Bausch Health ehemals VALEANT PHARMA Allergan-Übernahme beflügelt (Seite 104)

eröffnet am 30.04.14 17:10:46 von

neuester Beitrag 10.04.24 21:16:45 von

neuester Beitrag 10.04.24 21:16:45 von

Beiträge: 4.274

ID: 1.193.944

ID: 1.193.944

Aufrufe heute: 8

Gesamt: 389.939

Gesamt: 389.939

Aktive User: 0

ISIN: CA0717341071 · WKN: A2JQ1X · Symbol: BVF

7,2600

EUR

-3,80 %

-0,2870 EUR

Letzter Kurs 03.05.24 Tradegate

Neuigkeiten

02.05.24 · Accesswire |

25.04.24 · wO Chartvergleich |

11.04.24 · Accesswire |

11.04.24 · Accesswire |

Werte aus der Branche Pharmaindustrie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,2000 | +471,16 | |

| 13,110 | +38,44 | |

| 6,5000 | +27,45 | |

| 1,2100 | +21,00 | |

| 48,25 | +19,94 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 24,050 | -12,55 | |

| 4,0300 | -12,96 | |

| 6,2600 | -14,25 | |

| 3,8500 | -14,45 | |

| 36,70 | -22,87 |

Beitrag zu dieser Diskussion schreiben

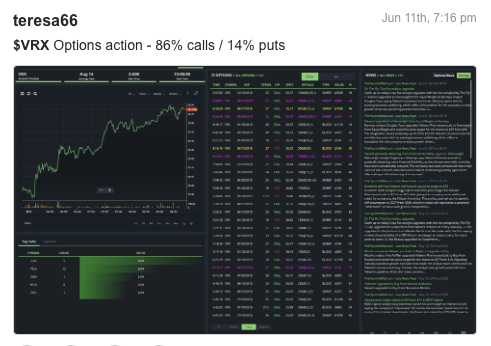

http://www.dividendbot.com/?s=VRX

Auch ganz nett.

Auch ganz nett.

https://swingtradebot.com/equities/VRX

Der hat ein nettes Charttool.

Der hat ein nettes Charttool.

