McDermott (MDR) -- Wette auf Investitionsgüter/Öl&Gas USA etc. - 500 Beiträge pro Seite

eröffnet am 26.01.18 16:50:10 von

neuester Beitrag 10.03.21 00:02:07 von

neuester Beitrag 10.03.21 00:02:07 von

Beiträge: 42

ID: 1.272.595

ID: 1.272.595

Aufrufe heute: 0

Gesamt: 2.358

Gesamt: 2.358

Aktive User: 0

ISIN: PAL1201471A1 · WKN: A2JL18

0,5400

EUR

+25,00 %

+0,1080 EUR

Letzter Kurs 21.01.20 Tradegate

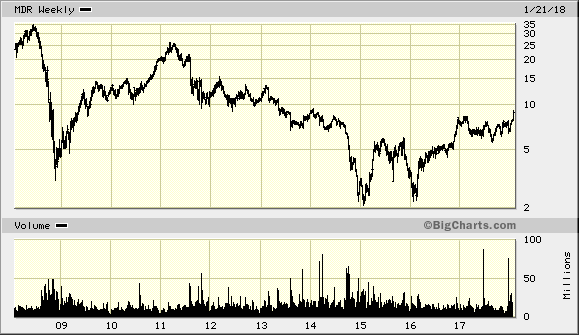

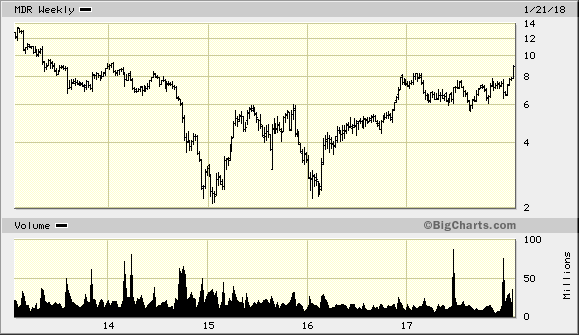

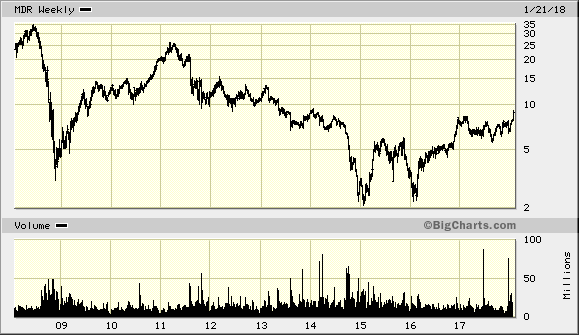

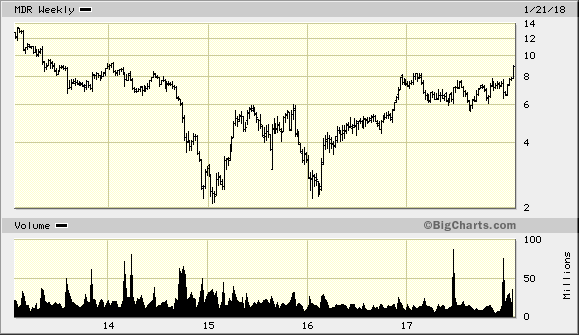

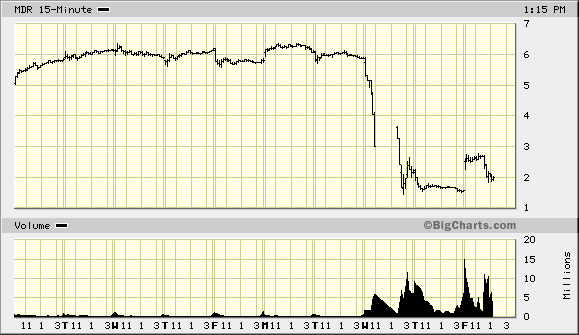

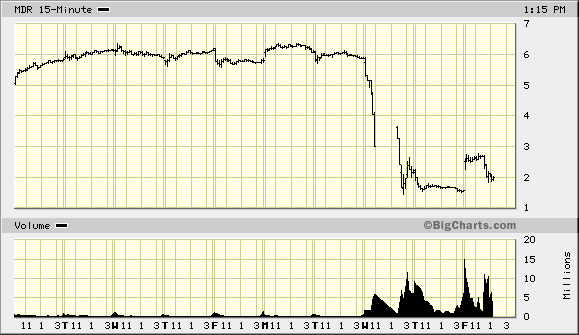

Chart sieht mMn nach sehr langer Zeit endlich mal gut aus:

Das Unternehmen hat bereits eine substantielle Transformation hinter sich.

Business (*):

MDR is an engineering, procurement, constructions (EPC) and installation company, which focuses on designing and executing complex offshore oil and gas projects worldwide.

It provides EPCI services and delivers fixed and floating production facilities, pipeline installations and subsea systems from concept to commissioning. It operates through the following segments: Americas, Europe, and Africa; the Middle East and Asia...

Nebenbei: ISIN = PA5800371096 --> Panama --> administrativ kein US-Unternehmen! Aber HQ in Houston/Texas: http://www.mcdermott-investors.com/phoenix.zhtml?c=96360&p=i…

Letzte Substanz-News: 24.1.2018

McDermott's stock jumps toward 3 1/2-year high after raised profit outlook

https://www.marketwatch.com/story/mcdermotts-stock-jumps-tow…

__

(*) dazu muss man wissen: MDR ist dabei Chicago Bridge & Iron Co. NV (CBI -- auch infrastructure and other products for the oil and gas industries) zu "übernehmen" iVv 53% zu 47% (all-stock transaction):

- https://www.marketwatch.com/story/mcdermott-cbi-to-merge-in-…

Natürlich - es gibt skeptische Stimmen dazu --> ich bin allerdings optimistisch:

- https://www.bloomberg.com/news/articles/2018-01-09/mcdermott… <--- "Pflichtlektüre"

- https://www.bloomberg.com/gadfly/articles/2017-12-19/mcdermo…

=> The catalyst for McDermott's CB&I bid is clearly price, but execution will be tricky.

=> das EPC-Geschäft ist generell und allzeit tricky => daher gibt es BW ja auf: https://www.wallstreet-online.de/diskussion/1259115-1-10/bab…

=> es gibt mMn nunmehr eine qualitative "EPC-Lücke" im Weltmarkt-Angebot. Natürlich, die "Chinesen" werden da zunehmend reinstossen --> daher meine ich ja "qualitativ"

Das Unternehmen hat bereits eine substantielle Transformation hinter sich.

Business (*):

MDR is an engineering, procurement, constructions (EPC) and installation company, which focuses on designing and executing complex offshore oil and gas projects worldwide.

It provides EPCI services and delivers fixed and floating production facilities, pipeline installations and subsea systems from concept to commissioning. It operates through the following segments: Americas, Europe, and Africa; the Middle East and Asia...

Nebenbei: ISIN = PA5800371096 --> Panama --> administrativ kein US-Unternehmen! Aber HQ in Houston/Texas: http://www.mcdermott-investors.com/phoenix.zhtml?c=96360&p=i…

Letzte Substanz-News: 24.1.2018

McDermott's stock jumps toward 3 1/2-year high after raised profit outlook

https://www.marketwatch.com/story/mcdermotts-stock-jumps-tow…

__

(*) dazu muss man wissen: MDR ist dabei Chicago Bridge & Iron Co. NV (CBI -- auch infrastructure and other products for the oil and gas industries) zu "übernehmen" iVv 53% zu 47% (all-stock transaction):

- https://www.marketwatch.com/story/mcdermott-cbi-to-merge-in-…

Natürlich - es gibt skeptische Stimmen dazu --> ich bin allerdings optimistisch:

- https://www.bloomberg.com/news/articles/2018-01-09/mcdermott… <--- "Pflichtlektüre"

- https://www.bloomberg.com/gadfly/articles/2017-12-19/mcdermo…

=> The catalyst for McDermott's CB&I bid is clearly price, but execution will be tricky.

=> das EPC-Geschäft ist generell und allzeit tricky => daher gibt es BW ja auf: https://www.wallstreet-online.de/diskussion/1259115-1-10/bab…

=> es gibt mMn nunmehr eine qualitative "EPC-Lücke" im Weltmarkt-Angebot. Natürlich, die "Chinesen" werden da zunehmend reinstossen --> daher meine ich ja "qualitativ"

Antwort auf Beitrag Nr.: 56.841.286 von faultcode am 26.01.18 16:50:10

=>

Shares of McDermott International Inc. soared 19% in premarket trade Monday, while shares of Chicago Bridge & Iron Co. which has agreed to be acquired by McDermott, sank 12% after Norway-based oil-services company Subsea 7 S.A. reportedly made a bid to buy McDermott.

Subsea said it made a buyout bid of $7 a share for McDermott, which was 15.7% above Friday's closing price, and values McDermott at about $2.0 billion, but McDermott rejected the deal, The Wall Street Journal reported.

Subsea said the deal was subject to the termination of McDermott's pending merger with Chicago Bridge & Iron, the WSJ report said...

