Starcore International Ventures - Goldproduzent mit KGV <3 bricht aus! (Seite 146)

eröffnet am 01.06.07 09:16:10 von

neuester Beitrag 30.04.24 08:58:41 von

neuester Beitrag 30.04.24 08:58:41 von

Beiträge: 2.524

ID: 1.128.155

ID: 1.128.155

Aufrufe heute: 21

Gesamt: 190.807

Gesamt: 190.807

Aktive User: 1

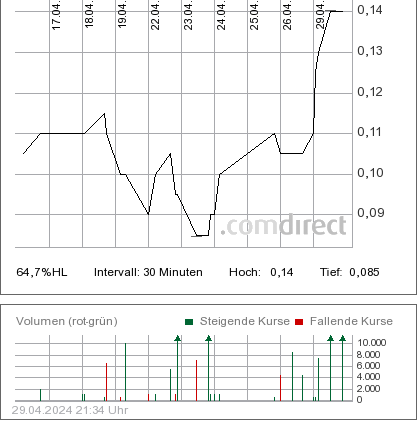

ISIN: CA85525T2020 · WKN: A2AACF · Symbol: V4JA

0,0925

EUR

+22,52 %

+0,0170 EUR

Letzter Kurs 29.04.24 Tradegate

Neuigkeiten

29.04.24 · IRW Press |

22.04.24 · IRW Press |

22.01.24 · IRW Press |

29.08.23 · IRW Press |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,4700 | +28,95 | |

| 1,3200 | +17,86 | |

| 0,8947 | +11,85 | |

| 0,5700 | +11,76 | |

| 0,5900 | +9,26 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 18,360 | -6,56 | |

| 10,500 | -6,67 | |

| 4,7500 | -7,77 | |

| 12,000 | -25,00 | |

| 46,95 | -98,00 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 42.315.667 von wasn am 07.11.11 22:42:49

...die frage ist halt nur.....wann bzw. zu welchem kurs sie zurückkommt

...die frage ist halt nur.....wann bzw. zu welchem kurs sie zurückkommt

Antwort auf Beitrag Nr.: 42.313.269 von married am 07.11.11 16:11:01im Gegentum.

Nunmehr alles rausgehauen, geiler Schnitt.

Die kommt zurück.

Nunmehr alles rausgehauen, geiler Schnitt.

Die kommt zurück.

Bid bleibt bei 0,185

Antwort auf Beitrag Nr.: 42.292.620 von wasn am 02.11.11 19:13:20

Hast du nun doch nachgekauft,

trotz des " losses " ?

09:52:22 T 0.18 0.015 75,000 69 Jordan 69 Jordan K

09:50:58 T 0.18 0.015 25,000 33 Canaccord 1 Anonymous K

09:47:39 T 0.175 0.01 100 33 Canaccord 79 CIBC E

09:47:39 T 0.175 0.01 2,000 2 RBC 1 Anonymous KW

09:47:39 T 0.175 0.01 1,000 2 RBC 1 Anonymous KW

09:47:39 T 0.175 0.01 100,000 2 RBC 1 Anonymous KW

Hast du nun doch nachgekauft,

trotz des " losses " ?

09:52:22 T 0.18 0.015 75,000 69 Jordan 69 Jordan K

09:50:58 T 0.18 0.015 25,000 33 Canaccord 1 Anonymous K

09:47:39 T 0.175 0.01 100 33 Canaccord 79 CIBC E

09:47:39 T 0.175 0.01 2,000 2 RBC 1 Anonymous KW

09:47:39 T 0.175 0.01 1,000 2 RBC 1 Anonymous KW

09:47:39 T 0.175 0.01 100,000 2 RBC 1 Anonymous KW

Antwort auf Beitrag Nr.: 42.292.620 von wasn am 02.11.11 19:13:20

jojo, ist doch wahr.

( Die letzten Monate meinte ich zu beobachten

dass du dich aus dem alten Schema befreien kannst )

jojo, ist doch wahr.

( Die letzten Monate meinte ich zu beobachten

dass du dich aus dem alten Schema befreien kannst )

Antwort auf Beitrag Nr.: 42.292.322 von married am 02.11.11 18:23:34jaja.

Antwort auf Beitrag Nr.: 42.288.914 von wasn am 02.11.11 07:16:58Copy & paste ......

