Newell Brands Announces Agreement with Carl C. Icahn (Seite 5) | Diskussion im Forum

eröffnet am 19.03.18 21:27:49 von

neuester Beitrag 23.04.24 03:15:45 von

neuester Beitrag 23.04.24 03:15:45 von

Beiträge: 64

ID: 1.276.646

ID: 1.276.646

Aufrufe heute: 0

Gesamt: 4.295

Gesamt: 4.295

Aktive User: 0

ISIN: US6512291062 · WKN: 860036

7,3900

EUR

+2,35 %

+0,1700 EUR

Letzter Kurs 22:59:50 Lang & Schwarz

Neuigkeiten

26.04.24 · wO Chartvergleich |

26.04.24 · Business Wire (engl.) |

12.04.24 · Business Wire (engl.) |

22.02.24 · Business Wire (engl.) |

Werte aus der Branche Konsum

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,5800 | +32,77 | |

| 1,3500 | +15,38 | |

| 2,2700 | +14,07 | |

| 4,0900 | +13,61 | |

| 5,8000 | +13,17 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,4000 | -9,68 | |

| 11,950 | -11,02 | |

| 8,6331 | -25,38 | |

| 6,1400 | -27,34 | |

| 2,2600 | -28,71 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 59.882.713 von faultcode am 15.02.19 12:57:35

=>

Newell Brands announced Thursday that President and CEO Michael Polk will retire at the end of the second quarter.

As Newell approaches the end of its "accelerated transformation plan," it and Polk agreed that it "is the right time for a management transition." The company, which owns consumer brands like Rubbermaid, said it has begun to look for Polk's successor and has retained executive search firm Heidrick & Struggles.

"I am proud of the progress we have made since 2011 transforming the portfolio and building a set of competitively advantaged capabilities in innovation, design and eCommerce," Polk said in a statement.

Polk has served as CEO and president since 2011. He has also been a member of Newell's board since 2009.

Patrick Campbell, non-executive independent chairman of Newell's board, said in a statement that Polk was a key figure behind the company's strategy as it sought global growth and diversification...

Newell Brands CEO Michael Polk to retire at end of second quarter

https://www.cnbc.com/amp/2019/03/14/newell-brands-ceo-michae…=>

Newell Brands announced Thursday that President and CEO Michael Polk will retire at the end of the second quarter.

As Newell approaches the end of its "accelerated transformation plan," it and Polk agreed that it "is the right time for a management transition." The company, which owns consumer brands like Rubbermaid, said it has begun to look for Polk's successor and has retained executive search firm Heidrick & Struggles.

"I am proud of the progress we have made since 2011 transforming the portfolio and building a set of competitively advantaged capabilities in innovation, design and eCommerce," Polk said in a statement.

Polk has served as CEO and president since 2011. He has also been a member of Newell's board since 2009.

Patrick Campbell, non-executive independent chairman of Newell's board, said in a statement that Polk was a key figure behind the company's strategy as it sought global growth and diversification...

premarket -8%

wg.:

-- Newell Brands sees 2019 revenue $8.2 bln-$8.4 bln; FactSet consensus $8.79 bln

-- Newell Brands sees 2019 adj. EPS $1.50-$1.65; FactSet consensus $1.91

--> https://ir.newellbrands.com/static-files/3e9baa9e-4199-4b08-…

=>

Fourth Quarter 2018 Executive Summary

- Net sales from continuing operations were $2.3 billion, a decline of 6.0 percent compared with $2.5 billion in the prior year period, reflecting headwinds from the adoption of the new 2018 revenue recognition standard, unfavorable foreign exchange and a decline in core sales.

- Core sales from continuing operations declined 1.2 percent from the prior year period. All segments posted improved core sales trends on a sequential basis, with the Learning & Development segment returning to growth. Three of four regions posted improved core sales growth trends on a sequential basis.

- Reported operating margin was 0.8 percent compared with 5.7 percent in the prior year period. Normalized operating margin was 11.4 percent compared to 10.7 percent in the prior year period.

- Reported diluted earnings per share for the total company were $0.46 compared with $3.38 in the prior year period. Reported diluted earnings per share from continuing operations were $0.36 versus $3.07 in the prior year period.

- Normalized diluted earnings per share for the total company were $0.71, compared with $0.68 in the prior year period. Normalized diluted earnings per share from continuing operations were $0.47, compared with $0.28 in the prior year period.

- Operating cash flow was $498 million compared with $990 million in the prior year period, with the difference attributable to the absence of the operating cash flow contribution from divested businesses, increased cash taxes and transaction-related costs, and a change in the timing of vendor payments relative to the prior year.

