FLSmidth - Mining und Cement

eröffnet am 12.08.18 21:09:58 von

neuester Beitrag 27.12.22 18:34:13 von

neuester Beitrag 27.12.22 18:34:13 von

Beiträge: 17

ID: 1.286.242

ID: 1.286.242

Aufrufe heute: 0

Gesamt: 1.219

Gesamt: 1.219

Aktive User: 0

ISIN: DK0010234467 · WKN: 860885 · Symbol: F6O1

48,76

EUR

+0,58 %

+0,28 EUR

Letzter Kurs 08.05.24 Tradegate

Neuigkeiten

30.04.24 · globenewswire |

15.04.24 · globenewswire |

11.04.24 · globenewswire |

10.04.24 · globenewswire |

13.03.24 · globenewswire |

Werte aus der Branche Industrie/Mischkonzerne

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7459 | +41,19 | |

| 1,7800 | +21,92 | |

| 18,020 | +15,51 | |

| 9,1000 | +10,98 | |

| 14,000 | +10,24 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 289,00 | -5,73 | |

| 150,00 | -6,54 | |

| 30,80 | -7,23 | |

| 36,60 | -8,04 | |

| 2,2000 | -11,29 |

Beitrag zu dieser Diskussion schreiben

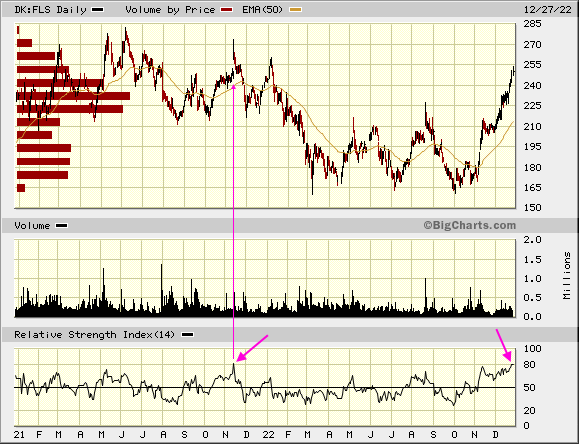

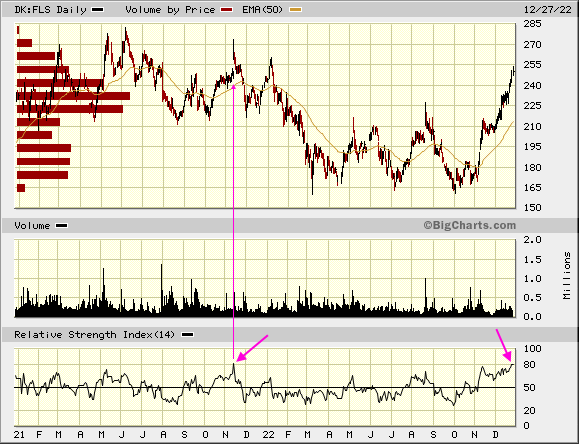

Antwort auf Beitrag Nr.: 72.461.139 von faultcode am 24.09.22 15:03:22Rock 'n roll -- der Chart ist schon sehr heiß gelaufen:

das "core Mining business" halt:

20.10.

FLSmidth announces strategic change to enhance long-term profitability and accelerate growth in the core Mining business. Synergy target is raised and accelerated, and financial guidance for 2022 is updated

https://www.flsmidth.com/en-gb/company/news/company-announce…

das "core Mining business" halt:

20.10.

FLSmidth announces strategic change to enhance long-term profitability and accelerate growth in the core Mining business. Synergy target is raised and accelerated, and financial guidance for 2022 is updated

https://www.flsmidth.com/en-gb/company/news/company-announce…

Antwort auf Beitrag Nr.: 68.906.211 von faultcode am 29.07.21 14:17:45

9.9.

Chart and FLSmidth to collaborate on carbon capture that targets over 90% removal of CO2 emissions from cement production

https://www.flsmidth.com/en-gb/company/news/company-announce…

FLSmidth has signed an agreement with Chart Industries, Inc. (“Chart”) to implement advanced carbon capture technology to significantly reduce CO2 emissions from cement production. Cement production represents 7-8% of the global CO2 emission – carbon capture technologies are essential to reduce that number and meet the targets of the Paris Agreement.

The new collaboration between FLSmidth and Chart joins the two companies’ efforts to adapt and commercialize Chart’s Cryogenic Carbon CaptureTM (CCC) for customers in the cement industry. CCC is an advanced post-combustion technology developed by Sustainable Energy Solutions (SES), a Chart company. CCC utilizes equipment manufactured by Chart and its affiliates to capture CO2 from exhaust gas at very high rates and produce it as a high-purity liquid ready for storage and use.

Working with Chart, FLSmidth will use its global reach and process knowledge to accelerate the commercialization of CCC and optimize the design of the technology for the cement industry. The ambition is to reduce over 90% of carbon emissions from industrial sources at half the cost and energy of current carbon capture processes.

