Goldproduktion in naher Zukunft? (Seite 2)

eröffnet am 21.02.18 17:51:45 von

neuester Beitrag 21.12.22 17:09:59 von

neuester Beitrag 21.12.22 17:09:59 von

Beiträge: 25

ID: 1.274.706

ID: 1.274.706

Aufrufe heute: 0

Gesamt: 3.253

Gesamt: 3.253

Aktive User: 0

ISIN: AU000000KIN8 · WKN: A1J3NB · Symbol: KIN

0,0690

AUD

+2,99 %

+0,0020 AUD

Letzter Kurs 24.04.24 Sydney

Neuigkeiten

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 227,00 | +21,91 | |

| 5,1500 | +21,75 | |

| 29,98 | +18,24 | |

| 16,050 | +17,41 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6850 | -6,80 | |

| 29,70 | -7,19 | |

| 0,8800 | -7,37 | |

| 0,5400 | -8,47 | |

| 46,59 | -98,01 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 65.084.593 von faultcode am 15.09.20 13:37:06

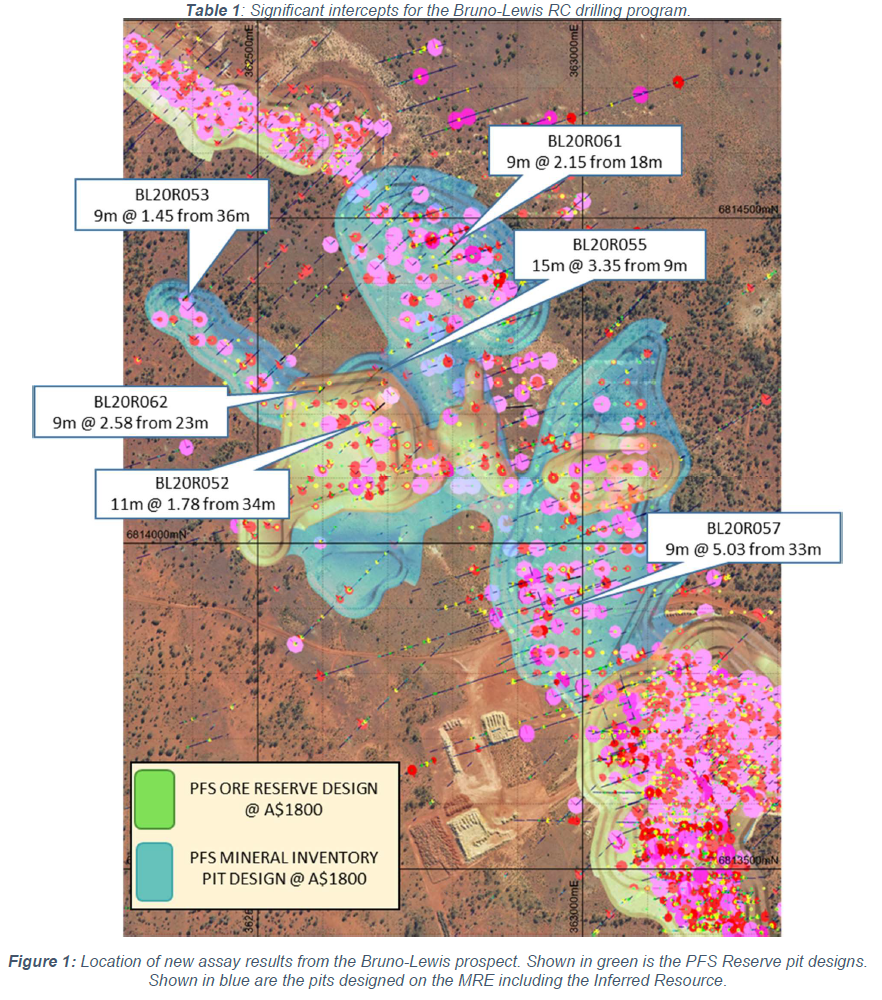

Antwort auf Beitrag Nr.: 64.002.717 von faultcode am 12.06.20 19:59:55da schau her, man findet doch noch mehr Gold (aber eigentlich tut man das ja fast immer  ):

):

...

