Aus TESCO Corp. wird Nabors Industries Ltd.

eröffnet am 01.01.18 18:13:12 von

neuester Beitrag 25.10.22 22:21:18 von

neuester Beitrag 25.10.22 22:21:18 von

Beiträge: 27

ID: 1.270.511

ID: 1.270.511

Aufrufe heute: 0

Gesamt: 1.549

Gesamt: 1.549

Aktive User: 0

ISIN: BMG6359F1370 · WKN: A2P3LV · Symbol: NBI1

71,50

EUR

-4,67 %

-3,50 EUR

Letzter Kurs 25.04.24 Tradegate

Neuigkeiten

11.01.24 · Business Wire (dt.) |

11.01.24 · Business Wire (engl.) |

19.06.23 · Business Wire (engl.) |

27.04.23 · Business Wire (dt.) |

26.04.23 · Business Wire (engl.) |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,240 | +26,53 | |

| 2,090 | +20,81 | |

| 75,38 | +19,99 | |

| 2,890 | +17,48 | |

| 5,060 | +11,45 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 11,600 | -8,66 | |

| 6,7200 | -8,82 | |

| 1,0500 | -11,02 | |

| 12,510 | -27,27 | |

| 9,3500 | -28,02 |

Beitrag zu dieser Diskussion schreiben

25.10.

Nabors Announces Third Quarter 2022 Results

https://investor.nabors.com/news-releases/news-details/2022/…

...

Mr. Petrello concluded, "We are proud of our third quarter results. As we look ahead, the commodity price environment remains positive, globally, for both oil and gas. Several of our strategic initiatives – building the drilling performance software portfolio, targeting the third-party rig market, and modularizing our technology – are gaining momentum. These set us in a unique position to capitalize on the favorable market. With that, we anticipate even stronger results in the fourth quarter."

...

Nabors Announces Third Quarter 2022 Results

https://investor.nabors.com/news-releases/news-details/2022/…

...

Mr. Petrello concluded, "We are proud of our third quarter results. As we look ahead, the commodity price environment remains positive, globally, for both oil and gas. Several of our strategic initiatives – building the drilling performance software portfolio, targeting the third-party rig market, and modularizing our technology – are gaining momentum. These set us in a unique position to capitalize on the favorable market. With that, we anticipate even stronger results in the fourth quarter."

...

...

Nabors Industries Ltd., which has a bigger international footprint than rivals as the world’s biggest supplier of rigs overall, estimates that international contracts average a year before higher prices can kick in. Still, prices are rising everywhere.

“The pricing environment is robust,” Chief Executive Officer Tony Petrello said Thursday on a first-quarter earnings call. “It applies to all markets and it’s moved faster than any time I’ve ever seen in my 30 years at Nabors.”

...

28.4.

Drilling Rig Prices Are Spiking in the U.S. Shale Patch

https://finance.yahoo.com/news/drilling-rig-prices-spiking-u…

Nabors Industries Ltd., which has a bigger international footprint than rivals as the world’s biggest supplier of rigs overall, estimates that international contracts average a year before higher prices can kick in. Still, prices are rising everywhere.

“The pricing environment is robust,” Chief Executive Officer Tony Petrello said Thursday on a first-quarter earnings call. “It applies to all markets and it’s moved faster than any time I’ve ever seen in my 30 years at Nabors.”

...

28.4.

Drilling Rig Prices Are Spiking in the U.S. Shale Patch

https://finance.yahoo.com/news/drilling-rig-prices-spiking-u…

😍😍😍

1.12.

Nabors Energy Transition

1.12.

Nabors Energy Transition

7.10.

Nabors Announces World's First Fully Automated Land Rig Has Successfully Drilled Its First Well

https://investor.nabors.com/news-releases/news-details/2021/…

...

