Centerra Gold - Gewaltiges Nachholpotential (Seite 9)

eröffnet am 28.11.08 18:08:55 von

neuester Beitrag 19.04.24 08:09:05 von

neuester Beitrag 19.04.24 08:09:05 von

Beiträge: 1.169

ID: 1.146.468

ID: 1.146.468

Aufrufe heute: 8

Gesamt: 190.386

Gesamt: 190.386

Aktive User: 0

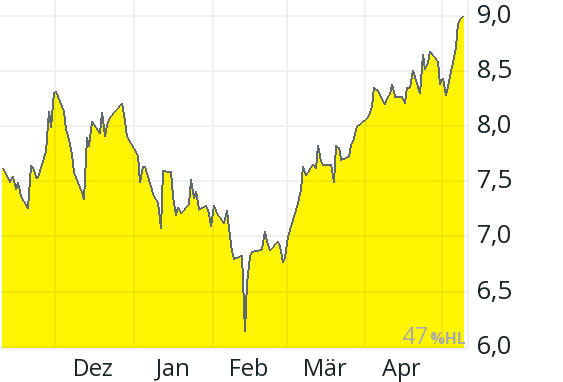

ISIN: CA1520061021 · WKN: A0B6PD · Symbol: CG

8,6800

CAD

+1,17 %

+0,1000 CAD

Letzter Kurs 26.04.24 Toronto

Neuigkeiten

18.04.24 · globenewswire |

28.03.24 · globenewswire |

22.02.24 · globenewswire |

22.02.24 · globenewswire |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,6900 | +23,96 | |

| 5,1500 | +21,75 | |

| 15,890 | +21,67 | |

| 0,8900 | +17,11 | |

| 0,9000 | +16,13 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,5200 | -6,61 | |

| 1,1200 | -6,67 | |

| 10,040 | -7,89 | |

| 3,7800 | -8,03 | |

| 0,5700 | -8,06 |

Beitrag zu dieser Diskussion schreiben

Also ich sehe das als Geschenk des Himmels. Centerra hat 730 Mio USD an Cash und ist aktuell 1,05 Milliarden USD Wert. Schaut Euch mal die Assets an. Außerdem war das Quartal jetzt auch nicht so schlimm. Schaut Euch zB.: Pan America Silver oder Equinox an. Die hatten echt schlechte Q2 Zahlen.

All-in costs on a by-product basis NG for the quarter of $2,082 per ounce.

Naja, 0,07 Cad. Divi für die, die am 25.8. noch dabei sind und eine brauchbaren Zukunft, mit stark reduzierten Aktienanteilen durch den Kirgisiendeal......

...ein mühsames Geschäftsfeld in Zeiten wie diesen.... etwas isch bei Centerra immer

Barrick hat an die 10 Milliarden MK in 2022 eingebüßt...ergo: irgendwann wirds besser, oder auch nicht....

...ein mühsames Geschäftsfeld in Zeiten wie diesen.... etwas isch bei Centerra immer

Barrick hat an die 10 Milliarden MK in 2022 eingebüßt...ergo: irgendwann wirds besser, oder auch nicht....

Ja, ganz schlecht:

TORONTO, Aug. 10, 2022 (GLOBE NEWSWIRE) -- Centerra Gold Inc. (“Centerra” or the “Company”) (TSX: CG and NYSE: CGAU) today reported its second quarter of 2022 results.

Significant financial and operating results of the second quarter ended June 30, 2022 included:

Net loss for the quarter of $2.6 million or $0.01 per common share (basic), including a $40.9 million reclamation provision revaluation recovery at the Endako Mine and the Thompson Creek Mine.

Adjusted loss NG for the quarter of $36.2 million or $0.12 per common share (basic).

Cash used in operating activities for the quarter of $3.5 million, was primarily due to a suspension of gold room operations at the ADR plant at the Öksüt Mine. No gold ounces were sold at the mine in the period but cash used in operating activities was $51.2 million to build up gold-in-carbon inventory.

Free cash flow deficit NG for the quarter of $31.2 million.

Gold production for the quarter of 42,728 ounces, solely from the Mount Milligan Mine. At the Öksüt Mine, mining and leaching activities during the quarter resulted in 58,469 recoverable ounces stored as gold-in-carbon inventory at the end of June.

Copper production for the quarter of 17.4 million pounds.

Gold production costs for the quarter of $961 per ounce.

Copper production costs for the quarter of $1.58 per pound.

