DAX-Werte im Chartcheck (Seite 17503)

eröffnet am 04.07.01 21:23:35 von

neuester Beitrag 07.05.24 10:16:22 von

neuester Beitrag 07.05.24 10:16:22 von

Beiträge: 222.005

ID: 432.317

ID: 432.317

Aufrufe heute: 17

Gesamt: 2.857.089

Gesamt: 2.857.089

Aktive User: 0

ISIN: DE0008469008 · WKN: 846900

18.440,00

PKT

+1,28 %

+233,00 PKT

Letzter Kurs 07.05.24 Lang & Schwarz

Neuigkeiten

07.05.24 · wallstreetONLINE Redaktion |

07.05.24 · dpa-AFX |

07.05.24 · Robby's Elliottwellen |

Beitrag zu dieser Diskussion schreiben

Evotec – Bullen erarbeiten sich Chancen, aber ...

von Alexander Paulus

Donnerstag 05.07.2012, 08:49 Uhr

+ Evotec - WKN: 566480 - ISIN: DE0005664809

Börse: Xetra in Euro / Kursstand: 2,20 Euro

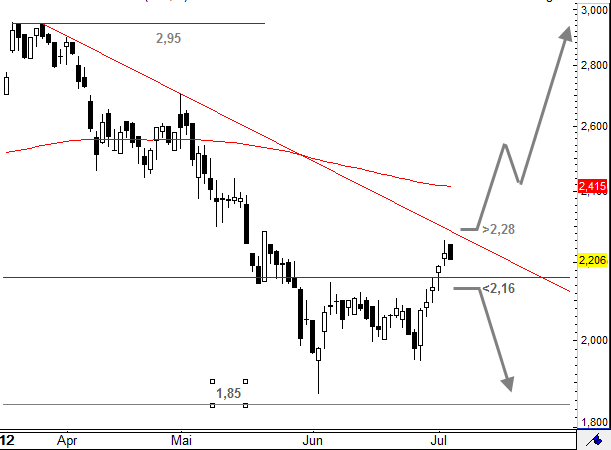

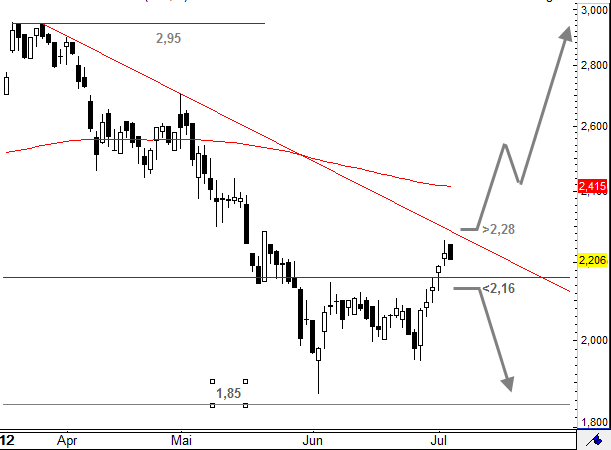

Die Aktie von Evotec hat sich in den letzten Tagen unerwartet gut entwickelt und brach sogar über den Widerstand bei 2,16 Euro aus. Damit hat der Wert nun die Chance auf einen Bruch des Abwärtstrends seit Ende März 2012. Dieser liegt aktuell bei 2,28 Euro. Gelingt ein Ausbruch, dann wäre eine weitere Rally in Richtung 2,95 Euro möglich. Fällt der Future unter 2,16 Euro zurück. droht allerdings ein Rückfall in Richtung 1,85 Euro.

Kursverlauf vom 19.03.2012 bis 04.07.2012 (log. Kerzendarstellung / 1 Kerze = 1 Stunde)

von Alexander Paulus

Donnerstag 05.07.2012, 08:49 Uhr

+ Evotec - WKN: 566480 - ISIN: DE0005664809

Börse: Xetra in Euro / Kursstand: 2,20 Euro

Die Aktie von Evotec hat sich in den letzten Tagen unerwartet gut entwickelt und brach sogar über den Widerstand bei 2,16 Euro aus. Damit hat der Wert nun die Chance auf einen Bruch des Abwärtstrends seit Ende März 2012. Dieser liegt aktuell bei 2,28 Euro. Gelingt ein Ausbruch, dann wäre eine weitere Rally in Richtung 2,95 Euro möglich. Fällt der Future unter 2,16 Euro zurück. droht allerdings ein Rückfall in Richtung 1,85 Euro.