Tag:

• BRUNO-LEWIS

):

):

...

Tag:

• BRUNO-LEWIS

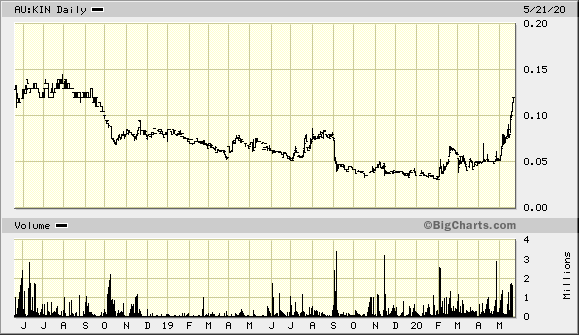

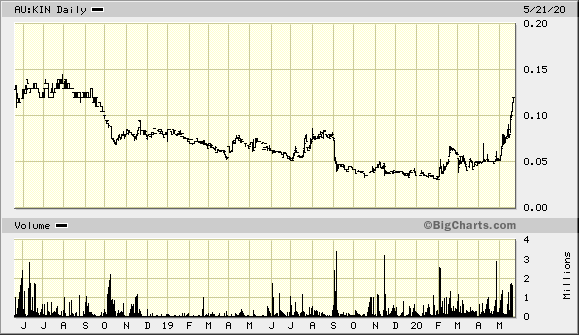

Antwort auf Beitrag Nr.: 63.762.685 von faultcode am 21.05.20 15:00:24in Down Under ist man von dem Teil immer noch ganz angetan - ich ja nicht so:

Mal wieder eine KE, um damit nun endlich den Abbau der Lawlers-Mühle zu finanzieren.

Schreibt man aber so nicht. Erst eine Meldung zum Abbau und dann nur einen Tag später eine Meldung mit KE

Mal wieder eine KE, um damit nun endlich den Abbau der Lawlers-Mühle zu finanzieren.

Schreibt man aber so nicht. Erst eine Meldung zum Abbau und dann nur einen Tag später eine Meldung mit KE

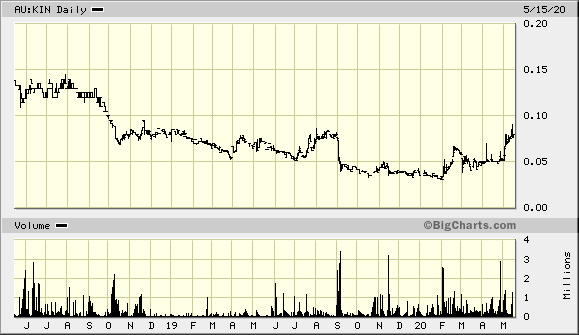

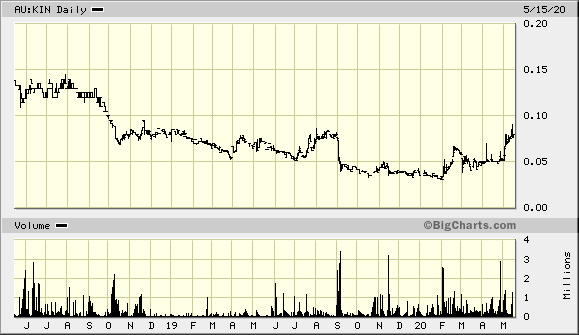

Antwort auf Beitrag Nr.: 63.693.685 von faultcode am 15.05.20 13:26:13neue Präsention: https://www.kinmining.com.au/

=>

Strategic focus has shifted from development (2019 PFS) to exploration targeting new, high-value, higher grade gold discoveries

Air-core and RC drilling in progress – strong upcoming news-flow

Recent drilling has highlighted the potential for a much larger mineralised system at Cardinia.

