Timburgs Langfristdepot - Start 2012 (Seite 2657)

eröffnet am 16.03.12 05:51:51 von

neuester Beitrag 05.05.24 22:06:59 von

neuester Beitrag 05.05.24 22:06:59 von

Beiträge: 56.764

ID: 1.173.084

ID: 1.173.084

Aufrufe heute: 72

Gesamt: 7.774.459

Gesamt: 7.774.459

Aktive User: 0

ISIN: US2605661048 · WKN: CG3AA2

38.670,25

PKT

+1,19 %

+454,07 PKT

Letzter Kurs 03.05.24 TTMzero (USD)

Neuigkeiten

03.05.24 · wallstreetONLINE Redaktion |

05.05.24 · Daniel Saurenz |

05.05.24 · Christoph Geyer |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 56.983.502 von clearasil am 09.02.18 12:44:56Junkie , passend zum Börsenverlauf- Finanzspritzen wären wirklich Gift. Was wir brauchen ist ein "cold turkey".

Wieso federn die ETF- Gelder diese Sprünge nicht ab ?

Verstehe aber mehr von Sucht und Entzug als von Wirtschaft...

Wieso federn die ETF- Gelder diese Sprünge nicht ab ?

Verstehe aber mehr von Sucht und Entzug als von Wirtschaft...

BlackRock's Larry Fink Wants to Become the Next Warren Buffett

02/07/2018 | 08:15pm EST

By Sarah Krouse

BlackRock Inc. is looking to raise more than $10 billion that it would use to buy and hold stakes in companies, replicating the approach of Warren Buffett's Berkshire Hathaway Inc.

It is the first-ever attempt by the world's largest asset manager to make such direct investments, according to people familiar with the matter. The move establishes BlackRock as a potential competitor to Wall Street private-equity giants like Carlyle Group LP and Apollo Global Management LLC.

For BlackRock Chief Executive Laurence Fink, it also sets up a rivalry with his old firm, Blackstone Group LP. Mr. Fink co-founded BlackRock as a division of Blackstone in 1988 but split from the private-equity giant in 1994.

BlackRock has since emerged as one of the biggest beneficiaries of an investor shift to cheaper funds that mimic stock and bond indexes, topping $6 trillion in assets for the first time in 2017.

Traditional asset managers like BlackRock and private-equity firms like Blackstone are increasingly battling for cash from the same clients as fees for certain products drop and competition for new pools of capital intensifies.

Big asset managers that have long catered to cost-conscious investors are trying to bulk up on products where they can charge big investors private equity-like fees. It is a way to add new revenue as clients large and small demand lower fees for traditional offerings. Private-equity firms, meanwhile, are offering more funds to wealthy retail investors to broaden their pool of assets.

BlackRock's new vehicle, known within the firm as a "long-term private capital" vehicle, is part of that push to emphasize alternative investments. The firm already manages $145 billion in higher-fee investment strategies that include private equity and hedge funds of funds, real assets and private credit. But it doesn't have a buyout fund of its own.

It is currently seeking capital from sovereign-wealth funds, pensions and other big investors that it would use to launch BlackRock Long-Term Private Capital, according to people familiar with the matter.

If BlackRock can attract the roughly $10 billion it is seeking, it would represent the largest amount ever raised by the company. BlackRock is also contributing some of its own money to the effort.

The company is raising money on the heels of a record year for private-equity fundraising. Private-equity firms raised a record $453 billion in 2017, according to data provider Preqin, but the amount unspent rose to more than $1 trillion for the first time ever. That pile of unspent money has raised concerns that the firms won't be able to find enough investment opportunities or generate adequate returns.

The "best known" example of BlackRock's approach with this new vehicle is Berkshire Hathaway, according to a fundraising document reviewed by The Wall Street Journal. The Omaha conglomerate run by Mr. Buffett is well known for its long-term ownership of companies.

The new vehicle plans to make investments of between $500 million and $2 billion in companies affected by what the document says are several "long-term themes" such as diverging demographics globally, a growing middle class in emerging markets and changing spending patterns by millennials. It is targeting annual returns in the low to mid teens.

The vehicle will look for investments with risks and returns that straddle those of stock investments and what buyout funds typically seek, according to the document. It is planning to hold those positions for more than 10 years.

