AKTIEN IM FOKUS: Übernahme von Aetna setzen CVS-Health-Aktien unter Druck - Älteste Beiträge zuerst (Seite 2) | Diskussion im Forum

eröffnet am 05.03.18 21:49:56 von

neuester Beitrag 05.05.24 21:02:22 von

neuester Beitrag 05.05.24 21:02:22 von

Beiträge: 89

ID: 1.275.619

ID: 1.275.619

Aufrufe heute: 137

Gesamt: 9.082

Gesamt: 9.082

Aktive User: 0

ISIN: US1266501006 · WKN: 859034

51,96

EUR

-0,12 %

-0,07 EUR

Letzter Kurs 22:22:50 Lang & Schwarz

Neuigkeiten

03.05.24 · Business Wire (engl.) |

03.05.24 · Business Wire (engl.) |

02.05.24 · Business Wire (engl.) |

02.05.24 · wO Chartvergleich |

Werte aus der Branche Einzelhandel

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8777 | +5.317,90 | |

| 9,2600 | +45,83 | |

| 2,5000 | +38,88 | |

| 7,4400 | +24,00 | |

| 1,3100 | +21,30 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,5975 | -6,85 | |

| 3,3100 | -7,28 | |

| 13,504 | -11,49 | |

| 5,3000 | -11,67 | |

| 0,6768 | -13,23 |

+4.5% (z.Z.)

..an einem wirklich schwachen Börsen-Tag:=> Flucht in "Sicherheit"?

keine neuen News: https://cvshealth.com/newsroom/press-releases#press-release

Antwort auf Beitrag Nr.: 58.020.598 von faultcode am 19.06.18 19:40:34

...und nicht nur dieser Wert nach unten.

CVS, Walgreens among pharmacy stocks trading lower after Amazon announces acquisition of online pharmacy PillPack

https://www.marketwatch.com/story/amazon-to-acquire-online-p…

=>

Amazon.com Inc. said Thursday that it has agreed to acquire PillPack, an online pharmacy that pre-sorts medications into different doses and handles both refills and renewals.

PillPack delivers medications to customers and specializes in customers who take multiple prescriptions per day. The deal is expected to close in the second half of the year, and terms weren't disclosed. "PillPack's visionary team has a combination of deep pharmacy experience and a focus on technology," said Jeff Wilke, the chief executive officer of Amazon's Worldwide Consumer segment, in a release.

Shares of pharmacy stocks CVS Health Corp., Walgreens Boots Alliance Inc. and Rite-Aid Corp. are down in premarket trading. Rite-Aid shares turned lower on the news, after they were initially up following earnings results. Insurers UnitedHealth Group Inc. and Aetna Inc. have seen their stocks fall as well.

Shares of Walmart Inc., McKesson Corp. and Express Scripts Holding Co. are also down.

Amazon hat wieder zugeschlagen

premarket: -9%...und nicht nur dieser Wert nach unten.

CVS, Walgreens among pharmacy stocks trading lower after Amazon announces acquisition of online pharmacy PillPack

https://www.marketwatch.com/story/amazon-to-acquire-online-p…

=>

Amazon.com Inc. said Thursday that it has agreed to acquire PillPack, an online pharmacy that pre-sorts medications into different doses and handles both refills and renewals.

PillPack delivers medications to customers and specializes in customers who take multiple prescriptions per day. The deal is expected to close in the second half of the year, and terms weren't disclosed. "PillPack's visionary team has a combination of deep pharmacy experience and a focus on technology," said Jeff Wilke, the chief executive officer of Amazon's Worldwide Consumer segment, in a release.

Shares of pharmacy stocks CVS Health Corp., Walgreens Boots Alliance Inc. and Rite-Aid Corp. are down in premarket trading. Rite-Aid shares turned lower on the news, after they were initially up following earnings results. Insurers UnitedHealth Group Inc. and Aetna Inc. have seen their stocks fall as well.

Shares of Walmart Inc., McKesson Corp. and Express Scripts Holding Co. are also down.

