Japan - Makro (Seite 2)

eröffnet am 10.12.20 00:03:26 von

neuester Beitrag 24.01.24 12:40:27 von

neuester Beitrag 24.01.24 12:40:27 von

Beiträge: 76

ID: 1.335.968

ID: 1.335.968

Aufrufe heute: 0

Gesamt: 7.633

Gesamt: 7.633

Aktive User: 0

ISIN: JP9010C00002 · WKN: CG3AA4

27.990,00

PKT

+0,85 %

+235,00 PKT

Letzter Kurs 04.08.22 CME

Neuigkeiten

09:02 Uhr · dpa-AFX |

07:35 Uhr · dpa-AFX |

03.05.24 · dpa-AFX |

02.05.24 · dpa-AFX |

02.05.24 · dpa-AFX |

Beitrag zu dieser Diskussion schreiben

Ziehen die Japaner nun nach ?

Die meisten Indices haben bereits MACD Kaufsignale geliefert ... der Nikkei folgt nun mit einem ... Spätzünder ...

weitere Analysen

Thread: Charts 2023 by Chartier

Die meisten Indices haben bereits MACD Kaufsignale geliefert ... der Nikkei folgt nun mit einem ... Spätzünder ...

weitere Analysen

Thread: Charts 2023 by Chartier

28.7.

Japan sends yen soaring and stocks tumbling with hint it could join rate-hiking party

https://edition.cnn.com/2023/07/28/investing/japan-boj-yield…

...

The BOJ said it wanted to maintain ultra-low interest rates because Japan hadn’t yet achieved its 2% inflation target and would “patiently” continue with monetary easing.

Japan’s core CPI, which excludes volatile fresh food items, rose 3.3% in June, accelerating from 3.2% in the previous month. It has stayed above the central bank’s inflation target for the fifteenth straight month.

On paper, the headline numbers suggest the BOJ’s inflation target has already been met. However, Kazuo Ueda, governor of the bank, says the price increases have been mainly being driven by “cost push factors,” such as high import costs, which could slow as the cost of imported commodities falls.

Officials are not convinced that deflation has been fully defeated. They have indicated that they want to see increases in wages, among other evidence, before considering ending their massive stimulus program.

Japan sends yen soaring and stocks tumbling with hint it could join rate-hiking party

https://edition.cnn.com/2023/07/28/investing/japan-boj-yield…

...

The BOJ said it wanted to maintain ultra-low interest rates because Japan hadn’t yet achieved its 2% inflation target and would “patiently” continue with monetary easing.

Japan’s core CPI, which excludes volatile fresh food items, rose 3.3% in June, accelerating from 3.2% in the previous month. It has stayed above the central bank’s inflation target for the fifteenth straight month.

On paper, the headline numbers suggest the BOJ’s inflation target has already been met. However, Kazuo Ueda, governor of the bank, says the price increases have been mainly being driven by “cost push factors,” such as high import costs, which could slow as the cost of imported commodities falls.

Officials are not convinced that deflation has been fully defeated. They have indicated that they want to see increases in wages, among other evidence, before considering ending their massive stimulus program.

12.7.

Yen Strengthens Through 140 as Bulls Bet on Turning Point

https://finance.yahoo.com/news/battered-yen-bulls-timing-glo…

...

The odds major economies will crash are rising as central banks are forced to keep tightening amid stickier-than-expected inflation, according to JPMorgan Chase & Co. economists. With that in mind, the yen — which tends to benefit from safe-haven flows — looks chronically undervalued as the currency’s trade-weighted, inflation-adjusted exchange rate hovers around lows last seen in 1971.

“We’re only going to get closer to that eventual global recessionary risk and the likelihood of that is only increasing as we get into year-end and next year,” said Viraj Patel, a strategist at Vanda Research, who sees the yen gaining about 20% if the world economy rolls over. “It’s just a matter of timing rather than the catalyst being wrong.”

...

15.5.

Goldman Sees More Japan Upside as Topix Approaches 33-Year High

https://finance.yahoo.com/news/japan-topix-index-edges-towar…

...