Nabors Industries Ltd. (NYSE: NBR), a leading provider of advanced technology for the global energy industry, today announced its PACE®-R801 – the world's first fully automated land drilling rig – has reached total depth on its first well, a horizontal well for ExxonMobil in the Permian Basin.

Combining Nabors proprietary Smart Suite of automated drilling software with Canrig® robotics on the PACE®-R801 creates an unmanned rig floor that removes crews from red zone areas and delivers consistent, predictable drilling performance.

...

Nabors Announces World's First Fully Automated Land Rig Has Successfully Drilled Its First Well

https://investor.nabors.com/news-releases/news-details/2021/…

...

Nabors Industries Ltd. (NYSE: NBR), a leading provider of advanced technology for the global energy industry, today announced its PACE®-R801 – the world's first fully automated land drilling rig – has reached total depth on its first well, a horizontal well for ExxonMobil in the Permian Basin.

Combining Nabors proprietary Smart Suite of automated drilling software with Canrig® robotics on the PACE®-R801 creates an unmanned rig floor that removes crews from red zone areas and delivers consistent, predictable drilling performance.

...

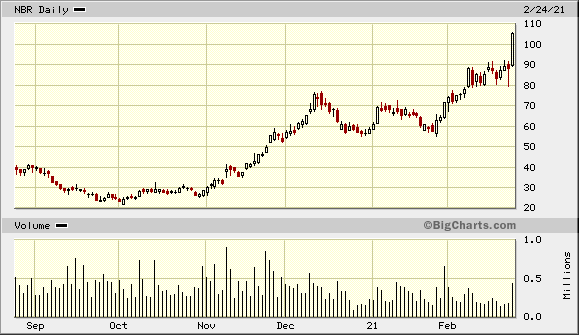

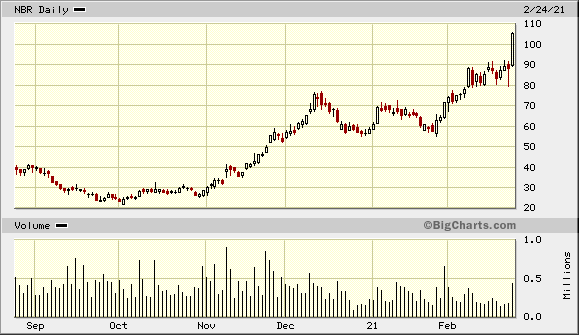

Antwort auf Beitrag Nr.: 67.176.693 von faultcode am 24.02.21 13:41:58Monster move

in Texas scheint richtig viel kaputt gegangen sein sein in der letzten Kältewelle

in Texas scheint richtig viel kaputt gegangen sein sein in der letzten Kältewelle