...

Chart Industries (NYSE: GTLS): Anlagenbauer aus Georgia für Anlagen zur Gasverflüssigung, Tanks, industrielle Wärmetauscher-Anlagen etc.

Chart and FLSmidth to collaborate on carbon capture that targets over 90% removal of CO2 emissions from cement production

https://www.flsmidth.com/en-gb/company/news/company-announce…

FLSmidth has signed an agreement with Chart Industries, Inc. (“Chart”) to implement advanced carbon capture technology to significantly reduce CO2 emissions from cement production. Cement production represents 7-8% of the global CO2 emission – carbon capture technologies are essential to reduce that number and meet the targets of the Paris Agreement.

The new collaboration between FLSmidth and Chart joins the two companies’ efforts to adapt and commercialize Chart’s Cryogenic Carbon CaptureTM (CCC) for customers in the cement industry. CCC is an advanced post-combustion technology developed by Sustainable Energy Solutions (SES), a Chart company. CCC utilizes equipment manufactured by Chart and its affiliates to capture CO2 from exhaust gas at very high rates and produce it as a high-purity liquid ready for storage and use.

Working with Chart, FLSmidth will use its global reach and process knowledge to accelerate the commercialization of CCC and optimize the design of the technology for the cement industry. The ambition is to reduce over 90% of carbon emissions from industrial sources at half the cost and energy of current carbon capture processes.

...

Chart Industries (NYSE: GTLS): Anlagenbauer aus Georgia für Anlagen zur Gasverflüssigung, Tanks, industrielle Wärmetauscher-Anlagen etc.

https://finance.yahoo.com/news/trevali-begins-pilot-testing-…

...

Tag:

• Rapid Oxidative Leach ("ROL") process

...

Tag:

• Rapid Oxidative Leach ("ROL") process

Antwort auf Beitrag Nr.: 66.457.544 von faultcode am 15.01.21 14:21:42jetzt hat's geklappt:

29.7.

FLSmidth to acquire thyssenkrupp’s Mining business – creating a global industry leader in mining technology

https://www.flsmidth.com/en-gb/company/news/company-announce…

...

=>

<Nasdaq Copenhagen>

29.7.

FLSmidth to acquire thyssenkrupp’s Mining business – creating a global industry leader in mining technology

https://www.flsmidth.com/en-gb/company/news/company-announce…

...

=>

<Nasdaq Copenhagen>

der Zement mal wieder:

...

Mining supplier FLSmidth said Wednesday that its group organic order intake was on par with last year.

The company supplies miners with processing equipment such as in-pit crushers and conveyors.

The group's revenue declined 16% organically, with the EBITA margin decreasing to 4.7%.

"Organically, the order intake in 2020 was on par with last year, comprising a 13% growth in mining and a 22% decline in cement," said the company in its year-end.

"Cement was loss-making, whereas profitability in mining was quite resilient."

The company touted strong cash flow, reduction in net working capital, and net debt.

FLSmidth sees continued growth in mining.

"The outlook for the mining industry remains positive. For 2021, the mining business revenue and EBITA are expected to grow in the second half of the year as COVID-19 restrictions are expected to ease. EBITA-margin for mining is expected to be high-single digit."

...

10.2.

FLSmidth gets 13% lift from mining

https://www.kitco.com/news/2021-02-10/FLSmidth-gets-13-lift-…

...

Mining supplier FLSmidth said Wednesday that its group organic order intake was on par with last year.

The company supplies miners with processing equipment such as in-pit crushers and conveyors.

The group's revenue declined 16% organically, with the EBITA margin decreasing to 4.7%.

"Organically, the order intake in 2020 was on par with last year, comprising a 13% growth in mining and a 22% decline in cement," said the company in its year-end.

"Cement was loss-making, whereas profitability in mining was quite resilient."

The company touted strong cash flow, reduction in net working capital, and net debt.

FLSmidth sees continued growth in mining.

"The outlook for the mining industry remains positive. For 2021, the mining business revenue and EBITA are expected to grow in the second half of the year as COVID-19 restrictions are expected to ease. EBITA-margin for mining is expected to be high-single digit."

...

10.2.

FLSmidth gets 13% lift from mining

https://www.kitco.com/news/2021-02-10/FLSmidth-gets-13-lift-…

Antwort auf Beitrag Nr.: 66.102.475 von faultcode am 17.12.20 12:54:05...

Die nach Buchprüfungen vorliegenden Angebote mehrerer Interessenten hätten nicht überzeugt, heißt es in einem internen Rundschreiben an die Mitarbeiter aus der vergangenen Woche. Deshalb sei beschlossen worden, den Verkaufsprozess "bis auf Weiteres auszusetzen und das Zementgeschäft in der thyssenkrupp-Gruppe zu belassen"

Ein Verkauf oder eine Partnerschaft sei auf längere Sicht allerdings nicht ausgeschlossen.

