CITIGOLD Corp. Ltd. zeigt nach 1.5 Jahren Tiefschlaf wieder Leben - Älteste Beiträge zuerst

eröffnet am 19.06.15 19:22:00 von

neuester Beitrag 05.02.23 14:22:59 von

neuester Beitrag 05.02.23 14:22:59 von

Beiträge: 19

ID: 1.214.436

ID: 1.214.436

Aufrufe heute: 0

Gesamt: 3.442

Gesamt: 3.442

Aktive User: 0

ISIN: AU000000CTO0 · WKN: 892606

0,0033

EUR

-7,14 %

-0,0003 EUR

Letzter Kurs 29.04.24 Lang & Schwarz

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,4700 | +28,95 | |

| 1,3200 | +17,86 | |

| 1,0100 | +13,48 | |

| 0,5650 | +13,00 | |

| 0,8400 | +12,75 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7100 | -7,79 | |

| 15,010 | -8,59 | |

| 3,3200 | -9,78 | |

| 3,9600 | -15,74 | |

| 12,000 | -25,00 |

heute in Australien +40% von A$0.03 auf A$0.042

Grund: ??

Meine Spekulation: kommt nun doch ein anderer JV-Partner oder Übernehmer zum Zug?

Die Nachricht über einen 6-Wochen-Aufschub für die Finanzierung des JV's mit den Kingsford Investment Groups Ltd ("KIG") über A$72m wurde am 10.6. veröffentlicht.

Also bis zum 22.07 muss KIG zahlen oder Citigold hat das Recht ein besseres Angebot anzunehmen.

Nicht vergessen: es sind so ungefähr 1.61b Shares ausstehend.

=> macht z.Z. Markt-Kapitalisierung von ca.: A$67.7m

KIG sollten ja bereits im Mai anzahlen, was nicht geschah und dann bis 10.06 was auch nicht geschah.

Wenn allerdings die bereits angefragten Angebote von Dritten nun auch nicht substantiell sind, dann implodiert der ganze Kurs auch wieder.

Also höchste Vorsicht!

also, wenn

Grund: ??

Meine Spekulation: kommt nun doch ein anderer JV-Partner oder Übernehmer zum Zug?

Die Nachricht über einen 6-Wochen-Aufschub für die Finanzierung des JV's mit den Kingsford Investment Groups Ltd ("KIG") über A$72m wurde am 10.6. veröffentlicht.

Also bis zum 22.07 muss KIG zahlen oder Citigold hat das Recht ein besseres Angebot anzunehmen.

Nicht vergessen: es sind so ungefähr 1.61b Shares ausstehend.

=> macht z.Z. Markt-Kapitalisierung von ca.: A$67.7m

KIG sollten ja bereits im Mai anzahlen, was nicht geschah und dann bis 10.06 was auch nicht geschah.

Wenn allerdings die bereits angefragten Angebote von Dritten nun auch nicht substantiell sind, dann implodiert der ganze Kurs auch wieder.

Also höchste Vorsicht!

also, wenn

Thread-Aktivierung auf Wunsch

Antwort auf Beitrag Nr.: 56.783.449 von MadMod am 21.01.18 20:47:09Merci!......

