Japan - Makro (Seite 5)

eröffnet am 10.12.20 00:03:26 von

neuester Beitrag 24.01.24 12:40:27 von

neuester Beitrag 24.01.24 12:40:27 von

Beiträge: 76

ID: 1.335.968

ID: 1.335.968

Aufrufe heute: 2

Gesamt: 7.633

Gesamt: 7.633

Aktive User: 0

ISIN: JP9010C00002 · WKN: CG3AA4

27.990,00

PKT

+0,85 %

+235,00 PKT

Letzter Kurs 04.08.22 CME

Neuigkeiten

03.05.24 · dpa-AFX |

02.05.24 · dpa-AFX |

02.05.24 · dpa-AFX |

01.05.24 · dpa-AFX |

30.04.24 · dpa-AFX |

Beitrag zu dieser Diskussion schreiben

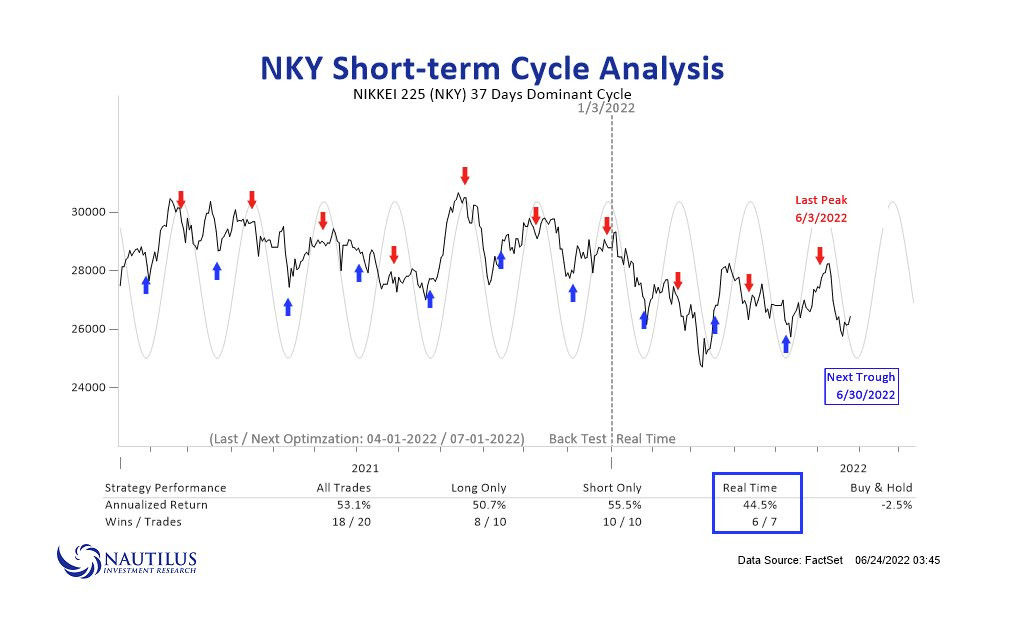

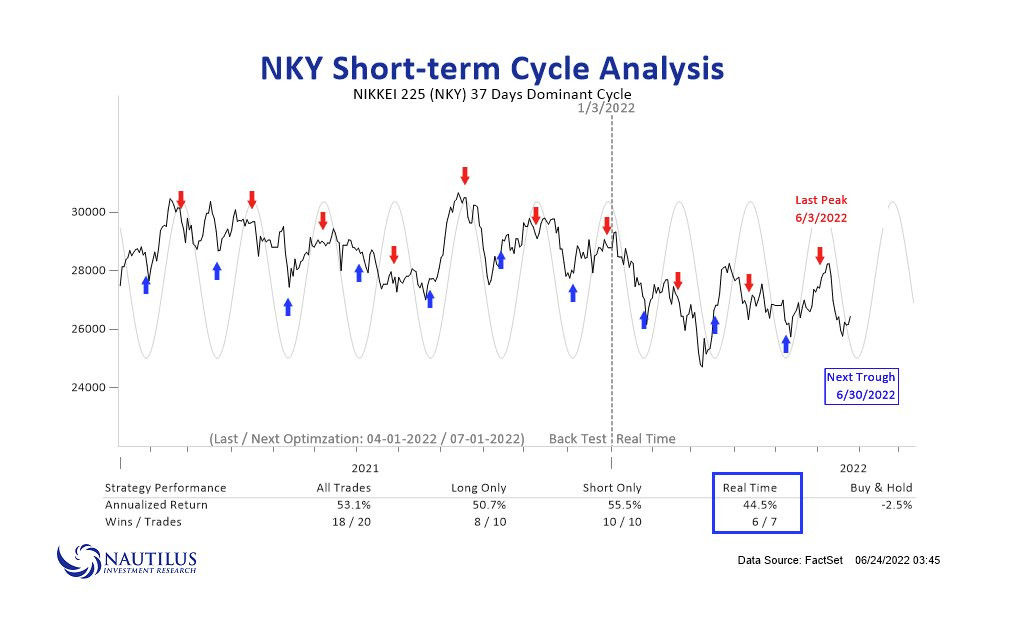

Zyklisch betrachtet sollte das Tief ab nächster Woche überwunden werden:

https://twitter.com/NautilusCap/status/1540312916938850304

https://twitter.com/NautilusCap/status/1540312916938850304

Antwort auf Beitrag Nr.: 71.800.274 von faultcode am 16.06.22 21:03:29

17.6.

...