Kursverlauf vom 19.03.2012 bis 04.07.2012 (log. Kerzendarstellung / 1 Kerze = 1 Stunde)

Volkswagen-Aktie: Integrierter Automobilkonzern mit Porsche

05.07.12 09:03

aktiencheck.de

Wolfsburg (www.aktiencheck.de) - Die Volkswagen AG (ISIN DE0007664039 / WKN 766403) und der Sportwagenhersteller Porsche Automobil Holding SE (ISIN DE000PAH0038 / WKN PAH003) schaffen einen integrierten Automobilkonzern durch die vollständige Einbringung des Automobilgeschäfts von Porsche in den Volkswagen-Konzern voraussichtlich bereits zum 1. August 2012.

Wie der Autobauer am Mittwochabend mitteilte, haben die zuständigen Gremien beider Unternehmen einem entsprechenden Konzept nach dem Vorliegen aller erforderlichen verbindlichen Auskünfte der Finanzbehörden zugestimmt. Die Porsche SE wird somit ihr Automobilgeschäft vollständig in die Volkswagen AG einbringen, die bereits indirekt 49,9 Prozent an der Porsche AG hält. Nach Abschluss der Transaktion wird Volkswagen über eine Zwischenholding 100 Prozent der Anteile an der Porsche AG halten. Die Porsche SE erhält dafür eine Gegenleistung in Höhe von insgesamt rund 4,46 Mrd. Euro plus einer Volkswagen-Stammaktie.

Diese Vollkonsolidierung wird einen positiven Einfluss auf das Konzernergebnis von Volkswagen haben, hieß es weiter. Im Operativen Ergebnis des laufenden Geschäftsjahres werden die anfänglich hohen Abschreibungen aus der sogenannten Kaufpreisallokation den Ergebnisbeitrag voraussichtlich weitestgehend ausgleichen. Infolge der Vollkonsolidierung muss Volkswagen eine Neubewertung der bislang gehaltenen Anteile an der Porsche Zwischenholding GmbH zum Zeitwert vornehmen. Dies wird im laufenden Geschäftsjahr, basierend auf den Bewertungsparametern zum 31. März 2012, zu einem deutlich positiven, nicht liquiditäts-wirksamen Effekt in Höhe von mehr als 9 Mrd. Euro im Finanzergebnis des Volkswagen-Konzerns führen. Die Nettoliquidität des Konzernbereichs Automobile wird sich voraussichtlich um insgesamt rund 7 Mrd. Euro verringern: Neben der Barleistung in Höhe von rund 4,46 Mrd. Euro wird sich die erstmalige Konsolidierung der negativen Nettoliquidität der Porsche AG voraussichtlich in Höhe von -2,5 Mrd. Euro im Volkswagen-Konzern liquiditäts-mindernd auswirken.

Die Aktie von Volkswagen schloss zuletzt mit einem Plus von 0,04 Prozent bei 128,00 Euro. (05.07.2012/ac/n/d)

05.07.12 09:03

aktiencheck.de

Wolfsburg (www.aktiencheck.de) - Die Volkswagen AG (ISIN DE0007664039 / WKN 766403) und der Sportwagenhersteller Porsche Automobil Holding SE (ISIN DE000PAH0038 / WKN PAH003) schaffen einen integrierten Automobilkonzern durch die vollständige Einbringung des Automobilgeschäfts von Porsche in den Volkswagen-Konzern voraussichtlich bereits zum 1. August 2012.

Wie der Autobauer am Mittwochabend mitteilte, haben die zuständigen Gremien beider Unternehmen einem entsprechenden Konzept nach dem Vorliegen aller erforderlichen verbindlichen Auskünfte der Finanzbehörden zugestimmt. Die Porsche SE wird somit ihr Automobilgeschäft vollständig in die Volkswagen AG einbringen, die bereits indirekt 49,9 Prozent an der Porsche AG hält. Nach Abschluss der Transaktion wird Volkswagen über eine Zwischenholding 100 Prozent der Anteile an der Porsche AG halten. Die Porsche SE erhält dafür eine Gegenleistung in Höhe von insgesamt rund 4,46 Mrd. Euro plus einer Volkswagen-Stammaktie.

Diese Vollkonsolidierung wird einen positiven Einfluss auf das Konzernergebnis von Volkswagen haben, hieß es weiter. Im Operativen Ergebnis des laufenden Geschäftsjahres werden die anfänglich hohen Abschreibungen aus der sogenannten Kaufpreisallokation den Ergebnisbeitrag voraussichtlich weitestgehend ausgleichen. Infolge der Vollkonsolidierung muss Volkswagen eine Neubewertung der bislang gehaltenen Anteile an der Porsche Zwischenholding GmbH zum Zeitwert vornehmen. Dies wird im laufenden Geschäftsjahr, basierend auf den Bewertungsparametern zum 31. März 2012, zu einem deutlich positiven, nicht liquiditäts-wirksamen Effekt in Höhe von mehr als 9 Mrd. Euro im Finanzergebnis des Volkswagen-Konzerns führen. Die Nettoliquidität des Konzernbereichs Automobile wird sich voraussichtlich um insgesamt rund 7 Mrd. Euro verringern: Neben der Barleistung in Höhe von rund 4,46 Mrd. Euro wird sich die erstmalige Konsolidierung der negativen Nettoliquidität der Porsche AG voraussichtlich in Höhe von -2,5 Mrd. Euro im Volkswagen-Konzern liquiditäts-mindernd auswirken.