All-in sustaining costs on a by-product basis NG for the quarter of $1,659 per ounce due no gold ounces sold at the Öksüt Mine and lower copper by-product credits at the Mount Milligan Mine from declining copper prices at the end of the quarter, resulting in a mark-to-market adjustment on provisionally priced copper contracts of $560 per ounce. At June 30, 2022, there were 33.8 million pounds of copper outstanding under contracts awaiting final settlement in future months. All of these copper pounds were adjusted to a market price of $3.71 per pound at the end of the quarter, resulting in an adjustment to copper revenue of $23.3 million from previously recorded prices.

All-in costs on a by-product basis NG for the quarter of $2,082 per ounce.

Strong balance sheet with net cash position at the quarter-end of $723.3 million.

Gold room operations at the ADR plant at the Öksüt Mine remain suspended since early March due to mercury detected in the gold room. The Company expects to complete a mercury abatement retrofit in the gold room by late 2022 and has assumed that Öksüt’s gold room operations will re-commence as soon as regulatory approvals are obtained. The Company expects that ounces inventoried in gold-in-carbon form during 2022 will be processed into gold doré in 2023, assuming the ADR plant resumes full operations as planned. For further details, see “Suspension of production at the Öksüt Mine”.

The Company is initiating the suspension of the Öksüt Mine’s stacking and leaching operations on August 10, 2022 due to the Company’s inability to obtain approval from regulators to use more activated carbon that is currently allowed in the Öksüt Mine’s environmental impact assessment (“EIA”). For further details, see “Suspension of production at the Öksüt Mine”.

2022 Guidance was updated to reflect the suspension of stacking and leaching activities and the continued suspension of gold room operations at the ADR plant at the Öksüt Mine until after year-end as well as to give effect to the recent decline in copper prices. The Mount Milligan Mine remains on track to achieve production guidance for both gold ounces and copper pounds. All of the Company’s previously issued 2023 guidance has been withdrawn and should not be relied upon.

Centerra closed the previously announced global arrangement agreement with Kyrgyzaltyn JSC (“Kyrgyzaltyn”) and Kyrgyz Republic to effect a separation of Centerra from Kyrgyzaltyn and the Kyrgyz Republic. This was achieved through the disposition of Centerra’s ownership in the Kumtor Mine and its investment in the Kyrgyz Republic, the purchase for cancellation by Centerra of all of Kyrgyzaltyn’s 77.4 million Centerra common shares, the termination of Kyrgyzaltyn’s involvement in the Company, the resolution of their disputes and aggregate cash payments of approximately $86 million (a portion of which was withheld on account of Canadian withholding taxes payable by Kyrgyzaltyn), among other provisions. As at August 9, 2022 the Company had 220,083,541 common shares issued and outstanding.

The Company continues to progress its life of mine planning work for the Mount Milligan Mine with a focus on assessing the impact of an extended mine life on capital equipment costs and tailings storage facility expansion requirements.

Quarterly Dividend declared of CAD$0.07 per common share.

Highlights of the Company’s revised consolidated guidance include:

2022 Guidance

- updated (1) Six Months

2022 results 2022 Guidance

- previous

Production

Total gold production (Koz) 245 - 265 137 400 - 450

Mount Milligan Mine (Koz) 190 - 210 82 190 - 210

Öksüt Mine (Koz) 55 55 210 - 240

Total copper production (Mlb) 70 - 80 38 70 - 80

Costs

Gold production costs (2) ($/oz) 675 - 725 624 500 - 550

All-in sustaining costs on a by-product basis NG(3)(4) ($/oz) 1,000 - 1,050 780 600 - 650

All-in costs on a by-product basis NG(3)(4) ($/oz) 1,225 - 1,275 994 700 - 750

All-in sustaining costs on a co-product basis NG ($/oz) 1,175 - 1,225 1,008 750 - 800

Copper production costs ($/lb) 1.55 - 1.70 1.68 1.70 - 1.85

All-in sustaining costs on a co-product basis NG ($/lb) 2.25 - 2.40 2.18 2.40 - 2.55

(1) For the discussion of significant differences in the forward-looking and historical non-GAAP measures, refer to the “Outlook” section.

(2) The updated guidance includes full year production costs and ounces of gold sold related to the Mount Milligan Mine and only first quarter of 2022 production costs and ounces of gold sold related to the Öksüt Mine.

(3) The updated guidance used a market copper price of $3.25 per pound and an average realized copper price at the Mount Milligan Mine of

$2.34 per pound for the last six months of 2022 after reflecting the streaming arrangement with Royal Gold (18.75% of the Mount Milligan Mine’s copper is sold at 15% of the spot price per metric tonne), after giving effect to the hedges and further mark-to-market adjustments on

33.8 million pounds of copper outstanding at June 30, 2022 under contracts awaiting final settlement in future months.

(4) Costs do not include the impact of any future standby charges at the Öksüt Mine as the Company assesses the operational implications of suspending certain activities.