Nabors Announces Fourth Quarter 2020 Results

Company Release - 2/23/2021 4:43 PM ET

https://www.prnewswire.com/news-releases/nabors-announces-fo…

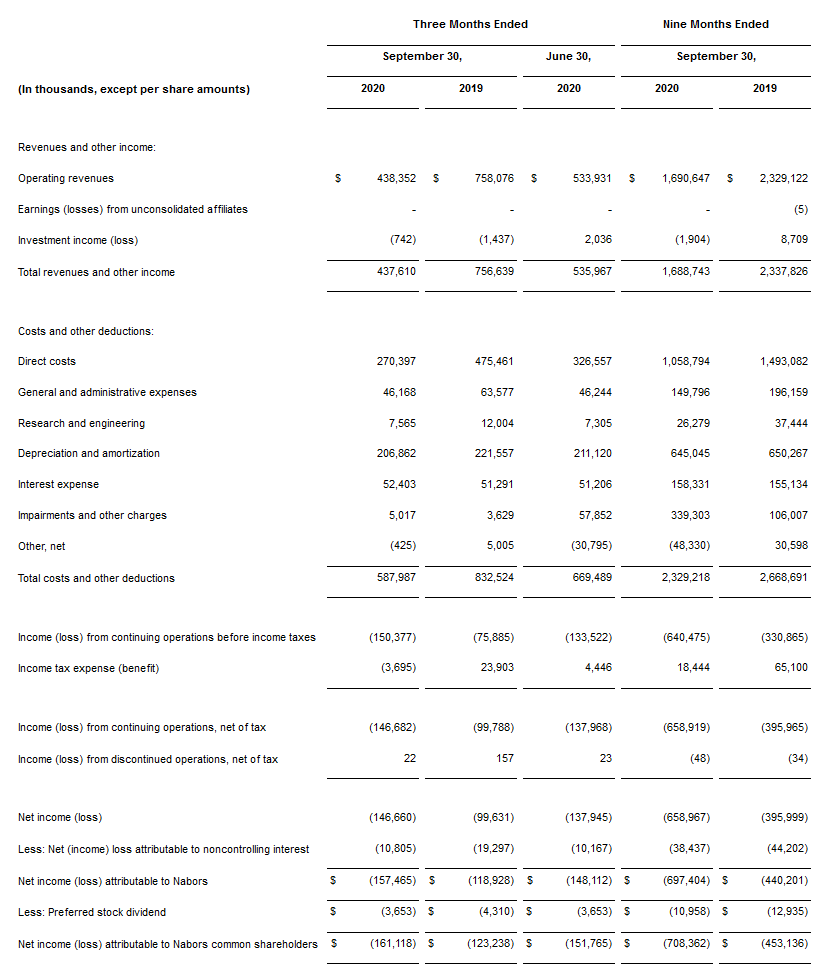

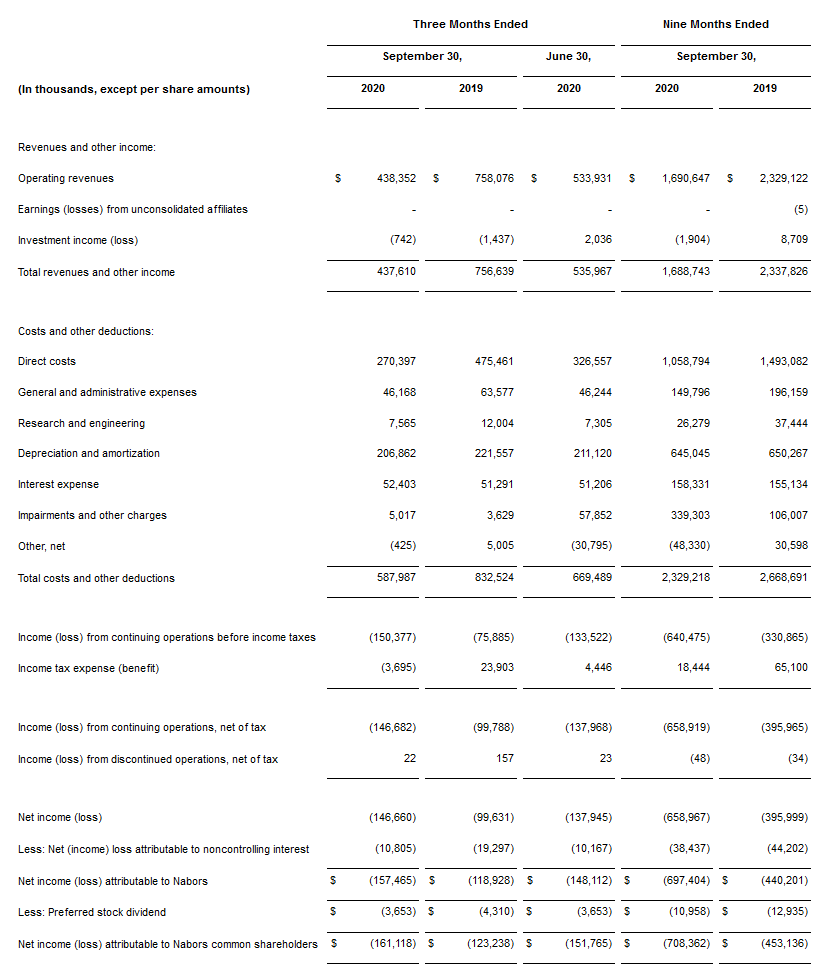

HAMILTON, Bermuda, Feb. 23, 2021 /PRNewswire/ -- Nabors Industries Ltd. ("Nabors" or the "Company") (NYSE: NBR) today reported fourth quarter 2020 operating revenues of $443 million, compared to operating revenues of $438 million in the third quarter of 2020. The net loss from continuing operations attributable to Nabors common shareholders for the quarter was $112 million, or $16.46 per share. The fourth quarter included $162 million of pretax gains from debt exchanges and repurchases, partially offset by charges of $71 million mainly from asset impairments, for a net after-tax gain of $52 million. This compares to a loss of $161 million, or $23.42 per share in the prior quarter. The third quarter included net after tax gains of $6 million related to gains from debt repurchases, asset impairments and severance costs.

For the fourth quarter, adjusted EBITDA was $108 million, compared to $114 million in the prior quarter. Although adjusted EBITDA for most of our segments improved sequentially, declines in International and Rig Technologies more than offset those increases. Reductions in our International rig count were almost fully compensated by increases in the North American market.

Anthony G. Petrello, Nabors Chairman, CEO and President, commented, "Our fourth quarter results were stronger than we expected. Once again, we executed well across our portfolio of businesses. We benefitted from activity increases in our North American markets. Margins were better than we projected in our Lower 48 and International rig markets, as well as in Drilling Solutions.

"We successfully completed exchanges of our outstanding notes during the fourth quarter. These transactions materially improved the Company's leverage and its debt maturity profile. Together with free cash flow generation during the quarter, we realized a significant reduction in net debt to just under $2.5 billion.

