Kleines Subportfolio "Lithium" - Produzenten oder nahe Produktion (Seite 2)

eröffnet am 30.05.17 17:40:26 von

neuester Beitrag 06.10.23 15:31:41 von

neuester Beitrag 06.10.23 15:31:41 von

Beiträge: 98

ID: 1.254.052

ID: 1.254.052

Aufrufe heute: 1

Gesamt: 11.137

Gesamt: 11.137

Aktive User: 0

ISIN: US37954Y8553 · WKN: A143H3

42,89

EUR

+0,33 %

+0,14 EUR

Letzter Kurs 18:32:21 Lang & Schwarz

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 40,00 | +300,00 | |

| 5,6000 | +49,33 | |

| 1,3100 | +43,17 | |

| 1,4600 | +43,14 | |

| 1,0500 | +22,09 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 14,750 | -14,14 | |

| 1,8775 | -14,17 | |

| 1,2600 | -16,00 | |

| 1.138,25 | -16,86 | |

| 1,1099 | -17,79 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 56.759.379 von faultcode am 18.01.18 18:43:43immer wieder Ärger in Chile bei den Li-Minern. War "früher" nicht so:

12.11.

Chile vows to take lithium giant Albemarle to arbitration over royalty spat

https://uk.reuters.com/article/chile-lithium-albemarle/chile…

...

Chilean regulators have accused Albemarle, the world’s largest lithium producer, of underpaying royalties by $11 million and vowed to take the U.S.-based miner to international arbitration over what they called a breach of its contract with the government.

Corfo, which oversees Albemarle’s contract for lithium mining in Chile’s Salar de Atacama, told lawmakers the miner had misinterpreted the part of their agreement that outlines the basis for royalty payments, favoring a too-low commission on its sales.

“For (Corfo) it is unacceptable that Albemarle pretends to alter what was negotiated and agreed upon by the two parties,” said Corfo vice-president Pablo Terrazas in an Oct. 14 letter to lawmakers viewed by Reuters. He said the disagreement represented a “breach” of the 2016 contract that increased Albemarle’s quota to extract lithium.

Albemarle rejected those claims in a statement to Reuters on Wednesday, saying Corfo’s call for arbitration was unnecessary. Albemarle said it has met its royalty obligations and the contract makes clear such disputes can be settled without arbitration.

“We do not understand Corfo’s insistence on international arbitration, which is a process that will take years and will mean an enormous expense...for the State,” Albemarle said.

The latest spat comes two months after Albemarle locked horns with Chilean nuclear agency CCHEN over reserves data. CCHEN has demanded additional information on reserves held by Albemarle at Atacama, details regulators say they need to assure the miner can sustain increased output. The two are still discussing the matter, Albemarle told Reuters.

