Vanoil Energy is preparing to drill in Q1 2013 in Kenya Blocks 3A and 3B - 500 Beiträge pro Seite

eröffnet am 27.12.12 13:20:13 von

neuester Beitrag 04.02.14 10:00:17 von

neuester Beitrag 04.02.14 10:00:17 von

Beiträge: 33

ID: 1.178.512

ID: 1.178.512

Aufrufe heute: 0

Gesamt: 5.967

Gesamt: 5.967

Aktive User: 0

ISIN: CA92209M1077 · WKN: A0YGEA · Symbol: VNLEF

0,0000

USD

-99,00 %

-0,0001 USD

Letzter Kurs 13.02.24 Nasdaq OTC

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,4500 | +15,99 | |

| 4,5500 | +9,90 | |

| 7,7100 | +9,83 | |

| 9,2800 | +9,69 | |

| 5,2000 | +9,47 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,6000 | -9,09 | |

| 0,6850 | -11,04 | |

| 4,4900 | -15,60 | |

| 1,3501 | -20,58 | |

| 9,3500 | -28,02 |

About Vanoil Energy Ltd.

Based in Vancouver, Canada, Vanoil is an internationally diversified resource company that has a comprehensive portfolio of oil and gas assets in the African countries of Kenya and Rwanda. In Kenya, Blocks 3A and 3B were acquired in October 2007 through the signing of a Production Sharing Contract with the Government of the Republic of Kenya. Blocks 3A and 3B, which cover 24,912 square kilometers, are part of the vastly under-explored Cretaceous Central African Rift Basin System. The Company is preparing to drill in Q1 2013 its first exploration well on its Kenyan concession. Vanoil's is also the holder of 1,631 square kilometers of an oil and gas exclusive licence in the East Kivu Graben in Rwanda at the southern extension of the Albertine Graben where Heritage and Tullow Oil made their historic discovery in neighbouring Uganda.

Highlights:

•Non-binding heads of terms agreed for the Acquisition in a cash-free-debt-free share transaction

•If completed, will deliver a 10% interest in Kenya offshore block L9 with its partners Ophir and FAR Limited and a 25% interest in Seychelles Areas A and B with its partner Afren plc

•Supports Vanoil's vision of becoming an emerging leader in East African oil and gas exploration

•Brings geological and geopolitical diversification to the existing onshore Vanoil portfolio

•Increases, at completion, Vanoil's net recoverable mean unrisked prospective resources from 927 million boe to well over two billion boe

•Accelerates Vanoil's exploration program, with two 3D seismic surveys and at least four drilling events scheduled for 2013 alone

http://www.vanoil.ca

Based in Vancouver, Canada, Vanoil is an internationally diversified resource company that has a comprehensive portfolio of oil and gas assets in the African countries of Kenya and Rwanda. In Kenya, Blocks 3A and 3B were acquired in October 2007 through the signing of a Production Sharing Contract with the Government of the Republic of Kenya. Blocks 3A and 3B, which cover 24,912 square kilometers, are part of the vastly under-explored Cretaceous Central African Rift Basin System. The Company is preparing to drill in Q1 2013 its first exploration well on its Kenyan concession. Vanoil's is also the holder of 1,631 square kilometers of an oil and gas exclusive licence in the East Kivu Graben in Rwanda at the southern extension of the Albertine Graben where Heritage and Tullow Oil made their historic discovery in neighbouring Uganda.

Highlights:

•Non-binding heads of terms agreed for the Acquisition in a cash-free-debt-free share transaction

•If completed, will deliver a 10% interest in Kenya offshore block L9 with its partners Ophir and FAR Limited and a 25% interest in Seychelles Areas A and B with its partner Afren plc

•Supports Vanoil's vision of becoming an emerging leader in East African oil and gas exploration

•Brings geological and geopolitical diversification to the existing onshore Vanoil portfolio

•Increases, at completion, Vanoil's net recoverable mean unrisked prospective resources from 927 million boe to well over two billion boe

•Accelerates Vanoil's exploration program, with two 3D seismic surveys and at least four drilling events scheduled for 2013 alone

http://www.vanoil.ca

Antwort auf Beitrag Nr.: 43.961.891 von abionaut am 27.12.12 13:20:13Wenn ich das richtig sehe, dann haben die gerade einmal noch 'ne halbe Mio. $ Cash!?

Ich denke hier steht erst einmal eine KE an, d.h. eine Kursverwässerung

Petri

Ich denke hier steht erst einmal eine KE an, d.h. eine Kursverwässerung

Petri

Antwort auf Beitrag Nr.: 43.964.011 von 2meterwaller am 28.12.12 03:57:06Hi 2meterwaller,

ganz so einfach ist es natürlich nicht. Es stimmt, dass Vanoil lediglich "'ne halbe Mio. $ Cash hat". Dazu kommen jedoch noch 3 Mio. die bei der Kenyanischen Regierung als Sicherheitsleistung hinterlegt wurden, damit Vanoil seiner Verpflichtung nachkommt bis zum 30. April 2013 in den Blöccken 3A und 3B mindestens 3000 m tief gebort zu haben.

Insofern wird hier in den nächsten 4 Monaten in jeden Fall noch einiges passieren. Eine weitere Kapitalerhöhung ist natürlich nicht ausgeschlossen, da es zumal im letzten Geschäftsjahr davon schon 3 gab ;-) (s.u.).

Nichts desto trotz habe ich schon mal eine erste Position aufgebaut da ich am Ende dem Zug nicht hiterhergucken möchte.

Gruß abionaut

Auszug aus dem Jahrsabschlußbericht vom 30.09.2012

3. RESTRICTED CASH

The Company has $2,949,600 (US$3,000,000) of restricted cash as at September 30, 2012 (September 30, 2011 - $471,690 (US$450,000)). The restricted cash is restricted as security for a letter of credit issued to the Republic of Kenya, to guarantee the work program in Block 3A and 3B in Kenya (notes 4 and 10). The letter of credit expires at the completion of the initial exploration period provided Vanoil completes its obligations pursuant to the work program. At October 1, 2010, the Company had $3,603,101 (US$3,500,000) which was restricted as security for a letter of credit, to secure payment by the Company of certain obligations pursuant to a seismic program at Block 3A in Kenya (notes 4 and 10).

10. COMMITMENTS

The Block 3A Kenyan property is subject to a signed Production Sharing Contract (“PSC”), dated October 16, 2007, with the Republic of Kenya (12,192 sq. kms). The initial contract period of three years, commenced January 14, 2008. On July 12, 2012, the Company announced it had received an extension to its PSC from the Kenyan Ministry of Energy. This extension

extends the initial exploration period, which will now expire on April 30, 2013. The Block 3B Kenyan property is subject to a signed PSC, dated October 16, 2007, with the Republic of Kenya (12,489 sq. kms). The initial contract period of three years, commenced January 14, 2008. On July 12, 2012, the Company announced it had received an extension to its PSC from

the Kenyan Ministry of Energy. This extension extends the initial exploration period, which will now expire on April 30, 2013.

In addition to the work already completed by Vanoil, through ongoing negotiations with the Republic of Kenya, the Company is committed to the following amended expenditure requirements for Kenya Blocks 3A and 3B:

For the period from October 1, 2012 to April 30, 2013:

o Design and acquire a minimum of 100 sq kms of 3D seismic at a cost of US$5,000,000;

o Process, interpret, and integrate all 2D and 3D seismic data at a minimum cost of

US$250,000;

o Drill a well at a minimum vertical depth of 3,000m at a cost of US$6,000,000.

(i) Vanoil closed a non-brokered private placement that was announced on September 14, 2011, for gross proceeds of $2,270,000. This consisted of 4,540,000 units at a price of $0.50 per unit. Each unit is comprised of one common share and one half of a non-transferable warrant.

A whole warrant entitles the holder thereof to purchase an additional common share of Vanoil at a price of $0.75 until October 6, 2013. The warrant will be subject to accelerated expiry if at any time after the date that is four months and one day after the closing, the Company’s common shares trade on the Exchange at a price of $1.00 or more for the preceding

20 consecutive trading days. The Company paid $313 in finder fees on the private placement. The net proceeds received from the placement was $2,269,687. The value of the warrants was allocated to the contributed surplus reserve account (see note 6(c)).

(ii) Vanoil closed a second non-brokered private placement that was announced on December 23, 2011, issuing 4,755,582 common shares at a price of $0.43 per share for total gross proceeds of $2,044,900. The securities issued pursuant to the private placement are subject to a four month hold period. As part of the private placement, Vanoil paid finder fees totaling $60,200.

(iii) Vanoil closed a third non-brokered private placement that was originally announced on June 18, 2012, issuing 8,373,937 units at a price of $0.60 per unit for aggregate gross proceeds of $5,024,363. Each unit comprised one common share of the Company and one whole non-transferable share purchase warrant. Each warrant entitles the holder to purchase one

share at a price of $1.00 for a period of 24 months following closing. The warrants are subject to accelerated expiry if, at any time after the date that is four months and one day after the closing, the Company's shares trade on the Exchange at a price of $1.50 or more for the preceding 20 consecutive trading days. The Company paid $78,455 in finder fees on

the private placement and issued 130,108 finder warrants. Each finder warrant entitles the holder to purchase one share at a price of $0.60 for a period of 24 months following closing. The finder warrants are subject to accelerated expiry if, at any time after the date that is four months and one day after the closing, the Company's shares trade on the Exchange at a price of $1.50 or more for the preceding 20 consecutive trading days. The net proceeds received from the placement was $4,945,908. The value of the share purchase warrants and finder warrants was allocated to the contributed surplus reserve account

http://www.vanoil.ca/i/pdf/2012-Q4-FS.pdf

ganz so einfach ist es natürlich nicht. Es stimmt, dass Vanoil lediglich "'ne halbe Mio. $ Cash hat". Dazu kommen jedoch noch 3 Mio. die bei der Kenyanischen Regierung als Sicherheitsleistung hinterlegt wurden, damit Vanoil seiner Verpflichtung nachkommt bis zum 30. April 2013 in den Blöccken 3A und 3B mindestens 3000 m tief gebort zu haben.

