AXT Inc. - 500 Beiträge pro Seite

eröffnet am 25.01.18 14:00:23 von

neuester Beitrag 17.11.20 20:36:32 von

neuester Beitrag 17.11.20 20:36:32 von

Beiträge: 21

ID: 1.272.523

ID: 1.272.523

Aufrufe heute: 0

Gesamt: 1.494

Gesamt: 1.494

Aktive User: 0

ISIN: US00246W1036 · WKN: 914410 · Symbol: AHV

2,7080

EUR

-3,90 %

-0,1100 EUR

Letzter Kurs 25.04.24 Tradegate

Neuigkeiten

16.04.24 · Business Wire (engl.) |

08.04.24 · Business Wire (engl.) |

08.04.24 · Business Wire (engl.) |

08.04.24 · globenewswire |

06.04.24 · Business Wire (engl.) |

Werte aus der Branche Elektrogeräte

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,3000 | +71.367,84 | |

| 25,12 | +39,05 | |

| 7,0900 | +33,02 | |

| 0,5900 | +31,11 | |

| 2,4500 | +23,10 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,9950 | -10,00 | |

| 1.080,20 | -10,45 | |

| 111,59 | -12,62 | |

| 0,5300 | -24,29 | |

| 4,0000 | -33,33 |

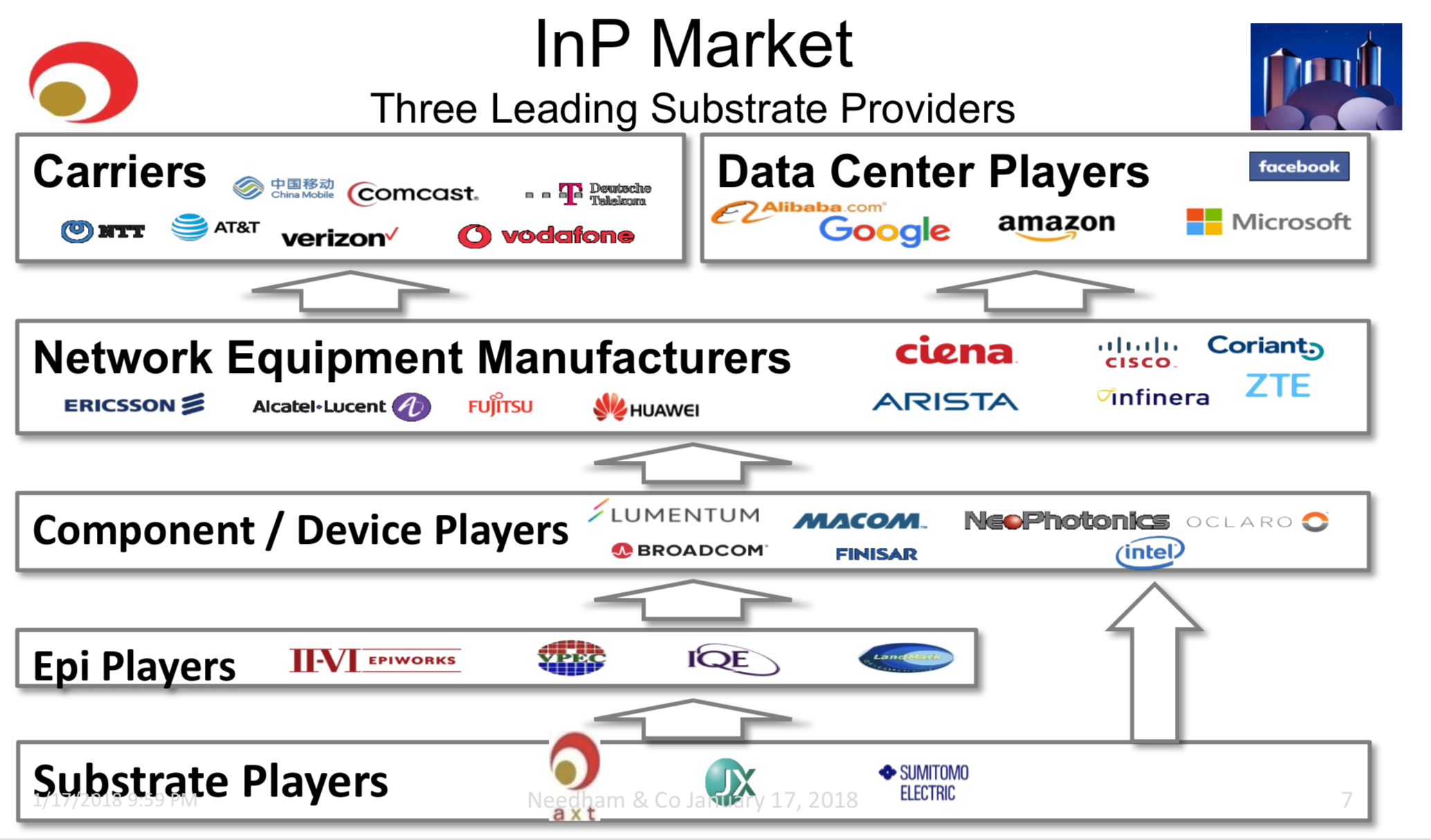

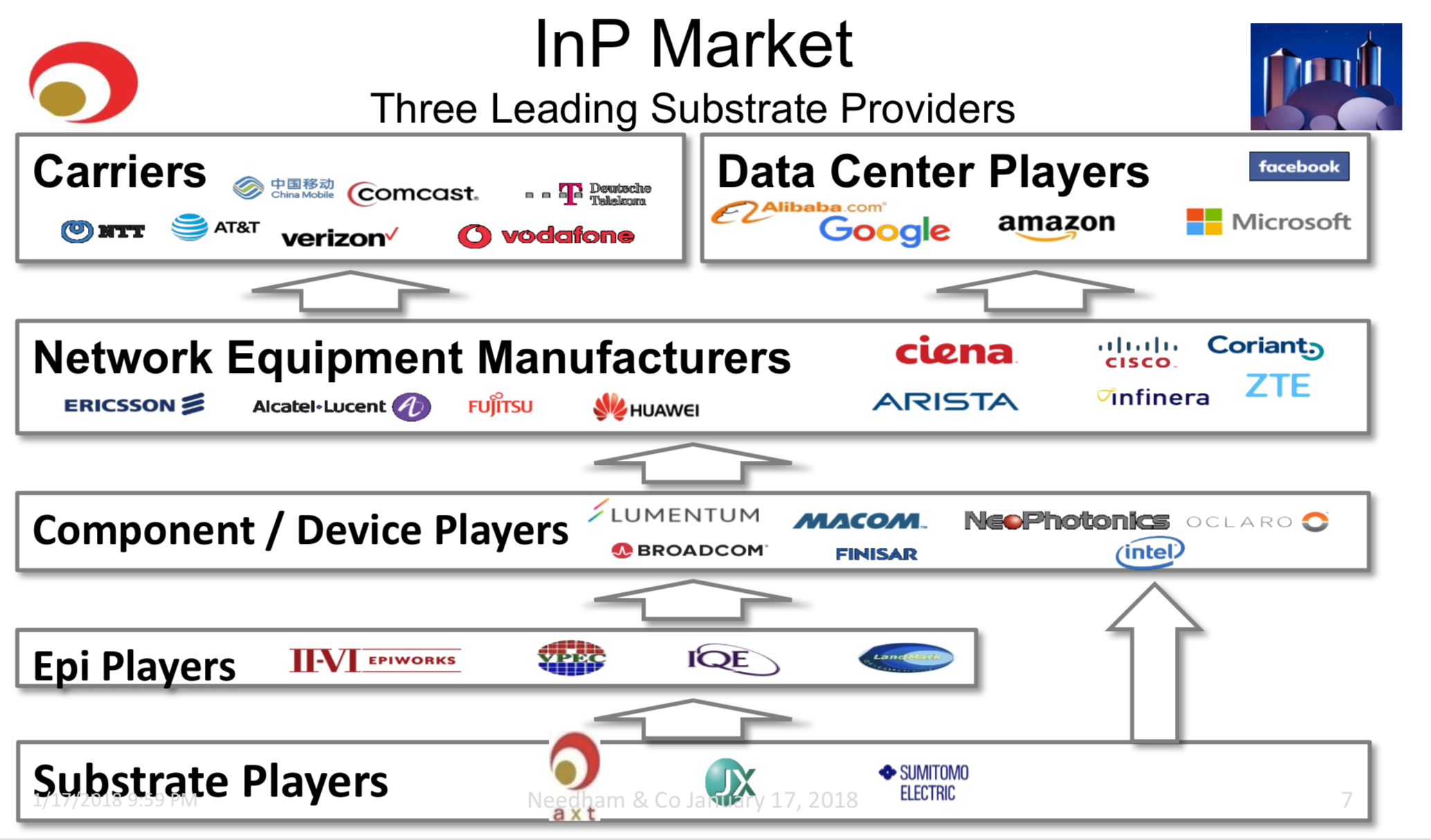

ist ein InP-Player

Die guten Firmen-Namen sind alle vergeben.

Antwort auf Beitrag Nr.: 56.825.317 von R-BgO am 25.01.18 14:00:23

AXT, Inc. Updates Expectations for the First Quarter 2018

Completes First Phase of New Factory in Dingxing, China

FREMONT, Calif., April 11, 2018 (GLOBE NEWSWIRE) --

AXT, Inc. (Nasdaq:AXTI), a leading manufacturer of compound semiconductor substrates, today provided an update to its expectations for the first quarter 2018 financial results, which will be announced on April 25, 2018.

