Neuer Schwächeanfall beim Bitcoin (Seite 5) | Diskussion im Forum

eröffnet am 04.12.18 16:50:58 von

neuester Beitrag 24.11.23 15:31:39 von

neuester Beitrag 24.11.23 15:31:39 von

Beiträge: 320

ID: 1.293.902

ID: 1.293.902

Aufrufe heute: 0

Gesamt: 18.906

Gesamt: 18.906

Aktive User: 0

ISIN: EU0009652759 · WKN: 965275 · Symbol: EUR/USD

1,0727

USD

-0,03 %

-0,0003 USD

Letzter Kurs 07:54:10 Forex berechnet

Neuigkeiten

23.04.24 · wallstreetONLINE Redaktion |

25.04.24 · dpa-AFX |

25.04.24 · dpa-AFX |

25.04.24 · dpa-AFX |

25.04.24 · dpa-AFX |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 72.825.299 von faultcode am 28.11.22 17:19:57und der nächste: Bitfront

29.11.

Crypto Exchange Backed by Social Media Titan Line Shuts Down

https://finance.yahoo.com/news/crypto-exchange-backed-social…

...

Bitfront, a crypto exchange backed by Japan’s social media giant Line Corp., said it’s shutting down amid challenges in a “rapidly evolving” industry.

The company has “regretfully determined that we need to shut down Bitfront in order to continue growing the LINE blockchain ecosystem and LINK token economy,” it said in a statement on its website.

The US-based firm signaled the step isn’t connected to the collapse of Sam Bankman-Fried’s FTX exchange by saying the closure is unrelated to “certain exchanges that have been accused of misconduct.”

Bitfront had six coins and 13 trading pairs and a 24-hour volume of nearly $94 million, according to CoinGecko. That’s a small fraction of total trading volumes in the crypto sector of almost $57 billion over the same period.

Bitfront said it stopped new sign-ups and credit card payments as of Nov. 28. It will suspend all withdrawals on March 31, 2023 and asked customers to withdraw all their assets by then.

Line opened Bitfront in 2020 under the goal of bringing the cryptocurrency industry into the mainstream.

29.11.

Crypto Exchange Backed by Social Media Titan Line Shuts Down

https://finance.yahoo.com/news/crypto-exchange-backed-social…

...

Bitfront, a crypto exchange backed by Japan’s social media giant Line Corp., said it’s shutting down amid challenges in a “rapidly evolving” industry.

The company has “regretfully determined that we need to shut down Bitfront in order to continue growing the LINE blockchain ecosystem and LINK token economy,” it said in a statement on its website.

The US-based firm signaled the step isn’t connected to the collapse of Sam Bankman-Fried’s FTX exchange by saying the closure is unrelated to “certain exchanges that have been accused of misconduct.”

Bitfront had six coins and 13 trading pairs and a 24-hour volume of nearly $94 million, according to CoinGecko. That’s a small fraction of total trading volumes in the crypto sector of almost $57 billion over the same period.

Bitfront said it stopped new sign-ups and credit card payments as of Nov. 28. It will suspend all withdrawals on March 31, 2023 and asked customers to withdraw all their assets by then.

Line opened Bitfront in 2020 under the goal of bringing the cryptocurrency industry into the mainstream.

Antwort auf Beitrag Nr.: 72.825.299 von faultcode am 28.11.22 17:19:57

schon erstaunlich, wie jeder auf Bitcoin schaut und der dennoch so runter rauscht. ein Markt ist das noch lange nicht. Bisher reinste Manipulation

Zitat von faultcode:Zitat von faultcode: ...

jetzt ist BlockFi womöglich selber dran:

15.11.

BlockFi Prepares for Potential Bankruptcy as Crypto Contagion Spreads

BlockFi, financially entangled with the now-bankrupt FTX, is planning to lay off workers and exploring a bankruptcy filing itself, people familiar say

https://www.wsj.com/articles/blockfi-prepares-for-potential-…

...

jetzt ist es soweit:

28.11.

Crypto lender BlockFi files for bankruptcy

https://www.axios.com/2022/11/28/blockfi-chapter-11-bankrupt…

...

Details: The firm and eight of its affiliates filed in the U.S. Bankruptcy Court for the District of New Jersey.

• The firm has engaged Haynes and Boone, Kirkland & Ellis, and Cole Schotz as legal counsel. Moelis & Company is serving as its investment banker, and Berkeley Research Group (BRG) is serving as its financial adviser.

