Japan - Makro (Seite 6)

eröffnet am 10.12.20 00:03:26 von

neuester Beitrag 24.01.24 12:40:27 von

neuester Beitrag 24.01.24 12:40:27 von

Beiträge: 76

ID: 1.335.968

ID: 1.335.968

Aufrufe heute: 0

Gesamt: 7.619

Gesamt: 7.619

Aktive User: 0

ISIN: JP9010C00002 · WKN: CG3AA4

27.990,00

PKT

+0,85 %

+235,00 PKT

Letzter Kurs 04.08.22 CME

Neuigkeiten

09:06 Uhr · dpa-AFX |

07:33 Uhr · dpa-AFX |

25.04.24 · dpa-AFX |

25.04.24 · dpa-AFX |

24.04.24 · dpa-AFX |

Beitrag zu dieser Diskussion schreiben

14.12.

Bank of Japan Tapers by Stealth First and Explains Later

https://finance.yahoo.com/news/bank-japan-tapers-stealth-fir…

...

The BOJ has more flexibility in its approach than other developed market central banks, according to Freya Beamish, head of macro research at TS Lombard.

“That facilitated a stealthy early withdrawal for the BOJ. In contrast, the Fed is now left in the position of accelerating its taper and communicating that in a way that doesn’t derail equity markets,” she said.

Ultimately, market participants have realized that action speaks louder than words.

“It’s easier to know what the BOJ is doing by watching rather than listening to them,” former BOJ chief economist Hideo Hayakawa said. “In a way, the BOJ has been done with tapering for some time.”

...

3.12.

More Companies Will List in Japan This Month Than Ever Before

https://uk.news.yahoo.com/more-companies-list-japan-month-23…

30.11.

MSCI Deals ‘Body Blow’ to Japan Stocks With Latest Round of Cuts

https://www.bnnbloomberg.ca/msci-deals-body-blow-to-japan-st…

...

A total of $16.3 trillion of assets under management were benchmarked to MSCI indexes globally as of Sept. 30, according to the index provider. The latest reshuffle, which takes effect Tuesday, is likely to result in an outflow of about 220 billion yen ($1.9 billion) from Japanese equities, Daiwa Securities analyst Junichi Hashimoto estimates.

Japan’s underperformance is one reason for MSCI’s cutting of Japanese names. The S&P 500 is up 24% so far this year versus an 8% advance for the Topix, pushing a ratio of the U.S. gauge to the Japanese benchmark to all-time high levels.

Prime Minister Fumio Kishida unveiled a nearly $500 billion stimulus package this month aimed at shoring up a sputtering economy and launching his new vision of capitalism. While Kishida has emphasized that the economy must get back on track before any tightening of the nation’s purse strings, the stimulus has done little to excite investors thus far.

“Japan has been slow in recovering from the pandemic,” Daiwa’s Hashimoto said. Unless Japan is able to implement economic measures effectively, Hashimoto said he sees “no end” to the reduction of the country’s MSCI weighting.

MSCI Deals ‘Body Blow’ to Japan Stocks With Latest Round of Cuts

https://www.bnnbloomberg.ca/msci-deals-body-blow-to-japan-st…

...

A total of $16.3 trillion of assets under management were benchmarked to MSCI indexes globally as of Sept. 30, according to the index provider. The latest reshuffle, which takes effect Tuesday, is likely to result in an outflow of about 220 billion yen ($1.9 billion) from Japanese equities, Daiwa Securities analyst Junichi Hashimoto estimates.

Japan’s underperformance is one reason for MSCI’s cutting of Japanese names. The S&P 500 is up 24% so far this year versus an 8% advance for the Topix, pushing a ratio of the U.S. gauge to the Japanese benchmark to all-time high levels.

Prime Minister Fumio Kishida unveiled a nearly $500 billion stimulus package this month aimed at shoring up a sputtering economy and launching his new vision of capitalism. While Kishida has emphasized that the economy must get back on track before any tightening of the nation’s purse strings, the stimulus has done little to excite investors thus far.

“Japan has been slow in recovering from the pandemic,” Daiwa’s Hashimoto said. Unless Japan is able to implement economic measures effectively, Hashimoto said he sees “no end” to the reduction of the country’s MSCI weighting.