"Global oil demand increased during the fourth quarter, reducing the inventory overhang. Commodity prices recovered as well. These factors have driven activity higher across markets. In the fourth quarter, the Lower 48 market grew by 23% on average. More recently, drilling activity has begun to strengthen in various international markets, particularly in Latin America and Saudi Arabia. As demand for oil continues to recover post-pandemic, we would expect drilling activity to increase steadily in the U.S. and international markets. With utilization continuing to improve, we also expect to see higher pricing throughout most markets during 2021.

"We are especially pleased to see the significant progress in our Drilling Solutions segment. Adjusted EBITDA increased by 44% versus the prior quarter. We saw continued growth in our SmartSLIDETM and SmartNAVTM apps. SmartSLIDETM is our directional steering control system which automates slide drilling. SmartNAVTM is our automated directional guidance system. These offerings are not only bolstering the performance of our Drilling Solutions segment, but they are also driving the performance of our global drilling rig business, allowing us to secure premium pricing and the highest Lower 48 daily margins among our peers.

"To summarize, the market is driving higher oil prices and higher drilling activity. As a result, all of our segments are moving in the right direction."

...

...

Company Release - 2/23/2021 4:43 PM ET

https://www.prnewswire.com/news-releases/nabors-announces-fo…

HAMILTON, Bermuda, Feb. 23, 2021 /PRNewswire/ -- Nabors Industries Ltd. ("Nabors" or the "Company") (NYSE: NBR) today reported fourth quarter 2020 operating revenues of $443 million, compared to operating revenues of $438 million in the third quarter of 2020. The net loss from continuing operations attributable to Nabors common shareholders for the quarter was $112 million, or $16.46 per share. The fourth quarter included $162 million of pretax gains from debt exchanges and repurchases, partially offset by charges of $71 million mainly from asset impairments, for a net after-tax gain of $52 million. This compares to a loss of $161 million, or $23.42 per share in the prior quarter. The third quarter included net after tax gains of $6 million related to gains from debt repurchases, asset impairments and severance costs.

