Phillips 66 Reports Second-Quarter Earnings of $1.0 Billion or $1.84 Per Share (Seite 5) | Diskussion im Forum

eröffnet am 17.09.15 13:06:55 von

neuester Beitrag 18.12.23 18:35:21 von

neuester Beitrag 18.12.23 18:35:21 von

Beiträge: 117

ID: 1.218.621

ID: 1.218.621

Aufrufe heute: 0

Gesamt: 6.811

Gesamt: 6.811

Aktive User: 0

ISIN: US7185461040 · WKN: A1JWQU · Symbol: R66

146,62

EUR

-0,58 %

-0,86 EUR

Letzter Kurs 25.04.24 Tradegate

Neuigkeiten

03.04.24 · Business Wire (engl.) |

02.04.24 · wO Newsflash |

01.04.24 · Business Wire (engl.) |

14.03.24 · Business Wire (engl.) |

29.02.24 · Business Wire (engl.) |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 75,38 | +19,99 | |

| 5,2000 | +9,47 | |

| 1,0600 | +8,16 | |

| 7,3300 | +7,79 | |

| 0,5300 | +7,72 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 11,000 | -13,39 | |

| 1,2501 | -15,25 | |

| 1,4000 | -18,13 | |

| 12,510 | -27,27 | |

| 9,3500 | -28,02 |

Beitrag zu dieser Diskussion schreiben

A Chinese national pleaded guilty on Tuesday to stealing trade secrets from U.S. petroleum company Phillips 66, where he worked on the research and development of next generation battery technologies , the U.S. Justice Department said.

, the U.S. Justice Department said.

https://finance.yahoo.com/news/1-chinese-national-pleads-gui…

, the U.S. Justice Department said.

, the U.S. Justice Department said.https://finance.yahoo.com/news/1-chinese-national-pleads-gui…

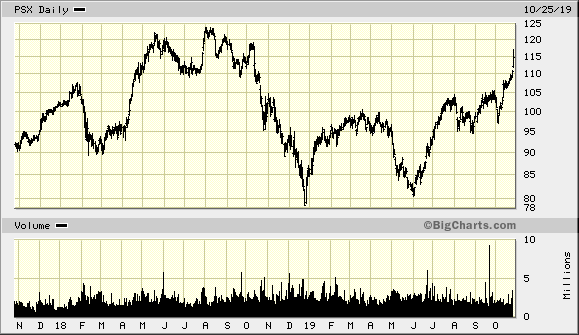

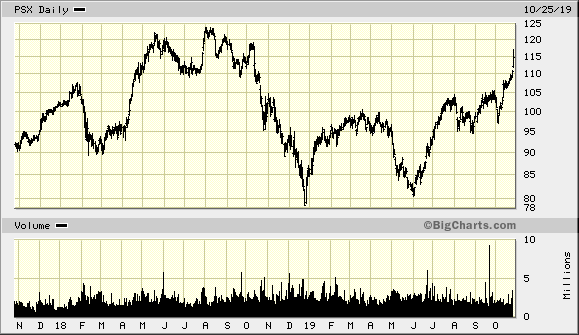

Antwort auf Beitrag Nr.: 61.015.481 von faultcode am 12.07.19 19:26:5925.10.

Refiner Phillips 66 beats profit estimates on fuel sales strength

https://finance.yahoo.com/news/1-refiner-phillips-66-beats-1…

=>

...U.S. refiner Phillips 66 beat estimates for quarterly profit on Friday, boosted by strong performance in its fuel sales business.

Phillips 66 processes, transports, stores and markets fuels and products and has been redesigning its Phillips 66, 76 and Conoco branded sites in the United States.

The efforts paid off with adjusted earnings in the segment jumping nearly 30% to $498 million.

Refined product exports rose nearly 16% to 220,000 barrels per day in the third quarter, the company said.

Net earnings fell to $712 million, or $1.58 per share, in the third quarter ended Sept. 30, from $1.49 billion, or $3.18 per share, a year earlier.

Excluding a $690 million impairment related to investments in DCP Midstream, the company earned $3.11 per share...

Refiner Phillips 66 beats profit estimates on fuel sales strength

https://finance.yahoo.com/news/1-refiner-phillips-66-beats-1…

=>

...U.S. refiner Phillips 66 beat estimates for quarterly profit on Friday, boosted by strong performance in its fuel sales business.

