Steinhoff: Tag der Rettung – wieviel Wert bleibt in der Aktie? (Seite 22) | Diskussion im Forum

eröffnet am 24.07.18 02:49:09 von

neuester Beitrag 22.08.23 16:02:26 von

neuester Beitrag 22.08.23 16:02:26 von

Beiträge: 230

ID: 1.285.031

ID: 1.285.031

Aufrufe heute: 0

Gesamt: 94.284

Gesamt: 94.284

Aktive User: 0

ISIN: NL0011375019 · WKN: A14XB9 · Symbol: SNH

0,0026

EUR

+8,33 %

+0,0002 EUR

Letzter Kurs 28.08.23 Tradegate

Neuigkeiten

01.05.24 · Felix Haupt Anzeige |

19.02.24 · dpa-AFX |

15.02.24 · dpa-AFX |

13.10.23 · EQS Group AG |

Werte aus der Branche Konsum

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,6800 | +24,44 | |

| 1,3300 | +17,70 | |

| 1,3500 | +15,38 | |

| 4,9400 | +12,80 | |

| 1,0100 | +11,78 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 16,260 | -7,03 | |

| 5,8700 | -7,41 | |

| 13,400 | -9,61 | |

| 8,6331 | -25,38 | |

| 6,1400 | -27,34 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 59.196.217 von Ines43 am 12.11.18 14:45:22knapp 9 % sind den FKs der Gruppe zuzurechnen. 72 % gehören SNH, Morgen oder übermorgen könnte man den Laden wieder ganz übernehmen, dass man PEPKOR Europe behält und PEPKOR f.k.a. STAR abstösst kann ich mir beim besten Willen nicht vorstellen.

Antwort auf Beitrag Nr.: 59.129.534 von freixenetter am 03.11.18 10:02:01Pepkor ist für seine Schulden selbst veranwortlich.PEPkor ist eigenständige AG.

29 % der Schulden gehören sowieso anderen, weil der Holding nur 71 % der Anteile gehören.Jefenfalls könnte man das so sehen.

Und PEPkor hat die Schulden an die Holding zurück gezahlt.

Das Problem ist,dass PEPkOR sehr wenig zum Cashflow der Holding beiträgt.

Alles muss von den mickrigen Dividenden kommen und der Steigerung des Aktienkurses. Da kommt man immer nur durch Verkauf ran, wenn man Geld benötigt.

Oder man kann Aktien hinterlegen, um Geld von Banken zu bekommen.

29 % der Schulden gehören sowieso anderen, weil der Holding nur 71 % der Anteile gehören.Jefenfalls könnte man das so sehen.

Und PEPkor hat die Schulden an die Holding zurück gezahlt.

Das Problem ist,dass PEPkOR sehr wenig zum Cashflow der Holding beiträgt.

Alles muss von den mickrigen Dividenden kommen und der Steigerung des Aktienkurses. Da kommt man immer nur durch Verkauf ran, wenn man Geld benötigt.

Oder man kann Aktien hinterlegen, um Geld von Banken zu bekommen.

Antwort auf Beitrag Nr.: 59.196.004 von faultcode am 12.11.18 14:19:23

Da dann frag mal bei denen nach, die bei unter 10 Cent ausgeknockt wurden ...

Zitat von faultcode: heute schon mal kurz unter die EUR0.10-Marke gerauscht

--> ist aber nur psychologisch von Interesse

Da dann frag mal bei denen nach, die bei unter 10 Cent ausgeknockt wurden ...

heute schon mal kurz unter die EUR0.10-Marke gerauscht

--> ist aber nur psychologisch von Interesse

--> die eigentliche Marke nach unten liegt bei so ~EUR0.085 — und die werden auch noch angesteuert im Rahmen dieser Abwärtsbewegung:

--> ist aber nur psychologisch von Interesse

--> die eigentliche Marke nach unten liegt bei so ~EUR0.085 — und die werden auch noch angesteuert im Rahmen dieser Abwärtsbewegung:

Antwort auf Beitrag Nr.: 59.192.128 von faultcode am 12.11.18 03:33:27

In a later interview, Jooste said that Homestyle had run out of cash and could not pay Steinhoff for the furniture it was supplying. "So we took a bold move and we bailed Homestyle out by recapitalising it with £100m — which was a huge amount of money for us in those days."

While Steinhoff gritted its teeth and risked its R1.1bn, the "Homestyle stalker" must have rubbed his hands with glee.

And even more so in 2006, when Steinhoff bought the rest of Homestyle for a whopping 100p a share.

Meanwhile, King, Jooste and the Steinhoff family had money to spend and, through the offshore companies and trusts created by Evans, they went on a property binge.

One company that they owned was Pearlbury Properties. In December 2001, newspapers reported that Pearlbury bought one of Wales’s largest factory sites for £4.25m (R73m).

In early 2002, £1m (R16m) flowed from the Steinhoff family’s Fihag through their Marksman Trust, Jamison, Pavilion, and finally to Mont de la Rocque Holdings in Jersey. Documents described this as some sort of "joint venture agreement" with King’s M&D. The partners then used this money, as well as a bank loan, to buy a Jersey hotel for £2.75m (R43m), which they planned to demolish to build "an aesthetically pleasing scheme of luxury high-class apartments".

King, Jooste and the Steinhoffs also owned the BVI-incorporated Burbury Investments, which tabled plans to develop a huge canal-side, mixed-used development in Ellesmere, North Shropshire, England.

And they used another BVI company, Chadbourne Estates, "to buy a development site near Heathrow airport".

Today, Chadbourne’s Heathrow property is well known in London as the ambitious "Rectory Farm" project — a huge stretch of disused land from which King’s company plans to extract 3-million cubic metres of gravel. It would leave behind sports pitches, paths and woodland, beneath which would lie a giant underground warehouse to be let to large firms that move goods such as, say, furniture.

There are at least five more British commercial properties bought in the late 2000s by offshore companies that were — at least in the early 2000s, according to our documents — secretly owned by Jooste, King and the Steinhoffs.

It was all going swimmingly for everyone involved until Evans made headlines in 2003 and 2004.

According to explosive news reports, Evans and his Warren Trustees were handling money for Polish and Russian officials working at corruption-ridden parastatals.

Jersey police and its financial regulator launched a money-laundering and fraud probe, forcing Evans to shut down Warren Trustees in 2006. Evans’ registered agent, the law firm Mossack Fonseca, was unaware of the regulator’s steps. But when news broke in 2007 that investigators had raided Evans’ office, found an illegal firearm and arrested him, the law firm’s compliance officers were alarmed.

An internal Mossack Fonseca report said: "It seems to me that Alan Evans is not a person we can trust." The writer of the report concluded that her firm should fire him as a client. Mossack Fonseca then began transferring many of Evans’ companies to agents in the BVI, the Bahamas and Switzerland.

Later in court, a judge said: "[Mr Evans] says that the police search left everything in a terrible mess ... Mr Evans now spends most of his time in Switzerland on other matters … It is clear that Mr Evans has little continuing connection with Jersey."

However, it would seem that the fallout prompted Evans to take greater steps to conceal himself and his clients’ business — and it became harder for us to trace Jooste and the Steinhoff family’s secrets.

By contrast, King’s next business move was easier to follow. He established a new property development company, Formal Investments, which went on to do rip-roaring deals with Steinhoff while expanding a property portfolio across Britain — with Evans’ help. In 2003, Evans had set up a company in the BVI called Rosewick Properties, for King to buy an English countryside inn. In 2008, King renamed it Formal Investments. Formal Investments’ English business accelerated dramatically, in part thanks to a major stimulus from Steinhoff.

It worked like this: A mysterious offshore company — said in various paperwork to be "in the care of Formal Investments" — would secure Steinhoff’s promise to lease a property, and then the offshore vehicle would raise finance to buy, build or renovate the property. Like Alvaglen’s Tewkesbury deal, this is known in the industry as "pre-letting".

Says one London property executive: "Pre-lets are normal before investment takes place. The developer will take the risk right up to planning permission being granted and then hold cash flow until long-term income is assured through 25-year leases."

Securing a tenant typically takes a lot of hard work and risk — unless, of course, you happen to control a tenant that is backed by other people’s money.

In 2008, Pearlbury — owned by King, Jooste and the Steinhoff family, at least in the early 2000s — bought a Cheltenham office block called Festival House.

The next year, Pearlbury and Formal filed an application to renovate Festival House specifically for Steinhoff. "The proposed extensions to Festival House will enable the existing building to be occupied principally by a single company. It is intended that the building will become the European headquarters for Steinhoff International," it said.

In 2011, Steinhoff moved in. Meanwhile, another BVI company, Eastnor Holdings, owned the vacant site adjacent to Festival House. Eastnor won council approval to build a £10m (R108m), six-floor office block called Honeybourne Place. And, according to local press, Steinhoff was again a pre-let client, having committed to occupy at least half of the building.

We have not traced Eastnor’s beneficial owners, but it too was in the "care of Formal Investments", and one planning document includes a specimen of Evans’ signature.

Similarly, in 2012, Formal Investments announced it had bought a factory at a site called Western Approach, just outside Bristol. Once again, Steinhoff had pre-let it. That site was owned by Hartberg Investments — "care of Formal Investments" — and its documents again include Evans’ signature.

And, also in 2012, Formal Investments announced it had bought a warehouse in Lutterworth near Leicestershire, pre-let by Steinhoff. Reportedly, the site cost more than £24m (R304m).

In a local article about Steinhoff’s move into the Western Approach warehouse, a journalist observed: "Cheltenham-based Formal Investments has a successful track record of making speculative purchases and finding tenants in a short time."

The Steinhoff stalker — Jooste’s friend King — seemed to be thriving.

King’s lawyer declined to explain Formal Investments’ apparently lucrative business relationship with Steinhoff.

