LITHIUM, POTASH und GOLD......wächst hier ne neue Perle heran ????? - 500 Beiträge pro Seite

eröffnet am 26.07.09 17:40:17 von

neuester Beitrag 31.08.12 15:38:54 von

neuester Beitrag 31.08.12 15:38:54 von

Beiträge: 75

ID: 1.151.977

ID: 1.151.977

Aufrufe heute: 0

Gesamt: 6.044

Gesamt: 6.044

Aktive User: 0

ISIN: CA15916P1053 · WKN: 878303

ne meeeenge infos zur comp. gibts auf der HP........

http://www.channelresources.ca/s/Home.asp

...uuuuuund insbesondere in ´brandakt.´ pres. vom 24.07.2009....

http://www.channelresources.ca/i/pdf/chu-presentation.pdf

in den letzten tagen markierten wir unter anziehendem vol. ein jahres- HIGH nach dem andren und denke, daß wir damit erst den

anfang einer NEU- bewertung gesehen haben

http://www.channelresources.ca/s/Home.asp

...uuuuuund insbesondere in ´brandakt.´ pres. vom 24.07.2009....

http://www.channelresources.ca/i/pdf/chu-presentation.pdf

in den letzten tagen markierten wir unter anziehendem vol. ein jahres- HIGH nach dem andren und denke, daß wir damit erst den

anfang einer NEU- bewertung gesehen haben

...hier läßt sich ausbruch der letzten tag noch besser erkennen.......wenngleich bei relativ geringem volumen !!!

jedoch verrät die grünblaue säulen- einfärbung eindeutig das

anwachsende KAUF- interesse.....

SK am vergangenen freitag...cad 0,08

jedoch verrät die grünblaue säulen- einfärbung eindeutig das

anwachsende KAUF- interesse.....

SK am vergangenen freitag...cad 0,08

Antwort auf Beitrag Nr.: 37.648.500 von hbg55 am 26.07.09 17:48:40

....auffällig auch die jüngsten INSIDER- käufe...........

Channel Resources Ltd. (CHU)

As of July 25th, 2009

Filing Date Transaction Date Insider Name Ownership Type Securities Nature of transaction # or value acquired or disposed of Unit Price

Jul 13/09 Jul 10/09 McAleenan, Colin Direct Ownership Common Shares 10 - Acquisition in the public market 5,000 $0.045

Jul 13/09 Jul 09/09 McAleenan, Colin Direct Ownership Common Shares 10 - Acquisition in the public market 5,000 $0.050

Jul 08/09 Jul 08/09 McAleenan, Colin Direct Ownership Common Shares 10 - Acquisition in the public market 5,000 $0.045

Jul 08/09 Jul 07/09 McAleenan, Colin Direct Ownership Common Shares 10 - Acquisition in the public market 5,000 $0.045

Jul 07/09 Jul 06/09 McAleenan, Colin Direct Ownership Common Shares 10 - Acquisition in the public market 22,000 $0.043

Jun 05/09 Jun 05/09 Ameli, Cyrus Direct Ownership Common Shares 10 - Acquisition in the public market 10,000 $0.040

Jun 05/09 Jun 04/09 Ameli, Cyrus Direct Ownership Common Shares 10 - Acquisition in the public market 40,000 $0.040

....auffällig auch die jüngsten INSIDER- käufe...........

Channel Resources Ltd. (CHU)

As of July 25th, 2009

Filing Date Transaction Date Insider Name Ownership Type Securities Nature of transaction # or value acquired or disposed of Unit Price

Jul 13/09 Jul 10/09 McAleenan, Colin Direct Ownership Common Shares 10 - Acquisition in the public market 5,000 $0.045

Jul 13/09 Jul 09/09 McAleenan, Colin Direct Ownership Common Shares 10 - Acquisition in the public market 5,000 $0.050

Jul 08/09 Jul 08/09 McAleenan, Colin Direct Ownership Common Shares 10 - Acquisition in the public market 5,000 $0.045

Jul 08/09 Jul 07/09 McAleenan, Colin Direct Ownership Common Shares 10 - Acquisition in the public market 5,000 $0.045

Jul 07/09 Jul 06/09 McAleenan, Colin Direct Ownership Common Shares 10 - Acquisition in the public market 22,000 $0.043

Jun 05/09 Jun 05/09 Ameli, Cyrus Direct Ownership Common Shares 10 - Acquisition in the public market 10,000 $0.040

Jun 05/09 Jun 04/09 Ameli, Cyrus Direct Ownership Common Shares 10 - Acquisition in the public market 40,000 $0.040

Da hat einer ja ganz schön zugefasst; Shares im Wert von 1600 Dollar!

Antwort auf Beitrag Nr.: 37.650.352 von Vinyard am 27.07.09 10:12:15Amerikanische Pensionsfonds oder doch Warren Buffett?

Antwort auf Beitrag Nr.: 37.650.711 von Datteljongleur am 27.07.09 11:01:37

....DIE haben sich bereits für die next PP angemeldet

....DIE haben sich bereits für die next PP angemeldet

....hier mal ein int. artikel ausm SH- board..........

demand will go through the roof

Companies line up to join electric-car battery industry

Grants: Feds offer $2 billion jump-start

Share this story

Buzz up!

Del.icio.us

Digg

Newsvine

Bookmark and Share

OTHER CONTENT

STEVEN MUFSON; The Washington Post

Published: 07/26/09 12:05 am

WASHINGTON – The Energy Department is getting ready to hand out about $2 billion in grants to create a domestic industry for electric-car batteries, and 122 companies are scrambling to get pieces.

The companies range from small niche firms to giants such as Dow Chemical and Johnson Controls. All are promising a combination of innovation and ability to deliver new products on a commercial scale to prevent the United States from trading dependence on foreign oil or reliance on foreign-made batteries.

“We’ve had 20 years of bad behavior in the United States in terms of developing ideas into products,” said Mary Ann Wright, chief executive of Johnson Controls’s joint venture developing hybrid battery systems.

Now policy-makers hope that helping domestic battery manufacturers will produce economic savings that often come with large-scale production and which are needed to make electric cars affordable. With funds provided by the stimulus bill in February, the Energy Department can cover up to half the cost of a battery-related project.

“This investment will not only reduce our dependence on foreign oil, it will put Americans back to work,” President Obama said in March. “It positions American manufacturers on the cutting edge of innovation and solving our energy challenges.”

The federally funded battery effort has its skeptics. Grants are expected to focus on lightweight lithium-ion batteries similar to those found in laptops. They are the newest thing in a business that had not changed much since lead-acid batteries were invented a century and a half ago.

But U.S. hopefuls face stiff competition from foreign firms such as Japan’s Panasonic and Sony, and South Korea’s LG Chem, which already dominate the lithium-ion battery market in power tools, laptops and cellphones. Some domestic firms have recruited foreign companies as partners in new U.S.-based manufacturing facilities.

Moreover, some economists warn of the perils of government subsidies. “To the extent that this is part of a broader industrial policy scheme, I’m against it for all the reasons I’ve always been against it,” said Charles Schultze, a Brookings Institution senior fellow and former chairman of the Council of Economic Advisers. “If you’re not heavy-handed about screening (applications), you’re going to get a lot of the equivalent of political pork.”

Some industry experts also note that lithium-ion batteries may not be ready for tough road conditions, that they generate a lot of heat and that there is no infrastructure for recycling them. For the moment, it is easier to recycle lead-acid batteries, like those in regular cars, or nickel-metal hydride batteries, like those in hybrid vehicles.

Nonetheless, Obama has set a goal of having 1 million electric cars on the road by 2015 and the Energy Department is trying to make sure a large share of them are powered by U.S.-made batteries. In addition to the $2 billion in grants it is expected to announce soon, the Energy Department can also lend from a separate $25 billion program.

It has already announced a $1.6 billion loan to help Nissan develop an electric car, including the construction of a new battery plant, and a $465 million loan for Tesla Motors.

Johnson Controls, the world’s largest maker of lead-acid batteries, is applying with Ford Motor to make lithium-ion batteries at a Michigan plant that once made automobile interiors. The Wisconsin-based company says the project would be up and running within 15 months, creating 4,700 jobs for Michigan.

“Some people won’t lose their jobs and some people who’ve lost theirs will get new ones,” said Alex Molinaroli, president of power solutions at Johnson Controls.

The company touts its experience. “It’s a natural extension of what we do,” Molinaroli said of the battery business. Last year, Johnson Controls made 112 million conventional car batteries.

....es wird zunehmend schwerer, stücke unter cad 0,08

zu schnappen..........

Recent Trades - Last 5

Time Ex Price Change Volume Buyer Seller Markers

14:58:55 V 0.08 - 10,000 2 RBC 7 TD Sec K

13:15:35 V 0.065 -0.015 25,000 1 Anonymous 7 TD Sec K

13:14:21 V 0.065 -0.015 25,000 1 Anonymous 7 TD Sec K

13:14:21 V 0.075 -0.005 15,000 7 TD Sec 7 TD Sec K

10:57:21 V 0.08 - 2,000 2 RBC 7 TD Sec KL

zu schnappen..........