2.5 Jahre später nach Thread-Eröffnung

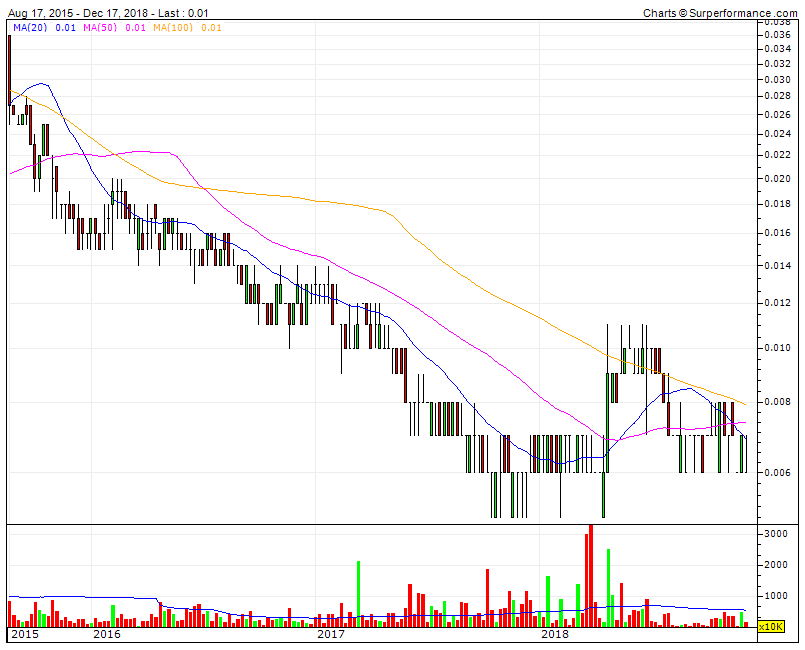

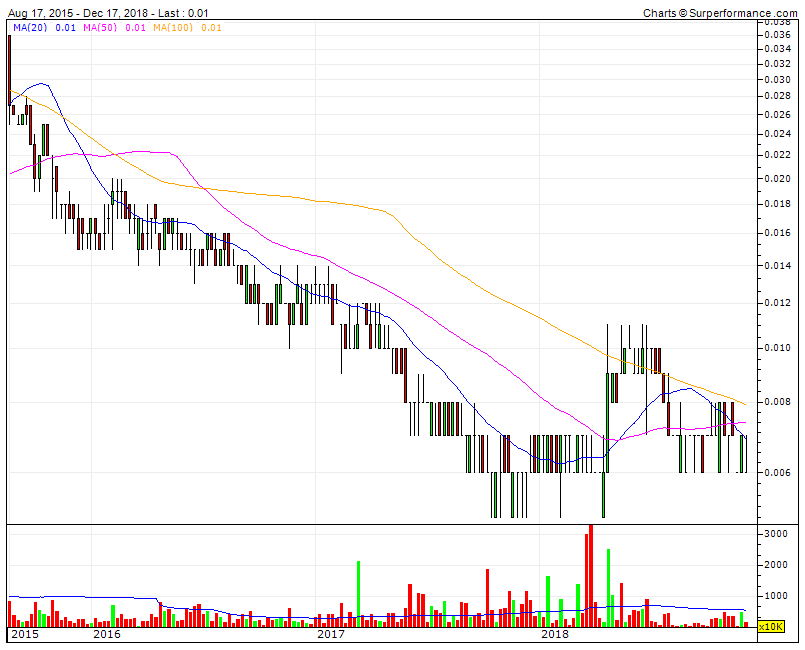

seitdem hat sich kursmässig das getan:

aus: http://www.4-traders.com/CITIGOLD-CORPORATION-LIMI-6494415/c…

=> das sind mal eben satte (AUD0.007 - AUD0.04)/AUD0.04 = -82.5%

..bei nur mehr einer MK von ~AUD13.39m (und 1.91Mrd. shares!)

siehe z.B.:

https://www.asx.com.au/asx/share-price-research/company/CTO

https://hotcopper.com.au/asx/cto/

..und sonst so? --> Wait and see (mMn)...

1/AGM war am 29.11.2017 und brachte nichts grossartig Überraschendes.

Man genehmigte die (obligatorische) Ausgabe von weiteren 33m Ordinary Shares an die Shareholder (der ich schon seit 2017-02 nicht mehr bin).

2/

2017-12-08: man hat seine Verarbeitungsablage ("Black Jack gold process plant") für AUD12m an Maroon Gold Pty Ltd (Maroon), of Western Australia:

...

The plant will be used to process ores from the region as a centralised toll processor, including Citigold’s ore.

Citigold retains all of its gold mineral deposits including its wholly owned Charters Towers underground mines of Central and Warrior/Imperial. Citigold had no defined mineral resources at Black Jack and thereby retains all of is gold Mineral Resources and Reserves.

The sale will facilitate and accelerate further development of Citigold’s Charters Towers mining operations.

