Skygold Ventures - 500 Beiträge pro Seite (Seite 3)

eröffnet am 09.03.06 21:37:53 von

neuester Beitrag 10.02.10 14:15:43 von

neuester Beitrag 10.02.10 14:15:43 von

Beiträge: 1.160

ID: 1.046.328

ID: 1.046.328

Aufrufe heute: 0

Gesamt: 94.025

Gesamt: 94.025

Aktive User: 0

ISIN: CA8464811097 · WKN: A0YJQF · Symbol: SPA

0,2150

CAD

+2,38 %

+0,0050 CAD

Letzter Kurs 25.04.24 TSX Venture

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,6900 | +23,96 | |

| 5,1500 | +21,75 | |

| 15,890 | +21,67 | |

| 0,8900 | +17,11 | |

| 0,9000 | +16,13 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,5200 | -6,61 | |

| 0,5180 | -7,09 | |

| 10,040 | -7,89 | |

| 0,5400 | -8,47 | |

| 46,88 | -97,99 |

hier im klartext

++

DAJIN RESOURCES ANNOUNCES SOIL SAMPLING PROGRAM COMPLETED ON ADDIE 1

DAJIN RESOURCES ANNOUNCES SOIL SAMPLING PROGRAM COMPLETED ON ADDIE 1

Oct. 19, 2009 (TheNewswire.ca) --

Vancouver, B.C. - October 19, 2009 - Dajin Resources (TSXV JI) Corp. ("Dajin")(DJI-V) is pleased to report that a geochemical sampling program has recently been completed on the Addie 1 claims which are located in the Cariboo Mining District in south central British Columbia. Dajin holds a 100% interest in 29 mineral claims covering 10,900 hectares which are along strike of the stratigraphy and regional structure that hosts potentially bulk tonnage mineable gold mineralization at Skygold Ventures Ltd.'s (TSXV:SKV) (SKV-V) Spanish Mountain gold discovery where SKV is currently drilling

JI) Corp. ("Dajin")(DJI-V) is pleased to report that a geochemical sampling program has recently been completed on the Addie 1 claims which are located in the Cariboo Mining District in south central British Columbia. Dajin holds a 100% interest in 29 mineral claims covering 10,900 hectares which are along strike of the stratigraphy and regional structure that hosts potentially bulk tonnage mineable gold mineralization at Skygold Ventures Ltd.'s (TSXV:SKV) (SKV-V) Spanish Mountain gold discovery where SKV is currently drilling

The Dajin soil sampling program consisted of 680 samples taken at twenty-five (25) meter intervals along eight (8) lines which were spaced at 500 metre intervals. The widely spaced soil sample lines are an initial low cost test of a several kilometre long anomalous zone identified by an earlier stream sediment sampling program and were designed to provide a focus for more detailed soil sampling. The soil samples acquired in the program were analyzed for gold using nominal 30 gram sample aliquots and wet chemical assay techniques at ACME Laboratories. Arsenic and other indicator elements were analyzed using a 0.5 gram sample aliquot and conventional ICP geochemical analysis techniques which also gave a second gold analytical value for each sample.

Initial review of the analyses shows clearly anomalous gold values above a threshold of 97 ppb on two adjacent lines with gold values to 750 ppb on one line and 638 ppb on the adjacent line. The 638 ppb gold value is one of several anomalous gold values encountered over a 100 metre length of Line 3. These samples that contain clearly anomalous quantities of gold in most cases also contain elevated quantities of molybdenum, lead, selenium and antimony. The gold anomalous samples are nested in a 400 metre long group of samples on Line 3 characterized by elevated gold contents that may yet prove to be indicative of underlying gold mineralization when the soil sampling grid is closed in with additional closer spaced lines. These encouraging geochemical results indicate the presence of a new anomalous gold region which may be up to 1.5 km long and which will require an additional soil sampling program with close line spacing to define drill targets for Dajin's 2010 exploration season.

About Dajin: (www.dajin.ca)

In the Cariboo Mining District Dajin owns a 100% interest in 20 mineral claims adjacent to Hawthorne Gold Corp's (OOTC:HWTHF) (TSXV:HGC) (HGC -V) Frasergold deposit and holds a 70/30 Joint Venture agreement with Hawthorne Gold Corp. in 18 adjacent claims, owns a 100% interest in 29 mineral claims in the Spanish Mountain region adjacent to Skygold Ventures Ltd's Spanish Mountain gold discovery and holds a Joint Venture agreement with Cariboo Rose Resources Ltd. (TSXV:CRB) (CRB-V) whereby Dajin can earn a 65% interest in the Cowtrail Property which is adjacent to the Fjordland/Cariboo Rose copper gold joint venture which was recently optioned by Gold Fields Limited (NYSE:GFI) with a $19 million work commitment over the next 7 years.

David Jenkins, P.Geo, a qualified person as defined by NI 43-101, has approved the technical content of this press release.

For further information please contact:

DAJIN RESOURCES CORP.

Brian Findlay, President

Phone: (604) 681-6151; Fax: (604) 689-7654

E-mail: brian@dajin.ca

++

DAJIN RESOURCES ANNOUNCES SOIL SAMPLING PROGRAM COMPLETED ON ADDIE 1

DAJIN RESOURCES ANNOUNCES SOIL SAMPLING PROGRAM COMPLETED ON ADDIE 1

Oct. 19, 2009 (TheNewswire.ca) --

Vancouver, B.C. - October 19, 2009 - Dajin Resources (TSXV

JI) Corp. ("Dajin")(DJI-V) is pleased to report that a geochemical sampling program has recently been completed on the Addie 1 claims which are located in the Cariboo Mining District in south central British Columbia. Dajin holds a 100% interest in 29 mineral claims covering 10,900 hectares which are along strike of the stratigraphy and regional structure that hosts potentially bulk tonnage mineable gold mineralization at Skygold Ventures Ltd.'s (TSXV:SKV) (SKV-V) Spanish Mountain gold discovery where SKV is currently drilling

JI) Corp. ("Dajin")(DJI-V) is pleased to report that a geochemical sampling program has recently been completed on the Addie 1 claims which are located in the Cariboo Mining District in south central British Columbia. Dajin holds a 100% interest in 29 mineral claims covering 10,900 hectares which are along strike of the stratigraphy and regional structure that hosts potentially bulk tonnage mineable gold mineralization at Skygold Ventures Ltd.'s (TSXV:SKV) (SKV-V) Spanish Mountain gold discovery where SKV is currently drillingThe Dajin soil sampling program consisted of 680 samples taken at twenty-five (25) meter intervals along eight (8) lines which were spaced at 500 metre intervals. The widely spaced soil sample lines are an initial low cost test of a several kilometre long anomalous zone identified by an earlier stream sediment sampling program and were designed to provide a focus for more detailed soil sampling. The soil samples acquired in the program were analyzed for gold using nominal 30 gram sample aliquots and wet chemical assay techniques at ACME Laboratories. Arsenic and other indicator elements were analyzed using a 0.5 gram sample aliquot and conventional ICP geochemical analysis techniques which also gave a second gold analytical value for each sample.

Initial review of the analyses shows clearly anomalous gold values above a threshold of 97 ppb on two adjacent lines with gold values to 750 ppb on one line and 638 ppb on the adjacent line. The 638 ppb gold value is one of several anomalous gold values encountered over a 100 metre length of Line 3. These samples that contain clearly anomalous quantities of gold in most cases also contain elevated quantities of molybdenum, lead, selenium and antimony. The gold anomalous samples are nested in a 400 metre long group of samples on Line 3 characterized by elevated gold contents that may yet prove to be indicative of underlying gold mineralization when the soil sampling grid is closed in with additional closer spaced lines. These encouraging geochemical results indicate the presence of a new anomalous gold region which may be up to 1.5 km long and which will require an additional soil sampling program with close line spacing to define drill targets for Dajin's 2010 exploration season.

About Dajin: (www.dajin.ca)

In the Cariboo Mining District Dajin owns a 100% interest in 20 mineral claims adjacent to Hawthorne Gold Corp's (OOTC:HWTHF) (TSXV:HGC) (HGC -V) Frasergold deposit and holds a 70/30 Joint Venture agreement with Hawthorne Gold Corp. in 18 adjacent claims, owns a 100% interest in 29 mineral claims in the Spanish Mountain region adjacent to Skygold Ventures Ltd's Spanish Mountain gold discovery and holds a Joint Venture agreement with Cariboo Rose Resources Ltd. (TSXV:CRB) (CRB-V) whereby Dajin can earn a 65% interest in the Cowtrail Property which is adjacent to the Fjordland/Cariboo Rose copper gold joint venture which was recently optioned by Gold Fields Limited (NYSE:GFI) with a $19 million work commitment over the next 7 years.

David Jenkins, P.Geo, a qualified person as defined by NI 43-101, has approved the technical content of this press release.

For further information please contact:

DAJIN RESOURCES CORP.

Brian Findlay, President

Phone: (604) 681-6151; Fax: (604) 689-7654

E-mail: brian@dajin.ca

Antwort auf Beitrag Nr.: 38.215.937 von umkehrformation am 20.10.09 18:35:35

Im Hintergrund habe ich gerade einen netten Gedankenaustausch mit einem hellen Menschen, der interessante Parallelen zum Januar aktuell sieht.

Dazu möchte ich zum Chart ein paar Posting weiter vorne noch etwas anfügen: RSI und Stochastik sind bereits deutlich abgekühlt, der MACD hat jedoch negativ getriggert.

Dazu muss ich aber folgende Anmerkung machen: Nach meiner Beoachtung bricht fast jede signifikante News den MACD, egal ob in die eine oder in die andere Richtung. Was ich damit sagen will: Legt Euch nicht auf die von mir anvisierten CAD 0,20 fest, sondern macht Euer eigenes DD-Ding...

Im Hintergrund habe ich gerade einen netten Gedankenaustausch mit einem hellen Menschen, der interessante Parallelen zum Januar aktuell sieht.

Dazu möchte ich zum Chart ein paar Posting weiter vorne noch etwas anfügen: RSI und Stochastik sind bereits deutlich abgekühlt, der MACD hat jedoch negativ getriggert.