=> ich bräucht USD7.1, um die Position wieder über Wasser zu haben...

nebenbei: Shortquote bei MDR liegt z.Z. bei sehr kräftigen 25%: https://www.shortpainbot.com/?s=mdr

Übernahme durch Subsea 7 ? (1)

https://www.marketwatch.com/story/mcdermotts-stock-soars-chi…=>

Shares of McDermott International Inc. soared 19% in premarket trade Monday, while shares of Chicago Bridge & Iron Co. which has agreed to be acquired by McDermott, sank 12% after Norway-based oil-services company Subsea 7 S.A. reportedly made a bid to buy McDermott.

Subsea said it made a buyout bid of $7 a share for McDermott, which was 15.7% above Friday's closing price, and values McDermott at about $2.0 billion, but McDermott rejected the deal, The Wall Street Journal reported.

Subsea said the deal was subject to the termination of McDermott's pending merger with Chicago Bridge & Iron, the WSJ report said...

=> ich bräucht USD7.1, um die Position wieder über Wasser zu haben...

nebenbei: Shortquote bei MDR liegt z.Z. bei sehr kräftigen 25%: https://www.shortpainbot.com/?s=mdr

Antwort auf Beitrag Nr.: 57.606.837 von faultcode am 23.04.18 14:13:53

* Piotroski F-Score: 7

* EV-to-EBITDA 4.41

* Debt-to-EBITDA 1.24

* Price-to-Tangible-Book 0.98 (Freitag)

* 2017 generierte man seit Jahren zum ersten Mal wieder freien Cashflow (unlevered) von ~USD17m

* ...

=> aber gut, probieren kann man es mal --> mMn kommt diese Übernahme nicht zustande

=> überhaupt sollte man für eine (weitere) Long-Positionierung zwei Dinge abwarten mMn:

1/ den Kursrückgang nach Rückzug vom Übernahmeangebot durch Subsea 7

2/ die Übernahme von Chicago Bridge & Iron Co. NV (CBI) muss auch erst verdaut werden

--> das Ganze hier wird sich so gesehen noch Monate hinziehen...

Übernahme durch Subsea 7 ? (2)

MDR hat z.Z. (ohne CBI):* Piotroski F-Score: 7

* EV-to-EBITDA 4.41

* Debt-to-EBITDA 1.24

* Price-to-Tangible-Book 0.98 (Freitag)

* 2017 generierte man seit Jahren zum ersten Mal wieder freien Cashflow (unlevered) von ~USD17m

* ...

=> aber gut, probieren kann man es mal --> mMn kommt diese Übernahme nicht zustande

=> überhaupt sollte man für eine (weitere) Long-Positionierung zwei Dinge abwarten mMn:

1/ den Kursrückgang nach Rückzug vom Übernahmeangebot durch Subsea 7

2/ die Übernahme von Chicago Bridge & Iron Co. NV (CBI) muss auch erst verdaut werden

--> das Ganze hier wird sich so gesehen noch Monate hinziehen...

Antwort auf Beitrag Nr.: 57.606.981 von faultcode am 23.04.18 14:25:19

=> so ist es.

..und auch Earning Reports

Published: Oct 31, 2018 8:33 a.m. ET

McDermott's stock plunges after disappointing earnings report prompts analyst downgrade

https://www.marketwatch.com/story/mcdermotts-stock-plunges-a…

=>

...Shares of McDermott International Inc. plunged 27% toward a 2 1/2-year low, to pace all premarket decliners, after provider of technology, engineering and construction services to the energy industry missed earnings and revenue expectations, and said it plans to sell its tank storage and U.S. pipe fabrication businesses.

The company also said late Tuesday that it recorded $744 million of changes in estimates on three projects after it took "significant steps to address performance issues" on the Cameron LNG, Freeport LNG and Calpine gas power projects.

Analyst Tahira Afzal at KeyBanc Capital followed by downgrading the company to sector weight from overweight. "We see management as staging a potential recovery through thoughtful execution, but our concerns are more around timeline and incremental risks that could arise and stretch into late 2019, keeping the stock volatile," Afzal wrote in a note to clients...

-40%

Zitat von faultcode: ...=> überhaupt sollte man für eine (weitere) Long-Positionierung zwei Dinge abwarten mMn:

1/ den Kursrückgang nach Rückzug vom Übernahmeangebot durch Subsea 7

2/ die Übernahme von Chicago Bridge & Iron Co. NV (CBI) muss auch erst verdaut werden..

=> so ist es.

..und auch Earning Reports

Published: Oct 31, 2018 8:33 a.m. ET

McDermott's stock plunges after disappointing earnings report prompts analyst downgrade

https://www.marketwatch.com/story/mcdermotts-stock-plunges-a…

=>

...Shares of McDermott International Inc. plunged 27% toward a 2 1/2-year low, to pace all premarket decliners, after provider of technology, engineering and construction services to the energy industry missed earnings and revenue expectations, and said it plans to sell its tank storage and U.S. pipe fabrication businesses.

The company also said late Tuesday that it recorded $744 million of changes in estimates on three projects after it took "significant steps to address performance issues" on the Cameron LNG, Freeport LNG and Calpine gas power projects.

Analyst Tahira Afzal at KeyBanc Capital followed by downgrading the company to sector weight from overweight. "We see management as staging a potential recovery through thoughtful execution, but our concerns are more around timeline and incremental risks that could arise and stretch into late 2019, keeping the stock volatile," Afzal wrote in a note to clients...

Antwort auf Beitrag Nr.: 59.108.651 von faultcode am 31.10.18 20:56:50Citi senkte auch nun USD13 (von USD21) -- das ist das neueste Kurziel, was ich kenne:

11/1/2018 -- Citigroup -- Lower Price Target -- Neutral ➝ Neutral -- $21.00 ➝ $13.00 High (impact)

11/1/2018 -- Citigroup -- Lower Price Target -- Neutral ➝ Neutral -- $21.00 ➝ $13.00 High (impact)

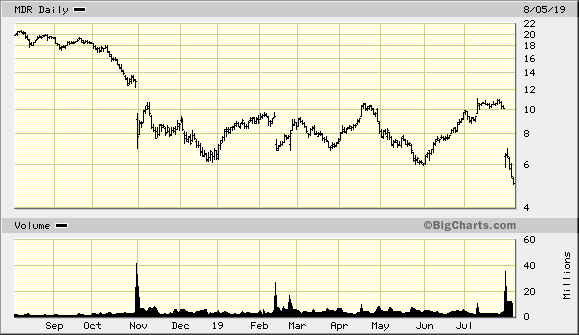

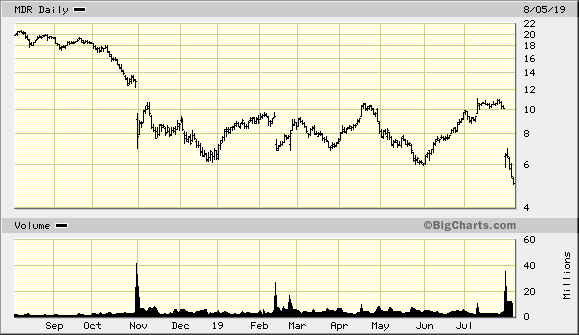

zurück über >USD12?

..nach dem Expansion Breakout heute:

wg.

15.4.

McDermott and Chiyoda Introduce Feed Gas to Train 1 at Cameron LNG

=>

...McDermott International, Inc. and its joint venture partner, Chiyoda International Corporation, a U.S.-based wholly-owned subsidiary of Chiyoda Corporation, Japan, today announced that Train 1 of the Cameron LNG project in Hackberry, La., has reached the final commissioning stage.

This includes the introduction of pipeline feed gas into Train 1 of the liquefaction export facility, the precursor for the production of liquefied natural gas (LNG).

"We are extremely proud of the Cameron LNG project team for this achievement and their remarkable safety performance," said Mark Coscio, McDermott's Senior Vice President for North, Central and South America. "Their accomplishment is more than just a project milestone; it is an impressive feat of engineering and construction. Once Train 1 is fully operational, it will have the capacity to produce 4 million tonnes of LNG per year."...

Antwort auf Beitrag Nr.: 60.369.643 von faultcode am 16.04.19 18:45:2430.7.

McDermott's stock plummets to pace NYSE losers after surprise loss, slashed guidance

https://www.marketwatch.com/story/mcdermotts-stock-plummets-…

=>

...Shares of McDermott International Inc. plummeted 37% on heavy volume in morning trading Tuesday, to pace all NYSE decliners, after the provider of engineering and construction services to the energy industry reported a surprise second-quarter loss and revenue that missed, and projected a surprise full-year loss.

Trading volume was 11.6 million shares, making it the second-most active NYSE stock and already more than triple the full-day average. The stock earlier hit an intraday low of $5.80, which was the lowest price seen during regular-session hours since September 2004, before paring some losses. The company provided 4 reasons for its revised 2019 outlook:

1) weaker-than-expected Q2 operating results;

2) "slippage" in certain new awards and customer changes to schedule on several projects;

3) changes to assumptions about the expected performance of legacy CB&I projects; and

4) a shift to 2020 from the fourth-quarter of 2019 in the assumed timing of remaining incentives on the Cameron liquefied natural gas (LNG) project...