BlackRock Long-Term Private Capital is likely to acquire minority stakes in companies, the people said. The investor document cites family-owned businesses, companies being spun out of parent firms, or companies where private-equity investors are seeking to exit their investment.

The effort is being overseen internally by Mark Wiseman, who is viewed as a potential successor to Mr. Fink. Mr. Wiseman joined BlackRock in late 2016 as chairman of its alternative investing business and global head of active equities. Since joining, Mr. Wiseman has led an overhaul of the stock-picking business and revamped the firm's global investment committee.

BlackRock has also hired André Bourbonnais, the chief executive of Canada's Public Sector Pension Investment Board, to lead the BlackRock Long-Term Private Capital effort. Prior to his current role, he spent nine years at the Canada Pension Plan Investment Board working with Mr. Wiseman, who previously was the organization's chief.

Unlike many private-equity funds, the BlackRock vehicle will take its investors' full commitment upfront, instead of drawing it down over time, and will reinvest proceeds as it exits investments. It aims to avoid a cash drag that some private-equity funds suffer from as they shop for opportunity or return cash to investors at the end of their lifespan. Executives envision a secondary market developing for units in the vehicle when investors want their money back, the people said.

BlackRock will receive a management fee that covers its expenses and a certain profit margin and a performance fee. It aims to close the fundraising by the second quarter with four to six large investors that will also have the right to invest additional money in certain deals." target="_blank" rel="nofollow ugc noopener">http://www.4-traders.com/business-leaders/Warren-Buffett-6/n…" target="_blank" rel="nofollow ugc noopener">

It is currently seeking capital from sovereign-wealth funds, pensions and other big investors that it would use to launch BlackRock Long-Term Private Capital, according to people familiar with the matter.

If BlackRock can attract the roughly $10 billion it is seeking, it would represent the largest amount ever raised by the company. BlackRock is also contributing some of its own money to the effort.

The company is raising money on the heels of a record year for private-equity fundraising. Private-equity firms raised a record $453 billion in 2017, according to data provider Preqin, but the amount unspent rose to more than $1 trillion for the first time ever. That pile of unspent money has raised concerns that the firms won't be able to find enough investment opportunities or generate adequate returns.

The "best known" example of BlackRock's approach with this new vehicle is Berkshire Hathaway, according to a fundraising document reviewed by The Wall Street Journal. The Omaha conglomerate run by Mr. Buffett is well known for its long-term ownership of companies.

The new vehicle plans to make investments of between $500 million and $2 billion in companies affected by what the document says are several "long-term themes" such as diverging demographics globally, a growing middle class in emerging markets and changing spending patterns by millennials. It is targeting annual returns in the low to mid teens.

The vehicle will look for investments with risks and returns that straddle those of stock investments and what buyout funds typically seek, according to the document. It is planning to hold those positions for more than 10 years.

BlackRock Long-Term Private Capital is likely to acquire minority stakes in companies, the people said. The investor document cites family-owned businesses, companies being spun out of parent firms, or companies where private-equity investors are seeking to exit their investment.

The effort is being overseen internally by Mark Wiseman, who is viewed as a potential successor to Mr. Fink. Mr. Wiseman joined BlackRock in late 2016 as chairman of its alternative investing business and global head of active equities. Since joining, Mr. Wiseman has led an overhaul of the stock-picking business and revamped the firm's global investment committee.

BlackRock has also hired André Bourbonnais, the chief executive of Canada's Public Sector Pension Investment Board, to lead the BlackRock Long-Term Private Capital effort. Prior to his current role, he spent nine years at the Canada Pension Plan Investment Board working with Mr. Wiseman, who previously was the organization's chief.

Unlike many private-equity funds, the BlackRock vehicle will take its investors' full commitment upfront, instead of drawing it down over time, and will reinvest proceeds as it exits investments. It aims to avoid a cash drag that some private-equity funds suffer from as they shop for opportunity or return cash to investors at the end of their lifespan. Executives envision a secondary market developing for units in the vehicle when investors want their money back, the people said.