• BlockFi says it has $256.9 million in cash on hand to support ongoing operations during the restructuring process.

Flashback: BlockFi was one of several firms FTX helped prop up following the liquidation of 3AC.

• In July, BlockFi agreed to a $400 million credit facility from FTX, along with an option for the crypto exchange to acquire it outright for up to $240 million.

State of play: But FTX's business quickly collapsed the company filed for bankruptcy, putting BlockFi's own future in doubt.

...

schon erstaunlich, wie jeder auf Bitcoin schaut und der dennoch so runter rauscht. ein Markt ist das noch lange nicht. Bisher reinste Manipulation

Antwort auf Beitrag Nr.: 72.760.775 von faultcode am 15.11.22 20:58:50

jetzt ist es soweit:

28.11.

Crypto lender BlockFi files for bankruptcy

https://www.axios.com/2022/11/28/blockfi-chapter-11-bankrupt…

...

Details: The firm and eight of its affiliates filed in the U.S. Bankruptcy Court for the District of New Jersey.

• The firm has engaged Haynes and Boone, Kirkland & Ellis, and Cole Schotz as legal counsel. Moelis & Company is serving as its investment banker, and Berkeley Research Group (BRG) is serving as its financial adviser.

• BlockFi says it has $256.9 million in cash on hand to support ongoing operations during the restructuring process.

Flashback: BlockFi was one of several firms FTX helped prop up following the liquidation of 3AC.

• In July, BlockFi agreed to a $400 million credit facility from FTX, along with an option for the crypto exchange to acquire it outright for up to $240 million.

State of play: But FTX's business quickly collapsed the company filed for bankruptcy, putting BlockFi's own future in doubt.

...

Zitat von faultcode: ...

jetzt ist BlockFi womöglich selber dran:

15.11.

BlockFi Prepares for Potential Bankruptcy as Crypto Contagion Spreads

BlockFi, financially entangled with the now-bankrupt FTX, is planning to lay off workers and exploring a bankruptcy filing itself, people familiar say

https://www.wsj.com/articles/blockfi-prepares-for-potential-…

...

jetzt ist es soweit:

28.11.

Crypto lender BlockFi files for bankruptcy

https://www.axios.com/2022/11/28/blockfi-chapter-11-bankrupt…

...

Details: The firm and eight of its affiliates filed in the U.S. Bankruptcy Court for the District of New Jersey.

• The firm has engaged Haynes and Boone, Kirkland & Ellis, and Cole Schotz as legal counsel. Moelis & Company is serving as its investment banker, and Berkeley Research Group (BRG) is serving as its financial adviser.

• BlockFi says it has $256.9 million in cash on hand to support ongoing operations during the restructuring process.

Flashback: BlockFi was one of several firms FTX helped prop up following the liquidation of 3AC.

• In July, BlockFi agreed to a $400 million credit facility from FTX, along with an option for the crypto exchange to acquire it outright for up to $240 million.

State of play: But FTX's business quickly collapsed the company filed for bankruptcy, putting BlockFi's own future in doubt.

...

Antwort auf Beitrag Nr.: 72.761.612 von faultcode am 16.11.22 00:31:5923.11.

Armanino LLP performs the financial audits for Binance.

Armanino LLP also audited FTX.

...

https://twitter.com/Bitfinexed/status/1595314790137749505

Armanino LLP performs the financial audits for Binance.

Armanino LLP also audited FTX.

...