This is the focus of current and planned exploration.

Allerdings: damit Cash (31 Mar 2020) $2.8M kommt man nicht sehr weit

Meine super-grobe Schätzung für eine RC drilling-Kampagne pro Jahr in WA liegt bei ~A$1.3m. Andere Schätzungen?

=> dazu kommen natürlich noch die Corporate overhead-Kosten

=> also eine KE kommt mMn, aber nicht für die Umsetzung der PFS (das wäre mMn immer noch der pure Wahnsinn), sondern um die weitere Exploration zu finanzieren

=>

Strategic focus has shifted from development (2019 PFS) to exploration targeting new, high-value, higher grade gold discoveries

Air-core and RC drilling in progress – strong upcoming news-flow

Recent drilling has highlighted the potential for a much larger mineralised system at Cardinia.

This is the focus of current and planned exploration.

Allerdings: damit Cash (31 Mar 2020) $2.8M kommt man nicht sehr weit

Meine super-grobe Schätzung für eine RC drilling-Kampagne pro Jahr in WA liegt bei ~A$1.3m. Andere Schätzungen?

=> dazu kommen natürlich noch die Corporate overhead-Kosten

=> also eine KE kommt mMn, aber nicht für die Umsetzung der PFS (das wäre mMn immer noch der pure Wahnsinn), sondern um die weitere Exploration zu finanzieren

1.5.2020

As Harmanis increases his stake, rejuvenated Kin sets out to do a De Grey with de rig

...

https://www.resourcesrisingstars.com.au/news-article/harmani…

Leonora gold explorer/developer Kin Mining is back on the radar after Kerry Harmanis of Jubilee Mines nickel fame took the opportunity presented by Kin’s recent capital raising to increase his stake from 15.2% to 17.1%.

Harmanis is the guy who built Jubilee from a spec stock to the $3.1 billion company that Mick Davis’ Xstrata took over in 2007. To Harmanis’ credit, he has continued to be a supporter of junior explorers ever since.

Kin (ASX:KIN) has been one of those.

It was a high-flyer up until three years ago when a half-baked plan to get its Cardinia gold project in to production fell apart. What was a 40c stock back then got as low as 3c at the start of this year.

Under a new management team there has been a reworking of Cardinia’s mineral resource under a conservative $A2000/oz gold price assumption.

The resource stands at 21mt grading 1.4g/t for 945,000oz which is not bad in itself for a company with a $32m market cap at Thursday’s closing price of 5.2c a share.

Now as its best-forgotten history would suggest, Kin could well consider it makes sense to rush into production to capture the benefits of the near record Aussie gold price.

But what Harmanis and other investors are likely attracted to this time around is Kin’s strategy to step out along the extensive mineralised structures its tenement package cover to make a new game-changing discovery, or at least find higher-grade resource positions to add to the Cardinia story.

It is an appealing strategy, one that has worked to great effect for De Grey Mining (ASX : DEG) in the Pilbara at the behest of Ed Eshuys of Jundee and Bronzewing discovery fame.

Eshuys’ DGO Gold (ASX : DGO), now a 16.5% De Grey shareholder with two board seats, made its first investment in the company back when it was a sub-5c stock and when its main focus was on the development chances of the 1.7Moz resource it had put together at its Mallina project in the Pilbara.

Eshuys was more interested in the potential of De Grey’s 200km strike length of prospective shear zones to host a big new discovery. The exploration focus versus development focus paid off big time, with De Grey unveiling the Hemi discovery earlier this year.

De Grey is now a 35c stock for a market cap of $385m.

Kin is pursuing a similar strategy, which to be fair, it started out on before De Grey got everyone thinking about what can be found in lightly explored areas along strike from a known deposit(s) which, for one reason or another, has hogged the attention at the expensive of potential game-changing exploration.