In later questions, we asked King: "You have a property portfolio and Steinhoff leased some properties from you. Did Markus Jooste have an interest in any of them, including the properties in Tewkesbury, Western Approach, Lutterworth and Festival House and Honeybourne Place?"

In spite of evidence to the contrary, King’s lawyer said: "No."

Tracking down what happened to Jooste’s offshore interests is complicated by the smoke and mirror tactics used to hide beneficial ownership.

Take the case of Pavilion Properties — the company based in Jersey, owned by Jooste and the Steinhoff family, which had shares in King’s property company.

After the Jersey regulator shut down Evans’ business on that island, Pavilion Properties disappeared from sight. But a new incarnation popped up, this time called Pavilion Capital Investments, in the BVI. Share registers show that in 2014, Pavilion Properties’ stake in King’s Marketing & Development was quietly renamed as belonging to Pavilion Capital, with none of the normal disclosures associated with an actual transfer between two different shareholders. It would seem the two Pavilion companies were one and the same.

While King’s lawyer insisted that Jooste "does not have an interest in Pavilion Capital", there are three other deals that tie them together.

In 2011, Jooste approached retail magnate Christo Wiese on behalf of mysterious foreign investors to buy his Stellenbosch wine farm, Lanzerac. After the sale, King and Jooste’s son-in-law Stefan Potgieter joined the Lanzerac board.

Then in 2012, the SA Coy’s Properties — directors: King and Potgieter — bought a luxurious apartment in Bantry Bay, Cape Town.

News reports last year revealed that Berdine Odendaal, Jooste’s alleged romantic partner, lived in that apartment.

King’s lawyer confirmed in e-mails to us that Pavilion Capital owned both Lanzerac and Coy’s.

Also, Pavilion Capital has put in a claim of R420m against Jooste’s SA investment vehicle Mayfair, which is being liquidated.

But if Jooste, or his relatives, do secretly own Pavilion Capital, it would have serious implications because of its key role in a very dubious affair — part of a wider problem at Steinhoff: the overvaluing of properties and therefore also the company’s true value.

Until last year, Steinhoff had valued its Dutch property holding company, Hemisphere International Properties, at €2.2bn (R37bn).

But since Jooste’s resignation, forensic investigators have pored over those deals, unravelling a web of overvalued properties.

In March, Steinhoff revealed that investigators had "uncovered various non-arm’s-length transactions where properties were sold and later repurchased at inflated values".

Steinhoff slashed Hemisphere’s value in half, to €1.1bn (R18bn), as it unwound "step-ups created through non-arm’s-length sales and buy-back transactions".

Put simply, Steinhoff had sold properties to someone’s friends and then overpaid to buy those properties back. Insiders agreed the likely upshot was that the friends got rich and Steinhoff’s balance sheet was artificially inflated.

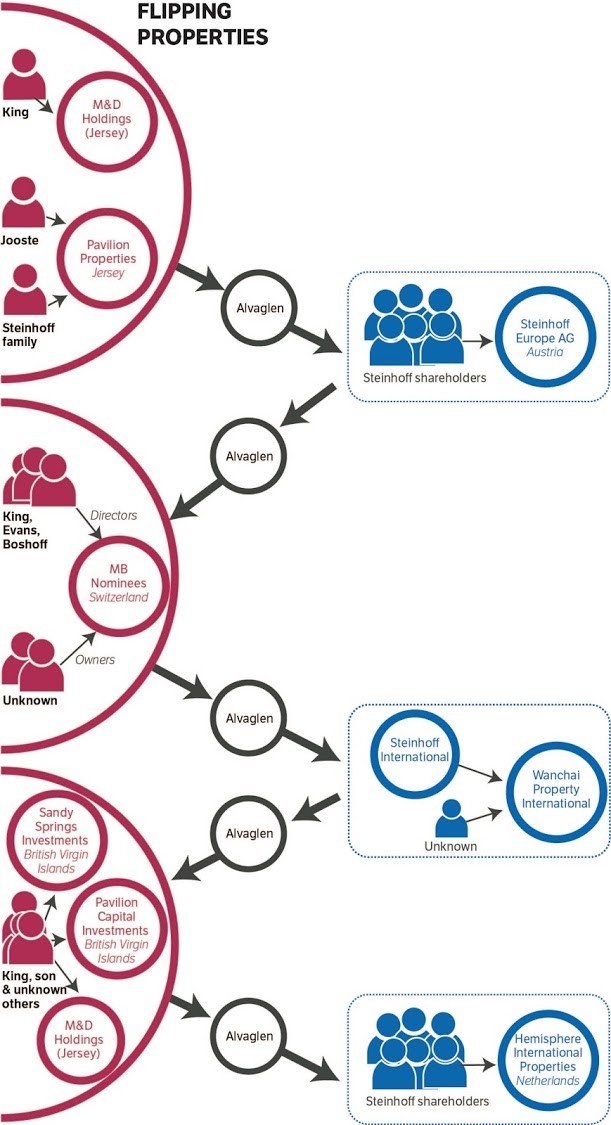

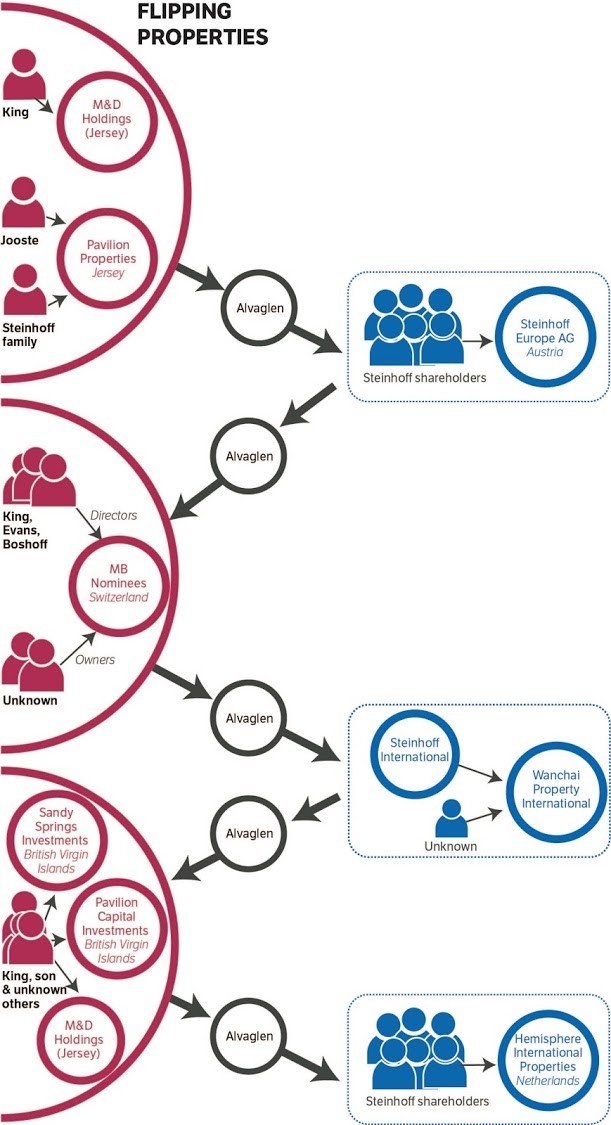

The path of Alvaglen — from Jooste, King and the Steinhoffs’ hands, via Pavilion Capital, to Hemisphere 14 years later — appeared to show exactly how this scheme worked.

Remember that King, Jooste and the Steinhoffs originally owned Alvaglen, through their offshore trusts and shell companies.

On June 25 2004, Alvaglen’s share register shows that its shares were transferred from them to two Jersey companies, Warren Trustees and WTG Managers, which Evans used to front offshore for his clients. However, Evans held these shares for only three days before, on June 28, transferring them to Steinhoff Europe.

This shows that King, Jooste and the Steinhoffs had just flipped their property company, via an anonymous cut-out, to Steinhoff. Steinhoff then held on to Alvaglen and its Tewkesbury property until November 2009, when it sold it to MB Nominees.

MB Nominees’ director was a company called MB Directors. And MB Directors’ directors in turn were King, Evans and a Formal Investments director named Robert Boshoff.

Boshoff is one of the most mysterious people in the story. He lives in SA where he is the director of a grubby machine workshop in the south of Johannesburg. Yet, internationally, he is purportedly a high-flying property director, associated with numerous King and Evans companies. (When contacted, Boshoff refused to speak to us.)

But then the property flipping became frenzied.

On January 13 2014, Alvaglen bought the Steinhoff-leased Western Approach warehouse from Hartberg Investments. It meant Alvaglen owned at least two warehouses acquired from companies related to King’s Formal Investments.

Just four days later on January 17 2014, another murky BVI-registered entity, Wanchai Property International, bought Alvaglen and its two warehouses. Wanchai was 50% owned by Steinhoff, and its other owners are not known – but it used the same BVI address as Formal Investments.

Wanchai owned Alvaglen for only four days before, on January 21, it flipped it to three more companies.

They were King’s M&D; Pavilion Capital, which bears Jooste’s fingerprints; and Sandy Springs Investments, which appears to link to King’s son Nicholas, a Formal Investments director. All three companies used Formal’s BVI address.

Startlingly, they too only owned Alvaglen for four days before, on January 25 2014, they flipped it to Steinhoff’s property company Hemisphere. And then, on February 26, Alvaglen bought Festival House from Pearlbury for £10.7m (R192m).

Pearlbury, if you recall, was one of the Formal Investments companies owned, at one stage at least, by Jooste and the Steinhoff family.

Looked at in their entirety, this complicated web of deals shows that properties owned by King and his friends — and leased to Steinhoff — were packaged into Alvaglen, and then flipped to Steinhoff itself.