https://twitter.com/Bitfinexed/status/1595314790137749505

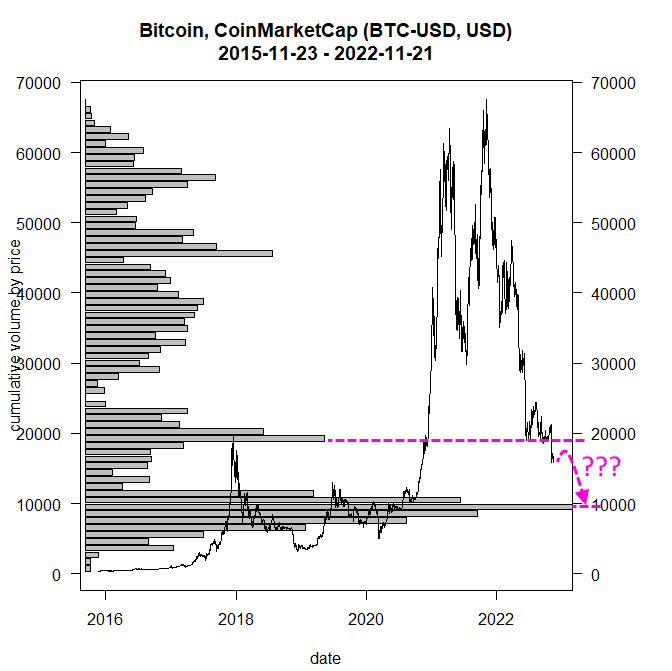

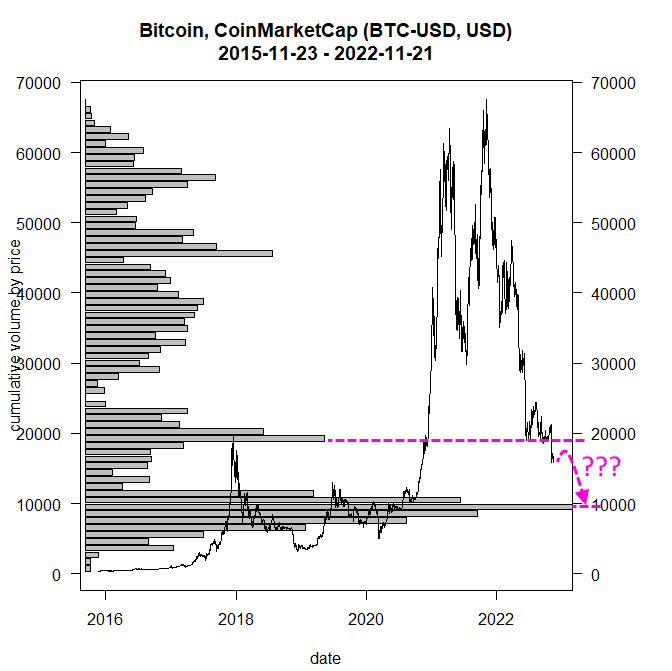

nebenbei: Bitcoin/$BTC ist mMn charttechnisch nun definitiv im Niemandsland angekommen. Angesichts der schlechten Nachrichtenlage bei einigen, noch verbliebenden institutionellen Beteiligten wie Hedge Funds, Crypto-Börsen etc., würde ich mal sagen..

..see you at $10,000 für einen Bitcoin in den nächsten Monaten.

..see you at $10,000 für einen Bitcoin in den nächsten Monaten.

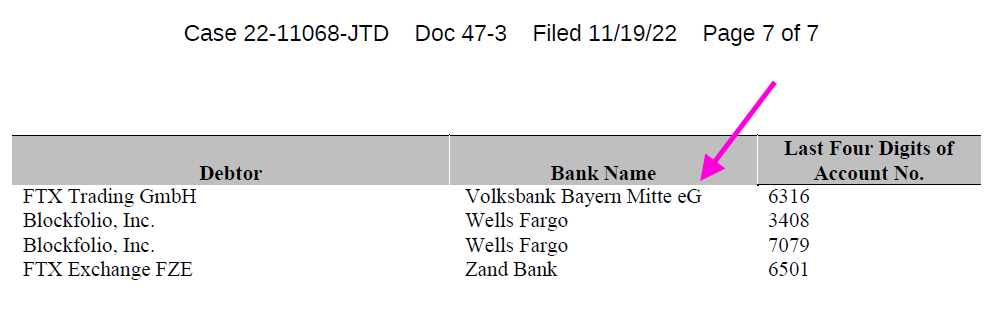

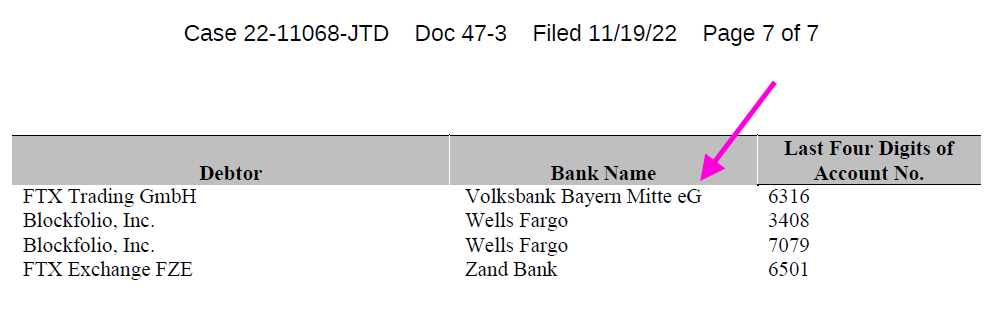

Antwort auf Beitrag Nr.: 72.746.696 von faultcode am 13.11.22 20:31:41Bankkonten von FTX u.a. bei der Volksbank Bayern Mitte eG (https://www.vr-bayernmitte.de/startseite.html)