BlackRock will receive a management fee that covers its expenses and a certain profit margin and a performance fee. It aims to close the fundraising by the second quarter with four to six large investors that will also have the right to invest additional money in certain deals." target="_blank" rel="nofollow ugc noopener">http://www.4-traders.com/business-leaders/Warren-Buffett-6/n…

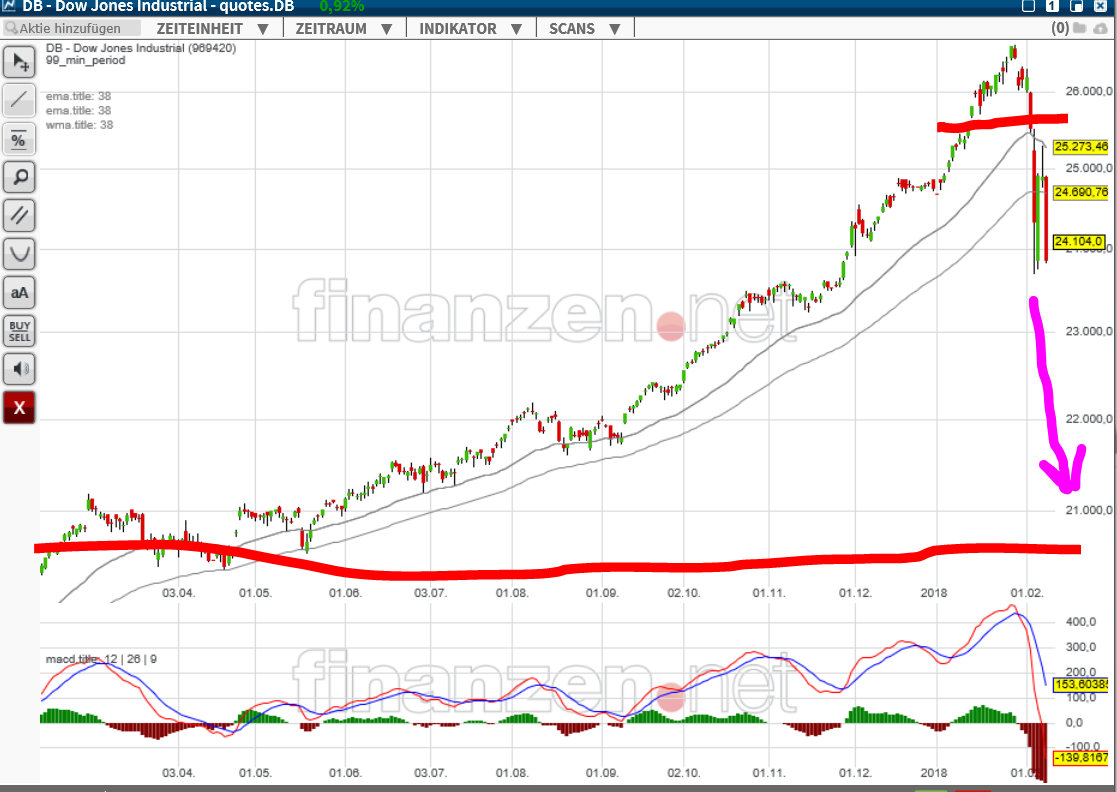

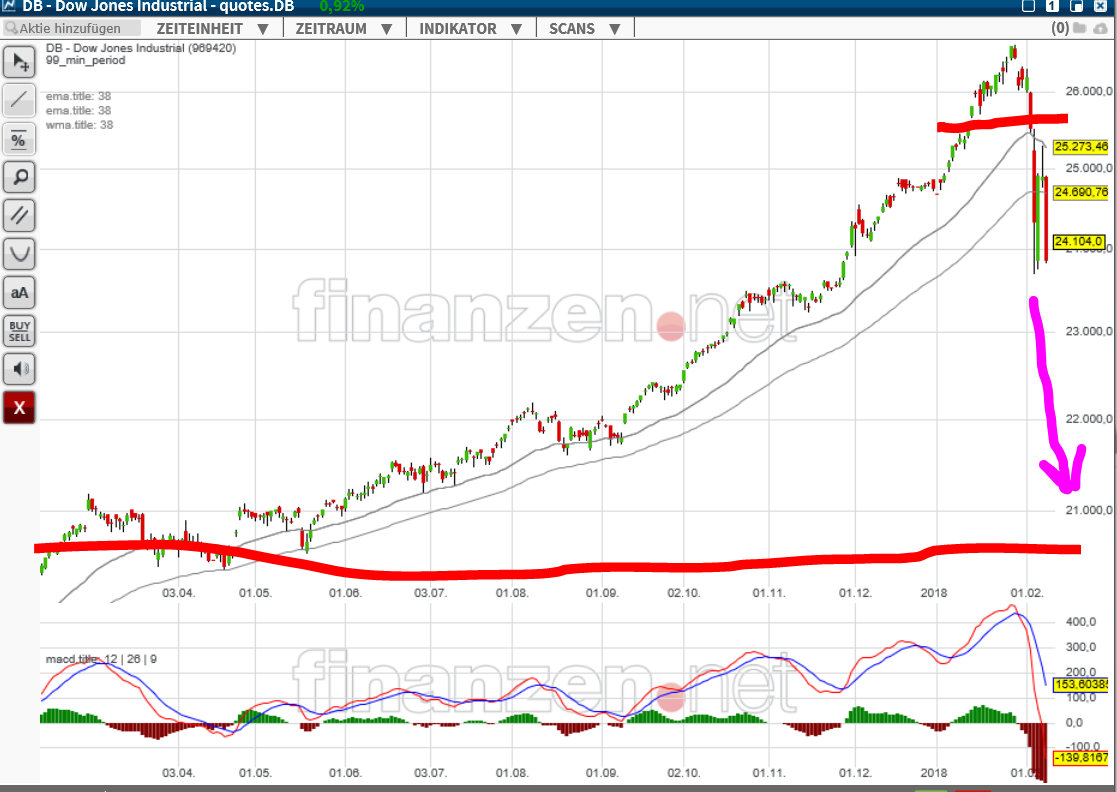

Antwort auf Beitrag Nr.: 56.983.463 von clearasil am 09.02.18 12:41:32man sehe sich das Maß an Überkauftheit an:

https://www.zonebourse.com/zbcache/charts/ObjectChart.aspx?N…" target="_blank" rel="nofollow ugc noopener">

https://www.zonebourse.com/zbcache/charts/ObjectChart.aspx?N…

https://www.zonebourse.com/zbcache/charts/ObjectChart.aspx?N…" target="_blank" rel="nofollow ugc noopener">

https://www.zonebourse.com/zbcache/charts/ObjectChart.aspx?N…

Antwort auf Beitrag Nr.: 56.982.971 von prallhans am 09.02.18 12:01:26

Zwingend notwendig wäre mal eine Geldspritze seitens einer Notenbank, BEVOR die Geldvernichtung die Realwirtschaft erreicht.