It was what Kin’s recent $2.64m placement at 4.5c – a then 9.8% premium to the market price – was all about.

Promising results have begun to flow, with Kin recently reporting initial assay results from the Cardinia Hill and Helens East prospects, about 2.5km east of the proposed Cardinia processing plant.

The results confirmed high-grade mineralisation at Cardinia Hill (15m at 4.42g/t from 34m and 17m at 3.29g/t from 10m) and new mineralisation trends between Cardinia Hill and Helens East which historical workings and drilling had previously missed.

Kin managing director Andrew Munckton said the results were some of the best seen to date as “part of our strategy to unlock the broader exploration potential of the Cardinia gold project, highlighting the opportunity to make substantial new gold discoveries outside of the existing mineral resources”.

...

As Harmanis increases his stake, rejuvenated Kin sets out to do a De Grey with de rig

...

https://www.resourcesrisingstars.com.au/news-article/harmani…

Leonora gold explorer/developer Kin Mining is back on the radar after Kerry Harmanis of Jubilee Mines nickel fame took the opportunity presented by Kin’s recent capital raising to increase his stake from 15.2% to 17.1%.

Harmanis is the guy who built Jubilee from a spec stock to the $3.1 billion company that Mick Davis’ Xstrata took over in 2007. To Harmanis’ credit, he has continued to be a supporter of junior explorers ever since.

Kin (ASX:KIN) has been one of those.

It was a high-flyer up until three years ago when a half-baked plan to get its Cardinia gold project in to production fell apart. What was a 40c stock back then got as low as 3c at the start of this year.

Under a new management team there has been a reworking of Cardinia’s mineral resource under a conservative $A2000/oz gold price assumption.

The resource stands at 21mt grading 1.4g/t for 945,000oz which is not bad in itself for a company with a $32m market cap at Thursday’s closing price of 5.2c a share.

Now as its best-forgotten history would suggest, Kin could well consider it makes sense to rush into production to capture the benefits of the near record Aussie gold price.

But what Harmanis and other investors are likely attracted to this time around is Kin’s strategy to step out along the extensive mineralised structures its tenement package cover to make a new game-changing discovery, or at least find higher-grade resource positions to add to the Cardinia story.

It is an appealing strategy, one that has worked to great effect for De Grey Mining (ASX : DEG) in the Pilbara at the behest of Ed Eshuys of Jundee and Bronzewing discovery fame.

Eshuys’ DGO Gold (ASX : DGO), now a 16.5% De Grey shareholder with two board seats, made its first investment in the company back when it was a sub-5c stock and when its main focus was on the development chances of the 1.7Moz resource it had put together at its Mallina project in the Pilbara.

Eshuys was more interested in the potential of De Grey’s 200km strike length of prospective shear zones to host a big new discovery. The exploration focus versus development focus paid off big time, with De Grey unveiling the Hemi discovery earlier this year.

De Grey is now a 35c stock for a market cap of $385m.

Kin is pursuing a similar strategy, which to be fair, it started out on before De Grey got everyone thinking about what can be found in lightly explored areas along strike from a known deposit(s) which, for one reason or another, has hogged the attention at the expensive of potential game-changing exploration.

It was what Kin’s recent $2.64m placement at 4.5c – a then 9.8% premium to the market price – was all about.

Promising results have begun to flow, with Kin recently reporting initial assay results from the Cardinia Hill and Helens East prospects, about 2.5km east of the proposed Cardinia processing plant.

The results confirmed high-grade mineralisation at Cardinia Hill (15m at 4.42g/t from 34m and 17m at 3.29g/t from 10m) and new mineralisation trends between Cardinia Hill and Helens East which historical workings and drilling had previously missed.

Kin managing director Andrew Munckton said the results were some of the best seen to date as “part of our strategy to unlock the broader exploration potential of the Cardinia gold project, highlighting the opportunity to make substantial new gold discoveries outside of the existing mineral resources”.

...

