Banca Monte Dei Paschi, Kurssturz! Wie geht es weiter?

eröffnet am 26.05.15 17:28:11 von

neuester Beitrag 07.02.24 12:16:53 von

neuester Beitrag 07.02.24 12:16:53 von

Beiträge: 376

ID: 1.213.066

ID: 1.213.066

Aufrufe heute: 0

Gesamt: 54.082

Gesamt: 54.082

Aktive User: 0

ISIN: IT0005508921 · WKN: A3DU7S · Symbol: MPI0

4,7360

EUR

+1,13 %

+0,0530 EUR

Letzter Kurs 10.05.24 Tradegate

Neuigkeiten

06.05.24 · wallstreetONLINE Redaktion |

03.05.24 · BörsenNEWS.de |

09.08.23 · wallstreetONLINE Redaktion |

09.06.23 · wO Chartvergleich |

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0000 | +99.900,00 | |

| 0,6550 | +43,17 | |

| 1,4600 | +43,14 | |

| 6,0000 | +16,73 | |

| 0,8750 | +16,67 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,4300 | -10,98 | |

| 9,9500 | -12,33 | |

| 1,2000 | -14,29 | |

| 14,950 | -14,33 | |

| 3,0000 | -16,52 |

Beitrag zu dieser Diskussion schreiben

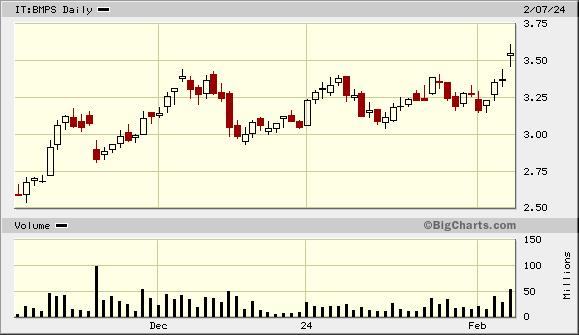

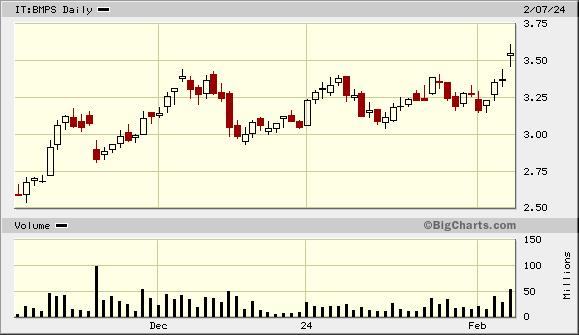

7.2.

Älteste Bank der Welt zahlt erste Dividende seit 13 Jahren

https://www.msn.com/de-at/finanzen/nachrichten/%C3%A4lteste-…

...

Die mehrheitlich in staatlichem Besitz stehende italienische Bank Monte dei Paschi di Siena (MPS) hat das Jahr 2023 mit einem Gewinn von 2,052 Milliarden Euro abgeschlossen. 2022 war noch ein Verlust von 205 Millionen gemeldet worden.

Das Ergebnis liegt über den von den Erwartungen und ermöglicht es der Bank, nach 13 Jahren wieder eine Dividende zu zahlen, zwei Jahre früher als geplant, wie das toskanische Geldhaus am Mittwoch mitteilte. Die Aktionäre bekommen eine Dividende von 0,25 Euro pro Aktie. Dies entspricht einer Gesamtsumme von 315 Millionen Euro.

...

=>

Älteste Bank der Welt zahlt erste Dividende seit 13 Jahren

https://www.msn.com/de-at/finanzen/nachrichten/%C3%A4lteste-…

...

Die mehrheitlich in staatlichem Besitz stehende italienische Bank Monte dei Paschi di Siena (MPS) hat das Jahr 2023 mit einem Gewinn von 2,052 Milliarden Euro abgeschlossen. 2022 war noch ein Verlust von 205 Millionen gemeldet worden.

Das Ergebnis liegt über den von den Erwartungen und ermöglicht es der Bank, nach 13 Jahren wieder eine Dividende zu zahlen, zwei Jahre früher als geplant, wie das toskanische Geldhaus am Mittwoch mitteilte. Die Aktionäre bekommen eine Dividende von 0,25 Euro pro Aktie. Dies entspricht einer Gesamtsumme von 315 Millionen Euro.

