Royal Dutch Shell - Back to the Future (Seite 191)

eröffnet am 16.10.08 13:30:00 von

neuester Beitrag 08.05.24 09:23:11 von

neuester Beitrag 08.05.24 09:23:11 von

Beiträge: 10.259

ID: 1.145.229

ID: 1.145.229

Aufrufe heute: 46

Gesamt: 1.169.229

Gesamt: 1.169.229

Aktive User: 5

ISIN: GB00BP6MXD84 · WKN: A3C99G

33,85

EUR

-0,19 %

-0,07 EUR

Letzter Kurs 09:32:10 Tradegate

Neuigkeiten

07.05.24 · wallstreetONLINE Redaktion |

07.05.24 · globenewswire |

07.05.24 · wallstreetONLINE Redaktion |

06.05.24 · globenewswire |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,6000 | +30,23 | |

| 189,99 | +17,28 | |

| 11,870 | +10,11 | |

| 4,5500 | +9,90 | |

| 28.000,00 | +9,80 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 21,800 | -8,02 | |

| 0,8800 | -8,33 | |

| 5,0070 | -10,68 | |

| 4,2000 | -11,39 | |

| 0,8100 | -22,86 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 70.291.573 von scharfkantig am 21.12.21 21:09:49

Sorry for Off-T. kann das sein ?

(Erwartete) Jahresdividende 0,8913 €

Dividendenrendite 20,07 %

Zitat von scharfkantig: PTR3/4 sehen interessant aus. Aber das ist hier der falsche Ort. Öffnet doch n neuen Sread.

Sorry for Off-T. kann das sein ?

(Erwartete) Jahresdividende 0,8913 €

Dividendenrendite 20,07 %

Texas lawsuit by laundromat owners seeks to block Shell refinery sale to Pemex

A pair of New York businessmen filed a lawsuit in a U.S. court seeking to block Mexico's state oil company Pemex from taking control of a Texas refinery, claiming the sale would raise U.S. gasoline prices.Royal Dutch Shell in May agreed to sell its majority stake in the 302,800 bpd Deer Park refinery outside Houston to Pemex, its long-time partner in the plant, for about $596 MM.

The lawsuit, filed in a U.S. District Court in Houston last week, alleges a sale would lead to "substantially less(en) competition" in gasoline and "significantly increase" the plaintiffs' energy costs. They asked the court to block the sale permanently or force Pemex to divest its holdings.

The deal has been delayed by an ongoing review by the Committee on Foreign Investment in the U.S. (CFIUS), a national security group that can block or set restrictions on foreign purchases of U.S. businesses. The CFIUS launched a second 45-day review that halted Pemex's plans to complete the sale this year.

Pemex did not respond to requests for comment.

Spokespeople for Shell, the CFIUS and U.S. Treasury Department declined to comment.

Mexican President, Andres Manuel Lopez Obrador has said the deal would move Mexico closer to energy self-sufficiency. He has promised to replace fuel imports by producing more domestically. Mexico this year imported about 60% of its motor fuel needs.

Lopez Obrador has complained that the 28-year-old JV with Shell had not been good for Mexico as dividends have been not been repatriated.

Aaron Hagele and Andrew Sarcinella, owners of a Mt. Vernon, N.Y., coin-operated laundromat who filed the lawsuit, said their business would suffer "an incalculable but evident" effect if more of Deer Park's output is exported.

Mark Lavery, an attorney for the pair, told Reuters Deer Park provides up to 2.5% of U.S. gasoline use and higher exports would reduce competition and lead to increased prices.

"This is a critical time right now in the gasoline market in the U.S.," he said, echoing criticism of high prices by U.S. President Joe Biden.

https://www.hydrocarbonprocessing.com/news/2021/12/texas-law…

Argentina President set to decree $1.6 bln Vaca Muerta gas pipeline - gov't source

(Reuters) – Argentina’s President Alberto Fernandez will sign a decree in the next few weeks to push forward construction of a major new gas pipeline system in the country’s huge Vaca Muerta shale formation, a government source told Reuters, a key move to boost gas exports.The timeline and plans for a decree, previously unreported, come as Argentina seeks to ramp up gas production and exports to bring in much-needed foreign currency to refill depleted reserve levels and amid debt talks with the International Monetary Fund (IMF).

The current pipeline network’s transport capacity is a key obstacle to plans to reduce Argentina’s reliance on energy imports, including expensive liquefied natural gas (LNG).

The project, the first stage of which will take 18 months and an investment of some $1.6 billion, will add transportation capacity of some 24 million cubic meters per day by 2023, said the source, who has direct knowledge of the plans and asked not to be identified.

“What is underway is a DNU (Decree of Necessity and Urgency) that the president will sign where he declares the Néstor Kirchner gas pipeline system of national interest,” the source said.

The person added that, under the decree, the program would be headed by the Ministry of Energy, which will build and seek bids for the pipeline network through IEASA, a public company that manages energy infrastructure projects and works.

The funds are expected to come from the state, despite the rejection of the government’s 2022 budget – which included $482 million to add to $1.1 billion already secured for the project – by Congress earlier this month.