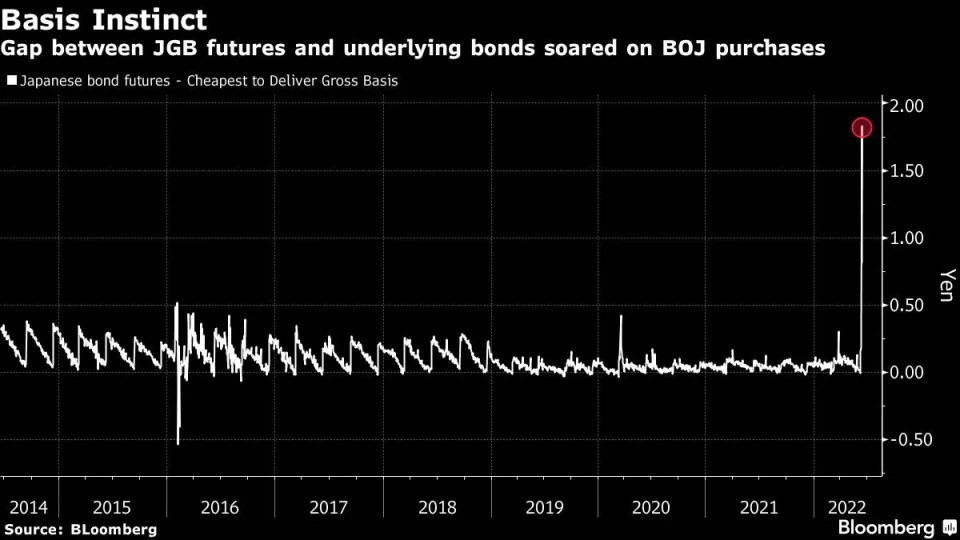

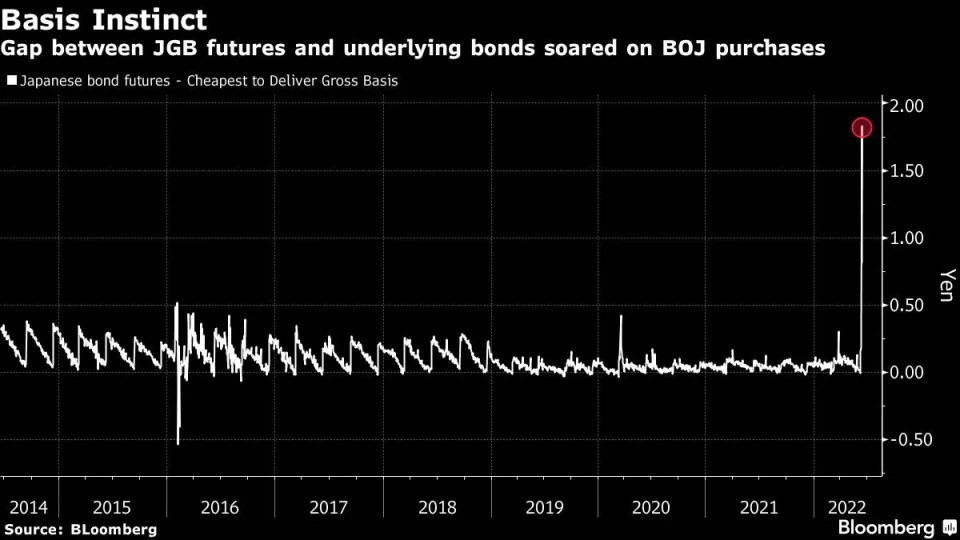

A small tweak to the Bank of Japan’s bond purchase plan this week blew up an arbitrage strategy popular with overseas investors known as the basis trade. It exacerbated a supply shortage of government bonds that has ramped up pressure on domestic financial institutions, leading them to turn to the BOJ for help to relieve the strain.

...

Arbitrageurs who were short the cheapest-to-deliver bonds and long the futures contracts suddenly faced steep losses and huge difficulties in closing their positions. The BOJ had effectively cornered the market in the cheapest-to-deliver bonds making it almost impossible for others to purchase them, while the futures price slumped to the brink of a trading halt as those caught out rushed to close.

...

“The selloff in futures has killed arbitrage opportunities,” said Mari Iwashita, chief market economist at Daiwa Securities. “This situation will eventually end up in a total stalemate in markets.”

Bets the Bank of Japan Will Break Are Popping Up Across Markets

But those purchases are also sucking up liquidity, piling pressure on local institutions, something which can be seen in the usage of the BOJ’s lending program -- another gauge of stress in the market.

The amount of bonds it lends temporarily to financial institutions to relieve supply tightness has hit a record, data compiled by Bloomberg show. The BOJ lent 3.2 trillion yen ($23.9 billion) of JGBs through its Securities Lending Facility on Thursday, well above the 2.3 trillion yen lent at the peak of coronavirus fears in March 2020.

Governor Haruhiko Kuroda told reporters on Friday that the BOJ will take appropriate measures to address any decline in bond market liquidity. He said he isn’t thinking about raising the 10-year yield ceiling from 0.25%.