Antwort auf Beitrag Nr.: 58.088.437 von faultcode am 28.06.18 14:58:17

Antitrust approval may come in the coming weeks

https://www.marketwatch.com/story/cvs-aetna-cigna-express-sc…

CVS-Aetna, Cigna-Express Scripts mergers close to Justice Department approval

5.9.Antitrust approval may come in the coming weeks

https://www.marketwatch.com/story/cvs-aetna-cigna-express-sc…

Antwort auf Beitrag Nr.: 58.632.165 von faultcode am 06.09.18 15:13:18--> nun ist es fast geschafft:

10.10.

DOJ approves CVS-Aetna merger as long as prescription drug business sold to WellCare

https://www.marketwatch.com/story/doj-approves-cvs-aetna-mer…

=>...

The Justice Department said Wednesday that CVS Health and Aetna will have to divest Aetna's Medicare Part D prescription drug plan business to proceed with its merger.

The proposed divestiture to WellCare Health Plans, Inc. would fully resolve the Justice Department's competition concerns, the agency said.

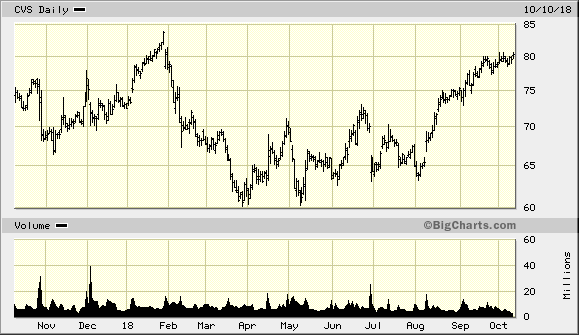

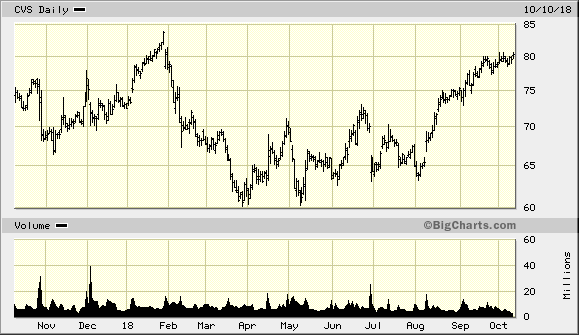

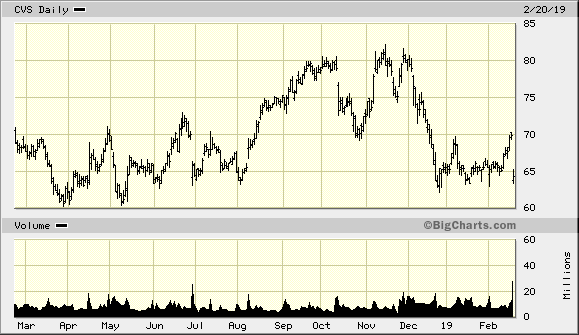

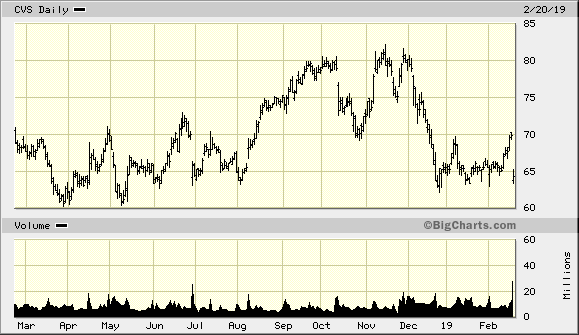

=> CVS zuletzt:

10.10.

DOJ approves CVS-Aetna merger as long as prescription drug business sold to WellCare

https://www.marketwatch.com/story/doj-approves-cvs-aetna-mer…

=>...

The Justice Department said Wednesday that CVS Health and Aetna will have to divest Aetna's Medicare Part D prescription drug plan business to proceed with its merger.

The proposed divestiture to WellCare Health Plans, Inc. would fully resolve the Justice Department's competition concerns, the agency said.

