Alio Gold -- ehem. Timmins Gold - 500 Beiträge pro Seite (Seite 2)

eröffnet am 02.11.13 23:17:00 von

neuester Beitrag 09.07.20 13:39:31 von

neuester Beitrag 09.07.20 13:39:31 von

Beiträge: 884

ID: 1.187.883

ID: 1.187.883

Aufrufe heute: 0

Gesamt: 89.133

Gesamt: 89.133

Aktive User: 0

ISIN: CA01627X1087 · WKN: A2DRQU

1,1230

EUR

-0,27 %

-0,0030 EUR

Letzter Kurs 02.07.20 Tradegate

Und nebenbei noch Ana Paula finazieren, wie soll das gehen? SF soll den CF bringen, was ich schon zweifelhaft finde, aber 3 Minen ist eine zuviel.

Antwort auf Beitrag Nr.: 58.147.127 von Global-Player83 am 05.07.18 18:11:25Nichts ungewöhnliches, die Schulden werden halt gestreckt. Der Aktienkurs von Alio scheint sich auch beruhigt zu haben, es geht wieder hoch. Wenn der Goldpreis anfängt zu steigen, wird Alio Gold überproportional zulegen.

Jetzt wird's spannend...2,12 Cad

Alio Gold Chart jetzt voll bullish.

Antwort auf Beitrag Nr.: 58.146.893 von Stockplan am 05.07.18 17:46:08

warum sollte das so sein. Rye hatte doch meines wissens über 25 Mio Cad Barmittel. Es sollte genug Kohle da sein.

Zitat von Stockplan: Ich denke es geht mehr um das Behalten von Liquidität und Flexibiliät in schwierigen Zeiten.

Eventuell benötigt Florida Canyon noch ne Finanzspritze.

warum sollte das so sein. Rye hatte doch meines wissens über 25 Mio Cad Barmittel. Es sollte genug Kohle da sein.

Antwort auf Beitrag Nr.: 58.155.593 von spezi1000 am 06.07.18 16:27:26Parallel will man doch auch Lincoln hill bis 2019 in Produktion bringen...

mensch, was die alles in produktion bringen wollen  dann sollen sie vorher nochmal ihre aktionäre anzapfen, damit sich das alles realisieren lässt....rye patch war auf jeden fall eine giftpille^^

dann sollen sie vorher nochmal ihre aktionäre anzapfen, damit sich das alles realisieren lässt....rye patch war auf jeden fall eine giftpille^^

dann sollen sie vorher nochmal ihre aktionäre anzapfen, damit sich das alles realisieren lässt....rye patch war auf jeden fall eine giftpille^^

dann sollen sie vorher nochmal ihre aktionäre anzapfen, damit sich das alles realisieren lässt....rye patch war auf jeden fall eine giftpille^^

Antwort auf Beitrag Nr.: 58.156.943 von Global-Player83 am 06.07.18 18:38:15

naja mit Ihrer jetztigen teuren Mine wird Alio aber auch nichts reißen, daher war der Schritt schon nicht verkehrt. Es müssen nur die richtigen Männer im MM sitzen dann wuppen die das auch. Ich denke Rye kann sich mit seinen Vorkommen und der Mine sehen lassen. Von einer Giftpille kann noch keine Rede sein.

Zitat von Global-Player83: mensch, was die alles in produktion bringen wollendann sollen sie vorher nochmal ihre aktionäre anzapfen, damit sich das alles realisieren lässt....rye patch war auf jeden fall eine giftpille^^

naja mit Ihrer jetztigen teuren Mine wird Alio aber auch nichts reißen, daher war der Schritt schon nicht verkehrt. Es müssen nur die richtigen Männer im MM sitzen dann wuppen die das auch. Ich denke Rye kann sich mit seinen Vorkommen und der Mine sehen lassen. Von einer Giftpille kann noch keine Rede sein.

Der Zusammenschluss von Alio Gold Inc. und Rye Patch Gold macht nach Ansicht der Analysten von Raymond James Sinn. Es werde aber Zeit brauchen, bis sich die Vorteile der Transaktion zeigen würden.

Kurzfristig werde der Cash flow von der Produktion des Florida Canyon-Projekts profitieren. Der mit der Kaufpreiszahlung verbundene Verwässerungseffekt laste aber auf dem Aktienkurs. Außerdem würden Guerrero-Risiken weiterhin Druck auf den Titel ausüben.

Kurzfristig werde der Cash flow von der Produktion des Florida Canyon-Projekts profitieren. Der mit der Kaufpreiszahlung verbundene Verwässerungseffekt laste aber auf dem Aktienkurs. Außerdem würden Guerrero-Risiken weiterhin Druck auf den Titel ausüben.

Analysts See $0.07 EPS for Alio Gold Inc.

July 23, 2018

Analysts expect Alio Gold Inc. (TSE:ALO) to report $0.07 EPS on August, 9.They anticipate $0.06 EPS change or 46.15% from last quarter’s $0.13 EPS. ALIO’s profit would be $5.86 million giving it 6.64 P/E if the $0.07 EPS is correct. After having $0.09 EPS previously, Alio Gold Inc.’s analysts see -22.22% EPS growth. The stock decreased 0.53% or $0.01 during the last trading session, reaching $1.86.

https://flecha123.com/2018/07/23/analysts-see-0-07-eps-for-a…

July 23, 2018

Analysts expect Alio Gold Inc. (TSE:ALO) to report $0.07 EPS on August, 9.They anticipate $0.06 EPS change or 46.15% from last quarter’s $0.13 EPS. ALIO’s profit would be $5.86 million giving it 6.64 P/E if the $0.07 EPS is correct. After having $0.09 EPS previously, Alio Gold Inc.’s analysts see -22.22% EPS growth. The stock decreased 0.53% or $0.01 during the last trading session, reaching $1.86.

https://flecha123.com/2018/07/23/analysts-see-0-07-eps-for-a…

Antwort auf Beitrag Nr.: 58.282.526 von Amphibie am 23.07.18 22:26:51Scheint so als erwarte man nicht mehr all zu viel von ALO. Ich warte mal noch die nächsten Zahlen ab.

Antwort auf Beitrag Nr.: 58.283.786 von Stockplan am 24.07.18 08:07:09Stockplan, warte doch mal ab, Alio Gold wird wie wie ein Phönix aus der Asche auferstehen und uns allen eines besseren belehren. Die gute, alte Timmins Gold wird in den kommenden Jahren eine top Performance hinlegen.

Überall wo Feuer ist, bleibt Asche zurück und daraus kann Neues entstehen. Und Neues ist Alio.

Überall wo Feuer ist, bleibt Asche zurück und daraus kann Neues entstehen. Und Neues ist Alio.

Asche zu Asche und Staub zu Staub. Amen

Mmmhhh, Direkt nach den Zahlen einen Call?

Vermutlich Schadensbegrenzung um schlechte Zahlen zu erklären?

VANCOUVER, July 23, 2018

VANCOUVER, July 23, 2018 /PRNewswire/ - Alio Gold Inc (TSX, NYSE AMERICAN: ALO) ("Alio Gold" or the "Company"), today announced that it will release its second quarter 2018 results on Friday, August 10, 2018, before the market opens, followed by a conference at 11:00am EDT.

Second Quarter 2018 Results Conference Call and Webcast Details:

Toll Free (US and Canada):

(855) 427-9509

Toll Free (Outside North America):

(210) 229-8822

Conference ID:

7099318

Webcast:

https://edge.media-server.com/m6/p/p84uiih9

Replay:

To be available at http://www.aliogold.com

Read more at http://www.stockhouse.com/news/press-releases/2018/07/23/ali…

Vermutlich Schadensbegrenzung um schlechte Zahlen zu erklären?

VANCOUVER, July 23, 2018

VANCOUVER, July 23, 2018 /PRNewswire/ - Alio Gold Inc (TSX, NYSE AMERICAN: ALO) ("Alio Gold" or the "Company"), today announced that it will release its second quarter 2018 results on Friday, August 10, 2018, before the market opens, followed by a conference at 11:00am EDT.

Second Quarter 2018 Results Conference Call and Webcast Details:

Toll Free (US and Canada):

(855) 427-9509

Toll Free (Outside North America):

(210) 229-8822

Conference ID:

7099318

Webcast:

https://edge.media-server.com/m6/p/p84uiih9

Replay:

To be available at http://www.aliogold.com

Read more at http://www.stockhouse.com/news/press-releases/2018/07/23/ali…

Gestern ein neues Low markiert in Kanada...irgendwas läuft da völlig aus dem Ruder.

Ich vermute das die aktuellen Zahlen desaströs ausfallen werden, deshalb vermutlich auch der direkte Call hinterher.

Da hat Rye patch seinen alten Aktionären ein wahrlich faules Ei ins Nest gelegt...

Ich vermute das die aktuellen Zahlen desaströs ausfallen werden, deshalb vermutlich auch der direkte Call hinterher.

Da hat Rye patch seinen alten Aktionären ein wahrlich faules Ei ins Nest gelegt...

BMO Capital Markets set a C$4.00 price target on Alio Gold and gave the company a “market perform” rating in a research note on Thursday, April 12th.

Royal Bank of Canada cut their price target on Alio Gold from C$6.00 to C$4.00 and set a “sector perform” rating on the stock in a research note on Tuesday, May 1st.

TD Securities cut their price target on Alio Gold from C$6.50 to C$6.00 in a research note on Thursday, May 10th.

Finally, Pi Financial set a C$3.50 price target on Alio Gold in a research note on Monday, June 18th.

Royal Bank of Canada cut their price target on Alio Gold from C$6.00 to C$4.00 and set a “sector perform” rating on the stock in a research note on Tuesday, May 1st.

TD Securities cut their price target on Alio Gold from C$6.50 to C$6.00 in a research note on Thursday, May 10th.

Finally, Pi Financial set a C$3.50 price target on Alio Gold in a research note on Monday, June 18th.

Antwort auf Beitrag Nr.: 58.368.876 von Amphibie am 03.08.18 14:50:21Solche bezahlten Analysen kannst du in die Tonne treten. Die sind selten das Papier wert...

Weiter geht's abwärts mit großen Schritten. Hier werden schlechte Zahlen vorweggenommen.

Bill hat sich keinen Gefallen getan. Mit seinem Abgang und Verkauf von Rye hat er ne Menge verbrannte Erde hinterlassen.

Weiter geht's abwärts mit großen Schritten. Hier werden schlechte Zahlen vorweggenommen.

Bill hat sich keinen Gefallen getan. Mit seinem Abgang und Verkauf von Rye hat er ne Menge verbrannte Erde hinterlassen.

Alio Gold Inc (NYSEAMERICAN:ALO) saw a large growth in short interest in June. As of June 29th, there was short interest totalling 1,327,506 shares, a growth of 48.1% from the June 15th total of 896,158 shares. Based on an average daily volume of 158,459 shares, the short-interest ratio is currently 8.4 days.

also wenn die jetzt nicht noch paar Mio in der Kasse hätten würde ich hier Raten das Schiff zu verlassen.

Aber auch mit cash sieht es hier ganz übel aus

Aber auch mit cash sieht es hier ganz übel aus

Antwort auf Beitrag Nr.: 58.403.481 von spezi1000 am 08.08.18 19:32:48was ist denn noch an Barmitteln vorhanden???

Antwort auf Beitrag Nr.: 58.403.577 von iwanowski am 08.08.18 19:42:39

habe mal was von 50-60mio Cad gelesen ohne die Rye Kohle. Ob im Deal das Rye Bargeld inbegriffen war weiß ich nicht. Das waren glaube ich so auch noch 20-30 Mio.

Zitat von iwanowski: was ist denn noch an Barmitteln vorhanden???

habe mal was von 50-60mio Cad gelesen ohne die Rye Kohle. Ob im Deal das Rye Bargeld inbegriffen war weiß ich nicht. Das waren glaube ich so auch noch 20-30 Mio.

ALO

$ 1.72 real time data Change Up

Change:

0.12 (7.50%)

Volume:

63,052

$ 1.72 real time data Change Up

Change:

0.12 (7.50%)

Volume:

63,052

Gut das ich hier nicht mehr investiert bin. Zahlen sind ja wohl eine Vollkatastrophe.