The company now expects first quarter revenue to be in the range of $24.0 million to $24.5 million, due to government-ordered mandatory factory shutdowns in Beijing caused by severe air pollution that occurred late in the quarter. From February 27 to March 31 over 300 manufacturing companies were intermittently shut down for a total of ten days, or 30 percent of the calendar days in this period. The revised revenue expectation is down from the company’s previous guidance of $26 million to $27 million, provided at its fourth quarter earnings announcement on February 21, 2018.

The company also announced that it has completed the first phase of facilitization of its new manufacturing facility in Dingxing, China, located approximately 90 miles south of its Beijing factory, and is progressing well on its staged relocation.

“We were disappointed that air quality conditions in Beijing triggered mandatory shutdowns late in the quarter, which prevented AXT from meeting our guidance expectations,” said Morris Young, chief executive officer. “We were working hard to narrow the gap but the last week of March alone had three shutdown days. The demand environment, however, remains solid as AXT substrates continue to perform well, particularly in applications where customer requirements are most stringent. We are optimistic about our business opportunity in 2018, and believe we are well-positioned to take advantage of positive trends in a number of applications, including high-end LED lighting, infrared and other sensors requiring low-EPD wafers, passive optical networks, data center connectivity and satellite solar cells.”

“We are pleased to report that we have completed the first phase of facilitization of our new facility in Dingxing, China, have installed wafer processing equipment and have produced initial wafers at this site that can be used for qualification,” Young said. “With the continued solid execution by our team, we are on schedule with our plans and pleased with our progress to date. This new technically advanced facility gives us the opportunity to plan our business for our next stage of growth and to support the longer-term capacity requirements of our customers.”

günstiger geworden:

.AXT, Inc. Updates Expectations for the First Quarter 2018

Completes First Phase of New Factory in Dingxing, China

FREMONT, Calif., April 11, 2018 (GLOBE NEWSWIRE) --

AXT, Inc. (Nasdaq:AXTI), a leading manufacturer of compound semiconductor substrates, today provided an update to its expectations for the first quarter 2018 financial results, which will be announced on April 25, 2018.

The company now expects first quarter revenue to be in the range of $24.0 million to $24.5 million, due to government-ordered mandatory factory shutdowns in Beijing caused by severe air pollution that occurred late in the quarter. From February 27 to March 31 over 300 manufacturing companies were intermittently shut down for a total of ten days, or 30 percent of the calendar days in this period. The revised revenue expectation is down from the company’s previous guidance of $26 million to $27 million, provided at its fourth quarter earnings announcement on February 21, 2018.