Dazu muss ich aber folgende Anmerkung machen: Nach meiner Beoachtung bricht fast jede signifikante News den MACD, egal ob in die eine oder in die andere Richtung. Was ich damit sagen will: Legt Euch nicht auf die von mir anvisierten CAD 0,20 fest, sondern macht Euer eigenes DD-Ding...

Antwort auf Beitrag Nr.: 38.222.513 von to_siam am 21.10.09 14:43:30Zustimmung,

man beachte zudem Gold, welches uns bei SKV ja einen Höllen-Hebel beschert.

Aktuell scheint sich die 1050 als Unterstützung zu etablieren und wir nehmen bald Fahrt in Richtung 1100 auf.

Bei SKV ahnen das wohl auch schon einige. In den frühen Stunden sind jedenfalls heute stärkere Umsätze bei anziehendem Kurs als die letzten Tage

man beachte zudem Gold, welches uns bei SKV ja einen Höllen-Hebel beschert.

Aktuell scheint sich die 1050 als Unterstützung zu etablieren und wir nehmen bald Fahrt in Richtung 1100 auf.

Bei SKV ahnen das wohl auch schon einige. In den frühen Stunden sind jedenfalls heute stärkere Umsätze bei anziehendem Kurs als die letzten Tage

ITG heute wieder auf der Käuferseite...

10:56:57 V 0.27 +0.005 8,000 14 ITG 2 RBC K

10:53:47 V 0.27 +0.005 33,000 14 ITG 1 Anonymous K

10:47:54 V 0.27 +0.005 9,000 14 ITG 85 Scotia K

10:39:21 V 0.275 -0.005 100 57 Interactive 59 PI E

10:20:01 V 0.26 -0.005 9,500 7 TD Sec 79 CIBC K

10:20:01 V 0.27 +0.005 65,500 14 ITG 79 CIBC K

10:09:15 V 0.27 +0.005 9,000 14 ITG 88 Scotia iTRADE K

10:07:24 V 0.27 +0.005 300 14 ITG 33 Canaccord E

10:07:24 V 0.27 +0.005 25,000 14 ITG 79 CIBC K

09:52:05 V 0.27 -0.01 100 57 Interactive 59 PI E

bs

10:56:57 V 0.27 +0.005 8,000 14 ITG 2 RBC K

10:53:47 V 0.27 +0.005 33,000 14 ITG 1 Anonymous K

10:47:54 V 0.27 +0.005 9,000 14 ITG 85 Scotia K

10:39:21 V 0.275 -0.005 100 57 Interactive 59 PI E

10:20:01 V 0.26 -0.005 9,500 7 TD Sec 79 CIBC K

10:20:01 V 0.27 +0.005 65,500 14 ITG 79 CIBC K

10:09:15 V 0.27 +0.005 9,000 14 ITG 88 Scotia iTRADE K

10:07:24 V 0.27 +0.005 300 14 ITG 33 Canaccord E

10:07:24 V 0.27 +0.005 25,000 14 ITG 79 CIBC K

09:52:05 V 0.27 -0.01 100 57 Interactive 59 PI E

bs

Antwort auf Beitrag Nr.: 38.242.353 von boersensoldat am 23.10.09 17:14:33Jep, allerdings wird er auf der 0,27 immer schön bedient.

Ein OB bräuchte man

Ein OB bräuchte man

Filing Date Transaction Date Insider Name Ownership Type Securities Nature of transaction # or value acquired or disposed of Unit Price

Oct 22/09 Oct 12/09 Watson, Ian Direct Ownership Options 50 - Grant of options 300,000 $0.290

Oct 19/09 Oct 13/09 Groves, Brian John Direct Ownership Options 50 - Grant of options 100,000 $0.290

bs

Oct 22/09 Oct 12/09 Watson, Ian Direct Ownership Options 50 - Grant of options 300,000 $0.290

Oct 19/09 Oct 13/09 Groves, Brian John Direct Ownership Options 50 - Grant of options 100,000 $0.290

bs

Antwort auf Beitrag Nr.: 38.242.419 von Lennon. am 23.10.09 17:20:47Market Depth By Order For SKV as of 2009-10-23 12:30:55

Special terms orders and non-boardlot orders do not appear in the Market Depth by Order.

Bid

Broker Volume Price

14 ITG 100,000 0.27

7 TD Sec 500 0.26

85 Scotia 11,000 0.26

62 Haywood 4,000 0.255

88 Scotia iTRADE 10,000 0.255

7 TD Sec 4,800 0.25

62 Haywood 10,000 0.24

7 TD Sec 12,000 0.235

88 Scotia iTRADE 10,000 0.235

69 Jordan 100,000 0.23

Ask

Price Volume Broker

0.275 45,500 9 BMO Nesbitt

0.28 10,000 33 Canaccord

0.28 15,000 85 Scotia

0.29 20,000 7 TD Sec

0.29 20,000 33 Canaccord

0.29 30,000 7 TD Sec

0.295 15,000 85 Scotia

0.30 3,100 2 RBC

0.30 3,000 2 RBC

0.30 2,500 7 TD Sec

Market Book For SKV

Special terms orders and non-boardlot orders do not appear in the Market Depth by Order.

Bid

Broker Volume Price

14 ITG 100,000 0.27

7 TD Sec 500 0.26

85 Scotia 11,000 0.26

62 Haywood 4,000 0.255

88 Scotia iTRADE 10,000 0.255

7 TD Sec 4,800 0.25

62 Haywood 10,000 0.24

7 TD Sec 12,000 0.235

88 Scotia iTRADE 10,000 0.235

69 Jordan 100,000 0.23

Ask

Price Volume Broker

0.275 45,500 9 BMO Nesbitt

0.28 10,000 33 Canaccord

0.28 15,000 85 Scotia

0.29 20,000 7 TD Sec

0.29 20,000 33 Canaccord

0.29 30,000 7 TD Sec

0.295 15,000 85 Scotia

0.30 3,100 2 RBC

0.30 3,000 2 RBC

0.30 2,500 7 TD Sec

Market Book For SKV

Antwort auf Beitrag Nr.: 38.243.300 von to_siam am 23.10.09 18:51:15Orderbuch scheint zu drehen...Konsolidierung beendet???

Bid

# Orders # Shares Price

4 210,000 0.27

1 30,000 0.265

4 108,500 0.26

3 134,000 0.255

2 11,500 0.24

Ask

Price # Shares # Orders

0.275 14,000 1

0.28 35,500 1

0.29 45,500 3

0.295 15,000 1

0.30 79,600 6

Market Depth By Order For SKV as of 2009-10-26 09:46:05

Bid

# Orders # Shares Price

4 210,000 0.27

1 30,000 0.265

4 108,500 0.26

3 134,000 0.255

2 11,500 0.24

Ask

Price # Shares # Orders

0.275 14,000 1

0.28 35,500 1

0.29 45,500 3

0.295 15,000 1

0.30 79,600 6

Market Depth By Order For SKV as of 2009-10-26 09:46:05

Antwort auf Beitrag Nr.: 38.252.985 von NewAccount am 26.10.09 15:15:00Ganz kurz, da ich heute sehr knapp mit der Zeit bin: Ja, ich denke auch, dass das Orderbuch gerade drehen könnte. Die Chancen stehen dafür recht gut, aber die großen Verkäufer müssen wegbleiben. Bin eben mit einer kleineren Post in Frankfurt zu € 0,184 wieder rein. Schaun mer mal...

Antwort auf Beitrag Nr.: 38.253.205 von to_siam am 26.10.09 15:32:57.....also Deine 17,5K...

Hab heut ne Info bekommen,das angeblich Osisko über nen Fonds bei SKV einsteigen will.

Die Info halte ich persönlich allerdings für nicht sehr glaubwürdig.Na mal sehen,man kann ja Osisko in München mal darauf ansprechen.

bs

Hab heut ne Info bekommen,das angeblich Osisko über nen Fonds bei SKV einsteigen will.

Die Info halte ich persönlich allerdings für nicht sehr glaubwürdig.Na mal sehen,man kann ja Osisko in München mal darauf ansprechen.

bs

Antwort auf Beitrag Nr.: 38.253.357 von boersensoldat am 26.10.09 15:44:491. Bei Osisko würde das niemand mitkriegen

2. Osisko kauft keine Fonds

3. In München ist kein Canadier, sondern meines Wissens ein Deutscher der die Internetseite auf Deutsch macht..????

2. Osisko kauft keine Fonds

3. In München ist kein Canadier, sondern meines Wissens ein Deutscher der die Internetseite auf Deutsch macht..????

Antwort auf Beitrag Nr.: 38.253.592 von viena am 26.10.09 16:03:03Danke für die Klarstellung.

Antwort auf Beitrag Nr.: 38.253.592 von viena am 26.10.09 16:03:03zu 3. Stimmt,die sind ja in Montreal am 6.und 7.

Dann werd ich es in München bei einem "Kuli raus,sofort" belassen.

Ansonsten, wie schon vorhin erwähnt,traue ich der Info auch nicht.

bs

Dann werd ich es in München bei einem "Kuli raus,sofort" belassen.

Ansonsten, wie schon vorhin erwähnt,traue ich der Info auch nicht.

bs

Antwort auf Beitrag Nr.: 38.255.728 von boersensoldat am 26.10.09 19:06:43Danke Dir. Schaun mer mal, Newsflow sollten wir ja noch bekommen die nächsten Wochen...

Heute war dann wohl eher kein Tag für die Trendwende, dafür macht der Gesamtmarkt einen Strich durch die Rechnung.

Aber wir wissen ja alle, wie schnell es in die eine wie die andere Richtung gehen kann...

Heute war dann wohl eher kein Tag für die Trendwende, dafür macht der Gesamtmarkt einen Strich durch die Rechnung.

Indexes

DJIA 9873.86 -98.32

Nasdaq 2141.52 -12.95

TSX 11244.69 -137.44

TSX-V 1307.68 -26.23

TSX-Gold 326.26 -10.59

Aber wir wissen ja alle, wie schnell es in die eine wie die andere Richtung gehen kann...

