Japan - Makro (Seite 3)

eröffnet am 10.12.20 00:03:26 von

neuester Beitrag 24.01.24 12:40:27 von

neuester Beitrag 24.01.24 12:40:27 von

Beiträge: 76

ID: 1.335.968

ID: 1.335.968

Aufrufe heute: 0

Gesamt: 7.620

Gesamt: 7.620

Aktive User: 0

ISIN: JP9010C00002 · WKN: CG3AA4

27.990,00

PKT

+0,85 %

+235,00 PKT

Letzter Kurs 04.08.22 CME

Neuigkeiten

26.04.24 · dpa-AFX |

26.04.24 · dpa-AFX |

25.04.24 · dpa-AFX |

25.04.24 · dpa-AFX |

24.04.24 · dpa-AFX |

Beitrag zu dieser Diskussion schreiben

7.3.

Yen has scope to jump around 60% if BOJ normalizes and Fed eases

https://www.japantimes.co.jp/news/2023/03/07/business/financ…

...

The yen could surge to be as strong as ¥85 per dollar if the market witnesses a combination of full-blown policy normalization by the Bank of Japan and an easing cycle from the Federal Reserve.

That’s the view outlined by Deutsche Bank in a note to clients Monday. Such a move would amount to an appreciation of close to 60% from the yen’s current level, which on Tuesday was around ¥136 to the dollar.

...

Yen has scope to jump around 60% if BOJ normalizes and Fed eases

https://www.japantimes.co.jp/news/2023/03/07/business/financ…

...

The yen could surge to be as strong as ¥85 per dollar if the market witnesses a combination of full-blown policy normalization by the Bank of Japan and an easing cycle from the Federal Reserve.

That’s the view outlined by Deutsche Bank in a note to clients Monday. Such a move would amount to an appreciation of close to 60% from the yen’s current level, which on Tuesday was around ¥136 to the dollar.

...

22.2.

Tokyo Bourse’s Buried Notice Spurs Surges in Cheap Japan Stocks

https://finance.yahoo.com/news/tokyo-bourse-buried-notice-sp…

...

A notice buried toward the back of a Tokyo Stock Exchange document last month encouraging better corporate governance has led to some big share price moves.

The Japanese bourse said it will request companies trading below book value to come up with capital improvement plans starting this spring. While just the latest in a long series of such directives from the TSE, corporate and market response has been surprisingly quick.

Citizen Watch Co., which had been trading below book for nearly five years, surprised investors last week with plans to buy back a whopping 25.6% of its shares. The timepiece maker, which acknowledged the TSE’s stance, has seen its stock surge more than 35% since then.

“The pace of change here is accelerating at a level that our team members haven’t ever seen in the last 60 years of our collective investment experience in Japan,” said Emily Badger, a portfolio manager at Man Group. “We think this is a really exciting opportunity for Japan.”

14.2.

‘Mr. Yen’ Says Ueda May Raise Rates by October, Currency to Gain

https://finance.yahoo.com/news/mr-yen-says-ueda-may-07002088…

...

The Bank of Japan may raise interest rates by the fourth quarter under the leadership of Kazuo Ueda, according to Eisuke Sakakibara.

Nicknamed “Mr. Yen” for his ability to influence the currency during his tenure as Japan’s vice finance minister from 1997-1999, Sakakibara said Ueda may be compelled to act between October and December as domestic inflation quickens. The yen is likely to benefit, strengthening to around the 120 per dollar level this year from around 132 now, he added.

Ueda “may change his policy if the Japanese economy gets overheated, which is expected at this moment,” Sakakibara said in an interview with Bloomberg Television. “He might be in a position to tighten monetary policy rather than continuing to ease.”

The nomination of Ueda, a university professor and former BOJ board member, is reinforcing bets for a shift in policy with traders boosting wagers that Japan’s interest rates will rise around July. Dubbed “Japan’s Ben Bernanke” by former Treasury Secretary Larry Summers, Ueda has been the subject of intense scrutiny since word of his appointment broke on Friday, with investors parsing his previous writings in an attempt to gain an insight into his views.

...

‘Mr. Yen’ Says Ueda May Raise Rates by October, Currency to Gain

https://finance.yahoo.com/news/mr-yen-says-ueda-may-07002088…

...

