Keine Unterstützung für ein solches Projekt (Seite 3)

eröffnet am 13.06.18 19:21:36 von

neuester Beitrag 30.04.24 15:45:55 von

neuester Beitrag 30.04.24 15:45:55 von

Beiträge: 60

ID: 1.282.353

ID: 1.282.353

Aufrufe heute: 1

Gesamt: 24.035

Gesamt: 24.035

Aktive User: 0

ISIN: CA8787422044 · WKN: 858265 · Symbol: TEKB

46,67

EUR

+1,90 %

+0,87 EUR

Letzter Kurs 09:20:40 Tradegate

Neuigkeiten

30.04.24 · wallstreetONLINE Redaktion |

26.04.24 · globenewswire |

25.04.24 · globenewswire |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,8360 | +17,66 | |

| 2,4000 | +14,83 | |

| 552,55 | +13,76 | |

| 33,17 | +13,52 | |

| 471,55 | +9,16 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,7600 | -7,57 | |

| 1,4000 | -7,89 | |

| 185,00 | -9,76 | |

| 12,000 | -25,00 | |

| 46,24 | -98,00 |

Beitrag zu dieser Diskussion schreiben

5.4.

Glencore Has Three Weeks to Salvage $23 Billion Teck Bid

https://nz.finance.yahoo.com/news/glencore-three-weeks-keep-…

...

Teck Resources Ltd.’s public rejection of a $23 billion offer from Glencore Plc has fired the starting gun on a three-week countdown for the Swiss commodities giant to keep its proposal alive.

Glencore isn’t actually trying to buy any Teck shares yet. There would be little point, after the company’s controlling investor — Canadian mining patriarch Norman Keevil — made clear he’s not interested in selling. Instead, the future of Glencore’s proposal for now depends on convincing Teck’s other shareholders to reject the company’s current strategy to split into two, at a vote scheduled for April 26.

Ironically, the same dual-class structure that gives Keevil his power through supervoting shares may also provide an opportunity for Glencore. Teck’s plan to separate its base metals and coal businesses will require two-thirds approval from both sets of investors separately — the powerful “A” shares dominated by the Keevil family, as well as the regular “B” shares.

That means shareholders with just a small percentage of the total voting rights could have the power to scupper Teck’s plan and throw its future into question.

Glencore now has three weeks to convince enough Teck investors to oppose the separation in the hopes of bringing Keevil and the board back to the negotiating table. Of course, the Keevil family’s holding will leave it in control regardless of the outcome of the vote. But it will provide a opportunity for the B shareholders to stage a protest should they choose to, leaving Teck without a clear strategy if the split fails.

“Shareholders of Teck have a chance to say they actually think the Glencore deal looks better by voting down the Teck split,” said George Cheveley, a portfolio manager at Ninety One UK Ltd., which holds shares in both companies. “If you vote down the split, you might find that other people then come in.”

...

Glencore Has Three Weeks to Salvage $23 Billion Teck Bid

https://nz.finance.yahoo.com/news/glencore-three-weeks-keep-…

...

Teck Resources Ltd.’s public rejection of a $23 billion offer from Glencore Plc has fired the starting gun on a three-week countdown for the Swiss commodities giant to keep its proposal alive.

Glencore isn’t actually trying to buy any Teck shares yet. There would be little point, after the company’s controlling investor — Canadian mining patriarch Norman Keevil — made clear he’s not interested in selling. Instead, the future of Glencore’s proposal for now depends on convincing Teck’s other shareholders to reject the company’s current strategy to split into two, at a vote scheduled for April 26.

Ironically, the same dual-class structure that gives Keevil his power through supervoting shares may also provide an opportunity for Glencore. Teck’s plan to separate its base metals and coal businesses will require two-thirds approval from both sets of investors separately — the powerful “A” shares dominated by the Keevil family, as well as the regular “B” shares.

That means shareholders with just a small percentage of the total voting rights could have the power to scupper Teck’s plan and throw its future into question.

Glencore now has three weeks to convince enough Teck investors to oppose the separation in the hopes of bringing Keevil and the board back to the negotiating table. Of course, the Keevil family’s holding will leave it in control regardless of the outcome of the vote. But it will provide a opportunity for the B shareholders to stage a protest should they choose to, leaving Teck without a clear strategy if the split fails.

“Shareholders of Teck have a chance to say they actually think the Glencore deal looks better by voting down the Teck split,” said George Cheveley, a portfolio manager at Ninety One UK Ltd., which holds shares in both companies. “If you vote down the split, you might find that other people then come in.”

...

4.4.

Teck Resources Is Said to Be Open to Offers Once Coal Spinoff Is Complete

https://finance.yahoo.com/news/teck-resources-said-open-offe…

...

Teck Resources Ltd. is willing to entertain offers from potential suitors after it finishes the spinoff of its steelmaking coal business, according to people familiar with the matter.

The Canadian miner said Monday it rejected an unsolicited $23 billion proposal from Glencore Plc and will forge ahead with an April 26 shareholder vote on separating its metals and coal divisions. If investors approve, the split is expected to happen by the end of May, with the base metals producer being renamed Teck Metals Corp.