Tolle Kopie.

Und so wie da geschrieben ( & von dir kommentarlos hier her kopiert ) nicht verwunderlich, dass es gestern einige mehr Verkäufe(r) gab .... von Aktionären die keine Ahnung haben und somit kein Recht auf diese Aktie.

Net loss of $4.0 million, which includes a net $6.6 million non-cash unrealized loss.

Also "echter" Verlust wie hoch, auf schwäbisch: wie viel fehlte in der Kasse ?

Kein Kommentar wie es möglich ist oder war, die

Total long-term liabilities im gennannten Zeitraum von $ 17,242 auf jetzt noch $ 13,803 zurückzufahren ( mit Hilfe des angeblichen " loss' " )

)

Und trotzdem gestiegene assets.

In 15 Monaten wird man sich wundern.

Tolle Kopie.

Und so wie da geschrieben ( & von dir kommentarlos hier her kopiert ) nicht verwunderlich, dass es gestern einige mehr Verkäufe(r) gab .... von Aktionären die keine Ahnung haben und somit kein Recht auf diese Aktie.

Net loss of $4.0 million, which includes a net $6.6 million non-cash unrealized loss.

Also "echter" Verlust wie hoch, auf schwäbisch: wie viel fehlte in der Kasse ?

Kein Kommentar wie es möglich ist oder war, die

Total long-term liabilities im gennannten Zeitraum von $ 17,242 auf jetzt noch $ 13,803 zurückzufahren ( mit Hilfe des angeblichen " loss' "

)

)Und trotzdem gestiegene assets.

In 15 Monaten wird man sich wundern.

Vancouver, B.C. - Starcore International Mines Ltd. (the "Company") has filed the results for the year ended July 31, 2011 for the Company and its mining operations from the San Martin Mine. Over the year ended July 31, 2011, the Company reports revenues of $39.5 million, earnings from mining operations of $13.8 million and a net loss of $4.0 million, which includes a net $6.6 million non-cash unrealized loss on forward sales contracts and a $234,000 non-cash stock-based compensation charge on option awards vested in the year. The basic and diluted loss per share for the year ended July 31, 2011 was $0.05.

The following table is a summary of mine production statistics for the San Martin mine for the six months ended July 31, 2011 and the cumulative amounts for the year ended January 31, 2011:

(Unaudited) Unit of measure Actual results for

6 months ended

July 31, 2011 Actual results for

12 months ended

January 31, 2011

Mine Production of Gold in Dore thousand ounces 7.8 15.6

Mine Production of Silver in Dore thousand ounces 134.9 170.0

Mine Equivalent ounces of Gold thousand ounces 11.1 18.5

Purchased Concentrate Equivalent ounces thousand ounces 5.2 2.5

Total Mine Production - Equivalent Ounces thousand ounces 16.3 21.0

Mine Gold grade grams/tonne 2.0 2.05

Mine Silver grade grams/tonne 40 31

Milled thousands of tonnes 146 274

Mine Operating Cost per tonne milled US dollars/tonne 50 39

Mine Operating Cost per Equivalent Ounce US dollars/ounces 699 577

* assuming a 41:1 silver to gold equivalency ratio for six months ended July 31, and 60:1 for the year ended January 31, 2011.

Overall equivalent gold production from mine operations, excluding purchased concentrate, was 11,100 ounces over the six months ended July 31, 2011, compared to an average of 4,625 per quarter for the previous twelve month period. The higher production was due mainly to consistently higher ore grades for silver, higher silver recoveries and the fact that the mine also increased tonnage through the mill to 146,000 tonnes for the six month period compared to 68,500 tonnes per quarter average for the twelve months.

Currently, the Company is continuing underground exploration in order to identify higher grade ore zones and has allocated a higher budget to support exploration, exceeding 11,000 metres of exploration drilling for the 2011 calendar year (See recent news releases of September 28th, September 22nd, August 29th and July 18, 2011).

