Anlagen- und Maschinenbau für Minenbetreiber etc. - Älteste Beiträge zuerst (Seite 7)

eröffnet am 08.02.17 20:51:00 von

neuester Beitrag 18.04.24 11:14:43 von

neuester Beitrag 18.04.24 11:14:43 von

Beiträge: 117

ID: 1.246.436

ID: 1.246.436

Aufrufe heute: 0

Gesamt: 8.784

Gesamt: 8.784

Aktive User: 0

ISIN: FI0009014575 · WKN: A0LBTW · Symbol: M6Q

10,770

EUR

+0,98 %

+0,105 EUR

Letzter Kurs 03.05.24 Tradegate

Werte aus der Branche Maschinenbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,2460 | +34,25 | |

| 0,7172 | +17,33 | |

| 1,4900 | +10,37 | |

| 11,180 | +10,04 | |

| 8,0500 | +9,97 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,0300 | -10,44 | |

| 38,68 | -12,05 | |

| 12,700 | -16,99 | |

| 14,850 | -25,71 | |

| 2.280,00 | -33,51 |

Antwort auf Beitrag Nr.: 60.955.060 von faultcode am 04.07.19 15:15:02

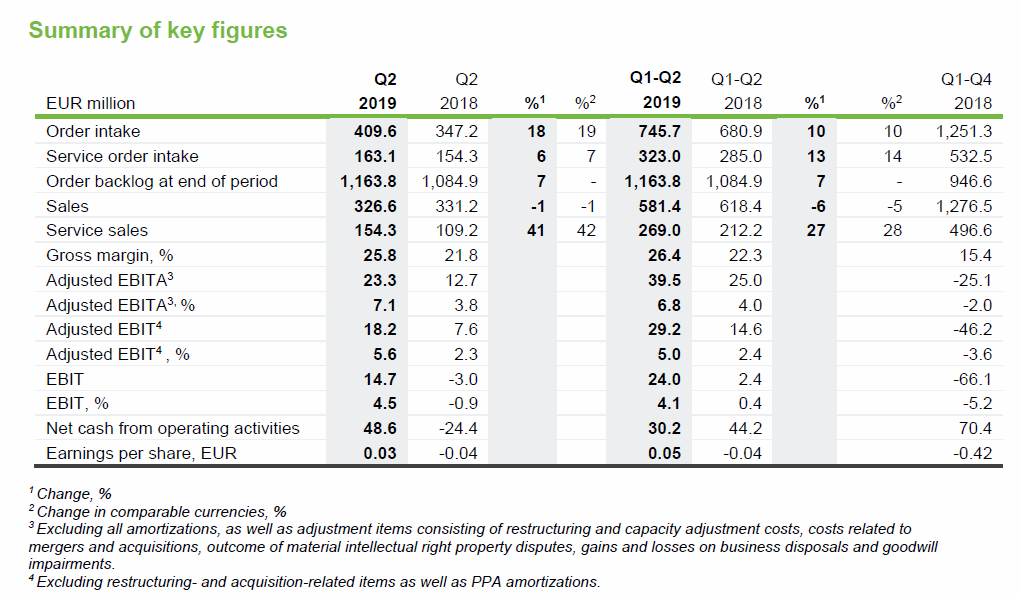

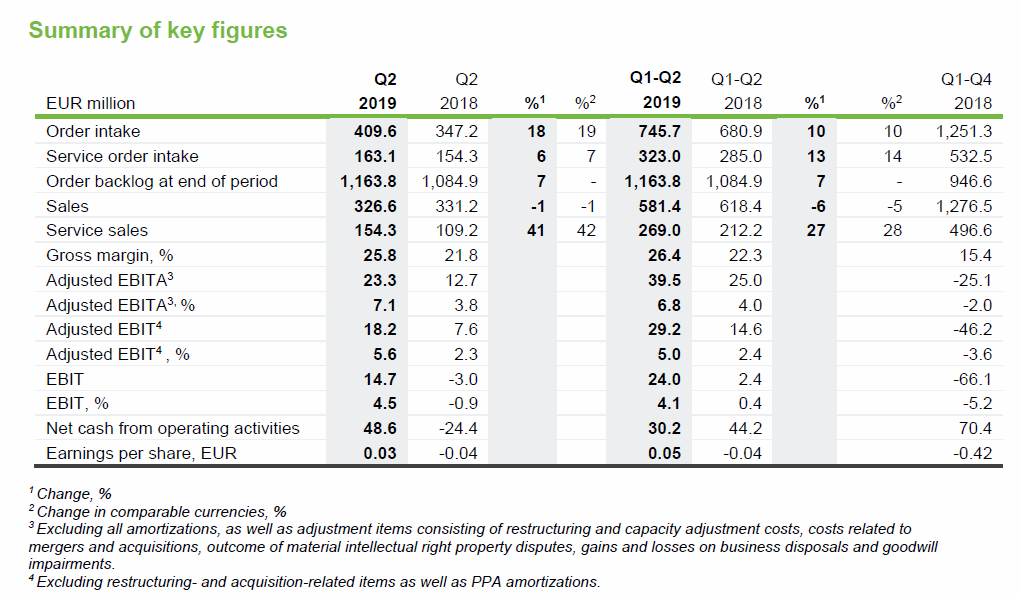

“The market for minerals and metals processing technologies continued to be active during the first half of the year. Our order intake increased by 10% from last year in the reporting period and by 18% in the second quarter. Received orders included approximately EUR 140 million gold processing plant as well as a copper concentrator and hydrometallurgical plant of approximately EUR 250 million, of which EUR 35 million was recorded in the second quarter order intake.