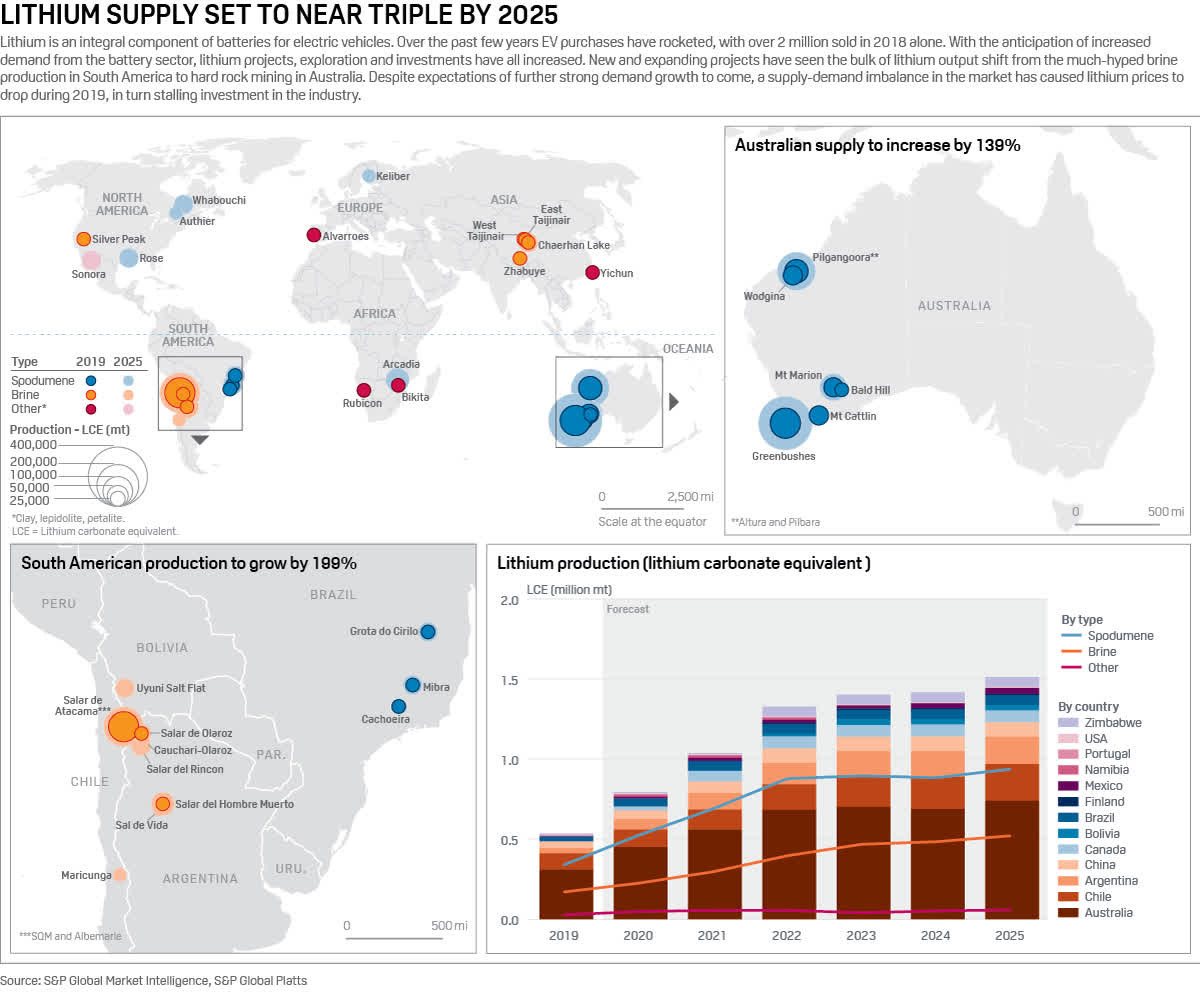

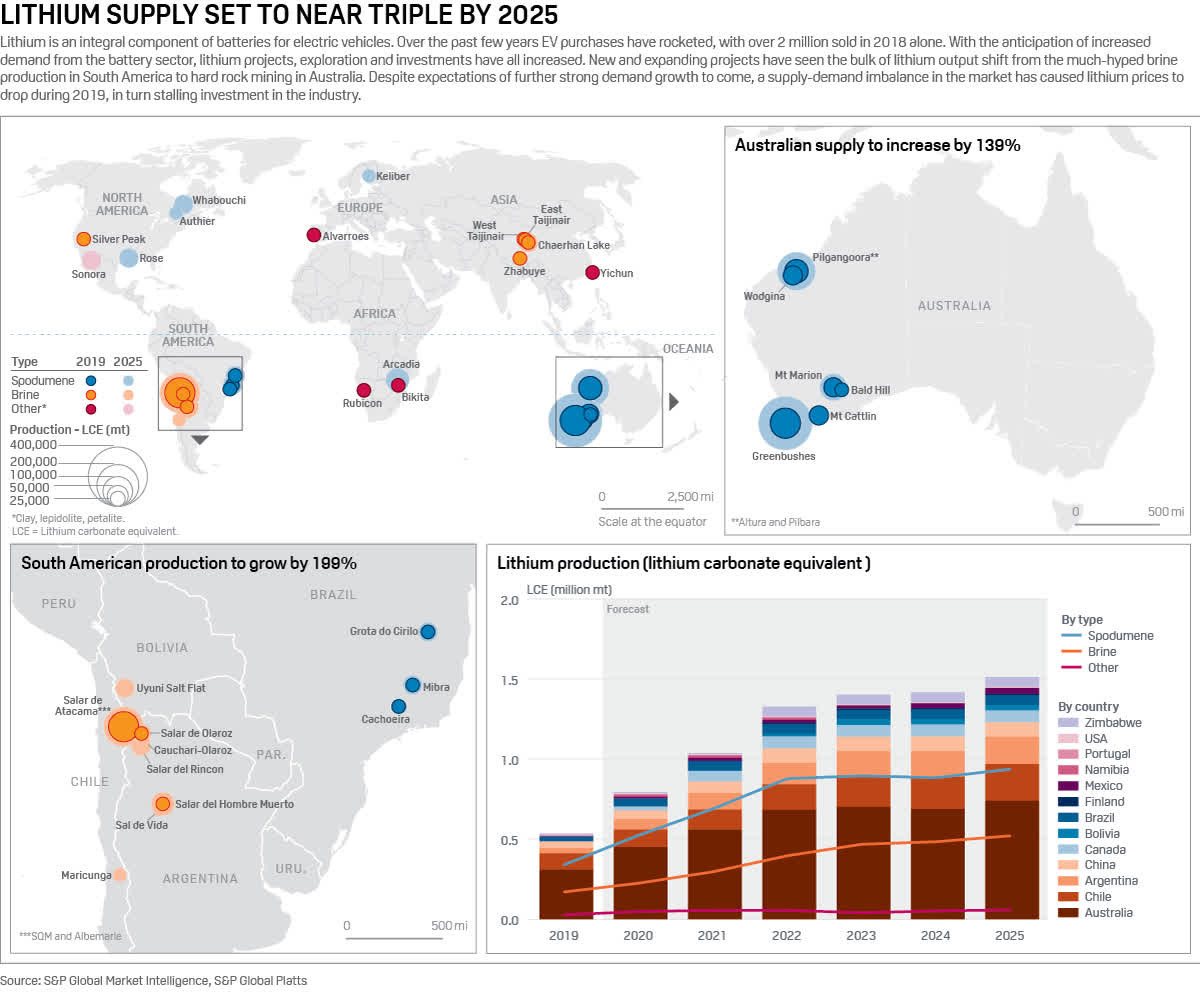

Albemarle has been pushing to expand its production in Chile. Marketwatchers expect demand for the white metal to triple by 2025 as automakers produce more electric vehicles (EVs).

The coronavirus pandemic and falling prices, however, have set many producers back, forcing them to shelve projects, cut costs and temporarily tamp down output.

...

___

Die Chilenen sind auch nicht doof. Die bekommen auch mit, was für ein klima-aktivistischer Affentanz in Europa wegen der BEV's etc. aufgeführt wird

12.11.

Chile vows to take lithium giant Albemarle to arbitration over royalty spat

https://uk.reuters.com/article/chile-lithium-albemarle/chile…

...

Chilean regulators have accused Albemarle, the world’s largest lithium producer, of underpaying royalties by $11 million and vowed to take the U.S.-based miner to international arbitration over what they called a breach of its contract with the government.

Corfo, which oversees Albemarle’s contract for lithium mining in Chile’s Salar de Atacama, told lawmakers the miner had misinterpreted the part of their agreement that outlines the basis for royalty payments, favoring a too-low commission on its sales.

“For (Corfo) it is unacceptable that Albemarle pretends to alter what was negotiated and agreed upon by the two parties,” said Corfo vice-president Pablo Terrazas in an Oct. 14 letter to lawmakers viewed by Reuters. He said the disagreement represented a “breach” of the 2016 contract that increased Albemarle’s quota to extract lithium.