Antwort auf Beitrag Nr.: 58.420.041 von Player82 am 10.08.18 14:03:42Die Zahlen sind ein Desaster. Jetzt kann sich auch der letzte erklären, warum der Kurs fast jeden Tag gefallen ist. Der Kurs hat die Nachrichten gemacht.

AISC von 1.300 Dollar, das ist Wahnsinn. Und jetzt hat man soviel Angst, dass einem der Cash ausgeht, dass man Ana Paula vorläufig stilllegt. Jahresprognose wurde natürlich sowieso einkassiert.

Also hier waren meine Erwartungen ja wirklich bescheiden, aber selbst die wurden noch untertroffen. Mir fällt nicht ein Grund ein warum man hier investiert sein muss bzw. bleiben sollte.

AISC von 1.300 Dollar, das ist Wahnsinn. Und jetzt hat man soviel Angst, dass einem der Cash ausgeht, dass man Ana Paula vorläufig stilllegt. Jahresprognose wurde natürlich sowieso einkassiert.

Also hier waren meine Erwartungen ja wirklich bescheiden, aber selbst die wurden noch untertroffen. Mir fällt nicht ein Grund ein warum man hier investiert sein muss bzw. bleiben sollte.

Little Steps...(zumindest für die alten Rye-Patcher)

"...The Florida Canyon Mine produced 4,724 gold ounces and 4,142 silver ounces subsequent to the completion of the acquisition of Rye Patch Gold on May 25, 2018. The gold and silver production for the full Q2 2018 was 11,587 ounces and 8,734 ounces, respectively, compared to 10,846 ounces and 5,709 ounces, respectively in Q1 2018..."

https://www.aliogold.com/media/news-releases/press-release-d…

"...The Florida Canyon Mine produced 4,724 gold ounces and 4,142 silver ounces subsequent to the completion of the acquisition of Rye Patch Gold on May 25, 2018. The gold and silver production for the full Q2 2018 was 11,587 ounces and 8,734 ounces, respectively, compared to 10,846 ounces and 5,709 ounces, respectively in Q1 2018..."

https://www.aliogold.com/media/news-releases/press-release-d…

Antwort auf Beitrag Nr.: 58.420.335 von Jakuba79 am 10.08.18 14:26:56"... Und jetzt hat man soviel Angst, dass einem der Cash ausgeht, dass man Ana Paula vorläufig stilllegt..."

Wo steht was von Stilllegung im Bericht???

Lies noch mal in aller Ruhe (die Weiterentwicklungsmassnahmen werden vorerst nicht weitergeführt, sondern die Effizienzsteigerung soll vorerst im Vordergrund stehen; ist schon ein Unterschied zum Begriff Stilllegung)...:

"...As a result, we have made the decision to temporarily suspend development work at Ana Paula while we focus on improving our operations to unlock opportunities to increase efficiencies, lower costs and generate cash flow..."

www.aliogold.com/media/news-releases/press-release-details/2018/Alio-Gold-Reports-Second-Quarter-2018

Wo steht was von Stilllegung im Bericht???

Lies noch mal in aller Ruhe (die Weiterentwicklungsmassnahmen werden vorerst nicht weitergeführt, sondern die Effizienzsteigerung soll vorerst im Vordergrund stehen; ist schon ein Unterschied zum Begriff Stilllegung)...:

"...As a result, we have made the decision to temporarily suspend development work at Ana Paula while we focus on improving our operations to unlock opportunities to increase efficiencies, lower costs and generate cash flow..."

www.aliogold.com/media/news-releases/press-release-details/2018/Alio-Gold-Reports-Second-Quarter-2018

Antwort auf Beitrag Nr.: 58.420.506 von iwanowski am 10.08.18 14:48:13Meinetwegen stellt man auch nur die Weiterentwicklungsmaßnahmen ein, bedeutet inhaltlich dasselbe (es passiert dort nix mehr), klingt aber natürlich aktionärsfreundlicher

Antwort auf Beitrag Nr.: 58.404.240 von Amphibie am 08.08.18 20:58:24Hi hallo die Zahlen finde ich erschreckend AISC von 1.300 Dollar wie will die Firma das überleben besser gesagt wie will man die Kosten senken?

Second Quarter Overview and Recent Developments

Completed the acquisition of Rye Patch Gold, including the Florida Canyon Mine, on May 25, 2018

Produced 19,190 ounces1 of gold at an all-in sustaining cost1,2 (“AISC”) of $1,314 per ounce

Updated Mineral Reserve5 estimate at the San Francisco Mine shows proven and probable mineral reserves were 854,472 ounces of gold (55.5 million tonnes at 0.49 g/t gold) as of July 1, 2018

Implemented interim mine plan at San Francisco to slow waste stripping rates and focus on profitable production while negotiating with mining contractor

Suspended development work at the Ana Paula project temporarily to focus capital expenditures on operating mines

Restructured debt facility with Macquarie Bank

https://www.aliogold.com/media/news-releases/press-release-d…

Second Quarter Overview and Recent Developments

Completed the acquisition of Rye Patch Gold, including the Florida Canyon Mine, on May 25, 2018

Produced 19,190 ounces1 of gold at an all-in sustaining cost1,2 (“AISC”) of $1,314 per ounce

Updated Mineral Reserve5 estimate at the San Francisco Mine shows proven and probable mineral reserves were 854,472 ounces of gold (55.5 million tonnes at 0.49 g/t gold) as of July 1, 2018

Implemented interim mine plan at San Francisco to slow waste stripping rates and focus on profitable production while negotiating with mining contractor

Suspended development work at the Ana Paula project temporarily to focus capital expenditures on operating mines

Restructured debt facility with Macquarie Bank

https://www.aliogold.com/media/news-releases/press-release-d…

Wie erwartet...katastrophal. Da wurden die alten RyePatcher völlig geklatscht von Bill...

Antwort auf Beitrag Nr.: 58.420.539 von Jakuba79 am 10.08.18 14:55:44Bin echt verwirrt????

Der Minenbetrieb auf Ana Paula wird eingestellt???

Was für ein Dünnpfiff erzählst du denn hier...

Solltest überlegen, ob du bei deinen oberflächlichen Kenntnissen weiterhin mit Minenaktien beschäftigst.

Der Minenbetrieb auf Ana Paula wird eingestellt???

Was für ein Dünnpfiff erzählst du denn hier...

Solltest überlegen, ob du bei deinen oberflächlichen Kenntnissen weiterhin mit Minenaktien beschäftigst.

Antwort auf Beitrag Nr.: 58.420.854 von iwanowski am 10.08.18 15:36:22Junge lies doch einfach mal richtig bevor Du hier dummes Zeug behauptest.

Auf AnaPaula wird die Weiterentwicklung gestoppt. Also passiert da erstmal nix mehr bis wieder genügend Kohle da ist. Das ist nix anderes als eine Mine vorübergehend stillzulegen. Natürlich gehört die weiterhin zu Alio, nur wird dem Aktionär das vorerst nix bringen.

Aber dieses ganze komplizierte deutsche Vokabular ist nicht jedermanns Sache...

Auf AnaPaula wird die Weiterentwicklung gestoppt. Also passiert da erstmal nix mehr bis wieder genügend Kohle da ist. Das ist nix anderes als eine Mine vorübergehend stillzulegen. Natürlich gehört die weiterhin zu Alio, nur wird dem Aktionär das vorerst nix bringen.

Aber dieses ganze komplizierte deutsche Vokabular ist nicht jedermanns Sache...

Antwort auf Beitrag Nr.: 58.147.127 von Global-Player83 am 05.07.18 18:11:25

heute kam dann folgende Meldung:

"Suspended development work at the Ana Paula project temporarily to focus capital expenditures on operating mines"

Zitat von Global-Player83: Und nebenbei noch Ana Paula finazieren, wie soll das gehen? SF soll den CF bringen, was ich schon zweifelhaft finde, aber 3 Minen ist eine zuviel.

heute kam dann folgende Meldung:

"Suspended development work at the Ana Paula project temporarily to focus capital expenditures on operating mines"

Antwort auf Beitrag Nr.: 58.288.544 von Amphibie am 24.07.18 14:39:47

Asche zu Asche und Staub zu Staub!

Die Q2/18 Zahlen waren ja mal katastrophal schlecht!

- Produktion nur 19 koz Gold

- Produktionsprognose kassiert

"As a result of the changes at the San Francisco Mine we will not meet our guidance for 2018 of between 90,000 and 100,000 ounces of gold production. With work continuing at Florida Canyon on an updated mine plan we do not expect to provide production and cost guidance for the remainder of 2018. Our focus is on improving operations at these two assets to generate cash flow and develop a fully executable plan for 2019.”

- AISC 1314$/oz, das liegt über dem Verkaufspreis von 1293$/oz

- SF Mine hat fertig --> unprofitabel

- Rye Patch Übernahme war eine Giftpille

- Ana Paula zu bauen war auch ein Fehler, da die Metrics von Anfang an nicht gestimmt haben

- tja, dumm nur das sie die Konstruktion der Ana Paula Mine dem Cash Flow aus der SF Mine stemmen wollten, und die SF Mine aber keinen positiven CF abwirft und die Konstruktion nun ausgesetzt/gestoppt werden musste

- Alio Gold steckt tief in der Scheisse und das war auch schon lange absehbar

Zitat von Amphibie: Stockplan, warte doch mal ab, Alio Gold wird wie wie ein Phönix aus der Asche auferstehen und uns allen eines besseren belehren. Die gute, alte Timmins Gold wird in den kommenden Jahren eine top Performance hinlegen.

Überall wo Feuer ist, bleibt Asche zurück und daraus kann Neues entstehen. Und Neues ist Alio.

Asche zu Asche und Staub zu Staub!

Die Q2/18 Zahlen waren ja mal katastrophal schlecht!

- Produktion nur 19 koz Gold

- Produktionsprognose kassiert

"As a result of the changes at the San Francisco Mine we will not meet our guidance for 2018 of between 90,000 and 100,000 ounces of gold production. With work continuing at Florida Canyon on an updated mine plan we do not expect to provide production and cost guidance for the remainder of 2018. Our focus is on improving operations at these two assets to generate cash flow and develop a fully executable plan for 2019.”

- AISC 1314$/oz, das liegt über dem Verkaufspreis von 1293$/oz

- SF Mine hat fertig --> unprofitabel

- Rye Patch Übernahme war eine Giftpille

- Ana Paula zu bauen war auch ein Fehler, da die Metrics von Anfang an nicht gestimmt haben

- tja, dumm nur das sie die Konstruktion der Ana Paula Mine dem Cash Flow aus der SF Mine stemmen wollten, und die SF Mine aber keinen positiven CF abwirft und die Konstruktion nun ausgesetzt/gestoppt werden musste

- Alio Gold steckt tief in der Scheisse und das war auch schon lange absehbar

Antwort auf Beitrag Nr.: 56.674.295 von Global-Player83 am 10.01.18 15:01:51

Vom 10.01.18

Zitat von Global-Player83: Ana Paula ist ein großartiges Projekt? Alio Gold hat jede Menge Cash? die Bewertung ist fair? die Margen sind weit über dem Durchschnitt des Sektor?

Lass mich raten? Deine Brille ist rosa

Vom 10.01.18

Antwort auf Beitrag Nr.: 54.119.036 von Global-Player83 am 19.01.17 16:05:53

Vom 19.01.17

Zitat von Global-Player83: Goldcorp zuschlägt? Niemals, dafür ist Timmins viel zu unbedeutend, mit solchen Peanuts macht Goldcorp nicht rum.

Und das Timmins die Kurve bekommen hat kann ich auch nicht sehen, die 13 Mio. $ aus der letzten Finanzierung sind schnell aufgebraucht.

Vom 19.01.17

Antwort auf Beitrag Nr.: 54.112.136 von Global-Player83 am 18.01.17 18:32:21

Vom 18.01.17

Zitat von Global-Player83: Bei Timmins Gold ist die Kuh noch lange nicht vom Eis, die Produktions der San Francisco Mine wird in 2017 stark rückläufig sein, dementsprechend könnte das die Kosten steigen lassen bzw. den Cash Flow belasten. Wie will Timmins Gold die Konstruktion des Ana-Paula Projektes finanzieren?