For the fourth quarter, adjusted EBITDA was $108 million, compared to $114 million in the prior quarter. Although adjusted EBITDA for most of our segments improved sequentially, declines in International and Rig Technologies more than offset those increases. Reductions in our International rig count were almost fully compensated by increases in the North American market.

Anthony G. Petrello, Nabors Chairman, CEO and President, commented, "Our fourth quarter results were stronger than we expected. Once again, we executed well across our portfolio of businesses. We benefitted from activity increases in our North American markets. Margins were better than we projected in our Lower 48 and International rig markets, as well as in Drilling Solutions.

"We successfully completed exchanges of our outstanding notes during the fourth quarter. These transactions materially improved the Company's leverage and its debt maturity profile. Together with free cash flow generation during the quarter, we realized a significant reduction in net debt to just under $2.5 billion.

"Global oil demand increased during the fourth quarter, reducing the inventory overhang. Commodity prices recovered as well. These factors have driven activity higher across markets. In the fourth quarter, the Lower 48 market grew by 23% on average. More recently, drilling activity has begun to strengthen in various international markets, particularly in Latin America and Saudi Arabia. As demand for oil continues to recover post-pandemic, we would expect drilling activity to increase steadily in the U.S. and international markets. With utilization continuing to improve, we also expect to see higher pricing throughout most markets during 2021.

"We are especially pleased to see the significant progress in our Drilling Solutions segment. Adjusted EBITDA increased by 44% versus the prior quarter. We saw continued growth in our SmartSLIDETM and SmartNAVTM apps. SmartSLIDETM is our directional steering control system which automates slide drilling. SmartNAVTM is our automated directional guidance system. These offerings are not only bolstering the performance of our Drilling Solutions segment, but they are also driving the performance of our global drilling rig business, allowing us to secure premium pricing and the highest Lower 48 daily margins among our peers.

"To summarize, the market is driving higher oil prices and higher drilling activity. As a result, all of our segments are moving in the right direction."

...

...

