 | |

| 14,750 | -14,14 | |

| 1.138,25 | -16,86 |

Beitrag zu dieser Diskussion schreiben

227,415 GBp +6,12 % +13,115

2,699 EUR +5,51 % +0,141

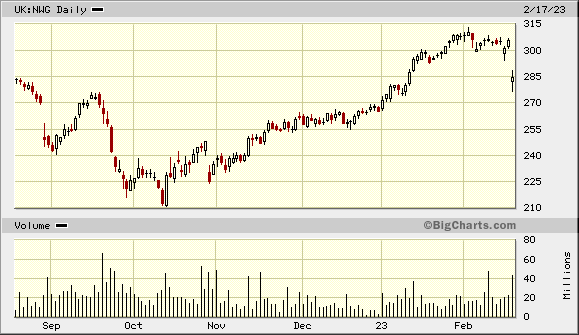

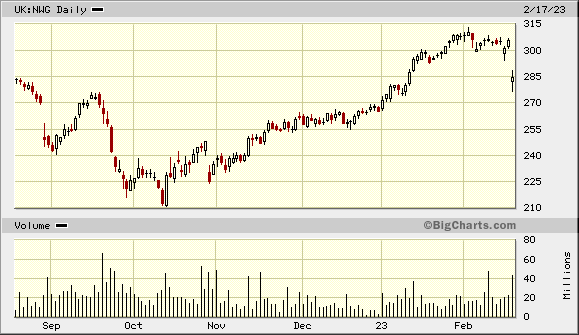

Der Kurseinbruch vom Oktober ist längst verdaut

Jahresergebnis 2023 heute veröffentlich und der Kurs geht ab

Leichte Delle im STXE 600 Banks Index vor einer Woche genutzt um Soc Gen nach zu legen

2,699 EUR +5,51 % +0,141

Der Kurseinbruch vom Oktober ist längst verdaut

Jahresergebnis 2023 heute veröffentlich und der Kurs geht ab

Leichte Delle im STXE 600 Banks Index vor einer Woche genutzt um Soc Gen nach zu legen

Antwort auf Beitrag Nr.: 74.704.655 von NickelChrome am 27.10.23 14:45:42

Na also .... besser kaufen wenn es kracht

2,592 EUR +3,43 % +0,086 ... Lockere 20 % im Plus ... Hatte nicht so viel Liquidität im Oktober weil es so viel Land unter gab

219,40 GBp +2,14 % +4,60

Zitat von NickelChrome: 27.10.2023 13:57:10 2,1150 2.000 Xetra ...

2,115 EUR -11,91 % -0,286

In London 180,20 GBp -12,44 % -25,60

Schluss Vortag 205,80

Eröffnung 173,00

Hoch 189,60

Tief 168,30

Hätte in London heute Morgen kaufen sollen aber das lohnt sich erst ab nem größeren Betrag

Heute Morgen in Deutschland Umsätze zu alten KursenNichts über Nacht stehen lassen !!!!

Spreads in Deutschland katastrophal hoch zu Handelsbeginn

Na also .... besser kaufen wenn es kracht

2,592 EUR +3,43 % +0,086 ... Lockere 20 % im Plus ... Hatte nicht so viel Liquidität im Oktober weil es so viel Land unter gab

219,40 GBp +2,14 % +4,60

22.11.

NatWest shares could be sold to public, says Hunt

https://www.bbc.co.uk/news/business-67500460

...

The government is considering selling some of its remaining shares in NatWest to the general public, the chancellor has said.

In the Autumn Statement, Jeremy Hunt said he would "explore options" for a retail share offer in the next year.

However, he added any sale would be "subject to market conditions and achieving full value for money".

The Treasury still owns 39% of the firm after a £46bn bailout of the bank during the 2008 financial crisis.

...

NatWest shares could be sold to public, says Hunt

https://www.bbc.co.uk/news/business-67500460

...

The government is considering selling some of its remaining shares in NatWest to the general public, the chancellor has said.

In the Autumn Statement, Jeremy Hunt said he would "explore options" for a retail share offer in the next year.

However, he added any sale would be "subject to market conditions and achieving full value for money".

The Treasury still owns 39% of the firm after a £46bn bailout of the bank during the 2008 financial crisis.

...

17.11.

Lloyds replaced by NatWest as Barclays' preferred UK banking play

https://www.proactiveinvestors.com/companies/news/1033492/ll…

...

Lloyds Banking Group PLC (LSE:LLOY) has been replaced by NatWest Group PLC as Barclays' preferred pick among UK banks.

The broker has upgraded NatWest to 'overweight' from 'equal weight' with a 330p price target, well above today's 206.50p share price.

Barclays said it has upgraded NatWest on signs of slowing deposit migration and now sees it as best placed to overcome term-funding risks.

It looks for a substantial rebound in net interest margin (NIM) and earnings, ahead of consensus, driven by a best-in-class structural hedge tailwind.

“As well as now being 10% ahead of consensus 2024E PBT, we see NatWest as able to comfortably deliver a double-digit RoTE over the medium term, even in the unlikely event of sharp rate cuts or a significant re-acceleration in deposit migration,” it said.

...

Lloyds replaced by NatWest as Barclays' preferred UK banking play

https://www.proactiveinvestors.com/companies/news/1033492/ll…

...

Lloyds Banking Group PLC (LSE:LLOY) has been replaced by NatWest Group PLC as Barclays' preferred pick among UK banks.

The broker has upgraded NatWest to 'overweight' from 'equal weight' with a 330p price target, well above today's 206.50p share price.

Barclays said it has upgraded NatWest on signs of slowing deposit migration and now sees it as best placed to overcome term-funding risks.

It looks for a substantial rebound in net interest margin (NIM) and earnings, ahead of consensus, driven by a best-in-class structural hedge tailwind.

“As well as now being 10% ahead of consensus 2024E PBT, we see NatWest as able to comfortably deliver a double-digit RoTE over the medium term, even in the unlikely event of sharp rate cuts or a significant re-acceleration in deposit migration,” it said.

...

195,00 GBp -0,10 % -0,20 Tief vor ner Woche 176,05 52 Wochentief 168,30

Aktie hat sich in einer Woche um 10 % erholt ... 52 Wochenhoch 313,10

Aktie hat sich in einer Woche um 10 % erholt ... 52 Wochenhoch 313,10

https://investors.natwestgroup.com/shareholder-centre/ordina…

Dieses Jahr gab es eine Final 10 pence für 2022 und 5,5 pence interim ... bei einem Kurs von 178,15 GBp -2,12 % -3,85

Dieses Jahr gab es eine Final 10 pence für 2022 und 5,5 pence interim ... bei einem Kurs von 178,15 GBp -2,12 % -3,85

Wohl we bei Barclays --- Na das wird mit den Quartalsberichten viel zu viele Kaufgelegenheiten geben

Vor zwei Wochen bei 2,70 Euro Februar 3,50 Zum Glück erst heute gekauft

Zum Glück erst heute gekauft

Vor zwei Wochen bei 2,70 Euro Februar 3,50

Zum Glück erst heute gekauft

Zum Glück erst heute gekauft

27.10.

