Japan - Makro (Seite 4)

eröffnet am 10.12.20 00:03:26 von

neuester Beitrag 24.01.24 12:40:27 von

neuester Beitrag 24.01.24 12:40:27 von

Beiträge: 76

ID: 1.335.968

ID: 1.335.968

Aufrufe heute: 2

Gesamt: 7.633

Gesamt: 7.633

Aktive User: 0

ISIN: JP9010C00002 · WKN: CG3AA4

27.990,00

PKT

+0,85 %

+235,00 PKT

Letzter Kurs 04.08.22 CME

Neuigkeiten

03.05.24 · dpa-AFX |

02.05.24 · dpa-AFX |

02.05.24 · dpa-AFX |

01.05.24 · dpa-AFX |

30.04.24 · dpa-AFX |

Beitrag zu dieser Diskussion schreiben

19.12.

Yen Traders’ Nerves Jangle on Growing Signs of BOJ Hawkish Pivot

https://nz.finance.yahoo.com/news/yen-jumps-report-kishida-f…

...

The yen whipsawed in Monday trade after reports on a potential change to a key agreement between the government and central bank fueled speculation policy makers are moving closer to a hawkish pivot.

Japan’s currency jumped as much as 0.6% after Kyodo said on Saturday that Prime Minister Fumio Kishida may seek to revise a decade-old accord with the Bank of Japan and consider adding flexibility to the 2% inflation goal, potentially paving the way for an end to its ultra-dovish policy. The yen pared gains after a top government spokesman denied the report.

...

Yen Traders’ Nerves Jangle on Growing Signs of BOJ Hawkish Pivot

https://nz.finance.yahoo.com/news/yen-jumps-report-kishida-f…

...

The yen whipsawed in Monday trade after reports on a potential change to a key agreement between the government and central bank fueled speculation policy makers are moving closer to a hawkish pivot.

Japan’s currency jumped as much as 0.6% after Kyodo said on Saturday that Prime Minister Fumio Kishida may seek to revise a decade-old accord with the Bank of Japan and consider adding flexibility to the 2% inflation goal, potentially paving the way for an end to its ultra-dovish policy. The yen pared gains after a top government spokesman denied the report.

...

5.12.

The Year’s Big Yen Short Set for a Dramatic U-Turn in 2023

https://finance.yahoo.com/news/big-yen-short-set-dramatic-07…

...

The world’s worst-performing major currency looks poised for an impressive turnaround in 2023 as its two key drivers -- a hawkish Federal Reserve and dovish Bank of Japan -- swap places in the eyes of some investors.

The yen -- a favored short against the dollar for a majority of this year -- could rally more than 7% from current levels next year, according to Barclays Plc and Nomura Holdings Inc., while Vontobel Asset Management AG said fair value is below 100 per dollar -- over 30% stronger. State Street Global Markets sees a quick snap back as fears of aggressive US interest rate hikes recede, while T. Rowe Price said there’s scope for gains on a more hawkish BOJ.

“We are probably approaching peak yen weakness to the dollar,” said Sébastien Page, head of global multi-asset at T. Rowe, which oversees $1.28 trillion in assets. When the Fed finally pauses on hiking, “there is room for the Bank of Japan to surprise the market by being a bit more aggressive” on policy and boost the currency.

...

24.11.

JPMorgan Asset Picks Industrials to Ride Rally in Japan Stocks

https://finance.yahoo.com/news/jpmorgan-asset-picks-industri…

...

JPMorgan Asset Management’s Japan equity fund is betting on undervalued industrial-related shares to shine amid a potential market rally driven by a weakening yen, rising capital expenditures and improving corporate earnings.

...

18.11.

Inflation in Japan erreicht 40-jährigen Höchststand

https://www.finanzen.net/nachricht/aktien/preisdruck-inflati…

...

Im Oktober stieg die Kernteuerungsrate (ohne frische Lebensmittel) mit 3,6 Prozent auf den höchsten Stand seit 40 Jahren, wie aus Regierungsdaten vom Freitag hervorgeht. Die Rate wird von der japanischen Notenbank besonders beachtet. Die Gesamtinflation (mit Energie und Lebensmitteln) sprang von 3,0 Prozent im Vormonat auf 3,7 Prozent. Die Raten liegen immer noch niedriger als in anderen Industrieländern, für japanische Verhältnisse sind sie aber hoch.

Das mittelfristige Preisziel der Bank of Japan von zwei Prozent wird zwar schon seit längerem klar überschritten. Die Währungshüter halten aber an ihrer Ansicht fest, dass der Anstieg ein nur übergangsweises Phänomen sei, dem geldpolitisch nicht begegnet werden müsse. Notenbankchef Haruhiko Kuroda bekräftige diese Haltung am Freitag vor dem japanischen Parlament.

...

Inflation in Japan erreicht 40-jährigen Höchststand

https://www.finanzen.net/nachricht/aktien/preisdruck-inflati…

...

Im Oktober stieg die Kernteuerungsrate (ohne frische Lebensmittel) mit 3,6 Prozent auf den höchsten Stand seit 40 Jahren, wie aus Regierungsdaten vom Freitag hervorgeht. Die Rate wird von der japanischen Notenbank besonders beachtet. Die Gesamtinflation (mit Energie und Lebensmitteln) sprang von 3,0 Prozent im Vormonat auf 3,7 Prozent. Die Raten liegen immer noch niedriger als in anderen Industrieländern, für japanische Verhältnisse sind sie aber hoch.

Das mittelfristige Preisziel der Bank of Japan von zwei Prozent wird zwar schon seit längerem klar überschritten. Die Währungshüter halten aber an ihrer Ansicht fest, dass der Anstieg ein nur übergangsweises Phänomen sei, dem geldpolitisch nicht begegnet werden müsse. Notenbankchef Haruhiko Kuroda bekräftige diese Haltung am Freitag vor dem japanischen Parlament.

...

3.11.

Carlyle’s Favorite Market Is Japan With ‘Everything on Sale’

https://finance.yahoo.com/news/carlyle-favorite-market-japan…

...

Private-equity giant Carlyle Group has its sights on Japan as its favorite market currently, according to co-founder and interim Chief Executive Officer William Conway.

“The market I’d probably prefer the most today would be Japan, and part of that is because I do have a dollar brain,” Conway said during a panel at the Global Financial Leaders’ Investment Summit in Hong Kong on Thursday. “Everything is on sale in Japan for people who have dollars, and I think that it’s something to take advantage of.”

The Japanese yen has fallen to a three-decade low against the dollar as the central bank keeps interest rates at rock-bottom levels. The slide has prompted the government to step in to support its currency for the first time since 1998. The yen is expected to remain under downward pressure versus the dollar as long as interest rates continue to widen between the US and Japan.

Man Group Chief Executive Officer Luke Ellis said that he “would agree from an equity market point of view, that Japan is about the most attractive.”

Still, there’s “a very difficult story” with the central bank having to maintain a stimulative position amid decades of deflation and low wage inflation, he said on the same panel.

...

Carlyle’s Favorite Market Is Japan With ‘Everything on Sale’

https://finance.yahoo.com/news/carlyle-favorite-market-japan…

...

Private-equity giant Carlyle Group has its sights on Japan as its favorite market currently, according to co-founder and interim Chief Executive Officer William Conway.

“The market I’d probably prefer the most today would be Japan, and part of that is because I do have a dollar brain,” Conway said during a panel at the Global Financial Leaders’ Investment Summit in Hong Kong on Thursday. “Everything is on sale in Japan for people who have dollars, and I think that it’s something to take advantage of.”

The Japanese yen has fallen to a three-decade low against the dollar as the central bank keeps interest rates at rock-bottom levels. The slide has prompted the government to step in to support its currency for the first time since 1998. The yen is expected to remain under downward pressure versus the dollar as long as interest rates continue to widen between the US and Japan.

Man Group Chief Executive Officer Luke Ellis said that he “would agree from an equity market point of view, that Japan is about the most attractive.”

Still, there’s “a very difficult story” with the central bank having to maintain a stimulative position amid decades of deflation and low wage inflation, he said on the same panel.

...

4.10.

Stocks in Japan Rally Most Since March as Fed Rate Concerns Ease

https://www.yahoo.com/now/topix-jumps-3-easing-fed-040551404…

...

Japanese stocks surged the most since early March as weak US economic data sparked a global rally on hopes for slower Federal Reserve tightening.

Technology shares were the biggest boost to the Topix, which closed 3.2% higher, after a drop in US Treasury yields prompted investors to buy growth stocks. The benchmark has now pared its loss for the year to under 5%, compared with slides of more than 20% in key indexes of US and regional equities. The Nikkei 225 Index climbed 3%.

Asian stocks extended gains in afternoon trading following the Australian central bank’s smaller-than-expected rate hike. Overnight, the S&P 500 Index posted its biggest rise since July after a drop in the Institute for Supply Management’s gauge of factory activity suggested the US economy may be faltering.

“It is still too early to conclude that the downtrend in the US market has really ended,” and Japanese stocks remain subject to global market turmoil, said Ikuo Mitsui, a fund manager at Aizawa Securities Group. Risk factors up ahead include corporate results and the US midterm elections, he added.

...

Stocks in Japan Rally Most Since March as Fed Rate Concerns Ease

https://www.yahoo.com/now/topix-jumps-3-easing-fed-040551404…

...

Japanese stocks surged the most since early March as weak US economic data sparked a global rally on hopes for slower Federal Reserve tightening.

Technology shares were the biggest boost to the Topix, which closed 3.2% higher, after a drop in US Treasury yields prompted investors to buy growth stocks. The benchmark has now pared its loss for the year to under 5%, compared with slides of more than 20% in key indexes of US and regional equities. The Nikkei 225 Index climbed 3%.

Asian stocks extended gains in afternoon trading following the Australian central bank’s smaller-than-expected rate hike. Overnight, the S&P 500 Index posted its biggest rise since July after a drop in the Institute for Supply Management’s gauge of factory activity suggested the US economy may be faltering.

“It is still too early to conclude that the downtrend in the US market has really ended,” and Japanese stocks remain subject to global market turmoil, said Ikuo Mitsui, a fund manager at Aizawa Securities Group. Risk factors up ahead include corporate results and the US midterm elections, he added.

...

24.8.

Threats of Blackouts Drive Japan to Embrace Nuclear Again

https://finance.yahoo.com/news/threats-blackouts-drive-japan…

...

Japan is planning a dramatic shift back to nuclear power more than a decade on from the Fukushima disaster, aiming to restart a sweep of idled reactors and to develop new plants using next-generation technologies.

Prime Minister Fumio Kishida said Wednesday that the government will explore development and construction of new reactors as the country aims to avoid new strains on power grids that buckled under heavy demand this summer, and to curb the nation’s reliance on energy imports. The Nikkei newspaper reported the move ahead of Kishida’s formal announcement.

At the same time, Japan wants to restart seven more nuclear reactors from next summer onward, Kishida said at a government meeting on “green transformation.” That would bring the number of reactors brought back online after the 2011 Fukushima catastrophe to 17 out of a total 33 operable units.

“Nuclear power and renewables are essential to proceed with a green transformation,” Kishida said. “Russia’s invasion changed the global energy situation.”

...

Threats of Blackouts Drive Japan to Embrace Nuclear Again

https://finance.yahoo.com/news/threats-blackouts-drive-japan…

...

Japan is planning a dramatic shift back to nuclear power more than a decade on from the Fukushima disaster, aiming to restart a sweep of idled reactors and to develop new plants using next-generation technologies.

Prime Minister Fumio Kishida said Wednesday that the government will explore development and construction of new reactors as the country aims to avoid new strains on power grids that buckled under heavy demand this summer, and to curb the nation’s reliance on energy imports. The Nikkei newspaper reported the move ahead of Kishida’s formal announcement.

At the same time, Japan wants to restart seven more nuclear reactors from next summer onward, Kishida said at a government meeting on “green transformation.” That would bring the number of reactors brought back online after the 2011 Fukushima catastrophe to 17 out of a total 33 operable units.

“Nuclear power and renewables are essential to proceed with a green transformation,” Kishida said. “Russia’s invasion changed the global energy situation.”

...

23.8.

Japan's Business Activity Shrinks in Sign of Lackluster Recovery

Japan’s business activities stalled in August, signaling a lack of strong momentum to help the world’s third largest economy get beyond a gradual recovery.

https://financialpost.com/pmn/business-pmn/japans-business-a…

...

Au Jibun Bank’s purchasing managers index of activity in Japan’s service sector fell to 49.2, its lowest reading since February, sliding to below the 50 mark that separates contractions from expansions.

A measure of the country’s export-heavy manufacturing sector also declined to 51.0, the lowest reading since January last year.

Japan’s economy is still struggling to gain momentum, especially as daily Covid infection cases surged to a new record this month, heightening concerns over consumer spending and its impact on the service sector. Households are also seeing real wages drop amid the highest inflation since 2008 excluding tax-hike years, leading to Prime Minister Fumio Kishida’s pledge to quell price increases.

“The strongest concerns among Japanese private sector firms were the impact of the Ukraine war, inflationary pressures due to rising raw material and energy costs, and a global economic slowdown,” Usamah Bhatti, economist at S&P Global Market Intelligence, wrote in the PMI report Tuesday.

<ich habe meine ITOCHU Corp-Position nun verkauft, obwohl die Aktie fundamental recht günstig ist, um meinen Japan-Anteil weiter zu reduzieren>

Japan's Business Activity Shrinks in Sign of Lackluster Recovery

Japan’s business activities stalled in August, signaling a lack of strong momentum to help the world’s third largest economy get beyond a gradual recovery.

https://financialpost.com/pmn/business-pmn/japans-business-a…

...

Au Jibun Bank’s purchasing managers index of activity in Japan’s service sector fell to 49.2, its lowest reading since February, sliding to below the 50 mark that separates contractions from expansions.

A measure of the country’s export-heavy manufacturing sector also declined to 51.0, the lowest reading since January last year.

Japan’s economy is still struggling to gain momentum, especially as daily Covid infection cases surged to a new record this month, heightening concerns over consumer spending and its impact on the service sector. Households are also seeing real wages drop amid the highest inflation since 2008 excluding tax-hike years, leading to Prime Minister Fumio Kishida’s pledge to quell price increases.

“The strongest concerns among Japanese private sector firms were the impact of the Ukraine war, inflationary pressures due to rising raw material and energy costs, and a global economic slowdown,” Usamah Bhatti, economist at S&P Global Market Intelligence, wrote in the PMI report Tuesday.

<ich habe meine ITOCHU Corp-Position nun verkauft, obwohl die Aktie fundamental recht günstig ist, um meinen Japan-Anteil weiter zu reduzieren>

22.8.

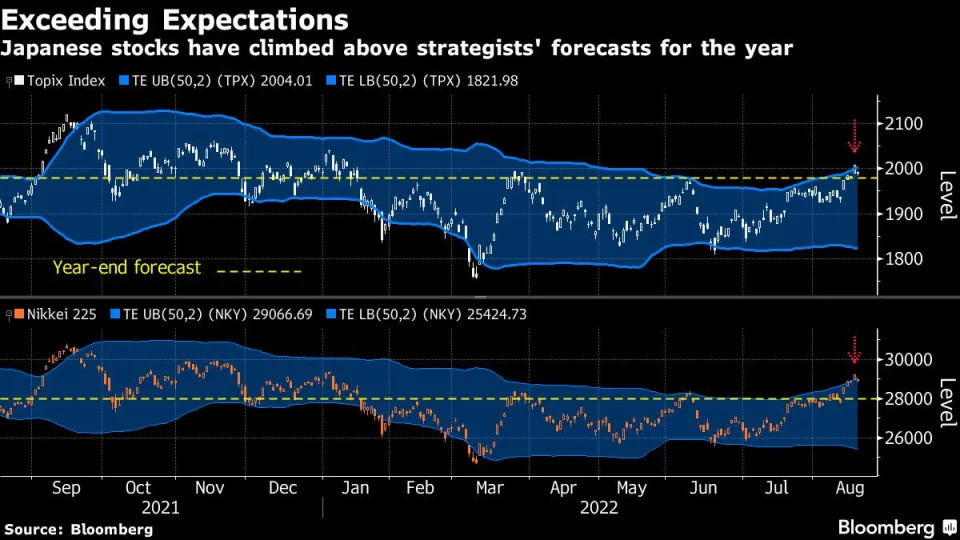

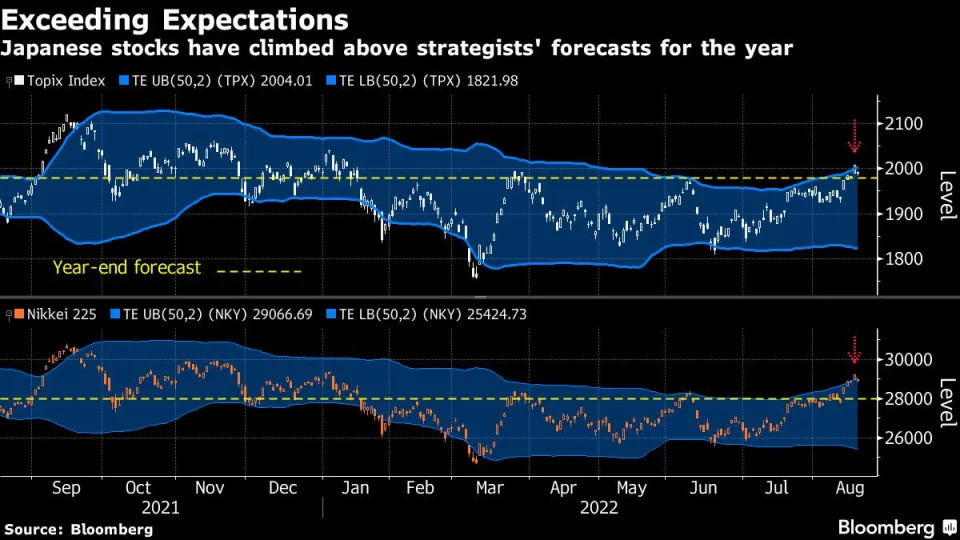

Japan Stocks Are Beating Global Peers. Share Buybacks Could Help Keep the Rally Going.

https://finance.yahoo.com/news/japan-stocks-beating-global-p…

...

Japanese stocks’ outperformance against global peers still has legs, thanks to rising share buybacks that are expected to reach the highest ever this fiscal year.

The blue-chip index Nikkei 225 was among the first major stock benchmarks in the world to erase its year-to-date loss last week as it climbed to a seven-month high.

Share buybacks have given Japanese stocks a new lease on life after they hit a low in March. NLI Research Institute and Jefferies Financial Group Inc. estimate that purchases may climb to a record high this fiscal year ending March 31. A solid earnings season in Japan means corporate coffers are replenished with more to spend. That contrasts with a slowdown in buybacks by American companies.

“Buybacks underlie the strong balance sheet position of Japanese companies combined with the growing shareholder-friendly policies,” said Joshua Crabb, a fund manager at Robeco Hong Kong Ltd. “This highlights the self-help nature of the Japanese equity market that insulates it somewhat from the macro concerns.”

Japanese firms have bought shares for 19 straight weeks, taking purchases so far this year to a net 2.7 trillion yen ($19.8 billion), according to data from Japan Exchange Group Inc. Honda Motor Co. Ltd., Canon Inc., Hoya Corp. and Denso Corp. all announced buybacks when releasing earnings.

Chizuru Morishita, a researcher at NLI Research Institute, expects total buybacks for the fiscal year to match or surpass last year’s all-time high of 8 trillion yen ($59 billion). Jefferies analyst Shrikant Kale says they may exceed 10 trillion yen for the first time.

This is likely to give Japanese stocks another leg up. The Nikkei 225 is expected to rise by 11% over the next 12 months, based on analysts’ consensus target price for all index members, data compiled by Bloomberg show. That matches the gains seen in the S&P 500.

...

Japan Stocks Are Beating Global Peers. Share Buybacks Could Help Keep the Rally Going.

https://finance.yahoo.com/news/japan-stocks-beating-global-p…

...

Japanese stocks’ outperformance against global peers still has legs, thanks to rising share buybacks that are expected to reach the highest ever this fiscal year.

The blue-chip index Nikkei 225 was among the first major stock benchmarks in the world to erase its year-to-date loss last week as it climbed to a seven-month high.

Share buybacks have given Japanese stocks a new lease on life after they hit a low in March. NLI Research Institute and Jefferies Financial Group Inc. estimate that purchases may climb to a record high this fiscal year ending March 31. A solid earnings season in Japan means corporate coffers are replenished with more to spend. That contrasts with a slowdown in buybacks by American companies.

“Buybacks underlie the strong balance sheet position of Japanese companies combined with the growing shareholder-friendly policies,” said Joshua Crabb, a fund manager at Robeco Hong Kong Ltd. “This highlights the self-help nature of the Japanese equity market that insulates it somewhat from the macro concerns.”

Japanese firms have bought shares for 19 straight weeks, taking purchases so far this year to a net 2.7 trillion yen ($19.8 billion), according to data from Japan Exchange Group Inc. Honda Motor Co. Ltd., Canon Inc., Hoya Corp. and Denso Corp. all announced buybacks when releasing earnings.

Chizuru Morishita, a researcher at NLI Research Institute, expects total buybacks for the fiscal year to match or surpass last year’s all-time high of 8 trillion yen ($59 billion). Jefferies analyst Shrikant Kale says they may exceed 10 trillion yen for the first time.

This is likely to give Japanese stocks another leg up. The Nikkei 225 is expected to rise by 11% over the next 12 months, based on analysts’ consensus target price for all index members, data compiled by Bloomberg show. That matches the gains seen in the S&P 500.

...

18.8.

Japan’s Inflation Getting Harder for Kuroda to Explain Away

https://finance.yahoo.com/news/japan-inflation-getting-harde…

03.05.24 · dpa-AFX · Apple |

02.05.24 · dpa-AFX · Nikkei 225 |

02.05.24 · dpa-AFX · DAX |

01.05.24 · dpa-AFX · Nikkei 225 |

30.04.24 · dpa-AFX · Apple |

30.04.24 · dpa-AFX · DAX |

29.04.24 · dpa-AFX · Alphabet |

26.04.24 · dpa-AFX · BHP Group |

26.04.24 · dpa-AFX · DAX |

25.04.24 · dpa-AFX · Nikkei 225 |

| Zeit | Titel |

|---|---|

| 20.05.23 |