Sales were slightly lower for the reporting period compared to the previous year. Sales for the second quarter were on the same level as during the previous year. This was primarily due to fewer plant and equipment deliveries resulting from the lower order intake during H2 2018. Our efforts to improve the service supply chain and delivery achieved good results. Service sales increased by 27% during the reporting period and 41% during the second quarter. Profitability significantly improved both in absolute and relative terms due to the sales mix and better project execution.

The profitability of the Metals, Energy & Water segment is developing in the right direction but is still unsatisfactory. Cash flow for the reporting period was solid as a result of positive development in trade receivables and for the second quarter due to increased customer advance payments.

R&D activities continued to provide valuable benefits to our customers. For example, we introduced a next generation Outotec Paste Thickener, designed especially for tailings treatment. Tailings dewatering and disposal is a challenge that every mining operation has to confront. We also introduced the FP-S Filter Press as a cost-effective product for a wide range of standard filtration applications.

Negotiations concerning the ilmenite smelter project are ongoing, and we remain confident that the EUR 110 million provision made in the last quarter of 2018 is adequate.

On July 4th, we announced the planned combination of Outotec and Metso Minerals. The strengths of these companies are highly complementary and with this merger we are creating a leading company in process technology, equipment and services serving the minerals, metals and aggregates industries. Completion is expected in the second quarter of 2020.

The new company Metso Outotec will be able to leverage the heritage of both companies: technology and R&D, product and process excellence, scale and global service footprint. I am excited about this new strategic direction into which we are heading......