Albemarle rejected those claims in a statement to Reuters on Wednesday, saying Corfo’s call for arbitration was unnecessary. Albemarle said it has met its royalty obligations and the contract makes clear such disputes can be settled without arbitration.

“We do not understand Corfo’s insistence on international arbitration, which is a process that will take years and will mean an enormous expense...for the State,” Albemarle said.

The latest spat comes two months after Albemarle locked horns with Chilean nuclear agency CCHEN over reserves data. CCHEN has demanded additional information on reserves held by Albemarle at Atacama, details regulators say they need to assure the miner can sustain increased output. The two are still discussing the matter, Albemarle told Reuters.

Albemarle has been pushing to expand its production in Chile. Marketwatchers expect demand for the white metal to triple by 2025 as automakers produce more electric vehicles (EVs).

The coronavirus pandemic and falling prices, however, have set many producers back, forcing them to shelve projects, cut costs and temporarily tamp down output.

...

___

Die Chilenen sind auch nicht doof. Die bekommen auch mit, was für ein klima-aktivistischer Affentanz in Europa wegen der BEV's etc. aufgeführt wird

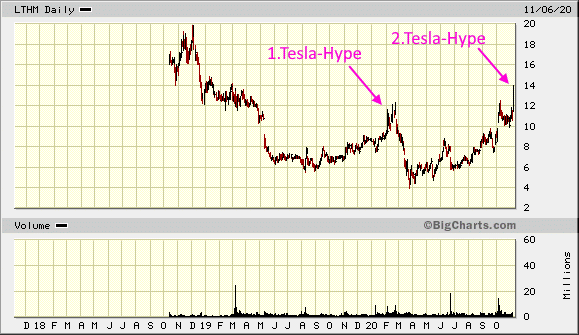

Antwort auf Beitrag Nr.: 65.639.130 von faultcode am 09.11.20 12:44:58Trotzdem: Sub-Portfolio mit beiden Rest-Komponenten heute aufgelöst:

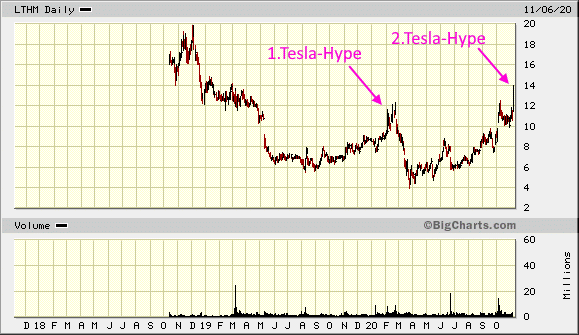

• Livent im Tesla-Hype #2

• Neometals auch, weil sehr klein mit ~20 MA's und einer Unternehmens-Politik, die ich bis heute für recht riskant halte.

Die beiden JV's (SMS + SSAB) kosten viel Geld und das ist in wenigen Jahren weg, wenn die damit verbundenen Anlagen nicht gleich zu einem positiven, oper. Cash flow beitragen (Positiv-Szenario).

Und diese Wahrscheinlichkeit halte ich für hoch, weil immer mehr große Player den Li battery recycling-Markt für sich entdecken werden (oft auch nur, weil sie es irgendwie müssen, so wie z.B. VW).

11.06.18

• Livent im Tesla-Hype #2

• Neometals auch, weil sehr klein mit ~20 MA's und einer Unternehmens-Politik, die ich bis heute für recht riskant halte.

Die beiden JV's (SMS + SSAB) kosten viel Geld und das ist in wenigen Jahren weg, wenn die damit verbundenen Anlagen nicht gleich zu einem positiven, oper. Cash flow beitragen (Positiv-Szenario).

Und diese Wahrscheinlichkeit halte ich für hoch, weil immer mehr große Player den Li battery recycling-Markt für sich entdecken werden (oft auch nur, weil sie es irgendwie müssen, so wie z.B. VW).

11.06.18

Zitat von faultcode: ...=> Neometals zahlte Dividende von AUD0.01 per Share (Extag : 31.05.2018)

=> man fragt sich: von was denn?

Schliesslich sind sie mitten drin, die Kalgoorlie lithium hydroxide facility zu entwickeln...

Antwort auf Beitrag Nr.: 65.624.489 von faultcode am 07.11.20 01:00:19Livent ist demnach noch immer erhöht geshortet:

https://twitter.com/IotraderScans/status/1325543707249139712

https://twitter.com/IotraderScans/status/1325543707249139712

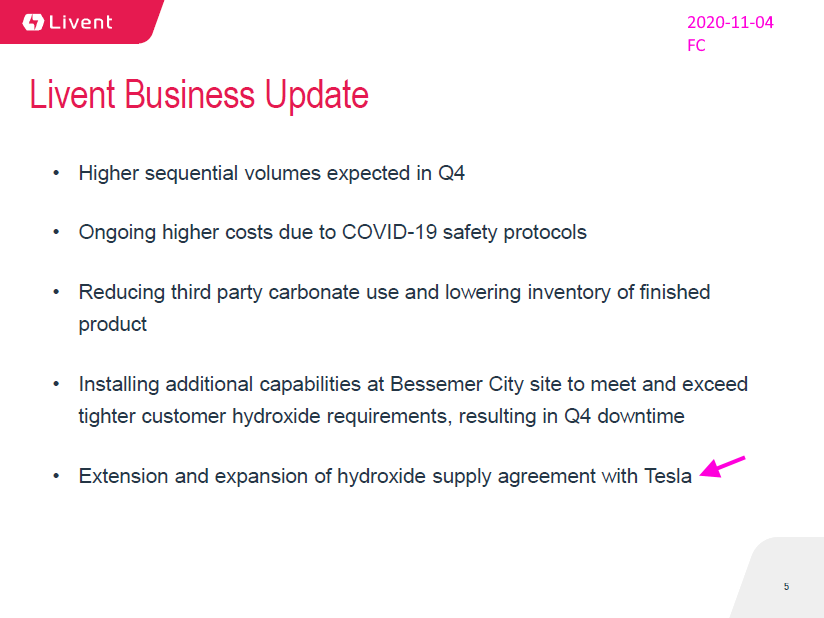

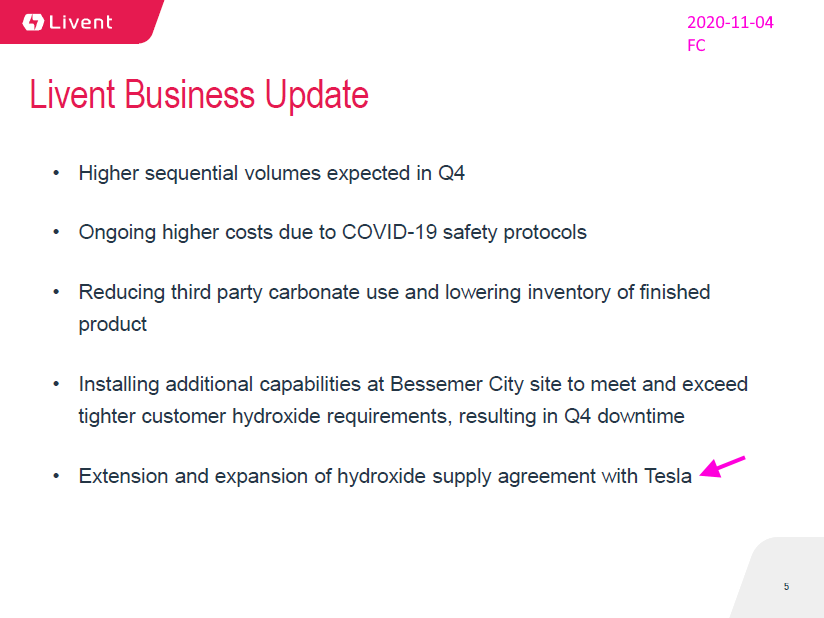

Antwort auf Beitrag Nr.: 64.719.616 von faultcode am 11.08.20 13:29:42Livent wieder im Tesla-Hype (*):

-->

6.11.

Tesla verlängert Lithium-Liefervertrag mit Livent

https://www.electrive.net/2020/11/06/tesla-verlaengert-lithi…

...

(*)

-->

6.11.

Tesla verlängert Lithium-Liefervertrag mit Livent

https://www.electrive.net/2020/11/06/tesla-verlaengert-lithi…

...

(*)

29.10.

'Lithium prices appear to have bottomed' - Orocobre

https://www.kitco.com/news/2020-10-29/-Lithium-prices-appear…

...

Sales volume for the quarter was up 112% quarter on quarter to 3,393 tonnes, while sales revenue was up 68% QoQ to $10.5 million following the sale of excess inventory. The realized average price achieved was $3,102/tonne on a free on board basis.

Cash cost of sales was successfully maintained near recent lows at US$3,974/tonne.

The EV material sector started the year downbeat. In January, Orocobre was laboring under lithium prices that dropped 24%.

"Lithium prices appear to have bottomed and realized Q2 FY21 prices are expected to be higher than Q1," wrote the company.

During the quarter Orocobre highlighted a non-binding MOU with Prime Planet Energy and Solutions (PPES), a joint venture between Toyota (51%) and Panasonic (49%) specializing in the production of automotive battery cells, for the long-term supply of product culminating in 30kt of lithium carbonate equivalent (LCE) in CY25. Orocobre said discussions are now underway to finalize the detailed terms of the agreement.

'Lithium prices appear to have bottomed' - Orocobre

https://www.kitco.com/news/2020-10-29/-Lithium-prices-appear…

...

Sales volume for the quarter was up 112% quarter on quarter to 3,393 tonnes, while sales revenue was up 68% QoQ to $10.5 million following the sale of excess inventory. The realized average price achieved was $3,102/tonne on a free on board basis.

Cash cost of sales was successfully maintained near recent lows at US$3,974/tonne.

The EV material sector started the year downbeat. In January, Orocobre was laboring under lithium prices that dropped 24%.

"Lithium prices appear to have bottomed and realized Q2 FY21 prices are expected to be higher than Q1," wrote the company.

During the quarter Orocobre highlighted a non-binding MOU with Prime Planet Energy and Solutions (PPES), a joint venture between Toyota (51%) and Panasonic (49%) specializing in the production of automotive battery cells, for the long-term supply of product culminating in 30kt of lithium carbonate equivalent (LCE) in CY25. Orocobre said discussions are now underway to finalize the detailed terms of the agreement.