- Announced and completed divestitures of two businesses, Pure Fishing and Jostens, for combined after-tax proceeds of $2.5 billion.

- Deployed $2.6 billion to debt repayment, $102 million to dividends and $996 million to share repurchases.

wg.:

-- Newell Brands sees 2019 revenue $8.2 bln-$8.4 bln; FactSet consensus $8.79 bln

-- Newell Brands sees 2019 adj. EPS $1.50-$1.65; FactSet consensus $1.91

--> https://ir.newellbrands.com/static-files/3e9baa9e-4199-4b08-…

=>

Fourth Quarter 2018 Executive Summary

- Net sales from continuing operations were $2.3 billion, a decline of 6.0 percent compared with $2.5 billion in the prior year period, reflecting headwinds from the adoption of the new 2018 revenue recognition standard, unfavorable foreign exchange and a decline in core sales.

- Core sales from continuing operations declined 1.2 percent from the prior year period. All segments posted improved core sales trends on a sequential basis, with the Learning & Development segment returning to growth. Three of four regions posted improved core sales growth trends on a sequential basis.

- Reported operating margin was 0.8 percent compared with 5.7 percent in the prior year period. Normalized operating margin was 11.4 percent compared to 10.7 percent in the prior year period.

- Reported diluted earnings per share for the total company were $0.46 compared with $3.38 in the prior year period. Reported diluted earnings per share from continuing operations were $0.36 versus $3.07 in the prior year period.

- Normalized diluted earnings per share for the total company were $0.71, compared with $0.68 in the prior year period. Normalized diluted earnings per share from continuing operations were $0.47, compared with $0.28 in the prior year period.

- Operating cash flow was $498 million compared with $990 million in the prior year period, with the difference attributable to the absence of the operating cash flow contribution from divested businesses, increased cash taxes and transaction-related costs, and a change in the timing of vendor payments relative to the prior year.

- Announced and completed divestitures of two businesses, Pure Fishing and Jostens, for combined after-tax proceeds of $2.5 billion.

- Deployed $2.6 billion to debt repayment, $102 million to dividends and $996 million to share repurchases.