=> CVS zuletzt:

Antwort auf Beitrag Nr.: 58.918.755 von faultcode am 10.10.18 17:07:02

https://www.marketwatch.com/story/cvs-shares-rise-after-earn…

=>

CVS Health Corp. shares rose 2.6% in Tuesday premarket trading after the pharmacy retailer reported third-quarter earnings and sales that beat consensus.

Net income totaled $1.39 billion, or $1.36 per share, up from $1.29 billion, or $1.26 per share, last year.

Adjusted EPS was $1.73. Revenue totaled $47.3 billion, up from $46.2 billion. And same-store sales rose 6.7% with pharmacy same-store sales up 8.7%.

The FactSet consensus was for EPS of $1.71, revenue of $47.2 billion, and same-store sales growth of 5.4%.

Pharmacy same-store sales were forecast to be up 7.6%.

CVS continues to expect full-year EPS of $1.40 to $1.50 and adjusted EPS of $6.98 to $7.08. The FactSet guidance is for EPS of $7.04....

=> P/E|2018e = ~USD76 / USD7.04 = ~10.8 --> nicht sehr teuer würde ich mal sagen

CVS shares rise after earnings and sales beat consensus

Published: Nov 6, 2018 7:14 a.m. EThttps://www.marketwatch.com/story/cvs-shares-rise-after-earn…

=>

CVS Health Corp. shares rose 2.6% in Tuesday premarket trading after the pharmacy retailer reported third-quarter earnings and sales that beat consensus.

Net income totaled $1.39 billion, or $1.36 per share, up from $1.29 billion, or $1.26 per share, last year.

Adjusted EPS was $1.73. Revenue totaled $47.3 billion, up from $46.2 billion. And same-store sales rose 6.7% with pharmacy same-store sales up 8.7%.

The FactSet consensus was for EPS of $1.71, revenue of $47.2 billion, and same-store sales growth of 5.4%.

Pharmacy same-store sales were forecast to be up 7.6%.

CVS continues to expect full-year EPS of $1.40 to $1.50 and adjusted EPS of $6.98 to $7.08. The FactSet guidance is for EPS of $7.04....

=> P/E|2018e = ~USD76 / USD7.04 = ~10.8 --> nicht sehr teuer würde ich mal sagen

Antwort auf Beitrag Nr.: 59.148.543 von faultcode am 06.11.18 13:51:35

=>

...WASHINGTON — A federal judge on Monday sharply questioned the Justice Department’s decision to green-light CVS Health Corp.’s nearly $70 billion acquisition of Aetna Inc. , and said he may order CVS to halt its integration of Aetna’s assets while he considers the merger’s implications.

It is highly unusual for a judge to make such an announcement, since Justice Department antitrust enforcers had approved the deal in October under the condition the companies sell Aetna’s Medicare drug business to preserve competition. The companies sold those assets to WellCare Health Plans Inc.

When the Justice Department identifies concerns with a merger — and reaches an agreement with the merging companies to address them — a federal law called the Tunney Act requires the government to file the proposed settlement for approval by a federal court, which determines whether the deal is in the public interest.

Such settlements are almost universally approved, often without a judge calling a hearing. But U.S. District Judge Richard Leon — who was a central figure in AT&T Inc.’s merger with Time Warner Inc. — made clear he would play an active role.

He said at a terse hearing Monday — in which he sought no input from either the Justice Department or the companies — that he was concerned that the department hadn’t adequately addressed the potential competitive harms raised by the merger.

=> Aktie eigentlich ungerührt

WSJ: Judge questions CVS-Aetna merger, says he may halt asset integration

https://www.marketwatch.com/story/judge-questions-cvs-aetna-…=>

...WASHINGTON — A federal judge on Monday sharply questioned the Justice Department’s decision to green-light CVS Health Corp.’s nearly $70 billion acquisition of Aetna Inc. , and said he may order CVS to halt its integration of Aetna’s assets while he considers the merger’s implications.

It is highly unusual for a judge to make such an announcement, since Justice Department antitrust enforcers had approved the deal in October under the condition the companies sell Aetna’s Medicare drug business to preserve competition. The companies sold those assets to WellCare Health Plans Inc.

When the Justice Department identifies concerns with a merger — and reaches an agreement with the merging companies to address them — a federal law called the Tunney Act requires the government to file the proposed settlement for approval by a federal court, which determines whether the deal is in the public interest.