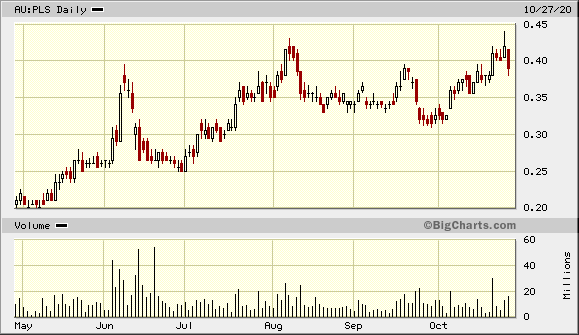

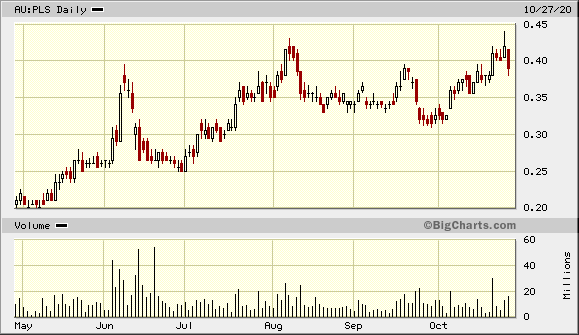

Antwort auf Beitrag Nr.: 65.521.636 von faultcode am 28.10.20 13:40:4628.10.

Pilbara Minerals lines up potential $175 million Altura lithium deal

https://www.reuters.com/article/altura-mining-m-a-pilbara-in…

...

Lithium miner Pilbara Minerals Ltd PLS.AX said on Wednesday it had entered into a conditional agreement to acquire Altura Mining Ltd's AJM.AX lithium project for about $175 million.

Pilbara was vying with Galaxy Resources GXY.AX to acquire the embattled hard rock lithium producer and was considered the frontrunner given the proximity of its lithium project to Altura's in Pilgangoora, Western Australia, according to a report by the Australian Financial Review. Altura entered administration on Tuesday after the impact of the pandemic exacerbated a prolonged period of low prices for battery materials.

Pilbara said the agreement with the senior secured loan noteholders of Altura provides it with a path to potentially acquire the project through the purchase of shares in Altura Lithium Operations Pty Ltd.

Loan Noteholders have agreed to vote in favour of the Pilbara should the acquisition proceed, the company said.

West Perth-based Pilbara has agreed to pay an upfront cash payment of $155 million and about $20 million for the shares in Altura Lithium Operations upon successful completion of the deal.

The cash portion will be mostly funded through future equity capital raising of about A$240 million ($171.10 million), Pilbara said.

Pilbara Minerals earlier in the day halted trading following media reports of it looking to buy Altura.

Pilbara Minerals lines up potential $175 million Altura lithium deal

https://www.reuters.com/article/altura-mining-m-a-pilbara-in…

...

Lithium miner Pilbara Minerals Ltd PLS.AX said on Wednesday it had entered into a conditional agreement to acquire Altura Mining Ltd's AJM.AX lithium project for about $175 million.

Pilbara was vying with Galaxy Resources GXY.AX to acquire the embattled hard rock lithium producer and was considered the frontrunner given the proximity of its lithium project to Altura's in Pilgangoora, Western Australia, according to a report by the Australian Financial Review. Altura entered administration on Tuesday after the impact of the pandemic exacerbated a prolonged period of low prices for battery materials.

Pilbara said the agreement with the senior secured loan noteholders of Altura provides it with a path to potentially acquire the project through the purchase of shares in Altura Lithium Operations Pty Ltd.

Loan Noteholders have agreed to vote in favour of the Pilbara should the acquisition proceed, the company said.

West Perth-based Pilbara has agreed to pay an upfront cash payment of $155 million and about $20 million for the shares in Altura Lithium Operations upon successful completion of the deal.

The cash portion will be mostly funded through future equity capital raising of about A$240 million ($171.10 million), Pilbara said.

Pilbara Minerals earlier in the day halted trading following media reports of it looking to buy Altura.