Die Aktie von Volkswagen schloss zuletzt mit einem Plus von 0,04 Prozent bei 128,00 Euro. (05.07.2012/ac/n/d)

Porsche - Die Bären werden vertrieben

von Rene Berteit

Donnerstag 05.07.2012, 08:45 Uhr

+ Porsche - WKN: 693773 - ISIN: DE000PAH0038

Börse: Xetra in Euro / Kursstand: 45,20 Euro

Flügel bekommen derzeit die Porsche Aktien, die mit den Nachrichten zur Fusion mit Volkswagen in den letzten Tagen deutlich zulegen und dabei auch gleich wichtige Abwärtstrendindikatoren durchbrechen konnten. Damit scheint die Aktie charttechnisch zurück im Bullenmarkt zu sein, was zu weiteren Gewinnen in Richtung 50,90 Euro führen dürfte. Da die Aktie derzeit newsgetrieben ist, sollten dabei jedoch erhöhte Volatilitäten eingeplant werden.

Kursverlauf vom 10.01.2012 bis 04.07.2012 (log. Kerzendarstellung / 1 Kerze = 1 Tag)

von Rene Berteit

Donnerstag 05.07.2012, 08:45 Uhr

+ Porsche - WKN: 693773 - ISIN: DE000PAH0038

Börse: Xetra in Euro / Kursstand: 45,20 Euro

Flügel bekommen derzeit die Porsche Aktien, die mit den Nachrichten zur Fusion mit Volkswagen in den letzten Tagen deutlich zulegen und dabei auch gleich wichtige Abwärtstrendindikatoren durchbrechen konnten. Damit scheint die Aktie charttechnisch zurück im Bullenmarkt zu sein, was zu weiteren Gewinnen in Richtung 50,90 Euro führen dürfte. Da die Aktie derzeit newsgetrieben ist, sollten dabei jedoch erhöhte Volatilitäten eingeplant werden.

Kursverlauf vom 10.01.2012 bis 04.07.2012 (log. Kerzendarstellung / 1 Kerze = 1 Tag)