Japanese stocks advanced for a second day, pushing the Topix closer to reaching its highest level since August 1990, with strategists at Goldman Sachs Group Inc. saying solid fundamentals and expectations for structural changes “justify a bullish stance” on the nation’s equities.

The economic outlook for Japan is strong given positive factors including an inbound recovery, plans for robust capital expenditure and ongoing monetary easing at the Bank of Japan, Goldman strategists Kazunori Tatebe and Bruce Kirk wrote in a note. In addition, companies are announcing solid earnings, valuations are cheap and long-term investors are positioned in the market.

...

“We note the solid fundamentals compared with stocks on overseas markets, and we also think that expectations for structural changes/reforms could push Japanese equities up even further,” the Goldman strategists wrote.

...

25.4.

Japan to Change Yield Curve Control Policy in June, Says Largest Insurance Company

https://news.metal.com/newscontent/102194594/Japan-to-Change…

...

According to the latest forecast of Nippon Life Insurance Co., the Bank of Japan (BOJ) will adjust the yield curve control (YCC) policy in June this year.

Japan's largest insurance company will accelerate the purchase of Japanese government bonds when the central bank adjusts its policy, according to the annual allocation plan.

Last week, another Japanese life-insurance giant, Fukoku Life Insurance Co., formulated a similar investment strategy for the fiscal year.

On Monday (April 24), Akira Tsuzuki, head of the Financial and Investment Planning Department of Nippon Life Insurance, told the media that the BOJ will raise the upper limit of the fluctuation range of the 10-year government bond yield from 0.5% to 1% to ease the pressure on Japan's dysfunctional bond market.

Tsuzuki added that the current 30-year Japanese bond yieds of about 1.3% is not an attractive level, "We plan to buy bonds slowly as interest rates rise, and yields of about 1.5% and closer to 2% will be very attractive."

During the day, Kazuo Ueda, the new governor of the BOJ, said that when it is foreseeable that the inflation rate will tend to reach 2%, it is necessary to move towards policy normalisation.

...

Japan to Change Yield Curve Control Policy in June, Says Largest Insurance Company

https://news.metal.com/newscontent/102194594/Japan-to-Change…

...

According to the latest forecast of Nippon Life Insurance Co., the Bank of Japan (BOJ) will adjust the yield curve control (YCC) policy in June this year.

Japan's largest insurance company will accelerate the purchase of Japanese government bonds when the central bank adjusts its policy, according to the annual allocation plan.

Last week, another Japanese life-insurance giant, Fukoku Life Insurance Co., formulated a similar investment strategy for the fiscal year.

On Monday (April 24), Akira Tsuzuki, head of the Financial and Investment Planning Department of Nippon Life Insurance, told the media that the BOJ will raise the upper limit of the fluctuation range of the 10-year government bond yield from 0.5% to 1% to ease the pressure on Japan's dysfunctional bond market.

Tsuzuki added that the current 30-year Japanese bond yieds of about 1.3% is not an attractive level, "We plan to buy bonds slowly as interest rates rise, and yields of about 1.5% and closer to 2% will be very attractive."

During the day, Kazuo Ueda, the new governor of the BOJ, said that when it is foreseeable that the inflation rate will tend to reach 2%, it is necessary to move towards policy normalisation.

...

11.4.

particularly given our belief that further cuts are likely.