Asked to explain this, King’s lawyer clarified nothing. "It is denied … that ownership of Alvaglen was ‘swapped’ three times in eight days in 2014," he said.

So what on earth was going on here?

Did Steinhoff overpay every time it bought Alvaglen? Was this part of the inflated "step-up" transactions that Steinhoff described, which ended up enriching the sellers and inflating Steinhoff’s balance sheet?

One former Steinhoff director, who had investigated similar transactions, was unsurprised when we explained this to him.

He told us how Steinhoff insiders had used what he called "back-end" companies involving King and similar insiders who "pretend to be unrelated" to do deals.

The Steinhoff director said those "back-end guys" would pack Steinhoff-leased properties into a holding company, then push up the price of the rentals, and based on that, increase the value of the property in their accounts. Finally, Steinhoff would buy the properties back at an inflated value.

"But he’s the buyer and the seller — Markus was just dealing with himself," he said.

Neither Jooste, the Steinhoff family nor the company that still bears his name, would respond to our questions. While King answered some of our questions through a lawyer, he said: "Many of your assumptions are inaccurate and are ones which you present as being based upon ‘statements of fact’ which are untrue and as such our client does not wish to engage [further]."

Evans did not respond to e-mails. A man answered his phone but hung up at the word "journalist" and ignored later calls.

One question that has always mystified others is why no-one ever blew the whistle inside Steinhoff. Ask those inside the company, and they will tell you how "trust" was central to the company’s mission. For example, in 2013, when Steinhoff celebrated the 15th anniversary of its JSE listing, its founders and executives expounded on this for hours. Ben le Grange, the now ousted chief of finance, said: "The glue that’s common — I think we’re fortunate that Steinhoff, as our culture, has adopted a common glue in all these jurisdictions. And the main part of that would be trust."

Stéhan Grobler — once an Alvaglen director — offered the same platitude. "Trust is probably one virtue that is key to all our team members. And it’s earned in the hard way. Everyone starts with a relationship and if you deliver what you promise, you earn trust in the end."

Bruno’s daughter Angela Krüger-Steinhoff explained how "my father — but also my uncle Norbert — both trusted Markus from their hearts".

Today, she is a Steinhoff director, tasked with looking after the company and its shareholders’ interests. This includes making sure Steinhoff identifies the fraud, and pushes for the prosecution of those who perpetrated it. We asked her in recent weeks what she knew of Jooste’s secret dealings, her family’s role and how it had benefited, as well as why investors and creditors should now trust her.

She did not respond.

Steinhoff’s secret history and the dirty world of Markus Jooste 3/3

...In a later interview, Jooste said that Homestyle had run out of cash and could not pay Steinhoff for the furniture it was supplying. "So we took a bold move and we bailed Homestyle out by recapitalising it with £100m — which was a huge amount of money for us in those days."

While Steinhoff gritted its teeth and risked its R1.1bn, the "Homestyle stalker" must have rubbed his hands with glee.

And even more so in 2006, when Steinhoff bought the rest of Homestyle for a whopping 100p a share.

Meanwhile, King, Jooste and the Steinhoff family had money to spend and, through the offshore companies and trusts created by Evans, they went on a property binge.

One company that they owned was Pearlbury Properties. In December 2001, newspapers reported that Pearlbury bought one of Wales’s largest factory sites for £4.25m (R73m).

In early 2002, £1m (R16m) flowed from the Steinhoff family’s Fihag through their Marksman Trust, Jamison, Pavilion, and finally to Mont de la Rocque Holdings in Jersey. Documents described this as some sort of "joint venture agreement" with King’s M&D. The partners then used this money, as well as a bank loan, to buy a Jersey hotel for £2.75m (R43m), which they planned to demolish to build "an aesthetically pleasing scheme of luxury high-class apartments".

King, Jooste and the Steinhoffs also owned the BVI-incorporated Burbury Investments, which tabled plans to develop a huge canal-side, mixed-used development in Ellesmere, North Shropshire, England.

And they used another BVI company, Chadbourne Estates, "to buy a development site near Heathrow airport".

Today, Chadbourne’s Heathrow property is well known in London as the ambitious "Rectory Farm" project — a huge stretch of disused land from which King’s company plans to extract 3-million cubic metres of gravel. It would leave behind sports pitches, paths and woodland, beneath which would lie a giant underground warehouse to be let to large firms that move goods such as, say, furniture.

There are at least five more British commercial properties bought in the late 2000s by offshore companies that were — at least in the early 2000s, according to our documents — secretly owned by Jooste, King and the Steinhoffs.

It was all going swimmingly for everyone involved until Evans made headlines in 2003 and 2004.

According to explosive news reports, Evans and his Warren Trustees were handling money for Polish and Russian officials working at corruption-ridden parastatals.

Jersey police and its financial regulator launched a money-laundering and fraud probe, forcing Evans to shut down Warren Trustees in 2006. Evans’ registered agent, the law firm Mossack Fonseca, was unaware of the regulator’s steps. But when news broke in 2007 that investigators had raided Evans’ office, found an illegal firearm and arrested him, the law firm’s compliance officers were alarmed.

An internal Mossack Fonseca report said: "It seems to me that Alan Evans is not a person we can trust." The writer of the report concluded that her firm should fire him as a client. Mossack Fonseca then began transferring many of Evans’ companies to agents in the BVI, the Bahamas and Switzerland.

Later in court, a judge said: "[Mr Evans] says that the police search left everything in a terrible mess ... Mr Evans now spends most of his time in Switzerland on other matters … It is clear that Mr Evans has little continuing connection with Jersey."

However, it would seem that the fallout prompted Evans to take greater steps to conceal himself and his clients’ business — and it became harder for us to trace Jooste and the Steinhoff family’s secrets.

By contrast, King’s next business move was easier to follow. He established a new property development company, Formal Investments, which went on to do rip-roaring deals with Steinhoff while expanding a property portfolio across Britain — with Evans’ help. In 2003, Evans had set up a company in the BVI called Rosewick Properties, for King to buy an English countryside inn. In 2008, King renamed it Formal Investments. Formal Investments’ English business accelerated dramatically, in part thanks to a major stimulus from Steinhoff.

It worked like this: A mysterious offshore company — said in various paperwork to be "in the care of Formal Investments" — would secure Steinhoff’s promise to lease a property, and then the offshore vehicle would raise finance to buy, build or renovate the property. Like Alvaglen’s Tewkesbury deal, this is known in the industry as "pre-letting".

Says one London property executive: "Pre-lets are normal before investment takes place. The developer will take the risk right up to planning permission being granted and then hold cash flow until long-term income is assured through 25-year leases."

Securing a tenant typically takes a lot of hard work and risk — unless, of course, you happen to control a tenant that is backed by other people’s money.

In 2008, Pearlbury — owned by King, Jooste and the Steinhoff family, at least in the early 2000s — bought a Cheltenham office block called Festival House.

The next year, Pearlbury and Formal filed an application to renovate Festival House specifically for Steinhoff. "The proposed extensions to Festival House will enable the existing building to be occupied principally by a single company. It is intended that the building will become the European headquarters for Steinhoff International," it said.

In 2011, Steinhoff moved in. Meanwhile, another BVI company, Eastnor Holdings, owned the vacant site adjacent to Festival House. Eastnor won council approval to build a £10m (R108m), six-floor office block called Honeybourne Place. And, according to local press, Steinhoff was again a pre-let client, having committed to occupy at least half of the building.

We have not traced Eastnor’s beneficial owners, but it too was in the "care of Formal Investments", and one planning document includes a specimen of Evans’ signature.

Similarly, in 2012, Formal Investments announced it had bought a factory at a site called Western Approach, just outside Bristol. Once again, Steinhoff had pre-let it. That site was owned by Hartberg Investments — "care of Formal Investments" — and its documents again include Evans’ signature.

And, also in 2012, Formal Investments announced it had bought a warehouse in Lutterworth near Leicestershire, pre-let by Steinhoff. Reportedly, the site cost more than £24m (R304m).

In a local article about Steinhoff’s move into the Western Approach warehouse, a journalist observed: "Cheltenham-based Formal Investments has a successful track record of making speculative purchases and finding tenants in a short time."

The Steinhoff stalker — Jooste’s friend King — seemed to be thriving.

King’s lawyer declined to explain Formal Investments’ apparently lucrative business relationship with Steinhoff.

In later questions, we asked King: "You have a property portfolio and Steinhoff leased some properties from you. Did Markus Jooste have an interest in any of them, including the properties in Tewkesbury, Western Approach, Lutterworth and Festival House and Honeybourne Place?"

In spite of evidence to the contrary, King’s lawyer said: "No."

Tracking down what happened to Jooste’s offshore interests is complicated by the smoke and mirror tactics used to hide beneficial ownership.

Take the case of Pavilion Properties — the company based in Jersey, owned by Jooste and the Steinhoff family, which had shares in King’s property company.

After the Jersey regulator shut down Evans’ business on that island, Pavilion Properties disappeared from sight. But a new incarnation popped up, this time called Pavilion Capital Investments, in the BVI. Share registers show that in 2014, Pavilion Properties’ stake in King’s Marketing & Development was quietly renamed as belonging to Pavilion Capital, with none of the normal disclosures associated with an actual transfer between two different shareholders. It would seem the two Pavilion companies were one and the same.

While King’s lawyer insisted that Jooste "does not have an interest in Pavilion Capital", there are three other deals that tie them together.

In 2011, Jooste approached retail magnate Christo Wiese on behalf of mysterious foreign investors to buy his Stellenbosch wine farm, Lanzerac. After the sale, King and Jooste’s son-in-law Stefan Potgieter joined the Lanzerac board.

Then in 2012, the SA Coy’s Properties — directors: King and Potgieter — bought a luxurious apartment in Bantry Bay, Cape Town.