“The absence of the budget bill generates an increase in costs,” the source said, adding, though, that the decree would exempt the project from taxes on bank credits and debits.

Argentina’s energy ministry did not immediately respond to a request for comment.

The first stage of the project includes construction of a gas pipeline from Tratayen, in the province of Neuquen where the Vaca Muerta formation is located, to Salliquelo, in the province of Buenos Aires.

The Vaca Muerta shale formation, which is the size of Belgium, is the world’s fourth-largest shale oil reserve and the second largest for shale gas. State energy company YPF SA (YPFD.BA), Royal Dutch Shell Plc (RDSa.L), Tecpetrol and Pampa Energía SA (PAMP.BA) produce gas in the area.

Analysts and economists have been skeptical about funding for the pipeline development amid tough negotiations with the IMF over a new program to roll over $45 billion in debts Argentina cannot currently pay back.

“Surely the project will be delayed,” said economist Agustín Monteverde from consultancy Massot / Monteverde y Asociados, adding that the government was likely to have to rein in its fiscal deficit in any IMF deal.

“From now on they will have to close some taps, and the easiest to close is capital expenditures.”

Argentina’s Energy Secretary Darío Martínez told Reuters earlier in December that the construction of a second stage of the gas pipeline, in the province of Santa Fe, would later allow an increase in daily gas transport by 40 million cubic meters.

“It will lead us to definitively stop importing LNG and stop burning fuel to generate electricity,” said Martínez, adding that it would be an “important step” in the transition toward cleaner energy sources to mitigate the impact of climate change.

“It would also open the door for us to supply gas to the region: Uruguay, Chile and Brazil.”

https://brazilenergyinsight.com/2021/12/21/exclusive-argenti…

Shell signs gas concession agreement for Block 10 in Oman’s Saih Rawl field

21 December, 2021Shell Integrated Gas Oman BV, a subsidiary of Royal Dutch Shell plc, along with its partners, OQ and Marsa Liquefied Natural Gas LLC (a joint venture between TotalEnergies and OQ), have signed a concession agreement with the Ministry of Energy and Minerals on behalf of the government of the Sultanate of Oman to develop and produce natural gas from block 10 of the Saih Rawl gas field. The parties also signed a separate gas sales agreement for gas produced from the block. The two agreements follow an interim upstream agreement signed in February 2019.

Shell’s entry into this block signifies a further commitment to Oman, while enhancing and diversifying Shell’s gas supply.

“These agreements represent a major step for Shell and for our relationship with Oman. They generate value and strengthen our Integrated Gas business, which we need to deliver the energy Oman and the world need today. And we are looking at how Shell can help Oman with developing low-carbon energy in the future,” said Wael Sawan, Shell Integrated Gas, Renewables and Energy Solutions Director.

The concession agreement establishes Shell as the operator of block 10, holding a 53.45% working interest, with OQ and Marsa Liquefied Natural Gas LLC holding 13.36% and 33.19% respectively. For the initial phase, Petroleum Development Oman (PDO) is building the infrastructure for the project, including the main pipeline to the Saih Rawl gas processing facility, on behalf of the Block 10 venture partners. The venture will drill and hook up wells to maintain the production beyond the initial phase. The block is expected to reach production of 0.5 billion standard cubic feet of gas per day (bscf/d). Start up is expected within the next two years.

In addition, Shell and Energy Development Oman (EDO) signed an agreement to process the natural gas from Block 10 in EDO’s Saih Rawl facility.

H.E. Dr Mohammed Al Rumhi, Minister of Energy and Minerals in Oman said: “We share a long and strategic collaboration with Shell and our other partners. This project will further maximise the potential of Oman’s energy industry, in line with the Sultanate’s strategy to create growth opportunities across all energy streams and in line with Oman’s Vision 2040 priorities.”

Shell and the government have agreed that, in parallel to the development of Block 10, Shell will develop options for a separate downstream gas project in which Shell could produce and sell low-carbon products and support the development of hydrogen in Oman. Any project would be subject to further agreements and future investment decisions.

Notes to editors

• Block 10 is located in Saih Rawl in the Al Wusta Governate of Oman – around 400 kilometres from the capital, Muscat.

• Block 10 covers an area of approximately 1200 km2.

About Oman Shell

Shell has been a partner in Oman’s development and progress over the last several decades. We have been providing pioneering technologies and expertise in the energy industry and creating value for the community.

Shell is active in Oman across the oil and gas industry and is involved in joint venture and independent activities ranging from research and development, exploration and production to trading, retail and new energies. Shell also implements an extensive social investment programme that contributes to the sustainable development of the country.

Shell holds interests in Petroleum Development Oman (34%), Oman LNG (30%) and Shell Oman Marketing Company (49%). Together they represent a substantial part of Oman’s economic growth.

Antwort auf Beitrag Nr.: 70.291.165 von Sugar2000 am 21.12.21 20:20:27PTR3/4 sehen interessant aus. Aber das ist hier der falsche Ort. Öffnet doch n neuen Sread.

Antwort auf Beitrag Nr.: 70.291.047 von GRILLER am 21.12.21 20:04:06Eigentlich sollte man das in Zeiten des Internets selbst rausfinden?!

