Enbridge Inc. - kandischer Energietransporteur (-versorger) - 500 Beiträge pro Seite

eröffnet am 22.06.10 00:17:01 von

neuester Beitrag 20.03.24 14:39:05 von

neuester Beitrag 20.03.24 14:39:05 von

Beiträge: 91

ID: 1.158.425

ID: 1.158.425

Aufrufe heute: 1

Gesamt: 13.422

Gesamt: 13.422

Aktive User: 0

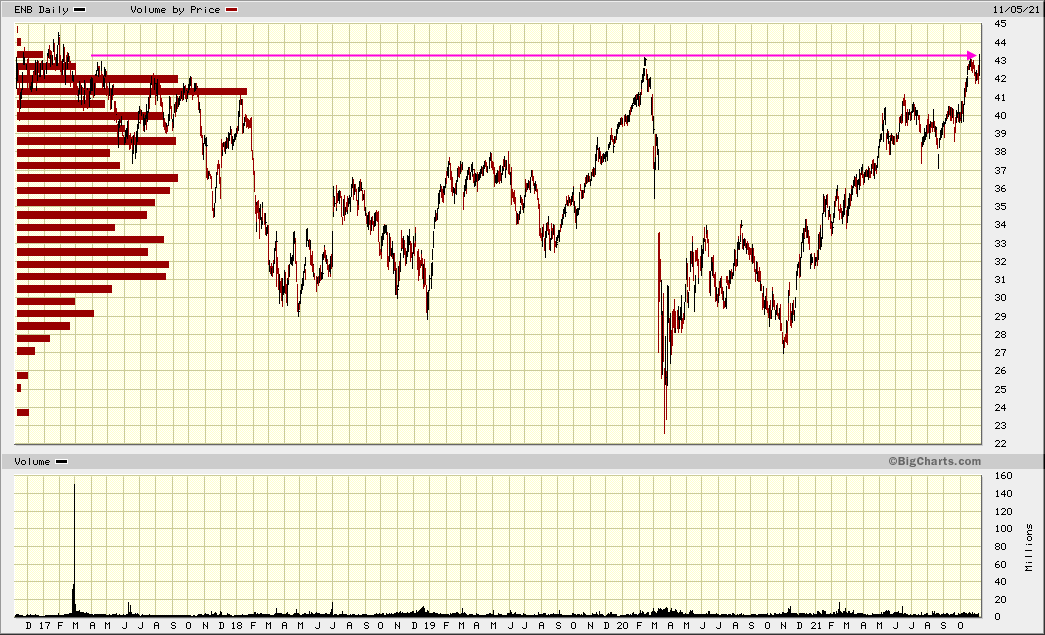

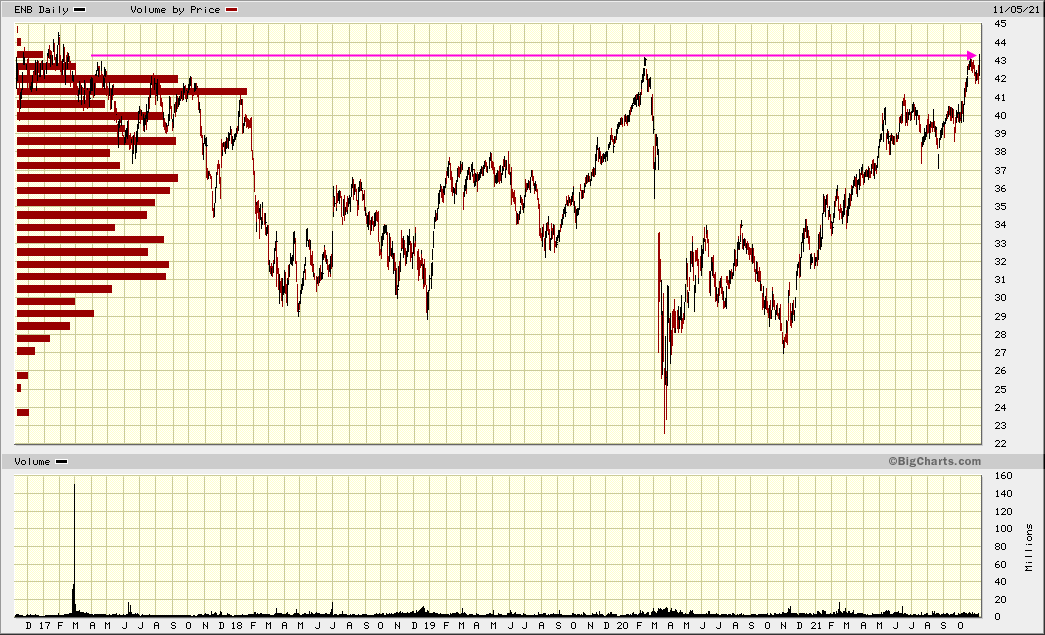

ISIN: CA29250N1050 · WKN: 885427 · Symbol: ENB

51,14

CAD

-0,02 %

-0,01 CAD

Letzter Kurs 09.05.24 Toronto

Neuigkeiten

08.05.24 · Accesswire |

06.05.24 · Accesswire |

02.05.24 · Accesswire |

30.04.24 · Accesswire |

23.04.24 · Accesswire |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,8050 | +39,52 | |

| 1,2760 | +37,95 | |

| 1,1500 | +27,78 | |

| 1,0400 | +18,18 | |

| 8,2500 | +16,36 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,4000 | -9,43 | |

| 2,0500 | -9,69 | |

| 850,20 | -12,51 | |

| 11,790 | -12,67 | |

| 1,5450 | -19,32 |

16.06.2010 22:16

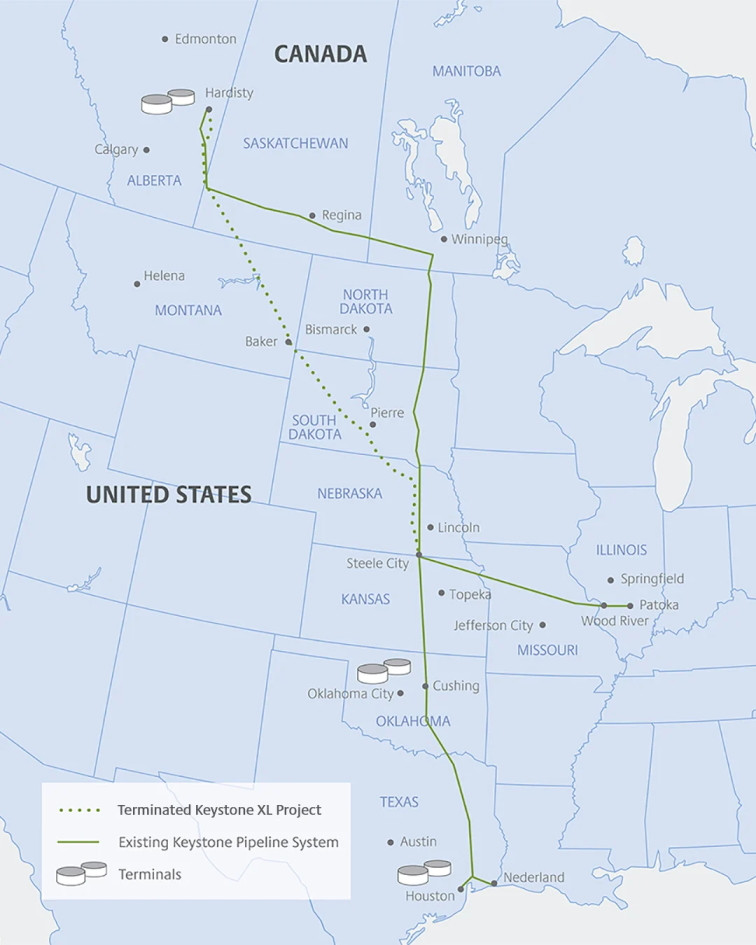

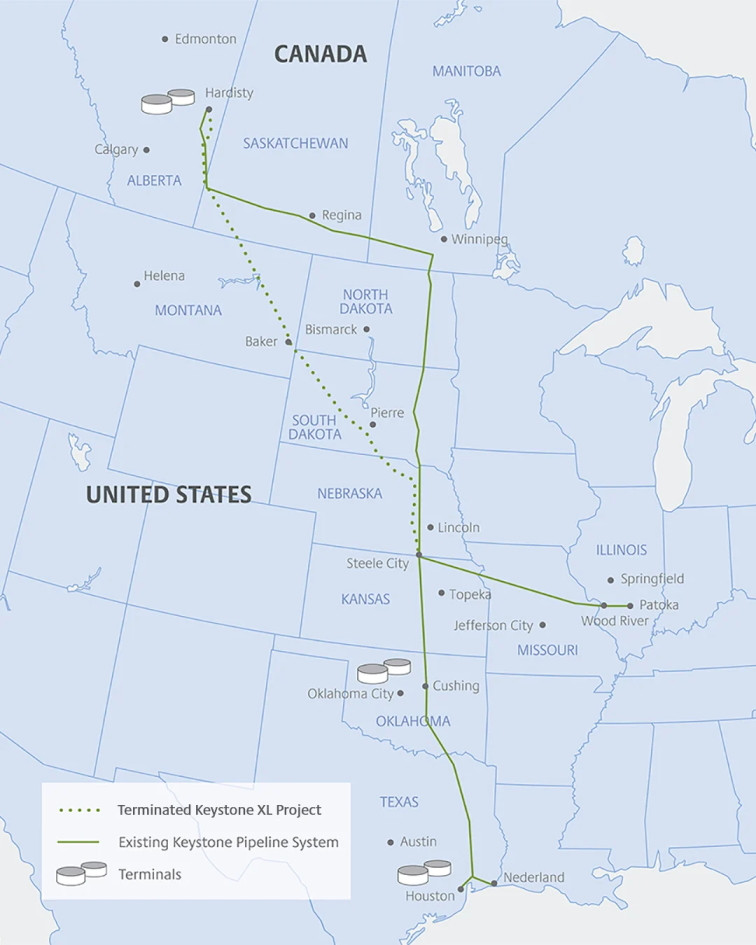

Enbridge Consolidates Crude Oil Storage Facilities at Hardisty Hub

CALGARY, ALBERTA -- (Marketwire) -- 06/16/10 -- Enbridge Inc. (TSX: ENB) (NYSE: ENB) today announced completion of the acquisition of the 50% of the Hardisty Caverns Limited Partnership previously owned by CCS Corporation for approximately $52 million. The Hardisty Caverns facility, now wholly owned by Enbridge, includes four salt caverns totaling 3.1 million barrels of capacity, and provides term storage services under long-term contracts.