News reports last year revealed that Berdine Odendaal, Jooste’s alleged romantic partner, lived in that apartment.

King’s lawyer confirmed in e-mails to us that Pavilion Capital owned both Lanzerac and Coy’s.

Also, Pavilion Capital has put in a claim of R420m against Jooste’s SA investment vehicle Mayfair, which is being liquidated.

But if Jooste, or his relatives, do secretly own Pavilion Capital, it would have serious implications because of its key role in a very dubious affair — part of a wider problem at Steinhoff: the overvaluing of properties and therefore also the company’s true value.

Until last year, Steinhoff had valued its Dutch property holding company, Hemisphere International Properties, at €2.2bn (R37bn).

But since Jooste’s resignation, forensic investigators have pored over those deals, unravelling a web of overvalued properties.

In March, Steinhoff revealed that investigators had "uncovered various non-arm’s-length transactions where properties were sold and later repurchased at inflated values".

Steinhoff slashed Hemisphere’s value in half, to €1.1bn (R18bn), as it unwound "step-ups created through non-arm’s-length sales and buy-back transactions".

Put simply, Steinhoff had sold properties to someone’s friends and then overpaid to buy those properties back. Insiders agreed the likely upshot was that the friends got rich and Steinhoff’s balance sheet was artificially inflated.

The path of Alvaglen — from Jooste, King and the Steinhoffs’ hands, via Pavilion Capital, to Hemisphere 14 years later — appeared to show exactly how this scheme worked.

Remember that King, Jooste and the Steinhoffs originally owned Alvaglen, through their offshore trusts and shell companies.

On June 25 2004, Alvaglen’s share register shows that its shares were transferred from them to two Jersey companies, Warren Trustees and WTG Managers, which Evans used to front offshore for his clients. However, Evans held these shares for only three days before, on June 28, transferring them to Steinhoff Europe.

This shows that King, Jooste and the Steinhoffs had just flipped their property company, via an anonymous cut-out, to Steinhoff. Steinhoff then held on to Alvaglen and its Tewkesbury property until November 2009, when it sold it to MB Nominees.

MB Nominees’ director was a company called MB Directors. And MB Directors’ directors in turn were King, Evans and a Formal Investments director named Robert Boshoff.

Boshoff is one of the most mysterious people in the story. He lives in SA where he is the director of a grubby machine workshop in the south of Johannesburg. Yet, internationally, he is purportedly a high-flying property director, associated with numerous King and Evans companies. (When contacted, Boshoff refused to speak to us.)

But then the property flipping became frenzied.

On January 13 2014, Alvaglen bought the Steinhoff-leased Western Approach warehouse from Hartberg Investments. It meant Alvaglen owned at least two warehouses acquired from companies related to King’s Formal Investments.

Just four days later on January 17 2014, another murky BVI-registered entity, Wanchai Property International, bought Alvaglen and its two warehouses. Wanchai was 50% owned by Steinhoff, and its other owners are not known – but it used the same BVI address as Formal Investments.

Wanchai owned Alvaglen for only four days before, on January 21, it flipped it to three more companies.

They were King’s M&D; Pavilion Capital, which bears Jooste’s fingerprints; and Sandy Springs Investments, which appears to link to King’s son Nicholas, a Formal Investments director. All three companies used Formal’s BVI address.

Startlingly, they too only owned Alvaglen for four days before, on January 25 2014, they flipped it to Steinhoff’s property company Hemisphere. And then, on February 26, Alvaglen bought Festival House from Pearlbury for £10.7m (R192m).

Pearlbury, if you recall, was one of the Formal Investments companies owned, at one stage at least, by Jooste and the Steinhoff family.

Looked at in their entirety, this complicated web of deals shows that properties owned by King and his friends — and leased to Steinhoff — were packaged into Alvaglen, and then flipped to Steinhoff itself.

Asked to explain this, King’s lawyer clarified nothing. "It is denied … that ownership of Alvaglen was ‘swapped’ three times in eight days in 2014," he said.

So what on earth was going on here?

Did Steinhoff overpay every time it bought Alvaglen? Was this part of the inflated "step-up" transactions that Steinhoff described, which ended up enriching the sellers and inflating Steinhoff’s balance sheet?

One former Steinhoff director, who had investigated similar transactions, was unsurprised when we explained this to him.

He told us how Steinhoff insiders had used what he called "back-end" companies involving King and similar insiders who "pretend to be unrelated" to do deals.

The Steinhoff director said those "back-end guys" would pack Steinhoff-leased properties into a holding company, then push up the price of the rentals, and based on that, increase the value of the property in their accounts. Finally, Steinhoff would buy the properties back at an inflated value.

"But he’s the buyer and the seller — Markus was just dealing with himself," he said.

Neither Jooste, the Steinhoff family nor the company that still bears his name, would respond to our questions. While King answered some of our questions through a lawyer, he said: "Many of your assumptions are inaccurate and are ones which you present as being based upon ‘statements of fact’ which are untrue and as such our client does not wish to engage [further]."

Evans did not respond to e-mails. A man answered his phone but hung up at the word "journalist" and ignored later calls.

One question that has always mystified others is why no-one ever blew the whistle inside Steinhoff. Ask those inside the company, and they will tell you how "trust" was central to the company’s mission. For example, in 2013, when Steinhoff celebrated the 15th anniversary of its JSE listing, its founders and executives expounded on this for hours. Ben le Grange, the now ousted chief of finance, said: "The glue that’s common — I think we’re fortunate that Steinhoff, as our culture, has adopted a common glue in all these jurisdictions. And the main part of that would be trust."

Stéhan Grobler — once an Alvaglen director — offered the same platitude. "Trust is probably one virtue that is key to all our team members. And it’s earned in the hard way. Everyone starts with a relationship and if you deliver what you promise, you earn trust in the end."

Bruno’s daughter Angela Krüger-Steinhoff explained how "my father — but also my uncle Norbert — both trusted Markus from their hearts".

Today, she is a Steinhoff director, tasked with looking after the company and its shareholders’ interests. This includes making sure Steinhoff identifies the fraud, and pushes for the prosecution of those who perpetrated it. We asked her in recent weeks what she knew of Jooste’s secret dealings, her family’s role and how it had benefited, as well as why investors and creditors should now trust her.

She did not respond.