https://twitter.com/VersusBtc/status/1593914295729164288 --> PDF -->

...

FTX Trading GmbH

Wülfeler Str. 63

30539 Hannover

Gesellschaftsvertrag vom 23.10.2020: https://www.online-handelsregister.de/handelsregisterauszug/…

https://twitter.com/VersusBtc/status/1593914295729164288 --> PDF -->

...

FTX Trading GmbH

Wülfeler Str. 63

30539 Hannover

Gesellschaftsvertrag vom 23.10.2020: https://www.online-handelsregister.de/handelsregisterauszug/…

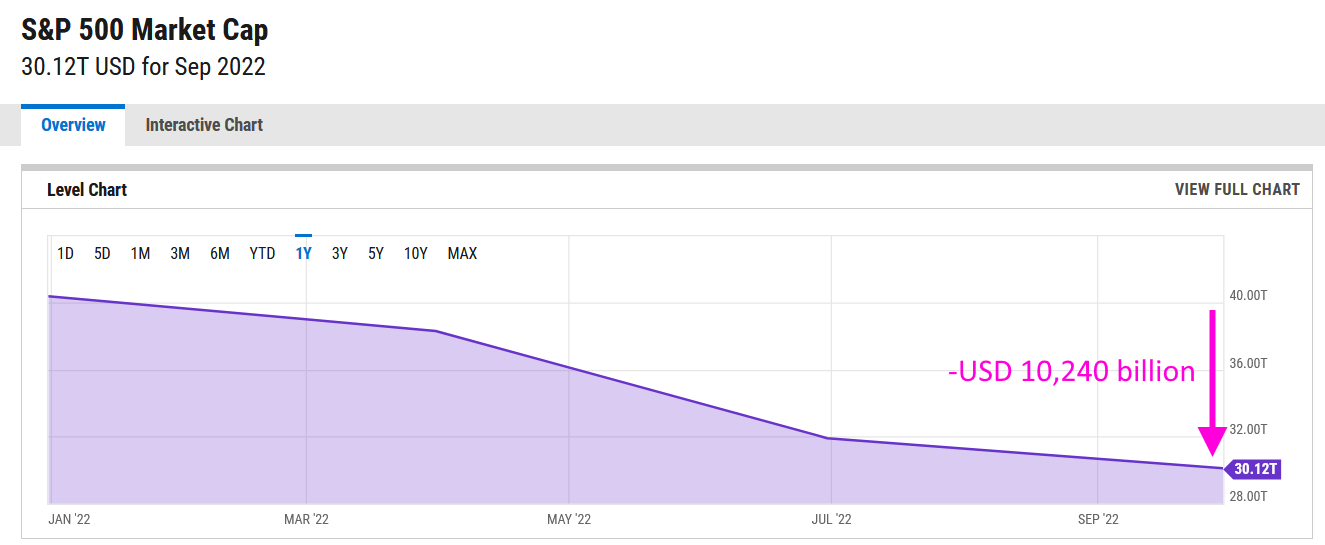

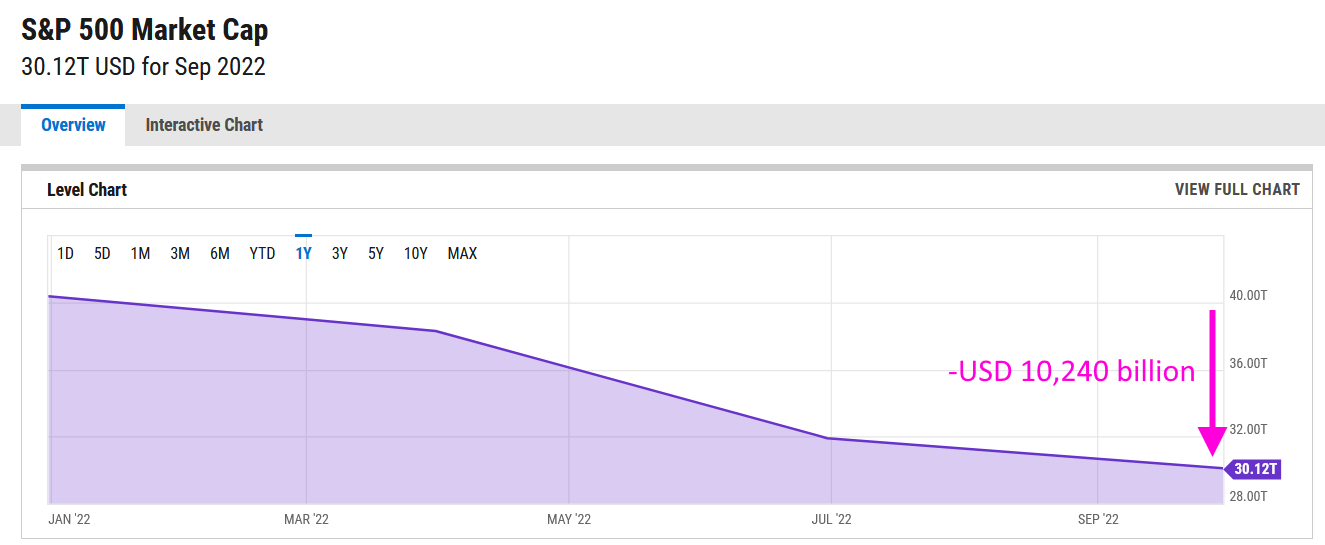

über großflächigen Bilanzbetrug zu sprechen, so wie mutmaßlich bei FTX und Alameda-Research geschehen, ist zwar (mMn) unterhaltsam, aber eigentlich macht es mMn in diesem Crypto-Bärenmarkt überhaupt nur noch begrenzt Sinn über den Crypto-Finanzmarkt zu sprechen.

Denn: er ist bereits recht klein geworden:

• coinmarketcap.com gibt die Global crypto market cap mit nur noch $831B derzeit an

• doch alleine der S&P 500 hat seit Jahresbeginn bis September über $10T (T für trillion) an Market cap verloren:

https://ycharts.com/indicators/sp_500_market_cap

Denn: er ist bereits recht klein geworden:

• coinmarketcap.com gibt die Global crypto market cap mit nur noch $831B derzeit an

• doch alleine der S&P 500 hat seit Jahresbeginn bis September über $10T (T für trillion) an Market cap verloren:

https://ycharts.com/indicators/sp_500_market_cap

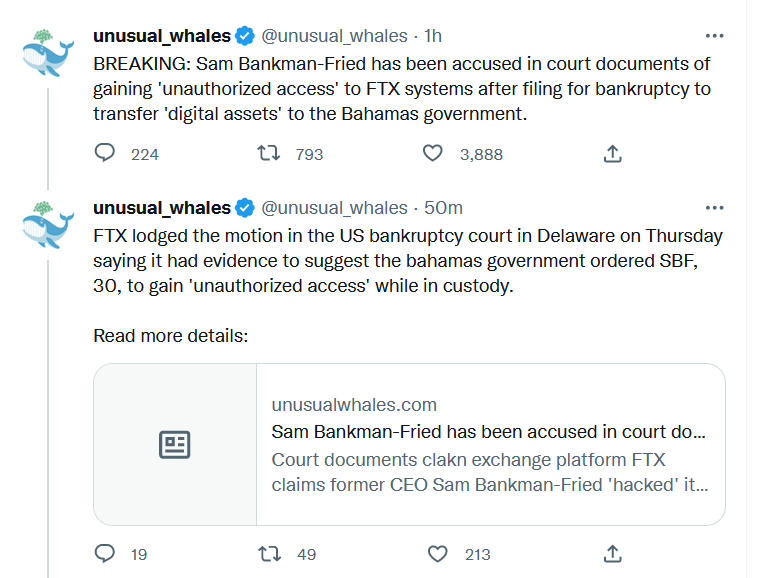

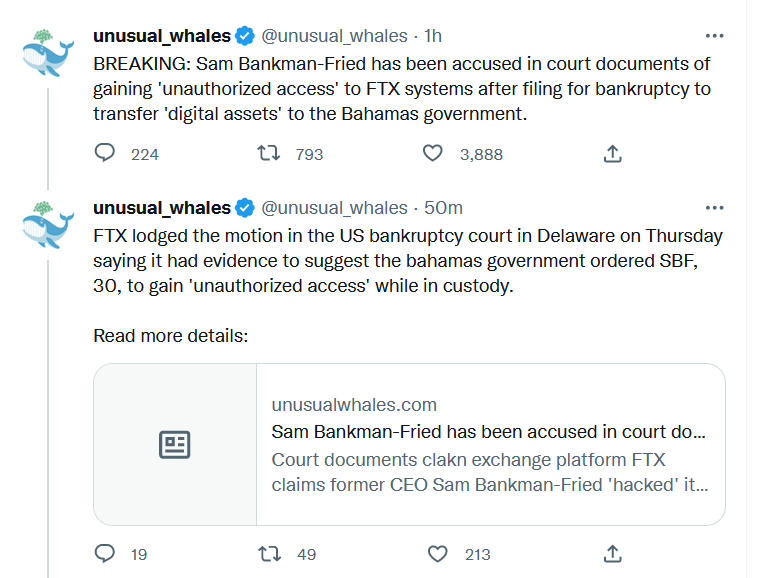

Antwort auf Beitrag Nr.: 72.775.418 von faultcode am 18.11.22 00:44:13das hier sollte noch ergänzt werden mMn. Denn was ist hier am Ende 'unauthorized access' bei der Beschlagnahmung der verbliebenden Vermögenswerte von FTX?

Last Updated: Nov. 19, 2022 at 7:49 a.m. ET

Supposed $477 million FTX ‘hack’ was actually a Bahamian government asset seizure

https://www.marketwatch.com/story/supposed-477-million-ftx-h…

,,,

The Securities Commission of the Bahamas has now acknowledged that it was behind the removal of $477 million in crypto assets from the bankrupt exchange on Nov. 12.

“The Securities Commission of the Bahamas, in the exercise of its powers as regulator acting under the authority of an order made by the Supreme Court of the Bahamas, took the action of directing the transfer of all the digital assets of FTX Digital Markets Ltd. to a digital wallet controlled by the commission, for safekeeping,” the agency said in a statement.

The transfer occurred the day after FTX had filed for Chapter 11 bankruptcy protection in Delaware and immediately sparked concerns of a major hack. The company announced that day that “unauthorized access to certain assets has occurred” and that they were coordinating with law enforcement on the matter.”

On Thursday, the U.S.-based bankruptcy administrators led by John Ray, III, who have taken control of FTX, said in court filings that they had “credible evidence” that officials in the Bahamas had directed FTX founder Sam Bankman-Fried to access FTX’s systems after the Chapter 11 filing, “for the purpose of obtaining digital assets of the debtors.”

...

Last Updated: Nov. 19, 2022 at 7:49 a.m. ET

Supposed $477 million FTX ‘hack’ was actually a Bahamian government asset seizure

https://www.marketwatch.com/story/supposed-477-million-ftx-h…

,,,

The Securities Commission of the Bahamas has now acknowledged that it was behind the removal of $477 million in crypto assets from the bankrupt exchange on Nov. 12.

“The Securities Commission of the Bahamas, in the exercise of its powers as regulator acting under the authority of an order made by the Supreme Court of the Bahamas, took the action of directing the transfer of all the digital assets of FTX Digital Markets Ltd. to a digital wallet controlled by the commission, for safekeeping,” the agency said in a statement.

The transfer occurred the day after FTX had filed for Chapter 11 bankruptcy protection in Delaware and immediately sparked concerns of a major hack. The company announced that day that “unauthorized access to certain assets has occurred” and that they were coordinating with law enforcement on the matter.”

On Thursday, the U.S.-based bankruptcy administrators led by John Ray, III, who have taken control of FTX, said in court filings that they had “credible evidence” that officials in the Bahamas had directed FTX founder Sam Bankman-Fried to access FTX’s systems after the Chapter 11 filing, “for the purpose of obtaining digital assets of the debtors.”

...