...

Citigold’s previously announced gold production goals for its Charters Towers operations remain unchanged.

This transaction will materially strengthen Citigold’s balance sheet.

...

3/

zu den 1.91Mrd. shares outstanding (siehe oben):

- in 2017-12 war wieder eine Aktion, bei der man (in Australien nur?) sein Kleinst-Paket mit weniger als AUD500 hätte zurückgeben können ohne zusätzliche Gebühren ("Small Holding Share Sale Facility") =>

As at 11 December 2017, of the approximately 8,194 Citigold Shareholders, 6,618 held a Small Holding totalling 98,567,635 shares making up approximately 5.15% of the Company’s total issued share capital.

4/

Link zum AR2017: http://www.citigold.com/investors/announcements/2017/607-ann…

=>

- man sucht einen starken Partner für die Wiederaufnahme der Produktion von anfangs 50k bis 220k oz. Au p.a. in 5 Jahren

- man will einen Vorwärtsverkauf von 100k oz. Au tätigen. Wörtlich:

Citigold entered into a sale agreement of up to 100,000 ounces of gold that may see circa up to $123 million in pre payments to Citigold received by June 2018, against gold to be delivered by 2022.

Antwort auf Beitrag Nr.: 56.784.418 von faultcode am 21.01.18 23:48:29

http://www.4-traders.com/CITIGOLD-CORPORATION-LIMI-6494415/n…

05/07/2018

Citigold Corporation Limited ('Citigold' or 'Company') announced its financial results for the half year with a profit after tax for the Group of $14.6 million as at 31 December 2017, being a strong improvement on the prior period.

The net assets for the Group grew to $102 million at 31 December 2017, being an increase from the prior period.

As previously announced on 8 December 2017 the process plant was sold for $12 million and the final payment received in March 2018. As part of the Company's outsourced model, the purchaser has agreed to the key terms of a future Citigold ore treating agreement.

Citigold and its secured lender completed a formal settlement agreement and finalised all financial and other matters between them following from the Loan Note Contract entered in 2015. The Loan Note has been paid out in full and cancelled.

Planning continued for the development of the Charters Towers project with the appointment and commencement of an experienced project manager.

The Company continues to review its business plans, schedules and strategies in rediness for moving back into gold mining and production with substantial capital savings recently identified.

Major complementary project funding discussions continue with potential interested strategic partners to expand Citigold's production ready Charters Towers Gold Project. This aims to add complementary funds to the already announced transactions

OPERATIONS

The underground mining operations at the Company's Charters Towers 'Central' and 'Imperial' mining areas remained on care and maintenance during the Quarter. No gold production operations were undertaken during the quarter.

Resumption of Mining

Corporate plans for the resumption of mining remain unchanged with the main 'Central' mining underground to be the first area planned to be reopened. Designs and strategies for the Central Mine continued to be refined during the quarter, including the decline development extension and the most efficient sizing and excavation method.

Resumption of mining at Charters Towers is contingent on a sufficient level of capital financing, with active planning and scheduling continuing during the Quarter in readiness. The Charters Towers Gold Project is the Company's sole and prime focus.

The 'Central' underground mine is to be the focus of future mining operations and is the area planned to be reopened. It is scheduled to grow progressively into a 220,000 ounces annual producer of gold, the works begin once funding is in place...

es tut sich was

http://www.4-traders.com/CITIGOLD-CORPORATION-LIMI-6494415/n…

05/07/2018

Citigold Corporation Limited ('Citigold' or 'Company') announced its financial results for the half year with a profit after tax for the Group of $14.6 million as at 31 December 2017, being a strong improvement on the prior period.

The net assets for the Group grew to $102 million at 31 December 2017, being an increase from the prior period.

As previously announced on 8 December 2017 the process plant was sold for $12 million and the final payment received in March 2018. As part of the Company's outsourced model, the purchaser has agreed to the key terms of a future Citigold ore treating agreement.

Citigold and its secured lender completed a formal settlement agreement and finalised all financial and other matters between them following from the Loan Note Contract entered in 2015. The Loan Note has been paid out in full and cancelled.