=>

--> (überraschend) gute Zahlen -- eigentlich Superzahlen mMn

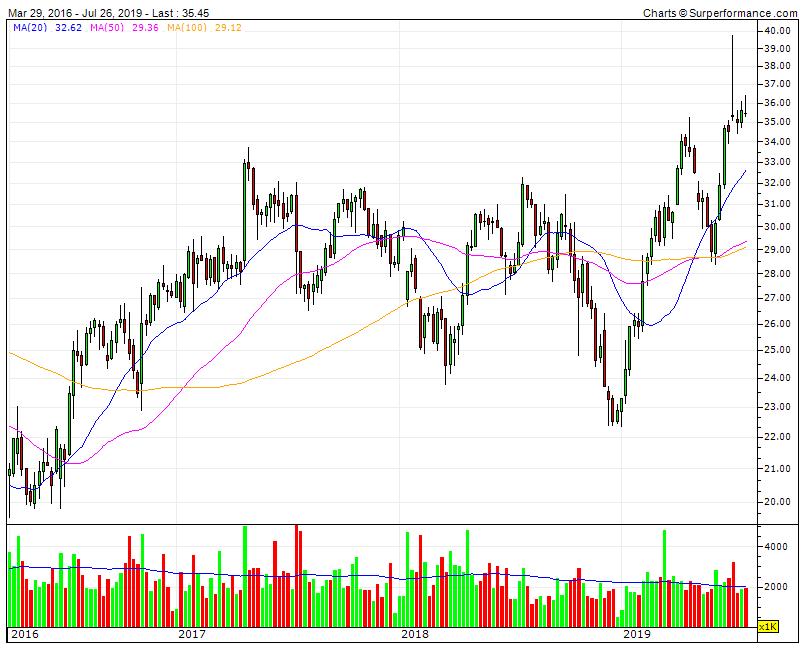

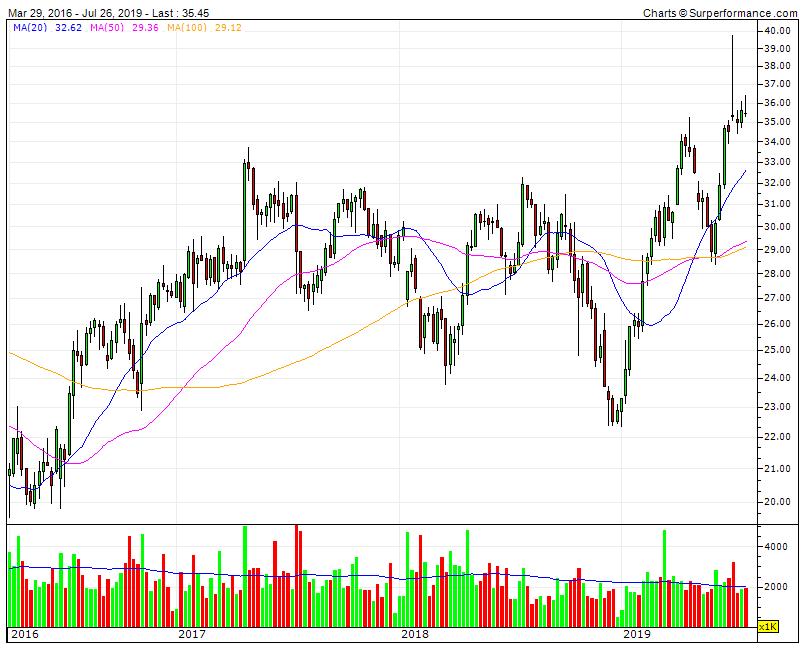

--> der Metso-Kurs hat auch schon zuletzt angezogen:

Outotec’s half year financial report 2019

Strong growth in order intake and service sales, significant improvement in profitability“The market for minerals and metals processing technologies continued to be active during the first half of the year. Our order intake increased by 10% from last year in the reporting period and by 18% in the second quarter. Received orders included approximately EUR 140 million gold processing plant as well as a copper concentrator and hydrometallurgical plant of approximately EUR 250 million, of which EUR 35 million was recorded in the second quarter order intake.

Sales were slightly lower for the reporting period compared to the previous year. Sales for the second quarter were on the same level as during the previous year. This was primarily due to fewer plant and equipment deliveries resulting from the lower order intake during H2 2018. Our efforts to improve the service supply chain and delivery achieved good results. Service sales increased by 27% during the reporting period and 41% during the second quarter. Profitability significantly improved both in absolute and relative terms due to the sales mix and better project execution.

The profitability of the Metals, Energy & Water segment is developing in the right direction but is still unsatisfactory. Cash flow for the reporting period was solid as a result of positive development in trade receivables and for the second quarter due to increased customer advance payments.

R&D activities continued to provide valuable benefits to our customers. For example, we introduced a next generation Outotec Paste Thickener, designed especially for tailings treatment. Tailings dewatering and disposal is a challenge that every mining operation has to confront. We also introduced the FP-S Filter Press as a cost-effective product for a wide range of standard filtration applications.

Negotiations concerning the ilmenite smelter project are ongoing, and we remain confident that the EUR 110 million provision made in the last quarter of 2018 is adequate.

On July 4th, we announced the planned combination of Outotec and Metso Minerals. The strengths of these companies are highly complementary and with this merger we are creating a leading company in process technology, equipment and services serving the minerals, metals and aggregates industries. Completion is expected in the second quarter of 2020.

The new company Metso Outotec will be able to leverage the heritage of both companies: technology and R&D, product and process excellence, scale and global service footprint. I am excited about this new strategic direction into which we are heading......

=>

--> (überraschend) gute Zahlen -- eigentlich Superzahlen mMn

--> der Metso-Kurs hat auch schon zuletzt angezogen:

Outotec delivers coated titanium anodes to Glencore Nikkelverk AS new copper tankhouse in Norway

OUTOTEC OYJ PRESS RELEASE OCTOBER 10.10.2019 AT 10:00 AMOutotec has agreed with Glencore Nikkelverk AS on the delivery of coated Titanium Anodes to the new tankhouse for copper electrowinning plant in Norway. The delivery will include over 5,000 of the new mixed metal oxide coated titanium anodes. The order value, booked into Outotec’s third quarter order intake, is approximately EUR 10 million.

Glencore Nikkleverk refinery in Kristiansand Norway produces approximately 40,000 tonnes of copper per annum. Outotec's coated titanium anodes were tested on-site for 5 years, and the results verified that Outotec anodes will operate at a significant reduction in energy consumption and provide higher current efficiency than traditional lead anodes.

Outotec Coated Titanium Anodes provide totally lead-free electrowinning operations and increased occupational health and safety by eliminating lead and lead sludge handling. The end result for Glencore Nikkelverk AS is green technology electrowinning operations with higher quality copper product at lower energy consumption and operating costs.

"This is one more reference delivery of Outotec Coated Titanium Anodes in the copper electrowinning industry. The energy efficiency benefits and lower operating costs of our anodes enable Glencore Nikkelverk to improve their profitability in a sustainable way”, says Kalle Härkki, head of Outotec's Metals, Energy & Water business area...

Outotec's interim report January-September 2019

25.10.https://www.outotec.com/company/media/news/2019/outotecs-int…

=> sehr gute Zahlen:

...We remain positive about the current market outlook for mining and metals and reiterate our guidance for 2019,” concludes President & CEO Markku Teräsvasara.

30.1.

Outotec and Neste introduce 100% bio-based diluent as a new solution for metals extraction

https://finance.yahoo.com/news/outotec-neste-introduce-100-b…

...