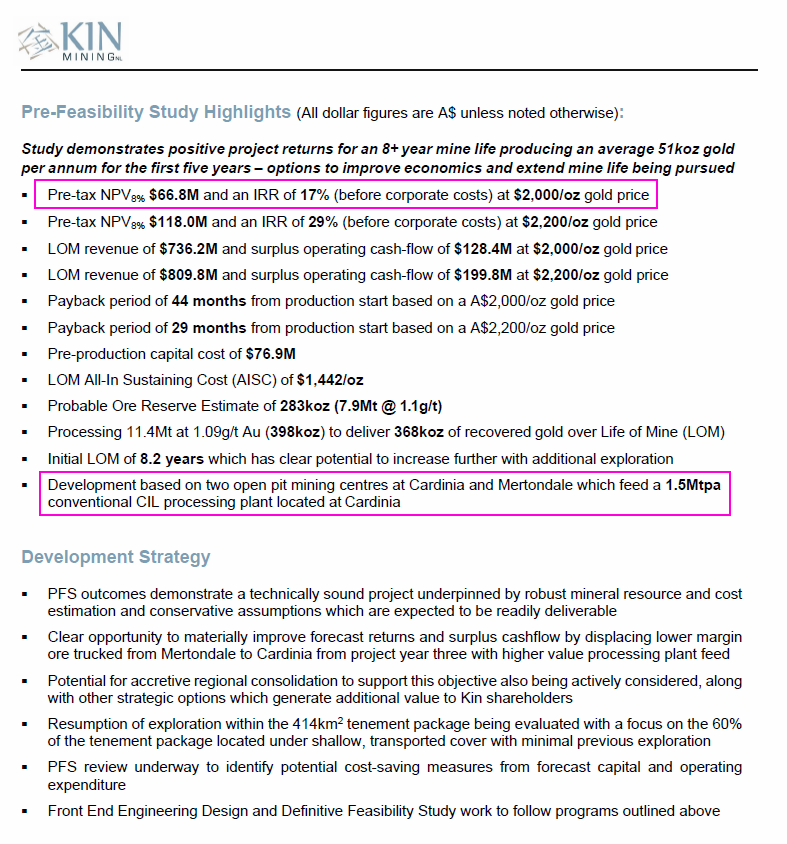

Antwort auf Beitrag Nr.: 61.432.067 von faultcode am 07.09.19 00:08:33..und wie der Titel sagt: das ist erst (wieder) eine PFS

--> also will man wohl auf der jetzigen Grundlage (wieder) Geld haben, um eine DFS anfertigen zu können, und auch neu nachdenken

=> bei aller Kritik, muss man der Unternehmensverwaltung mMn zugute halten, nicht auf Grund der alten DFS in die Vollen gegangen zu sein, und am Ende wirklich vor'm Bankrott zu stehen!

--> wäre nicht der erste Produzent in Australien, der bei klar steigenden Goldpreisen diesen Weg gegangen ist

--> also will man wohl auf der jetzigen Grundlage (wieder) Geld haben, um eine DFS anfertigen zu können, und auch neu nachdenken

=> bei aller Kritik, muss man der Unternehmensverwaltung mMn zugute halten, nicht auf Grund der alten DFS in die Vollen gegangen zu sein, und am Ende wirklich vor'm Bankrott zu stehen!

--> wäre nicht der erste Produzent in Australien, der bei klar steigenden Goldpreisen diesen Weg gegangen ist

Antwort auf Beitrag Nr.: 61.432.007 von faultcode am 06.09.19 23:40:38

-->

a/ seinerzeit (DFS2017) war noch von einer 800ktpa Plant (in Cardinia) die Rede, nun sind's schon fast das doppelte

b/ da wundern mich die lausigen 17% IRR (before corporate costs) bei einem ini.CAPEX von AUD77m (alle $ sind AUD) nicht

c/ hypersaline water --> ist mir neu in Raeside; sind zwar nur 87k (total Resources), aber die sind mMn auch "weg"