Planning continued for the development of the Charters Towers project with the appointment and commencement of an experienced project manager.

The Company continues to review its business plans, schedules and strategies in rediness for moving back into gold mining and production with substantial capital savings recently identified.

Major complementary project funding discussions continue with potential interested strategic partners to expand Citigold's production ready Charters Towers Gold Project. This aims to add complementary funds to the already announced transactions

OPERATIONS

The underground mining operations at the Company's Charters Towers 'Central' and 'Imperial' mining areas remained on care and maintenance during the Quarter. No gold production operations were undertaken during the quarter.

Resumption of Mining

Corporate plans for the resumption of mining remain unchanged with the main 'Central' mining underground to be the first area planned to be reopened. Designs and strategies for the Central Mine continued to be refined during the quarter, including the decline development extension and the most efficient sizing and excavation method.

Resumption of mining at Charters Towers is contingent on a sufficient level of capital financing, with active planning and scheduling continuing during the Quarter in readiness. The Charters Towers Gold Project is the Company's sole and prime focus.

The 'Central' underground mine is to be the focus of future mining operations and is the area planned to be reopened. It is scheduled to grow progressively into a 220,000 ounces annual producer of gold, the works begin once funding is in place...

Antwort auf Beitrag Nr.: 57.895.188 von faultcode am 03.06.18 00:58:19

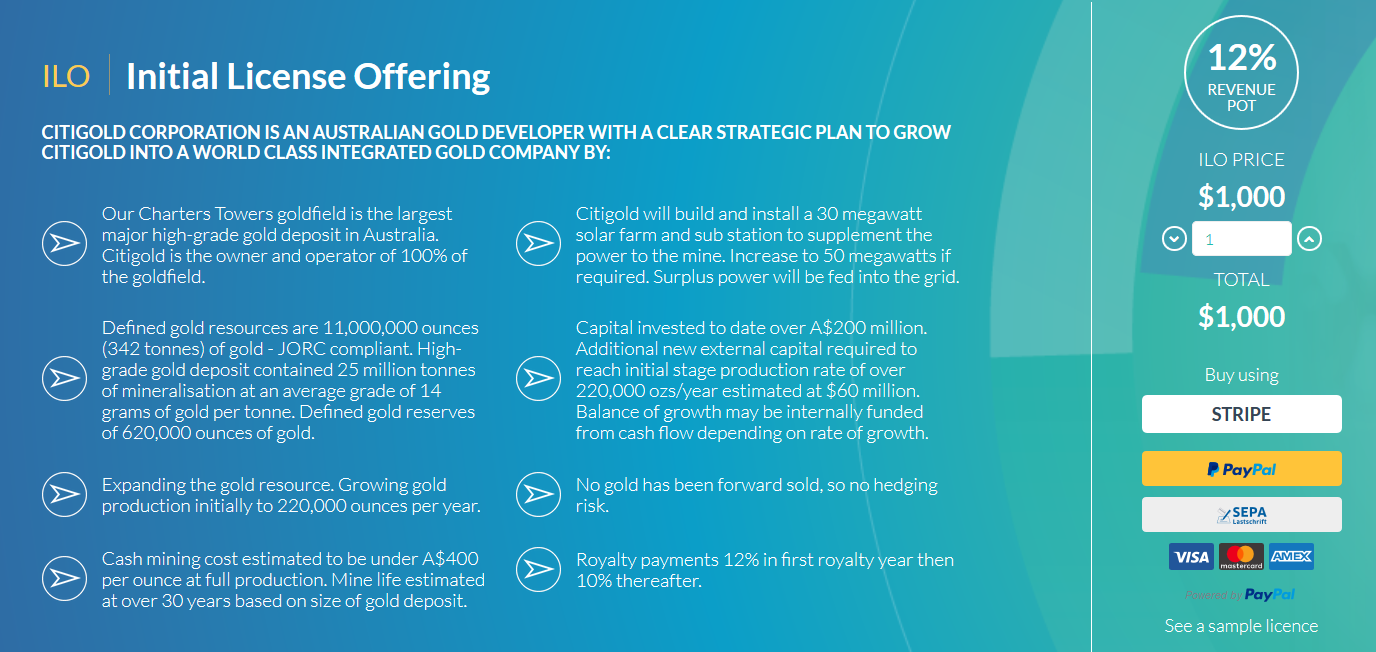

Citigold Corporation launches $100 Million unique funding program on ILOCX

30.4.https://www.issuewire.com/citigold-corporation-launches-100-…

=>

...As many mining companies seek new ways to raise capital and bring participants into their story Citigold Corporation (Citigold) has opted to launch an Initial License Offering (ILO) to bring attention and mass marketing to the unique features they have as a modern day and forward-thinking gold mining company.

ILOs are unique. They combine new capital in the form of license sales with the additional benefit of marketing and the promotion of the story to a mass market. ILO units are offered for sale on the ILOCX platform at www.ILOexchange.com

“Citigold has a great ILO, however, at first we didn’t think we could list it as it was a gold mining company and, usually there is little that is unique about gold mines. After meeting with their management, I understood this was not an ordinary gold mining company. They are completely unique in their extraction process using their own tech and processes to reduce cost, risk and any harm to the environment. Citigold have the ability to effect massive change in the sector and this is what the ILOers buying Citigold will be promoting.” said Edward Fitzpatrick CEO of ILOCX.