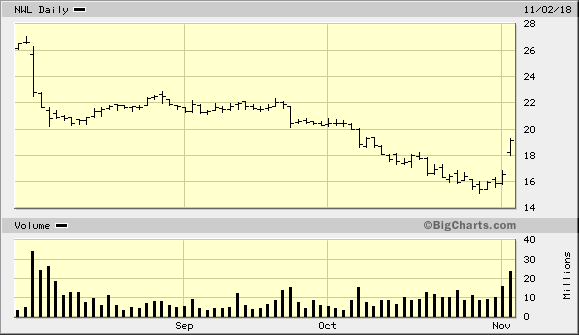

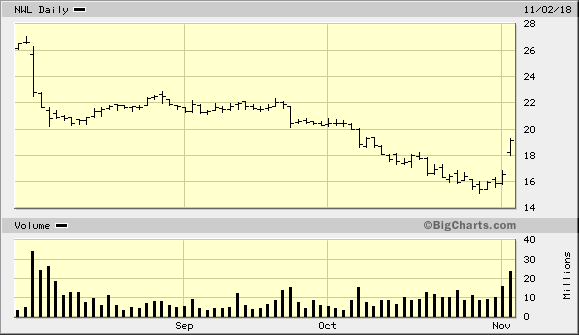

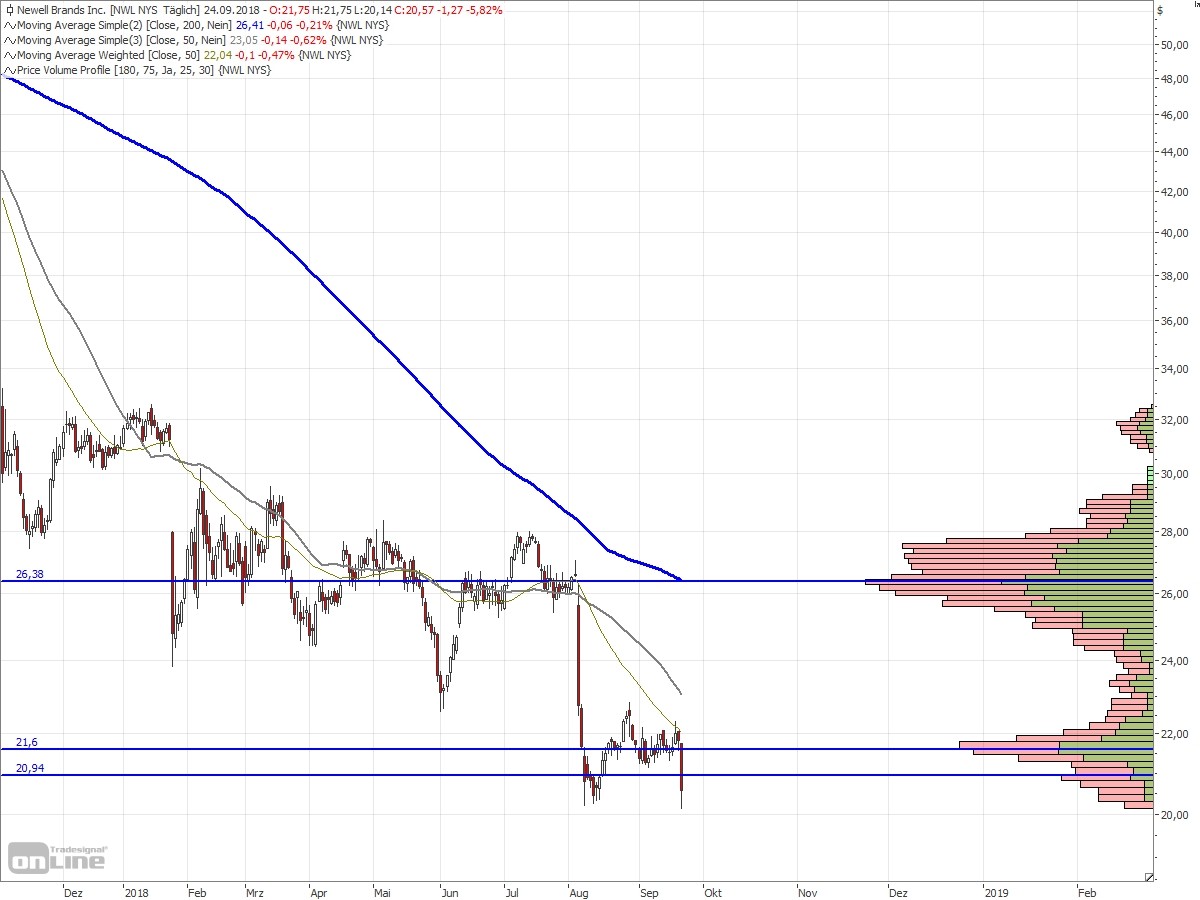

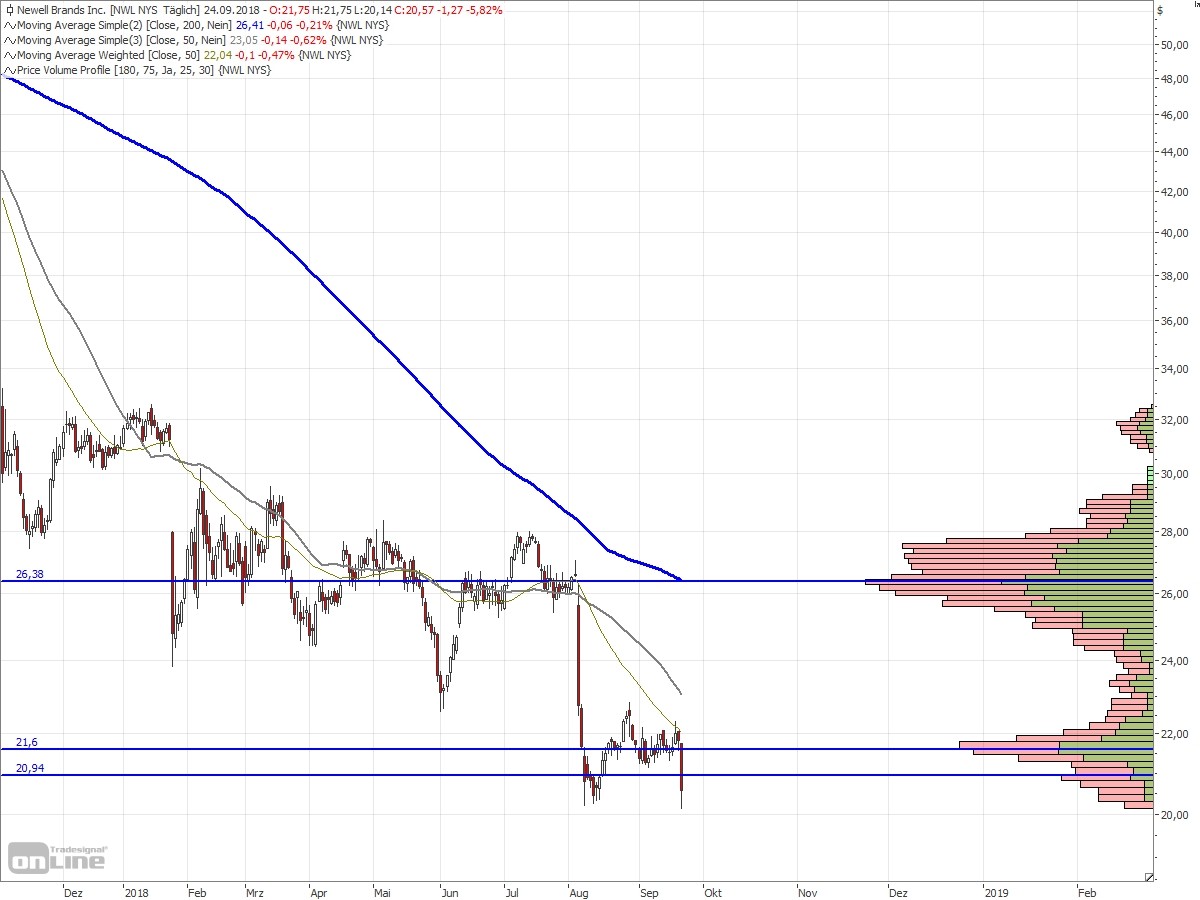

Antwort auf Beitrag Nr.: 58.786.718 von faultcode am 24.09.18 21:28:30die USD20.4 wieder zügig zurückerobert:

=> ich habe den Eindruck, daß die ~USD16 hier Geschichte sind

=> ich habe den Eindruck, daß die ~USD16 hier Geschichte sind

Antwort auf Beitrag Nr.: 58.786.718 von faultcode am 24.09.18 21:28:30reicht noch nicht ganz