Wann und wie kommt der nächste Crash? (Seite 2)

eröffnet am 15.07.14 10:19:59 von

neuester Beitrag 23.01.24 14:11:46 von

neuester Beitrag 23.01.24 14:11:46 von

Beiträge: 1.339

ID: 1.196.416

ID: 1.196.416

Aufrufe heute: 2

Gesamt: 179.936

Gesamt: 179.936

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 47 Minuten | 6364 | |

| heute 10:56 | 6328 | |

| vor 46 Minuten | 3896 | |

| heute 09:20 | 2568 | |

| vor 48 Minuten | 2174 | |

| vor 55 Minuten | 2024 | |

| vor 57 Minuten | 1477 | |

| vor 52 Minuten | 1229 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.926,40 | +0,14 | 216 | |||

| 2. | 4. | 3,8900 | +5,14 | 75 | |||

| 3. | 3. | 8,2700 | -0,24 | 71 | |||

| 4. | 2. | 184,31 | +2,40 | 62 | |||

| 5. | 14. | 0,0163 | +1,88 | 57 | |||

| 6. | 9. | 0,9750 | +1,04 | 49 | |||

| 7. | 11. | 2.295,26 | +0,42 | 37 | |||

| 8. | 6. | 6,6280 | -0,78 | 37 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 74.895.357 von faultcode am 01.12.23 14:00:34

so ist es:

22.12.

Record Cash Inflows Show Investors Missed Out on Stock Rally

https://finance.yahoo.com/news/record-cash-inflows-show-inve…

...

The figures illustrate how this year’s equity rally took most investors by surprise after a dismal 2022. And it could mean there’s still a lot of money on the sidelines that’s waiting to be pushed into stocks and bonds in the new year, should expectations of central bank policy easing prove correct.

“There is significant dry power available for investors to come back to equities, should the rate cuts/soft landing scenario pan out,” Emmanuel Cau, a Barclays Plc strategist, wrote in a separate note.

Unexpectedly resilient economies provided a platform for this year’s equity rally, which gained extra impetus in the fourth quarter as optimism about central bank easing took hold.

...

Zitat von faultcode: ... nicht nur die, sondern auch viele Altherren in den prallhans- und Reibkuchen-Foren

...

so ist es:

22.12.

Record Cash Inflows Show Investors Missed Out on Stock Rally

https://finance.yahoo.com/news/record-cash-inflows-show-inve…

...

The figures illustrate how this year’s equity rally took most investors by surprise after a dismal 2022. And it could mean there’s still a lot of money on the sidelines that’s waiting to be pushed into stocks and bonds in the new year, should expectations of central bank policy easing prove correct.

“There is significant dry power available for investors to come back to equities, should the rate cuts/soft landing scenario pan out,” Emmanuel Cau, a Barclays Plc strategist, wrote in a separate note.

Unexpectedly resilient economies provided a platform for this year’s equity rally, which gained extra impetus in the fourth quarter as optimism about central bank easing took hold.

...