Antwort auf Beitrag Nr.: 72.772.646 von faultcode am 17.11.22 15:21:42

https://twitter.com/unusual_whales/status/159336994865879859…

https://unusualwhales.com/news/sam-bankman-fried-has-been-ac…

https://twitter.com/unusual_whales/status/159336994865879859…

https://unusualwhales.com/news/sam-bankman-fried-has-been-ac…

Last Updated: Nov. 17, 2022 at 9:14 a.m. ET

An auditor in the metaverse. No proper tracking of cash or employees. New FTX CEO describes Sam Bankman-Fried’s haphazard management.

https://www.marketwatch.com/story/new-ftx-ceo-says-hes-never…

...

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.”

That unvarnished take is from John Ray, the new chief executive of FTX, in a filing to the U.S. Bankruptcy Court for the District of Delaware.

Ray, it should be emphasized, has more than 40 years of legal and restructuring experience, including presiding over the collapsed energy company Enron in 2001.

The filing underlines the haphazard management of Sam Bankman-Fried, the former CEO. According to Ray, there wasn’t an accurate list of bank accounts and account signatories, much less attention to the creditworthiness of banking partners. The current estimate is that FTX has $564 million in cash.

“Bankman-Fried often communicated by using applications that were set to auto-delete after a short period of time, and encouraged employees to do the same,” said Ray.

Ray said software was used to conceal the misuse of customer funds, and that there was a secret exemption of Alameda, the hedge-fund arm, from its auto-liquidation protocol.

Ray dryly notes the auditor of FTX.com, the non-U.S. exchange arm, was Prager Metis, “a firm with which I am not familiar and whose website indicates that they are the ‘first-ever CPA firm to officially open its Metaverse headquarters in the metaverse platform Decentraland.’” He said he has “substantial concerns” on that audit.

Alameda, the hedge-fund arm, doesn’t have any audited financial statements at all. Nor do FTX’s venture capital investments have that information.

Ray further stated that there aren’t good enough human-resource records to even establish who worked there.

The filing also states that Bankman-Fried is in the Bahamas. The former executive in several media interviews, as well as social-media posts, has declined to identify where he was located. Ray said Bankman-Fried’s comments were both “erratic and misleading.”

An auditor in the metaverse. No proper tracking of cash or employees. New FTX CEO describes Sam Bankman-Fried’s haphazard management.

https://www.marketwatch.com/story/new-ftx-ceo-says-hes-never…

...

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.”

That unvarnished take is from John Ray, the new chief executive of FTX, in a filing to the U.S. Bankruptcy Court for the District of Delaware.

Ray, it should be emphasized, has more than 40 years of legal and restructuring experience, including presiding over the collapsed energy company Enron in 2001.

The filing underlines the haphazard management of Sam Bankman-Fried, the former CEO. According to Ray, there wasn’t an accurate list of bank accounts and account signatories, much less attention to the creditworthiness of banking partners. The current estimate is that FTX has $564 million in cash.

“Bankman-Fried often communicated by using applications that were set to auto-delete after a short period of time, and encouraged employees to do the same,” said Ray.

Ray said software was used to conceal the misuse of customer funds, and that there was a secret exemption of Alameda, the hedge-fund arm, from its auto-liquidation protocol.

Ray dryly notes the auditor of FTX.com, the non-U.S. exchange arm, was Prager Metis, “a firm with which I am not familiar and whose website indicates that they are the ‘first-ever CPA firm to officially open its Metaverse headquarters in the metaverse platform Decentraland.’” He said he has “substantial concerns” on that audit.

Alameda, the hedge-fund arm, doesn’t have any audited financial statements at all. Nor do FTX’s venture capital investments have that information.

Ray further stated that there aren’t good enough human-resource records to even establish who worked there.

The filing also states that Bankman-Fried is in the Bahamas. The former executive in several media interviews, as well as social-media posts, has declined to identify where he was located. Ray said Bankman-Fried’s comments were both “erratic and misleading.”

25.04.24 · dpa-AFX · Bristol-Myers Squibb |

25.04.24 · dpa-AFX · EUR/USD |

25.04.24 · dpa-AFX · Deutsche Bank |

25.04.24 · dpa-AFX · EUR/USD |

25.04.24 · dpa-AFX · BASF |

25.04.24 · dpa-AFX · EUR/USD |

25.04.24 · dpa-AFX · EUR/USD |

| Zeit | Titel |

|---|---|

| 25.04.24 | |

| 14.04.24 | |

| 19.03.24 | |

| 28.12.23 | |

| 24.12.23 | |

| 17.12.23 | |

| 01.12.23 | |

| 23.10.23 | |

| 10.09.23 | |

| 24.08.23 |