bis zum (großen) Widerstand bei (nun) ~USD21.5 -- aber das Lebenszeichen ist gut --> warten auf Anschlusskäufe:

das könnte der turn around sein

https://seekingalpha.com/news/3404636-newell-brands-plus-11-…

https://seekingalpha.com/news/3404636-newell-brands-plus-11-…

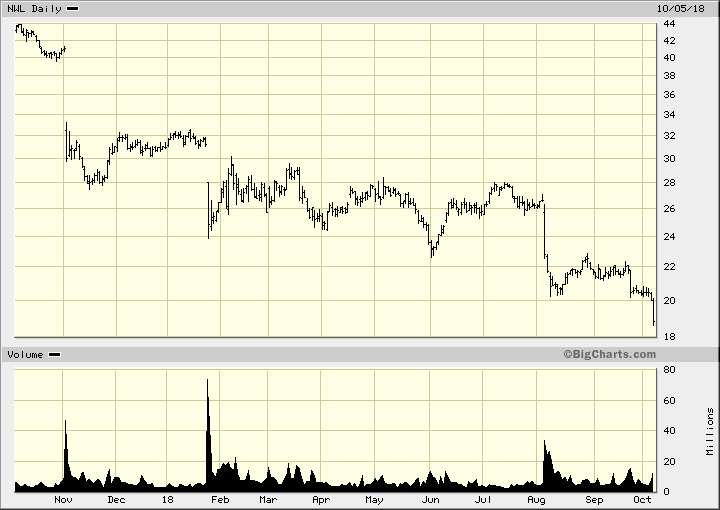

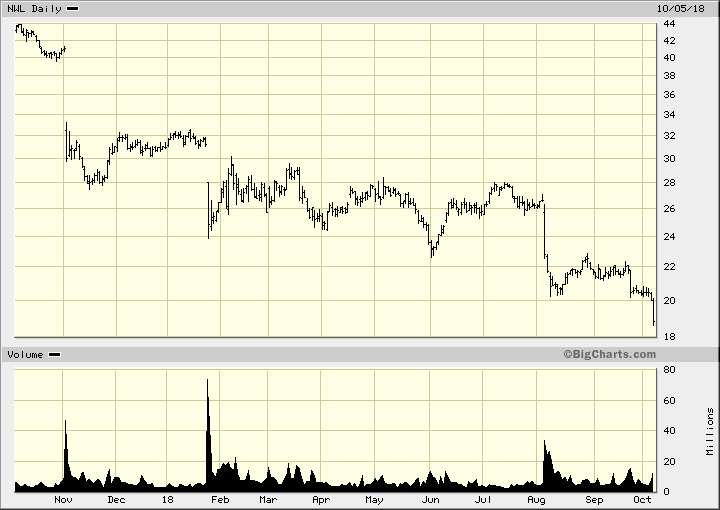

Antwort auf Beitrag Nr.: 58.786.718 von faultcode am 24.09.18 21:28:30=> wahrscheinlich tut er das (sell the rumor, buy the fact...) --> Nein!