=> fast forward, 5.8.:

McDermott's stock plummets to pace NYSE losers after surprise loss, slashed guidance

https://www.marketwatch.com/story/mcdermotts-stock-plummets-…

=>

...Shares of McDermott International Inc. plummeted 37% on heavy volume in morning trading Tuesday, to pace all NYSE decliners, after the provider of engineering and construction services to the energy industry reported a surprise second-quarter loss and revenue that missed, and projected a surprise full-year loss.

Trading volume was 11.6 million shares, making it the second-most active NYSE stock and already more than triple the full-day average. The stock earlier hit an intraday low of $5.80, which was the lowest price seen during regular-session hours since September 2004, before paring some losses. The company provided 4 reasons for its revised 2019 outlook:

1) weaker-than-expected Q2 operating results;

2) "slippage" in certain new awards and customer changes to schedule on several projects;

3) changes to assumptions about the expected performance of legacy CB&I projects; and

4) a shift to 2020 from the fourth-quarter of 2019 in the assumed timing of remaining incentives on the Cameron liquefied natural gas (LNG) project...

=> fast forward, 5.8.:

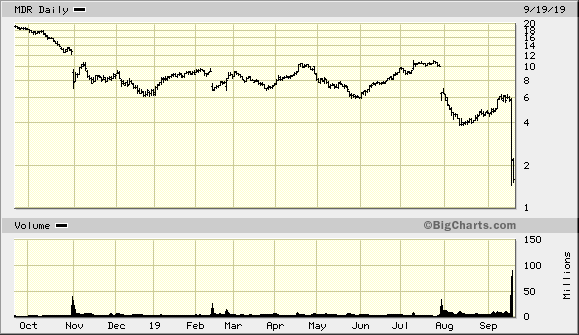

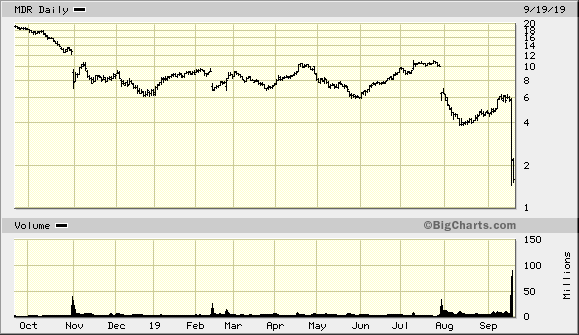

Antwort auf Beitrag Nr.: 61.186.035 von faultcode am 06.08.19 14:41:54

Engineering firm is working with AlixPartners on effort to stem net losses

McDermott International Inc. has engaged turnaround consulting firm AlixPartners LLP to advise on efforts to improve cash flow and stem a recent spate of net losses at the offshore oil-and-gas engineering and construction company, said people familiar with the matter.

https://www.wsj.com/articles/mcdermott-enlists-turnaround-ad…

=>

McDermott Enlists Turnaround Adviser After Guidance Cut

Sept. 18, 2019 1:32 pm ETEngineering firm is working with AlixPartners on effort to stem net losses

McDermott International Inc. has engaged turnaround consulting firm AlixPartners LLP to advise on efforts to improve cash flow and stem a recent spate of net losses at the offshore oil-and-gas engineering and construction company, said people familiar with the matter.

https://www.wsj.com/articles/mcdermott-enlists-turnaround-ad…

=>

Antwort auf Beitrag Nr.: 61.515.287 von faultcode am 18.09.19 20:30:38

Interessantes Ding

Zitat von faultcode: Sept. 18, 2019 1:32 pm ET

Engineering firm is working with AlixPartners on effort to stem net losses

McDermott International Inc. has engaged turnaround consulting firm AlixPartners LLP to advise on efforts to improve cash flow and stem a recent spate of net losses at the offshore oil-and-gas engineering and construction company, said people familiar with the matter.

https://www.wsj.com/articles/mcdermott-enlists-turnaround-ad…

=>

Interessantes Ding

Ich hatte mir gestern paar Stücke zugelegt.

Schon verwunderlich. Erst gab es mehrere Trading halts. Es wurde gemunkelt es könnte Chapter 11 geben

Dann wurde gemunkelt dass die Beraterfirma beauftragt wurde die viele Chapter 11 macht....

50 Millionen short zum 30.8.

Kurs von 5 Euro runtergehämmert auf unter 1,5 bei Volumen von über 170 Millionen Aktien an 2 Tagen

Heute kommt Meldung von einem Verkauf von einem Unternehmensteil für über 2,5 Milliarden Dollar.

Ganz ehrlich diese Finanzmafia ist wirklich unfassbar. Dass die das einfach so weitermachen dürfen. Haben wir jetzt schon zig Mal erlebt. Die Shorter manipilieren den Markt und die Sec schaut zu. Die Bafin schaut zu. Wirklich unfassbar. Hier werden die anständigen Leute beklaut und verarscht. Was für eine Welt. Es kotzt mich an.

Premarket 10 Millionen Aktien gehandelt. Ich hoffe die Shortis sind noch nicht raus und bekommen auf die Fresse.

Ist hier noch jemand drin? Wird sicher ein interessanter Tag heute. Sehe die heutige Range von 2-6 Euro. We will see.

Antwort auf Beitrag Nr.: 61.530.800 von 1Fuchschen am 20.09.19 14:19:16

https://www.marketwatch.com/story/mcdermotts-stock-rockets-a…

=>

...Shares of McDermott International Inc. rocketed 82% in very active premarket trading Friday, after the provider of engineering and construction services to the energy industry said it was exploring the sale of its Lummus Technology business, which has been valued at more than $2.5 billion.

Trading volume topped 8.9 million shares, making the stock the most actively traded ahead of the open. The company said it recently received unsolicited approaches to acquire all or part of Lummus, which is a licensor of proprietary petrochemicals, refining, gasification and gas processing technologies.

"The process of exploring strategic alternatives is part of our ongoing efforts intended to improve McDermott's capital structure, and we plan to use the proceeds from any transaction involving Lummus Technology to strengthen our balance sheet," said Chief Executive David Dickson.

McDermott said it has retained Evercore as lead advisor on strategic alternatives for McDermott...

--> mein Eindruck ist, daß seit dem Juli-Massaker ein Liquiditäts-Engpass droht (--> Beitrag Nr. 7), welcher nun schnell behoben werden muss

--> das heißt aber mMn auch, daß die Fusion mit Chicago Bridge & Iron ab Ende 2017 nicht zur Stabilisierung des Unternehmens führte

--> einen Monat nach der Ankündigung ging es mit dem Kurs im Schnitt nur bergab. Aber, siehe oben, warnende Stimmen gab's schon damals sofort nach Ankündigung, und das ist mMn eher auffallend

--> aktuell premarket: +80%

McDermott's stock rockets after exploring sale of Lummus business, valued at over USD2.5 bln

20.9.https://www.marketwatch.com/story/mcdermotts-stock-rockets-a…

=>

...Shares of McDermott International Inc. rocketed 82% in very active premarket trading Friday, after the provider of engineering and construction services to the energy industry said it was exploring the sale of its Lummus Technology business, which has been valued at more than $2.5 billion.

Trading volume topped 8.9 million shares, making the stock the most actively traded ahead of the open. The company said it recently received unsolicited approaches to acquire all or part of Lummus, which is a licensor of proprietary petrochemicals, refining, gasification and gas processing technologies.

"The process of exploring strategic alternatives is part of our ongoing efforts intended to improve McDermott's capital structure, and we plan to use the proceeds from any transaction involving Lummus Technology to strengthen our balance sheet," said Chief Executive David Dickson.

McDermott said it has retained Evercore as lead advisor on strategic alternatives for McDermott...

--> mein Eindruck ist, daß seit dem Juli-Massaker ein Liquiditäts-Engpass droht (--> Beitrag Nr. 7), welcher nun schnell behoben werden muss

--> das heißt aber mMn auch, daß die Fusion mit Chicago Bridge & Iron ab Ende 2017 nicht zur Stabilisierung des Unternehmens führte

--> einen Monat nach der Ankündigung ging es mit dem Kurs im Schnitt nur bergab. Aber, siehe oben, warnende Stimmen gab's schon damals sofort nach Ankündigung, und das ist mMn eher auffallend