The Bank of Japan may raise interest rates by the fourth quarter under the leadership of Kazuo Ueda, according to Eisuke Sakakibara.

Nicknamed “Mr. Yen” for his ability to influence the currency during his tenure as Japan’s vice finance minister from 1997-1999, Sakakibara said Ueda may be compelled to act between October and December as domestic inflation quickens. The yen is likely to benefit, strengthening to around the 120 per dollar level this year from around 132 now, he added.

Ueda “may change his policy if the Japanese economy gets overheated, which is expected at this moment,” Sakakibara said in an interview with Bloomberg Television. “He might be in a position to tighten monetary policy rather than continuing to ease.”

The nomination of Ueda, a university professor and former BOJ board member, is reinforcing bets for a shift in policy with traders boosting wagers that Japan’s interest rates will rise around July. Dubbed “Japan’s Ben Bernanke” by former Treasury Secretary Larry Summers, Ueda has been the subject of intense scrutiny since word of his appointment broke on Friday, with investors parsing his previous writings in an attempt to gain an insight into his views.

...

10.2.

Kishida to Pick Ueda for BOJ in Shock as Amamiya Turns Job Down

https://uk.finance.yahoo.com/news/kishida-reported-pick-ueda…

...

Japanese Prime Minister Fumio Kishida will nominate Kazuo Ueda, a professor and former Bank of Japan board member, to take the helm of the central bank from April, according to people familiar with the matter, in a shock move that sparked sharp moves in the yen.

The decision blindsided investors who had expected long-time front-runner and Deputy Governor Masayoshi Amamiya to succeed Haruhiko Kuroda. Amamiya refused to take the post, the Nikkei newspaper reported.

The yen initially rose on media reports of Ueda’s selection as markets decided he would prove more hawkish than Amamiya at a time when the BOJ is under pressure to restrain its ultra-easy monetary policy.

Those gains were trimmed after Ueda said the BOJ’s stimulus should stay in place.

“The Bank of Japan’s current policy is appropriate and monetary easing needs to be continued at this point,” he told reporters as broadcast by NTV.

The choice suggests that while Kishida is seeking some change at the BOJ, he’s not seeking a drastic pivot.

...

Kishida to Pick Ueda for BOJ in Shock as Amamiya Turns Job Down

https://uk.finance.yahoo.com/news/kishida-reported-pick-ueda…

...

Japanese Prime Minister Fumio Kishida will nominate Kazuo Ueda, a professor and former Bank of Japan board member, to take the helm of the central bank from April, according to people familiar with the matter, in a shock move that sparked sharp moves in the yen.

The decision blindsided investors who had expected long-time front-runner and Deputy Governor Masayoshi Amamiya to succeed Haruhiko Kuroda. Amamiya refused to take the post, the Nikkei newspaper reported.

The yen initially rose on media reports of Ueda’s selection as markets decided he would prove more hawkish than Amamiya at a time when the BOJ is under pressure to restrain its ultra-easy monetary policy.

Those gains were trimmed after Ueda said the BOJ’s stimulus should stay in place.

“The Bank of Japan’s current policy is appropriate and monetary easing needs to be continued at this point,” he told reporters as broadcast by NTV.

The choice suggests that while Kishida is seeking some change at the BOJ, he’s not seeking a drastic pivot.

...

7.2.

Nomura’s Japan Staff to Get Bigger Raises as Inflation Quickens

https://finance.yahoo.com/news/nomura-japan-staff-bigger-rai…

...

Nomura Holdings Inc. will give its employees in Japan bigger pay raises starting in April, citing intensifying competition for talent and faster inflation.

Employees excluding executives will get a slightly larger raise than the roughly 3% average of the past few years, Japan’s largest brokerage said in a statement Tuesday.

A growing number of Japanese firms have signaled plans to raise wages following government requests to help workers cope with the highest inflation since 1981. Sustained pay rises may prompt the Bank of Japan to shift away from its long-standing ultra-easy monetary policy.

Nomura employees who are in their 20s and 30s and hold non-managerial jobs will receive a slightly higher raise than the 6.2% average over recent years, the company said. The figure is about base salary and performance- and promotion-related gains, and excludes bonuses and allowances. The firm employs just over 15,000 in Japan.

Japan’s nominal wages are increasing at the sharpest pace since the late 1990s, something new to many after years of deflation. Even struggling regional banks are under pressure to hike salaries as the nation’s financial regulator urges them to invest in talent, according to people familiar with the matter.

...

Nomura’s Japan Staff to Get Bigger Raises as Inflation Quickens

https://finance.yahoo.com/news/nomura-japan-staff-bigger-rai…

...

Nomura Holdings Inc. will give its employees in Japan bigger pay raises starting in April, citing intensifying competition for talent and faster inflation.

Employees excluding executives will get a slightly larger raise than the roughly 3% average of the past few years, Japan’s largest brokerage said in a statement Tuesday.

A growing number of Japanese firms have signaled plans to raise wages following government requests to help workers cope with the highest inflation since 1981. Sustained pay rises may prompt the Bank of Japan to shift away from its long-standing ultra-easy monetary policy.

Nomura employees who are in their 20s and 30s and hold non-managerial jobs will receive a slightly higher raise than the 6.2% average over recent years, the company said. The figure is about base salary and performance- and promotion-related gains, and excludes bonuses and allowances. The firm employs just over 15,000 in Japan.

Japan’s nominal wages are increasing at the sharpest pace since the late 1990s, something new to many after years of deflation. Even struggling regional banks are under pressure to hike salaries as the nation’s financial regulator urges them to invest in talent, according to people familiar with the matter.

...

16.1.

TV Announcer Turned Portfolio Manager Beats 97% of Japan Peers

https://finance.yahoo.com/news/tv-announcer-turned-portfolio…

...

Betting on macro trends is a key element of Uda’s investment style. One of her expectations is that infrastructure spending in Japan will rise further as the economy recovers from the pandemic, benefiting the commodity operations of trading houses. She also reckons the Bank of Japan will raise its cap for 10-year sovereign yields to 1.5% to 2% within two years from 0.5% now, helping bolster lenders’ interest income.

“We are bullish on Japanese economy overall, and we think that it will do well relative to the US in terms of year-over-year GDP growth,” Uda said in an interview.

Itochu Corp. is the top holding in the fund that she runs with her father, who founded Tokyo-based Evarich Asset Management in 2002. The fund also has large bets on Marubeni Corp. and Mitsubishi Corp., a bullishness toward trading houses that’s shared by Warren Buffett’s Berkshire Hathaway Inc.

Sumitomo Mitsui Financial Group Inc. and Mitsubishi UFJ Financial Group Inc. are the second- and third-largest holdings.

E.I. Sturdza Fund plc - Nippon Growth (UCITS) Fund, the 6.6 billion yen ($52 million) equity fund that Uda runs with her father Yutaka Uda, returned almost 16% in 2022 as Japan’s benchmark Topix index dropped 5.1%. The two were jointly ranked No. 5 Japanese equities fund managers according to Citywire rankings for the year to Nov. 30, 2022.

The BOJ will probably move further away from keeping bond yields low after Governor Haruhiko Kuroda’s term ends in April, Uda said, adding that the central bank’s December shift in its yield-curve control program was the first sign of that.

...

TV Announcer Turned Portfolio Manager Beats 97% of Japan Peers

https://finance.yahoo.com/news/tv-announcer-turned-portfolio…

...

Betting on macro trends is a key element of Uda’s investment style. One of her expectations is that infrastructure spending in Japan will rise further as the economy recovers from the pandemic, benefiting the commodity operations of trading houses. She also reckons the Bank of Japan will raise its cap for 10-year sovereign yields to 1.5% to 2% within two years from 0.5% now, helping bolster lenders’ interest income.

“We are bullish on Japanese economy overall, and we think that it will do well relative to the US in terms of year-over-year GDP growth,” Uda said in an interview.

Itochu Corp. is the top holding in the fund that she runs with her father, who founded Tokyo-based Evarich Asset Management in 2002. The fund also has large bets on Marubeni Corp. and Mitsubishi Corp., a bullishness toward trading houses that’s shared by Warren Buffett’s Berkshire Hathaway Inc.

Sumitomo Mitsui Financial Group Inc. and Mitsubishi UFJ Financial Group Inc. are the second- and third-largest holdings.

E.I. Sturdza Fund plc - Nippon Growth (UCITS) Fund, the 6.6 billion yen ($52 million) equity fund that Uda runs with her father Yutaka Uda, returned almost 16% in 2022 as Japan’s benchmark Topix index dropped 5.1%. The two were jointly ranked No. 5 Japanese equities fund managers according to Citywire rankings for the year to Nov. 30, 2022.

The BOJ will probably move further away from keeping bond yields low after Governor Haruhiko Kuroda’s term ends in April, Uda said, adding that the central bank’s December shift in its yield-curve control program was the first sign of that.

...

23.12.

Here’s how U.S. investors can position themselves for the sea change out of Japan, according to Bank of America and Citi

https://www.marketwatch.com/story/heres-how-u-s-investors-ca…

...

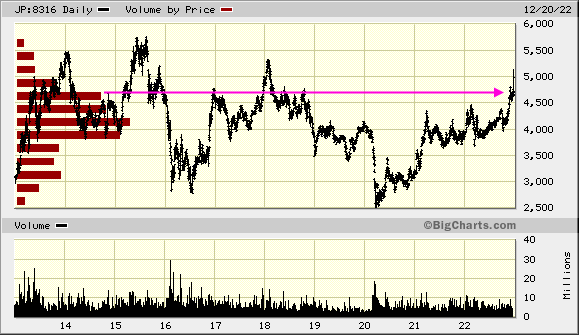

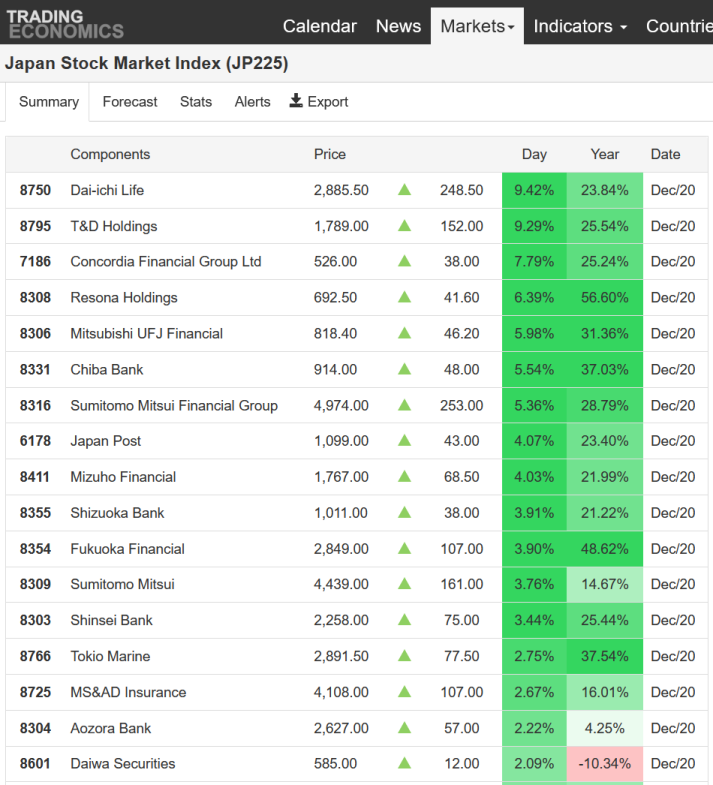

Bank of America strategists led by Michael Hartnett say the move means there’s a higher floor for global interest rates. Deflationary Japan had set the floor for global interest rates for the last 30 years, but now that’s changing, and the Bank of Japan may get rid of yield curve control altogether next year. The investment implications? They’re bullish for commodities but not credit, equities outside the U.S., small caps, value stocks, industrials and banks.

In particular, higher Japanese yields will mean a bull market for Japanese banks, the BofA strategists say. And they note that banks and real estate have historically outperformed when Japanese government bond yields rise.

It’s not just Bank of America making that call. Strategists at Citi say going long Japanese banks, in U.S. dollars, has always been its preferred way to position for a Bank of Japan shift. At 0.6 price-to-book value, they are still well below their levels before yield curve control. In particular, they like Mitsubishi UFJ Financial Group and Resona, the Citi strategists say.

...

Antwort auf Beitrag Nr.: 72.949.262 von faultcode am 20.12.22 16:19:26

21.12.

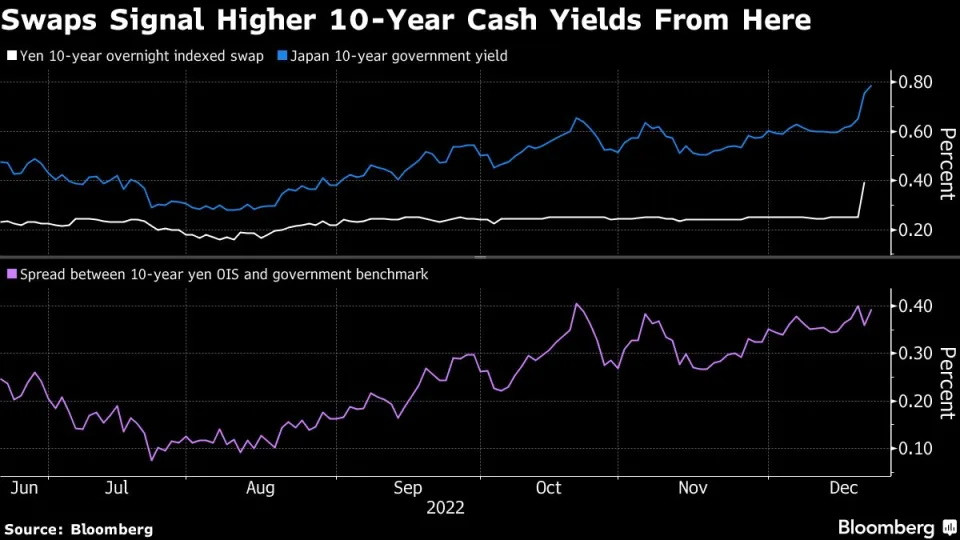

Japan Swaps Signal Yields to Break BOJ’s New Ceiling: In Charts

https://finance.yahoo.com/news/japan-swaps-signal-higher-yie…

21.12.

Japan Swaps Signal Yields to Break BOJ’s New Ceiling: In Charts

https://finance.yahoo.com/news/japan-swaps-signal-higher-yie…

20.12.

Strategiewechsel der japanischen Zentralbank schockt internationale Märkte

https://www.finanzen.net/nachricht/aktien/straffung-der-geld…

...

Mit einem überraschenden Strategiewechsel hat die japanische Zentralbank am Dienstag Schockwellen durch die Märkte geschickt.

Die Bank of Japan (BoJ) entschied am Dienstag nach zweitägiger Sitzung, die Spanne, in der sich die langfristige Anleiherendite bewegt, zu lockern. Das wurde an den Märkten als erster Schritt hin zu einer Straffung der geldpolitischen Zügel gewertet. Bis zu diesem Tag hatte die BoJ stets betont, als einzige große Zentralbank der Welt ihre Strategie der extrem lockeren Geldpolitik und Stützung der heimischen Nachfrage beizubehalten.

Die BOJ hielt zwar an ihrem Programm fest, die Kreditkosten auf einem Tiefststand zu halten. Sie beschloss jedoch, die Renditen zehnjähriger japanischer Staatsanleihen zwischen minus 0,5 Prozent und 0,5 Prozent zuzulassen. Das liegt über der aktuellen Spanne von minus 0,25 Prozent und 0,25 Prozent. Die Entscheidung überraschte selbst Ökonomen. In Reaktion darauf gab der Nikkei-Index an Tokios Börse stark nach, während der Yen zum Dollar deutlich anzog. Die Renditen der Staatsanleihen legten ebenfalls stark zu.

...

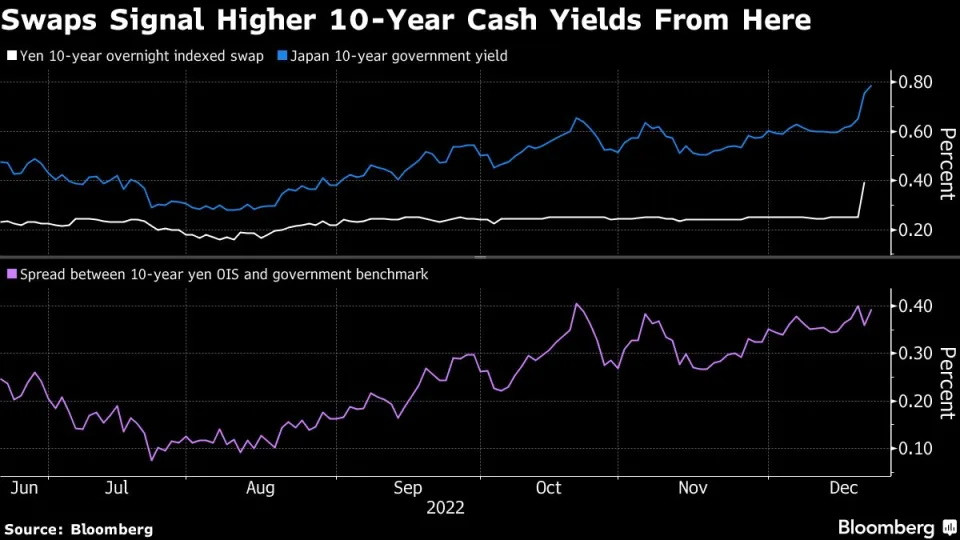

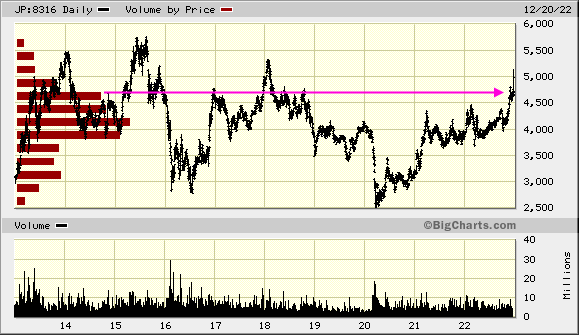

=> Erst-Posi Sumitomo Mitsui Financial Group (JP:8316; willkürlich, aber nicht unsinnig mMn; für eine Japan-Bank wollte ich mich entscheiden):

ansonsten:

...

https://tradingeconomics.com/japan/stock-market

Strategiewechsel der japanischen Zentralbank schockt internationale Märkte

https://www.finanzen.net/nachricht/aktien/straffung-der-geld…

...

Mit einem überraschenden Strategiewechsel hat die japanische Zentralbank am Dienstag Schockwellen durch die Märkte geschickt.

Die Bank of Japan (BoJ) entschied am Dienstag nach zweitägiger Sitzung, die Spanne, in der sich die langfristige Anleiherendite bewegt, zu lockern. Das wurde an den Märkten als erster Schritt hin zu einer Straffung der geldpolitischen Zügel gewertet. Bis zu diesem Tag hatte die BoJ stets betont, als einzige große Zentralbank der Welt ihre Strategie der extrem lockeren Geldpolitik und Stützung der heimischen Nachfrage beizubehalten.

Die BOJ hielt zwar an ihrem Programm fest, die Kreditkosten auf einem Tiefststand zu halten. Sie beschloss jedoch, die Renditen zehnjähriger japanischer Staatsanleihen zwischen minus 0,5 Prozent und 0,5 Prozent zuzulassen. Das liegt über der aktuellen Spanne von minus 0,25 Prozent und 0,25 Prozent. Die Entscheidung überraschte selbst Ökonomen. In Reaktion darauf gab der Nikkei-Index an Tokios Börse stark nach, während der Yen zum Dollar deutlich anzog. Die Renditen der Staatsanleihen legten ebenfalls stark zu.

...

=> Erst-Posi Sumitomo Mitsui Financial Group (JP:8316; willkürlich, aber nicht unsinnig mMn; für eine Japan-Bank wollte ich mich entscheiden):

ansonsten:

...

https://tradingeconomics.com/japan/stock-market

26.04.24 · dpa-AFX · BHP Group |

26.04.24 · dpa-AFX · DAX |

25.04.24 · dpa-AFX · Nikkei 225 |

25.04.24 · dpa-AFX · IBM |

24.04.24 · dpa-AFX · Texas Instruments |

24.04.24 · dpa-AFX · DAX |

23.04.24 · dpa-AFX · Nikkei 225 |

23.04.24 · dpa-AFX · SAP |

22.04.24 · dpa-AFX · NVIDIA |

22.04.24 · dpa-AFX · American Express |

| Zeit | Titel |

|---|---|

| 20.05.23 |