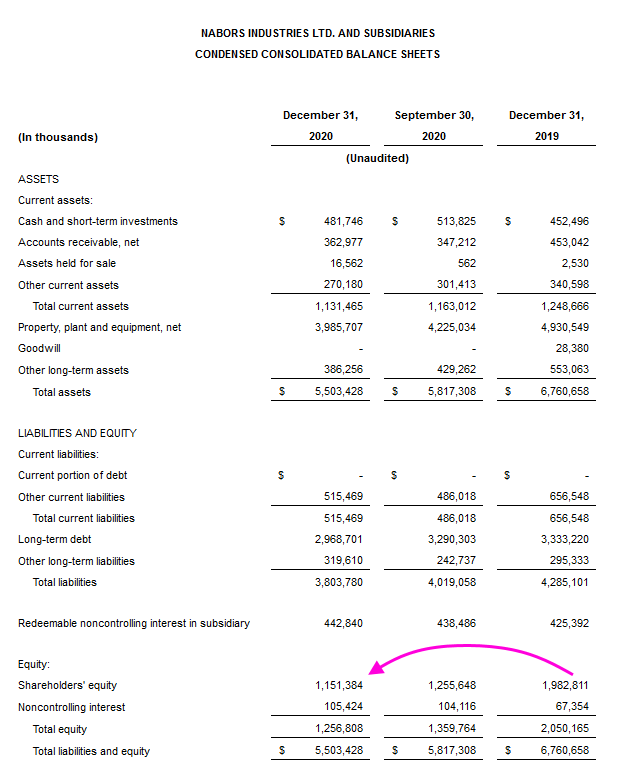

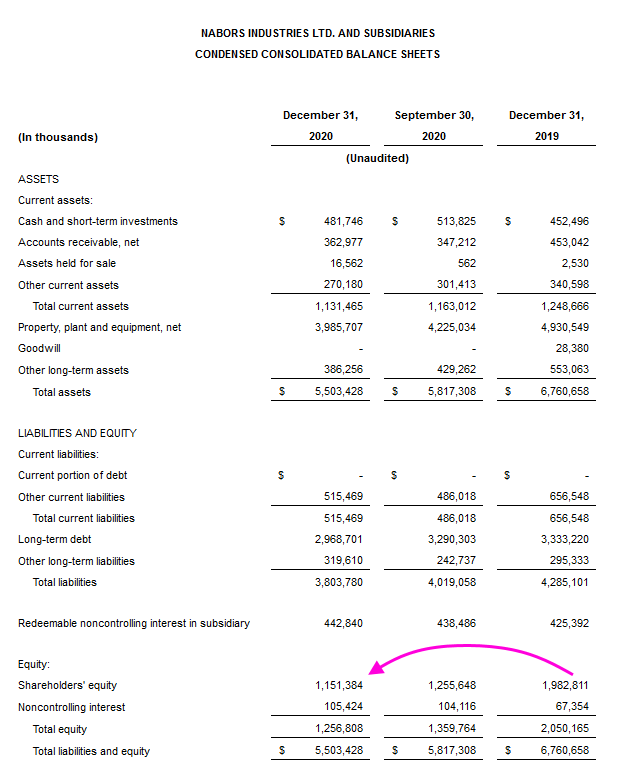

Antwort auf Beitrag Nr.: 63.766.318 von faultcode am 21.05.20 23:05:55ich habe gestern den Corona-Impfstoff-Hype, insbesondere bei den O&G-Service-Firmen (TechnipFMC war Tagesgewinner im S&P500), zum "Steuer-Ausstieg" (einer alten TESCO Corp.-Position mit einmal falschem NBR-BTD) genutzt.

Ich denke zwar, daß das Unternehmen (mit >10k Beschäftigten und nach wie vor relevanter Technologie) die nächsten Jahre überleben wird, aber mMn gilt das weniger für die Bestandsaktionäre.

Die Gesamt-Verbindlichkeiten (non-current) sind nun bei fast USD4Mrd angekommen zum 30.9.2020. So schlimm war's relativ gesehen seit 2011 noch nie.

An Baker Hughes Co. / BKR halte ich fest (als Plan). Dort blieb z.B. die oper. Marge zum 30.9.2020 noch positiv, während man bei NBR da in einen Abgrund schaut.

Ich denke zwar, daß das Unternehmen (mit >10k Beschäftigten und nach wie vor relevanter Technologie) die nächsten Jahre überleben wird, aber mMn gilt das weniger für die Bestandsaktionäre.

Die Gesamt-Verbindlichkeiten (non-current) sind nun bei fast USD4Mrd angekommen zum 30.9.2020. So schlimm war's relativ gesehen seit 2011 noch nie.

An Baker Hughes Co. / BKR halte ich fest (als Plan). Dort blieb z.B. die oper. Marge zum 30.9.2020 noch positiv, während man bei NBR da in einen Abgrund schaut.

Antwort auf Beitrag Nr.: 63.766.318 von faultcode am 21.05.20 23:05:553.11.

Nabors Announces Third Quarter 2020 Results

http://investor.nabors.com/file/Index?KeyFile=405851096

...

...

Anthony G. Petrello, Nabors Chairman, CEO and President, commented, "Our third quarter results were somewhat better than we expected. We executed well across the enterprise. Even as activity deteriorated as anticipated, margins were better than we projected in the Lower 48 and International rig markets. The spending reductions we implemented earlier this year supported our free cash flow generation and a modest improvement in net debt.

"The third quarter appears to mark an inflection point in the Lower 48 industry rig market, which has risen some 52 rigs, or 23%, from the level in mid-August. This momentum bolstered our own rig count through the quarter, and supported daily rig margins in the face of challenging industry utilization. Based on quarterly average working rig counts, we increased our Lower 48 market share by approximately three points sequentially, and in the third quarter held approximately a 15% share. In a difficult environment, this gain demonstrates growing client preference for our value proposition.