davon hatten wir junkies ja nun wirklich genug seit 2008.

der graduelle Entzug fällt dementsprechend schwer.

Zwingend notwendig wäre mal eine Geldspritze seitens einer Notenbank, BEVOR die Geldvernichtung die Realwirtschaft erreicht.

davon hatten wir junkies ja nun wirklich genug seit 2008.

der graduelle Entzug fällt dementsprechend schwer.

Antwort auf Beitrag Nr.: 56.982.758 von codiman am 09.02.18 11:41:36lehne mich mal aus dem Fenster und stelle mal diesen s+p-chart als Gegenthese ein:

http://www.ariva.de/chart/images/chart.png?z=a4152~A1~B38:10…" target="_blank" rel="nofollow ugc noopener">

http://www.ariva.de/chart/images/chart.png?z=a4152~A1~B38:10…

und sage dann:

+++ der gesamte gesunde Rücksetzer wirkt sehr orchestriert. Überfällig war er so was von.

+++ 200 TL getestetet, gestern mustergültiger pullback (Händler love this!), momentum von +200 auf -200, rsi von 90 rot auf 30 blau.

+++ so lange wir den Bereich von 2550 nicht nachhaltig unterschreiten, ist ctechnisch nichts schlimmes passiert.

+++ fundamental ist die Weltwirtschaft in Topverfassung.

+++ financial engineering at it's best.

