Intermune - 500 Beiträge pro Seite

eröffnet am 27.12.13 15:04:26 von

neuester Beitrag 25.08.14 06:57:04 von

neuester Beitrag 25.08.14 06:57:04 von

Beiträge: 47

ID: 1.189.821

ID: 1.189.821

Aufrufe heute: 0

Gesamt: 9.054

Gesamt: 9.054

Aktive User: 0

ISIN: US45884X1037 · WKN: 936428

Neuigkeiten

Werte aus der Branche Pharmaindustrie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 10,000 | +25,00 | |

| 6,0000 | +25,00 | |

| 0,7113 | +21,90 | |

| 0,6400 | +18,52 | |

| 1,1100 | +15,70 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8410 | -17,06 | |

| 9,7200 | -19,60 | |

| 4,0000 | -27,27 | |

| 2,7280 | -29,14 | |

| 14,510 | -32,32 |

Hallo

vor einigen Jahren wurde die Aktie in diesem Board schon einmal besprochen und dann wurde es ruhig um den Wert. Zwischenzeitlich wurden die Präperate in verschiedenen Ländern auf den Markt gebracht und generieren seit dem steigende Umsätze.

Was fehlt ist noch Amerika.

Aber nicht mehr lange. Bereits in Q2 2014 wird das Präperat dort seine Zulassung finden. Man ist hier ganz klar auf Kurs. Und das wird die Aktie richtig nach vorne bringen. Eine Vervielfachung ist hier möglich.

Per heute fangen wir mit rd. 15 Dollar an. Mal sehen, was die nächsten 2-5 Jahre bringen.

Ich stelle noch einige Berichte und Links ein.

Auf geht´s Intermune.

China

vor einigen Jahren wurde die Aktie in diesem Board schon einmal besprochen und dann wurde es ruhig um den Wert. Zwischenzeitlich wurden die Präperate in verschiedenen Ländern auf den Markt gebracht und generieren seit dem steigende Umsätze.

Was fehlt ist noch Amerika.

Aber nicht mehr lange. Bereits in Q2 2014 wird das Präperat dort seine Zulassung finden. Man ist hier ganz klar auf Kurs. Und das wird die Aktie richtig nach vorne bringen. Eine Vervielfachung ist hier möglich.

Per heute fangen wir mit rd. 15 Dollar an. Mal sehen, was die nächsten 2-5 Jahre bringen.

Ich stelle noch einige Berichte und Links ein.

Auf geht´s Intermune.

China

InterMune (ITMN) has an opportunity to build a market-leading franchise for idiopathic pulmonary fibrosis, or IPF, which represents an attractive market due to its relatively high prevalence, unmet needs, high pricing, and limited competition. The improved sentiment in Europe for Esbriet's launch (also known as pirfenidone) and ASCEND's success probability make InterMune a good stock for long-term growth.

Given the larger homogeneous IPF patient population compared to the CAPACITY studies, I anticipate Esbriet to show a significant statistical improvement (percentage change) in its primary endpoint, for forced vital capacity, or FVC. Esbriet's market is in a growth curve, which bodes very well for its U.S. market potential if the ASCEND data proves to be positive. The ASCEND trial has 70% chances of success when the results are reported in second quarter of 2014. ASCEND can unlock Esbriet's $500 million U.S. opportunity. Additionally, InterMune is currently conducting a safety and tolerability study of Esbriet in systemic sclerosis-related interstitial lung disease, or SSc-ILD, patients with the aim of expanding the drug's usage. The potential from U.S. sales should be at least double the European sales because of the favorable pricing environment.

Given the larger homogeneous IPF patient population compared to the CAPACITY studies, I anticipate Esbriet to show a significant statistical improvement (percentage change) in its primary endpoint, for forced vital capacity, or FVC. Esbriet's market is in a growth curve, which bodes very well for its U.S. market potential if the ASCEND data proves to be positive. The ASCEND trial has 70% chances of success when the results are reported in second quarter of 2014. ASCEND can unlock Esbriet's $500 million U.S. opportunity. Additionally, InterMune is currently conducting a safety and tolerability study of Esbriet in systemic sclerosis-related interstitial lung disease, or SSc-ILD, patients with the aim of expanding the drug's usage. The potential from U.S. sales should be at least double the European sales because of the favorable pricing environment.

BRISBANE, Calif., Oct. 30, 2013 /PRNewswire/ --InterMune, Inc. (NASDAQ: ITMN) today announced results from operations for the third quarter and nine months ended September 30, 2013, and recent business highlights.

InterMune reported Esbriet® (pirfenidone) revenue in the third quarter of 2013 of $19.7 million, compared with $7.5 million of Esbriet revenue in the third quarter of 2012, an increase of 163 percent. Sequentially, Esbriet revenue in the third quarter of 2013 increased 37 percent from $14.4 million in the second quarter of 2013. Esbriet is InterMune's product marketed in Europe and Canada for the treatment of adult patients with mild to moderate idiopathic pulmonary fibrosis (IPF).

Dan Welch, Chairman, Chief Executive Officer and President of InterMune, said, "Notably, Esbriet revenue growth in the third quarter came from both new country launches and growth in countries where the product has been available. During the quarter we launched Esbriet in Italy and the UK, two of the five largest countries in Europe, as well as in Finland and Ireland. Esbriet revenue grew in the third quarter in countries where Esbriet had previously been launched, with Germany, France, the mid-sized European countries and Canada all reporting sequential double-digit growth. We are particularly pleased to report strong growth in Germany during the third quarter, where we see continued market penetration and improved persistence after two full years of marketing Esbriet in that country."

"Regarding the U.S. market, we remain on track to report top-line results from the confirmatory Phase 3 ASCEND study of Esbriet in the second quarter of 2014," Mr. Welch added.

Recent Business and Clinical Development Highlights

■In July 2013, InterMune launched Esbriet in Italy. Up to nine months are needed in Italy for completion of regional procedures before full reimbursement for Esbriet is available in all regions of the country.

■In mid-August 2013, InterMune launched Esbriet in the UK.

■The company noted that revenue in the first few months following launch in newly launched countries such as Italy and the UK may be affected by certain one-time events that are not expected to recur in subsequent quarters.

■Esbriet has now been launched in 13 of InterMune's 15 original targeted European countries in Europe, plus Canada.

■The company continues discussions with regulatory authorities in Spain and the Netherlands, two of InterMune's original 15 top-priority European countries, regarding the pricing and reimbursement of Esbriet. The company now expects that additional clarity on the status of Esbriet reimbursement in these two countries will be available during the first half of 2014.

■The process of gaining reimbursement from private insurance carriers in Canada has been largely completed with 90 percent of private plans now reimbursing Esbriet. Approximately one third of IPF patients in Canada are covered under private insurance. Reimbursement of a new medicine from the public plans (provincial and territorial) typically requires approximately 18-24 months. InterMune currently expects that meaningful reimbursement from the public plans will begin to be secured in the second half of 2014 and the process to be concluded in mid-2015.

■Study conduct in the ASCEND Phase 3 study remains excellent with a level of patient retention in the study that exceeds 90 percent. More than 90 percent of eligible patients who have completed the ASCEND study have decided to enter the RECAP open-label extension study in which all patients receive pirfenidone. ASCEND is InterMune's confirmatory Phase 3 study of Esbriet in 555 IPF patients to support marketing approval in the United States. InterMune currently expects to report top-line results from ASCEND in the second quarter of 2014 and intends to present the results at the May 2014 International Conference of the American Thoracic Society (ATS) in San Diego.

Third Quarter 2013 Financial Results (Unaudited)

InterMune reported total Esbriet revenue in the third quarter of 2013 of $19.7 million, compared with $7.5 million in the third quarter of 2012, an increase of 163 percent. Sequentially, Esbriet revenue in the third quarter of 2013 increased 37 percent from $14.4 million in the second quarter of 2013. Revenue growth in the third quarter of 2013 reflects additional Esbriet launches in Italy, the UK, Finland and Ireland, as well as continued growth in countries in which Esbriet had previously been launched. In addition, Esbriet revenue from non-reimbursed countries contributed about $1.5 million to third quarter 2013 revenue. InterMune reported total revenue for the first nine months of 2013 of $44.6 million, compared with $18.0 million in the first nine months of 2012, an increase of 148 percent.

Research and development (R&D) expenses in the third quarter of 2013 were $27.3 million, compared with $26.2 million in the third quarter of 2012, an increase of four percent. R&D expenses were $80.7 million for the nine months ended September 30, 2013, compared with $74.6 million in the comparable period of 2012, an increase of eight percent. Higher R&D expenses in both the three and nine-month periods reflect increased expenses primarily due to conduct of the ASCEND trial, for which patient enrollment was completed in January of 2013, and the associated expenses of the RECAP study, the open-label roll-over of ASCEND patients.