Vom 18.01.17

Antwort auf Beitrag Nr.: 58.421.544 von Global-Player83 am 10.08.18 16:44:15Nachtreten bringt jetzt auch nichts. Aber FC Giftpille? Wenn ich das richtig sehe, ist FC einzig profitabel in diesem Laden.

Gibts schon Erkenntnisse aus dem angesetzten Call?

Antwort auf Beitrag Nr.: 54.268.715 von Global-Player83 am 08.02.17 12:15:49

Vom 08.02.17

Time has told!

Zitat von Global-Player83: Ewig währender Daueroptimismus von Investierten incl. Durchhalteparolen.

Time will tell.

Vom 08.02.17

Time has told!

Antwort auf Beitrag Nr.: 57.975.168 von Global-Player83 am 13.06.18 12:23:24

Vom 13.06.18

Zitat von Global-Player83: Alio hat sich mit der Übernahme von Rye Patch keinen gefallen getan, wenn sich 2 Trottel zusammentun wird noch lange kein Genie daraus, dass trifft auch auf Alio zu.

Die Aktie notiert auf einem 52 Wochen TIEF! keiner will, dieses Papier anfassen, warum auch bei den schwachen Aussichten.

Vom 13.06.18

Antwort auf Beitrag Nr.: 58.421.682 von Global-Player83 am 10.08.18 16:59:41Was bist du denn für ein Charakter. Lustig machen über die Veröuste anderer? Danke an den Ignorebutton

Schätze der Call ist nun durch, da es nochmal kräftig nach unten ging.

Antwort auf Beitrag Nr.: 58.420.854 von iwanowski am 10.08.18 15:36:22Also so weit ich es verstanden habe wird die Weiterentwicklung eingestellt so habe ich es verstanden. Nicht das Minenleben...

Erstmal informieren bevor man dummes Zeug postet

Erstmal informieren bevor man dummes Zeug postet

Antwort auf Beitrag Nr.: 58.421.571 von Global-Player83 am 10.08.18 16:47:13Market Cap: 116,459,852

Also so wie ich das sehe macht man massive Verluste wenn man das nicht schnell in den Griff bekommt mit den Kosten und diese zumindest unter 1000 Dollar drückt...

Ist da eine Market cap von 120 Millionen nach angemessen?

Also so wie ich das sehe macht man massive Verluste wenn man das nicht schnell in den Griff bekommt mit den Kosten und diese zumindest unter 1000 Dollar drückt...

Ist da eine Market cap von 120 Millionen nach angemessen?

Gerade 4.000 Stücke gekauft und keine 3.800.-€ bezahlt.

Wer hätte gedacht, dass man noch mal unter einem Euro pro Aktie an ein so werthaltiges Unternehmen kommt.

Braucht man natürlich bei derzeitiger Aktenlage ordentlich Cochones.....also nichts für Heulsusen wie Globallabertasche oder Fracksausen-Freddy.

Wer hätte gedacht, dass man noch mal unter einem Euro pro Aktie an ein so werthaltiges Unternehmen kommt.

Braucht man natürlich bei derzeitiger Aktenlage ordentlich Cochones.....also nichts für Heulsusen wie Globallabertasche oder Fracksausen-Freddy.

Antwort auf Beitrag Nr.: 58.423.047 von iwanowski am 10.08.18 19:50:48Hatte auch schon überlegt. Warte aber den Montag ab und wie da nochmal die Reaktionen sind.

Antwort auf Beitrag Nr.: 58.423.047 von iwanowski am 10.08.18 19:50:48

"....ein so werthaltiges Unternehmen..."

Ein Unternehmen das von 33$ auf 1$ abstürzt ist also "werthaltig"

Na kein Wunder das deine Verluste so hoch sind

Zitat von iwanowski: Gerade 4.000 Stücke gekauft und keine 3.800.-€ bezahlt.

Wer hätte gedacht, dass man noch mal unter einem Euro pro Aktie an ein so werthaltiges Unternehmen kommt.

Braucht man natürlich bei derzeitiger Aktenlage ordentlich Cochones.....also nichts für Heulsusen wie Globallabertasche oder Fracksausen-Freddy.

"....ein so werthaltiges Unternehmen..."

Ein Unternehmen das von 33$ auf 1$ abstürzt ist also "werthaltig"

Na kein Wunder das deine Verluste so hoch sind

Antwort auf Beitrag Nr.: 58.423.047 von iwanowski am 10.08.18 19:50:48Warum wirst du gleich Beleidigend passt es dir vllt nicht das die Firma aktuell nicht Gewinnbringend ist...?

Produced 19,190 ounces1 of gold at an all-in sustaining cost1,2 (“AISC”) of $1,314 per ounce

Iwanowski vllt hast du das nicht verstanden der Goldpreis steht bei 1211 Dollar das heißt man macht massive Verluste mit jeder Unze Gold die man fördert..

Wie will man in die Gewinnzone kommen?

https://www.finanzen.net/aktien/Alio_Gold-Aktie

Die Firma stand letzten September bei 4 Euro und jetzt ca 90 Cent das wirklich eine sehr positive Entwicklung und auch das man Verluste schreibt das machen wirklich nur gute Firmen...

naja die guten Goldfirmen machen bei diesen Goldpreisen noch Gewinn ...

Produced 19,190 ounces1 of gold at an all-in sustaining cost1,2 (“AISC”) of $1,314 per ounce

Iwanowski vllt hast du das nicht verstanden der Goldpreis steht bei 1211 Dollar das heißt man macht massive Verluste mit jeder Unze Gold die man fördert..

Wie will man in die Gewinnzone kommen?

https://www.finanzen.net/aktien/Alio_Gold-Aktie

Die Firma stand letzten September bei 4 Euro und jetzt ca 90 Cent das wirklich eine sehr positive Entwicklung und auch das man Verluste schreibt das machen wirklich nur gute Firmen...

naja die guten Goldfirmen machen bei diesen Goldpreisen noch Gewinn ...

Antwort auf Beitrag Nr.: 58.423.047 von iwanowski am 10.08.18 19:50:48Was ist bei diesen Kosten pro Unze Werthaltig? Sind Verluste etwas Wertvolles.....

all-in sustaining cost1,2 (“AISC”) of $1,314 per ounce

all-in sustaining cost1,2 (“AISC”) of $1,314 per ounce

Antwort auf Beitrag Nr.: 58.423.047 von iwanowski am 10.08.18 19:50:48Alio Gold Aktie

WKN: A2DRQU / ISIN: CA01627X1087

Symbol: ALO

0,9170EUR-0,1730EUR-15,87%

WOW ---- 15 Prozent und das soll eine "Werthaltiges Unternehmen sein???" dazu noch 1300 ALL In Cost

Bei einem Goldpreis von 1211 das dabei kein Gewinn hängen bleibt merkst du selber nee

WKN: A2DRQU / ISIN: CA01627X1087

Symbol: ALO

0,9170EUR-0,1730EUR-15,87%

WOW ---- 15 Prozent und das soll eine "Werthaltiges Unternehmen sein???" dazu noch 1300 ALL In Cost

Bei einem Goldpreis von 1211 das dabei kein Gewinn hängen bleibt merkst du selber nee

Antwort auf Beitrag Nr.: 58.424.559 von freddy1989 am 10.08.18 23:47:19Iwanowski ist bekannt solche "Perlen" sein eigen nennen zu duerfen. und schuld sind imemr die boesen bezahltenbasher hier auf wo:

Antwort auf Beitrag Nr.: 58.424.532 von freddy1989 am 10.08.18 23:39:58Die Zahlen waren ja mal nicht besonders gut, aber das war ja auch zu erwarten. Operativ wurde ein Verlust von $106 Tausend USD erzielt. Netto wurde ein Gewinn von ca. $3,3 Millionen USD verbucht, jedoch nur wegen eines Einmaleffektes (Gain on derivative contracts). Die AISC lagen bei der San Francisco Mine bei 1172 USD. Das ist zwar nicht umwerfend aber in Ordnung. Die AISC der Florida Canyon Mine wurden nicht veröffentlicht, diese müssen allerdings verheerend ausgefallen sein, da die gesamten AISC sich auf 1314 USD beliefen. Das Ana Paula Projekt wurde vorerst einmal auf Eis gelegt, was ich als plausibel betrachte, um Kosten zu sparen. Ohne eine weitere Kapitalerhöhung könnte man das Projekt sowieso nicht stemmen und diese wäre bei den aktuellen Kursen auch nicht gerade von Vorteil für die Aktionäre. Die Produktionsziele für das restliche Jahr 2018 können des Weiteren auch nicht eingehalten werden und man versucht erst einmal die beiden operativen Minen in den Griff zu bekommen. Diese Vorgehensweiße halte ich für vorausschauend und richtig. Es macht absolut keinen Sinn, komme was wolle einfach nur alles aus dem Boden zu holen, wenn man sowieso fast keinen Gewinn erzielt, oder sogar einen Verlust einfährt.

Der Buchwert des Unternehmens liegt nun bei ca. $274,32 Millionen USD. Das sind 3,27 USD pro Aktie. Das Barvermögen von ALO beläuft sich auf aktuell ca. $29,70 Millionen USD und das working capital lag bei $78,20 Millionen USD. Die Marktkapitalisierung liegt bei gerade mal ca. 88 Millionen USD. Das Unternehmen ist also extrem günstig bewertet. Selbst bei den aktuellen Goldpreisen von 1200 USD sollte der Cashburn ziemlich gering ausfallen. Bei ungefähr 25.000 Unzen im Quartal sind es wenige einstellige Millionen USD (2 bis 4 Millionen) operativer Verlust. Das ist nicht wirklich viel.

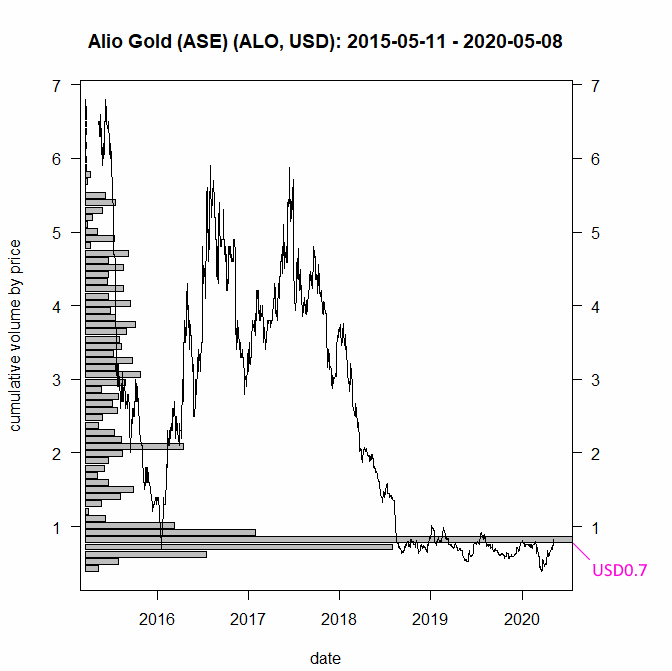

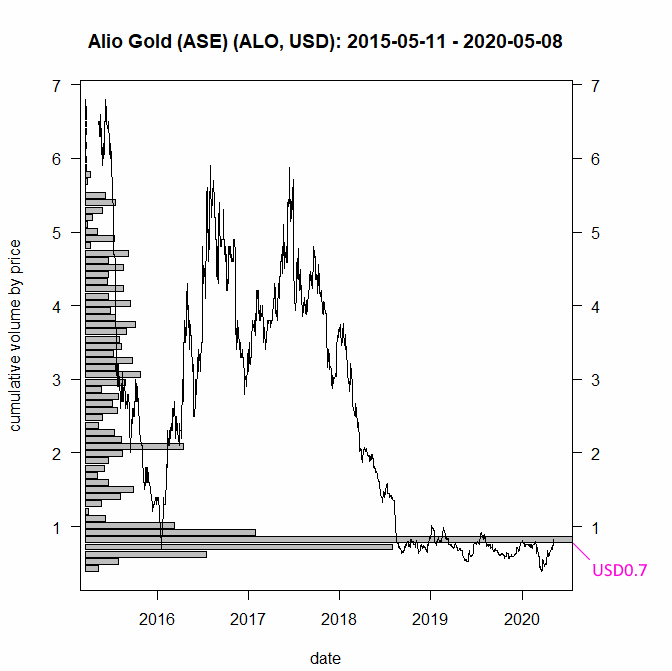

Sollte der Goldpreis in den nächsten Jahren wieder deutlich steigen ist ALO locker ein Tenbagger und Mehr. Kurzfristig kann es natürlich noch weiter runter gehen. Der Chart ist schlecht, die Lage aktuell nicht besonders und unklar und der Goldpreis ist am Fallen. Bei diesen aktuellen Preisen hoffe ich jedoch, dass ALO nicht selbst von einem größeren Producer übernommen wird, denn die Bewertung ist der Wahnsinn.