Outotec and Neste have jointly verified the viability of applying Neste MY Renewable Isoalkane™ as a fully bio-based diluent for extracting metals in hydrometallurgical processes. The diluent is based on Neste’s NEXBTL technology and produced entirely from bio-based waste and residue raw materials.

Laboratory studies and pilot trials at the Outotec Research Center in Pori and Neste’s Technology Center in Porvoo, Finland, confirmed the high-level performance of the product for solvent extraction of copper, and it can be also used for other base metals.

Thanks to its renewable origins and being readily biodegradable, the bio-based diluent reduces environmental risk and has a remarkably smaller carbon footprint over its life cycle when compared to fossil equivalents. Moreover, Neste MY Renewable Isoalkane evaporates at a lower rate, which improves copper extraction efficiency and safety due to significantly reduced volatile organic compounds (VOCs).

Neste MY Renewable Isoalkane is fully compatible with conventional fossil diluents at solvent extraction plants, and it can be introduced into the extraction process without any downtime.

...

Outotec and Neste have agreed to cooperate in introducing the Neste MY Renewable Isoalkane to metal producers. Outotec will provide technical industry expertise, whereas Neste will be responsible for the production, sales and deliveries of the bio-based diluent to the solvent extraction sites globally.

...

Outotec and Neste introduce 100% bio-based diluent as a new solution for metals extraction

https://finance.yahoo.com/news/outotec-neste-introduce-100-b…

...

Outotec and Neste have jointly verified the viability of applying Neste MY Renewable Isoalkane™ as a fully bio-based diluent for extracting metals in hydrometallurgical processes. The diluent is based on Neste’s NEXBTL technology and produced entirely from bio-based waste and residue raw materials.

Laboratory studies and pilot trials at the Outotec Research Center in Pori and Neste’s Technology Center in Porvoo, Finland, confirmed the high-level performance of the product for solvent extraction of copper, and it can be also used for other base metals.

Thanks to its renewable origins and being readily biodegradable, the bio-based diluent reduces environmental risk and has a remarkably smaller carbon footprint over its life cycle when compared to fossil equivalents. Moreover, Neste MY Renewable Isoalkane evaporates at a lower rate, which improves copper extraction efficiency and safety due to significantly reduced volatile organic compounds (VOCs).

Neste MY Renewable Isoalkane is fully compatible with conventional fossil diluents at solvent extraction plants, and it can be introduced into the extraction process without any downtime.

...

Outotec and Neste have agreed to cooperate in introducing the Neste MY Renewable Isoalkane to metal producers. Outotec will provide technical industry expertise, whereas Neste will be responsible for the production, sales and deliveries of the bio-based diluent to the solvent extraction sites globally.

...

6.2.