At that point, the Teck board is likely to be open to hearing offers from prospective partners or buyers including Glencore, the people said, asking not to be identified as the matter is private.

The Swiss commodities firm’s offer for Teck, at a 20% premium, is another sign that big mining companies are on the hunt for acquisitions. BHP Group Ltd. and Rio Tinto Plc are also said to be actively looking to increase their copper exposure.

...

Teck Resources Is Said to Be Open to Offers Once Coal Spinoff Is Complete

https://finance.yahoo.com/news/teck-resources-said-open-offe…

...

Teck Resources Ltd. is willing to entertain offers from potential suitors after it finishes the spinoff of its steelmaking coal business, according to people familiar with the matter.

The Canadian miner said Monday it rejected an unsolicited $23 billion proposal from Glencore Plc and will forge ahead with an April 26 shareholder vote on separating its metals and coal divisions. If investors approve, the split is expected to happen by the end of May, with the base metals producer being renamed Teck Metals Corp.

At that point, the Teck board is likely to be open to hearing offers from prospective partners or buyers including Glencore, the people said, asking not to be identified as the matter is private.

The Swiss commodities firm’s offer for Teck, at a 20% premium, is another sign that big mining companies are on the hunt for acquisitions. BHP Group Ltd. and Rio Tinto Plc are also said to be actively looking to increase their copper exposure.

...

Es bleibt spannend:

Analysts eye sweeter deal for Teck as Glencore stresses synergies in call:

https://seekingalpha.com/news/3953877-analysts-eye-sweeter-d…

Analysts eye sweeter deal for Teck as Glencore stresses synergies in call:

https://seekingalpha.com/news/3953877-analysts-eye-sweeter-d…

...

Teck Resources Limited (TSX: TECK.A and TECK.B, NYSE: TECK) (“Teck”) today announced that the Board of Directors of Teck has received and unanimously rejected an unsolicited and opportunistic acquisition proposal from Glencore plc, which would see that company acquire Teck and subsequently separate to create two businesses, which would expose Teck shareholders to thermal coal and oil trading.

“The Board is not contemplating a sale of the company at this time. We believe that our planned separation creates a greater spectrum of opportunities to maximize value for Teck shareholders,” said Sheila Murray, Chair of the Board, Teck. “The Special Committee and Board remain confident that the proposed separation into Teck Metals and Elk Valley Resources (EVR) is in the best interests of Teck and all its stakeholders, is a much more compelling transaction and does not limit our optionality going forward.”

“The Glencore proposal would expose Teck shareholders to a large thermal coal business, an oil trading business and significant jurisdictional risk, all of which would negatively impact the value potential of Teck’s business, is contrary to our ESG commitments and would transfer significant value to Glencore at the expense of Teck shareholders,” said Jonathan Price, CEO, Teck.

...

3.4.

Teck Board of Directors Rejects Unsolicited Acquisition Proposal

https://www.wallstreet-online.de/nachricht/16759642-teck-boa…

___

=> meine Annahme: er wird nicht zu einer Übernahme durch Glencore, zumindest nicht als Ganzes, kommen

ABER: dieser Übernahmeversuch zeigt mMn, trotz des Metallurgical coal-Geschäfts (--> "Elk Valley Resources Ltd."-Spin-Off als Idee), daß TECK zur Zeit unterbewertet ist

Teck Resources Limited (TSX: TECK.A and TECK.B, NYSE: TECK) (“Teck”) today announced that the Board of Directors of Teck has received and unanimously rejected an unsolicited and opportunistic acquisition proposal from Glencore plc, which would see that company acquire Teck and subsequently separate to create two businesses, which would expose Teck shareholders to thermal coal and oil trading.

“The Board is not contemplating a sale of the company at this time. We believe that our planned separation creates a greater spectrum of opportunities to maximize value for Teck shareholders,” said Sheila Murray, Chair of the Board, Teck. “The Special Committee and Board remain confident that the proposed separation into Teck Metals and Elk Valley Resources (EVR) is in the best interests of Teck and all its stakeholders, is a much more compelling transaction and does not limit our optionality going forward.”

“The Glencore proposal would expose Teck shareholders to a large thermal coal business, an oil trading business and significant jurisdictional risk, all of which would negatively impact the value potential of Teck’s business, is contrary to our ESG commitments and would transfer significant value to Glencore at the expense of Teck shareholders,” said Jonathan Price, CEO, Teck.

...

3.4.

Teck Board of Directors Rejects Unsolicited Acquisition Proposal

https://www.wallstreet-online.de/nachricht/16759642-teck-boa…

___

=> meine Annahme: er wird nicht zu einer Übernahme durch Glencore, zumindest nicht als Ganzes, kommen

ABER: dieser Übernahmeversuch zeigt mMn, trotz des Metallurgical coal-Geschäfts (--> "Elk Valley Resources Ltd."-Spin-Off als Idee), daß TECK zur Zeit unterbewertet ist

Der erste Übernahmeversuch durch Glencore steht an:

https://www.investorsobserver.com/news/stock-update/teck-res…

https://www.investorsobserver.com/news/stock-update/teck-res…

21.2.