Insofern wird hier in den nächsten 4 Monaten in jeden Fall noch einiges passieren. Eine weitere Kapitalerhöhung ist natürlich nicht ausgeschlossen, da es zumal im letzten Geschäftsjahr davon schon 3 gab ;-) (s.u.).

Nichts desto trotz habe ich schon mal eine erste Position aufgebaut da ich am Ende dem Zug nicht hiterhergucken möchte.

Gruß abionaut

Auszug aus dem Jahrsabschlußbericht vom 30.09.2012

3. RESTRICTED CASH

The Company has $2,949,600 (US$3,000,000) of restricted cash as at September 30, 2012 (September 30, 2011 - $471,690 (US$450,000)). The restricted cash is restricted as security for a letter of credit issued to the Republic of Kenya, to guarantee the work program in Block 3A and 3B in Kenya (notes 4 and 10). The letter of credit expires at the completion of the initial exploration period provided Vanoil completes its obligations pursuant to the work program. At October 1, 2010, the Company had $3,603,101 (US$3,500,000) which was restricted as security for a letter of credit, to secure payment by the Company of certain obligations pursuant to a seismic program at Block 3A in Kenya (notes 4 and 10).

10. COMMITMENTS

The Block 3A Kenyan property is subject to a signed Production Sharing Contract (“PSC”), dated October 16, 2007, with the Republic of Kenya (12,192 sq. kms). The initial contract period of three years, commenced January 14, 2008. On July 12, 2012, the Company announced it had received an extension to its PSC from the Kenyan Ministry of Energy. This extension

extends the initial exploration period, which will now expire on April 30, 2013. The Block 3B Kenyan property is subject to a signed PSC, dated October 16, 2007, with the Republic of Kenya (12,489 sq. kms). The initial contract period of three years, commenced January 14, 2008. On July 12, 2012, the Company announced it had received an extension to its PSC from

the Kenyan Ministry of Energy. This extension extends the initial exploration period, which will now expire on April 30, 2013.

In addition to the work already completed by Vanoil, through ongoing negotiations with the Republic of Kenya, the Company is committed to the following amended expenditure requirements for Kenya Blocks 3A and 3B:

For the period from October 1, 2012 to April 30, 2013:

o Design and acquire a minimum of 100 sq kms of 3D seismic at a cost of US$5,000,000;

o Process, interpret, and integrate all 2D and 3D seismic data at a minimum cost of

US$250,000;

o Drill a well at a minimum vertical depth of 3,000m at a cost of US$6,000,000.

(i) Vanoil closed a non-brokered private placement that was announced on September 14, 2011, for gross proceeds of $2,270,000. This consisted of 4,540,000 units at a price of $0.50 per unit. Each unit is comprised of one common share and one half of a non-transferable warrant.

A whole warrant entitles the holder thereof to purchase an additional common share of Vanoil at a price of $0.75 until October 6, 2013. The warrant will be subject to accelerated expiry if at any time after the date that is four months and one day after the closing, the Company’s common shares trade on the Exchange at a price of $1.00 or more for the preceding

20 consecutive trading days. The Company paid $313 in finder fees on the private placement. The net proceeds received from the placement was $2,269,687. The value of the warrants was allocated to the contributed surplus reserve account (see note 6(c)).

(ii) Vanoil closed a second non-brokered private placement that was announced on December 23, 2011, issuing 4,755,582 common shares at a price of $0.43 per share for total gross proceeds of $2,044,900. The securities issued pursuant to the private placement are subject to a four month hold period. As part of the private placement, Vanoil paid finder fees totaling $60,200.

(iii) Vanoil closed a third non-brokered private placement that was originally announced on June 18, 2012, issuing 8,373,937 units at a price of $0.60 per unit for aggregate gross proceeds of $5,024,363. Each unit comprised one common share of the Company and one whole non-transferable share purchase warrant. Each warrant entitles the holder to purchase one

share at a price of $1.00 for a period of 24 months following closing. The warrants are subject to accelerated expiry if, at any time after the date that is four months and one day after the closing, the Company's shares trade on the Exchange at a price of $1.50 or more for the preceding 20 consecutive trading days. The Company paid $78,455 in finder fees on

the private placement and issued 130,108 finder warrants. Each finder warrant entitles the holder to purchase one share at a price of $0.60 for a period of 24 months following closing. The finder warrants are subject to accelerated expiry if, at any time after the date that is four months and one day after the closing, the Company's shares trade on the Exchange at a price of $1.50 or more for the preceding 20 consecutive trading days. The net proceeds received from the placement was $4,945,908. The value of the share purchase warrants and finder warrants was allocated to the contributed surplus reserve account

http://www.vanoil.ca/i/pdf/2012-Q4-FS.pdf

Schön, dass sich andere auch für Vanoil Energy interessieren. Dann brauch ich die Vanoil Energy News nimmer im Vanoil Resources Thread zu posten.

Wäre wirklich schön, wenn hier mal langsam Bewegung rein kommen würde. Bin schon länger dabei. Noch aus Zeiten, bevor Vanoil Energy sich von Vanoil Resources abgesplittet hat. Energy scheint jedenfalls aktuell besser zu laufen als das Mutterschiff Resources. Schau mer mal....

Wäre wirklich schön, wenn hier mal langsam Bewegung rein kommen würde. Bin schon länger dabei. Noch aus Zeiten, bevor Vanoil Energy sich von Vanoil Resources abgesplittet hat. Energy scheint jedenfalls aktuell besser zu laufen als das Mutterschiff Resources. Schau mer mal....

http://secure.campaigner.com/Campaigner/Public/t.show?Ysad--…

VANOIL CLOSES PRIVATE PLACEMENT

-------------------------------------------------------------------------------------------------------------------------------------------------------

December 31, 2012 - Vancouver, British Columbia - Vanoil Energy Ltd. ("Vanoil" or the "Company") has closed its non-brokered private placement (the “NB Offering”), announced on December 11 2012, issuing 7,450,549 units (the “NB Units”) of the Company at a price of $0.60 per NB Unit for total gross proceeds of $4,470,329. Each NB Unit consists of one common share of the Company (a “Share”) and one whole non-transferable share purchase warrant (a “Warrant”). Each Warrant will entitle the holder to purchase one Share at a price of $1.00 for a period of 24 months following closing. The Warrant will be subject to accelerated expiry if, at any time after the date that is four months and one day of the closing, the Company’s Shares trade on the TSX Venture Exchange (the “Exchange”) at a price of $1.50 or more for the preceding 20 consecutive trading days.

No finder fees were paid in connection with the private placement. The securities issued pursuant to the NB Offering will be subject to a four month hold period expiring May 1, 2013.

About Vanoil Energy Ltd.

Based in Vancouver, Canada, Vanoil is an internationally diversified resource company that has a portfolio of oil and gas assets in the African countries of Kenya and Rwanda. In Kenya, Blocks 3A and 3B were acquired in October 2007 through the signing of a Production Sharing Contract with the Government of the Republic of Kenya. Blocks 3A and 3B, which cover 24,912 square kilometers, potentially contain prospective resources in excess of 900 million boe, positioned between Tullow’s recent oil discovery and Apache’s offshore gas well. Vanoil's 1,631 square kilometers of oil and gas exclusive licence in the East Kivu Graben in Rwanda is at the southern extension of the Albertine Graben where Heritage and Tullow Oil made their historic discovery in neighbouring Uganda.

On behalf of the Board of

VANOIL ENERGY LTD.

“Aaron D’Este”

Aaron D’Este, President and CEO

VANOIL CLOSES PRIVATE PLACEMENT

-------------------------------------------------------------------------------------------------------------------------------------------------------

December 31, 2012 - Vancouver, British Columbia - Vanoil Energy Ltd. ("Vanoil" or the "Company") has closed its non-brokered private placement (the “NB Offering”), announced on December 11 2012, issuing 7,450,549 units (the “NB Units”) of the Company at a price of $0.60 per NB Unit for total gross proceeds of $4,470,329. Each NB Unit consists of one common share of the Company (a “Share”) and one whole non-transferable share purchase warrant (a “Warrant”). Each Warrant will entitle the holder to purchase one Share at a price of $1.00 for a period of 24 months following closing. The Warrant will be subject to accelerated expiry if, at any time after the date that is four months and one day of the closing, the Company’s Shares trade on the TSX Venture Exchange (the “Exchange”) at a price of $1.50 or more for the preceding 20 consecutive trading days.

No finder fees were paid in connection with the private placement. The securities issued pursuant to the NB Offering will be subject to a four month hold period expiring May 1, 2013.

About Vanoil Energy Ltd.

Based in Vancouver, Canada, Vanoil is an internationally diversified resource company that has a portfolio of oil and gas assets in the African countries of Kenya and Rwanda. In Kenya, Blocks 3A and 3B were acquired in October 2007 through the signing of a Production Sharing Contract with the Government of the Republic of Kenya. Blocks 3A and 3B, which cover 24,912 square kilometers, potentially contain prospective resources in excess of 900 million boe, positioned between Tullow’s recent oil discovery and Apache’s offshore gas well. Vanoil's 1,631 square kilometers of oil and gas exclusive licence in the East Kivu Graben in Rwanda is at the southern extension of the Albertine Graben where Heritage and Tullow Oil made their historic discovery in neighbouring Uganda.

On behalf of the Board of

VANOIL ENERGY LTD.

“Aaron D’Este”

Aaron D’Este, President and CEO

Dann sollten sie ja jetzt genug $ in der Kasse haben um bis zum 30. April die Bohrungen durchgeführt zu haben ;-)

Es kam, was zu vermuten war: Verlängerung des Work Programs. Vanoil muss nun vor 31.07. mit der ersten Bohrung beginnen und kann bei beiden Bohrungen innerhalb beider Blöcke frei wählen wo diese stattfinden sollen.