Recent Trades - Last 5

Time Ex Price Change Volume Buyer Seller Markers

14:58:55 V 0.08 - 10,000 2 RBC 7 TD Sec K

13:15:35 V 0.065 -0.015 25,000 1 Anonymous 7 TD Sec K

13:14:21 V 0.065 -0.015 25,000 1 Anonymous 7 TD Sec K

13:14:21 V 0.075 -0.005 15,000 7 TD Sec 7 TD Sec K

10:57:21 V 0.08 - 2,000 2 RBC 7 TD Sec KL

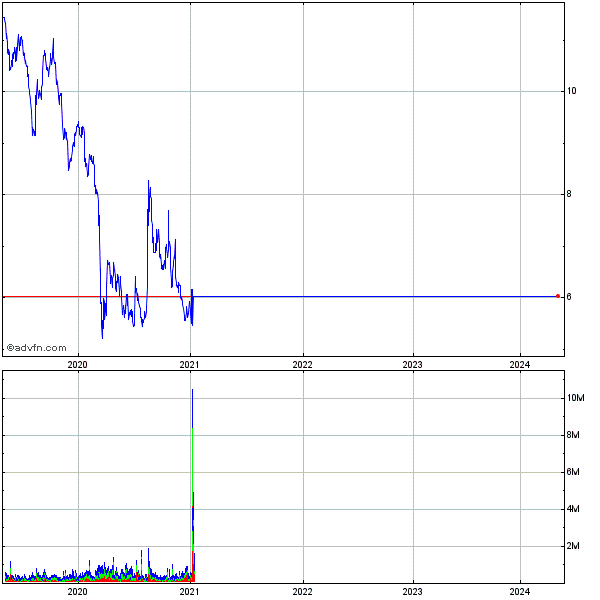

....auch mal int. nen 5-jahres- chart sich anzuschauen...........uuuuund die gewaltigen chancen zu

erkennen, die CHU auf akt. basis aufweist !!!!

erkennen, die CHU auf akt. basis aufweist !!!!

...KLOTZEN statt kleckern !!!!

Wirtschaft

Mittwoch, 05. August 2009

Investitionen von 2,4 Mrd. Dollar

Obama setzt auf Elektroautos

Mit einer großen offensive will US-Präsident Obama die USA zu einem führenden Standort zum Bau von Elektroautos machen. Sein Land habe viel zu lange diesen Bereich vernachlässigt. Nun sollen 2,4 Milliarden Dollar investiert werden.

US-Präsident Barack Obama will rund 2,4 Milliarden Dollar (1,7 Milliarden Euro) in die Entwicklung von Elektroautos investieren. Mit dieser Maßnahme sollten zehntausende Arbeitsplätze geschaffen werden, sagte Obama in einer Fabrik in Wakarusa im US-Bundesstaat Indiana im Norden des Landes. Die USA seien viel zu lange "außerstande" gewesen, in diesen Bereich innovativer Jobs zu investieren, sagte der US-Präsident. Länder wie China und Japan seien da sehr viel weiter.

Die Investition sei die "größte dieser Art" in der US-Geschichte in diesem Technologiebereich, sagte Obama in Indiana, das von der Wirtschaftskrise hart getroffen wurde. Der Großteil der geplanten Investition soll demnach in die industrielle Forschung zu Komponenten und Akkus sowie in das Recycling fließen.

http://www.n-tv.de/wirtschaft/Obama-setzt-auf-Elektroautos-a…

.....damit sollte auch der sektor der lithium- expl. nen schub nach norden machen können....IMO !!!

Antwort auf Beitrag Nr.: 37.742.035 von hbg55 am 10.08.09 09:18:17....CHU gaaaanz besonders....IMO, da diese durch die besondere ´brine- verarbeitung´ und bereits bestehende infrastruktur wesentlich kürzer mit der produktion beginnen könnten als jene konkurrenten, die lith.- carbonat aus gestein gewinnen !!!

....meeeehr hierzu in der brandakt. pres. aus 07.09 - insbesondere

seite 13- 19 !!!!

http://www.channelresources.ca/i/pdf/chu-presentation.pdf

....meeeehr hierzu in der brandakt. pres. aus 07.09 - insbesondere

seite 13- 19 !!!!

http://www.channelresources.ca/i/pdf/chu-presentation.pdf

im SH- board entdeckt.........

Investors take a shine to Canadian small caps

09/08/09

By Jennifer Kwan

TORONTO (Reuters) - Canadian investors are pumping money into small cap companies that they normally shun in uncertain times, enticed into riskier assets by signs the economy is stabilizing and by bargain prices.

The widely followed BMO Small Cap Index has raced ahead of other closely watched Canadian indexes as optimism over a global economic recovery has coaxed investors back into stocks hit especially hard by last fall's market meltdown.

http://www.globeinvestor.com/servlet/story/ROC.20090809.2009…

...sehen hier HEUTE nen bemerkenswerten vol.- anstieg.........uuuund der kurs dürfte bei diesem niv. auch die längste zeit zu sehen sein.......IMO !!!!

RT...noch cad 0,08

RT...noch cad 0,08

Antwort auf Beitrag Nr.: 37.749.217 von hbg55 am 10.08.09 21:45:45

Time Ex Price Change Volume Buyer Seller Markers

15:31:46 V 0.08 - 45,000 2 RBC 59 PI K

14:02:31 V 0.08 - 15,000 54 Global 59 PI K

14:01:26 V 0.08 - 5,000 54 Global 88 Scotia iTRADE K

14:01:26 V 0.08 - 30,000 54 Global 59 PI K

09:43:51 V 0.085 +0.005 1,000 2 RBC 7 TD Sec K

09:43:51 V 0.08 - 12,000 2 RBC 7 TD Sec K

09:43:51 V 0.08 - 25,000 2 RBC 7 TD Sec K

09:33:42 V 0.08 - 20,000 7 TD Sec 7 TD Sec K

09:30:00 V 0.08 - 1,000 7 TD Sec 7 TD Sec KL

Time Ex Price Change Volume Buyer Seller Markers

15:31:46 V 0.08 - 45,000 2 RBC 59 PI K

14:02:31 V 0.08 - 15,000 54 Global 59 PI K

14:01:26 V 0.08 - 5,000 54 Global 88 Scotia iTRADE K

14:01:26 V 0.08 - 30,000 54 Global 59 PI K

09:43:51 V 0.085 +0.005 1,000 2 RBC 7 TD Sec K

09:43:51 V 0.08 - 12,000 2 RBC 7 TD Sec K

09:43:51 V 0.08 - 25,000 2 RBC 7 TD Sec K

09:33:42 V 0.08 - 20,000 7 TD Sec 7 TD Sec K

09:30:00 V 0.08 - 1,000 7 TD Sec 7 TD Sec KL

Antwort auf Beitrag Nr.: 37.749.265 von hbg55 am 10.08.09 21:50:19

...KEINER gibt mehr stück unter cad 0,08 her

...KEINER gibt mehr stück unter cad 0,08 her

Antwort auf Beitrag Nr.: 37.749.217 von hbg55 am 10.08.09 21:45:45

...bitte ZUSTEIGEN........baby kommt ins rollen...........

Time Ex Price Change Volume Buyer Seller Markers

10:05:33 V 0.09 +0.01 36,000 33 Canaccord 7 TD Sec K

10:05:33 V 0.09 +0.01 20,000 33 Canaccord 7 TD Sec K

09:41:25 V 0.085 +0.005 15,000 33 Canaccord 7 TD Sec K

09:41:25 V 0.085 +0.005 29,000 33 Canaccord 7 TD Sec K

09:30:00 V 0.085 +0.005 20,000 79 CIBC 7 TD Sec KL

...bitte ZUSTEIGEN........baby kommt ins rollen...........

Time Ex Price Change Volume Buyer Seller Markers

10:05:33 V 0.09 +0.01 36,000 33 Canaccord 7 TD Sec K

10:05:33 V 0.09 +0.01 20,000 33 Canaccord 7 TD Sec K

09:41:25 V 0.085 +0.005 15,000 33 Canaccord 7 TD Sec K

09:41:25 V 0.085 +0.005 29,000 33 Canaccord 7 TD Sec K

09:30:00 V 0.085 +0.005 20,000 79 CIBC 7 TD Sec KL

RT jetzt schon...cad 0,10

Antwort auf Beitrag Nr.: 37.755.604 von hbg55 am 11.08.09 16:48:21

...und DAS sind ordt. blöcke, die da wechhhh gehen....

Time Ex Price Change Volume Buyer Seller Markers

10:41:40 V 0.10 +0.02 30,000 1 Anonymous 7 TD Sec K

10:41:40 V 0.10 +0.02 70,000 1 Anonymous 7 TD Sec K

10:40:14 V 0.095 +0.015 39,000 1 Anonymous 1 Anonymous K

10:39:41 V 0.095 +0.015 10,000 2 RBC 1 Anonymous K

10:33:45 V 0.09 +0.01 10,000 33 Canaccord 9 BMO Nesbitt K

10:32:21 V 0.095 +0.015 1,000 88 Scotia iTRADE 1 Anonymous K

10:32:21 V 0.095 +0.015 14,000 88 Scotia iTRADE 9 BMO Nesbitt K

10:21:01 V 0.095 +0.015 400 33 Canaccord 89 Raymond James E

10:21:01 V 0.095 +0.015 3,000 33 Canaccord 9 BMO Nesbitt K

10:20:50 V 0.095 +0.015 13,000 33 Canaccord 9 BMO Nesbitt K

...und DAS sind ordt. blöcke, die da wechhhh gehen....