"Our partnership on the Hardisty Caverns with CCS has been a fruitful and mutually beneficial one," said Stephen J. Wuori, Executive Vice President, Liquids Pipelines. "We're pleased to be able to consolidate our contract storage position at Hardisty, Alberta which we view as an important hub for growing oil sands production.

"The facility has excellent long-term growth prospects, including development of additional caverns as well as extensive surface storage development potential in an area where well-located land is difficult to acquire."

Significant demand for contract storage exists in the Hardisty region as a result of the growth of the oil sands and the development of expanded export pipelines. Enbridge is the largest operator of contract storage facilities at the Hardisty hub with its ownership of the 3.1 million barrel Hardisty Caverns storage facility, plus the 7.5 million barrel Hardisty Contract Terminal surface storage facility. Enbridge also operates 1.6 million barrels of regulated tankage at its adjacent Hardisty mainline terminal, providing receipt and delivery operational tankage for its mainline system.

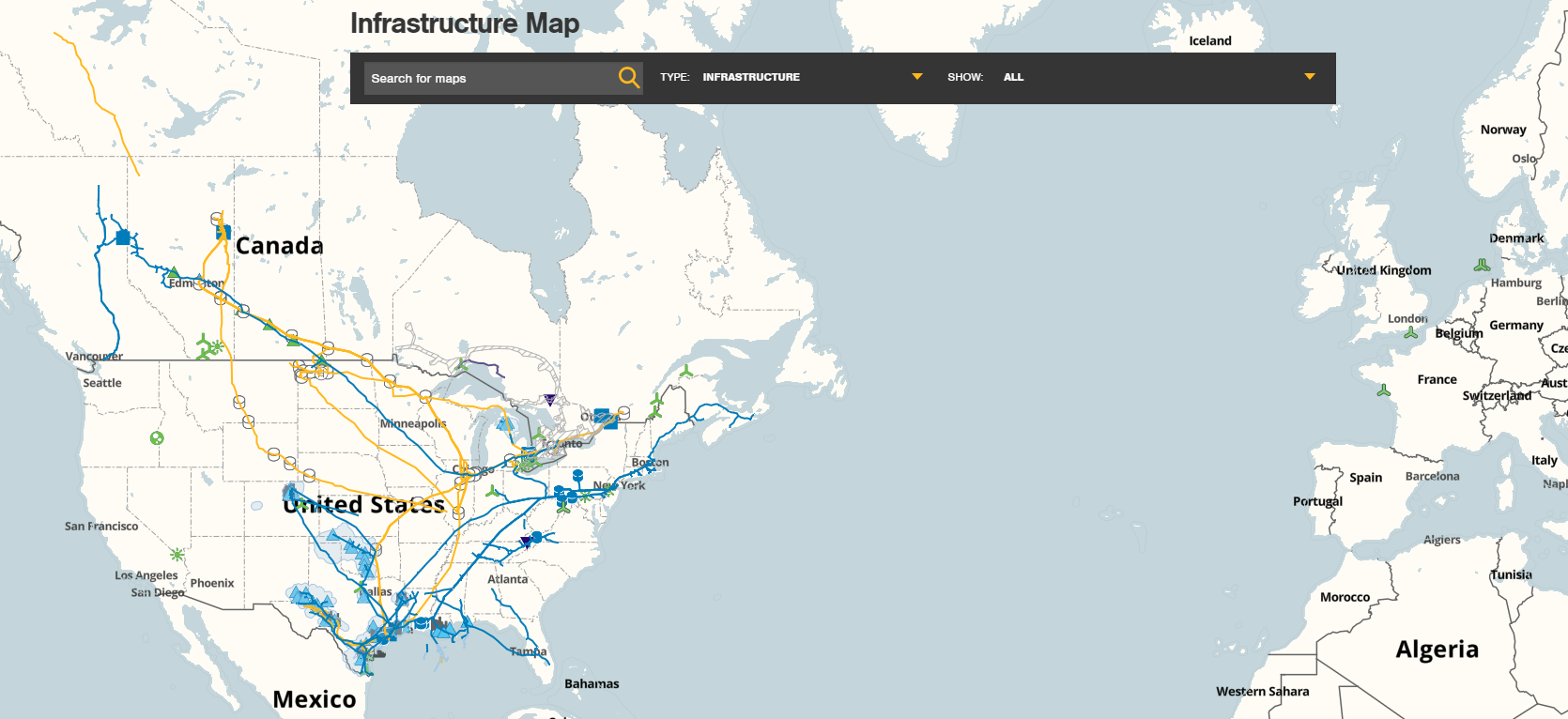

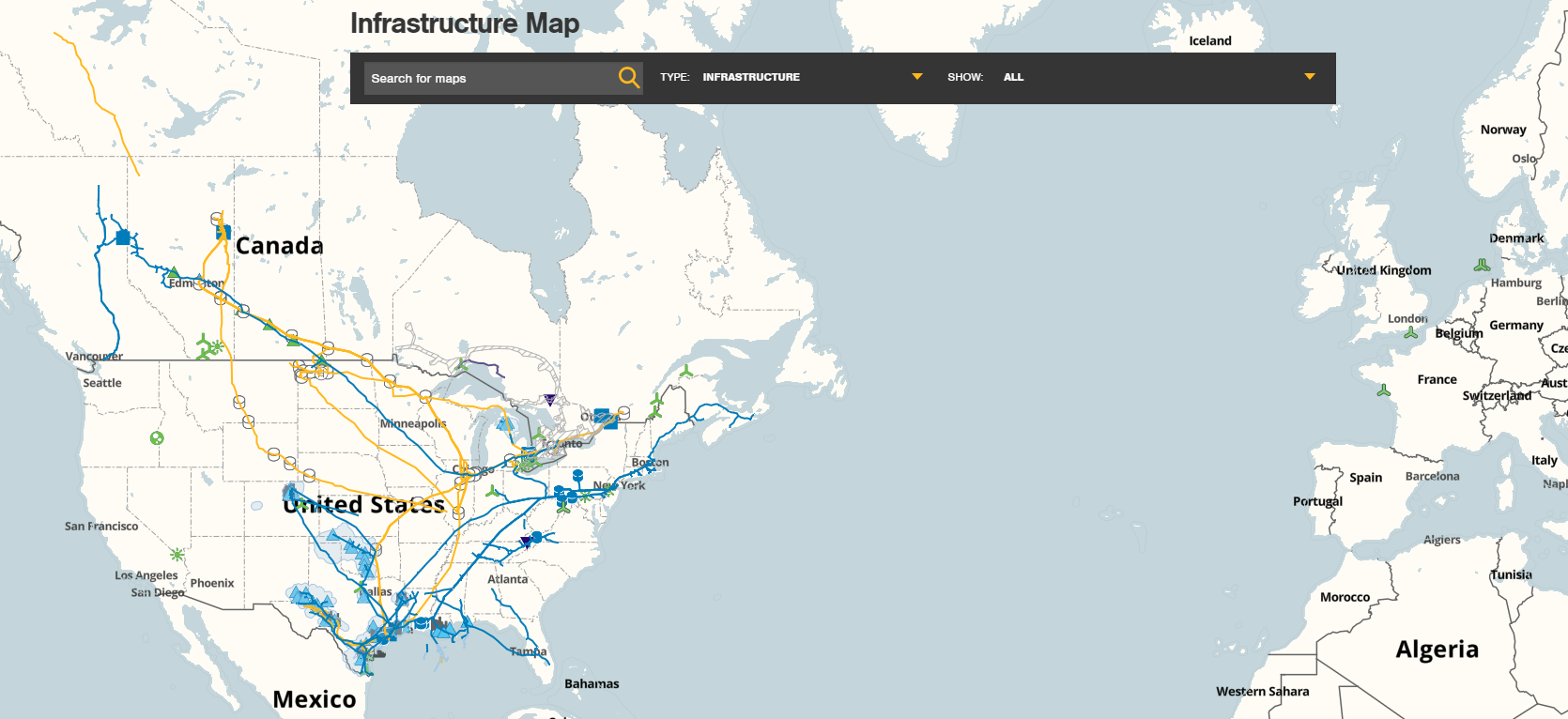

Enbridge Inc., a Canadian company, is a North American leader in delivering energy and one of the Global 100 Most Sustainable Corporations. As a transporter of energy, Enbridge operates, in Canada and the U.S., the world's longest crude oil and liquids transportation system. The Company also has a growing involvement in the natural gas transmission and midstream businesses, and is expanding its interests in renewable and green energy technologies including wind and solar energy, hybrid fuel cells and carbon dioxide sequestration. As a distributor of energy, Enbridge owns and operates Canada's largest natural gas distribution company, and provides distribution services in Ontario, Quebec, New Brunswick and New York State. Enbridge employs approximately 6,000 people, primarily in Canada and the U.S., and is ranked as one of Canada's Greenest Employers, and one of the Top 100 Companies to Work for in Canada. Enbridge's common shares trade on the Toronto and New York stock exchanges under the symbol ENB. For more information, visit enbridge.com.

Enbridge Consolidates Crude Oil Storage Facilities at Hardisty Hub

CALGARY, ALBERTA -- (Marketwire) -- 06/16/10 -- Enbridge Inc. (TSX: ENB) (NYSE: ENB) today announced completion of the acquisition of the 50% of the Hardisty Caverns Limited Partnership previously owned by CCS Corporation for approximately $52 million. The Hardisty Caverns facility, now wholly owned by Enbridge, includes four salt caverns totaling 3.1 million barrels of capacity, and provides term storage services under long-term contracts.

"Our partnership on the Hardisty Caverns with CCS has been a fruitful and mutually beneficial one," said Stephen J. Wuori, Executive Vice President, Liquids Pipelines. "We're pleased to be able to consolidate our contract storage position at Hardisty, Alberta which we view as an important hub for growing oil sands production.

"The facility has excellent long-term growth prospects, including development of additional caverns as well as extensive surface storage development potential in an area where well-located land is difficult to acquire."