Q3: https://investors.natwestgroup.com/results-centre

NatWest Cuts Margin Guidance on Growing Savings Competition

https://www.bnnbloomberg.ca/natwest-cuts-margin-guidance-on-…

...

The bank reported a net interest margin of 2.94%, compared with 2.99% a year ago, and said the full-year figure was set to be above 3%, down from its previous expectations.

NatWest executives pointed to customers shifting into fixed-term accounts to take advantage of better rates, which means the bank spends more on interest payments, as well as the potential end of Bank of England rate hikes that have buoyed earnings on deposits for the past two years.

“This is a material downgrade to consensus earnings expectations,” Barclays analysts wrote in a note.

Its shares were trading 9.23% lower at the time of publication, having fallen as much as 18.2%. The UK government remains NatWest’s biggest shareholder following a bailout during the financial crisis.

Chief Financial Officer Katie Murray told reporters the trend toward fixed-term accounts was “beginning to slow down a little bit,” and the bank is set to end the year with 17% of its deposits in fixed-term accounts, compared to 15% currently. This type of product was a tiny slice of banking business when interest rates were at rock-bottom.

The UK’s biggest corporate lender reported operating pretax profit of £1.3 billion ($1.6 billion) for the third quarter, a rise of more than 22% on a year ago, but slightly below analyst expectations.

“Credit losses and impairments remain low and we are ready and able to stand by our customers and businesses through the current economic uncertainty,” Paul Thwaite, interim chief executive officer, said in a statement.

...

Q3: https://investors.natwestgroup.com/results-centre

NatWest Cuts Margin Guidance on Growing Savings Competition

https://www.bnnbloomberg.ca/natwest-cuts-margin-guidance-on-…

...

The bank reported a net interest margin of 2.94%, compared with 2.99% a year ago, and said the full-year figure was set to be above 3%, down from its previous expectations.

NatWest executives pointed to customers shifting into fixed-term accounts to take advantage of better rates, which means the bank spends more on interest payments, as well as the potential end of Bank of England rate hikes that have buoyed earnings on deposits for the past two years.

“This is a material downgrade to consensus earnings expectations,” Barclays analysts wrote in a note.

Its shares were trading 9.23% lower at the time of publication, having fallen as much as 18.2%. The UK government remains NatWest’s biggest shareholder following a bailout during the financial crisis.

Chief Financial Officer Katie Murray told reporters the trend toward fixed-term accounts was “beginning to slow down a little bit,” and the bank is set to end the year with 17% of its deposits in fixed-term accounts, compared to 15% currently. This type of product was a tiny slice of banking business when interest rates were at rock-bottom.

The UK’s biggest corporate lender reported operating pretax profit of £1.3 billion ($1.6 billion) for the third quarter, a rise of more than 22% on a year ago, but slightly below analyst expectations.

“Credit losses and impairments remain low and we are ready and able to stand by our customers and businesses through the current economic uncertainty,” Paul Thwaite, interim chief executive officer, said in a statement.

...

27.10.2023 13:57:10 2,1150 2.000 Xetra ...

2,115 EUR -11,91 % -0,286

In London 180,20 GBp -12,44 % -25,60

Schluss Vortag 205,80

Eröffnung 173,00

Hoch 189,60

Tief 168,30

Hätte in London heute Morgen kaufen sollen aber das lohnt sich erst ab nem größeren Betrag

Heute Morgen in Deutschland Umsätze zu alten Kursen Nichts über Nacht stehen lassen !!!!

Nichts über Nacht stehen lassen !!!!

Spreads in Deutschland katastrophal hoch zu Handelsbeginn

2,115 EUR -11,91 % -0,286

In London 180,20 GBp -12,44 % -25,60

Schluss Vortag 205,80

Eröffnung 173,00

Hoch 189,60

Tief 168,30

Hätte in London heute Morgen kaufen sollen aber das lohnt sich erst ab nem größeren Betrag

Heute Morgen in Deutschland Umsätze zu alten Kursen

Nichts über Nacht stehen lassen !!!!

Nichts über Nacht stehen lassen !!!!Spreads in Deutschland katastrophal hoch zu Handelsbeginn

13.10.

NatWest considers selling £1.2B stake in Phoenix Energy

https://www.investing.com/news/stock-market-news/natwest-con…

...

In recent developments, NatWest Group Pension Fund is reportedly contemplating the sale of its stake in Phoenix Energy, a greenfield project co-owned by the fund and the Utilities Trust of Australia. The stake, valued at £1.2 billion (GBP1 = USD1.0524), has attracted interest from investors based in Europe and Asia.

Phoenix Energy was initiated as a greenfield project by British Gas Plc back in 1996. It now delivers natural gas to over 350,000 households in Northern Ireland. The NatWest Group Pension Fund, previously known as Royal Bank of Scotland Group (LON:NWG) Pension Fund, along with the Utilities Trust of Australia, acquired their stakes in Phoenix Energy in 2013.

...

NatWest considers selling £1.2B stake in Phoenix Energy

https://www.investing.com/news/stock-market-news/natwest-con…

...

In recent developments, NatWest Group Pension Fund is reportedly contemplating the sale of its stake in Phoenix Energy, a greenfield project co-owned by the fund and the Utilities Trust of Australia. The stake, valued at £1.2 billion (GBP1 = USD1.0524), has attracted interest from investors based in Europe and Asia.

Phoenix Energy was initiated as a greenfield project by British Gas Plc back in 1996. It now delivers natural gas to over 350,000 households in Northern Ireland. The NatWest Group Pension Fund, previously known as Royal Bank of Scotland Group (LON:NWG) Pension Fund, along with the Utilities Trust of Australia, acquired their stakes in Phoenix Energy in 2013.

...

28.7.: Ausblick gesenkt: https://otp.tools.investis.com/clients/uk/rbs/RNS/regulatory…

...

We have delivered a strong performance in the first half of the year and maintained our robust capital and liquidity position. We continue to monitor the evolving economic outlook including the continued rise in cost of living and are mindful of the impact that rising inflation and higher interest rates are having on our customers.

...

NatWest reports profit rise amid fallout from Farage fiasco

https://www.cnbc.com/2023/07/28/natwest-reports-profit-rise-…

...

NatWest booked a £233 million pounds charge for potential loan defaults — compared to the release of £54 million last year — and lowered its net interest margin forecast for the year to below 3.2%, with an expectation of it hitting 3.15%.

...

...

We have delivered a strong performance in the first half of the year and maintained our robust capital and liquidity position. We continue to monitor the evolving economic outlook including the continued rise in cost of living and are mindful of the impact that rising inflation and higher interest rates are having on our customers.

...