Time Ex Price Change Volume Buyer Seller Markers

10:41:40 V 0.10 +0.02 30,000 1 Anonymous 7 TD Sec K

10:41:40 V 0.10 +0.02 70,000 1 Anonymous 7 TD Sec K

10:40:14 V 0.095 +0.015 39,000 1 Anonymous 1 Anonymous K

10:39:41 V 0.095 +0.015 10,000 2 RBC 1 Anonymous K

10:33:45 V 0.09 +0.01 10,000 33 Canaccord 9 BMO Nesbitt K

10:32:21 V 0.095 +0.015 1,000 88 Scotia iTRADE 1 Anonymous K

10:32:21 V 0.095 +0.015 14,000 88 Scotia iTRADE 9 BMO Nesbitt K

10:21:01 V 0.095 +0.015 400 33 Canaccord 89 Raymond James E

10:21:01 V 0.095 +0.015 3,000 33 Canaccord 9 BMO Nesbitt K

10:20:50 V 0.095 +0.015 13,000 33 Canaccord 9 BMO Nesbitt K

RT...cad 0,105

....wie uns die blaugrüne säulen- einfärbung zeigt sehen wir

bislang mehrheitlich KÄUFE..........

bislang mehrheitlich KÄUFE..........

Antwort auf Beitrag Nr.: 37.756.982 von hbg55 am 11.08.09 19:16:11Dachte bislang immer, das jedem Kauf auch ein Verkauf gegenübersteht.

So kann man sich täuschen!

So kann man sich täuschen!

Antwort auf Beitrag Nr.: 37.757.013 von Datteljongleur am 11.08.09 19:19:20

....anner börse gibts halt immmmmmer WAS zuzulernen, DT

....anner börse gibts halt immmmmmer WAS zuzulernen, DT

mit neuen HÖCHST- marken bei vol.- und kurs beendeten wir

gestrigen handel.........nur knapp unter TH von cad 0,11........

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:26:37 V 0.105 +0.025 10,000 2 RBC 7 TD Sec K

15:08:21 V 0.105 +0.025 20,000 2 RBC 7 TD Sec K

13:46:23 V 0.10 +0.02 30,000 1 Anonymous 1 Anonymous K

13:45:56 V 0.10 +0.02 5,000 1 Anonymous 7 TD Sec K

13:05:13 V 0.10 +0.02 10,000 1 Anonymous 2 RBC K

12:40:41 V 0.10 +0.02 10,000 1 Anonymous 88 Scotia iTRADE K

12:40:27 V 0.10 +0.02 39,000 1 Anonymous 2 RBC K

12:40:27 V 0.105 +0.025 11,000 7 TD Sec 2 RBC K

12:11:05 V 0.11 +0.03 10,000 88 Scotia iTRADE 1 Anonymous K

12:09:25 V 0.11 +0.03 3,000 88 Scotia iTRADE 1 Anonymous K

...damit konnte CHU schön in den focus pot. investoren rücken - sollte kurs weiteren anschub geben......IMO

...HEUTE ´lith.- day´........CLQ,MCI,WLC haben schon gewaltig

vorgelegt...........CHU ´noch´ in schlummer- posi !!!!

vorgelegt...........CHU ´noch´ in schlummer- posi !!!!

Antwort auf Beitrag Nr.: 37.774.673 von hbg55 am 13.08.09 16:55:31...hat zwar abissl gedauert, aber jetzt gehts auch hier UPPPP

RT....cad 0,125

...mal sehen, was noch bis zum handelsende geht......NEUES TOP

beim vol.

RT....cad 0,125

...mal sehen, was noch bis zum handelsende geht......NEUES TOP

beim vol.

Antwort auf Beitrag Nr.: 37.776.358 von hbg55 am 13.08.09 19:41:35

....gaaaanz so ists geworden.......trotz einiger gewinn- mitnahmen

zum ende der sitzung übertrafen wir erstmals vol. von 1mio und haben uns

damit schöööön oberhalb der marke von cad 0,10 festgesetzt !!!!

....gaaaanz so ists geworden.......trotz einiger gewinn- mitnahmen

zum ende der sitzung übertrafen wir erstmals vol. von 1mio und haben uns

damit schöööön oberhalb der marke von cad 0,10 festgesetzt !!!!

Electric Vehicles Face Bright Future in U.S.

Date Published: 11 Aug 2009

By Matt Scruggs, Research Analyst, Frost & Sullivan's Automotive Practice and Veerender Kaul, Research Director, Frost & Sullivan's Automotive Practice

President Obama's announcement of a $2.4 billion government grant will open up the electric vehicle frontier on a larger scale than initially predicted. This will prove to be an important measure in reducing the initial cost of electric vehicles and opening the market to consumers. Additionally, electric vehicle development can provide a healthy boost to a stagnant economy with the creation of manufacturing jobs, a great number of which were lost due to the U.S. automotive industry decline. These benefits apply not only to purely-electric vehicles, but also to hybrid vehicles and extended-range electric vehicles (aka plug-in hybrids).

Of the $2.4 billion allocated in the program, approximately $1.5 billion is allocated to companies that manufacture batteries and battery components, as well as companies that recycle batteries once spent. $500 million goes to companies that manufacture electric drive systems or components, and the remaining $400 million is to be used for the creation of electric vehicle education and training, the creation of charging infrastructure, and the purchase of hybrid and electric vehicles for testing and evaluation. Based on Frost & Sullivan's analysis, this allocation of funding is poised to offer the maximum benefit to the future of electric vehicles.

The battery is the single-most expensive component of an electric vehicle, ranging from $8,000 to $15,000 on most vehicles in volume quantities. Automakers are working closely with battery suppliers and recyclers to develop several sales scenarios designed to reduce the initial battery cost to a point within reach of the average consumer. This may entail the consumer paying for a portion of the battery cost along with the price of the vehicle and leasing the rest of the cost over the life of the vehicle. Consumers are expected to be receptive to this, since they would not need to purchase gasoline, and electric recharge costs are expected to range from $0.70 to $2.50 per charge, depending on peak usage rates for each area. Companies that recycle batteries can also subsidize the cost, based on the end-of-life value of the battery pack.

The problem with these scenarios is still the initial cost, which lies not in the materials, but rather the labor and creation of manufacturing facilities for the batteries. The grant provides battery manufacturers with much-needed start-up funds to overcome the initial hurdle, since manufacturers have few options other than either burdening the consumer with excessive costs or absorbing the high prices and losing money on each battery. Once production reaches a significant level, prices will drop, and the cost will stabilize profitably, with price declines potentially reaching 50% by 2015.

The manufacture of electric drive components is expected to present only mild difficulty for the industry, as the technology is proven. The problem of scale, however, must be addressed, though the funds allocated for this are expected to be sufficient. The recipients of these funds are OEMs, 1st-Tier suppliers, or current manufacturers of electric vehicle drive components, suggesting that a straightforward expansion of manufacturing capacity will be the principle strategy.

Electric vehicles, while currently faced with challenges as viable modes of transportation, will continue to evolve to suit the changing face of the American market. Urban sprawl has separated working areas of a city from living areas, leading to an increase in average driving distance over the past few years. This trend is expected to continue, and is the largest single challenge to electric vehicle battery development. Initially, extended-range electric vehicles will offer an all-electric range of around 40 miles, which would be sufficient to meet the needs of the average driver. However, battery development is expected to progress quickly, with range being the first priority.

Aiding and abetting this is the expected creation of recharging infrastructure. Funds granted in this area are the lowest of the categories, though this is not expected to be problematic, as challenges here are largely those of business development. Opportunities are rampant in the infrastructure market, but will not be widely commercially viable until electric vehicles achieve significant market adoption, most likely around 2012.

For more information, please contact David Escalante, Corporate Communications, at 210.477.8427 or david.escalante@frost.com.

http://www.frost.com/prod/servlet/market-insight-top.pag?Src…

Date Published: 11 Aug 2009

By Matt Scruggs, Research Analyst, Frost & Sullivan's Automotive Practice and Veerender Kaul, Research Director, Frost & Sullivan's Automotive Practice

President Obama's announcement of a $2.4 billion government grant will open up the electric vehicle frontier on a larger scale than initially predicted. This will prove to be an important measure in reducing the initial cost of electric vehicles and opening the market to consumers. Additionally, electric vehicle development can provide a healthy boost to a stagnant economy with the creation of manufacturing jobs, a great number of which were lost due to the U.S. automotive industry decline. These benefits apply not only to purely-electric vehicles, but also to hybrid vehicles and extended-range electric vehicles (aka plug-in hybrids).

Of the $2.4 billion allocated in the program, approximately $1.5 billion is allocated to companies that manufacture batteries and battery components, as well as companies that recycle batteries once spent. $500 million goes to companies that manufacture electric drive systems or components, and the remaining $400 million is to be used for the creation of electric vehicle education and training, the creation of charging infrastructure, and the purchase of hybrid and electric vehicles for testing and evaluation. Based on Frost & Sullivan's analysis, this allocation of funding is poised to offer the maximum benefit to the future of electric vehicles.

The battery is the single-most expensive component of an electric vehicle, ranging from $8,000 to $15,000 on most vehicles in volume quantities. Automakers are working closely with battery suppliers and recyclers to develop several sales scenarios designed to reduce the initial battery cost to a point within reach of the average consumer. This may entail the consumer paying for a portion of the battery cost along with the price of the vehicle and leasing the rest of the cost over the life of the vehicle. Consumers are expected to be receptive to this, since they would not need to purchase gasoline, and electric recharge costs are expected to range from $0.70 to $2.50 per charge, depending on peak usage rates for each area. Companies that recycle batteries can also subsidize the cost, based on the end-of-life value of the battery pack.