“Market functioning and liquidity have deteriorated sharply with the BOJ’s massive JGB purchases,” Barclays strategist Shinji Ebihara wrote in a note.

...

Basis Trade Blowup Adds New Drama to BOJ Fight With Bond Market

https://finance.yahoo.com/news/basis-trade-blowup-adds-drama…

17.6.

...

A small tweak to the Bank of Japan’s bond purchase plan this week blew up an arbitrage strategy popular with overseas investors known as the basis trade. It exacerbated a supply shortage of government bonds that has ramped up pressure on domestic financial institutions, leading them to turn to the BOJ for help to relieve the strain.

...

Arbitrageurs who were short the cheapest-to-deliver bonds and long the futures contracts suddenly faced steep losses and huge difficulties in closing their positions. The BOJ had effectively cornered the market in the cheapest-to-deliver bonds making it almost impossible for others to purchase them, while the futures price slumped to the brink of a trading halt as those caught out rushed to close.

...

“The selloff in futures has killed arbitrage opportunities,” said Mari Iwashita, chief market economist at Daiwa Securities. “This situation will eventually end up in a total stalemate in markets.”

Bets the Bank of Japan Will Break Are Popping Up Across Markets

But those purchases are also sucking up liquidity, piling pressure on local institutions, something which can be seen in the usage of the BOJ’s lending program -- another gauge of stress in the market.

The amount of bonds it lends temporarily to financial institutions to relieve supply tightness has hit a record, data compiled by Bloomberg show. The BOJ lent 3.2 trillion yen ($23.9 billion) of JGBs through its Securities Lending Facility on Thursday, well above the 2.3 trillion yen lent at the peak of coronavirus fears in March 2020.

Governor Haruhiko Kuroda told reporters on Friday that the BOJ will take appropriate measures to address any decline in bond market liquidity. He said he isn’t thinking about raising the 10-year yield ceiling from 0.25%.

“Market functioning and liquidity have deteriorated sharply with the BOJ’s massive JGB purchases,” Barclays strategist Shinji Ebihara wrote in a note.

...

Basis Trade Blowup Adds New Drama to BOJ Fight With Bond Market

https://finance.yahoo.com/news/basis-trade-blowup-adds-drama…

Antwort auf Beitrag Nr.: 71.798.546 von faultcode am 16.06.22 17:37:11

https://twitter.com/zerohedge/status/1537465049081577479

https://twitter.com/zerohedge/status/1537465049081577479

16.6.

Bets on Yen Rally Suggest Dovish BOJ May Finally Capitulate

https://www.bnnbloomberg.ca/bets-on-yen-rally-suggest-dovish…

...

Currency options traders are betting that the Bank of Japan will join its global peers in delivering a surprise this week.

Demand to hedge one-day price swings in the yen ahead of the BOJ’s meeting Friday is the highest since the pandemic first rattled global markets in March 2020. Traders are also betting that the yen -- already surging -- could rally in the most compelling fashion since then.

While Japan’s policy makers are expected to continue with monetary easing, pressure on the central bank to alter its policy stance or outlook is growing following strong moves by the Federal Reserve and the Swiss National Bank. The yen rallied as much as 1.1% Thursday.

In a Bloomberg survey last week, all but one of 45 surveyed economists forecast no change in the BOJ’s main policy settings for its yield curve control and asset purchases. The central bank could catch markets wrong-footed by escaping negative rates territory, altering guidance that it “expects short- and long-term policy interest rates to remain at their present or lower levels,” or by reshaping curve control.

“Speculators have mounted a direct challenge to the YCC policy by selling JGB futures,” said John Hardy, head of currency strategy at Saxo Bank. “With the Fed raising the pace of its rate tightening yesterday and the ECB getting priced to move to a faster pace of hiking than previously anticipated, the pressure may become intolerable on the Japanese yen and force the BOJ to capitulate soon.”

PM Fumio Kishida:

1.6.

A Quiet Ex-Banker Shocks Markets With ‘Socialist’ Tilt in Japan

https://finance.yahoo.com/news/quiet-ex-banker-shocks-market…

...

Kishida, who’s highlighted the problem of growing income disparities for years, panicked investors in October, during the week of his inauguration, with talk of redistributing wealth and raising wages and capital- gains taxes. “Kishida Shock” trended on Twitter. The Nikkei 225 Stock Average posted its longest losing streak in more than a decade. Although he backed away from the tax idea, Kishida continues to promote a “new form of capitalism” that he says will address inequality and climate change.

The sudden leftward tilt opened up rare debate on the best direction for the world’s third-largest economy, which has been mired in slow growth for decades. Kishida, who has a habit of pulling out a notebook during speeches to refer to grievances and comments he’s heard from constituents, says voters feel left behind by former Prime Minister Shinzo Abe’s growth-focused policies, known as Abenomics. Kishida remains faithful to some aspects of Abenomics, such as the Bank of Japan’s 2% inflation target, but he’s pushed for an end to the US-style, markets-first policies.

“Disparities and poverty have expanded because of overreliance on markets,” Kishida said in his New Year’s speech. “Under a new form of capitalism, rather than leaving everything to the markets and competition, the important thing is for public- and private-sector entities to play roles together.”

So far, Kishida’s new capitalism remains a broad set of ideas in which the government plays a bigger role in creating incentives for the private sector to address social problems. Possible solutions include tax incentives to encourage companies to raise wages, invest in training a more diverse workforce, and spend more on research and development. The new capitalism also envisions more investment in startups as well as green and digital initiatives.

Kishida and his supporters say the fresh approach will be fairer and more inclusive than the free-market “neoliberalism” that’s dominated since the 1980s. If more people in society benefit from economic expansion, growth will be more sustainable, they say. The results will serve as a better model to counter the growing power of authoritarian states, they add.

Some see the approach as part of a global phenomenon, with other world leaders such as Joe Biden in the US and France’s Emmanuel Macron facing growing discontent. In Japan, as elsewhere, the pandemic has laid bare differences between those with steady incomes and those with low pay or unstable employment.

Opponents, particularly those in financial markets, have derided Kishida’s ideas as out-of-touch, socialist rhetoric. Only 3% of investors in a January Nikkei-CNBC survey said they supported him, a staggeringly low figure for the leader of the Liberal Democratic Party, considered the ally of Japanese business. In October, Hiroshi Mikitani, the billionaire founder of Rakuten Group Inc., summed up the attitude of many in this camp when he tweeted, “New capitalism = socialism.”

With a key national election coming up, Kishida made an effort to reassure these critics—and overseas investors—during a speech on May 5 in London’s financial district. He described himself as the only Japanese prime minister since World War II with experience working in the finance industry. He stressed his commitment to a “robust economy supported by the animal spirits of the private sector,” tax cuts, and incentives to encourage citizens to move savings into asset management “to stimulate the market.”

Kishida, who turns 65 in July, hasn’t accepted Bloomberg News’ repeated requests for an interview since he took office.

...

1.6.

A Quiet Ex-Banker Shocks Markets With ‘Socialist’ Tilt in Japan

https://finance.yahoo.com/news/quiet-ex-banker-shocks-market…

...

Kishida, who’s highlighted the problem of growing income disparities for years, panicked investors in October, during the week of his inauguration, with talk of redistributing wealth and raising wages and capital- gains taxes. “Kishida Shock” trended on Twitter. The Nikkei 225 Stock Average posted its longest losing streak in more than a decade. Although he backed away from the tax idea, Kishida continues to promote a “new form of capitalism” that he says will address inequality and climate change.

The sudden leftward tilt opened up rare debate on the best direction for the world’s third-largest economy, which has been mired in slow growth for decades. Kishida, who has a habit of pulling out a notebook during speeches to refer to grievances and comments he’s heard from constituents, says voters feel left behind by former Prime Minister Shinzo Abe’s growth-focused policies, known as Abenomics. Kishida remains faithful to some aspects of Abenomics, such as the Bank of Japan’s 2% inflation target, but he’s pushed for an end to the US-style, markets-first policies.

“Disparities and poverty have expanded because of overreliance on markets,” Kishida said in his New Year’s speech. “Under a new form of capitalism, rather than leaving everything to the markets and competition, the important thing is for public- and private-sector entities to play roles together.”

So far, Kishida’s new capitalism remains a broad set of ideas in which the government plays a bigger role in creating incentives for the private sector to address social problems. Possible solutions include tax incentives to encourage companies to raise wages, invest in training a more diverse workforce, and spend more on research and development. The new capitalism also envisions more investment in startups as well as green and digital initiatives.

Kishida and his supporters say the fresh approach will be fairer and more inclusive than the free-market “neoliberalism” that’s dominated since the 1980s. If more people in society benefit from economic expansion, growth will be more sustainable, they say. The results will serve as a better model to counter the growing power of authoritarian states, they add.

Some see the approach as part of a global phenomenon, with other world leaders such as Joe Biden in the US and France’s Emmanuel Macron facing growing discontent. In Japan, as elsewhere, the pandemic has laid bare differences between those with steady incomes and those with low pay or unstable employment.

Opponents, particularly those in financial markets, have derided Kishida’s ideas as out-of-touch, socialist rhetoric. Only 3% of investors in a January Nikkei-CNBC survey said they supported him, a staggeringly low figure for the leader of the Liberal Democratic Party, considered the ally of Japanese business. In October, Hiroshi Mikitani, the billionaire founder of Rakuten Group Inc., summed up the attitude of many in this camp when he tweeted, “New capitalism = socialism.”

With a key national election coming up, Kishida made an effort to reassure these critics—and overseas investors—during a speech on May 5 in London’s financial district. He described himself as the only Japanese prime minister since World War II with experience working in the finance industry. He stressed his commitment to a “robust economy supported by the animal spirits of the private sector,” tax cuts, and incentives to encourage citizens to move savings into asset management “to stimulate the market.”

Kishida, who turns 65 in July, hasn’t accepted Bloomberg News’ repeated requests for an interview since he took office.

...

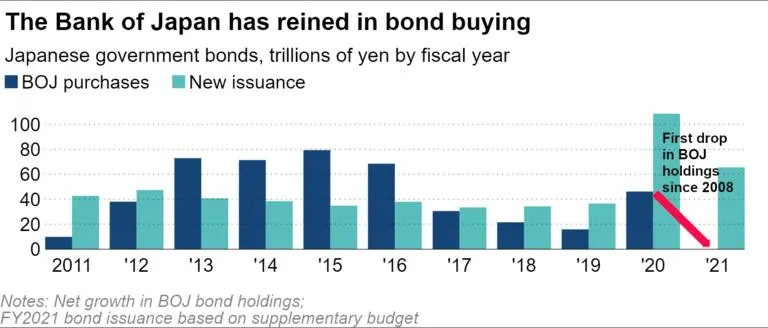

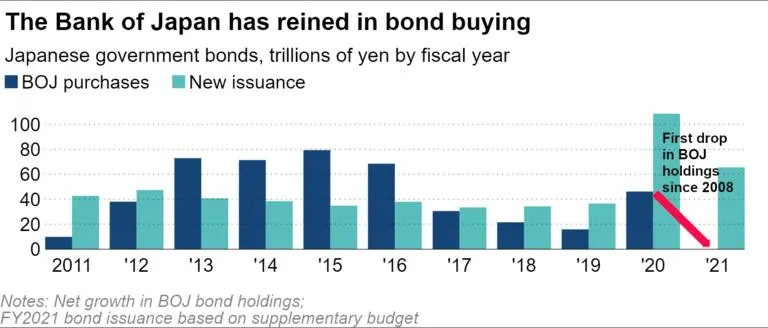

stealth taper

6.1.2022

BOJ's stealth taper: Bond holdings shrink for 1st time under Kuroda

Still struggling to reach 2% inflation, Japan's central bank quietly tackles risk

https://asia.nikkei.com/Business/Finance/BOJ-s-stealth-taper…

...

...

The BOJ has pledged to continue to expand the monetary base until the yearly rise in the consumer price index, excluding fresh foods, surpasses and stays above 2% threshold in a stable manner. But some voices at the bank sound open to temporary contraction.

Even if the monetary base decreases in the short run, there will be no contradiction with the bank's inflation commitment as long as a long-term increase trend is maintained, a policy board member said at a Dec. 21 meeting, according to a BOJ readout.

Still, market watchers expressed doubts about the sustainability of the BOJ's easing policy.

An executive at one of Japan's top banks said policy management faces "problems with consistency after a reckless series of add-ons and renovations."

6.1.2022

BOJ's stealth taper: Bond holdings shrink for 1st time under Kuroda

Still struggling to reach 2% inflation, Japan's central bank quietly tackles risk

https://asia.nikkei.com/Business/Finance/BOJ-s-stealth-taper…

...

...

The BOJ has pledged to continue to expand the monetary base until the yearly rise in the consumer price index, excluding fresh foods, surpasses and stays above 2% threshold in a stable manner. But some voices at the bank sound open to temporary contraction.

Even if the monetary base decreases in the short run, there will be no contradiction with the bank's inflation commitment as long as a long-term increase trend is maintained, a policy board member said at a Dec. 21 meeting, according to a BOJ readout.

Still, market watchers expressed doubts about the sustainability of the BOJ's easing policy.

An executive at one of Japan's top banks said policy management faces "problems with consistency after a reckless series of add-ons and renovations."

Antwort auf Beitrag Nr.: 70.418.512 von faultcode am 06.01.22 13:52:58billiger Yen --> gut für Exporteure

6.1.

Yen Is Cheapest Ever After Tumble, JPMorgan Index Shows

https://ca.finance.yahoo.com/news/yen-tumble-even-worse-look…

...

Goldman Sachs und Co. machen mal wieder "I talk my book"

17.12.

Goldman, Morgan Stanley Say It’s Time to Jump Into Japan Stocks

https://ca.news.yahoo.com/cheap-valuations-low-inflation-boo…

...

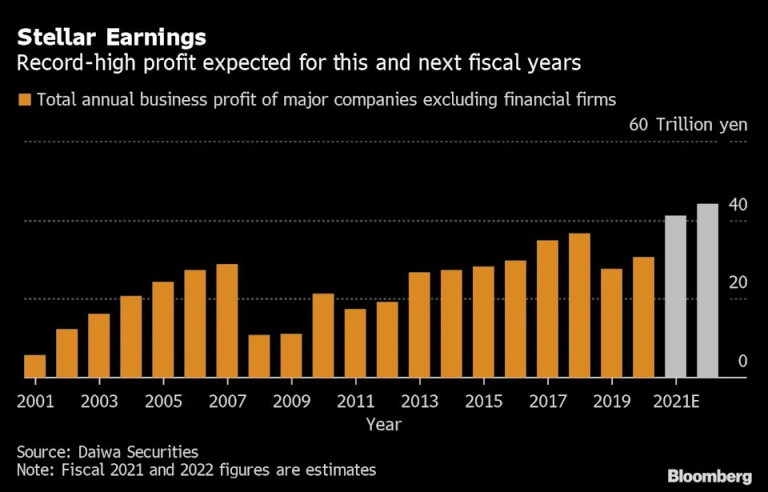

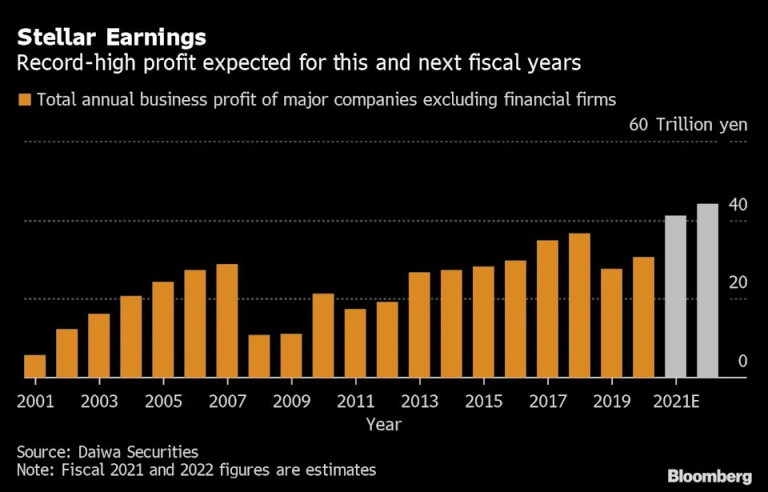

“Cheap valuations and foreigners’ low exposure will all work to the benefit of Japanese stocks,” Goldman strategist Kazunori Tatebe told reporters at a virtual media briefing on Dec. 13. As reopening picks up pace, Tatebe sees a “powerful bout of inflow” from foreign funds who he estimates have sold up to 7 trillion yen ($61.3 billion) of Japan stocks since the pandemic began.

Japan has seen Covid infections and deaths fall to near-record lows despite the global spread of the omicron variant. That, along with the highest inoculation rate among the Group of Seven countries, is boosting expectations for economic reopening.

...

With the Topix trading at about 14 times estimated earnings versus the S&P 500’s 22 times, Japan’s price-to-earnings ratio is not only “significantly cheaper” than the U.S., but also lower than its own 15-year average of about 16 times, said Tai Hui, Asia chief market strategist at JPMorgan Asset Management in Hong Kong.

...

The Topix is seen advancing almost 17% over the next 12 months, according to estimates from sell-side analysts compiled by Bloomberg. That’s versus an upside of 10% seen for the S&P 500. Japan’s stock benchmark has trailed its U.S. peer by about 14 percentage points this year.

Also boosting the optimism is a recovery in corporate earnings that many say isn’t yet priced in.

“Over the past three months, Japan has witnessed the highest earnings revision globally, led by exporters,” analysts at Jefferies Financial Group Inc. including Shrikant Kale wrote in a recent note. “As the reopening gains momentum, both the engines of growth — exporters and domestics — will fire the next leg of earnings acceleration.”

Another factor for the bull case is Japan’s exceptionally low inflation. Consumer prices excluding fresh food increased just 0.1% in October from a year earlier, a far cry from the U.S. where prices are rising at the fastest pace in nearly 40 years.

...

Risks still remain, with a delayed reopening far from the only cap on share-price gains. The stock market is often a victim of China-driven selloffs, while uncertainty surrounding the Kishida administration’s policies have led to market jitters. The specter of Omicron also looms, though community transmission hasn’t yet been found in the country.

Goldman’s Tatebe also remains skeptical over the possibility of sustained foreign stock-buying in the absence of a broader narrative.

“What foreigners want are policies that address the issue of shrinking population, low growth and low productivity,” he said. “But so far, Kishida hasn’t delivered on these -- or rather, he hasn’t rekindled any expectations.”

...

17.12.

Goldman, Morgan Stanley Say It’s Time to Jump Into Japan Stocks

https://ca.news.yahoo.com/cheap-valuations-low-inflation-boo…

...

“Cheap valuations and foreigners’ low exposure will all work to the benefit of Japanese stocks,” Goldman strategist Kazunori Tatebe told reporters at a virtual media briefing on Dec. 13. As reopening picks up pace, Tatebe sees a “powerful bout of inflow” from foreign funds who he estimates have sold up to 7 trillion yen ($61.3 billion) of Japan stocks since the pandemic began.

Japan has seen Covid infections and deaths fall to near-record lows despite the global spread of the omicron variant. That, along with the highest inoculation rate among the Group of Seven countries, is boosting expectations for economic reopening.

...

With the Topix trading at about 14 times estimated earnings versus the S&P 500’s 22 times, Japan’s price-to-earnings ratio is not only “significantly cheaper” than the U.S., but also lower than its own 15-year average of about 16 times, said Tai Hui, Asia chief market strategist at JPMorgan Asset Management in Hong Kong.

...

The Topix is seen advancing almost 17% over the next 12 months, according to estimates from sell-side analysts compiled by Bloomberg. That’s versus an upside of 10% seen for the S&P 500. Japan’s stock benchmark has trailed its U.S. peer by about 14 percentage points this year.

Also boosting the optimism is a recovery in corporate earnings that many say isn’t yet priced in.

“Over the past three months, Japan has witnessed the highest earnings revision globally, led by exporters,” analysts at Jefferies Financial Group Inc. including Shrikant Kale wrote in a recent note. “As the reopening gains momentum, both the engines of growth — exporters and domestics — will fire the next leg of earnings acceleration.”

Another factor for the bull case is Japan’s exceptionally low inflation. Consumer prices excluding fresh food increased just 0.1% in October from a year earlier, a far cry from the U.S. where prices are rising at the fastest pace in nearly 40 years.

...

Risks still remain, with a delayed reopening far from the only cap on share-price gains. The stock market is often a victim of China-driven selloffs, while uncertainty surrounding the Kishida administration’s policies have led to market jitters. The specter of Omicron also looms, though community transmission hasn’t yet been found in the country.

Goldman’s Tatebe also remains skeptical over the possibility of sustained foreign stock-buying in the absence of a broader narrative.

“What foreigners want are policies that address the issue of shrinking population, low growth and low productivity,” he said. “But so far, Kishida hasn’t delivered on these -- or rather, he hasn’t rekindled any expectations.”

...

03.05.24 · dpa-AFX · Apple |

02.05.24 · dpa-AFX · Nikkei 225 |

02.05.24 · dpa-AFX · DAX |

01.05.24 · dpa-AFX · Nikkei 225 |

30.04.24 · dpa-AFX · Apple |

30.04.24 · dpa-AFX · DAX |

29.04.24 · dpa-AFX · Alphabet |

26.04.24 · dpa-AFX · BHP Group |

26.04.24 · dpa-AFX · DAX |

25.04.24 · dpa-AFX · Nikkei 225 |

| Zeit | Titel |

|---|---|

| 20.05.23 |