NatWest reports profit rise amid fallout from Farage fiasco

https://www.cnbc.com/2023/07/28/natwest-reports-profit-rise-…

...

NatWest booked a £233 million pounds charge for potential loan defaults — compared to the release of £54 million last year — and lowered its net interest margin forecast for the year to below 3.2%, with an expectation of it hitting 3.15%.

...

26.7.

Skandal um Konto-Schließung von Nigel Farage kostet Bankchefin Job

https://www.wallstreet-online.de/nachricht/17172948-skandal-…

...

Finanz-Staatssekretär Andrew Griffiths begrüßte am Mittwoch den Rücktritt der Bank-Chefin. "Das wäre nie passiert, wenn NatWest sich nicht herausgenommen hätte, das Konto von jemandem aufgrund dessen legaler politischer Ansichten zu schließen. Das war und ist immer inakzeptabel", twitterte der konservative Politiker.

Wie Farage aus internen Bank-Dokumenten, deren Herausgabe er erzwungen hatte, in der vergangenen Woche nachweisen konnte, waren die Gründe für die Kontoschließung nicht allein finanziell. Daraus ging hervor, dass sich das Geldhaus Sorgen machte um seine Reputation mit dem Rechtspopulisten Farage als Kunden.

Farage beklagte sich über politische Diskriminierung und machte geltend, er habe Schwierigkeiten, überhaupt ein Konto zu bekommen. Er erhielt Rückendeckung von der Regierung. Selbst Premierminister Rishi Sunak äußerte sich in der Angelegenheit und kündigte an, die Regeln für Kontoschließungen zu verschärfen.

...

Skandal um Konto-Schließung von Nigel Farage kostet Bankchefin Job

https://www.wallstreet-online.de/nachricht/17172948-skandal-…

...

Finanz-Staatssekretär Andrew Griffiths begrüßte am Mittwoch den Rücktritt der Bank-Chefin. "Das wäre nie passiert, wenn NatWest sich nicht herausgenommen hätte, das Konto von jemandem aufgrund dessen legaler politischer Ansichten zu schließen. Das war und ist immer inakzeptabel", twitterte der konservative Politiker.

Wie Farage aus internen Bank-Dokumenten, deren Herausgabe er erzwungen hatte, in der vergangenen Woche nachweisen konnte, waren die Gründe für die Kontoschließung nicht allein finanziell. Daraus ging hervor, dass sich das Geldhaus Sorgen machte um seine Reputation mit dem Rechtspopulisten Farage als Kunden.

Farage beklagte sich über politische Diskriminierung und machte geltend, er habe Schwierigkeiten, überhaupt ein Konto zu bekommen. Er erhielt Rückendeckung von der Regierung. Selbst Premierminister Rishi Sunak äußerte sich in der Angelegenheit und kündigte an, die Regeln für Kontoschließungen zu verschärfen.

...

Antwort auf Beitrag Nr.: 74.041.524 von Patzer_Frank am 22.06.23 00:52:34meine Meinung: Angst vor den möglichen Negativ-Folgen der hohen und weiter steigenden Zinsen:

22.6.

Höhere Leitzinsen -- Britischen Hausbesitzern droht Kostenexplosion

Bereits jetzt liegen die Leitzinsen im Vereinigten Königreich auf dem höchsten Niveau seit der Finanzkrise 2008. Die Bank of England dürfte sie am Donnerstag weiter erhöhen. Experten warnen vor gravierenden Folgen für Immobilienbesitzer.

https://www.manager-magazin.de/finanzen/britischen-hausbesit…

...

Schon jetzt haben 50 Prozent der Hypothekeninhaber Probleme mit Krediten

...

22.6.

Höhere Leitzinsen -- Britischen Hausbesitzern droht Kostenexplosion

Bereits jetzt liegen die Leitzinsen im Vereinigten Königreich auf dem höchsten Niveau seit der Finanzkrise 2008. Die Bank of England dürfte sie am Donnerstag weiter erhöhen. Experten warnen vor gravierenden Folgen für Immobilienbesitzer.

https://www.manager-magazin.de/finanzen/britischen-hausbesit…

...

Schon jetzt haben 50 Prozent der Hypothekeninhaber Probleme mit Krediten

...

..und warum nimmt der Markt das nicht so gut auf?

13.6.

NatWest Hikes Rates, Santander Pulls Deals Amid UK Mortgage Pain

https://www.bnnbloomberg.ca/natwest-hikes-rates-santander-pu…

...

NatWest Group Plc has told brokers it will increase prices on some new and existing mortgages from Tuesday, becoming the latest British lender to respond to the spike in market rates.

The bank said in an email it would increase rates for first-time buyers and new buy-to-let purchases on selected two- and five-year deals, as well as other products. The rates offered on a number of buy-to-let products will rise by more than 1% overnight.

...

2.6.

State and NatWest offload 10% of Permanent TSB

Government and UK bank sell two thirds more of lender than had been expected

https://www.irishtimes.com/business/2023/06/02/state-and-nat…

...

NatWest received a 16.7 per cent stake late last year as part payment for loans it sold in its Ulster Bank unit to PTSB. This avoided PTSB having to go to the State and other shareholders for cash to help complete the loans purchase.

The deal has reduced Irish taxpayers’ stake in the bank from 62.4 per cent to 57.4 per cent, while NatWest’s has fallen to from 16.7 per cent to 11.7 per cent. The shares were sold at €2.025 each, representing an almost 8 per cent discount to their closing price on Thursday.

NatWest chief executive Alison Rose said: “This transaction represents further positive progress on our phased withdrawal from the Republic of Ireland.”

...

State and NatWest offload 10% of Permanent TSB

Government and UK bank sell two thirds more of lender than had been expected

https://www.irishtimes.com/business/2023/06/02/state-and-nat…

...

NatWest received a 16.7 per cent stake late last year as part payment for loans it sold in its Ulster Bank unit to PTSB. This avoided PTSB having to go to the State and other shareholders for cash to help complete the loans purchase.

The deal has reduced Irish taxpayers’ stake in the bank from 62.4 per cent to 57.4 per cent, while NatWest’s has fallen to from 16.7 per cent to 11.7 per cent. The shares were sold at €2.025 each, representing an almost 8 per cent discount to their closing price on Thursday.

NatWest chief executive Alison Rose said: “This transaction represents further positive progress on our phased withdrawal from the Republic of Ireland.”

...

22.5.

Britain chips away at NatWest stake with $1.6 billion share sale

https://finance.yahoo.com/news/britain-lowers-stake-natwest-…

...

British state-backed bank NatWest has agreed to buy 1.3 billion pounds ($1.6 billion) worth of its shares back from the government, as it edges closer towards private ownership 15 years after it was bailed out in the global financial crisis.

The deal will reduce the government's stake in the former Royal Bank of Scotland to 38.69% from around 41.4%.

The bank returned to majority private ownership in March 2022 after a similar block sale, as the government targets fully returning NatWest to private ownership by 2026.