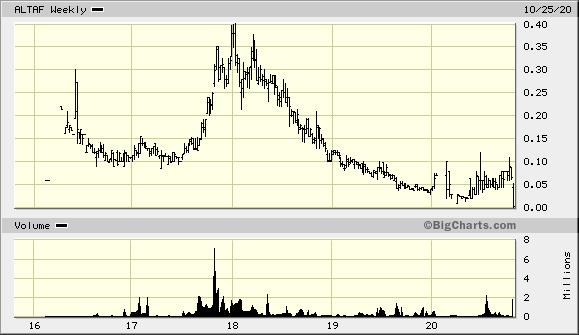

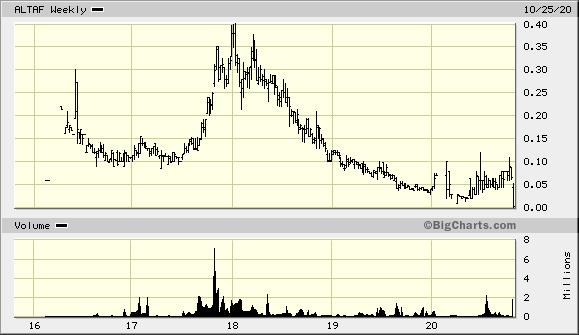

Another one bites the dust:

26.10.

ASX-listed Altura Mining in receivership; $150m recap sinks

https://www.afr.com/street-talk/asx-listed-lithium-play-altu…

...

26.10.

ASX-listed Altura Mining in receivership; $150m recap sinks

https://www.afr.com/street-talk/asx-listed-lithium-play-altu…

...

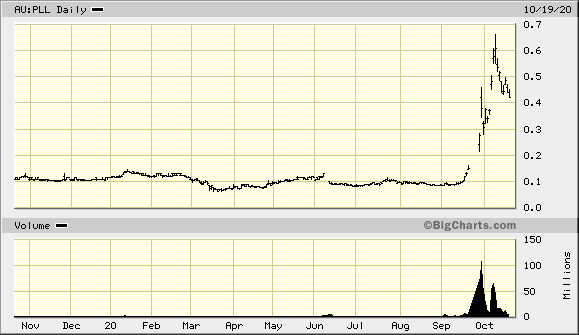

20.10.

This Miner Stock Is Rising Because Tesla Needs More Lithium

https://www.barrons.com/articles/tesla-demand-is-driving-thi…

Stock in exploration-stage lithium miner Piedmont Lithium has soared—by about 166%—since electric-vehicle behemoth Tesla hosted its battery technology day on Sept. 22.

At the event, Tesla painted a picture of future EV demand that implied the world needs a lot more EV-related materials, including lithium. Now Piedmont (PLL) is using its recent share strength to raise money to fund growth.

On Monday, Piedmont announced plans to raise money by selling stock. The company wants to sell up to 1.5 million American depositary receipts, or ADRs.

...

The sale has the potential to bring in roughly $45 million to company coffers, depending on the price discount offered on the sale. Piedmont has about $19 million in cash on its balance sheet, based on recent filings.

The company might use the cash toward the hard rock mine it is developing in North Carolina. (Most of the world’s lithium today comes from evaporating salt from brine ponds.) Early phases of Piedmont’s mine should cost about $170 million, according to CEO Keith Phillips.

Piedmont is also getting some money from Tesla. Piedmont stock soared more than 200% on Sept 28, days after Telsa’s battery event, when Tesla signed a deal for five years of lithium-ore supply, with a possible extension for another five years. Deliveries from Piedmont to Telsa are expected to start around 2022.

The lithium sector is heating up, and Barron’s recently wrote positively about lithium miners. We prefer Livent (LTHM), believing higher demand from EVs will drive higher commodity volumes for all miners, as well as higher lithium-linked commodity prices.

When we wrote about the miners, we focused on the established players, including SQM (SQM), Albemarle (ALB), and Livent. Those three have an aggregate market capitalization of more than $19 billion.

But there are riskier plays. Piedmont, with a market value of about $340 million, is one. Lithium Americas (LAC), valued at $1.2 billion, is another. Those two don’t have sales yet. Orocobre (ORE.Australia) is another small-capitalization lithium firm, though with some sales. It produces lithium from brines in Argentina, and has a market cap of about $640 million.

Orocobre stock is down 5% since Tesla’s battery event. Lithium Americas stock has climbed 42%.

Year to date, Piedmont shares are up about 250%. Excluding Piedmont, the other five lithium mining stocks are up about 77% year to date, on average, far better than comparable returns of the S&P 500 and Dow Jones Industrial Average.

To buy mining startups or exploration-stage companies, investors have to be confident in their ability to understand proven and probable mining reserves, along with how much the companies plan to spend before generating free cash flow.

This Miner Stock Is Rising Because Tesla Needs More Lithium

https://www.barrons.com/articles/tesla-demand-is-driving-thi…

Stock in exploration-stage lithium miner Piedmont Lithium has soared—by about 166%—since electric-vehicle behemoth Tesla hosted its battery technology day on Sept. 22.