--> ist mir neu in Raeside; sind zwar nur 87k (total Resources), aber die sind mMn auch "weg"

--> JORC 2012 Resource (Raeside): 134k oz Au

PFS2019 (2)

-->

a/ seinerzeit (DFS2017) war noch von einer 800ktpa Plant (in Cardinia) die Rede, nun sind's schon fast das doppelte

b/ da wundern mich die lausigen 17% IRR (before corporate costs) bei einem ini.CAPEX von AUD77m (alle $ sind AUD) nicht

c/ hypersaline water

--> ist mir neu in Raeside; sind zwar nur 87k (total Resources), aber die sind mMn auch "weg"

--> ist mir neu in Raeside; sind zwar nur 87k (total Resources), aber die sind mMn auch "weg"--> JORC 2012 Resource (Raeside): 134k oz Au

Antwort auf Beitrag Nr.: 59.549.551 von faultcode am 03.01.19 12:46:32

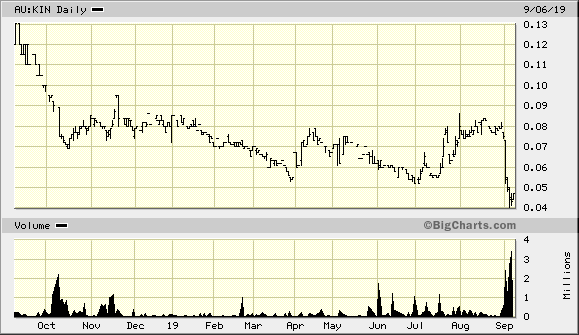

--> schlechtes Zeichen: dem Markt gefällt die PFS2019 überhaupt nicht:

PFS2019 (1)

gutes oder schlechtes Zeichen?--> schlechtes Zeichen: dem Markt gefällt die PFS2019 überhaupt nicht:

Sprott Credit Facility Update

noch vom 24.12.2018 ne Meldung - wie sinnig

Kin modifies agreement with Sprott and completes repayment

-- Kin has completed repayment of the outstanding balance on the Credit Facility

-- Credit Facility remains in place as a potential source of future funding

-- Sprott remains keen to partner with Kin in the Leonora Gold Project

-- Security and Mortgage over LGP tenements reduced

Kin Mining NL (ASX: KIN) is pleased to advise that it has repaid all but US$1 of the senior secured credit facility (Credit Facility) with Sprott Private Resource Lending (Collector) LP (Sprott).

The Credit Facility was formalised on 23 December 2017 with the first drawdown of US$5M occurring on 27 December 2017. Kin repaid US$2M in August 2018 and a further US$1.3M in November 2018. The final repayment of US$1.7M (minus US$1) has now been made.

Repaying the Facility in tranches allowed the Company to utilise its cash in the most effective manner to progress additional drilling and metallurgical work programs at the Helens and Lewis Deposits, undertake the Water Exploration and production bore drilling programs at Bummer Creek and Cardinia Creek and advance the project approvals all required to contribute to the Board’s confidence to restart the construction phase of the Leonora Gold Project (LGP).

Sprott has expressed a desire to remain involved in the LGP and has agreed to leave the Credit Facility structure in place while Kin completes its LGP work programs.

Progress on those programs is ongoing with management confident of satisfactory resolutions to the items being investigated or reviewed.

Importantly, following this payment, all Credit Facility covenants and the majority of secured positions have been removed. The general security and covenants will be reinstated in the event that Kin seeks to recommence drawdowns on the Credit Facility (subject to further due diligence by Sprott).

The royalty of 1.5% NSR on the first 100,000oz of gold produced from the LGP remains in place and is secured by mortgages over a reduced set of tenements associated with the LGP and a general featherweight security....

=> ASX:

=> praktisch kein Volumen mehr

--> gutes oder schlechtes Zeichen?

--> gutes oder schlechtes Zeichen?