Antwort auf Beitrag Nr.: 38.255.855 von to_siam am 26.10.09 19:23:49....es kann halt nicht jeden Tag nach oben gehen (RRI heut auch mit einem Dämpfer,allerdings ohne Volumen).

bs

bs

Antwort auf Beitrag Nr.: 38.255.984 von boersensoldat am 26.10.09 19:35:44RRI: Ja, das sind aktuell die Schlafmützen, die das Volumen zum Glattstellen verpasst haben. Ich selber habe nicht eine Share verkauft und freue mich lieber drauf, mit 100 % Bestand in die BE´s gehen zu können... ...hoppy oder toppy.

Es gibt Tage, da sollte man nicht mal im Traum ans verkaufen denken - sondern eher ans Einsammeln.

Vorhin hat mir einer eine Jux-Email geschickt, wieso ich denn so eine "komische" Zahl von 17.500 SKV gekauft hätte? Er weiß, dass ich sonst die Nullen mag. Hier aber mal die Antwort für alle, da sie auch Aufschlüsse über den "Mut zum Verkaufen im Hype" gibt: Es sind in etwa die "free Shares" aus den Gewinnen meines letzten SKV-Investments...

Es gibt Tage, da sollte man nicht mal im Traum ans verkaufen denken - sondern eher ans Einsammeln.

Vorhin hat mir einer eine Jux-Email geschickt, wieso ich denn so eine "komische" Zahl von 17.500 SKV gekauft hätte? Er weiß, dass ich sonst die Nullen mag. Hier aber mal die Antwort für alle, da sie auch Aufschlüsse über den "Mut zum Verkaufen im Hype" gibt: Es sind in etwa die "free Shares" aus den Gewinnen meines letzten SKV-Investments...

KAUFEN!

gefunden auf caesarsreport.com

After our sell-alert on SkyGold Ventures (SKV.V) at C$0.40, we are currently looking to buy again. We prefer to buy a first tranche under the C$0.27 mark.

gefunden auf caesarsreport.com

After our sell-alert on SkyGold Ventures (SKV.V) at C$0.40, we are currently looking to buy again. We prefer to buy a first tranche under the C$0.27 mark.

"Hi Dennis,

We have 3 drills on Spanish Mountain at present with the objective of finishing the program before the end of November. Our last announcement for Spanish Mtn clearly stated that we were planning about 4000m of HQ (large diameter) drilling. We have one HQ drill turning and a second will start this week to help keep the program on schedule. The third drill came from Spanish Creek where we completed a small program of 6 additional holes in early October. We have completed 3 deep (600m) holes and are considering one more hole.

We should see assays coming from the Spanish Creek holes this week and will plan a NR accordingly. With regard to the HQ, I have had a metallurgist review our assay procedures to ensure that we are optimizing the potential to see improved grades from the larger diameter drilling. This review has identified a revised procedure where we will be analyzing a larger sample of the core. As a consequence, sample preparation will be more time consuming and we expect that assay turn around times will not be as rapid (but still better than the experience in previous years as we have changed assay labs to expedite turnaround).

As I mentioned in an earlier message to you, I will be in London next week and plan a trip to Toronto in late November and a trip to the US in early December. I would hope that trading volumes will reflect the effort to inform more people of Skygold.

Regards,

Brian" Groves (CEO)

Quelle: http://www.stockhouse.com/Bullboards/MessageDetail.aspx?s=SKV&t=LIST&m=27587427&l=0&pd=2&r=0

We have 3 drills on Spanish Mountain at present with the objective of finishing the program before the end of November. Our last announcement for Spanish Mtn clearly stated that we were planning about 4000m of HQ (large diameter) drilling. We have one HQ drill turning and a second will start this week to help keep the program on schedule. The third drill came from Spanish Creek where we completed a small program of 6 additional holes in early October. We have completed 3 deep (600m) holes and are considering one more hole.

We should see assays coming from the Spanish Creek holes this week and will plan a NR accordingly. With regard to the HQ, I have had a metallurgist review our assay procedures to ensure that we are optimizing the potential to see improved grades from the larger diameter drilling. This review has identified a revised procedure where we will be analyzing a larger sample of the core. As a consequence, sample preparation will be more time consuming and we expect that assay turn around times will not be as rapid (but still better than the experience in previous years as we have changed assay labs to expedite turnaround).

As I mentioned in an earlier message to you, I will be in London next week and plan a trip to Toronto in late November and a trip to the US in early December. I would hope that trading volumes will reflect the effort to inform more people of Skygold.

Regards,

Brian" Groves (CEO)

Quelle: http://www.stockhouse.com/Bullboards/MessageDetail.aspx?s=SKV&t=LIST&m=27587427&l=0&pd=2&r=0

Antwort auf Beitrag Nr.: 38.314.942 von NewAccount am 04.11.09 02:11:08Ausbruch - mit 0,29 CAD sind wir drüber über dem KurzfristAbwärtstrend

Antwort auf Beitrag Nr.: 38.321.503 von umkehrformation am 04.11.09 20:13:26Der Caesars Report schreibt gerade eben:

SkyGold Ventures (SKV.V) is up 9.5% today. We hope you were able to buy some yesterday? I don't think much of you will have bought shares at our original .25-.255 buying limit, but at C$0.26, you could've been lucky to catch some!

SkyGold Ventures (SKV.V) is up 9.5% today. We hope you were able to buy some yesterday? I don't think much of you will have bought shares at our original .25-.255 buying limit, but at C$0.26, you could've been lucky to catch some!

Antwort auf Beitrag Nr.: 38.321.536 von umkehrformation am 04.11.09 20:16:04

Die 10k zu € 0,185 gestern in FRA liegen jetzt bei mir im Depot. Schaun mer mal. Hoher Goldpreis + positiver SKV-Newsflow = (IMHO) steigender SKV-Kurs...

...uns dieses sogar recht kurzfristig (2009). We will see!

Die 10k zu € 0,185 gestern in FRA liegen jetzt bei mir im Depot. Schaun mer mal. Hoher Goldpreis + positiver SKV-Newsflow = (IMHO) steigender SKV-Kurs...

...uns dieses sogar recht kurzfristig (2009). We will see!

Bißchen Bewegung ist heute ja schon mal wieder reingekommen (Schlusskurs an der TSX-V CAD 0.295 +0.01 +3.5%), aber zum richtig Spaß haben brauchen wir wohl positive News. Schaun mer mal, müsste ja eigentlich bald was kommen. Der Goldkurs an sich spielt ja gut mit und den braucht SKV ja auch, um die wirtschaftlichen Kennzahlen mit den aktuellen Eckdaten (z.B. Unzen, Goldgehalte und Recovery-Rates) weiter zu verbessern.

Antwort auf Beitrag Nr.: 38.352.809 von to_siam am 09.11.09 23:03:24ich glaube so richtig passiert hier erst was wenn Eckdaten zur Wirtschaftlichkeit zur Verfügung stehen ... in Kanada fischt jemand um die 29 cent alles weg was auf den Markt kommt...das sieht eigentlich so schlecht nicht aus. Ein paar gute Bohrergebnisse könnten auch helfen, vor allem wenn sie ausserhalb der Mainzone erbohrt werden. Je grösser das Deposit desto besser.

Antwort auf Beitrag Nr.: 38.367.809 von umkehrformation am 11.11.09 18:03:14

Ja, danke, sehr interessant. Die erwarten die Resultate von Bohrlöchern, die schon Ende September fertig waren. Könnte eigentlich jeden Tag losgehen...

Ja, danke, sehr interessant. Die erwarten die Resultate von Bohrlöchern, die schon Ende September fertig waren. Könnte eigentlich jeden Tag losgehen...

Nicht umsonst ist jetzt auch Pictet als Aktionär dabei (laut stockhouse), die sind es wohl, die um die 0,29 herum einsammeln.

heute schon 400.000 Stück...

da bahnt sich was an

heute schon 400.000 Stück...

da bahnt sich was an

Antwort auf Beitrag Nr.: 38.368.052 von umkehrformation am 11.11.09 18:31:00

Diese "Anbahnung" könnte ich vielleicht etwas beschleunigen. Ich weiß noch, wie es Ende September war. Mein EK war CAD 0,20 der Kurs auch und die Aktie kam irgendwie nicht aus dem Quark. Das ging mir auf den Sack und das habe ich hier auch geschrieben. Da wurde es plötzlich besser, ich musste aber weg in den Urlaub. Da habe ich vorher noch eine VK-Order auf die CAD 0,38 gepackt und als ich nach einer guten Woche wieder da war, hatte ich 90 % im Sack. Die Aktie war in der Spitze bis CAD 0,41/0,42 gelaufen...

...soll ich wieder?

Na ja, warten wir noch mal ein oder zwei Tage ab...

Diese "Anbahnung" könnte ich vielleicht etwas beschleunigen. Ich weiß noch, wie es Ende September war. Mein EK war CAD 0,20 der Kurs auch und die Aktie kam irgendwie nicht aus dem Quark. Das ging mir auf den Sack und das habe ich hier auch geschrieben. Da wurde es plötzlich besser, ich musste aber weg in den Urlaub. Da habe ich vorher noch eine VK-Order auf die CAD 0,38 gepackt und als ich nach einer guten Woche wieder da war, hatte ich 90 % im Sack. Die Aktie war in der Spitze bis CAD 0,41/0,42 gelaufen...

...soll ich wieder?

Na ja, warten wir noch mal ein oder zwei Tage ab...

Warten ist gefährlich...

schon sehr erstaunlich, daß kaum jemand mitliest, in kanada sind mehr leute aktiv.

Naja der deutsche Michel liegt ja meist falsch...

schon sehr erstaunlich, daß kaum jemand mitliest, in kanada sind mehr leute aktiv.

Naja der deutsche Michel liegt ja meist falsch...

Antwort auf Beitrag Nr.: 38.368.950 von umkehrformation am 11.11.09 20:23:06Na ja, gestern hatten viele Leute wohl andere Dinge im

Kopf, denke da mal an die auch für mich erschütternde

Entwicklung um Robert Enke.