--> aktuell premarket: +80%

Antwort auf Beitrag Nr.: 61.531.046 von faultcode am 20.09.19 14:34:29

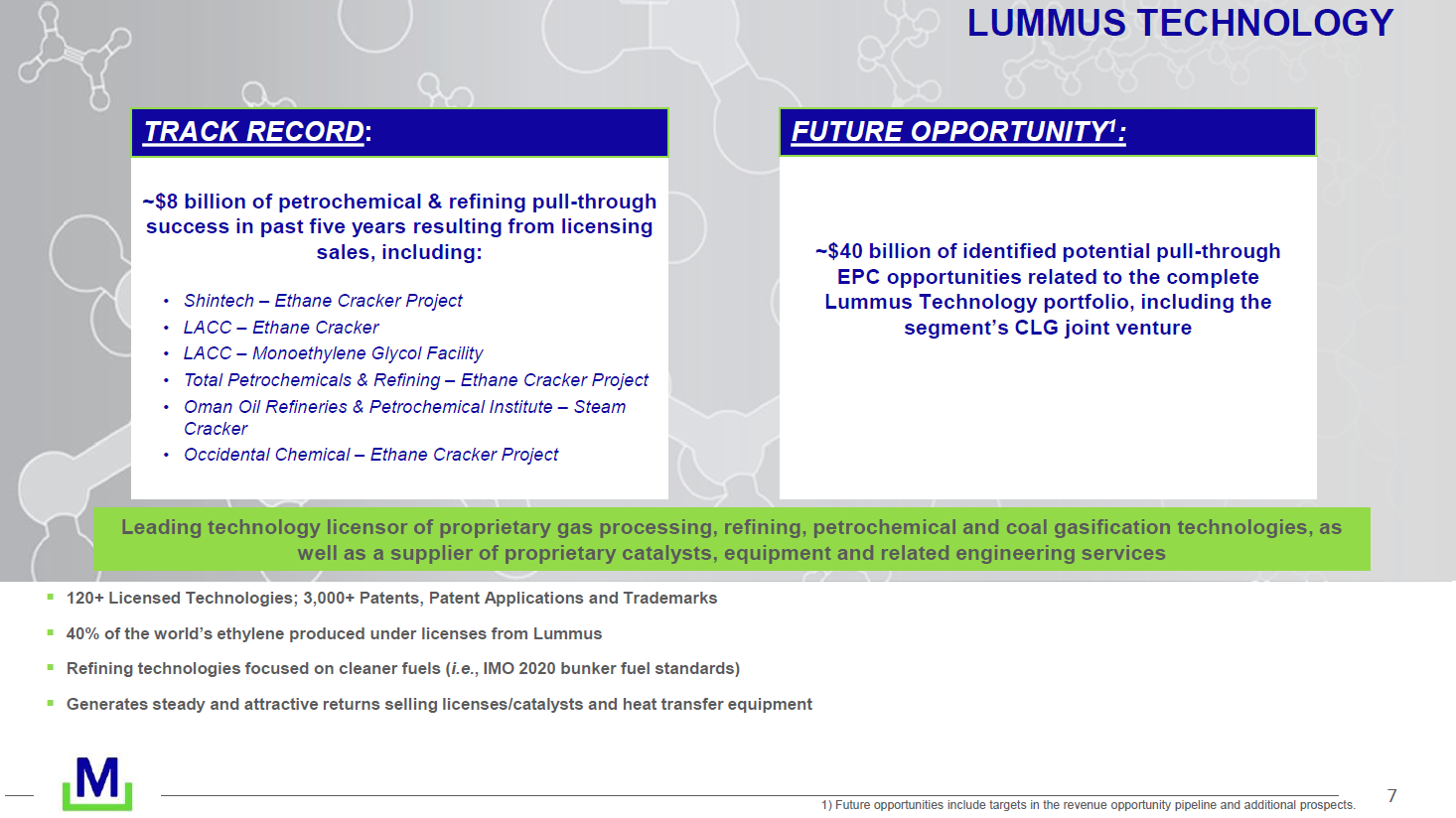

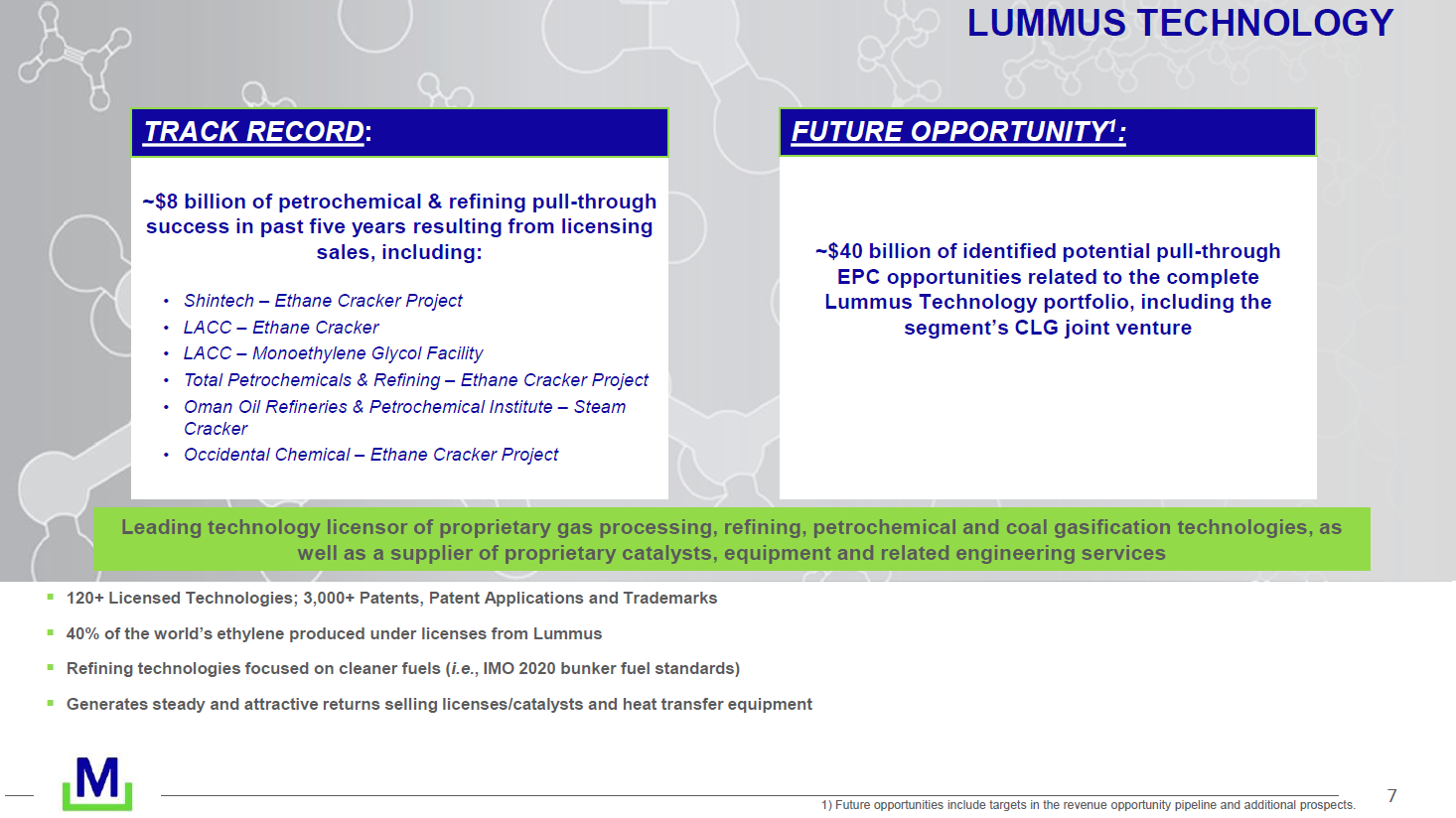

(Q2-Präsentation)

--> daher auch (mMn) nun die unaufgeforderten Angebote für Lummus

--> es gibt auch ein 50/50-JV mit Chevron dazu namens CLG = Chevron-Lummus Global

Lummus Technology

Lummus Technology ist quasi die Perle bei MDR, der Rest siehe Kursverlauf:

(Q2-Präsentation)

--> daher auch (mMn) nun die unaufgeforderten Angebote für Lummus

--> es gibt auch ein 50/50-JV mit Chevron dazu namens CLG = Chevron-Lummus Global

Ich war durch den Absturz vorgestern überhaupt erst auf die Aktie aufmerksam geworden und ein paar Stücke zu 2 € eingesammelt. Wollte mir gestern schon die Kugel geben und heute nun das... zu 2,70 € raus, nicht mal mehr mit der Kneifzange gehe ich da erneut ran.

Antwort auf Beitrag Nr.: 61.531.184 von faultcode am 20.09.19 14:47:53

--> ich fass die Aktie nicht so schnell mehr an (nachdem ich sie kürzlich als Trümmerleiche aus dem Depot warf)

--> siehe BW (Babcock & Wilcox Enterprises) -- wobei, die sind "USA", MDR aber rechtlich gesehen "REPUBLIC OF PANAMA" -- PA5800371096; Heimatbörse ist aber die NYSE; daneben auch IRS Employer Identification Number und 10-K für die SEC etc.

--> dennoch kann es hier mMn zu Komplikationen für die Aktionäre kommen, ihre (erwarteten) Rechte durchzusetzen (im Vgl. zu einem vollständigen US-Unternehmen)

--> d.h., die die spät dran sind, haben mMn bei Überleben in dieser / ähnlicher Form die besseren Karten, als diejenigen, die mit MDR-Aktien durch die Restrukturierung mit all den üblichen Verwässerungen gehen werden, die viele Monate dauern wird typischerweise (unschön unprofitable Alt-Projekt-Abwicklung nur so als mögliches Beispiel)

<natürlich, Day tradiing ist was anderes als Anlage>

--> bei BW war rückblickend betrachtet der bester "Zeitpunkt" (bislang) kurz vor der letzten KE, von der man halt annehmen muss, das es auch die letzte ist im Rahmen einer Restrukturierung ist (mehr als 2 sollten es mMn nicht sein in so ~1 1/2...3 Jahren)

--> als Überraschung für die meisten/viele Aktionäre kommt sowas sowieso, da die Formulierungen in den Meldungen (im Prospekt eher nicht so) halt immer optimistisch sind, und man leicht denken kann: "So, das war's jetzt auch."