Selling, general and administrative (SG&A) expenses were $35.2 million in the third quarter of 2013, compared with $23.8 million in the same period a year earlier, an increase of 48 percent. SG&A expenses were $102.5 million in the first nine months of 2013, an increase of 35 percent from $75.7 million in the same period of 2012. Increased SG&A expense for the three and nine-month periods in 2013 compared with the same periods in 2012 is primarily attributed to the continued development of InterMune's commercial infrastructure and investments in the pre-launch and launches of Esbriet in Europe and Canada.

InterMune reported a net loss for the third quarter of 2013 of $49.9 million, or $0.61 per share, compared with a net loss of $40.9 million, or $0.63 per share, in the third quarter of 2012. Net loss for the first nine months of 2013 was $162.7 million, or $2.03 per share, compared with a net loss of $96.8 million, or $1.49 per share, in the comparable nine months of 2012. The net loss in the third quarter of 2013 reflects income from discontinued operations of $0.3 million, or $0.01 per share, net of taxes, related to the divestiture of the company's rights to Actimmune® (interferon gamma-1b), which was completed on June 19, 2012.

As a result of the June 19, 2012 divestiture of Actimmune, historical Actimmune revenue, cost of goods sold, operating costs, and tax impact are reported in discontinued operations in this and future financial statements and therefore do not appear in the comparisons above regarding on-going operations.

As of September 30, 2013, InterMune had cash, cash equivalents and available-for-sale securities of approximately $337.2 million.

Guidance for 2013 Revenue and Operating Expenses

InterMune today updated its forward-looking financial guidance for Esbriet revenue and reiterated its forward-looking financial guidance for operating expenses in 2013:

■Esbriet full year 2013 revenue: currently projected to be in a range of $60 to $70 million (previously projected at $55 to $70 million). With regard to its 2013 revenue guidance, InterMune also noted the following: ■Up to nine months are needed in Italy for completion of all regional procedures before full reimbursement for Esbriet is available in all regions of the country;

■Revenue in the third quarter 2013 in newly launched countries such as Italy and the UK was affected by certain one-time events in the first few months of launch that are not expected to recur;

■Additional information on the status of Esbriet reimbursement in Spain and the Netherlands is currently expected in the first half of 2014. Therefore, InterMune does not expect to receive reimbursement of Esbriet in these countries in 2013;

■Esbriet is reimbursed in Canada for approximately 90 percent of the one-third of IPF patients who are covered under private insurance. No meaningful public reimbursement of Esbriet is expected until the second half of 2014;

■The company anticipates that sequential quarterly revenue growth of Esbriet will continue. The company also anticipates that the very high rate of sequential quarterly growth seen in recent quarters will naturally moderate in subsequent quarters as the one-time effects typical of new country launches are not repeated and the Esbriet revenue base increases in absolute terms.

■R&D expense: currently anticipated to be toward the middle of the previous guidance range of $100 to $120 million.

■SG&A expense: currently anticipated to be toward the lower end of the previous guidance range of $145 to $165 million.

■Total Operating Expenses (R&D and SG&A): currently anticipated to be toward the lower end of the previous guidance range of $245 to $285 million.

Conference Call and Webcast Details

InterMune will host a live webcast of a conference call today at 4:30 p.m. EDT to discuss business highlights and financial results for the third quarter and first nine months of 2013. Interested investors and others may participate in the conference call by dialing 800-709-0218 (U.S.) or +1 212-231-2901 (international), conference ID# 21682163. A replay of the webcast and teleconference will be available approximately three hours after the call, and will remain available on the company's website until the next earnings call.

To access the webcast, please log on to the company's website at www.intermune.com at least 15 minutes prior to the start of the call to ensure adequate time for any software downloads that may be required.

A telephonic replay will be available for 10 business days following the call and can be accessed by dialing 800-633-8284 (U.S.) or +1 402-977-9140 (international), and entering the conference ID# 21682163.

InterMune reported Esbriet® (pirfenidone) revenue in the third quarter of 2013 of $19.7 million, compared with $7.5 million of Esbriet revenue in the third quarter of 2012, an increase of 163 percent. Sequentially, Esbriet revenue in the third quarter of 2013 increased 37 percent from $14.4 million in the second quarter of 2013. Esbriet is InterMune's product marketed in Europe and Canada for the treatment of adult patients with mild to moderate idiopathic pulmonary fibrosis (IPF).

Dan Welch, Chairman, Chief Executive Officer and President of InterMune, said, "Notably, Esbriet revenue growth in the third quarter came from both new country launches and growth in countries where the product has been available. During the quarter we launched Esbriet in Italy and the UK, two of the five largest countries in Europe, as well as in Finland and Ireland. Esbriet revenue grew in the third quarter in countries where Esbriet had previously been launched, with Germany, France, the mid-sized European countries and Canada all reporting sequential double-digit growth. We are particularly pleased to report strong growth in Germany during the third quarter, where we see continued market penetration and improved persistence after two full years of marketing Esbriet in that country."

"Regarding the U.S. market, we remain on track to report top-line results from the confirmatory Phase 3 ASCEND study of Esbriet in the second quarter of 2014," Mr. Welch added.

Recent Business and Clinical Development Highlights

■In July 2013, InterMune launched Esbriet in Italy. Up to nine months are needed in Italy for completion of regional procedures before full reimbursement for Esbriet is available in all regions of the country.

■In mid-August 2013, InterMune launched Esbriet in the UK.

■The company noted that revenue in the first few months following launch in newly launched countries such as Italy and the UK may be affected by certain one-time events that are not expected to recur in subsequent quarters.

■Esbriet has now been launched in 13 of InterMune's 15 original targeted European countries in Europe, plus Canada.

■The company continues discussions with regulatory authorities in Spain and the Netherlands, two of InterMune's original 15 top-priority European countries, regarding the pricing and reimbursement of Esbriet. The company now expects that additional clarity on the status of Esbriet reimbursement in these two countries will be available during the first half of 2014.

■The process of gaining reimbursement from private insurance carriers in Canada has been largely completed with 90 percent of private plans now reimbursing Esbriet. Approximately one third of IPF patients in Canada are covered under private insurance. Reimbursement of a new medicine from the public plans (provincial and territorial) typically requires approximately 18-24 months. InterMune currently expects that meaningful reimbursement from the public plans will begin to be secured in the second half of 2014 and the process to be concluded in mid-2015.

■Study conduct in the ASCEND Phase 3 study remains excellent with a level of patient retention in the study that exceeds 90 percent. More than 90 percent of eligible patients who have completed the ASCEND study have decided to enter the RECAP open-label extension study in which all patients receive pirfenidone. ASCEND is InterMune's confirmatory Phase 3 study of Esbriet in 555 IPF patients to support marketing approval in the United States. InterMune currently expects to report top-line results from ASCEND in the second quarter of 2014 and intends to present the results at the May 2014 International Conference of the American Thoracic Society (ATS) in San Diego.

Third Quarter 2013 Financial Results (Unaudited)

InterMune reported total Esbriet revenue in the third quarter of 2013 of $19.7 million, compared with $7.5 million in the third quarter of 2012, an increase of 163 percent. Sequentially, Esbriet revenue in the third quarter of 2013 increased 37 percent from $14.4 million in the second quarter of 2013. Revenue growth in the third quarter of 2013 reflects additional Esbriet launches in Italy, the UK, Finland and Ireland, as well as continued growth in countries in which Esbriet had previously been launched. In addition, Esbriet revenue from non-reimbursed countries contributed about $1.5 million to third quarter 2013 revenue. InterMune reported total revenue for the first nine months of 2013 of $44.6 million, compared with $18.0 million in the first nine months of 2012, an increase of 148 percent.

Research and development (R&D) expenses in the third quarter of 2013 were $27.3 million, compared with $26.2 million in the third quarter of 2012, an increase of four percent. R&D expenses were $80.7 million for the nine months ended September 30, 2013, compared with $74.6 million in the comparable period of 2012, an increase of eight percent. Higher R&D expenses in both the three and nine-month periods reflect increased expenses primarily due to conduct of the ASCEND trial, for which patient enrollment was completed in January of 2013, and the associated expenses of the RECAP study, the open-label roll-over of ASCEND patients.

Selling, general and administrative (SG&A) expenses were $35.2 million in the third quarter of 2013, compared with $23.8 million in the same period a year earlier, an increase of 48 percent. SG&A expenses were $102.5 million in the first nine months of 2013, an increase of 35 percent from $75.7 million in the same period of 2012. Increased SG&A expense for the three and nine-month periods in 2013 compared with the same periods in 2012 is primarily attributed to the continued development of InterMune's commercial infrastructure and investments in the pre-launch and launches of Esbriet in Europe and Canada.