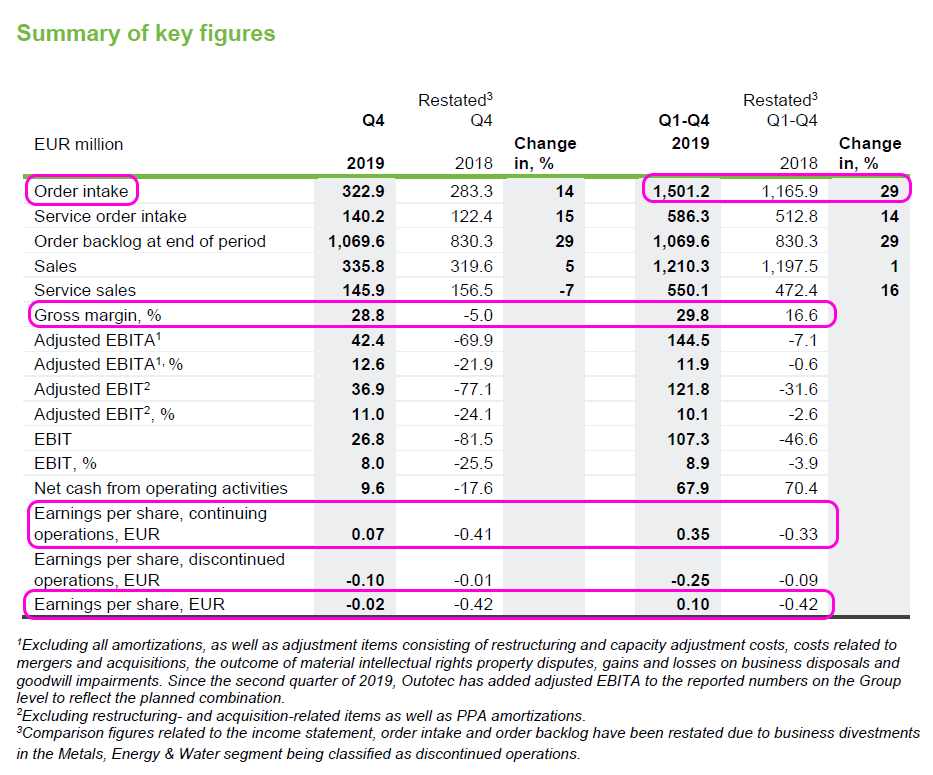

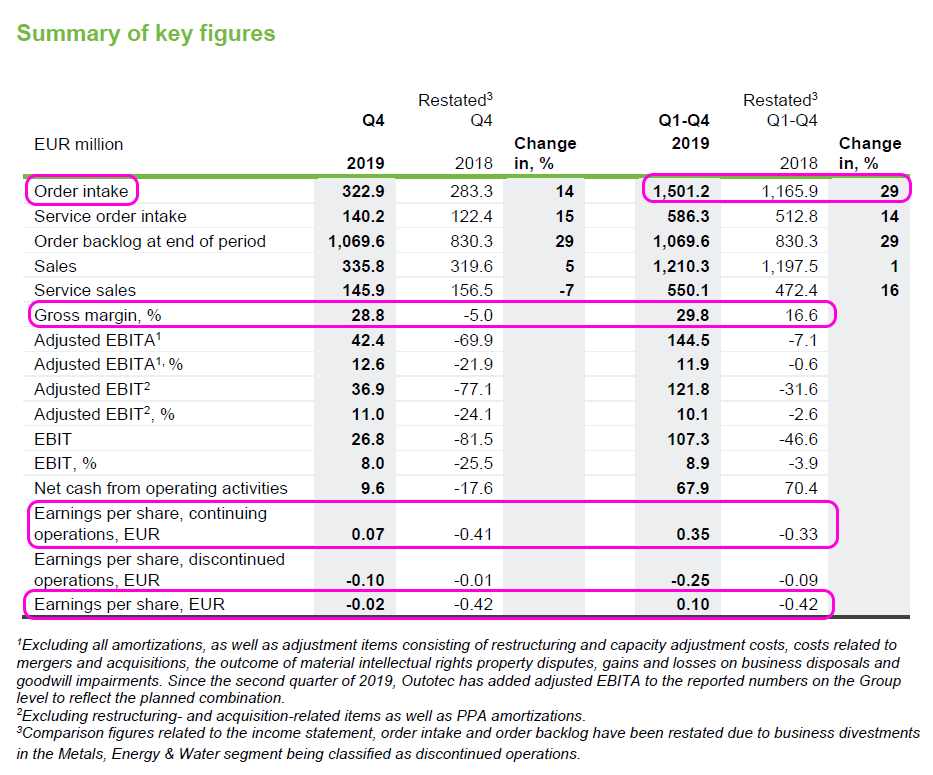

Outotec's Financial Statements Review January-December 2019

https://www.wallstreet-online.de/nachricht/12139324-outotec-…

=>

Rock 'n' Roll:

...

THE COMBINATION OF OUTOTEC AND METSO MINERALS

Outotec and Metso have previously communicated that the completion of the combination of Outotec and Metso’s Minerals business is expected to take place in the second quarter of 2020, subject to the receipt of all required regulatory and other approvals, including competition clearances.

Considering the progress of the regulatory approval process, Outotec and Metso currently expect the completion of the combination of Outotec and Metso’s Minerals business to take place on June 30, 2020, subject to the receipt of all required regulatory and other approvals, including competition clearances.

...

OUTLOOK FOR 2020

The market activity in minerals processing and metals refining is currently expected to remain at present level. Copper, gold and nickel projects are expected to continue to be the most active. The timing of large investments is uncertain.

Outotec will not issue Group financial guidance for 2020, as the combination of Outotec and Metso’s Minerals business is currently expected to take place on June 30, 2020. This remains subject to the receipt of all required regulatory and other approvals, including competition clearances.

...

(FC: Format)

Outotec's Financial Statements Review January-December 2019

https://www.wallstreet-online.de/nachricht/12139324-outotec-…

=>

Rock 'n' Roll:

...

THE COMBINATION OF OUTOTEC AND METSO MINERALS

Outotec and Metso have previously communicated that the completion of the combination of Outotec and Metso’s Minerals business is expected to take place in the second quarter of 2020, subject to the receipt of all required regulatory and other approvals, including competition clearances.

Considering the progress of the regulatory approval process, Outotec and Metso currently expect the completion of the combination of Outotec and Metso’s Minerals business to take place on June 30, 2020, subject to the receipt of all required regulatory and other approvals, including competition clearances.

...

OUTLOOK FOR 2020

The market activity in minerals processing and metals refining is currently expected to remain at present level. Copper, gold and nickel projects are expected to continue to be the most active. The timing of large investments is uncertain.

Outotec will not issue Group financial guidance for 2020, as the combination of Outotec and Metso’s Minerals business is currently expected to take place on June 30, 2020. This remains subject to the receipt of all required regulatory and other approvals, including competition clearances.

...

(FC: Format)

12.2.