P.S. dax wirkt sehr unten:

http://www.ariva.de/chart/images/chart.png?z=a290~A1~B38:100…" target="_blank" rel="nofollow ugc noopener">

http://www.ariva.de/chart/images/chart.png?z=a290~A1~B38:100…

der letzte Anstieg im dax wurde übrigens von keinem der Indikatoren mehr unterstützt = negative Divergenzen.

huch ... ich erschrecke ... was ist nur aus dem bär in mir geworden ... haben 9 Jahre Hausse meine ohnehin spärlichen Zellen aufgefuttert? das muss pöse enden.

das muss pöse enden.

dow hat noch Platz bis zur 200 TL bei 23 000.

wir sind einfach sehr weit hochgelaufen.

http://www.4-traders.com/BLACKROCK-11862/news/Meltdown-raise…" target="_blank" rel="nofollow ugc noopener">

http://www.4-traders.com/BLACKROCK-11862/news/Meltdown-raise…

ihr könnt mich ja dann später verhauen.

http://www.ariva.de/chart/images/chart.png?z=a4152~A1~B38:10…" target="_blank" rel="nofollow ugc noopener">

http://www.ariva.de/chart/images/chart.png?z=a4152~A1~B38:10…

und sage dann:

+++ der gesamte gesunde Rücksetzer wirkt sehr orchestriert. Überfällig war er so was von.

+++ 200 TL getestetet, gestern mustergültiger pullback (Händler love this!), momentum von +200 auf -200, rsi von 90 rot auf 30 blau.

+++ so lange wir den Bereich von 2550 nicht nachhaltig unterschreiten, ist ctechnisch nichts schlimmes passiert.

+++ fundamental ist die Weltwirtschaft in Topverfassung.

+++ financial engineering at it's best.

P.S. dax wirkt sehr unten:

http://www.ariva.de/chart/images/chart.png?z=a290~A1~B38:100…" target="_blank" rel="nofollow ugc noopener">

http://www.ariva.de/chart/images/chart.png?z=a290~A1~B38:100…

der letzte Anstieg im dax wurde übrigens von keinem der Indikatoren mehr unterstützt = negative Divergenzen.

huch ... ich erschrecke ... was ist nur aus dem bär in mir geworden ... haben 9 Jahre Hausse meine ohnehin spärlichen Zellen aufgefuttert?

das muss pöse enden.

das muss pöse enden. dow hat noch Platz bis zur 200 TL bei 23 000.

wir sind einfach sehr weit hochgelaufen.

http://www.4-traders.com/BLACKROCK-11862/news/Meltdown-raise…" target="_blank" rel="nofollow ugc noopener">

http://www.4-traders.com/BLACKROCK-11862/news/Meltdown-raise…

ihr könnt mich ja dann später verhauen.

Zwingend notwendig wäre mal eine Geldspritze seitens einer Notenbank, BEVOR die Geldvernichtung die Realwirtschaft erreicht.

Die Stimmung ist leider noch nicht schlecht genug. Zu viele sehen das als Gelegenheit.

Die Stimmung ist leider noch nicht schlecht genug. Zu viele sehen das als Gelegenheit.

Antwort auf Beitrag Nr.: 56.980.082 von Timburg am 09.02.18 06:55:23Guten Morgen Timburg, @all

Die letzten Tage sind - nach langer Zeit - ein erster richtige Härtetest für's Depot.

Ich neige dazu mich zu vergleichen und habe als Benchmark LRS gewählt.

LRS ist so nett seine Depotstrategie [unterstelle ich mal] in einem Wikifolio abzubilden.

Ich kann mich erinnern, dass hier mal ~61 % stand, so das man unterstellen kann,

dass LRS in etwa 12 % Punkte vom Hoch verloren hat. [LRS-Benchmark - bitte nicht übel nehmen.]

In etwa in der selben Höhe liegen die Verluste in meinem Depot. [ohne Deutsche Bank & Teva würde ich bei -8% liegen

- bedeutet, dass meine langfrist-Strategie auf dem richtigen Weg ist].

Also alles in allem in der Range.

In Summe sieht das natürlich anders aus, die Verluste betragen einen nagelneun VW Polo

in der Comfortline Version, auch das ist ein Teil der Wahrheit .

Sollte die Korrektur weiter gehen, können noch ein-zwei dazu kommen.

