Platinum Group Metals der Neue Stern am Rohstoffmarkt! (Seite 46)

eröffnet am 11.03.16 20:38:19 von

neuester Beitrag 17.04.24 08:44:25 von

neuester Beitrag 17.04.24 08:44:25 von

Beiträge: 509

ID: 1.228.305

ID: 1.228.305

Aufrufe heute: 0

Gesamt: 39.919

Gesamt: 39.919

Aktive User: 0

ISIN: CA72765Q8829 · WKN: A2PAHQ · Symbol: P6MB

1,2150

EUR

-2,41 %

-0,0300 EUR

Letzter Kurs 03.05.24 Tradegate

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,8360 | +17,66 | |

| 1,0950 | +16,00 | |

| 2,4000 | +14,83 | |

| 552,55 | +13,76 | |

| 33,17 | +13,52 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,4400 | -8,16 | |

| 1,3160 | -9,12 | |

| 185,00 | -9,76 | |

| 12,000 | -25,00 | |

| 46,24 | -98,00 |

Beitrag zu dieser Diskussion schreiben

endlich News....

http://www.finanznachrichten.de/nachrichten-2016-09/38621268…VANCOUVER, BRITISH COLUMBIA and JOHANNESBURG, SOUTH AFRICA -- (Marketwired) -- 09/19/16 -- Platinum Group Metals Ltd. (TSX: PTM)(NYSE MKT: PLG) ("Platinum Group" or the "Company") is pleased to provide the following update on progress at its South African operations.

Maseve Mine

Primary development at the Maseve Mine accessed mining Block 11 in mid-August. Block 11 hosts some of the best grade thickness ore at the Maseve Mine and is an important part of the next several years of scheduled mining. Seam thickness where accessed is approximately 2.0 metres, with a well-developed and near flat dipping Merensky Reef present as modelled. Vertical channel sampling has returned assays of 7.4 grams per tonne platinum, palladium, rhodium and gold ("4E") over a true width of 193 cm. This block is amenable to bord and pillar stoping utilizing efficient mechanized mining methods.

CEO R. Michael Jones commented "Access to Block 11 has been a primary objective for the last two years. We are very pleased to find the reef in this area as good or better than expected. We are currently driving primary access along Block 11. Breakaway drives for mining are also in process. We are excited to mine the excellent tonnes and grade available in Block 11 as we continue to drive for volume."

Block 11 is a large, well-drilled and stable mining block estimated to host more than 545,000 4E Merensky Reef ounces (3,066,512 tonnes at 5.53 gpt 4E Indicated). This block is modelled as flat dipping at an average of 9 degrees, with an average seam thickness of 157 cm and is scheduled to be mined initially utilizing a bord and pillar mechanized method. (NI 43-101 report titled "An Independent Technical Report on the Maseve Project (WBJV Project areas 1 and 1A) located on the Western Limb of the Bushveld Igneous Complex, South Africa" effective July 15, 2015.)

Initial mining in Block 11 consists of "on reef" development of both primary access and breakaway tunnels and material from these excavations is being fed into the mill. Low profile bord and pillar mining in Block 11 will commence in the weeks ahead.

The Maseve Mine is fully constructed and is in the ramp up phase of production. Development at Maseve has established approximately 20 ends where the Merensky Reef is exposed and of these 18 are currently working ends. Recent efforts have been focused on primary access development. Active stoping areas are increasing as development and set up is completed on Merensky Reef ends.

The deposit blocks that have been accessed for current mining continue to show good grade thickness correlation to the block model as reported earlier. Mining methods have been varied based on any changes in the dips and position of the reef and the primary grade thickness of the reef has been appropriately modelled. There are currently no planned changes to earlier resource and reserve estimates. Recoveries and performance of the mill have been at or above design criteria and the plant can handle throughput in excess of the nameplate 110,000 tonnes per month utilizing the current MF1 circuit.

Production challenges have related to the ramp up of stoping tonnes. Project construction savings have offset some but not all of the costs resulting from the delay. Difficulties and delays have been experienced in certain areas of underground infrastructure, causing bottlenecks in the movement of waste and ore out of the mine. Completion of the first underground silo top, the addition of a belt loader at this silo and future top and bottom completions at silos two and three are expected to increase production from September 2016 into 2017.