CEO Commentary

Scott Perry, President and Chief Executive Officer of Centerra stated, “Subsequent to quarter-end, we announced the closing of the previously announced global arrangement agreement with Kyrgyzaltyn and the government of the Kyrgyz Republic. This separation allowed Centerra to significantly reduce its share count and positions the Company to move forward with renewed focus on our core operations, the Mount Milligan Mine and Öksüt Mine, in addition to exploration and drilling at our greenfield and brownfield exploration projects.”

“In the second quarter of 2022, the Company continued to demonstrate that safety remains Centerra’s top priority, with the Kemess team achieving three years without a lost time injury. On the operational front, the Mount Milligan mine produced 42,728 ounces of gold and 17.4 million pounds of copper in the second quarter, and at the Öksüt Mine, 58,469 ounces were stored in gold-in-carbon inventory. The Mount Milligan Mine 2022 gold and copper production remains on track and the mine continues to forecast a positive free cash flow for the year.”

“The Company has completed engineering work and ordered equipment to retrofit the ADR plant for safe operation within the gold room at the Öksüt Mine, with all equipment expected to be installed by late 2022. The Company is also suspending stacking and leaching operations at the Öksüt Mine in August 2022 while it pursues an amendment to its EIA to align permitted limits with current operational plans. The Company is also evaluating whether to suspend mining and crushing activities in the current circumstances. The suspension of these activities will have an impact on 2022 results, and the Company will continue to seek requisite approvals to re-commence full operations as quickly as possible.”

“During the second quarter, overall operating costs at the Öksüt Mine were not significantly affected by the suspension of gold room operations at the ADR plant. At the Mount Milligan Mine, gold production costs and all-in sustaining costs on a by-product basis NG per ounce sold in the second quarter of 2022 were $961 and $1,238, respectively. Both metrics were significantly impacted by the declining copper price at quarter end, with all-in sustaining costs on a by-product basis NG , including a mark-to-market adjustment on copper pounds that remain open to be re-priced at June 30, 2022. For the six months ended June 30, 2022 gold production costs and all-in sustaining costs on a by-product basis NG per ounce sold for the Mount Milligan Mine were $783 and $641, respectively.”

“As a result of the suspension of certain activities at the Öksüt Mine together with the continuing impact of declining copper prices at the Mount Milligan Mine, the Company revised its consolidated 2022 gold production to be between 245,000 and 265,000 gold ounces. Updated copper price assumption and reduced production resulted in an increase to gold production costs per ounce sold to $675 to $725 and all-in sustaining costs on a by-product basis NG per ounce sold to $1,000 to $1,050.”

“Financially, in the second quarter, we recorded a consolidated free cash flow deficit NG of $31.2 million; however, the free cash flow from mine operations NG generated at the Mount Milligan Mine of $55.8 million was able to offset the free cash flow deficit from mine operations NG at the Öksüt Mine of $55.1 million. The Company ended the quarter with a net cash balance of $723.3 million. Based on the Company’s strong financial position, the Board approved a quarterly dividend of CAD$0.07 per share on August 9, 2022 to shareholders of record on August 25, 2022.”

“Despite a challenging quarter, we continue to see strong operational future for our existing mines and anticipate that this will be reflected in our financial performance in 2023. We look forward to completing our 2022 drilling program at the Goldfield Project, and publishing a resource update in 2023 and a feasibility study thereafter.”

Suspension of production at the Öksüt Mine

On March 18, 2022, Centerra announced that it had suspended gold doré bar production at the Öksüt Mine due to mercury detected in the gold room at the ADR plant. At that point, mining, stockpiling, crushing, stacking and leaching activities continued at the Öksüt Mine and ore continued to be processed into gold-in-carbon form.

After identifying mercury in the gold room of the ADR plant, all stripping, electrowinning, refining, and pouring operations were stopped. The affected areas were professionally cleaned, and any contaminated material was removed and properly disposed of. An engineered solution was developed with the assistance of external consultants to ensure that mercury levels are detected and monitored, and any potential emissions are captured to prevent exposure to personnel and to safeguard the environment.

Mercury control initiatives include an upgraded ventilation system with a dedicated heating, ventilation and air conditioning unit in the gold room area. In addition, equipment will be properly covered, vented and off-gases scrubbed. The drying oven, which was used to dry the gold sludge prior to refining, will be replaced by a mercury retort system. This unit will allow mercury to be safely vaporized from the sludge, with the vapor condensed and collected in a fully contained system. The furnace off-gas system will also be replaced to ensure that any remaining mercury is scrubbed from the gas and captured. The procurement process for all the equipment mentioned above has been started and is progressing well. The capital cost of the mercury abatement retrofit is expected to be $5 million.