D O N N E R S T A G, 5. Juli 2012

Niederlande

09:30 Verbraucherpreise Jun.12

Spanien

10:30 Anleihenauktion

Frankreich

11:00 Anleihenauktion

Deutschland

12:00 Auftragseingang Industrie Mai 2012

Großbritannien

10:30 Bank of England Ratssitzung

13:00 Bank of England Zinsentscheid

Euroland

09:00 EZB Ratssitzung

13:45 EZB Zinsentscheid

14:30 EZB Pressekonferenz

USA

13:30 Challenger Report Jun.12

14:15 ADP-Arbeitsmarktbericht Jun.12

14:30 wöchentliche Erstanträge auf Arbeitslosenhilfe

15:00 Ankündigung 10-jähriger T-Notes

15:00 Ankündigung 3-jähriger T-Notes

15:00 Ankündigung 30-jähriger Bonds

16:00 ISM-Index Dienste Jun.12

16:30 wöchentlicher US-Erdgasbericht

16:30 wöchentlicher US-EIA Ölmarktbericht

17:00 Ankündigung 3- u. 6-monatiger Bills

Niederlande

09:30 Verbraucherpreise Jun.12

Spanien

10:30 Anleihenauktion

Frankreich

11:00 Anleihenauktion

Deutschland

12:00 Auftragseingang Industrie Mai 2012

Großbritannien

10:30 Bank of England Ratssitzung

13:00 Bank of England Zinsentscheid

Euroland

09:00 EZB Ratssitzung

13:45 EZB Zinsentscheid

14:30 EZB Pressekonferenz

USA

13:30 Challenger Report Jun.12

14:15 ADP-Arbeitsmarktbericht Jun.12

14:30 wöchentliche Erstanträge auf Arbeitslosenhilfe

15:00 Ankündigung 10-jähriger T-Notes

15:00 Ankündigung 3-jähriger T-Notes

15:00 Ankündigung 30-jähriger Bonds

16:00 ISM-Index Dienste Jun.12

16:30 wöchentlicher US-Erdgasbericht

16:30 wöchentlicher US-EIA Ölmarktbericht

17:00 Ankündigung 3- u. 6-monatiger Bills

MARKTRELEVANTE UNTERNEHMENSTERMINE - DONNERSTAG, 05.Juli 2012

ab 08:00 Easyjet Verkehrszahlen Jun.12

ab 09:00 AT&S Hauptversammlung

ab 10:00 Fielmann Hauptversammlung

ab 10:30 Grohe Jahrespressekonferenz

ab 11:00 Bijou Brigitte Hauptversammlung

ab 11:00 Hornbach-Baumarkt AG Hauptversammlung

USA – VOR u. WAEHREND der BORSE AB 07:00 UHR MESZ - DONNERSTAG, 05.Juli 2012

ambow education holding ltd AMBO 0.29 vorbörslich ab 07:00 MESZ

begbies traynor group plc BEG.L N/A vorbörslich ab 07:00 MESZ

international speedway corp ISCA 0.4 vorbörslich ab 07:00 MESZ

kirkland lake gold inc KGI.TO 0.15 vorbörslich ab 07:00 MESZ

ncc group plc NCC.L N/A vorbörslich ab 07:00 MESZ

USA – NACHBOERSLICH AB 22:00 UHR MESZ - DONNERSTAG, 05.Juli 2012

xyratex ltd XRTX 0.29 nachbörslich ab 22:00 MESZ

USA – OHNE ZEITANGABEN - DONNERSTAG, 05.Juli 2012

adm hamburg ag OEL.F N/A keine Zeitinfo

aptech ltd APTECHT.NS N/A keine Zeitinfo

atacama pacific gold corp ATM.V N/A keine Zeitinfo

berliner synchron ag B5S.F N/A keine Zeitinfo

cgn mining co ltd 1164.HK N/A keine Zeitinfo

china technology development group corp CTDC N/A keine Zeitinfo

evergreen energy inc KFXA.F N/A keine Zeitinfo

migdal insurance and financial holdings ltd MGDL.TA N/A keine Zeitinfo

november ag NBXB.F N/A keine Zeitinfo

picton property income ltd PCTN.L N/A keine Zeitinfo

redstone plc RED.L N/A keine Zeitinfo

richelieu hardware ltd RCH.TO 0.54 keine Zeitinfo

rit technologies ltd RITT N/A keine Zeitinfo

stolt nielsen ltd SNI.OL N/A keine Zeitinfo

velan inc VLN.TO N/A keine Zeitinfo

--------------------------------------------------------------------------------

ab 08:00 Easyjet Verkehrszahlen Jun.12

ab 09:00 AT&S Hauptversammlung

ab 10:00 Fielmann Hauptversammlung

ab 10:30 Grohe Jahrespressekonferenz

ab 11:00 Bijou Brigitte Hauptversammlung

ab 11:00 Hornbach-Baumarkt AG Hauptversammlung

USA – VOR u. WAEHREND der BORSE AB 07:00 UHR MESZ - DONNERSTAG, 05.Juli 2012

ambow education holding ltd AMBO 0.29 vorbörslich ab 07:00 MESZ

begbies traynor group plc BEG.L N/A vorbörslich ab 07:00 MESZ

international speedway corp ISCA 0.4 vorbörslich ab 07:00 MESZ

kirkland lake gold inc KGI.TO 0.15 vorbörslich ab 07:00 MESZ

ncc group plc NCC.L N/A vorbörslich ab 07:00 MESZ

USA – NACHBOERSLICH AB 22:00 UHR MESZ - DONNERSTAG, 05.Juli 2012

xyratex ltd XRTX 0.29 nachbörslich ab 22:00 MESZ

USA – OHNE ZEITANGABEN - DONNERSTAG, 05.Juli 2012

adm hamburg ag OEL.F N/A keine Zeitinfo

aptech ltd APTECHT.NS N/A keine Zeitinfo

atacama pacific gold corp ATM.V N/A keine Zeitinfo

berliner synchron ag B5S.F N/A keine Zeitinfo

cgn mining co ltd 1164.HK N/A keine Zeitinfo

china technology development group corp CTDC N/A keine Zeitinfo

evergreen energy inc KFXA.F N/A keine Zeitinfo

migdal insurance and financial holdings ltd MGDL.TA N/A keine Zeitinfo

november ag NBXB.F N/A keine Zeitinfo

picton property income ltd PCTN.L N/A keine Zeitinfo

redstone plc RED.L N/A keine Zeitinfo

richelieu hardware ltd RCH.TO 0.54 keine Zeitinfo

rit technologies ltd RITT N/A keine Zeitinfo

stolt nielsen ltd SNI.OL N/A keine Zeitinfo

velan inc VLN.TO N/A keine Zeitinfo

--------------------------------------------------------------------------------

DAX, Bearish Harami Cross

05.07.2012 - 09:02:44 Uhr

Helaba

Frankfurt a. M. (www.derivatecheck.de) - Christian Schmidt, Handelsexperte bei der Helaba, äußert sich zur aktuellen Marktlage am DAX.