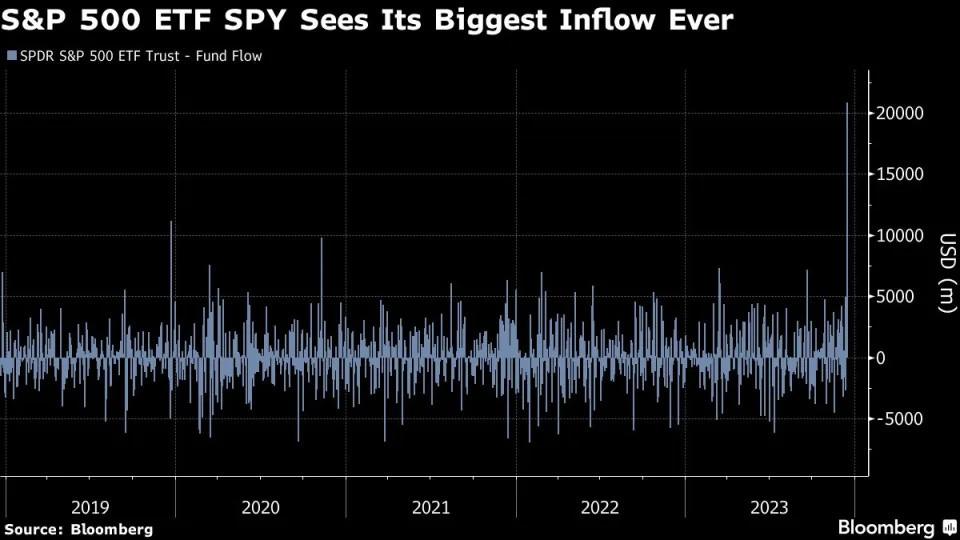

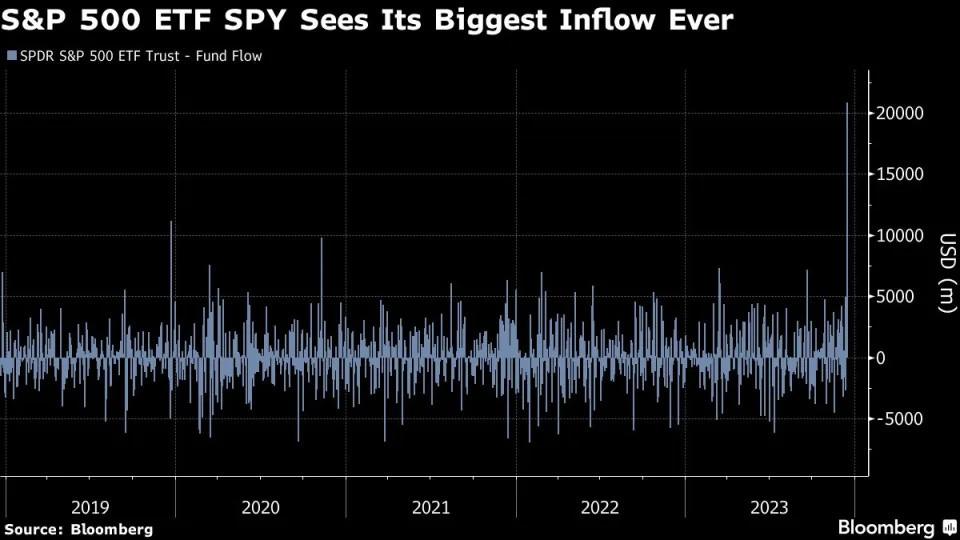

$SPY

19.12.

World’s Biggest ETF Sees Record $21 Billion Flow on Stock Rally

https://finance.yahoo.com/news/world-biggest-etf-sees-record…

...

State Street’s $478 billion SPDR S&P 500 ETF (ticker SPY) raked in $20.8 billion on Friday, the biggest inflow since the fund’s inception in 1993.

According to Bloomberg Intelligence, it was the largest one-day flow for any ETF. For the week, the ETF garnered more than $24 billion, also a record, data compiled by Bloomberg showed.

SPY’s inflows coincided with several events known to increase trading activity, said Matt Bartolini, head of SPDR Americas Research at State Street Global Advisors. Friday was the final trading day before the S&P 500 and Nasdaq 100’s rebalancings went into effect, which can prompt funds managing trillions of dollars to readjust to align with new index compositions. Roughly $5 trillion of options also expired on the same day, which generally sees Wall Street managers roll over existing positions or start new ones.

“The flow that we saw on Friday was 100% organic from clients and investors and traders,” Bartolini said by phone. “It also reflects the massive Santa Claus rally that we have seen in the past few days — so momentum-trading going into SPY as well.”

...

19.12.

World’s Biggest ETF Sees Record $21 Billion Flow on Stock Rally

https://finance.yahoo.com/news/world-biggest-etf-sees-record…

...