InterMune reported a net loss for the third quarter of 2013 of $49.9 million, or $0.61 per share, compared with a net loss of $40.9 million, or $0.63 per share, in the third quarter of 2012. Net loss for the first nine months of 2013 was $162.7 million, or $2.03 per share, compared with a net loss of $96.8 million, or $1.49 per share, in the comparable nine months of 2012. The net loss in the third quarter of 2013 reflects income from discontinued operations of $0.3 million, or $0.01 per share, net of taxes, related to the divestiture of the company's rights to Actimmune® (interferon gamma-1b), which was completed on June 19, 2012.

As a result of the June 19, 2012 divestiture of Actimmune, historical Actimmune revenue, cost of goods sold, operating costs, and tax impact are reported in discontinued operations in this and future financial statements and therefore do not appear in the comparisons above regarding on-going operations.

As of September 30, 2013, InterMune had cash, cash equivalents and available-for-sale securities of approximately $337.2 million.

Guidance for 2013 Revenue and Operating Expenses

InterMune today updated its forward-looking financial guidance for Esbriet revenue and reiterated its forward-looking financial guidance for operating expenses in 2013:

■Esbriet full year 2013 revenue: currently projected to be in a range of $60 to $70 million (previously projected at $55 to $70 million). With regard to its 2013 revenue guidance, InterMune also noted the following: ■Up to nine months are needed in Italy for completion of all regional procedures before full reimbursement for Esbriet is available in all regions of the country;

■Revenue in the third quarter 2013 in newly launched countries such as Italy and the UK was affected by certain one-time events in the first few months of launch that are not expected to recur;

■Additional information on the status of Esbriet reimbursement in Spain and the Netherlands is currently expected in the first half of 2014. Therefore, InterMune does not expect to receive reimbursement of Esbriet in these countries in 2013;

■Esbriet is reimbursed in Canada for approximately 90 percent of the one-third of IPF patients who are covered under private insurance. No meaningful public reimbursement of Esbriet is expected until the second half of 2014;

■The company anticipates that sequential quarterly revenue growth of Esbriet will continue. The company also anticipates that the very high rate of sequential quarterly growth seen in recent quarters will naturally moderate in subsequent quarters as the one-time effects typical of new country launches are not repeated and the Esbriet revenue base increases in absolute terms.

■R&D expense: currently anticipated to be toward the middle of the previous guidance range of $100 to $120 million.

■SG&A expense: currently anticipated to be toward the lower end of the previous guidance range of $145 to $165 million.

■Total Operating Expenses (R&D and SG&A): currently anticipated to be toward the lower end of the previous guidance range of $245 to $285 million.

Conference Call and Webcast Details

InterMune will host a live webcast of a conference call today at 4:30 p.m. EDT to discuss business highlights and financial results for the third quarter and first nine months of 2013. Interested investors and others may participate in the conference call by dialing 800-709-0218 (U.S.) or +1 212-231-2901 (international), conference ID# 21682163. A replay of the webcast and teleconference will be available approximately three hours after the call, and will remain available on the company's website until the next earnings call.

To access the webcast, please log on to the company's website at www.intermune.com at least 15 minutes prior to the start of the call to ensure adequate time for any software downloads that may be required.

A telephonic replay will be available for 10 business days following the call and can be accessed by dialing 800-633-8284 (U.S.) or +1 402-977-9140 (international), and entering the conference ID# 21682163.

BRISBANE, Calif., Jan. 9, 2014 /PRNewswire/ --InterMune, Inc. (NASDAQ: ITMN) today announced unaudited revenue for the fourth quarter and year ended December 31, 2013. The company also provided updated 2013 expense guidance, highlighted recent progress in its commercial and other business activities and provided forward-looking guidance for 2014 revenue and expenses.

Dan Welch, Chairman, Chief Executive Officer and President of InterMune said, "2013 was a year of strong execution and growing momentum in every part of our business. Revenue from our Esbriet product, marketed in certain European countries and Canada for the treatment of patients with idiopathic pulmonary fibrosis, or IPF, grew by 168 percent in 2013 to approximately $70.2 million, and we expect Esbriet revenue growth to continue in 2014 by 65-90 percent to $115-$135 million. We are proud to have reported four consecutive quarters of revenue growth during 2013 and nine consecutive quarters of growth since Esbriet was first launched. Our European operations are performing well and we expect cash flows from our European sales to fully support our European operations sometime in the latter half of 2014.

"Today, we announced that we expect to communicate top-line results from the ASCEND study early in the second quarter of 2014, and to present the study results at the American Thoracic Society (ATS) conference in May 2014," Mr. Welch added. "As we closed out 2013, we announced our progress and planned investments in our growing R&D pipeline that build on our commercial momentum with Esbriet, leverage our expertise in IPF and fibrosis and move us toward realizing our strategic vision of becoming a leader in specialty fibrotic diseases."

2013 Highlights

InterMune noted the following achievements in 2013:

■Unaudited Esbriet revenue in the fourth quarter of 2013 totaled approximately $25.6 million, compared with $8.2 million in the fourth quarter of 2012, an increase of 212 percent. Unaudited Esbriet revenue totaled approximately $70.2 million for the full-year 2013, compared with $26.2 million in 2012, an increase of 168 percent.

■Esbriet is now reimbursed, attractively priced and launched in countries that comprise approximately 85 percent of the population in the company's 15 priority countries in Europe.

■In January 2013, InterMune launched Esbriet in Canada, the world's ninth largest pharmaceutical market. Esbriet is now reimbursed by approximately 90 percent of the private insurers in Canada, which cover approximately one third of all IPF patients in that country. InterMune currently expects that meaningful reimbursement from the public plans will begin to be secured in the second half of 2014 and the process to be concluded in mid-2015.

■The last patients will complete treatment later this month in ASCEND, the company's pivotal Phase 3 trial of pirfenidone to support marketing approval in the United States. A safety follow-up period on the last patients must be completed and typical industry procedures conducted to ensure data integrity for all 555 patients at 127 sites prior to reporting top-line results. Top-line results are expected to be reported early in the second quarter of 2014.

■Study conduct in ASCEND remains excellent with a level of patient retention in the study that exceeds 90 percent. More than 95 percent of eligible patients (those patients who remain on blinded pirfenidone or placebo therapy) who have completed the ASCEND study have decided to enter the open-label RECAP extension study. RECAP is a study in which all patients receive pirfenidone. RECAP also includes patients rolled over from the company's prior CAPACITY program which completed in late 2008 and enrolled 779 patients in two Phase 3 studies. RECAP provides valuable long-term safety data that further expands the already large safety database for pirfenidone in patients with IPF.

■In November of 2013, InterMune announced its new strategic growth plan that will guide the company's investments and business focus to achieve its vision of becoming a leader in specialty fibrotic diseases. The strategic growth plan calls for targeted investments that will enable the company to: ■Successfully commercialize Esbriet for IPF in its focus countries;

■Expand the knowledge and use of Esbriet by introducing new formulations, conducting additional clinical studies, exploring possible new indications and implementing patient registries; and

■Grow beyond Esbriet and beyond IPF, by developing compounds from internal R&D efforts and external business development that treat specific fibrotic indications with significant unmet medical need.

■Also in November of 2013, InterMune announced significant progress in advancing the company's strategic growth plan including: ■Initiation in the third quarter of the PANORAMA clinical trial to evaluate the safety and tolerability of N-acetylcysteine (NAC) when added to Esbriet in IPF patients;

■Initiation in October of the LOTUSS clinical trial to evaluate the safety and tolerability of Esbriet in patients with systemic sclerosis-related interstitial lung disease (SSc-ILD). SSc-ILD is an orphan disease with a prevalence approximately as large as that of IPF and with no approved therapies. In November, pirfenidone was granted orphan drug status for the treatment of SSc-ILD in the United States;

■Development of an improved Esbriet formulation intended to enhance patient convenience and potentially lead to greater compliance and persistence;

■Advancement to IND preparation stage of a second-generation pirfenidone compound (pirfenidone analog) which has demonstrated, in animals, greater potency, improved pharmacokinetics and improved dosing schedule and for which an IND filing is currently planned in approximately one year;

■Advancement of an LPA-1 receptor program. LPA-1 is a bioactive lipid receptor that is implicated in fibrosis in numerous organ systems;

■Progress in the company's research efforts aimed at the discovery and evaluation of new compounds representing various antifibrotic mechanisms that have been shown to address important aspects of fibrotic pathophysiology;

■More than a dozen scientific abstracts covering the company's growing antifibrotic research and development pipeline have been submitted for presentation at the American Thoracic Society (ATS) meeting in May 2014.

Esbriet Fourth Quarter and Full-Year 2013 Unaudited Net Sales

Unaudited Esbriet revenue for the fourth quarter of 2013 totaled approximately $25.6 million, compared with $8.2 million in the fourth quarter of 2012, an increase of 212 percent. Unaudited Esbriet revenue totaled approximately $70.2 million for the full-year 2013, compared with $26.2 million in 2012, an increase of 168 percent. Higher revenues in both the three and 12-month periods of 2013 were driven by both increased penetration in countries in which Esbriet was launched in late 2011 or 2012 as well as additional launches of Esbriet in European countries and Canada during 2013.