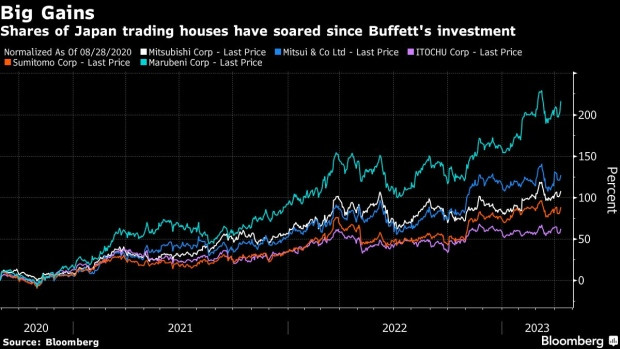

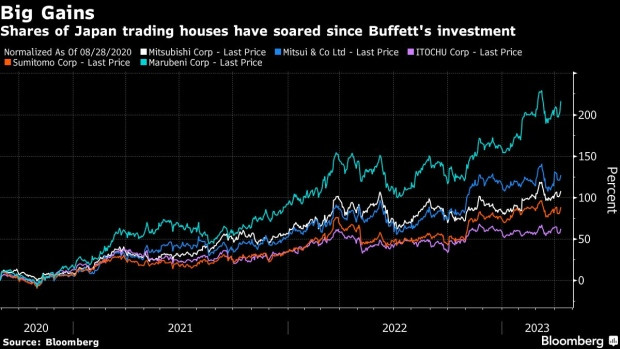

https://www.bnnbloomberg.ca/buffett-s-4-5-billion-japan-gain…

...

The legendary stock picker, who told Japanese media he’s open to more investment opportunities in the country at the right price, has gained an estimated $4.5 billion from his positions in a clutch of Japanese trading houses since 2020, according to data compiled by Bloomberg.

Buffett, the chairman of Berkshire Hathaway Inc., unveiled his stakes in the companies in August 2020, investing an estimated $6.1 billion before boosting his holdings by about $2.4 billion in November. Those positions are now worth almost $13 billion.

Buffett told Nikkei he has since raised his holdings even further, though Berkshire has yet to officially disclose any additional purchases.

Buffett’s initial bet on the trading houses, which earn much of their income from energy-related businesses, came at a time when the Covid pandemic had left oil prices deeply depressed. All but one of the businesses were valued at less than their net assets when Buffett purchased his initial stakes. While valuations have since climbed, several are still trading at discounts to Japan’s benchmark Topix index.

...

particularly given our belief that further cuts are likely.

https://www.bnnbloomberg.ca/buffett-s-4-5-billion-japan-gain…

...

The legendary stock picker, who told Japanese media he’s open to more investment opportunities in the country at the right price, has gained an estimated $4.5 billion from his positions in a clutch of Japanese trading houses since 2020, according to data compiled by Bloomberg.

Buffett, the chairman of Berkshire Hathaway Inc., unveiled his stakes in the companies in August 2020, investing an estimated $6.1 billion before boosting his holdings by about $2.4 billion in November. Those positions are now worth almost $13 billion.

Buffett told Nikkei he has since raised his holdings even further, though Berkshire has yet to officially disclose any additional purchases.

Buffett’s initial bet on the trading houses, which earn much of their income from energy-related businesses, came at a time when the Covid pandemic had left oil prices deeply depressed. All but one of the businesses were valued at less than their net assets when Buffett purchased his initial stakes. While valuations have since climbed, several are still trading at discounts to Japan’s benchmark Topix index.

...

30.3.

Citadel to Resume Hedge Fund Business in Japan With Tokyo Office

https://finance.yahoo.com/news/citadel-resume-hedge-fund-bus…

...

Ken Griffin’s hedge fund firm Citadel is planning to set up a team in Tokyo, returning to Japan more than a decade after it shuttered operations there during the global financial crisis, according to a person familiar with the matter.

The company is applying for an investment management license to operate a hedge fund in the country and seeking to tap local talent, the person said, asking not to be named because the matter is private. Citadel has yet to decide when the office will open, the person added.

Griffin is expanding his footprint in Asia. His other firm Citadel Securities LLC, which focuses on market-making business, has more than doubled its headcount in the region in the past three years.

The latest move is a plus for Tokyo’s ambitions to improve its status as a financial hub. Citadel Securities opened an office in the Japanese capital last year to sell US fixed-income offerings.

...

=> warum kehrt Citadel (Hedge fund) nach so vielen Jahren wieder nach Japan zurück?

Citadel to Resume Hedge Fund Business in Japan With Tokyo Office

https://finance.yahoo.com/news/citadel-resume-hedge-fund-bus…

...

Ken Griffin’s hedge fund firm Citadel is planning to set up a team in Tokyo, returning to Japan more than a decade after it shuttered operations there during the global financial crisis, according to a person familiar with the matter.