The company also announced that it has completed the first phase of facilitization of its new manufacturing facility in Dingxing, China, located approximately 90 miles south of its Beijing factory, and is progressing well on its staged relocation.

“We were disappointed that air quality conditions in Beijing triggered mandatory shutdowns late in the quarter, which prevented AXT from meeting our guidance expectations,” said Morris Young, chief executive officer. “We were working hard to narrow the gap but the last week of March alone had three shutdown days. The demand environment, however, remains solid as AXT substrates continue to perform well, particularly in applications where customer requirements are most stringent. We are optimistic about our business opportunity in 2018, and believe we are well-positioned to take advantage of positive trends in a number of applications, including high-end LED lighting, infrared and other sensors requiring low-EPD wafers, passive optical networks, data center connectivity and satellite solar cells.”

“We are pleased to report that we have completed the first phase of facilitization of our new facility in Dingxing, China, have installed wafer processing equipment and have produced initial wafers at this site that can be used for qualification,” Young said. “With the continued solid execution by our team, we are on schedule with our plans and pleased with our progress to date. This new technically advanced facility gives us the opportunity to plan our business for our next stage of growth and to support the longer-term capacity requirements of our customers.”

und aufgestockt

Antwort auf Beitrag Nr.: 56.825.317 von R-BgO am 25.01.18 14:00:23

Antwort auf Beitrag Nr.: 57.607.515 von R-BgO am 23.04.18 15:17:43AXT, Inc. Announces First Quarter 2018 Financial Results

FREMONT, Calif., April 25, 2018 (GLOBE NEWSWIRE) --

AXT, Inc. (NasdaqGS:AXTI), a leading manufacturer of compound semiconductor substrates, today reported financial results for the first quarter, ended March 31, 2018.

First Quarter 2018 Results

Revenue for the first quarter of 2018 was $24.4 million, compared with $26.3 million in the fourth quarter of 2017 and $20.6 million for the first quarter of 2017.

Gross margin was 39.2 percent of revenue for the first quarter of 2018, compared with 37.2 percent of revenue in the fourth quarter of 2017 and 30.5 percent for the first quarter of 2017.

Operating expenses were $5.6 million in the first quarter of 2018, compared with $6.1 million in the fourth quarter of 2017 and $4.9 million for the first quarter of 2017.

Operating profit for the first quarter of 2018 was $3.9 million, compared with operating profit of $3.7 million in the fourth quarter of 2017 and $1.4 million for the first quarter of 2017.

Interest and other, net was a loss of $0.4 million for the first quarter of 2018, compared with a loss of $0.3 million in the fourth quarter of 2017 and a loss of $0.8 million for the first quarter of 2017. Interest and other, net for the first quarter of 2018 included interest income of $0.1 million, a foreign exchange loss of $0.2 million and a net loss of $0.3 million from the seven partially owned companies in the company’s supply chain, accounted for under the equity method.

Income tax expense in the first quarter of 2018 was $0.3 million, compared with $0.1 million in the fourth quarter of 2017 and $0.2 million for the first quarter of 2017.

Net income in the first quarter of 2018 was $2.9 million, or $0.07 per diluted share, compared with a net income of $3.1 million or $0.08 per diluted share in the fourth quarter of 2017 and $0.7 million or $0.02 per diluted share for the first quarter of 2017.

Management Qualitative Comments

“Although our Q1 revenue was impacted by air quality-related mandatory factory shutdowns in Beijing as previously announced, Q1 was a positive quarter in many respects,” said Morris Young, chief executive officer. “We continued to see positive demand for AXT products. In addition, a favorable product mix and good manufacturing yields combined for increased gross margin. Regarding our Dingxing facility, we completed the first phase of facilitization, installed wafer processing equipment and produced initial wafers that can be used for qualification. We continue to execute our plans, supported by a healthy market environment and solid customer relationships. We are encouraged by the opportunities unfolding across our portfolio, as well as our readiness to participate in them.”