--> da stehen nun mMn einige wichtige Fragen zur Klärung an; siehe oben die Fusion mit Chicago Bridge & Iron z.B.

--> es ist nicht das erste Mal, daß so eine Fusion in Wahrheit die drohende Zahlungsunfähigkeit eines der Partner verdecken soll

--> ich fass die Aktie nicht so schnell mehr an (nachdem ich sie kürzlich als Trümmerleiche aus dem Depot warf)

--> siehe BW (Babcock & Wilcox Enterprises) -- wobei, die sind "USA", MDR aber rechtlich gesehen "REPUBLIC OF PANAMA" -- PA5800371096; Heimatbörse ist aber die NYSE; daneben auch IRS Employer Identification Number und 10-K für die SEC etc.

--> dennoch kann es hier mMn zu Komplikationen für die Aktionäre kommen, ihre (erwarteten) Rechte durchzusetzen (im Vgl. zu einem vollständigen US-Unternehmen)

--> d.h., die die spät dran sind, haben mMn bei Überleben in dieser / ähnlicher Form die besseren Karten, als diejenigen, die mit MDR-Aktien durch die Restrukturierung mit all den üblichen Verwässerungen gehen werden, die viele Monate dauern wird typischerweise (unschön unprofitable Alt-Projekt-Abwicklung nur so als mögliches Beispiel)

<natürlich, Day tradiing ist was anderes als Anlage>

--> bei BW war rückblickend betrachtet der bester "Zeitpunkt" (bislang) kurz vor der letzten KE, von der man halt annehmen muss, das es auch die letzte ist im Rahmen einer Restrukturierung ist (mehr als 2 sollten es mMn nicht sein in so ~1 1/2...3 Jahren)

--> als Überraschung für die meisten/viele Aktionäre kommt sowas sowieso, da die Formulierungen in den Meldungen (im Prospekt eher nicht so) halt immer optimistisch sind, und man leicht denken kann: "So, das war's jetzt auch."

--> da stehen nun mMn einige wichtige Fragen zur Klärung an; siehe oben die Fusion mit Chicago Bridge & Iron z.B.

--> es ist nicht das erste Mal, daß so eine Fusion in Wahrheit die drohende Zahlungsunfähigkeit eines der Partner verdecken soll

Antwort auf Beitrag Nr.: 61.534.439 von faultcode am 20.09.19 20:09:19

Naja die Verkaufen Assets für ca. 3,5 Milliarden. Die Schulden betragen gerade mal 4,6 Milliarden. Wenn ich mir da so andere Schwergewichte wie GE etc ansehe mit über 100 Milliarden Schulden ist das ja noch machbar. Die Shortis Hedgefonds haben das Ding ja erst richtig runtergeprügelt. Von 6 Dollar unter 2 in 2 Tagen. Da wird erst Kohle mit fallenden Kursen verdient und danach mit steigenden. Der Kleinaktionär der schmeißt ist da meistens der Verlierer. Die Finanzmafia ist clever. Erst Ängste schüren und dann einsammeln und long gehen. So läufts halt heutzutage.

Zitat von faultcode:

--> ich fass die Aktie nicht so schnell mehr an (nachdem ich sie kürzlich als Trümmerleiche aus dem Depot warf)

--> siehe BW (Babcock & Wilcox Enterprises) -- wobei, die sind "USA", MDR aber rechtlich gesehen "REPUBLIC OF PANAMA" -- PA5800371096; Heimatbörse ist aber die NYSE; daneben auch IRS Employer Identification Number und 10-K für die SEC etc.

--> dennoch kann es hier mMn zu Komplikationen für die Aktionäre kommen, ihre (erwarteten) Rechte durchzusetzen (im Vgl. zu einem vollständigen US-Unternehmen)

--> d.h., die die spät dran sind, haben mMn bei Überleben in dieser / ähnlicher Form die besseren Karten, als diejenigen, die mit MDR-Aktien durch die Restrukturierung mit all den üblichen Verwässerungen gehen werden, die viele Monate dauern wird typischerweise (unschön unprofitable Alt-Projekt-Abwicklung nur so als mögliches Beispiel)

<natürlich, Day tradiing ist was anderes als Anlage>

--> bei BW war rückblickend betrachtet der bester "Zeitpunkt" (bislang) kurz vor der letzten KE, von der man halt annehmen muss, das es auch die letzte ist im Rahmen einer Restrukturierung ist (mehr als 2 sollten es mMn nicht sein in so ~1 1/2...3 Jahren)

--> als Überraschung für die meisten/viele Aktionäre kommt sowas sowieso, da die Formulierungen in den Meldungen (im Prospekt eher nicht so) halt immer optimistisch sind, und man leicht denken kann: "So, das war's jetzt auch."

--> da stehen nun mMn einige wichtige Fragen zur Klärung an; siehe oben die Fusion mit Chicago Bridge & Iron z.B.

--> es ist nicht das erste Mal, daß so eine Fusion in Wahrheit die drohende Zahlungsunfähigkeit eines der Partner verdecken soll

Naja die Verkaufen Assets für ca. 3,5 Milliarden. Die Schulden betragen gerade mal 4,6 Milliarden. Wenn ich mir da so andere Schwergewichte wie GE etc ansehe mit über 100 Milliarden Schulden ist das ja noch machbar. Die Shortis Hedgefonds haben das Ding ja erst richtig runtergeprügelt. Von 6 Dollar unter 2 in 2 Tagen. Da wird erst Kohle mit fallenden Kursen verdient und danach mit steigenden. Der Kleinaktionär der schmeißt ist da meistens der Verlierer. Die Finanzmafia ist clever. Erst Ängste schüren und dann einsammeln und long gehen. So läufts halt heutzutage.

21.10.

McDermott's stock rockets after new $1.7 billion financing deal

https://www.marketwatch.com/story/mcdermotts-stock-rockets-a…

=>

...Shares of McDermott International Inc. rocketed 31% in premarket trading Monday, after the provider of technology, engineering and construction services to the energy industry announced an agreement on $1.7 billion in new financing.

Under terms of the agreement, the company will have immediate access to $650 million in financing, including $550 million available under a term loan and a $100 million letter of credit facility.

McDermott said it expects to use the new financing for working capital and to support the issuance of required performance guarantees on new projects...

McDermott's stock rockets after new $1.7 billion financing deal

https://www.marketwatch.com/story/mcdermotts-stock-rockets-a…

=>

...Shares of McDermott International Inc. rocketed 31% in premarket trading Monday, after the provider of technology, engineering and construction services to the energy industry announced an agreement on $1.7 billion in new financing.

Under terms of the agreement, the company will have immediate access to $650 million in financing, including $550 million available under a term loan and a $100 million letter of credit facility.

McDermott said it expects to use the new financing for working capital and to support the issuance of required performance guarantees on new projects...

Antwort auf Beitrag Nr.: 61.737.991 von faultcode am 21.10.19 20:12:26

--> Lieferanten werden schon nicht mehr bezahlt:

7.11.

Construction on McDermott's HQ comes to a halt

https://finance.yahoo.com/m/2c77efff-d95b-36f3-bf04-9a2381e7…

--> gut daß man - und das kommt nicht selten vor - vorher noch Anflüge von Größenwahn hatte:

--> das Gebäude wurde schon 2016 fertig; sollte aber in 2019 fertig werden als neues HQ für eine größere MDR

--> merke: wer sich bei seinen Headquarters verplant, der tut das auch woanders im Unternehmen

--> ich weiß schon, was nachher wieder gesagt wird: man war halt zu optimistisch

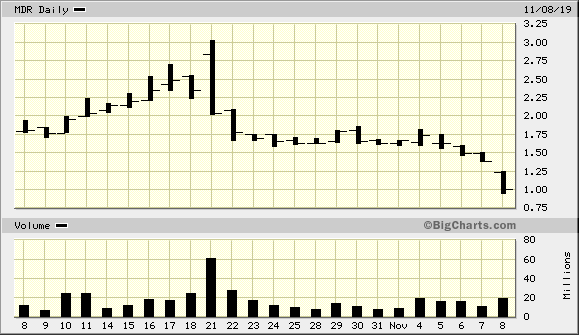

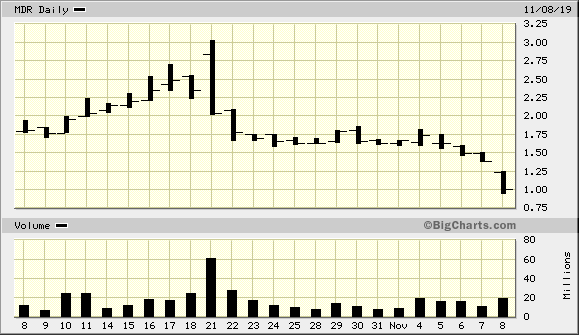

-27%

fast Penny stock -- damit ist hier vorerst Schicht im Schacht:

--> Lieferanten werden schon nicht mehr bezahlt:

7.11.