Ein paar Monate hin oder her sollten kein Problem sein, M.E. braucht man ohnehin noch einen JV-Partner und ein PP. Und die Konditionen für ein Farmout sollten eher besser werden...

Alles imho, viel Erfolg

Disclaimer: Ich halte keine Vanoils.

------------------------

News Releases

January 25, 2013

Vanoil Receives Work Program Extension

January 25, 2013 - Vancouver, British Columbia -Vanoil Energy Ltd. ("Vanoil" or the "Company") is pleased to announce that the Kenyan Ministry of Energy has extended the deadlines within which Vanoil must satisfy the work program obligations defined in its Production Sharing Contract ("PSC").

Previously, Vanoil was obligated to finish drilling its first well by April 30, 2013. Now, under the terms of the latest extension, Vanoil must only commence drilling its first well before July 31, 2013 and, with sufficient technical justification, Vanoil may place its first two wells anywhere within the boundaries of Block 3A and 3B to satisfy the work program obligations within the Initial Exploration Period of its PSC.

Aaron D'Este, the Company's President and CEO stated; "We were very pleased to secure this key extension. Vanoil is the first company to complete 3D seismic onshore in Kenya and our exploration program is among the most robust ever completed in country. The time extension granted to Vanoil allows us to fully realise value from our 3D data and to drill our first two wells in rapid succession. The ability to place both wells anywhere within the boundaries of 3A and 3B also gives Vanoil the flexibility to target its most exciting prospects. We view 2013 as a transformational year for the Company and we now have the time and operational flexibility to extract maximum value from our assets."

http://www.vanoil.ca/s/NewsReleases.asp?ReportID=567653&_Typ…

Ein paar Monate hin oder her sollten kein Problem sein, M.E. braucht man ohnehin noch einen JV-Partner und ein PP. Und die Konditionen für ein Farmout sollten eher besser werden...

Alles imho, viel Erfolg

Disclaimer: Ich halte keine Vanoils.

------------------------

News Releases

January 25, 2013

Vanoil Receives Work Program Extension

January 25, 2013 - Vancouver, British Columbia -Vanoil Energy Ltd. ("Vanoil" or the "Company") is pleased to announce that the Kenyan Ministry of Energy has extended the deadlines within which Vanoil must satisfy the work program obligations defined in its Production Sharing Contract ("PSC").

Previously, Vanoil was obligated to finish drilling its first well by April 30, 2013. Now, under the terms of the latest extension, Vanoil must only commence drilling its first well before July 31, 2013 and, with sufficient technical justification, Vanoil may place its first two wells anywhere within the boundaries of Block 3A and 3B to satisfy the work program obligations within the Initial Exploration Period of its PSC.

Aaron D'Este, the Company's President and CEO stated; "We were very pleased to secure this key extension. Vanoil is the first company to complete 3D seismic onshore in Kenya and our exploration program is among the most robust ever completed in country. The time extension granted to Vanoil allows us to fully realise value from our 3D data and to drill our first two wells in rapid succession. The ability to place both wells anywhere within the boundaries of 3A and 3B also gives Vanoil the flexibility to target its most exciting prospects. We view 2013 as a transformational year for the Company and we now have the time and operational flexibility to extract maximum value from our assets."

http://www.vanoil.ca/s/NewsReleases.asp?ReportID=567653&_Typ…

Auf Seite 9 der Vanoil Praesentation wird deutlich, warum Africa Oils Bohrung in PaiPai in Block 10a (nahe der Grenze zu Block 9) auch fuer Vanoil bedeutend ist. Ein Erfolg untermauert die These einer durchgaengigen Formation von den sudanesischen Oelfeldern bis Kenia.

http://www.vanoil.ca/i/pdf/Corporate-Presentation-Oct2012.pd…

http://www.vanoil.ca/i/pdf/Corporate-Presentation-Oct2012.pd…

Auch die Ruanda-PSC-Verhandlungen wurden verlängert...

@bmann025: Sehe ich auch so, Cretaceous Rift.

....................

News Release

January 29, 2013

Vanoil Extends Technical Evaluation Agreement With Ministry of Natural Resources of Rwanda

January 29, 2013 - Vancouver, British Columbia -Vanoil Energy Ltd. ("Vanoil" or the "Company") is pleased to announce it has executed a two month extension to its Technical Evaluation Agreement with the Rwandan Ministry of Natural Resources. The agreement provides Vanoil with the exclusive right to negotiate a Production Sharing Contract ("PSC") covering approximately 1,631 square kilometres of the East Kivu Graben, located beneath Lake Kivu, Rwanda.

[...]

http://www.vanoil.ca/s/NewsReleases.asp?ReportID=568381&_Typ…

@bmann025: Sehe ich auch so, Cretaceous Rift.

....................

News Release

January 29, 2013

Vanoil Extends Technical Evaluation Agreement With Ministry of Natural Resources of Rwanda

January 29, 2013 - Vancouver, British Columbia -Vanoil Energy Ltd. ("Vanoil" or the "Company") is pleased to announce it has executed a two month extension to its Technical Evaluation Agreement with the Rwandan Ministry of Natural Resources. The agreement provides Vanoil with the exclusive right to negotiate a Production Sharing Contract ("PSC") covering approximately 1,631 square kilometres of the East Kivu Graben, located beneath Lake Kivu, Rwanda.

[...]

http://www.vanoil.ca/s/NewsReleases.asp?ReportID=568381&_Typ…

Verstehe allerdings nicht, wie Vanoil den Termin einhalten will, mit welchem Rig, welchem Geld und welchem Partner soll gebohrt werden ?

Antwort auf Beitrag Nr.: 44.090.347 von bmann025 am 01.02.13 01:08:55Hi bmann025,

zu deinen Fragen hält sich VEL auch sehr bedeckt.

- Rig: Auszug NR vom 12.11.2012 - ich gehe davon aus dass das noch gilt.

"Vanoil has furthermore signed a contract with Sinopec to secure the last available onshore drilling rig in Kenya. The rig is stacked in Nairobi and ready for mobilisation. Vanoil's contract includes two firm wells and an option for two more.

With its seismic surveys completed and a drilling rig in place, Vanoil is on track to spud its first well in Q1 2013."

http://www.vanoil.ca/s/NewsReleases.asp?ReportID=557135&_Typ…

- Geld/Partner: Mit der derzeit ausgewiesenen Cash-Posi können sie keine Bohrung durchführen, schon gar nicht zwei. Damit sind wir, m.E. untrennlich verbunden, beim Thema Partner. Wenn sie kein weiteres Geld durch ein Placement einnehmen wollen, dann müssten sie ein free carried drilling anstreben. Dementsprechend müssten sie wohl auch einen größeren Teil am Block abgeben.

Auffällig ist aber, dass gerade die kleinen sehr zurückhaltend sind mit den Farmouts. Und hier vermute ich, dass es sehr wohl stark mit den PaiPai-Ergebnissen zusammenhängt. Ein positives Ergebnis dort würde die Liegenschaften enorm aufwerten und so ein ganz anders Farmout-Ergebnis ermöglichen oder eben einen andere Bewertung beim Placement ermöglichen.

Alles imho, time will tell...

zu deinen Fragen hält sich VEL auch sehr bedeckt.

- Rig: Auszug NR vom 12.11.2012 - ich gehe davon aus dass das noch gilt.

"Vanoil has furthermore signed a contract with Sinopec to secure the last available onshore drilling rig in Kenya. The rig is stacked in Nairobi and ready for mobilisation. Vanoil's contract includes two firm wells and an option for two more.

With its seismic surveys completed and a drilling rig in place, Vanoil is on track to spud its first well in Q1 2013."

http://www.vanoil.ca/s/NewsReleases.asp?ReportID=557135&_Typ…

- Geld/Partner: Mit der derzeit ausgewiesenen Cash-Posi können sie keine Bohrung durchführen, schon gar nicht zwei. Damit sind wir, m.E. untrennlich verbunden, beim Thema Partner. Wenn sie kein weiteres Geld durch ein Placement einnehmen wollen, dann müssten sie ein free carried drilling anstreben. Dementsprechend müssten sie wohl auch einen größeren Teil am Block abgeben.

Auffällig ist aber, dass gerade die kleinen sehr zurückhaltend sind mit den Farmouts. Und hier vermute ich, dass es sehr wohl stark mit den PaiPai-Ergebnissen zusammenhängt. Ein positives Ergebnis dort würde die Liegenschaften enorm aufwerten und so ein ganz anders Farmout-Ergebnis ermöglichen oder eben einen andere Bewertung beim Placement ermöglichen.

Alles imho, time will tell...

Neue Präsentation online - beeindruckend was VEL nun alles zu bieten hat...

http://www.vanoil.ca/i/pdf/Vanoil-Corporate-Presentation_201…

http://www.vanoil.ca/i/pdf/Vanoil-Corporate-Presentation_201…

Antwort auf Beitrag Nr.: 44.097.268 von motz1 am 03.02.13 11:21:13Hi motz1, bmann025,...

Noch bin ich kein VEL holder, plane das jedoch zeitnah (möglichst vor den PaiPai results, denn da bin ich optimistich bezüglich einer möglichen wet gas / light oil discovery) zu ändern....

http://www.theeastafrican.co.ke/business/Canadian-firm-Vanoi…

Canadian firm Vanoil’s contract for oil exploration extended

By Kennedy Senelwa

Posted Saturday, February 16 2013 at 16:16

Canadian explorer Vanoil Energy has received a deadline extension to finish drilling a well for crude oil in northeastern Kenya.

The firm was previously obligated to finish drilling its first well by April 30 this year. Under the terms of the extension, Vanoil must only commence drilling its first well before July 31.

The company may place its first two wells anywhere within the boundaries of Block 3A and 3B to satisfy the obligations within the initial exploration period.