Phillips 66 processes, transports, stores and markets fuels and products and has been redesigning its Phillips 66, 76 and Conoco branded sites in the United States.

The efforts paid off with adjusted earnings in the segment jumping nearly 30% to $498 million.

Refined product exports rose nearly 16% to 220,000 barrels per day in the third quarter, the company said.

Net earnings fell to $712 million, or $1.58 per share, in the third quarter ended Sept. 30, from $1.49 billion, or $3.18 per share, a year earlier.

Excluding a $690 million impairment related to investments in DCP Midstream, the company earned $3.11 per share...

https://www.globalwitness.org/en/campaigns/oil-gas-and-minin…

wer verdient mehr daran transport oder verarbeitung?

wer verdient mehr daran transport oder verarbeitung?

UPDATE 2-Intensifying storm shuts U.S. coastal refinery, adding to energy production losses

Saison geht wieder los:11.7.

Threatened flooding from a tropical storm in the U.S. Gulf of Mexico that cut nearly a third of the region's oil production has forced the shutdown of a coastal refinery, pushing oil and gasoline prices higher on Thursday.

Phillips 66 said it expected to complete the closing of its 253,600-barrel-per-day (bpd) Alliance, Louisiana, refinery on Thursday after local authorities ordered a mandatory evacuation of the area.

Pipeline operator Enbridge evacuated staff from three offshore platforms and halted operations on some deepwater Gulf of Mexico natural gas pipelines.

Oil companies have shut a third of offshore U.S. Gulf of Mexico production ahead of Tropical Storm Barry, which could become a Hurricane late Friday, according to a National Weather Service (NWS) forecast.

At least 17 offshore oil and gas platforms operated by Anadarko Petroleum, Chevron, Royal Dutch Shell and others were evacuated, and many halted production, according to company reports.

Crude futures, which rose more than 4% on Wednesday, were fractionally higher on Thursday, with U.S. crude trading at $60.69, the highest since May. Gasoline futures also rose a fraction.

The storm's predicted path puts landfall near two of the nation's four operating liquefied natural gas (LNG) export terminals, Cheniere Energy's Sabine Pass and Sempra Energy's Cameron plants.

Data provider Refinitiv said natural gas output in the Lower 48 states could drop to a seven-week low of 87.2 billion cubic feet per day (bcfd) on Thursday due to the closings, from a record high of 91.1 bcfd on July 5.

On Thursday morning, the storm was about 95 miles (150 km) southeast of the mouth of the Mississippi River, moving west at about 5 miles per hour (7 km per hour). It could make landfall on Saturday on the Louisiana coast and bring up to 15 inches (38 cm) of rain to the central Gulf Coast, forecasters said.

The potential storm could become a Category 1 hurricane with winds of at least 74 mph (119 kph) and drive ocean water up the Mississippi, forecasters said. The storm surge is projected to bring 3 feet to 6 feet (.9 meter to 1.8 meters) to shore, worsening flooding from heavy rains, according to the weather service.

The Alliance refinery sits next to the river 39 miles (63 km) south of New Orleans. The last hurricane to flood the refinery was 2012's Hurricane Isaac. The refinery was also shut by Hurricane Gustav in 2008 and Hurricane Katrina in 2005.

In 2017, Hurricane Nate led Phillips 66 to shut the refinery, which was restarted within days as the storm turned away from the area.

PBF Energy and Valero Energy Corp do not plan to idle their refineries in Chalmette and Meraux, Louisiana, sources familiar with plant operations said on Thursday morning...

Antwort auf Beitrag Nr.: 60.458.672 von biviol1 am 30.04.19 17:38:00kommt!

--> May 17 -- $0.90 (vorher $0.80)

--> May 17 -- $0.90 (vorher $0.80)

HOUSTON (AP) _ Phillips 66 (PSX) on Tuesday reported first-quarter net income of $204 million.

On a per-share basis, the Houston-based company said it had net income of 44 cents. Earnings, adjusted for non-recurring gains, were 40 cents per share.

etwas nachgekauft.

div erhöhung (3,60$?) sollte ja kommen.

On a per-share basis, the Houston-based company said it had net income of 44 cents. Earnings, adjusted for non-recurring gains, were 40 cents per share.

etwas nachgekauft.

div erhöhung (3,60$?) sollte ja kommen.