Der Buchwert des Unternehmens liegt nun bei ca. $274,32 Millionen USD. Das sind 3,27 USD pro Aktie. Das Barvermögen von ALO beläuft sich auf aktuell ca. $29,70 Millionen USD und das working capital lag bei $78,20 Millionen USD. Die Marktkapitalisierung liegt bei gerade mal ca. 88 Millionen USD. Das Unternehmen ist also extrem günstig bewertet. Selbst bei den aktuellen Goldpreisen von 1200 USD sollte der Cashburn ziemlich gering ausfallen. Bei ungefähr 25.000 Unzen im Quartal sind es wenige einstellige Millionen USD (2 bis 4 Millionen) operativer Verlust. Das ist nicht wirklich viel.

Sollte der Goldpreis in den nächsten Jahren wieder deutlich steigen ist ALO locker ein Tenbagger und Mehr. Kurzfristig kann es natürlich noch weiter runter gehen. Der Chart ist schlecht, die Lage aktuell nicht besonders und unklar und der Goldpreis ist am Fallen. Bei diesen aktuellen Preisen hoffe ich jedoch, dass ALO nicht selbst von einem größeren Producer übernommen wird, denn die Bewertung ist der Wahnsinn.

Bemerkenswert, trotz mieser Geschäftszahlen ist, daß wie auch in Q1 unter dem Strich ein Gewinn von $ 3,284 (0,05 $) ausgewiesen wurde.

Antwort auf Beitrag Nr.: 58.426.605 von benefactor am 11.08.18 15:41:51Sollte der POG in den nächsten Jahren wieder deutlich steigen......

Ja, dann könnte es mit Alio wieder ein wenig aufwärts gehen !

Aber der POG kann in den nächsten Jahren auch noch deutlich weiter fallen !

IMHOP haben sich die Weltbank und andere Banken ihre Prognose bez. des weiter fallenden POG nicht einfach aus dem Ärmel geschüttelt, sondern uns freundlicherweise mitgeteilt wohin die Eliten den POG in den nächsten Jahren treiben werden. Mal sehen wie Alio damit umgehen wird.

Ja, dann könnte es mit Alio wieder ein wenig aufwärts gehen !

Aber der POG kann in den nächsten Jahren auch noch deutlich weiter fallen !

IMHOP haben sich die Weltbank und andere Banken ihre Prognose bez. des weiter fallenden POG nicht einfach aus dem Ärmel geschüttelt, sondern uns freundlicherweise mitgeteilt wohin die Eliten den POG in den nächsten Jahren treiben werden. Mal sehen wie Alio damit umgehen wird.

!

Dieser Beitrag wurde von CloudMOD moderiert. Grund: bitte das Threadthema beachten, persönliche Befindlichkeiten klären Sie bitte ausserhalb des Threads!

Dieser Beitrag wurde von MODelfin moderiert. Grund: Bezug auf den Beitrag zuvor, bitte bleiben Sie sachlich und unterlassen Sie zudem "Namensverhohnepiepelungen", Danke.

sorry, soll heißen ....derzeit sind.. u.s.w.,

!

Dieser Beitrag wurde von CommunityAssistance moderiert. Grund: auf eigenen Wunsch des Users

Nicht sabbeln, sondern nachkaufen..

Ach nee, geht ja nur , wenn man wirklich Eier in der Hose hat...

P.S. Habe weitere 2000 Alio-Shares vor einer Stunde zu 0,90€ gekauft

Ach nee, geht ja nur , wenn man wirklich Eier in der Hose hat...

P.S. Habe weitere 2000 Alio-Shares vor einer Stunde zu 0,90€ gekauft

Antwort auf Beitrag Nr.: 58.434.511 von iwanowski am 13.08.18 13:20:10Respekt, macht -10% in 3 Stunden. Aber das gute ist, da kannste direkt wieder billiger nachkaufen (hast ja heute nach dem freitäglichem Nachkauf auch schon so gemacht), dieses Prinzip ist wirklich unschlagbar. Also ich persönlich würde damit ein Beratungsmodell aufbauen, dann Verdienste Dich doppelt dumm und dusselig.

....Verdienste.... ???

Wird das in diesem Fall nicht klein geschrieben???

Wird das in diesem Fall nicht klein geschrieben???

Antwort auf Beitrag Nr.: 58.436.371 von iwanowski am 13.08.18 16:46:34Hast recht!

Aber Du hast immerhin auch Verdienste ggü. vielen Kleinaktionären hier erworben, da Du denen deren Aktien abkaufst, welche ihnen sonst keiner mehr abnehmen würde.

Aber Du hast immerhin auch Verdienste ggü. vielen Kleinaktionären hier erworben, da Du denen deren Aktien abkaufst, welche ihnen sonst keiner mehr abnehmen würde.

Antwort auf Beitrag Nr.: 58.436.389 von Jakuba79 am 13.08.18 16:48:33Gibt es dafür eigentlich auch das Bundesverdienstkreuz??

Antwort auf Beitrag Nr.: 58.436.431 von iwanowski am 13.08.18 16:51:31Ne leider nicht!

Aber die gigantischen Gewinne werden Entschädigung genug sein.

Man muss halt nur die Eier haben und hoffen dass der Goldpreis steigt bevor der Cash verbrannt ist. Bei den AISC braucht man da allerdings wirklich ganz dicke Eier.

Aber die gigantischen Gewinne werden Entschädigung genug sein.

Man muss halt nur die Eier haben und hoffen dass der Goldpreis steigt bevor der Cash verbrannt ist. Bei den AISC braucht man da allerdings wirklich ganz dicke Eier.

Antwort auf Beitrag Nr.: 58.436.485 von Jakuba79 am 13.08.18 16:59:06

Ich glaube da sind wir bei ihm an der falschen Adresse ....

Tja, man sollte sich aufch fragen, was passiert hier, wenn Edelmetalle auf lange SIcht nicht sgteigen ? 99,99... % Verlust sind immer möglich, egal wo man eingakauft hat

Zitat von Jakuba79: Ne leider nicht!

Aber die gigantischen Gewinne werden Entschädigung genug sein.

Man muss halt nur die Eier haben und hoffen dass der Goldpreis steigt bevor der Cash verbrannt ist. Bei den AISC braucht man da allerdings wirklich ganz dicke Eier.

Ich glaube da sind wir bei ihm an der falschen Adresse ....

Tja, man sollte sich aufch fragen, was passiert hier, wenn Edelmetalle auf lange SIcht nicht sgteigen ? 99,99... % Verlust sind immer möglich, egal wo man eingakauft hat

Konnte ich mir nicht nehmen lassen 2000 Stück zu 0,84 nachgekauft

Antwort auf Beitrag Nr.: 58.436.371 von iwanowski am 13.08.18 16:46:3412% Verlust sind doch eine deutliche Sprache...

Die Firma verbrennt Cash wenn ich das nicht falsch verstanden habe und damit muss man langsam mal reagieren das man die Kosten unter 1000 Dollar bekommt

Bei 1300 Dollar kosten ist Alio nicht Lebensfährig außer natürlich 2019 steigt der Goldpreis auf 1400 oder 1500 Dollar aber selbst dann ist die Gewinnmarge nicht sehr groß

Die Firma verbrennt Cash wenn ich das nicht falsch verstanden habe und damit muss man langsam mal reagieren das man die Kosten unter 1000 Dollar bekommt

Bei 1300 Dollar kosten ist Alio nicht Lebensfährig außer natürlich 2019 steigt der Goldpreis auf 1400 oder 1500 Dollar aber selbst dann ist die Gewinnmarge nicht sehr groß

Antwort auf Beitrag Nr.: 58.436.431 von iwanowski am 13.08.18 16:51:31P.S. Habe weitere 2000 Alio-Shares vor einer Stunde zu 0,90€ gekauft

Alio Gold Inc

FRA: T66B

0,80 EUR −0,10 (11,47 %)

Fast 12 Verlust bei einer Top Firma wirklich nicht schlecht....warum sehen die anderen Investoren nicht das Potenzial?

Kosten müssen runter das ist Fakt

Alio Gold Inc

FRA: T66B

0,80 EUR −0,10 (11,47 %)

Fast 12 Verlust bei einer Top Firma wirklich nicht schlecht....warum sehen die anderen Investoren nicht das Potenzial?

Kosten müssen runter das ist Fakt

Alio von der MK her nun Übernahmekandidat

Antwort auf Beitrag Nr.: 58.436.905 von Stockplan am 13.08.18 17:29:13Chapeau, Chapeau an dich....kurzfristig verfügbares Cash wird bei mir zwar langsam knapp, werde aber nach 20.00h noch mal schauen, wie die Kursentwicklung verlaufen ist (obwohl unter einem Euro eh ein Witz) und dann wahrscheinlich nachlegen.

Antwort auf Beitrag Nr.: 58.437.013 von Stockplan am 13.08.18 17:39:27Wär käme denn da in Frage?

Iamgold würde bei meinem Depot 1. Wahl darstellen...

Iamgold würde bei meinem Depot 1. Wahl darstellen...

Am 17. Februar 2015 hat Timmins Gold sämtliche Aktien des ebenfalls in Vancouver / British Columbia beheimateten Explorers Newstrike Capital übernommen und hat den hierfür vereinbarten Kaufpreis von rund 140 Mio. CAD überwiegend mit eigenen Aktien beglichen.

Kernprojekt der Gesellschaft ist die hochgradige und oberflächennahe Gold- und Silber-Entdeckung 'Ana Paula' im südmexikanischen Bundesstaat Guerrero. Das zum sog. 'Guerrero'-Goldgürtel gehörende Vorkommen, für das bereits ein vorläufiges Wirtschaftlichkeitsgutachten erstellt wurde, umfasst derzeit rund 1,9 Mio. Unzen an gemessene bzw. angezeigte ('measured & indicated') Gold- sowie 7,1 Mio. Unzen an entsprechenden Silberressourcen.

Das waren also 140 Mio. CAD für Alna Paula. Die derzeitige Marktkapitalisierung von Alio Gold beträgt aktuell lediglich 103,0 Mio. CAD.

Kernprojekt der Gesellschaft ist die hochgradige und oberflächennahe Gold- und Silber-Entdeckung 'Ana Paula' im südmexikanischen Bundesstaat Guerrero. Das zum sog. 'Guerrero'-Goldgürtel gehörende Vorkommen, für das bereits ein vorläufiges Wirtschaftlichkeitsgutachten erstellt wurde, umfasst derzeit rund 1,9 Mio. Unzen an gemessene bzw. angezeigte ('measured & indicated') Gold- sowie 7,1 Mio. Unzen an entsprechenden Silberressourcen.

Das waren also 140 Mio. CAD für Alna Paula. Die derzeitige Marktkapitalisierung von Alio Gold beträgt aktuell lediglich 103,0 Mio. CAD.

Antwort auf Beitrag Nr.: 58.437.058 von iwanowski am 13.08.18 17:45:29Wenn das doch so ein Witz ist warum kaufen dann nicht alle wie verrückt

Wie will man die Kosten senken und in die Gewinnzone kommen wenn der Preis auf vllt 1000 Dollar pro Unze fällt was macht Alio dann?

Wie möchte das Managment die Kosten in den Griff bekommen?

Die Market cap ist wirklich sehr gering muss ich sagen 100 Millionen ca glaube ich

Wie will man die Kosten senken und in die Gewinnzone kommen wenn der Preis auf vllt 1000 Dollar pro Unze fällt was macht Alio dann?