***

Skygold: Ein paar Tage Ruhe vielleicht noch, doch dann

könnte es meiner Meinung nach in der nächsten oder

übernächsten Woche mit dem Upmove (newsbegleitend)

beginnen. Ansonsten wären wir auch schon bald im Dezember,

wenn ab Monatsmitte der Markt zumeist auf die

Feiertage bzw. Tax-Loss-Selling umstellt:

Kopf, denke da mal an die auch für mich erschütternde

Entwicklung um Robert Enke.

***

Skygold: Ein paar Tage Ruhe vielleicht noch, doch dann

könnte es meiner Meinung nach in der nächsten oder

übernächsten Woche mit dem Upmove (newsbegleitend)

beginnen. Ansonsten wären wir auch schon bald im Dezember,

wenn ab Monatsmitte der Markt zumeist auf die

Feiertage bzw. Tax-Loss-Selling umstellt:

Antwort auf Beitrag Nr.: 38.371.875 von to_siam am 12.11.09 10:35:52tax loss selling

schau dir doch mal deinen chart an - letztes jahr dezember

tax win buying fand da statt

schau dir doch mal deinen chart an - letztes jahr dezember

tax win buying fand da statt

Antwort auf Beitrag Nr.: 38.371.909 von umkehrformation am 12.11.09 10:39:54

Da stand der Kurs doch weitgehend bei CAD 0,10, bis in den Januar 09 hinein - ein Witz damals. Aber das galt für fast alle Explorer seinerzeit...

Da stand der Kurs doch weitgehend bei CAD 0,10, bis in den Januar 09 hinein - ein Witz damals. Aber das galt für fast alle Explorer seinerzeit...

Möglicherweise sind "Wir" auch Gegenstand des folgenden Artikels

http://www.bloomberg.com/apps/news?pid=20601082&sid=aHBYpk8p…

http://www.bloomberg.com/apps/news?pid=20601082&sid=aHBYpk8p…

Nov 13/09 Nov 11/09 Watson, Ian Indirect Ownership Common Shares 10 - Acquisition in the public market 74,000 $0.301

Nov 11/09 Nov 04/09 Watson, Ian Indirect Ownership Common Shares 10 - Acquisition in the public market 26,000 $0.270

http://www.canadianinsider.com/coReport/allTransactions.php?…

Nov 11/09 Nov 04/09 Watson, Ian Indirect Ownership Common Shares 10 - Acquisition in the public market 26,000 $0.270

http://www.canadianinsider.com/coReport/allTransactions.php?…

Heute hat CIBC fast alles weggekauft

Antwort auf Beitrag Nr.: 38.405.985 von NewAccount am 17.11.09 20:33:46Das sind 100.000 Shares!

Nov 25/09 Nov 25/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 50,000 $0.260

http://www.canadianinsider.com/coReport/allTransactions.php?…

http://www.canadianinsider.com/coReport/allTransactions.php?…

Antwort auf Beitrag Nr.: 38.464.680 von ernie021 am 26.11.09 22:10:16Danke schön, das hilft die aktuell laue Zeit bei SKV in einem allgemeinen Gold-Bullenmarkt etwas zu überbrücken.

Wann hat der Verkäufer endlich fertig?

Jetzt sind 254K im ASK auf der 0,26

Na dann Prost

Jetzt sind 254K im ASK auf der 0,26

Na dann Prost

Antwort auf Beitrag Nr.: 38.496.036 von Haxe08 am 02.12.09 17:12:20

Geht mir auch auf dem Sack, aber denk Bitte noch mal an die Zeit vor dem letzten > 100 % Run zurück.

Da hatte einer eine siebenstellige Stückzahl für rund CAD 0,17/0,18 verscherbelt, ich hatte das ziemlich akribisch hier aufgerechnet. Und dann?

Ja, irgendwann war er fertig, dann kamen weitere Käufe (die vom Seller wurden ja auch genommen), dann kamen News, Empfehlungen, noch mehr Käufe und Zack - waren wir über CAD 0,40!

Manchmal muss man eben ein dickes Fell haben und Geduld und dann im Hype den Sell-Button zur halbwegs rechten Zeit finden...

Geht mir auch auf dem Sack, aber denk Bitte noch mal an die Zeit vor dem letzten > 100 % Run zurück.

Da hatte einer eine siebenstellige Stückzahl für rund CAD 0,17/0,18 verscherbelt, ich hatte das ziemlich akribisch hier aufgerechnet. Und dann?

Ja, irgendwann war er fertig, dann kamen weitere Käufe (die vom Seller wurden ja auch genommen), dann kamen News, Empfehlungen, noch mehr Käufe und Zack - waren wir über CAD 0,40!

Manchmal muss man eben ein dickes Fell haben und Geduld und dann im Hype den Sell-Button zur halbwegs rechten Zeit finden...

Antwort auf Beitrag Nr.: 38.497.598 von to_siam am 02.12.09 20:15:00Danke für deine aufmunternden Worte.

Das ärgerliche an der Sache ist, das SKV den Hebel Gold keineswegs nutzen konnte. Ich will gar nicht wissen was passiert wenn Gold anfängt zu schwächeln. Gute News in einer Konsolidierungsphase von Gold werden verpuffen meiner Meinung nach.

Naja man kanns nicht ändern, warten wir es ab.

Das ärgerliche an der Sache ist, das SKV den Hebel Gold keineswegs nutzen konnte. Ich will gar nicht wissen was passiert wenn Gold anfängt zu schwächeln. Gute News in einer Konsolidierungsphase von Gold werden verpuffen meiner Meinung nach.

Naja man kanns nicht ändern, warten wir es ab.

Antwort auf Beitrag Nr.: 38.501.917 von Haxe08 am 03.12.09 13:31:40Ich kenne weder Deinen EK noch Deinen Anlagehintergrund hier, aber für mich ist das eine kurzfristige Sache, da ich hier nicht auf eine Mine spekuliere. Aber ein klein wenig sollte B.G. schon noch an News in der Pipeline haben, um hier zumindest noch mal einen Test der CAD 0,40 zu sehen.

Immerhin haben die Insider zu diesen Kursen auch gekauft, also kann es so schlecht um SKV nicht stehen:

Quelle: http://www.canadianinsider.com/coReport/allTransactions.php?…

Und auch der Chart sagt mir, dass wir das untere Ende der Fahnenstange eigentlich bald gesehen haben müssten. Ob der Kurs-TurnAround nun noch im Dezember 2009 stattfindet oder erst in 2010, dass weiß ich natürlich genauso wenig, wir irgend jemand hier:

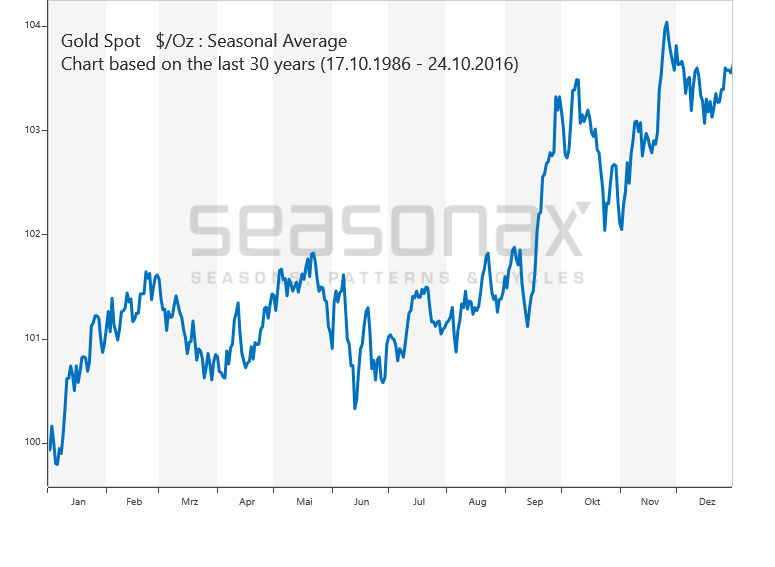

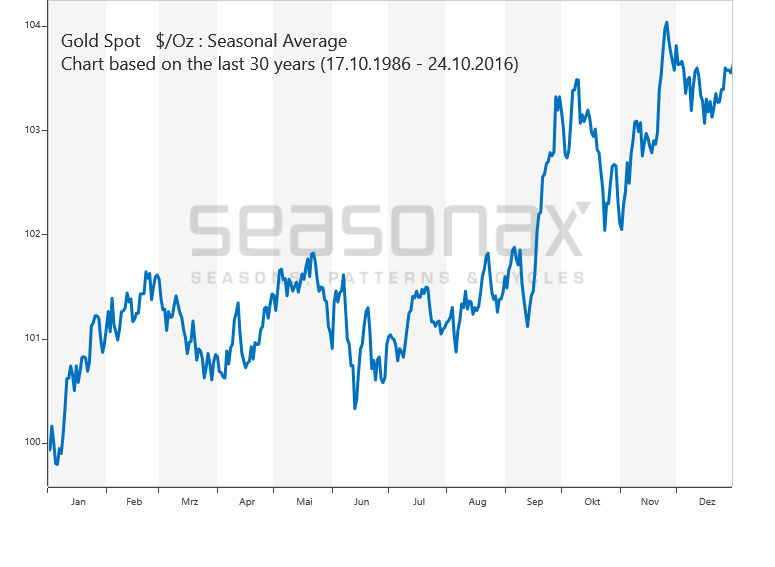

Aber auch das jeweils erste Quartal eines Jahres ist oft ein Goldquartal, zumindest die ersten beiden Monate Januar und Februar:

Ich denke schon, dass ich hier noch einmal meinen Schnitt machen werde. Der Aufwärtstrend bei SKV ist jedenfalls noch voll intakt und testet aktuell sogar die untere Begrenzung. Wenn die hält und es gibt einen Abpraller nach oben...