In October, the Vancouver-based company signed a production sharing contract (PSC) with the Kenyan government.

“The time extension allows us to drill our first two wells in rapid succession. The ability to place both wells anywhere within the boundaries of 3A and 3B also gives Vanoil flexibility to target its most exciting prospects,” said Vanoil chief executive officer Aaron D’Este.

It is estimated that the area contains more than 900 million barrels of oil equivalent (BOE), as it is positioned between Tullow’s recent oil discovery onshore and Apache’s offshore gas well.

“We view 2013 as a transformational year for the company. We now have the time and operational flexibility to extract maximum value from our assets,” said Mr D’Este.

Meanwhile, Far Ltd of Australia is preparing to drill an offshore well in Block L6 in Lamu at the Kenyan Coast.

“Planning activities for drilling in 2013 have commenced. A tender for drilling project management services has been issued and environmental impact assessment is well advanced,” said Far’s managing director Cath Norman.

Far, Pancontinental Oil and Gas NL own 60 per cent equity and 40 per cent shares respectively in L6.

Ms Norman said the success in the wells will be significant for Far’s exploration areas L6 and L9 blocks.

Far is seeking a partner for drilling the wells. The company started the first quarter of 2013 with cash position of $17.4 million, and long term cash deposits of $5.8 million.

Noch bin ich kein VEL holder, plane das jedoch zeitnah (möglichst vor den PaiPai results, denn da bin ich optimistich bezüglich einer möglichen wet gas / light oil discovery) zu ändern....

http://www.theeastafrican.co.ke/business/Canadian-firm-Vanoi…

Canadian firm Vanoil’s contract for oil exploration extended

By Kennedy Senelwa

Posted Saturday, February 16 2013 at 16:16

Canadian explorer Vanoil Energy has received a deadline extension to finish drilling a well for crude oil in northeastern Kenya.

The firm was previously obligated to finish drilling its first well by April 30 this year. Under the terms of the extension, Vanoil must only commence drilling its first well before July 31.

The company may place its first two wells anywhere within the boundaries of Block 3A and 3B to satisfy the obligations within the initial exploration period.

In October, the Vancouver-based company signed a production sharing contract (PSC) with the Kenyan government.

“The time extension allows us to drill our first two wells in rapid succession. The ability to place both wells anywhere within the boundaries of 3A and 3B also gives Vanoil flexibility to target its most exciting prospects,” said Vanoil chief executive officer Aaron D’Este.

It is estimated that the area contains more than 900 million barrels of oil equivalent (BOE), as it is positioned between Tullow’s recent oil discovery onshore and Apache’s offshore gas well.

“We view 2013 as a transformational year for the company. We now have the time and operational flexibility to extract maximum value from our assets,” said Mr D’Este.

Meanwhile, Far Ltd of Australia is preparing to drill an offshore well in Block L6 in Lamu at the Kenyan Coast.

“Planning activities for drilling in 2013 have commenced. A tender for drilling project management services has been issued and environmental impact assessment is well advanced,” said Far’s managing director Cath Norman.

Far, Pancontinental Oil and Gas NL own 60 per cent equity and 40 per cent shares respectively in L6.

Ms Norman said the success in the wells will be significant for Far’s exploration areas L6 and L9 blocks.

Far is seeking a partner for drilling the wells. The company started the first quarter of 2013 with cash position of $17.4 million, and long term cash deposits of $5.8 million.

Hier gibt es neues Futter, VEL hat eine Technical Presentation veröffentlicht: http://www.vanoil.ca/i/pdf/Vanoil-PP-Technical-Presentation.…

Btw, wo VEL "Technical" drauf schreibt, ist auch Technik drin...

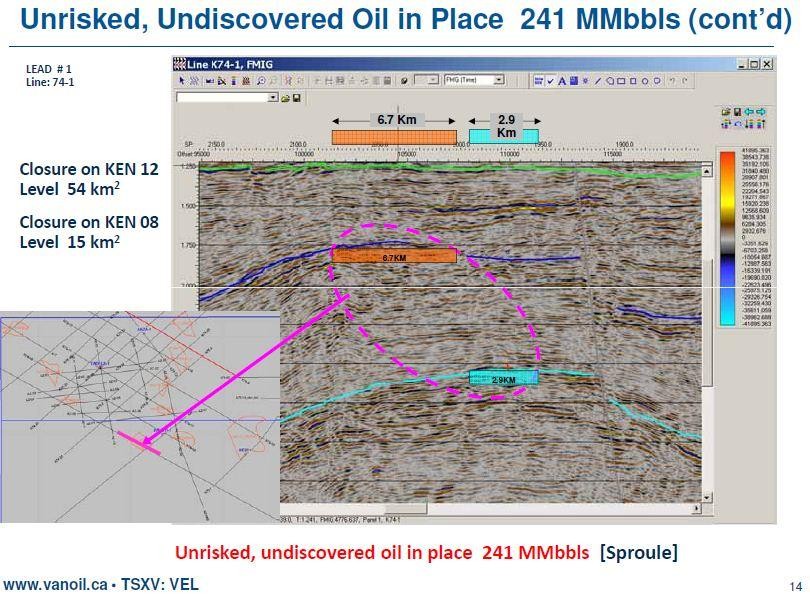

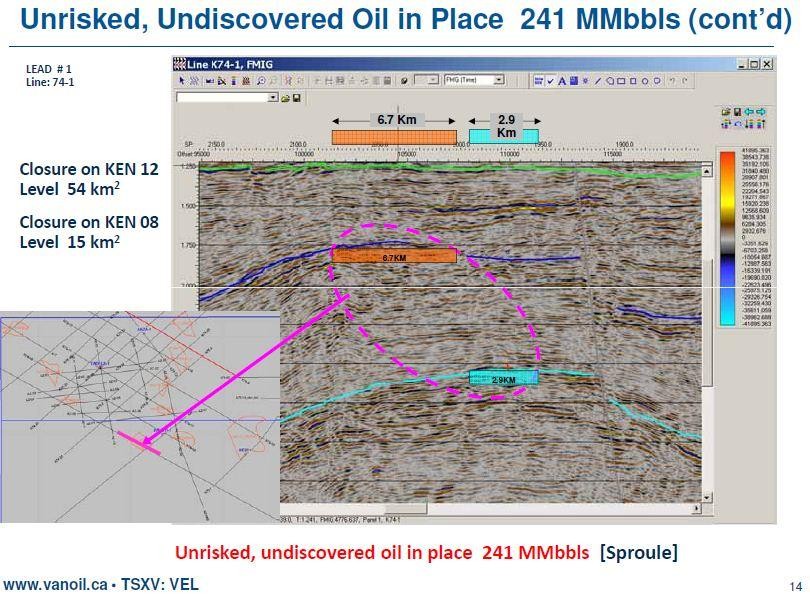

Die Seismic zu Lead #1 sieht z.B. so aus und zeigt -wenn ich es richtig verstehe- ziemliches Potential im Upper Cretaceous und im Upper Jurassic:

Btw, wo VEL "Technical" drauf schreibt, ist auch Technik drin...

Die Seismic zu Lead #1 sieht z.B. so aus und zeigt -wenn ich es richtig verstehe- ziemliches Potential im Upper Cretaceous und im Upper Jurassic:

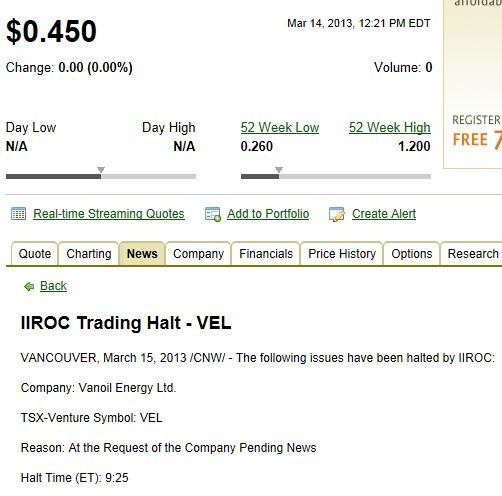

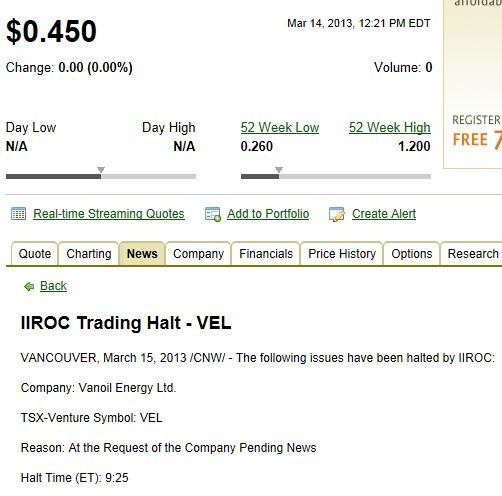

Antwort auf Beitrag Nr.: 44.258.870 von motz1 am 15.03.13 18:20:29Eben erst bemerkt, wir sind ja im Trading Halt

http://web.tmxmoney.com/article.php?newsid=58785142&qm_symbo…

Pending news... fingers crossed

http://web.tmxmoney.com/article.php?newsid=58785142&qm_symbo…

Pending news... fingers crossed

Antwort auf Beitrag Nr.: 44.258.956 von motz1 am 15.03.13 18:36:49Da wird ja ganz ordentlich was geboten heute.