Direct Platinum Group Metals oversight of the underground contractors has been increased in the past 60 days. Underground equipment maintenance management has been changed and equipment availability is improving.

Feed to the plant since commissioning in March until July, 2016 has been substantially comprised of low grade development stockpiles. Mill feed is currently a combination of mined stoping tonnes and development tonnes from primary headings where Merensky Reef is present. Looking forward, tonnes mined are scheduled to increase as key mining blocks are accessed, developed and stoped. Successful stoping in bord and pillar areas and long-hole areas has now started and is ramping up. Grade of material feed to the mill is increasing as the proportion of stoped tonnes increases relative to development tonnes.

A conveyor from underground has been commissioned that feeds directly to the overland conveyor and into the primary crusher and mill. In the months ahead a final conveyor leg directly to Block 11 is planned to be installed, which will greatly improve the ability to move good grade tonnes out of the mine and directly into the mill.

Monthly production at Maseve is increasing. During the month of August, 2016 the Maseve Mine produced 1,893 ounces 4E and associated copper and nickel in concentrate. Initial monthly revenue from concentrate sales before commercial production are treated as a reduction in project capital cost.

Production is expected to double in September, 2016 from August levels and then continue to increase monthly into 2017. Guidance for concentrate production for the Maseve Mine (100% project basis) from April 2016 to April 2017 is amended from 110,000 4E to 91,500 ounces 4E.

Working Capital Facilities Amended and Extended

During the month of August 2016 representatives of the Sprott Resource Lending Partnership ("Sprott") and Liberty Metals & Mining Holdings, LLC ("LMM") completed on site due diligence at Maseve. The Sprott lenders and LMM (together the "Lenders") have agreed to amend certain terms to their existing loan facility agreements with the Company. A summary of material amendments follows:

The Sprott lenders have agreed to defer 12 planned monthly repayments of

their original US $40 million loan facility from commencing on January

31, 2017 to commencing on January 31, 2018;

-- LMM has agreed to defer 9 planned quarterly repayments of its original

US $40 million loan facility plus capitalized interest from commencing

December 31, 2018 until June 30, 2019;

-- LMM has agreed to defer the quarterly payment of interest due to LMM

from commencing December 31, 2016 until December 31, 2017. During the

additional twelve-month period interest will continue to be accrued

monthly and capitalized to principal;

-- Sprott and LMM have both agreed to reset agreed monthly production

covenants so that month one of production will be October, 2016.

-- Under the terms of the LMM loan facility, pursuant to the production

payment agreement referred to therein, LMM was granted the right to 1.5%

of net proceeds received on concentrate sales or other minerals from the

Maseve Mine. LMM and the Company have agreed to extinguish the Company's

right to buy back 1% of LMM's 1.5% production payment right for US$17.5

million until January 1, 2019 or for US$20 million until December 31,

2021; and

-- Sprott and LMM have agreed to waive certain cash sweep requirements they

would otherwise be entitled to under the original loan facilities.

In consideration of the amendments, the Company has agreed to issue 801,314 common shares of the Company as directed by the Sprott lenders pursuant to the Sprott facility amendment and 801,314 in common shares of the Company to Liberty pursuant to the Liberty facility amendment. This amount is based on the value of five percent of the initial principal balance of the LMM loan facility and the Sprott loan facility (together, the "Working Capital Facilities") (in each case, such amount being US $2.0 million). The shares are priced at the five-day volume weighted average price on the Toronto Stock Exchange (the "TSX") of $3.66 per share, less a ten percent discount, converted to US dollars using the Bank of Canada noon spot rate. The shares will be subject to a four month and one day hold period from the date of issuance under applicable securities laws in Canada and where applicable will also be subject to re-sale restrictions under the securities laws of the United States. If such shares are not issued by October 6, 2016, the Company must instead pay an amount equal to US $2.0 million pursuant to each of the Working Capital Facilities, in each case, payable in cash in lieu of shares. In addition, the Company has agreed to pay the Sprott lenders a 3% cash repayment fee in respect of any voluntary prepayment made on or before December 31, 2017. The issuance of the above noted shares is subject to the completion and execution of final documentation and the approval of the TSX and the NYSE MKT LLC ("NYSE MKT").