Significant demand for contract storage exists in the Hardisty region as a result of the growth of the oil sands and the development of expanded export pipelines. Enbridge is the largest operator of contract storage facilities at the Hardisty hub with its ownership of the 3.1 million barrel Hardisty Caverns storage facility, plus the 7.5 million barrel Hardisty Contract Terminal surface storage facility. Enbridge also operates 1.6 million barrels of regulated tankage at its adjacent Hardisty mainline terminal, providing receipt and delivery operational tankage for its mainline system.

Enbridge Inc., a Canadian company, is a North American leader in delivering energy and one of the Global 100 Most Sustainable Corporations. As a transporter of energy, Enbridge operates, in Canada and the U.S., the world's longest crude oil and liquids transportation system. The Company also has a growing involvement in the natural gas transmission and midstream businesses, and is expanding its interests in renewable and green energy technologies including wind and solar energy, hybrid fuel cells and carbon dioxide sequestration. As a distributor of energy, Enbridge owns and operates Canada's largest natural gas distribution company, and provides distribution services in Ontario, Quebec, New Brunswick and New York State. Enbridge employs approximately 6,000 people, primarily in Canada and the U.S., and is ranked as one of Canada's Greenest Employers, and one of the Top 100 Companies to Work for in Canada. Enbridge's common shares trade on the Toronto and New York stock exchanges under the symbol ENB. For more information, visit enbridge.com.

29.06.2010 22:07

Enbridge to Invest US$500 Million in 250-Megawatt Colorado Wind Energy Project

CALGARY, ALBERTA AND DENVER, COLORADO -- (Marketwire) -- 06/29/10 -- Enbridge Inc. (TSX: ENB) (NYSE: ENB) announced today that it has entered into an agreement with Renewable Energy Systems Americas Inc. (RES Americas) under which a U.S. affiliate of Enbridge Inc. will own and operate the 250-megawatt (MW) Cedar Point Wind Energy Project. Enbridge's investment in the project will be approximately US$500 million and the Broomfield, Colorado-based RES Americas will construct it under a fixed-price engineering, procurement and construction (EPC) contract to Enbridge.

The Cedar Point Wind Energy Project, developed by RES Americas, is located approximately 80 miles east of Denver. Construction of the project will begin shortly with substantial completion expected in late 2011. The project will deliver electricity to the Public Service Company of Colorado (PSCo) electricity transmission grid under a 20-year, fixed-price power purchase agreement with PSCo.

"Renewable energy aligns very well with our objective to profitably grow our energy infrastructure business," said Al Monaco, Executive Vice President, Major Projects and Green Energy, Enbridge Inc. "Our green energy investments provide attractive returns and establish a new source of earnings growth that complements existing growth in our liquids and natural gas transportation businesses. The investment in Cedar Point bolsters our already strong portfolio of green energy projects and establishes a beach head for future investment into the growing U.S. green energy market. We expect to continue to grow our renewable portfolio, particularly in states like Colorado that support green energy development. The project is expected to be accretive to earnings per share in the first full year of operation in 2012."

"In addition to boosting our bottom line, green energy is a key component in our plan to achieve a neutral environmental footprint as we grow our operations," said Mr. Monaco. "In 2009 we committed to generating a kilowatt hour of renewable energy for every kilowatt hour of energy that our operations consume, and we are making good progress on that objective. We are also very pleased to once again work with RES Americas."

The Cedar Point Wind Energy Project brings Enbridge's interests in renewable energy projects to eight facilities, including interests in wind and solar projects, a hybrid fuel cell and waste heat recovery facilities. The 250-MW Cedar Point project brings the total generating capacity of the green energy projects in which Enbridge has interests to more than 800 MW - enough to meet the energy needs of about 260,000 homes.

The Cedar Point Wind Energy Project will comprise 139 Vestas 1.8 MW turbines, which will be connected to the PSCo grid by a 42-mile transmission line. RES Americas will construct the wind farm and transmission line under a fixed price, turnkey EPC agreement with Enbridge. Vestas will provide operations and maintenance services under a five-year, fixed price service, maintenance and warranty agreement.

A world-leading, fully-integrated renewable energy player in development, engineering, procurement, construction and operating services, RES Americas has developed and/or constructed approximately 10 percent of the installed U.S. wind energy capacity. The Cedar Point Wind Energy Project, the company's third project with Enbridge and first large project in Colorado, will bring RES Americas' constructed and under-construction portfolio to more than 4,800 MW.

"The Cedar Point Wind Energy Project upholds RES Americas' commitment to provide clean renewable energy and jobs to the state of Colorado," said Richard Ashby, CFO of RES Americas. "Working with Enbridge and PSCo, RES Americas is excited to contribute to the state's goals of providing economic benefits to the community and helping ensure a secure energy future."

Development of the Cedar Point Wind Energy Project aligns not only with Enbridge's goals, but with those of the state of Colorado as well. On March 22, 2010, Colorado Gov. Bill Ritter signed into law landmark legislation that gives the state the highest renewable energy standard in the Rocky Mountain West, requiring that 30 percent of the state's electricity be generated from renewable sources by 2020. "The Cedar Point Wind Energy Project will help provide Colorado's supply of clean, reliable power while bringing jobs and economic development to communities in our state, fulfilling our promise of a new energy economy," said Gov. Ritter.

Enbridge and RES Americas expect the project will create up to 250 construction jobs and, through its ongoing operations, generate revenue for businesses in the region.

Cedar Point Wind Energy Project at a glance:

Capacity peak: about 250 MW

Turbines: 139 Vestas 1.8 MW turbines

Annual yield: approximately 875,000 MWh (corresponding to the annual consumption of around 80,000 Colorado households)

CO2 saving: about 710,000 tons per year

Enbridge to Invest US$500 Million in 250-Megawatt Colorado Wind Energy Project

CALGARY, ALBERTA AND DENVER, COLORADO -- (Marketwire) -- 06/29/10 -- Enbridge Inc. (TSX: ENB) (NYSE: ENB) announced today that it has entered into an agreement with Renewable Energy Systems Americas Inc. (RES Americas) under which a U.S. affiliate of Enbridge Inc. will own and operate the 250-megawatt (MW) Cedar Point Wind Energy Project. Enbridge's investment in the project will be approximately US$500 million and the Broomfield, Colorado-based RES Americas will construct it under a fixed-price engineering, procurement and construction (EPC) contract to Enbridge.

The Cedar Point Wind Energy Project, developed by RES Americas, is located approximately 80 miles east of Denver. Construction of the project will begin shortly with substantial completion expected in late 2011. The project will deliver electricity to the Public Service Company of Colorado (PSCo) electricity transmission grid under a 20-year, fixed-price power purchase agreement with PSCo.

"Renewable energy aligns very well with our objective to profitably grow our energy infrastructure business," said Al Monaco, Executive Vice President, Major Projects and Green Energy, Enbridge Inc. "Our green energy investments provide attractive returns and establish a new source of earnings growth that complements existing growth in our liquids and natural gas transportation businesses. The investment in Cedar Point bolsters our already strong portfolio of green energy projects and establishes a beach head for future investment into the growing U.S. green energy market. We expect to continue to grow our renewable portfolio, particularly in states like Colorado that support green energy development. The project is expected to be accretive to earnings per share in the first full year of operation in 2012."

"In addition to boosting our bottom line, green energy is a key component in our plan to achieve a neutral environmental footprint as we grow our operations," said Mr. Monaco. "In 2009 we committed to generating a kilowatt hour of renewable energy for every kilowatt hour of energy that our operations consume, and we are making good progress on that objective. We are also very pleased to once again work with RES Americas."

The Cedar Point Wind Energy Project brings Enbridge's interests in renewable energy projects to eight facilities, including interests in wind and solar projects, a hybrid fuel cell and waste heat recovery facilities. The 250-MW Cedar Point project brings the total generating capacity of the green energy projects in which Enbridge has interests to more than 800 MW - enough to meet the energy needs of about 260,000 homes.

The Cedar Point Wind Energy Project will comprise 139 Vestas 1.8 MW turbines, which will be connected to the PSCo grid by a 42-mile transmission line. RES Americas will construct the wind farm and transmission line under a fixed price, turnkey EPC agreement with Enbridge. Vestas will provide operations and maintenance services under a five-year, fixed price service, maintenance and warranty agreement.

A world-leading, fully-integrated renewable energy player in development, engineering, procurement, construction and operating services, RES Americas has developed and/or constructed approximately 10 percent of the installed U.S. wind energy capacity. The Cedar Point Wind Energy Project, the company's third project with Enbridge and first large project in Colorado, will bring RES Americas' constructed and under-construction portfolio to more than 4,800 MW.

"The Cedar Point Wind Energy Project upholds RES Americas' commitment to provide clean renewable energy and jobs to the state of Colorado," said Richard Ashby, CFO of RES Americas. "Working with Enbridge and PSCo, RES Americas is excited to contribute to the state's goals of providing economic benefits to the community and helping ensure a secure energy future."

Development of the Cedar Point Wind Energy Project aligns not only with Enbridge's goals, but with those of the state of Colorado as well. On March 22, 2010, Colorado Gov. Bill Ritter signed into law landmark legislation that gives the state the highest renewable energy standard in the Rocky Mountain West, requiring that 30 percent of the state's electricity be generated from renewable sources by 2020. "The Cedar Point Wind Energy Project will help provide Colorado's supply of clean, reliable power while bringing jobs and economic development to communities in our state, fulfilling our promise of a new energy economy," said Gov. Ritter.

Enbridge and RES Americas expect the project will create up to 250 construction jobs and, through its ongoing operations, generate revenue for businesses in the region.

Cedar Point Wind Energy Project at a glance:

Capacity peak: about 250 MW

Turbines: 139 Vestas 1.8 MW turbines

Annual yield: approximately 875,000 MWh (corresponding to the annual consumption of around 80,000 Colorado households)

CO2 saving: about 710,000 tons per year

Enbridge Invests in 35-MW Geothermal Plant

Published: 8. September 2010

Oregon, United States -- The Idaho-based geothermal power plant developer U.S. Geothermal is partnering with a major North American energy company on a 35-MW project in Oregon.

The Neal Hot Springs development project is the first geothermal project to be offered a conditional commitment for a loan guarantee under Department of Energy's loan guarantee program.

Enbridge Inc, a company with deep roots in the traditional energy sector, is investing $23.8 million in the Neal Hot Springs geothermal power plant in eastern Oregon.

At Neal Hot Springs, USG Oregon LLC (a subsidiary of U.S Geothermal) is constructing a new modular, air-cooled binary cycle power plant manufactured by TAS Energy Inc. of Houston, Texas, with gross capacity of 35 MW. The company expects the plant to be in operation by 2012.