Antwort auf Beitrag Nr.: 59.192.122 von faultcode am 12.11.18 03:26:04

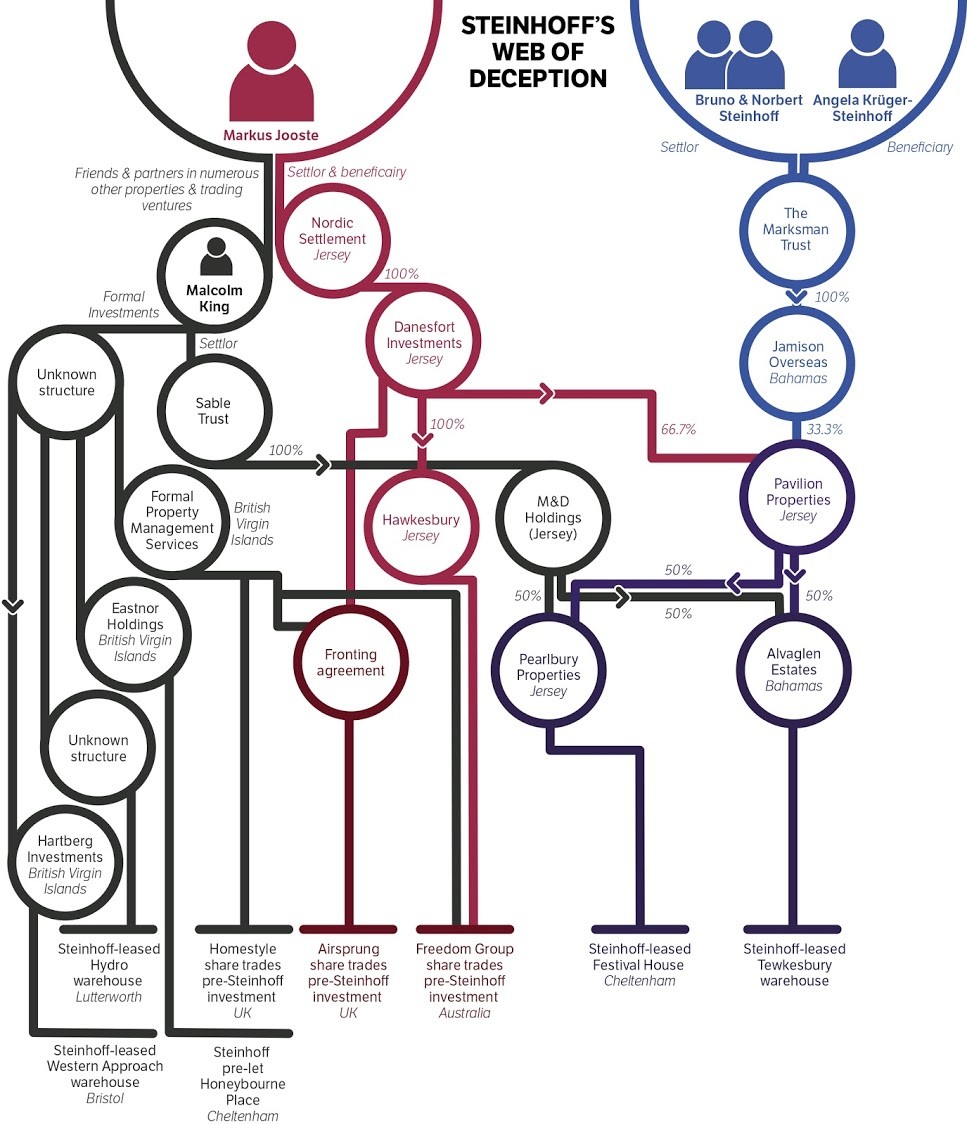

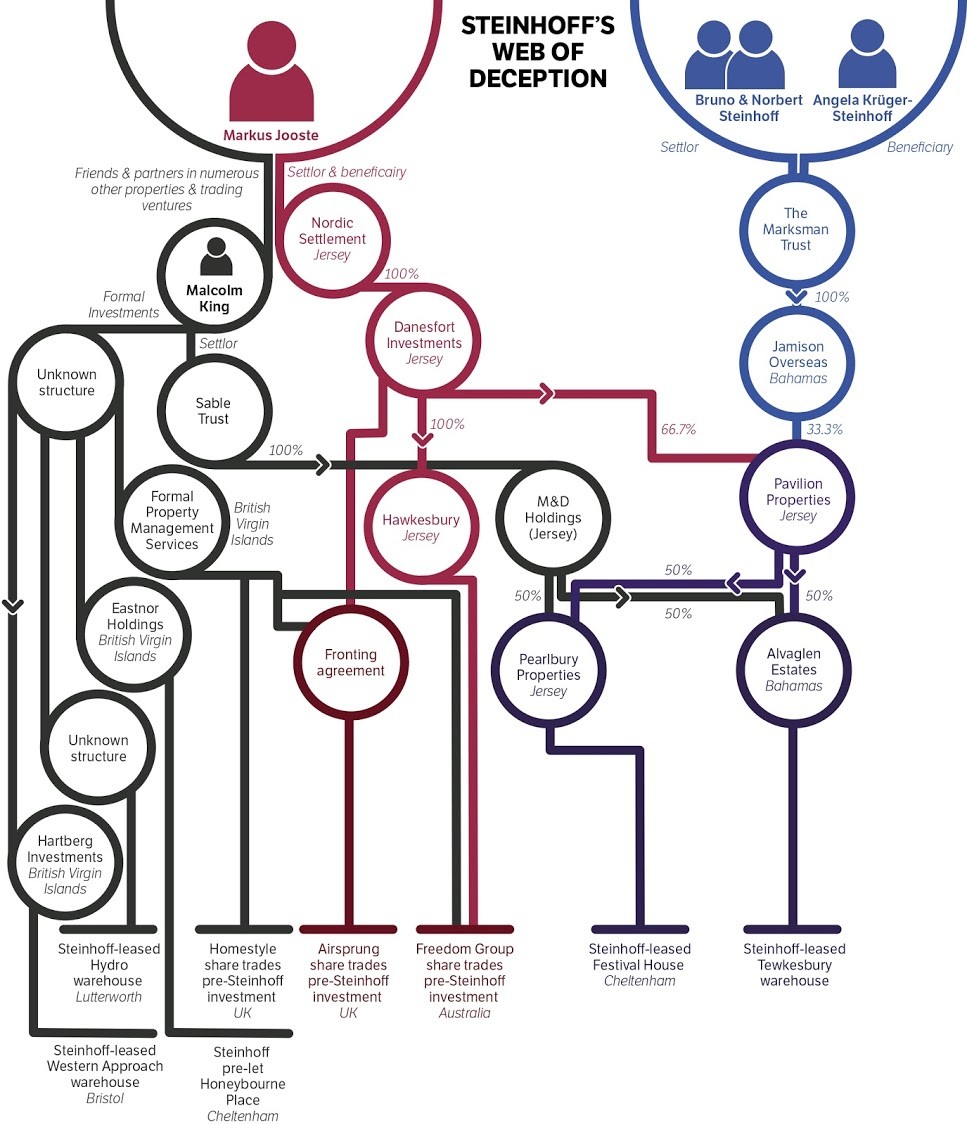

Evans was born 68 years ago in Wales. When he was 23, he moved to the island tax haven of Jersey in the English Channel to join Citibank and learn the ropes of offshore wealth management and financial secrecy. He stayed with Citibank through the 1970s and 1980s, taking assignments in New York, Kenya and Turkey before resigning in 1990 "to pursue private interests". He returned to Jersey to set himself up as a professional trust provider, founding a company called Warren Trustees Group.

By 1997, Evans was handling both Jooste’s and the Steinhoff family’s offshore affairs. First, he incorporated Danesfort Investments in Jersey as Jooste’s own company — though its true ownership was hidden behind the Warren Trustees brass plate. Warren Trustees and Bruno Steinhoff also created The Marksman Trust for the benefit of Steinhoff’s daughters. Not long after, Evans began managing Jooste’s existing trust, Nordic Settlement, which Jooste had created years earlier to hold his offshore wealth. Evans would place Danesfort under Nordic too.

These entities would be the main vehicles for the secret deals.

Equally pivotal to these deals was King. In 1993, King lived in Cirencester, England. He was wealthy, with investments in commercial properties around Weston-super-Mare, an hour’s drive from Cirencester.

According to Jooste’s former colleagues, King met Jooste at that time through a British acquaintance. They hit it off. In 1993, Jooste and a number of his SA friends bought a 25% stake in two of King’s property companies: Marketing & Development (Holdings) in the UK and another registered in the British Virgin Islands (BVI), a tax haven.

Marketing & Development owned a number of properties, including Formal House and Formal Industrial Park. The "Formal" brand later came to define King’s property empire, which was boosted by his, Evans’ and Jooste’s Steinhoff "self-dealing".

But to understand how it got to this, we need to understand Steinhoff’s early days.

Bruno Steinhoff founded his company in 1964, based on the simple model of buying furniture cheaply in communist East Germany and selling it in the relatively richer West. One of his close friends was German industrialist Claas Daun, who had bought a number of furniture companies in SA and invested in Gommagomma, a furniture company run by Jooste in the early 1990s. In 1995, Daun sent Jooste to visit Bruno "to go and have a look and see if there was something we could create between the two businesses", Jooste later recalled.

The three formed a joint venture in SA that would become the platform for the modern Steinhoff.

In an interview, Daun explained that in the 1990s, "we needed money … and I mentioned it in a discussion with Markus: is it not possible to take money from the stock exchange?… Markus jumped on this horse. He said: ‘That’s it! Stock exchange!’ And out of that things developed very quickly."

Jooste and Bruno Steinhoff then began preparing to list the company on the JSE to take money from the public, which finally happened in September 1998.

Unbeknown to investors, Evans was simultaneously setting up Jooste and Bruno Steinhoff’s overseas trusts, which would end up benefiting from Steinhoff’s rapidly expanding appetite for deals.

For example, one of the assets Jooste packaged for the listing was a UK firm, Spearhead Furniture (later renamed Steinhoff UK Furniture), which imported knockdown SA pine furniture into the UK.

Steinhoff bought Spearhead from Jooste’s friend, Jim Lewis. He co-owned racehorses with Jooste and Malcolm King. (Lewis hung up when we called him and ignored further messages and calls.)

By the time of the 1998 listing, Steinhoff owned half of Spearhead. A year later, it bought the rest — but in the interim Jooste and Lewis set out to find a site for a new warehouse to become Steinhoff’s UK headquarters.

What followed might be described as Jooste’s first bite of the forbidden fruit that poisoned Steinhoff.

In February 1999, Evans’ staff at Warren Trustees bought a shelf company in the Bahamas called Alvaglen Estates from the Panamanian law firm Mossack Fonseca.

Mossack Fonseca lay at the heart of offshore finance. It had a global network of offices that registered thousands of companies, mostly in British tax havens, for hidden clients.

At the outset, Alvaglen’s founding directors were Evans, one of his employees and two nominees. In a May 1999 document, Evans said Alvaglen wanted to buy "certain industrial premises located at Ashchurch, Tewkesbury, Gloucestershire, United Kingdom". For this, Barclays Bank would lend Alvaglen £2.65m (R26m then).

But Alvaglen was a faceless shelf company with no track record or assets. How would it repay the loan? Why would Barclays take a risk on an unknown entity?

The answer was that Steinhoff was standing behind it. As Evans put it, Alvaglen was "desirous of entering into a lease agreement with Spearhead … to lease the said premises for a period of 25 years". Other documents confirm that Steinhoff Europe would also guarantee Spearhead’s lease.

Which was a lucky break. So, Alvaglen would simultaneously sign a lease with Steinhoff, get a loan on the strength of that lease and buy the property.

In other words, Steinhoff used its balance sheet to bankroll Alvaglen’s new property — which might be fine if the deal was good, and there were no Steinhoff executives hiding behind Evans.

Only, there were.

Alvaglen’s company documents, obtained in this investigation, revealed its shareholders: "[Fifty] shares held each by M&D Holdings (Jersey) Ltd and Pavilion Properties Ltd."

Weeks of digging through company documents showed that Jooste’s friend, King, owned M&D while, crucially, Jooste and the Steinhoffs themselves owned Pavilion, which was incorporated in Jersey and registered at Warren Trustees.

In other words, the wealth created by Steinhoff’s lease payments and its financial guarantee had flowed to a company covertly owned by Steinhoff top brass.

Though this hasn’t been revealed until now, Jooste had acquired part of Pavilion in 1993, holding it through his trust Nordic, alongside a number of his friends and business associates.

It was the same Pavilion which, in 1993, had invested in two of King’s property companies, including Marketing & Development.

Internal records at the time claim that Pavilion was worth £3.55m (R37m) after Alvaglen picked up the Tewkesbury site in 1999 — so this property deal represented a windfall for Jooste.

Then the Steinhoff family got involved in Pavilion too. In early 2000, Evans bought a shelf company called Jamison Overseas, which took shares in Pavilion. Soon after, the Steinhoff family’s Marksman Trust took ownership of Jamison.

Internal memos show that Alvaglen planned to develop the Tewkesbury site, and then lease it to "UK trading companies". The plan, actually, was to refurbish a rundown warehouse that stood on the Tewkesbury site and lease it to Steinhoff.