Wie möchte das Managment die Kosten in den Griff bekommen?

Die Market cap ist wirklich sehr gering muss ich sagen 100 Millionen ca glaube ich

Antwort auf Beitrag Nr.: 58.436.317 von Jakuba79 am 13.08.18 16:41:37Aber immerhin ist unser Iwan ehrlich !

Wünsche ihm echt, dass Alio auch mal wieder steigt,.

Wünsche ihm echt, dass Alio auch mal wieder steigt,.

Antwort auf Beitrag Nr.: 58.437.058 von iwanowski am 13.08.18 17:45:29Schon die Tatsache, dass RPM nun komplett mit Null bewertet ist, macht die Sache hier für mich sehr interessant. War lange Jahre Rye Patcher, hab damals durch den grandiosen Deal mit Coeur einen sehr guten Schnitt gemacht. RPM verbindet schon lange eine , etwas unrühmliche Geschichte, die Coeur schon lange quer saß. Ich denke es macht Sinn nicht nur die direkten Nachbarn von Alio im Auge zu haben, sondern auch die von der ehemaligen RPM. Und da gibt es einige im Speckgürtel...

Echt spannend zu sehen, wie weit dieser Abverkauf noch geht...

Antwort auf Beitrag Nr.: 58.454.731 von Stockplan am 15.08.18 16:28:59

der wird noch weiter gehen, normal ist das nicht. Hier stinkt was aber kein Furz, 10%- dann 15% und wieder 10%. Bin hier schon raus. Habe meine Rye Aktien schon abgestoßen und wünsche allen Investiereten viel Glück bei den schweren Entscheidungen. Habe meinen 60% Verlust zu 50% wieder kompensiert. Aber ich denke es wird die nächste Zeit alles runter gehen. Wenn die

Minen nicht mehr laufen dann knallt es bald am Markt. Die großen bringen Ihre Schäfchen ins trockene.

Zitat von Stockplan: Echt spannend zu sehen, wie weit dieser Abverkauf noch geht...

der wird noch weiter gehen, normal ist das nicht. Hier stinkt was aber kein Furz, 10%- dann 15% und wieder 10%. Bin hier schon raus. Habe meine Rye Aktien schon abgestoßen und wünsche allen Investiereten viel Glück bei den schweren Entscheidungen. Habe meinen 60% Verlust zu 50% wieder kompensiert. Aber ich denke es wird die nächste Zeit alles runter gehen. Wenn die

Minen nicht mehr laufen dann knallt es bald am Markt. Die großen bringen Ihre Schäfchen ins trockene.

wow...knapp 20% minus in 3 Handelstagen...

kauft ihr noch schön fleißig nach?

kauft ihr noch schön fleißig nach?

Antwort auf Beitrag Nr.: 58.437.058 von iwanowski am 13.08.18 17:45:29-10,26 %

-0,120 CAD

Wow ganz schöner Kurssturz ich glaube andere Aktionäre merken das eng werden könnte wenn der Goldpreis weiter so abschmiert...

-0,120 CAD

Wow ganz schöner Kurssturz ich glaube andere Aktionäre merken das eng werden könnte wenn der Goldpreis weiter so abschmiert...

Weitere 12.000 abgeschnappt.

Denke, dass 71 Eurocent kein schlechter Einkaufspreis in dieser Abverkaufsschlacht sind.

Muß mich langsam zügeln, sonst werde ich hier schneller 6-stellig, als gewollt.

Aber was soll´s... im Gedenken an Kostolany....lasst die Kanonen donnern...

Denke, dass 71 Eurocent kein schlechter Einkaufspreis in dieser Abverkaufsschlacht sind.

Muß mich langsam zügeln, sonst werde ich hier schneller 6-stellig, als gewollt.

Aber was soll´s... im Gedenken an Kostolany....lasst die Kanonen donnern...

Antwort auf Beitrag Nr.: 58.457.176 von iwanowski am 15.08.18 20:10:51Viel glück

Ich hoffe nur das Alio es schafft die Kosten zu senken pro Unze...

Ich hoffe nur das Alio es schafft die Kosten zu senken pro Unze...

Antwort auf Beitrag Nr.: 58.457.176 von iwanowski am 15.08.18 20:10:51Glückwunsch. Ich warte morgen ab, ob wir unter 1 CAD gehen.

So mal ne kleine Zockerposi auf der 0,696 € gegönnt. Müsste irgendwann mal eine kleine Gegenreaktion geben, vielleicht wenn der Goldpreis mal 2 Tage stabil bleibt. Und dann wieder nix wie raus hier.

Antwort auf Beitrag Nr.: 58.476.916 von Amphibie am 17.08.18 21:50:04

Da haben...

....die wohl das Minus-Vorzeichen vergessen. 😂

Verzockt! Wirklich krass, dieses Fass hier hat keinen Boden. Keine Gegenreaktion, nicht mal minimal und bei zumindest mal 3 Tage stabilem Goldpreis.

Nun geht es bei Alio Gold richtig zur Sache. Es kann nicht sein, daß sich Aktionäre hier beteiligen und dann kurz danach vor einen riesigen Scherbenhaufen stehen. Das ist Missmanagement und gehört sich nicht.

"As a result, Paul Hosford, Vice President of Project Development, and the Project Manager, Terry Murphy, will be leaving the Company on August 31, 2018".

In addition, Colette Rustad, Chief Financial Officer, has left the Company on August 17, 2018.

"As a result, Paul Hosford, Vice President of Project Development, and the Project Manager, Terry Murphy, will be leaving the Company on August 31, 2018".

In addition, Colette Rustad, Chief Financial Officer, has left the Company on August 17, 2018.

Antwort auf Beitrag Nr.: 58.457.176 von iwanowski am 15.08.18 20:10:51Jetzt nur noch bei 66 cent wenn man die zu 1 Euro oder 0,90 cent gekauft hat das tut doch weh so eine Geldvernichtung in so kurzer Zeit...

Warum legt die Firma kein ordentlichen Konzept vor wie man die Kosten senken will...

Warum legt die Firma kein ordentlichen Konzept vor wie man die Kosten senken will...

Zum Glück haben die Highrisk Spekulanten hier auf w.o. dicke Eier 😂

VANCOUVER, Aug. 20, 2018 /CNW/ - Alio Gold Inc (TSX, NYSE AMERICAN: ALO) ("Alio Gold" or the "Company"), or the "Company"), today reports changes aimed at aligning capability to focus on its operating mines and reduce overhead costs. Recently, the Company announced the temporary suspension of exploration and development work at its Ana Paula project and a commitment to focus its efforts and capital allocation on its two operating mines, San Francisco and Florida Canyon. The Company is aligning its capability to support these efforts. As a result, Paul Hosford, Vice President of Project Development, and the Project Manager, Terry Murphy, will be leaving the Company on August 31, 2018. The Company has also taken steps to reduce costs at the Ana Paula project site in Mexico while maintaining a level of local employment and community engagement.

"We would like to thank Paul and his development team for their efforts in advancing Ana Paula," said Greg McCunn, Chief Executive Officer. "We have increased our knowledge of the project greatly over the last year and made significant improvements to the infrastructure which will make it simpler to resume work when we are in a position to do so."

In addition, Colette Rustad, Chief Financial Officer, has left the Company on August 17, 2018.

"Colette was brought on last year to lead the arrangement of $100 million in debt financing and put all the financial systems in place to build a mine," Greg McCunn added. "We made excellent progress on those efforts, but the decline in gold price and the equity capital market conditions are not supportive of advancing the Ana Paula project at this time. We wish Colette all the best in her future endeavors."

Ian Harcus, currently Corporate Controller, has been appointed Vice President Finance and will lead the finance function for the Company. In conjunction with this, the Company has also implemented a number of changes at its corporate office in Vancouver which in total are expected to reduce the corporate overhead by approximately $1.2 million over the next 12 months.

Technical capability is now being aligned under Doug Jones, Chief Operating Officer, as the Company focuses on the technical review of the San Francisco mining operations in Sonora, Mexico. The objective of the review is to improve understanding and mining operations in the San Francisco pit aiming at reduced mining dilution and improved grades feeding the crushing circuit ahead of heap leaching. At Florida Canyon, the Company has begun implementing new management systems and processes as part of the integration process. Joe Campbell, the current General Manager at San Francisco, will be moving into the General Manager role at Florida Canyon to lead these changes. The new life of mine plan and supporting technical report for Florida Canyon is on track for completion by the end of this year.

About Alio Gold

Alio Gold is a growth-oriented gold mining company, focused on exploration, development and production in Mexico and the USA. Its principal assets include its 100%-owned and operating San Francisco Mine in Sonora, Mexico, its 100%-owned and operating Florida Canyon Mine in Nevada, USA and its 100%-owned development stage Ana Paula Project in Guerrero, Mexico. The Company also has a portfolio of other exploration properties located in Mexico and the USA.

Read more at http://www.stockhouse.com/news/press-releases/2018/08/20/ali…

"We would like to thank Paul and his development team for their efforts in advancing Ana Paula," said Greg McCunn, Chief Executive Officer. "We have increased our knowledge of the project greatly over the last year and made significant improvements to the infrastructure which will make it simpler to resume work when we are in a position to do so."

In addition, Colette Rustad, Chief Financial Officer, has left the Company on August 17, 2018.

"Colette was brought on last year to lead the arrangement of $100 million in debt financing and put all the financial systems in place to build a mine," Greg McCunn added. "We made excellent progress on those efforts, but the decline in gold price and the equity capital market conditions are not supportive of advancing the Ana Paula project at this time. We wish Colette all the best in her future endeavors."

Ian Harcus, currently Corporate Controller, has been appointed Vice President Finance and will lead the finance function for the Company. In conjunction with this, the Company has also implemented a number of changes at its corporate office in Vancouver which in total are expected to reduce the corporate overhead by approximately $1.2 million over the next 12 months.

Technical capability is now being aligned under Doug Jones, Chief Operating Officer, as the Company focuses on the technical review of the San Francisco mining operations in Sonora, Mexico. The objective of the review is to improve understanding and mining operations in the San Francisco pit aiming at reduced mining dilution and improved grades feeding the crushing circuit ahead of heap leaching. At Florida Canyon, the Company has begun implementing new management systems and processes as part of the integration process. Joe Campbell, the current General Manager at San Francisco, will be moving into the General Manager role at Florida Canyon to lead these changes. The new life of mine plan and supporting technical report for Florida Canyon is on track for completion by the end of this year.

About Alio Gold

Alio Gold is a growth-oriented gold mining company, focused on exploration, development and production in Mexico and the USA. Its principal assets include its 100%-owned and operating San Francisco Mine in Sonora, Mexico, its 100%-owned and operating Florida Canyon Mine in Nevada, USA and its 100%-owned development stage Ana Paula Project in Guerrero, Mexico. The Company also has a portfolio of other exploration properties located in Mexico and the USA.

Read more at http://www.stockhouse.com/news/press-releases/2018/08/20/ali…

Antwort auf Beitrag Nr.: 58.501.551 von Stockplan am 21.08.18 20:12:20Mit 96/97CC bin ich seit gestern mit ein wenig auch wieder dabei.

Schreibe das auf ausdrücklichen Wunsch eine w.o. users der überall dort sofort aussteigen will, wo ich ( wieder ) einsteige !

Wird natürlich mal wieder schief gehen , wie fast alle meine EM Aktien Käufe, meinte der Kollege .

Schreibe das auf ausdrücklichen Wunsch eine w.o. users der überall dort sofort aussteigen will, wo ich ( wieder ) einsteige !

Wird natürlich mal wieder schief gehen , wie fast alle meine EM Aktien Käufe, meinte der Kollege .

Antwort auf Beitrag Nr.: 58.457.176 von iwanowski am 15.08.18 20:10:51und wie schaut es aus ? Willste nochmal bei der Perle anchlegen, sind doch Schnaeppchenpreise...

Antwort auf Beitrag Nr.: 58.517.919 von Keilfleckbarbe am 23.08.18 15:26:14Keili das war klar, wenn ich mir hier was kaufe geht es runter , daher die Warnung !

