Goldproduktion in naher Zukunft? (Seite 3)

eröffnet am 21.02.18 17:51:45 von

neuester Beitrag 21.12.22 17:09:59 von

neuester Beitrag 21.12.22 17:09:59 von

Beiträge: 25

ID: 1.274.706

ID: 1.274.706

Aufrufe heute: 0

Gesamt: 3.253

Gesamt: 3.253

Aktive User: 0

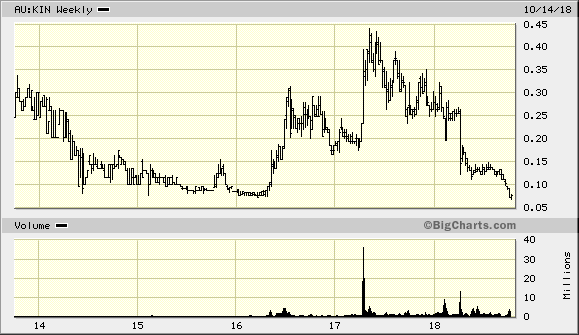

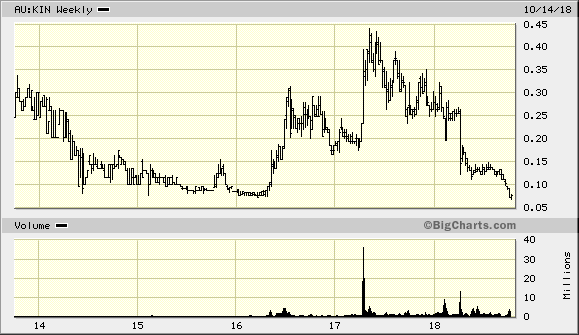

ISIN: AU000000KIN8 · WKN: A1J3NB · Symbol: KIN

0,0610

AUD

+1,67 %

+0,0010 AUD

Letzter Kurs 09.05.24 Sydney

Neuigkeiten

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0000 | +809,09 | |

| 8,0000 | +45,45 | |

| 11,000 | +19,57 | |

| 1,2000 | +18,05 | |

| 1,6640 | +16,04 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 324,70 | -10,30 | |

| 9,8500 | -10,54 | |

| 12,070 | -18,99 | |

| 0,6166 | -19,12 | |

| 0,6601 | -26,22 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 59.019.610 von faultcode am 22.10.18 13:14:27

Antwort auf Beitrag Nr.: 57.984.846 von faultcode am 14.06.18 12:44:20

--> neuer Managing Director Andrew Munckton

--> die bisherige Planung war stark lückenhaft und damit viel zu optimistisch

=> alles was nicht ausgeplant ist, ist bei den hohen Kosten heutzutage in WA ein grosses Problem und Risiko

--> interessant zu lesen der Brief vom Chairman Jeremy Kirkwood zur derzeitigen Situation:

12 October 2018

Dear Kin Mining shareholder

On behalf of the Board of Directors of Kin Mining NL (ASX:KIN), I am pleased to present to you the

accompanying offer document in relation to a non‐renounceable rights issue to raise up to A$10.4 million (before costs). I ask that you consider this document carefully and in its entirety.

In summary, Kin shareholders are being offered the opportunity to subscribe for 2 new ordinary Kin shares for every 5 Kin shares held at the record date of 17 October 2018.

The new shares are being offered at a price of $0.08, representing an 11% discount to the last traded price of Kin shares and a 17% discount to the 10‐day Volume Weighted Average Price before the announcement of the rights issue on 9 October 2018.

Pleasingly, the Company has received confirmation from its three major shareholders that they intend to fully participate in the offer. Collectively these shareholders hold 21% of Kin’s total shares on issue.

The capital raising will underpin our continued work programs at our Leonora Gold Project (LGP) in Western Australia which has been reset on a lower risk path to a development decision in 2019.

Shareholders should be aware that the Kin Board took the difficult decision to suspend construction of the LGP in May this year following confirmation the capital costs of the Cardinia Processing Plant would substantially exceed budgeted estimates. This avoided an immediate, significant capital raising at the time which, in any event, may not have been sufficient to complete the LGP as it was planned.

The Kin Board were not prepared to risk shareholder value through proceeding with the LGP in the face of such construction cost and funding uncertainty.

In addition, a review led by our new Managing Director Andrew Munckton identified a number of

opportunities to enhance the long‐term returns from the project. It also highlighted aspects of the project with sufficient uncertainty that they created an unacceptable risk for shareholders had we proceeded with the development in its then form.