The Neal Hot Springs development project is the first geothermal project to be offered a conditional commitment for a loan guarantee under Department of Energy's loan guarantee program, which was created by the Energy Policy Act of 2005 to support the deployment of innovative clean energy technologies.

The Enbridge equity investment in the Neal Hot Springs project will fully fund the remaining equity share of the construction costs, with the rest of the costs being funded by a loan guarantee from the Department of Energy. Enbridge will acquire 20% direct ownership interest in the project and will receive 24% of the Investment Tax Credit cash grant.

U.S. Geothermal has now already invested approximately $13.0 million in USG Oregon LLC, its subsidiary that owns the project. A total of up to $36.8 million in equity, together with up to $102.2 million of project debt provided under the loan guarantee program from the DOE, is now invested in or available for completion of the $124.3 million project.

Published: 8. September 2010

Oregon, United States -- The Idaho-based geothermal power plant developer U.S. Geothermal is partnering with a major North American energy company on a 35-MW project in Oregon.

The Neal Hot Springs development project is the first geothermal project to be offered a conditional commitment for a loan guarantee under Department of Energy's loan guarantee program.

Enbridge Inc, a company with deep roots in the traditional energy sector, is investing $23.8 million in the Neal Hot Springs geothermal power plant in eastern Oregon.

At Neal Hot Springs, USG Oregon LLC (a subsidiary of U.S Geothermal) is constructing a new modular, air-cooled binary cycle power plant manufactured by TAS Energy Inc. of Houston, Texas, with gross capacity of 35 MW. The company expects the plant to be in operation by 2012.

The Neal Hot Springs development project is the first geothermal project to be offered a conditional commitment for a loan guarantee under Department of Energy's loan guarantee program, which was created by the Energy Policy Act of 2005 to support the deployment of innovative clean energy technologies.

The Enbridge equity investment in the Neal Hot Springs project will fully fund the remaining equity share of the construction costs, with the rest of the costs being funded by a loan guarantee from the Department of Energy. Enbridge will acquire 20% direct ownership interest in the project and will receive 24% of the Investment Tax Credit cash grant.

U.S. Geothermal has now already invested approximately $13.0 million in USG Oregon LLC, its subsidiary that owns the project. A total of up to $36.8 million in equity, together with up to $102.2 million of project debt provided under the loan guarantee program from the DOE, is now invested in or available for completion of the $124.3 million project.

SARNIA, ONTARIO, Sep 30, 2010 (MARKETWIRE via COMTEX) --

Enbridge Inc. (TSX: ENB) (NYSE: ENB) and First Solar, Inc. (NASDAQ: FSLR) have completed the expansion of the Sarnia Solar Project from 20 megawatts of capacity to 80 megawatts (MW) making it the largest operating photovoltaic facility in the world.

To celebrate this milestone, Enbridge will hold a Grand Opening celebration in Sarnia, Ontario. Enbridge and First Solar representatives along with the Ontario Energy Minister, Hon. Brad Duguid, will be on-hand after the formalities to speak with the media.

Date: October 4, 2010

Enbridge Inc. (TSX: ENB) (NYSE: ENB) and First Solar, Inc. (NASDAQ: FSLR) have completed the expansion of the Sarnia Solar Project from 20 megawatts of capacity to 80 megawatts (MW) making it the largest operating photovoltaic facility in the world.

To celebrate this milestone, Enbridge will hold a Grand Opening celebration in Sarnia, Ontario. Enbridge and First Solar representatives along with the Ontario Energy Minister, Hon. Brad Duguid, will be on-hand after the formalities to speak with the media.

Date: October 4, 2010

CALGARY, ALBERTA -- (Marketwire) -- 12/01/10 -- Enbridge Inc. (TSX: ENB), (NYSE: ENB) today announced that its Board of Directors has declared a quarterly dividend of $0.49 per common share payable on March 1, 2011 to shareholders of record on February 15, 2011. The dividend reflects a 15% increase from the Company's prior quarterly rate of $0.425 per share. Enbridge also announced its 2011 guidance for adjusted operating earnings of $2.75 to $2.95 per share.

"Enbridge's current policy is to pay out between 60 and 70% of its adjusted earnings as dividends to its shareholders," said Patrick D. Daniel, President and Chief Executive Officer, Enbridge Inc. "The 15% increase announced today still leaves us within our current policy range for 2011 and is supported by strong growth in earnings and cash flow. Cash flow growth is expected to continue to outperform earnings through 2014, providing scope for us to consider continuing to grow our dividends faster than earnings over the medium term.""

"In 2010, Enbridge brought into service the Alberta Clipper Expansion Project, which is the single largest project in our history; the Southern Lights diluent pipeline; and the 60 megawatt second phase of the Sarnia Solar project," said Mr. Daniel. "All together, we've brought $6.5 billion in projects into service this year and $12 billion over the past three years. Notably, all are now generating cash flow.

"We expect to sustain that growth. Between now and the end of the year, we're on track to commission the $285 million, 100 megawatt Talbot Wind Project as well as the $140 million Enbridge Saskatchewan pipeline expansion in the Bakken play, and we have secured more than $5 billion in projects that will come into service between 2011 and 2014," he added. "The steady growth of our liquids pipelines, natural gas transportation and green energy businesses will continue to drive strong earnings growth and even more significant cash flow growth in coming years.

"Enbridge offers investors visible, transparent and sustained earnings and cash flow growth; a substantial and growing dividend; and a very reliable business model. The unique combination of these three attributes differentiates Enbridge and continues to deliver superior returns to our shareholders."

"Enbridge's current policy is to pay out between 60 and 70% of its adjusted earnings as dividends to its shareholders," said Patrick D. Daniel, President and Chief Executive Officer, Enbridge Inc. "The 15% increase announced today still leaves us within our current policy range for 2011 and is supported by strong growth in earnings and cash flow. Cash flow growth is expected to continue to outperform earnings through 2014, providing scope for us to consider continuing to grow our dividends faster than earnings over the medium term.""

"In 2010, Enbridge brought into service the Alberta Clipper Expansion Project, which is the single largest project in our history; the Southern Lights diluent pipeline; and the 60 megawatt second phase of the Sarnia Solar project," said Mr. Daniel. "All together, we've brought $6.5 billion in projects into service this year and $12 billion over the past three years. Notably, all are now generating cash flow.

"We expect to sustain that growth. Between now and the end of the year, we're on track to commission the $285 million, 100 megawatt Talbot Wind Project as well as the $140 million Enbridge Saskatchewan pipeline expansion in the Bakken play, and we have secured more than $5 billion in projects that will come into service between 2011 and 2014," he added. "The steady growth of our liquids pipelines, natural gas transportation and green energy businesses will continue to drive strong earnings growth and even more significant cash flow growth in coming years.

"Enbridge offers investors visible, transparent and sustained earnings and cash flow growth; a substantial and growing dividend; and a very reliable business model. The unique combination of these three attributes differentiates Enbridge and continues to deliver superior returns to our shareholders."

Enbridge Reports 2010 Results: Another Strong Year

February 3, 2011

CALGARY, ALBERTA--(Marketwire - Feb. 3, 2011) - Enbridge Inc. (TSX:ENB) (NYSE:ENB)

HIGHLIGHTS

(all financial figures are unaudited and in Canadian dollars unless

otherwise noted)

- Fourth quarter earnings were $326 million; earnings for the full year

were $963 million

- Fourth quarter adjusted earnings were $0.64 per common share, or $238

million

- Full year adjusted earnings were $2.66 per common share, a 13% increase

- $6.5 billion of Liquids Pipelines and renewable energy projects brought

into service during the year

- In September 2010, Enbridge affiliate acquired US$700 million in gas

gathering and processing assets

- Additional $2.2 billion of regional oil sands projects secured during

the year, bringing total to $2.6 billion under development

- $400 million of additional investments in solar energy, Gulf of Mexico

gas infrastructure and Quebec gas distribution recently announced

- Guidance for 2011 adjusted earnings of $2.75 to $2.95 per common share

- Quarterly dividend increased by 15% to $0.49 per common share effective

March 1, 2011

"We are pleased to report strong financial results for the fourth quarter and for the full year 2010," said Patrick D. Daniel, President and Chief Executive Officer. "For the fourth quarter, adjusted earnings totaled $238 million or $0.64 per common share. Our 2010 adjusted earnings per share increased 13% over 2009 to $2.66 per share, achieving the upper half of our guidance range for the year.

"Our strong performance in 2010 builds on an exceptional year in 2009, and extends the Company's performance record. Enbridge's 2010 results were driven by strong performance across all of our business units, and reflected the positive impact of cash generated from new projects coming into service. Enbridge brought $6.5 billion of projects into service during 2010, including Alberta Clipper, the Southern Lights Pipeline, the North Dakota and Saskatchewan System expansions, and the Talbot Wind Energy and Sarnia Solar projects. Over the past three years, we've brought more than $12 billion in projects into service."

Enbridge's continued strong growth enabled the Company to announce a 15% increase in its common share dividend in December 2010.

"Few peers can match Enbridge's track record of consistently increasing its dividend. Over the past ten years, we have delivered an average annual dividend increase of 11%," said Mr. Daniel. "With our adjusted earnings per share growth rate anticipated to grow at an average rate of 10% through the middle of this decade, and with cash flow growing even more rapidly, we expect to be able to continue delivering exceptional dividend growth to our investors."

Mr. Daniel noted that responding to incidents that occurred in 2010 on the Company's liquids pipelines system remains a top priority.

"The incidents of the summer and early fall in Marshall, Michigan and Romeoville, Illinois were humbling for our Company and a test of our ability to respond not only to the clean-up of the oil spilled, but also to the individuals and communities affected by the spills, and to the transportation needs of our shippers who were affected by the prolonged shutdown of certain of our pipelines," said Mr. Daniel. "Our efforts continue on all fronts.

"Enbridge's comprehensive pipeline integrity program, and regulatory requirements to accelerate planned work on sections of Line 6B, continue to have impacts on the available capacity of our mainline system," said Mr. Daniel. "We greatly appreciate the continued cooperation of our shippers as we complete this important work."

Looking ahead to 2011, Mr. Daniel said that Enbridge will continue to focus on growth across all of its business segments, with key focus areas including the expansion of oil sands infrastructure, further developments in the Bakken and Three Forks formations, new green energy projects and opportunities for growth in its natural gas businesses.