The Company expects that the refinery retrofit will be completed in late 2022 and it will work with relevant governmental authorities to obtain all required approvals to restart gold room operations at the ADR plant as quickly as possible thereafter. As further discussed below, the Company is also in discussions with Turkish regulators with respect to environmental and other permits relating to the Öksüt Mine. The Company also continues to consider alternatives to monetize the gold-in-carbon inventory prior to the full restart of the gold room at the ADR plant.

Permitting

In May, 2022 the Öksüt Mine was inspected by the Ministry of Environment, Urbanization and Climate Change (the “Ministry of Environment”). The Ministry of Environment informed the site management of a number of deficiencies relating to the Öksüt Mine’s EIA. Since that time, the Company has worked to address the majority of the deficiencies and understood that the permitted production capacity and activated carbon usage at the mine continued to be under review by the Ministry of Environment.

On August 9, 2022, the Company met with the Ministry of Environment which did not approve the Company’s request to use more activated carbon than is permitted in the Öksüt Mine’s EIA. That request became necessary because the Company is unable to operate the gold room at the ADR plant which would allow the Company to recycle activated carbon in the normal course of operations. Consequently, the Öksüt Mine is suspending stacking and leaching of ore on the heap leach pad and the Company is now considering whether to continue mining and crushing activities in the current circumstances.

The Ministry of Environment also noted that while the Öksüt Mine was in compliance with EIA limits in terms of both mining production and crushing capacity, it had stacked more ore tonnes on the heap leach pad than had been permitted in the EIA during the years 2019, 2020 and 2021. The Company is seeking further clarification on the interpretation of these topics from the Ministry of Environment.

Given the position expressed by the Ministry of Environment and the need for further clarity on the Öksüt Mine’s EIA, the Company is in the process of preparing a new EIA which would clarify, among other things, the heap leach stacking capacity of the mine and the amount of activated carbon usage allowed. The Company expects to submit the new proposed EIA application by the end of August and pursue its approval as quickly as possible.

The Company is also in pursuit of other ordinary course permits, including: (i) an enlarged grazing land permit to allow expansion of the existing operation to the currently defined EIA boundary of the Keltepe and Güneytepe pits; and (ii) an extension of the Öksüt Mine’s overall operating license which is scheduled to expire in January 2023.

As noted above, Centerra is involved in several discussions with various Turkish regulatory authorities which, in some cases, concern interrelated issues. While the Company will continue to pursue a new EIA and all required permits, there can be no assurance that the Company will be able to successfully resolve any of the matters discussed above nor can there be any assurance as to the timing of any of the foregoing. The inability to successfully resolve matters could have a material adverse impact and delay on the Company’s mining, stacking, leaching and production activities at the Öksüt Mine, future cash flows, earnings, results of operations and financial condition.

Exploration Update

Exploration activities in the second quarter of 2022 included drilling, surface sampling, geological mapping and geophysical surveying at the Company’s various projects and earn-in properties, targeting gold and copper mineralization in Canada, Türkiye and the United States of America. Exploration expenditures in the second quarter of 2022 were $15.2 million. The activities were primarily focused on expanded drilling programs at the Mount Milligan Mine in British Columbia and the Öksüt Mine in Türkiye and the commencement of exploration drilling at the Goldfield District in Nevada.

At the Mount Milligan Mine, 23 drill holes totalling 16,670 metres of diamond drilling were completed in the second quarter of 2022, including exploration drilling (983 metres in 2 drill holes) and resource expansion drilling (15,687 metres in 21 drill holes). In the third quarter of 2022, drilling at the Mount Milligan Mine will continue to target porphyry-style gold-copper mineralization below and adjacent to the current ultimate open-pit boundary, as well as continuing to test targets with potential for shallower porphyry-style gold-copper mineralization and high gold-low copper style mineralization peripheral to the current pits.

At the Öksüt Mine, 43 drill holes totalling 11,176 metres of diamond drilling were completed in the second quarter of 2022. Exploration drilling activities were mainly focused on testing the potential for further oxide gold mineralization at the Keltepe Northwest and Keltepe North-Northwest deposits. In the third quarter of 2022, drilling at the Öksüt Mine will continue to target potential expansion of oxide gold mineralization at the Keltepe North, Keltepe Northwest, and Keltepe North-Northwest deposits as well as testing the potential for new oxide gold mineralization at targets peripheral to the known deposits.