State Street’s $478 billion SPDR S&P 500 ETF (ticker SPY) raked in $20.8 billion on Friday, the biggest inflow since the fund’s inception in 1993.

According to Bloomberg Intelligence, it was the largest one-day flow for any ETF. For the week, the ETF garnered more than $24 billion, also a record, data compiled by Bloomberg showed.

SPY’s inflows coincided with several events known to increase trading activity, said Matt Bartolini, head of SPDR Americas Research at State Street Global Advisors. Friday was the final trading day before the S&P 500 and Nasdaq 100’s rebalancings went into effect, which can prompt funds managing trillions of dollars to readjust to align with new index compositions. Roughly $5 trillion of options also expired on the same day, which generally sees Wall Street managers roll over existing positions or start new ones.

“The flow that we saw on Friday was 100% organic from clients and investors and traders,” Bartolini said by phone. “It also reflects the massive Santa Claus rally that we have seen in the past few days — so momentum-trading going into SPY as well.”

...

Antwort auf Beitrag Nr.: 74.964.745 von faultcode am 14.12.23 11:55:20Last Updated: Dec. 18, 2023 at 4:02 p.m. ET

Fed’s dovish pivot is big gamble that’s likely to fail, says former top New York Fed official

https://www.marketwatch.com/story/feds-dovish-pivot-is-big-g…

...

In a Bloomberg column on Monday, Dudley wrote that Fed Chair Jerome Powell and other policy makers are taking a pretty big gamble by expecting that they’ll be able to vanquish inflation without causing a U.S. recession.

At the moment, the Fed’s thinking amounts to the idea that further drops in inflation should make earlier and more rapid rate cuts possible, and officials have penciled in three quarter-point cuts for next year.

But a pivot like the one being contemplated by the Fed would also reduce the risk of either an economic downturn or even harder landing, through its spillover effects into financial markets, according to Dudley. The more weight that Powell puts on cutting rates to avoid a recession, “the greater the risk of failing to control inflation — and of markets getting a big, unpleasant surprise,” Dudley wrote.

The problem is that the central bank’s dovishness “increases the possibility of no landing at all — that is, overheating and persistent inflation that could undermine the Fed’s credibility, while requiring renewed tightening and a deeper recession to get things back under control,” according to the ex-New York Fed president.

And “there’s plenty that can go wrong,” Dudley said. One is that the slowdown in economy seen late this year might reverse in 2024. Another is that prices could accelerate again, with services inflation excluding housing possibly proving to be more unexpectedly stubborn. And a third is that the job market could remain too tight if 2023’s large increase in labor supply fails to extend into the new year.

...

Fed’s dovish pivot is big gamble that’s likely to fail, says former top New York Fed official

https://www.marketwatch.com/story/feds-dovish-pivot-is-big-g…

...

In a Bloomberg column on Monday, Dudley wrote that Fed Chair Jerome Powell and other policy makers are taking a pretty big gamble by expecting that they’ll be able to vanquish inflation without causing a U.S. recession.

At the moment, the Fed’s thinking amounts to the idea that further drops in inflation should make earlier and more rapid rate cuts possible, and officials have penciled in three quarter-point cuts for next year.

But a pivot like the one being contemplated by the Fed would also reduce the risk of either an economic downturn or even harder landing, through its spillover effects into financial markets, according to Dudley. The more weight that Powell puts on cutting rates to avoid a recession, “the greater the risk of failing to control inflation — and of markets getting a big, unpleasant surprise,” Dudley wrote.

The problem is that the central bank’s dovishness “increases the possibility of no landing at all — that is, overheating and persistent inflation that could undermine the Fed’s credibility, while requiring renewed tightening and a deeper recession to get things back under control,” according to the ex-New York Fed president.