The amendments described above are not effective unless closing conditions have been satisfied, including, without limitation, the receipt of regulatory approvals and the Company's payment of the applicable shares or cash.

The Company has also entered into discussions with the Lenders regarding an increase to the current credit facilities in order to provide the Company with additional working capital for the Maseve Mine. There is no assurance that any such increase will occur.

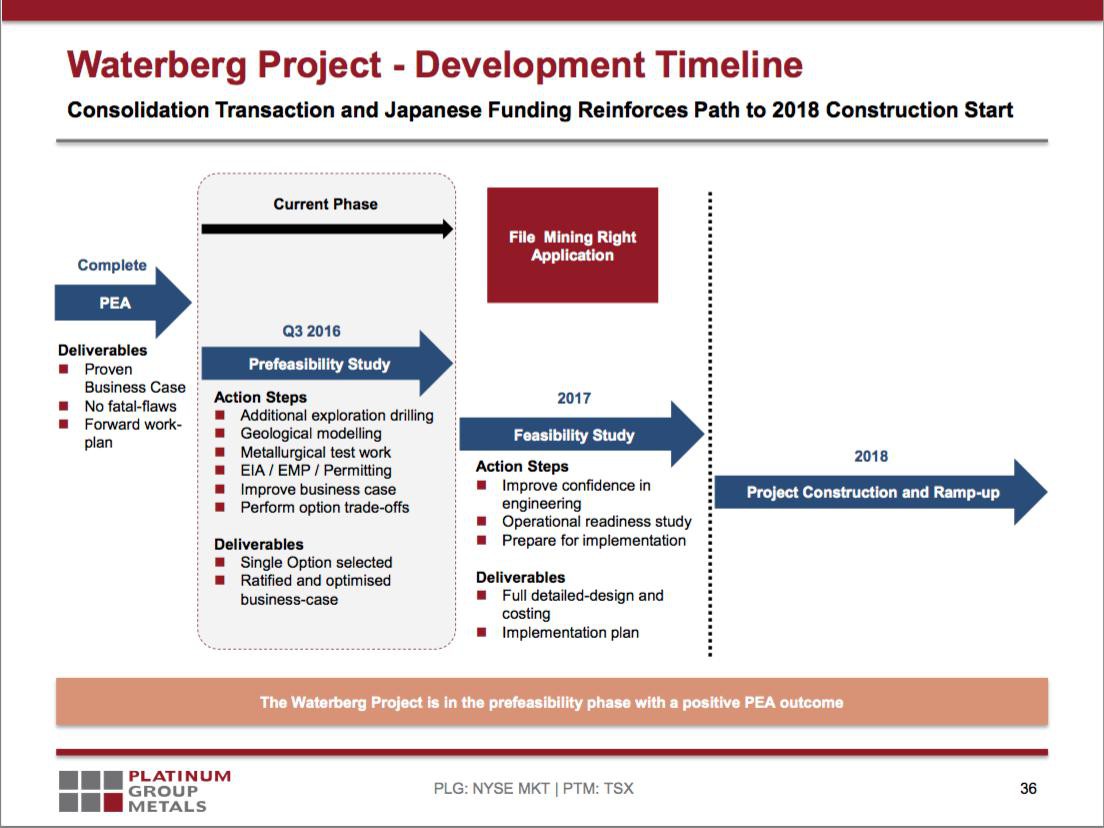

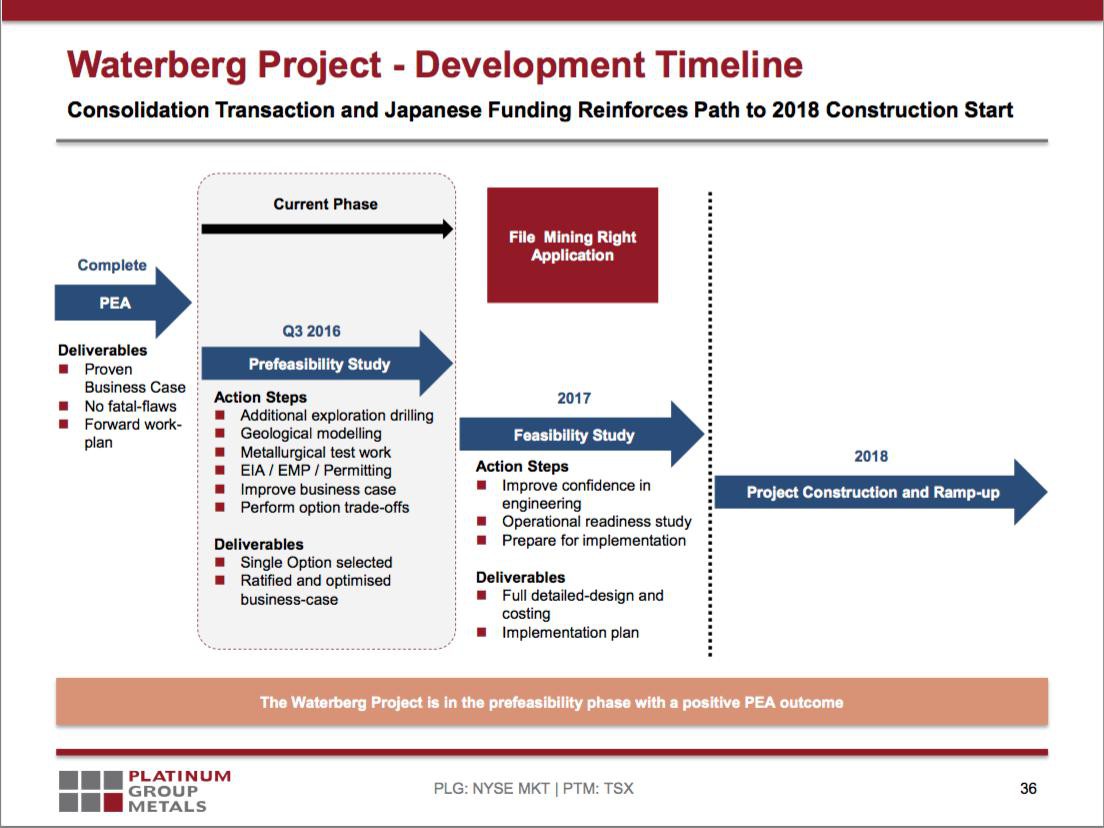

Waterberg

Expenditures on the Waterberg Project are currently being funded by the Japan Oil, Gas and Metals National Corporation ("JOGMEC"). To date JOGMEC has funded 100% of approximately US $11.0 million for the current phase of planned work and a budget of approximately US $3.0 million remains to be spent by March 31, 2017. For the period after March 31, 2017 another US $6.0 million of JOGMEC funding is to be provided. Funding in place from JOGMEC will allow the project to advance and grow without a draw on the Company's working capital. Work at present is focused on the completion of an ongoing pre-feasibility study at Waterberg and the results of this study are planned to be published in the weeks ahead.

In preparation for a planned feasibility study at Waterberg, other work now underway or to commence soon includes infrastructure engineering for power and water, metallurgical work, geophysical studies and core drilling to bring certain areas of the known Waterberg deposit into the measured category of confidence. Further work will also be done for mill design optimization, infrastructure design and location planning and capital cost and operating cost estimating and optimization.

Outlook

The Company's key business objectives for calendar 2016 continue to be the completion of critical underground development and production ramp up at the Maseve Mine and to advance the Waterberg Project. The Company plans to focus management effort and the cash on hand to increase production at the Maseve Mine, in line with the mine plan. Development work and mining in Blocks 12, 11, 10 and 9 in the North Mine and Block 16 in the South Mine are key to the mining plans and ramp up of production for the Maseve Mine.

About Platinum Group Metals Ltd.

Platinum Group Metals Ltd., based in Johannesburg, South Africa and Vancouver, Canada, has a successful track record with more than 20 years of experience in exploration, mine discovery, mine construction and mine operations.

Formed in 2002, Platinum Group holds significant mineral rights in the Bushveld Igneous Complex of South Africa, which is host to over 70% of the world's primary platinum production. The Company is currently focused on ramping up the Maseve Mine, its first near-surface platinum mine, to commercial production.

Platinum Group has expanded its exploration efforts on the North Limb of the Bushveld Complex on the Waterberg Project. Waterberg represents a new bulk type of platinum, palladium and gold deposit that is being studied for potential mechanized mining.