=> wobei:

• ich habe Mitte September eine kleine Dividende bekommen -- als Zeichen des guten Willens quasi

=> wobei:

• ich habe Mitte September eine kleine Dividende bekommen -- als Zeichen des guten Willens quasi

Antwort auf Beitrag Nr.: 58.786.649 von faultcode am 24.09.18 21:24:06

=> wahrscheinlich tut er das (sell the rumor, buy the fact )

)

USD21

...nach -6% heute guck ich erstmal, ob der aktuelle, neue Boden bei so ~USD21 hält:

=> wahrscheinlich tut er das (sell the rumor, buy the fact

)

)

Antwort auf Beitrag Nr.: 58.786.604 von faultcode am 24.09.18 21:21:11

-->

24.9.

Newell Brands’ Slide Is Called Too Steep

https://www.barrons.com/articles/newell-brands-slide-is-call…

=>

...

Herzog believes that Newell has less exposure to Sears than it did to Toys ‘R’ Us, saying the struggling department store wasn’t listed on the company’s top-ten customer list in its 2017 10K filing, while Toys ‘R’ Us was.

At nearly 14% of sales, Walmart(WMT) is Newell’s biggest customer.

...

Newell fällt wg. Sears-Insolvenz-Ängsten (2)

Sears ist aber kein großer NWL-Kunde mehr (< #10); Walmart ist #1 in 2017 gewesen:-->

24.9.

Newell Brands’ Slide Is Called Too Steep

https://www.barrons.com/articles/newell-brands-slide-is-call…

=>

...

Herzog believes that Newell has less exposure to Sears than it did to Toys ‘R’ Us, saying the struggling department store wasn’t listed on the company’s top-ten customer list in its 2017 10K filing, while Toys ‘R’ Us was.

At nearly 14% of sales, Walmart(WMT) is Newell’s biggest customer.

...

Newell fällt wg. Sears-Insolvenz-Ängsten (1)

24.9.Sears CEO Proposes Debt Restructuring Plan To Avoid Bankruptcy; Stock Down

https://www.finanznachrichten.de/nachrichten-2018-09/4484484…

=>

...The hedge fund owned by Sears Holdings chief Executive Officer Edward Lampert, ESL Investments, proposed restructuring Sears to help stave off bankruptcy. Meanwhile, Sears Holdings Corp. (SHLD) Monday confirmed that its board has received a proposal from ESL Investments regarding certain liability management and real estate transactions.

SHLD is currently trading at $1.19, down $0.08 or 6.30 percent.

Sears Holdings said that its Board has directed the Company's management and its legal and financial advisors to work closely with ESL, its advisors and the Company's other stakeholders to seek to pursue liability management transactions of the nature described in the proposal.

The Special Committee of the Board, which is also engaged in negotiations with ESL concerning the proposals made in ESL's August 14, 2018 letter, Sears said.

Meanwhile, Edward Lampert's ESL Investments today asked Sears board to sell off about $1.75 billion worth of assets, which would reduce the retailer's total debt to about $1.24 billion.

ESL Investments also proposed Sears sell about $1.5 billion worth of real estate.

ESL said its goal is to enable Sears to return to profitability, for the of Sears and all of its stakeholders. It said Sears must extend near-terms debt maturities, reduce its long-term debt and eliminate the associated cash interest obligations.

ESL believes liability management proposal could save Sears $33 million per year in cash interest and eliminate $1.1 billion in debt.

Sears faces significant near-term liquidity constraints, including a $134 million maturity for second Lien Notes due October 15 2018, and associated debt maturity reserve requirements on October 1 2018.

=> die Sears-Insolvenz kommt mMn sowieso, wenn nicht 2018, dann 2019 -- oder so ein Deal, der für die Aktionäre Insolvenz-Charakter hat:

Antwort auf Beitrag Nr.: 58.387.404 von faultcode am 06.08.18 23:44:28Ehrenrunde.....

Newell Brands Announces Agreement with Carl C. Icahn