FREMONT, Calif., April 25, 2018 (GLOBE NEWSWIRE) --

AXT, Inc. (NasdaqGS:AXTI), a leading manufacturer of compound semiconductor substrates, today reported financial results for the first quarter, ended March 31, 2018.

First Quarter 2018 Results

Revenue for the first quarter of 2018 was $24.4 million, compared with $26.3 million in the fourth quarter of 2017 and $20.6 million for the first quarter of 2017.

Gross margin was 39.2 percent of revenue for the first quarter of 2018, compared with 37.2 percent of revenue in the fourth quarter of 2017 and 30.5 percent for the first quarter of 2017.

Operating expenses were $5.6 million in the first quarter of 2018, compared with $6.1 million in the fourth quarter of 2017 and $4.9 million for the first quarter of 2017.

Operating profit for the first quarter of 2018 was $3.9 million, compared with operating profit of $3.7 million in the fourth quarter of 2017 and $1.4 million for the first quarter of 2017.

Interest and other, net was a loss of $0.4 million for the first quarter of 2018, compared with a loss of $0.3 million in the fourth quarter of 2017 and a loss of $0.8 million for the first quarter of 2017. Interest and other, net for the first quarter of 2018 included interest income of $0.1 million, a foreign exchange loss of $0.2 million and a net loss of $0.3 million from the seven partially owned companies in the company’s supply chain, accounted for under the equity method.

Income tax expense in the first quarter of 2018 was $0.3 million, compared with $0.1 million in the fourth quarter of 2017 and $0.2 million for the first quarter of 2017.

Net income in the first quarter of 2018 was $2.9 million, or $0.07 per diluted share, compared with a net income of $3.1 million or $0.08 per diluted share in the fourth quarter of 2017 and $0.7 million or $0.02 per diluted share for the first quarter of 2017.

Management Qualitative Comments

“Although our Q1 revenue was impacted by air quality-related mandatory factory shutdowns in Beijing as previously announced, Q1 was a positive quarter in many respects,” said Morris Young, chief executive officer. “We continued to see positive demand for AXT products. In addition, a favorable product mix and good manufacturing yields combined for increased gross margin. Regarding our Dingxing facility, we completed the first phase of facilitization, installed wafer processing equipment and produced initial wafers that can be used for qualification. We continue to execute our plans, supported by a healthy market environment and solid customer relationships. We are encouraged by the opportunities unfolding across our portfolio, as well as our readiness to participate in them.”

Antwort auf Beitrag Nr.: 57.634.116 von R-BgO am 26.04.18 13:01:04@R-BgO: Wir zwei sind auch die einzigen auf w:o, die sich für US-Nebenwerte interessieren, oder?

Axt Inc. wurde gestern von Michael Robinson und seinem Radical Technology Profits-Brief empfohlen. Kannst Dich glücklich schätzen, falls Du noch investiert bist. Denn Du hast Dir Deinen "Ground-Floor Stake in the X-31 Revolution" bereits gesichert. Es winkt ein Gewinn von 4000% ;-)

https://www.stockgumshoe.com/reviews/radical-technology-prof…

Axt Inc. wurde gestern von Michael Robinson und seinem Radical Technology Profits-Brief empfohlen. Kannst Dich glücklich schätzen, falls Du noch investiert bist. Denn Du hast Dir Deinen "Ground-Floor Stake in the X-31 Revolution" bereits gesichert. Es winkt ein Gewinn von 4000% ;-)

https://www.stockgumshoe.com/reviews/radical-technology-prof…

Antwort auf Beitrag Nr.: 57.830.243 von ArminBrack am 25.05.18 10:13:31

sowas ist ja wohl eher ein

Kontraindikator?

Antwort auf Beitrag Nr.: 57.830.546 von R-BgO am 25.05.18 10:48:27Ich denke, dass der Kurssprung von gestern darauf zurückzuführen war und der könnte natürlich wieder etwas abgebaut werden.

Kontraindikator würde ich nicht unbedingt sagen. Kann natürlich immer sein, dass bei so etwas auch ein Hype entsteht. Hast Du die Aktie auch mit dieser Galliumarsenid-Fantasie im Hinterkopf gekauft oder nur wegen des aussichtsreichen aktuellen Geschäfts?