That memo explained that Alvagen was 50% owned by King with the other 50% held by Jooste and the Steinhoffs through Pavilion. Breaking it down further, Jooste’s Nordic held 66.7% of Pavilion through Danesfort, while the Steinhoffs’ Marksman Trust held 33.3% through Jamison.

Behind layers of shell companies and trusts, they had done everything possible to hide their stakes in Alvaglen.

The problem was that the Steinhoff top brass were on both sides of the deal — and there was no disclosure in official documents of this "related party" transaction.

At the time, Jooste, Bruno Steinhoff and his brother Norbert were Steinhoff executives, and Jooste and Norbert were also Spearhead directors while the lease was finalised with Alvaglen.

Tewkesbury, it seemed, was a scheme in which Jooste and the Steinhoffs ultimately used their control over Steinhoff to covertly enrich themselves and Jooste’s friend, King.

Besides the rent paid to Alvaglen, Evans also invoiced Steinhoff Europe director Siegmar Schmidt every three months on an Alvaglen letterhead for £100,000 (R1.4m) for a "management charge".

Schmidt did not respond to e-mails, but we asked someone who worked at Steinhoff’s Tewkesbury warehouse about these payments. "There’s no reason for it. None whatsoever. What the hell could it be for?" he said.

This former Steinhoff employee explained King’s role at the time: "King did the Tewkesbury development. He bought the site and he then built it. He had employees on site, front-end loaders. He made it happen." He added that while he believed King owned it, whenever Jooste came to the UK, he stayed with King at his house. "I felt, purely from the conversations at the time, that they were in partnership somehow — King and Markus, and Bruno Steinhoff," he said.

As we now know, this suspicion appears to have been right.

But there were other mysterious deals between Steinhoff and Pavilion.

On July 24 2000, Evans wrote to Steinhoff Europe’s Schmidt again: "I understand that agreement has been reached for the sale from Steinhoff to Pavilion." But Evans did not say what was being sold.

Three days later, internal documents show, Jooste’s trust transferred £30.4m (R318m) to Pavilion, with the transactions described as "Steinhoff: re Pavilion Properties". It would seem that Jooste had bought something from Steinhoff for £30.4m, but it’s not clear what. Yet Steinhoff’s audited accounts for that year showed no trace of a huge deal with its executives Jooste, Bruno Steinhoff and Norbert.

In one small disclosure, the company revealed: "Steinhoff Africa disposed of its entire property portfolio to an institutional investor." No name was provided.

According to Steinhoff’s accounts, the proceeds received from the sale of the property, plant and equipment amounted to R340m — which, translated at the exchange rates of the time, amounted to just over £30.4m. Had Jooste bought the entire property portfolio of Steinhoff Africa?

As Steinhoff expanded globally, Jooste, King and Evans rolled out another secret scheme.

Investors and journalists caught on to this one in the mid-2000s, reporting how shady offshore companies had amassed shares in companies that would later be bought by Steinhoff in the UK and Australia for a premium. The implication was that this was "front-running" — a form of market manipulation where insiders use their knowledge to buy into companies knowing that a deal is imminent and they can make a quick profit.

Though news reports at the time showed that King and Evans were linked to those offshore companies, there was no concrete evidence back then that Jooste could have made money from the Steinhoff deals.

However, evidence has now emerged that shows how King appears to have fronted for Jooste in at least two of these furniture share deals.

For example, in 1999, a BVI company called Formal Property Management Services bought shares in the London-listed bed and mattress firm Airsprung Furniture Group.

According to news reports at the time, Formal (represented by King) had scooped up 2% of Airsprung by March 2003. Later in 2003, Steinhoff announced it would buy Airsprung’s major asset, its subsidiary Sprung Slumber. In 2000, Formal Property Management Services, bought shares in British furniture maker Cornwell Parker. We do not know if this was a Steinhoff target or trading partner, but internal Formal documents revealed a back-to-back agreement between it and Jooste’s Danesfort.

One says: "In both above transactions [Airsprung and Cornwell Parker] the company [Formal Property] is acting 50% for its own account and 50% for account of Danesfort Investments Ltd who have paid the company 50% of the purchase costs."

In other words, King was fronting for Jooste.

Yet King’s lawyer told us: "Mr Jooste has never had an interest in Formal Property Management Services." He also said: "For the avoidance of [doubt] our client does not recognise your description of him acting as a ‘proxy’ or ‘bagman’ to Mr Jooste and you should be very careful to ensure that you do not make any defamatory statements about him."

But the truly shocking trades were still to come.

Steinhoff’s Australian adventure began in 1999, when it opened a small factory to supply the Australian-listed furniture retailer Freedom Group. In 2001, Steinhoff and Freedom then formed a strategic partnership through a new 50/50 joint venture, called Steinhoff Pacific.

Jooste joined Freedom’s board, while at the same time, his associates King and Evans began to buy Freedom shares. King used Formal Property to buy the shares, while Evans used a Bahamian company called Hawkesbury. By mid-2002, Formal Property and Hawkesbury had, between them, built an impressive 27% position in Freedom.

The Steinhoff family’s own Swiss investment vehicle, Fihag Finanz und Handels, also built up a large position in Freedom. Jooste, it turns out, signed share transfer paperwork on Fihag’s behalf too — demonstrating his involvement.

Even at the time, investors were sceptical. As one told the Australian Financial Review: "I find it very hard to understand why [Formal and Hawkesbury] would put so much capital into a small Australian retailer and have no active involvement."

But it proved a great investment because, in 2003, Steinhoff part-funded the Freedom Group’s managers when they announced they would buy out Freedom’s shareholders for A$221m (R1bn) at a premium.

In other words, anyone who’d bought shares knowing a buyout was imminent would have been in a position to score.

King’s lawyer claimed there was no front-running. "All transactions relating to the acquisition and takeover of Freedom Group were disclosed to the appropriate regulatory authorities in Australia at the relevant time," he told us.

But another revelation is that Jooste had hidden skin in the game here too, as he secretly owned Hawkesbury.

The implications are staggering. It means that Steinhoff, controlled by Jooste, backed a deal to buy shares from companies secretly owned by him and his friend King.

And then it happened again.

By August 2004, Formal Property had built up a 5.1% stake in the UK furniture retailer Homestyle. Steinhoff supplied furniture to Homestyle at the time.

A journalist at the British Independent said: "[Formal Property] has a history of spotting companies on the cusp of being taken over. Could something similar be on the cards at Homestyle?"

Investors thought so and Homestyle stock reportedly surged. London publisher Citywire dubbed Formal Property the "Homestyle stalker".

Up to that point, Steinhoff had not been a retailer. It made furniture and sold it to retailers like Homestyle. But, as King may or may not have known, that was about to change. In 2005, Steinhoff bought 61% of Homestyle, offering 55p a share.

Steinhoff’s secret history and the dirty world of Markus Jooste 2/3

...Evans was born 68 years ago in Wales. When he was 23, he moved to the island tax haven of Jersey in the English Channel to join Citibank and learn the ropes of offshore wealth management and financial secrecy. He stayed with Citibank through the 1970s and 1980s, taking assignments in New York, Kenya and Turkey before resigning in 1990 "to pursue private interests". He returned to Jersey to set himself up as a professional trust provider, founding a company called Warren Trustees Group.

By 1997, Evans was handling both Jooste’s and the Steinhoff family’s offshore affairs. First, he incorporated Danesfort Investments in Jersey as Jooste’s own company — though its true ownership was hidden behind the Warren Trustees brass plate. Warren Trustees and Bruno Steinhoff also created The Marksman Trust for the benefit of Steinhoff’s daughters. Not long after, Evans began managing Jooste’s existing trust, Nordic Settlement, which Jooste had created years earlier to hold his offshore wealth. Evans would place Danesfort under Nordic too.

These entities would be the main vehicles for the secret deals.

Equally pivotal to these deals was King. In 1993, King lived in Cirencester, England. He was wealthy, with investments in commercial properties around Weston-super-Mare, an hour’s drive from Cirencester.

According to Jooste’s former colleagues, King met Jooste at that time through a British acquaintance. They hit it off. In 1993, Jooste and a number of his SA friends bought a 25% stake in two of King’s property companies: Marketing & Development (Holdings) in the UK and another registered in the British Virgin Islands (BVI), a tax haven.

Marketing & Development owned a number of properties, including Formal House and Formal Industrial Park. The "Formal" brand later came to define King’s property empire, which was boosted by his, Evans’ and Jooste’s Steinhoff "self-dealing".

But to understand how it got to this, we need to understand Steinhoff’s early days.

Bruno Steinhoff founded his company in 1964, based on the simple model of buying furniture cheaply in communist East Germany and selling it in the relatively richer West. One of his close friends was German industrialist Claas Daun, who had bought a number of furniture companies in SA and invested in Gommagomma, a furniture company run by Jooste in the early 1990s. In 1995, Daun sent Jooste to visit Bruno "to go and have a look and see if there was something we could create between the two businesses", Jooste later recalled.

The three formed a joint venture in SA that would become the platform for the modern Steinhoff.

In an interview, Daun explained that in the 1990s, "we needed money … and I mentioned it in a discussion with Markus: is it not possible to take money from the stock exchange?… Markus jumped on this horse. He said: ‘That’s it! Stock exchange!’ And out of that things developed very quickly."

Jooste and Bruno Steinhoff then began preparing to list the company on the JSE to take money from the public, which finally happened in September 1998.

Unbeknown to investors, Evans was simultaneously setting up Jooste and Bruno Steinhoff’s overseas trusts, which would end up benefiting from Steinhoff’s rapidly expanding appetite for deals.