Outotec to deliver process equipment to a gold project in Cambodia

https://www.wallstreet-online.de/nachricht/12159667-outotec-…

...

Outotec has been awarded a contract from Renaissance Minerals (Cambodia) Limited, a subsidiary of Emerald Resources NL, for the delivery of process equipment to the greenfield Okvau Gold Project. The order value, booked into Outotec’s 2020 first quarter order intake, is approximately EUR 13 million.

Outotec's scope includes the delivery of an Outotec HIGmill high intensity grinding mill, a semi-autogenous (SAG) mill, TankCell flotation cells, an OKTOP Conditioner, thickeners and spare parts. The Okvau Gold Project is located in the Mondulkiri province of eastern Cambodia. The 2 million tonnes per annum operation will be the first large-scale mining project in the country. Project commissioning is expected in the second quarter of 2021.

...

Outotec to deliver process equipment to a gold project in Cambodia

https://www.wallstreet-online.de/nachricht/12159667-outotec-…

...

Outotec has been awarded a contract from Renaissance Minerals (Cambodia) Limited, a subsidiary of Emerald Resources NL, for the delivery of process equipment to the greenfield Okvau Gold Project. The order value, booked into Outotec’s 2020 first quarter order intake, is approximately EUR 13 million.

Outotec's scope includes the delivery of an Outotec HIGmill high intensity grinding mill, a semi-autogenous (SAG) mill, TankCell flotation cells, an OKTOP Conditioner, thickeners and spare parts. The Okvau Gold Project is located in the Mondulkiri province of eastern Cambodia. The 2 million tonnes per annum operation will be the first large-scale mining project in the country. Project commissioning is expected in the second quarter of 2021.

...

Antwort auf Beitrag Nr.: 62.662.144 von faultcode am 12.02.20 20:36:04CEO des Übernehmers Metso hat zuletzt Aktien (von Metso) gekauft: https://www.marketscreener.com/METSO-OYJ-1412488/news/Metso-…

Gestern kam diese Meldung raus. China scheint sich tatsächlich überall zu normalisieren:

31.3.

Metso Oyj : cancels its market outlook statement and provides an update on the Covid-19 impact

https://www.marketscreener.com/METSO-OYJ-1412488/news/Metso-…

Due to the current market uncertainty caused by the Covid-19 pandemic, Metso has decided to cancel its market outlook statement dated February 6, 2020. The market development in January and February 2020 was in line with the outlook statement, but uncertainty caused by the measures to globally fight against the spreading of the coronavirus has increased in our markets towards the end of March.

The cancelled market outlook was as follows: Market activity in both segments, Flow Control and Minerals, is expected to remain at the current level in both the equipment and services business.

Metso will publish a new market outlook statement in its Interim Review for January-March 2020, which is scheduled to be published on May 7, 2020.

Update on the Covid-19 impact

During February, Metso's operations in China were largely impacted by the coronavirus situation. The Chinese factories were nevertheless restarted successfully during the month and are now running at the normal capacity. The order intake from China in the first quarter is estimated to be on the planned level, while sales in China will be lower than planned, having a minor impact on Metso's financial performance.

The quickly enforced measures to contain the spreading of the virus in various countries around the world are limiting the mobility of workforce and have started to have an impact on our field service operations recently. Currently, Metso's operations especially in India, Peru and South Africa are affected by the restrictions imposed by governments. If prolonged for several weeks, the restrictions might also affect supply chain activities.

Under these circumstances, Metso will continue to focus on the safety of its personnel and customers, as well as leveraging its global operations in order to provide a maximum flexibility to ensure continuation of its own and its customers' operations. Simultaneously, the company continues to prepare actions to adapt to short-term challenges in various locations and focus on cost control and cash flow.

The company has already earlier implemented a strong cost control, due to the upcoming demerger and its liquidity position is solid. The planned short-term activities could include reduction of worktime and reduced overall spend. Reduced worktime is likely to have a temporary negative impact on the compensation for many employees, and therefore the Metso Executive Team has decided to participate in this undertaking by lowering its own compensation during this period as well.

Gestern kam diese Meldung raus. China scheint sich tatsächlich überall zu normalisieren:

31.3.

Metso Oyj : cancels its market outlook statement and provides an update on the Covid-19 impact

https://www.marketscreener.com/METSO-OYJ-1412488/news/Metso-…

Due to the current market uncertainty caused by the Covid-19 pandemic, Metso has decided to cancel its market outlook statement dated February 6, 2020. The market development in January and February 2020 was in line with the outlook statement, but uncertainty caused by the measures to globally fight against the spreading of the coronavirus has increased in our markets towards the end of March.

The cancelled market outlook was as follows: Market activity in both segments, Flow Control and Minerals, is expected to remain at the current level in both the equipment and services business.

Metso will publish a new market outlook statement in its Interim Review for January-March 2020, which is scheduled to be published on May 7, 2020.