The problem with these scenarios is still the initial cost, which lies not in the materials, but rather the labor and creation of manufacturing facilities for the batteries. The grant provides battery manufacturers with much-needed start-up funds to overcome the initial hurdle, since manufacturers have few options other than either burdening the consumer with excessive costs or absorbing the high prices and losing money on each battery. Once production reaches a significant level, prices will drop, and the cost will stabilize profitably, with price declines potentially reaching 50% by 2015.

The manufacture of electric drive components is expected to present only mild difficulty for the industry, as the technology is proven. The problem of scale, however, must be addressed, though the funds allocated for this are expected to be sufficient. The recipients of these funds are OEMs, 1st-Tier suppliers, or current manufacturers of electric vehicle drive components, suggesting that a straightforward expansion of manufacturing capacity will be the principle strategy.

Electric vehicles, while currently faced with challenges as viable modes of transportation, will continue to evolve to suit the changing face of the American market. Urban sprawl has separated working areas of a city from living areas, leading to an increase in average driving distance over the past few years. This trend is expected to continue, and is the largest single challenge to electric vehicle battery development. Initially, extended-range electric vehicles will offer an all-electric range of around 40 miles, which would be sufficient to meet the needs of the average driver. However, battery development is expected to progress quickly, with range being the first priority.

Aiding and abetting this is the expected creation of recharging infrastructure. Funds granted in this area are the lowest of the categories, though this is not expected to be problematic, as challenges here are largely those of business development. Opportunities are rampant in the infrastructure market, but will not be widely commercially viable until electric vehicles achieve significant market adoption, most likely around 2012.

For more information, please contact David Escalante, Corporate Communications, at 210.477.8427 or david.escalante@frost.com.

http://www.frost.com/prod/servlet/market-insight-top.pag?Src…

...nach furiosem vortag, sehen wir heute bislang recht

entspannten handel um die 0,10- marke..........

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

11:58:17 V 0.11 - 3,000 88 Scotia iTRADE 1 Anonymous K ....akt. TH

11:54:56 V 0.105 -0.005 15,000 79 CIBC 1 Anonymous K

11:54:20 V 0.105 -0.005 20,000 2 RBC 1 Anonymous K

11:54:20 V 0.105 -0.005 10,000 2 RBC 1 Anonymous K

11:33:05 V 0.105 -0.005 8,000 7 TD Sec 1 Anonymous K

11:28:45 V 0.10 -0.01 26,000 1 Anonymous 33 Canaccord K

10:57:59 V 0.095 -0.015 3,000 1 Anonymous 88 Scotia iTRADE K

10:35:07 V 0.10 -0.01 5,000 7 TD Sec 33 Canaccord K

10:35:07 V 0.10 -0.01 19,000 1 Anonymous 33 Canaccord K

10:13:20 V 0.105 -0.005 2,000 1 Anonymous 1 Anonymous K

entspannten handel um die 0,10- marke..........

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

11:58:17 V 0.11 - 3,000 88 Scotia iTRADE 1 Anonymous K ....akt. TH

11:54:56 V 0.105 -0.005 15,000 79 CIBC 1 Anonymous K

11:54:20 V 0.105 -0.005 20,000 2 RBC 1 Anonymous K

11:54:20 V 0.105 -0.005 10,000 2 RBC 1 Anonymous K

11:33:05 V 0.105 -0.005 8,000 7 TD Sec 1 Anonymous K

11:28:45 V 0.10 -0.01 26,000 1 Anonymous 33 Canaccord K

10:57:59 V 0.095 -0.015 3,000 1 Anonymous 88 Scotia iTRADE K

10:35:07 V 0.10 -0.01 5,000 7 TD Sec 33 Canaccord K

10:35:07 V 0.10 -0.01 19,000 1 Anonymous 33 Canaccord K

10:13:20 V 0.105 -0.005 2,000 1 Anonymous 1 Anonymous K

VANCOUVER, BRITISH COLUMBIA--(Marketwire

- Aug. 17, 2009) - Channel Resources Ltd. ("Channel" or the "Company") (TSX VENTURE:CHU - News) announces that a sampling program at the Fox Creek Lithium / Potash project has commenced.

The program has been designed to test lithium concentrations within the Fox Creek brine that form the basis of a historical lithium metal resource estimate for the source aquifers, as described in the NI43-101 technical report for the project published in May of 2009. The brine will also be tested for other potentially commercial mineral content, including for potassium (a primary element in the production of potash), bromine and boron.

Oil and gas operators in the Fox Creek area are supporting and participating in the sampling program, in which the Company will obtain brine samples from 16 individual producing gas wells in the central portion of the Fox Creek permit area, targeting the Beaverhill Lake aquifer, as well as from blended sources from two gas plants in the region.

Results of this sampling program will be assessed with detailed information on 113 oil and gas wells that have been drilled on the property and that penetrate the Beaverhill Lake carbonate reef complex. Active wells in the area are producing substantial volumes of brine from the Beaverhill Lake aquifer which is separated from petroleum products before being injected back into designated disposal wells. No lithium or other mineral production from these brines has taken place to-date at Fox Creek. Channel believes that existing infrastructure at Fox Creek will facilitate the progression of the project through resource definition, brine processing assessment, feasibility and development stages.

The Fox Creek project comprises 369 square kilometres of mineral rights over mineral-rich brine aquifers. This deposit is being assessed by Channel to determine the overall size of the deposit and its potential to produce lithium and potash, together with boron and bromine.

This news release has been prepared under the supervision of Colin H. McAleenan, P.Geo, who is the Company's "Qualified Person" under the definition of NI 43-101. Readers are encouraged to review the 43-101 technical report for the Fox Creek Project authored by Michael B. Dufresne, M.Sc., P.Geol., President of APEX Geoscience Ltd. of Edmonton, Alberta, who is an 'Independent Qualified Person' as defined in the instrument.

Some of the statements contained herein are forward-looking statements which involve known and unknown risks and uncertainties. Without limitation, statements regarding potential mineralization and resources, exploration results, and future plans and objectives of the Company are forward looking statements that involve various degrees of risk. The following are important factors that could cause the Company's actual results to differ materially from those expressed or implied by such forward looking statements: changes in the price of minerals, general market conditions, risks inherent in mineral exploration, risks associated with development, construction and mining operations, the uncertainty of future profitability and the uncertainty of access to additional capital. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements or the foregoing list of factors, whether as a result of new information or future events or otherwise. Further disclosure on risk factors is available in the Company's various corporate filings at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Contact:

Colin McAleenan

Channel Resources Ltd.

President & CEO

604.684.7098

Cyrus Ameli

Channel Resources Ltd.

CFO & VP Corporate Affairs

604.684.7098

604.684.7079 (FAX)

info@channelresources.ca

www.channelresources.ca

Time Ex Price Change Volume Buyer Seller Markers

11:47:59 V 0.115 +0.02 48,000 67 Northern 88 Scotia iTRADE K

11:47:59 V 0.115 +0.02 12,000 67 Northern 62 Haywood K

11:06:15 V 0.115 +0.02 5,000 7 TD Sec 62 Haywood K

11:05:53 V 0.115 +0.02 5,000 7 TD Sec 62 Haywood K

11:05:23 V 0.115 +0.02 5,000 7 TD Sec 62 Haywood K

11:04:53 V 0.115 +0.02 5,000 7 TD Sec 62 Haywood K

11:04:44 V 0.115 +0.02 5,000 7 TD Sec 62 Haywood K

11:04:34 V 0.115 +0.02 3,000 7 TD Sec 62 Haywood K

11:04:34 V 0.115 +0.02 2,000 7 TD Sec 7 TD Sec K

11:04:23 V 0.115 +0.02 5,000 7 TD Sec 7 TD Sec K

11:47:59 V 0.115 +0.02 48,000 67 Northern 88 Scotia iTRADE K

11:47:59 V 0.115 +0.02 12,000 67 Northern 62 Haywood K

11:06:15 V 0.115 +0.02 5,000 7 TD Sec 62 Haywood K

11:05:53 V 0.115 +0.02 5,000 7 TD Sec 62 Haywood K

11:05:23 V 0.115 +0.02 5,000 7 TD Sec 62 Haywood K

11:04:53 V 0.115 +0.02 5,000 7 TD Sec 62 Haywood K

11:04:44 V 0.115 +0.02 5,000 7 TD Sec 62 Haywood K

11:04:34 V 0.115 +0.02 3,000 7 TD Sec 62 Haywood K

11:04:34 V 0.115 +0.02 2,000 7 TD Sec 7 TD Sec K

11:04:23 V 0.115 +0.02 5,000 7 TD Sec 7 TD Sec K

Antwort auf Beitrag Nr.: 37.804.286 von hbg55 am 18.08.09 18:32:00

...schlossen schlussendlich mit nem stattlichen PLUS von

über 20 % ........gaaaaanz nahe des TH von 0,12........

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:54:13 V 0.115 +0.02 1,000 80 National Bank 85 Scotia K

15:54:13 V 0.115 +0.02 49,000 80 National Bank 88 Scotia iTRADE K

15:28:30 V 0.10 +0.005 5,000 88 Scotia iTRADE 54 Global K

15:28:30 V 0.105 +0.01 25,000 33 Canaccord 54 Global K

15:28:30 V 0.105 +0.01 10,000 124 Questrade 54 Global K

15:28:30 V 0.11 +0.015 10,000 7 TD Sec 54 Global K

15:28:30 V 0.11 +0.015 50,000 67 Northern 54 Global K

15:16:33 V 0.115 +0.02 1,000 2 RBC 88 Scotia iTRADE K

14:14:01 V 0.11 +0.015 10,000 9 BMO Nesbitt 7 TD Sec K

14:14:01 V 0.11 +0.015 10,000 67 Northern 7 TD Sec K

....denke, unser baby bietet akt. noch immer attr. zustiegs- chancen und verweisen geeeerne auf den highflyer der lith.- werte

MCI

...schlossen schlussendlich mit nem stattlichen PLUS von

über 20 % ........gaaaaanz nahe des TH von 0,12........