And “there’s plenty that can go wrong,” Dudley said. One is that the slowdown in economy seen late this year might reverse in 2024. Another is that prices could accelerate again, with services inflation excluding housing possibly proving to be more unexpectedly stubborn. And a third is that the job market could remain too tight if 2023’s large increase in labor supply fails to extend into the new year.

...

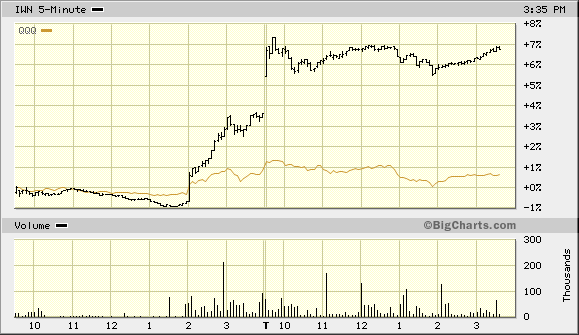

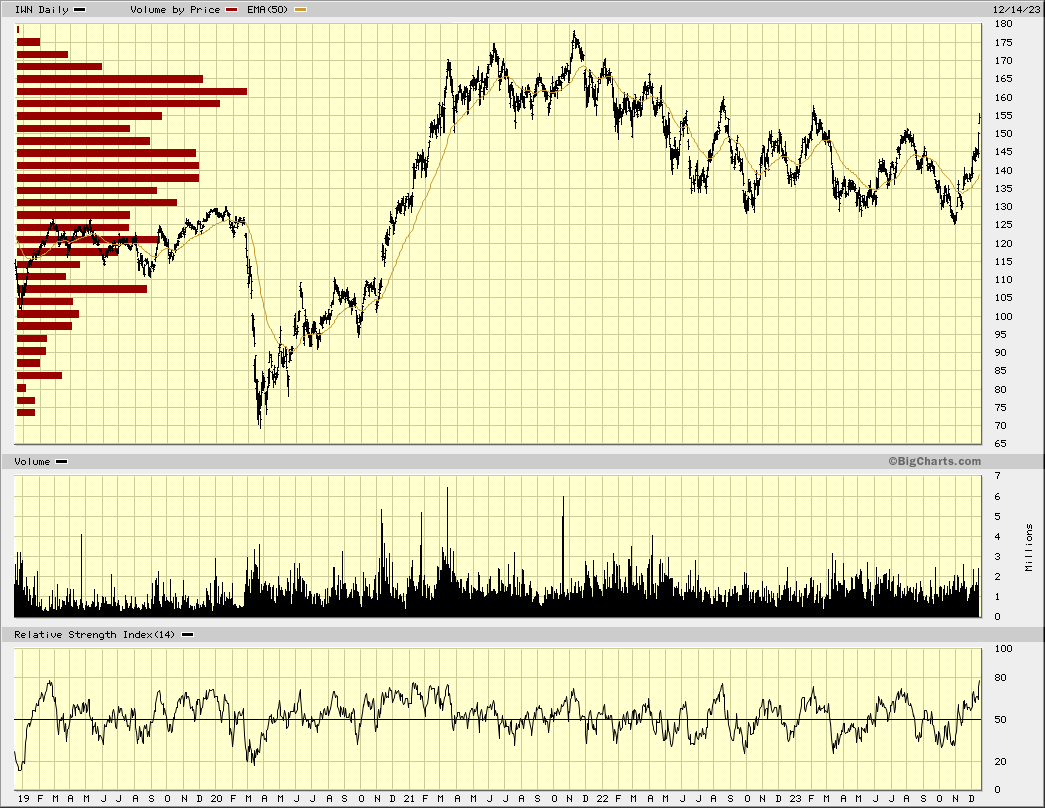

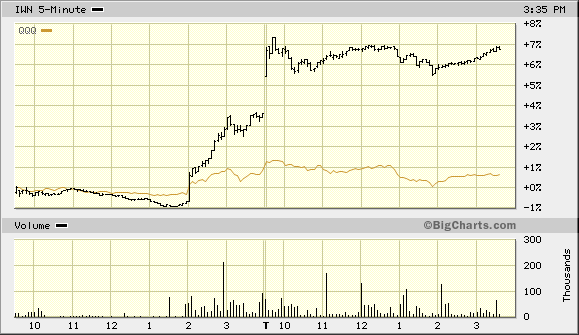