Aber nicht nur Alio verliert heute, der ganze Sektor scheint sich aufzulösen .

Aber nicht nur Alio verliert heute, der ganze Sektor scheint sich aufzulösen .

So einen Schrott würde ich mir nicht ins Depot legen...

Antwort auf Beitrag Nr.: 58.519.569 von leone2 am 23.08.18 18:06:32Hast Recht !

Gold und Goldminen sind grundsätzlich Anlage-Schrott

Aber augenblicklich bin ich meinen Alio 's schon wieder im Plus

saludos

Gold und Goldminen sind grundsätzlich Anlage-Schrott

Aber augenblicklich bin ich meinen Alio 's schon wieder im Plus

saludos

Eine beispiellose Geldvernichtung findet hier statt. Wer glaubte das Management von RPM sei stümperhaft gewesen, es war nichts gegen die Stümper bei Alio

Antwort auf Beitrag Nr.: 58.521.303 von Stockplan am 23.08.18 20:57:34Ja das ist ein Trauerspiel hier - bin auch als Rye Aktionär hier rein geschliddert und hätte die Reißleine ziehen sollen. Dachte, das kann hier nur besser werden und wurde eines besseren belehrt.

Die news bezog sich leider fast ausschließlich auf personelle Änderungen. Im Grunde gehen jetzt ein paar Leute - aber wer ersetzt die? Oder gehen die Ersatzlos?

Doch viel wichtiger: Was wird gemacht, um die Kosten pro Unze zu senken? Dazu leider nichts.

Daher bin ich auch nicht sicher, ob wir endlich einen Boden erreicht haben.

Das ist hier wirklich enttäuschend.

Die news bezog sich leider fast ausschließlich auf personelle Änderungen. Im Grunde gehen jetzt ein paar Leute - aber wer ersetzt die? Oder gehen die Ersatzlos?

Doch viel wichtiger: Was wird gemacht, um die Kosten pro Unze zu senken? Dazu leider nichts.

Daher bin ich auch nicht sicher, ob wir endlich einen Boden erreicht haben.

Das ist hier wirklich enttäuschend.

CEO bought 5000 shares yesterday, brings position to 70k

Decent sign. Would like to expect more from board members.

Decent sign. Would like to expect more from board members.

Endlich mal wenigstens ne kleine Gegenreaktion.

Antwort auf Beitrag Nr.: 58.529.574 von Stockplan am 24.08.18 18:16:06Wenn bei der Entwicklung des Goldpreises nicht mal heute ein Plus dagestanden hätte....

Alio Gold Inc (ALO:NYSE American)

Real Time Quote | NASDAQ Last

0.7571 +0.05 (+7.15%)

Real Time Quote | NASDAQ Last

0.7571 +0.05 (+7.15%)

Antwort auf Beitrag Nr.: 58.529.460 von Amphibie am 24.08.18 18:00:51ich bin hier Gott sei dank nicht investiert aber man muss schnell einen Weg finden um die Produktionkosten zu senken und dafür muss man einen Plan haben....

So genau gebe ich zu bin ich in der Materie nicht drin gibt es Cash Reserven um diese Flaute zu überstehen oder zahlt man schon aus der Substanz...?

So genau gebe ich zu bin ich in der Materie nicht drin gibt es Cash Reserven um diese Flaute zu überstehen oder zahlt man schon aus der Substanz...?

alles aus der Substanz

Meiner Meinung nach wird Alio Gold noch dieses Jahr von einen anderen Minenunternehmen übernommen. Die Übernahme ist kaum noch abzuwenden. Fragt sich nur zu welchen Preis? 1,00 USD oder höher? Bei einer Übernahme werden wohl so gut wie alle verlieren, bis auf die, die erst vor kurzen Aktien von Alio Gold gekauft haben.

Antwort auf Beitrag Nr.: 58.546.772 von Amphibie am 27.08.18 22:47:12Also die Leute die hier vor kurzem noch meinten bei 0,95 cent wäre die Firma ein Schnäppchen und man kann günstig einsammeln ....ich glaube das wir in einem Fetten Verlust Enden...

Die Frage ist welche Firma würde Alio Gold übernehmen und sich diese Probleme die Alio Gold hat besonders mit den hohen kosten antun??

Die Frage ist welche Firma würde Alio Gold übernehmen und sich diese Probleme die Alio Gold hat besonders mit den hohen kosten antun??

Verkaufen und in solide Werte mit anständigem Balance Sheet investieren .

Für mich unverständlich, warum Alio Gold so weit nach unten durchgereicht wird. Das Ana Paula Projekt allein ist meiner Meinung nach mehr wert als die derzeitige Marktkapitalisierung von Alio Gold. Ich würde den Gesamtwert vom Ana Paula Projekt auf 80,00 Mio. USD beziffern. Sicherlich waren die Zahlen auf der "Florida Canyon Mine" schwach. Dabei sollte man aber auch bedenken, daß Alio Gold recht schnell und noch nicht einmal mit 35,00 Mio. USD "Lincoln Hill" in die Produktion bringen kann. Spätestens dann wird "Florida Canyon" gute Zahlen schreiben.

______________________________________________________________________________________________________

Ana Paula gold mine reserves

Measured resources at the mine are estimated to be 22,767kt, grading 1.608g/t AU, containing 1.177Moz of gold and 3.587Moz of silver. Indicated resources are estimated at 18,243kt, grading 1.163g/t AU, and containing 683,000oz of gold and 3.489Moz of silver.

The inferred resources are estimated to be 1,904kt, grading 1.113g/t AU, and containing 68,000oz of gold and 664,000oz of silver.

______________________________________________________________________________________________________

Ana Paula gold mine reserves

Measured resources at the mine are estimated to be 22,767kt, grading 1.608g/t AU, containing 1.177Moz of gold and 3.587Moz of silver. Indicated resources are estimated at 18,243kt, grading 1.163g/t AU, and containing 683,000oz of gold and 3.489Moz of silver.

The inferred resources are estimated to be 1,904kt, grading 1.113g/t AU, and containing 68,000oz of gold and 664,000oz of silver.

Wenn du Kosten von 1500 Dollar je Unze hast , bringt das aber alles relativ wenig wenn der Spot bzw Verkaufspreis bei 1200 steht..

Ja, stimmt die Kosten sind zu hoch. Ich verstehe nicht, wieso die sich nicht an das "Lincoln Hill" Projekt hängen. Der Capex war doch sehr niedrig. Das würden die auch von einer Bank finanziert bekommen. Was geht da im Unternehmen vor sich? Außerdem hat "Lincoln Hill" schon sehr vielversprechende Bohrergebnisse geliefert.

wer sollte alio gold übernehmen wollen bei soviel baustellen.

florida canyon - schrott

sanfranciso - ausgebeutet

ana paula - unwirtschaftlich

florida canyon - schrott

sanfranciso - ausgebeutet

ana paula - unwirtschaftlich

"Florida Canyon" sieht schon wieder ganz anders aus, wenn Lincoln Hill in Produktion geht. Dann werden wir AISC von nur noch 1100,00 USD je Unze sehen.

Die San Francisco Mine hat immer noch Reserven von 800k Stck. Goldunzen.

"Ana Paula" unwirtschaftlich? Nein, unwirtschaftlich ist Ana Paula sicherlich nicht. Von der "Ana Paula" Mine, kann man direkt auf die erfolgreich geführte "El Limon" Mine von Torex schauen.

Die San Francisco Mine hat immer noch Reserven von 800k Stck. Goldunzen.

"Ana Paula" unwirtschaftlich? Nein, unwirtschaftlich ist Ana Paula sicherlich nicht. Von der "Ana Paula" Mine, kann man direkt auf die erfolgreich geführte "El Limon" Mine von Torex schauen.

Jeder kann sich eine eigene Meinung bilden, bzgl. der Seriosität von Alio Gold, Rye Patch Gold.

https://youtu.be/nAeKVr8VPdY

https://youtu.be/nAeKVr8VPdY

Wohin für Alio Gold der Weg gehen wird, sieht man hier ganz klar. Es ist meiner Meinung nur noch eine Frage des Preises.

McCunn gibt zu, dass Alio Gold mit einem großen Landpaket und einer ziemlich bescheidenen Marktkapitalisierung ein Übernahmeziel werden könnte. Auf die Frage, ob Leagold Mining (TSX: LMC) interessiert sein könnte, räumt McCunn ein, dass er die Gerüchte gehört hat.

McCunn gibt zu, dass Alio Gold mit einem großen Landpaket und einer ziemlich bescheidenen Marktkapitalisierung ein Übernahmeziel werden könnte. Auf die Frage, ob Leagold Mining (TSX: LMC) interessiert sein könnte, räumt McCunn ein, dass er die Gerüchte gehört hat.

Antwort auf Beitrag Nr.: 58.604.664 von Abuzer am 03.09.18 20:28:06

?

Woher hast du dieses Statement? Leagold hat im Moment bekanntlich selbst genug Baustellen...

Diese Aktie ist der schleichende Tod... Mit einem unglaublich inkompetenten Management. Keinerlei Statement oder Plan, den Werteverfall zu stoppen.

!

Dieser Beitrag wurde von CloudMOD moderiert. Grund: auffällige/abwertende Vulgärsprache

Ich befürchte wirklich, dass wir von Rye Patch Gold richtig über den Tisch gezogen wurden. Der aktuelle Kurs sagt das jedenfalls aus. Nur, wer trägt die Verantwortung dafür?

!

Dieser Beitrag wurde von CloudMOD moderiert. Grund: bitte das Threadthema beachten, bleiben Sie bitte sachlich

Antwort auf Beitrag Nr.: 58.641.960 von Amphibie am 07.09.18 13:18:13Da wurde keiner über den Tisch gezogen. Da sind zwei nicht rentable Unternehmen mit einem auf beiden Seiten miesen Management fusioniert worden. Ganz nach dem Motto minus und minus macht plus. Das klappt aber nur in der Mathematik und nicht im Wirtschaftsleben. Dazu kommt das katastrophale Umfeld für Minenunternehmen. In der Summe führt das dann zu dem Kurs, ich sehe die noch nicht einmal als unterbewertet an, da hier zu diesen Goldpreisen jeden Tag Geld verbrannt wird.

Und zu Iwanowski: Das der Typ etwas schräg drauf ist, war mir ja direkt klar. Aber dieser letzte Post von ihm zeigt ja eine Gesinnung auf, die dann doch eher schon sehr ungesund ist. Aber irgendwie passt er als Aktionär genau zu diesem Unternehmen.

Und zu Iwanowski: Das der Typ etwas schräg drauf ist, war mir ja direkt klar. Aber dieser letzte Post von ihm zeigt ja eine Gesinnung auf, die dann doch eher schon sehr ungesund ist. Aber irgendwie passt er als Aktionär genau zu diesem Unternehmen.

Antwort auf Beitrag Nr.: 58.703.646 von Amphibie am 14.09.18 19:09:25Der Absturz ist mehr als Krass

Mein Gott was wurde hier geschrieben wie toll die Firma ist....

Ich weiss es nicht genau aber scheint so als ob die Firma ums überleben kämpft wenn man nicht schnell reagiert und die Kosten in den Griff bekommt.

Mein Gott was wurde hier geschrieben wie toll die Firma ist....

Ich weiss es nicht genau aber scheint so als ob die Firma ums überleben kämpft wenn man nicht schnell reagiert und die Kosten in den Griff bekommt.

Antwort auf Beitrag Nr.: 58.761.556 von freddy1989 am 21.09.18 13:59:44"denke du bist bei alio besser aufgehoben." da stand der Kurs bei 1,30 Euro ca heute bei 0,65 Cent

Naja die letzten Tage war der Alio-Kurs immer grün. Ich sehe Licht am Horizont. Natürlich ist der Kursverlauf enttäuschend, aber Alio braucht nur eine gute Nachricht, dann geht bei der Aktie die Post ab. Der Aktie ist so runter gedrosselt worden, daß hier, auf den Weg nach oben, nur noch ein zündender Funke fehlt. Lass uns abwarten und hoffen.