Qualified Person

R. Michael Jones, P.Eng., the Company's President, Chief Executive Officer and a significant shareholder of the Company, is a non-independent qualified person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects and is responsible for preparing the technical information contained in this news release.

On behalf of the Board of Platinum Group Metals Ltd.

R. Michael Jones, President and CEO

Antwort auf Beitrag Nr.: 53.273.781 von crystalsonic am 14.09.16 12:35:57Im Mai gab es noch einmal eine KE, weil das Kapital zum erfolgreichen Start der Maseve Mine nicht ausgereicht hat.

Anleger warten jetzt ab, ob nun wirklich Geld verdient wird aus Sorge vor einer weitern KE.

Sobald diese Unsicherheiten weg sind und die Produktion stabil läuft und Platium die anvisierten Produktionszahlen bestätigt, ist schlagartig Unsicherheit raus und der Kurs sollte damit kräftig steigen.

Wie in den Charts zu sehen, hat sich der Kurs unter geringem Volumen nach unten bewegt.

86% aller Aktien sind hier in festen Händen. Siehe dazu ein paar Seiten weiter zurück, darunter Blackrock, Genesis usw.

Lediglich 14% Freeflot...

Wenn hier gute News kommen, sollte der Kurs kein halten mehr kennen...

http://www.finanznachrichten.de/nachrichten-2016-05/37296317…

Anleger warten jetzt ab, ob nun wirklich Geld verdient wird aus Sorge vor einer weitern KE.

Sobald diese Unsicherheiten weg sind und die Produktion stabil läuft und Platium die anvisierten Produktionszahlen bestätigt, ist schlagartig Unsicherheit raus und der Kurs sollte damit kräftig steigen.

Wie in den Charts zu sehen, hat sich der Kurs unter geringem Volumen nach unten bewegt.

86% aller Aktien sind hier in festen Händen. Siehe dazu ein paar Seiten weiter zurück, darunter Blackrock, Genesis usw.

Lediglich 14% Freeflot...

Wenn hier gute News kommen, sollte der Kurs kein halten mehr kennen...

http://www.finanznachrichten.de/nachrichten-2016-05/37296317…

Antwort auf Beitrag Nr.: 53.273.610 von crystalsonic am 14.09.16 12:07:58

An Verbindlichkeiten gibt es Stand November 2015 80Mio Dollar die von Sprott Asset Management und LMM bereit gestellt wurden.

Für das Geschäftsjahr 2016 sind 110.000UZ geplant die von zuvor 116.000UZ revidiert wurden.

2017 = 185.000

2018 = 250.000

Platinum spricht hier von 4E (Platin, Palladium, Rhodium und Gold)

Die Produktionskosten belaufen sich auf 625Dollar.

Das Gestein setzt sich aus:

64% Platin

27% Palladium

9% sowie Rhodium und Gold als Nebenprodukte

zusammen.

Somit kannst Du Dir ca. den aktuellen Erlös ausrechnen. 1000Dollar sind es somit nicht ganz.

Die richtige Produktion ist somit wahrscheinlich erst im August gestartet mit erreichen und Abbau von Block 11. Siehe dazu auch die letzte Quartalsmeldung mit Update.

Was letztendlich produziert und verkauft wurde, sehen wir spätestens mit den nächsten Quartalszahlen.

Ich hatte mir ein Update zu Block11 gewünscht, aber bin nicht gehört worden...

Totti

Antworten:

Die Mine wurde von den Altaktionären durch KE "bezahlt".An Verbindlichkeiten gibt es Stand November 2015 80Mio Dollar die von Sprott Asset Management und LMM bereit gestellt wurden.

Für das Geschäftsjahr 2016 sind 110.000UZ geplant die von zuvor 116.000UZ revidiert wurden.

2017 = 185.000

2018 = 250.000

Platinum spricht hier von 4E (Platin, Palladium, Rhodium und Gold)

Die Produktionskosten belaufen sich auf 625Dollar.

Das Gestein setzt sich aus:

64% Platin

27% Palladium

9% sowie Rhodium und Gold als Nebenprodukte

zusammen.

Somit kannst Du Dir ca. den aktuellen Erlös ausrechnen. 1000Dollar sind es somit nicht ganz.

Die richtige Produktion ist somit wahrscheinlich erst im August gestartet mit erreichen und Abbau von Block 11. Siehe dazu auch die letzte Quartalsmeldung mit Update.