Kontraindikator würde ich nicht unbedingt sagen. Kann natürlich immer sein, dass bei so etwas auch ein Hype entsteht. Hast Du die Aktie auch mit dieser Galliumarsenid-Fantasie im Hinterkopf gekauft oder nur wegen des aussichtsreichen aktuellen Geschäfts?

Antwort auf Beitrag Nr.: 57.830.582 von ArminBrack am 25.05.18 10:53:25

Kann ich Dir nicht mal genau sagen...

ist bei mir irgendwie in der gleichen "Compound Semi" Schublade verortet wie IQE, II-VI, Emcore, ...

Antwort auf Beitrag Nr.: 57.830.624 von R-BgO am 25.05.18 10:57:14Alles klar, danke, frag nur, weil ich die Aktie 2015 als Substanzspekulation auf dem Zettel gehabt hab, damals hatten Sie bei ca. 2 US-Dollar Kurs mehr als die Hälfte der Market Cap in Cash und Buchwert von über 4 US-Dollar bei auch noch extrem niedrigem KUV.

Jetzt find ich es schwer, einzuschätzen, ob die Aktie noch Potenzial hat. Hast Du da ne klare Meinung?

Jetzt find ich es schwer, einzuschätzen, ob die Aktie noch Potenzial hat. Hast Du da ne klare Meinung?

Antwort auf Beitrag Nr.: 57.830.675 von ArminBrack am 25.05.18 11:03:18Ich frage mich nur, warum sie so lange zögern und nicht einsteigen.

Sie haben bis heute 20 Prozent Gewinn verpasst.

Sie haben bis heute 20 Prozent Gewinn verpasst.

Galliumarsenid..., da gabs doch mal was mit POET Tech?

Antwort auf Beitrag Nr.: 58.197.992 von Schif am 12.07.18 15:57:06@Schif: Weil ich - wie geschrieben - fundamental nicht von der Aktie überzeugt war.

Substrat-Hersteller für Compound Semiconductor (Epitaxy), primär in China tätig

Geschäftsmodell disruptierbar durch GaN on silicon, etc.?

Geschäftsmodell disruptierbar durch GaN on silicon, etc.?

kurz die Zahlen eines (nicht gelisteten) Wettbewerbers (Freiberger Compound Materials) angesehen:

Umsatz: knapp 70 Mio € (2015 und 2016)

Gewinn: etwas über 6 Mio € (2015 und 2016)

Axt: Umsatz ca 100 Mio € (10 Mio € Gewinn) (2017),

man wächst 2018 etwas und expandiert in neue Hallen in Nähe Peking (AXT Announces Purchase of New Manufacturing Facility in Dingxing, China 09/2017, http://axtinc.gcs-web.com/news-releases/news-release-details…

Umsatz: knapp 70 Mio € (2015 und 2016)

Gewinn: etwas über 6 Mio € (2015 und 2016)

Axt: Umsatz ca 100 Mio € (10 Mio € Gewinn) (2017),

man wächst 2018 etwas und expandiert in neue Hallen in Nähe Peking (AXT Announces Purchase of New Manufacturing Facility in Dingxing, China 09/2017, http://axtinc.gcs-web.com/news-releases/news-release-details…

Antwort auf Beitrag Nr.: 59.164.047 von haowenshan am 08.11.18 06:51:59

so, wollte das für mich korrigieren: die machen nicht GaN, sondern GaAs, InP

hier dürfts aktuell so aussehen:

Epitaxial growth of highly mismatched III-V materials on (001) silicon for

electronics and optoelectronics

http://www.ee.ust.hk/~ptc/Papers/2017/qli_Review2017.pdf

Fazit dürfte noch reichlich Zeit bis dahin (wenn überhaupt) dauern... (obwohl eine dt. Firma https://www.nasp.de/about_us.html dran ist)

GaAs Wafer and Epiwafer Market: RF, Photonics, LED, and PV Applications

https://www.slideshare.net/Yole_Developpement/gaas-wafer-and…

Zitat von haowenshan: Substrat-Hersteller für Compound Semiconductor (Epitaxy), primär in China tätig