The Goldfield District Project was acquired late in the first quarter of 2022 and comprises three known deposits as well as large areas of underexplored and highly prospective tenure. Initial exploration activities involved review and assessment of the available geological, geophysical, geochemical, and drilling data, geological modelling and interpretation, geophysical surveying, and the design and commencement of exploration and infill and resource expansion drilling programs. Ground geophysical surveying, consisting of Controlled Source Audio-frequency Magnetotellurics and Induced Polarization surveys were completed in the second quarter of 2022 over the Gemfield and Goldfield Main deposits and to the west of the Gemfield deposit. Exploration diamond drilling commenced at the Gemfield deposit late in the second quarter of 2022, with four holes completed totaling 962 metres.

In the third quarter of 2022, exploration drilling at the Goldfield Project will include approximately 10,800 metres of diamond and reverse circulation (“RC”) drilling at the Gemfield and Goldfield Main deposits while the technical services drilling program will include approximately 3,800 metres of diamond and RC drilling at the Gemfield, Goldfield Main and McMahon Ridge deposits.

Selected drill program results and intercepts are highlighted in the supplementary data at the end of this news release. The drill collar locations and associated graphics are available at the following: http://ml.globenewswire.com/Resource/Download/0c01a4ea-2448-…

TORONTO, Aug. 10, 2022 (GLOBE NEWSWIRE) -- Centerra Gold Inc. (“Centerra” or the “Company”) (TSX: CG and NYSE: CGAU) today reported its second quarter of 2022 results.

Significant financial and operating results of the second quarter ended June 30, 2022 included:

Net loss for the quarter of $2.6 million or $0.01 per common share (basic), including a $40.9 million reclamation provision revaluation recovery at the Endako Mine and the Thompson Creek Mine.

Adjusted loss NG for the quarter of $36.2 million or $0.12 per common share (basic).

Cash used in operating activities for the quarter of $3.5 million, was primarily due to a suspension of gold room operations at the ADR plant at the Öksüt Mine. No gold ounces were sold at the mine in the period but cash used in operating activities was $51.2 million to build up gold-in-carbon inventory.

Free cash flow deficit NG for the quarter of $31.2 million.

Gold production for the quarter of 42,728 ounces, solely from the Mount Milligan Mine. At the Öksüt Mine, mining and leaching activities during the quarter resulted in 58,469 recoverable ounces stored as gold-in-carbon inventory at the end of June.

Copper production for the quarter of 17.4 million pounds.

Gold production costs for the quarter of $961 per ounce.

Copper production costs for the quarter of $1.58 per pound.

All-in sustaining costs on a by-product basis NG for the quarter of $1,659 per ounce due no gold ounces sold at the Öksüt Mine and lower copper by-product credits at the Mount Milligan Mine from declining copper prices at the end of the quarter, resulting in a mark-to-market adjustment on provisionally priced copper contracts of $560 per ounce. At June 30, 2022, there were 33.8 million pounds of copper outstanding under contracts awaiting final settlement in future months. All of these copper pounds were adjusted to a market price of $3.71 per pound at the end of the quarter, resulting in an adjustment to copper revenue of $23.3 million from previously recorded prices.

All-in costs on a by-product basis NG for the quarter of $2,082 per ounce.

Strong balance sheet with net cash position at the quarter-end of $723.3 million.

Gold room operations at the ADR plant at the Öksüt Mine remain suspended since early March due to mercury detected in the gold room. The Company expects to complete a mercury abatement retrofit in the gold room by late 2022 and has assumed that Öksüt’s gold room operations will re-commence as soon as regulatory approvals are obtained. The Company expects that ounces inventoried in gold-in-carbon form during 2022 will be processed into gold doré in 2023, assuming the ADR plant resumes full operations as planned. For further details, see “Suspension of production at the Öksüt Mine”.

The Company is initiating the suspension of the Öksüt Mine’s stacking and leaching operations on August 10, 2022 due to the Company’s inability to obtain approval from regulators to use more activated carbon that is currently allowed in the Öksüt Mine’s environmental impact assessment (“EIA”). For further details, see “Suspension of production at the Öksüt Mine”.

2022 Guidance was updated to reflect the suspension of stacking and leaching activities and the continued suspension of gold room operations at the ADR plant at the Öksüt Mine until after year-end as well as to give effect to the recent decline in copper prices. The Mount Milligan Mine remains on track to achieve production guidance for both gold ounces and copper pounds. All of the Company’s previously issued 2023 guidance has been withdrawn and should not be relied upon.

Centerra closed the previously announced global arrangement agreement with Kyrgyzaltyn JSC (“Kyrgyzaltyn”) and Kyrgyz Republic to effect a separation of Centerra from Kyrgyzaltyn and the Kyrgyz Republic. This was achieved through the disposition of Centerra’s ownership in the Kumtor Mine and its investment in the Kyrgyz Republic, the purchase for cancellation by Centerra of all of Kyrgyzaltyn’s 77.4 million Centerra common shares, the termination of Kyrgyzaltyn’s involvement in the Company, the resolution of their disputes and aggregate cash payments of approximately $86 million (a portion of which was withheld on account of Canadian withholding taxes payable by Kyrgyzaltyn), among other provisions. As at August 9, 2022 the Company had 220,083,541 common shares issued and outstanding.

The Company continues to progress its life of mine planning work for the Mount Milligan Mine with a focus on assessing the impact of an extended mine life on capital equipment costs and tailings storage facility expansion requirements.

Quarterly Dividend declared of CAD$0.07 per common share.

Highlights of the Company’s revised consolidated guidance include:

2022 Guidance

- updated (1) Six Months

2022 results 2022 Guidance

- previous

Production

Total gold production (Koz) 245 - 265 137 400 - 450

Mount Milligan Mine (Koz) 190 - 210 82 190 - 210

Öksüt Mine (Koz) 55 55 210 - 240

Total copper production (Mlb) 70 - 80 38 70 - 80

Costs

Gold production costs (2) ($/oz) 675 - 725 624 500 - 550

All-in sustaining costs on a by-product basis NG(3)(4) ($/oz) 1,000 - 1,050 780 600 - 650

All-in costs on a by-product basis NG(3)(4) ($/oz) 1,225 - 1,275 994 700 - 750

All-in sustaining costs on a co-product basis NG ($/oz) 1,175 - 1,225 1,008 750 - 800

Copper production costs ($/lb) 1.55 - 1.70 1.68 1.70 - 1.85

All-in sustaining costs on a co-product basis NG ($/lb) 2.25 - 2.40 2.18 2.40 - 2.55

(1) For the discussion of significant differences in the forward-looking and historical non-GAAP measures, refer to the “Outlook” section.

(2) The updated guidance includes full year production costs and ounces of gold sold related to the Mount Milligan Mine and only first quarter of 2022 production costs and ounces of gold sold related to the Öksüt Mine.

(3) The updated guidance used a market copper price of $3.25 per pound and an average realized copper price at the Mount Milligan Mine of

$2.34 per pound for the last six months of 2022 after reflecting the streaming arrangement with Royal Gold (18.75% of the Mount Milligan Mine’s copper is sold at 15% of the spot price per metric tonne), after giving effect to the hedges and further mark-to-market adjustments on

33.8 million pounds of copper outstanding at June 30, 2022 under contracts awaiting final settlement in future months.

(4) Costs do not include the impact of any future standby charges at the Öksüt Mine as the Company assesses the operational implications of suspending certain activities.

CEO Commentary

Scott Perry, President and Chief Executive Officer of Centerra stated, “Subsequent to quarter-end, we announced the closing of the previously announced global arrangement agreement with Kyrgyzaltyn and the government of the Kyrgyz Republic. This separation allowed Centerra to significantly reduce its share count and positions the Company to move forward with renewed focus on our core operations, the Mount Milligan Mine and Öksüt Mine, in addition to exploration and drilling at our greenfield and brownfield exploration projects.”

“In the second quarter of 2022, the Company continued to demonstrate that safety remains Centerra’s top priority, with the Kemess team achieving three years without a lost time injury. On the operational front, the Mount Milligan mine produced 42,728 ounces of gold and 17.4 million pounds of copper in the second quarter, and at the Öksüt Mine, 58,469 ounces were stored in gold-in-carbon inventory. The Mount Milligan Mine 2022 gold and copper production remains on track and the mine continues to forecast a positive free cash flow for the year.”

“The Company has completed engineering work and ordered equipment to retrofit the ADR plant for safe operation within the gold room at the Öksüt Mine, with all equipment expected to be installed by late 2022. The Company is also suspending stacking and leaching operations at the Öksüt Mine in August 2022 while it pursues an amendment to its EIA to align permitted limits with current operational plans. The Company is also evaluating whether to suspend mining and crushing activities in the current circumstances. The suspension of these activities will have an impact on 2022 results, and the Company will continue to seek requisite approvals to re-commence full operations as quickly as possible.”

“During the second quarter, overall operating costs at the Öksüt Mine were not significantly affected by the suspension of gold room operations at the ADR plant. At the Mount Milligan Mine, gold production costs and all-in sustaining costs on a by-product basis NG per ounce sold in the second quarter of 2022 were $961 and $1,238, respectively. Both metrics were significantly impacted by the declining copper price at quarter end, with all-in sustaining costs on a by-product basis NG , including a mark-to-market adjustment on copper pounds that remain open to be re-priced at June 30, 2022. For the six months ended June 30, 2022 gold production costs and all-in sustaining costs on a by-product basis NG per ounce sold for the Mount Milligan Mine were $783 and $641, respectively.”

“As a result of the suspension of certain activities at the Öksüt Mine together with the continuing impact of declining copper prices at the Mount Milligan Mine, the Company revised its consolidated 2022 gold production to be between 245,000 and 265,000 gold ounces. Updated copper price assumption and reduced production resulted in an increase to gold production costs per ounce sold to $675 to $725 and all-in sustaining costs on a by-product basis NG per ounce sold to $1,000 to $1,050.”

“Financially, in the second quarter, we recorded a consolidated free cash flow deficit NG of $31.2 million; however, the free cash flow from mine operations NG generated at the Mount Milligan Mine of $55.8 million was able to offset the free cash flow deficit from mine operations NG at the Öksüt Mine of $55.1 million. The Company ended the quarter with a net cash balance of $723.3 million. Based on the Company’s strong financial position, the Board approved a quarterly dividend of CAD$0.07 per share on August 9, 2022 to shareholders of record on August 25, 2022.”

“Despite a challenging quarter, we continue to see strong operational future for our existing mines and anticipate that this will be reflected in our financial performance in 2023. We look forward to completing our 2022 drilling program at the Goldfield Project, and publishing a resource update in 2023 and a feasibility study thereafter.”

Suspension of production at the Öksüt Mine

On March 18, 2022, Centerra announced that it had suspended gold doré bar production at the Öksüt Mine due to mercury detected in the gold room at the ADR plant. At that point, mining, stockpiling, crushing, stacking and leaching activities continued at the Öksüt Mine and ore continued to be processed into gold-in-carbon form.

After identifying mercury in the gold room of the ADR plant, all stripping, electrowinning, refining, and pouring operations were stopped. The affected areas were professionally cleaned, and any contaminated material was removed and properly disposed of. An engineered solution was developed with the assistance of external consultants to ensure that mercury levels are detected and monitored, and any potential emissions are captured to prevent exposure to personnel and to safeguard the environment.

Mercury control initiatives include an upgraded ventilation system with a dedicated heating, ventilation and air conditioning unit in the gold room area. In addition, equipment will be properly covered, vented and off-gases scrubbed. The drying oven, which was used to dry the gold sludge prior to refining, will be replaced by a mercury retort system. This unit will allow mercury to be safely vaporized from the sludge, with the vapor condensed and collected in a fully contained system. The furnace off-gas system will also be replaced to ensure that any remaining mercury is scrubbed from the gas and captured. The procurement process for all the equipment mentioned above has been started and is progressing well. The capital cost of the mercury abatement retrofit is expected to be $5 million.

The Company expects that the refinery retrofit will be completed in late 2022 and it will work with relevant governmental authorities to obtain all required approvals to restart gold room operations at the ADR plant as quickly as possible thereafter. As further discussed below, the Company is also in discussions with Turkish regulators with respect to environmental and other permits relating to the Öksüt Mine. The Company also continues to consider alternatives to monetize the gold-in-carbon inventory prior to the full restart of the gold room at the ADR plant.

Permitting

In May, 2022 the Öksüt Mine was inspected by the Ministry of Environment, Urbanization and Climate Change (the “Ministry of Environment”). The Ministry of Environment informed the site management of a number of deficiencies relating to the Öksüt Mine’s EIA. Since that time, the Company has worked to address the majority of the deficiencies and understood that the permitted production capacity and activated carbon usage at the mine continued to be under review by the Ministry of Environment.

On August 9, 2022, the Company met with the Ministry of Environment which did not approve the Company’s request to use more activated carbon than is permitted in the Öksüt Mine’s EIA. That request became necessary because the Company is unable to operate the gold room at the ADR plant which would allow the Company to recycle activated carbon in the normal course of operations. Consequently, the Öksüt Mine is suspending stacking and leaching of ore on the heap leach pad and the Company is now considering whether to continue mining and crushing activities in the current circumstances.

The Ministry of Environment also noted that while the Öksüt Mine was in compliance with EIA limits in terms of both mining production and crushing capacity, it had stacked more ore tonnes on the heap leach pad than had been permitted in the EIA during the years 2019, 2020 and 2021. The Company is seeking further clarification on the interpretation of these topics from the Ministry of Environment.

Given the position expressed by the Ministry of Environment and the need for further clarity on the Öksüt Mine’s EIA, the Company is in the process of preparing a new EIA which would clarify, among other things, the heap leach stacking capacity of the mine and the amount of activated carbon usage allowed. The Company expects to submit the new proposed EIA application by the end of August and pursue its approval as quickly as possible.

The Company is also in pursuit of other ordinary course permits, including: (i) an enlarged grazing land permit to allow expansion of the existing operation to the currently defined EIA boundary of the Keltepe and Güneytepe pits; and (ii) an extension of the Öksüt Mine’s overall operating license which is scheduled to expire in January 2023.

As noted above, Centerra is involved in several discussions with various Turkish regulatory authorities which, in some cases, concern interrelated issues. While the Company will continue to pursue a new EIA and all required permits, there can be no assurance that the Company will be able to successfully resolve any of the matters discussed above nor can there be any assurance as to the timing of any of the foregoing. The inability to successfully resolve matters could have a material adverse impact and delay on the Company’s mining, stacking, leaching and production activities at the Öksüt Mine, future cash flows, earnings, results of operations and financial condition.

Exploration Update

Exploration activities in the second quarter of 2022 included drilling, surface sampling, geological mapping and geophysical surveying at the Company’s various projects and earn-in properties, targeting gold and copper mineralization in Canada, Türkiye and the United States of America. Exploration expenditures in the second quarter of 2022 were $15.2 million. The activities were primarily focused on expanded drilling programs at the Mount Milligan Mine in British Columbia and the Öksüt Mine in Türkiye and the commencement of exploration drilling at the Goldfield District in Nevada.

At the Mount Milligan Mine, 23 drill holes totalling 16,670 metres of diamond drilling were completed in the second quarter of 2022, including exploration drilling (983 metres in 2 drill holes) and resource expansion drilling (15,687 metres in 21 drill holes). In the third quarter of 2022, drilling at the Mount Milligan Mine will continue to target porphyry-style gold-copper mineralization below and adjacent to the current ultimate open-pit boundary, as well as continuing to test targets with potential for shallower porphyry-style gold-copper mineralization and high gold-low copper style mineralization peripheral to the current pits.

At the Öksüt Mine, 43 drill holes totalling 11,176 metres of diamond drilling were completed in the second quarter of 2022. Exploration drilling activities were mainly focused on testing the potential for further oxide gold mineralization at the Keltepe Northwest and Keltepe North-Northwest deposits. In the third quarter of 2022, drilling at the Öksüt Mine will continue to target potential expansion of oxide gold mineralization at the Keltepe North, Keltepe Northwest, and Keltepe North-Northwest deposits as well as testing the potential for new oxide gold mineralization at targets peripheral to the known deposits.

The Goldfield District Project was acquired late in the first quarter of 2022 and comprises three known deposits as well as large areas of underexplored and highly prospective tenure. Initial exploration activities involved review and assessment of the available geological, geophysical, geochemical, and drilling data, geological modelling and interpretation, geophysical surveying, and the design and commencement of exploration and infill and resource expansion drilling programs. Ground geophysical surveying, consisting of Controlled Source Audio-frequency Magnetotellurics and Induced Polarization surveys were completed in the second quarter of 2022 over the Gemfield and Goldfield Main deposits and to the west of the Gemfield deposit. Exploration diamond drilling commenced at the Gemfield deposit late in the second quarter of 2022, with four holes completed totaling 962 metres.

In the third quarter of 2022, exploration drilling at the Goldfield Project will include approximately 10,800 metres of diamond and reverse circulation (“RC”) drilling at the Gemfield and Goldfield Main deposits while the technical services drilling program will include approximately 3,800 metres of diamond and RC drilling at the Gemfield, Goldfield Main and McMahon Ridge deposits.

Selected drill program results and intercepts are highlighted in the supplementary data at the end of this news release. The drill collar locations and associated graphics are available at the following: http://ml.globenewswire.com/Resource/Download/0c01a4ea-2448-…

Miese Zahlen am 10. 8. ???

Antwort auf Beitrag Nr.: 71.507.264 von petersylvester am 06.05.22 08:09:05Der unsere sieht nicht besser aus.....Miner lassen alle Federn....

Eldorade lässt anständig Federn.....

Börse Tradegate

Aktuell 8,687 EUR

.. das war schon einmal 2007 Thema .. man kennt sich also ..

https://www.reuters.com/article/eldorado-centerra-idUSN16274…

Wäre sicherlich erst einmal eine WinWin Situation, Eldorada ist in Griechenland und Centerra in der Türkei um die Ecke aktiv .. aber wenn zwischen den beiden Ländern mal "knallt".. 🙄 mhm ..

https://www.reuters.com/article/eldorado-centerra-idUSN16274…

Wäre sicherlich erst einmal eine WinWin Situation, Eldorada ist in Griechenland und Centerra in der Türkei um die Ecke aktiv .. aber wenn zwischen den beiden Ländern mal "knallt".. 🙄 mhm ..

12.02.24 · wO Chartvergleich · Bel Fuse (B) |