Wie zu erwarten gewesen wäre, sei der Mittwochs-Aktienhandel im DAX, bedingt durch den US Feiertag, relativ impuls- und lustlos verlaufen. Die Indikation liege heute bei 6.550 Punkten. Die Handelsspanne erwartet der Stratege bei der Helaba zwischen 6.440 und 6.620 Stellen. Unter technischen Gesichtspunkten falle ein sogenanntes "Bearish Harami Cross" auf, welches sich gestern gebildet habe. Diese Konstellation verdeutliche die nachlassende Aufwärtsdynamik und lege die Vermutung nahe, dass eine obere Wendeformation ausgebildet werde. Allerdings sei im Sinne einer Bestätigung erforderlich, dass der deutsche Leitindex heute mit einem Abschlag aus dem Handel gehe. Die ersten Supports ließen sich bei 6.529, bei 6.513, bei 6.507 und bei 6.473 Zählern definieren. Darüber hinaus fänden sich Unterstützungen bei 6.455 und bei 6.440 Punkten. Die Marken von 6.572 und 6.597 Zählern stellten Widerstände dar.

05.07.2012 - 09:02:44 Uhr

Helaba

Frankfurt a. M. (www.derivatecheck.de) - Christian Schmidt, Handelsexperte bei der Helaba, äußert sich zur aktuellen Marktlage am DAX.

Wie zu erwarten gewesen wäre, sei der Mittwochs-Aktienhandel im DAX, bedingt durch den US Feiertag, relativ impuls- und lustlos verlaufen. Die Indikation liege heute bei 6.550 Punkten. Die Handelsspanne erwartet der Stratege bei der Helaba zwischen 6.440 und 6.620 Stellen. Unter technischen Gesichtspunkten falle ein sogenanntes "Bearish Harami Cross" auf, welches sich gestern gebildet habe. Diese Konstellation verdeutliche die nachlassende Aufwärtsdynamik und lege die Vermutung nahe, dass eine obere Wendeformation ausgebildet werde. Allerdings sei im Sinne einer Bestätigung erforderlich, dass der deutsche Leitindex heute mit einem Abschlag aus dem Handel gehe. Die ersten Supports ließen sich bei 6.529, bei 6.513, bei 6.507 und bei 6.473 Zählern definieren. Darüber hinaus fänden sich Unterstützungen bei 6.455 und bei 6.440 Punkten. Die Marken von 6.572 und 6.597 Zählern stellten Widerstände dar.

ThyssenKrupp, Hoffnung auf Besserung

04.07.2012 - 11:03:13 Uhr

HSBC Trinkaus & Burkhardt

Frankfurt a. M. (www.derivatecheck.de) - Die Marktexperten bei der HSBC Trinkaus & Burkhardt blicken auf die Entwicklung und die Tendenzen bei der ThyssenKrupp-Aktie .

Nachdem die Thyssen-Aktie seit Juni 2011 massiv unter Druck gestanden hätte, bestehe nun aus charttechnischer Sicht Hoffnung auf Besserung. Der Optimismus der Experten stütze sich dabei auf die jüngsten Umkehrmuster im Kursverlauf. So habe der Stahltitel auf Basis der Tiefstände von 2009 und 2008 bei 12,22/11,71 Euro im Wochenbereich zuletzt zwei Kerzen mit markanten Dochten ausgeprägt. Dieser "Schwenk" zugunsten der Bullen werde zusätzlich durch den jüngsten "Hammer" im Monatschart bestätigt. Mittlerweile schlügen auch die ersten quantitativen Indikatoren in diese Kerbe. So sei es jüngst zeitgleich zum Bruch des Abwärtstrends seit Februar im Verlauf des RSI gekommen und auch zu einem neuen Einsstiegssignal seitens des Oszillators.

Um das Bild abzurunden: Auf Tagesbasis liege eine kurzfristige Bodenbildung vor, aus der sich ein kalkulatorisches Kursziel von rund 14,90 Euro ableiten lasse. Knapp darüber verlaufe zudem der steile Baissetrend seit Mitte Februar bei aktuell 15,28 Euro. Auf der Unterseite gelte es fortan, die genannten Tiefpunkte bzw. das jüngste Verlaufstief bei 11,45 Euro nicht mehr zu unterschreiten.

04.07.2012 - 11:03:13 Uhr

HSBC Trinkaus & Burkhardt

Frankfurt a. M. (www.derivatecheck.de) - Die Marktexperten bei der HSBC Trinkaus & Burkhardt blicken auf die Entwicklung und die Tendenzen bei der ThyssenKrupp-Aktie .