Geschäftsmodell disruptierbar durch GaN on silicon, etc.?

so, wollte das für mich korrigieren: die machen nicht GaN, sondern GaAs, InP

hier dürfts aktuell so aussehen:

Epitaxial growth of highly mismatched III-V materials on (001) silicon for

electronics and optoelectronics

http://www.ee.ust.hk/~ptc/Papers/2017/qli_Review2017.pdf

Fazit dürfte noch reichlich Zeit bis dahin (wenn überhaupt) dauern... (obwohl eine dt. Firma https://www.nasp.de/about_us.html dran ist)

GaAs Wafer and Epiwafer Market: RF, Photonics, LED, and PV Applications

https://www.slideshare.net/Yole_Developpement/gaas-wafer-and…

AXT, Inc. Updates Expectations for the Fourth Quarter 2018

FREMONT, Calif., Jan. 14, 2019 (GLOBE NEWSWIRE) -- AXT, Inc. (NasdaqGS: AXTI), a leading manufacturer of compound semiconductor substrates, today provided an update to its expectations for its fourth quarter 2018 financial results, which will be announced on February 20, 2019.

The company now expects fourth quarter revenue to be in the range of $22.0 million to $22.4 million. The revised revenue expectation is down from the company’s previous guidance of $26.5 million to $27.5 million, provided at its third quarter earnings announcement on October 31, 2018.

“AXT saw a significant slowdown during the last two months of the quarter,” said Morris Young, chief executive officer. “The business climate grew increasingly cautious over the quarter and customers generally did not follow through with the level of orders they had previously forecasted. As a result, revenue for all our product lines came in below our expectations. We remain optimistic about the many drivers for our business growth, including data center connectivity, PON, LED lighting, 3-D sensing, 5-G wireless, among others. We believe our new manufacturing facilities, technological proficiency, and efficient cost structure position us well to benefit when the demand environment strengthens.”

The company also announced that one of its partially owned supply chain companies was required to temporarily shut down during the fourth quarter to install manufacturing improvements mandated by a regional environmental agency. Under the equity method of accounting, AXT will incur a charge of $1.1 million, which represents AXT’s 25 percent ownership of this company. The supply chain company resumed production and operations later in Q4.

Antwort auf Beitrag Nr.: 59.625.521 von R-BgO am 14.01.19 13:17:10

=> eingesetztes Kapital gleich $3,43 pro Aktie

maximale upside ist 1-5,00/3,43 => 46%

Zukauf für ,93

veroptioniert per short-call Aug19@$5 für 40c=> eingesetztes Kapital gleich $3,43 pro Aktie

maximale upside ist 1-5,00/3,43 => 46%

Ausblick aus dem earning call Q4 für Q1:

https://finance.yahoo.com/news/axt-inc-announces-fourth-quar…

"And as we discussed, we do not expect business conditions to improve meaningfully in the first quarter. As such, we expect to see revenue in Q1 of between $20.0 million to $21.0 million. We believe our loss per share in Q1 will be in the range of $0.04 to $0.06 based on 39.2 million basic shares outstanding."

https://finance.yahoo.com/news/axt-inc-announces-fourth-quar…

"And as we discussed, we do not expect business conditions to improve meaningfully in the first quarter. As such, we expect to see revenue in Q1 of between $20.0 million to $21.0 million. We believe our loss per share in Q1 will be in the range of $0.04 to $0.06 based on 39.2 million basic shares outstanding."

AXT Announces Strategic Plan to Access China’s Capital Markets

https://www.globenewswire.com/news-release/2020/11/16/212776…

https://www.globenewswire.com/news-release/2020/11/16/212776…

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| 0,00 | |

| +0,23 | |

| +1,32 | |

| 0,00 | |

| +0,62 | |

| +1,95 | |

| +0,12 | |

| +0,33 | |

| 0,00 | |

| +0,35 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 236 | ||

| 113 | ||

| 104 | ||

| 81 | ||

| 56 | ||

| 39 | ||

| 37 | ||

| 36 | ||

| 33 | ||

| 29 |