Immerhin haben die Insider zu diesen Kursen auch gekauft, also kann es so schlecht um SKV nicht stehen:

Nov 27/09 Nov 27/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 50,000 $0.250

Nov 27/09 Nov 18/09 Watson, Ian Direct Ownership Common Shares 10 - Acquisition in the public market 100,000 $0.270

Nov 25/09 Nov 25/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 50,000 $0.260

Nov 13/09 Nov 11/09 Watson, Ian Indirect Ownership Common Shares 10 - Acquisition in the public market 74,000 $0.301

Nov 11/09 Nov 04/09 Watson, Ian Indirect Ownership Common Shares 10 - Acquisition in the public market 26,000 $0.270

Quelle: http://www.canadianinsider.com/coReport/allTransactions.php?…

Und auch der Chart sagt mir, dass wir das untere Ende der Fahnenstange eigentlich bald gesehen haben müssten. Ob der Kurs-TurnAround nun noch im Dezember 2009 stattfindet oder erst in 2010, dass weiß ich natürlich genauso wenig, wir irgend jemand hier:

Aber auch das jeweils erste Quartal eines Jahres ist oft ein Goldquartal, zumindest die ersten beiden Monate Januar und Februar:

Ich denke schon, dass ich hier noch einmal meinen Schnitt machen werde. Der Aufwärtstrend bei SKV ist jedenfalls noch voll intakt und testet aktuell sogar die untere Begrenzung. Wenn die hält und es gibt einen Abpraller nach oben...

Antwort auf Beitrag Nr.: 38.502.145 von to_siam am 03.12.09 14:02:39Irgendwie bekomme ich die BigCharts hier nicht mehr rein, unten zur Sicherheit mal der Link:

http://bigcharts.marketwatch.com/charts/big.chart?frames=1&s…

http://bigcharts.marketwatch.com/charts/big.chart?frames=1&s…

Es wird weiter fleißig gesammelt bei SKV...

Skygold Ventures Ltd. (SKV)

As of December 4th, 2009

Dec 04/09 Dec 04/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 100,000 $0.235

bs

Skygold Ventures Ltd. (SKV)

As of December 4th, 2009

Dec 04/09 Dec 04/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 100,000 $0.235

bs

Antwort auf Beitrag Nr.: 38.515.548 von boersensoldat am 05.12.09 17:48:25Vielen Dank.

Vielleicht auch interessant

December 7, 2009 - Vancouver, British Columbia - Happy Creek Minerals Ltd. (TSX-V: HPY, the "Company") is pleased to announce that it has acquired an option to earn a 100 percent interest in a mineral property that adjoins the south side of the Company's Art - DL gold-silver property and adjoins the north side of Skygold Ventures Ltd. Spanish Creek-Thunder Ridge gold-silver discovery.

http://www.tradingmarkets.com/.site/news/Stock%20News/270552…

December 7, 2009 - Vancouver, British Columbia - Happy Creek Minerals Ltd. (TSX-V: HPY, the "Company") is pleased to announce that it has acquired an option to earn a 100 percent interest in a mineral property that adjoins the south side of the Company's Art - DL gold-silver property and adjoins the north side of Skygold Ventures Ltd. Spanish Creek-Thunder Ridge gold-silver discovery.

http://www.tradingmarkets.com/.site/news/Stock%20News/270552…

die meldung zeigt wirkung

bis zum pp-niveau fast 40% plus möglich ...

bis zum pp-niveau fast 40% plus möglich ...

Antwort auf Beitrag Nr.: 38.528.808 von umkehrformation am 08.12.09 16:06:09

Jo, deshalb habe ich dem Makler in Frankfurt eben auch noch zwei Schübe zu € 0,151 abgenommen. Könnte nach PP-Closing ein schneller Cent werden...

Jo, deshalb habe ich dem Makler in Frankfurt eben auch noch zwei Schübe zu € 0,151 abgenommen. Könnte nach PP-Closing ein schneller Cent werden...

Antwort auf Beitrag Nr.: 38.528.808 von umkehrformation am 08.12.09 16:06:09der Preis das PP ist wirklich ein Fingerzeig...warum schon istein Investor bereit soviel Aufschlag zu zahlen? ..nun, ich denke es sind wieder die Engländer und die wollen unbedingt den Anteil an Skygold ausbauen..nimmt man die Warrants dazu kommen sie locker auf 20% der Company wenn sie denn ausüben .. das bringt einen weiteren positiven Effekt..die Aktie aus dem PP werden nicht sofort auf den Markt fliegen sondern gehalten werden. Die Engländer sind wohl längerfristig an SKV interessiert anstatt den schnellen Dollar verdienen zu wollen.

Haben sie sich erstmal genügend Anteile gesichert werden auch entspechende PR-Massnahmen beginnen .

.

Billig ist SKV allemal im Verhältnis zu ITH oder Brett Resources.. die sind mit äusserst ähnlichem Deposit das 10-fache Wert nur Aufgrund einer positiven PEA...

Haben sie sich erstmal genügend Anteile gesichert werden auch entspechende PR-Massnahmen beginnen

.

.Billig ist SKV allemal im Verhältnis zu ITH oder Brett Resources.. die sind mit äusserst ähnlichem Deposit das 10-fache Wert nur Aufgrund einer positiven PEA...

Antwort auf Beitrag Nr.: 38.529.237 von to_siam am 08.12.09 16:49:49ich versuch zu 13,5 cent zusammeln falls Gold weiter abtaucht und die Paniker anfangen ihre Aktien zu verschenken ...wenns klappt gut, wenn nicht auch nich schlimm

...wenns klappt gut, wenn nicht auch nich schlimm

...wenns klappt gut, wenn nicht auch nich schlimm

...wenns klappt gut, wenn nicht auch nich schlimm

Unser großer Verkäufer lässt sich durch die News nicht beeinflussen und verkauft fröhlich weiter

Antwort auf Beitrag Nr.: 38.539.591 von Haxe08 am 09.12.09 21:34:44Das PP muss schnell zu und dann müssen gute News her. Vor dem letzten Upmove war es ähnlich...

Antwort auf Beitrag Nr.: 38.540.758 von to_siam am 10.12.09 07:34:08so sehe ich das auch...

über TD Securities werden mehrfach große Blöcke gekauft...

über TD Securities werden mehrfach große Blöcke gekauft...

Antwort auf Beitrag Nr.: 38.552.836 von umkehrformation am 11.12.09 17:11:05die Rücksetzer die wir grad ertragen müssen bieten wunderare Nachkaufmöglichkeiten... irgendwann hab ich die 100000 Aktien voll und dann ab auf 1-2$  ...wenn die Engländer das PP schon zu 33 cent nehmen (und sie sollten informiert sein was in der Company passiert) wird das schon seinen Grund haben ... also Augen zu und durch..nicht ärgern sondern weiter aufstocken solange es noch billig ist

...wenn die Engländer das PP schon zu 33 cent nehmen (und sie sollten informiert sein was in der Company passiert) wird das schon seinen Grund haben ... also Augen zu und durch..nicht ärgern sondern weiter aufstocken solange es noch billig ist

...wenn die Engländer das PP schon zu 33 cent nehmen (und sie sollten informiert sein was in der Company passiert) wird das schon seinen Grund haben ... also Augen zu und durch..nicht ärgern sondern weiter aufstocken solange es noch billig ist

...wenn die Engländer das PP schon zu 33 cent nehmen (und sie sollten informiert sein was in der Company passiert) wird das schon seinen Grund haben ... also Augen zu und durch..nicht ärgern sondern weiter aufstocken solange es noch billig ist

In letzter Zeit schön eingekauft

Skygold Ventures Ltd. (SKV)

As of December 15th, 2009

Filing Date Transaction Date Insider Name Ownership Type Securities Nature of transaction # or value acquired or disposed of Unit Price

Dec 11/09 Dec 11/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 2,000 $0.225

Dec 07/09 Dec 07/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 1,000 $0.225

Dec 04/09 Dec 04/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 100,000 $0.235

Nov 27/09 Nov 27/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 50,000 $0.250

Nov 27/09 Nov 18/09 Watson, Ian Direct Ownership Common Shares 10 - Acquisition in the public market 100,000 $0.270

Nov 25/09 Nov 25/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 50,000 $0.260

Nov 13/09 Nov 11/09 Watson, Ian Indirect Ownership Common Shares 10 - Acquisition in the public market 74,000 $0.301

Nov 11/09 Nov 04/09 Watson, Ian Indirect Ownership Common Shares 10 - Acquisition in the public market 26,000 $0.270

Nov 11/09 Sep 28/09 Watson, Ian Indirect Ownership Common Shares 00 - Opening Balance-Initial SEDI Report

Oct 22/09 Oct 12/09 Watson, Ian Direct Ownership Options 50 - Grant of options 300,000 $0.290

Skygold Ventures Ltd. (SKV)

As of December 15th, 2009

Filing Date Transaction Date Insider Name Ownership Type Securities Nature of transaction # or value acquired or disposed of Unit Price

Dec 11/09 Dec 11/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 2,000 $0.225

Dec 07/09 Dec 07/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 1,000 $0.225

Dec 04/09 Dec 04/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 100,000 $0.235

Nov 27/09 Nov 27/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 50,000 $0.250

Nov 27/09 Nov 18/09 Watson, Ian Direct Ownership Common Shares 10 - Acquisition in the public market 100,000 $0.270

Nov 25/09 Nov 25/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 50,000 $0.260

Nov 13/09 Nov 11/09 Watson, Ian Indirect Ownership Common Shares 10 - Acquisition in the public market 74,000 $0.301

Nov 11/09 Nov 04/09 Watson, Ian Indirect Ownership Common Shares 10 - Acquisition in the public market 26,000 $0.270

Nov 11/09 Sep 28/09 Watson, Ian Indirect Ownership Common Shares 00 - Opening Balance-Initial SEDI Report

Oct 22/09 Oct 12/09 Watson, Ian Direct Ownership Options 50 - Grant of options 300,000 $0.290

Einstieg voraus:

SKV

SKYGOLD VENTURES LTD

Weekly Commentary

Our system posted BUY-IF . The previous SELL recommendation that was confirmed was made on 11.27.2009 (18) days ago, when the stock price was 0.2700 . Since then SKV has fallen -11.11% .

A bullish pattern has developed and a BUY-IF alert is issued. Now, the task is to confirm the validity of this bullish pattern. We are posting daily the current confirmation status, but It is still your duty to do your homework. A good starting point would be to keep an eye on futures trading to get preliminary hints about the direction of the market. Related news, events, economic data, and the world stock markets should also be closely followed prior to and during the confirmation week.