heute war "Rage buying" in der zweiten Reihe angesagt, hier der $IWN (US-Nebenwerte, iShares Russell 2000 Value ETF) vs $QQQ (NASDAQ100-Proxy):

mit Gap-up

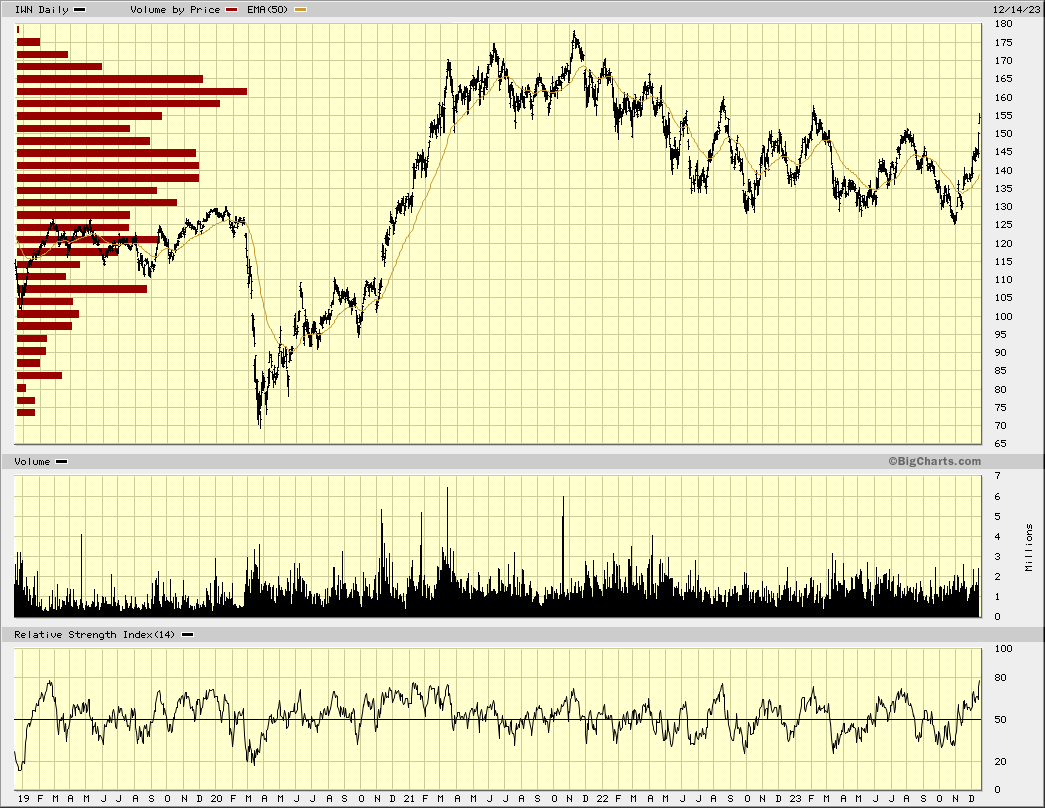

bigger picture:

<kein Total return; Number of Holdings as of Dec 13, 2023: 1,437 --> https://www.ishares.com/us/products/239712/ishares-russell-2…>

mit Gap-up

bigger picture:

<kein Total return; Number of Holdings as of Dec 13, 2023: 1,437 --> https://www.ishares.com/us/products/239712/ishares-russell-2…>

Der nächste Crash könnte kommen wenn die Zentralbanken anfangen den Zins zu senken.

Solange die Wirtschaft läuft, senken sie nicht.