Construction on McDermott's HQ comes to a halt

https://finance.yahoo.com/m/2c77efff-d95b-36f3-bf04-9a2381e7…

--> gut daß man - und das kommt nicht selten vor - vorher noch Anflüge von Größenwahn hatte:

--> das Gebäude wurde schon 2016 fertig; sollte aber in 2019 fertig werden als neues HQ für eine größere MDR

--> merke: wer sich bei seinen Headquarters verplant, der tut das auch woanders im Unternehmen

--> ich weiß schon, was nachher wieder gesagt wird: man war halt zu optimistisch

Da kommt wohl die Insolvenz oder?

Schade, war doch nochmal recht fett eingestiegen, aber jetzt mit -50% raus. Hier steht imho die Insolvenz wohl an. Und vertröstet wird man vorher noch mit Neuaufträgen mit einem Volumen von 1 bis 50 Mio. USD. Was sind das überhaupt für schwammige Angaben? Konzernzerntrale Neubau gestoppt war wohl für den Markt der endgültige Wink mit dem Zaunpfahl. Rechne nicht mehr mit einer Kurserholung und wenn doch findet diese ohne mich statt.

Bei über 2 Milliarden USD Verlust im letzten Quartal (über 10 USD/Aktie) nützen auch die neuen Kreditlinien nichts mehr. So, jetzt aber Schluss hier.

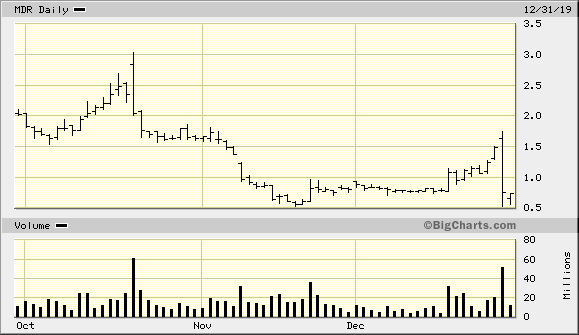

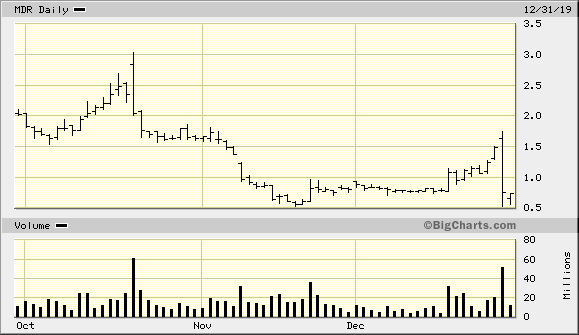

31.12.

McDermott's Stock Keeps Tumbling After WSJ Report Of Bankruptcy Discussions

https://www.marketwatch.com/story/mcdermotts-stock-keeps-tum…

Shares of McDermott International Inc. tumbled 15% in premarket trading Tuesday, adding to the previous session's 50% plunge, as investors brace for a potential bankruptcy filing.

The Wall Street Journal reported late in Monday's session that the provider of engineering and construction services to the energy industry has been in talks with its lenders to file for bankruptcy within weeks.

The stock was trading up 7.4% at a near 8-week high around 3 p.m. Eastern Monday, just before the WSJ report was released, then fell as much as 64.4% before closing down 49.7% at 75 cents.

Citing people familiar with the situation, the WSJ report said a group of lenders, led by HPS Investment Partners and Baupost Group LLC were in talks to provide a loan of around $2 billion to keep McDermott's operations running during bankruptcy...

=> auch hier gehe ich davon aus, daß sich maßgeblich Hedgies - über die Gläubigerseite - das Unternehmen unter den Nagel reißen werden und dann versuchen, es profitabel aufzuteilen; siehe z.B. Lummus Technology

McDermott's Stock Keeps Tumbling After WSJ Report Of Bankruptcy Discussions

https://www.marketwatch.com/story/mcdermotts-stock-keeps-tum…

Shares of McDermott International Inc. tumbled 15% in premarket trading Tuesday, adding to the previous session's 50% plunge, as investors brace for a potential bankruptcy filing.

The Wall Street Journal reported late in Monday's session that the provider of engineering and construction services to the energy industry has been in talks with its lenders to file for bankruptcy within weeks.

The stock was trading up 7.4% at a near 8-week high around 3 p.m. Eastern Monday, just before the WSJ report was released, then fell as much as 64.4% before closing down 49.7% at 75 cents.

Citing people familiar with the situation, the WSJ report said a group of lenders, led by HPS Investment Partners and Baupost Group LLC were in talks to provide a loan of around $2 billion to keep McDermott's operations running during bankruptcy...

=> auch hier gehe ich davon aus, daß sich maßgeblich Hedgies - über die Gläubigerseite - das Unternehmen unter den Nagel reißen werden und dann versuchen, es profitabel aufzuteilen; siehe z.B. Lummus Technology

Zitat von faultcode: ...MDR aber rechtlich gesehen "REPUBLIC OF PANAMA" -- PA5800371096; Heimatbörse ist aber die NYSE; daneben auch IRS Employer Identification Number und 10-K für die SEC etc.

--> dennoch kann es hier mMn zu Komplikationen für die Aktionäre kommen, ihre (erwarteten) Rechte durchzusetzen (im Vgl. zu einem vollständigen US-Unternehmen)...

Antwort auf Beitrag Nr.: 61.875.729 von faultcode am 08.11.19 18:09:28

21.1.

McDermott to file for Chapter 11 bankruptcy protection

https://uk.reuters.com/article/us-mcdermott-intern-bankruptc…

..U.S. oilfield services provider McDermott International Inc MDR.N said on Tuesday it would file for prepackaged bankruptcy protection under Chapter 11, as it looks to cut debt that ballooned following a major acquisition in 2018.

The restructuring will be financed by a debtor-in-possession (DIP) financing of $2.81 billion, the company said. As part of the deal, McDermott has also entered a stalking-horse agreement to sell its Lummus Technology unit for $2.73 billion.

DIP financing packages allow bankrupt companies to remain in business and fund operations as bankruptcy case proceeds.

Texas-based McDermott’s total debt stood at $9.86 billion as of Nov. 4, 2019.

“As a result of the transaction, we are eliminating over $4.6 billion in debt from our balance sheet and we will emerge with robust liquidity and significant financing to execute on customer projects in our backlog,” Chief Executive Officer of McDermott David Dickson said in a note.

McDermott’s shares were down 15% in premarket trade. Bloomberg reported on Friday the company was preparing to file for bankruptcy..

McDermott has been reeling under heavy debt since it combined its offshore engineering and construction business with Chicago Bridge & Iron Co (CB&I) in an all-stock deal valued at around $6 billion including nearly $4 billion in debt.

The company’s total liabilities jumped to $7.86 billion at the end of June 2018 after it acquired CB&I, from $1.36 billion in the previous quarter.

McDermott last year raised another $1.7 billion to support its operations and concurrently withdrew its full-year forecast...

20.09.19

MDRIQ -- McDermott files for Chapter 11

Zitat von faultcode: fast Penny stock -- damit ist hier vorerst Schicht im Schacht:..

21.1.

McDermott to file for Chapter 11 bankruptcy protection

https://uk.reuters.com/article/us-mcdermott-intern-bankruptc…

..U.S. oilfield services provider McDermott International Inc MDR.N said on Tuesday it would file for prepackaged bankruptcy protection under Chapter 11, as it looks to cut debt that ballooned following a major acquisition in 2018.

The restructuring will be financed by a debtor-in-possession (DIP) financing of $2.81 billion, the company said. As part of the deal, McDermott has also entered a stalking-horse agreement to sell its Lummus Technology unit for $2.73 billion.

DIP financing packages allow bankrupt companies to remain in business and fund operations as bankruptcy case proceeds.

Texas-based McDermott’s total debt stood at $9.86 billion as of Nov. 4, 2019.

“As a result of the transaction, we are eliminating over $4.6 billion in debt from our balance sheet and we will emerge with robust liquidity and significant financing to execute on customer projects in our backlog,” Chief Executive Officer of McDermott David Dickson said in a note.

McDermott’s shares were down 15% in premarket trade. Bloomberg reported on Friday the company was preparing to file for bankruptcy..

McDermott has been reeling under heavy debt since it combined its offshore engineering and construction business with Chicago Bridge & Iron Co (CB&I) in an all-stock deal valued at around $6 billion including nearly $4 billion in debt.

The company’s total liabilities jumped to $7.86 billion at the end of June 2018 after it acquired CB&I, from $1.36 billion in the previous quarter.

McDermott last year raised another $1.7 billion to support its operations and concurrently withdrew its full-year forecast...

20.09.19

Zitat von faultcode: Lummus Technology ist quasi die Perle bei MDR, der Rest siehe Kursverlauf...

Zitat von faultcode: ...--> das heißt aber mMn auch, daß die Fusion mit Chicago Bridge & Iron ab Ende 2017 nicht zur Stabilisierung des Unternehmens führte

--> einen Monat nach der Ankündigung ging es mit dem Kurs im Schnitt nur bergab. Aber, siehe oben, warnende Stimmen gab's schon damals sofort nach Ankündigung, und das ist mMn eher auffallend...

Antwort auf Beitrag Nr.: 62.482.872 von faultcode am 24.01.20 23:18:0823.1.