Nachdem die Thyssen-Aktie seit Juni 2011 massiv unter Druck gestanden hätte, bestehe nun aus charttechnischer Sicht Hoffnung auf Besserung. Der Optimismus der Experten stütze sich dabei auf die jüngsten Umkehrmuster im Kursverlauf. So habe der Stahltitel auf Basis der Tiefstände von 2009 und 2008 bei 12,22/11,71 Euro im Wochenbereich zuletzt zwei Kerzen mit markanten Dochten ausgeprägt. Dieser "Schwenk" zugunsten der Bullen werde zusätzlich durch den jüngsten "Hammer" im Monatschart bestätigt. Mittlerweile schlügen auch die ersten quantitativen Indikatoren in diese Kerbe. So sei es jüngst zeitgleich zum Bruch des Abwärtstrends seit Februar im Verlauf des RSI gekommen und auch zu einem neuen Einsstiegssignal seitens des Oszillators.

Um das Bild abzurunden: Auf Tagesbasis liege eine kurzfristige Bodenbildung vor, aus der sich ein kalkulatorisches Kursziel von rund 14,90 Euro ableiten lasse. Knapp darüber verlaufe zudem der steile Baissetrend seit Mitte Februar bei aktuell 15,28 Euro. Auf der Unterseite gelte es fortan, die genannten Tiefpunkte bzw. das jüngste Verlaufstief bei 11,45 Euro nicht mehr zu unterschreiten.

DAX, markantes Widerstandsniveau

05.07.2012 - 08:51:06 Uhr

IG Markets

Frankfurt a. M. (www.derivatecheck.de) - Die Experten bei IG Markets blicken auf die aktuelle Situation des DAX und dessen aktuellen Perspektiven.

Der DAX habe sich gestern innerhalb der Handelsspanne des Vortages bewegt und damit keine neuen Impulse geliefert. Am Vormittag habe der schwächere Einkaufsmanagerindex den Markt belastet und zu einem kleinen Rücksetzer geführt. Es hätten jedoch nachhaltige Impulse aus den USA gefehlt. Die Aktie der Metro sei durch die Bekantgabe einer Stellenstreichung belastet worden und mit einem Rückgang von 3,37% der größte Verlierer gewesen. Auch die Aktie der Commerzbank habe um mehr als 3 % nachgegeben. Auslöser war nach Ansicht der Experten hierfür die Ankündigung der EZB, Kredite restriktiver zu vergeben.

Die Zone um 6.610 Zähler bilde im DAX weiterhin ein markantes Widerstandsniveau. Erst der Anstieg über diese Zone würde weitere Aufwärtsdynamik in den Markt bringen.

05.07.2012 - 08:51:06 Uhr

IG Markets

Frankfurt a. M. (www.derivatecheck.de) - Die Experten bei IG Markets blicken auf die aktuelle Situation des DAX und dessen aktuellen Perspektiven.

Der DAX habe sich gestern innerhalb der Handelsspanne des Vortages bewegt und damit keine neuen Impulse geliefert. Am Vormittag habe der schwächere Einkaufsmanagerindex den Markt belastet und zu einem kleinen Rücksetzer geführt. Es hätten jedoch nachhaltige Impulse aus den USA gefehlt. Die Aktie der Metro sei durch die Bekantgabe einer Stellenstreichung belastet worden und mit einem Rückgang von 3,37% der größte Verlierer gewesen. Auch die Aktie der Commerzbank habe um mehr als 3 % nachgegeben. Auslöser war nach Ansicht der Experten hierfür die Ankündigung der EZB, Kredite restriktiver zu vergeben.

Die Zone um 6.610 Zähler bilde im DAX weiterhin ein markantes Widerstandsniveau. Erst der Anstieg über diese Zone würde weitere Aufwärtsdynamik in den Markt bringen.

....DAX, Pull Back-Bewegung

05.07.2012 - 08:37:22 Uhr

DZ BANK

Frankfurt a. M. (www.derivatecheck.de) - Die Handelsexperten bei der DZ Bank blicken auf die aktuelle Situation und technische Entwicklung des DAX.

Mit Blick auf die feiertags bedingt geschlossenen US Börsen ("Unabhängigkeitstag") habe sich gestern nach der positiven Kursentwicklung der vergangenen Handelstagen beim deutschen Blue Chip Index ein recht umsatzarmer Handel gezeigt. Dabei habe nach dem Kurssprung vom Donnerstagstief von fast 8 % ein leichter Angebotsüberschuss einen ersten Konsolidierungstag induziert.

Die gestrigen Kursabgaben hätten sich deutlich oberhalb der charttechnischen Unterstützung um 6.445 Punkte gezeigt. Mit dem dynamischen Durchbruch über diesen wichtigen "Schlüsselwiderstand" am Montag könne die Annahme getroffen werden, dass der Abschluss einer "rechten Schulter" im Rahmen eines "inversen Kopf- Schulter"-Bodenbildungsprozesses erfolgt sei. In diesem Kontext zeige sich somit gestern eine erste "Pull Back"-Bewegung in Richtung des Ausbruchsniveaus. Alleine auf Basis der abgeschlossenen Formation ergebe sich jedoch ein mittelfristiges Mindestkurspotenzial (M) bis in den Bereich des charttechnischen Widerstands um 6.875 Punkte.