These areas include:

1) Mining approvals not currently being in place.

2) An insufficient long‐term water supply to the processing plant.

3) The selection of diesel fuel for power supply (and its price escalation risk) to the exclusion of gas fuelled power.

4) Uncertainty around the Tailings Storage Facility.

5) A lack of confidence in the robustness of the capital and operating cost estimates included in the LGP Definitive Feasibility Study.

Furthermore, we were not in a position to quantify the potential upside of the mine plan being focussed solely on near surface oxide ores as the depth potential of the known deposits had not been tested by drilling. We see this as a key potential value driver in the period ahead.

As we have previously advised shareholders, your Board believes there are no fatal flaws with the project and all of the potential risks identified are capable of being significantly reduced or overcome through a diligent forward work program.

In the five months since the suspension of the LGP development, the Kin Management team has been focused on capturing the project enhancement opportunities and de‐risking the project.

Our clear objective is to deliver the LGP to a far lower risk development decision point in the second half of 2019 to support our objective of being at the forefront of the next wave of profitable Australian gold producers.

The pressure this pathway has created on the Kin share price in the short‐term is as disappointing to your Board as we know it is to our shareholders. But we remain resolute in our belief that greater and more certain long‐term value for Kin shareholders will be created by de‐risking the project through completion of more work on the water, power and tailings

infrastructure, securing key mining and infrastructure approvals, testing the LGP’s known orebodies at depth and advancing our regional exploration targets.

The LGP has a substantial gold endowment of more than 1 million ounces and is located in a strategic gold mining province. The Company has a firm belief this inventory will be increased with more drilling and this will be a key use of proceeds from the entitlement offer. Funds will also be directed towards the full repayment of the Sprott Facility which will leave the business debt free and in a stronger financial position to deliver on our current strategy.

Your Board believes the LGP holds significant value that is not being reflected in the current share price. We are asking shareholders for their support in delivering an enhanced and de‐risked LGP to a development decision in 2019.

I intend to take up my entitlement in full. On behalf of the Company I thank you for your continued support.

Yours sincerely

Jeremy Kirkwood,

Chairman

für längere Zeit tot hier --> 2019H2

..und nun die nächste KE --> über 100m neue Aktien--> neuer Managing Director Andrew Munckton

--> die bisherige Planung war stark lückenhaft und damit viel zu optimistisch

=> alles was nicht ausgeplant ist, ist bei den hohen Kosten heutzutage in WA ein grosses Problem und Risiko

--> interessant zu lesen der Brief vom Chairman Jeremy Kirkwood zur derzeitigen Situation:

12 October 2018

Dear Kin Mining shareholder

On behalf of the Board of Directors of Kin Mining NL (ASX:KIN), I am pleased to present to you the

accompanying offer document in relation to a non‐renounceable rights issue to raise up to A$10.4 million (before costs). I ask that you consider this document carefully and in its entirety.

In summary, Kin shareholders are being offered the opportunity to subscribe for 2 new ordinary Kin shares for every 5 Kin shares held at the record date of 17 October 2018.

The new shares are being offered at a price of $0.08, representing an 11% discount to the last traded price of Kin shares and a 17% discount to the 10‐day Volume Weighted Average Price before the announcement of the rights issue on 9 October 2018.

Pleasingly, the Company has received confirmation from its three major shareholders that they intend to fully participate in the offer. Collectively these shareholders hold 21% of Kin’s total shares on issue.

The capital raising will underpin our continued work programs at our Leonora Gold Project (LGP) in Western Australia which has been reset on a lower risk path to a development decision in 2019.

Shareholders should be aware that the Kin Board took the difficult decision to suspend construction of the LGP in May this year following confirmation the capital costs of the Cardinia Processing Plant would substantially exceed budgeted estimates. This avoided an immediate, significant capital raising at the time which, in any event, may not have been sufficient to complete the LGP as it was planned.

The Kin Board were not prepared to risk shareholder value through proceeding with the LGP in the face of such construction cost and funding uncertainty.

In addition, a review led by our new Managing Director Andrew Munckton identified a number of

opportunities to enhance the long‐term returns from the project. It also highlighted aspects of the project with sufficient uncertainty that they created an unacceptable risk for shareholders had we proceeded with the development in its then form.

These areas include:

1) Mining approvals not currently being in place.