Such settlements are almost universally approved, often without a judge calling a hearing. But U.S. District Judge Richard Leon — who was a central figure in AT&T Inc.’s merger with Time Warner Inc. — made clear he would play an active role.

He said at a terse hearing Monday — in which he sought no input from either the Justice Department or the companies — that he was concerned that the department hadn’t adequately addressed the potential competitive harms raised by the merger.

=> Aktie eigentlich ungerührt

Antwort auf Beitrag Nr.: 59.360.066 von faultcode am 04.12.18 15:19:34

https://www.marketwatch.com/story/cvss-stock-jumps-after-dea…

=>

...Shares of CVS Health Corp. rallied 2.6% in premarket trade Friday, after the drugstore chain and Walmart Inc. have reached a multi-year agreement in which Walmart will continue to participate in the CVS Caremark pharmacy benefit management (PBM) retail pharmacy networks.

Walmart shares were still inactive. The companies did not disclose financial terms of the agreement. Earlier this week, CVS said Walmart had decided to leave its PBM networks because of a dispute over pricing. "We are very pleased to have reached a mutually agreeable solution with Walmart. As a PBM, our top priority is to help our clients and consumers lower their pharmacy costs," said CVS Caremark President Derica Rice. "This new agreement accomplishes our top priority and enables Walmart to continue participating in CVS Caremark's commercial and Managed Medicaid pharmacy networks and provides enhanced network stability for our clients and their members."...

CVS's stock jumps after deal to keep Walmart participating in PBM networks

18.1.https://www.marketwatch.com/story/cvss-stock-jumps-after-dea…

=>

...Shares of CVS Health Corp. rallied 2.6% in premarket trade Friday, after the drugstore chain and Walmart Inc. have reached a multi-year agreement in which Walmart will continue to participate in the CVS Caremark pharmacy benefit management (PBM) retail pharmacy networks.

Walmart shares were still inactive. The companies did not disclose financial terms of the agreement. Earlier this week, CVS said Walmart had decided to leave its PBM networks because of a dispute over pricing. "We are very pleased to have reached a mutually agreeable solution with Walmart. As a PBM, our top priority is to help our clients and consumers lower their pharmacy costs," said CVS Caremark President Derica Rice. "This new agreement accomplishes our top priority and enables Walmart to continue participating in CVS Caremark's commercial and Managed Medicaid pharmacy networks and provides enhanced network stability for our clients and their members."...