The company is applying for an investment management license to operate a hedge fund in the country and seeking to tap local talent, the person said, asking not to be named because the matter is private. Citadel has yet to decide when the office will open, the person added.

Griffin is expanding his footprint in Asia. His other firm Citadel Securities LLC, which focuses on market-making business, has more than doubled its headcount in the region in the past three years.

The latest move is a plus for Tokyo’s ambitions to improve its status as a financial hub. Citadel Securities opened an office in the Japanese capital last year to sell US fixed-income offerings.

...

=> warum kehrt Citadel (Hedge fund) nach so vielen Jahren wieder nach Japan zurück?

"normalization will come to Japan"

30.3.A $3 Trillion Threat to Global Financial Markets Looms in Japan

https://uk.finance.yahoo.com/news/3-trillion-threat-global-f…

...

Bank of Japan Governor Haruhiko Kuroda changed the course of global markets when he unleashed a $3.4 trillion firehose of Japanese cash on the investment world. Now Kazuo Ueda is likely to dismantle his legacy, setting the stage for a flow reversal that risks sending shockwaves through the global economy.

Just over a week before a momentous leadership change at the BOJ, investors are gearing up for the seemingly inevitable end to a decade of ultra-low interest rates that punished domestic savers and sent a wall of money overseas. The exodus accelerated after Kuroda moved to suppress bond yields in 2016, culminating in a mountain of offshore investments worth more than two-thirds Japan’s economy.

All this risks unraveling under the new governor Ueda, who may have little choice but to end the world’s boldest easy-money experiment just as rising interest rates elsewhere are already jolting the international banking sector and threatening financial stability. The stakes are enormous: Japanese investors are the biggest foreign holders of US government bonds and own everything from Brazilian debt to European power stations to bundles of risky loans stateside.

An increase in Japan’s borrowing costs threatens to amplify the swings in global bond markets, which are being rocked by the Federal Reserve’s year-long campaign to combat inflation and the new danger of a credit crunch. Against this backdrop, tighter monetary policy by the BOJ is likely to intensify scrutiny of its country’s lenders in the wake of recent bank turmoil in the US and Europe.

...

The flow reversal is already underway. Japanese investors sold a record amount of overseas debt last year as local yields rose on speculation that the BOJ would normalize policy.

Kuroda added fuel to the fire last December when he relaxed the central bank’s grip on yields by a fraction. In just hours, Japanese government bonds plunged and the yen skyrocketed, jolting everything from Treasuries to the Australian dollar.

...

For others like 36-year markets veteran Rajeev De Mello, it’s likely only a matter of time before Ueda has to act and the consequences may have global repercussions.

“I fully agree with the consensus that the BOJ will tighten — they’ll want to end this policy as soon as possible,” said De Mello, a money manager at GAMA Asset Management in Geneva. “It comes down to central bank credibility, it comes down to inflation conditions being increasingly fulfilled now — normalization will come to Japan.”

...

Antwort auf Beitrag Nr.: 72.519.868 von faultcode am 04.10.22 14:34:34

9.3.

A Kuroda Surprise Risks Blocking Topix’s Ascent to 32-Year High

https://finance.yahoo.com/news/kuroda-surprise-risks-blockin…

9.3.

A Kuroda Surprise Risks Blocking Topix’s Ascent to 32-Year High

https://finance.yahoo.com/news/kuroda-surprise-risks-blockin…

09:02 Uhr · dpa-AFX · Nikkei 225 |

07:35 Uhr · dpa-AFX · Advanced Micro Devices |

03.05.24 · dpa-AFX · Apple |

02.05.24 · dpa-AFX · Nikkei 225 |

02.05.24 · dpa-AFX · DAX |

01.05.24 · dpa-AFX · Nikkei 225 |

30.04.24 · dpa-AFX · Apple |

30.04.24 · dpa-AFX · DAX |

29.04.24 · dpa-AFX · Alphabet |

26.04.24 · dpa-AFX · BHP Group |

| Zeit | Titel |

|---|---|

| 20.05.23 |