Guidance for 2013 Operating Expenses

The company refined its financial guidance for 2013 operating expenses:

■R&D expense: currently anticipated to be in the range of $110 to $115 million versus the previous guidance range of $100 to $120 million.

■SG&A expense: currently anticipated to be in the range of $145 to $150 million versus the previous guidance range of $145 to $165 million.

■Total Operating Expenses (R&D and SG&A): currently anticipated to be in the range of $255 to $265 million compared to the previous guidance range of $245 to $285 million.

2014 Outlook and Milestones

■Esbriet in Europe■The company expects to continue its growth of Esbriet revenue in the 13 of 15 targeted countries in which Esbriet has now been launched.

■InterMune expects to have further information on the status of pricing and reimbursement of Esbriet in Spain and the Netherlands in the first half of 2014.

■In late 2014, the company expects to begin commercializing Esbriet in other countries beyond its initial EU priority 15 countries.

■InterMune currently has 170 employees in Europe and expects to expand its European commercial infrastructure to between 190 and 220 employees by the end of 2014 depending upon the need to support potential launches in Spain, the Netherlands and additional European countries beyond the initial first-priority 15 countries.

■ASCEND and U.S. Pre-Launch Preparations ■InterMune currently expects to report top-line results from ASCEND early in the second quarter of 2014 and to present study results at the May 2014 International Conference of the American Thoracic Society (ATS) in San Diego.

■The company plans to provide a timeline for the Esbriet NDA resubmission when it announces the top-line results of ASCEND in the second quarter of 2014.

■InterMune currently plans to expand its current U.S. commercial infrastructure in 2014 and to invest during the year in various pre-launch preparations for Esbriet. The majority of headcount additions are expected to occur in the second half of 2014 and are premised on certain key events such as the results of the ASCEND study, filing of the U.S. NDA resubmission and progress on regulatory milestones.

Guidance for 2014 Revenue and Operating Expenses

The company provided its forward-looking financial guidance for Esbriet revenue and operating expenses in 2014. The revenue projections underscore the strong momentum in Esbriet revenue growth. The operating expense guidance reflects the investment the company is making to simultaneously fund the continued growth of Esbriet revenue in the EU and Canada, build its U.S. commercial infrastructure to prepare for the expected U.S. launch of Esbriet and advance its growing antifibrotic R&D pipeline:

■Esbriet revenue: currently projected to be in a range of $115 to $135 million, compared to $70.2 million in 2013. The guidance range includes the recent decrease in the mandatory industry rebate in Germany from 16% to a maximum of 7% of gross revenues effective January 1, 2014. The revenue guidance range includes potential Esbriet revenues from Spain and the Netherlands and potential revenues in late 2014 from other countries beyond the first-priority 15 EU countries. InterMune expects to have additional clarity on the status of Esbriet reimbursement in Spain and the Netherlands during the first half of 2014. The revenue guidance also accounts for the projected time needed to address public reimbursement procedures in Canada before meaningful Esbriet revenues can be achieved in all provinces and territories in that country.

■Research and Development (R&D) expense: currently anticipated to be in a range of $110 to $120 million. The anticipated increase of approximately 0-5 percent in R&D expense in 2014 when compared to 2013 is accounted for by a reduction in expense from the completion of the ASCEND trial in the second quarter of 2014 which is more than offset by several factors: increased expenses in 2014 related to the full-year effect on expenses of the RECAP study (during 2013, an increasing number of patients in the ASCEND study were enrolledinto the open-label RECAP study); expenses related to the expected preparation, submission and prosecution of the Esbriet NDA resubmission; and new investments in the company's advancing research, pre-clinical and clinical development programs focused on antifibrotic therapies as mentioned above.

■Selling, General and Administrative (SG&A) expense: currently anticipated to be in a range of $210 to $225 million. The approximate 45-50 percent growth in SG&A expense in 2014 when compared to 2013 is anticipated to come from three areas in descending order of magnitude: infrastructure building and commercial pre-launch preparations for the expected launch of Esbriet in the United States in 2015; the full-year effect on 2014 expenses of commercial organizations that were established in the summer of 2013 in Italy and the UK and additional infrastructure to support the marketing of Esbriet in European countries beyond the company's 15 initial targeted EU markets. Investments in the U.S. will be tied to certain key events such as the results of the ASCEND study, filing of the U.S. NDA resubmission and progress on regulatory milestones.

■Total Operating Expenses (R&D and SG&A): currently anticipated to be in a range of $320 to $345 million.

About ASCEND

ASCEND is a multinational, randomized, double-blind, placebo controlled Phase 3 trial of 555 patients designed to evaluate the safety and efficacy of Esbriet® (pirfenidone) in IPF patients with mild to moderate impairment in lung function. Patients were randomly assigned 1:1 to receive oral pirfenidone (2403 mg/day) or placebo. The primary endpoint is change in percent predicted forced vital capacity (FVC), with the primary outcome analysis a Rank ANCOVA at Week 52. The magnitude of effect will be presented as a categorical measure of the proportion of patients with decrements of less than 0% or greater than 10% at Week 52. The study was conservatively powered by estimating the treatment effect size of pirfenidone based on the results of the intent-to-treat analysis of the pooled results of the two CAPACITY Phase 3 studies at Week 52.

The two key secondary endpoints are change in six-minute walk test (6MWT) distance and progression-free survival, which will be based on the earliest of time to death, FVC decrement of 10% or greater, or decrement in 6MWT distance of 50 meters or more. Additional secondary endpoints in ASCEND include all-cause mortality and on-treatment IPF-related deaths (both evaluated independently in ASCEND as well as pooled with the previous CAPACITY data), and dyspnea. Based on the relatively low mortality rate in this patient population, ASCEND is not powered for the mortality endpoint, even after pooling with CAPACITY data.

Relative to InterMune's two previous studies of pirfenidone in IPF (CAPACITY), the entry criteria for ASCEND were refined to enrich the study population for patients who are more likely to experience decline in lung function and disease progression during the study. This included modest changes to the eligibility criteria for FVC, DLco, FEV1/FVC ratio, and time since diagnosis. These changes increase the likelihood of demonstrating significant findings on multiple endpoints in ASCEND. The median baseline percent predicted FVC of patients enrolled in ASCEND is 68% compared with 73% in CAPACITY.

About IPF

Idiopathic pulmonary fibrosis (IPF) is an irreversible, unpredictable and ultimately fatal disease characterized by scarring (fibrosis) in the lungs, hindering the ability to process oxygen. IPF inevitably leads to worsening lung function and exercise tolerance, and shortness of breath. Every IPF patient follows a different and unpredictable course and it is not possible to predict if a patient will progress slowly or rapidly, or when the rate of decline may change. Periods of transient clinical stability in IPF, should they occur, inevitably give way to continued disease progression. The median survival time from diagnosis is two to five years, with a five-year survival rate of approximately 20-40 percent, which makes IPF more rapidly lethal than many malignancies, including breast, ovarian and colorectal cancers. IPF typically occurs in patients over the age of 45, and tends to affect slightly more men than women.

About InterMune

InterMune is a biotechnology company focused on the research, development and commercialization of innovative therapies in pulmonology and orphan fibrotic diseases. In pulmonology, the company is focused on therapies for the treatment of idiopathic pulmonary fibrosis (IPF), a progressive, irreversible, unpredictable and ultimately fatal lung disease. Pirfenidone, the only medicine approved for IPF anywhere in the world, is approved for marketing by InterMune in the EU and Canada. Esbriet® is not approved for sale in the United States but is currently in a Phase 3 clinical trial to support regulatory registration in the United States. InterMune's research programs are focused on the discovery of targeted, small-molecule therapeutics and biomarkers to treat and monitor serious pulmonary and fibrotic diseases.For additional information about InterMune and its R&D pipeline, please visit www.intermune.com.

Forward-Looking Statements

This news release contains forward-looking statements within the meaning of section 21E of the Securities Exchange Act of 1934, as amended, that reflect InterMune's judgment and involve risks and uncertainties as of the date of this release, including without limitation InterMune's expectations regarding continued growth of Esbriet revenue in 2014 and that cash flow from sales of Esbriet in Europe will fully support its European operations sometime in the latter half of 2014; InterMune's expectation regarding the results of the ASCEND study, including the time of availability and announcement of top-line data from the study, and the prospects for success thereof; its anticipated timing of concluding pricing and reimbursement discussions and/or initiating commercial launches for Esbriet in various European countries, including the Netherlands and Spain, and expectations regarding the potential for sales in these countries to contribute to InterMune revenue; InterMune's expectations regarding the timing of the reimbursement process in Canada; InterMune's expectations regarding the advancement and timing of submission of an IND for a second-generation pirfenidone compound; InterMune's expectations and belief of growing beyond Esbriet and IPF; its expectations regarding the growth of its European commercial infrastructure; InterMune's expectations regarding the timing of building its U.S. commercial infrastructure and preparations for a pre-launch of Esbriet in the U.S.; its projected operating expense for 2013; and InterMune's projected revenue from sales of Esbriet and operating expenses for 2014. All forward-looking statements and other information included in this press release are based on information available to InterMune as of the date hereof, and InterMune assumes no obligation to update any such forward-looking statements or information. InterMune's actual results could differ materially from those described in InterMune's forward-looking statements.