Was letztendlich produziert und verkauft wurde, sehen wir spätestens mit den nächsten Quartalszahlen.

Ich hatte mir ein Update zu Block11 gewünscht, aber bin nicht gehört worden...

Totti

Ja hab den 83% Anteil vergessen bei der Berechnung. Aber trotzdem günstig die PGM. Seit wann seid ihr denn hier dabei? Warum ist denn der Kurs so abgerutscht na klar Platin Preis aber auch bei der Unternehmung Probleme? Ach ja und 80m debt aber auch zu vernachlässigen :-)

Antwort auf Beitrag Nr.: 53.271.588 von Totti_78 am 14.09.16 07:33:44Hi,

bin über Integra Posts auf diese Firma hier aufmerksam geworden aber noch nicht investiert. Sieht interessant aus, sind in Produktion aber derzeit noch Verarbeitung von Tailings erst ab Ende August wohl wirkliches Erz aus den Schichten der Blocks. Die haben derzeit gut 60m Verbindlichkeiten und 45m Cash. Die Mine ist bezahlt wisst Ihr zufällig wie??? Habe nicht in die Historie geschaut normalerweise haben die eine viel höhere Verschuldung. Aktuell geplant 100k Unzen mit Costs von ca 600 bei Preisen von 1000 macht ca 400 Marge und 40m Cash Flow operativ. Bei derzeit 92m Aktien und knappen 3 USD etwa 270m USD. Sagt mal bauen sie 100k Palladium oder Platinium ab??? Platin oder? Da Sie ja 2017/2018 bereits 185k planen wäre n das dann etwa 80m cash flow und selbst die erste Rechnung ist schon fair bewertet ohne Waterberg hab ich was über sehen bitte um kritische Kommentierung. Grüße Sonic

bin über Integra Posts auf diese Firma hier aufmerksam geworden aber noch nicht investiert. Sieht interessant aus, sind in Produktion aber derzeit noch Verarbeitung von Tailings erst ab Ende August wohl wirkliches Erz aus den Schichten der Blocks. Die haben derzeit gut 60m Verbindlichkeiten und 45m Cash. Die Mine ist bezahlt wisst Ihr zufällig wie??? Habe nicht in die Historie geschaut normalerweise haben die eine viel höhere Verschuldung. Aktuell geplant 100k Unzen mit Costs von ca 600 bei Preisen von 1000 macht ca 400 Marge und 40m Cash Flow operativ. Bei derzeit 92m Aktien und knappen 3 USD etwa 270m USD. Sagt mal bauen sie 100k Palladium oder Platinium ab??? Platin oder? Da Sie ja 2017/2018 bereits 185k planen wäre n das dann etwa 80m cash flow und selbst die erste Rechnung ist schon fair bewertet ohne Waterberg hab ich was über sehen bitte um kritische Kommentierung. Grüße Sonic

Platin Chart Update

Sieht so aus, als ob der Aufwärtstrend der bei 988Dollar verläuft noch einmal getestet wird.Die Stochastic hat hier noch Luft. Kann sich im Idealfall aber nur noch um Tage handeln... 21./22.9.? evtl. ?

Für Platinum stellt der etwas günstigere Platinpreis kein Problem da, da zu 625Dollar p.UZ produziert wird (in der Theorie bzw. Studien).

Chart Update

Die 3,60CAD haben erstmal gehalten.Ansonsten kann man den Chart schlecht auswerten...

Antwort auf Beitrag Nr.: 53.253.567 von phobieeee am 11.09.16 13:04:14Ja Waterberg ist gigantisch!

Man hat ab einer Tiefe von 1250m aufgehört zu erkunden, da man an tieferen Zielen und Abbau kein Interesse hat.

Interessant sind die teilweise 60m dicken mineralisierten Schichten welche mechanisch abgetragen werden sollen.

Zum Vergleich; das Merensky Reef hat 1,2m dicke Schichten.

Platinum selber sieht in Waterberg das 2.grösste Palladiumvorkommen weltweit!

Das Projekt ist wahnsinnig groß und könnte eine Jahresproduktion von 700.000 UZ 4E hervor bringen...

Waterberg hat noch einen weiten Weg vor sich und wird wahrscheinlich zum Zeitpunkt des größten Defizits in Produktion gehen.