"We expect activity in the Lower 48 to continue improving. As we place rigs back to work, pricing on these rigs should be meaningfully below our Lower 48 fleet average. We have mitigated pricing erosion with significant reductions to our direct costs. Nonetheless, the full impact of current market pricing on our margins still lies ahead.

"In our International Drilling segment, rig count declined by 11 rigs. This change primarily reflects reduced activity in the Eastern Hemisphere in reaction to weak market fundamentals. Temporary suspensions accounted for most of the quarter's reduction in rig count. We expect our suspended rigs to resume operations beginning in early 2021. In addition to this reduction in activity, our revenue continues to be affected materially by lower negotiated and standby rates reflecting COVID restrictions in a few markets.

"Activity trends in our international markets are mixed. We continue to see a gradual recovery in the Latin America markets. During the third quarter, we drilled a record well for an operator in Argentina. As a direct result of this performance, we have been awarded additional content from our Drilling Solutions portfolio on future wells, displacing incumbent competitors in the process.

"In the Eastern Hemisphere, we have experienced further activity suspensions in the fourth quarter. Although we expect our International rig count to decline during the remainder of the year, we anticipate it to stabilize by year end and gradually improve throughout 2021.

"The resurgence of COVID, and the recent volatility in oil prices, may temper this improvement in the market. Those factors notwithstanding, we remain focused on cost and capital discipline in order to generate free cash flow and reduce net debt."

...

Nabors Announces Third Quarter 2020 Results

http://investor.nabors.com/file/Index?KeyFile=405851096

...

...

Anthony G. Petrello, Nabors Chairman, CEO and President, commented, "Our third quarter results were somewhat better than we expected. We executed well across the enterprise. Even as activity deteriorated as anticipated, margins were better than we projected in the Lower 48 and International rig markets. The spending reductions we implemented earlier this year supported our free cash flow generation and a modest improvement in net debt.

"The third quarter appears to mark an inflection point in the Lower 48 industry rig market, which has risen some 52 rigs, or 23%, from the level in mid-August. This momentum bolstered our own rig count through the quarter, and supported daily rig margins in the face of challenging industry utilization. Based on quarterly average working rig counts, we increased our Lower 48 market share by approximately three points sequentially, and in the third quarter held approximately a 15% share. In a difficult environment, this gain demonstrates growing client preference for our value proposition.

"We expect activity in the Lower 48 to continue improving. As we place rigs back to work, pricing on these rigs should be meaningfully below our Lower 48 fleet average. We have mitigated pricing erosion with significant reductions to our direct costs. Nonetheless, the full impact of current market pricing on our margins still lies ahead.

"In our International Drilling segment, rig count declined by 11 rigs. This change primarily reflects reduced activity in the Eastern Hemisphere in reaction to weak market fundamentals. Temporary suspensions accounted for most of the quarter's reduction in rig count. We expect our suspended rigs to resume operations beginning in early 2021. In addition to this reduction in activity, our revenue continues to be affected materially by lower negotiated and standby rates reflecting COVID restrictions in a few markets.

"Activity trends in our international markets are mixed. We continue to see a gradual recovery in the Latin America markets. During the third quarter, we drilled a record well for an operator in Argentina. As a direct result of this performance, we have been awarded additional content from our Drilling Solutions portfolio on future wells, displacing incumbent competitors in the process.

"In the Eastern Hemisphere, we have experienced further activity suspensions in the fourth quarter. Although we expect our International rig count to decline during the remainder of the year, we anticipate it to stabilize by year end and gradually improve throughout 2021.

"The resurgence of COVID, and the recent volatility in oil prices, may temper this improvement in the market. Those factors notwithstanding, we remain focused on cost and capital discipline in order to generate free cash flow and reduce net debt."

...

Aus TESCO Corp. wird Nabors Industries Ltd.