Update on the Covid-19 impact

During February, Metso's operations in China were largely impacted by the coronavirus situation. The Chinese factories were nevertheless restarted successfully during the month and are now running at the normal capacity. The order intake from China in the first quarter is estimated to be on the planned level, while sales in China will be lower than planned, having a minor impact on Metso's financial performance.

The quickly enforced measures to contain the spreading of the virus in various countries around the world are limiting the mobility of workforce and have started to have an impact on our field service operations recently. Currently, Metso's operations especially in India, Peru and South Africa are affected by the restrictions imposed by governments. If prolonged for several weeks, the restrictions might also affect supply chain activities.

Under these circumstances, Metso will continue to focus on the safety of its personnel and customers, as well as leveraging its global operations in order to provide a maximum flexibility to ensure continuation of its own and its customers' operations. Simultaneously, the company continues to prepare actions to adapt to short-term challenges in various locations and focus on cost control and cash flow.

The company has already earlier implemented a strong cost control, due to the upcoming demerger and its liquidity position is solid. The planned short-term activities could include reduction of worktime and reduced overall spend. Reduced worktime is likely to have a temporary negative impact on the compensation for many employees, and therefore the Metso Executive Team has decided to participate in this undertaking by lowering its own compensation during this period as well.

8.4.

Outotec to deliver minerals processing technology to First Majestic in Mexico

https://www.wallstreet-online.de/nachricht/12386398-outotec-…

Outotec has been awarded a contract by First Majestic Silver Corp. for the delivery of minerals processing technology for First Majestic’s mill optimization projects in Mexico. The approximately EUR 15 million order has been booked in Outotec’s 2020 first quarter order intake.

Outotec’s scope covers the design and delivery of an autogenous (AG) mill, counter current decantation (CCD) thickener and a tailings filter for the San Dimas Silver/Gold Mine, and thickeners and a tailings filter for the Santa Elena Silver/Gold Mine. The deliveries are expected to take place in 2020 and 2021.

This project follows previously delivered Outotec HIGmill high-intensity grinding mills to First Majestic. One of these mills is at the Santa Elena operation, where the fine grinding mill has significantly improved the recovery of silver and gold. “We are pleased to continue working with First Majestic in these projects. The energy efficient AG mill and environmentally sound thickeners and tailings filters will enable First Majestic to improve plant operations in a sustainable way,” says Paul Sohlberg, head of Outotec’s Minerals Processing business.

...

Outotec to deliver minerals processing technology to First Majestic in Mexico

https://www.wallstreet-online.de/nachricht/12386398-outotec-…

Outotec has been awarded a contract by First Majestic Silver Corp. for the delivery of minerals processing technology for First Majestic’s mill optimization projects in Mexico. The approximately EUR 15 million order has been booked in Outotec’s 2020 first quarter order intake.

Outotec’s scope covers the design and delivery of an autogenous (AG) mill, counter current decantation (CCD) thickener and a tailings filter for the San Dimas Silver/Gold Mine, and thickeners and a tailings filter for the Santa Elena Silver/Gold Mine. The deliveries are expected to take place in 2020 and 2021.

This project follows previously delivered Outotec HIGmill high-intensity grinding mills to First Majestic. One of these mills is at the Santa Elena operation, where the fine grinding mill has significantly improved the recovery of silver and gold. “We are pleased to continue working with First Majestic in these projects. The energy efficient AG mill and environmentally sound thickeners and tailings filters will enable First Majestic to improve plant operations in a sustainable way,” says Paul Sohlberg, head of Outotec’s Minerals Processing business.

...

7.5.

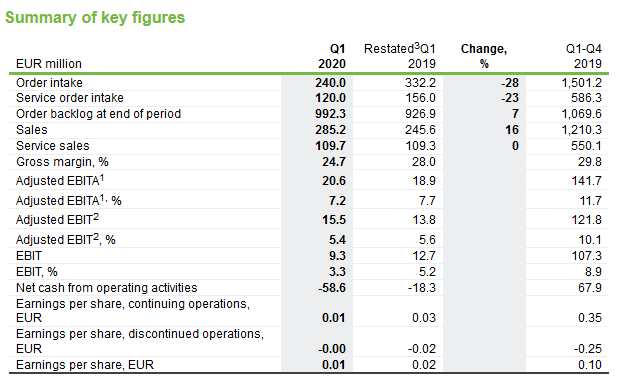

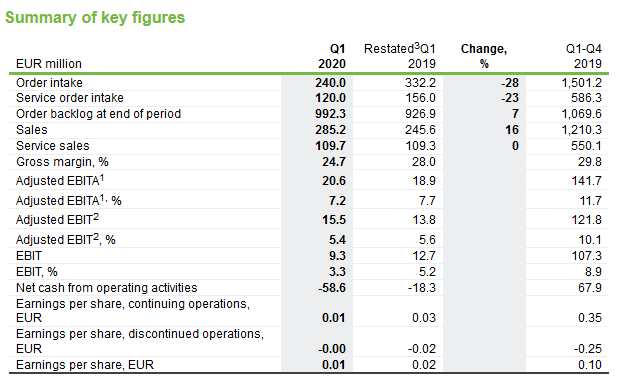

Outotec’s interim report January-March 2020

https://news.cision.com/outotec-oyj/r/outotec-s-interim-repo…

...

ansonsten:

...