Wenn die Gewerkschaften mit hohen Lohnforderungen aufhören, wird der Zins fallen, und der Crash kommen.

Auch Krankenversicherungen, Telcos und Eisenbahnen sollten sich zurückhalten.

Gibt natürlich auch andere Meinungen.

Bevor der nächste Crash kommt, warte ich das nächste DAX ATH ab.

Solange die Wirtschaft läuft, senken sie nicht.

Wenn die Gewerkschaften mit hohen Lohnforderungen aufhören, wird der Zins fallen, und der Crash kommen.

Auch Krankenversicherungen, Telcos und Eisenbahnen sollten sich zurückhalten.

Gibt natürlich auch andere Meinungen.

Bevor der nächste Crash kommt, warte ich das nächste DAX ATH ab.

14.12.

Swedish Real Estate, Mining Stocks Lead Post-Fed Rally in Europe

https://finance.yahoo.com/news/swedish-real-estate-mining-st…

...

The news sent battered real estate stocks soaring, with the likes of Fastighets AB, Sagax AB and Vonovia SE leading the charge higher.

Anglo American Plc — Europe’s worst-performing mining stock of 2023 — jumped.

Orsted and Vestas Wind Systems A/S also soared after dismal performance this year.

“Anything small and value is currently gaining, as a reflection of how much loser financial conditions matter to these stocks,” said Florian Ielpo, head of macro research at Lombard Odier Asset Management. “This is a Fed recovery trend, and as long as the Fed does not shift direction, this trend is likely to be with us.”

Banks — which outperformed the market this year — lagged amid the prospects of rate cuts, with Italian and Spanish lenders particularly lagging.

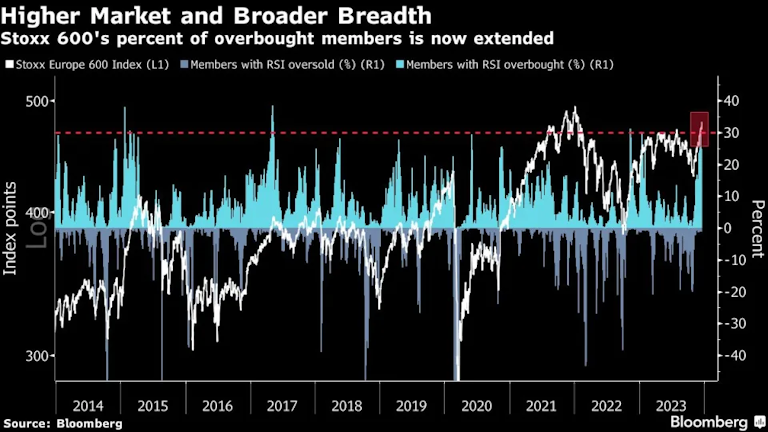

European stocks are rallying for a second month amid optimism about central bank easing next year. The Stoxx 600 has surged nearly 12% since a low in late October, and technical indicators show the index at the most overbought level in two years.

Gains in The Euro Stoxx 50 index have run so hot this week that technical indicators showed it’s at the most overbought level since 1999. Benchmark indexes in the region including France’s CAC 40 and Germany’s DAX hit fresh record highs.

...

14.12.

Wall Street Traders Go All-In on Great Monetary Pivot of 2024

https://finance.yahoo.com/news/wall-street-traders-great-mon…

...

“This is a massive paradigm shift on Wall Street, with the most aggressive rate-hiking cycle in decades coming to an end,” said Adam Sarhan, founder of 50 Park Investments. “The Fed is no longer dealing with inflation as public enemy No. 1.”

Investors are now pricing in six quarter-point rate reductions in 2024 by the Fed, twice the three penciled in by the central bankers. Economists at Goldman Sachs Group Inc. revised their forecast to show cuts starting in March.

...

Wall Street Traders Go All-In on Great Monetary Pivot of 2024

https://finance.yahoo.com/news/wall-street-traders-great-mon…

...