"In 2010, Enbridge reinforced its strong presence in the oil sands by securing six new growth and expansion projects. We currently have secured a total of $2.6 billion in oil sands infrastructure projects that are expected to go into service between 2011 and 2014. Those projects include expansion of the Company's Athabasca Pipeline to its maximum capacity of 570,000 barrels per day; expansion of the Waupisoo Pipeline; three new pipelines, the Woodland, Wood Buffalo and Norealis pipelines; and expansion of Enbridge's Edmonton terminal facilities. Enbridge's Regional Oil Sands System currently connects five producing oil sands projects and will have eight producing projects connected by 2014. As we continue to hear encouraging announcements of growth and investment in the oil sands, Enbridge is very well positioned to provide a wide range of flexible and cost effective transportation solutions to existing and new shippers."

The Bakken Formation also offers significant growth opportunities for Enbridge's sponsored investments, Enbridge Income Fund and Enbridge Energy Partners.

"In the fourth quarter, the expansion of the Enbridge Saskatchewan System was substantially completed. This is the latest expansion project brought into service in a series of expansion projects Enbridge affiliates are undertaking in Saskatchewan and North Dakota. The next phase is the Bakken Expansion Program being constructed in North Datoka and Saskatchewan which is expected to come into service in early 2013 and will add approximately 145,000 barrels per day of incremental capacity and connection into the Enbridge Mainline," said Mr. Daniel. "The Bakken and Three Forks formations represent an area of tremendous opportunity for both Enbridge Energy Partners and Enbridge Income Fund. We have extensive existing operations in the region, and strong producer support for the Bakken Expansion Program. We are well positioned to provide shippers with attractive transportation options for the continued production growth expected to come from this region."

Enbridge's Green Energy business also saw substantial expansion in 2010 and that momentum has continued in the new year.

"The commissioning of the 80-megawatt Sarnia Solar facility was a highlight of a year that saw Enbridge announce the 99-megawatt Greenwich Wind Energy Project in Ontario and mark its entry into the U.S. green energy market through securing the 250-megawatt Cedar Point Wind Energy Project in Colorado. We concluded 2010 with the substantial completion of the Talbot Wind Energy project, and earlier this week announced the acquisition of the Amherstburg and Tilbury solar projects, further expanding our solar portfolio and green energy interests in Ontario," said Mr. Daniel. "Our Green Energy investments are an excellent fit with our reliable business model."

In Enbridge's Gas Pipelines, Processing and Energy Services segment, growth will continue to be driven by developments on the supply side and opportunities within the midstream sector.

"In 2010, we grew our Texas natural gas gathering and processing assets through the acquisition by Enbridge Energy Partners of US$700 million in assets located in the prolific Granite Wash area. We will continue to seek out similar opportunities to grow our transportation and midstream businesses, both organically and through acquisitions that fit with our business model," said Mr. Daniel. "Our interests in the Alliance Pipeline also promise to deliver longer term returns by virtue of its proximity to shale plays in northeast B.C. and the Bakken, and its ability to transport liquids rich gas.

"In Offshore, the sanctioning by Chevron of the Jack-St. Malo project in October enables us to advance our Walker Ridge project, one of two secured projects, and we continue to pursue other opportunities in the ultradeep waters of the Gulf of Mexico," said Mr. Daniel. "This week, we announced an expansion of the condensate processing capacity of our Venice, Louisiana facility. This expansion, which is expected to be in service in late 2013, carries similar favourable financial terms to those negotiated for our other recently announced investment in the Gulf Coast.

"Enbridge has an exceptionally strong asset base, proven ability to secure new projects with attractive terms and a track record of on time, on budget execution. The safety and integrity of our operations remains our highest priority," said Mr. Daniel. "Our positive financial results in 2010 reflect the collective efforts of our employees across the organization to achieve our vision of being the leading energy delivery company in North America, and in doing so, deliver superior results to our shareholders."

RECENT DEVELOPMENTS

- Enbridge announced on February 3, 2011 that it will invest $0.1 billion to acquire an additional 6.8% interest in Noverco from Laurentides Investissements (SAS), a subsidiary of GDF SUEZ, bringing its total interest in Noverco to 38.9%. Trencap, a partnership managed by the Caisse de Depot et Placement du Quebec, will acquire Laurentides Investissements' remaining 10.8% interest in Noverco, following which Enbridge and Trencap will become the sole shareholders of Noverco. The transaction is expected to close later in the year once all regulatory approvals have been received. Noverco is a holding company that owns 71% of the Gaz Metro Limited Partnership (Gaz Metro) which owns gas distribution and gas pipelines assets in the province of Quebec and gas and electric power distribution and transmission assets in the State of Vermont.

- On February 1, 2011, Enbridge announced agreements to acquire two new solar energy projects totaling 20 MW generating capacity from First Solar Inc. (First Solar) for $0.1 billion. The 5-MW Tilbury Solar Project, completed in December 2010, is located in Tilbury, Ontario. The Amherstburg II Solar Project, located in Amherstburg, Ontario, consists of two separate facilities that, together, total 15 MW. First Solar constructed (and, in the case of the Amherstburg II Solar Project, will construct) the projects for Enbridge under fixed price engineering, procurement and construction contracts. Construction is expected to begin in March 2011 and is expected to be complete in the third quarter 2011. Enbridge will sell the facilities' power output to the Ontario Power Authority pursuant to 20-year Power Purchase Agreements under the terms of the Ontario Government's Renewable Energy Standard Offer Program.

- On January 31, 2011, Enbridge announced plans for an estimated $0.2 billion expansion of the condensate processing capacity of its Venice, Louisiana facility within its offshore gas business. The expanded condensate processing capacity will be required to accommodate additional natural gas production from the recently sanctioned Olympus offshore oil and gas development. Natural gas production from Olympus will move to Enbridge's onshore facility at Venice via Enbridge's Mississippi Canyon offshore pipeline where it will be processed to separate and stabilize the condensate. The expansion, which will more than double the capacity of the facility to approximately 12,000 barrels of condensate per day, is expected to be in service in late 2013.

- On December 16, 2010, the Company announced it will undertake an expansion of its Athabasca Pipeline to its full capacity to accommodate additional contractual commitments, including recent incremental shipping commitments by the Christina Lake Oilsands Project operated by Cenovus. This expansion will increase the capacity of the Athabasca Pipeline to its maximum capacity of approximately 570,000 bpd, depending on crude slate. Subject to regulatory approval, the estimated cost of this full expansion is approximately $0.4 billion. The expansion will be completed in stages, with full completion expected in early 2014. The Athabasca Pipeline transports crude oil from various oil sands projects to the mainline hub at Hardisty, Alberta.

February 3, 2011

CALGARY, ALBERTA--(Marketwire - Feb. 3, 2011) - Enbridge Inc. (TSX:ENB) (NYSE:ENB)

HIGHLIGHTS

(all financial figures are unaudited and in Canadian dollars unless

otherwise noted)

- Fourth quarter earnings were $326 million; earnings for the full year

were $963 million

- Fourth quarter adjusted earnings were $0.64 per common share, or $238

million

- Full year adjusted earnings were $2.66 per common share, a 13% increase

- $6.5 billion of Liquids Pipelines and renewable energy projects brought

into service during the year

- In September 2010, Enbridge affiliate acquired US$700 million in gas

gathering and processing assets

- Additional $2.2 billion of regional oil sands projects secured during

the year, bringing total to $2.6 billion under development

- $400 million of additional investments in solar energy, Gulf of Mexico

gas infrastructure and Quebec gas distribution recently announced

- Guidance for 2011 adjusted earnings of $2.75 to $2.95 per common share

- Quarterly dividend increased by 15% to $0.49 per common share effective

March 1, 2011

"We are pleased to report strong financial results for the fourth quarter and for the full year 2010," said Patrick D. Daniel, President and Chief Executive Officer. "For the fourth quarter, adjusted earnings totaled $238 million or $0.64 per common share. Our 2010 adjusted earnings per share increased 13% over 2009 to $2.66 per share, achieving the upper half of our guidance range for the year.

"Our strong performance in 2010 builds on an exceptional year in 2009, and extends the Company's performance record. Enbridge's 2010 results were driven by strong performance across all of our business units, and reflected the positive impact of cash generated from new projects coming into service. Enbridge brought $6.5 billion of projects into service during 2010, including Alberta Clipper, the Southern Lights Pipeline, the North Dakota and Saskatchewan System expansions, and the Talbot Wind Energy and Sarnia Solar projects. Over the past three years, we've brought more than $12 billion in projects into service."

Enbridge's continued strong growth enabled the Company to announce a 15% increase in its common share dividend in December 2010.

"Few peers can match Enbridge's track record of consistently increasing its dividend. Over the past ten years, we have delivered an average annual dividend increase of 11%," said Mr. Daniel. "With our adjusted earnings per share growth rate anticipated to grow at an average rate of 10% through the middle of this decade, and with cash flow growing even more rapidly, we expect to be able to continue delivering exceptional dividend growth to our investors."

Mr. Daniel noted that responding to incidents that occurred in 2010 on the Company's liquids pipelines system remains a top priority.

"The incidents of the summer and early fall in Marshall, Michigan and Romeoville, Illinois were humbling for our Company and a test of our ability to respond not only to the clean-up of the oil spilled, but also to the individuals and communities affected by the spills, and to the transportation needs of our shippers who were affected by the prolonged shutdown of certain of our pipelines," said Mr. Daniel. "Our efforts continue on all fronts.

"Enbridge's comprehensive pipeline integrity program, and regulatory requirements to accelerate planned work on sections of Line 6B, continue to have impacts on the available capacity of our mainline system," said Mr. Daniel. "We greatly appreciate the continued cooperation of our shippers as we complete this important work."

Looking ahead to 2011, Mr. Daniel said that Enbridge will continue to focus on growth across all of its business segments, with key focus areas including the expansion of oil sands infrastructure, further developments in the Bakken and Three Forks formations, new green energy projects and opportunities for growth in its natural gas businesses.