Other factors that could cause or contribute to such differences include, but are not limited to, those discussed in detail under the heading "Risk Factors" in InterMune's most recent annual report on Form 10-K filed with the Securities and Exchange Commission (SEC) on March 1, 2013 (the "Form 10-K"), most recent quarterly report on Form 10-Q filed with the SEC on November 1, 2013 (the "Form 10-Q") and other periodic reports filed with the SEC, including but not limited to the following: (i) the risks related to the uncertain, lengthy and expensive clinical development process for the company's product candidates, including having no unexpected safety, toxicology, clinical or other issues and having no unexpected clinical trial results such as unexpected new clinical data and unexpected additional analysis of existing clinical data; (ii) risks related to the regulatory process for the company's product candidates, including the possibility that the results of the new 52-week Phase 3 clinical trial (ASCEND) having an FVC endpoint may not be satisfactory to the FDA for InterMune to receive regulatory approval for pirfenidone in the United States; (iii) risks related to unexpected regulatory actions or delays or government regulation generally; (iv) risks related to the company's manufacturing strategy, which relies on third-party manufacturers and which exposes InterMune to additional risks where it may lose potential revenue; (v) government, industry and general public pricing pressures; (vi) risks related to our ability to successfully launch and commercialize Esbriet in Europe and Canada, including successfully establishing a commercial operation in Europe and Canada and receiving favorable governmental pricing and reimbursement approvals in the various European countries and securing coverage from private insurance plans and reimbursement from public (provincial) drug reimbursement plans in Canada; and (vii) InterMune's ability to obtain or maintain patent or other proprietary intellectual property protections. The risks and other factors discussed above should be considered only in connection with the fully discussed risks and other factors discussed in detail in the Form 10-K and Form 10-Q and InterMune's other periodic reports filed with the SEC, all of which are available via InterMune's web site at www.intermune.com.

Dan Welch, Chairman, Chief Executive Officer and President of InterMune said, "2013 was a year of strong execution and growing momentum in every part of our business. Revenue from our Esbriet product, marketed in certain European countries and Canada for the treatment of patients with idiopathic pulmonary fibrosis, or IPF, grew by 168 percent in 2013 to approximately $70.2 million, and we expect Esbriet revenue growth to continue in 2014 by 65-90 percent to $115-$135 million. We are proud to have reported four consecutive quarters of revenue growth during 2013 and nine consecutive quarters of growth since Esbriet was first launched. Our European operations are performing well and we expect cash flows from our European sales to fully support our European operations sometime in the latter half of 2014.

"Today, we announced that we expect to communicate top-line results from the ASCEND study early in the second quarter of 2014, and to present the study results at the American Thoracic Society (ATS) conference in May 2014," Mr. Welch added. "As we closed out 2013, we announced our progress and planned investments in our growing R&D pipeline that build on our commercial momentum with Esbriet, leverage our expertise in IPF and fibrosis and move us toward realizing our strategic vision of becoming a leader in specialty fibrotic diseases."

2013 Highlights

InterMune noted the following achievements in 2013:

■Unaudited Esbriet revenue in the fourth quarter of 2013 totaled approximately $25.6 million, compared with $8.2 million in the fourth quarter of 2012, an increase of 212 percent. Unaudited Esbriet revenue totaled approximately $70.2 million for the full-year 2013, compared with $26.2 million in 2012, an increase of 168 percent.

■Esbriet is now reimbursed, attractively priced and launched in countries that comprise approximately 85 percent of the population in the company's 15 priority countries in Europe.

■In January 2013, InterMune launched Esbriet in Canada, the world's ninth largest pharmaceutical market. Esbriet is now reimbursed by approximately 90 percent of the private insurers in Canada, which cover approximately one third of all IPF patients in that country. InterMune currently expects that meaningful reimbursement from the public plans will begin to be secured in the second half of 2014 and the process to be concluded in mid-2015.

■The last patients will complete treatment later this month in ASCEND, the company's pivotal Phase 3 trial of pirfenidone to support marketing approval in the United States. A safety follow-up period on the last patients must be completed and typical industry procedures conducted to ensure data integrity for all 555 patients at 127 sites prior to reporting top-line results. Top-line results are expected to be reported early in the second quarter of 2014.

■Study conduct in ASCEND remains excellent with a level of patient retention in the study that exceeds 90 percent. More than 95 percent of eligible patients (those patients who remain on blinded pirfenidone or placebo therapy) who have completed the ASCEND study have decided to enter the open-label RECAP extension study. RECAP is a study in which all patients receive pirfenidone. RECAP also includes patients rolled over from the company's prior CAPACITY program which completed in late 2008 and enrolled 779 patients in two Phase 3 studies. RECAP provides valuable long-term safety data that further expands the already large safety database for pirfenidone in patients with IPF.

■In November of 2013, InterMune announced its new strategic growth plan that will guide the company's investments and business focus to achieve its vision of becoming a leader in specialty fibrotic diseases. The strategic growth plan calls for targeted investments that will enable the company to: ■Successfully commercialize Esbriet for IPF in its focus countries;

■Expand the knowledge and use of Esbriet by introducing new formulations, conducting additional clinical studies, exploring possible new indications and implementing patient registries; and

■Grow beyond Esbriet and beyond IPF, by developing compounds from internal R&D efforts and external business development that treat specific fibrotic indications with significant unmet medical need.

■Also in November of 2013, InterMune announced significant progress in advancing the company's strategic growth plan including: ■Initiation in the third quarter of the PANORAMA clinical trial to evaluate the safety and tolerability of N-acetylcysteine (NAC) when added to Esbriet in IPF patients;

■Initiation in October of the LOTUSS clinical trial to evaluate the safety and tolerability of Esbriet in patients with systemic sclerosis-related interstitial lung disease (SSc-ILD). SSc-ILD is an orphan disease with a prevalence approximately as large as that of IPF and with no approved therapies. In November, pirfenidone was granted orphan drug status for the treatment of SSc-ILD in the United States;

■Development of an improved Esbriet formulation intended to enhance patient convenience and potentially lead to greater compliance and persistence;

■Advancement to IND preparation stage of a second-generation pirfenidone compound (pirfenidone analog) which has demonstrated, in animals, greater potency, improved pharmacokinetics and improved dosing schedule and for which an IND filing is currently planned in approximately one year;

■Advancement of an LPA-1 receptor program. LPA-1 is a bioactive lipid receptor that is implicated in fibrosis in numerous organ systems;

■Progress in the company's research efforts aimed at the discovery and evaluation of new compounds representing various antifibrotic mechanisms that have been shown to address important aspects of fibrotic pathophysiology;

■More than a dozen scientific abstracts covering the company's growing antifibrotic research and development pipeline have been submitted for presentation at the American Thoracic Society (ATS) meeting in May 2014.

Esbriet Fourth Quarter and Full-Year 2013 Unaudited Net Sales

Unaudited Esbriet revenue for the fourth quarter of 2013 totaled approximately $25.6 million, compared with $8.2 million in the fourth quarter of 2012, an increase of 212 percent. Unaudited Esbriet revenue totaled approximately $70.2 million for the full-year 2013, compared with $26.2 million in 2012, an increase of 168 percent. Higher revenues in both the three and 12-month periods of 2013 were driven by both increased penetration in countries in which Esbriet was launched in late 2011 or 2012 as well as additional launches of Esbriet in European countries and Canada during 2013.

Guidance for 2013 Operating Expenses

The company refined its financial guidance for 2013 operating expenses:

■R&D expense: currently anticipated to be in the range of $110 to $115 million versus the previous guidance range of $100 to $120 million.

■SG&A expense: currently anticipated to be in the range of $145 to $150 million versus the previous guidance range of $145 to $165 million.

■Total Operating Expenses (R&D and SG&A): currently anticipated to be in the range of $255 to $265 million compared to the previous guidance range of $245 to $285 million.

2014 Outlook and Milestones

■Esbriet in Europe■The company expects to continue its growth of Esbriet revenue in the 13 of 15 targeted countries in which Esbriet has now been launched.

■InterMune expects to have further information on the status of pricing and reimbursement of Esbriet in Spain and the Netherlands in the first half of 2014.

■In late 2014, the company expects to begin commercializing Esbriet in other countries beyond its initial EU priority 15 countries.