...

=>

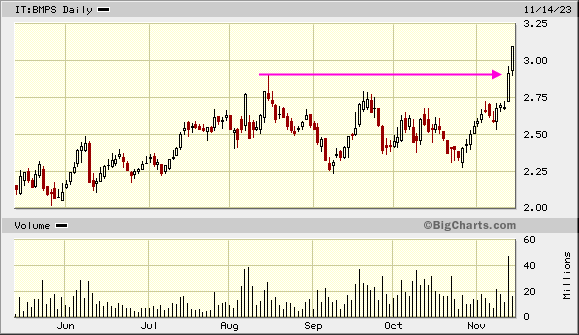

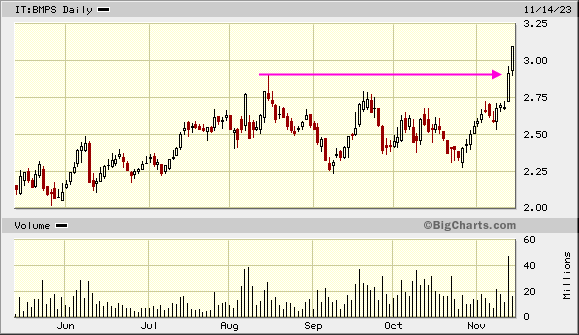

21.11.

Monte dei Paschi-Aktie klar in Rot: Italien verkauft 25-Prozent-Anteil an Monte dei Paschi

https://www.finanzen.net/nachricht/aktien/vor-privatisierung…

...

Die Aktien seien am Markt platziert worden, teilte das italienische Finanzministerium am Montagabend mit. Die Erlöse bezifferte die Behörde auf 920 Millionen Euro. Die Anteilsscheine seien zu 2,92 Euro je Stück veräußert worden, was einem Abschlag von 4,9 Prozent auf den Schlusskurs vom Montag entspricht.

Nach dem Verkauf der Aktien sei der Anteil der Behörde an Monte dei Paschi auf rund 39 Prozent gesunken.

...

Monte dei Paschi-Aktie klar in Rot: Italien verkauft 25-Prozent-Anteil an Monte dei Paschi

https://www.finanzen.net/nachricht/aktien/vor-privatisierung…

...

Die Aktien seien am Markt platziert worden, teilte das italienische Finanzministerium am Montagabend mit. Die Erlöse bezifferte die Behörde auf 920 Millionen Euro. Die Anteilsscheine seien zu 2,92 Euro je Stück veräußert worden, was einem Abschlag von 4,9 Prozent auf den Schlusskurs vom Montag entspricht.

Nach dem Verkauf der Aktien sei der Anteil der Behörde an Monte dei Paschi auf rund 39 Prozent gesunken.

...

Hoffe das diese Aktie meine Bank of Ireland 2.0 wird 😂

Banca Monte dei Paschi ist nun auch angesprungen:

13.11.

Monte dei Paschi di Siena, l’utile miliardario atteso a fine anno cambia le carte del risiko bancario

<Monte dei Paschi di Siena, der zum Jahresende erwartete Milliardengewinn verändert die Karten des Bankenrisikos>

https://www.corriere.it/economia/finanza/23_novembre_13/mont…

13.11.

Monte dei Paschi di Siena, l’utile miliardario atteso a fine anno cambia le carte del risiko bancario

<Monte dei Paschi di Siena, der zum Jahresende erwartete Milliardengewinn verändert die Karten des Bankenrisikos>

https://www.corriere.it/economia/finanza/23_novembre_13/mont…

hmm…. das Teil könnte in Zukunft Freude machen 😀

6.10.

Italy to pick advisers to cut Monte dei Paschi stake

https://www.marketscreener.com/quote/stock/BANCA-MONTE-DEI-P…

...

Italy on Friday kicked off the process to pick financial and legal advisers to help the economy ministry find the best way to cut its controlling stake in Banca Monte dei Paschi di Siena, the Treasury said.

A source familiar with the matter said the ministry planned to end the selection process "in a few weeks".

MPS privatisation is part of a wider 21 billion euro ($22.22 billion) sell-off plan announced by Prime Minister Giorgia Meloni to keep in check the euro zone's second-largest debt pile as a proportion of gross domestic output (GDP).