At the event, Tesla painted a picture of future EV demand that implied the world needs a lot more EV-related materials, including lithium. Now Piedmont (PLL) is using its recent share strength to raise money to fund growth.

On Monday, Piedmont announced plans to raise money by selling stock. The company wants to sell up to 1.5 million American depositary receipts, or ADRs.

...

The sale has the potential to bring in roughly $45 million to company coffers, depending on the price discount offered on the sale. Piedmont has about $19 million in cash on its balance sheet, based on recent filings.

The company might use the cash toward the hard rock mine it is developing in North Carolina. (Most of the world’s lithium today comes from evaporating salt from brine ponds.) Early phases of Piedmont’s mine should cost about $170 million, according to CEO Keith Phillips.

Piedmont is also getting some money from Tesla. Piedmont stock soared more than 200% on Sept 28, days after Telsa’s battery event, when Tesla signed a deal for five years of lithium-ore supply, with a possible extension for another five years. Deliveries from Piedmont to Telsa are expected to start around 2022.

The lithium sector is heating up, and Barron’s recently wrote positively about lithium miners. We prefer Livent (LTHM), believing higher demand from EVs will drive higher commodity volumes for all miners, as well as higher lithium-linked commodity prices.

When we wrote about the miners, we focused on the established players, including SQM (SQM), Albemarle (ALB), and Livent. Those three have an aggregate market capitalization of more than $19 billion.

But there are riskier plays. Piedmont, with a market value of about $340 million, is one. Lithium Americas (LAC), valued at $1.2 billion, is another. Those two don’t have sales yet. Orocobre (ORE.Australia) is another small-capitalization lithium firm, though with some sales. It produces lithium from brines in Argentina, and has a market cap of about $640 million.

Orocobre stock is down 5% since Tesla’s battery event. Lithium Americas stock has climbed 42%.

Year to date, Piedmont shares are up about 250%. Excluding Piedmont, the other five lithium mining stocks are up about 77% year to date, on average, far better than comparable returns of the S&P 500 and Dow Jones Industrial Average.

To buy mining startups or exploration-stage companies, investors have to be confident in their ability to understand proven and probable mining reserves, along with how much the companies plan to spend before generating free cash flow.

Antwort auf Beitrag Nr.: 65.359.422 von faultcode am 12.10.20 15:45:26

...

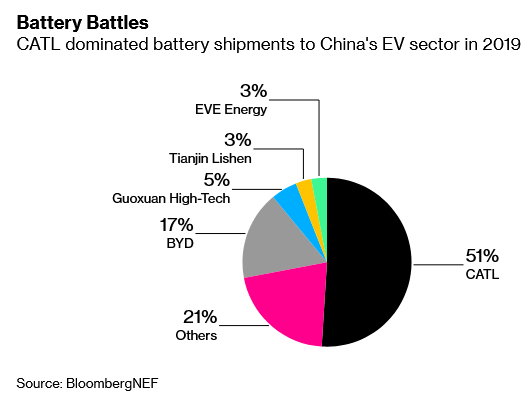

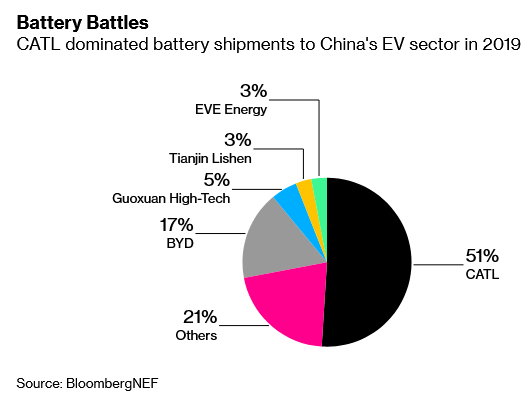

Huizhou, Guangdong-based EVE, which has pacts with automakers including Daimler AG, has seen tentative signals of a recovery in lithium and cobalt prices in China, meaning there’d be an advantage to lock in additional supplies now, Chairman Liu Jincheng said in a phone interview.

...

https://www.bloomberg.com/news/articles/2020-10-12/eve-energ…

Huizhou, Guangdong-based EVE, which has pacts with automakers including Daimler AG, has seen tentative signals of a recovery in lithium and cobalt prices in China, meaning there’d be an advantage to lock in additional supplies now, Chairman Liu Jincheng said in a phone interview.

...

https://www.bloomberg.com/news/articles/2020-10-12/eve-energ…