■InterMune currently has 170 employees in Europe and expects to expand its European commercial infrastructure to between 190 and 220 employees by the end of 2014 depending upon the need to support potential launches in Spain, the Netherlands and additional European countries beyond the initial first-priority 15 countries.

■ASCEND and U.S. Pre-Launch Preparations ■InterMune currently expects to report top-line results from ASCEND early in the second quarter of 2014 and to present study results at the May 2014 International Conference of the American Thoracic Society (ATS) in San Diego.

■The company plans to provide a timeline for the Esbriet NDA resubmission when it announces the top-line results of ASCEND in the second quarter of 2014.

■InterMune currently plans to expand its current U.S. commercial infrastructure in 2014 and to invest during the year in various pre-launch preparations for Esbriet. The majority of headcount additions are expected to occur in the second half of 2014 and are premised on certain key events such as the results of the ASCEND study, filing of the U.S. NDA resubmission and progress on regulatory milestones.

Guidance for 2014 Revenue and Operating Expenses

The company provided its forward-looking financial guidance for Esbriet revenue and operating expenses in 2014. The revenue projections underscore the strong momentum in Esbriet revenue growth. The operating expense guidance reflects the investment the company is making to simultaneously fund the continued growth of Esbriet revenue in the EU and Canada, build its U.S. commercial infrastructure to prepare for the expected U.S. launch of Esbriet and advance its growing antifibrotic R&D pipeline:

■Esbriet revenue: currently projected to be in a range of $115 to $135 million, compared to $70.2 million in 2013. The guidance range includes the recent decrease in the mandatory industry rebate in Germany from 16% to a maximum of 7% of gross revenues effective January 1, 2014. The revenue guidance range includes potential Esbriet revenues from Spain and the Netherlands and potential revenues in late 2014 from other countries beyond the first-priority 15 EU countries. InterMune expects to have additional clarity on the status of Esbriet reimbursement in Spain and the Netherlands during the first half of 2014. The revenue guidance also accounts for the projected time needed to address public reimbursement procedures in Canada before meaningful Esbriet revenues can be achieved in all provinces and territories in that country.

■Research and Development (R&D) expense: currently anticipated to be in a range of $110 to $120 million. The anticipated increase of approximately 0-5 percent in R&D expense in 2014 when compared to 2013 is accounted for by a reduction in expense from the completion of the ASCEND trial in the second quarter of 2014 which is more than offset by several factors: increased expenses in 2014 related to the full-year effect on expenses of the RECAP study (during 2013, an increasing number of patients in the ASCEND study were enrolledinto the open-label RECAP study); expenses related to the expected preparation, submission and prosecution of the Esbriet NDA resubmission; and new investments in the company's advancing research, pre-clinical and clinical development programs focused on antifibrotic therapies as mentioned above.

■Selling, General and Administrative (SG&A) expense: currently anticipated to be in a range of $210 to $225 million. The approximate 45-50 percent growth in SG&A expense in 2014 when compared to 2013 is anticipated to come from three areas in descending order of magnitude: infrastructure building and commercial pre-launch preparations for the expected launch of Esbriet in the United States in 2015; the full-year effect on 2014 expenses of commercial organizations that were established in the summer of 2013 in Italy and the UK and additional infrastructure to support the marketing of Esbriet in European countries beyond the company's 15 initial targeted EU markets. Investments in the U.S. will be tied to certain key events such as the results of the ASCEND study, filing of the U.S. NDA resubmission and progress on regulatory milestones.

■Total Operating Expenses (R&D and SG&A): currently anticipated to be in a range of $320 to $345 million.

About ASCEND

ASCEND is a multinational, randomized, double-blind, placebo controlled Phase 3 trial of 555 patients designed to evaluate the safety and efficacy of Esbriet® (pirfenidone) in IPF patients with mild to moderate impairment in lung function. Patients were randomly assigned 1:1 to receive oral pirfenidone (2403 mg/day) or placebo. The primary endpoint is change in percent predicted forced vital capacity (FVC), with the primary outcome analysis a Rank ANCOVA at Week 52. The magnitude of effect will be presented as a categorical measure of the proportion of patients with decrements of less than 0% or greater than 10% at Week 52. The study was conservatively powered by estimating the treatment effect size of pirfenidone based on the results of the intent-to-treat analysis of the pooled results of the two CAPACITY Phase 3 studies at Week 52.

The two key secondary endpoints are change in six-minute walk test (6MWT) distance and progression-free survival, which will be based on the earliest of time to death, FVC decrement of 10% or greater, or decrement in 6MWT distance of 50 meters or more. Additional secondary endpoints in ASCEND include all-cause mortality and on-treatment IPF-related deaths (both evaluated independently in ASCEND as well as pooled with the previous CAPACITY data), and dyspnea. Based on the relatively low mortality rate in this patient population, ASCEND is not powered for the mortality endpoint, even after pooling with CAPACITY data.

Relative to InterMune's two previous studies of pirfenidone in IPF (CAPACITY), the entry criteria for ASCEND were refined to enrich the study population for patients who are more likely to experience decline in lung function and disease progression during the study. This included modest changes to the eligibility criteria for FVC, DLco, FEV1/FVC ratio, and time since diagnosis. These changes increase the likelihood of demonstrating significant findings on multiple endpoints in ASCEND. The median baseline percent predicted FVC of patients enrolled in ASCEND is 68% compared with 73% in CAPACITY.

About IPF

Idiopathic pulmonary fibrosis (IPF) is an irreversible, unpredictable and ultimately fatal disease characterized by scarring (fibrosis) in the lungs, hindering the ability to process oxygen. IPF inevitably leads to worsening lung function and exercise tolerance, and shortness of breath. Every IPF patient follows a different and unpredictable course and it is not possible to predict if a patient will progress slowly or rapidly, or when the rate of decline may change. Periods of transient clinical stability in IPF, should they occur, inevitably give way to continued disease progression. The median survival time from diagnosis is two to five years, with a five-year survival rate of approximately 20-40 percent, which makes IPF more rapidly lethal than many malignancies, including breast, ovarian and colorectal cancers. IPF typically occurs in patients over the age of 45, and tends to affect slightly more men than women.

About InterMune

InterMune is a biotechnology company focused on the research, development and commercialization of innovative therapies in pulmonology and orphan fibrotic diseases. In pulmonology, the company is focused on therapies for the treatment of idiopathic pulmonary fibrosis (IPF), a progressive, irreversible, unpredictable and ultimately fatal lung disease. Pirfenidone, the only medicine approved for IPF anywhere in the world, is approved for marketing by InterMune in the EU and Canada. Esbriet® is not approved for sale in the United States but is currently in a Phase 3 clinical trial to support regulatory registration in the United States. InterMune's research programs are focused on the discovery of targeted, small-molecule therapeutics and biomarkers to treat and monitor serious pulmonary and fibrotic diseases.For additional information about InterMune and its R&D pipeline, please visit www.intermune.com.

Forward-Looking Statements

This news release contains forward-looking statements within the meaning of section 21E of the Securities Exchange Act of 1934, as amended, that reflect InterMune's judgment and involve risks and uncertainties as of the date of this release, including without limitation InterMune's expectations regarding continued growth of Esbriet revenue in 2014 and that cash flow from sales of Esbriet in Europe will fully support its European operations sometime in the latter half of 2014; InterMune's expectation regarding the results of the ASCEND study, including the time of availability and announcement of top-line data from the study, and the prospects for success thereof; its anticipated timing of concluding pricing and reimbursement discussions and/or initiating commercial launches for Esbriet in various European countries, including the Netherlands and Spain, and expectations regarding the potential for sales in these countries to contribute to InterMune revenue; InterMune's expectations regarding the timing of the reimbursement process in Canada; InterMune's expectations regarding the advancement and timing of submission of an IND for a second-generation pirfenidone compound; InterMune's expectations and belief of growing beyond Esbriet and IPF; its expectations regarding the growth of its European commercial infrastructure; InterMune's expectations regarding the timing of building its U.S. commercial infrastructure and preparations for a pre-launch of Esbriet in the U.S.; its projected operating expense for 2013; and InterMune's projected revenue from sales of Esbriet and operating expenses for 2014. All forward-looking statements and other information included in this press release are based on information available to InterMune as of the date hereof, and InterMune assumes no obligation to update any such forward-looking statements or information. InterMune's actual results could differ materially from those described in InterMune's forward-looking statements.