Gut , dass wissen wir jetzt, was tun ?

Ich habe jetzt mal stellvertretend den Dow Jones für den US Markt gewählt [wobei der S&P richtiger wäre, aber er ist in den Medien nicht so omnipräsent].

Eine Strategie wäre, [wenn man denn seine Schnäppchenjägersucht irgendwie unter Kontrolle hat]

mit weiteren Zukäufen zu warten, bis der Markt seine 38iger wiedererobert ,

o d e r er sich bei 21.000 + X eingependelt hat.

In der Zwischenzeit schauen, ob man "C Werte" nicht doch versilbert und sich adäquate,

hochwertige, Dividendensicherere, "Konsumer" evtl. Versorger oder verprügelte High Techs raussucht um dann zuschlagen zu können.

Viele Grüße codiman

Die letzten Tage sind - nach langer Zeit - ein erster richtige Härtetest für's Depot.

Ich neige dazu mich zu vergleichen und habe als Benchmark LRS gewählt.

LRS ist so nett seine Depotstrategie [unterstelle ich mal] in einem Wikifolio abzubilden.

Ich kann mich erinnern, dass hier mal ~61 % stand, so das man unterstellen kann,

dass LRS in etwa 12 % Punkte vom Hoch verloren hat. [LRS-Benchmark - bitte nicht übel nehmen.]

In etwa in der selben Höhe liegen die Verluste in meinem Depot. [ohne Deutsche Bank & Teva würde ich bei -8% liegen

- bedeutet, dass meine langfrist-Strategie auf dem richtigen Weg ist].

Also alles in allem in der Range.

In Summe sieht das natürlich anders aus, die Verluste betragen einen nagelneun VW Polo

in der Comfortline Version, auch das ist ein Teil der Wahrheit .

Sollte die Korrektur weiter gehen, können noch ein-zwei dazu kommen.

Gut , dass wissen wir jetzt, was tun ?

Ich habe jetzt mal stellvertretend den Dow Jones für den US Markt gewählt [wobei der S&P richtiger wäre, aber er ist in den Medien nicht so omnipräsent].

Eine Strategie wäre, [wenn man denn seine Schnäppchenjägersucht irgendwie unter Kontrolle hat]

mit weiteren Zukäufen zu warten, bis der Markt seine 38iger wiedererobert ,

o d e r er sich bei 21.000 + X eingependelt hat.

In der Zwischenzeit schauen, ob man "C Werte" nicht doch versilbert und sich adäquate,

hochwertige, Dividendensicherere, "Konsumer" evtl. Versorger oder verprügelte High Techs raussucht um dann zuschlagen zu können.

Viele Grüße codiman

Antwort auf Beitrag Nr.: 56.980.043 von prallhans am 09.02.18 06:41:20Gibt bestimmt schlechtere Invests als Dividendenpapiere - überhaupt in stürmischen Zeiten. Und ich hoffe doch dass meine "essen-trinken-rauchen-zähneputzen-Fraktion" irgendwann mal wieder entdeckt wird. Einige - wie die gestern erwähnte Ebro - scheinen sich ja mittlerweile stabilisiert zu haben. Andere gehen einfach ihren Weg weiter - siehe Emmi:

http://www.finanzen.ch/nachrichten/aktien/Emmi-uebertrifft-U…

http://www.finanzen.ch/nachrichten/aktien/Emmi-uebertrifft-U…

05.05.24 · Daniel Saurenz · DAX |

05.05.24 · Christoph Geyer · DAX |

04.05.24 · Robby's Elliottwellen · DAX |

04.05.24 · Daniel Saurenz · DAX |

03.05.24 · dpa-AFX · Amgen |

03.05.24 · Redaktion dts · Dow Jones |

03.05.24 · dpa-AFX · Amgen |

03.05.24 · dpa-AFX · Henkel VZ |

03.05.24 · dpa-AFX · Amgen |

| Zeit | Titel |

|---|---|

| 05.05.24 | |

| 27.04.24 | |

| 26.04.24 | |

| 25.04.24 | |

| 22.02.24 | |

| 17.01.24 | |

| 15.12.23 | |

| 08.12.23 | |

| 14.11.23 | |

| 28.10.23 |