...

Britain chips away at NatWest stake with $1.6 billion share sale

https://finance.yahoo.com/news/britain-lowers-stake-natwest-…

...

British state-backed bank NatWest has agreed to buy 1.3 billion pounds ($1.6 billion) worth of its shares back from the government, as it edges closer towards private ownership 15 years after it was bailed out in the global financial crisis.

The deal will reduce the government's stake in the former Royal Bank of Scotland to 38.69% from around 41.4%.

The bank returned to majority private ownership in March 2022 after a similar block sale, as the government targets fully returning NatWest to private ownership by 2026.

...

28.4.

NatWest Shares Drop as Lack of Guidance Upgrade Disappoints

https://www.morningstar.com/news/dow-jones/202304283785/natw…

...

NatWest shares tumble to the bottom of the FTSE 100 index at market open after the British bank reported first-quarter results. Shares open more than 6.5% lower at around 254 pence. The lender's lack of upgrade to its 2023 revenue guidance is likely to disappoint despite the earnings beat on better credit costs and noninterest income, Jefferies says in a note.

"Management really needed to raise the GBP14.8 billion 2023 revenue guide to around GBP15 billion given the incremental 25bps rate hike and higher swap rates," analyst Joseph Dickerson and associate Aqil Taiyeb say. NatWest's backing of its outlook guidance issued in February was the price-sensitive element of the update, they say.

...

NatWest Shares Drop as Lack of Guidance Upgrade Disappoints

https://www.morningstar.com/news/dow-jones/202304283785/natw…

...

NatWest shares tumble to the bottom of the FTSE 100 index at market open after the British bank reported first-quarter results. Shares open more than 6.5% lower at around 254 pence. The lender's lack of upgrade to its 2023 revenue guidance is likely to disappoint despite the earnings beat on better credit costs and noninterest income, Jefferies says in a note.

"Management really needed to raise the GBP14.8 billion 2023 revenue guide to around GBP15 billion given the incremental 25bps rate hike and higher swap rates," analyst Joseph Dickerson and associate Aqil Taiyeb say. NatWest's backing of its outlook guidance issued in February was the price-sensitive element of the update, they say.

...

11.4.

Hedge Fund Marshall Wace Builds £156 Million Short Position in NatWest

https://finance.yahoo.com/news/hedge-fund-marshall-wace-buil…

...

Hedge Fund Marshall Wace Builds £156 Million Short Position in NatWest

https://finance.yahoo.com/news/hedge-fund-marshall-wace-buil…

...

3.3.

NatWest Traders in Regulatory ‘Red Zone’ After String of Unexpected Losses

https://finance.yahoo.com/news/natwest-traders-regulatory-re…

...

NatWest Group Plc has proposed changing its risk models after suffering a string of unexpected losses that left its trading unit in the regulatory “red zone.”

NatWest Markets Plc exceeded its risk estimates on 16 days in 2022, and booked actual trading losses that were larger than expected on 10 days, according to recent company filings. This was more than allowed by financial supervisors.

Banks are supposed to keep track of the “value at risk” within their trading books under international Basel rules. They back-test their models each day to make sure any gains or losses were broadly expected.

But this proved particularly tough during last year’s volatility, with markets jolted by surprises such as the Russian invasion of Ukraine, the UK’s disastrous “mini budget” and rapidly rising interest rates. Banks including HSBC Holdings Plc and Standard Chartered Plc have vowed to update their risk models after being hit by a series of gains or losses that were greater than they anticipated.

While HSBC and StanChart hit the “amber zone” under Basel rules, NatWest’s more frequent breaches mean it’s expected to remain in the “red zone” until at least the end of the first quarter, inviting greater regulatory scrutiny.

“A prospective update to make the VaR model more sensitive to recent market conditions has been submitted to the PRA,” said the bank in a filing, referring to the UK Prudential Regulation Authority, which is part of the Bank of England.

...

NatWest Traders in Regulatory ‘Red Zone’ After String of Unexpected Losses

https://finance.yahoo.com/news/natwest-traders-regulatory-re…

...

NatWest Group Plc has proposed changing its risk models after suffering a string of unexpected losses that left its trading unit in the regulatory “red zone.”

NatWest Markets Plc exceeded its risk estimates on 16 days in 2022, and booked actual trading losses that were larger than expected on 10 days, according to recent company filings. This was more than allowed by financial supervisors.

Banks are supposed to keep track of the “value at risk” within their trading books under international Basel rules. They back-test their models each day to make sure any gains or losses were broadly expected.

But this proved particularly tough during last year’s volatility, with markets jolted by surprises such as the Russian invasion of Ukraine, the UK’s disastrous “mini budget” and rapidly rising interest rates. Banks including HSBC Holdings Plc and Standard Chartered Plc have vowed to update their risk models after being hit by a series of gains or losses that were greater than they anticipated.

While HSBC and StanChart hit the “amber zone” under Basel rules, NatWest’s more frequent breaches mean it’s expected to remain in the “red zone” until at least the end of the first quarter, inviting greater regulatory scrutiny.

“A prospective update to make the VaR model more sensitive to recent market conditions has been submitted to the PRA,” said the bank in a filing, referring to the UK Prudential Regulation Authority, which is part of the Bank of England.

...

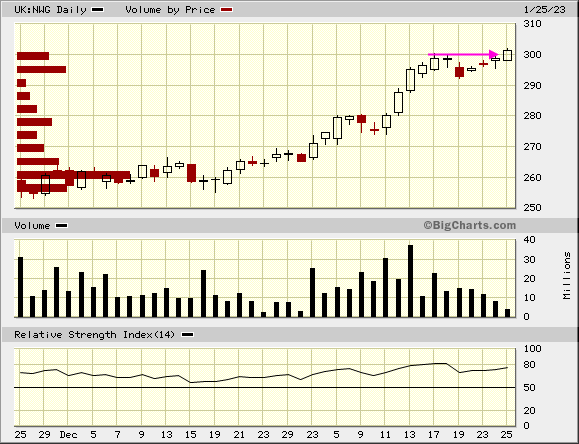

17.2.

Natwest Group announces buybacks worth $959 million as profit edges past forecasts

https://www.msn.com/en-us/money/companies/natwest-group-anno…

...

NatWest Group PLC on Friday posted a rise in pretax profit for the fourth quarter of 2022, which came in slightly ahead of market views, and said it intends to start a share buyback program of up to 800 million pounds ($959 million) in the first half of 2023.

The U.K. bank posted a pretax profit of GBP1.43 billion for the three months to Dec. 31 compared with GBP543 million for the fourth quarter of 2021, against the GBP1.40 billion expected in a company-compiled consensus.

The lender, in which the U.K. government has a 44% stake, said its net profit was GBP1.26 billion compared with a GBP434 million for the year-earlier period and consensus’ GBP940 million.

