Silvercorp Metals - Jetzt geht\'s hier richtig los!

eröffnet am 11.12.06 17:04:22 von

neuester Beitrag 27.04.24 00:46:50 von

neuester Beitrag 27.04.24 00:46:50 von

Beiträge: 4.808

ID: 1.099.579

ID: 1.099.579

Aufrufe heute: 25

Gesamt: 529.918

Gesamt: 529.918

Aktive User: 0

ISIN: CA82835P1036 · WKN: A0EAS0 · Symbol: SVM

3,1000

EUR

-5,95 %

-0,1960 EUR

Letzter Kurs 26.04.24 Tradegate

Meistbewertete Beiträge

| Datum | Beiträge | Bewertungen |

|---|---|---|

| 04.04.24 |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,6900 | +23,96 | |

| 5,1500 | +21,75 | |

| 15,890 | +21,67 | |

| 0,8900 | +17,11 | |

| 0,9000 | +16,13 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,1200 | -6,67 | |

| 0,5180 | -7,09 | |

| 10,040 | -7,89 | |

| 0,5700 | -8,06 | |

| 46,88 | -97,99 |

Beitrag zu dieser Diskussion schreiben

Silvercorp to acquire Adventus in all-share deal

https://www.stockwatch.com/News/Item/Z-C!SVM-3541498/C/SVMfür mich ok, hab beide...

Celsius sollten sie auch wieder richtig einsteigen, damals war der Kurs noch ohne Genehmigung, die nun kam aber

komischerweise 0,0% kursrelevant war (ausser 2 Tage)

wegen Silvercorp 100% höher (vor dem Absprung)

Antwort auf Beitrag Nr.: 75.673.440 von 90BVB09 am 24.04.24 10:03:22Deutlich mehr Mined & Milled, aber im Gegenzug sind die head grades runter von 261g/t auf 231g/t

VANCOUVER, British Columbia – April 23, 2024 – Silvercorp Metals Inc. (TSX/NYSE American: SVM) reports production and sales figures for the fourth quarter (Q4 Fiscal 2024) and fiscal year ended March 31, 2024 and the production and cost guidance for the 2025 fiscal year ending March 31, 2025.

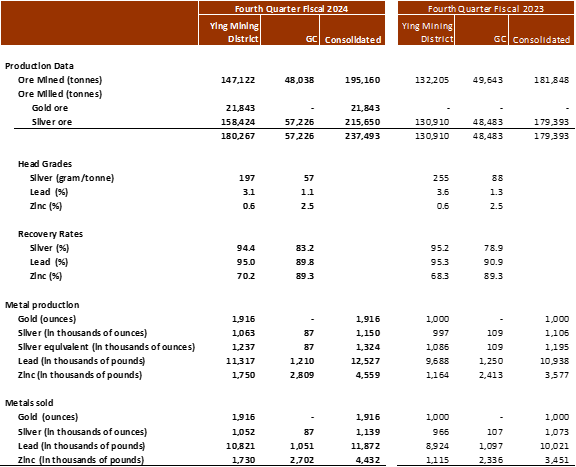

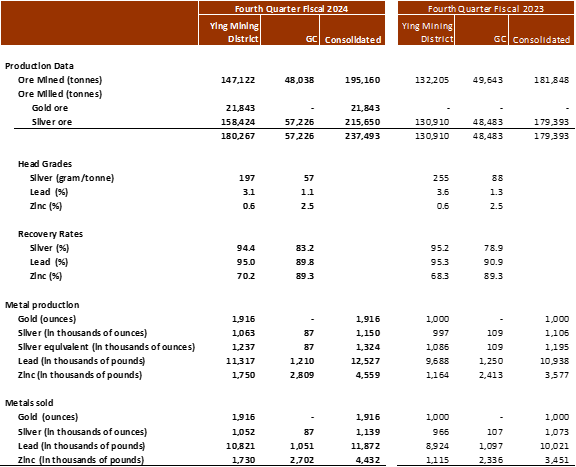

Q4 Operational Results

- Gold production of 1,916 ounces, up 92% over the same quarter last year (“Q4 Fiscal 2023”);

- Silver equivalent (only silver and gold) production of approximately 1.3 million ounces, up 11% over Q4 Fiscal 2023;

- Lead production of approximately 12.5 million pounds, up 15% over Q4 Fiscal 2023; and

- Zinc production of approximately 4.56 million pounds, up 27% over Q4 Fiscal 2023.

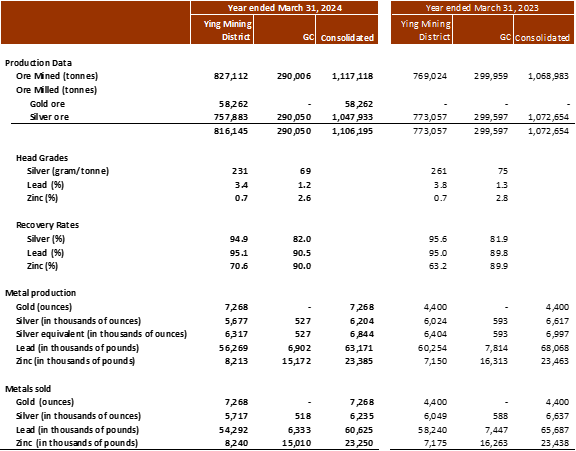

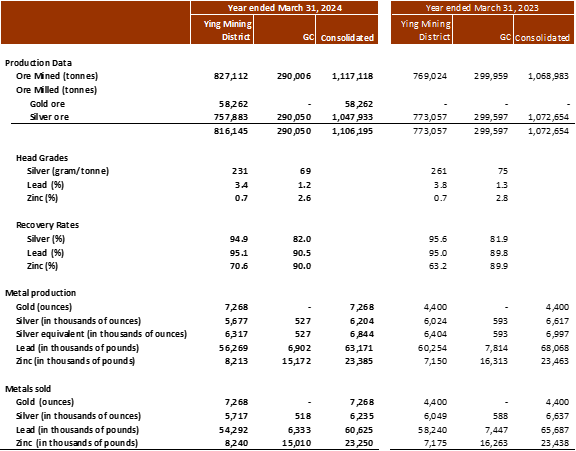

2024 Operational Results

- Gold production of 7,268 ounces, an increase of 65% over Fiscal 2023;

- Silver equivalent (only silver and gold) production of approximately 6.8 million ounces, a decrease of 2% over Fiscal 2023;

- Lead production of approximately 63.2 million pounds, a decrease of 7% over Fiscal 2023; and

- Zinc production of approximately 23.4 million pounds, a decrease of 1% over Fiscal 2023; and

The decrease in silver and lead production was mainly due to

i) lower head grades achieved due to mining sequences;

ii) 58,262 tonnes of gold ores were mined and processed with grades of 1.8 grams per tonne gold, 77 g/t silver, 1.1% lead, and 0.2% zinc to produce gravity gold concentrates, silver-gold-lead (copper) concentrate, and zinc concentrate in Fiscal 2024. The gold recovery rate for gold ores processed was 92.0%.

The total capital expenditures for mine optimization and facilities improvement at the Ying Mining District are estimated at $78.7 million. For mine optimization, the Company plans to spend a total $48.1 million.

https://silvercorpmetals.com/silvercorp-reports-operational-…

VANCOUVER, British Columbia – April 23, 2024 – Silvercorp Metals Inc. (TSX/NYSE American: SVM) reports production and sales figures for the fourth quarter (Q4 Fiscal 2024) and fiscal year ended March 31, 2024 and the production and cost guidance for the 2025 fiscal year ending March 31, 2025.

Q4 Operational Results

- Gold production of 1,916 ounces, up 92% over the same quarter last year (“Q4 Fiscal 2023”);

- Silver equivalent (only silver and gold) production of approximately 1.3 million ounces, up 11% over Q4 Fiscal 2023;

- Lead production of approximately 12.5 million pounds, up 15% over Q4 Fiscal 2023; and

- Zinc production of approximately 4.56 million pounds, up 27% over Q4 Fiscal 2023.

2024 Operational Results

- Gold production of 7,268 ounces, an increase of 65% over Fiscal 2023;

- Silver equivalent (only silver and gold) production of approximately 6.8 million ounces, a decrease of 2% over Fiscal 2023;

- Lead production of approximately 63.2 million pounds, a decrease of 7% over Fiscal 2023; and

- Zinc production of approximately 23.4 million pounds, a decrease of 1% over Fiscal 2023; and

The decrease in silver and lead production was mainly due to

i) lower head grades achieved due to mining sequences;

ii) 58,262 tonnes of gold ores were mined and processed with grades of 1.8 grams per tonne gold, 77 g/t silver, 1.1% lead, and 0.2% zinc to produce gravity gold concentrates, silver-gold-lead (copper) concentrate, and zinc concentrate in Fiscal 2024. The gold recovery rate for gold ores processed was 92.0%.

The total capital expenditures for mine optimization and facilities improvement at the Ying Mining District are estimated at $78.7 million. For mine optimization, the Company plans to spend a total $48.1 million.

https://silvercorpmetals.com/silvercorp-reports-operational-…

Operational Results and Financial Results Release Date for Fiscal 2024, and Issues Fiscal 2025 Production, Cash Costs, and Capital Expenditure Guidance

https://ceo.ca/@newswire/silvercorp-reports-operational-resu…

https://ceo.ca/@newswire/silvercorp-reports-operational-resu…

Antwort auf Beitrag Nr.: 75.658.329 von 90BVB09 am 22.04.24 08:23:41Gibts nen konkreten Plan oder entscheidest du auch eher spontan?

Ich bleibe bei meinen Silberwerten erstmal weiter dabei und warte auf den Hype. Noch sind wir in der Wall Of Worry Phase, zu viel Vorsicht, zu wenig Spinner mit Kursziel dausend. Aussteigen will ich bei Silber 50 bis 60 Dollar (wenn das Ziel erreicht wird).

Vielleicht gibt es aber auch eine gemeinsame Aktion um Silber nicht so weit steigen zu lassen:

Standard Chartered, HSBC, JP Morgan, UOB, Deutsche Bank, Heraeus etc. have visited the Shanghai Gold Exchange intensively to discuss cooperation.

Die sehen ihre Felle davon schwimmen und dass deren Einfluß auf den Preis immer mehr schwindet...!

https://en.sge.com.cn/eng_news_News

Ich bleibe bei meinen Silberwerten erstmal weiter dabei und warte auf den Hype. Noch sind wir in der Wall Of Worry Phase, zu viel Vorsicht, zu wenig Spinner mit Kursziel dausend. Aussteigen will ich bei Silber 50 bis 60 Dollar (wenn das Ziel erreicht wird).

Vielleicht gibt es aber auch eine gemeinsame Aktion um Silber nicht so weit steigen zu lassen:

Standard Chartered, HSBC, JP Morgan, UOB, Deutsche Bank, Heraeus etc. have visited the Shanghai Gold Exchange intensively to discuss cooperation.

Die sehen ihre Felle davon schwimmen und dass deren Einfluß auf den Preis immer mehr schwindet...!

https://en.sge.com.cn/eng_news_News

Nee, waren ganz allgemein die Buchgewinne, die da lockten. Wobei SVM wohl bei Silber > 30 USD weiterhin den >Sektor outperformen könnte. Was die geplatzte Übernahme betrifft und das vorherige sowie jetzt wieder aufflammende Tächtelmächtel mit Celsius, da kann man ihnen ja nicht direkt nen Vorwurf machen.

Ist die Frage, ob das mit Celsius sukzessive klappen würde oder es auch dort dann irgendwann zu einer Art Wettbieten kommen könnte...

Ich schaue es mir mit etwas Cash jetzt erst mal von der Seitenlinie an und würde bei aufkommender Schwäche wieder einsteigen...sofern sie denn kommen sollte

Waren 50% realisierte Gewinne, gabs in den letzten Monaten auch sehr selten bzw gar net

Was ist dein Plan hier? Gibts nen konkreten Plan oder entscheidest du auch eher spontan?

Ist die Frage, ob das mit Celsius sukzessive klappen würde oder es auch dort dann irgendwann zu einer Art Wettbieten kommen könnte...

Ich schaue es mir mit etwas Cash jetzt erst mal von der Seitenlinie an und würde bei aufkommender Schwäche wieder einsteigen...sofern sie denn kommen sollte

Waren 50% realisierte Gewinne, gabs in den letzten Monaten auch sehr selten bzw gar net

Was ist dein Plan hier? Gibts nen konkreten Plan oder entscheidest du auch eher spontan?

Antwort auf Beitrag Nr.: 75.652.568 von 90BVB09 am 20.04.24 09:20:42Zu viel Hick hack mit Ore Corp? Jetzt wird es wieder Celsius ...!

Persönlicher Nachtrag

Hier bin ich seit Ende letzter Woche raus 😬

Celsius Resources Ltd on Thursday said it has GBP922,000, to help fund project work.

Celsius Resources is a resource development company with projects in Africa and the Philippines. It said it has raised GBP922,000 in total.

The company explained that it has signed a binding subscription agreement with Silvercorp Metals Inc, raising a further GBP117,317.

Silvercorp has agreed to subscribe to 19.6 million shares priced at 0.60p each. Shares in Celsius were trading at 0.60 pence each in London on Thursday around midday.

Celsius said the proceeds will go toward early development works at the company's MCB project, permitting costs at the Sagay copper-gold project, exploration expenditure at the Botilao copper-gold-prospect, as well as for working capital purposes.

Celsius Resources is a resource development company with projects in Africa and the Philippines. It said it has raised GBP922,000 in total.

The company explained that it has signed a binding subscription agreement with Silvercorp Metals Inc, raising a further GBP117,317.

Silvercorp has agreed to subscribe to 19.6 million shares priced at 0.60p each. Shares in Celsius were trading at 0.60 pence each in London on Thursday around midday.

Celsius said the proceeds will go toward early development works at the company's MCB project, permitting costs at the Sagay copper-gold project, exploration expenditure at the Botilao copper-gold-prospect, as well as for working capital purposes.

Im Producerbereich eine der Outperformer und mittlerweile auch deutliches im Plus in meinem Depot. Sehr schön - auch wenn es aktuell schon etwas zu steil ausschaut. Auf SVM ist im Bullenmarkt augenscheinlich immer Verlass.

Silber auch offensichtlich den dritten Tag in Folge mit besserer Performance ggü. gold. Schauen wir mal, wo das hinführen kann

Aktuell wird (noch) nix verkauft!

Silber auch offensichtlich den dritten Tag in Folge mit besserer Performance ggü. gold. Schauen wir mal, wo das hinführen kann

Aktuell wird (noch) nix verkauft!

Silvercorp Metals

VANCOUVER, BC, March 25, 2024 - Silvercorp Metals Inc. (TSX: SVM) announced today that, further to its off-market takeover bid for all of the ordinary shares in OreCorp Limited, Silvercorp did not satisfy the 50.1% minimum acceptance condition prior to the close of the Offer on March 22, 2024 and elected not to exercise its "right to match" a competing offer for OreCorp.

Silvercorp will remain entitled to payment of a break fee of approximately AUD$2.8 million in certain circumstances, as set out in the BID.

https://finance.yahoo.com/news/silvercorp-offer-orecorp-laps…

VANCOUVER, BC, March 25, 2024 - Silvercorp Metals Inc. (TSX: SVM) announced today that, further to its off-market takeover bid for all of the ordinary shares in OreCorp Limited, Silvercorp did not satisfy the 50.1% minimum acceptance condition prior to the close of the Offer on March 22, 2024 and elected not to exercise its "right to match" a competing offer for OreCorp.

Silvercorp will remain entitled to payment of a break fee of approximately AUD$2.8 million in certain circumstances, as set out in the BID.

https://finance.yahoo.com/news/silvercorp-offer-orecorp-laps…