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:54:13 V 0.115 +0.02 1,000 80 National Bank 85 Scotia K

15:54:13 V 0.115 +0.02 49,000 80 National Bank 88 Scotia iTRADE K

15:28:30 V 0.10 +0.005 5,000 88 Scotia iTRADE 54 Global K

15:28:30 V 0.105 +0.01 25,000 33 Canaccord 54 Global K

15:28:30 V 0.105 +0.01 10,000 124 Questrade 54 Global K

15:28:30 V 0.11 +0.015 10,000 7 TD Sec 54 Global K

15:28:30 V 0.11 +0.015 50,000 67 Northern 54 Global K

15:16:33 V 0.115 +0.02 1,000 2 RBC 88 Scotia iTRADE K

14:14:01 V 0.11 +0.015 10,000 9 BMO Nesbitt 7 TD Sec K

14:14:01 V 0.11 +0.015 10,000 67 Northern 7 TD Sec K

....denke, unser baby bietet akt. noch immer attr. zustiegs- chancen und verweisen geeeerne auf den highflyer der lith.- werte

MCI

Antwort auf Beitrag Nr.: 37.776.358 von hbg55 am 13.08.09 19:41:35

...SIE will nach oben.......uuuuund SIE geht nach oben, denn

im gegensatz zu div. andren lith.- picks siehts hier noch recht

´beschaulich´ aus..........wie ich meine:....zu UNRECHT

HEUTE sind sie da........die FETT- trades.......

Time Ex Price Change Volume Buyer Seller Markers

14:15:26 V 0.12 +0.005 98,000 80 National Bank 62 Haywood K

14:15:26 V 0.12 +0.005 10,000 80 National Bank 2 RBC K

14:15:26 V 0.12 +0.005 11,000 80 National Bank 33 Canaccord K

14:15:26 V 0.12 +0.005 10,000 80 National Bank 2 RBC K

14:15:26 V 0.12 +0.005 10,000 80 National Bank 19 Desjardins K

13:04:18 V 0.115 - 60,000 2 RBC 67 Northern K

12:36:23 V 0.115 - 30,000 5 Penson 67 Northern K

12:17:17 V 0.115 - 120,000 80 National Bank 67 Northern K

12:03:48 V 0.115 - 50,000 80 National Bank 88 Scotia iTRADE K

12:03:48 V 0.115 - 10,000 80 National Bank 19 Desjardins K

...SIE will nach oben.......uuuuund SIE geht nach oben, denn

im gegensatz zu div. andren lith.- picks siehts hier noch recht

´beschaulich´ aus..........wie ich meine:....zu UNRECHT

HEUTE sind sie da........die FETT- trades.......

Time Ex Price Change Volume Buyer Seller Markers

14:15:26 V 0.12 +0.005 98,000 80 National Bank 62 Haywood K

14:15:26 V 0.12 +0.005 10,000 80 National Bank 2 RBC K

14:15:26 V 0.12 +0.005 11,000 80 National Bank 33 Canaccord K

14:15:26 V 0.12 +0.005 10,000 80 National Bank 2 RBC K

14:15:26 V 0.12 +0.005 10,000 80 National Bank 19 Desjardins K

13:04:18 V 0.115 - 60,000 2 RBC 67 Northern K

12:36:23 V 0.115 - 30,000 5 Penson 67 Northern K

12:17:17 V 0.115 - 120,000 80 National Bank 67 Northern K

12:03:48 V 0.115 - 50,000 80 National Bank 88 Scotia iTRADE K

12:03:48 V 0.115 - 10,000 80 National Bank 19 Desjardins K

....und jetzt sehen wir schon die 0,13

Antwort auf Beitrag Nr.: 37.813.426 von hbg55 am 19.08.09 20:45:22

...joooo, SIE ist angekommen..........und zwar mit REKORD- vol.

auf REKORD- kurs

mit knapp 2mios sahen wir noch ne schöne end- rally auf 0,135.....

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:59:41 V 0.135 +0.02 8,500 59 PI 88 Scotia iTRADE K

15:59:13 V 0.135 +0.02 50,000 59 PI 33 Canaccord K

15:59:13 V 0.135 +0.02 10,000 59 PI 7 TD Sec K

15:59:13 V 0.135 +0.02 30,000 59 PI 9 BMO Nesbitt K

15:59:13 V 0.13 +0.015 1,500 59 PI 88 Scotia iTRADE K

15:52:37 V 0.13 +0.015 10,000 59 PI 88 Scotia iTRADE K

15:52:37 V 0.13 +0.015 3,500 59 PI 88 Scotia iTRADE K

15:36:47 V 0.135 +0.02 5,000 88 Scotia iTRADE 88 Scotia iTRADE K

15:35:24 V 0.13 +0.015 16,500 59 PI 1 Anonymous K

15:31:14 V 0.13 +0.015 8,000 88 Scotia iTRADE 1 Anonymous K

.......und auch jetzt gibts noch genug luft nach oben........IMO

...joooo, SIE ist angekommen..........und zwar mit REKORD- vol.

auf REKORD- kurs

mit knapp 2mios sahen wir noch ne schöne end- rally auf 0,135.....

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:59:41 V 0.135 +0.02 8,500 59 PI 88 Scotia iTRADE K

15:59:13 V 0.135 +0.02 50,000 59 PI 33 Canaccord K

15:59:13 V 0.135 +0.02 10,000 59 PI 7 TD Sec K

15:59:13 V 0.135 +0.02 30,000 59 PI 9 BMO Nesbitt K

15:59:13 V 0.13 +0.015 1,500 59 PI 88 Scotia iTRADE K

15:52:37 V 0.13 +0.015 10,000 59 PI 88 Scotia iTRADE K

15:52:37 V 0.13 +0.015 3,500 59 PI 88 Scotia iTRADE K

15:36:47 V 0.135 +0.02 5,000 88 Scotia iTRADE 88 Scotia iTRADE K

15:35:24 V 0.13 +0.015 16,500 59 PI 1 Anonymous K

15:31:14 V 0.13 +0.015 8,000 88 Scotia iTRADE 1 Anonymous K

.......und auch jetzt gibts noch genug luft nach oben........IMO

kaum wahrgenommen, krabbelt sie weiter gen norden.......

RT...cad 0,125

RT...cad 0,125

Antwort auf Beitrag Nr.: 37.841.535 von hbg55 am 24.08.09 21:18:23

...auch HEUTE wieder.........und zwar mit ansehnlichen trades....

Time Ex Price Change Volume Buyer Seller Markers

09:46:30 V 0.13 +0.005 21,500 1 Anonymous 2 RBC K

09:45:15 V 0.13 +0.005 25,000 1 Anonymous 1 Anonymous K

09:44:50 V 0.13 +0.005 3,500 1 Anonymous 2 RBC K

09:43:57 V 0.13 +0.005 50,000 1 Anonymous 2 RBC K

09:42:41 V 0.135 +0.01 15,000 1 Anonymous 1 Anonymous K

09:42:41 V 0.135 +0.01 10,000 1 Anonymous 7 TD Sec K

09:42:41 V 0.135 +0.01 25,000 1 Anonymous 88 Scotia iTRADE K

09:36:19 V 0.135 +0.01 15,000 85 Scotia 2 RBC K

09:36:19 V 0.13 +0.005 15,000 85 Scotia 7 TD Sec K

09:36:19 V 0.13 +0.005 40,000 85 Scotia 7 TD Sec K

...auch HEUTE wieder.........und zwar mit ansehnlichen trades....

Time Ex Price Change Volume Buyer Seller Markers

09:46:30 V 0.13 +0.005 21,500 1 Anonymous 2 RBC K

09:45:15 V 0.13 +0.005 25,000 1 Anonymous 1 Anonymous K

09:44:50 V 0.13 +0.005 3,500 1 Anonymous 2 RBC K

09:43:57 V 0.13 +0.005 50,000 1 Anonymous 2 RBC K

09:42:41 V 0.135 +0.01 15,000 1 Anonymous 1 Anonymous K

09:42:41 V 0.135 +0.01 10,000 1 Anonymous 7 TD Sec K

09:42:41 V 0.135 +0.01 25,000 1 Anonymous 88 Scotia iTRADE K

09:36:19 V 0.135 +0.01 15,000 85 Scotia 2 RBC K

09:36:19 V 0.13 +0.005 15,000 85 Scotia 7 TD Sec K

09:36:19 V 0.13 +0.005 40,000 85 Scotia 7 TD Sec K

.....werden HIERMIT ´neue zeiten´ eingeläutet

9:04 AM ET, November 10, 2009

VANCOUVER, BRITISH COLUMBIA, Nov 10, 2009 (MARKETWIRE via COMTEX)

-- Channel Resources Ltd. ("Channel" or the "Company") (CHU) announces that it has appointed two new members to its 'Advisory Committee to the Board of Directors': Frank H. Crerie and Richard P. Schutte.