The following table contains selected highlights from the Company's consolidated statement of operations and consolidated balance sheet for the years ending July 31, 2011 and 2010 (all amounts per table and discussion below are stated in thousands of Canadian dollars):

(000's) July 31, 2011 July 31, 2010

Revenues

Mined ore $ 29,413 $ 22,046

Purchased concentrate 10,052 1,155

$ 39,465 $ 23,201

Cost of Sales

Mined Ore 13,415 10,728

Purchased concentrate 9,752 1,054

Amortization, depletion and reclamation 2,497 1,983

$ (25,664) $ (13,765)

Earnings from mining operations 13,801 9,436

Net loss

(i) Net loss for the year $ (4,023) $ (3,728)

(ii) Income (loss) per share - basic $ (0.05) $ (0.05)

(iii) Income (loss) per share - diluted $ (0.05) $ (0.05)

Total assets $ 46,637 $ 45,170

Total long-term liabilities $ 13,803 $ 17,242

Revenues for the year ended July 31, 2011, were higher at $39,465 than 2010 revenues of $23,201 due mainly to the sale of metal from purchased concentrate, but also due to higher metal prices in 2011 and higher metal production from mine operations. For the year ended July 31, 2011, metal sales of 20,002 ounces of gold and 425,414 ounces of silver sold at average prices of US$1,308 per ounce and US$32 per ounce, respectively, compared to the year ended July 31, 2010 which approximated 17,343 ounces of gold and 181,876 ounces of silver sold at average prices of US$1,105 and US$17 per ounce, respectively. Loss for the year ended July 31, 2011 increased to a loss of $4,023 due mainly to the fluctuation in realized and unrealized forward sales contracts losses. Net realized and unrealized loss on forward contracts for the year ended July 31, 2011 was $12,541 compared to $9,873 for 2010 due to the increase in gold price from US$1,180 at July 31, 2010 to US$1,621, at July 31, 2011 on the remaining 21,343 ounces which are to be sold at an average of 1,185 ounces per month until January 31, 2013.

The Company also had positive cash flow from operations of $2,125 for the year ended July 31, 2011 compared to $3,540 for the same period in 2010.

Full financial statements are available on SEDAR at www.sedar.com and on Starcore's website at www.starcore.com.

ON BEHALF OF STARCORE INTERNATIONAL

MINES LTD.

Signed "Gary Arca"

Gary Arca, Chief Financial Officer and Director

FOR FURTHER INFORMATION PLEASE CONTACT INVESTOR RELATIONS

Telephone: 1-604-602-4935

Toll Free: 1-866-602-4935 / Facsimile: 1-604-602-4936

The Toronto Stock Exchange has not reviewed nor does it accept responsibility for the adequacy or accuracy of this press release

The following table is a summary of mine production statistics for the San Martin mine for the six months ended July 31, 2011 and the cumulative amounts for the year ended January 31, 2011:

(Unaudited) Unit of measure Actual results for

6 months ended

July 31, 2011 Actual results for

12 months ended

January 31, 2011

Mine Production of Gold in Dore thousand ounces 7.8 15.6

Mine Production of Silver in Dore thousand ounces 134.9 170.0

Mine Equivalent ounces of Gold thousand ounces 11.1 18.5

Purchased Concentrate Equivalent ounces thousand ounces 5.2 2.5

Total Mine Production - Equivalent Ounces thousand ounces 16.3 21.0

Mine Gold grade grams/tonne 2.0 2.05

Mine Silver grade grams/tonne 40 31

Milled thousands of tonnes 146 274

Mine Operating Cost per tonne milled US dollars/tonne 50 39

Mine Operating Cost per Equivalent Ounce US dollars/ounces 699 577

* assuming a 41:1 silver to gold equivalency ratio for six months ended July 31, and 60:1 for the year ended January 31, 2011.

Overall equivalent gold production from mine operations, excluding purchased concentrate, was 11,100 ounces over the six months ended July 31, 2011, compared to an average of 4,625 per quarter for the previous twelve month period. The higher production was due mainly to consistently higher ore grades for silver, higher silver recoveries and the fact that the mine also increased tonnage through the mill to 146,000 tonnes for the six month period compared to 68,500 tonnes per quarter average for the twelve months.

Currently, the Company is continuing underground exploration in order to identify higher grade ore zones and has allocated a higher budget to support exploration, exceeding 11,000 metres of exploration drilling for the 2011 calendar year (See recent news releases of September 28th, September 22nd, August 29th and July 18, 2011).