1. Der Deal mit Avana ist über die Bühne. http://web.tmxmoney.com/article.php?newsid=58794121&qm_symbo…

2. VEL verkündet, "Fluormin PLC" (http://www.fluormin.com/index.html) kaufen zu wollen. http://web.tmxmoney.com/article.php?newsid=58793812&qm_symbo…

Commenting on the intention to make the Acquisition, Aaron D'Este, Chief Executive Officer of Vanoil, said:

"Vanoil's strategic objective is to build a highly prospective portfolio of assets across East Africa and to fund the exploration and development of its properties without delay. Our previously announced offer for the entire issued share capital of Avana Petroleum Limited has the potential to double Vanoil's recoverable mean unrisked prospective resources while providing both geological and geopolitical diversification to further de-risk our portfolio. Further to this, the acquisition of Fluormin provides an invaluable source of capital, acquired at a premium to our current share price, to fund our near term operational programme, which includes the drilling of two onshore wells in the Anza basin adjacent to recent successes in Block 10a. Completing both acquisitions in rapid succession paves the way for realising Vanoil's ambitious growth plans."

...

"•Under the terms of the Acquisition, Fluormin is valued at US$27 million. In consideration for the purchase of the entire issued and to be issued share capital of Fluormin, Vanoil will issue an aggregate of: ◦45,000,000 Vanoil Shares, based upon a price of US$0.60 per Vanoil Share;

◦31,973,667 CAN$1.00 Warrants, entitling the holder to subscribe for one Vanoil Share at any time during the two year period immediately following the Acquisition; and

◦6,500,000 CAN$0.75 Warrants, entitling the holder to subscribe for one Vanoil Share at any time prior to 13 March 2014."

Ich verstehe das wie folgt: VEL kauft Fluormin, dessen Bewertung wurde auf 27Mio USD festgelegt. Diese Summe wird mit 45 Mio neuen VEL Shares beglichen, das entspricht USD 0,60/Share - im Vergleich zum derzeitigen Marktpreis eine gute Sache.

Die Bewertung für Fluormin kann ich auf die Schnelle nicht nachvollziehen, die Marketcap liegt bei rund 17Mio USD. Das ganze wird wohl auf den errechneten Veräusserungserlösen aus dem geplanten Asset-Verkauf von Fluormin beruhen:

"•The Acquisition is expected to deliver financial and operational synergies of a potentially transformational nature for both Fluormin and Vanoil. It will permit Fluormin's shareholders to exit their current shareholding, whilst also assisting with an orderly disposal of Fluormin's assets in conjunction with Vanoil's network and expertise. The Acquisition also introduces Vanoil to Fluormin's international investor base, whose support will be highly valuable to Vanoil and its enlarged group in the future."

So, der Hammer kommt aber jetzt erst: Es gibt einen neuen starken Mann - James Passin, bisheriger Chairman von VEL UND Fluormin. Sowohl an VEL (bisher rund 23,5Mio Shares) als auch in Fluormin (etwa 35,5 Mio Shares) ist er wesentlich beteiligt. Wenn der Deal in dieser Form über die Bühne geht wird er zu 40,3% (bezogen auf die ausgegebenen Aktien) an VEL beteiligt sein...

"•As noted above, James Passin is Chairman of Fluormin and is Chairman of Vanoil. In addition, Mr Passin is a principal of the manager of the Firebird Funds, and has control or direction over 22,916,876 Vanoil Shares and 35,606,693 Fluormin Shares held by the Firebird Funds. Mr Passin also personally holds 500,000 Vanoil Shares (representing an aggregate control, direction or holding over approximately 50 per cent. of the approximately 104,173,161 then issued share capital of Vanoil on the conclusion of the Acquisition and approximately 40.3 per cent. of the approximately 129,173,161 then issued share capital of Vanoil in the event that the Avana Acquisition is also concluded (and assuming all conditions to the payment of further consideration under the Avana Acquisition are met)."

Und als kleines Bonbon gab es für VEL bereits 5Mio USD in Cash als Darlehen vorab - schon eingetroffen . http://web.tmxmoney.com/article.php?newsid=58794243&qm_symbo…

. http://web.tmxmoney.com/article.php?newsid=58794243&qm_symbo…

1. Der Deal mit Avana ist über die Bühne. http://web.tmxmoney.com/article.php?newsid=58794121&qm_symbo…

2. VEL verkündet, "Fluormin PLC" (http://www.fluormin.com/index.html) kaufen zu wollen. http://web.tmxmoney.com/article.php?newsid=58793812&qm_symbo…

Commenting on the intention to make the Acquisition, Aaron D'Este, Chief Executive Officer of Vanoil, said:

"Vanoil's strategic objective is to build a highly prospective portfolio of assets across East Africa and to fund the exploration and development of its properties without delay. Our previously announced offer for the entire issued share capital of Avana Petroleum Limited has the potential to double Vanoil's recoverable mean unrisked prospective resources while providing both geological and geopolitical diversification to further de-risk our portfolio. Further to this, the acquisition of Fluormin provides an invaluable source of capital, acquired at a premium to our current share price, to fund our near term operational programme, which includes the drilling of two onshore wells in the Anza basin adjacent to recent successes in Block 10a. Completing both acquisitions in rapid succession paves the way for realising Vanoil's ambitious growth plans."

...

"•Under the terms of the Acquisition, Fluormin is valued at US$27 million. In consideration for the purchase of the entire issued and to be issued share capital of Fluormin, Vanoil will issue an aggregate of: ◦45,000,000 Vanoil Shares, based upon a price of US$0.60 per Vanoil Share;

◦31,973,667 CAN$1.00 Warrants, entitling the holder to subscribe for one Vanoil Share at any time during the two year period immediately following the Acquisition; and

◦6,500,000 CAN$0.75 Warrants, entitling the holder to subscribe for one Vanoil Share at any time prior to 13 March 2014."

Ich verstehe das wie folgt: VEL kauft Fluormin, dessen Bewertung wurde auf 27Mio USD festgelegt. Diese Summe wird mit 45 Mio neuen VEL Shares beglichen, das entspricht USD 0,60/Share - im Vergleich zum derzeitigen Marktpreis eine gute Sache.

Die Bewertung für Fluormin kann ich auf die Schnelle nicht nachvollziehen, die Marketcap liegt bei rund 17Mio USD. Das ganze wird wohl auf den errechneten Veräusserungserlösen aus dem geplanten Asset-Verkauf von Fluormin beruhen:

"•The Acquisition is expected to deliver financial and operational synergies of a potentially transformational nature for both Fluormin and Vanoil. It will permit Fluormin's shareholders to exit their current shareholding, whilst also assisting with an orderly disposal of Fluormin's assets in conjunction with Vanoil's network and expertise. The Acquisition also introduces Vanoil to Fluormin's international investor base, whose support will be highly valuable to Vanoil and its enlarged group in the future."

So, der Hammer kommt aber jetzt erst: Es gibt einen neuen starken Mann - James Passin, bisheriger Chairman von VEL UND Fluormin. Sowohl an VEL (bisher rund 23,5Mio Shares) als auch in Fluormin (etwa 35,5 Mio Shares) ist er wesentlich beteiligt. Wenn der Deal in dieser Form über die Bühne geht wird er zu 40,3% (bezogen auf die ausgegebenen Aktien) an VEL beteiligt sein...

"•As noted above, James Passin is Chairman of Fluormin and is Chairman of Vanoil. In addition, Mr Passin is a principal of the manager of the Firebird Funds, and has control or direction over 22,916,876 Vanoil Shares and 35,606,693 Fluormin Shares held by the Firebird Funds. Mr Passin also personally holds 500,000 Vanoil Shares (representing an aggregate control, direction or holding over approximately 50 per cent. of the approximately 104,173,161 then issued share capital of Vanoil on the conclusion of the Acquisition and approximately 40.3 per cent. of the approximately 129,173,161 then issued share capital of Vanoil in the event that the Avana Acquisition is also concluded (and assuming all conditions to the payment of further consideration under the Avana Acquisition are met)."

Und als kleines Bonbon gab es für VEL bereits 5Mio USD in Cash als Darlehen vorab - schon eingetroffen

. http://web.tmxmoney.com/article.php?newsid=58794243&qm_symbo…

. http://web.tmxmoney.com/article.php?newsid=58794243&qm_symbo…

Eine Bohrung kann ja nicht ohne Vorbereitungen durchgefuehrt werden, man denke nur an die Infrastruktur, die AOI in Ngamia errichet hat.

Wann muestte VEL spaetestens loslegen, um "theoretisch" die Chance zu bewahren, bis 31. Juli mit der Bohrung zu beginnen ?

Wann muestte VEL spaetestens loslegen, um "theoretisch" die Chance zu bewahren, bis 31. Juli mit der Bohrung zu beginnen ?

Hi bmann025,

ich kann dir keinen konkreten Termin nennen. Ich denke die site preparation sollte in 6-8 Wochen machbar sein, das kann aber nach gewählter Location auch ganz anders aussehen. Man darf wohl davon ausgehen dass es um die Infrastruktur nicht zum besten steht, andererseits muss Ngamia oder auch South Omo nicht unbedingt repräsentativ sein. Das Rig ist bereits im Land und vom Hafen aus ist es zumindest nicht so weit wie in den Norden zu den AOI sites.

Ich kann mir vorstellen dass die gesamte Logistik im Hintergrund bereits angelaufen ist, seit die Verlängerung und Flexibilisierung der Drillings zugestanden wurde - damit konnten im Prinzip die Locations gewählt werden.

Wir sollten dazu noch Infos bekommen. Hast du bedenken dass es zeitlich knapp werden könnte? In Africa doch nicht ...

...

Eine andere Info gab es heute: Fluormin sagt "ja bitte":

.......................................

Confirmation of the Intention of Vanoil Energy Ltd. ("Vanoil") to Acquire Fluormin PLC ("Fluormin" or the "Company")

Vanoil Energy Ltd, a TSX-V-listed oil and gas company with a portfolio of assets in East Africa, today confirms its intention to acquire the entire issued and to be issued share capital of AIM listed Fluormin PLC and the entry into of the Implementation Agreement.

The Independent Vanoil Directors have been advised that the Independent Fluormin Directors will recommend the Acquisition to Fluormin Shareholders.

Highlights

•If completed, the Acquisition is expected to provide significant cash resources in the order of US$27 million, including an advance loan of US$5 million.

•This capital provides the near term financial flexibility necessary for Vanoil to proceed with its ambitious drilling and seismic programmes to unlock the potential value of its acreage, with two 3D seismic surveys and at least two drilling events scheduled in 2013 alone.

The Independent Vanoil Directors believe that the Acquisition should lead to the following benefits for the shareholders of Vanoil:

•Vanoil's strategic objective is to build a highly prospective portfolio of assets across East Africa and to fund the exploration and development of its properties. Vanoil's previously announced offer for the entire issued share capital of Avana has the potential to double Vanoil's recoverable mean unrisked prospective resources while providing both geological and geopolitical diversification to further de-risk Vanoil's portfolio;

•the acquisition of Fluormin provides an invaluable source of capital, acquired at a premium to Vanoil's current share price, to fund Vanoil's near term operational programme, which includes the drilling of two onshore wells in the Anza basin adjacent to recent successes in Kenyan Block 10a;

•completing both the Avana and Fluormin acquisitions in rapid succession would pave the way for realising Vanoil's ambitious growth plans as the acquisitions are expected to deliver financial and operational synergies of a potentially transformational nature for the enlarged Vanoil Group and provide Vanoil with the near term financial flexibility necessary for Vanoil to proceed with its ambitious drilling and seismic programmes to unlock the potential value of its acreage, with two 3D seismic surveys and at least two drilling events scheduled for 2013 alone;

•the acquisition of Fluormin will assist with an orderly disposal of Fluormin's assets in conjunction with Vanoil's network and expertise; and

•the acquisition of Fluormin also introduces Vanoil to Fluormin's international investor base, whose support will be highly valuable to Vanoil and its enlarged group in the future.

Summary

•The Independent Vanoil Directors have been advised that the Independent Fluormin Directors will recommend that Fluormin Shareholders approve the acquisition by Vanoil (or a wholly owned subsidiary of Vanoil) of the entire issued and to be issued ordinary share capital of Fluormin (the "Acquisition").

•Fluormin is not currently subject to the jurisdiction of the Panel on Takeovers and Mergers. Accordingly, the Acquisition will not be subject to the City Code on Takeovers and Mergers.

•The Acquisition is to be made in accordance with the terms of the Implementation Agreement and is intended to be conducted by way of a Court-sanctioned scheme of arrangement pursuant to Part 26 of the Companies Act 2006.

•Based upon independent valuations, the Vanoil Directors expect that aggregate cash reserves in the order of US$27 million can be realised from Fluormin's existing accounts and receivables and from the subsequent realization of Fluormin's assets.

•Under the terms of the Acquisition, Fluormin is valued at US$27 million. In consideration for the purchase of the entire issued and to be issued share capital of Fluormin, Vanoil will issue an aggregate of:

◦approximately 45,000,000 Vanoil Shares, based upon a price of US$0.60 per Vanoil Share;

◦approximately 31,973,667 CAN$1.00 Warrants, entitling the holder to subscribe for one Vanoil Share at any time during the two year period immediately following the Acquisition; and

◦approximately 6,500,000 CAN$0.75 Warrants, entitling the holder to subscribe for one Vanoil Share at any time prior to 13 March 2014.

•Based upon Fluormin's existing share capital, for each Fluormin Share held, Scheme Shareholders will be entitled to receive 0.806 new Vanoil Shares and be issued with 0.572 CAN$1.00 Warrants and 0.116 CAN$0.75 Warrants.

•Outside the terms of the Scheme, Fluormin Optionholders will each be entitled to receive, in respect of the cancellation of their Fluormin Options, 0.5 CAN$1.00 Warrants (each whole warrant exercisable at any time during the two year period immediately following the Acquisition) in respect of each Fluormin Share over which they have a Fluormin Option. The total number of CAN$1.00 Warrants granted pursuant to this is 1,776,333.

•Vanoil is a TSXV-listed oil and gas company with a diversified portfolio of assets in East Africa. Its focus is on prospective basins, adjacent to the acreage of, or endorsed by, major exploration players. Vanoil's onshore Kenya acreage, containing in excess of 900 million barrels of oil equivalent ("boe") of prospective recoverable mean unrisked resources, lies in the same Anza basin as Block 10a where Africa Oil Plc recently announced a light hydrocarbon discovery in the Lower Cretaceous interval. Vanoil also has the exclusive right to negotiate a production sharing contract with the Republic of Rwanda covering 1,631 square kilometres of oil and gas concessions in the northwestern part of the Republic of Rwanda, better known as "East Kivu Graben".

•Further, on March 15, 2013, Vanoil confirmed that its wholly owned subsidiary, Vanoil Energy Holdings Ltd. had received irrevocable acceptances of its offer (the "Avana Offer") for the entire issued share capital of Avana Petroleum Limited ("Avana") in respect of at least 90 per cent. of the issued share capital of Avana. As such, the acceptance condition to the Avana Offer had been satisfied and the Avana Offer has become wholly unconditional. Avana's portfolio comprises:

◦a 25% participating interest in oil and gas exploration Areas A and B in the Seychelles (the "Seychelles Asset"), alongside partner East African Exploration Seychelles Limited (a wholly owned subsidiary of Afren plc ("Afren")); and

◦perfecting title to a 10% participating interest in Kenya offshore Block L9 (the "Kenyan Asset"), alongside partner Dominion Petroleum Kenya Limited (a wholly owned subsidiary of Ophir Energy plc ("Ophir")).

•The Acquisition is expected to deliver financial and operational synergies of a potentially transformational nature for both Fluormin and Vanoil. It will permit Fluormin's shareholders to exit their current shareholding, whilst also assisting with an orderly disposal of Fluormin's assets in conjunction with Vanoil's network and expertise. The Acquisition also introduces Vanoil to Fluormin's international investor base, whose support will be highly valuable to Vanoil and its enlarged group in the future.

•James Passin (the Chairman of Fluormin and Chairman of Vanoil) is not regarded as an Independent Fluormin Director, or an Independent Vanoil Director, due to the related party arrangements relating to the Acquisition described below.

•There are currently 55,865,722 Fluormin Shares in issue and Fluormin Options over a total of 3,537,999 Fluormin Shares.

•There are currently 66,588,455 Vanoil Shares in issue and 22,733,166 warrants in issue and options have been granted over a total of 7,100,000 Vanoil Shares. As a result of the Avana Offer being concluded, the enlarged issued share capital (assuming all conditions to the payment of further consideration under the Avana Offer are met) will comprise approximately 91,588,455 Vanoil Shares in issue with a further approximately 491,428 warrants yet to be granted.

•As noted above, James Passin is Chairman of Fluormin and is Chairman of Vanoil. In addition, Mr Passin is a principal of the manager of the Firebird Funds, and has control or direction over 22,916,876 Vanoil Shares and 35,606,451 Fluormin Shares held by the Firebird Funds, Mr Passin also personally holds 500,000 Vanoil Shares (representing an aggregate control, direction or holding over approximately 46.7 per cent. of the approximately 111,588,455 then issued share capital of Vanoil based on the current outstanding and the conclusion of the Acquisition, and approximately 40.3 per cent. of the 129,173,161 then issued share capital of Vanoil as a result of the Avana Offer being concluded (and assuming all conditions to the payment of further consideration under the Avana Offer are met)).

•It is intended that the Acquisition will be implemented by way of Fluormin proceeding with a Court-sanctioned scheme of arrangement under Part 26 of the Companies Act 2006. However, Vanoil (with the consent of the Company) could make an offer to Fluormin Shareholders by way of a Takeover Offer rather than pursuing the scheme of arrangement detailed in this Announcement.

•The Acquisition would be conditional on the conditions set out in the Implementation Agreement, which are included in Appendix I to this Announcement, including the passing of the Scheme Resolutions required to implement the Scheme by Scheme Shareholders at the Court Meeting and by Fluormin Shareholders at the General Meeting, and the sanction of the Court.

•The Acquisition remains subject to TSX-V approval.

http://web.tmxmoney.com/article.php?newsid=59037355&qm_symbo…

ich kann dir keinen konkreten Termin nennen. Ich denke die site preparation sollte in 6-8 Wochen machbar sein, das kann aber nach gewählter Location auch ganz anders aussehen. Man darf wohl davon ausgehen dass es um die Infrastruktur nicht zum besten steht, andererseits muss Ngamia oder auch South Omo nicht unbedingt repräsentativ sein. Das Rig ist bereits im Land und vom Hafen aus ist es zumindest nicht so weit wie in den Norden zu den AOI sites.

Ich kann mir vorstellen dass die gesamte Logistik im Hintergrund bereits angelaufen ist, seit die Verlängerung und Flexibilisierung der Drillings zugestanden wurde - damit konnten im Prinzip die Locations gewählt werden.

Wir sollten dazu noch Infos bekommen. Hast du bedenken dass es zeitlich knapp werden könnte? In Africa doch nicht

...

...Eine andere Info gab es heute: Fluormin sagt "ja bitte":

.......................................

Confirmation of the Intention of Vanoil Energy Ltd. ("Vanoil") to Acquire Fluormin PLC ("Fluormin" or the "Company")

Vanoil Energy Ltd, a TSX-V-listed oil and gas company with a portfolio of assets in East Africa, today confirms its intention to acquire the entire issued and to be issued share capital of AIM listed Fluormin PLC and the entry into of the Implementation Agreement.

The Independent Vanoil Directors have been advised that the Independent Fluormin Directors will recommend the Acquisition to Fluormin Shareholders.

Highlights

•If completed, the Acquisition is expected to provide significant cash resources in the order of US$27 million, including an advance loan of US$5 million.

•This capital provides the near term financial flexibility necessary for Vanoil to proceed with its ambitious drilling and seismic programmes to unlock the potential value of its acreage, with two 3D seismic surveys and at least two drilling events scheduled in 2013 alone.

The Independent Vanoil Directors believe that the Acquisition should lead to the following benefits for the shareholders of Vanoil:

•Vanoil's strategic objective is to build a highly prospective portfolio of assets across East Africa and to fund the exploration and development of its properties. Vanoil's previously announced offer for the entire issued share capital of Avana has the potential to double Vanoil's recoverable mean unrisked prospective resources while providing both geological and geopolitical diversification to further de-risk Vanoil's portfolio;

•the acquisition of Fluormin provides an invaluable source of capital, acquired at a premium to Vanoil's current share price, to fund Vanoil's near term operational programme, which includes the drilling of two onshore wells in the Anza basin adjacent to recent successes in Kenyan Block 10a;

•completing both the Avana and Fluormin acquisitions in rapid succession would pave the way for realising Vanoil's ambitious growth plans as the acquisitions are expected to deliver financial and operational synergies of a potentially transformational nature for the enlarged Vanoil Group and provide Vanoil with the near term financial flexibility necessary for Vanoil to proceed with its ambitious drilling and seismic programmes to unlock the potential value of its acreage, with two 3D seismic surveys and at least two drilling events scheduled for 2013 alone;

•the acquisition of Fluormin will assist with an orderly disposal of Fluormin's assets in conjunction with Vanoil's network and expertise; and

•the acquisition of Fluormin also introduces Vanoil to Fluormin's international investor base, whose support will be highly valuable to Vanoil and its enlarged group in the future.

Summary

•The Independent Vanoil Directors have been advised that the Independent Fluormin Directors will recommend that Fluormin Shareholders approve the acquisition by Vanoil (or a wholly owned subsidiary of Vanoil) of the entire issued and to be issued ordinary share capital of Fluormin (the "Acquisition").

•Fluormin is not currently subject to the jurisdiction of the Panel on Takeovers and Mergers. Accordingly, the Acquisition will not be subject to the City Code on Takeovers and Mergers.

•The Acquisition is to be made in accordance with the terms of the Implementation Agreement and is intended to be conducted by way of a Court-sanctioned scheme of arrangement pursuant to Part 26 of the Companies Act 2006.

•Based upon independent valuations, the Vanoil Directors expect that aggregate cash reserves in the order of US$27 million can be realised from Fluormin's existing accounts and receivables and from the subsequent realization of Fluormin's assets.

•Under the terms of the Acquisition, Fluormin is valued at US$27 million. In consideration for the purchase of the entire issued and to be issued share capital of Fluormin, Vanoil will issue an aggregate of:

◦approximately 45,000,000 Vanoil Shares, based upon a price of US$0.60 per Vanoil Share;

◦approximately 31,973,667 CAN$1.00 Warrants, entitling the holder to subscribe for one Vanoil Share at any time during the two year period immediately following the Acquisition; and

◦approximately 6,500,000 CAN$0.75 Warrants, entitling the holder to subscribe for one Vanoil Share at any time prior to 13 March 2014.

•Based upon Fluormin's existing share capital, for each Fluormin Share held, Scheme Shareholders will be entitled to receive 0.806 new Vanoil Shares and be issued with 0.572 CAN$1.00 Warrants and 0.116 CAN$0.75 Warrants.

•Outside the terms of the Scheme, Fluormin Optionholders will each be entitled to receive, in respect of the cancellation of their Fluormin Options, 0.5 CAN$1.00 Warrants (each whole warrant exercisable at any time during the two year period immediately following the Acquisition) in respect of each Fluormin Share over which they have a Fluormin Option. The total number of CAN$1.00 Warrants granted pursuant to this is 1,776,333.

•Vanoil is a TSXV-listed oil and gas company with a diversified portfolio of assets in East Africa. Its focus is on prospective basins, adjacent to the acreage of, or endorsed by, major exploration players. Vanoil's onshore Kenya acreage, containing in excess of 900 million barrels of oil equivalent ("boe") of prospective recoverable mean unrisked resources, lies in the same Anza basin as Block 10a where Africa Oil Plc recently announced a light hydrocarbon discovery in the Lower Cretaceous interval. Vanoil also has the exclusive right to negotiate a production sharing contract with the Republic of Rwanda covering 1,631 square kilometres of oil and gas concessions in the northwestern part of the Republic of Rwanda, better known as "East Kivu Graben".

•Further, on March 15, 2013, Vanoil confirmed that its wholly owned subsidiary, Vanoil Energy Holdings Ltd. had received irrevocable acceptances of its offer (the "Avana Offer") for the entire issued share capital of Avana Petroleum Limited ("Avana") in respect of at least 90 per cent. of the issued share capital of Avana. As such, the acceptance condition to the Avana Offer had been satisfied and the Avana Offer has become wholly unconditional. Avana's portfolio comprises:

◦a 25% participating interest in oil and gas exploration Areas A and B in the Seychelles (the "Seychelles Asset"), alongside partner East African Exploration Seychelles Limited (a wholly owned subsidiary of Afren plc ("Afren")); and

◦perfecting title to a 10% participating interest in Kenya offshore Block L9 (the "Kenyan Asset"), alongside partner Dominion Petroleum Kenya Limited (a wholly owned subsidiary of Ophir Energy plc ("Ophir")).

•The Acquisition is expected to deliver financial and operational synergies of a potentially transformational nature for both Fluormin and Vanoil. It will permit Fluormin's shareholders to exit their current shareholding, whilst also assisting with an orderly disposal of Fluormin's assets in conjunction with Vanoil's network and expertise. The Acquisition also introduces Vanoil to Fluormin's international investor base, whose support will be highly valuable to Vanoil and its enlarged group in the future.

•James Passin (the Chairman of Fluormin and Chairman of Vanoil) is not regarded as an Independent Fluormin Director, or an Independent Vanoil Director, due to the related party arrangements relating to the Acquisition described below.

•There are currently 55,865,722 Fluormin Shares in issue and Fluormin Options over a total of 3,537,999 Fluormin Shares.

•There are currently 66,588,455 Vanoil Shares in issue and 22,733,166 warrants in issue and options have been granted over a total of 7,100,000 Vanoil Shares. As a result of the Avana Offer being concluded, the enlarged issued share capital (assuming all conditions to the payment of further consideration under the Avana Offer are met) will comprise approximately 91,588,455 Vanoil Shares in issue with a further approximately 491,428 warrants yet to be granted.

•As noted above, James Passin is Chairman of Fluormin and is Chairman of Vanoil. In addition, Mr Passin is a principal of the manager of the Firebird Funds, and has control or direction over 22,916,876 Vanoil Shares and 35,606,451 Fluormin Shares held by the Firebird Funds, Mr Passin also personally holds 500,000 Vanoil Shares (representing an aggregate control, direction or holding over approximately 46.7 per cent. of the approximately 111,588,455 then issued share capital of Vanoil based on the current outstanding and the conclusion of the Acquisition, and approximately 40.3 per cent. of the 129,173,161 then issued share capital of Vanoil as a result of the Avana Offer being concluded (and assuming all conditions to the payment of further consideration under the Avana Offer are met)).

•It is intended that the Acquisition will be implemented by way of Fluormin proceeding with a Court-sanctioned scheme of arrangement under Part 26 of the Companies Act 2006. However, Vanoil (with the consent of the Company) could make an offer to Fluormin Shareholders by way of a Takeover Offer rather than pursuing the scheme of arrangement detailed in this Announcement.

•The Acquisition would be conditional on the conditions set out in the Implementation Agreement, which are included in Appendix I to this Announcement, including the passing of the Scheme Resolutions required to implement the Scheme by Scheme Shareholders at the Court Meeting and by Fluormin Shareholders at the General Meeting, and the sanction of the Court.

•The Acquisition remains subject to TSX-V approval.

http://web.tmxmoney.com/article.php?newsid=59037355&qm_symbo…

http://secure.campaigner.com/Campaigner/Public/t.show?5d86j-…

FLUORMIN TRANSACTION UPDATE AND ENTRY INTO

TRANSFER AGREEMENT IN RESPECT OF BLOCK L9 Kenya

April 19, 2013 - Vanoil Energy Ltd., a TSX-V-listed oil and gas company with a portfolio of assets in East Africa ("Vanoil"), is pleased to announce that, following the announcement on 26 March 2013, confirming its intention to acquire the entire issued and to be issued share capital of AIM-listed Fluormin PLC (AIM: FLOR) ("Fluormin"), it has received confirmation of Fluormin's shareholders having passed by the necessary majorities, the resolutions proposed at the Court Meeting (convened by order of the High Court of Justice in connection with the scheme of arrangement) and at the general meeting held yesterday.

The approval by Fluormin's shareholders of the scheme of arrangement is a significant step towards the implementation of the scheme, which is expected to become effective on 17 May 2013, subject to the satisfaction of further conditions.

Vanoil is also pleased to announce that its newly acquired subsidiary, Avana Petroleum Kenya Limited ("Avana"), has entered into a transfer agreement with Dominion Petroleum Kenya Limited ("Dominion") (a wholly owned subsidiary of Ophir Energy plc), to perfect Avana's title to a 10% participating interest in Kenya offshore Block L9. Dominion holds the balance of the participating interest.

Aaron D'Este, President and CEO, commented:

"It was excellent to see such strong support from Fluormin's shareholders at the meetings held yesterday. The affirmative results are a significant and positive step in the implementation of the scheme of arrangement. The acquisition of Fluormin, once completed, will provide an invaluable source of capital for Vanoil. Execution of the L9 transfer agreement is also a welcome step in the diversification of our East African asset portfolio. The encouraging results in neighbouring blocks, and the density of seismic already acquired, give us cause for optimism in L9."

Vanoil also announces that it has filed a 51-101 report on the prospective resources of Avana Petroleum Ltd., which is available under the Company's profile at www.sedar.com.

To find out more about Vanoil, please visit our website at www.vanoil.ca or contact:

Don Padgett +1 604 763-1229

Malcolm Burke +1 604 220-2000

Scott Rose +1 604 684-1974 x 227

FTI Consulting

Billy Clegg, Natalia Erikssen, Sara Powell +44 20 7269 9348

About Vanoil Energy Ltd.