Dr. Schutte earned a Ph.D. in Inorganic Chemistry from the University of British Columbia in 1995. He has developed a strong background in advanced chemical processing and applications, currently with a major international industrial gases and engineering company. Dr. Schutte has extensive expertise and hands-on experience in the process, quality control and sales aspects of the commercial production of specialty gases and metals, as well as in the recovery and sale of lithium carbonate from recycled lithium ion batteries. Based in Edmonton, Alberta, Dr. Schutte has also gained first-hand knowledge and familiarity with standards and regulations applicable to complex chemical processing facilities in Alberta and British Columbia.

Mr. Crerie brings to Channel extensive experience in investment banking, venture capital and corporate finance. He received his B.A. degree from Columbia University, and also attended the Columbia University Law School. As President of Crerie & Co., an investment banking firm with offices in Houston and New York City, Mr. Crerie underwrote the development of numerous resource projects globally. He has also founded, financed and taken public on North American stock exchanges numerous resource companies. He is currently a director of Molina Exploration Corp. and Fractal Mining Corporation, both private resource companies.

"I would like to welcome Mr. Crerie and Dr. Schutte to the Company," said Colin McAleenan, President of Channel Resources. "These new appointments add a great deal of technical and corporate finance depth to our team, further positioning the Company for growth and the rapid assessment and development of the Fox Creek mineral brine project."

Grant of Options

Channel also announces that it has granted stock options ("Options") to its advisor and consultants for the purchase of up to a total of 310,000 common shares of the Company at an exercise price of $0.10 per share. The Options have a term of five years, are subject to vesting provisions, and are governed by the Company's Stock Option Plan, pursuant to which Options may be granted up to a maximum 10% of the issued and outstanding common shares of the Company from time to time.

All shares issuable pursuant to the exercise of Options are subject to a four-month hold period commencing from the date the Options are granted.

Some of the statements contained herein are forward-looking statements which involve known and unknown risks and uncertainties. Without limitation, statements regarding potential mineralization and resources, exploration results, and future plans and objectives of the Company are forward looking statements that involve various degrees of risk. The following are important factors that could cause the Company's actual results to differ materially from those expressed or implied by such forward looking statements: changes in the price of minerals, general market conditions, risks inherent in mineral exploration, risks associated with development, construction and mining operations, the uncertainty of future profitability and the uncertainty of access to additional capital. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements or the foregoing list of factors, whether as a result of new information or future events or otherwise. Further disclosure on risk factors is available in the Company's various corporate filings at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Contacts:

Channel Resources Ltd.

Colin McAleenan

President & CEO

604.684.7098

Channel Resources Ltd.

Cyrus Ameli

CFO & VP Corporate Affairs

604.684.7098

604.684.7079 (FAX)

info@channelresources.ca

www.channelresources.ca

SOURCE: Channel Resources Ltd.

mailto:info@channelresources.ca

http://www.channelresources.ca

Copyright 2009 Marketwire, Inc., All rights reserved.

Antwort auf Beitrag Nr.: 38.429.873 von hbg55 am 20.11.09 21:17:29

....man könnts meinen - auch auf der INSIDER- seite

wird mobilgemacht und zugeschnappt......

http://www.canadianinsider.com/coReport/allTransactions.php?…

....man könnts meinen - auch auf der INSIDER- seite

wird mobilgemacht und zugeschnappt......

http://www.canadianinsider.com/coReport/allTransactions.php?…

...für NEU- interessierte hier ein link zu einer

kurzen zusammnefassung.......

http://www.channelresources.ca/i/pdf/CHUfactsheet.pdf

kurzen zusammnefassung.......

http://www.channelresources.ca/i/pdf/CHUfactsheet.pdf

Antwort auf Beitrag Nr.: 38.430.406 von hbg55 am 20.11.09 23:33:47

...meeeeehr und vor allem brandakt. infos sind folg.

pres. aus 11.2009 zu entnehmen.........

http://www.channelresources.ca/i/pdf/chu-presentation.pdf

...meeeeehr und vor allem brandakt. infos sind folg.

pres. aus 11.2009 zu entnehmen.........

http://www.channelresources.ca/i/pdf/chu-presentation.pdf

Channel Resources Announces Non-Brokered Private Placement Financing

9:00 AM ET, December 2, 2009

VANCOUVER, BRITISH COLUMBIA, Dec 2, 2009 (Marketwire via COMTEX) -- NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Channel Resources Ltd. ("Channel" or the "Company") (CHU) announces a private placement of up to 3,750,000 units (a "Unit") at a price of CDN$0.08 per Unit. Each Unit will be comprised of one common share of the Company ("Common Shares") and one share purchase warrant (a "Warrant"), with each Warrant being exercisable for one Common Share ("Warrant Share") at an exercise price of CDN$0.11 for a period of 24 months.

The proceeds of the private placement will be used to fund exploration and pre-development work on its properties, primarily the Fox Creek Lithium/Potash Brine Project located in Alberta, as well as for corporate development and working capital purposes.

Completion of the private placement is subject to execution and delivery of standard documentation and receipt of all required regulatory approvals and consents, including the approval of the TSX Venture Exchange.

"A real advantage that Fox Creek offers the Company is the ability to advance the project through major milestones, like process testing and resource estimation, on a much lower budget than a comparable hard rock project," commented Colin McAleenan, President and CEO of Channel Resources. "This unit placement, for gross proceeds of up to $300,000, will enable the Company to take some major steps in advancing the project while minimizing share dilution."

Some of the statements contained herein are forward-looking statements which involve known and unknown risks and uncertainties. Without limitation, statements regarding potential mineralization and resources, exploration results, and future plans and objectives of the Company are forward looking statements that involve various degrees of risk. The following are important factors that could cause the Company's actual results to differ materially from those expressed or implied by such forward looking statements: changes in the price of minerals, general market conditions, risks inherent in mineral exploration, risks associated with development, construction and mining operations, the uncertainty of future profitability and the uncertainty of access to additional capital. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements or the foregoing list of factors, whether as a result of new information or future events or otherwise. Further disclosure on risk factors is available in the Company's various corporate filings at www.sedar.com.

SOURCE: Channel Resources Ltd.

Channel Resources Ltd.

Colin McAleenan

President & CEO

604.684.7098

Channel Resources Ltd.

Cyrus Ameli

CFO & VP Corporate Affairs

604.684.7098

604.684.7079 (FAX)

info@channelresources.ca

www.channelresources.ca

Copyright (C) 2009 Marketwire. All rights reserved.

9:00 AM ET, December 2, 2009

VANCOUVER, BRITISH COLUMBIA, Dec 2, 2009 (Marketwire via COMTEX) -- NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Channel Resources Ltd. ("Channel" or the "Company") (CHU) announces a private placement of up to 3,750,000 units (a "Unit") at a price of CDN$0.08 per Unit. Each Unit will be comprised of one common share of the Company ("Common Shares") and one share purchase warrant (a "Warrant"), with each Warrant being exercisable for one Common Share ("Warrant Share") at an exercise price of CDN$0.11 for a period of 24 months.

The proceeds of the private placement will be used to fund exploration and pre-development work on its properties, primarily the Fox Creek Lithium/Potash Brine Project located in Alberta, as well as for corporate development and working capital purposes.

Completion of the private placement is subject to execution and delivery of standard documentation and receipt of all required regulatory approvals and consents, including the approval of the TSX Venture Exchange.

"A real advantage that Fox Creek offers the Company is the ability to advance the project through major milestones, like process testing and resource estimation, on a much lower budget than a comparable hard rock project," commented Colin McAleenan, President and CEO of Channel Resources. "This unit placement, for gross proceeds of up to $300,000, will enable the Company to take some major steps in advancing the project while minimizing share dilution."

Some of the statements contained herein are forward-looking statements which involve known and unknown risks and uncertainties. Without limitation, statements regarding potential mineralization and resources, exploration results, and future plans and objectives of the Company are forward looking statements that involve various degrees of risk. The following are important factors that could cause the Company's actual results to differ materially from those expressed or implied by such forward looking statements: changes in the price of minerals, general market conditions, risks inherent in mineral exploration, risks associated with development, construction and mining operations, the uncertainty of future profitability and the uncertainty of access to additional capital. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements or the foregoing list of factors, whether as a result of new information or future events or otherwise. Further disclosure on risk factors is available in the Company's various corporate filings at www.sedar.com.

SOURCE: Channel Resources Ltd.

Channel Resources Ltd.

Colin McAleenan

President & CEO

604.684.7098

Channel Resources Ltd.

Cyrus Ameli

CFO & VP Corporate Affairs

604.684.7098

604.684.7079 (FAX)

info@channelresources.ca

www.channelresources.ca

Copyright (C) 2009 Marketwire. All rights reserved.

....mit beginn des jahres und der neu entfachten lith.- phantasie

kommt auch CHU wieder ins rollen......

RT...cad 0,10

kommt auch CHU wieder ins rollen......