"In 2010, Enbridge reinforced its strong presence in the oil sands by securing six new growth and expansion projects. We currently have secured a total of $2.6 billion in oil sands infrastructure projects that are expected to go into service between 2011 and 2014. Those projects include expansion of the Company's Athabasca Pipeline to its maximum capacity of 570,000 barrels per day; expansion of the Waupisoo Pipeline; three new pipelines, the Woodland, Wood Buffalo and Norealis pipelines; and expansion of Enbridge's Edmonton terminal facilities. Enbridge's Regional Oil Sands System currently connects five producing oil sands projects and will have eight producing projects connected by 2014. As we continue to hear encouraging announcements of growth and investment in the oil sands, Enbridge is very well positioned to provide a wide range of flexible and cost effective transportation solutions to existing and new shippers."

The Bakken Formation also offers significant growth opportunities for Enbridge's sponsored investments, Enbridge Income Fund and Enbridge Energy Partners.

"In the fourth quarter, the expansion of the Enbridge Saskatchewan System was substantially completed. This is the latest expansion project brought into service in a series of expansion projects Enbridge affiliates are undertaking in Saskatchewan and North Dakota. The next phase is the Bakken Expansion Program being constructed in North Datoka and Saskatchewan which is expected to come into service in early 2013 and will add approximately 145,000 barrels per day of incremental capacity and connection into the Enbridge Mainline," said Mr. Daniel. "The Bakken and Three Forks formations represent an area of tremendous opportunity for both Enbridge Energy Partners and Enbridge Income Fund. We have extensive existing operations in the region, and strong producer support for the Bakken Expansion Program. We are well positioned to provide shippers with attractive transportation options for the continued production growth expected to come from this region."

Enbridge's Green Energy business also saw substantial expansion in 2010 and that momentum has continued in the new year.

"The commissioning of the 80-megawatt Sarnia Solar facility was a highlight of a year that saw Enbridge announce the 99-megawatt Greenwich Wind Energy Project in Ontario and mark its entry into the U.S. green energy market through securing the 250-megawatt Cedar Point Wind Energy Project in Colorado. We concluded 2010 with the substantial completion of the Talbot Wind Energy project, and earlier this week announced the acquisition of the Amherstburg and Tilbury solar projects, further expanding our solar portfolio and green energy interests in Ontario," said Mr. Daniel. "Our Green Energy investments are an excellent fit with our reliable business model."

In Enbridge's Gas Pipelines, Processing and Energy Services segment, growth will continue to be driven by developments on the supply side and opportunities within the midstream sector.

"In 2010, we grew our Texas natural gas gathering and processing assets through the acquisition by Enbridge Energy Partners of US$700 million in assets located in the prolific Granite Wash area. We will continue to seek out similar opportunities to grow our transportation and midstream businesses, both organically and through acquisitions that fit with our business model," said Mr. Daniel. "Our interests in the Alliance Pipeline also promise to deliver longer term returns by virtue of its proximity to shale plays in northeast B.C. and the Bakken, and its ability to transport liquids rich gas.

"In Offshore, the sanctioning by Chevron of the Jack-St. Malo project in October enables us to advance our Walker Ridge project, one of two secured projects, and we continue to pursue other opportunities in the ultradeep waters of the Gulf of Mexico," said Mr. Daniel. "This week, we announced an expansion of the condensate processing capacity of our Venice, Louisiana facility. This expansion, which is expected to be in service in late 2013, carries similar favourable financial terms to those negotiated for our other recently announced investment in the Gulf Coast.

"Enbridge has an exceptionally strong asset base, proven ability to secure new projects with attractive terms and a track record of on time, on budget execution. The safety and integrity of our operations remains our highest priority," said Mr. Daniel. "Our positive financial results in 2010 reflect the collective efforts of our employees across the organization to achieve our vision of being the leading energy delivery company in North America, and in doing so, deliver superior results to our shareholders."

RECENT DEVELOPMENTS

- Enbridge announced on February 3, 2011 that it will invest $0.1 billion to acquire an additional 6.8% interest in Noverco from Laurentides Investissements (SAS), a subsidiary of GDF SUEZ, bringing its total interest in Noverco to 38.9%. Trencap, a partnership managed by the Caisse de Depot et Placement du Quebec, will acquire Laurentides Investissements' remaining 10.8% interest in Noverco, following which Enbridge and Trencap will become the sole shareholders of Noverco. The transaction is expected to close later in the year once all regulatory approvals have been received. Noverco is a holding company that owns 71% of the Gaz Metro Limited Partnership (Gaz Metro) which owns gas distribution and gas pipelines assets in the province of Quebec and gas and electric power distribution and transmission assets in the State of Vermont.

- On February 1, 2011, Enbridge announced agreements to acquire two new solar energy projects totaling 20 MW generating capacity from First Solar Inc. (First Solar) for $0.1 billion. The 5-MW Tilbury Solar Project, completed in December 2010, is located in Tilbury, Ontario. The Amherstburg II Solar Project, located in Amherstburg, Ontario, consists of two separate facilities that, together, total 15 MW. First Solar constructed (and, in the case of the Amherstburg II Solar Project, will construct) the projects for Enbridge under fixed price engineering, procurement and construction contracts. Construction is expected to begin in March 2011 and is expected to be complete in the third quarter 2011. Enbridge will sell the facilities' power output to the Ontario Power Authority pursuant to 20-year Power Purchase Agreements under the terms of the Ontario Government's Renewable Energy Standard Offer Program.

- On January 31, 2011, Enbridge announced plans for an estimated $0.2 billion expansion of the condensate processing capacity of its Venice, Louisiana facility within its offshore gas business. The expanded condensate processing capacity will be required to accommodate additional natural gas production from the recently sanctioned Olympus offshore oil and gas development. Natural gas production from Olympus will move to Enbridge's onshore facility at Venice via Enbridge's Mississippi Canyon offshore pipeline where it will be processed to separate and stabilize the condensate. The expansion, which will more than double the capacity of the facility to approximately 12,000 barrels of condensate per day, is expected to be in service in late 2013.

- On December 16, 2010, the Company announced it will undertake an expansion of its Athabasca Pipeline to its full capacity to accommodate additional contractual commitments, including recent incremental shipping commitments by the Christina Lake Oilsands Project operated by Cenovus. This expansion will increase the capacity of the Athabasca Pipeline to its maximum capacity of approximately 570,000 bpd, depending on crude slate. Subject to regulatory approval, the estimated cost of this full expansion is approximately $0.4 billion. The expansion will be completed in stages, with full completion expected in early 2014. The Athabasca Pipeline transports crude oil from various oil sands projects to the mainline hub at Hardisty, Alberta.

Enbridge Reports First Quarter Adjusted Earnings of $376 Million or $0.50 Per Common Share

May 9, 2012

CALGARY, ALBERTA--(Marketwire - May 9, 2012) -

HIGHLIGHTS

(all financial figures are unaudited and in Canadian dollars)

First quarter earnings were $264 million including unrealized non-cash mark-to-market losses

First quarter adjusted earnings increased 14% to $376 million

U.S. Gulf Coast access initiative upsized to a $5.2 billion investment

Acquisition of a 100% interest in the 50-megawatt Silver State North Solar Project development in Nevada

Issuance of $1.05 billion in preference shares

Enbridge named one of the Global 100 Most Sustainable Corporations, one of Canada's Greenest Employers and a member of the FTSE4Good Index

Enbridge Inc. (TSX:ENB) (NYSE:ENB) - "With first quarter adjusted earnings of $376 million, or $0.50 per share, Enbridge begins 2012 firmly on track to achieve our full year adjusted earnings guidance of $1.58 to $1.74 per share," said Patrick D. Daniel, Chief Executive Officer.

First quarter 2012 earnings of $264 million included unrealized non-cash mark-to-market losses, primarily related to the revaluation of financial derivatives used to risk manage the profitability of forward transportation and storage transactions. These short-term non-cash fluctuations in reported earnings are a result of Enbridge's hedging program, which over the long-term will support the Company's reliable cash flows and capacity for ongoing dividend growth.

In the first quarter, Enbridge announced it had received sufficient commitments from shippers to upsize its proposed Flanagan South Pipeline Project and, with joint venture partner, Enterprise Products Partners, L.P. (Enterprise) to twin the Seaway Crude Pipeline System, bringing Enbridge's expected investment in its U.S. Gulf Coast initiative to $5.2 billion.

"The commitments secured in the open seasons held in the fourth quarter of last year and the first quarter of 2012 will support additional infrastructure to meet the growing transportation needs of Bakken and western Canadian producers and U.S. Gulf Coast refiners, contributing to North America's energy security," said Mr. Daniel. "The new upsized Flanagan South Pipeline, combined with our existing Spearhead Pipeline system, will offer shippers 775,000 barrels per day of capacity from Flanagan to Cushing, with the Seaway Crude Pipeline System reversal and expansion offering capacity of 850,000 barrels per day from Cushing to the Gulf Coast.

"By leveraging existing infrastructure wherever possible, impacts to landowners, communities and the environment will be minimized," added Mr. Daniel.

In green energy, Enbridge added to its growing portfolio of renewable generation assets with the acquisition of a 100% interest in the Silver State North Solar Project (Silver State) development in Nevada.

"Silver State marks Enbridge's entry into the U.S. solar energy market, which offers significant growth opportunities given the excellent solar resource, supportive regulatory environment and expanding portfolio of solar energy projects," said Mr. Daniel. "The project complements Enbridge's growing portfolio of renewable and alternative energy technologies that now includes interests in eight wind farms, four solar projects, a hybrid fuel cell, geothermal and four waste heat recovery facilities. Together, Enbridge has interests in a renewable energy portfolio of almost 1,000 megawatts."

During the quarter, Enbridge continued to be active in capital markets. Noted Mr. Daniel, "Over the past eight months Enbridge has issued $2 billion in preference shares, bolstering our balance sheet as we embark upon the largest slate of growth projects we've ever had before us."

In January, Enbridge was recognized as one of the Corporate Knights Global 100 Most Sustainable Corporations, and in March, FTSE Group reaffirmed Enbridge's membership in the FTSE4Good Index series which identifies companies that meet globally recognized corporate responsibility standards. In April, Enbridge was named one of Canada's Greenest Employers.

"It is gratifying to be recognized for the sustainability of our business model, our commitment to delivering on our social responsibilities, and our continuing efforts to minimize the environmental impact of our activities," said Mr. Daniel. "Enbridge's more than 7,000 employees work tirelessly to achieve our vision of being the leading energy delivery company in North America. I thank all of them for their outstanding work and continuing commitment to our corporate values and to Corporate Social Responsibility."