“This is a massive paradigm shift on Wall Street, with the most aggressive rate-hiking cycle in decades coming to an end,” said Adam Sarhan, founder of 50 Park Investments. “The Fed is no longer dealing with inflation as public enemy No. 1.”

Investors are now pricing in six quarter-point rate reductions in 2024 by the Fed, twice the three penciled in by the central bankers. Economists at Goldman Sachs Group Inc. revised their forecast to show cuts starting in March.

...

https://www.marketwatch.com/livecoverage/cpi-report-for-nove…

12.12.

Hot shelter inflation catches traders' attention. It could help keep Fed on hold, Goldman Sachs says

...

It seems traders are focusing on signs that the long-expected disinflation in the cost of shelter still hadn't arrived in November, according to commentary from a top strategist at Goldman Sachs Group.

As MarketWatch highlighted earlier, owners' equivalent rent, a key component of shelter costs, rose 0.5% in November, helping to drive overall shelter-related costs up 0.4%. The Fed has said they're paying particularly close attention to the cost of housing, and Goldman concluded that the data would likely support the Fed keeping interest rates on hold.

"Today's Core CPI print was below expectations. The number was expected to be higher due in part to residual seasonality and new source data that was incorporated in the health insurance calculation. However, the important indicator on inflation in focus was OER. Big reversion from upside miss on shelter last month to a meaningful deceleration in shelter. This should solidify the Fed on hold in December," said Lindsay Rosner, head of multi-sector fixed income investing at Goldman Sachs Asset Management.

Shelter wasn't the only surprisingly hot component of the report. Used-car prices climbed 1.6% in November, eschewing expectations for a slower increase, or even a decline.

To be sure, the data weren't all that bad: core prices rose 4% year-over-year, while the six-month annualized pace slowed to 2.9%, drawing closer to the Fed's 2% target.

...

12.12.

Hot shelter inflation catches traders' attention. It could help keep Fed on hold, Goldman Sachs says

...

It seems traders are focusing on signs that the long-expected disinflation in the cost of shelter still hadn't arrived in November, according to commentary from a top strategist at Goldman Sachs Group.

As MarketWatch highlighted earlier, owners' equivalent rent, a key component of shelter costs, rose 0.5% in November, helping to drive overall shelter-related costs up 0.4%. The Fed has said they're paying particularly close attention to the cost of housing, and Goldman concluded that the data would likely support the Fed keeping interest rates on hold.

"Today's Core CPI print was below expectations. The number was expected to be higher due in part to residual seasonality and new source data that was incorporated in the health insurance calculation. However, the important indicator on inflation in focus was OER. Big reversion from upside miss on shelter last month to a meaningful deceleration in shelter. This should solidify the Fed on hold in December," said Lindsay Rosner, head of multi-sector fixed income investing at Goldman Sachs Asset Management.

Shelter wasn't the only surprisingly hot component of the report. Used-car prices climbed 1.6% in November, eschewing expectations for a slower increase, or even a decline.

To be sure, the data weren't all that bad: core prices rose 4% year-over-year, while the six-month annualized pace slowed to 2.9%, drawing closer to the Fed's 2% target.

...

Antwort auf Beitrag Nr.: 74.915.191 von faultcode am 05.12.23 17:37:23Wer gibt ihm denn viele Mrd. an US$, um die Alt-Währung zu ersetzen, die hoch inflationiert ist, um die dicken Sozialprogramme zu finanzieren?

--> gute Frage:

10.12.

In inaugural speech, Argentina's Javier Milei prepares nation for painful shock adjustment

https://www.msn.com/en-us/news/world/in-inaugural-speech-arg…

...

--> gute Frage:

10.12.

In inaugural speech, Argentina's Javier Milei prepares nation for painful shock adjustment

https://www.msn.com/en-us/news/world/in-inaugural-speech-arg…

...