For example, one of the assets Jooste packaged for the listing was a UK firm, Spearhead Furniture (later renamed Steinhoff UK Furniture), which imported knockdown SA pine furniture into the UK.

Steinhoff bought Spearhead from Jooste’s friend, Jim Lewis. He co-owned racehorses with Jooste and Malcolm King. (Lewis hung up when we called him and ignored further messages and calls.)

By the time of the 1998 listing, Steinhoff owned half of Spearhead. A year later, it bought the rest — but in the interim Jooste and Lewis set out to find a site for a new warehouse to become Steinhoff’s UK headquarters.

What followed might be described as Jooste’s first bite of the forbidden fruit that poisoned Steinhoff.

In February 1999, Evans’ staff at Warren Trustees bought a shelf company in the Bahamas called Alvaglen Estates from the Panamanian law firm Mossack Fonseca.

Mossack Fonseca lay at the heart of offshore finance. It had a global network of offices that registered thousands of companies, mostly in British tax havens, for hidden clients.

At the outset, Alvaglen’s founding directors were Evans, one of his employees and two nominees. In a May 1999 document, Evans said Alvaglen wanted to buy "certain industrial premises located at Ashchurch, Tewkesbury, Gloucestershire, United Kingdom". For this, Barclays Bank would lend Alvaglen £2.65m (R26m then).

But Alvaglen was a faceless shelf company with no track record or assets. How would it repay the loan? Why would Barclays take a risk on an unknown entity?

The answer was that Steinhoff was standing behind it. As Evans put it, Alvaglen was "desirous of entering into a lease agreement with Spearhead … to lease the said premises for a period of 25 years". Other documents confirm that Steinhoff Europe would also guarantee Spearhead’s lease.

Which was a lucky break. So, Alvaglen would simultaneously sign a lease with Steinhoff, get a loan on the strength of that lease and buy the property.

In other words, Steinhoff used its balance sheet to bankroll Alvaglen’s new property — which might be fine if the deal was good, and there were no Steinhoff executives hiding behind Evans.

Only, there were.

Alvaglen’s company documents, obtained in this investigation, revealed its shareholders: "[Fifty] shares held each by M&D Holdings (Jersey) Ltd and Pavilion Properties Ltd."

Weeks of digging through company documents showed that Jooste’s friend, King, owned M&D while, crucially, Jooste and the Steinhoffs themselves owned Pavilion, which was incorporated in Jersey and registered at Warren Trustees.

In other words, the wealth created by Steinhoff’s lease payments and its financial guarantee had flowed to a company covertly owned by Steinhoff top brass.

Though this hasn’t been revealed until now, Jooste had acquired part of Pavilion in 1993, holding it through his trust Nordic, alongside a number of his friends and business associates.

It was the same Pavilion which, in 1993, had invested in two of King’s property companies, including Marketing & Development.

Internal records at the time claim that Pavilion was worth £3.55m (R37m) after Alvaglen picked up the Tewkesbury site in 1999 — so this property deal represented a windfall for Jooste.

Then the Steinhoff family got involved in Pavilion too. In early 2000, Evans bought a shelf company called Jamison Overseas, which took shares in Pavilion. Soon after, the Steinhoff family’s Marksman Trust took ownership of Jamison.

Internal memos show that Alvaglen planned to develop the Tewkesbury site, and then lease it to "UK trading companies". The plan, actually, was to refurbish a rundown warehouse that stood on the Tewkesbury site and lease it to Steinhoff.

That memo explained that Alvagen was 50% owned by King with the other 50% held by Jooste and the Steinhoffs through Pavilion. Breaking it down further, Jooste’s Nordic held 66.7% of Pavilion through Danesfort, while the Steinhoffs’ Marksman Trust held 33.3% through Jamison.

Behind layers of shell companies and trusts, they had done everything possible to hide their stakes in Alvaglen.

The problem was that the Steinhoff top brass were on both sides of the deal — and there was no disclosure in official documents of this "related party" transaction.

At the time, Jooste, Bruno Steinhoff and his brother Norbert were Steinhoff executives, and Jooste and Norbert were also Spearhead directors while the lease was finalised with Alvaglen.

Tewkesbury, it seemed, was a scheme in which Jooste and the Steinhoffs ultimately used their control over Steinhoff to covertly enrich themselves and Jooste’s friend, King.

Besides the rent paid to Alvaglen, Evans also invoiced Steinhoff Europe director Siegmar Schmidt every three months on an Alvaglen letterhead for £100,000 (R1.4m) for a "management charge".

Schmidt did not respond to e-mails, but we asked someone who worked at Steinhoff’s Tewkesbury warehouse about these payments. "There’s no reason for it. None whatsoever. What the hell could it be for?" he said.

This former Steinhoff employee explained King’s role at the time: "King did the Tewkesbury development. He bought the site and he then built it. He had employees on site, front-end loaders. He made it happen." He added that while he believed King owned it, whenever Jooste came to the UK, he stayed with King at his house. "I felt, purely from the conversations at the time, that they were in partnership somehow — King and Markus, and Bruno Steinhoff," he said.

As we now know, this suspicion appears to have been right.

But there were other mysterious deals between Steinhoff and Pavilion.

On July 24 2000, Evans wrote to Steinhoff Europe’s Schmidt again: "I understand that agreement has been reached for the sale from Steinhoff to Pavilion." But Evans did not say what was being sold.

Three days later, internal documents show, Jooste’s trust transferred £30.4m (R318m) to Pavilion, with the transactions described as "Steinhoff: re Pavilion Properties". It would seem that Jooste had bought something from Steinhoff for £30.4m, but it’s not clear what. Yet Steinhoff’s audited accounts for that year showed no trace of a huge deal with its executives Jooste, Bruno Steinhoff and Norbert.

In one small disclosure, the company revealed: "Steinhoff Africa disposed of its entire property portfolio to an institutional investor." No name was provided.

According to Steinhoff’s accounts, the proceeds received from the sale of the property, plant and equipment amounted to R340m — which, translated at the exchange rates of the time, amounted to just over £30.4m. Had Jooste bought the entire property portfolio of Steinhoff Africa?

As Steinhoff expanded globally, Jooste, King and Evans rolled out another secret scheme.

Investors and journalists caught on to this one in the mid-2000s, reporting how shady offshore companies had amassed shares in companies that would later be bought by Steinhoff in the UK and Australia for a premium. The implication was that this was "front-running" — a form of market manipulation where insiders use their knowledge to buy into companies knowing that a deal is imminent and they can make a quick profit.

Though news reports at the time showed that King and Evans were linked to those offshore companies, there was no concrete evidence back then that Jooste could have made money from the Steinhoff deals.

However, evidence has now emerged that shows how King appears to have fronted for Jooste in at least two of these furniture share deals.

For example, in 1999, a BVI company called Formal Property Management Services bought shares in the London-listed bed and mattress firm Airsprung Furniture Group.

According to news reports at the time, Formal (represented by King) had scooped up 2% of Airsprung by March 2003. Later in 2003, Steinhoff announced it would buy Airsprung’s major asset, its subsidiary Sprung Slumber. In 2000, Formal Property Management Services, bought shares in British furniture maker Cornwell Parker. We do not know if this was a Steinhoff target or trading partner, but internal Formal documents revealed a back-to-back agreement between it and Jooste’s Danesfort.

One says: "In both above transactions [Airsprung and Cornwell Parker] the company [Formal Property] is acting 50% for its own account and 50% for account of Danesfort Investments Ltd who have paid the company 50% of the purchase costs."

In other words, King was fronting for Jooste.

Yet King’s lawyer told us: "Mr Jooste has never had an interest in Formal Property Management Services." He also said: "For the avoidance of [doubt] our client does not recognise your description of him acting as a ‘proxy’ or ‘bagman’ to Mr Jooste and you should be very careful to ensure that you do not make any defamatory statements about him."

But the truly shocking trades were still to come.

Steinhoff’s Australian adventure began in 1999, when it opened a small factory to supply the Australian-listed furniture retailer Freedom Group. In 2001, Steinhoff and Freedom then formed a strategic partnership through a new 50/50 joint venture, called Steinhoff Pacific.

Jooste joined Freedom’s board, while at the same time, his associates King and Evans began to buy Freedom shares. King used Formal Property to buy the shares, while Evans used a Bahamian company called Hawkesbury. By mid-2002, Formal Property and Hawkesbury had, between them, built an impressive 27% position in Freedom.

The Steinhoff family’s own Swiss investment vehicle, Fihag Finanz und Handels, also built up a large position in Freedom. Jooste, it turns out, signed share transfer paperwork on Fihag’s behalf too — demonstrating his involvement.

Even at the time, investors were sceptical. As one told the Australian Financial Review: "I find it very hard to understand why [Formal and Hawkesbury] would put so much capital into a small Australian retailer and have no active involvement."

But it proved a great investment because, in 2003, Steinhoff part-funded the Freedom Group’s managers when they announced they would buy out Freedom’s shareholders for A$221m (R1bn) at a premium.

In other words, anyone who’d bought shares knowing a buyout was imminent would have been in a position to score.

King’s lawyer claimed there was no front-running. "All transactions relating to the acquisition and takeover of Freedom Group were disclosed to the appropriate regulatory authorities in Australia at the relevant time," he told us.

But another revelation is that Jooste had hidden skin in the game here too, as he secretly owned Hawkesbury.

The implications are staggering. It means that Steinhoff, controlled by Jooste, backed a deal to buy shares from companies secretly owned by him and his friend King.

And then it happened again.

By August 2004, Formal Property had built up a 5.1% stake in the UK furniture retailer Homestyle. Steinhoff supplied furniture to Homestyle at the time.

A journalist at the British Independent said: "[Formal Property] has a history of spotting companies on the cusp of being taken over. Could something similar be on the cards at Homestyle?"