Der zyklentechnische Fahrplan der wichtigsten übergeordneten Aktienmarktzyklen (US-Präsidentschafts- und Dekadenzyklus) finde mit der aktuellen Entwicklung nun auch charttechnisch eine Bestätigung. Auf Basis der Daten der letzten 110 Jahre lasse sich daraus zumindest eine günstige Kursentwicklung bis zur US Präsidentschaftswahl im November ableiten.

05.07.2012 - 08:37:22 Uhr

DZ BANK

Frankfurt a. M. (www.derivatecheck.de) - Die Handelsexperten bei der DZ Bank blicken auf die aktuelle Situation und technische Entwicklung des DAX.

Mit Blick auf die feiertags bedingt geschlossenen US Börsen ("Unabhängigkeitstag") habe sich gestern nach der positiven Kursentwicklung der vergangenen Handelstagen beim deutschen Blue Chip Index ein recht umsatzarmer Handel gezeigt. Dabei habe nach dem Kurssprung vom Donnerstagstief von fast 8 % ein leichter Angebotsüberschuss einen ersten Konsolidierungstag induziert.

Die gestrigen Kursabgaben hätten sich deutlich oberhalb der charttechnischen Unterstützung um 6.445 Punkte gezeigt. Mit dem dynamischen Durchbruch über diesen wichtigen "Schlüsselwiderstand" am Montag könne die Annahme getroffen werden, dass der Abschluss einer "rechten Schulter" im Rahmen eines "inversen Kopf- Schulter"-Bodenbildungsprozesses erfolgt sei. In diesem Kontext zeige sich somit gestern eine erste "Pull Back"-Bewegung in Richtung des Ausbruchsniveaus. Alleine auf Basis der abgeschlossenen Formation ergebe sich jedoch ein mittelfristiges Mindestkurspotenzial (M) bis in den Bereich des charttechnischen Widerstands um 6.875 Punkte.

Der zyklentechnische Fahrplan der wichtigsten übergeordneten Aktienmarktzyklen (US-Präsidentschafts- und Dekadenzyklus) finde mit der aktuellen Entwicklung nun auch charttechnisch eine Bestätigung. Auf Basis der Daten der letzten 110 Jahre lasse sich daraus zumindest eine günstige Kursentwicklung bis zur US Präsidentschaftswahl im November ableiten.

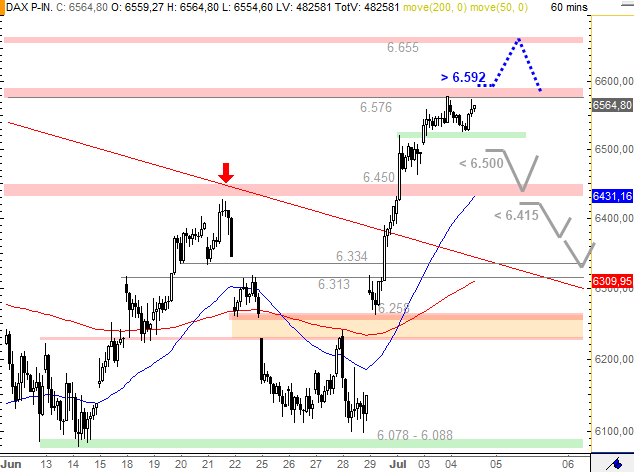

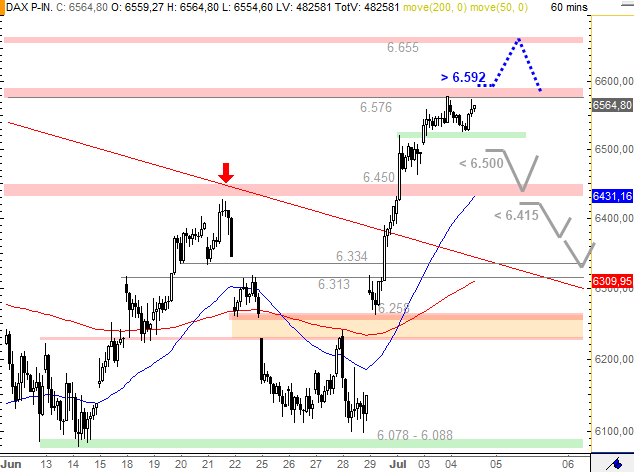

DAX - Tagesausblick für Donnerstag, den 05. Juli 2012

von André Rain, Donnerstag 05.07.2012, 08:21 Uhr

Der DAX konsolidierte gestern ausgehend vom Widerstandsbereich bei 6.576 - 6.589 Punktenauf hohem Niveau, am Ende zog der Index wieder in Richtung der Hochs. Der träge Handel bei geschlossenem US Markt brachte eine wenig aussagende Unsicherheitskerze im Tageschart. Das kurzfristige Bild ist weiterhin bullisch zu werten, der im kurzfristigen Bild überkaufte Zustand wurde mit der gestrigen Konsolidierung teilweise abgebaut.