RT...cad 0,10

Antwort auf Beitrag Nr.: 38.697.743 von hbg55 am 08.01.10 20:53:15Time Ex Price Change Volume Buyer Seller Markers

14:49:30 V 0.10 +0.025 9,000 80 National Bank 62 Haywood K

14:49:30 V 0.10 +0.025 7,000 80 National Bank 79 CIBC K

14:49:30 V 0.10 +0.025 5,000 80 National Bank 1 Anonymous K

14:49:30 V 0.10 +0.025 24,000 80 National Bank 33 Canaccord K

14:39:24 V 0.095 +0.02 12,000 85 Scotia 7 TD Sec K

14:39:24 V 0.095 +0.02 61,000 85 Scotia 1 Anonymous K

14:37:47 V 0.095 +0.02 75,000 33 Canaccord 1 Anonymous K

14:37:44 V 0.095 +0.02 50,000 33 Canaccord 1 Anonymous K

14:23:12 V 0.095 +0.02 5,000 7 TD Sec 7 TD Sec K

14:23:12 V 0.095 +0.02 15,000 7 TD Sec 7 TD Sec K

14:49:30 V 0.10 +0.025 9,000 80 National Bank 62 Haywood K

14:49:30 V 0.10 +0.025 7,000 80 National Bank 79 CIBC K

14:49:30 V 0.10 +0.025 5,000 80 National Bank 1 Anonymous K

14:49:30 V 0.10 +0.025 24,000 80 National Bank 33 Canaccord K

14:39:24 V 0.095 +0.02 12,000 85 Scotia 7 TD Sec K

14:39:24 V 0.095 +0.02 61,000 85 Scotia 1 Anonymous K

14:37:47 V 0.095 +0.02 75,000 33 Canaccord 1 Anonymous K

14:37:44 V 0.095 +0.02 50,000 33 Canaccord 1 Anonymous K

14:23:12 V 0.095 +0.02 5,000 7 TD Sec 7 TD Sec K

14:23:12 V 0.095 +0.02 15,000 7 TD Sec 7 TD Sec K

Antwort auf Beitrag Nr.: 38.504.723 von hbg55 am 03.12.09 18:54:45

Channel Resources Announces Oversubscription of Private Placement

12:14 PM ET, January 13, 2010

VANCOUVER, BRITISH COLUMBIA, Jan 13, 2010 (Marketwire via COMTEX) -- NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Channel Resources Ltd. ("Channel" or the "Company") (CHU) announces that its private placement described in a news release on December 2, 2009 for up to 3,750,000 units (a "Unit") at a price of CDN$0.08 per Unit has been oversubscribed. The private placement now consists of a total 4,225,000 Units for gross proceeds to the Company of $338,000, including subscriptions accepted by the Company in a partial closing of the financing announced December 21, 2009.

Each Unit will be comprised of one common share of the Company ("Common Shares") and one share purchase warrant (a "Warrant"), with each Warrant being exercisable for one Common Share ("Warrant Share") at an exercise price of CDN$0.11 for a period of 24 months.

The proceeds of the private placement will be used to fund exploration and pre-development work on its properties, primarily the Fox Creek Lithium / Potash Brine Project located in Alberta, as well as for corporate development and working capital purposes.

Completion of the private placement is subject to execution and delivery of standard documentation and receipt of all required regulatory approvals and consents, including the approval of the TSX Venture Exchange.

Some of the statements contained herein are forward-looking statements which involve known and unknown risks and uncertainties. Without limitation, statements regarding potential mineralization and resources, exploration results, and future plans and objectives of the Company are forward looking statements that involve various degrees of risk. The following are important factors that could cause the Company's actual results to differ materially from those expressed or implied by such forward looking statements: changes in the price of minerals, general market conditions, risks inherent in mineral exploration, risks associated with development, construction and mining operations, the uncertainty of future profitability and the uncertainty of access to additional capital. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements or the foregoing list of factors, whether as a result of new information or future events or otherwise. Further disclosure on risk factors is available in the Company's various corporate filings at www.sedar.com.

SOURCE: Channel Resources Ltd.

Channel Resources Ltd.

Colin McAleenan

President & CEO

604.684.7098

Channel Resources Ltd.

Cyrus Ameli

CFO & VP Corporate Affairs

604.684.7098

604.684.7079 (FAX)

info@channelresources.ca

www.channelresources.ca

Copyright (C) 2010 Marketwire. All rights reserved.

Channel Resources Announces Oversubscription of Private Placement

12:14 PM ET, January 13, 2010

VANCOUVER, BRITISH COLUMBIA, Jan 13, 2010 (Marketwire via COMTEX) -- NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Channel Resources Ltd. ("Channel" or the "Company") (CHU) announces that its private placement described in a news release on December 2, 2009 for up to 3,750,000 units (a "Unit") at a price of CDN$0.08 per Unit has been oversubscribed. The private placement now consists of a total 4,225,000 Units for gross proceeds to the Company of $338,000, including subscriptions accepted by the Company in a partial closing of the financing announced December 21, 2009.

Each Unit will be comprised of one common share of the Company ("Common Shares") and one share purchase warrant (a "Warrant"), with each Warrant being exercisable for one Common Share ("Warrant Share") at an exercise price of CDN$0.11 for a period of 24 months.

The proceeds of the private placement will be used to fund exploration and pre-development work on its properties, primarily the Fox Creek Lithium / Potash Brine Project located in Alberta, as well as for corporate development and working capital purposes.

Completion of the private placement is subject to execution and delivery of standard documentation and receipt of all required regulatory approvals and consents, including the approval of the TSX Venture Exchange.

Some of the statements contained herein are forward-looking statements which involve known and unknown risks and uncertainties. Without limitation, statements regarding potential mineralization and resources, exploration results, and future plans and objectives of the Company are forward looking statements that involve various degrees of risk. The following are important factors that could cause the Company's actual results to differ materially from those expressed or implied by such forward looking statements: changes in the price of minerals, general market conditions, risks inherent in mineral exploration, risks associated with development, construction and mining operations, the uncertainty of future profitability and the uncertainty of access to additional capital. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements or the foregoing list of factors, whether as a result of new information or future events or otherwise. Further disclosure on risk factors is available in the Company's various corporate filings at www.sedar.com.

SOURCE: Channel Resources Ltd.

Channel Resources Ltd.

Colin McAleenan

President & CEO

604.684.7098

Channel Resources Ltd.

Cyrus Ameli

CFO & VP Corporate Affairs

604.684.7098

604.684.7079 (FAX)

info@channelresources.ca

www.channelresources.ca

Copyright (C) 2010 Marketwire. All rights reserved.

Channel Resources Adds Five New Lithium Brine Permits to Alberta Portfolio

6:56 PM ET, January 25, 2010

VANCOUVER, BRITISH COLUMBIA, Jan 25, 2010 (Marketwire via COMTEX) -- Channel Resources Ltd. ("Channel" or the "Company") (CHU) announces that it has applied for new mineral permits in five separate blocks in central Alberta. The new permits encompass 435 square kilometers in aggregate

, located approximately 300 kilometers southeast of the Company's Fox Creek lithium/potash brine project.

, located approximately 300 kilometers southeast of the Company's Fox Creek lithium/potash brine project.

Data on lithium content published on January 20, 2010 by the Alberta Geological Survey on ground and formation water geochemistry has enabled Channel to identify these new target aquifers related to Upper Devonian oil and gas pools. Lithium values within these aquifers range up to 140 parts per million in each of the five claim blocks.

Channel will further assess the potential for the new permits to host commercially viable concentrations of minerals in addition to Lithium.

The Company will also evaluate the availability of infrastructure and energy sources in the region that would contribute to the development of a brine processing facility, as has been encountered at the Fox Creek project.

Some of the statements contained herein are forward-looking statements which involve known and unknown risks and uncertainties. Without limitation, statements regarding potential mineralization and resources, exploration results, and future plans and objectives of the Company are forward looking statements that involve various degrees of risk. The following are important factors that could cause the Company's actual results to differ materially from those expressed or implied by such forward looking statements: changes in the price of minerals, general market conditions, risks inherent in mineral exploration, risks associated with development, construction and mining operations, the uncertainty of future profitability and the uncertainty of access to additional capital. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements or the foregoing list of factors, whether as a result of new information or future events or otherwise. Further disclosure on risk factors is available in the Company's various corporate filings at www.sedar.com.

SOURCE: Channel Resources Ltd.

Channel Resources Ltd.

Colin McAleenan

President & CEO

604.684.7098

Channel Resources Ltd.

Cyrus Ameli

CFO & VP Corporate Affairs

604.684.7098

604.684.7079 (FAX)

info@channelresources.ca

www.channelresources.ca

Copyright (C) 2010 Marketwire. All rights reserved.

6:56 PM ET, January 25, 2010

VANCOUVER, BRITISH COLUMBIA, Jan 25, 2010 (Marketwire via COMTEX) -- Channel Resources Ltd. ("Channel" or the "Company") (CHU) announces that it has applied for new mineral permits in five separate blocks in central Alberta. The new permits encompass 435 square kilometers in aggregate

, located approximately 300 kilometers southeast of the Company's Fox Creek lithium/potash brine project.

, located approximately 300 kilometers southeast of the Company's Fox Creek lithium/potash brine project.Data on lithium content published on January 20, 2010 by the Alberta Geological Survey on ground and formation water geochemistry has enabled Channel to identify these new target aquifers related to Upper Devonian oil and gas pools. Lithium values within these aquifers range up to 140 parts per million in each of the five claim blocks.

Channel will further assess the potential for the new permits to host commercially viable concentrations of minerals in addition to Lithium.

The Company will also evaluate the availability of infrastructure and energy sources in the region that would contribute to the development of a brine processing facility, as has been encountered at the Fox Creek project.