The mine has a 30-year life based on the reserve. Citigold has already invested 200m AUD (approx. £100m) to date with none of the gold forward-sold or hedged.

Citigold have issued a 5-year license to potential buyers (ILOers) offering a 12% royalty in year 2 and 10% in years 3, 4 and 5. ILOers qualify for royalties when they participate in the mass promotion of the company. Each ILO unit costs $1000 and if the company reaches their projected revenue numbers at the end of year two, this should provide a royalty payment to each qualifying ILOer of $73.20. In year 3, the royalty would be $178.00, increasing to $205.00 in year 4 and then finally $262.00 in year 5. This will value the ILO at almost 3 times the original price after the royalties, with a further upside in the transfer of IP, tech and knowhow to other mines around the world. ILOers can have a major impact on this company and this sector while owning a license secured in gold in a professional established company.

The ILO is secured on physical gold in the ground, Citigold Corporation has the opportunity to transfer their IP and know-how to other mines around the world. In addition to the royalty payments on this ILO, Citigold gives each license holder the first right to buy into all future spin-offs and use cases issued on ILOCX. More information about this can be found here https://iloexchange.com/learn_more.php?ilo=Citigold

John Foley Citigold Corporation director said, “This story needs to be told and discovering ILOCX was a way for us to do that. Not only will we get the capital we need to extract the gold, we will do it efficiently and cleanly with no risk to the environment using unique Solar Tech at the mine surface to create key economies and safety measures. We are excited to be adding large scale efficiency measures in the field of gold mining while doing the same in our capital and marketing structure using the ILO created by ILOCX.”

Citigold Corporation is an Australian Gold Mining company operating in the country’s highest grade and major goldfield at Charters Towers in Northern Australia. They are listed on the ASX and own Australia’s largest high-grade major deposit with mineral resources of 11 million ounces of gold...

Antwort auf Beitrag Nr.: 60.763.173 von faultcode am 07.06.19 21:37:56wie groß ist denn eine IAO-Einheit? 🤒

Antwort auf Beitrag Nr.: 61.156.169 von sharepicker321 am 01.08.19 21:32:35AUD1000: https://iloexchange.com/learn_more.php?ilo=Citigold

=>

=>

Beitrag zu dieser Diskussion schreiben

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -6,67 | |

| -1,08 | |

| +20,00 | |

| +11,76 | |

| +0,39 | |

| +4,60 | |

| +8,70 | |

| +1,37 | |

| +1,55 | |

| 0,00 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 207 | ||

| 119 | ||

| 59 | ||

| 50 | ||

| 46 | ||

| 39 | ||

| 38 | ||

| 30 | ||

| 30 | ||

| 28 |