...

https://www.finanzen.net/nachricht/aktien/turnaround-angestr…

Die nach Buchprüfungen vorliegenden Angebote mehrerer Interessenten hätten nicht überzeugt, heißt es in einem internen Rundschreiben an die Mitarbeiter aus der vergangenen Woche. Deshalb sei beschlossen worden, den Verkaufsprozess "bis auf Weiteres auszusetzen und das Zementgeschäft in der thyssenkrupp-Gruppe zu belassen"

Ein Verkauf oder eine Partnerschaft sei auf längere Sicht allerdings nicht ausgeschlossen.

...

https://www.finanzen.net/nachricht/aktien/turnaround-angestr…

Antwort auf Beitrag Nr.: 66.310.727 von faultcode am 06.01.21 15:24:5115.1.

Dänische FLSmidth an Tagebaugeschäft von Thyssenkrupp interessiert

https://www.wallstreet-online.de/nachricht/13368341-daenisch…

...

Der dänische Anlagenbauer FLSmidth & Co ist an Teilen der Industrieanlagensparte von Thyssenkrupp interessiert. Es gebe Gespräche über einen Kauf des Geschäfts mit Tagebauanlagen, teilte das Unternehmen am Freitag in Kopenhagen mit.

Die Verhandlungen seien in einer nicht-bindenden Phase und es gebe keine Gewähr, dass es zu einer Transaktion kommen werde.

...

Im Dezember wurde bereits über ein Interesse von FLSmidth an dem Bergbaugeschäft von Thyssenkrupp in der Presse spekuliert. Die Dänen konzentrieren sich auf Anlagen und Dienstleistungen für Zement und den Bergbau.

...

Dänische FLSmidth an Tagebaugeschäft von Thyssenkrupp interessiert

https://www.wallstreet-online.de/nachricht/13368341-daenisch…

...

Der dänische Anlagenbauer FLSmidth & Co ist an Teilen der Industrieanlagensparte von Thyssenkrupp interessiert. Es gebe Gespräche über einen Kauf des Geschäfts mit Tagebauanlagen, teilte das Unternehmen am Freitag in Kopenhagen mit.

Die Verhandlungen seien in einer nicht-bindenden Phase und es gebe keine Gewähr, dass es zu einer Transaktion kommen werde.

...

Im Dezember wurde bereits über ein Interesse von FLSmidth an dem Bergbaugeschäft von Thyssenkrupp in der Presse spekuliert. Die Dänen konzentrieren sich auf Anlagen und Dienstleistungen für Zement und den Bergbau.

...

Antwort auf Beitrag Nr.: 66.102.475 von faultcode am 17.12.20 12:54:05FLSmidth announces the sale of its Möller pneumatic conveying systems business to REEL

https://www.marketscreener.com/quote/stock/FLSMIDTH-CO-14129…

...

On 29 December, 2020, FLSmidth entered into a definitive agreement to sell its Germany-based Möller business to French conglomerate REEL. REEL is an industrial group specialising in complex handling and lifting systems with annual sales of €400m.

Möller, also known as FLSmidth Hamburg GmbH, is a specialist in design, supply, installation and service of pneumatic conveying systems. The company caters to the power and aluminium industries. All of Möller’s 60 employees will join the REEL family.

Möller, founded in 1934, was acquired by FLSmidth in 1996 with the intention of enhancing FLSmidth’s business in the power sector which is no longer a sector of focus for FLSmidth.

Carsten Riisberg Lund, FLSmidth’s Cement President, commented:

“The sale of Möller is part of an ongoing process aimed at reshaping FLSmidth’s Cement industry. Consistent with the corporate strategy we announced earlier this year, we are pursuing a more focused Cement portfolio. The new owner has a strong focus on the aluminium and related sectors and is therefore a natural fit for Möller’s future.”

Terms of this transaction will remain confidential.

https://www.marketscreener.com/quote/stock/FLSMIDTH-CO-14129…

...

On 29 December, 2020, FLSmidth entered into a definitive agreement to sell its Germany-based Möller business to French conglomerate REEL. REEL is an industrial group specialising in complex handling and lifting systems with annual sales of €400m.

Möller, also known as FLSmidth Hamburg GmbH, is a specialist in design, supply, installation and service of pneumatic conveying systems. The company caters to the power and aluminium industries. All of Möller’s 60 employees will join the REEL family.

Möller, founded in 1934, was acquired by FLSmidth in 1996 with the intention of enhancing FLSmidth’s business in the power sector which is no longer a sector of focus for FLSmidth.

Carsten Riisberg Lund, FLSmidth’s Cement President, commented:

“The sale of Möller is part of an ongoing process aimed at reshaping FLSmidth’s Cement industry. Consistent with the corporate strategy we announced earlier this year, we are pursuing a more focused Cement portfolio. The new owner has a strong focus on the aluminium and related sectors and is therefore a natural fit for Möller’s future.”

Terms of this transaction will remain confidential.