Aber ist ja bald Weihnachten...

BRPETRACNPR6

Aber ist ja bald Weihnachten...

BRPETRACNPR6

Antwort auf Beitrag Nr.: 70.261.605 von Sugar2000 am 17.12.21 20:25:11

ISIN?

Zitat von Sugar2000: Heute auch wieder eine Position in Petr4 eingegangen ;-)

ISIN?

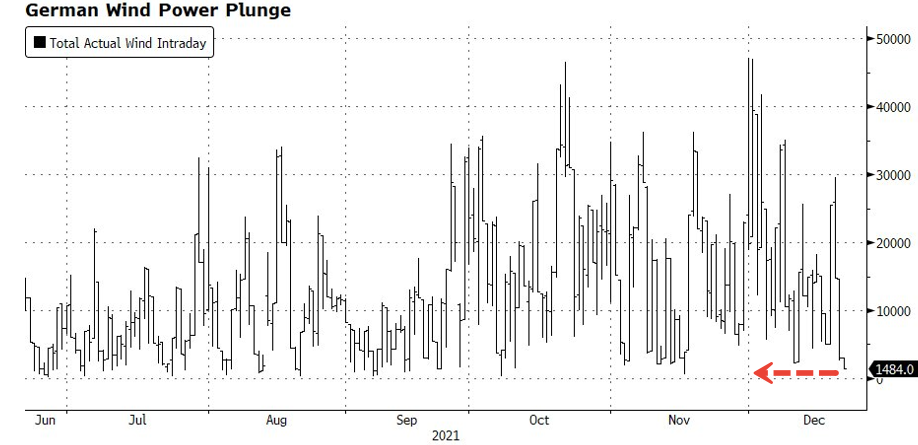

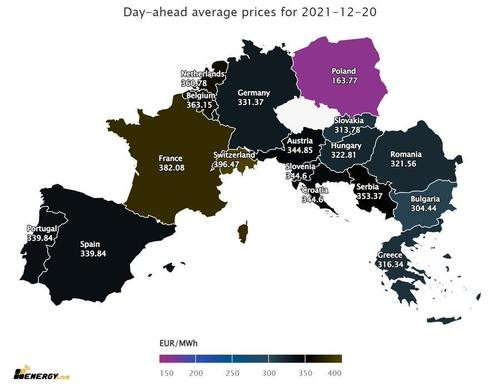

Europe On Edge Of Energy Disaster As Power Prices Smash All Records

https://www.zerohedge.com/commodities/europes-energy-crisis-…Frankreich hat Total, Italien ENI, Österreich die OMV und England sogar BP plus Shell und das übervölkerte Buntland hat das, während es seinen Herren brav folgend auf Rußland eindrischt:

Die Energiecharts schauen ziemlich angespannt aus. Als obs plötzlich ZAPP! machen könnte.

Wir haben zwar Holzvorrat für 4 Winter, aber ohne Strom wärs trotzdem übel. Hab mir vorhin zur Sicherheit für den Generator drei Kanister nach Hause geholt und beide Autos vollgetankt. Kann man zur Not ja auch abzapfen.

Antwort auf Beitrag Nr.: 70.283.169 von moneymakerzzz am 21.12.21 00:53:51...

At least 25% of the EDF's 56 atomic reactors are offline for maintenance. For some context, this is highly unusual for this time of year, considering the Northern Hemisphere winter is about to begin. A cold spell has sent much of the country into a deep freeze as power demand soars.

...

https://www.zerohedge.com/commodities/another-french-nuclear…

Erstmals hat ein Insekt in der Europäischen Union die Zulassung als Lebensmittel erhalten.

Mehlwürmer als Lebensmittel zugelassen

4. Mai 2021, 14.20 Uhr

EU gibt Wanderheuschrecke als Lebensmittel frei

12. November 2021, 18.14 Uhr

At least 25% of the EDF's 56 atomic reactors are offline for maintenance. For some context, this is highly unusual for this time of year, considering the Northern Hemisphere winter is about to begin. A cold spell has sent much of the country into a deep freeze as power demand soars.

...

https://www.zerohedge.com/commodities/another-french-nuclear…

Erstmals hat ein Insekt in der Europäischen Union die Zulassung als Lebensmittel erhalten.

Mehlwürmer als Lebensmittel zugelassen

4. Mai 2021, 14.20 Uhr

EU gibt Wanderheuschrecke als Lebensmittel frei

12. November 2021, 18.14 Uhr

Ja, soll wohl Ende Januar/Anfang Februar 2022 dann über der Bühne sein ( Vereinfachung aller Aktien auf Shell PLC ).

Hoffentlich schiebt dies dann mal langsam an

Hoffentlich schiebt dies dann mal langsam an

07.05.24 · wallstreetONLINE Redaktion · Apple |

07.05.24 · wallstreetONLINE Redaktion · BP |

02.05.24 · dpa-AFX · A.P. Moeller - Maersk (B) |

02.05.24 · BörsenNEWS.de · Amgen |

02.05.24 · dpa-AFX · Bayer |