Total income rose to GBP3.71 billion from GBP2.62 billion, beating the GBP3.58 billion forecasted by analysts. Net interest income for the quarter was GBP2.87 billion against consensus’ expected GBP2.88 million.

NatWest’s common equity Tier 1 ratio–a key measure of balance-sheet strength–stood at 14.2% at Dec. 31, in line with consensus and ahead of the bank’s end-2022 target of 14%.

The board proposed a final dividend of 10 pence a share.

For 2023, the lender said it sees total income excluding notable items of around GBP14.8 billion and a full-year net interest margin around 3.20%, along with a cost income ratio below 52%.

...

=> Total income 2022Q4: GBP3.71B x 4 = GBP14.84B ==> 2023e: GBP14.8B

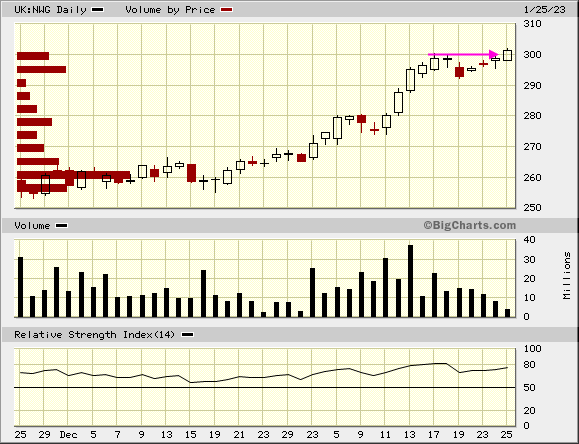

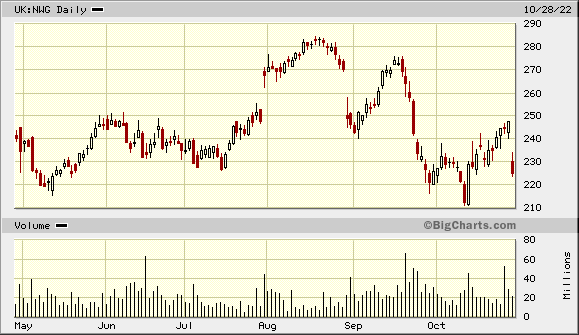

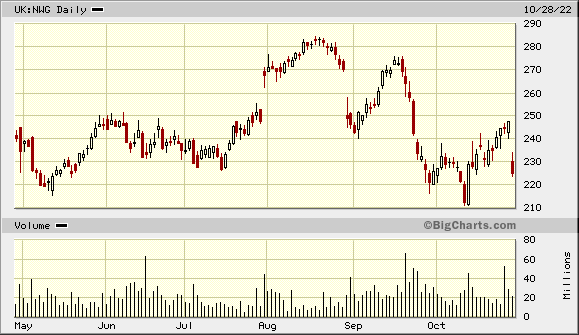

=> die Party ist vorläufig vorbei mMn --> seitwärts:

Natwest Group announces buybacks worth $959 million as profit edges past forecasts

https://www.msn.com/en-us/money/companies/natwest-group-anno…

...

NatWest Group PLC on Friday posted a rise in pretax profit for the fourth quarter of 2022, which came in slightly ahead of market views, and said it intends to start a share buyback program of up to 800 million pounds ($959 million) in the first half of 2023.

The U.K. bank posted a pretax profit of GBP1.43 billion for the three months to Dec. 31 compared with GBP543 million for the fourth quarter of 2021, against the GBP1.40 billion expected in a company-compiled consensus.

The lender, in which the U.K. government has a 44% stake, said its net profit was GBP1.26 billion compared with a GBP434 million for the year-earlier period and consensus’ GBP940 million.

Total income rose to GBP3.71 billion from GBP2.62 billion, beating the GBP3.58 billion forecasted by analysts. Net interest income for the quarter was GBP2.87 billion against consensus’ expected GBP2.88 million.

NatWest’s common equity Tier 1 ratio–a key measure of balance-sheet strength–stood at 14.2% at Dec. 31, in line with consensus and ahead of the bank’s end-2022 target of 14%.

The board proposed a final dividend of 10 pence a share.

For 2023, the lender said it sees total income excluding notable items of around GBP14.8 billion and a full-year net interest margin around 3.20%, along with a cost income ratio below 52%.

...

=> Total income 2022Q4: GBP3.71B x 4 = GBP14.84B ==> 2023e: GBP14.8B

=> die Party ist vorläufig vorbei mMn --> seitwärts:

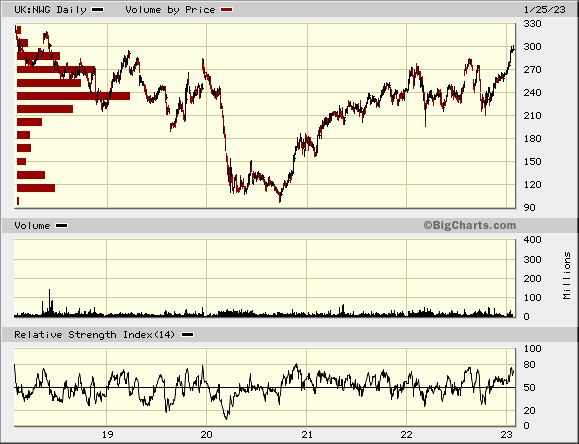

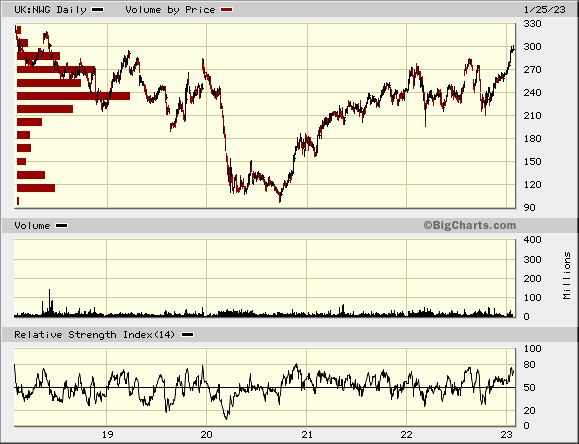

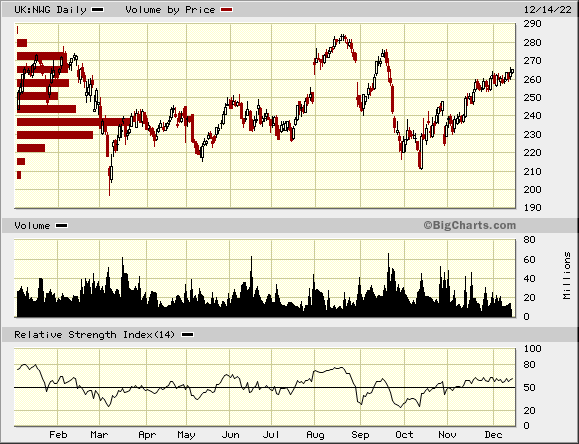

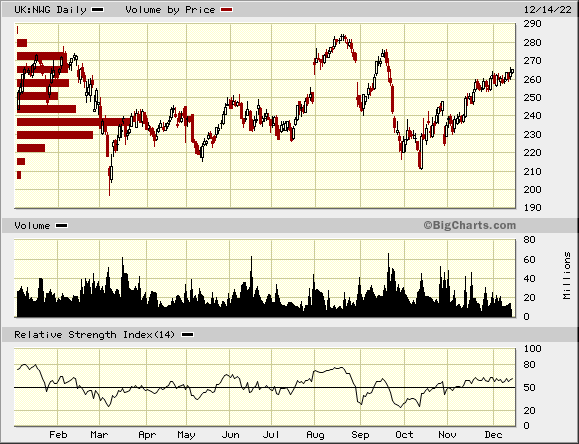

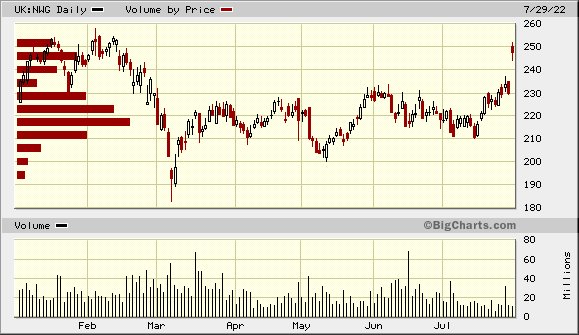

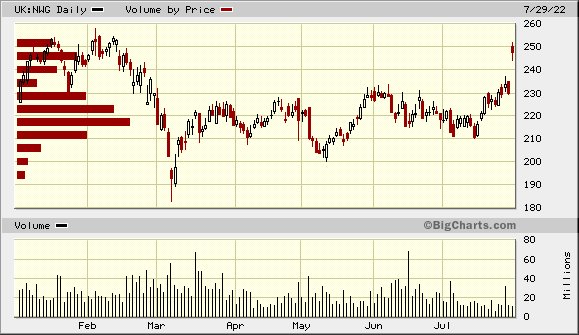

Antwort auf Beitrag Nr.: 72.912.283 von faultcode am 14.12.22 14:47:50kein Problem hier: aktuell 4-Jahreshoch (in GBp):

14.12.

UK Inflation Eases More Than Expected From 41-Year High

• Core inflation, petrol and used car prices all softened

• Figures unlikely to deter Bank of England rate rise this week

https://www.bloomberg.com/news/articles/2022-12-14/uk-inflat…

...

Ansonsten:

UK Inflation Eases More Than Expected From 41-Year High

• Core inflation, petrol and used car prices all softened

• Figures unlikely to deter Bank of England rate rise this week

https://www.bloomberg.com/news/articles/2022-12-14/uk-inflat…

...

Ansonsten:

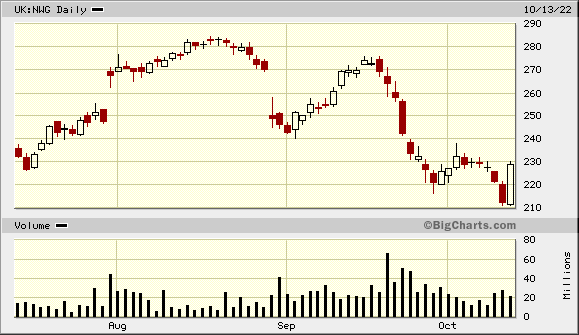

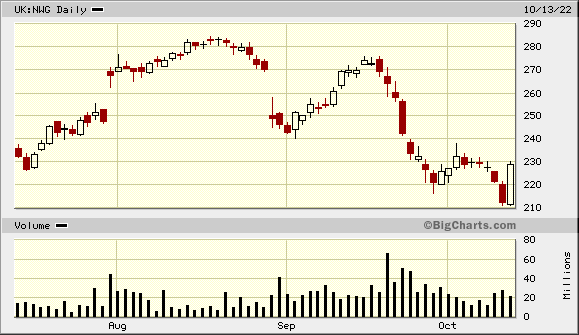

28.10.

NatWest Shares Drop as Lender Warns on Costs and UK Economy

https://finance.yahoo.com/news/natwest-misses-earnings-econo…

...

NatWest Group Plc missed estimates in the third quarter as it took bigger than expected charges for souring loans and warned of further gloom to come.

The UK’s biggest corporate lender reported operating profit before tax of £1.086 billion ($1.26 billion) on Friday, below analyst estimates compiled by Bloomberg.

“Clearly the economic outlook has worsened,” Alison Rose, chief executive officer, told Bloomberg Television’s Dani Burger. “We’re not seeing delinquencies, we’re not seeing customers going into default but the outlook is more challenging so we’re weighting more to the downside.”

Provisions for bad loans were £247 million, compared with consensus estimates of £163.4 million, marking a return to caution about borrowers’ prospects. To reflect the economic gloom, NatWest tweaked its outlook for next year, saying that income will be higher but “we no longer expect costs to be broadly stable given increased inflationary pressures.” Impairments will also increase.

...

=>

NatWest Shares Drop as Lender Warns on Costs and UK Economy

https://finance.yahoo.com/news/natwest-misses-earnings-econo…

...

NatWest Group Plc missed estimates in the third quarter as it took bigger than expected charges for souring loans and warned of further gloom to come.

The UK’s biggest corporate lender reported operating profit before tax of £1.086 billion ($1.26 billion) on Friday, below analyst estimates compiled by Bloomberg.

“Clearly the economic outlook has worsened,” Alison Rose, chief executive officer, told Bloomberg Television’s Dani Burger. “We’re not seeing delinquencies, we’re not seeing customers going into default but the outlook is more challenging so we’re weighting more to the downside.”

Provisions for bad loans were £247 million, compared with consensus estimates of £163.4 million, marking a return to caution about borrowers’ prospects. To reflect the economic gloom, NatWest tweaked its outlook for next year, saying that income will be higher but “we no longer expect costs to be broadly stable given increased inflationary pressures.” Impairments will also increase.

...

=>

UK-Pensionsfondskrise wieder vorbei?

Morgen soll ja das "Ultimatum" enden:

13.10.

UK Pension Funds Selling Stokes Fear Across Bond Markets

https://www.yahoo.com/now/uk-pension-funds-selling-stokes-01…

...

UK pension funds are dumping assets to meet margin calls as the BOE confirmed it will end emergency bond buying, and the reverberations are being felt everywhere from Sydney to Frankfurt and New York.

...

“Investors fear further selling from UK liability-driven investment managers in response to margin calls, including selling of USD high-grade credit,” JPMorgan Chase & Co. strategist Eric Beinstein wrote Wednesday. “There was some evidence of this selling yesterday.”