16,11,

Long-Short Fund Sees Chance in Widening Governance Gap in Japan

https://www.bnnbloomberg.ca/long-short-fund-sees-chance-in-w…

...

Japan’s multiyear efforts to improve corporate governance have created a greater gap between good and bad companies.

That’s the view of Zuhair Khan, who launched a long-short fund at Union Bancaire Privee in July 2020 to capitalize on this divergence. The $100 million U Access Long/Short Japan Corporate Governance fund has made an annualized return of 11% since inception, he said.

The “comply or explain” nature of the nation’s corporate governance code introduced by Prime Minister Shinzo Abe in 2015 means it’s not mandatory and carries no fines for noncompliance, Khan explained. While some firms have made big improvements, helped in part by pressure from activists and other investors, there is still a long way to go.

“The good governance companies are actually getting better and better, at a pretty fast pace,” he said in a video interview from Tokyo. The bad companies are “improving in a more superficial manner, but not in terms of real change.”

...

Long-Short Fund Sees Chance in Widening Governance Gap in Japan

https://www.bnnbloomberg.ca/long-short-fund-sees-chance-in-w…

...

Japan’s multiyear efforts to improve corporate governance have created a greater gap between good and bad companies.

That’s the view of Zuhair Khan, who launched a long-short fund at Union Bancaire Privee in July 2020 to capitalize on this divergence. The $100 million U Access Long/Short Japan Corporate Governance fund has made an annualized return of 11% since inception, he said.

The “comply or explain” nature of the nation’s corporate governance code introduced by Prime Minister Shinzo Abe in 2015 means it’s not mandatory and carries no fines for noncompliance, Khan explained. While some firms have made big improvements, helped in part by pressure from activists and other investors, there is still a long way to go.

“The good governance companies are actually getting better and better, at a pretty fast pace,” he said in a video interview from Tokyo. The bad companies are “improving in a more superficial manner, but not in terms of real change.”

...

1.11.

Wahlen in Japan - Regierende LDP behält stabile Mehrheit

https://www.finanzen.net/nachricht/aktien/wahlen-in-japan-re…

...

Die regierende LDP des japanischen Premierministers Fumio Kishida hat bei den Parlamentswahlen am Sonntag entgegen den Erwartungen eine stabile Mehrheit erhalten.

Die LDP und ihr Junior-Koalitionspartner Komeito errangen 293 Sitze und damit mehr als die 261 Sitze, die für eine "absolute stabile Mehrheit" erforderlich sind. Die LDP alleine erhielt 261 Sitze, 15 weniger als bei den letzten Wahlen. Umfragen und erste Prognosen hatten darauf hingedeutet, dass die LDP für eine Mehrheit auf ihre Junior-Koalitionspartei angewiesen sein würde.

Kishidas konservative Liberaldemokratische Partei (LDP) behält damit trotz Sitzverlusten im Unterhaus ihre Ein-Parteien-Mehrheit bei - ein großer Sieg für Kishida, der erst vor einem Monat an die Macht kam. Kishida war Anfang Oktober vom Parlament zum Ministerpräsidenten gewählt worden, nachdem sein weitgehend glücklos agierender Vorgänger Yoshihide Suga nach nur einem Jahr das Handtuch geworfen hatte. Er war wegen seiner Corona-Politik in die Kritik geraten und hatte dramatisch an Popularität verloren. Kishida setzte danach eine Neuwahl an, um von der Bevölkerung das Mandat für eine Regierung unter seiner Führung einzuholen. Der frühere Banker kämpft mit dem Image, wenig Charisma zu haben.

Kishida vertritt die traditionelle Politik des rechten Flügels seiner Partei und drängt auf eine Erhöhung der Militärausgaben. Er hat jedoch auch versprochen, gegen die Ungleichheit zwischen Arm und Reich in Japan vorzugehen, und propagiert einen "neuen Kapitalismus", der bei Investoren Besorgnis erregt hat.

Ein großer Gewinner der Wahl war die konservative Japanische Innovationspartei, die ihre Sitze voraussichtlich mehr als verdreifachen und die Komeito als dritte Kraft im Unterhaus nach der oppositionellen Demokratischen Verfassungspartei Japans überholen wird. Der Aufstieg der Partei aus Osaka zu einer nationalen Kraft könnte Kishidas Versprechen, die neoliberale Wirtschaftspolitik Japans zurückzudrehen, erschweren.

=> Nikkei225 +2%

Wahlen in Japan - Regierende LDP behält stabile Mehrheit

https://www.finanzen.net/nachricht/aktien/wahlen-in-japan-re…

...

Die regierende LDP des japanischen Premierministers Fumio Kishida hat bei den Parlamentswahlen am Sonntag entgegen den Erwartungen eine stabile Mehrheit erhalten.

Die LDP und ihr Junior-Koalitionspartner Komeito errangen 293 Sitze und damit mehr als die 261 Sitze, die für eine "absolute stabile Mehrheit" erforderlich sind. Die LDP alleine erhielt 261 Sitze, 15 weniger als bei den letzten Wahlen. Umfragen und erste Prognosen hatten darauf hingedeutet, dass die LDP für eine Mehrheit auf ihre Junior-Koalitionspartei angewiesen sein würde.

Kishidas konservative Liberaldemokratische Partei (LDP) behält damit trotz Sitzverlusten im Unterhaus ihre Ein-Parteien-Mehrheit bei - ein großer Sieg für Kishida, der erst vor einem Monat an die Macht kam. Kishida war Anfang Oktober vom Parlament zum Ministerpräsidenten gewählt worden, nachdem sein weitgehend glücklos agierender Vorgänger Yoshihide Suga nach nur einem Jahr das Handtuch geworfen hatte. Er war wegen seiner Corona-Politik in die Kritik geraten und hatte dramatisch an Popularität verloren. Kishida setzte danach eine Neuwahl an, um von der Bevölkerung das Mandat für eine Regierung unter seiner Führung einzuholen. Der frühere Banker kämpft mit dem Image, wenig Charisma zu haben.

Kishida vertritt die traditionelle Politik des rechten Flügels seiner Partei und drängt auf eine Erhöhung der Militärausgaben. Er hat jedoch auch versprochen, gegen die Ungleichheit zwischen Arm und Reich in Japan vorzugehen, und propagiert einen "neuen Kapitalismus", der bei Investoren Besorgnis erregt hat.

Ein großer Gewinner der Wahl war die konservative Japanische Innovationspartei, die ihre Sitze voraussichtlich mehr als verdreifachen und die Komeito als dritte Kraft im Unterhaus nach der oppositionellen Demokratischen Verfassungspartei Japans überholen wird. Der Aufstieg der Partei aus Osaka zu einer nationalen Kraft könnte Kishidas Versprechen, die neoliberale Wirtschaftspolitik Japans zurückzudrehen, erschweren.

=> Nikkei225 +2%

Antwort auf Beitrag Nr.: 69.584.274 von faultcode am 13.10.21 14:48:0114.10.

If History’s a Guide, Japan Stocks Are Set for an Election Rally

https://www.bnnbloomberg.ca/if-history-s-a-guide-japan-stock…

...

Prime Minister Fumio Kishida has so far done little to impress stock traders unnerved by talk of higher taxes. But if history repeats itself, the Japanese leader should expect to see shares take off soon as Japan prepares to go to the polls.

The benchmark Topix tends to rise ahead of the formation of a new parliament, as expectations grow for fresh economic and financial stimulus. Kishida, who was appointed prime minister earlier this month, will dissolve parliament on Thursday and has called for a general election for Oct. 31.

In the last five general elections, the Topix has risen an average of about 6.4% between the time the lower house was dissolved and voting day, according to Bloomberg calculations. In the three months after the dissolution, that gain was an average 15%, a rally most prominent when Shinzo Abe took power in 2012.

“The dissolution of parliament is a buy sign for Japanese stocks,” said Eiji Kinouchi, chief technical analyst at Daiwa Securities Co. While investors may be inclined to stay sidelined, “the market is anticipating the dissolution will serve as a trigger for a turnaround in shares.”

...

If History’s a Guide, Japan Stocks Are Set for an Election Rally

https://www.bnnbloomberg.ca/if-history-s-a-guide-japan-stock…

...

Prime Minister Fumio Kishida has so far done little to impress stock traders unnerved by talk of higher taxes. But if history repeats itself, the Japanese leader should expect to see shares take off soon as Japan prepares to go to the polls.

The benchmark Topix tends to rise ahead of the formation of a new parliament, as expectations grow for fresh economic and financial stimulus. Kishida, who was appointed prime minister earlier this month, will dissolve parliament on Thursday and has called for a general election for Oct. 31.

In the last five general elections, the Topix has risen an average of about 6.4% between the time the lower house was dissolved and voting day, according to Bloomberg calculations. In the three months after the dissolution, that gain was an average 15%, a rally most prominent when Shinzo Abe took power in 2012.

“The dissolution of parliament is a buy sign for Japanese stocks,” said Eiji Kinouchi, chief technical analyst at Daiwa Securities Co. While investors may be inclined to stay sidelined, “the market is anticipating the dissolution will serve as a trigger for a turnaround in shares.”

...

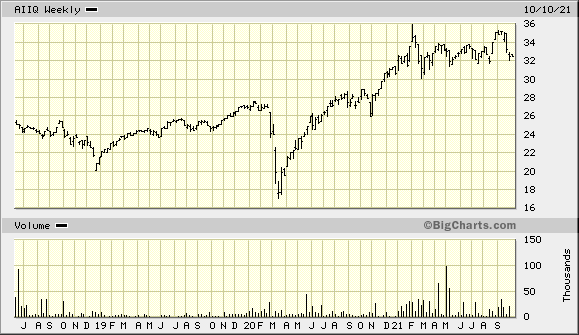

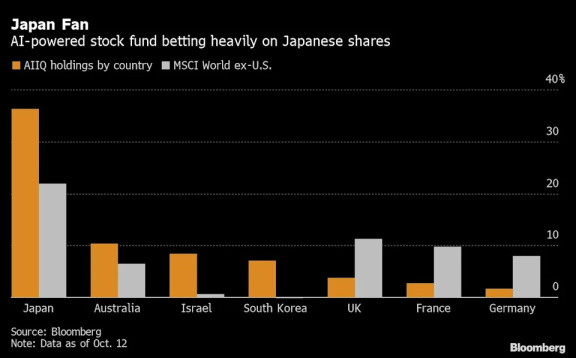

AIIQ -- AI Powered International Equity ETF

While the $11 million fund is tiny, the approach of its “manager” may be of interest to investors: an AI model which runs 24/7 on IBM’s supercomputer Watson platform. The quantitative model -- developed by EquBot Inc. -- scrapes millions of regulatory filings, news stories, management profiles, sentiment gauges, financial models, valuations and bits of market data, and then chooses developed-market stocks for the fund.

13.10.

AI-Powered Stock Fund Doubles Down on Japan’s Whipsawing Shares

https://finance.yahoo.com/news/ai-powered-stock-fund-doubles…

...

The AI Powered International Equity exchange-traded fund (ticker AIIQ) has increased its weighting in the country to 36% this week from just 9% at the beginning of the year, according to data compiled by Bloomberg. That compares with a 22% weighting in Japanese stocks in the MSCI World ex-U.S. Index.

AIIQ has risen about 6% so far this year, neck and neck with the MSCI gauge which is up almost 7%. The ETF beat the index by about 9 percentage points last year.

Japanese shares have been whipsawed in recent months by a change of government, the global surge in yields and a slump in the yen. The Topix Index rose as much as 8% from the end of August amid investor optimism about potential stimulus before losing all those gains by the beginning of October as investors balked at new Prime Minister Fumio Kishida’s plans for a “new type of Japanese capitalism.”

Still, the country’s shares are seen as cheap compared with international peers, with export-heavy companies that offer good exposure to the global reflation trade.

...

Launched in June 2018, AIIQ has delivered a total return of about 38% since inception, compared with 26% for the MSCI World ex-U.S.

While the $11 million fund is tiny, the approach of its “manager” may be of interest to investors: an AI model which runs 24/7 on IBM’s supercomputer Watson platform. The quantitative model -- developed by EquBot Inc. -- scrapes millions of regulatory filings, news stories, management profiles, sentiment gauges, financial models, valuations and bits of market data, and then chooses developed-market stocks for the fund.

13.10.

AI-Powered Stock Fund Doubles Down on Japan’s Whipsawing Shares

https://finance.yahoo.com/news/ai-powered-stock-fund-doubles…

...

The AI Powered International Equity exchange-traded fund (ticker AIIQ) has increased its weighting in the country to 36% this week from just 9% at the beginning of the year, according to data compiled by Bloomberg. That compares with a 22% weighting in Japanese stocks in the MSCI World ex-U.S. Index.

AIIQ has risen about 6% so far this year, neck and neck with the MSCI gauge which is up almost 7%. The ETF beat the index by about 9 percentage points last year.

Japanese shares have been whipsawed in recent months by a change of government, the global surge in yields and a slump in the yen. The Topix Index rose as much as 8% from the end of August amid investor optimism about potential stimulus before losing all those gains by the beginning of October as investors balked at new Prime Minister Fumio Kishida’s plans for a “new type of Japanese capitalism.”

Still, the country’s shares are seen as cheap compared with international peers, with export-heavy companies that offer good exposure to the global reflation trade.

...

Launched in June 2018, AIIQ has delivered a total return of about 38% since inception, compared with 26% for the MSCI World ex-U.S.

11.10.

Japan Investors Cheer ‘Good Listener’ Kishida’s Tax-Policy Reversal

https://finance.yahoo.com/news/japan-investors-cheer-good-li…

...

Asked to describe himself in the race to become Japan’s Prime Minister, Fumio Kishida often gave one answer: that he was a “good listener.” His quick retreat on plans to raise the country’s capital gains tax shows that he is certainly listening to stock traders.

Japanese equity markets Monday cheered Kishida’s comments over the weekend that he wasn’t thinking of reviewing the nation’s capital gains taxes for now. His remarks, which along with a weakening yen helped drive the Nikkei 225 Stock Average up 1.6%, followed a plunge in equities since he won the vote to replace Yoshihide Suga.

‘Kishida Shock’ Hits Japan Markets Wary of Redistribution Plan

“A misunderstanding has been spreading that it’s something we’ll do soon,” Kishida said on a Fuji TV news program Sunday. “That needs to be cleared up to avoid any undue anxiety.”

The remarks were a “de facto shift in policy,” economists at Morgan Stanley MUFG Securities wrote in a report. “Market concerns that the Kishida administration might give undue weight to redistribution over growth should be allayed to some extent.”

The prime minister’s talk of a “new form of Japanese capitalism” and pledges to redistribute wealth to narrow the gap between rich and poor have been the cause of much anxiety in Tokyo markets since his election. “Kishida Shock” became the talk of the town as the Nikkei fell for eight straight sessions through Oct. 6, its longest losing streak since 2009.

...

Japan Investors Cheer ‘Good Listener’ Kishida’s Tax-Policy Reversal

https://finance.yahoo.com/news/japan-investors-cheer-good-li…

...

Asked to describe himself in the race to become Japan’s Prime Minister, Fumio Kishida often gave one answer: that he was a “good listener.” His quick retreat on plans to raise the country’s capital gains tax shows that he is certainly listening to stock traders.

Japanese equity markets Monday cheered Kishida’s comments over the weekend that he wasn’t thinking of reviewing the nation’s capital gains taxes for now. His remarks, which along with a weakening yen helped drive the Nikkei 225 Stock Average up 1.6%, followed a plunge in equities since he won the vote to replace Yoshihide Suga.

‘Kishida Shock’ Hits Japan Markets Wary of Redistribution Plan

“A misunderstanding has been spreading that it’s something we’ll do soon,” Kishida said on a Fuji TV news program Sunday. “That needs to be cleared up to avoid any undue anxiety.”

The remarks were a “de facto shift in policy,” economists at Morgan Stanley MUFG Securities wrote in a report. “Market concerns that the Kishida administration might give undue weight to redistribution over growth should be allayed to some extent.”

The prime minister’s talk of a “new form of Japanese capitalism” and pledges to redistribute wealth to narrow the gap between rich and poor have been the cause of much anxiety in Tokyo markets since his election. “Kishida Shock” became the talk of the town as the Nikkei fell for eight straight sessions through Oct. 6, its longest losing streak since 2009.

...

4.10.

Abenomics Champion Bows Out as Japan Seeks Post-Pandemic Reboot

https://uk.finance.yahoo.com/news/abenomics-champion-bows-ja…

...

Aso’s departure marks another step away from the Abenomics experiment that helped spur periods of economic growth, but couldn’t deliver sustained income gains or cut the aging nation’s massive debt pile.

After nearly nine years on the job, Aso is replaced by his 68-year-old brother-in-law, Shunichi Suzuki, a former Olympics minister and ruling party lawmaker who helped install Japan’s new premier, Fumio Kishida.

Kishida, after winning a party leadership vote last week, said he wanted to appoint younger lawmakers to key positions, in an attempt to freshen up the government before national elections this fall. After being made prime minister on Monday, Kishida formed his cabinet and replaced the 81-year-old Aso.

...

Aso often criticized Japan Inc. for hoarding cash rather than boosting investment and wages, but failed to get much change to happen.

Kishida, for his part, has dangled the idea of a “new type of Japanese capitalism,” favoring redistribution and pay increases, but has only sketched the outline of how he’ll get it done.

To pay for rising social security costs as Japan’s population aged, Aso oversaw two hikes in the sales tax that doubled the levy to 10%. The increases helped boost revenue, but also triggered recessions in 2014 and 2019.

Higher revenues also didn’t stop Japan’s budget deficit from widening even in years when the economy was expanding as the inevitable growth in social security costs drove up spending.

Over the near-decade that Aso has been in charge of Japan’s finances, government debt has risen to above 250% of gross domestic product. Even with central bank bond purchases keeping interest rates near zero, debt payments consume almost a quarter of the budget.

In his final year, Aso oversaw record borrowing as the world was hit by Covid-19. Three extra budgets meant an additional 80 trillion yen ($720 billion) of new bonds issued, adding to Japan’s already enormous debt pile.

While it’s unclear whether Suzuki or Kishida might bring fundamental changes to economic policy, they will be left with the task of dealing with the country’s fiscal imbalances.

Japan’s Record Budget May Just Be the Start in Election Year

The government has a goal of balancing its budget by the year ending March 2026. The target excludes the costs of paying for debt, but is still seen as unreachable this decade even by the government’s own projections.

The first order of business for Kishida’s new administration will be preparing for the upcoming election, and that likely means additional stimulus.

Kishida has said that tens of trillions of yen must be spent in the near term to support the recovery. Economists including Masaki Kuwahara at Nomura Securities expect a stimulus package of about 30 trillion yen.

Longer term, Kishida has talked about distributing wealth more equitably, and seeking to jump-start a virtuous economic cycle by raising public sector wages. Last week, he singled out nurses, caregivers to the elderly and kindergarten workers as having too low a wage, signaling he’ll attempt to boost their paychecks.

...

Abenomics Champion Bows Out as Japan Seeks Post-Pandemic Reboot

https://uk.finance.yahoo.com/news/abenomics-champion-bows-ja…

...

Aso’s departure marks another step away from the Abenomics experiment that helped spur periods of economic growth, but couldn’t deliver sustained income gains or cut the aging nation’s massive debt pile.

After nearly nine years on the job, Aso is replaced by his 68-year-old brother-in-law, Shunichi Suzuki, a former Olympics minister and ruling party lawmaker who helped install Japan’s new premier, Fumio Kishida.

Kishida, after winning a party leadership vote last week, said he wanted to appoint younger lawmakers to key positions, in an attempt to freshen up the government before national elections this fall. After being made prime minister on Monday, Kishida formed his cabinet and replaced the 81-year-old Aso.

...

Aso often criticized Japan Inc. for hoarding cash rather than boosting investment and wages, but failed to get much change to happen.

Kishida, for his part, has dangled the idea of a “new type of Japanese capitalism,” favoring redistribution and pay increases, but has only sketched the outline of how he’ll get it done.

To pay for rising social security costs as Japan’s population aged, Aso oversaw two hikes in the sales tax that doubled the levy to 10%. The increases helped boost revenue, but also triggered recessions in 2014 and 2019.

Higher revenues also didn’t stop Japan’s budget deficit from widening even in years when the economy was expanding as the inevitable growth in social security costs drove up spending.

Over the near-decade that Aso has been in charge of Japan’s finances, government debt has risen to above 250% of gross domestic product. Even with central bank bond purchases keeping interest rates near zero, debt payments consume almost a quarter of the budget.

In his final year, Aso oversaw record borrowing as the world was hit by Covid-19. Three extra budgets meant an additional 80 trillion yen ($720 billion) of new bonds issued, adding to Japan’s already enormous debt pile.

While it’s unclear whether Suzuki or Kishida might bring fundamental changes to economic policy, they will be left with the task of dealing with the country’s fiscal imbalances.

Japan’s Record Budget May Just Be the Start in Election Year

The government has a goal of balancing its budget by the year ending March 2026. The target excludes the costs of paying for debt, but is still seen as unreachable this decade even by the government’s own projections.

The first order of business for Kishida’s new administration will be preparing for the upcoming election, and that likely means additional stimulus.

Kishida has said that tens of trillions of yen must be spent in the near term to support the recovery. Economists including Masaki Kuwahara at Nomura Securities expect a stimulus package of about 30 trillion yen.

Longer term, Kishida has talked about distributing wealth more equitably, and seeking to jump-start a virtuous economic cycle by raising public sector wages. Last week, he singled out nurses, caregivers to the elderly and kindergarten workers as having too low a wage, signaling he’ll attempt to boost their paychecks.

...

Antwort auf Beitrag Nr.: 69.230.148 von faultcode am 03.09.21 12:45:356.9.

Green Energy Stocks Surge in Japan on Bets for Anti-Nuclear PM

https://www.bnnbloomberg.ca/green-energy-stocks-surge-in-jap…

...

Frenzied buying from retail traders sent Japan’s renewable energy stocks soaring Monday as Taro Kono -- a politician known for opposing nuclear power -- emerged as a top contender to become prime minister.

Renova Inc., which operates solar and biomass power plants, soared 15% while solar energy firm West Holdings Co. jumped more than 9% to a record high. Nuclear power names were notable loser for the day, with Kansai Electric Power Co. dropping 2.7%.

The surge of interest from individual investors comes weeks ahead of a decision by ruling party members on who will succeed Prime Minister Yoshihide Suga, and before it is know whether Kono would stick with an anti-nuclear stance if he became leader. Kono topped media polls over the weekend when people were asked for their preferred leader.

...

Green Energy Stocks Surge in Japan on Bets for Anti-Nuclear PM

https://www.bnnbloomberg.ca/green-energy-stocks-surge-in-jap…

...

Frenzied buying from retail traders sent Japan’s renewable energy stocks soaring Monday as Taro Kono -- a politician known for opposing nuclear power -- emerged as a top contender to become prime minister.

Renova Inc., which operates solar and biomass power plants, soared 15% while solar energy firm West Holdings Co. jumped more than 9% to a record high. Nuclear power names were notable loser for the day, with Kansai Electric Power Co. dropping 2.7%.

The surge of interest from individual investors comes weeks ahead of a decision by ruling party members on who will succeed Prime Minister Yoshihide Suga, and before it is know whether Kono would stick with an anti-nuclear stance if he became leader. Kono topped media polls over the weekend when people were asked for their preferred leader.

...

09:06 Uhr · dpa-AFX · BHP Group |

07:33 Uhr · dpa-AFX · DAX |

25.04.24 · dpa-AFX · Nikkei 225 |

25.04.24 · dpa-AFX · IBM |

24.04.24 · dpa-AFX · Texas Instruments |

24.04.24 · dpa-AFX · DAX |

23.04.24 · dpa-AFX · Nikkei 225 |

23.04.24 · dpa-AFX · SAP |

22.04.24 · dpa-AFX · NVIDIA |

22.04.24 · dpa-AFX · American Express |

| Zeit | Titel |

|---|---|

| 20.05.23 |