McDermott International Enters Chapter 11 Bankruptcy

https://seekingalpha.com/article/4318778-mcdermott-internati…

• The management team at McDermott International, after several months of inaction and poor decision-making, finally took the company into Chapter 11 protection.

• This move will wipe shareholders out and leave the most junior holders of debt with very little.

• The company that emerges from the process looks to have significant potential, but only time will tell.

...

Common shareholders will be essentially wiped out, while holders of the Senior Notes of the firm won’t end up much better off.

...

In the first half of 2019, the company saw new bookings worth around $14 billion. In the second half of the year, this figure plummeted to less than $3 billion.

...

The firm has also secured a $2.4 billion letter of credit facility, and when all is said and done, it will exit Chapter 11 with around $500 million in funded debt on its books. In all, $4.6 billion in debt will be wiped clean from the company’s books.

...

One frustrating thing from the perspective of a watcher of the firm (and likely even more frustrating for shareholders) is that management delayed selling off Lummus Technology for far too long. Had action been taken up a year earlier, it’s very likely McDermott would not be in this tough position today, but only now that they decided to file for bankruptcy did they decide to sell their valuable technology segment off. (FC: an zwei private equity firms: The Chatterjee Group + Rhone Group als Plan)

...

Senior Notes holders, for instance, are going to walk away with only 19% of their estimated value of $1.402 billion. This will come in the form of an estimated 6% of the common shares in the new company that will emerge from bankruptcy. They will also receive some additional shares (an unspecified amount, but likely nominal) plus some warrants. Everybody junior to them, like shareholders, will walk away with nothing.

...

Last year, it was estimated that free cash flow for the business was -$1.191 billion. If bankruptcy only takes a short part of the 2020 fiscal year, the company believes it will see net outflows this year of an additional $550 million. Next year, though, it should see net inflows of $56 million, and for the full period of 2020 through 2024, it expects net inflows of $1.808 billion. If this does come to pass, the company should go on to be worth far more than the $2.25 billion mid-point a third-party firm evaluated it to be worth on an EV (enterprise value) basis. This could leave new shareholders holding an attractive business, even if the absence of Lummus Technology will cost the company $255 million in lost operating income on a run rate basis.

...

McDermott International Enters Chapter 11 Bankruptcy

https://seekingalpha.com/article/4318778-mcdermott-internati…

• The management team at McDermott International, after several months of inaction and poor decision-making, finally took the company into Chapter 11 protection.

• This move will wipe shareholders out and leave the most junior holders of debt with very little.

• The company that emerges from the process looks to have significant potential, but only time will tell.

...

Common shareholders will be essentially wiped out, while holders of the Senior Notes of the firm won’t end up much better off.

...

In the first half of 2019, the company saw new bookings worth around $14 billion. In the second half of the year, this figure plummeted to less than $3 billion.

...

The firm has also secured a $2.4 billion letter of credit facility, and when all is said and done, it will exit Chapter 11 with around $500 million in funded debt on its books. In all, $4.6 billion in debt will be wiped clean from the company’s books.

...

One frustrating thing from the perspective of a watcher of the firm (and likely even more frustrating for shareholders) is that management delayed selling off Lummus Technology for far too long. Had action been taken up a year earlier, it’s very likely McDermott would not be in this tough position today, but only now that they decided to file for bankruptcy did they decide to sell their valuable technology segment off. (FC: an zwei private equity firms: The Chatterjee Group + Rhone Group als Plan)

...

Senior Notes holders, for instance, are going to walk away with only 19% of their estimated value of $1.402 billion. This will come in the form of an estimated 6% of the common shares in the new company that will emerge from bankruptcy. They will also receive some additional shares (an unspecified amount, but likely nominal) plus some warrants. Everybody junior to them, like shareholders, will walk away with nothing.

...

Last year, it was estimated that free cash flow for the business was -$1.191 billion. If bankruptcy only takes a short part of the 2020 fiscal year, the company believes it will see net outflows this year of an additional $550 million. Next year, though, it should see net inflows of $56 million, and for the full period of 2020 through 2024, it expects net inflows of $1.808 billion. If this does come to pass, the company should go on to be worth far more than the $2.25 billion mid-point a third-party firm evaluated it to be worth on an EV (enterprise value) basis. This could leave new shareholders holding an attractive business, even if the absence of Lummus Technology will cost the company $255 million in lost operating income on a run rate basis.

...

Antwort auf Beitrag Nr.: 62.482.959 von faultcode am 24.01.20 23:34:12

Es stehen vielleicht noch einige Class actions aus 2018 und 2018 an, und nicht nur durch Aktionäre:

https://www.classaction.org/news/four-companies-face-lawsuit…

--> und, wie auch oben angesprochen, ergibt sich mMn hieraus auch Potenzial für weitere Class actions:

20.09.19

--> David Dickson (ein Schotte) ist President & Chief Executive Officer seit 2013 (davor 11 Jahre Technip):

https://www.mcdermott.com/Who-We-Are/Leadership-Team/Meet-Ou…

--> der Mann hat's versaut; so einfach ist das; entweder aus Dummheit, Hybris oder krimineller Energie, oder eine Mischung aus dem

--> das Unternehmen ist keine Pommesbude, wurde aber so geführt, und hatte Ende 2018 noch 14,600 eigene MA's weltweit:

At December 31, 2018, we employed approximately 31,900 persons worldwide, comprised of approximately 14,600 salaried employees and approximately 17,300 hourly and craft employees. Our number of employees, particularly hourly and craft, varies in relation to the location, number and size of projects we have in process at any given time.

CEO David Dickson

Ich warte hier auf ein neues Management (siehe auch z.B. bei CGG Veritas, denen das gut bekam), bevor ich weitersehe.Es stehen vielleicht noch einige Class actions aus 2018 und 2018 an, und nicht nur durch Aktionäre:

https://www.classaction.org/news/four-companies-face-lawsuit…

--> und, wie auch oben angesprochen, ergibt sich mMn hieraus auch Potenzial für weitere Class actions:

20.09.19

Zitat von faultcode: ...--> da stehen nun mMn einige wichtige Fragen zur Klärung an; siehe oben die Fusion mit Chicago Bridge & Iron z.B....

--> David Dickson (ein Schotte) ist President & Chief Executive Officer seit 2013 (davor 11 Jahre Technip):

https://www.mcdermott.com/Who-We-Are/Leadership-Team/Meet-Ou…

--> der Mann hat's versaut; so einfach ist das; entweder aus Dummheit, Hybris oder krimineller Energie, oder eine Mischung aus dem

--> das Unternehmen ist keine Pommesbude, wurde aber so geführt, und hatte Ende 2018 noch 14,600 eigene MA's weltweit:

At December 31, 2018, we employed approximately 31,900 persons worldwide, comprised of approximately 14,600 salaried employees and approximately 17,300 hourly and craft employees. Our number of employees, particularly hourly and craft, varies in relation to the location, number and size of projects we have in process at any given time.

Dieser Laden steckt einfach nur bis zum Kopf voll mit krimineller Energie!

Ch11 wäre nicht nötig gewesen, wenn man sich mal anschaut mit welch prosperiender Eigenwerbung sie ihr volles Auftragsbuch anpreisen um andere Gemüter zu überzeugen. $20Milliarden backlog für 2020+2021. Selbst wenn sie in diesen Jahren durch Inkompetenz jährlich weitere $2Milliarden an Strafzahlungen durch CB&I Projekte akquirieren und somit ihre Ausgaben auf $8Millarden pushen wie 2019, dann hätten sie mit momentan $5Milliarden Schulden irgendwann in 2022 diese auf $1Milliarde gesenkt (8+8+5-20=1). Zumindest nach meiner Milchmädchenrechnung. Aber debt-to-equity is ja was Schönes was es so interessanterweise auch nur in den USA gibt...

Ch11 wäre nicht nötig gewesen, wenn man sich mal anschaut mit welch prosperiender Eigenwerbung sie ihr volles Auftragsbuch anpreisen um andere Gemüter zu überzeugen. $20Milliarden backlog für 2020+2021. Selbst wenn sie in diesen Jahren durch Inkompetenz jährlich weitere $2Milliarden an Strafzahlungen durch CB&I Projekte akquirieren und somit ihre Ausgaben auf $8Millarden pushen wie 2019, dann hätten sie mit momentan $5Milliarden Schulden irgendwann in 2022 diese auf $1Milliarde gesenkt (8+8+5-20=1). Zumindest nach meiner Milchmädchenrechnung. Aber debt-to-equity is ja was Schönes was es so interessanterweise auch nur in den USA gibt...

Antwort auf Beitrag Nr.: 62.483.079 von faultcode am 25.01.20 00:00:06auch hier fröhliches Chapter 11-Daytrading:

Antwort auf Beitrag Nr.: 63.922.283 von faultcode am 06.06.20 00:21:0306/30/2020

McDermott Successfully Completes Comprehensive Restructuring Process

http://www.mcdermott-investors.com/news/press-release-detail…

HOUSTON, June 30, 2020 /PRNewswire/ -- McDermott International Ltd. ("McDermott" or the "Company") today announced that the Company has successfully completed its restructuring process. The comprehensive balance sheet restructuring equitizes nearly all of McDermott's $4.6 billion of funded debt. The Company emerges with $2.4 billion in letter of credit capacity and $544 million of funded debt.