That selling was manifest in risk premium movements. On Tuesday, US investment-grade bond spreads widened five basis points, according to Bloomberg index data. But the Markit CDX North American Investment Grade Index, a proxy for credit risk, widened just 1.9 basis point. Similar underperformance of cash bonds happened two weeks ago when the UK pension issue first flared up, JPMorgan’s Beinstein wrote.

Meanwhile, selling by UK liability-driven funds “continues to result in a much-higher-than-usual” amount of Australian securitization notes being offered, National Australia Bank analysts including Ken Hanton wrote in a Thursday report.

...

If the BOE holds course and ends the buying program on Friday, the next crunch date could be Oct. 31. That’s when Kwarteng will announce his medium-term fiscal strategy and the non-partisan Office for Budget Responsibility will publish an accompanying assessment. The date was brought forward by more than three weeks after City of London figures warned Kwarteng that he couldn’t wait until late November to reassure markets.

...

Morgen soll ja das "Ultimatum" enden:

13.10.

UK Pension Funds Selling Stokes Fear Across Bond Markets

https://www.yahoo.com/now/uk-pension-funds-selling-stokes-01…

...

UK pension funds are dumping assets to meet margin calls as the BOE confirmed it will end emergency bond buying, and the reverberations are being felt everywhere from Sydney to Frankfurt and New York.

...

“Investors fear further selling from UK liability-driven investment managers in response to margin calls, including selling of USD high-grade credit,” JPMorgan Chase & Co. strategist Eric Beinstein wrote Wednesday. “There was some evidence of this selling yesterday.”

That selling was manifest in risk premium movements. On Tuesday, US investment-grade bond spreads widened five basis points, according to Bloomberg index data. But the Markit CDX North American Investment Grade Index, a proxy for credit risk, widened just 1.9 basis point. Similar underperformance of cash bonds happened two weeks ago when the UK pension issue first flared up, JPMorgan’s Beinstein wrote.

Meanwhile, selling by UK liability-driven funds “continues to result in a much-higher-than-usual” amount of Australian securitization notes being offered, National Australia Bank analysts including Ken Hanton wrote in a Thursday report.

...

If the BOE holds course and ends the buying program on Friday, the next crunch date could be Oct. 31. That’s when Kwarteng will announce his medium-term fiscal strategy and the non-partisan Office for Budget Responsibility will publish an accompanying assessment. The date was brought forward by more than three weeks after City of London figures warned Kwarteng that he couldn’t wait until late November to reassure markets.

...

28.9.

Bank of England warns of risk to UK financial stability as it intervenes in gilt market

Emergency action follows historic sell-off in government bonds

https://www.ft.com/content/756e81d1-b2a6-4580-9054-206386353…

...

The Bank of England took emergency action on Wednesday to stem a crisis in government debt markets, suspending its programme to sell gilts and instead pledging to buy long-dated bonds.

The central bank warned of a “material risk to UK financial stability” from the turmoil in the UK government bond market that has followed chancellor Kwasi Kwarteng’s tax cuts and borrowing plan. It also raised the prospect of a “tightening of financing conditions and a reduction of the flow of credit to the real economy”.

...

That market turmoil heaped pressure on pension funds to sell bonds to stave off concerns about solvency. Thousands of such groups had faced urgent demands for additional cash from investment managers to meet margin calls after the collapse in UK government bond prices blew a hole in strategies to protect them against inflation and interest-rate risks.

...

Bank of England warns of risk to UK financial stability as it intervenes in gilt market

Emergency action follows historic sell-off in government bonds

https://www.ft.com/content/756e81d1-b2a6-4580-9054-206386353…

...

The Bank of England took emergency action on Wednesday to stem a crisis in government debt markets, suspending its programme to sell gilts and instead pledging to buy long-dated bonds.

The central bank warned of a “material risk to UK financial stability” from the turmoil in the UK government bond market that has followed chancellor Kwasi Kwarteng’s tax cuts and borrowing plan. It also raised the prospect of a “tightening of financing conditions and a reduction of the flow of credit to the real economy”.

...

That market turmoil heaped pressure on pension funds to sell bonds to stave off concerns about solvency. Thousands of such groups had faced urgent demands for additional cash from investment managers to meet margin calls after the collapse in UK government bond prices blew a hole in strategies to protect them against inflation and interest-rate risks.

...

21.9.

UK Looks at QE Change to Avert £10 Billion Payout to Banks

UK Prime Minister Liz Truss’s new government has looked at changing the Bank of England’s money-printing program to save the UK taxpayer billions of pounds at a time when the public finances are under increasing strain.

https://financialpost.com/pmn/business-pmn/uk-looks-at-qe-ch…

...

The UK isn’t alone in reviewing a possible change to interest on reserves. Last month, Bank of France Governor Francois Villeroy de Galhau said the combination of the “massive excess liquidity” created by QE and rising interest rates “would provide a sizeable risk-free income to the banking system and a similar loss” for central banks.

For the UK, one proposal to reduce the cost to the state is “tiering,” under which some reserves would be ring-fenced and earn no interest. Zero-rating the £450 billion of QE during the pandemic would save around £10 billion a year with BOE rates at 2.5%, equivalent to almost 2% on income tax.

Jonathan Pierce, a banking analyst at Numis in London, estimates that the net annual taxpayer transfer will be around £17 billion if BOE interest rates hit 4%. Traders are betting that UK rates will rise to 4.5% by the middle of next year. He expects the UK will introduce tiering, under which “a portion of reserves would attract a 0% rate, with marginal balances continuing to receive base rate.”

BOE Governor Andrew Bailey has said the arrangement would effectively be a tax on the banks and is therefore a decision for the Treasury.

Targeting the £450 billion of reserves would slash UK commercial bank profits by 25%, Pierce estimates. At £10 billion a year, the loss of income would be more than the banking industry payments in corporation tax, the bank surcharge and bank levy in 2021 combined, according to figures from PWC and UK Finance.

Yet, the savings would likely be much welcomed by Truss amid questions about the funding for her economic proposals.

Michael Forsyth, who led the House of Lords Economics Affairs Committee review into QE last year, said that for the government “it is a honey pot, maybe one too tempting to resist.”

...

UK Looks at QE Change to Avert £10 Billion Payout to Banks

UK Prime Minister Liz Truss’s new government has looked at changing the Bank of England’s money-printing program to save the UK taxpayer billions of pounds at a time when the public finances are under increasing strain.

https://financialpost.com/pmn/business-pmn/uk-looks-at-qe-ch…

...

The UK isn’t alone in reviewing a possible change to interest on reserves. Last month, Bank of France Governor Francois Villeroy de Galhau said the combination of the “massive excess liquidity” created by QE and rising interest rates “would provide a sizeable risk-free income to the banking system and a similar loss” for central banks.

For the UK, one proposal to reduce the cost to the state is “tiering,” under which some reserves would be ring-fenced and earn no interest. Zero-rating the £450 billion of QE during the pandemic would save around £10 billion a year with BOE rates at 2.5%, equivalent to almost 2% on income tax.