Other factors that could cause or contribute to such differences include, but are not limited to, those discussed in detail under the heading "Risk Factors" in InterMune's most recent annual report on Form 10-K filed with the Securities and Exchange Commission (SEC) on March 1, 2013 (the "Form 10-K"), most recent quarterly report on Form 10-Q filed with the SEC on November 1, 2013 (the "Form 10-Q") and other periodic reports filed with the SEC, including but not limited to the following: (i) the risks related to the uncertain, lengthy and expensive clinical development process for the company's product candidates, including having no unexpected safety, toxicology, clinical or other issues and having no unexpected clinical trial results such as unexpected new clinical data and unexpected additional analysis of existing clinical data; (ii) risks related to the regulatory process for the company's product candidates, including the possibility that the results of the new 52-week Phase 3 clinical trial (ASCEND) having an FVC endpoint may not be satisfactory to the FDA for InterMune to receive regulatory approval for pirfenidone in the United States; (iii) risks related to unexpected regulatory actions or delays or government regulation generally; (iv) risks related to the company's manufacturing strategy, which relies on third-party manufacturers and which exposes InterMune to additional risks where it may lose potential revenue; (v) government, industry and general public pricing pressures; (vi) risks related to our ability to successfully launch and commercialize Esbriet in Europe and Canada, including successfully establishing a commercial operation in Europe and Canada and receiving favorable governmental pricing and reimbursement approvals in the various European countries and securing coverage from private insurance plans and reimbursement from public (provincial) drug reimbursement plans in Canada; and (vii) InterMune's ability to obtain or maintain patent or other proprietary intellectual property protections. The risks and other factors discussed above should be considered only in connection with the fully discussed risks and other factors discussed in detail in the Form 10-K and Form 10-Q and InterMune's other periodic reports filed with the SEC, all of which are available via InterMune's web site at www.intermune.com.

Immer noch kein weiterer Aktionär, obwohl "dieser" Intermune so schön empfohlen hat.

Na ja. Mir reicht es, wenn bei 40-50 Euro alle reinwollen....

Na ja. Mir reicht es, wenn bei 40-50 Euro alle reinwollen....

Hallo, ich bin bei 13,40€ eingestiegen und werde wenns unter 10 geht nochmals nachlegen da ich auch von diesem Wert überzeugt bin.

Gruss Elisa

Gruss Elisa

ich bin bei so einem kurs eingestiegen,

so ein paar Stück sind auch ins Depot gewandert!

gibt es was neues weil der kurs um 13% abstürtzt?

ich habe nach gekauft, ich habe keine nachrichten gefunden warum die Aktie um 13% abgestürzt ist. für mich nochmal gelgenhein günstig einzukaufen.

Antwort auf Beitrag Nr.: 46.353.927 von mecknes1 am 31.01.14 16:30:44über Twitter lässt sich meistens schnell der Grund finden... https://twitter.com/search?q=%24itmn&src=typd

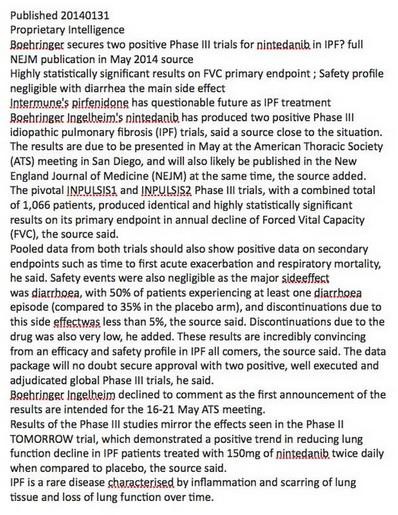

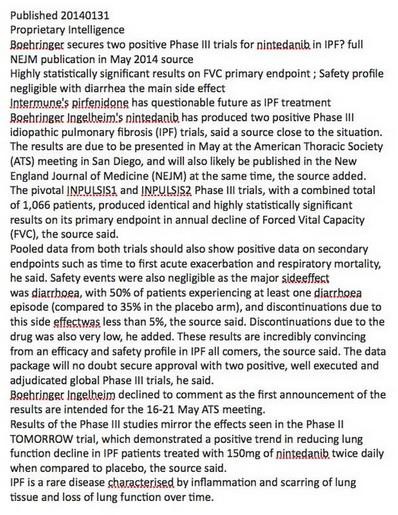

Es gibt Gerüchte, dass ein Konkurrenzprodukt von Boehringer erfolgreich sein soll:

http://www.streetinsider.com/Analyst+Comments/InterMune+%28I…

InterMune Inc. (NASDAQ: ITMN) stock declined on Friday after a journalist posted tweets suggesting that competitor Boehringer Ingelheim's (BI) nintedanib's ph.III results in IPF are available. Analyst Brian Abrahams of Wells Fargo contacted Boehringer Ingelheim to ask about the data release and they said results have not been disclosed.

"We had the opportunity to speak with BI directly, who told us that its data have NOT been released, and will not be disclosed until the ATS meeting in May (they will not be toplined prior to this)," said Abrahams.

"We have not been able to contact the journalist, and it is still possible that they received some leaked information about the study. However, from what we can tell, it appears that the competitor data are not yet disclosed, and the reports may have been erroneous. We are continuing to follow up on this."

"We continue to like ITMN's reward/risk going into its ph.III ASCEND data, and would use any weakness on confusion related to competitor data as a buying opportunity," he added.

Wells Fargo has an Outperform rating on InterMune Inc.

https://twitter.com/adamfeuerstein/status/429293200189034497…

Excerpt from @BioPharmInsight story on BI’s IPF drug. $ITMN

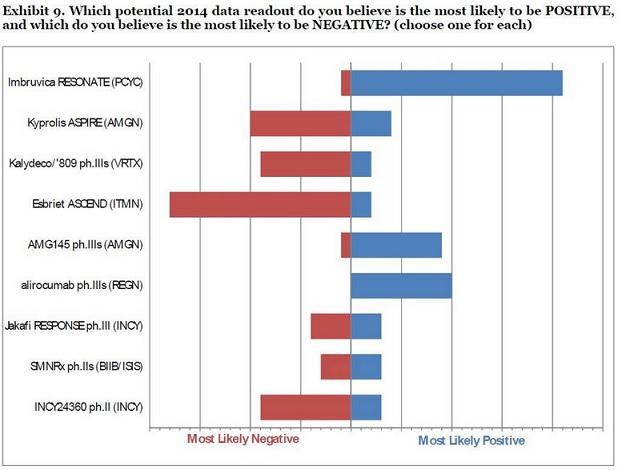

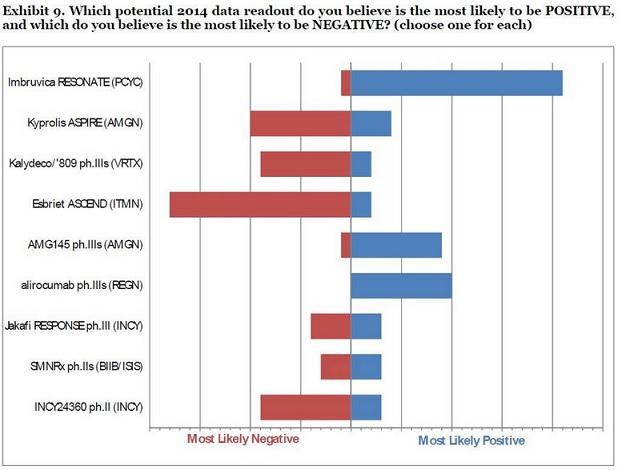

Insgesamt werden die Chancen von ITMN offensichtlich nicht gut beurteilt:

Gruß

ipollit

Es gibt Gerüchte, dass ein Konkurrenzprodukt von Boehringer erfolgreich sein soll:

http://www.streetinsider.com/Analyst+Comments/InterMune+%28I…

InterMune Inc. (NASDAQ: ITMN) stock declined on Friday after a journalist posted tweets suggesting that competitor Boehringer Ingelheim's (BI) nintedanib's ph.III results in IPF are available. Analyst Brian Abrahams of Wells Fargo contacted Boehringer Ingelheim to ask about the data release and they said results have not been disclosed.

"We had the opportunity to speak with BI directly, who told us that its data have NOT been released, and will not be disclosed until the ATS meeting in May (they will not be toplined prior to this)," said Abrahams.

"We have not been able to contact the journalist, and it is still possible that they received some leaked information about the study. However, from what we can tell, it appears that the competitor data are not yet disclosed, and the reports may have been erroneous. We are continuing to follow up on this."

"We continue to like ITMN's reward/risk going into its ph.III ASCEND data, and would use any weakness on confusion related to competitor data as a buying opportunity," he added.

Wells Fargo has an Outperform rating on InterMune Inc.

https://twitter.com/adamfeuerstein/status/429293200189034497…

Excerpt from @BioPharmInsight story on BI’s IPF drug. $ITMN

Insgesamt werden die Chancen von ITMN offensichtlich nicht gut beurteilt:

Gruß

ipollit

also ich sehe das anders, das hört sich schlimmer als es ist

man sollte ich darüber im klaren sein, dass das "Teil" in Europa und Canada zugelassen ist! Warum sollte dann in Amerkia es dann anders sein?

Feuerstein kennt sich mit Ariad auch sehr gut aus

Hallo, die Gegenbewegung ist am laufen, der Titel ist ja auch viel zu stark abverkauft worden. Ich gehe von einer starken Reversal in den nächsten Tagen aus.