There are three possible cases of confirmation. This week, you have to follow the sessions carefully to check if these cases will hold or not:

The week opens with an upward gap, signaling a bullish sentiment in the first case. Your benchmark will be the week's opening price. If the prices stay over the benchmark, go long. Any white candlestick with an upward gap is a valid confirmation criterion.

In the second case, the week opens at a level, equal to or below the previous week’s close. The benchmark is that previous close. If prices during the week stay over the benchmark, go long. Any white candlestick closing above the previous week’s close is the second confirmation criterion.

If, however, in both cases, the prices during the week start coming below the benchmark, avoid buying. Sell if you feel a definite tendency in prices to close the week below the benchmark.

The third case of confirmation is rarely observed. The week opens with a big downward gap suggesting a very bearish week, and the week ends with a long white candlestick, but still closing below the previous week’s close. However, such a week satisfies the third confirmation criterion and in this case the closing price of the long white candlestick is taken as the price of confirmation.

If one of the three confirmation criteria is not fulfilled, or in case of a black candlestick or a doji on the confirmation week, the BUY-IF alert remains valid, however without confirmation and the three confirmation criteria are then sought in the following week. The only exception is the long black candlestick. Any long black candlestick following a BUY-IF alert makes it (the signal) void and invalid.

We do not suggest any new short positions given the bullish alert. The short sellers should consider covering their positions if the market confirms the BUY-IF signal. Otherwise, existing short positions should be carried.

Data provided by: End of Day Data

BUY-IF

0.2400

+0.0100 +4.35%

Candlestick Analysis

Intraweek Candlestick:

Doji

Last Week's Pattern(s):

Bullish (Doji) Star

Candlestick Pattern

Intraweek Confirmation Status : Currenly not confirmed.

An intraweek Doji was formed. This shows indecision about the direction of the market and it represents a tug-of-war between buyers and sellers.

For more about this candlestick click here.

The last two week's candlestick pattern that is subject to confirmation is a Bullish (Doji) Star Pattern . This is a bullish reversal pattern that marks a potential change in trend. However, its reliability is not very high and it requires confirmation.

For more about this pattern click here.

SKV

SKYGOLD VENTURES LTD

Weekly Commentary

Our system posted BUY-IF . The previous SELL recommendation that was confirmed was made on 11.27.2009 (18) days ago, when the stock price was 0.2700 . Since then SKV has fallen -11.11% .

A bullish pattern has developed and a BUY-IF alert is issued. Now, the task is to confirm the validity of this bullish pattern. We are posting daily the current confirmation status, but It is still your duty to do your homework. A good starting point would be to keep an eye on futures trading to get preliminary hints about the direction of the market. Related news, events, economic data, and the world stock markets should also be closely followed prior to and during the confirmation week.

There are three possible cases of confirmation. This week, you have to follow the sessions carefully to check if these cases will hold or not:

The week opens with an upward gap, signaling a bullish sentiment in the first case. Your benchmark will be the week's opening price. If the prices stay over the benchmark, go long. Any white candlestick with an upward gap is a valid confirmation criterion.

In the second case, the week opens at a level, equal to or below the previous week’s close. The benchmark is that previous close. If prices during the week stay over the benchmark, go long. Any white candlestick closing above the previous week’s close is the second confirmation criterion.

If, however, in both cases, the prices during the week start coming below the benchmark, avoid buying. Sell if you feel a definite tendency in prices to close the week below the benchmark.

The third case of confirmation is rarely observed. The week opens with a big downward gap suggesting a very bearish week, and the week ends with a long white candlestick, but still closing below the previous week’s close. However, such a week satisfies the third confirmation criterion and in this case the closing price of the long white candlestick is taken as the price of confirmation.

If one of the three confirmation criteria is not fulfilled, or in case of a black candlestick or a doji on the confirmation week, the BUY-IF alert remains valid, however without confirmation and the three confirmation criteria are then sought in the following week. The only exception is the long black candlestick. Any long black candlestick following a BUY-IF alert makes it (the signal) void and invalid.

We do not suggest any new short positions given the bullish alert. The short sellers should consider covering their positions if the market confirms the BUY-IF signal. Otherwise, existing short positions should be carried.

Data provided by: End of Day Data

BUY-IF

0.2400

+0.0100 +4.35%

Candlestick Analysis

Intraweek Candlestick:

Doji

Last Week's Pattern(s):

Bullish (Doji) Star

Candlestick Pattern

Intraweek Confirmation Status : Currenly not confirmed.

An intraweek Doji was formed. This shows indecision about the direction of the market and it represents a tug-of-war between buyers and sellers.

For more about this candlestick click here.

The last two week's candlestick pattern that is subject to confirmation is a Bullish (Doji) Star Pattern . This is a bullish reversal pattern that marks a potential change in trend. However, its reliability is not very high and it requires confirmation.

For more about this pattern click here.

scheint so als ob unser Verkäufer langsam fertig ist... sollte ab jetzt wieder aufwärts gehen..die Ampeln stehen auf grün

..könnten steuerbedingte Verkäufe gewesen sein

..könnten steuerbedingte Verkäufe gewesen sein

schöner endspurt heute

auf grüne Ampeln

noch 1 so ein tag und der Ausbruch ist da... dann gehts schnell wieder auf 30-40 cent ... 2010 sollte dann der Durchbruch gelingen.. das Gold ist da ..fehlt nur noch die erste ökonomische Studie und SKV ist auf dem Übernahmeteller ...

2$ sind das Ziel ohne weitere Fund (bei derzeitigen Goldpreis und ohne weitere Verwässerung in naher Zukunft)

..also haltet euch ran und kauft billig zu

2$ sind das Ziel ohne weitere Fund (bei derzeitigen Goldpreis und ohne weitere Verwässerung in naher Zukunft)

..also haltet euch ran und kauft billig zu

Antwort auf Beitrag Nr.: 38.628.789 von German2 am 23.12.09 22:57:23Skygold schaut jetzt wieder richtig gut aus!

MACD mit fettem Kaufsignal!

Weiterhin schöne Insiderkäufe und nicht zu vergessen, das kürzlich angekündigte PP zu 0,33 CAD!!!

Hier kann man imho bei einem Kauf wenig falsch machen...

Skygold Ventures Ltd. (SKV) As of December 24th, 2009

Filing Date Transaction Date Insider Name Ownership Type Securities Nature of transaction # or value acquired or disposed of Unit Price

Dec 19/09 Dec 18/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 43,500 $0.225

Dec 11/09 Dec 11/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 2,000 $0.225

Dec 07/09 Dec 07/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 1,000 $0.225

Dec 04/09 Dec 04/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 100,000 $0.235

Nov 27/09 Nov 27/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 50,000 $0.250

Nov 27/09 Nov 18/09 Watson, Ian Direct Ownership Common Shares 10 - Acquisition in the public market 100,000 $0.270

Nov 25/09 Nov 25/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 50,000 $0.260

Nov 13/09 Nov 11/09 Watson, Ian Indirect Ownership Common Shares 10 - Acquisition in the public market 74,000 $0.301

Nov 11/09 Nov 04/09 Watson, Ian Indirect Ownership Common Shares 10 - Acquisition in the public market 26,000 $0.270

Quelle: http://www.canadianinsider.com/coReport/allTransactions.php?…

MACD mit fettem Kaufsignal!

Weiterhin schöne Insiderkäufe und nicht zu vergessen, das kürzlich angekündigte PP zu 0,33 CAD!!!

Hier kann man imho bei einem Kauf wenig falsch machen...

Skygold Ventures Ltd. (SKV) As of December 24th, 2009

Filing Date Transaction Date Insider Name Ownership Type Securities Nature of transaction # or value acquired or disposed of Unit Price

Dec 19/09 Dec 18/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 43,500 $0.225

Dec 11/09 Dec 11/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 2,000 $0.225

Dec 07/09 Dec 07/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 1,000 $0.225

Dec 04/09 Dec 04/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 100,000 $0.235

Nov 27/09 Nov 27/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 50,000 $0.250

Nov 27/09 Nov 18/09 Watson, Ian Direct Ownership Common Shares 10 - Acquisition in the public market 100,000 $0.270

Nov 25/09 Nov 25/09 Sharp, Donald Douglas Direct Ownership Common Shares 10 - Acquisition in the public market 50,000 $0.260

Nov 13/09 Nov 11/09 Watson, Ian Indirect Ownership Common Shares 10 - Acquisition in the public market 74,000 $0.301

Nov 11/09 Nov 04/09 Watson, Ian Indirect Ownership Common Shares 10 - Acquisition in the public market 26,000 $0.270

Quelle: http://www.canadianinsider.com/coReport/allTransactions.php?…

Antwort auf Beitrag Nr.: 38.631.724 von NewAccount am 25.12.09 19:42:47BUY CONFIRMED

http://www.americanbulls.com/weekly/StockPage.asp?CompanyTic…

http://www.americanbulls.com/weekly/StockPage.asp?CompanyTic…

Antwort auf Beitrag Nr.: 38.632.492 von NewAccount am 26.12.09 16:24:18Bottom-Fish Comment - October 2, 2009:

Skygold attracts backing from London group headed by Ian Watson

Skygold Ventures Ltd, the gold junior with a 2.9 million ounce open-pittable gold deposit in British Columbia that has languished because of management's lack of "skin the game", appears to have solved this problem by completing a private placement of 13 million units at .17 with a London group headed by Ian Watson. The $2,210,000 financing was announced on September 23 and has already closed, with Ian Watson himself taking down 4,184,140 units, Haywood broker Scott Hunter 150,000 units, and CEO Brian Groves with 150,000 units. The Pamicon team headed by Doug Fulcher which manages Skygold and owns a whopping 76,000 shares kept their wallets closed. The fact that the CEO which Pamicon had recruited added to the position he had accumulated in the open market after Skygold publlished its latest resource estimate for Spanish Mountain can be interpreted as a sign that he is aligned with Skygold's new financial backers rather than the group which hired him. I first heard of Ian Watson during the eighties when the former Burns Fry broker brought Centennial Minerals to the market and persuaded Pegasus to take it out. More recently his group made some very timely investments in Northern Dynasty and Uramin, which his vehicle Galahad Gold plc cashed out of before being voluntarily liquidated. His decision to adopt the orphaned Skygold will likely lead to a turnaround in the market's perception of Spanish Mountain. Skygold initiated an 8,000 metre drill program in August which will include drilling for metallurgical samples, the recovery of larger diameter core from the high grade structures to assess the nugget effect, and stepout drilling to the north, south and at depth. The program anticipates six holes to a depth of 600 metres in what is an attempt to understand the feeder system underlying this sediment hosted gold system which contains locally enriched vertical structures. While the other drilling will push the resource perhaps higher and in any case towards a production decision, the deep drilling has the potential for a surprise that scales this project from the intermediate league into the major league. After this financing Skygold has 125.2 million shares fully diluted, which at .26 translates into an implied project value of $33 million. Based on the recent people development I am upgrading Skygold from medium priority to a top priority bottom-fish buy in the .20-.29 range.