Some of the statements contained herein are forward-looking statements which involve known and unknown risks and uncertainties. Without limitation, statements regarding potential mineralization and resources, exploration results, and future plans and objectives of the Company are forward looking statements that involve various degrees of risk. The following are important factors that could cause the Company's actual results to differ materially from those expressed or implied by such forward looking statements: changes in the price of minerals, general market conditions, risks inherent in mineral exploration, risks associated with development, construction and mining operations, the uncertainty of future profitability and the uncertainty of access to additional capital. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements or the foregoing list of factors, whether as a result of new information or future events or otherwise. Further disclosure on risk factors is available in the Company's various corporate filings at www.sedar.com.

SOURCE: Channel Resources Ltd.

Channel Resources Ltd.

Colin McAleenan

President & CEO

604.684.7098

Channel Resources Ltd.

Cyrus Ameli

CFO & VP Corporate Affairs

604.684.7098

604.684.7079 (FAX)

info@channelresources.ca

www.channelresources.ca

Copyright (C) 2010 Marketwire. All rights reserved.

....woooow.....HEUTE erwacht sie ausm winterschlag.....mit

TOP- vol. von bisher schon 4mios.....

RT....cad 0,09

Channel Resources Announces Non-Brokered Private Placement Financing

12:33 PM ET, January 29, 2010

VANCOUVER, BRITISH COLUMBIA, Jan 29, 2010 (Marketwire via COMTEX) -- NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Channel Resources Ltd. ("Channel" or the "Company") (CHU) announces a private placement of up to 4,000,000 units (a "Unit") at a price of CDN$0.08 per Unit. Each Unit will be comprised of one common share of the Company ("Common Shares") and one share purchase warrant (a "Warrant"), with each Warrant being exercisable for one Common Share ("Warrant Share") at an exercise price of CDN$0.11 for a period of 24 months.

This financing is being conducted in addition to the private placement that closed on January 18, 2010 due to increasing investor interest, primarily in the assessment and development of the Company's Lithium / Potash brine portfolio in Alberta.

In connection with the private placement, insiders and associates of the Company will subscribe for all of the Units placed. In a separate transaction the same number of common shares will be sold from the subscribers' personal holdings through the facilities of the TSX Venture Exchange (the "TSX.V") to third-party investors.

The proceeds of the private placement will be used to fund exploration and pre-development work on its project portfolio, as well as for corporate development and working capital purposes.

Completion of the private placement is subject to execution and delivery of standard documentation and receipt of all required regulatory approvals and consents, including the approval of the TSX.V. Securities issued pursuant to this private placement are subject to a four month hold period in compliance with applicable securities laws and the policies of the TSX.V.

Some of the statements contained herein are forward-looking statements which involve known and unknown risks and uncertainties. Without limitation, statements regarding potential mineralization and resources, exploration results, and future plans and objectives of the Company are forward looking statements that involve various degrees of risk. The following are important factors that could cause the Company's actual results to differ materially from those expressed or implied by such forward looking statements: changes in the price of minerals, general market conditions, risks inherent in mineral exploration, risks associated with development, construction and mining operations, the uncertainty of future profitability and the uncertainty of access to additional capital. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements or the foregoing list of factors, whether as a result of new information or future events or otherwise. Further disclosure on risk factors is available in the Company's various corporate filings at www.sedar.com.

SOURCE: Channel Resources Ltd.

Channel Resources Ltd.

Colin McAleenan

President & CEO

604.684.7098

Channel Resources Ltd.

Cyrus Ameli

CFO & VP Corporate Affairs

604.684.7098

604.684.7079 (FAX)

info@channelresources.ca

www.channelresources.ca

Copyright (C) 2010 Marketwire. All rights reserved.

12:33 PM ET, January 29, 2010

VANCOUVER, BRITISH COLUMBIA, Jan 29, 2010 (Marketwire via COMTEX) -- NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Channel Resources Ltd. ("Channel" or the "Company") (CHU) announces a private placement of up to 4,000,000 units (a "Unit") at a price of CDN$0.08 per Unit. Each Unit will be comprised of one common share of the Company ("Common Shares") and one share purchase warrant (a "Warrant"), with each Warrant being exercisable for one Common Share ("Warrant Share") at an exercise price of CDN$0.11 for a period of 24 months.

This financing is being conducted in addition to the private placement that closed on January 18, 2010 due to increasing investor interest, primarily in the assessment and development of the Company's Lithium / Potash brine portfolio in Alberta.

In connection with the private placement, insiders and associates of the Company will subscribe for all of the Units placed. In a separate transaction the same number of common shares will be sold from the subscribers' personal holdings through the facilities of the TSX Venture Exchange (the "TSX.V") to third-party investors.

The proceeds of the private placement will be used to fund exploration and pre-development work on its project portfolio, as well as for corporate development and working capital purposes.

Completion of the private placement is subject to execution and delivery of standard documentation and receipt of all required regulatory approvals and consents, including the approval of the TSX.V. Securities issued pursuant to this private placement are subject to a four month hold period in compliance with applicable securities laws and the policies of the TSX.V.

Some of the statements contained herein are forward-looking statements which involve known and unknown risks and uncertainties. Without limitation, statements regarding potential mineralization and resources, exploration results, and future plans and objectives of the Company are forward looking statements that involve various degrees of risk. The following are important factors that could cause the Company's actual results to differ materially from those expressed or implied by such forward looking statements: changes in the price of minerals, general market conditions, risks inherent in mineral exploration, risks associated with development, construction and mining operations, the uncertainty of future profitability and the uncertainty of access to additional capital. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements or the foregoing list of factors, whether as a result of new information or future events or otherwise. Further disclosure on risk factors is available in the Company's various corporate filings at www.sedar.com.

SOURCE: Channel Resources Ltd.

Channel Resources Ltd.

Colin McAleenan

President & CEO

604.684.7098

Channel Resources Ltd.

Cyrus Ameli

CFO & VP Corporate Affairs

604.684.7098

604.684.7079 (FAX)

info@channelresources.ca

www.channelresources.ca

Copyright (C) 2010 Marketwire. All rights reserved.

Antwort auf Beitrag Nr.: 38.848.136 von hbg55 am 30.01.10 13:14:17....und HEUTE wird eine weitere PP gemeldet, die jedoch zur

weiterentwicklung des GOLD- proj. in burkina faso verwendet

werden soll........

Channel Resources Announces Non-Brokered Private Placement Financing

9:00 AM ET, April 9, 2010

VANCOUVER, BRITISH COLUMBIA, Apr 9, 2010 (Marketwire via COMTEX) -- NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Channel Resources Ltd. ("Channel" or the "Company") (CHU) announces a private placement of up to 5,000,000 units (a "Unit") at a price of CDN$0.07 per Unit for gross proceeds of up to $350,000. Each Unit will be comprised of one common share of the Company ("Common Shares") and one share purchase warrant (a "Warrant"), with each Warrant being exercisable for one Common Share ("Warrant Share") at an exercise price of CDN$0.11 for a period of 24 months. If, during the first six months following the closing date of the financing, the shares of the Company close at a price of $0.20 or higher for a minimum of 10 consecutive trading sessions, then the Warrants must be exercised within 15 business days after notice by the Company of that event, failing which they will expire.

Channel may pay finders' fees in connection with the private placement in the form of cash and / or securities of the Company, in accordance with the policies of the TSX Venture Exchange.

The proceeds of the private placement will be used primarily to fund exploration work on the Tanlouka Gold Project in Burkina Faso, as well as for corporate development and working capital purposes.

Completion of the private placement is subject to execution and delivery of standard documentation and receipt of all required regulatory approvals and consents, including the approval of the TSX Venture Exchange.

"Channel has advanced the Tanlouka Gold Project to the drill-ready stage, most recently with an IP program that outlined compelling geophysical structures that correlate well with soil geochemistry anomalies, channel sampling results and RAB drilling data gathered on the 105 square kilometre property," commented Colin McAleenan,

President and CEO of the Company. "Earlier this year the Company funded process test work for the Fox Creek Lithium / Potash Brine Project in Alberta, and while that work is ongoing, the proceeds of this placement will be used to follow through with a planned RC drill program at Tanlouka that, in addition to completing the earn-in on Channel's option for 90% ownership of the project, will determine the continuity of mineralization encountered on and near-surface, including shallow RAB drill intersections of up to 12.7 g/T gold over 8.0 metres."

Some of the statements contained herein are forward-looking statements which involve known and unknown risks and uncertainties. Without limitation, statements regarding potential mineralization and resources, exploration results, and future plans and objectives of the Company are forward looking statements that involve various degrees of risk. The following are important factors that could cause the Company's actual results to differ materially from those expressed or implied by such forward looking statements: changes in the price of minerals, general market conditions, risks inherent in mineral exploration, risks associated with development, construction and mining operations, the uncertainty of future profitability and the uncertainty of access to additional capital. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements or the foregoing list of factors, whether as a result of new information or future events or otherwise. Further disclosure on risk factors is available in the Company's various corporate filings at www.sedar.com.

SOURCE: Channel Resources Ltd.

Channel Resources Ltd.

Colin McAleenan

President & CEO

604.684.7098

Channel Resources Ltd.

Cyrus Ameli

CFO & VP Corporate Affairs

604.684.7098

604.684.7079 (FAX)

info@channelresources.ca

www.channelresources.ca

Copyright (C) 2010 Marketwire. All rights reserved.

weiterentwicklung des GOLD- proj. in burkina faso verwendet

werden soll........

Channel Resources Announces Non-Brokered Private Placement Financing

9:00 AM ET, April 9, 2010

VANCOUVER, BRITISH COLUMBIA, Apr 9, 2010 (Marketwire via COMTEX) -- NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES