Transocean - Rig-Betreiber

eröffnet am 02.01.09 14:38:38 von

neuester Beitrag 17.10.23 14:12:19 von

neuester Beitrag 17.10.23 14:12:19 von

Beiträge: 633

ID: 1.147.226

ID: 1.147.226

Aufrufe heute: 0

Gesamt: 57.357

Gesamt: 57.357

Aktive User: 0

ISIN: CH0048265513 · WKN: A0REAY · Symbol: RIG

5,8350

USD

+1,66 %

+0,0950 USD

Letzter Kurs 18:54:18 NYSE

Neuigkeiten

18.04.24 · globenewswire |

17.04.24 · globenewswire |

17.04.24 · globenewswire |

12.04.24 · globenewswire |

11.04.24 · globenewswire |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,4500 | +15,99 | |

| 13,810 | +10,39 | |

| 9,2900 | +9,81 | |

| 5,2000 | +9,47 | |

| 7,6200 | +8,55 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,6000 | -9,09 | |

| 0,6850 | -11,04 | |

| 4,4000 | -17,29 | |

| 1,3501 | -20,58 | |

| 9,3500 | -28,02 |

Beitrag zu dieser Diskussion schreiben

16.10.

U.S. oil drillers to pivot from shale to offshore projects, EIA reports

https://www.worldoil.com/news/2023/10/16/u-s-oil-drillers-to…

...

The latest evidence of a pivot by oil operators from U.S. shale to offshore appeared Monday as the U.S. Energy Information Administration warned that a drop in onshore production is accelerating into November.

After revising its own figures from previous months, a decline in oil output is now expected to gain speed in every month from September through November, when combined production from the seven biggest shale fields will fall to 9.6 MMbpd, according to Monday’s report by the U.S. agency. The Permian basin of West Texas and New Mexico continues to lead the contraction.

Reports of a shrinking shale patch come as total U.S. output soared to a record 13.13 MMbpd last quarter. U.S. Gulf oil production was almost 2 MMbpd in July, according to the most recent data available. That’s up 4% from the previous month and marks an 11.7% jump from the same period a year earlier.

As shale growth slows, deepwater drilling is enjoying a renaissance, with more than $500 billion in global offshore investments expected through 2025, according to the oilfield services giant SLB.

...

U.S. oil drillers to pivot from shale to offshore projects, EIA reports

https://www.worldoil.com/news/2023/10/16/u-s-oil-drillers-to…

...

The latest evidence of a pivot by oil operators from U.S. shale to offshore appeared Monday as the U.S. Energy Information Administration warned that a drop in onshore production is accelerating into November.

After revising its own figures from previous months, a decline in oil output is now expected to gain speed in every month from September through November, when combined production from the seven biggest shale fields will fall to 9.6 MMbpd, according to Monday’s report by the U.S. agency. The Permian basin of West Texas and New Mexico continues to lead the contraction.

Reports of a shrinking shale patch come as total U.S. output soared to a record 13.13 MMbpd last quarter. U.S. Gulf oil production was almost 2 MMbpd in July, according to the most recent data available. That’s up 4% from the previous month and marks an 11.7% jump from the same period a year earlier.

As shale growth slows, deepwater drilling is enjoying a renaissance, with more than $500 billion in global offshore investments expected through 2025, according to the oilfield services giant SLB.

...

8.8.

Offshore Drillers See No New Rigs Even as Demand Nears 2019 Peak

https://uk.finance.yahoo.com/news/offshore-drillers-see-no-r…

...

As the world’s biggest offshore drillers gear up for more than $500 billion in new investments in the coming years, don’t expect rig contractors to meet the boom with a new round of vessel building.

Second-quarter earnings calls from the biggest offshore drillers over the past week revealed little enthusiasm to build costly new rigs that take years to roll out. Instead, the rig owners will maintain tight global supplies in order to push day rates higher.

“We believe that we are in the early stages of the next long-term upcycle, albeit one conspicuously without the frothy asset bubble conditions that drove the supply side off the rails,” Robert Eifler, chief executive officer of Noble Corp. — the biggest offshore-drilling contractor by market value — told investors last week on a conference call.

...

Antwort auf Beitrag Nr.: 73.952.906 von faultcode am 04.06.23 13:16:55Ich frage mich nur warum, bin leider lange raus und nicht mehr up to date.

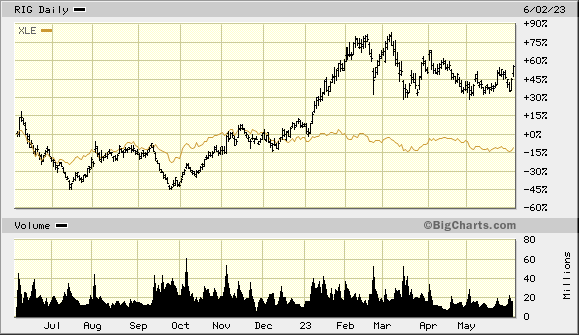

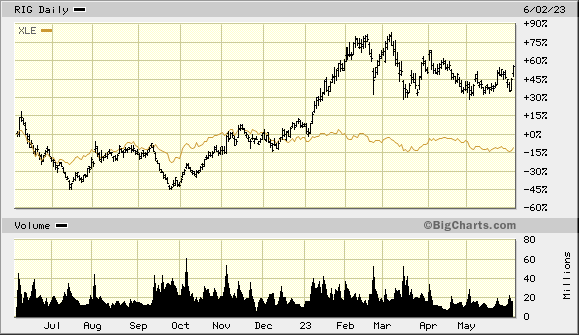

$RIG hält sich ziemlich gut.

Hier im Vergleich zum Energy Select Sector SPDR ETF für 2023 (auch in USD; nicht dort enthalten, ist aber ein guter Oil&Gas-Benchmark):

<kein Total return>

Hier im Vergleich zum Energy Select Sector SPDR ETF für 2023 (auch in USD; nicht dort enthalten, ist aber ein guter Oil&Gas-Benchmark):

<kein Total return>

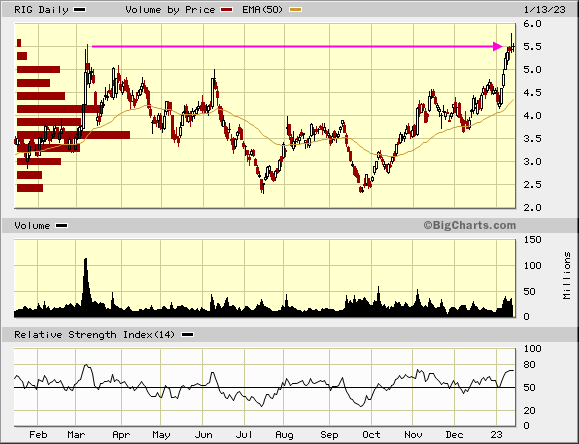

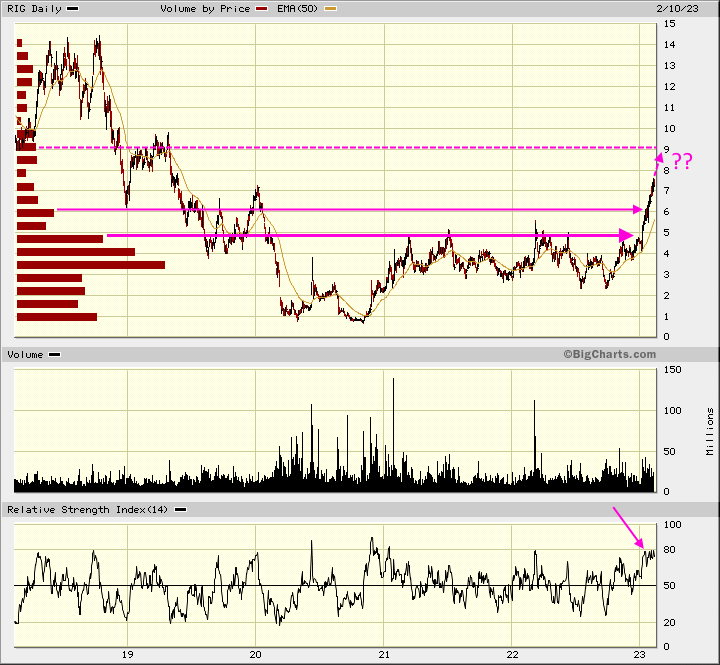

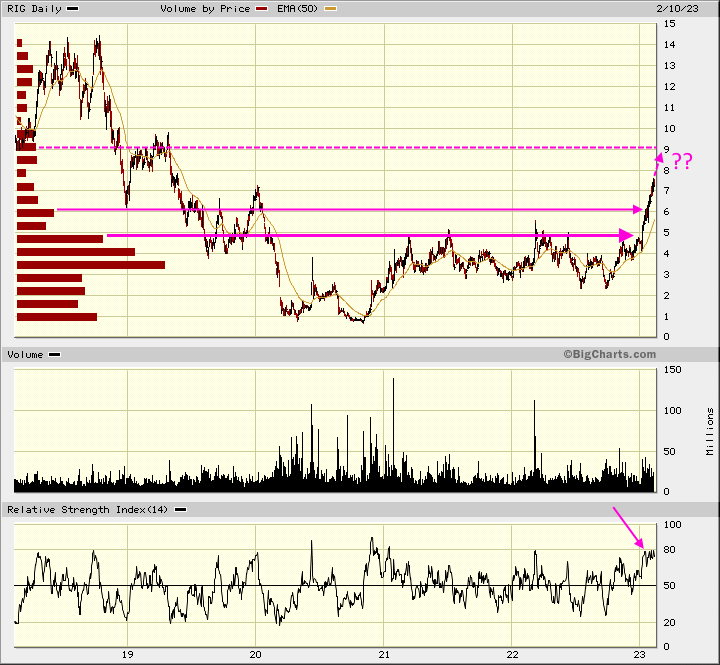

Antwort auf Beitrag Nr.: 73.087.463 von faultcode am 13.01.23 17:51:50ja, und wie:

=> mein Kursziel wären die USD9+ in dieser Aufwärtsbewegung. Und dann erstmal eine Konso, denn die Aktie ist schon ziemlich heiß gelaufen mMn

=> mein Kursziel wären die USD9+ in dieser Aufwärtsbewegung. Und dann erstmal eine Konso, denn die Aktie ist schon ziemlich heiß gelaufen mMn

Ich halte hier noch die Anleihe US893830AZ29 . Haette gerne noch im Sommer 2022 zu 50 % zugekauft. Geht leider nicht, da fuer Kleinanleger nicht mehr handelbar. Die Anleihe stand übrigens im Sommer 2020 bei 13 %. Glueckwunsch dem der damals die Nerven hatte und kaufte.

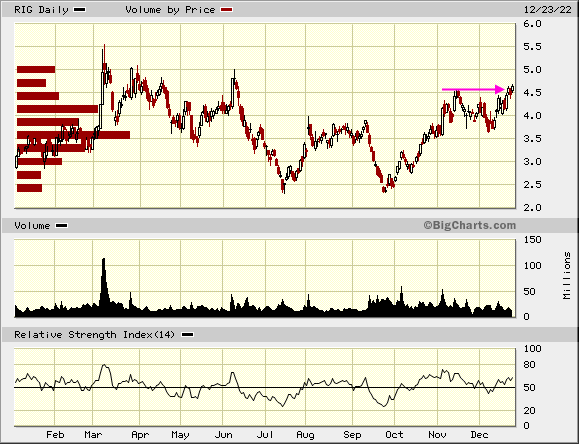

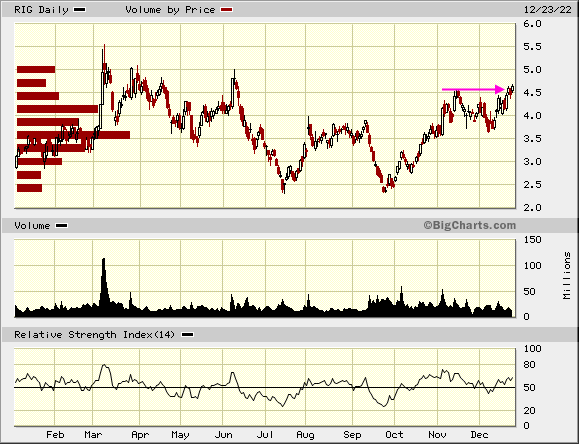

Antwort auf Beitrag Nr.: 72.737.828 von faultcode am 11.11.22 16:41:09klammheimlich: $4.6650 @ NYSE:

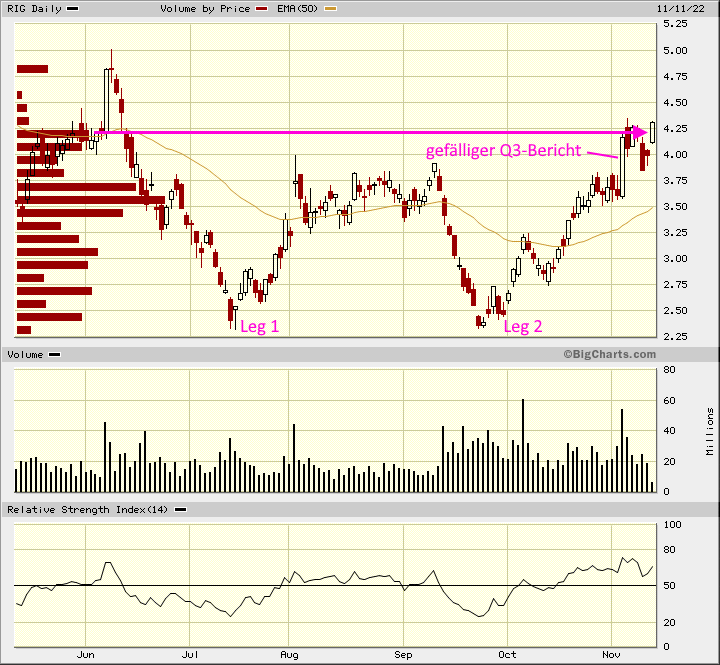

Hier schauen alle auf den Auftragseingang! Eine Milliarde Aufträge im Quartal ist das erste mal seit 5 oder 6 Jahren, dass sich das Orderbuch erhöht. Da schaut der Markt drauf. Im CC wurde auch noch einmal darauf hingewiesen, dass es erste Interessten für die eingemotten RIG'S gibt. Man aber noch wartet, bis sich das Bild verfestigt.

Alles in allem sehr positiv.

Negativ schlägt lediglich das ATM Programm mit Morgan Stanley durch. Das man nochmal Aktien für 400 Mio im Markt abladen will, hält den Kurs einfach vom durchstarten ab.

Alles in allem sehr positiv.

Negativ schlägt lediglich das ATM Programm mit Morgan Stanley durch. Das man nochmal Aktien für 400 Mio im Markt abladen will, hält den Kurs einfach vom durchstarten ab.