"Enbridge continues to deliver strong financial performance across our liquids pipelines, gas pipelines and processing, gas distribution and green energy businesses," concluded Mr. Daniel. "We have had exceptional success in securing new projects across all of our business units, we are well positioned to fund our growth and, with a strong start to the year, we expect to continue to deliver superior returns to our investors."

FIRST QUARTER 2012 OVERVIEW

For more information on Enbridge's growth projects and operating results, please see the Management's Discussion and Analysis (MD&A) which is filed on SEDAR and EDGAR and also available on the Company's website at www.enbridge.com/InvestorRelations.aspx.

The decrease in earnings from $364 million for the first quarter of 2011 to $264 million for the first quarter of 2012 was primarily due to the recognition of net unrealized fair value losses of $110 million (2011 - nil) from the revaluation of financial derivatives related to the Company's risk management activities. Contributing to the overall decrease in earnings were lower earnings from Enbridge Gas Distribution (EGD) due to warmer weather. Partially offsetting these quarter-over-quarter declines were increased earnings from Liquids Pipelines as a result of favourable operating performance under the Competitive Toll Settlement.

Enbridge's first quarter adjusted earnings increased 14% to $376 million as a result of increased contributions from Canadian Mainline, which benefited from strong volumes, continued positive performance at EGD reflecting favourable operating performance, and an increase in earnings from Enbridge Energy Partners, L.P. due to stronger results from the liquids and natural gas businesses, as well as higher incentive income. Corporate earnings also contributed to increased first quarter adjusted earnings due to the Company's increased investment in Noverco Inc. (Noverco) and lower residual financing costs.

On May 7, 2012, Enbridge announced Silver State began commercial operation. A 100% interest in the 50-megawatt Silver State development in Clark County, Nevada was acquired in March 2012 at an estimated cost of $0.2 billion. Located 65 kilometers (40 miles) south of Las Vegas, Nevada, Silver State was constructed under a fixed-price engineering, procurement and construction agreement with First Solar. First Solar will provide operations and maintenance services under a long-term contract. NV Energy will purchase the energy output under a 25-year power purchase agreement.

On April 19, 2012, Enbridge announced the closing of the issue of eight million cumulative redeemable preference shares, series J at a price of US$25 per share for aggregate gross proceeds of US$200 million.

On April 16, 2012, the Government of New Brunswick enacted a final rates and tariffs regulation which set limits on gas distribution rates within the province. Enbridge had advised on March 12, 2012, when the regulation was still in draft form, that it faced a potential write down of a significant portion of the value of its investment in Enbridge Gas New Brunswick (EGNB), the New Brunswick gas distribution utility. With the finalization of the regulation, Enbridge has confirmed a write down of $262 million. The impact of this charge was recognized as a subsequent event in the Company's 2011 United States generally accepted accounting principles (U.S. GAAP) consolidated financial statements, voluntarily filed on May 2, 2012.

On April 26, 2012, the Company, Enbridge Energy Distribution Inc. (EEDI) and EGNB, commenced an action against the Province of New Brunswick in the New Brunswick Court of Queen's Bench, claiming damages in the amount of $650 million as a result of the continuing breaches by the Province of the General Franchise Agreement it signed with Enbridge in 1999. Additionally, on May 2, 2012, the Company, EEDI and EGNB filed a Notice of Application with the New Brunswick Court of Queen's Bench seeking a declaration from the Court that the rates and tariffs regulation is invalid. There is no assurance these actions will be successful or will result in any recovery.

On March 29, 2012, Enbridge closed its offering of cumulative redeemable preference shares, series H. Due to strong investor demand, the size of the offering was increased to 14 million shares, for aggregate gross proceeds of $350 million.

Enbridge announced on March 26, 2012, its intent to upsize the capacity of its U.S. Gulf Coast Access projects. The Flanagan South Pipeline from Flanagan, Illinois to Cushing, Oklahoma will be upsized to a 36-inch diameter line with an initial annual capacity of 585,000 barrels per day (bpd). Enbridge, with joint venture partner Enterprise will construct an 805-kilometre (500-mile), 30-inch diameter twin (a parallel line) along the route of their jointly owned Seaway Pipeline, adding 450,000 bpd of capacity to the existing system. The partners will also proceed with construction of an extension from Houston to Port Arthur/Beaumont, adding 560,000 bpd of capacity to that system. The total estimated cost of the Flanagan South Pipeline project, as a result of the larger capacity and pipeline size, has increased from the original US$1.9 billion to US$2.8 billion. In addition, the Enbridge share of the cost of the Seaway Pipeline twin line and extension is expected to be approximately US$1.0 billion.

The increased Flanagan South Pipeline and Seaway Pipeline capacity is required to accommodate additional commitments for Gulf Coast service, originating from both Flanagan and Cushing, received through recently completed second open seasons. Both the Flanagan South Pipeline and Seaway twin pipeline are expected to be in service by mid-2014.

Enterprise and Enbridge are nearing completion of the first phase of the reversal of the Seaway Pipeline, which will provide 150,000 bpd of southbound takeaway capacity from Cushing to the Gulf Coast, anticipated to be in service in May 2012. Following pump station additions and modifications, which are expected to be completed by the first quarter 2013, capacity would increase to 400,000 bpd depending upon the mix of light and heavy grades of crude oil.

On March 22, 2012, Noverco sold 22.5 million Enbridge common shares through a secondary offering. Enbridge's share of the proceeds of approximately $317 million, expected to be received as a dividend from Noverco in the second quarter of 2012, will be used to pay a portion of the Company's quarterly dividend on June 1, 2012.

On February 27, 2012, the Board of Directors of Enbridge announced that Patrick D. Daniel, President and Chief Executive Officer (CEO), will retire at or before the end of 2012. The Board also announced the appointment of Al Monaco, previously President, Gas Pipelines, Green Energy and International, to Enbridge's Board of Directors and to the position of President, effective February 27, 2012. Mr. Daniel will continue as CEO and a member of the Board until his retirement.

On February 23, 2012, Enbridge welcomed the publication of Transport Canada's TERMPOL Review Process Report of the proposed Northern Gateway Project's proposed marine operations. Transport Canada has filed the results of the study with the federal Joint Review Panel (JRP) tasked with assessing the project. The study reviewed the marine operations associated with the Northern Gateway terminal and associated tanker traffic in Canadian waters. The review concluded that: "While there will always be residual risk in any project, after reviewing the proponent's studies and taking into account the proponent's commitments, no regulatory concerns have been identified for the vessels, vessel operations, the proposed routes, navigability, other waterway users and the marine terminal operations associated with vessels supporting the Northern Gateway Project." The TERMPOL report was prepared and approved by Canadian government authorities including Transport Canada; Environment Canada; Fisheries and Oceans Canada; Canadian Coast Guard; and Pacific Pilotage Authority Canada. Further review of the Northern Gateway application by the JRP, as well as other agencies, is ongoing.

On January 18, 2012, Enbridge closed the offering of cumulative redeemable preference shares, series F. Due to strong investor demand, the size of the offering was increased to 20 million shares, resulting in aggregate gross proceeds of $500 million.

May 9, 2012

CALGARY, ALBERTA--(Marketwire - May 9, 2012) -

HIGHLIGHTS

(all financial figures are unaudited and in Canadian dollars)

First quarter earnings were $264 million including unrealized non-cash mark-to-market losses

First quarter adjusted earnings increased 14% to $376 million

U.S. Gulf Coast access initiative upsized to a $5.2 billion investment

Acquisition of a 100% interest in the 50-megawatt Silver State North Solar Project development in Nevada

Issuance of $1.05 billion in preference shares

Enbridge named one of the Global 100 Most Sustainable Corporations, one of Canada's Greenest Employers and a member of the FTSE4Good Index

Enbridge Inc. (TSX:ENB) (NYSE:ENB) - "With first quarter adjusted earnings of $376 million, or $0.50 per share, Enbridge begins 2012 firmly on track to achieve our full year adjusted earnings guidance of $1.58 to $1.74 per share," said Patrick D. Daniel, Chief Executive Officer.

First quarter 2012 earnings of $264 million included unrealized non-cash mark-to-market losses, primarily related to the revaluation of financial derivatives used to risk manage the profitability of forward transportation and storage transactions. These short-term non-cash fluctuations in reported earnings are a result of Enbridge's hedging program, which over the long-term will support the Company's reliable cash flows and capacity for ongoing dividend growth.

In the first quarter, Enbridge announced it had received sufficient commitments from shippers to upsize its proposed Flanagan South Pipeline Project and, with joint venture partner, Enterprise Products Partners, L.P. (Enterprise) to twin the Seaway Crude Pipeline System, bringing Enbridge's expected investment in its U.S. Gulf Coast initiative to $5.2 billion.

"The commitments secured in the open seasons held in the fourth quarter of last year and the first quarter of 2012 will support additional infrastructure to meet the growing transportation needs of Bakken and western Canadian producers and U.S. Gulf Coast refiners, contributing to North America's energy security," said Mr. Daniel. "The new upsized Flanagan South Pipeline, combined with our existing Spearhead Pipeline system, will offer shippers 775,000 barrels per day of capacity from Flanagan to Cushing, with the Seaway Crude Pipeline System reversal and expansion offering capacity of 850,000 barrels per day from Cushing to the Gulf Coast.

"By leveraging existing infrastructure wherever possible, impacts to landowners, communities and the environment will be minimized," added Mr. Daniel.

In green energy, Enbridge added to its growing portfolio of renewable generation assets with the acquisition of a 100% interest in the Silver State North Solar Project (Silver State) development in Nevada.

"Silver State marks Enbridge's entry into the U.S. solar energy market, which offers significant growth opportunities given the excellent solar resource, supportive regulatory environment and expanding portfolio of solar energy projects," said Mr. Daniel. "The project complements Enbridge's growing portfolio of renewable and alternative energy technologies that now includes interests in eight wind farms, four solar projects, a hybrid fuel cell, geothermal and four waste heat recovery facilities. Together, Enbridge has interests in a renewable energy portfolio of almost 1,000 megawatts."

During the quarter, Enbridge continued to be active in capital markets. Noted Mr. Daniel, "Over the past eight months Enbridge has issued $2 billion in preference shares, bolstering our balance sheet as we embark upon the largest slate of growth projects we've ever had before us."

In January, Enbridge was recognized as one of the Corporate Knights Global 100 Most Sustainable Corporations, and in March, FTSE Group reaffirmed Enbridge's membership in the FTSE4Good Index series which identifies companies that meet globally recognized corporate responsibility standards. In April, Enbridge was named one of Canada's Greenest Employers.