Quelle: http://www.stockhouse.com/Bullboards/MessageDetail.aspx?s=sk…

Skygold attracts backing from London group headed by Ian Watson

Skygold Ventures Ltd, the gold junior with a 2.9 million ounce open-pittable gold deposit in British Columbia that has languished because of management's lack of "skin the game", appears to have solved this problem by completing a private placement of 13 million units at .17 with a London group headed by Ian Watson. The $2,210,000 financing was announced on September 23 and has already closed, with Ian Watson himself taking down 4,184,140 units, Haywood broker Scott Hunter 150,000 units, and CEO Brian Groves with 150,000 units. The Pamicon team headed by Doug Fulcher which manages Skygold and owns a whopping 76,000 shares kept their wallets closed. The fact that the CEO which Pamicon had recruited added to the position he had accumulated in the open market after Skygold publlished its latest resource estimate for Spanish Mountain can be interpreted as a sign that he is aligned with Skygold's new financial backers rather than the group which hired him. I first heard of Ian Watson during the eighties when the former Burns Fry broker brought Centennial Minerals to the market and persuaded Pegasus to take it out. More recently his group made some very timely investments in Northern Dynasty and Uramin, which his vehicle Galahad Gold plc cashed out of before being voluntarily liquidated. His decision to adopt the orphaned Skygold will likely lead to a turnaround in the market's perception of Spanish Mountain. Skygold initiated an 8,000 metre drill program in August which will include drilling for metallurgical samples, the recovery of larger diameter core from the high grade structures to assess the nugget effect, and stepout drilling to the north, south and at depth. The program anticipates six holes to a depth of 600 metres in what is an attempt to understand the feeder system underlying this sediment hosted gold system which contains locally enriched vertical structures. While the other drilling will push the resource perhaps higher and in any case towards a production decision, the deep drilling has the potential for a surprise that scales this project from the intermediate league into the major league. After this financing Skygold has 125.2 million shares fully diluted, which at .26 translates into an implied project value of $33 million. Based on the recent people development I am upgrading Skygold from medium priority to a top priority bottom-fish buy in the .20-.29 range.

Quelle: http://www.stockhouse.com/Bullboards/MessageDetail.aspx?s=sk…

Ian Watson Announces Purchase of Units of Skygold Ventures Ltd.

LONDON, UNITED KINGDOM--(Marketwire - Jan. 4, 2010) - Ian Watson today announced that he has purchased 2,180,000 units ("Units") of Skygold Ventures Ltd. ("Skygold") (TSX VENTURE:SKV - News) at a purchase price of C$0.23 per Unit for total consideration of C$501,400. Ian Watson is a Director of Skygold. Each Unit consists of one common share (each, a "Common Share") of Skygold and one common share purchase warrant of Skygold. As a result of this transaction, Mr. Watson beneficially holds 6,576,640 Common Shares, representing approximately 6.17% of the issued and outstanding Common Shares. Mr. Watson also beneficially holds a total of 6,561,640 warrants entitling Mr. Watson to purchase 6,561,640 Common Shares.

The Common Shares were acquired by Mr. Watson for investment purposes under the accredited investor exemptions of applicable securities laws. Mr. Watson may from time to time increase or decrease his holdings of Common Shares or other securities of Skygold.

For further information, or to obtain a copy of the Purchaser's early warning report filed under applicable securities laws, please see the contact information below.

LONDON, UNITED KINGDOM--(Marketwire - Jan. 4, 2010) - Ian Watson today announced that he has purchased 2,180,000 units ("Units") of Skygold Ventures Ltd. ("Skygold") (TSX VENTURE:SKV - News) at a purchase price of C$0.23 per Unit for total consideration of C$501,400. Ian Watson is a Director of Skygold. Each Unit consists of one common share (each, a "Common Share") of Skygold and one common share purchase warrant of Skygold. As a result of this transaction, Mr. Watson beneficially holds 6,576,640 Common Shares, representing approximately 6.17% of the issued and outstanding Common Shares. Mr. Watson also beneficially holds a total of 6,561,640 warrants entitling Mr. Watson to purchase 6,561,640 Common Shares.

The Common Shares were acquired by Mr. Watson for investment purposes under the accredited investor exemptions of applicable securities laws. Mr. Watson may from time to time increase or decrease his holdings of Common Shares or other securities of Skygold.

For further information, or to obtain a copy of the Purchaser's early warning report filed under applicable securities laws, please see the contact information below.

Jan 04, 2010 09:47 ET

Skygold Announces Change of Company Name to Spanish Mountain Gold and Closes Financing

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Jan. 4, 2010) - Skygold Ventures Ltd. ("Skygold" or the "Company") (TSX VENTURE:SKV) is pleased to announce that it will be changing its name to "Spanish Mountain Gold Ltd." in January 2010 and that it has closed the previously announced $2 million "flow-through" financing.

"Spanish Mountain Gold Ltd."

The Company's Board of Directors has approved "Spanish Mountain Gold Ltd." as the Company's new name. Subject to regulatory approval, the name change will become effective later in January. The Company will issue a further news release prior to the effective date of the name change and provide the new trading symbol.

The name change reflects the future focus of the Company as it transitions from pure exploration to advancing to a development stage of the Spanish Mountain Gold Project in south-central British Columbia.

The main strategic focus of Spanish Mountain Gold Ltd. will be to prepare for the commissioning of a Preliminary Economic Assessment of the Spanish Mountain Project in early 2010. This will be the first step to advance the project to the development stage. Preparatory work will include the completion of processing of HQ diameter drill core samples at G&T Metallurgical Laboratory in Kamloops, BC. Processing of these samples is currently underway to i) ascertain the potential for gold grade enhancement by utilizing larger samples from the larger diameter HQ drill core compared to smaller samples from NQ drill core and, ii) further refinement of metallurgical recoveries (the Company has previously disclosed that grinding and flotation of the mineralized material recovers 88% to 90% gold).

There will also be ongoing exploration of Thunder Ridge which is located approximately 100km south of Spanish Mountain.

Financing

The Company closed a non-brokered private placement on December 30, 2009, pursuant to which it issued 6,100,000 "flow-through" common share units ("FT Units") at a price of $0.33 per FT Unit for gross proceeds of $2,013,000. Each FT Unit consisted of one common share issued on a flow-through basis and one share purchase warrant (a "Warrant") of the Company. Each Warrant entitles the holder to purchase one (non-flow-through) common share for a period of three years at a price of $0.33 per share. The Company intends to use the proceeds to fund programs on the Company's Spanish Mountain Gold Project and Thunder Ridge properties. A cash finders' fee of 6% was paid to Wellington West Capital Markets Inc. All of the securities issued in connection with the private placement are subject to four month hold periods. The private placement is subject to the final acceptance of the TSX Venture Exchange.

On Behalf of the Board,

SKYGOLD VENTURES LTD.

Skygold Announces Change of Company Name to Spanish Mountain Gold and Closes Financing

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Jan. 4, 2010) - Skygold Ventures Ltd. ("Skygold" or the "Company") (TSX VENTURE:SKV) is pleased to announce that it will be changing its name to "Spanish Mountain Gold Ltd." in January 2010 and that it has closed the previously announced $2 million "flow-through" financing.

"Spanish Mountain Gold Ltd."

The Company's Board of Directors has approved "Spanish Mountain Gold Ltd." as the Company's new name. Subject to regulatory approval, the name change will become effective later in January. The Company will issue a further news release prior to the effective date of the name change and provide the new trading symbol.

The name change reflects the future focus of the Company as it transitions from pure exploration to advancing to a development stage of the Spanish Mountain Gold Project in south-central British Columbia.

The main strategic focus of Spanish Mountain Gold Ltd. will be to prepare for the commissioning of a Preliminary Economic Assessment of the Spanish Mountain Project in early 2010. This will be the first step to advance the project to the development stage. Preparatory work will include the completion of processing of HQ diameter drill core samples at G&T Metallurgical Laboratory in Kamloops, BC. Processing of these samples is currently underway to i) ascertain the potential for gold grade enhancement by utilizing larger samples from the larger diameter HQ drill core compared to smaller samples from NQ drill core and, ii) further refinement of metallurgical recoveries (the Company has previously disclosed that grinding and flotation of the mineralized material recovers 88% to 90% gold).

There will also be ongoing exploration of Thunder Ridge which is located approximately 100km south of Spanish Mountain.

Financing

The Company closed a non-brokered private placement on December 30, 2009, pursuant to which it issued 6,100,000 "flow-through" common share units ("FT Units") at a price of $0.33 per FT Unit for gross proceeds of $2,013,000. Each FT Unit consisted of one common share issued on a flow-through basis and one share purchase warrant (a "Warrant") of the Company. Each Warrant entitles the holder to purchase one (non-flow-through) common share for a period of three years at a price of $0.33 per share. The Company intends to use the proceeds to fund programs on the Company's Spanish Mountain Gold Project and Thunder Ridge properties. A cash finders' fee of 6% was paid to Wellington West Capital Markets Inc. All of the securities issued in connection with the private placement are subject to four month hold periods. The private placement is subject to the final acceptance of the TSX Venture Exchange.