Naja die letzten Tage war der Alio-Kurs immer grün. Ich sehe Licht am Horizont. Natürlich ist der Kursverlauf enttäuschend, aber Alio braucht nur eine gute Nachricht, dann geht bei der Aktie die Post ab. Der Aktie ist so runter gedrosselt worden, daß hier, auf den Weg nach oben, nur noch ein zündender Funke fehlt. Lass uns abwarten und hoffen.

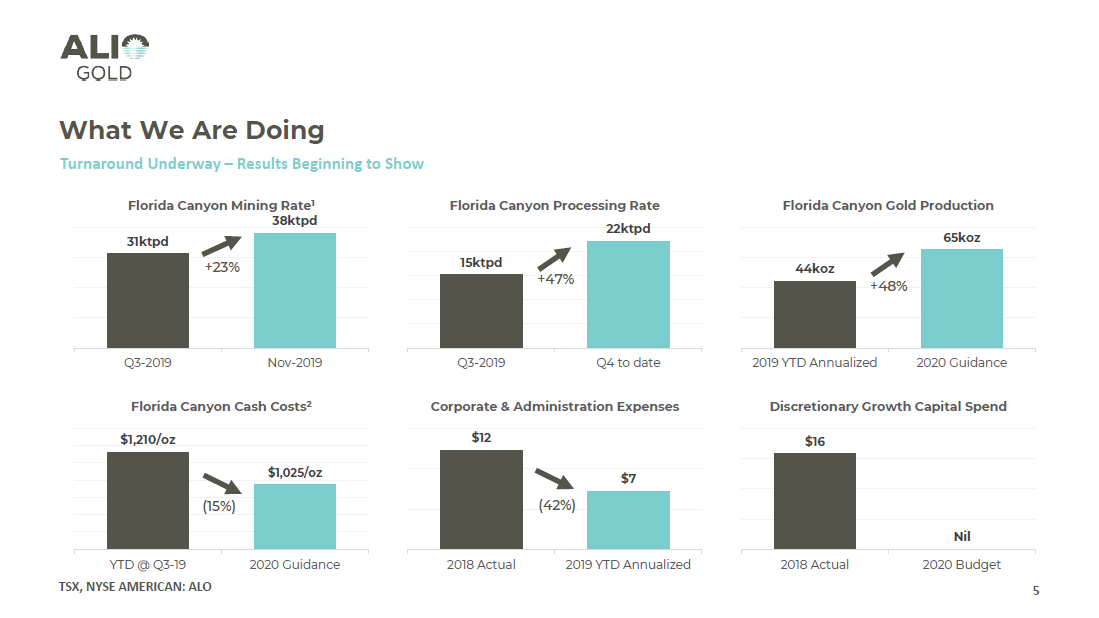

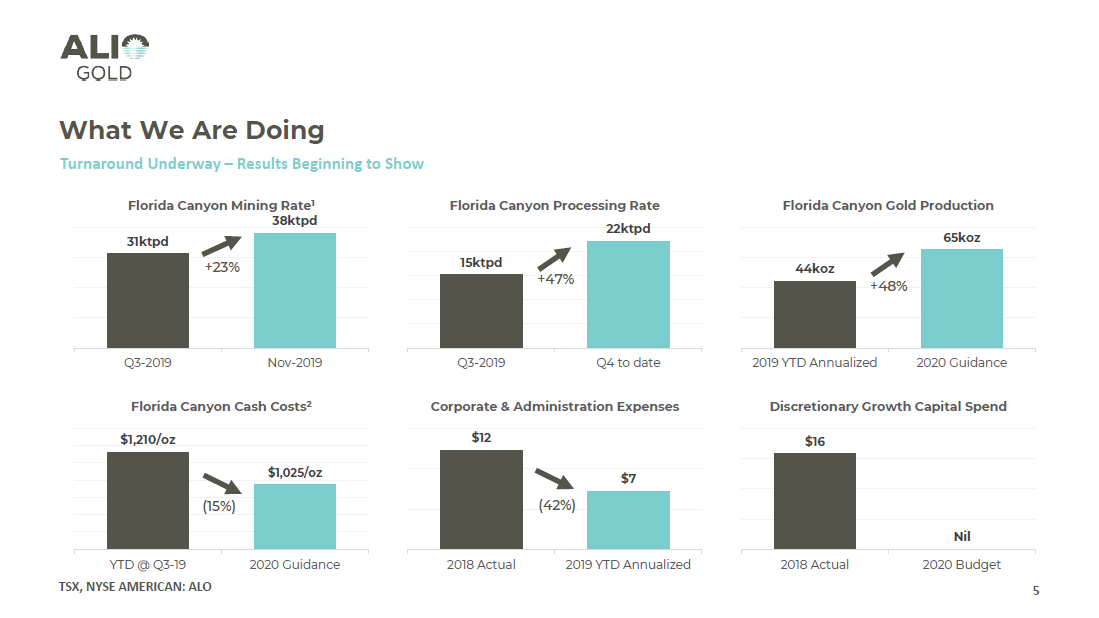

Wenn es überhaupt noch außer mir jemanden hier interessiert - anbei die neuste Präsentationsmappe von der gestrigen Precious Metals Summit (Beaver Creek)...

http://static.gowebcasting.com/documents/files/events/event_…

http://static.gowebcasting.com/documents/files/events/event_…

Antwort auf Beitrag Nr.: 58.774.550 von iwanowski am 23.09.18 13:56:38richtig einsetzten bitte einbettung da auf link

http://static.gowebcasting.com/documents/files/events/event_…

http://static.gowebcasting.com/documents/files/events/event_…

Aus dem Stockhouse Forum

Great conference, AISC $!1000

http://www.gowebcasting.com/conferences/2018/09/20/precious-…

ValuePumpKing - 3 hours ago

Great conference, AISC $!1000

http://www.gowebcasting.com/conferences/2018/09/20/precious-…

ValuePumpKing - 3 hours ago

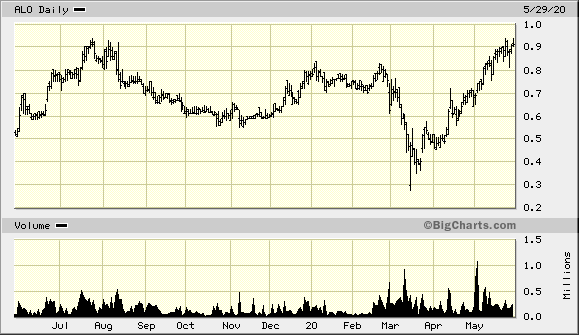

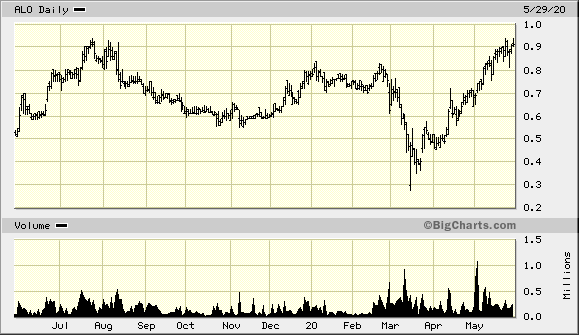

Mal schauen wie lange der Uptrend geht...sieht gut aus derzeit.

Antwort auf Beitrag Nr.: 58.798.187 von Stockplan am 25.09.18 22:24:49http://www.gowebcasting.com/conferences/2018/09/20/precious-…

Nicht schon wieder ein Call nach den Zahlen...

VANCOUVER, British Columbia, Oct. 01, 2018 (GLOBE NEWSWIRE) -- Alio Gold Inc (TSX, NYSE AMERICAN: ALO) (“Alio Gold” or the “Company”), today announced that it will release its third quarter 2018 results on Thursday, November 8, 2018, before the market opens, followed by a conference call at 11:00am EST.

Third Quarter 2018 Results Conference Call and Webcast Details:

US and Canada (toll-free): (855) 427-9509

Outside North America: (210) 229-8822

Conference ID: 6094766

Webcast: https://edge.media-server.com/m6/p/8rte5x2f

Replay: To be available at http://www.aliogold.com

About Alio Gold

Read more at http://www.stockhouse.com/news/press-releases/2018/10/01/ali…

VANCOUVER, British Columbia, Oct. 01, 2018 (GLOBE NEWSWIRE) -- Alio Gold Inc (TSX, NYSE AMERICAN: ALO) (“Alio Gold” or the “Company”), today announced that it will release its third quarter 2018 results on Thursday, November 8, 2018, before the market opens, followed by a conference call at 11:00am EST.

Third Quarter 2018 Results Conference Call and Webcast Details:

US and Canada (toll-free): (855) 427-9509

Outside North America: (210) 229-8822

Conference ID: 6094766

Webcast: https://edge.media-server.com/m6/p/8rte5x2f

Replay: To be available at http://www.aliogold.com

About Alio Gold

Read more at http://www.stockhouse.com/news/press-releases/2018/10/01/ali…

Nicht schon wieder ein Call nach den Zahlen...

VANCOUVER, British Columbia, Oct. 01, 2018 (GLOBE NEWSWIRE) -- Alio Gold Inc (TSX, NYSE AMERICAN: ALO) (“Alio Gold” or the “Company”), today announced that it will release its third quarter 2018 results on Thursday, November 8, 2018, before the market opens, followed by a conference call at 11:00am EST.

Third Quarter 2018 Results Conference Call and Webcast Details:

US and Canada (toll-free): (855) 427-9509

Outside North America: (210) 229-8822

Conference ID: 6094766

Webcast: https://edge.media-server.com/m6/p/8rte5x2f

Replay: To be available at http://www.aliogold.com

About Alio Gold

Read more at http://www.stockhouse.com/news/press-releases/2018/10/01/ali…

VANCOUVER, British Columbia, Oct. 01, 2018 (GLOBE NEWSWIRE) -- Alio Gold Inc (TSX, NYSE AMERICAN: ALO) (“Alio Gold” or the “Company”), today announced that it will release its third quarter 2018 results on Thursday, November 8, 2018, before the market opens, followed by a conference call at 11:00am EST.

Third Quarter 2018 Results Conference Call and Webcast Details:

US and Canada (toll-free): (855) 427-9509

Outside North America: (210) 229-8822

Conference ID: 6094766

Webcast: https://edge.media-server.com/m6/p/8rte5x2f

Replay: To be available at http://www.aliogold.com

About Alio Gold

Read more at http://www.stockhouse.com/news/press-releases/2018/10/01/ali…

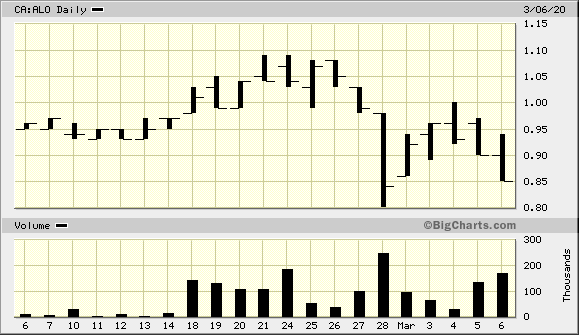

Das Chartbild von Alio Gold, hat sich in der letzten Zeit verbessert.

Ein "Call" bedeutet automatisch, dass es keine guten Nachrichten geben wird und diese vom Managemant im "Call" versucht gerechtfertigt zu werden?

Antwort auf Beitrag Nr.: 58.869.588 von xMarcelx am 04.10.18 15:44:10Nö, sie können ja auch sagen, dass die Produktionskosten so runter gegangen sind, dass sie in Ana Paula wieder loslegen...

Das letzte Posting und auch das vorletzte Posting sind Unsinn. Auf Ana Paula wird sich wahrscheinlich die kommende Monate nichts bewegen. Jetzt wird erst einmal mit den Kandidaten die für eine Übernahme von Alio Gold in Frage kommen gesprochen. Ich vermute, daß es für Alio Gold einige Interessenten gibt. Das der conference call vor Eröffnung der Börse kommt, ist doch nicht ungewöhnlich.

Wie wäre der RPG Kurs jetzt?

Re-Split und Umtausch bereinigt?

Re-Split und Umtausch bereinigt?

Haha...wer sollte alio übernehmen wollen...

Die nächsten Quartalszahlen sind entscheidend. Alles andere ist im Moment sinnlose Spekulation.