"It is gratifying to be recognized for the sustainability of our business model, our commitment to delivering on our social responsibilities, and our continuing efforts to minimize the environmental impact of our activities," said Mr. Daniel. "Enbridge's more than 7,000 employees work tirelessly to achieve our vision of being the leading energy delivery company in North America. I thank all of them for their outstanding work and continuing commitment to our corporate values and to Corporate Social Responsibility."

"Enbridge continues to deliver strong financial performance across our liquids pipelines, gas pipelines and processing, gas distribution and green energy businesses," concluded Mr. Daniel. "We have had exceptional success in securing new projects across all of our business units, we are well positioned to fund our growth and, with a strong start to the year, we expect to continue to deliver superior returns to our investors."

FIRST QUARTER 2012 OVERVIEW

For more information on Enbridge's growth projects and operating results, please see the Management's Discussion and Analysis (MD&A) which is filed on SEDAR and EDGAR and also available on the Company's website at www.enbridge.com/InvestorRelations.aspx.

The decrease in earnings from $364 million for the first quarter of 2011 to $264 million for the first quarter of 2012 was primarily due to the recognition of net unrealized fair value losses of $110 million (2011 - nil) from the revaluation of financial derivatives related to the Company's risk management activities. Contributing to the overall decrease in earnings were lower earnings from Enbridge Gas Distribution (EGD) due to warmer weather. Partially offsetting these quarter-over-quarter declines were increased earnings from Liquids Pipelines as a result of favourable operating performance under the Competitive Toll Settlement.

Enbridge's first quarter adjusted earnings increased 14% to $376 million as a result of increased contributions from Canadian Mainline, which benefited from strong volumes, continued positive performance at EGD reflecting favourable operating performance, and an increase in earnings from Enbridge Energy Partners, L.P. due to stronger results from the liquids and natural gas businesses, as well as higher incentive income. Corporate earnings also contributed to increased first quarter adjusted earnings due to the Company's increased investment in Noverco Inc. (Noverco) and lower residual financing costs.

On May 7, 2012, Enbridge announced Silver State began commercial operation. A 100% interest in the 50-megawatt Silver State development in Clark County, Nevada was acquired in March 2012 at an estimated cost of $0.2 billion. Located 65 kilometers (40 miles) south of Las Vegas, Nevada, Silver State was constructed under a fixed-price engineering, procurement and construction agreement with First Solar. First Solar will provide operations and maintenance services under a long-term contract. NV Energy will purchase the energy output under a 25-year power purchase agreement.

On April 19, 2012, Enbridge announced the closing of the issue of eight million cumulative redeemable preference shares, series J at a price of US$25 per share for aggregate gross proceeds of US$200 million.

On April 16, 2012, the Government of New Brunswick enacted a final rates and tariffs regulation which set limits on gas distribution rates within the province. Enbridge had advised on March 12, 2012, when the regulation was still in draft form, that it faced a potential write down of a significant portion of the value of its investment in Enbridge Gas New Brunswick (EGNB), the New Brunswick gas distribution utility. With the finalization of the regulation, Enbridge has confirmed a write down of $262 million. The impact of this charge was recognized as a subsequent event in the Company's 2011 United States generally accepted accounting principles (U.S. GAAP) consolidated financial statements, voluntarily filed on May 2, 2012.

On April 26, 2012, the Company, Enbridge Energy Distribution Inc. (EEDI) and EGNB, commenced an action against the Province of New Brunswick in the New Brunswick Court of Queen's Bench, claiming damages in the amount of $650 million as a result of the continuing breaches by the Province of the General Franchise Agreement it signed with Enbridge in 1999. Additionally, on May 2, 2012, the Company, EEDI and EGNB filed a Notice of Application with the New Brunswick Court of Queen's Bench seeking a declaration from the Court that the rates and tariffs regulation is invalid. There is no assurance these actions will be successful or will result in any recovery.

On March 29, 2012, Enbridge closed its offering of cumulative redeemable preference shares, series H. Due to strong investor demand, the size of the offering was increased to 14 million shares, for aggregate gross proceeds of $350 million.

Enbridge announced on March 26, 2012, its intent to upsize the capacity of its U.S. Gulf Coast Access projects. The Flanagan South Pipeline from Flanagan, Illinois to Cushing, Oklahoma will be upsized to a 36-inch diameter line with an initial annual capacity of 585,000 barrels per day (bpd). Enbridge, with joint venture partner Enterprise will construct an 805-kilometre (500-mile), 30-inch diameter twin (a parallel line) along the route of their jointly owned Seaway Pipeline, adding 450,000 bpd of capacity to the existing system. The partners will also proceed with construction of an extension from Houston to Port Arthur/Beaumont, adding 560,000 bpd of capacity to that system. The total estimated cost of the Flanagan South Pipeline project, as a result of the larger capacity and pipeline size, has increased from the original US$1.9 billion to US$2.8 billion. In addition, the Enbridge share of the cost of the Seaway Pipeline twin line and extension is expected to be approximately US$1.0 billion.

The increased Flanagan South Pipeline and Seaway Pipeline capacity is required to accommodate additional commitments for Gulf Coast service, originating from both Flanagan and Cushing, received through recently completed second open seasons. Both the Flanagan South Pipeline and Seaway twin pipeline are expected to be in service by mid-2014.

Enterprise and Enbridge are nearing completion of the first phase of the reversal of the Seaway Pipeline, which will provide 150,000 bpd of southbound takeaway capacity from Cushing to the Gulf Coast, anticipated to be in service in May 2012. Following pump station additions and modifications, which are expected to be completed by the first quarter 2013, capacity would increase to 400,000 bpd depending upon the mix of light and heavy grades of crude oil.

On March 22, 2012, Noverco sold 22.5 million Enbridge common shares through a secondary offering. Enbridge's share of the proceeds of approximately $317 million, expected to be received as a dividend from Noverco in the second quarter of 2012, will be used to pay a portion of the Company's quarterly dividend on June 1, 2012.

On February 27, 2012, the Board of Directors of Enbridge announced that Patrick D. Daniel, President and Chief Executive Officer (CEO), will retire at or before the end of 2012. The Board also announced the appointment of Al Monaco, previously President, Gas Pipelines, Green Energy and International, to Enbridge's Board of Directors and to the position of President, effective February 27, 2012. Mr. Daniel will continue as CEO and a member of the Board until his retirement.

On February 23, 2012, Enbridge welcomed the publication of Transport Canada's TERMPOL Review Process Report of the proposed Northern Gateway Project's proposed marine operations. Transport Canada has filed the results of the study with the federal Joint Review Panel (JRP) tasked with assessing the project. The study reviewed the marine operations associated with the Northern Gateway terminal and associated tanker traffic in Canadian waters. The review concluded that: "While there will always be residual risk in any project, after reviewing the proponent's studies and taking into account the proponent's commitments, no regulatory concerns have been identified for the vessels, vessel operations, the proposed routes, navigability, other waterway users and the marine terminal operations associated with vessels supporting the Northern Gateway Project." The TERMPOL report was prepared and approved by Canadian government authorities including Transport Canada; Environment Canada; Fisheries and Oceans Canada; Canadian Coast Guard; and Pacific Pilotage Authority Canada. Further review of the Northern Gateway application by the JRP, as well as other agencies, is ongoing.

On January 18, 2012, Enbridge closed the offering of cumulative redeemable preference shares, series F. Due to strong investor demand, the size of the offering was increased to 20 million shares, resulting in aggregate gross proceeds of $500 million.

dehistorize

bis auf ein Erinnerungsstück verkauft

Antwort auf Beitrag Nr.: 47.108.212 von R-BgO am 05.06.14 13:32:24

nix

verpasst seitdem Enbridge, Spectra Energy agree merger

Enbridge and Spectra Energy on Tuesday entered into a merger agreement in a US$ 28 billion stock-for-stock transaction creating the largest energy infrastructure company in North America. Boards of directors of both companies have unanimously approved the transaction which is expected to close in the first quarter of 2017, subject to shareholders and regulatory approvals, a joint statement reads.

Under the terms of the transaction, Spectra Energy shareholders will receive 0.984 shares of the combined company for each share of Spectra Energy common stock they own, valued at $40.33 per Spectra Energy share.

Upon completion of the transaction, Enbridge shareholders are expected to own approximately 57 percent of the combined company and Spectra Energy shareholders are expected to own approximately 43 percent of the joint company called Enbridge.

The joint company will be headquartered in Calgary with Al Monaco serving as the company’s president and CEO.

Enbridge operates crude oil and liquids transportation systems across Canada and the U.S. and is involved in natural gas gathering, transmission and midstream business, while Spectra Energy’s operations in the United States and Canada include approximately 21,000 miles of natural gas and crude oil pipelines, natural gas storage, crude oil storage as well as natural gas gathering, processing, and local distribution operations.

With the merger, Enbridge will take over Spectra Energy’s stake in the proposed Westcoast Connector Gas Transmission pipeline, planned to transport natural gas to the Prince Rupert LNG liquefaction and export facility on the southwest side of Ridley Island, near Prince Rupert.

2016 war mal wieder ein ganz brauchbares Jahr

Antwort auf Beitrag Nr.: 55.517.133 von R-BgO am 13.08.17 21:09:18

Dividende aktuell 5,6%,

kommt aber aus der Substanz und macht in Canada sowieso keinen Spaß

Antwort auf Beitrag Nr.: 58.429.188 von R-BgO am 12.08.18 12:56:04Enbridge Inc (ENB)

The "Berkshire of Midstream"

Own North America's largest distribution system for energy resources (oil, NG, etc)

99% of cash flow is long-term contracts of 20-30 years. Contracts are with mostly utilities. They get paid no matter what happens and therefore, have no commodity sensitivity

BBB+ credit rating, strong balance sheet

Pay 6% dividend (grow by 10% each year) with a 65% payout ratio and aim to reduce to 55%

Have a 100% self-funded business model, so they are not sensitive to equity markets

Expect 14% annual total return

Quelle: https://seekingalpha.com/article/4195689-5-amazing-stocks-re…

The "Berkshire of Midstream"

Own North America's largest distribution system for energy resources (oil, NG, etc)

99% of cash flow is long-term contracts of 20-30 years. Contracts are with mostly utilities. They get paid no matter what happens and therefore, have no commodity sensitivity