2) An insufficient long‐term water supply to the processing plant.

3) The selection of diesel fuel for power supply (and its price escalation risk) to the exclusion of gas fuelled power.

4) Uncertainty around the Tailings Storage Facility.

5) A lack of confidence in the robustness of the capital and operating cost estimates included in the LGP Definitive Feasibility Study.

Furthermore, we were not in a position to quantify the potential upside of the mine plan being focussed solely on near surface oxide ores as the depth potential of the known deposits had not been tested by drilling. We see this as a key potential value driver in the period ahead.

As we have previously advised shareholders, your Board believes there are no fatal flaws with the project and all of the potential risks identified are capable of being significantly reduced or overcome through a diligent forward work program.

In the five months since the suspension of the LGP development, the Kin Management team has been focused on capturing the project enhancement opportunities and de‐risking the project.

Our clear objective is to deliver the LGP to a far lower risk development decision point in the second half of 2019 to support our objective of being at the forefront of the next wave of profitable Australian gold producers.

The pressure this pathway has created on the Kin share price in the short‐term is as disappointing to your Board as we know it is to our shareholders. But we remain resolute in our belief that greater and more certain long‐term value for Kin shareholders will be created by de‐risking the project through completion of more work on the water, power and tailings

infrastructure, securing key mining and infrastructure approvals, testing the LGP’s known orebodies at depth and advancing our regional exploration targets.

The LGP has a substantial gold endowment of more than 1 million ounces and is located in a strategic gold mining province. The Company has a firm belief this inventory will be increased with more drilling and this will be a key use of proceeds from the entitlement offer. Funds will also be directed towards the full repayment of the Sprott Facility which will leave the business debt free and in a stronger financial position to deliver on our current strategy.

Your Board believes the LGP holds significant value that is not being reflected in the current share price. We are asking shareholders for their support in delivering an enhanced and de‐risked LGP to a development decision in 2019.

I intend to take up my entitlement in full. On behalf of the Company I thank you for your continued support.

Yours sincerely

Jeremy Kirkwood,

Chairman

Antwort auf Beitrag Nr.: 57.541.563 von faultcode am 14.04.18 01:45:39

Begründung:

Dear Shareholder

As announced on 30 May 2018, the Company is undertaking a fully underwritten nonrenounceable rights issue on the basis of one New Share for every three Existing Shares held at an issue price of $0.11 per New Share to raise approximately $8,930,091 before issue costs.

This Offer Document outlines the details of the Offer.

The rights issue is expected to result in the issue of approximately 81,182,644 New Shares in the Company.

The proceeds from the Offer are planned to be used for exploration activities, to repay the Sprott Credit Facility if required (or desired) and if not so determined additional exploration activities, expenses of the Offer and for general working capital purposes.

This will allow the Company to ‘reset’ after the Board’s decision to cease construction of the Leonora Gold Project pending a full review of its costs and design. Together with the ongoing exploration and resource definition, which this Offer helps fund, the review of the Leonora Gold Project will position the Company to recommence construction with a more robust and optimized project.

If you have any queries regarding your entitlement or participation in the upcoming rights issue, please do not hesitate to contact your stockbroker or financial advisor. I commend this rights issue to you and look forward to your continued support as a Shareholder.

Jeremy Kirkwood

Chairman

Capital raise (KE)

werd ich zeichnen, und wenn möglich überbeziehen.Begründung:

Dear Shareholder

As announced on 30 May 2018, the Company is undertaking a fully underwritten nonrenounceable rights issue on the basis of one New Share for every three Existing Shares held at an issue price of $0.11 per New Share to raise approximately $8,930,091 before issue costs.

This Offer Document outlines the details of the Offer.

The rights issue is expected to result in the issue of approximately 81,182,644 New Shares in the Company.

The proceeds from the Offer are planned to be used for exploration activities, to repay the Sprott Credit Facility if required (or desired) and if not so determined additional exploration activities, expenses of the Offer and for general working capital purposes.

This will allow the Company to ‘reset’ after the Board’s decision to cease construction of the Leonora Gold Project pending a full review of its costs and design. Together with the ongoing exploration and resource definition, which this Offer helps fund, the review of the Leonora Gold Project will position the Company to recommence construction with a more robust and optimized project.

If you have any queries regarding your entitlement or participation in the upcoming rights issue, please do not hesitate to contact your stockbroker or financial advisor. I commend this rights issue to you and look forward to your continued support as a Shareholder.