Antwort auf Beitrag Nr.: 58.868.874 von Amphibie am 04.10.18 14:19:14Hola,

Nun hat sich das Chartbild aber wieder massiv eingetrübt !

Gold ist nun mal out für die nächsten 10-20Jahre, ob es dann steigen wird , was meinst Du ?

Nun hat sich das Chartbild aber wieder massiv eingetrübt !

Gold ist nun mal out für die nächsten 10-20Jahre, ob es dann steigen wird , was meinst Du ?

Antwort auf Beitrag Nr.: 58.883.268 von ernestokg am 05.10.18 22:41:08Naja mal sehen wie es kommt die Firma muss die Kosten auf 900 Dollar oder niedriger drücken dann bleibt auch etwas hängen....

https://goldswitzerland.com/de/gold-muesste-bei-16450-stehen…

Hoffe sehr das wir in 2019 die 1400 Dollar im Geld sehen )))würde vielen Produzenten sehr helfen

https://goldswitzerland.com/de/gold-muesste-bei-16450-stehen…

Hoffe sehr das wir in 2019 die 1400 Dollar im Geld sehen )))würde vielen Produzenten sehr helfen

Antwort auf Beitrag Nr.: 58.882.491 von Global-Player83 am 05.10.18 21:19:37On 30 September 2018, Mexico-focused silver miner Americas Silver (USAS) announced that it has agreed to acquire Nevada-focused gold mining company Pershing Gold (PGLC) at an implied value of $56.7 million.

Das Relief Canyon Projekt von Pershing Gold liegt unweit entfernt von Alios Florida Canyon Mine und von Lincoln Hill. Assets in Nevada sind allgemein sehr begehrt.

Das Relief Canyon Projekt von Pershing Gold liegt unweit entfernt von Alios Florida Canyon Mine und von Lincoln Hill. Assets in Nevada sind allgemein sehr begehrt.

Antwort auf Beitrag Nr.: 58.889.061 von Amphibie am 07.10.18 14:41:20Die Frage ist hat Alio im letzten Quartal schwarze Zahlen geschrieben und wir wollen sie soviel Cashflow erzielen um wieder auf die richtige Spur zu kommen

Der Aktienpreisverfall ist erschreckend einige meinten vor ein paar Monaten 0,90 cent wären Traumpreis und perfekt ganz schön daneben

Der Aktienpreisverfall ist erschreckend einige meinten vor ein paar Monaten 0,90 cent wären Traumpreis und perfekt ganz schön daneben

hat Alio im letzten Quartal schwarze Zahlen geschrieben?

Glaube ich kaum. Irgendwoher muß dieser Kursverfall ja kommen. Der Quartalsverlust wurde schon lange vorweggenommen.

und wie wollen sie soviel Cashflow erzielen um wieder auf die richtige Spur zu kommen?

Spätestens zusammen mit dem Lincoln Hill Projekt wird Alio wieder Gewinne schreiben. Um dieses Projekt in Produktion gehen zu lassen bedarf es keiner großen Investition.

Glaube ich kaum. Irgendwoher muß dieser Kursverfall ja kommen. Der Quartalsverlust wurde schon lange vorweggenommen.

und wie wollen sie soviel Cashflow erzielen um wieder auf die richtige Spur zu kommen?

Spätestens zusammen mit dem Lincoln Hill Projekt wird Alio wieder Gewinne schreiben. Um dieses Projekt in Produktion gehen zu lassen bedarf es keiner großen Investition.

Antwort auf Beitrag Nr.: 58.897.824 von Amphibie am 08.10.18 18:59:59Die Frage ist nur wo wie Alio das Geld her bekommen ob ein Bank das Geld gibt oder ob es über Aktienverwässerung gehen muss...

Verstehst du es nicht?

Pre-Production Capital Costs (USD$) $26.2 M

Pre-Production Period (years) 1

Total Costs per Ounce of Gold Equivalent Produced (Includes

all Capital) $759

Pre-Production Capital Costs (USD$) $26.2 M

Pre-Production Period (years) 1

Total Costs per Ounce of Gold Equivalent Produced (Includes

all Capital) $759

Antwort auf Beitrag Nr.: 58.903.248 von Amphibie am 09.10.18 10:42:40Doch ich verstehe es schon und wo ist die Finanzierung wenn es doch so einfach ist?

Warum ist der Aktienkurs so im Keller wenn doch alles so toll ist bei der Firma))

Warum ist der Aktienkurs so im Keller wenn doch alles so toll ist bei der Firma))

Aha, jetzt verstehe ich, du denkst, die bekommen die 30,00 Mio. USD für die Mine nicht zusammen? Das glaube ich schon, daß sie die zusammen bekommen, wenn es nötig ist.

Antwort auf Beitrag Nr.: 58.908.219 von Amphibie am 09.10.18 17:37:36Ja ich frage mich nur wer es finanziert und zu welchen Konditionen man eine Finanzierung bekommt

Ich hoffe für alle Investoren das Alio schwarze Zahlen schreibt und Cash reserven hat.

Ich hoffe für alle Investoren das Alio schwarze Zahlen schreibt und Cash reserven hat.

Antwort auf Beitrag Nr.: 58.910.304 von freddy1989 am 09.10.18 21:12:47Schwarze Zahlen wird Alio in Q3 wahrscheinlich nicht geschrieben haben. Nicht umsonst ist der Aktienkurs 2018 um 70% gefallen.

Antwort auf Beitrag Nr.: 58.916.058 von Amphibie am 10.10.18 13:55:24+ 14% - habe keine zweite Goldmine die heute so derart abgeht...

Alio Gold Inc (ALO:NYSE American)

0.8283 +0.11 (+15.04%)

0.8283 +0.11 (+15.04%)

Coeur Mining bekommt die Produktion bestimmt gebacken im gegensatz zu Alio.

Coeur Mining (CDE) Reports Acquisition of Projects Adjacent to Rochester Operation from Alio Gold Inc. (ALO) for $19M

Quelle:StreetInsider.com

Coeur Mining (CDE) Reports Acquisition of Projects Adjacent to Rochester Operation from Alio Gold Inc. (ALO) for $19M

Quelle:StreetInsider.com

Florida Canyon behalten sie scheinbar, wenn ich das richtig verstanden habe und der Rest in Nevada(die Zukunft) verkaufen sie. Gut das ich hier schon lange nicht mehr investiert bin.

Nur noch traurig was hier abgeht.

Nur noch traurig was hier abgeht.

Antwort auf Beitrag Nr.: 58.971.687 von Player82 am 16.10.18 15:17:04Haben die jetzt einen Großteil der Rye Patch Gold Assets für 19 Mio. verkauft, welche sie für über 100 Mio. vor nem halben Jahr gekauft haben oder bin ich da auf dem völlig falschen Dampfer???

Antwort auf Beitrag Nr.: 58.971.765 von Jakuba79 am 16.10.18 15:26:12Ja, so habe ich das auch verstanden.

VANCOUVER, British Columbia, Oct. 16, 2018 (GLOBE NEWSWIRE) -- Alio Gold Inc. (TSX, NYSE AMERICAN: ALO) (“Alio Gold” or the “Company”), today announced that it has entered into a definitive agreement to sell non-core assets, located 40 kilometers south of the Company’s Florida Canyon Mine in Nevada to Coeur Rochester, Inc., a wholly-owned subsidiary of Coeur Mining, Inc. (“Coeur”) (NYSE: CDE). The assets include those comprising the Lincoln Hill Project, Wilco Project, Gold Ridge Property and other nearby claims. Under the terms of the definitive agreement, the Company will receive total consideration of $19 million upon closing of the transaction (the “Transaction”), payable in shares of Coeur common stock (the “Consideration Shares”) valued based on a volume-weighted average stock price for the five (5) trading day period ending on the third trading day preceding the closing.

VANCOUVER, British Columbia, Oct. 16, 2018 (GLOBE NEWSWIRE) -- Alio Gold Inc. (TSX, NYSE AMERICAN: ALO) (“Alio Gold” or the “Company”), today announced that it has entered into a definitive agreement to sell non-core assets, located 40 kilometers south of the Company’s Florida Canyon Mine in Nevada to Coeur Rochester, Inc., a wholly-owned subsidiary of Coeur Mining, Inc. (“Coeur”) (NYSE: CDE). The assets include those comprising the Lincoln Hill Project, Wilco Project, Gold Ridge Property and other nearby claims. Under the terms of the definitive agreement, the Company will receive total consideration of $19 million upon closing of the transaction (the “Transaction”), payable in shares of Coeur common stock (the “Consideration Shares”) valued based on a volume-weighted average stock price for the five (5) trading day period ending on the third trading day preceding the closing.

Antwort auf Beitrag Nr.: 58.972.008 von Player82 am 16.10.18 15:44:43Das wäre ja eine beispiellose Kapitalvernichtung. Tja am Ende des Tages bekommt man dann halt immer die Erklärung für den Aktienkursverlauf.

Das ist doch Quatsch. Lest doch mal die news. Non Core assets

Die Liegenschaften sind alles low grade und haben mit Florida nichts zu tun. Wer weiß wann und ob die je produziert worden wären. Jetzt erst mal Cash gesichert

Non core assets

The assets include those comprising the Lincoln Hill Project, Wilco Project, Gold Ridge Property and other nearby claims. Das waren die wichtigsten Zukunfts Projecte für Alio und die sind jetzt weg. Raus aus der Aktie so lange man noch so "gute" Kurse bekommt. Nur meine persönliche Meinung

The assets include those comprising the Lincoln Hill Project, Wilco Project, Gold Ridge Property and other nearby claims. Das waren die wichtigsten Zukunfts Projecte für Alio und die sind jetzt weg. Raus aus der Aktie so lange man noch so "gute" Kurse bekommt. Nur meine persönliche Meinung

Antwort auf Beitrag Nr.: 58.972.248 von Player82 am 16.10.18 16:01:53Das finde ich nicht. Ist nur das land das bis zur förderung unendlich Geld verschlungen hätte. So hat man jetzt erstmal cash und geht einer Kapitalerhöhung aus dem weg und kann sich auf die andern Projekte konzentrieren

Antwort auf Beitrag Nr.: 58.972.284 von Fireflash77 am 16.10.18 16:06:06So sieht’s aus.

Antwort auf Beitrag Nr.: 58.972.284 von Fireflash77 am 16.10.18 16:06:06Habe die Mitteilung zwar nur überflogen, aber ich meine, dass es kein Cash gibt - erstmal nur Coeur-Aktien bis zum Gesamtwert von 19 Mio. US-Dollar.

Antwort auf Beitrag Nr.: 58.972.332 von iwanowski am 16.10.18 16:08:56Ja aber aktien kann man verkaufen wenn man kohle braucht. Land bringst nicht so einfach los. Ob die 19 mio jetzt viel oder wenig ist will ich nicht beurteilen

Florida C.. nicht profitabel, San Franc.. wirft kaum was ab, für Ana Paula weiter zu entwickeln fehlt das Geld. Ich würde hier keinen Cent mehr investieren, muss halt jeder selbst für sich entscheiden.

Antwort auf Beitrag Nr.: 58.972.365 von Fireflash77 am 16.10.18 16:13:07Ich denke auch, dass bei Coeur noch ordentlich Luft nach oben ist.

Wird wichtig werden, wie der Kurs sich an den fünf Tagen der Gewichtung verhält.

Wird wichtig werden, wie der Kurs sich an den fünf Tagen der Gewichtung verhält.

Alio Gold Sells Non-Core Assets for $19 Million

Jetzt verkaufen sie auch noch ihr Tafelsilber. Wie verzweifelt und mit dem Rücken zur Wand muß es um Alio Gold eigentlich stehen, um jetzt solche dramatischen Schritte zu unternehmen. Der Verkauf von den Projekten in Nevada enttäuscht mich sehr. Das Lincoln Hill Project, Wilco Project, Gold Ridge Property Project wurden alle verkauft. Aber so schlecht sah die Bilanz doch gar nicht aus, ich verstehe das nicht. Das waren die absoluten Zukunftsprojekte. Jetzt steht die Florida Canyon Mine blank da. Wo ist jetzt noch die Vision für Florida Canyon?