Antwort auf Beitrag Nr.: 46.381.770 von tancho am 05.02.14 11:40:09"man sollte ich darüber im klaren sein, dass das "Teil" in Europa und Canada zugelassen ist! Warum sollte dann in Amerkia es dann anders sein?"

man sollte sich aber auch im Klaren sein, dass dies der 2. Versuch in Amerika ist. Man hat es schonmal versucht mit eher gemischten PIII-Ergebnissen... die FDA hat sich gegen eine Zulassung ausgesprochen, die EMA in Europa für eine Zulassung, jeweils auf Basis der gleichen Daten! Wegen der FDA hat ITMN die aktuelle weitere PIII gestartet, deren Ergebnisse noch ausstehen.

Dies ist noch von 2010... man beachte auch den Preis, wo ITMN mal gestanden hat vor dem negativen Entscheid der FDA und danach. Chancen und Risiken sind entsprechend hoch, bzw. ist IPF schon ein relevanter großer Markt mit wenig Konkurrenz, doch Pirfenidone scheint noch nicht der Durchbruch zu sein, so dass möglicher Nachfolger es wieder verdrängen können, falls es zugelassen wird.

http://www.fiercebiotech.com/story/breaking-news-fda-demands…

InterMune shares bludgeoned after FDA demands new trial for pirfenidone

May 4, 2010 | By John Carroll

InterMune took its best case for pirfenidone to the FDA, and lost. The agency ruled Tuesday afternoon that the developer would need to mount a new clinical trial for the drug before it could provide a green light for marketing. Shares of InterMune were halted ahead of the decision at $45.44. But once investors had a chance to act on the news, the developer's share price (ITMN) plunged a stunning 81 percent.

InterMune only hit the primary endpoint in one of two late-stage trials. But with no approved therapies available for idiopathic pulmonary fibrosis -- a lethal disease characterized by inflammation and scarring of the lungs -- and a recommendation from an influential panel of agency experts, the news was a bitter pill to have to swallow.

"After the positive FDA Advisory Committee meeting of March 9 at which the Committee recommended the approval of the pirfenidone NDA by a 9-3 margin, we are disappointed by this outcome," noted InterMune CEO Dan Welch. "We will meet with the FDA as soon as possible to understand their points of view and to determine the most appropriate path forward to expeditiously make Esbriet available to the approximately 100,000 patients with IPF and their families who suffer from this terrible disease and for whom no FDA-approved medicines exist."

Over at TheStreet this morning, Adam Feuerstein notes that InterMune's failure to sell shares in the company after the advisory panel vote left it in bad shape for raising more money for a new clinical trial. And for IPF patients in the U.S., says Andrew Pollack of the New York Times, the only available treatment remains a lung transplant.

InterMune still has near-term hopes for the European market, though, where it filed for an approval in March. Here's more on the mixed late-stage data. But InterMune has faced a rocky road in its quest to treat IPF. Last fall former CEO Scott Harkonen was convicted of wire fraud for his role in writing a press release that made false claims about Actimmune's ability to treat IPF. He faces up to 20 years in prison as a result.

Gruß

ipollit

man sollte sich aber auch im Klaren sein, dass dies der 2. Versuch in Amerika ist. Man hat es schonmal versucht mit eher gemischten PIII-Ergebnissen... die FDA hat sich gegen eine Zulassung ausgesprochen, die EMA in Europa für eine Zulassung, jeweils auf Basis der gleichen Daten! Wegen der FDA hat ITMN die aktuelle weitere PIII gestartet, deren Ergebnisse noch ausstehen.

Dies ist noch von 2010... man beachte auch den Preis, wo ITMN mal gestanden hat vor dem negativen Entscheid der FDA und danach. Chancen und Risiken sind entsprechend hoch, bzw. ist IPF schon ein relevanter großer Markt mit wenig Konkurrenz, doch Pirfenidone scheint noch nicht der Durchbruch zu sein, so dass möglicher Nachfolger es wieder verdrängen können, falls es zugelassen wird.

http://www.fiercebiotech.com/story/breaking-news-fda-demands…

InterMune shares bludgeoned after FDA demands new trial for pirfenidone

May 4, 2010 | By John Carroll

InterMune took its best case for pirfenidone to the FDA, and lost. The agency ruled Tuesday afternoon that the developer would need to mount a new clinical trial for the drug before it could provide a green light for marketing. Shares of InterMune were halted ahead of the decision at $45.44. But once investors had a chance to act on the news, the developer's share price (ITMN) plunged a stunning 81 percent.

InterMune only hit the primary endpoint in one of two late-stage trials. But with no approved therapies available for idiopathic pulmonary fibrosis -- a lethal disease characterized by inflammation and scarring of the lungs -- and a recommendation from an influential panel of agency experts, the news was a bitter pill to have to swallow.

"After the positive FDA Advisory Committee meeting of March 9 at which the Committee recommended the approval of the pirfenidone NDA by a 9-3 margin, we are disappointed by this outcome," noted InterMune CEO Dan Welch. "We will meet with the FDA as soon as possible to understand their points of view and to determine the most appropriate path forward to expeditiously make Esbriet available to the approximately 100,000 patients with IPF and their families who suffer from this terrible disease and for whom no FDA-approved medicines exist."

Over at TheStreet this morning, Adam Feuerstein notes that InterMune's failure to sell shares in the company after the advisory panel vote left it in bad shape for raising more money for a new clinical trial. And for IPF patients in the U.S., says Andrew Pollack of the New York Times, the only available treatment remains a lung transplant.

InterMune still has near-term hopes for the European market, though, where it filed for an approval in March. Here's more on the mixed late-stage data. But InterMune has faced a rocky road in its quest to treat IPF. Last fall former CEO Scott Harkonen was convicted of wire fraud for his role in writing a press release that made false claims about Actimmune's ability to treat IPF. He faces up to 20 years in prison as a result.

Gruß

ipollit

100% Change!!!

InterMune Inc. (NASDAQ: ITMN) got hit last week when a competitors Phase III data on similar top pipeline candidate was supposedly leaked. Top Wall Street biotech firm Summer Street Research immediately came out and said InterMune weakness is a buying opportunity and expects the ASCEND trial of pirfenidone for idiopathic pulmonary fibrosis to be successful when the data is top lined. InterMune is also one of its top picks for 2014. The J.P. Morgan team concurs and also continues to believe there is a high probability of success for the Phase III ASCEND trial. Data is expected in the second quarter, so current entry timing may be good. The J.P. Morgan price target is a strong $23. The Thomson/First Call estimate is at $17.43. InterMune was trading mid-day at $11.26. A move to the target would be a gigantic 102% move for shareholders.

Read more: J.P. Morgan: Two Biotech Stocks to Buy With 65% to 100% Upside - NPS Pharmaceuticals, Inc. (NASDAQ:NPSP) - 24/7 Wall St. http://247wallst.com/investing/2014/02/06/j-p-morgan-two-bio…

Follow us: @247wallst on Twitter | 247wallst on Facebook

Quelle: http://247wallst.com/investing/2014/02/06/j-p-morgan-two-bio…

InterMune Inc. (NASDAQ: ITMN) got hit last week when a competitors Phase III data on similar top pipeline candidate was supposedly leaked. Top Wall Street biotech firm Summer Street Research immediately came out and said InterMune weakness is a buying opportunity and expects the ASCEND trial of pirfenidone for idiopathic pulmonary fibrosis to be successful when the data is top lined. InterMune is also one of its top picks for 2014. The J.P. Morgan team concurs and also continues to believe there is a high probability of success for the Phase III ASCEND trial. Data is expected in the second quarter, so current entry timing may be good. The J.P. Morgan price target is a strong $23. The Thomson/First Call estimate is at $17.43. InterMune was trading mid-day at $11.26. A move to the target would be a gigantic 102% move for shareholders.

Read more: J.P. Morgan: Two Biotech Stocks to Buy With 65% to 100% Upside - NPS Pharmaceuticals, Inc. (NASDAQ:NPSP) - 24/7 Wall St. http://247wallst.com/investing/2014/02/06/j-p-morgan-two-bio…

Follow us: @247wallst on Twitter | 247wallst on Facebook

Quelle: http://247wallst.com/investing/2014/02/06/j-p-morgan-two-bio…

2011 erfolgte signifikante Weiterentwicklung, daher besteht eine hohe Wahrscheinlichkeit, dass auch eine Zulassung in den USA folgt.

Hallo, ich bin Ganz Deiner Meinung und so wie es momentan aussieht noch viele mehr. Über 10% den zweitenTag in Folge!

Hallo Leute,

ab heute kann ich die Aktie als richtig heiß empfehlen. Es geht um Amerika. Mehr kann ich nicht sagen...

Das Ergebnis an der Börse kommt bis allerspätestens Ende Q2.

China