The sale of the stake could happen through one or more transactions, the ministry said in a statement.

...

Italy to pick advisers to cut Monte dei Paschi stake

https://www.marketscreener.com/quote/stock/BANCA-MONTE-DEI-P…

...

Italy on Friday kicked off the process to pick financial and legal advisers to help the economy ministry find the best way to cut its controlling stake in Banca Monte dei Paschi di Siena, the Treasury said.

A source familiar with the matter said the ministry planned to end the selection process "in a few weeks".

MPS privatisation is part of a wider 21 billion euro ($22.22 billion) sell-off plan announced by Prime Minister Giorgia Meloni to keep in check the euro zone's second-largest debt pile as a proportion of gross domestic output (GDP).

The sale of the stake could happen through one or more transactions, the ministry said in a statement.

...

14.9.

Italy Banks Drop as Meloni Rules Out Capping Windfall Tax Inflow

https://www.bnnbloomberg.ca/italy-banks-drop-as-meloni-rules…

...

Shares in Italian lenders fell on Thursday, making them the worst performers on the STOXX Europe 600 Banks index, after Prime Minister Giorgia Meloni said that even if a new windfall tax on banks’ profits is modified, the state will still expect inflows of almost €3 billion ($3.2 billion).

Meloni’s comments on Wednesday “should revert the market’s concerns on Italian banks in our view today, triggering a negative share price reaction,” analysts at Mediobanca SpA wrote in a Thursday note.

...

Intesa and UniCredit, the two biggest lender in the country, face the steepest costs from the new levy.

...

Italy Banks Drop as Meloni Rules Out Capping Windfall Tax Inflow

https://www.bnnbloomberg.ca/italy-banks-drop-as-meloni-rules…

...

Shares in Italian lenders fell on Thursday, making them the worst performers on the STOXX Europe 600 Banks index, after Prime Minister Giorgia Meloni said that even if a new windfall tax on banks’ profits is modified, the state will still expect inflows of almost €3 billion ($3.2 billion).

Meloni’s comments on Wednesday “should revert the market’s concerns on Italian banks in our view today, triggering a negative share price reaction,” analysts at Mediobanca SpA wrote in a Thursday note.

...

Intesa and UniCredit, the two biggest lender in the country, face the steepest costs from the new levy.

...

Bin dabei, die Bank ist saniert und macht grosse Gewinne

Nach vielen vielen Jahren kommt nun die Erntezeit!Die Bank steht wieder nach der letzten Kapitalerhöhung sehr solide da.Hat eine der höchsten Kpaitalquoten in Europa.

Der jetzige CEO macht die Hausaufgaben, tausende Stellen wurden abgbaut, die Kosten gesenkt.

Das Eigenkapital wächst stark an, im Gesamtjahr wird mit knapp 1 Millarde€ an Gewin gerechnet.

Im ersten Hlabjahr 2023 waren es bereirs über 600 Millionen€ Gewinn

Die Bank wird weiter aufgefrischt, um sie möglichst teuer zu verkaufen, der Staat als Hauptaktionär hat viele Milliarden€ in die Bank investiert und möchte davon bei einem Verkauf eine teilweise Rückzahlung seiner Investitionen.

Für mich bleibt die Bank ein TOP Übernahmekandidat, meiner Einschätzung nach wird die grösste Französische Bank BNP Paribas einsteigen.

Die BNP Paribas hat im Jahr 2006 bereits die Italienische Bank Banca nationale di Livorno (BNL) übernommen.

Banca Monte und BNL würden sich vorzüglich ergänzen.

4.9.

Paschi Drops With Investors Worried About Italy’s Sale Plan

https://uk.news.yahoo.com/paschi-drops-investors-worried-gov…

...

Banca Monte dei Paschi di Siena SpA was the lead decliner on the Italian stock benchmark index amid concern by analysts and investors about the lack of a clear strategy for the state’s sale of its stake.

Any merger or acquisition process would be complex in the short term, Luigi De Bellis, an analyst at Equita Group SpA said in a note Monday, while “placing a significant stake on the market without the identification of a strategic partner may pose an overhang risk for the stock.”

Deputy Prime Minister Antonio Tajani, who took over the business-friendly Forza Italia party after the death of its founder Silvio Berlusconi, told Bloomberg Television at the weekend that the government should accelerate its efforts to sell a controlling stake in Monte Paschi.