Teck’s Mining Breakup Sets the Scene for Copper Takeovers

https://finance.yahoo.com/news/teck-mining-breakup-sets-scen…

...

Teck Resources Ltd.’s move to split its metals and coal operations is likely to attract the attention of some of the world’s biggest mining companies as the industry looks to consolidate amid the energy transition.

The Canadian company confirmed Tuesday that it plans a spinoff that will eventually see Teck split into two independent publicly listed companies: Teck Metals Corp will focus on minerals such as copper, and Elk Valley Resources Ltd., which will operate the metallurgical coal assets.

The move almost certainly makes Teck Metals a takeover target when big mining companies are on the hunt for copper as demand for the wiring metal accelerates and a global shortfall looms. BHP Group, Rio Tinto Group and Glencore Plc are actively looking to grow their copper exposure and have been longtime admirers of Teck’s assets across the Americas, according to people familiar with the situation.

Teck owns four copper mines in South America and Canada that produced 270,000 metric tons last year. The company expects to double copper output after the second phase of its Quebrada Blanca project in Chile ramps up to full capacity by the end of this year.

...

Teck’s Mining Breakup Sets the Scene for Copper Takeovers

https://finance.yahoo.com/news/teck-mining-breakup-sets-scen…

...

Teck Resources Ltd.’s move to split its metals and coal operations is likely to attract the attention of some of the world’s biggest mining companies as the industry looks to consolidate amid the energy transition.

The Canadian company confirmed Tuesday that it plans a spinoff that will eventually see Teck split into two independent publicly listed companies: Teck Metals Corp will focus on minerals such as copper, and Elk Valley Resources Ltd., which will operate the metallurgical coal assets.

The move almost certainly makes Teck Metals a takeover target when big mining companies are on the hunt for copper as demand for the wiring metal accelerates and a global shortfall looms. BHP Group, Rio Tinto Group and Glencore Plc are actively looking to grow their copper exposure and have been longtime admirers of Teck’s assets across the Americas, according to people familiar with the situation.

Teck owns four copper mines in South America and Canada that produced 270,000 metric tons last year. The company expects to double copper output after the second phase of its Quebrada Blanca project in Chile ramps up to full capacity by the end of this year.

...

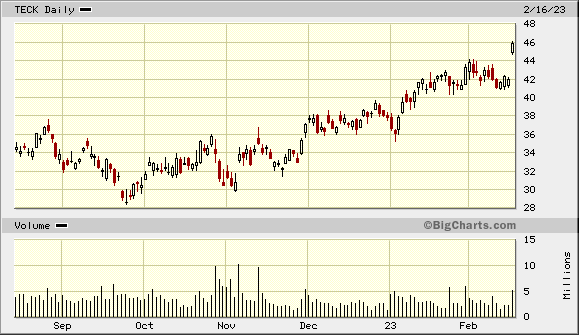

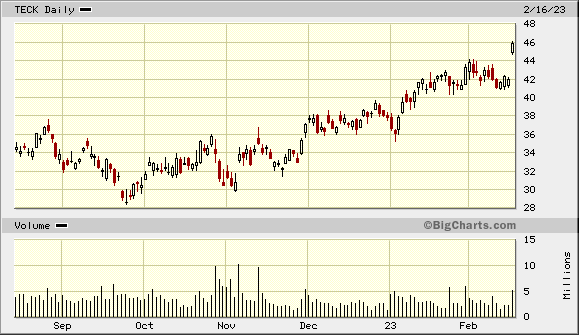

+9%

Trading Halt an der NYSE wegen News pending: 2023-02-16, 10:55:58 https://www.nyse.com/trade-halt-current

Wegen Kohle-Divestment?

Trading Halt an der NYSE wegen News pending: 2023-02-16, 10:55:58 https://www.nyse.com/trade-halt-current

Wegen Kohle-Divestment?

Antwort auf Beitrag Nr.: 72.983.296 von Bergfreund am 28.12.22 05:08:02Läuft ebenso wie meine Siliziumaktien Albemarle,Alkem und Uran CAMECO.

Scheint eine richtig Klasse Bergbaubude zusein.

Saubere Bilanz(Versch.etwas hoch) und konzentriert sich verstärkt auf Kupfer und anderen

wichtigen Zukunftsmetallen.

Leider bin ich erst jetzt auf TR gekommen,da dieser Minenwert kaum medial im Scheinwerfer ist.

Steige heute ein.

NF

Saubere Bilanz(Versch.etwas hoch) und konzentriert sich verstärkt auf Kupfer und anderen

wichtigen Zukunftsmetallen.

Leider bin ich erst jetzt auf TR gekommen,da dieser Minenwert kaum medial im Scheinwerfer ist.

Steige heute ein.

NF

30.04.24 · wallstreetONLINE Redaktion · BHP Group |

21.02.24 · wallstreetONLINE Redaktion · Teck Resources Registered (B) |

| Zeit | Titel |

|---|---|

| 30.04.24 |