McDermott has completed the sale of Lummus Technology to a joint partnership between Haldia Petrochemicals Ltd., a flagship company of The Chatterjee Group, and Rhône Capital having received all required regulatory approvals and pursuant to the Company's plan of reorganization.

Proceeds from the sale of Lummus Technology will repay the debtor-in-possession financing in full, as well as fund emergence costs and provide cash to the balance sheet for long-term liquidity.

"We are pleased to have completed this process so swiftly thanks to the dedication of our employees and the support of our new owners, customers, suppliers and partners," said David Dickson, President and Chief Executive Officer of McDermott. "We will continue executing on our significant backlog, with a new capital structure to match and support the strength of our operating business, and we emerge well-positioned for long-term growth and success, even amid this period of global uncertainty. We look forward to continued delivery on customer projects. Finally, we congratulate our Lummus colleagues, and look forward to continuing our working partnership with Lummus as we move into the future."

...

McDermott Successfully Completes Comprehensive Restructuring Process

http://www.mcdermott-investors.com/news/press-release-detail…

HOUSTON, June 30, 2020 /PRNewswire/ -- McDermott International Ltd. ("McDermott" or the "Company") today announced that the Company has successfully completed its restructuring process. The comprehensive balance sheet restructuring equitizes nearly all of McDermott's $4.6 billion of funded debt. The Company emerges with $2.4 billion in letter of credit capacity and $544 million of funded debt.

McDermott has completed the sale of Lummus Technology to a joint partnership between Haldia Petrochemicals Ltd., a flagship company of The Chatterjee Group, and Rhône Capital having received all required regulatory approvals and pursuant to the Company's plan of reorganization.

Proceeds from the sale of Lummus Technology will repay the debtor-in-possession financing in full, as well as fund emergence costs and provide cash to the balance sheet for long-term liquidity.

"We are pleased to have completed this process so swiftly thanks to the dedication of our employees and the support of our new owners, customers, suppliers and partners," said David Dickson, President and Chief Executive Officer of McDermott. "We will continue executing on our significant backlog, with a new capital structure to match and support the strength of our operating business, and we emerge well-positioned for long-term growth and success, even amid this period of global uncertainty. We look forward to continued delivery on customer projects. Finally, we congratulate our Lummus colleagues, and look forward to continuing our working partnership with Lummus as we move into the future."

...

ich habe die IR gefragt, ob und wann mit einem IPO der neuen McDermott zu rechnen sei.

Ja, sei angedacht innerhalb von circa 3 Jahren nach Abschluss des Insolvenz-Verfahrens. (Das müsste mMn im Juni gewesen sein; siehe Beitrag Nr. 38 oben.)

Konkrete Pläne lägen derzeit aber nicht vor.

Ja, sei angedacht innerhalb von circa 3 Jahren nach Abschluss des Insolvenz-Verfahrens. (Das müsste mMn im Juni gewesen sein; siehe Beitrag Nr. 38 oben.)

Konkrete Pläne lägen derzeit aber nicht vor.

Antwort auf Beitrag Nr.: 65.775.648 von faultcode am 19.11.20 22:00:12http://www.mcdermott-investors.com/news/press-release-detail…

McDermott Expands Participation in $170 Million Common Share Issuance

ich finde es schon etwas lustig, daß die Email alerts hier immer noch funktionieren

Diesen Data room habe ich so auch nicht nicht gesehen: http://www.mcdermott-investors.com/data-room/default.aspx

McDermott maintains a password-protected data room containing material financial and other information concerning our business. Shareholders and prospective shareholders can obtain access to the data room upon entering into a confidentiality agreement with McDermott. To request a confidentiality agreement, please contact Maria Lopez at...

McDermott Expands Participation in $170 Million Common Share Issuance

ich finde es schon etwas lustig, daß die Email alerts hier immer noch funktionieren

Diesen Data room habe ich so auch nicht nicht gesehen: http://www.mcdermott-investors.com/data-room/default.aspx

McDermott maintains a password-protected data room containing material financial and other information concerning our business. Shareholders and prospective shareholders can obtain access to the data room upon entering into a confidentiality agreement with McDermott. To request a confidentiality agreement, please contact Maria Lopez at...

Antwort auf Beitrag Nr.: 66.009.266 von faultcode am 10.12.20 01:05:055.1.

McDermott Completes New Capital Raise For $560 Million

http://www.mcdermott-investors.com/news/press-release-detail…

Bolsters Balance Sheet and Provides Financial Flexibility

...

McDermott International, Ltd today announced that on Dec. 31, 2020, it secured $560 million in new capital. As announced on Nov. 18, 2020, the new capital was provided through a series of transactions which was secured through commitments from certain existing lenders and shareholders. McDermott met all conditions necessary to close these transactions and has strengthened its balance sheet and increased its liquidity to provide financial flexibility for continued strong project execution and pursuit of new opportunities.

"With the completion of the capital raise, McDermott has recapitalized its business with the support of its investors," said David Dickson, President and Chief Executive Officer of McDermott. "This additional capital solidifies our liquidity position and allows us to continue delivering superior project execution for our customers and pursue new growth opportunities. We want to thank our investors for the confidence they have in McDermott and its business model and our customers for their continued support."

...

http://www.mcdermott-investors.com/news/press-release-detail…

McDermott Completes New Capital Raise For $560 Million

http://www.mcdermott-investors.com/news/press-release-detail…

Bolsters Balance Sheet and Provides Financial Flexibility

...

McDermott International, Ltd today announced that on Dec. 31, 2020, it secured $560 million in new capital. As announced on Nov. 18, 2020, the new capital was provided through a series of transactions which was secured through commitments from certain existing lenders and shareholders. McDermott met all conditions necessary to close these transactions and has strengthened its balance sheet and increased its liquidity to provide financial flexibility for continued strong project execution and pursuit of new opportunities.

"With the completion of the capital raise, McDermott has recapitalized its business with the support of its investors," said David Dickson, President and Chief Executive Officer of McDermott. "This additional capital solidifies our liquidity position and allows us to continue delivering superior project execution for our customers and pursue new growth opportunities. We want to thank our investors for the confidence they have in McDermott and its business model and our customers for their continued support."

...

http://www.mcdermott-investors.com/news/press-release-detail…

Antwort auf Beitrag Nr.: 62.482.872 von faultcode am 24.01.20 23:18:08Lummus ist wieder da!

20.09.19

8.3.

McDermott Reinforces Technology Focus, Completes Minority Investment in Lummus Technology

https://www.mcdermott-investors.com/news/press-release-detai…

...

McDermott International, Ltd today announced that it has invested in Lummus Technology Holdings I LLC, a holding company of Lummus Technology. Under the terms of the share and asset purchase agreement for the sale of Lummus Technology—entered into with a joint partnership between Haldia Petrochemicals Ltd., a flagship company of The Chatterjee Group, and Rhône Capital (the "Joint Partnership") on January 21, 2020—McDermott was provided the option to purchase a minority common equity ownership interest in the entity purchasing Lummus. McDermott recently exercised its option.

"This agreement not only reinforces our already-robust and active relationship, but also reflects our support of—and belief in—Lummus' long-term strategic plan," said David Dickson, President and CEO of McDermott. "Together, we will continue to combine McDermott's innovative EPC delivery with Lummus' innovative technology solutions to our customers across the globe."

The sale of Lummus was part of McDermott's comprehensive restructuring process, which McDermott successfully completed on June 30, 2020. Since the sale, McDermott and Lummus have continued to work together through their strategic agreement to bring customers technology solutions through the entire plant life cycle.

...

20.09.19

Zitat von faultcode: Lummus Technology ist quasi die Perle bei MDR, der Rest siehe Kursverlauf...

8.3.

McDermott Reinforces Technology Focus, Completes Minority Investment in Lummus Technology

https://www.mcdermott-investors.com/news/press-release-detai…

...

McDermott International, Ltd today announced that it has invested in Lummus Technology Holdings I LLC, a holding company of Lummus Technology. Under the terms of the share and asset purchase agreement for the sale of Lummus Technology—entered into with a joint partnership between Haldia Petrochemicals Ltd., a flagship company of The Chatterjee Group, and Rhône Capital (the "Joint Partnership") on January 21, 2020—McDermott was provided the option to purchase a minority common equity ownership interest in the entity purchasing Lummus. McDermott recently exercised its option.

"This agreement not only reinforces our already-robust and active relationship, but also reflects our support of—and belief in—Lummus' long-term strategic plan," said David Dickson, President and CEO of McDermott. "Together, we will continue to combine McDermott's innovative EPC delivery with Lummus' innovative technology solutions to our customers across the globe."

The sale of Lummus was part of McDermott's comprehensive restructuring process, which McDermott successfully completed on June 30, 2020. Since the sale, McDermott and Lummus have continued to work together through their strategic agreement to bring customers technology solutions through the entire plant life cycle.

...

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +0,51 | |

| +1,26 | |

| -2,33 | |

| +0,82 | |

| -0,11 | |

| +1,01 | |

| +0,50 | |

| +1,74 | |

| -0,57 | |

| -1,90 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 240 | ||

| 98 | ||

| 81 | ||

| 78 | ||

| 75 | ||

| 53 | ||

| 41 | ||

| 38 | ||

| 36 | ||

| 33 |