Order intake decreased by 28% compared to the comparison period because customers started to slow down decision-making relating to large projects. In the Minerals Processing segment, smaller equipment orders continued to be at a good level.

Sales grew by 16%. Large projects received last year contributed to 22% growth in the Minerals Processing segment and 5% growth in the Metals Refining segment. Currencies and sales mix had a negative impact on profitability.

In the service business, travel restrictions and site closures restricted our field service personnel’s access to customer sites. Customers also postponed service projects. This resulted in a 23% decline in service orders. Service sales were at the level of the comparison period. Spare parts continued to grow in spite of various challenges.

Net cash flow from operating activities was EUR -59 (-18) million. The cash flow was negative mainly due to inventory build-up related to the delivery phase of the three large projects received last year.

As we started to see signs of market uncertainty, we initiated actions on several fronts. Securing our employee’s health and safety has been the key priority. I am pleased with the way we have been able to shift to remote working where necessary and actively continue to support our customers. Examples of our virtual support include remote installation and commissioning services, advanced process and control systems, as well as virtual seminars and trainings. We have also initiated cost-saving actions covering the whole organization.

Our planned merger with Metso’s Minerals business is proceeding and the closing of the transaction is expected to take place on June 30 subject to regulatory approvals.

We are working actively with the existing market opportunities and strong backlog as well as achieving our cost-savings targets,” concludes President & CEO Markku Teräsvasara.

...

OUTLOOK FOR 2020 REVISED

Due to the ongoing COVID-19 pandemic, market activity and visibility in the minerals processing and metals refining market have weakened. The timing of larger investments in particular is uncertain.

The previous outlook, issued on February 6, 2020: The market activity in minerals processing and metals refining is currently expected to remain at the present level. Copper, gold and nickel projects are expected to continue to be the most active. The timing of large investments is uncertain.

...

=> NASDAQ OMX HELSINKI -4.5%

Outotec’s interim report January-March 2020

https://news.cision.com/outotec-oyj/r/outotec-s-interim-repo…

...

ansonsten:

...

Order intake decreased by 28% compared to the comparison period because customers started to slow down decision-making relating to large projects. In the Minerals Processing segment, smaller equipment orders continued to be at a good level.

Sales grew by 16%. Large projects received last year contributed to 22% growth in the Minerals Processing segment and 5% growth in the Metals Refining segment. Currencies and sales mix had a negative impact on profitability.

In the service business, travel restrictions and site closures restricted our field service personnel’s access to customer sites. Customers also postponed service projects. This resulted in a 23% decline in service orders. Service sales were at the level of the comparison period. Spare parts continued to grow in spite of various challenges.

Net cash flow from operating activities was EUR -59 (-18) million. The cash flow was negative mainly due to inventory build-up related to the delivery phase of the three large projects received last year.

As we started to see signs of market uncertainty, we initiated actions on several fronts. Securing our employee’s health and safety has been the key priority. I am pleased with the way we have been able to shift to remote working where necessary and actively continue to support our customers. Examples of our virtual support include remote installation and commissioning services, advanced process and control systems, as well as virtual seminars and trainings. We have also initiated cost-saving actions covering the whole organization.

Our planned merger with Metso’s Minerals business is proceeding and the closing of the transaction is expected to take place on June 30 subject to regulatory approvals.

We are working actively with the existing market opportunities and strong backlog as well as achieving our cost-savings targets,” concludes President & CEO Markku Teräsvasara.

...

OUTLOOK FOR 2020 REVISED

Due to the ongoing COVID-19 pandemic, market activity and visibility in the minerals processing and metals refining market have weakened. The timing of larger investments in particular is uncertain.

The previous outlook, issued on February 6, 2020: The market activity in minerals processing and metals refining is currently expected to remain at the present level. Copper, gold and nickel projects are expected to continue to be the most active. The timing of large investments is uncertain.

...

=> NASDAQ OMX HELSINKI -4.5%

Antwort auf Beitrag Nr.: 63.593.340 von faultcode am 07.05.20 12:43:40https://news.cision.com/outotec-oyj/r/future-metso-outotec-b…

=>

...

=>

...

Beitrag zu dieser Diskussion schreiben

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -0,49 | |

| -1,28 | |

| +0,51 | |

| +1,91 | |

| 0,00 | |

| +2,39 | |

| +1,75 | |

| +0,88 | |

| 0,00 | |

| +1,68 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 183 | ||

| 87 | ||

| 73 | ||

| 66 | ||

| 50 | ||

| 44 | ||

| 39 | ||

| 35 | ||

| 32 | ||

| 31 |