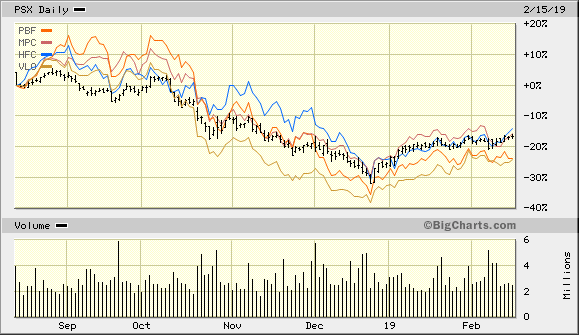

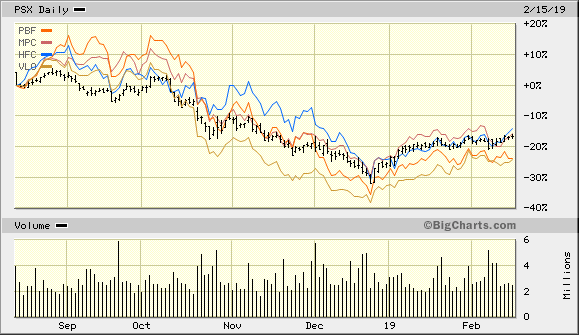

Antwort auf Beitrag Nr.: 59.593.100 von faultcode am 09.01.19 14:44:446m-Rückschau:

--> US oil refiners machen alle dasselbe

--> US oil refiners machen alle dasselbe

Antwort auf Beitrag Nr.: 59.522.836 von faultcode am 28.12.18 19:18:54

.

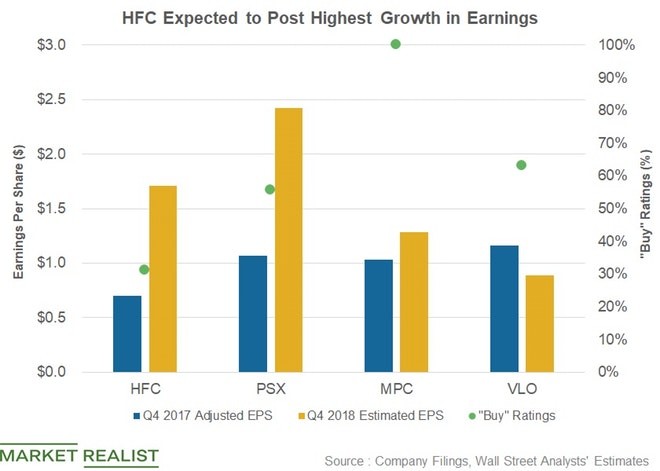

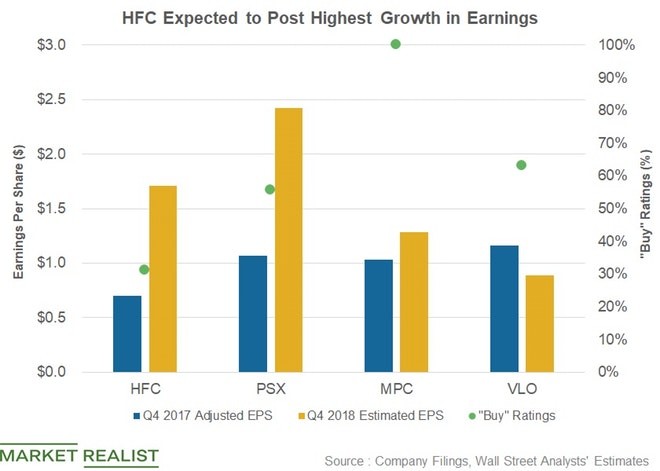

aus: https://marketrealist.com/2019/01/mpc-vlo-hfc-and-psx-q4-est…

MPC, VLO, HFC, and PSX: Q4 Estimates and Rankings

..

aus: https://marketrealist.com/2019/01/mpc-vlo-hfc-and-psx-q4-est…

Will Refiners’ Q4 Renewable Identification Numbers (RIN's) Expense Fall?

...this cost is continuously denting earnings for refiners. However, due to softening RINs prices in 2018, Valero’s RINs cost fell by $200 million YoY to $431 million in the first nine months...

aus:

https://marketrealist.com/2018/12/will-refiners-q4-renewable…

Phillips 66 Reports Second-Quarter Earnings of $1.0 Billion or $1.84 Per Share