_____________________________________________

DAX - WKN: 846900 - ISIN: DE0008469008

Börse: Xetra in Euro / Kursstand: 6.565

Widerstände: 6.576 / 6.592 + 6.655 / 6.666

Unterstützungen: 6.520 / 6.525 + 6.508 + 6.427 / 6.450 + 6.390 + 6.350 / 6.360

Charttechnischer Ausblick: Der DAX hätte heute im Prinzip dieselben Möglichkeiten wie gestern. Eine obere Trendumkehr fehlt weiterhin, weshalb die Chancen für die Bullen noch etwas besser stehen. Geht es nachhaltig über 6.592 Punkte, liegt bei 6.655 - 6.666 Punkten der nächste Widerstandsbereich. Spätestens von dort aus sollte dann eine mehrtägige Abwärtskorrektur starten.

Alternativ startet diese Korrektur sofort: Dreht der DAX hingegen erneut bei 6.576 - 6.589 Punkten nach unten abund fällt signifikant unter 6.500 zurück, dürften Rücksetzer bis ans Ausbruchslevel bei 6.427 - 6.450 Punkte starten. Unterhalb von 6.415 Punkten drohen weitere Abgaben bis 6.350 - 6.360 oder darunter ggf. 6.313 - 6.334 Punkte.

[COLOR="Blue"]DAX 60 min[/COLOR]

[COLOR="Blue"]DAX Tag[/COLOR]

Offenlegung gemäß §34b WpHG wegen möglicher Interessenkonflikte: Der Autor ist in den besprochenen Wertpapieren bzw. Basiswerten derzeit nicht investiert.

von André Rain, Donnerstag 05.07.2012, 08:21 Uhr

Der DAX konsolidierte gestern ausgehend vom Widerstandsbereich bei 6.576 - 6.589 Punktenauf hohem Niveau, am Ende zog der Index wieder in Richtung der Hochs. Der träge Handel bei geschlossenem US Markt brachte eine wenig aussagende Unsicherheitskerze im Tageschart. Das kurzfristige Bild ist weiterhin bullisch zu werten, der im kurzfristigen Bild überkaufte Zustand wurde mit der gestrigen Konsolidierung teilweise abgebaut.

_____________________________________________

DAX - WKN: 846900 - ISIN: DE0008469008

Börse: Xetra in Euro / Kursstand: 6.565

Widerstände: 6.576 / 6.592 + 6.655 / 6.666

Unterstützungen: 6.520 / 6.525 + 6.508 + 6.427 / 6.450 + 6.390 + 6.350 / 6.360

Charttechnischer Ausblick: Der DAX hätte heute im Prinzip dieselben Möglichkeiten wie gestern. Eine obere Trendumkehr fehlt weiterhin, weshalb die Chancen für die Bullen noch etwas besser stehen. Geht es nachhaltig über 6.592 Punkte, liegt bei 6.655 - 6.666 Punkten der nächste Widerstandsbereich. Spätestens von dort aus sollte dann eine mehrtägige Abwärtskorrektur starten.

Alternativ startet diese Korrektur sofort: Dreht der DAX hingegen erneut bei 6.576 - 6.589 Punkten nach unten abund fällt signifikant unter 6.500 zurück, dürften Rücksetzer bis ans Ausbruchslevel bei 6.427 - 6.450 Punkte starten. Unterhalb von 6.415 Punkten drohen weitere Abgaben bis 6.350 - 6.360 oder darunter ggf. 6.313 - 6.334 Punkte.

[COLOR="Blue"]DAX 60 min[/COLOR]

[COLOR="Blue"]DAX Tag[/COLOR]

Offenlegung gemäß §34b WpHG wegen möglicher Interessenkonflikte: Der Autor ist in den besprochenen Wertpapieren bzw. Basiswerten derzeit nicht investiert.

07.05.24 · dpa-AFX · Fresenius |

07.05.24 · Robby's Elliottwellen · DAX |

07.05.24 · dpa-AFX · Fresenius Medical Care |

07.05.24 · Konstantin Oldenburger · DAX |

07.05.24 · dpa-AFX · Infineon Technologies |

07.05.24 · dpa-AFX · Leonardo |

| Zeit | Titel |

|---|---|

| 05:01 Uhr | |

| 07.05.24 | |

| 07.05.24 | |

| 07.05.24 | |

| 07.05.24 | |

| 07.05.24 | |

| 07.05.24 | |

| 07.05.24 | |

| 06.05.24 | |

| 06.05.24 |