Jonathan Pierce, a banking analyst at Numis in London, estimates that the net annual taxpayer transfer will be around £17 billion if BOE interest rates hit 4%. Traders are betting that UK rates will rise to 4.5% by the middle of next year. He expects the UK will introduce tiering, under which “a portion of reserves would attract a 0% rate, with marginal balances continuing to receive base rate.”

BOE Governor Andrew Bailey has said the arrangement would effectively be a tax on the banks and is therefore a decision for the Treasury.

Targeting the £450 billion of reserves would slash UK commercial bank profits by 25%, Pierce estimates. At £10 billion a year, the loss of income would be more than the banking industry payments in corporation tax, the bank surcharge and bank levy in 2021 combined, according to figures from PWC and UK Finance.

Yet, the savings would likely be much welcomed by Truss amid questions about the funding for her economic proposals.

Michael Forsyth, who led the House of Lords Economics Affairs Committee review into QE last year, said that for the government “it is a honey pot, maybe one too tempting to resist.”

...

8.9.

UK Banks May Write Off £41 Billion in Loans Due to Recession, Credit Suisse Says

https://financialpost.com/pmn/business-pmn/uk-banks-may-writ…

...

Britain’s lenders will have to write off £31 billion to £41 billion ($35.6 billion to $47.1 billion) of loans over the next three years as the country is hit by a recession, analysts at Credit Suisse Group AG predicted.

The estimates are based on an economic contraction of between 1.5% and 4%, Omar Keenan and Alexander Demetriou said in a note. The write-offs would be 40% to 90% above regular “through-the-cycle” levels, they added.

The forecast reflects the damage that the cost-of-living crisis is set to inflict on Britain’s economy. Liz Truss, the new prime minister, is due to set out her plan to tackle soaring energy bills on Thursday.

Still, UK bank stocks such as NatWest Group Plc and Lloyds Banking Group Plc have outperformed this year as rising interest rates are set to benefit margins on loans. Banks set aside billions of pounds for potentially failing loans during the pandemic, but have begun to unwind these provisions as borrowers have coped better than expected.

Valuations remain attractive in a mild-recession scenario, Credit Suisse said, adding that developments in the energy market and government support will be key for sentiment on credit losses. They kept outperform ratings on NatWest, Lloyds and Barclays Plc.

...

UK Banks May Write Off £41 Billion in Loans Due to Recession, Credit Suisse Says

https://financialpost.com/pmn/business-pmn/uk-banks-may-writ…

...

Britain’s lenders will have to write off £31 billion to £41 billion ($35.6 billion to $47.1 billion) of loans over the next three years as the country is hit by a recession, analysts at Credit Suisse Group AG predicted.

The estimates are based on an economic contraction of between 1.5% and 4%, Omar Keenan and Alexander Demetriou said in a note. The write-offs would be 40% to 90% above regular “through-the-cycle” levels, they added.

The forecast reflects the damage that the cost-of-living crisis is set to inflict on Britain’s economy. Liz Truss, the new prime minister, is due to set out her plan to tackle soaring energy bills on Thursday.

Still, UK bank stocks such as NatWest Group Plc and Lloyds Banking Group Plc have outperformed this year as rising interest rates are set to benefit margins on loans. Banks set aside billions of pounds for potentially failing loans during the pandemic, but have begun to unwind these provisions as borrowers have coped better than expected.

Valuations remain attractive in a mild-recession scenario, Credit Suisse said, adding that developments in the energy market and government support will be key for sentiment on credit losses. They kept outperform ratings on NatWest, Lloyds and Barclays Plc.

...

29.7.

NatWest to splash billions in dividends as profits jump

https://finance.yahoo.com/news/natwest-splash-billions-divid…

...

NATWEST is to hand out more than £2 billion in dividends to investors, of which half goes to the UK government, as it showed strong form almost 15 years after it was bailed out.

The bank still 48% owned by the Treasury is in rude enough health to pay a special dividend of 16.8p and a 3.5p interim divi, worth £2.1 billion in all.

It is also buying back shares and puts the returns to shareholders so far this year at £3.3 billion.

With the economy shaking, that could prove controversial.

Chief executive Alison Rose insists the balance sheet is robust enough to allow for the pay-outs while still supporting customers. She says so far there are no signs of distress, but admits that is likely to change as higher energy bills arrive.

“We are very comfortable with where we are, there are no signs of defaults. But we are going to see a fall in disposable incomes. Lots of households and businesses have never had to operate in a high interest or inflationary environment,” she said.

Half-year profits jumped from £1.5 billion to £2.8 billion and guidance for the rest of the year was raised. NatWest shares jumped 17p, 7%, to 247p.

On the economy Rose told the Standard: “Clearly it is going to get tougher. My job over the next two to three years or however long the economic cycle is to make sure we are in good shape to help customers.”

NatWest is doing 5000 financial health checks a week and has already spoken to three million customers it fears may be hit hardest.

...

=> Rock 'n' Roll:

NatWest to splash billions in dividends as profits jump

https://finance.yahoo.com/news/natwest-splash-billions-divid…

...

NATWEST is to hand out more than £2 billion in dividends to investors, of which half goes to the UK government, as it showed strong form almost 15 years after it was bailed out.

The bank still 48% owned by the Treasury is in rude enough health to pay a special dividend of 16.8p and a 3.5p interim divi, worth £2.1 billion in all.

It is also buying back shares and puts the returns to shareholders so far this year at £3.3 billion.

With the economy shaking, that could prove controversial.

Chief executive Alison Rose insists the balance sheet is robust enough to allow for the pay-outs while still supporting customers. She says so far there are no signs of distress, but admits that is likely to change as higher energy bills arrive.

“We are very comfortable with where we are, there are no signs of defaults. But we are going to see a fall in disposable incomes. Lots of households and businesses have never had to operate in a high interest or inflationary environment,” she said.

Half-year profits jumped from £1.5 billion to £2.8 billion and guidance for the rest of the year was raised. NatWest shares jumped 17p, 7%, to 247p.

On the economy Rose told the Standard: “Clearly it is going to get tougher. My job over the next two to three years or however long the economic cycle is to make sure we are in good shape to help customers.”

NatWest is doing 5000 financial health checks a week and has already spoken to three million customers it fears may be hit hardest.

...

=> Rock 'n' Roll:

26.04.24 · dpa-AFX · BASF |

26.04.24 · wallstreetONLINE Redaktion · TotalEnergies |

16.02.24 · wallstreetONLINE Redaktion · ENI |

15.02.24 · BörsenNEWS.de · Electricite de France bearer and/or registered shares |

30.11.23 · dpa-AFX · BBVA |

22.11.23 · dpa-AFX · NatWest Group |

27.10.23 · wallstreetONLINE Redaktion · Equinor |

27.07.23 · dpa-AFX · NatWest Group |

26.07.23 · dpa-AFX · NatWest Group |