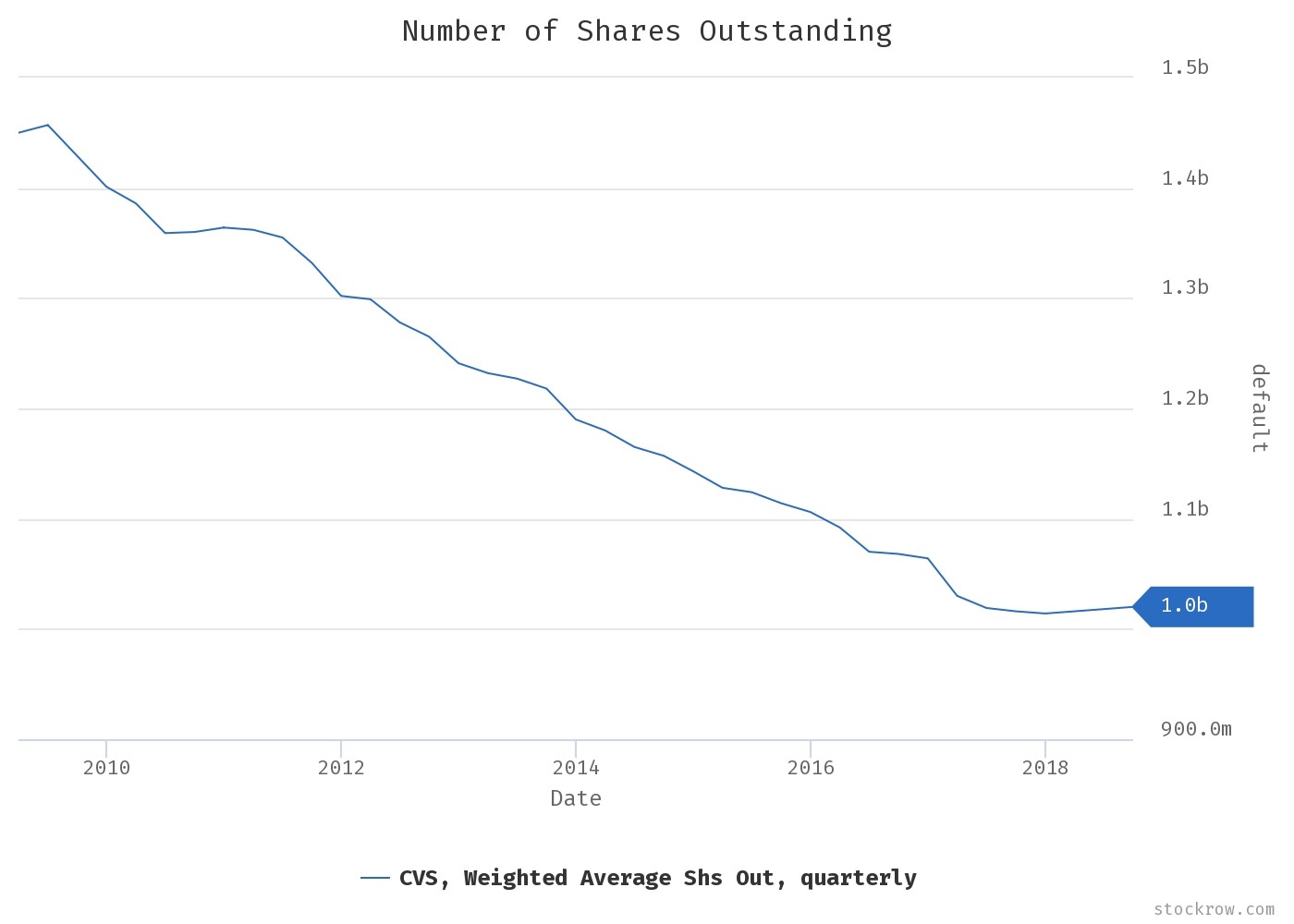

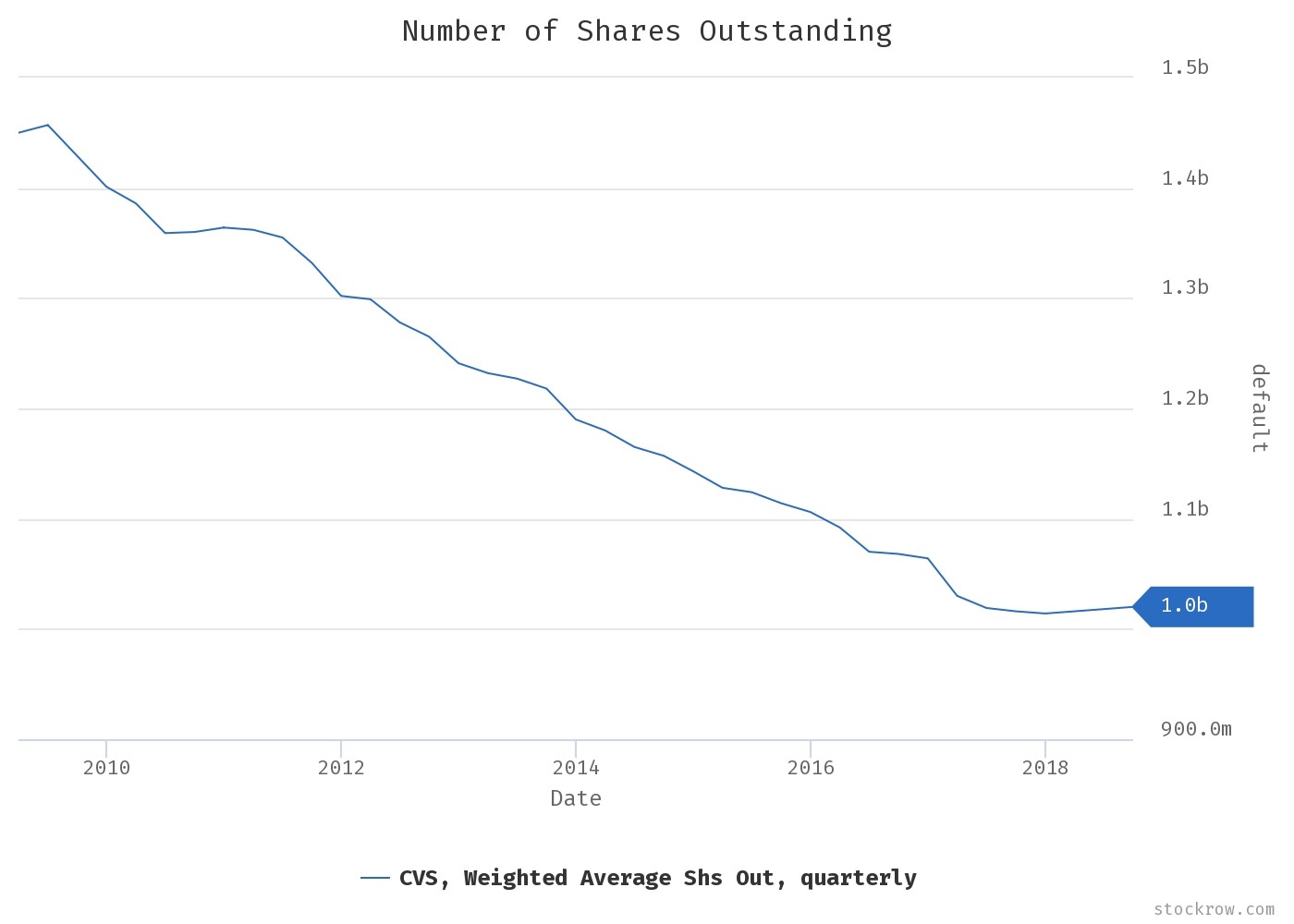

Antwort auf Beitrag Nr.: 59.661.401 von faultcode am 18.01.19 12:58:46auch so'n Ober-Aktienrückkäufer - eine Seuche:

Antwort auf Beitrag Nr.: 59.884.573 von faultcode am 15.02.19 15:49:35aus der 2018Q4-Präsi:

Balancing Near-term Execution with Long-term Vision: The Challenges in 2019

• Ongoing pharmacy reimbursement pressures in our businesses and reduction in offsets to those pressures, including a declining benefit from generics

• Lower brand inflation and ongoing questions around rebates

• Structural and CVS-specific challenges in long-term care space

These challenges are having a disproportionate impact compared to prior years

=> daher die Ernüchterung gestern mit -8% =>

Balancing Near-term Execution with Long-term Vision: The Challenges in 2019

• Ongoing pharmacy reimbursement pressures in our businesses and reduction in offsets to those pressures, including a declining benefit from generics

• Lower brand inflation and ongoing questions around rebates

• Structural and CVS-specific challenges in long-term care space

These challenges are having a disproportionate impact compared to prior years

=> daher die Ernüchterung gestern mit -8% =>

Beitrag zu dieser Diskussion schreiben

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +1,37 | |

| -0,73 | |

| -0,39 | |

| -0,35 | |

| +0,57 | |

| -0,84 | |

| -0,25 | |

| +1,63 | |

| +1,40 | |

| -0,13 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 255 | ||

| 79 | ||

| 72 | ||

| 66 | ||

| 36 | ||

| 34 | ||

| 26 | ||

| 23 | ||

| 22 | ||

| 22 |

02.05.24 · wO Chartvergleich · Ansys |

01.05.24 · wallstreetONLINE Redaktion · CVS Health |

01.05.24 · dpa-AFX · Advanced Micro Devices |

23.04.24 · Aktienwelt360 · Chevron Corporation |

16.04.24 · dpa-AFX · CVS Health |

03.04.24 · wallstreetONLINE Redaktion · CVS Health |

02.04.24 · dpa-AFX · CVS Health |