Das Waterberg-Projekt wird vom Markt mit 0 bewertet...

Momentan geht's es aber erstmal um die Maseve Mine welche seit Feb 2016 in Produktion ist.

Wie in der letzten News von Platinum mitgeteilt wurde, konzentriert man sich auf die Maseve Mine und einen schnellstmöglichen Cashflow.

Ich gehe davon aus, dass man Block 11 im August bereits erreicht hat. ( wenn man sich den zeitlichen Ablauf mit den vorherigen News und die angegebenen Entfernungen hoch rechnet )

Hätte mich hier über News gefreut, leider war dem nicht so.

Vermutlich verarbeitet man bereits Material aus Block 11 welches nun auch über Förderbänder in die Verarbeitung transportiert wird.

Zahlen werden wir mit den nächsten Quartalsergebnissen sehen. Hier wird dann spannend sein, wieviel UZ 4E tatsächlich produziert wurden und ob man das (bereits reduzierte) anvisierte Jahresergebnis halten können wird.

Ich bin überaus gespannt...

Totti

Man hat ab einer Tiefe von 1250m aufgehört zu erkunden, da man an tieferen Zielen und Abbau kein Interesse hat.

Interessant sind die teilweise 60m dicken mineralisierten Schichten welche mechanisch abgetragen werden sollen.

Zum Vergleich; das Merensky Reef hat 1,2m dicke Schichten.

Platinum selber sieht in Waterberg das 2.grösste Palladiumvorkommen weltweit!

Das Projekt ist wahnsinnig groß und könnte eine Jahresproduktion von 700.000 UZ 4E hervor bringen...

Waterberg hat noch einen weiten Weg vor sich und wird wahrscheinlich zum Zeitpunkt des größten Defizits in Produktion gehen.

Das Waterberg-Projekt wird vom Markt mit 0 bewertet...

Momentan geht's es aber erstmal um die Maseve Mine welche seit Feb 2016 in Produktion ist.

Wie in der letzten News von Platinum mitgeteilt wurde, konzentriert man sich auf die Maseve Mine und einen schnellstmöglichen Cashflow.

Ich gehe davon aus, dass man Block 11 im August bereits erreicht hat. ( wenn man sich den zeitlichen Ablauf mit den vorherigen News und die angegebenen Entfernungen hoch rechnet )

Hätte mich hier über News gefreut, leider war dem nicht so.

Vermutlich verarbeitet man bereits Material aus Block 11 welches nun auch über Förderbänder in die Verarbeitung transportiert wird.

Zahlen werden wir mit den nächsten Quartalsergebnissen sehen. Hier wird dann spannend sein, wieviel UZ 4E tatsächlich produziert wurden und ob man das (bereits reduzierte) anvisierte Jahresergebnis halten können wird.

Ich bin überaus gespannt...

Totti

Antwort auf Beitrag Nr.: 53.253.318 von phobieeee am 11.09.16 11:54:34Danke für Deine Sichtweise.

Ich habe lediglich auf Jahressicht die Veränderung gesehen.

Unterm Strich können wir jedoch trotzdem von einer geringeren Produktion der Südafrikanischen Minen ausgehen.

Totti

Ich habe lediglich auf Jahressicht die Veränderung gesehen.

Unterm Strich können wir jedoch trotzdem von einer geringeren Produktion der Südafrikanischen Minen ausgehen.

Totti

Den nächsten Jahresbericht wird es gegen Ende November geben (2015er wir de am 25.11.2015 veröffentlicht).

Bin gespannt wie weit wir dann in Hinblick auf die PFS für Wartenberg sein werden.

Hier der Ausschnitt aus der Juni Präsentation. Die reinen Zahlen zu Waterberg sind phänomenal und der aktuelle Aktienkurs spiegelt dieses enorme Potential aus meiner Sicht nicht wieder.

Gruß phobieeee

Bin gespannt wie weit wir dann in Hinblick auf die PFS für Wartenberg sein werden.

Hier der Ausschnitt aus der Juni Präsentation. Die reinen Zahlen zu Waterberg sind phänomenal und der aktuelle Aktienkurs spiegelt dieses enorme Potential aus meiner Sicht nicht wieder.

Gruß phobieeee