Jeremy Kirkwood

Chairman

besser so, als sich wie so viele ins Aus zu projektieren...

Oh ein Thread - das ist nett

=> hielt sich soweit wacker -- bis zum Trading Halt am 9.4. wg. einem Leonora Gold Project Update: http://www.kinmining.com.au/wp-content/uploads/2013/10/Leono…

=> Projekt kommt so nicht!! --> Kosten unterschätzt in der DFS! --> neue Kapitalerhöhung (AUD11m)

The Board of Directors (Board) of Kin Mining NL (Kin or Company) has taken the decision to curtail construction works on the Leonora Gold Project (LGP), pending a full review of the capital cost and schedule for completion.

This decision has been necessitated by an expected increase in the existing pre-production capital cost estimate for the LGP.

The existing estimate of A$35.4 million was detailed in the Definitive Feasibility Study (DFS) on the LGP completed in October 2017 (see Kin ASX release dated 2 October 2017). Following the recent changes to the composition of Kin's Board, a review process of key aspects of the LGP was commenced pursuant to which it has become apparent that the DFS estimate of pre-production capital costs will need to be adjusted.

If the Company had continued with the development of the LGP the potential scope of increase in capital costs would have given rise to the requirement for a significant equity capital raising to fund the increase, along with expected exploration and corporate costs, during the construction period for the LGP.

The Board wishes to undertake a comprehensive review of the LGP to ensure that, before full project development is resumed, it has a high degree of confidence in key project parameters, cost and time estimates, and a clear and certain funding path in place to complete the LGP.

Accordingly, the Company has engaged Como Engineers as its external and principal consultant to undertake an independent and thorough review of the LGP. Como is to be tasked with generating new cost and time to complete estimates, along with a rigorous implementation plan for the LGP.

The Board will seek to provide shareholders with an update on the progress of this review in the coming weeks.

The Board considers that this course of action is necessary to ensure that a significant equity capital raising is not conducted at a time when the Board cannot be confident of the projected capital cost and schedule to complete the LGP. The Board therefore believes that the interests of all Kin shareholders are best served by the curtailment of construction activities until a comprehensive review of LGP costs and timing can be finalised.

The Board remains confident that the LGP holds significant value. With a delineated resource base of over 1 Moz gold, located within the highly endowed and operationally active Leonora gold region, the LGP possesses considerable economic and strategic value. This course of action is designed to ensure that, when LGP development is fully resumed, shareholder value will be far greater than if the Company had continued down the path it had been pursuing.....

In the interim the Company will continue its targeted exploration programme on the LGP and surrounding areas.

It also plans to complete its search for, and appointment of, a new Managing Director. One of the key tasks of the incoming Managing Director will be close oversight of the review and targeted resumption of full development of the LGP.

Sprott Resource Lending LLC (Sprott), the existing debt provider for the LGP, has been advised of the decision to curtail works on the LGP. Kin is in discussions with Sprott to determine the most effective way forward. The Company has only drawn US$5 million under the Sprott facility and has the option to repay this amount at any time, for an accompanying fee.

In the near term the Company will be seeking to raise approximately A$11 million of new funding.

Together with its existing cash balance of approximately A$7.7 million (as at 9 April 2018), this is expected to enable Kin to fund its current liabilities (including potential repayment, if necessary, of the drawn amount under the Sprott facility), curtailed construction works, review costs, exploration programme and corporate overheads for the next 6 months.

Shareholders will be informed of how this new funding will be sought once these details have been finalised. The Board assures all Kin shareholders that it will seek to structure any proposed equity component of this planned funding in a manner that is as fair and minimally dilutive as possible.

Cash expenditure on LGP development totalled A$5.9 million to 9 April 2018. Further committed expenditure on LGP development are estimated to be A$3.1 million as at 9 April 2018. These committed items include work on CIL tank construction, concrete foundations and bridging steel work that has been running ahead of schedule. Costs related to the decision to enact, and period of, curtailment are being determined...

Hallo wollte einmal kurz diese Minefirma vorstellen weil dort wohl bald die Produktion starten kann was haltet ihr von der Firma?

Presentation

https://www.kinmining.com.au/wp-content/uploads/2013/10/MD-P…

http://www.mining-journal.com/resourcestocks-company-profile…

Presentation

https://www.kinmining.com.au/wp-content/uploads/2013/10/MD-P…

http://www.mining-journal.com/resourcestocks-company-profile…