Investors thought so and Homestyle stock reportedly surged. London publisher Citywire dubbed Formal Property the "Homestyle stalker".

Up to that point, Steinhoff had not been a retailer. It made furniture and sold it to retailers like Homestyle. But, as King may or may not have known, that was about to change. In 2005, Steinhoff bought 61% of Homestyle, offering 55p a share.

Antwort auf Beitrag Nr.: 59.132.222 von faultcode am 03.11.18 21:25:15

https://www.businesslive.co.za/fm/features/cover-story/2018-…

=>

For years, former CEO Markus Jooste and his inner circle wove an intricate web of opaque deals hidden from shareholders to covertly enrich themselves

An amaBhungane and FM investigation has confirmed what many have long suspected: former Steinhoff CEO Markus Jooste held secret stakes in companies that traded with Steinhoff for years to Jooste’s covert benefit. These deals’ true beneficiaries were hidden from investors.

Nor was he the only one. Some of the deals also secretly included the Steinhoff family, through a trust founded by the company’s founder, Bruno Steinhoff, for his daughters, including current Steinhoff director Angela Krüger-Steinhoff.

Weeks ahead of the expected findings of a PwC forensic report on what went wrong at Steinhoff, this new evidence suggests Jooste, 57, used Steinhoff to secretly enrich himself and Bruno Steinhoff’s family at the expense of shareholders, who were none the wiser about this "self-dealing".

It also suggests that, contrary to the view that Steinhoff only took a wrong turn shortly before it imploded last December, a systematic heist played out from the start, when Steinhoff listed on the JSE in 1998.

It’s an alarming new twist in what could be SA’s biggest corporate swindle. After Jooste resigned on December 5 and Steinhoff admitted to "accounting irregularities", Steinhoff’s stock tumbled more than 90% — a loss of more than R200bn.

Now it turns out that Jooste, who has holed up in the seaside town of Hermanus since the scandal broke, had built a network of a few key individuals who helped him construct these secret deals for two decades.

Two linchpins of the network were a British property developer, Malcolm King, and George Alan Evans, a Geneva-based former banker with a patchy history.

King, 74, sometimes fronted for Jooste in furniture company trades, while Evans handled Jooste’s and the Steinhoffs’ offshore companies, using "placeholders" to hide the identity of the real owners.

For example, Jooste used one such company to amass a stake in a listed Australian firm shortly before Steinhoff acquired it. This may have been an example of insider trading, which is illegal.

This pattern of purchasing hidden stakes in companies, which were in some cases bought by Steinhoff for a premium, confirms what investigators have been trying to uncover.

Our revelations about Jooste’s secret dealings came, in part, from the Panama Papers — the cache of 11.5-million documents leaked in 2015 by Panamanian law firm Mossack Fonseca to German newspaper Süddeutsche Zeitung and shared with journalists around the world. But a substantial number of new documents were also sourced from people with intimate knowledge of Steinhoff’s inner workings.

Jooste refused to answer any of our questions about these deals. This wasn’t altogether surprising. For months, he resisted MPs’ demands to answer questions in parliament until, in August, a court ordered him to appear. When he did, he gave little away.

In parliament Jooste was composed. He claimed that a disgruntled European business partner had attacked Steinhoff; that Steinhoff’s auditors were unreasonable; and that he knew of no "accounting irregularities". When one MP asked him about his dealings with King and Evans, Jooste ducked, giving away nothing. But another MP, David Maynier (DA), persisted: "What is your business relationship and or indeed personal relationship with a gentleman called George Alan Evans?"

Jooste’s answer was unhelpfully obvious: "George Alan Evans that you refer to is the senior partner of Campion Capital."

Jooste set his eyes on Maynier, swallowed, leant back and struck out with his right hand to shut off his microphone. He looked down at his notes and up at Maynier again, and down, then back up.

Maynier didn’t relent: "I mean, did you have a personal business relationship with George Alan Evans? Did you ever meet him? Interact with him?"

Jooste snapped: "Of course. I know him well. Done business for years. It’s not a … I have no financial interest in him or his affairs. We dealt as …" Jooste paused and gestured irritably: "… counterparties to each other."

Only this does not appear to be true.

...

Steinhoff’s secret history and the dirty world of Markus Jooste 1/3 --> Endspiel

1.11.https://www.businesslive.co.za/fm/features/cover-story/2018-…

=>

For years, former CEO Markus Jooste and his inner circle wove an intricate web of opaque deals hidden from shareholders to covertly enrich themselves

An amaBhungane and FM investigation has confirmed what many have long suspected: former Steinhoff CEO Markus Jooste held secret stakes in companies that traded with Steinhoff for years to Jooste’s covert benefit. These deals’ true beneficiaries were hidden from investors.

Nor was he the only one. Some of the deals also secretly included the Steinhoff family, through a trust founded by the company’s founder, Bruno Steinhoff, for his daughters, including current Steinhoff director Angela Krüger-Steinhoff.

Weeks ahead of the expected findings of a PwC forensic report on what went wrong at Steinhoff, this new evidence suggests Jooste, 57, used Steinhoff to secretly enrich himself and Bruno Steinhoff’s family at the expense of shareholders, who were none the wiser about this "self-dealing".

It also suggests that, contrary to the view that Steinhoff only took a wrong turn shortly before it imploded last December, a systematic heist played out from the start, when Steinhoff listed on the JSE in 1998.

It’s an alarming new twist in what could be SA’s biggest corporate swindle. After Jooste resigned on December 5 and Steinhoff admitted to "accounting irregularities", Steinhoff’s stock tumbled more than 90% — a loss of more than R200bn.

Now it turns out that Jooste, who has holed up in the seaside town of Hermanus since the scandal broke, had built a network of a few key individuals who helped him construct these secret deals for two decades.

Two linchpins of the network were a British property developer, Malcolm King, and George Alan Evans, a Geneva-based former banker with a patchy history.

King, 74, sometimes fronted for Jooste in furniture company trades, while Evans handled Jooste’s and the Steinhoffs’ offshore companies, using "placeholders" to hide the identity of the real owners.

For example, Jooste used one such company to amass a stake in a listed Australian firm shortly before Steinhoff acquired it. This may have been an example of insider trading, which is illegal.

This pattern of purchasing hidden stakes in companies, which were in some cases bought by Steinhoff for a premium, confirms what investigators have been trying to uncover.

Our revelations about Jooste’s secret dealings came, in part, from the Panama Papers — the cache of 11.5-million documents leaked in 2015 by Panamanian law firm Mossack Fonseca to German newspaper Süddeutsche Zeitung and shared with journalists around the world. But a substantial number of new documents were also sourced from people with intimate knowledge of Steinhoff’s inner workings.

Jooste refused to answer any of our questions about these deals. This wasn’t altogether surprising. For months, he resisted MPs’ demands to answer questions in parliament until, in August, a court ordered him to appear. When he did, he gave little away.

In parliament Jooste was composed. He claimed that a disgruntled European business partner had attacked Steinhoff; that Steinhoff’s auditors were unreasonable; and that he knew of no "accounting irregularities". When one MP asked him about his dealings with King and Evans, Jooste ducked, giving away nothing. But another MP, David Maynier (DA), persisted: "What is your business relationship and or indeed personal relationship with a gentleman called George Alan Evans?"

Jooste’s answer was unhelpfully obvious: "George Alan Evans that you refer to is the senior partner of Campion Capital."

Jooste set his eyes on Maynier, swallowed, leant back and struck out with his right hand to shut off his microphone. He looked down at his notes and up at Maynier again, and down, then back up.

Maynier didn’t relent: "I mean, did you have a personal business relationship with George Alan Evans? Did you ever meet him? Interact with him?"

Jooste snapped: "Of course. I know him well. Done business for years. It’s not a … I have no financial interest in him or his affairs. We dealt as …" Jooste paused and gestured irritably: "… counterparties to each other."

Only this does not appear to be true.

...

Antwort auf Beitrag Nr.: 59.124.284 von faultcode am 02.11.18 14:47:08

=> dabei entstand ein Expansion Pivot bearish, welches nur einen Tag später handelbar wurde

=> damit war der anschließende Niedergang des Aktienkurses endgültig eingeleitet

=> davon wird sich die Steinhoff-Aktie mit an Sicherheit grenzender Wahrscheinlichkeit (mittelfristig), und im derzeitigen und zukünftigen globalen Konjunkturumfeld, nicht mehr erholen:

20. September 2018 -- der Tag, an dem die letzten Steinhoff-Hoffnungen begraben wurden

an dem Tag (http://www.sharenet.co.za/free/sens/disp_news.phtml?tdate=20…) fand in London ein Lenders’ meeting statt:=> dabei entstand ein Expansion Pivot bearish, welches nur einen Tag später handelbar wurde

=> damit war der anschließende Niedergang des Aktienkurses endgültig eingeleitet

=> davon wird sich die Steinhoff-Aktie mit an Sicherheit grenzender Wahrscheinlichkeit (mittelfristig), und im derzeitigen und zukünftigen globalen Konjunkturumfeld, nicht mehr erholen:

Moin, wieso könnt ihr nicht einfach mal abwarten? Aktien von SH kaufen und dann am liebsten innerhalb eines monats ne verzehnfachung? Schön wärs, klappt leider nur sehr selten. Entweder man vetraut dem management und der erfolgreichen restruktierung oder eben nicht. Naja, danke an die leute die novh wertvolle beiträge/infomartionen hier einstellen

Antwort auf Beitrag Nr.: 59.126.978 von Ines43 am 02.11.18 19:32:11Die Expansion ist noch nicht erfasst und würde somit verschenkt. 10% zahlt man auch nicht auf pepkor Schulden.. ich glaube nicht dass man pepkor abstößt

Steinhoff: Tag der Rettung – wieviel Wert bleibt in der Aktie?