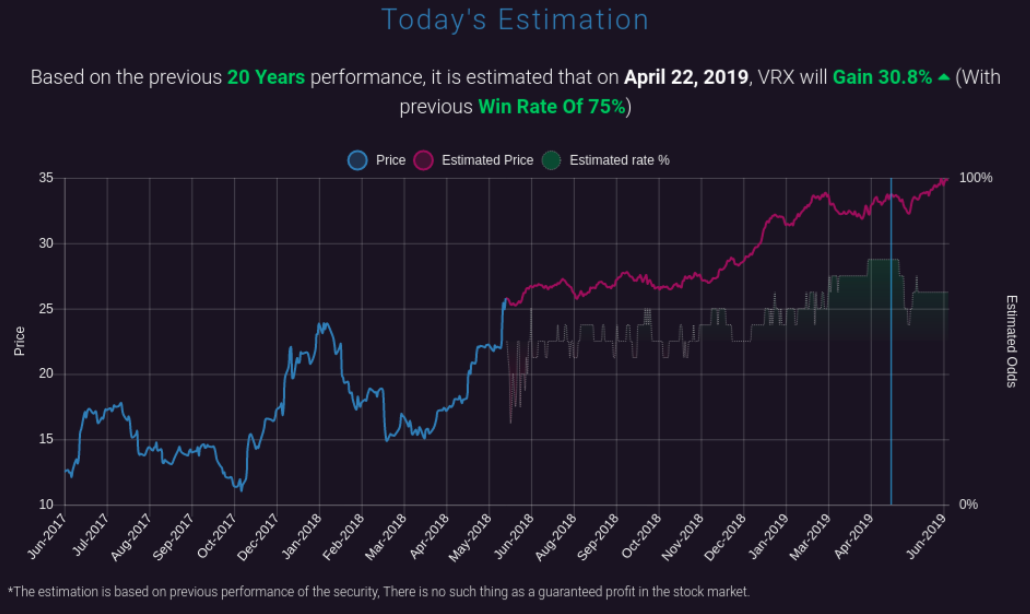

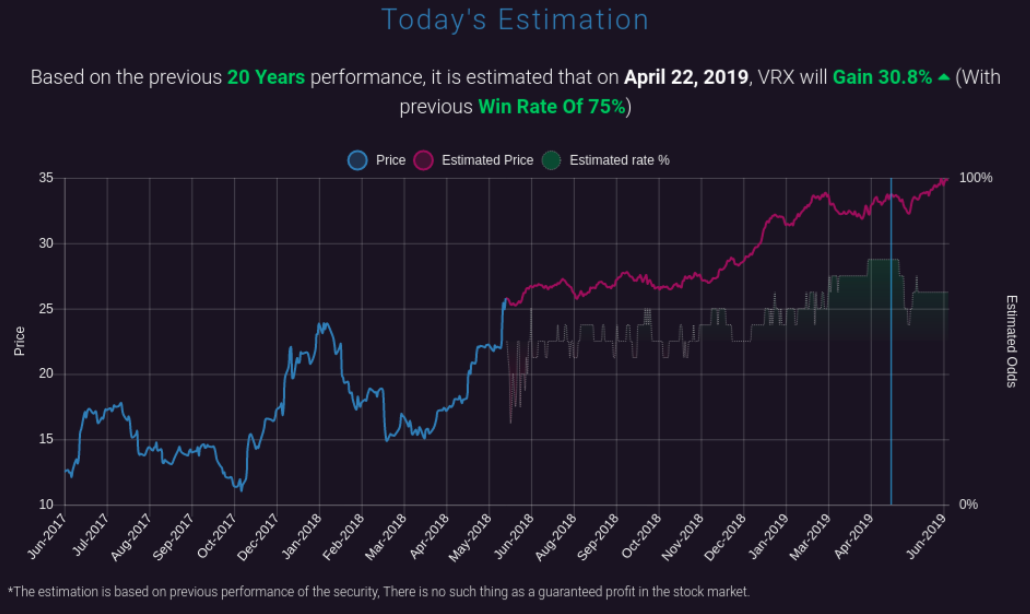

Eine Graphik aus den Muppet-Labors, wo die Zukunft schon heute gemacht wird:

https://app.seasonaledge.com/tools/I/VRX

Basierend auf den letzen 20 Jahren...?

Mit alten CEO´s, Geschäftsmodellen etc.

Nur die Mathematik macht es nicht möglich in die Zukunft zu sehen. Trotzdem eine schönes Bild.

https://app.seasonaledge.com/tools/I/VRX

Basierend auf den letzen 20 Jahren...?

Mit alten CEO´s, Geschäftsmodellen etc.

Nur die Mathematik macht es nicht möglich in die Zukunft zu sehen. Trotzdem eine schönes Bild.

Argentum Pharmaceuticals Wins Patent Invalidation Trial Against Patent on Valeant's JUBLIA®

https://www.prnewswire.com/news-releases/argentum-pharmaceut… Valeant Pharmaceuticals-Aktie: Wendepunkt ist erreicht! - Aktienanalyse

http://www.aktiencheck.de/exklusiv/Nyse-Valeant_Pharmaceutic… Valeant wird Bausch

https://www.apotheke-adhoc.de/nachrichten/detail/markt/valea… Valeant Pharmaceuticals Intl Inc. (TSX:VRX) Rockets Past 52-Week Highs: Time to Buy?

https://www.fool.ca/2018/06/07/valeant-pharmaceuticals-intl-… 25.04.24 · wO Chartvergleich · BAVARIA Industries Group Akt |

04.03.24 · wO Chartvergleich · Myriad Genetics |