But members of fellow-Deputy Premier Matteo Salvini’s anti-immigrant League party — the other junior partner in the right-wing alliance — retorted that the sale of Paschi shouldn’t be rushed.

...

Paschi Drops With Investors Worried About Italy’s Sale Plan

https://uk.news.yahoo.com/paschi-drops-investors-worried-gov…

...

Banca Monte dei Paschi di Siena SpA was the lead decliner on the Italian stock benchmark index amid concern by analysts and investors about the lack of a clear strategy for the state’s sale of its stake.

Any merger or acquisition process would be complex in the short term, Luigi De Bellis, an analyst at Equita Group SpA said in a note Monday, while “placing a significant stake on the market without the identification of a strategic partner may pose an overhang risk for the stock.”

Deputy Prime Minister Antonio Tajani, who took over the business-friendly Forza Italia party after the death of its founder Silvio Berlusconi, told Bloomberg Television at the weekend that the government should accelerate its efforts to sell a controlling stake in Monte Paschi.

But members of fellow-Deputy Premier Matteo Salvini’s anti-immigrant League party — the other junior partner in the right-wing alliance — retorted that the sale of Paschi shouldn’t be rushed.

...

4.8.

Banca Monte Dei Paschi Shares Rise After 1H Result and 2023 Outlook

https://www.marketwatch.com/story/banca-monte-dei-paschi-sha…

...

Banca Monte dei Paschi di Siena shares ticked upward in early trading Friday after the Italian bank reported an increase in half-year earnings and provided an outlook for the year that guided for more than 2.1 billion euros ($2.30 billion) of net interest income.

At 0748 GMT, shares traded 3.1% higher to EUR2.54, losing some ground after having traded more than 6% higher earlier in the session.

The Italian bank, in addition to net interest income, guided for more than EUR1.3 billion in fees, less than EUR1.85 billion in costs, a CET 1 ratio of 16.5% and a pretax profit in excess of EUR1 billion for 2023.

The Italian bank said that it made EUR619 million in net profit for the first six months of the year compared with EUR53.1 million a year ago, on total revenue that grew 19% to EUR1.85 billion.

Banca Monte dei Paschi saw a significant 64% increase in net interest income in the reporting period, driven by higher interest income on loans, the result of higher interest rates, the bank said.

The result, driven by net interest income and lower costs and provisions, was better than was expected, Citi analysts Azzurra Guelfi and Guru Prasad Chowdhary said in a research note, adding the bank's net interest income outlook was ahead of consensus.

Its 2023 cost of risk guidance of around 55 basis points, compared with consensus of around 64 basis points, results in better overall profitability, the analyst said.

Banca Monte Dei Paschi Shares Rise After 1H Result and 2023 Outlook

https://www.marketwatch.com/story/banca-monte-dei-paschi-sha…

...

Banca Monte dei Paschi di Siena shares ticked upward in early trading Friday after the Italian bank reported an increase in half-year earnings and provided an outlook for the year that guided for more than 2.1 billion euros ($2.30 billion) of net interest income.

At 0748 GMT, shares traded 3.1% higher to EUR2.54, losing some ground after having traded more than 6% higher earlier in the session.

The Italian bank, in addition to net interest income, guided for more than EUR1.3 billion in fees, less than EUR1.85 billion in costs, a CET 1 ratio of 16.5% and a pretax profit in excess of EUR1 billion for 2023.

The Italian bank said that it made EUR619 million in net profit for the first six months of the year compared with EUR53.1 million a year ago, on total revenue that grew 19% to EUR1.85 billion.

Banca Monte dei Paschi saw a significant 64% increase in net interest income in the reporting period, driven by higher interest income on loans, the result of higher interest rates, the bank said.

The result, driven by net interest income and lower costs and provisions, was better than was expected, Citi analysts Azzurra Guelfi and Guru Prasad Chowdhary said in a research note, adding the bank's net interest income outlook was ahead of consensus.

Its 2023 cost of risk guidance of around 55 basis points, compared with consensus of around 64 basis points, results in better overall profitability, the analyst said.

06.05.24 · wallstreetONLINE Redaktion · American Express |

03.05.24 · BörsenNEWS.de · American Express |

09.08.23 · wallstreetONLINE Redaktion · Intesa Sanpaolo |

09.06.23 · wO Chartvergleich · BASF |