The following table contains selected highlights from the Company's consolidated statement of operations and consolidated balance sheet for the years ending July 31, 2011 and 2010 (all amounts per table and discussion below are stated in thousands of Canadian dollars):

(000's) July 31, 2011 July 31, 2010

Revenues

Mined ore $ 29,413 $ 22,046

Purchased concentrate 10,052 1,155

$ 39,465 $ 23,201

Cost of Sales

Mined Ore 13,415 10,728

Purchased concentrate 9,752 1,054

Amortization, depletion and reclamation 2,497 1,983

$ (25,664) $ (13,765)

Earnings from mining operations 13,801 9,436

Net loss

(i) Net loss for the year $ (4,023) $ (3,728)

(ii) Income (loss) per share - basic $ (0.05) $ (0.05)

(iii) Income (loss) per share - diluted $ (0.05) $ (0.05)

Total assets $ 46,637 $ 45,170

Total long-term liabilities $ 13,803 $ 17,242

Revenues for the year ended July 31, 2011, were higher at $39,465 than 2010 revenues of $23,201 due mainly to the sale of metal from purchased concentrate, but also due to higher metal prices in 2011 and higher metal production from mine operations. For the year ended July 31, 2011, metal sales of 20,002 ounces of gold and 425,414 ounces of silver sold at average prices of US$1,308 per ounce and US$32 per ounce, respectively, compared to the year ended July 31, 2010 which approximated 17,343 ounces of gold and 181,876 ounces of silver sold at average prices of US$1,105 and US$17 per ounce, respectively. Loss for the year ended July 31, 2011 increased to a loss of $4,023 due mainly to the fluctuation in realized and unrealized forward sales contracts losses. Net realized and unrealized loss on forward contracts for the year ended July 31, 2011 was $12,541 compared to $9,873 for 2010 due to the increase in gold price from US$1,180 at July 31, 2010 to US$1,621, at July 31, 2011 on the remaining 21,343 ounces which are to be sold at an average of 1,185 ounces per month until January 31, 2013.

The Company also had positive cash flow from operations of $2,125 for the year ended July 31, 2011 compared to $3,540 for the same period in 2010.

Full financial statements are available on SEDAR at www.sedar.com and on Starcore's website at www.starcore.com.

ON BEHALF OF STARCORE INTERNATIONAL

MINES LTD.

Signed "Gary Arca"

Gary Arca, Chief Financial Officer and Director

FOR FURTHER INFORMATION PLEASE CONTACT INVESTOR RELATIONS

Telephone: 1-604-602-4935

Toll Free: 1-866-602-4935 / Facsimile: 1-604-602-4936

The Toronto Stock Exchange has not reviewed nor does it accept responsibility for the adequacy or accuracy of this press release

Antwort auf Beitrag Nr.: 42.194.316 von married am 10.10.11 21:42:52... und 5000$ billiger zurückgekauft. Guter Schnitt!

Nun hat er es sich plötzlich wieder anders überlegt:

Oct 07/11 Oct 04/11 Wheeler, John Indirect Ownership Common Shares 10 - Acquisition in the public market 50,000 $0.130

Oct 07/11 Oct 04/11 Wheeler, John Indirect Ownership Common Shares 10 - Acquisition in the public market 50,000 $0.135

Sep 20/11 Sep 16/11 Wheeler, John Indirect Ownership Common Shares 10 - Disposition in the public market -50,000 $0.185

Sep 20/11 Sep 16/11 Wheeler, John Indirect Ownership Common Shares 10 - Disposition in the public market -50,000 $0.180

Sep 15/11 Sep 15/11 Wheeler, John Indirect Ownership Common Shares 10 - Disposition in the public market -50,000 $0.165

Sep 09/11 Sep 06/11 Wheeler, John Indirect Ownership Common Shares 10 - Disposition in the public market -50,000 $0.155

Sep 06/11 Sep 01/11 Wheeler, John Indirect Ownership Common Shares 10 - Disposition in the public market -50,000 $0.145

29.04.24 · IRW Press · Starcore International Mines |

22.04.24 · IRW Press · Starcore International Mines |

22.01.24 · IRW Press · Starcore International Mines |

29.08.23 · IRW Press · Starcore International Mines |

Starcore setzt mit dem Erwerb eines Projekts an der Côte d‘Ivoire auf geopolitische Diversifizierung 16.08.23 · IRW Press · Starcore International Mines |