Based in Vancouver, Canada, Vanoil is an oil and gas company with a portfolio of assets in East Africa.

In onshore Kenya, Blocks 3A and 3B were acquired in October 2007 through the signing of a Production Sharing Contract with the Government of the Republic of Kenya. These blocks, which cover 24,912 km2, potentially contain prospective resources in excess of 0.9 boe, positioned between Tullow's recent oil discovery and Apache's offshore gas well. In offshore Kenya, the anticipated perfection of a 10% participating interest in 5,110 km2 offshore Block L9, alongside partner Dominion Petroleum Kenya Limited (a wholly owned subsidiary of Ophir Energy plc ("Ophir")), is estimated by Ophir to represent a net 270 million boe to Vanoil.

In the Seychelles, Vanoil's 25% participating interest alongside partner East African Exploration Seychelles Limited (a wholly owned subsidiary of Afren plc ("Afren")) in oil and gas exploration Areas A and B, which total some 14,000 km2, has a recoverable mean unrisked prospective resource net to Vanoil estimated by Afren of 0.7 boe.

Vanoil also has the exclusive right to negotiate a production sharing contract with the Republic of Rwanda covering 1,631 square kilometres of oil and gas concessions in the northwestern part of the Republic of Rwanda, better known as "East Kivu Graben".

FLUORMIN TRANSACTION UPDATE AND ENTRY INTO

TRANSFER AGREEMENT IN RESPECT OF BLOCK L9 Kenya

April 19, 2013 - Vanoil Energy Ltd., a TSX-V-listed oil and gas company with a portfolio of assets in East Africa ("Vanoil"), is pleased to announce that, following the announcement on 26 March 2013, confirming its intention to acquire the entire issued and to be issued share capital of AIM-listed Fluormin PLC (AIM: FLOR) ("Fluormin"), it has received confirmation of Fluormin's shareholders having passed by the necessary majorities, the resolutions proposed at the Court Meeting (convened by order of the High Court of Justice in connection with the scheme of arrangement) and at the general meeting held yesterday.

The approval by Fluormin's shareholders of the scheme of arrangement is a significant step towards the implementation of the scheme, which is expected to become effective on 17 May 2013, subject to the satisfaction of further conditions.

Vanoil is also pleased to announce that its newly acquired subsidiary, Avana Petroleum Kenya Limited ("Avana"), has entered into a transfer agreement with Dominion Petroleum Kenya Limited ("Dominion") (a wholly owned subsidiary of Ophir Energy plc), to perfect Avana's title to a 10% participating interest in Kenya offshore Block L9. Dominion holds the balance of the participating interest.

Aaron D'Este, President and CEO, commented:

"It was excellent to see such strong support from Fluormin's shareholders at the meetings held yesterday. The affirmative results are a significant and positive step in the implementation of the scheme of arrangement. The acquisition of Fluormin, once completed, will provide an invaluable source of capital for Vanoil. Execution of the L9 transfer agreement is also a welcome step in the diversification of our East African asset portfolio. The encouraging results in neighbouring blocks, and the density of seismic already acquired, give us cause for optimism in L9."

Vanoil also announces that it has filed a 51-101 report on the prospective resources of Avana Petroleum Ltd., which is available under the Company's profile at www.sedar.com.

To find out more about Vanoil, please visit our website at www.vanoil.ca or contact:

Don Padgett +1 604 763-1229

Malcolm Burke +1 604 220-2000

Scott Rose +1 604 684-1974 x 227

FTI Consulting

Billy Clegg, Natalia Erikssen, Sara Powell +44 20 7269 9348

About Vanoil Energy Ltd.

Based in Vancouver, Canada, Vanoil is an oil and gas company with a portfolio of assets in East Africa.

In onshore Kenya, Blocks 3A and 3B were acquired in October 2007 through the signing of a Production Sharing Contract with the Government of the Republic of Kenya. These blocks, which cover 24,912 km2, potentially contain prospective resources in excess of 0.9 boe, positioned between Tullow's recent oil discovery and Apache's offshore gas well. In offshore Kenya, the anticipated perfection of a 10% participating interest in 5,110 km2 offshore Block L9, alongside partner Dominion Petroleum Kenya Limited (a wholly owned subsidiary of Ophir Energy plc ("Ophir")), is estimated by Ophir to represent a net 270 million boe to Vanoil.

In the Seychelles, Vanoil's 25% participating interest alongside partner East African Exploration Seychelles Limited (a wholly owned subsidiary of Afren plc ("Afren")) in oil and gas exploration Areas A and B, which total some 14,000 km2, has a recoverable mean unrisked prospective resource net to Vanoil estimated by Afren of 0.7 boe.

Vanoil also has the exclusive right to negotiate a production sharing contract with the Republic of Rwanda covering 1,631 square kilometres of oil and gas concessions in the northwestern part of the Republic of Rwanda, better known as "East Kivu Graben".

Heute gab es drei Neuigkeiten:

a) Funding

b) Farm-out läuft

c) Neue Präsentation

...........................................

Vanoil Announces Offering of Common Shares

VANCOUVER, BRITISH COLUMBIA--(Marketwired - May 7, 2013) -

[...]

Vanoil Energy Ltd. (TSX VENTURE:VEL), an oil and gas company with a portfolio of assets in East Africa ("Vanoil" or the "Company") has filed with, and obtained receipt for, a preliminary short form prospectus from the securities regulatory authorities in British Columbia, Alberta and Ontario (the "Qualifying Provinces") in connection with a marketed offering (the "Offering") of common shares. The Offering will also be made in such other jurisdictions outside of Canada where the Offering can be completed on a private-placement basis, exempt from any prospectus, registration or other similar requirements.

The Offering will be led by GMP Securities L.P. ("GMP") and will be conducted on a best efforts agency basis. The final terms of the Offering, including size and price, will be determined in the context of the market, and the net proceeds will be primarily used to fund Vanoil's previously announced 2013 two-well drill program in Kenya commencing in July of this year. Vanoil has concurrently launched a farm-out process to find a suitable partner for its 100%-owned blocks 3A and 3B in the South Anza Basin, onshore Kenya, where the wells are being drilled, and the Company has an active work programme in place on its other East African licences, with two seismic surveys completed recently and two further wells to be drilled in 2014.

The Offering is subject to customary conditions and the receipt of required regulatory approvals, including the approval of the TSX Venture Exchange. The Offering is scheduled to close on or about June 3rd, 2013, or such other date as the Company and GMP may agree.

http://web.tmxmoney.com/article.php?newsid=60016127&qm_symbo…

---------------------------------

Neue Präsentation - imho sehr sehenswert:

http://www.vanoil.ca/i/pdf/Vanoil-Presentation-may2013.pdf

- Rig-Mobilisierung im Juni (Sinopec-Rig)

- Full Service durch Schlumberger

- Spud von "Madogashe-1" im Juli > erwartete Drilling-Dauer von 70 Tagen für etwa 4.300(!)m; aus meiner Sich "viiiiieeeeel" zu optimistisch!

- Farmout angestoßen

a) Funding

b) Farm-out läuft

c) Neue Präsentation

...........................................

Vanoil Announces Offering of Common Shares

VANCOUVER, BRITISH COLUMBIA--(Marketwired - May 7, 2013) -

[...]

Vanoil Energy Ltd. (TSX VENTURE:VEL), an oil and gas company with a portfolio of assets in East Africa ("Vanoil" or the "Company") has filed with, and obtained receipt for, a preliminary short form prospectus from the securities regulatory authorities in British Columbia, Alberta and Ontario (the "Qualifying Provinces") in connection with a marketed offering (the "Offering") of common shares. The Offering will also be made in such other jurisdictions outside of Canada where the Offering can be completed on a private-placement basis, exempt from any prospectus, registration or other similar requirements.

The Offering will be led by GMP Securities L.P. ("GMP") and will be conducted on a best efforts agency basis. The final terms of the Offering, including size and price, will be determined in the context of the market, and the net proceeds will be primarily used to fund Vanoil's previously announced 2013 two-well drill program in Kenya commencing in July of this year. Vanoil has concurrently launched a farm-out process to find a suitable partner for its 100%-owned blocks 3A and 3B in the South Anza Basin, onshore Kenya, where the wells are being drilled, and the Company has an active work programme in place on its other East African licences, with two seismic surveys completed recently and two further wells to be drilled in 2014.

The Offering is subject to customary conditions and the receipt of required regulatory approvals, including the approval of the TSX Venture Exchange. The Offering is scheduled to close on or about June 3rd, 2013, or such other date as the Company and GMP may agree.

http://web.tmxmoney.com/article.php?newsid=60016127&qm_symbo…

---------------------------------

Neue Präsentation - imho sehr sehenswert:

http://www.vanoil.ca/i/pdf/Vanoil-Presentation-may2013.pdf

- Rig-Mobilisierung im Juni (Sinopec-Rig)

- Full Service durch Schlumberger

- Spud von "Madogashe-1" im Juli > erwartete Drilling-Dauer von 70 Tagen für etwa 4.300(!)m; aus meiner Sich "viiiiieeeeel" zu optimistisch!

- Farmout angestoßen

Antwort auf Beitrag Nr.: 44.587.051 von motz1 am 07.05.13 23:23:46Habe gerade entdeckt dass die Präsentation wieder offline ist - und ich hatte sie noch nicht gespeichert

HAT IRGENDJEMAND EINE KOPIE GESPEICHERT? Wäre super, bitte einfach kurz hier melden oder per Board Mail . . . Danke!

HAT IRGENDJEMAND EINE KOPIE GESPEICHERT? Wäre super, bitte einfach kurz hier melden oder per Board Mail . . . Danke!

3fach-Update:

a) Neue Präsi ist wieder online - und bei mir für den Fall der Fälle bereits gespeichert

http://www.vanoil.ca/i/pdf/Vanoil_Corporate_Presentation_201…