On Behalf of the Board,

SKYGOLD VENTURES LTD.

schön ausgebrochen

jetzt kanns schnell bis 0,42 cad gehen

Antwort auf Beitrag Nr.: 38.669.668 von ernie021 am 05.01.10 17:46:24schön ausgebrochen

jetzt kanns schnell bis 0,42 cad gehen

Jup, war zu erwarten, dass der Kurs nach dem Closing sich dem PP-Niveau recht fix angleicht. Nun könnten positive BE-News für den "Rest" sorgen...

jetzt kanns schnell bis 0,42 cad gehen

Jup, war zu erwarten, dass der Kurs nach dem Closing sich dem PP-Niveau recht fix angleicht. Nun könnten positive BE-News für den "Rest" sorgen...

SKV ist übrigens auch hier:

Vancouver Resource Investment Conference - January 17 & 18, 2010

http://www.cambridgehouse.ca/index.php/vancouver-resource-in…

Diese Veranstaltung ist in der Branche nicht ohne Gewicht

und es war für mich nicht wirklich überraschend, dass man

vorher schon etwas für positiven Gesprächsstoff gesorgt hat.

Würde mich auch nicht wundern, wenn die vorgelagert noch mal

nachlegen.

Vancouver Resource Investment Conference - January 17 & 18, 2010

http://www.cambridgehouse.ca/index.php/vancouver-resource-in…

Diese Veranstaltung ist in der Branche nicht ohne Gewicht

und es war für mich nicht wirklich überraschend, dass man

vorher schon etwas für positiven Gesprächsstoff gesorgt hat.

Würde mich auch nicht wundern, wenn die vorgelagert noch mal

nachlegen.

so, die Insider haben sich jetzt das Boot vollgeladen und die Reise kann losgehen... ich kann mit bei all den Käufen einfach nicht vorstellen das die kommende erste Studie zur Wirtschaftlichkeit schlecht ausfällt. Immerhin ist die Erstellung der PEA ein fortlaufender Prozeß ber der Daten so nach und nach eintrudeln..ich denke mal Herr Sharp und Herr Watson sind sich recht sicher in welche Richtung das Ganze läuft...

..also weiter aufstocken solange SKV so billig ist. Alles unter 1$ ist ein Witz

..also weiter aufstocken solange SKV so billig ist. Alles unter 1$ ist ein Witz

lasst euch blos nicht rausschütteln hier.. es stehe wichtige News an im 1. Halbjahr 2010 ... viell gibt es nochma einen kleinen Rücksetzter bis 30 cent in Canada ... danach aber wohl weiter aufwärts.. mit der PEA sollte dann der endgültige Durchbruch kommen falls nicht schon vorher gute Bohrdaten von Thunder Rigde dazu führen ... recht spannend grad was bei SKV passiert

..stay long

..stay long

zum Ende hin wurde das ask doch arg abgeknabbert und das bid füllte sich wieder.. sieht diesma besser aus

Die Jungs vom Caesars Report verkaufen partiell

We sell 1/4th of our holdings in Skygold Ventures (SKV.V) at C$0.34, for a gain of 33%

We sell 1/4th of our holdings in Skygold Ventures (SKV.V) at C$0.34, for a gain of 33%

Antwort auf Beitrag Nr.: 38.711.389 von umkehrformation am 11.01.10 19:25:13...die haben aber schon am 06.01. verkauft

bs

bs

Antwort auf Beitrag Nr.: 38.711.389 von umkehrformation am 11.01.10 19:25:13unwichtig, die traden nur mit einem Teil des Bestandes..wichtig ist das diesma um die 30-32 cent wesentlich mehr Unterstützung vorhanden istals beim letzten Run ... ich hoffe SKV bringt sehr bald eine gute News das der Kurs erstmal die 40 cent schafft ...mit der PEA Ende des ersten Quartals gehts dann wieder Richtung 1$ ...kein Scherz, vor allem wenn man auf Thunder Ridge nochmal auf paar hochgradige Brocken trifft  ...diese Property ist noch absolut nicht eingepreist.

...diese Property ist noch absolut nicht eingepreist.

...diese Property ist noch absolut nicht eingepreist.

...diese Property ist noch absolut nicht eingepreist.

Quelle: www.stockwatch.com

Skygold Ventures 6.1-million-share private placement

Ticker Symbol: C:SKV

Skygold Ventures 6.1-million-share private placement

Skygold Ventures Ltd (C:SKV)

Shares Issued 87,009,515

Last Close 1/8/2010 $0.32

Monday January 11 2010 - Private Placement

The TSX Venture Exchange has accepted for filing documentation with respect to a non-brokered private placement announced Dec. 8, 2009.

Shares:6.1 millionPurchase price:33 centsWarrants:6.1 million share purchase warrants to purchase 6.1 million sharesWarrant exercise price:33 cents for a one-year period, 33 cents in the second year and 33 cents in the third yearHidden placees:twoFinder's fee:$120,780 payable to Wellington West Capital Markets Inc.

2010 Canjex Publishing Ltd.

Skygold Ventures 6.1-million-share private placement

Ticker Symbol: C:SKV

Skygold Ventures 6.1-million-share private placement

Skygold Ventures Ltd (C:SKV)

Shares Issued 87,009,515

Last Close 1/8/2010 $0.32

Monday January 11 2010 - Private Placement

The TSX Venture Exchange has accepted for filing documentation with respect to a non-brokered private placement announced Dec. 8, 2009.

Shares:6.1 millionPurchase price:33 centsWarrants:6.1 million share purchase warrants to purchase 6.1 million sharesWarrant exercise price:33 cents for a one-year period, 33 cents in the second year and 33 cents in the third yearHidden placees:twoFinder's fee:$120,780 payable to Wellington West Capital Markets Inc.

2010 Canjex Publishing Ltd.

mehr Gold auf Thunder Ridge...

Skygold Reports 19.30 g/t Gold Over 1.5 Metres at Thunder Ridge (Spanish Creek)

VANCOUVER, BRITISH COLUMBIA, Jan 12, 2010 (Marketwire via COMTEX News Network) --

Skygold Ventures Ltd. ("Skygold" or the "Company") (TSX VENTURE:SKV) is pleased to announce results from drilling at Thunder Ridge on its wholly-owned Spanish Creek project. A total of 1825.76 metres was completed in six holes in October 2009.

Highlights:

- Hole SC019 intersected 19.30 g/t gold over 1.5 metres and a second zone

of 0.67 g/t over 21.40 metres including 0.87 g/t over 14.50 metres.

- Hole SC021 intersected 1.42 g/t gold over 14.75 metres including 4.54

g/t over 3.80 metres and a separate intersection of 705 g/t silver over

1.25 metres.

- Hole SC022 intersected 0.61 g/t gold over 21.50 metres.

- Hole SC023 intersected 0.80 g/t gold over 38.30 metres including 1.03 g/t

over 26.0 metres also including 5.33 g/t over 1.50 metres.

Significant results are presented in Table 1. The location of drill holes are presented in Map 1 that is located www.skygold.ca under "Exploration Projects - Spanish Creek".

Gold mineralization at Thunder Ridge occurs at the intersection of southwest and northeast trending structures and vein systems. Gold mineralization encountered within holes SC019 and SC023 occurs within one of these vein/structure systems. The holes are located 400 metres apart. Mineralized zones remain open in all directions.

Gold mineralization has now been encountered over a strike length of at least 800 metres. All drilling to date was targeted within a larger gold geochemical anomaly which extends for over 1.5 kilometres. The Company believes that there is good potential to expand the extent of the currently defined mineralized corridor.

The Spanish Creek Project is located approximately 50 kilometres northeast of the town of 100 Mile House in central British Columbia. The property is underlain by a sequence of Triassic black phyllite similar to the rocks that underlie the Main Zone at the Spanish Mountain Property. Gold mineralization is associated with silica flooding and quartz veining within northeast trending structures.

The Company is planning for further drilling in 2010 to follow up these results and to test geophysical targets generated from an airborne geophysical survey completed in the fall of 2009.

Table 1

Hole From (m) To (m) Width(i) Au (g/t)

-------------------------------------------------------------

SC019 62.00 63.50 1.50 19.30

-------------------------------------------------------------

SC019 Including 116.00 121.00 5.00 0.55

-------------------------------------------------------------

SC019 191.50 212.90 21.40 0.67

-------------------------------------------------------------

SC019 Including 197.00 211.50 14.50 0.87

-------------------------------------------------------------

SC019 Including 197.00 205.50 8.50 1.05

-------------------------------------------------------------

SC020 anomalous

-------------------------------------------------------------

SC021 176.75 191.50 14.75 1.42

-------------------------------------------------------------

SC021 Including 176.75 180.55 3.80 4.54

-------------------------------------------------------------

SC021 And 239.88 246.50 6.62 0.55

-------------------------------------------------------------

SC022 204.00 224.00 20.00 0.64

-------------------------------------------------------------

SC022 Including 210.00 214.50 4.50 1.47

-------------------------------------------------------------

SC022 and including 221.00 224.00 3.00 1.37

-------------------------------------------------------------

SC023 251.50 276.00 24.50 1.08

-------------------------------------------------------------

SC023 and including 264.03 265.50 1.47 3.54

-------------------------------------------------------------

SC023 and including 268.50 274.30 5.80 2.29

-------------------------------------------------------------

SC023 and including 268.50 270.00 1.50 5.33

-------------------------------------------------------------

(i) core length - does not represent true width

Project Quality Control / Quality Assurance

NQ core samples were logged and cut with a diamond saw on site. Recoveries were generally better than 90%. Samples were shipped directly to Eco Tech Labs, Stewart Group. Eco Tech Laboratories Ltd. of Kamloops BC, a BC accredited laboratory which is independent of the Company, is conducting the sample preparation and analyses of samples. Skygold routinely submits standards, blanks and duplicates into the sample stream to maintain quality control. All gold analyses will utilize standard screen metallic assay techniques. Robert Darney, P.Geo. and R. Bob Singh P.Geo are the qualified persons (as defined in NI 43-101) who have reviewed this news release.

On Behalf of the Board,

SKYGOLD VENTURES LTD.

Brian Groves, President

Forward-Looking Information